Quote:

Originally Posted by GregW

This is a good idea only if applied to all income from all sources over the 99th percentile. A lesser tax of 50% should be levied on incomes between the 90th and 99th percentile. That would free up a lot of spendable funds for the sub 90th percentil folks to spend, save and invest as they will.

|

If you want something to go away all you need to do is tax it as the stupid French are figuring that out now.

Hollande's popularity hits new low as economic strains persist - Xinhua | English.news.cn

Taxes of then didn't work and anyone who wants to revisit these rates are true morons.

http://taxfoundation.org/sites/taxfo...d-20110909.pdf

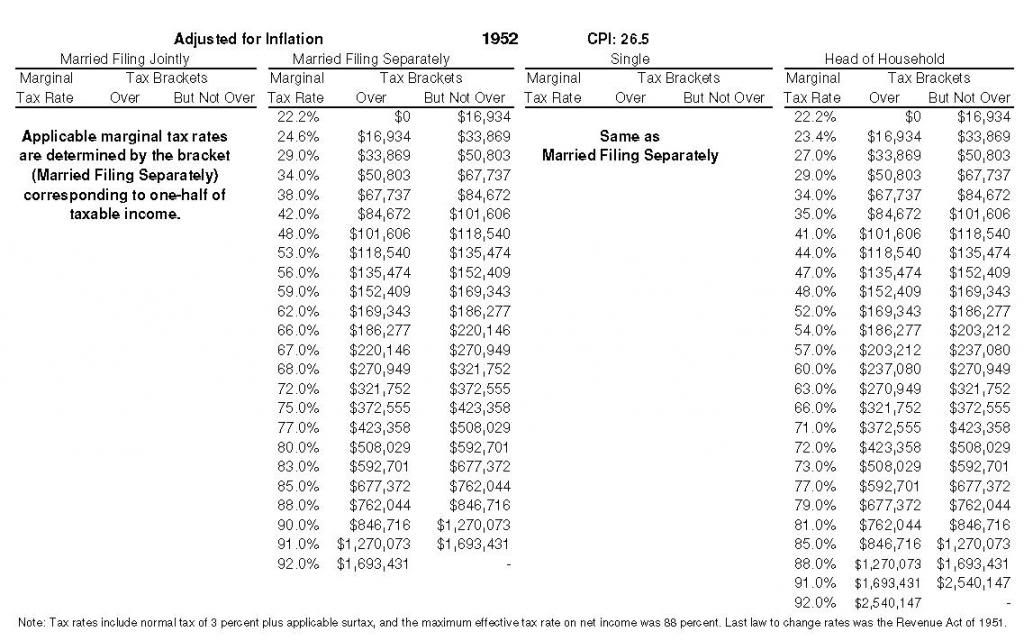

Does anyone really want to go back to 1951?

Note the table below is adjusted for inflation.

Because if you do then we would have to apply all the old rates to everyone.

Imagine having to pay an effective tax rate of 22.2% on a minimum wage job. Sound good to you in the age before food stamps and welfare?

I remember having to file and pay income taxes as a young man in the 60's. My jobs were minimum wage, I only made one or two thousand dollars, and I did end up having to pay federal income tax.

Raising taxes has NEVER brought more money into the treasury. On the contrary it has always resulted in less revenue.

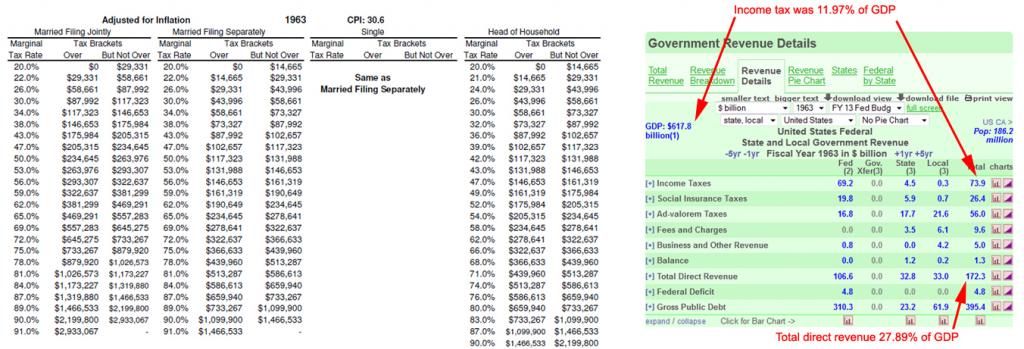

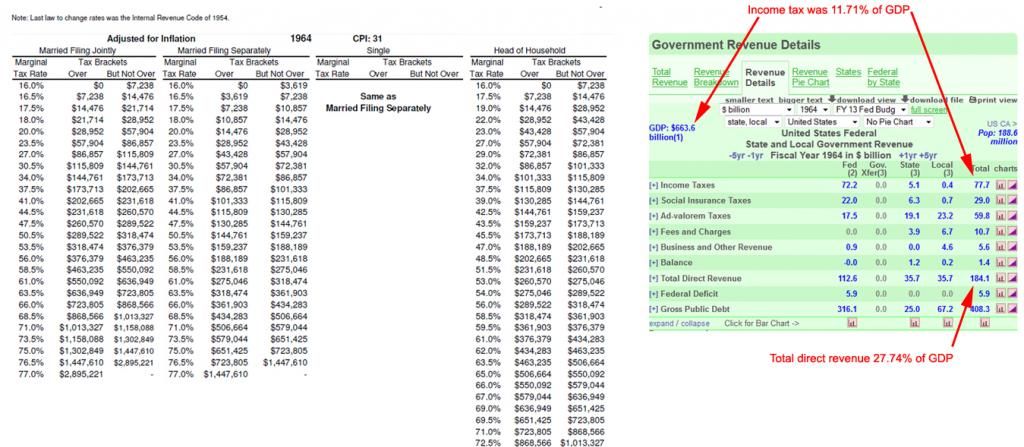

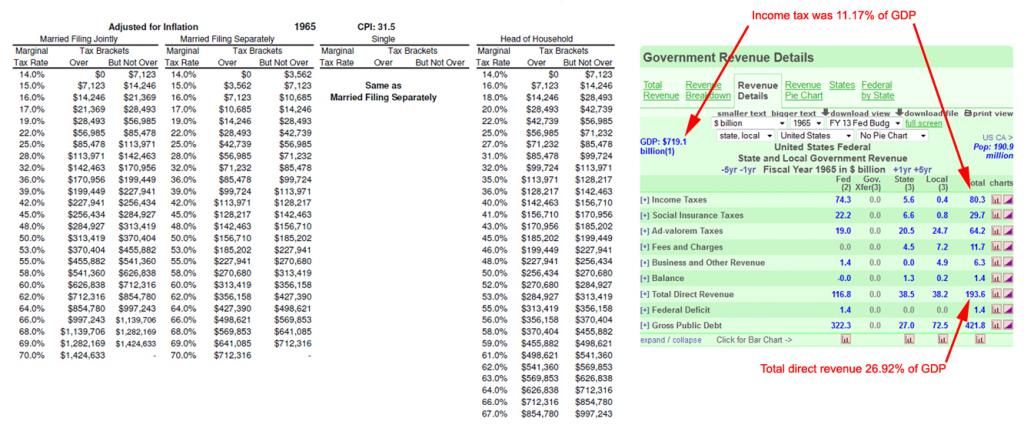

For example let's look at what happened to money flowing into the public treasure before and after the 1964 tax act that lowed the tax rate.

Revenue Act of 1964 - Wikipedia, the free encyclopedia

1963

1964

1965

How can this be? Cutting the tax rates significantly increased the amount of money being collected by the treasury and at the same time the economy boomed!

How can this be? Everyone knows government is responsible for jobs, how can jobs be created by private rich cats?

The simply truth is regardless of what the tax rates have ever been the maximum collected by the treasury has always been right out 21% from the end of WW2.

91%, 59% or 29% the amount collected by income tax has always been right around 21% of GDP.

Please register to participate in our discussions with 2 million other members - it's free and quick! Some forums can only be seen by registered members. After you create your account, you'll be able to customize options and access all our 15,000 new posts/day with fewer ads.

Please register to participate in our discussions with 2 million other members - it's free and quick! Some forums can only be seen by registered members. After you create your account, you'll be able to customize options and access all our 15,000 new posts/day with fewer ads.