Property valuation of Hiikala Place, Honolulu, HI: 1487 #21, 1487 #22, 1487 #23, 1487 #24, 1487 #25, 1487 #26, 1487 #27, 1487 #28, 1487 #29, 1487 #30 (tax assessments)

Other nearby streets: Hiikala Place (1)  Hiikala Place (2)

Hiikala Place (2)  Oili Loop

Oili Loop  Wahinekoa Place (1)

Wahinekoa Place (1)  Wahinekoa Place (2)

Wahinekoa Place (2)

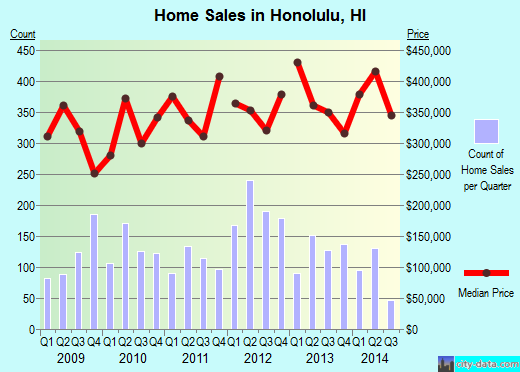

Listed properties vs overall distribution of properties in Honolulu, HI:

Advertisements

1487 Hiikala Place #21

Honolulu, HI

Find on map >>

1st Fee Owner: AMY S BEDAL

2nd Fee Owner: LINDA D BEDAL

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $525,200 (it was $450,200 in 2010)

Total value for property: $790,400 (it was $677,500 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $525,200 (it was $330,200 in 2010)

Current total net taxable: $790,400 (it was $557,500 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $447,900 (it was $442,500 in 2010)

Previous year total value: $691,500 (it was $694,200 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $327,900 (it was $322,500 in 2010)

Previous total net taxable: $571,500 (it was $574,200 in 2010)

Land class: Residential

Assessments for tax year: 2014

Honolulu, HI

Find on map >>

1st Fee Owner: AMY S BEDAL

2nd Fee Owner: LINDA D BEDAL

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $525,200 (it was $450,200 in 2010)

Total value for property: $790,400 (it was $677,500 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $525,200 (it was $330,200 in 2010)

Current total net taxable: $790,400 (it was $557,500 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $447,900 (it was $442,500 in 2010)

Previous year total value: $691,500 (it was $694,200 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $327,900 (it was $322,500 in 2010)

Previous total net taxable: $571,500 (it was $574,200 in 2010)

Land class: Residential

Assessments for tax year: 2014

1487 Hiikala Place #22

Honolulu, HI

Find on map >>

1st Fee Owner: DIANE S LAU TRUST

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $570,500 (it was $483,300 in 2010)

Total value for property: $835,700 (it was $710,600 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $450,500 (it was $403,300 in 2010)

Current total net taxable: $715,700 (it was $630,600 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $483,300 (it was $495,700 in 2010)

Previous year total value: $726,900 (it was $747,400 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $363,300 (it was $415,700 in 2010)

Previous total net taxable: $606,900 (it was $667,400 in 2010)

Land class: Residential

Assessments for tax year: 2014

Honolulu, HI

Find on map >>

1st Fee Owner: DIANE S LAU TRUST

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $570,500 (it was $483,300 in 2010)

Total value for property: $835,700 (it was $710,600 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $450,500 (it was $403,300 in 2010)

Current total net taxable: $715,700 (it was $630,600 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $483,300 (it was $495,700 in 2010)

Previous year total value: $726,900 (it was $747,400 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $363,300 (it was $415,700 in 2010)

Previous total net taxable: $606,900 (it was $667,400 in 2010)

Land class: Residential

Assessments for tax year: 2014

1487 Hiikala Place #23

Honolulu, HI

Find on map >>

1st Fee Owner: GREGORY A/CYNTHIA S NICHOLS

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $570,500 (it was $483,300 in 2010)

Total value for property: $835,700 (it was $710,600 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $570,500 (it was $483,300 in 2010)

Current total net taxable: $835,700 (it was $710,600 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $483,300 (it was $495,700 in 2010)

Previous year total value: $726,900 (it was $747,400 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $483,300 (it was $495,700 in 2010)

Previous total net taxable: $726,900 (it was $747,400 in 2010)

Land class: Residential

Assessments for tax year: 2014

Honolulu, HI

Find on map >>

1st Fee Owner: GREGORY A/CYNTHIA S NICHOLS

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $570,500 (it was $483,300 in 2010)

Total value for property: $835,700 (it was $710,600 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $570,500 (it was $483,300 in 2010)

Current total net taxable: $835,700 (it was $710,600 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $483,300 (it was $495,700 in 2010)

Previous year total value: $726,900 (it was $747,400 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $483,300 (it was $495,700 in 2010)

Previous total net taxable: $726,900 (it was $747,400 in 2010)

Land class: Residential

Assessments for tax year: 2014

1487 Hiikala Place #24

Honolulu, HI

Find on map >>

1st Fee Owner: WEILI CHENG TR

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $525,200 (it was $450,200 in 2010)

Total value for property: $790,400 (it was $677,500 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $525,200 (it was $370,200 in 2010)

Current total net taxable: $790,400 (it was $597,500 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $447,900 (it was $442,500 in 2010)

Previous year total value: $691,500 (it was $694,200 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $447,900 (it was $362,500 in 2010)

Previous total net taxable: $691,500 (it was $614,200 in 2010)

Land class: Residential

Assessments for tax year: 2014

Honolulu, HI

Find on map >>

1st Fee Owner: WEILI CHENG TR

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $525,200 (it was $450,200 in 2010)

Total value for property: $790,400 (it was $677,500 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $525,200 (it was $370,200 in 2010)

Current total net taxable: $790,400 (it was $597,500 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $447,900 (it was $442,500 in 2010)

Previous year total value: $691,500 (it was $694,200 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $447,900 (it was $362,500 in 2010)

Previous total net taxable: $691,500 (it was $614,200 in 2010)

Land class: Residential

Assessments for tax year: 2014

1487 Hiikala Place #25

Honolulu, HI

Find on map >>

1st Fee Owner: RICHARD M/JEANEY J GARCIA

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $525,200 (it was $450,200 in 2010)

Total value for property: $790,400 (it was $677,500 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $525,200 (it was $330,200 in 2010)

Current total net taxable: $790,400 (it was $557,500 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $447,900 (it was $442,500 in 2010)

Previous year total value: $691,500 (it was $694,200 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $447,900 (it was $322,500 in 2010)

Previous total net taxable: $691,500 (it was $574,200 in 2010)

Land class: Residential

Assessments for tax year: 2014

Honolulu, HI

Find on map >>

1st Fee Owner: RICHARD M/JEANEY J GARCIA

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $525,200 (it was $450,200 in 2010)

Total value for property: $790,400 (it was $677,500 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $525,200 (it was $330,200 in 2010)

Current total net taxable: $790,400 (it was $557,500 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $447,900 (it was $442,500 in 2010)

Previous year total value: $691,500 (it was $694,200 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $447,900 (it was $322,500 in 2010)

Previous total net taxable: $691,500 (it was $574,200 in 2010)

Land class: Residential

Assessments for tax year: 2014

1487 Hiikala Place #26

Honolulu, HI

Find on map >>

1st Fee Owner: MELANIE B YAMAUCHI

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $570,500 (it was $483,300 in 2010)

Total value for property: $835,700 (it was $710,600 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $570,500 (it was $483,300 in 2010)

Current total net taxable: $835,700 (it was $710,600 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $483,300 (it was $495,700 in 2010)

Previous year total value: $726,900 (it was $747,400 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $483,300 (it was $495,700 in 2010)

Previous total net taxable: $726,900 (it was $747,400 in 2010)

Land class: Residential

Assessments for tax year: 2014

Honolulu, HI

Find on map >>

1st Fee Owner: MELANIE B YAMAUCHI

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $570,500 (it was $483,300 in 2010)

Total value for property: $835,700 (it was $710,600 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $570,500 (it was $483,300 in 2010)

Current total net taxable: $835,700 (it was $710,600 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $483,300 (it was $495,700 in 2010)

Previous year total value: $726,900 (it was $747,400 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $483,300 (it was $495,700 in 2010)

Previous total net taxable: $726,900 (it was $747,400 in 2010)

Land class: Residential

Assessments for tax year: 2014

1487 Hiikala Place #27

Honolulu, HI

Find on map >>

1st Fee Owner: ERNEST W JR/INGRID SCHEERER

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $525,200 (it was $450,200 in 2010)

Total value for property: $790,400 (it was $677,500 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $405,200 (it was $330,200 in 2010)

Current total net taxable: $670,400 (it was $557,500 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $447,900 (it was $442,500 in 2010)

Previous year total value: $691,500 (it was $694,200 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $327,900 (it was $322,500 in 2010)

Previous total net taxable: $571,500 (it was $574,200 in 2010)

Land class: Residential

Assessments for tax year: 2014

Honolulu, HI

Find on map >>

1st Fee Owner: ERNEST W JR/INGRID SCHEERER

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $525,200 (it was $450,200 in 2010)

Total value for property: $790,400 (it was $677,500 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $405,200 (it was $330,200 in 2010)

Current total net taxable: $670,400 (it was $557,500 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $447,900 (it was $442,500 in 2010)

Previous year total value: $691,500 (it was $694,200 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $327,900 (it was $322,500 in 2010)

Previous total net taxable: $571,500 (it was $574,200 in 2010)

Land class: Residential

Assessments for tax year: 2014

1487 Hiikala Place #28

Honolulu, HI

Find on map >>

1st Fee Owner: RICHARD S/ANITA M SHERMAN

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $419,000 (it was $396,200 in 2010)

Total value for property: $684,200 (it was $623,500 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $299,000 (it was $316,200 in 2010)

Current total net taxable: $564,200 (it was $543,500 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $358,900 (it was $329,100 in 2010)

Previous year total value: $602,500 (it was $580,800 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $278,900 (it was $249,100 in 2010)

Previous total net taxable: $522,500 (it was $500,800 in 2010)

Land class: Residential

Assessments for tax year: 2014

Honolulu, HI

Find on map >>

1st Fee Owner: RICHARD S/ANITA M SHERMAN

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $419,000 (it was $396,200 in 2010)

Total value for property: $684,200 (it was $623,500 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $299,000 (it was $316,200 in 2010)

Current total net taxable: $564,200 (it was $543,500 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $358,900 (it was $329,100 in 2010)

Previous year total value: $602,500 (it was $580,800 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $278,900 (it was $249,100 in 2010)

Previous total net taxable: $522,500 (it was $500,800 in 2010)

Land class: Residential

Assessments for tax year: 2014

1487 Hiikala Place #29

Honolulu, HI

Find on map >>

1st Fee Owner: THOMAS J MITRANO TR

2nd Fee Owner: LINDA B LETTA TR

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $525,200 (it was $450,200 in 2010)

Total value for property: $790,400 (it was $677,500 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $405,200 (it was $330,200 in 2010)

Current total net taxable: $670,400 (it was $557,500 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $447,900 (it was $442,500 in 2010)

Previous year total value: $691,500 (it was $694,200 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $327,900 (it was $362,500 in 2010)

Previous total net taxable: $571,500 (it was $614,200 in 2010)

Land class: Residential

Assessments for tax year: 2014

Honolulu, HI

Find on map >>

1st Fee Owner: THOMAS J MITRANO TR

2nd Fee Owner: LINDA B LETTA TR

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $525,200 (it was $450,200 in 2010)

Total value for property: $790,400 (it was $677,500 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $405,200 (it was $330,200 in 2010)

Current total net taxable: $670,400 (it was $557,500 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $447,900 (it was $442,500 in 2010)

Previous year total value: $691,500 (it was $694,200 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $327,900 (it was $362,500 in 2010)

Previous total net taxable: $571,500 (it was $614,200 in 2010)

Land class: Residential

Assessments for tax year: 2014

1487 Hiikala Place #30

Honolulu, HI

Find on map >>

1st Fee Owner: BARBARA A CAMPBELL TR

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $515,000 (it was $442,000 in 2010)

Total value for property: $780,200 (it was $669,300 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $435,000 (it was $362,000 in 2010)

Current total net taxable: $700,200 (it was $589,300 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $439,200 (it was $429,300 in 2010)

Previous year total value: $682,800 (it was $681,000 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $359,200 (it was $349,300 in 2010)

Previous total net taxable: $602,800 (it was $601,000 in 2010)

Land class: Residential

Assessments for tax year: 2014

Honolulu, HI

Find on map >>

1st Fee Owner: BARBARA A CAMPBELL TR

Current land market value: $265,200 (it was $227,300 in 2010)

Current building market value: $515,000 (it was $442,000 in 2010)

Total value for property: $780,200 (it was $669,300 in 2010)

Current land net taxable: $265,200 (it was $227,300 in 2010)

Current building net taxable: $435,000 (it was $362,000 in 2010)

Current total net taxable: $700,200 (it was $589,300 in 2010)

Previous year land market value: $243,600 (it was $251,700 in 2010)

Previous year building market value: $439,200 (it was $429,300 in 2010)

Previous year total value: $682,800 (it was $681,000 in 2010)

Previous year land net taxable: $243,600 (it was $251,700 in 2010)

Previous year building net taxable: $359,200 (it was $349,300 in 2010)

Previous total net taxable: $602,800 (it was $601,000 in 2010)

Land class: Residential

Assessments for tax year: 2014

Other nearby streets: Hiikala Place (1)  Hiikala Place (2)

Hiikala Place (2)  Oili Loop

Oili Loop  Wahinekoa Place (1)

Wahinekoa Place (1)  Wahinekoa Place (2)

Wahinekoa Place (2)

Recent posts about Honolulu, Hawaii on our local forum with over 2,400,000 registered users. Honolulu is mentioned 12,095 times on our forum: