Asheville, North Carolina

Asheville: Biltmore House, Asheville, NC

Asheville: Downtown Asheville

Asheville: Asheville NC

Asheville: Rear of Biltmore House from the carriage ride trails.

Asheville: North Carolina Aboretum near Asheville

Asheville: Statues Outside Bldg Downtown

Asheville: Sunset over Asheville, NC

Asheville: Downtown Asheville

Asheville: Another Statue Downtown

Asheville: Women Outside Malaprop's Bookstore

Asheville: Biltmore House, Asheville, NC

- see

74

more - add

your

Submit your own pictures of this city and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +36.1%

| Males: 44,331 | |

| Females: 49,445 |

| Median resident age: | 42.2 years |

| North Carolina median age: | 39.2 years |

Zip codes: 28704, 28715, 28732, 28801, 28803, 28804, 28805, 28806.

Asheville Zip Code Map| Asheville: | $64,548 |

| NC: | $67,481 |

Estimated per capita income in 2022: $41,343 (it was $20,024 in 2000)

Asheville city income, earnings, and wages data

Estimated median house or condo value in 2022: $410,200 (it was $105,200 in 2000)

| Asheville: | $410,200 |

| NC: | $280,600 |

Mean prices in 2022: all housing units: $525,618; detached houses: $534,711; townhouses or other attached units: $325,800; in 2-unit structures: $576,220; in 3-to-4-unit structures: $505,131; in 5-or-more-unit structures: $914,664; mobile homes: $66,554

Median gross rent in 2022: $1,290.

(11.2% for White Non-Hispanic residents, 28.3% for Black residents, 23.7% for Hispanic or Latino residents, 1.9% for American Indian residents, 13.9% for Native Hawaiian and other Pacific Islander residents, 28.2% for other race residents, 15.9% for two or more races residents)

Detailed information about poverty and poor residents in Asheville, NC

- 73,84377.6%White alone

- 9,0829.5%Black alone

- 6,1636.5%Hispanic

- 3,1563.3%Two or more races

- 1,3141.4%Asian alone

- 6160.6%Other race alone

- 3770.4%Native Hawaiian and Other

Pacific Islander alone - 2180.2%American Indian alone

Races in Asheville detailed stats: ancestries, foreign born residents, place of birth

According to our research of North Carolina and other state lists, there were 237 registered sex offenders living in Asheville, North Carolina as of April 25, 2024.

The ratio of all residents to sex offenders in Asheville is 377 to 1.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is about the same as the state average.- means the value is bigger than the state average.

- means the value is much bigger than the state average.

Crime rate in Asheville detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 211 (162 officers - 133 male; 29 female).

| Officers per 1,000 residents here: | 1.73 |

| North Carolina average: | 2.27 |

| Am I the only one who doesn't love Asheville? (79 replies) |

| 1 out of 86 Asheville residents are gang members? (59 replies) |

| The Hyping of Asheville for Financial Gain (22 replies) |

| Relocating to Asheville from Florida (63 replies) |

| Asheville, North Carolina: Restaurants (64 replies) |

| A Chicagoans take on Asheville. (83 replies) |

Latest news from Asheville, NC collected exclusively by city-data.com from local newspapers, TV, and radio stations

Asheville, NC City Guides:

Ancestries: English (27.7%), American (6.5%), German (5.5%), Irish (4.9%), Scotch-Irish (3.2%), European (2.9%).

Current Local Time: EST time zone

Incorporated in 1797

Elevation: 2134 feet

Land area: 40.9 square miles.

Population density: 2,292 people per square mile (low).

7,551 residents are foreign born (3.4% Latin America, 2.2% Europe, 1.6% Asia).

| This city: | 7.9% |

| North Carolina: | 8.3% |

Median real estate property taxes paid for housing units with mortgages in 2022: $2,938 (0.7%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $2,739 (0.7%)

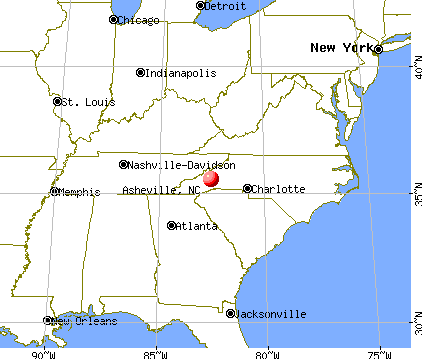

Nearest city with pop. 200,000+: Charlotte, NC (100.7 miles

, pop. 540,828).

Nearest city with pop. 1,000,000+: Philadelphia, PA (507.1 miles

, pop. 1,517,550).

Nearest cities:

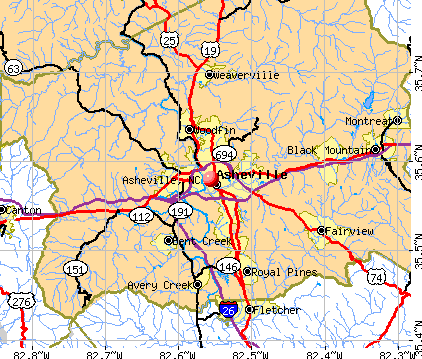

Latitude: 35.58 N, Longitude: 82.56 W

Daytime population change due to commuting: +53,989 (+57.6%)

Workers who live and work in this city: 39,668 (83.2%)

Area code: 828

Asheville tourist attractions:

- Asheville Mall - Asheville, NC - One of the Largest Barnes & Noble's Bookstores and 110+ Stores

- Biltmore Square Mall - Asheville, NC - 52+ Stores and Innovative Movie Theater

- Natural Wonders like Chimney Rock (NC) Abound near Asheville in Western North Carolina

- Hotel Indigo Asheville Downtown

- Residence Inn Asheville Biltmore

- The Biltmore Estate in Asheville, North Carolina is the Country's Grandest Estate

- The North Carolina Arboretum is a Treat for all the Senses

- Grove Park Inn Spa in North Carolina a Lovely Place to Relax

- Sliding Rock in Asheville, NC Offers Lots of Family Fun

- Renaissance Asheville Hotel - Asheville, North Carolina - A Prime Downtown Hotel with Upscale Service

- Haywood Park Hotel - Asheville, North Carolina - A State of the Art Hotel with Southern Hospitality and Charm

- Grand Bohemian Hotel - Asheville, North Carolina - Old World Charm With Today's Technological Convenience

- The Grove Park Inn Resort & Spa - Asheville, North Carolina - Where Exquisite Taste Meets Mountain Air

- The Inn on Biltmore Estate - Asheville, North Carolina - The Home of History and Never-ending Luxury

- Biltmore Village - Asheville, North Carolina - One of the Most Unique Shopping Districts in the South

- Pack Square - Asheville, North Carolina - A Beautiful Park in the Making

- River Arts District - Asheville, North Carolina - Asheville's Answer To New York City's Soho

- The Health Adventure - Asheville, North Carolina - Experiential Learning for Kids All Ages

- Doubletree Hotel Biltmore - Asheville, North Carolina - Prime Location and Vacation Hub

- The Residences at Biltmore - Asheville, North Carolina - Luxury Condominium Rentals

- Western North Carolina Nature Center - Asheville, North Carolina - small public zoo and nature center

Single-family new house construction building permits:

- 2022: 390 buildings, average cost: $200,100

- 2021: 453 buildings, average cost: $200,100

- 2020: 397 buildings, average cost: $200,100

- 2019: 343 buildings, average cost: $200,100

- 2018: 334 buildings, average cost: $200,100

- 2017: 319 buildings, average cost: $200,100

- 2016: 289 buildings, average cost: $200,100

- 2015: 270 buildings, average cost: $200,000

- 2014: 252 buildings, average cost: $200,400

- 2013: 235 buildings, average cost: $198,500

- 2012: 202 buildings, average cost: $193,900

- 2011: 164 buildings, average cost: $205,800

- 2010: 238 buildings, average cost: $164,200

- 2009: 177 buildings, average cost: $184,600

- 2008: 344 buildings, average cost: $196,500

- 2007: 356 buildings, average cost: $184,600

- 2006: 458 buildings, average cost: $170,500

- 2005: 321 buildings, average cost: $166,900

- 2004: 367 buildings, average cost: $158,300

- 2003: 230 buildings, average cost: $134,800

- 2002: 208 buildings, average cost: $134,800

- 2001: 199 buildings, average cost: $131,100

- 2000: 163 buildings, average cost: $120,900

- 1999: 175 buildings, average cost: $126,300

- 1998: 312 buildings, average cost: $96,800

- 1997: 151 buildings, average cost: $98,800

| Here: | 2.6% |

| North Carolina: | 3.2% |

Population change in the 1990s: +2,461 (+3.7%).

- Health care (13.0%)

- Accommodation & food services (9.8%)

- Educational services (9.1%)

- Construction (6.6%)

- Professional, scientific, technical services (5.0%)

- Administrative & support & waste management services (3.3%)

- Public administration (3.0%)

- Construction (12.1%)

- Accommodation & food services (8.9%)

- Health care (6.7%)

- Professional, scientific, technical services (5.9%)

- Educational services (5.7%)

- Administrative & support & waste management services (3.7%)

- Arts, entertainment, recreation (3.1%)

- Health care (19.5%)

- Educational services (12.6%)

- Accommodation & food services (10.8%)

- Professional, scientific, technical services (4.2%)

- Public administration (3.4%)

- Social assistance (3.1%)

- Administrative & support & waste management services (2.8%)

- Cooks and food preparation workers (8.3%)

- Other management occupations, except farmers and farm managers (6.5%)

- Building and grounds cleaning and maintenance occupations (4.3%)

- Registered nurses (3.4%)

- Waiters and waitresses (3.2%)

- Counselors, social workers, and other community and social service specialists (3.0%)

- Retail sales workers, except cashiers (2.4%)

- Cooks and food preparation workers (8.0%)

- Other management occupations, except farmers and farm managers (6.3%)

- Building and grounds cleaning and maintenance occupations (5.3%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (3.5%)

- Other production occupations, including supervisors (3.0%)

- Computer specialists (2.7%)

- Retail sales workers, except cashiers (2.7%)

- Cooks and food preparation workers (8.4%)

- Other management occupations, except farmers and farm managers (6.7%)

- Registered nurses (5.8%)

- Waiters and waitresses (4.5%)

- Counselors, social workers, and other community and social service specialists (4.3%)

- Other office and administrative support workers, including supervisors (3.8%)

- Building and grounds cleaning and maintenance occupations (3.4%)

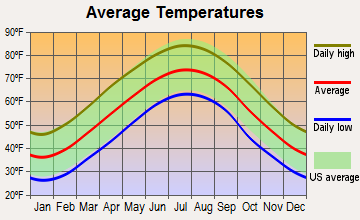

Average climate in Asheville, North Carolina

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2023 was 72.6. This is about average.

| City: | 72.6 |

| U.S.: | 72.6 |

Ozone [ppb] level in 2022 was 26.8. This is better than average. Closest monitor was 1.4 miles away from the city center.

| City: | 26.8 |

| U.S.: | 33.3 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 6.01. This is better than average. Closest monitor was 2.4 miles away from the city center.

| City: | 6.01 |

| U.S.: | 8.11 |

Tornado activity:

Asheville-area historical tornado activity is below North Carolina state average. It is 40% smaller than the overall U.S. average.

On 5/5/1989, a category F4 (max. wind speeds 207-260 mph) tornado 47.3 miles away from the Asheville city center killed 2 people and injured 35 people and caused between $500,000 and $5,000,000 in damages.

On 5/5/1989, a category F4 tornado 55.5 miles away from the city center killed 4 people and injured 52 people and caused between $5,000,000 and $50,000,000 in damages.

Earthquake activity:

Asheville-area historical earthquake activity is significantly above North Carolina state average. It is 29% greater than the overall U.S. average.On 8/9/2020 at 12:07:37, a magnitude 5.1 (5.1 MW, Depth: 4.7 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 102.6 miles away from the city center

On 8/2/1974 at 08:52:09, a magnitude 4.9 (4.3 MB, 4.9 LG, Class: Light, Intensity: IV - V) earthquake occurred 118.2 miles away from Asheville center

On 11/30/1973 at 07:48:41, a magnitude 4.7 (4.7 MB, 4.6 ML) earthquake occurred 80.4 miles away from the city center

On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi) earthquake occurred 302.5 miles away from the city center

On 7/27/1980 at 18:52:21, a magnitude 5.2 (5.1 MB, 4.7 MS, 5.0 UK, 5.2 UK) earthquake occurred 197.1 miles away from Asheville center

On 4/29/2003 at 08:59:39, a magnitude 4.9 (4.4 MB, 4.6 MW, 4.9 LG) earthquake occurred 189.5 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Buncombe County (11) is smaller than the US average (15).Major Disasters (Presidential) Declared: 8

Emergencies Declared: 2

Causes of natural disasters: Floods: 4, Hurricanes: 3, Storms: 3, Winter Storms: 2, Blizzard: 1, Landslide: 1, Mudslide: 1, Snowfall: 1, Tropical Storm: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: INGLES MARKETS INC (RETAIL-GROCERY STORES).

Hospitals in Asheville:

- ASHEVILLE SPECIALTY HOSPITAL (428 BILTMORE AVENUE 4TH FLOOR)

- ASHEVILLE-OTEEN VA MEDICAL CENTER (Government Federal, provides emergency services, 1100 TUNNEL ROAD)

- CHILES AVENUE GROUP HOME (22 CHILES AVENUE)

- HIGHLAND HOSP (provides emergency services, 49 ZILLICOA ST)

- IWRC-DOGWOOD (2 ROSE STREET)

- MONTFORD GROUP HOME (406 MONTFORD AVE)

- MOUNTAIN AREA HOSPICE, INC (21 BELVEDERE ROAD)

- ORA STREET GROUP HOME (95 ORA STREET)

- PISGAH GROUP HOME (28 PISGAHVIEW AVENUE)

- THOMS REHABILITATION HOSP (68 SWEETEN CREEK RD)

- WNC GROUP HOME-KENMORE (1 KENMORE STREET)

Airports and heliports located in Asheville:

- Asheville Regional Airport (AVL) (Runways: 1, Commercial Ops: 6,193, Air Taxi Ops: 10,874, Itinerant Ops: 27,864, Local Ops: 20,483, Military Ops: 2,889)

- Six Oaks Airport (NC67) (Runways: 1)

- Mission Hospitals Heliport (NC95)

Colleges/Universities in Asheville:

- Asheville-Buncombe Technical Community College (Full-time enrollment: 6,992; Location: 340 Victoria Rd; Public; Website: www.abtech.edu)

- University of North Carolina at Asheville (Full-time enrollment: 3,312; Location: One University Hts; Public; Website: www.unca.edu; Offers Master's degree)

- South College-Asheville (Full-time enrollment: 295; Location: 140 Sweeten Creek Road; Private, for-profit; Website: www.southcollegenc.edu)

- Daoist Traditions College of Chinese Medical Arts (Full-time enrollment: 150; Location: 382 Montford Ave; Private, for-profit; Website: daoisttraditions.edu; Offers Master's degree)

- Carolina College of Hair Design (Full-time enrollment: 87; Location: 85 Tunnel Road; Private, for-profit; Website: carolinacollege.com/)

- Center for Massage & Natural Health (Full-time enrollment: 42; Location: 16 Eagle Street, Suite 100; Private, for-profit; Website: centerformassage.com)

Other colleges/universities with over 2000 students near Asheville:

- North Greenville University (about 37 miles; Tigerville, SC; Full-time enrollment: 2,341)

- Western Carolina University (about 39 miles; Cullowhee, NC; FT enrollment: 8,684)

- Isothermal Community College (about 40 miles; Spindale, NC; FT enrollment: 2,165)

- Tusculum College (about 43 miles; Greeneville, TN; FT enrollment: 2,070)

- Furman University (about 47 miles; Greenville, SC; FT enrollment: 2,988)

- Western Piedmont Community College (about 50 miles; Morganton, NC; FT enrollment: 2,205)

- Bob Jones University (about 51 miles; Greenville, SC; FT enrollment: 3,308)

Biggest public high schools in Asheville:

- ASHEVILLE HIGH (Location: 419 MCDOWELL STREET, Grades: 9-12)

- SCHOOL OF INQUIRY AND LIFE SCIENCES (Location: 419 MCDOWELL STREET, Grades: 9-12)

- THE FRANKLIN SCHOOL OF INNOVATION (Location: 104 PEACHTREE ROAD, Grades: 6-9, Charter school)

- INVEST COLLEGIATE - IMAGINE (Location: 1000 BREVARD ROAD, STE. 175, Grades: KG-10, Charter school)

- REYNOLDS HIGH (Location: 1 ROCKET DRIVE, Grades: 9-12)

- ERWIN HIGH (Location: 60 LEES CREEK ROAD, Grades: 9-12)

- ROBERSON HIGH (Location: 250 OVERLOOK ROAD, Grades: 9-12)

- EARLY COLLEGE (Location: 340 VICTORIA ROAD, Grades: 9-12)

- MIDDLE COLLEGE (Location: 340 VICTORIA ROAD, Grades: 11-12)

- NESBITT DISCOVERY ACADEMY (Location: 175 BINGHAM RD STE 10, Grades: 9)

Private high schools in Asheville:

- CAROLINA DAY SCHOOL (Students: 654, Location: 1345 HENDERSONVILLE RD, Grades: PK-12)

- ASHEVILLE SCHOOL (Students: 275, Location: 360 ASHEVILLE SCHOOL RD, Grades: 9-12)

- NORTH ASHEVILLE CHRISTIAN SCHOOL (Students: 145, Location: 20 REYNOLDS MOUNTAIN BLVD, Grades: PK-12)

- CAROLINA CHRISTIAN SCHOOL (Students: 129, Location: 48 WOODLAND HILLS RD, Grades: PK-12)

- ODYSSEY COMMUNITY SCHOOL (Students: 114, Location: 90 ZILLICOA ST, Grades: PK-12)

- TEMPLE BAPTIST SCHOOL (Students: 111, Location: 985 1/2 PATTON AVE, Grades: PK-12)

- ADONAI CHRISTIAN ACADEMY (Students: 33, Location: 119 CUMBERLAND AVE, Grades: KG-12)

- ELIADA ACADEMY (Students: 29, Location: 2 COMPTON DR, Grades: UG-12)

Biggest public elementary/middle schools in Asheville:

- FRANCINE DELANY NEW SCHOOL (Location: 119 BREVARD ROAD, Grades: KG-8, Charter school)

- EVERGREEN COMMUNITY CHARTER (Location: 50 BELL ROAD, Grades: KG-8, Charter school)

- HALL FLETCHER ELEMENTARY (Location: 60 RIDGELAWN AVENUE, Grades: KG-5)

- CLAXTON ELEMENTARY (Location: 241 MERRIMON AVENUE, Grades: KG-5)

- IRA B JONES ELEMENTARY (Location: 544 KIMBERLY AVENUE, Grades: KG-5)

- ASHEVILLE MIDDLE (Location: 197 S FRENCH BROAD AVENUE, Grades: 6-8)

- VANCE ELEMENTARY (Location: 98 SULPHUR SPRINGS ROAD, Grades: KG-5)

- ISAAC DICKSON ELEMENTARY (Location: 90 MONTFORD AVE., Grades: KG-5)

- REYNOLDS MIDDLE (Location: 2 ROCKET DRIVE, Grades: 6-8)

- BELL ELEMENTARY (Location: 90 MAPLE SPRINGS ROAD, Grades: KG-5)

Private elementary/middle schools in Asheville:

- EMMANUEL LUTHERAN SCHOOL (Students: 244, Location: 51 WILBURN PL, Grades: PK-8)

- ASHEVILLE CATHOLIC SCHOOL (Students: 200, Location: 12 CULVERN ST, Grades: PK-8)

- NAZARENE CHRISTIAN SCHOOL (Students: 71, Location: 385 HAZEL MILL RD, Grades: PK-8)

- HANGER HALL SCHOOL (Students: 67, Location: 30 BEN LIPPEN SCHOOL RD STE 207, Grades: 6-8, Girls only)

- NEW CITY CHRISTIAN SCHOOL (Students: 45, Location: 56 WALTON ST, Grades: KG-4)

- FRENCH BROAD RIVER ACADEMY (Students: 33, Location: 191 LYMAN STREET STUDIO 316, Grades: 6-8, Boys only)

Library in Asheville:

User-submitted facts and corrections:

- Eileen Fulton - actress was born in Asheville in 1933. She has played Lisa on "As the World Turns" (CBS-TV) since 1960.

- medical center around Asheville: Family Care IMS (about 17 miles; BLACK MOUNTAIN, NC) http://www.familycaremed.com please link to our site

- include Warren Wilson College (www.warren-wilson.edu/main)in the list of colleges and universities in Asheville.

- Montessori Learning Center of Asheville 1 School Rd. Asheville NC 28806- 828-259-9880 Fax: 828-259-9880 montessori-learningcenter.org Affiliation(s): PAMS Class Level(s): Toddler 3-6

- Warren Wilson college in Swannanoa Montreat College in Black Mountain

Points of interest:

Notable locations in Asheville: Fairview (A), Country Club of Asheville (B), Grace Plaza (C), River Ridge Market Place (D), Parkway Plaza (E), Eliada Plaza (F), Biltmore Square (G), Biltmore Forest Center (H), Arden Plaza (I), Municipal Golf Course (J), Great Smokies Hilton (K), Beaver Lake Golf Course (L), Buncombe County Courthouse (M), CarePartners Rehabilitation Hospital (N), Asheville Surgery Center (O). Display/hide their locations on the map

Shopping Centers: Northland Shopping Center (1), Westgate Regional Shopping Center (2), Innsbruck Mall (3), Eastvale Shopping Center (4), Asheville Mall (5), Town and Country Shopping Center (6). Display/hide their locations on the map

Main business address in Asheville: INGLES MARKETS INC (A). Display/hide its location on the map

Churches in Asheville include: New Salem Church (A), Azalea Church (B), Midway Church (C), Beaverdam Church (D), Harmony Hill Church (E), Grace Church (F), Fairmount Church (G), Deaver View Church (H), Cedar Hill Church (I). Display/hide their locations on the map

Cemeteries: Green Hills Cemetery (1), Lewis Memorial Cemetery (2), Harkins Cemetery (3), Old Academy Cemetery (4), Woodlawn Cemetery (5), West Chapel Cemetery (6), Sunset Cemetery (7). Display/hide their locations on the map

Reservoirs: Lake Ashnoca (A), Asheville Recreation Park Lake (B), Lake Kenilworth (C), White Flawn Reservoir (D), Kenilworth Lake (E), Beaver Lake (F). Display/hide their locations on the map

Streams, rivers, and creeks: Rhododendron Creek (A), Haw Creek (B), Grassy Branch (C), Gashes Creek (D), Swannanoa River (E), Boring Mill Branch (F), Bent Creek (G), Buttermilk Creek (H), Moore Branch (I). Display/hide their locations on the map

Parks in Asheville include: Rhododendron Park (1), Memorial Stadium (2), Malvern Hills Park (3), Richmond Hill Park (4), Walton Street Park (5), Murry Hill Park (6), Patton Avenue Park (7), Montford Park (8), Weaver Park (9). Display/hide their locations on the map

Tourist attractions: Asheville Art Museum (2 South Pack Square) (1), Friends of WNC Nature Center (Museums; 75 Gashes Creek Road) (2), Estes-Winn Memorial Automobile Museum (111 Grovewood Road) (3), Colburn Gem & Mineral Museum (2 South Pack Square) (4), Grovewood Gallery (Museums; 111 Grovewood Road) (5), Health Adventure (Museums; 2 South Pack Square) (6), Black Mountain College Museum & Art Center (56 Broadway Street) (7), Ad Lib (Cultural Attractions- Events- & Facilities; 40 Biltmore Avenue) (8), U S Government - Appalachian Highlands Inventory & Monitoring Networ- Interior Depart (Recreation Areas; 67 Ranger Drive) (9). Display/hide their approximate locations on the map

Hotels: Haywood Park Hotel & Promenade (1 Battery Park Avenue) (1), Holiday Inn Asheville-Biltmore East (1450 Tunnel Road) (2), Carolina Insulation (14 Chapel Hill Road) (3), Days Inn (201 Tunnel Road) (4), Comfort Inn West (15 Crowell Road) (5), Asheville-Days Inn East (1500 Tunnel Rd) (6), Days Inn Biltmore East (1435 Tunnel Road) (7), Hampton Inn Asheville-I-26 Biltmore Squa (1 Rocky Ridge Road) (8), Haywood Park Hotel (1 Battery Park Ave) (9). Display/hide their approximate locations on the map

Courts: U S Government - U S District Court-Asheville- Bankruptcy Clerk (100 Otis Street) (1), North Carolina State Government - General Courts Of Justice- Clerk Of Superior Court- Of (60 Court Plaza) (2), Courts - Federal - Clerk's Office Information- District Courts- District C (100 Otis Street) (3), Federal Bureau of Investigation (151 Patton Avenue) (4). Display/hide their approximate locations on the map

Birthplace of: Thomas Wolfe - Writer, Warren Haynes - Rock guitarist, Karl Anderson - Professional wrestler, Henry Russell Sanders - College football coach, Joseph Tydings - Politician, Franklin Graham - Christian minister, Angela Shelton - Documentary filmmaker, Erin O'Kelley - Beauty pageant winner, Bellamy Young - Artist, Bill Hendon - Politician.

Drinking water stations with addresses in Asheville and their reported violations in the past:

ASHEVILLE CITY OF (Population served: 124,300, Surface water):Past monitoring violations:BILTMORE FOREST, TOWN OF (Population served: 1,356, Purch surface water):

- Monitoring of Treatment (SWTR-Filter) - In JAN-2014. Follow-up actions: St Compliance achieved (FEB-01-2014), St Public Notif requested (MAR-11-2014), St Formal NOV issued (MAR-11-2014), St AO (w/o penalty) issued (MAR-11-2014), St Public Notif received (APR-04-2014)

- Failure Submit IDSE/Subpart V Plan Rpt - In JAN-02-2009, Contaminant: DBP STAGE 2. Follow-up actions: St Compliance achieved (APR-16-2009)

Past monitoring violations:ROCKY KNOB MAIN AREA (Serves VA, Population served: 250, Groundwater):

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2009, Contaminant: Lead and Copper Rule. Follow-up actions: St Formal NOV issued (MAY-04-2010), St Public Notif requested (MAY-04-2010), St Public Notif received (MAY-19-2010), St AO (w/penalty) issued (OCT-27-2010), St Case dropped (NOV-22-2010), St Compliance achieved (JUL-18-2012)

- Failure Submit IDSE/Subpart V Plan Rpt - In JAN-02-2009, Contaminant: DBP STAGE 2. Follow-up actions: St Compliance achieved (JUL-02-2009)

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2006, Contaminant: Lead and Copper Rule. Follow-up actions: St Formal NOV issued (JAN-18-2007), St Public Notif requested (JAN-18-2007), St Public Notif received (FEB-26-2007), St Compliance achieved (AUG-01-2007)

Past monitoring violations:LINVILLE FALLS VISITORS CENTER (Population served: 250, Groundwater):

- One minor monitoring violation

Past monitoring violations:BUFFALO MOUNTAIN (Population served: 187, Groundwater):

- 2 regular monitoring violations

Past monitoring violations:COUNTRY PLACE S/D (Population served: 160, Groundwater):

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2008, Contaminant: Lead and Copper Rule. Follow-up actions: St Formal NOV issued (MAY-04-2009), St Public Notif requested (MAY-04-2009), St Public Notif received (JUN-03-2009), St AO (w/penalty) issued (AUG-13-2009), St Compliance achieved (DEC-10-2009)

- Monitoring and Reporting (DBP) - Between JAN-2008 and DEC-2008, Contaminant: TTHM. Follow-up actions: St Public Notif requested (MAR-12-2009), St Formal NOV issued (MAR-12-2009), St AO (w/penalty) issued (APR-02-2009), St Public Notif received (JUN-25-2009), St Compliance achieved (APR-29-2010)

- Monitoring and Reporting (DBP) - Between JAN-2008 and DEC-2008, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Public Notif requested (MAR-12-2009), St Formal NOV issued (MAR-12-2009), St AO (w/penalty) issued (APR-02-2009), St Public Notif received (JUN-25-2009), St Compliance achieved (APR-29-2010)

- Monitoring and Reporting (DBP) - Between JAN-2007 and DEC-2007, Contaminant: TTHM. Follow-up actions: St Formal NOV issued (2 times from MAY-23-2008 to MAY-23-2008), St Public Notif requested (2 times from MAY-23-2008 to MAY-23-2008), St AO (w/penalty) issued (JUN-13-2008), St Compliance achieved (APR-29-2010)

- Monitoring and Reporting (DBP) - Between JAN-2007 and DEC-2007, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Formal NOV issued (2 times from MAY-23-2008 to MAY-23-2008), St Public Notif requested (2 times from MAY-23-2008 to MAY-23-2008), St AO (w/penalty) issued (JUN-13-2008), St Compliance achieved (APR-29-2010)

- 60 regular monitoring violations

- 3 other older monitoring violations

Past monitoring violations:USFS-BADIN LAKE CAMPGROUND (Address: US FOREST SERVICE - ASHEVILLE , Population served: 100, Groundwater):

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2005, Contaminant: Lead and Copper Rule. Follow-up actions: St Formal NOV issued (JUN-28-2006), St Public Notif requested (JUN-28-2006), St Compliance achieved (SEP-29-2009)

Past health violations:MARKET CENTER EXPRESS (Address: MARKET CENTER EXPRESS, INC , Population served: 100, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - Between OCT-2011 and DEC-2011, Contaminant: Coliform. Follow-up actions: St Public Notif received (OCT-08-2011), St Public Notif requested (OCT-10-2011), St Formal NOV issued (OCT-10-2011), St AO (w/o penalty) issued (OCT-10-2011), St Compliance achieved (MAR-31-2012)

- One routine major monitoring violation

Past health violations:Past monitoring violations:

- MCL, Monthly (TCR) - Between APR-2012 and JUN-2012, Contaminant: Coliform. Follow-up actions: St Public Notif requested (JUN-18-2012), St Formal NOV issued (JUN-18-2012), St AO (w/o penalty) issued (JUN-18-2012), St Public Notif received (JUN-19-2012), St Compliance achieved (SEP-30-2012)

- One routine major monitoring violation

Drinking water stations with addresses in Asheville that have no violations reported:

- MABRY MILL NO. 1 (Serves VA, Population served: 600, Primary Water Source Type: Groundwater)

- WESTRIDGE OUTDOOR RESORTS (Population served: 400, Primary Water Source Type: Groundwater)

- ROCKY KNOB PICNIC AREA (Serves VA, Population served: 250, Primary Water Source Type: Groundwater)

- LINVILLE FALLS CAMPGROUND (Population served: 250, Primary Water Source Type: Groundwater)

- GILLESPIE GAP MAINTENANCE (Population served: 250, Primary Water Source Type: Groundwater)

- NORTHWEST TRADING POST (Population served: 200, Primary Water Source Type: Groundwater)

- ROAN MOUNTAIN (Address: US FOREST SERVICE - ASHEVILLE , Population served: 75, Primary Water Source Type: Groundwater)

- KINGS MOUTAIN REC AREA (Address: US FOREST SERVICE - ASHEVILLE , Population served: 50, Primary Water Source Type: Groundwater)

- FRENCH BROAD RIVER CAMPGROUND (Population served: 50, Primary Water Source Type: Groundwater)

- BEAR LAKE RESERVE GOLDEN FARMS (Population served: 46, Primary Water Source Type: Groundwater)

| This city: | 2.1 people |

| North Carolina: | 2.5 people |

| This city: | 49.4% |

| Whole state: | 66.7% |

| This city: | 8.6% |

| Whole state: | 5.9% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 1.1% of all households

- Gay men: 0.7% of all households

People in group quarters in Asheville in 2010:

- 1,141 people in college/university student housing

- 1,047 people in nursing facilities/skilled-nursing facilities

- 722 people in hospitals with patients who have no usual home elsewhere

- 446 people in local jails and other municipal confinement facilities

- 405 people in group homes intended for adults

- 186 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 160 people in other noninstitutional facilities

- 44 people in residential treatment centers for juveniles (non-correctional)

- 36 people in workers' group living quarters and job corps centers

- 29 people in residential treatment centers for adults

- 19 people in in-patient hospice facilities

- 14 people in group homes for juveniles (non-correctional)

People in group quarters in Asheville in 2000:

- 929 people in college dormitories (includes college quarters off campus)

- 743 people in nursing homes

- 598 people in other noninstitutional group quarters

- 457 people in local jails and other confinement facilities (including police lockups)

- 119 people in homes or halfway houses for drug/alcohol abuse

- 91 people in other group homes

- 90 people in other types of correctional institutions

- 71 people in homes for the mentally retarded

- 49 people in orthopedic wards and institutions for the physically handicapped

- 35 people in other nonhousehold living situations

- 12 people in hospitals/wards and hospices for chronically ill

- 12 people in hospices or homes for chronically ill

- 6 people in hospitals or wards for drug/alcohol abuse

- 6 people in unknown juvenile institutions

- 5 people in religious group quarters

Banks with most branches in Asheville (2011 data):

- Wells Fargo Bank, National Association: 8 branches. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- SunTrust Bank: 7 branches. Info updated 2010/05/27: Bank assets: $171,291.7 mil, Deposits: $129,833.2 mil, headquarters in Atlanta, GA, positive income, Commercial Lending Specialization, 1716 total offices, Holding Company: Suntrust Banks, Inc.

- First-Citizens Bank & Trust Company: 7 branches. Info updated 2011/10/11: Bank assets: $20,566.4 mil, Deposits: $17,596.8 mil, headquarters in Raleigh, NC, positive income, Commercial Lending Specialization, 433 total offices, Holding Company: First Citizens Bancshares, Inc.

- Asheville Savings Bank, S.S.B.: Reynolds Branch, Asheville Savings Bank, S.S.b., 778 Merimon Ave Branch, 1012 Patton Avenue Branch, 10 South Tunnel Road Branch, Skyland Branch. Info updated 2006/11/03: Bank assets: $785.8 mil, Deposits: $625.3 mil, local headquarters, positive income, 13 total offices, Holding Company: Asb Bancorp, Inc.

- Bank of America, National Association: Skyland Branch, West Asheville Branch, College Street Branch, North Asheville Branch, Biltmore Village Branch, Asheville Downtown. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Branch Banking and Trust Company: East Asheville Branch, Asheville Main Branch, Merrimon Avenue Branch, West Asheville Branch, South Asheville Branch. Info updated 2010/03/29: Bank assets: $168,867.6 mil, Deposits: $127,549.5 mil, headquarters in Winston Salem, NC, positive income, Commercial Lending Specialization, 1793 total offices, Holding Company: Bb&T Corporation

- HomeTrust Bank: Asheville Office Branch, Skyland Office Branch, Asheville Branch, Tunnel Road Branch. Info updated 2011/07/21: Bank assets: $1,578.5 mil, Deposits: $1,249.7 mil, headquarters in Clyde, NC, negative income in the last year, Mortgage Lending Specialization, 20 total offices

- TD Bank, National Association: Asheville Branch, Leicester Hwy Branch, Skyland Branch, Merrimon Avenue Branch. Info updated 2010/10/04: Bank assets: $188,912.6 mil, Deposits: $153,149.8 mil, headquarters in Wilmington, DE, positive income, 1314 total offices, Holding Company: Toronto-Dominion Bank, The

- First Bank: South Asheville, Leicester Branch, The Bank Of Asheville Branch, Reynolds Office Branch. Info updated 2011/01/25: Bank assets: $3,289.4 mil, Deposits: $2,759.1 mil, headquarters in Troy, NC, positive income, Commercial Lending Specialization, 98 total offices, Holding Company: First Bancorp

- 7 other banks with 13 local branches

For population 15 years and over in Asheville:

- Never married: 44.0%

- Now married: 36.9%

- Separated: 1.6%

- Widowed: 5.7%

- Divorced: 11.7%

For population 25 years and over in Asheville:

- High school or higher: 93.1%

- Bachelor's degree or higher: 54.3%

- Graduate or professional degree: 23.6%

- Unemployed: 6.1%

- Mean travel time to work (commute): 15.0 minutes

| Here: | 11.5 |

| North Carolina average: | 11.7 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Asheville:

(Asheville, North Carolina Neighborhood Map)- Adams Run neighborhood

- Angell, Donald Robby neighborhood

- Arbor Ridge neighborhood

- Asheville neighborhood

- Bartrams Walk neighborhood

- Bennington Oaks Aka Bilt. Oaks neighborhood

- Bennington Oaks Ii neighborhood

- Buckshot Ridge neighborhood

- Bull Creek Ranch Estates neighborhood

- Cedar Crest Heights neighborhood

- Chi Asheville neighborhood

- Crest Mountain neighborhood

- Dover, Charles Travis neighborhood

- Elk Mountain Preserve neighborhood

- Fender, Dean neighborhood

- Fox Trails neighborhood

- Glen Merrill neighborhood

- Hampton Parish neighborhood

- Leicester Village neighborhood

- Lower Grassy Creek neighborhood

- Magnolia Farms neighborhood

- Mount Carmel Commercial Center neighborhood

- Oak Hollow neighborhood

- Pinner's Ridge neighborhood

- Pisgah Property neighborhood

- Poplar Ridge neighborhood

- Ramble, The neighborhood

- Reynolds Mountain neighborhood

- Riceville Meadows neighborhood

- Rock Springs neighborhood

- Serenity Forest neighborhood

- Sharon Cove neighborhood

- Southside Estates neighborhood

- Teems Lane Townhomes neighborhood

- Trinity Baptist Church neighborhood

- Village Park neighborhood

- Village Park Townhomes neighborhood

- Webb Cove neighborhood

- Willow Oaks neighborhood

Religion statistics for Asheville, NC (based on Buncombe County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 82,696 | 245 |

| Mainline Protestant | 23,724 | 90 |

| Catholic | 8,832 | 5 |

| Other | 4,668 | 26 |

| Black Protestant | 2,019 | 13 |

| Orthodox | 444 | 3 |

| None | 115,753 | - |

Food Environment Statistics:

| Buncombe County: | 2.16 / 10,000 pop. |

| North Carolina: | 2.05 / 10,000 pop. |

| This county: | 0.04 / 10,000 pop. |

| State: | 0.14 / 10,000 pop. |

| Buncombe County: | 0.93 / 10,000 pop. |

| North Carolina: | 0.92 / 10,000 pop. |

| Buncombe County: | 4.90 / 10,000 pop. |

| State: | 4.75 / 10,000 pop. |

| Here: | 10.60 / 10,000 pop. |

| State: | 7.57 / 10,000 pop. |

| This county: | 8.7% |

| North Carolina: | 9.8% |

| Buncombe County: | 21.2% |

| North Carolina: | 28.3% |

| This county: | 15.3% |

| State: | 15.6% |

Health and Nutrition:

| Asheville: | 50.2% |

| North Carolina: | 48.9% |

| This city: | 47.1% |

| North Carolina: | 46.1% |

| Asheville: | 28.5 |

| North Carolina: | 28.8 |

| Asheville: | 20.3% |

| North Carolina: | 20.7% |

| This city: | 10.9% |

| State: | 10.7% |

| Asheville: | 6.9 |

| North Carolina: | 6.8 |

| Asheville: | 33.1% |

| North Carolina: | 33.7% |

| This city: | 56.0% |

| North Carolina: | 55.8% |

| Asheville: | 78.7% |

| North Carolina: | 79.7% |

More about Health and Nutrition of Asheville, NC Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Firefighters | 272 | $1,342,651 | $59,235 | 1 | $3,418 |

| Police Protection - Officers | 205 | $897,630 | $52,544 | 7 | $9,223 |

| Other and Unallocable | 114 | $506,954 | $53,364 | 60 | $148,708 |

| Water Supply | 63 | $267,539 | $50,960 | 2 | $1,920 |

| Parks and Recreation | 55 | $210,084 | $45,837 | 11 | $22,187 |

| Streets and Highways | 54 | $188,894 | $41,976 | 3 | $4,002 |

| Police - Other | 53 | $244,079 | $55,263 | 10 | $8,177 |

| Financial Administration | 51 | $292,509 | $68,826 | 1 | $2,059 |

| Sewerage | 39 | $139,078 | $42,793 | 0 | $0 |

| Transit | 34 | $148,897 | $52,552 | 0 | $0 |

| Solid Waste Management | 33 | $110,079 | $40,029 | 1 | $1,329 |

| Welfare | 30 | $140,717 | $56,287 | 1 | $605 |

| Other Government Administration | 18 | $118,941 | $79,294 | 1 | $1,628 |

| Judicial and Legal | 6 | $58,559 | $117,118 | 0 | $0 |

| Fire - Other | 3 | $13,630 | $54,520 | 0 | $0 |

| Health | 1 | $4,106 | $49,272 | 0 | $0 |

| Totals for Government | 1,031 | $4,684,347 | $54,522 | 98 | $203,257 |

Asheville government finances - Expenditure in 2021 (per resident):

- Construction - Regular Highways: $17,890,000 ($190.77)

Water Utilities: $10,831,000 ($115.50)

Parks and Recreation: $2,539,000 ($27.08)

General Public Buildings: $2,443,000 ($26.05)

Local Fire Protection: $1,078,000 ($11.50)

Sewerage: $273,000 ($2.91)

Parking Facilities: $221,000 ($2.36)

- Current Operations - Local Fire Protection: $28,796,000 ($307.07)

Liquor Stores: $28,714,000 ($306.20)

Police Protection: $27,615,000 ($294.48)

Water Utilities: $22,971,000 ($244.96)

Housing and Community Development: $15,370,000 ($163.90)

Transit Utilities: $14,536,000 ($155.01)

Parks and Recreation: $13,865,000 ($147.85)

Central Staff Services: $9,250,000 ($98.64)

General - Other: $8,310,000 ($88.62)

Regular Highways: $7,178,000 ($76.54)

Solid Waste Management: $5,558,000 ($59.27)

Sewerage: $5,351,000 ($57.06)

Financial Administration: $2,966,000 ($31.63)

Parking Facilities: $2,927,000 ($31.21)

General Public Buildings: $2,467,000 ($26.31)

Judicial and Legal Services: $1,102,000 ($11.75)

Health - Other: $281,000 ($3.00)

Natural Resources - Other: $3,000 ($0.03)

- General - Interest on Debt: $3,240,000 ($34.55)

- Intergovernmental to Local - Other - Police Protection: $923,000 ($9.84)

Other - Local Fire Protection: $225,000 ($2.40)

Other - Health - Other: $104,000 ($1.11)

- Other Capital Outlay - General - Other: $33,984,000 ($362.40)

Transit Utilities: $3,911,000 ($41.71)

General Public Building: $3,887,000 ($41.45)

Police Protection: $1,555,000 ($16.58)

Housing and Community Development: $1,475,000 ($15.73)

Parks and Recreation: $859,000 ($9.16)

Water Utilities: $568,000 ($6.06)

Solid Waste Management: $471,000 ($5.02)

Local Fire Protection: $447,000 ($4.77)

Regular Highways: $194,000 ($2.07)

Parking Facilities: $126,000 ($1.34)

Sewerage: $80,000 ($0.85)

- Total Salaries and Wages: $5,811,000 ($61.97)

- Water Utilities - Interest on Debt: $1,838,000 ($19.60)

Asheville government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $6,495,000 ($69.26)

Solid Waste Management: $5,525,000 ($58.92)

Parking Facilities: $4,160,000 ($44.36)

Miscellaneous Commercial Activities: $3,938,000 ($41.99)

Other: $3,860,000 ($41.16)

Regular Highways: $1,752,000 ($18.68)

Parks and Recreation: $1,087,000 ($11.59)

Natural Resources - Other: $32,000 ($0.34)

- Federal Intergovernmental - Transit Utilities: $9,035,000 ($96.35)

Housing and Community Development: $2,887,000 ($30.79)

Highways: $2,860,000 ($30.50)

Other: $2,198,000 ($23.44)

General Local Government Support: $287,000 ($3.06)

- Local Intergovernmental - Other: $2,070,000 ($22.07)

Highways: $1,718,000 ($18.32)

General Local Government Support: $871,000 ($9.29)

Public Welfare: $102,000 ($1.09)

Transit Utilities: $20,000 ($0.21)

Housing and Community Development: $4,000 ($0.04)

- Miscellaneous - Sale of Property: $3,944,000 ($42.06)

General Revenue - Other: $2,360,000 ($25.17)

Donations From Private Sources: $1,973,000 ($21.04)

Rents: $704,000 ($7.51)

Interest Earnings: $209,000 ($2.23)

Fines and Forfeits: $4,000 ($0.04)

- Revenue - Liquor Stores: $34,057,000 ($363.17)

Water Utilities: $33,366,000 ($355.81)

Transit Utilities: $35,000 ($0.37)

- State Intergovernmental - General Local Government Support: $8,914,000 ($95.06)

Highways: $2,358,000 ($25.15)

Other: $174,000 ($1.86)

Transit Utilities: $9,000 ($0.10)

- Tax - Property: $69,979,000 ($746.24)

General Sales and Gross Receipts: $31,406,000 ($334.90)

Motor Vehicle License: $6,639,000 ($70.80)

Alcoholic Beverage Sales: $3,698,000 ($39.43)

Occupation and Business License - Other: $798,000 ($8.51)

Other License: $23,000 ($0.25)

Asheville government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $129,751,000 ($1383.63)

Outstanding Unspecified Public Purpose: $125,042,000 ($1333.41)

Retired Unspecified Public Purpose: $8,223,000 ($87.69)

Issue, Unspecified Public Purpose: $3,514,000 ($37.47)

| Businesses in Asheville, NC | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| AMF Bowling | 1 | Lane Bryant | 1 | |

| AT&T | 5 | Lane Furniture | 2 | |

| Abercrombie & Fitch | 1 | LensCrafters | 2 | |

| Ace Hardware | 1 | Little Caesars Pizza | 3 | |

| Advance Auto Parts | 4 | Long John Silver's | 3 | |

| Aeropostale | 1 | Lowe's | 2 | |

| American Eagle Outfitters | 1 | Marriott | 6 | |

| Applebee's | 3 | MasterBrand Cabinets | 4 | |

| Arby's | 3 | Maurices | 1 | |

| Ashley Furniture | 1 | McDonald's | 11 | |

| Audi | 1 | Men's Wearhouse | 1 | |

| AutoZone | 2 | Motel 6 | 1 | |

| Banana Republic | 1 | Motherhood Maternity | 2 | |

| Barnes & Noble | 2 | New Balance | 6 | |

| Bath & Body Works | 2 | New York & Co | 1 | |

| Baymont Inn | 1 | Nike | 12 | |

| Bed Bath & Beyond | 1 | Nissan | 1 | |

| Best Western | 1 | Office Depot | 2 | |

| Blockbuster | 4 | OfficeMax | 1 | |

| Brooks Brothers | 1 | Old Navy | 1 | |

| Buffalo Wild Wings | 1 | Olive Garden | 1 | |

| Burger King | 5 | Outback | 1 | |

| CVS | 7 | Outback Steakhouse | 1 | |

| Casual Male XL | 1 | Pac Sun | 1 | |

| Catherines | 1 | Panda Express | 1 | |

| Charlotte Russe | 1 | Panera Bread | 1 | |

| Chevrolet | 1 | Papa John's Pizza | 2 | |

| Chick-Fil-A | 4 | Payless | 1 | |

| Chico's | 1 | Penske | 2 | |

| Chuck E. Cheese's | 1 | PetSmart | 1 | |

| Cold Stone Creamery | 2 | Pier 1 Imports | 1 | |

| Coldwater Creek | 1 | Pizza Hut | 8 | |

| Comfort Inn | 1 | Plato's Closet | 1 | |

| Comfort Suites | 1 | Quality | 1 | |

| Cracker Barrel | 2 | Quiznos | 2 | |

| Curves | 2 | RadioShack | 4 | |

| Dairy Queen | 3 | Ramada | 2 | |

| Days Inn | 3 | Red Lobster | 1 | |

| Dennys | 1 | Red Roof Inn | 1 | |

| Domino's Pizza | 3 | Rite Aid | 3 | |

| DressBarn | 1 | Rodeway Inn | 2 | |

| Dressbarn | 1 | Rue21 | 1 | |

| Dunkin Donuts | 4 | Ryan's Grill | 2 | |

| Eddie Bauer | 1 | SONIC Drive-In | 4 | |

| Ethan Allen | 1 | Sam's Club | 1 | |

| Extended Stay America | 1 | Sears | 3 | |

| FedEx | 37 | Shoe Carnival | 1 | |

| Finish Line | 1 | Sleep Inn | 2 | |

| Firestone Complete Auto Care | 1 | Soma Intimates | 1 | |

| Foot Locker | 1 | Spencer Gifts | 1 | |

| Ford | 1 | Sprint Nextel | 3 | |

| GNC | 4 | Staples | 1 | |

| GameStop | 3 | Starbucks | 9 | |

| Gap | 1 | Subaru | 1 | |

| Gymboree | 1 | Subway | 17 | |

| H&R Block | 8 | Super 8 | 1 | |

| Hardee's | 2 | T-Mobile | 7 | |

| Havertys Furniture | 1 | T.G.I. Driday's | 1 | |

| Haworth | 1 | T.J.Maxx | 1 | |

| Hilton | 5 | Taco Bell | 4 | |

| Holiday Inn | 6 | Talbots | 1 | |

| Hollister Co. | 1 | Target | 1 | |

| Home Depot | 2 | Tire Kingdom | 1 | |

| Hot Topic | 1 | Toys"R"Us | 2 | |

| Howard Johnson | 1 | U-Haul | 13 | |

| Hyundai | 1 | U.S. Cellular | 7 | |

| IHOP | 2 | UPS | 34 | |

| J. Jill | 1 | Urban Outfitters | 1 | |

| J.Crew | 1 | Vans | 3 | |

| JCPenney | 1 | Verizon Wireless | 1 | |

| JoS. A. Bank | 1 | Victoria's Secret | 1 | |

| Jones New York | 1 | Volkswagen | 1 | |

| Journeys | 1 | Waffle House | 4 | |

| Justice | 1 | Walgreens | 4 | |

| KFC | 3 | Walmart | 2 | |

| Kincaid | 2 | Wendy's | 5 | |

| Kmart | 4 | Wet Seal | 1 | |

| Kohl's | 1 | Whole Foods Market | 1 | |

| La-Z-Boy | 1 | YMCA | 6 | |

Strongest AM radio stations in Asheville:

- WKJV (1380 AM; 25 kW; ASHEVILLE, NC; Owner: INTERNATIONAL BAPTIST OUTREACH MISSIONS)

- WWNC (570 AM; 5 kW; ASHEVILLE, NC; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WSKY (1230 AM; 1 kW; ASHEVILLE, NC; Owner: MACON MEDIA, INC.)

- WISE (1310 AM; 5 kW; ASHEVILLE, NC; Owner: ASHVILLE RADIO PARTNERS, LLC)

- WFGW (1010 AM; 50 kW; BLACK MOUNTAIN, NC; Owner: BLUE RIDGE BROADCASTING CORP.)

- WPEK (880 AM; daytime; 5 kW; FAIRVIEW, NC; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WWRN (1350 AM; 10 kW; BLACK MOUNTAIN, NC; Owner: BLACK MOUNTAIN BROADCASTING CORP.)

- WLFJ (660 AM; daytime; 50 kW; GREENVILLE, SC; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WGCR (720 AM; daytime; 10 kW; PISGAH FOREST, NC; Owner: ANCHOR BAPTIST BROADCASTING ASSOCIATION)

- WCSZ (1070 AM; 50 kW; SANS SOUCI, SC; Owner: WHYZ RADIO, L.P.)

- WOXL (970 AM; 5 kW; CANTON, NC; Owner: SAGA COMMUNICATIONS OF NORTH CAROLINA, LLC)

- WHBK (1460 AM; 5 kW; MARSHALL, NC; Owner: SOUTHERN BROADCASTING, INC.)

- WJFJ (1160 AM; 10 kW; TRYON, NC; Owner: COLUMBUS BROADCAST CORPORATION, INC.)

Strongest FM radio stations in Asheville:

- W249AR (97.7 FM; ASHEVILLE, NC; Owner: ENTERCOM GREENVILLE LICENSE, LLC)

- W292CJ (106.3 FM; ASHEVILLE, NC; Owner: BLUE RIDGE BROADCASTING CORP.)

- WCQS (88.1 FM; ASHEVILLE, NC; Owner: WESTERN NORTH CAROLINA PUBLIC RADIO)

- WLFA (91.3 FM; ASHEVILLE, NC; Owner: ASHEVILLE EDUCATIONAL ASSOCIATION, INC.)

- WKSF (99.9 FM; ASHEVILLE, NC; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WMIT (106.9 FM; BLACK MOUNTAIN, NC; Owner: BLUE RIDGE BROADCASTING CORPORATION)

- WNCW (88.7 FM; SPINDALE, NC; Owner: ISOTHERMAL COMMUNITY COLLEGE)

- W220CD (91.9 FM; ENKA, NC; Owner: CALVARY CHAPEL OF TWIN FALLS, INC.)

- WQNS (104.9 FM; WAYNESVILLE, NC; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WMYI (102.5 FM; HENDERSONVILLE, NC; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WTPT (93.3 FM; FOREST CITY, NC; Owner: UPSTATE BROADCASTING, LLC)

- W237AR (95.3 FM; HAZELWOOD, ETC., NC; Owner: WESTERN NORTH CAROLINA PUBLIC RADIO)

- WESC-FM (92.5 FM; GREENVILLE, SC; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WQNQ (104.3 FM; OLD FORT, NC; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WSPA-FM (98.9 FM; SPARTANBURG, SC; Owner: ENTERCOM GREENVILLE LICENSE, LLC)

- WFBC-FM (93.7 FM; GREENVILLE, SC; Owner: ENTERCOM GREENVILLE LICENSE, LLC)

- W218AD (91.5 FM; BREVARD, NC; Owner: WESTERN NORTH CAROLINA PUBLIC RADIO)

- WAEZ (94.9 FM; GREENEVILLE, TN; Owner: BRISTOL BROADCASTING COMPANY, INC.)

- WHCB (91.5 FM; BRISTOL, TN; Owner: APPALACHIAN EDUC. COMMUNICATION CORP)

- WAGI-FM (105.3 FM; GAFFNEY, SC; Owner: GAFFNEY BROADCASTING, INC.)

TV broadcast stations around Asheville:

- W14AS (Channel 14; WEST ASHEVILLE, NC; Owner: MEREDITH CORPORATION)

- WASV-TV (Channel 62; ASHEVILLE, NC; Owner: MEDIA GENERAL BROADCASTING OF SOUTH CAROLINA HOLDINGS, INC.)

- WHNS (Channel 21; ASHEVILLE, NC; Owner: MEREDITH CORPORATION)

- W08BP (Channel 8; BEAVER DAM, NC; Owner: MEDIA GENERAL BROADCASTING OF SO. CAROLINA HOLDINGS, INC.)

- W52BA (Channel 52; BLACK MOUNTAIN, NC; Owner: UNIVERSITY OF NORTH CAROLINA)

- W51CK (Channel 51; TALBERT, KY; Owner: MS COMMUNICATIONS, LLC)

- W23BQ (Channel 23; ASHEVILLE, ETC., NC; Owner: CAROLINA CHRISTIAN BROADCASTING, INC.)

- W50AB (Channel 50; HIAWASSEE, GA; Owner: GEORGIA PUBLIC TELECOMMUNICATIONS COMMISSION)

- W41BQ (Channel 41; ASHEVILLE, NC; Owner: THREE ANGELS BROADCASTING NETWORK)

- W35AV (Channel 35; BLACK MOUNTAIN, NC; Owner: MEREDITH CORPORATION)

- WYFF (Channel 4; GREENVILLE, SC; Owner: WYFF HEARST-ARGYLE TELEVISION, INC.)

- WLOS (Channel 13; ASHEVILLE, NC; Owner: WLOS LICENSEE, LLC)

- WJJV-LP (Channel 25; ASHEVILLE, NC; Owner: CAROLINA CHRISTIAN BROADCASTING, INC.)

- WAEN-LP (Channel 64; ASHEVILLE, NC; Owner: ASHEVILLE MEDIA GROUP, L.L.C.)

- WUNF-TV (Channel 33; ASHEVILLE, NC; Owner: UNIVERSITY OF NORTH CAROLINA)

- W09AR (Channel 9; WEAVERVILLE, NC; Owner: MEDIA GENERAL BROADCASTING OF SO. CAROLINA HOLDINGS, INC.)

- W69DC (Channel 69; ASHEVILLE, NC; Owner: NATIONAL MINORITY T.V., INC.)

- W06AL (Channel 6; OTEEN/WARREN, NC; Owner: WLOS LICENSEE, LLC)

- National Bridge Inventory (NBI) Statistics

- 395Number of bridges

- 4,206ft / 1,282mTotal length

- $3,167,000Total costs

- 6,601,405Total average daily traffic

- 920,452Total average daily truck traffic

- New bridges - historical statistics

- 11910-1919

- 71920-1929

- 71930-1939

- 31940-1949

- 311950-1959

- 1221960-1969

- 1121970-1979

- 521980-1989

- 171990-1999

- 232000-2009

- 192010-2019

- 12020-2022

FCC Registered Antenna Towers: 297 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 8 (See the full list of FCC Registered Commercial Land Mobile Towers in Asheville, NC)

FCC Registered Private Land Mobile Towers: 9 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 148 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 146 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 8 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 12 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 697 (See the full list of FCC Registered Amateur Radio Licenses in Asheville)

FAA Registered Aircraft: 106 (See the full list of FAA Registered Aircraft in Asheville)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 9 full and 22 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 119 | $163,071 | 514 | $201,905 | 1,424 | $190,392 | 49 | $115,825 | 10 | $621,252 | 312 | $194,579 | 9 | $83,017 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 4 | $131,088 | 33 | $162,279 | 86 | $185,697 | 5 | $99,610 | 1 | $326,000 | 22 | $156,350 | 1 | $47,170 |

| APPLICATIONS DENIED | 22 | $154,329 | 72 | $195,979 | 457 | $185,804 | 32 | $153,661 | 2 | $432,030 | 79 | $195,509 | 7 | $71,709 |

| APPLICATIONS WITHDRAWN | 18 | $158,063 | 71 | $206,875 | 310 | $191,149 | 11 | $95,688 | 1 | $18,847,500 | 68 | $177,739 | 2 | $100,360 |

| FILES CLOSED FOR INCOMPLETENESS | 8 | $182,008 | 16 | $194,497 | 64 | $193,655 | 1 | $64,670 | 0 | $0 | 7 | $205,280 | 2 | $70,720 |

Detailed mortgage data for all 25 tracts in Asheville, NC

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 9 full and 22 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 67 | $196,683 | 33 | $214,676 | 1 | $192,860 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 28 | $201,716 | 20 | $214,851 | 5 | $256,684 |

| APPLICATIONS DENIED | 7 | $250,001 | 5 | $247,554 | 5 | $306,680 |

| APPLICATIONS WITHDRAWN | 7 | $193,990 | 7 | $244,763 | 2 | $191,500 |

| FILES CLOSED FOR INCOMPLETENESS | 2 | $320,290 | 3 | $229,003 | 0 | $0 |

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Asheville, NC

- 4,18852.3%Structure Fires

- 2,53131.6%Outside Fires

- 1,00212.5%Mobile Property/Vehicle Fires

- 2803.5%Other

Based on the data from the years 2002 - 2018 the average number of fires per year is 471. The highest number of reported fire incidents - 712 took place in 2007, and the least - 136 in 2013. The data has a growing trend.

Based on the data from the years 2002 - 2018 the average number of fires per year is 471. The highest number of reported fire incidents - 712 took place in 2007, and the least - 136 in 2013. The data has a growing trend. When looking into fire subcategories, the most reports belonged to: Structure Fires (52.3%), and Outside Fires (31.6%).

When looking into fire subcategories, the most reports belonged to: Structure Fires (52.3%), and Outside Fires (31.6%).Fire-safe hotels and motels in Asheville, North Carolina:

- Quality Inn & Suites, 1430 Tunnel Rd, Asheville, North Carolina 28815 , Phone: (828) 298-5519, Fax: (828) 298-4739

- Ramada, 800 Fairview Rd, Asheville, North Carolina 28803 , Phone: (828) 298-9141, Fax: (828) 298-6629

- Econo Lodge Asheville, 190 Tunnel Rd, Asheville, North Carolina 28815 , Phone: (828) 254-9521

- Fairfield Inn By Marriott Asheville, 31 Airport Park Dr, Asheville, North Carolina 28732 , Phone: (704) 684-1144, Fax: (704) 684-3377

- Comfort Suites Asheville, 890 Brevard Rd, Asheville, North Carolina 28806 , Phone: (828) 665-4000, Fax: (828) 665-9082

- Ramada Limited, 180 Tunl Rd, Asheville, North Carolina 28805 , Phone: (828) 254-7451, Fax: (828) 254-3880

- Town House Motel, 141 Tunnel Rd, Asheville, North Carolina 28805 , Phone: (828) 253-8753

- Extended Stay America - Asheville - Tunnel Rd, 6 Kenilworth Knl, Asheville, North Carolina 28805 , Phone: (828) 253-3483, Fax: (828) 253-3482

- 36 other hotels and motels

| Most common first names in Asheville, NC among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| James | 1,153 | 72.6 years |

| William | 1,046 | 75.0 years |

| Mary | 1,007 | 78.9 years |

| John | 884 | 74.6 years |

| Robert | 708 | 72.3 years |

| Charles | 589 | 72.5 years |

| George | 456 | 75.3 years |

| Margaret | 411 | 79.5 years |

| Ruth | 365 | 79.5 years |

| Helen | 336 | 79.4 years |

| Most common last names in Asheville, NC among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 498 | 76.2 years |

| Jones | 381 | 74.6 years |

| Williams | 360 | 75.4 years |

| Davis | 342 | 75.5 years |

| Brown | 310 | 76.2 years |

| Johnson | 286 | 75.3 years |

| Wilson | 279 | 75.4 years |

| Miller | 255 | 76.7 years |

| Moore | 227 | 75.1 years |

| Rice | 205 | 76.0 years |

- 47.2%Electricity

- 41.4%Utility gas

- 6.5%Fuel oil, kerosene, etc.

- 2.7%Bottled, tank, or LP gas

- 0.9%Wood

- 0.8%Solar energy

- 0.3%Other fuel

- 0.2%No fuel used

- 77.2%Electricity

- 16.1%Utility gas

- 3.4%Fuel oil, kerosene, etc.

- 1.6%Bottled, tank, or LP gas

- 0.8%No fuel used

- 0.6%Wood

- 0.1%Other fuel

Asheville compared to North Carolina state average:

- Unemployed percentage below state average.

- Median age below state average.

- House age above state average.

- Institutionalized population percentage above state average.

- Percentage of population with a bachelor's degree or higher above state average.

Asheville on our top lists:

- #1 on the list of "Top 101 cities with largest percentage of females in occupations: construction and extraction occupations (population 50,000+)"

- #1 on the list of "Top 101 cities with the highest maximum monthly morning or afternoon humidity (population 50,000+)"

- #3 on the list of "Top 101 cities with largest percentage of males in industries: management of companies and enterprises (population 50,000+)"

- #5 on the list of "Top 101 cities with the largest percentage of likely lesbian couples (counted as self-reported female-female unmarried-partner households) (population 50,000+)"

- #5 on the list of "Top 101 cities with largest percentage of males in industries: health care and social assistance (population 50,000+)"

- #13 on the list of "Top 101 cities with largest percentage of females in industries: utilities (population 50,000+)"

- #15 on the list of "Top 101 cities with the largest percentage of likely homosexual households (counted as self-reported same-sex unmarried-partner households) (population 50,000+)"

- #20 on the list of "Top 101 cities with the most users submitting photos to our site per 10,000 residents (population 50,000+)"

- #20 on the list of "Top 101 cities with largest percentage of males in occupations: community and social service occupations (population 50,000+)"

- #21 on the list of "Top 101 cities with the highest number of thefts per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #30 on the list of "Top 101 cities with the most full-time park and recreation workers per 1000 residents (population 5,000+)"

- #32 on the list of "Top 101 cities with largest percentage of males in industries: accommodation and food services (population 50,000+)"

- #32 on the list of "Top 101 cities with largest percentage of males in occupations: health diagnosing and treating practitioners and other technical occupations (population 50,000+)"

- #36 on the list of "Top 101 cities that people commute into (largest positive percentage daily daytime population change due to commuting) (population 50,000+)"

- #43 on the list of "Top 100 cities with shortest commuting times (pop. 50,000+)"

- #48 on the list of "Top 101 cities with the largest percentage of likely gay men couples (counted as self-reported male-male unmarried-partner households) (population 50,000+)"

- #51 on the list of "Top 101 cities with largest percentage of males in occupations: food preparation and serving related occupations (population 50,000+)"

- #51 on the list of "Top 101 cities with the smallest sunshine amount differences during a year (population 50,000+)"

- #52 on the list of "Top 101 cities with largest percentage of females in occupations: community and social service occupations (population 50,000+)"

- #52 on the list of "Top 100 cities with strongest arts, entertainment, recreation, accommodation and food services industries (pop. 50,000+)"

- #95 (28804) on the list of "Top 101 zip codes with the largest percentage of Scotch-Irish first ancestries (pop 5,000+)"

- #99 (28801) on the list of "Top 101 zip codes with the most museums in 2005"

- #30 on the list of "Top 101 counties with the lowest percentage of residents that drank alcohol in the past 30 days"

- #32 on the list of "Top 101 counties with the largest number of people moving in compared to moving out (pop. 50,000+)"

- #55 on the list of "Top 101 counties with the highest percentage of residents that keep firearms around their homes"

- #84 on the list of "Top 101 counties with the lowest percentage of residents that visited a dentist within the past year"

- #89 on the list of "Top 101 counties with the highest percentage of residents that smoked 100+ cigarettes in their lives"

|

|

Total of 426 patent applications in 2008-2024.