Birmingham, Alabama

Birmingham: Kelly Ingram Park

Birmingham: Kelly Ingram Park

Birmingham: MLK Statue in Kelly Ingram Park

Birmingham: Sloss Furnace and Downtown Birmingham at Sunset. When Sloss was operating, this was Smoke City.

Birmingham: Panorama of Birmingham

Birmingham: Wachovia Tower and AmSouth Center

Birmingham: Birmingham Garden

Birmingham: Birmingham Garden

Birmingham: Downtown

Birmingham: Downtown Birmingham

Birmingham: Birmingham Garden

- see

108

more - add

your

Submit your own pictures of this city and show them to the world

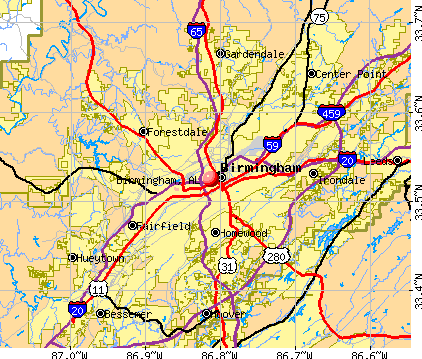

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: -18.9%

| Males: 92,128 | |

| Females: 104,782 |

| Median resident age: | 35.2 years |

| Alabama median age: | 39.6 years |

Zip codes: 35061, 35064, 35068, 35094, 35117, 35126, 35127, 35203, 35204, 35205, 35206, 35207, 35208, 35209, 35210, 35212, 35213, 35215, 35217, 35218, 35221, 35222, 35223, 35228, 35233, 35234, 35235, 35242, 35243, 35254.

Birmingham Zip Code Map| Birmingham: | $39,326 |

| AL: | $59,674 |

Estimated per capita income in 2022: $29,492 (it was $15,663 in 2000)

Birmingham city income, earnings, and wages data

Estimated median house or condo value in 2022: $125,500 (it was $62,200 in 2000)

| Birmingham: | $125,500 |

| AL: | $200,900 |

Mean prices in 2022: all housing units: $213,472; detached houses: $202,843; townhouses or other attached units: $230,379; in 2-unit structures: $283,001; in 3-to-4-unit structures: $383,117; in 5-or-more-unit structures: $481,701; mobile homes: $46,111

Median gross rent in 2022: $963.

(21.7% for White Non-Hispanic residents, 27.5% for Black residents, 28.2% for Hispanic or Latino residents, 46.0% for American Indian residents, 18.3% for Native Hawaiian and other Pacific Islander residents, 26.5% for other race residents, 19.1% for two or more races residents)

Detailed information about poverty and poor residents in Birmingham, AL

- 139,41471.0%Black alone

- 43,01121.9%White alone

- 6,0223.1%Hispanic

- 3,6171.8%Asian alone

- 2,5731.3%Two or more races

- 1,5350.8%Other race alone

- 1810.09%American Indian alone

According to our research of Alabama and other state lists, there were 660 registered sex offenders living in Birmingham, Alabama as of April 19, 2024.

The ratio of all residents to sex offenders in Birmingham is 322 to 1.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is smaller than the state average.- means the value is about the same as the state average.

- means the value is bigger than the state average.

- means the value is much bigger than the state average.

Crime rate in Birmingham detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 951 (756 officers - 651 male; 105 female).

| Officers per 1,000 residents here: | 3.66 |

| Alabama average: | 2.40 |

| Downtown Birmingham's population growing rapidly! (67 replies) |

| Tech hub designation granted to Birmingham! (9 replies) |

| Birmingham Downtown Parking (0 replies) |

| Songs with Birmingham in the title (11 replies) |

| Niche Best Places to Live - what has to happen to get Birmingham on this map? (17 replies) |

| Which city is the 'Southern Silicon Valley?' Birmingham or Huntsville? (72 replies) |

Latest news from Birmingham, AL collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: American (10.4%), African (3.5%), English (2.3%), Irish (1.3%), German (1.1%).

Current Local Time: CST time zone

Incorporated on 12/19/1871

Elevation: 600 feet

Land area: 149.9 square miles.

Population density: 1,313 people per square mile (low).

7,998 residents are foreign born (2.0% Latin America, 1.1% Asia).

| This city: | 4.0% |

| Alabama: | 3.5% |

Median real estate property taxes paid for housing units with mortgages in 2022: $1,083 (0.6%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $659 (0.8%)

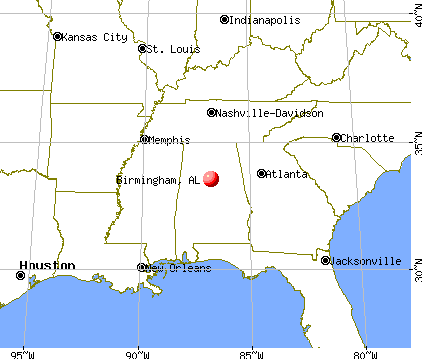

Nearest city with pop. 1,000,000+: Houston, TX (567.5 miles

, pop. 1,953,631).

Nearest cities:

Latitude: 33.52 N, Longitude: 86.81 W

Daytime population change due to commuting: +101,640 (+51.8%)

Workers who live and work in this city: 55,193 (61.9%)

Area code: 205

Detailed articles:

- Birmingham: Introduction

- Birmingham Basic Facts

- Birmingham: Communications

- Birmingham: Convention Facilities

- Birmingham: Economy

- Birmingham: Education and Research

- Birmingham: Geography and Climate

- Birmingham: Health Care

- Birmingham: History

- Birmingham: Municipal Government

- Birmingham: Population Profile

- Birmingham: Recreation

- Birmingham: Transportation

Birmingham tourist attractions:

- 16th Street Baptist Church - Birmingham, Alabama - Historic Church

- Alabama Theatre, Birmingham, AL

- Birmingham Civil Rights Institute, Birmingham, AL

- Birmingham Jefferson Civic Center, Birmingham, AL

- Birmingham Museum of Art, Birmingham, AL

- Birmingham-Shuttlesworth International Airport - Birmingham, AL - Public airport

- Courtyard by Marriott Downtown UAB, Birmingham, AL

- Embassy Suites Hotel Birmingham, AL

- Hotel Highland at Five Points, Birmingham, AL

- Marriott Birmingham, Birmingham, AL

- McWane Science Center, Birmingham, AL

- Renaissance Ross Bridge Golf Resort and Spa, Birmingham, AL

- Rickwood Field Park, Birmingham, AL

- Ruffner Mountain Nature Center, Birmingham, AL

- Sheraton Birmingham, Birmingham, AL

- Sloss Furnaces National Historical Landmark, Birmingham, AL

- Southern Museum of Flight, Birmingham, AL

- The Summit - Birmingham, Alabama - Shopping Mall

- The Wynfrey Hotel at Riverchase, Birmingham, AL

- The Birmingham Zoo in Birmingham, Alabama

- Vulcan Park, Birmingham, AL

Birmingham, Alabama accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 111 buildings, average cost: $232,400

- 2021: 90 buildings, average cost: $247,900

- 2020: 86 buildings, average cost: $215,500

- 2019: 78 buildings, average cost: $211,500

- 2018: 66 buildings, average cost: $230,500

- 2017: 97 buildings, average cost: $189,400

- 2016: 90 buildings, average cost: $209,700

- 2015: 36 buildings, average cost: $290,500

- 2014: 76 buildings, average cost: $226,400

- 2013: 80 buildings, average cost: $248,200

- 2012: 88 buildings, average cost: $195,700

- 2011: 121 buildings, average cost: $179,400

- 2010: 110 buildings, average cost: $171,500

- 2009: 75 buildings, average cost: $180,500

- 2008: 132 buildings, average cost: $187,300

- 2007: 232 buildings, average cost: $190,000

- 2006: 303 buildings, average cost: $180,100

- 2005: 220 buildings, average cost: $178,000

- 2004: 144 buildings, average cost: $163,800

- 2003: 152 buildings, average cost: $157,000

- 2002: 188 buildings, average cost: $135,600

- 2001: 108 buildings, average cost: $128,100

- 2000: 118 buildings, average cost: $123,800

- 1999: 137 buildings, average cost: $113,000

- 1998: 152 buildings, average cost: $88,400

- 1997: 128 buildings, average cost: $107,200

| Here: | 3.2% |

| Alabama: | 2.6% |

- Health care (15.3%)

- Educational services (9.9%)

- Accommodation & food services (9.1%)

- Finance & insurance (5.9%)

- Administrative & support & waste management services (5.5%)

- Professional, scientific, technical services (5.0%)

- Construction (4.5%)

- Construction (8.8%)

- Accommodation & food services (8.7%)

- Administrative & support & waste management services (8.1%)

- Educational services (7.4%)

- Health care (7.3%)

- Professional, scientific, technical services (5.2%)

- Finance & insurance (4.1%)

- Health care (22.7%)

- Educational services (12.2%)

- Accommodation & food services (9.5%)

- Finance & insurance (7.5%)

- Public administration (5.0%)

- Professional, scientific, technical services (4.9%)

- Social assistance (4.3%)

- Cooks and food preparation workers (6.4%)

- Building and grounds cleaning and maintenance occupations (6.0%)

- Other management occupations, except farmers and farm managers (4.3%)

- Cashiers (3.6%)

- Laborers and material movers, hand (3.1%)

- Driver/sales workers and truck drivers (3.0%)

- Material recording, scheduling, dispatching, and distributing workers (2.7%)

- Building and grounds cleaning and maintenance occupations (7.0%)

- Cooks and food preparation workers (6.7%)

- Driver/sales workers and truck drivers (5.8%)

- Other management occupations, except farmers and farm managers (5.0%)

- Laborers and material movers, hand (5.0%)

- Material recording, scheduling, dispatching, and distributing workers (4.3%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (3.1%)

- Cooks and food preparation workers (6.1%)

- Cashiers (5.6%)

- Building and grounds cleaning and maintenance occupations (5.0%)

- Secretaries and administrative assistants (4.8%)

- Nursing, psychiatric, and home health aides (4.2%)

- Registered nurses (3.9%)

- Other office and administrative support workers, including supervisors (3.9%)

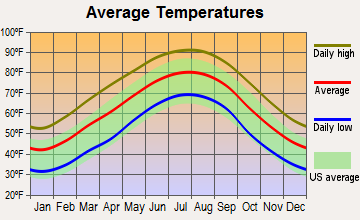

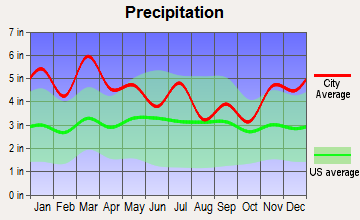

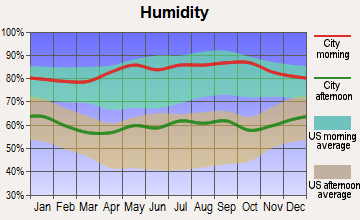

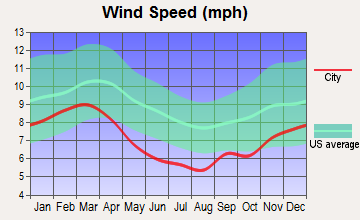

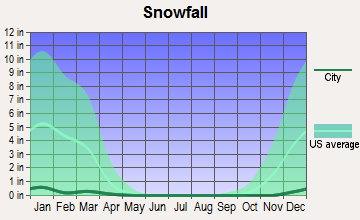

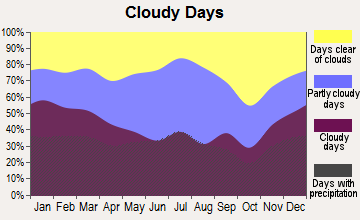

Average climate in Birmingham, Alabama

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

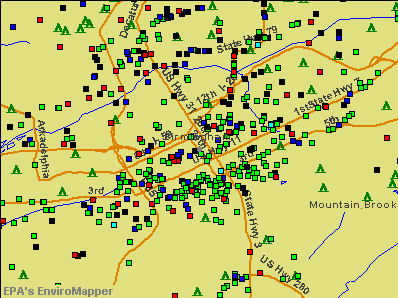

Air Quality Index (AQI) level in 2022 was 82.1. This is about average.

| City: | 82.1 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.241. This is about average. Closest monitor was 0.7 miles away from the city center.

| City: | 0.241 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 8.54. This is significantly worse than average. Closest monitor was 0.7 miles away from the city center.

| City: | 8.54 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.254. This is significantly better than average. Closest monitor was 0.7 miles away from the city center.

| City: | 0.254 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 26.8. This is better than average. Closest monitor was 0.7 miles away from the city center.

| City: | 26.8 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 18.3. This is about average. Closest monitor was 0.7 miles away from the city center.

| City: | 18.3 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 11.0. This is worse than average. Closest monitor was 1.8 miles away from the city center.

| City: | 11.0 |

| U.S.: | 8.1 |

Tornado activity:

Birmingham-area historical tornado activity is slightly above Alabama state average. It is 152% greater than the overall U.S. average.

On 4/8/1998, a category F5 (max. wind speeds 261-318 mph) tornado 5.0 miles away from the Birmingham city center killed 32 people and injured 259 people and caused $200 million in damages.

On 4/4/1977, a category F5 tornado 6.8 miles away from the city center killed 22 people and injured 130 people and caused between $5,000,000 and $50,000,000 in damages.

Earthquake activity:

Birmingham-area historical earthquake activity is significantly above Alabama state average. It is 130% greater than the overall U.S. average.On 1/18/1999 at 07:00:53, a magnitude 4.8 (4.8 MB, 4.0 LG, Depth: 0.6 mi, Class: Light, Intensity: IV - V) earthquake occurred 26.8 miles away from Birmingham center

On 4/29/2003 at 08:59:39, a magnitude 4.9 (4.4 MB, 4.6 MW, 4.9 LG) earthquake occurred 95.4 miles away from the city center

On 6/24/1975 at 11:11:36, a magnitude 4.5 (4.5 MB) earthquake occurred 60.7 miles away from the city center

On 4/29/2003 at 08:59:39, a magnitude 4.6 (4.6 MW, Depth: 12.3 mi) earthquake occurred 95.4 miles away from the city center

On 10/24/1997 at 08:35:17, a magnitude 4.9 (4.8 MB, 4.2 MS, 4.9 LG, Depth: 6.2 mi) earthquake occurred 168.3 miles away from Birmingham center

On 11/7/2004 at 11:20:21, a magnitude 4.3 (4.3 MW, Depth: 3.1 mi) earthquake occurred 88.8 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Jefferson County (32) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 24

Emergencies Declared: 6

Causes of natural disasters: Storms: 18, Tornadoes: 16, Floods: 14, Hurricanes: 6, Winds: 6, Drought: 1, Fire: 1, Heavy Rain: 1, Snowfall: 1, Winter Storm: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: GOLDEN ENTERPRISES INC (MISCELLANEOUS FOOD PREPARATIONS & KINDRED PRODUCTS), AMSOUTH AUTO RECEIVABLES LLC (MISCELLANEOUS BUSINESS CREDIT INSTITUTION), BIOCRYST PHARMACEUTICALS INC (BIOLOGICAL PRODUCTS (NO DIAGNOSTIC SUBSTANCES)), PROTECTIVE LIFE CORP (LIFE INSURANCE), COLONIAL REALTY LIMITED PARTNERSHIP (REAL ESTATE INVESTMENT TRUSTS), TORCHMARK CORP (LIFE INSURANCE), PROASSURANCE CORP (FIRE, MARINE & CASUALTY INSURANCE), ALABAMA NATIONAL BANCORPORATION (STATE COMMERCIAL BANKS) and 23 other public companies.

Hospitals in Birmingham:

- AFFINITY HOME HOSPICE SERVICES (140 OXMOOR ROAD, SUITE H)

- BIRMINGHAM VA MEDICAL CENTER (Government Federal, provides emergency services, 700 SOUTH 19TH STREET)

- CARRAWAY METHODIST MEDICAL CTR HOSPICE (1600 CARRAWAY BOULEVARD)

- EVERCARE HOSPICE AND PALLIATIVE CARE (33 INVERNESS CENTER PARKWAY, # 350)

- HOPE HOSPICE, INC (1600 CARRAWAY BOULEVARD, SUITE 444)

- LONG TERM CARE HOSP AT MED CENTER EAST,THE (50 MEDICAL PARK EAST DR, 8TH FLOOR)

- NEW BEACON OF BIRMINGHAM (2145 HIGHLAND AVENUE SUITE 110)

- PERSONA HEALTH SERVICES, INC (2800 MILAN COURT, SUITE 127)

- ST VINCENT'S BIRMINGHAM (Voluntary non-profit - Private, 810 ST VINCENT'S DRIVE)

- TRINITY MEDICAL CENTER (Proprietary, provides emergency services, 800 MONTCLAIR RD)

- WIREGRASS HOSPICE BIRMINGHAM (2084 VALLEYDALE ROAD)

Airports and heliports located in Birmingham:

- Birmingham-Shuttlesworth International Airport (BHM) (Runways: 2, Commercial Ops: 30,424, Air Taxi Ops: 25,873, Itinerant Ops: 39,927, Local Ops: 618, Military Ops: 5,902)

- Bonham Airport (AL40) (Runways: 1)

- Heliports: 10

Colleges/Universities in Birmingham:

- University of Alabama at Birmingham (Full-time enrollment: 14,853; Location: Administration Bldg Suite 1070; Public; Website: www.uab.edu; Offers Doctor's degree)

- Virginia College-Birmingham (Full-time enrollment: 8,167; Location: 488 Palisades Blvd.; Private, for-profit; Website: www.vc.edu; Offers Master's degree)

- Jefferson State Community College (Full-time enrollment: 6,041; Location: 2601 Carson Rd; Public; Website: www.jeffstateonline.com)

- Samford University (Full-time enrollment: 3,829; Location: 800 Lakeshore Drive; Private, not-for-profit; Website: www.samford.edu; Offers Doctor's degree)

- Lawson State Community College-Birmingham Campus (Full-time enrollment: 2,695; Location: 3060 Wilson Rd SW; Public; Website: www.lawsonstate.edu)

- Fortis Institute-Birmingham (Full-time enrollment: 1,392; Location: 100 London Pkwy Ste 150; Private, for-profit; Website: www.fortis.edu)

- Birmingham Southern College (Full-time enrollment: 1,331; Location: 900 Arkadelphia Road; Private, not-for-profit; Website: www.bsc.edu/)

- Brown Mackie College-Birmingham (Full-time enrollment: 743; Location: 105 Vulcan Road, Suite 100; Private, for-profit; Website: www.brownmackie.edu)

- Strayer University-Alabama (Full-time enrollment: 672; Location: 3570 Grandview Pkwy Ste 200; Private, for-profit; Website: www.strayer.edu/alabama/birmingham; Offers Master's degree)

- Herzing University-Birmingham (Full-time enrollment: 338; Location: 280 West Valley Ave; Private, for-profit; Website: www.herzing.edu/birmingham)

- University of Phoenix-Birmingham Campus (Full-time enrollment: 308; Location: 100 Corporate Parkway; Private, for-profit; Website: www.phoenix.edu; Offers Master's degree)

- Southeastern School of Cosmetology (Full-time enrollment: 162; Location: 849 Dennison Ave. SW, Suite 101; Private, not-for-profit; Website: www.southeasternschoolofcosmetology.com)

- Southeastern Bible College (Full-time enrollment: 149; Location: 2545 Valleydale Road; Private, not-for-profit; Website: www.sebc.edu)

Libraries in Birmingham:

- BIRMINGHAM PUBLIC LIBRARY (Operating income: $18,161,924; Location: 2100 PARK PLACE; 798,413 books; 200 e-books; 29,770 audio materials; 49,814 video materials; 32 local licensed databases; 81 state licensed databases; 6 other licensed databases; 1,794 print serial subscriptions; 2,364 electronic serial subscriptions)

- NORTH SHELBY LIBRARY (Operating income: $1,045,765; Location: 5521 CAHABA VALLEY ROAD; 57,567 books; 1,597 audio materials; 2,737 video materials; 3 local licensed databases; 81 state licensed databases; 1 other licensed databases; 50 print serial subscriptions; 3 electronic serial subscriptions)

Points of interest:

Notable locations in Birmingham: Boswell Golf Course (A), Cooper Green Golf Course (B), Hillcrest Country Club (C), Village Creek Sewage Treatment Plant (D), Louisville and Nashville Railroad Station (E), Roebuck Municipal Golf Course (F), Farmers Market (G), East Thomas Yards (H), Rickwood Field (I), Alabama State Fairgrounds (J), Arlington Historic House and Gardens (K), Eastwood Shopping Plaza (L), Ernest Norris Yards (M), Birmingham International Raceway (N), Camp Tanglewood (O), Camp Blossom Hill (P), Birmingham Terminal Station (Q), University of Alabama at Birmingham Arena (R), Queenstown Industrial Park (S), Airport Industrial Park (T). Display/hide their locations on the map

Shopping Centers: Festival Shopping Center (1), Village East Shopping Center (2), The Magic Place Shopping Center (3), Roebuck Shopping City Shopping Center (4), Roebuck Plaza Shopping Center (5), Queensbury Shopping Center (6), Parkway East Huffman Shopping Center (7), Acipco Shopping Center (8), Cahaba Mall Shopping Center (9). Display/hide their locations on the map

Main business address in Birmingham include: GOLDEN ENTERPRISES INC (A), AMSOUTH AUTO RECEIVABLES LLC (B), COLONIAL REALTY LIMITED PARTNERSHIP (C), TORCHMARK CORP (D), ALABAMA NATIONAL BANCORPORATION (E). Display/hide their locations on the map

Churches in Birmingham include: Pike Avenue Baptist Church (A), Oxmoor United Methodist Church (B), Pleasant Hill Church (C), Pleasant Valley Church (D), Mount Ararat Baptist Church (E), Crestway Baptist Church (F), Saint Lukes Church (G), Bold Spring Presbyterian Church (H), Bethlehem United Methodist Church (I). Display/hide their locations on the map

Cemeteries: Earltown Cemetery (1), Hodges Cemetery (2), Oak Hill Cemetery (3), Oakland Cemetery (4), McElwain Cemetery (5), East Lake Cemetery (6), Inglenook Cemetery (7). Display/hide their locations on the map

Reservoirs: East Thomas Gardens Lake (A), East Lake (B), Alton Lake (C), City of Birmingham - Roebuck Plaza Lake (D), Miller Steam Plant Water Storagep (E), Spring Lake (F), Lake Purdy (G), Elmore Lake (H). Display/hide their locations on the map

Streams, rivers, and creeks: Tarrant Spring Branch (A), South Prong Cox Creek (B), Short Creek (C), Shephard Branch (D), Abes Creek (E), Lee Branch (F), McCombs Branch (G), North Prong Cox Creek (H), Village Creek (I). Display/hide their locations on the map

Parks in Birmingham include: Downey Park (1), North Birmingham Park (2), Marconi Park (3), Legion Field (4), Lassiter Mountain Raceway Park (5), Jimmy Morgan Zoo (6), Eldorado Park (7), Clayton Park (8), Central Park (9). Display/hide their locations on the map

Tourist attractions: Birmingham Civil Rights Institute (Museums; 520 16th Street North) (1), Alabama Jazz Hall of Fame (Museums; 1631 4th Avenue North) (2), The Hip Hop Museum of Art (1761 50th Street) (3), Samuel Ullman Museum (2150 15th Avenue South) (4), McWane Center (Museums; 200 19th Street Ensley) (5), Southern Museum of Flight (4343 73rd Street North) (6), Terrace Cafe (Museums; 2000 8th Avenue North) (7), Alan's Discount Music (Museums; 1425 Montgomery Highway) (8), Alabama Sports Hall of Fame-Educationl Otrch Prgrm (Museums; 2150 Richard Arrington Jr) (9). Display/hide their approximate locations on the map

Hotels: Marriott Hotel Birmingham (3590 Grandview Parkway) (1), Rime Garden Extended Stay Suites (5320 Beacon Drive) (2), Studioplus (101 Cahaba Park Circle) (3), Travelers Rest Motel (1066 Forestdale Boulevard) (4), Intown Suites Oxmoor (90 Oxmoor Road) (5), Royal Inn (821 20th St S) (6), Candlewood Suites (600 Corporate Rdg) (7), Jackson Hospitality (#1 Office Park Circle) (8), Homewood Lodge (103 Green Springs Highway) (9). Display/hide their approximate locations on the map

Courts: Courts - Federal - Probation Office (1729 5th Avenue North Suite 325) (1), Tarrant City - Municipal Court (1604 Pinson Valley Parkway) (2), Jefferson County Courthouse Birmingham - Environmental Services Depart (610 Avenue D) (3), United States District Court - Probation Office (1729 5th Avenue North) (4), Hoover City - Municipal Court- Animal Control (100 Municipal Drive) (5), Vestavia Hills City - Municipal Court (513 Montgomery Highway) (6), Jefferson County Courthouse Birmingham - Line Maintenance & Sewer Construc (610 Avenue D) (7), Sessions Jeff Senator (1800 5th Avenue North) (8), Birmingham City - Municipal Court (801 17th Street North) (9). Display/hide their approximate locations on the map

Birthplace of: Taylor Hicks - Blues musician, Charlie Fonville - Record-setting African shotputter, Bobby Bowden - Football coach, Alveda King - Politician, Carl Lewis - Track & field athlete, Sun Ra - (died 1993), singer-songwriter, musician, Andre Smith (American football) - College football player, Spencer Bachus - Politician, Condoleezza Rice - (born 1954), National Security Advisor, Darrin Hancock - Basketball player.

Drinking water stations with addresses in Birmingham and their reported violations in the past:

BIRMINGHAM WATER WORKS BOARD (Population served: 591,243, Surface water):Past monitoring violations:PARKER CREEK WATER COMPANY (Population served: 1,500, Purch surface water):

- Monitoring of Treatment (SWTR-Filter) - In APR-2014, Contaminant: LT2ESWTR. Follow-up actions: St Public Notif requested (JUN-06-2014), St Compliance achieved (JUN-06-2014), St Violation/Reminder Notice (JUN-06-2014)

- One minor monitoring violation

Past monitoring violations:MONTGOMERY CAMPGROUND LLC (Address: 51 SHADY CREST ROAD , Population served: 1,200, Groundwater):

- One routine major monitoring violation

Past monitoring violations:

- Follow-up Or Routine LCR Tap M/R - In OCT-11-2008, Contaminant: Lead and Copper Rule. Follow-up actions: St Public Notif requested (NOV-26-2008), St Violation/Reminder Notice (NOV-26-2008), St Formal NOV issued (NOV-05-2009), St Public Notif received (DEC-21-2009), St Compliance achieved (SEP-30-2010)

| This city: | 2.3 people |

| Alabama: | 2.5 people |

| This city: | 55.0% |

| Whole state: | 67.8% |

| This city: | 6.1% |

| Whole state: | 4.7% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.5% of all households

People in group quarters in Birmingham in 2010:

- 3,284 people in college/university student housing

- 1,559 people in nursing facilities/skilled-nursing facilities

- 1,060 people in local jails and other municipal confinement facilities

- 707 people in other noninstitutional facilities

- 691 people in residential treatment centers for adults

- 581 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 448 people in group homes intended for adults

- 280 people in state prisons

- 145 people in mental (psychiatric) hospitals and psychiatric units in other hospitals

- 120 people in correctional facilities intended for juveniles

- 68 people in residential treatment centers for juveniles (non-correctional)

- 39 people in hospitals with patients who have no usual home elsewhere

- 29 people in group homes for juveniles (non-correctional)

- 24 people in workers' group living quarters and job corps centers

People in group quarters in Birmingham in 2000:

- 2,141 people in college dormitories (includes college quarters off campus)

- 1,895 people in nursing homes

- 1,274 people in local jails and other confinement facilities (including police lockups)

- 1,228 people in other noninstitutional group quarters

- 569 people in homes or halfway houses for drug/alcohol abuse

- 324 people in homes for the mentally ill

- 293 people in halfway houses

- 289 people in unknown juvenile institutions

- 287 people in other group homes

- 205 people in other nonhousehold living situations

- 146 people in homes for the mentally retarded

- 59 people in mental (psychiatric) hospitals or wards

- 42 people in other types of correctional institutions

- 37 people in schools, hospitals, or wards for the intellectually disabled

- 26 people in homes for the physically handicapped

- 24 people in religious group quarters

- 13 people in hospitals/wards and hospices for chronically ill

- 13 people in other hospitals or wards for chronically ill

Banks with most branches in Birmingham (2011 data):

- Regions Bank: 37 branches. Info updated 2011/02/24: Bank assets: $123,368.2 mil, Deposits: $98,301.3 mil, local headquarters, positive income, Commercial Lending Specialization, 1778 total offices, Holding Company: Regions Financial Corporation

- Wells Fargo Bank, National Association: 18 branches. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- Compass Bank: 16 branches. Info updated 2011/02/24: Bank assets: $63,107.0 mil, Deposits: $46,232.4 mil, local headquarters, negative income in the last year, Commercial Lending Specialization, 720 total offices, Holding Company: Banco Bilbao Vizcaya Argentaria, S.A.

- PNC Bank, National Association: 8 branches. Info updated 2012/03/20: Bank assets: $263,309.6 mil, Deposits: $197,343.0 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 3085 total offices, Holding Company: Pnc Financial Services Group, Inc., The

- Cadence Bank, N.A.: at 17 20th Street North, Birmingham Branch, Mountain Brook Branch, Trussville Branch, Greystone Branch, Highway 119 Hoover. Info updated 2011/12/14: Bank assets: $3,909.7 mil, Deposits: $3,124.0 mil, local headquarters, positive income, Commercial Lending Specialization, 112 total offices, Holding Company: Cadence Bancorp Llc

- Synovus Bank: Downtown Branch, Inverness Corners Bkng. Ctr. Branch, Vestavia Branch, Brookdale Place Branch, Southbridge - Homewood Drive-Thru Fa, Birmingham Branch. Info updated 2011/01/25: Bank assets: $26,863.3 mil, Deposits: $22,415.0 mil, headquarters in Columbus, GA, positive income, Commercial Lending Specialization, 296 total offices, Holding Company: Synovus Financial Corp.

- BancorpSouth Bank: Colonnade Parkway Branch, Trussville Branch, Hoover Branch, One Federal Place, Highland Avenue Branch. Info updated 2007/07/18: Bank assets: $12,990.3 mil, Deposits: $10,863.8 mil, headquarters in Tupelo, MS, positive income, Commercial Lending Specialization, 271 total offices, Holding Company: Bancorpsouth, Inc.

- Branch Banking and Trust Company: Meadow Brook Branch, Shades Valley Main Branch, Grayson Valley Branch, Birmingham Branch, Roebuck Branch. Info updated 2010/03/29: Bank assets: $168,867.6 mil, Deposits: $127,549.5 mil, headquarters in Winston Salem, NC, positive income, Commercial Lending Specialization, 1793 total offices, Holding Company: Bb&T Corporation

- Bryant Bank: Cahaba Village Branch, Homewood Branch, 280 Branch. Info updated 2011/02/24: Bank assets: $951.1 mil, Deposits: $781.0 mil, headquarters in Tuscaloosa, AL, positive income, Commercial Lending Specialization, 13 total offices

- 15 other banks with 20 local branches

For population 15 years and over in Birmingham:

- Never married: 49.3%

- Now married: 28.5%

- Separated: 2.1%

- Widowed: 7.1%

- Divorced: 13.0%

For population 25 years and over in Birmingham:

- High school or higher: 88.2%

- Bachelor's degree or higher: 30.5%

- Graduate or professional degree: 11.4%

- Unemployed: 10.8%

- Mean travel time to work (commute): 19.2 minutes

| Here: | 11.8 |

| Alabama average: | 11.5 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Birmingham:

(Birmingham, Alabama Neighborhood Map)- Airport Highlands neighborhood

- Airport Hills neighborhood

- Brownsville Heights neighborhood

- Brummit Heights neighborhood

- Central City neighborhood

- Druid Hills neighborhood

- East Birmingham neighborhood

- Evergreen neighborhood

- Five Points South neighborhood

- Fountain Heights neighborhood

- Glen Iris neighborhood

Religion statistics for Birmingham, AL (based on Jefferson County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 308,984 | 710 |

| Black Protestant | 106,653 | 257 |

| Mainline Protestant | 67,037 | 150 |

| Catholic | 55,083 | 32 |

| Other | 13,073 | 45 |

| Orthodox | 1,424 | 4 |

| None | 106,212 | - |

Food Environment Statistics:

| Jefferson County: | 2.05 / 10,000 pop. |

| State: | 1.89 / 10,000 pop. |

| Jefferson County: | 0.18 / 10,000 pop. |

| Alabama: | 0.20 / 10,000 pop. |

| This county: | 0.99 / 10,000 pop. |

| Alabama: | 0.65 / 10,000 pop. |

| Jefferson County: | 5.77 / 10,000 pop. |

| Alabama: | 6.32 / 10,000 pop. |

| Jefferson County: | 5.42 / 10,000 pop. |

| Alabama: | 5.75 / 10,000 pop. |

| This county: | 12.4% |

| Alabama: | 11.8% |

| Here: | 31.1% |

| State: | 31.7% |

| Here: | 12.0% |

| State: | 13.5% |

Health and Nutrition:

| Birmingham: | 48.3% |

| Alabama: | 49.0% |

| Birmingham: | 45.6% |

| Alabama: | 45.7% |

| Birmingham: | 29.8 |

| Alabama: | 28.9 |

| Birmingham: | 17.8% |

| Alabama: | 20.7% |

| Birmingham: | 13.6% |

| State: | 11.0% |

| Here: | 6.6 |

| Alabama: | 6.8 |

| Here: | 35.4% |

| State: | 34.4% |

| Here: | 54.4% |

| Alabama: | 55.2% |

| Here: | 82.4% |

| Alabama: | 79.3% |

More about Health and Nutrition of Birmingham, AL Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 782 | $4,632,459 | $71,086 | 0 | $0 |

| Firefighters | 627 | $4,273,930 | $81,798 | 0 | $0 |

| Water Supply | 605 | $3,886,447 | $77,087 | 8 | $13,523 |

| Other and Unallocable | 343 | $1,706,236 | $59,693 | 21 | $37,149 |

| Natural Resources | 240 | $866,758 | $43,338 | 0 | $0 |

| Parks and Recreation | 236 | $1,031,860 | $52,467 | 25 | $29,959 |

| Solid Waste Management | 217 | $779,827 | $43,124 | 0 | $0 |

| Other Government Administration | 151 | $997,283 | $79,254 | 0 | $0 |

| Financial Administration | 140 | $872,040 | $74,746 | 0 | $0 |

| Local Libraries | 129 | $601,626 | $55,965 | 67 | $72,365 |

| Streets and Highways | 115 | $612,890 | $63,954 | 0 | $0 |

| Police - Other | 113 | $539,757 | $57,319 | 0 | $0 |

| Judicial and Legal | 106 | $641,002 | $72,566 | 0 | $0 |

| Correction | 80 | $421,774 | $63,266 | 0 | $0 |

| Housing and Community Development (Local) | 51 | $277,978 | $65,407 | 0 | $0 |

| Fire - Other | 24 | $198,678 | $99,339 | 0 | $0 |

| Totals for Government | 3,959 | $22,340,545 | $67,716 | 121 | $152,996 |

Birmingham government finances - Expenditure in 2021 (per resident):

- Construction - General - Other: $117,024,000 ($594.30)

Water Utilities: $45,212,000 ($229.61)

Regular Highways: $13,845,000 ($70.31)

Housing and Community Development: $5,866,000 ($29.79)

Parks and Recreation: $555,000 ($2.82)

- Current Operations - Police Protection: $106,672,000 ($541.73)

Water Utilities: $103,469,000 ($525.46)

Local Fire Protection: $71,158,000 ($361.37)

General - Other: $59,481,000 ($302.07)

Regular Highways: $56,443,000 ($286.64)

Central Staff Services: $30,949,000 ($157.17)

Parks and Recreation: $24,098,000 ($122.38)

Financial Administration: $14,976,000 ($76.06)

Protective Inspection and Regulation - Other: $13,864,000 ($70.41)

General Public Buildings: $13,679,000 ($69.47)

Libraries: $13,569,000 ($68.91)

Housing and Community Development: $10,258,000 ($52.09)

Judicial and Legal Services: $6,812,000 ($34.59)

Parking Facilities: $554,000 ($2.81)

Correctional Institutions: $498,000 ($2.53)

- General - Interest on Debt: $26,226,000 ($133.19)

- Other Capital Outlay - Water Utilities: $13,854,000 ($70.36)

General - Other: $1,327,000 ($6.74)

- Water Utilities - Interest on Debt: $37,041,000 ($188.11)

Birmingham government finances - Revenue in 2021 (per resident):

- Charges - Other: $17,066,000 ($86.67)

Parking Facilities: $2,002,000 ($10.17)

Parks and Recreation: $1,559,000 ($7.92)

- Federal Intergovernmental - Housing and Community Development: $8,435,000 ($42.84)

- Local Intergovernmental - Highways: $4,946,000 ($25.12)

Other: $1,637,000 ($8.31)

General Local Government Support: $1,263,000 ($6.41)

- Miscellaneous - Interest Earnings: $28,026,000 ($142.33)

General Revenue - Other: $6,936,000 ($35.22)

Special Assessments: $5,359,000 ($27.22)

Fines and Forfeits: $2,464,000 ($12.51)

Sale of Property: $1,528,000 ($7.76)

Donations From Private Sources: $214,000 ($1.09)

- Revenue - Water Utilities: $200,382,000 ($1017.63)

- State Intergovernmental - General Local Government Support: $17,862,000 ($90.71)

Other: $17,818,000 ($90.49)

Health and Hospitals: $17,379,000 ($88.26)

Highways: $7,633,000 ($38.76)

Water Utilities: $675,000 ($3.43)

- Tax - General Sales and Gross Receipts: $185,782,000 ($943.49)

Individual Income: $102,226,000 ($519.15)

Property: $76,044,000 ($386.19)

Occupation and Business License - Other: $58,406,000 ($296.61)

Public Utilities Sales: $17,335,000 ($88.04)

Other Selective Sales: $14,706,000 ($74.68)

Other License: $12,576,000 ($63.87)

Alcoholic Beverage Sales: $1,831,000 ($9.30)

Birmingham government finances - Debt in 2021 (per resident):

- Long Term Debt - Outstanding Unspecified Public Purpose: $1,527,729,000 ($7758.51)

Beginning Outstanding - Unspecified Public Purpose: $1,465,568,000 ($7442.83)

Issue, Unspecified Public Purpose: $247,157,000 ($1255.18)

Retired Unspecified Public Purpose: $184,996,000 ($939.50)

Birmingham government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $125,725,000 ($638.49)

- Other Funds - Cash and Securities: $553,985,000 ($2813.39)

- Sinking Funds - Cash and Securities: $144,962,000 ($736.18)

6.20% of this county's 2020 resident taxpayers moved to other counties in 2021 ($76,918 average adjusted gross income)

| Here: | 6.20% |

| Alabama average: | 6.41% |

0.01% of residents moved to foreign countries ($73 average AGI)

Jefferson County: 0.01% Alabama average: 0.02%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Shelby County, AL | |

| to St. Clair County, AL | |

| to Blount County, AL |

| Businesses in Birmingham, AL | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| ALDI | 2 | Journeys | 1 | |

| ALDO | 1 | Juicy Couture | 1 | |

| AT&T | 8 | Justice | 3 | |

| Abercrombie Kids | 1 | KFC | 7 | |

| Academy Sports + Outdoors | 2 | Kmart | 2 | |

| Ace Hardware | 2 | Kohl's | 2 | |

| Advance Auto Parts | 6 | La Quinta | 2 | |

| Aeropostale | 4 | La-Z-Boy | 1 | |

| American Eagle Outfitters | 4 | Lane Furniture | 3 | |

| Ann Taylor | 3 | LensCrafters | 4 | |

| Apple Store | 1 | Little Caesars Pizza | 5 | |

| Applebee's | 4 | Lowe's | 2 | |

| Arby's | 10 | Macy's | 2 | |

| Ascend Collection | 1 | Marriott | 9 | |

| Ashley Furniture | 1 | MasterBrand Cabinets | 10 | |

| AutoZone | 6 | Maurices | 1 | |

| Avenue | 1 | McDonald's | 19 | |

| Banana Republic | 1 | Men's Wearhouse | 1 | |

| Barnes & Noble | 1 | Microtel | 1 | |

| Bath & Body Works | 3 | Motel 6 | 1 | |

| Baymont Inn | 1 | Motherhood Maternity | 4 | |

| Bebe | 2 | New Balance | 6 | |

| Bed Bath & Beyond | 2 | New York & Co | 4 | |

| Best Western | 1 | Nike | 35 | |

| Blockbuster | 1 | Nissan | 3 | |

| Brooks Brothers | 1 | Office Depot | 3 | |

| Brookstone | 2 | OfficeMax | 2 | |

| Brunswick Bowling & Billiards | 1 | Old Navy | 2 | |

| Budget Car Rental | 2 | Olive Garden | 2 | |

| Buffalo Wild Wings | 3 | Outback | 3 | |

| Burger King | 9 | Outback Steakhouse | 3 | |

| Burlington Coat Factory | 2 | Panera Bread | 2 | |

| CVS | 9 | Papa John's Pizza | 5 | |

| Cache | 3 | Payless | 3 | |

| Catherines | 3 | Penske | 3 | |

| Charlotte Russe | 1 | PetSmart | 1 | |

| Chevrolet | 3 | Pier 1 Imports | 3 | |

| Chick-Fil-A | 9 | Pizza Hut | 9 | |

| Chico's | 2 | Popeyes | 5 | |

| Chipotle | 2 | Pottery Barn | 1 | |

| Chuck E. Cheese's | 1 | Pottery Barn Kids | 1 | |

| Church's Chicken | 10 | Publix Super Markets | 5 | |

| Circle K | 4 | Quality | 2 | |

| Clarion | 1 | Quiznos | 2 | |

| Clarks | 2 | RadioShack | 7 | |

| Coldwater Creek | 1 | Red Lobster | 1 | |

| Comfort Inn | 3 | Red Robin | 1 | |

| Cracker Barrel | 1 | Rite Aid | 6 | |

| Curves | 1 | Ruby Tuesday | 4 | |

| DHL | 4 | Rue21 | 1 | |

| Dairy Queen | 4 | Ryder Rental & Truck Leasing | 2 | |

| Days Inn | 4 | SONIC Drive-In | 3 | |

| Decora Cabinetry | 2 | Saks Fifth Avenue | 1 | |

| Dennys | 1 | Sam's Club | 1 | |

| Domino's Pizza | 6 | Sears | 5 | |

| Econo Lodge | 1 | Sephora | 1 | |

| Eddie Bauer | 1 | Sheraton | 1 | |

| Express | 2 | Shoe Carnival | 1 | |

| FedEx | 128 | Soma Intimates | 1 | |

| Finish Line | 3 | Sprint Nextel | 1 | |

| Firestone Complete Auto Care | 6 | Staples | 2 | |

| Foot Locker | 3 | Starbucks | 13 | |

| Ford | 2 | Studio Plus Deluxe Studios | 2 | |

| GNC | 9 | Subaru | 1 | |

| GameStop | 8 | Subway | 32 | |

| Gap | 2 | T-Mobile | 14 | |

| Goodwill | 13 | T.J.Maxx | 1 | |

| Gymboree | 2 | Taco Bell | 7 | |

| H&R Block | 8 | Talbots | 1 | |

| Haagen-Dazs | 1 | Target | 3 | |

| Hardee's | 1 | The Cheesecake Factory | 1 | |

| Haworth | 1 | The Limited | 1 | |

| Hilton | 11 | The Room Place | 2 | |

| Hobby Lobby | 1 | Toyota | 2 | |

| Holiday Inn | 5 | U-Haul | 19 | |

| Home Depot | 3 | UPS | 165 | |

| Homestead Studio Suites | 1 | Urban Outfitters | 1 | |

| Honda | 2 | Vans | 3 | |

| Hot Topic | 1 | Verizon Wireless | 4 | |

| Howard Johnson | 1 | Victoria's Secret | 2 | |

| Hyatt | 1 | Volkswagen | 2 | |

| Hyundai | 2 | Waffle House | 5 | |

| IHOP | 2 | Walgreens | 10 | |

| InTown Suites | 2 | Walmart | 6 | |

| J. Jill | 1 | Wet Seal | 3 | |

| J.Crew | 1 | Whole Foods Market | 1 | |

| Jimmy John's | 1 | Wingate | 1 | |

| JoS. A. Bank | 3 | YMCA | 10 | |

| Johnny Rockets | 1 | Z Gallerie | 1 | |

| Jones New York | 11 | |||

Strongest AM radio stations in Birmingham:

- WYDE (1260 AM; 5 kW; BIRMINGHAM, AL; Owner: KIMTRON, INC.)

- WAPI (1070 AM; 50 kW; BIRMINGHAM, AL; Owner: CITADEL BROADCASTING COMPANY)

- WJOX (690 AM; 50 kW; BIRMINGHAM, AL; Owner: CITADEL BROADCASTING COMPANY)

- WERC (960 AM; 5 kW; BIRMINGHAM, AL; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WDJC (850 AM; 50 kW; BIRMINGHAM, AL; Owner: KIMTRON, INC.)

- WRJS (1320 AM; 5 kW; BIRMINGHAM, AL; Owner: CXR HOLDINGS, INC.)

- WATV (900 AM; 1 kW; BIRMINGHAM, AL)

- WAYE (1220 AM; 1 kW; BIRMINGHAM, AL; Owner: BIRMINGHAM CHRISTIAN RADIO, INC.)

- WLPH (1480 AM; daytime; 5 kW; IRONDALE, AL; Owner: BIRMINGHAM CHRISTIAN RADIO, INC.)

- WJLD (1400 AM; 1 kW; FAIRFIELD, AL; Owner: RICHARDSON BROADCASTING CORPORATION)

- WNSI (810 AM; 50 kW; JACKSONVILLE, AL; Owner: UNITED BROADCASTING NETWORK, INC.)

- WCOC (1010 AM; 5 kW; DORA, AL; Owner: AZTECA COMMUNICATIONS OF ALABAMA, INC.)

- WSMQ (1450 AM; 1 kW; BESSEMER, AL; Owner: BESSEMER RADIO INC.)

Strongest FM radio stations in Birmingham:

- WBPT (106.9 FM; BIRMINGHAM, AL; Owner: CXR HOLDINGS, INC.)

- WBHK (98.7 FM; WARRIOR, AL; Owner: CXR HOLDINGS, INC.)

- WBHM (90.3 FM; BIRMINGHAM, AL; Owner: BD OF TRUSTEES/U OF AL AT BIRMINGHAM)

- WZZK-FM (104.7 FM; BIRMINGHAM, AL; Owner: CXR HOLDINGS, INC.)

- WBFR (89.5 FM; BIRMINGHAM, AL; Owner: FAMILY STATIONS, INC.)

- WODL (97.3 FM; HOMEWOOD, AL; Owner: CXR HOLDINGS, INC.)

- WYSF (94.5 FM; BIRMINGHAM, AL; Owner: CITADEL BROADCASTING COMPANY)

- WMJJ (96.5 FM; BIRMINGHAM, AL; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WQEN (103.7 FM; GADSDEN, AL; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WDJC-FM (93.7 FM; BIRMINGHAM, AL; Owner: KIMTRON, INC.)

- WZRR (99.5 FM; BIRMINGHAM, AL; Owner: CITADEL BROADCASTING COMPANY)

- WENN (105.9 FM; TRUSSVILLE, AL; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WVSU-FM (91.1 FM; BIRMINGHAM, AL; Owner: SAMFORD UNIVERSITY)

- W281AB (104.1 FM; MOUNTAIN BROOK, AL; Owner: FAMILY STATIONS, INC.)

- WRAX (107.7 FM; BIRMINGHAM, AL; Owner: CITADEL BROADCASTING COMPANY)

- WGIB (91.9 FM; BIRMINGHAM, AL; Owner: GLEN IRIS BAPTIST SCHOOL)

- WLJR (88.5 FM; BIRMINGHAM, AL; Owner: BRIARWOOD PRESBYTERIAN CHURCH)

- WDXB (102.5 FM; JASPER, AL; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WYDE-FM (101.1 FM; CULLMAN, AL; Owner: KIMTRON, INC.)

- WQEM (101.5 FM; COLUMBIANA, AL; Owner: GLEN IRIS BAPTIST SCHOOL)

TV broadcast stations around Birmingham:

- W46DK (Channel 46; BIRMINGHAM, AL; Owner: TRINITY BROADCASTING NETWORK)

- WBRC (Channel 6; BIRMINGHAM, AL; Owner: WBRC LICENSE, INC.)

- WVTM-TV (Channel 13; BIRMINGHAM, AL; Owner: BIRMINGHAM BROADCASTING (WVTM-TV), LLC)

- WIAT (Channel 42; BIRMINGHAM, AL; Owner: MEDIA GENERAL COMMUNICATIONS, INC.)

- WBIQ (Channel 10; BIRMINGHAM, AL; Owner: ALABAMA EDUCATIONAL TELEVISION COMMISSION)

- WTTO (Channel 21; HOMEWOOD, AL; Owner: WTTO LICENSEE, LLC)

- W27CM (Channel 27; BIRMINGHAM, AL; Owner: EQUITY BROADCASTING CORPORATION)

- WABM (Channel 68; BIRMINGHAM, AL; Owner: BIRMINGHAM (WABM-TV) LICENSEE, INC.)

- WBXA-CA (Channel 2; BIRMINGHAM, AL; Owner: THE BOX WORLDWIDE LLC)

- W49AY (Channel 49; BIRMINGHAM, AL; Owner: GLEN IRIS BAPTIST SCHOOL)

- W34BI (Channel 34; BIRMINGHAM, AL; Owner: VENTANA TELEVISION, INC.)

- W62BG (Channel 62; BIRMINGHAM, AL; Owner: WTTO LICENSEE, LLC)

- WBMA-LP (Channel 58; BIRMINGHAM, AL; Owner: TV ALABAMA, INC.)

- WDBB (Channel 17; BESSEMER, AL; Owner: WDBB-TV, INC.)

- WCFT-TV (Channel 33; TUSCALOOSA, AL; Owner: TV ALABAMA, INCORPORATED)

- WJSU-TV (Channel 40; ANNISTON, AL; Owner: TV ALABAMA, INC.)

- WTJP (Channel 60; GADSDEN, AL; Owner: TRINITY BROADCASTING NETWORK)

Medal of Honor Recipients

Medal of Honor Recipient born in Birmingham: Harold E. Wilson.

- National Bridge Inventory (NBI) Statistics

- 687Number of bridges

- 15,840ft / 4,828mTotal length

- $2,159,122,000Total costs

- 16,111,541Total average daily traffic

- 1,575,974Total average daily truck traffic

- New bridges - historical statistics

- 11900-1909

- 121910-1919

- 151920-1929

- 291930-1939

- 131940-1949

- 231950-1959

- 1211960-1969

- 2511970-1979

- 721980-1989

- 141990-1999

- 122000-2009

- 1232010-2019

- 12020-2022

FCC Registered Antenna Towers: 1,493 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 31 (See the full list of FCC Registered Commercial Land Mobile Towers in Birmingham, AL)

FCC Registered Private Land Mobile Towers: 51 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 374 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 319 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 57 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 48 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 1,507 (See the full list of FCC Registered Amateur Radio Licenses in Birmingham)

FAA Registered Aircraft Manufacturers and Dealers: 4 (See the full list of FAA Registered Manufacturers and Dealers in Birmingham)

FAA Registered Aircraft: 358 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 47 full and 34 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 476 | $123,888 | 555 | $167,990 | 2,102 | $160,338 | 142 | $38,626 | 30 | $1,758,106 | 297 | $81,269 | 1 | $79,730 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 29 | $109,175 | 35 | $154,301 | 227 | $119,361 | 23 | $27,636 | 2 | $3,772,500 | 18 | $75,981 | 3 | $70,873 |

| APPLICATIONS DENIED | 157 | $98,967 | 141 | $98,038 | 1,556 | $105,173 | 391 | $25,730 | 3 | $375,000 | 182 | $78,039 | 10 | $42,590 |

| APPLICATIONS WITHDRAWN | 88 | $121,173 | 95 | $155,815 | 1,025 | $130,850 | 37 | $68,749 | 3 | $2,353,000 | 78 | $108,778 | 2 | $26,825 |

| FILES CLOSED FOR INCOMPLETENESS | 37 | $102,845 | 15 | $180,418 | 256 | $119,899 | 26 | $72,482 | 0 | $0 | 24 | $92,819 | 0 | $0 |

Detailed mortgage data for all 81 tracts in Birmingham, AL

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 26 full and 29 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 83 | $173,722 | 50 | $192,288 | 2 | $201,520 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 34 | $158,695 | 30 | $187,634 | 2 | $102,750 |

| APPLICATIONS DENIED | 16 | $167,105 | 14 | $190,292 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 11 | $152,082 | 6 | $161,912 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 3 | $154,943 | 5 | $86,102 | 3 | $54,667 |

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Birmingham, AL

- 12,38142.3%Structure Fires

- 9,24431.6%Outside Fires

- 6,43822.0%Mobile Property/Vehicle Fires

- 1,1974.1%Other

According to the data from the years 2002 - 2018 the average number of fire incidents per year is 1721. The highest number of fire incidents - 2,660 took place in 2005, and the least - 396 in 2012. The data has a declining trend.

According to the data from the years 2002 - 2018 the average number of fire incidents per year is 1721. The highest number of fire incidents - 2,660 took place in 2005, and the least - 396 in 2012. The data has a declining trend. When looking into fire subcategories, the most incidents belonged to: Structure Fires (42.3%), and Outside Fires (31.6%).

When looking into fire subcategories, the most incidents belonged to: Structure Fires (42.3%), and Outside Fires (31.6%).Fire-safe hotels and motels in Birmingham, Alabama:

- Embassy Suites Hotel Birmingham, 2300 Woodcrest Pl, Birmingham, Alabama 35209 , Phone: (205) 879-7400, Fax: (205) 870-4523

- Red Roof Inn, 1466 Montgomery Ave, Birmingham, Alabama 35216 , Phone: (205) 822-2224, Fax: (205) 822-9421

- Hampton Inn MT Brook, 2731 US Hwy 280, Birmingham, Alabama 35223 , Phone: (205) 870-7822, Fax: (205) 871-7610

- Redmont Hotel Birmingham, 2101 5TH Ave N, Birmingham, Alabama 35203 , Phone: (205) 957-6828, Fax: (205) 957-6851

- Sheraton Birmingham Hotel, 2101 Richard Arrington Blvd N, Birmingham, Alabama 35203 , Phone: (205) 324-5000, Fax: (205) 307-3045

- Days Inn, 905 11th Court W, Birmingham, Alabama 35204 , Phone: (205) 324-4510, Fax: (205) 252-7972

- Delux Inn & Suites, 7905 Crestwood Blvd, Birmingham, Alabama 35210 , Phone: (205) 956-4440, Fax: (205) 956-3011

- Hotel Indigo Birmingham Five Points S- UAB, 1023 20th St S, Birmingham, Alabama 35205 , Phone: (205) 933-9555, Fax: (205) 917-5642

- 87 other hotels and motels

| Most common first names in Birmingham, AL among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| James | 4,667 | 71.6 years |

| Mary | 4,548 | 78.8 years |

| John | 3,815 | 73.2 years |

| William | 3,704 | 73.5 years |

| Robert | 2,631 | 70.8 years |

| Willie | 2,513 | 72.6 years |

| Annie | 1,785 | 79.4 years |

| Charles | 1,776 | 70.7 years |

| George | 1,669 | 74.6 years |

| Margaret | 1,241 | 78.6 years |

| Most common last names in Birmingham, AL among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 2,474 | 73.8 years |

| Williams | 2,013 | 73.3 years |

| Jones | 1,982 | 74.1 years |

| Johnson | 1,652 | 73.6 years |

| Brown | 1,411 | 74.1 years |

| Davis | 1,294 | 74.1 years |

| Jackson | 1,148 | 72.7 years |

| Thomas | 1,028 | 73.2 years |

| Harris | 1,005 | 75.1 years |

| Moore | 899 | 73.6 years |

- 62.5%Utility gas

- 35.3%Electricity

- 1.1%No fuel used

- 0.7%Bottled, tank, or LP gas

- 0.2%Other fuel

- 65.8%Electricity

- 32.1%Utility gas

- 1.1%Bottled, tank, or LP gas

- 0.7%No fuel used

- 0.1%Wood

Birmingham compared to Alabama state average:

- Median household income below state average.

- Median house value below state average.

- Black race population percentage above state average.

- Hispanic race population percentage below state average.

- Median age below state average.

- Renting percentage above state average.

- Length of stay since moving in above state average.

- House age above state average.

- Percentage of population with a bachelor's degree or higher above state average.

Birmingham, AL compared to other similar cities:

Birmingham on our top lists:

- #8 on the list of "Top 100 cities with declining populations from 2000 to 2014 (pop. 50,000+)"

- #9 on the list of "Top 101 cities with the largest percentage population decrease from 2000 (population 50,000+)"

- #10 on the list of "Top 100 least-safe cities (highest city-data.com crime index) (pop. 50,000+)"

- #10 on the list of "Top 101 cities with the highest number of police officers per 1000 residents (population 50,000+)"

- #12 on the list of "Top 101 cities with the highest city-data.com crime index, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #12 on the list of "Top 101 cities with the most people born in the same U.S. state as the city (population 50,000+)"

- #13 on the list of "Top 101 cities with the highest number of assaults per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #13 on the list of "Top 101 cities with the highest percentage of single-parent households, population 50,000+"

- #14 on the list of "Top 101 cities with the highest number of burglaries per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #15 on the list of "Top 101 cities with the highest number of murders per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #18 on the list of "Top 101 cities with largest percentage population decreases in the 1990s) (population 50,000+)"

- #21 on the list of "Top 101 cities with the lowest percentage of workers working at home, population 50,000+"

- #28 on the list of "Top 101 cities with the highest number of robberies per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #31 on the list of "Top 101 cities with the highest percentage of English-only speaking households, population 50,000+"

- #35 on the list of "Top 101 cities with largest percentage of females in occupations: fire fighting and prevention workers including supervisors (population 50,000+)"

- #36 on the list of "Top 101 cities with largest percentage of males in industries: administrative and support and waste management services (population 50,000+)"

- #38 on the list of "Top 100 cities with the largest percentage of females (pop. 50,000+)"

- #38 on the list of "Top 101 cities with the highest number of thefts per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #40 on the list of "Top 101 cities with the highest number of rapes per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #40 on the list of "Top 101 cities with the most local government spending on current operations of parking facilities per resident (population 10,000+)"

- #2 (35204) on the list of "Top 101 zip codes with the largest percentage of United States first ancestries (pop 5,000+)"

- #13 (35223) on the list of "Top 101 zip codes with the largest percentage of taxpayers using charity contributions deductions in 2012 (pop 5,000+)"

- #23 (35234) on the list of "Top 101 zip codes with the smallest percentage of taxpayers reporting taxable interest in 2012 (pop 5,000+)"

- #26 (35206) on the list of "Top 101 zip codes with the lowest 2012 average net capital gain/loss (pop 5,000+)"

- #32 (35061) on the list of "Top 101 zip codes with the largest percentage of Subsaharan African first ancestries"

- #37 (35203) on the list of "Top 101 zip codes with the most museums in 2005"

- #38 (35221) on the list of "Top 101 zip codes with the lowest 2012 average taxable interest for individuals (pop 5,000+)"

- #55 (35234) on the list of "Top 101 zip codes with the lowest 2012 average Adjusted Gross Income (AGI) for individuals (pop 5,000+)"

- #57 (35127) on the list of "Top 101 zip codes with the lowest 2012 average reported profit/loss from business (pop 5,000+)"

- #57 (35223) on the list of "Top 101 zip codes with the largest percentage of Scottish first ancestries (pop 5,000+)"

- #60 (35233) on the list of "Top 101 zip codes with the most big companies in 2005 (at least 1000 employees)"

- #65 (35064) on the list of "Top 101 zip codes with the largest charity contributions deductions as a percentage of AGI in 2012 (pop 5,000+)"

- #83 (35203) on the list of "Top 101 zip codes with the most offices of lawyers in 2005"

- #83 (35234) on the list of "Top 101 zip codes with the lowest average reported salary/wage in 2012 (pop 5,000+)"

- #84 (35223) on the list of "Top 101 zip codes with the largest percentage of taxpayers reporting net capital gain/loss in 2012 (pop 5,000+)"

- #87 (35223) on the list of "Top 101 zip codes with the highest 2012 average Adjusted Gross Income (AGI) for individuals (pop 5,000+)"

- #101 (35208) on the list of "Top 101 zip codes with the smallest percentage of taxpayers reporting net capital gain/loss in 2012 (pop 5,000+)"

- #5 on the list of "Top 101 counties with the highest number of infant deaths per 1000 residents 2007-2013 (pop. 50,000+)"

- #5 on the list of "Top 101 counties with the most Black Protestant adherents"

- #5 on the list of "Top 101 counties with the most Black Protestant congregations"

- #9 on the list of "Top 101 counties with the highest average weight of females"

- #9 on the list of "Top 101 counties with the most Evangelical Protestant adherents"

State forum archive:

|

|

Total of 1087 patent applications in 2008-2024.