Boca Raton, Florida

Boca Raton: Boca Raton Resort

Boca Raton: Red Reef Park

Boca Raton: Red Reef Park

Boca Raton: Mizner Park

Boca Raton: Mizner Park

Boca Raton: 2 Gators @ BCC between holes 4 & 5. . . dont try to get your ball if it goes in the water!

Boca Raton: Lake At Boca Arbor Way

Boca Raton: Red Reef Park with Seagull

Boca Raton: Japan? No, it's Morikami Japanese Garden in Boca Raton!

Boca Raton: Sugar Sand Park

Boca Raton: Red Reef Park

- see

14

more - add

your

Submit your own pictures of this city and show them to the world

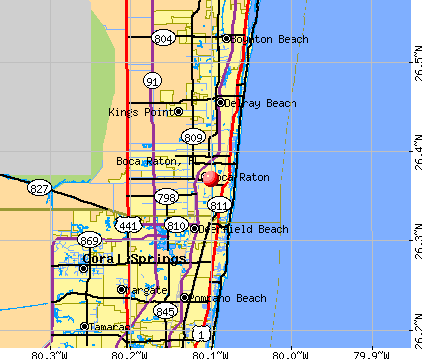

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +32.4%

| Males: 45,917 | |

| Females: 53,092 |

| Median resident age: | 44.5 years |

| Florida median age: | 42.7 years |

Zip codes: 33431, 33432, 33433, 33434, 33444, 33445, 33486, 33487, 33496.

Boca Raton Zip Code Map| Boca Raton: | $88,620 |

| FL: | $69,303 |

Estimated per capita income in 2022: $77,027 (it was $45,628 in 2000)

Boca Raton city income, earnings, and wages data

Estimated median house or condo value in 2022: $779,700 (it was $195,200 in 2000)

| Boca Raton: | $779,700 |

| FL: | $354,100 |

Mean prices in 2022: all housing units: over $1,000,000; detached houses: over $1,000,000; townhouses or other attached units: $641,918; in 2-unit structures: $541,004; in 3-to-4-unit structures: $379,137; in 5-or-more-unit structures: $824,965; mobile homes: $446,650

Median gross rent in 2022: $2,232.

(7.3% for White Non-Hispanic residents, 6.5% for Black residents, 12.8% for Hispanic or Latino residents, 18.8% for other race residents, 10.5% for two or more races residents)

Detailed information about poverty and poor residents in Boca Raton, FL

- 67,65568.3%White alone

- 19,70919.9%Hispanic

- 4,7504.8%Two or more races

- 3,6033.6%Black alone

- 2,6792.7%Asian alone

- 6010.6%Other race alone

Races in Boca Raton detailed stats: ancestries, foreign born residents, place of birth

According to our research of Florida and other state lists, there were 104 registered sex offenders living in Boca Raton, Florida as of April 19, 2024.

The ratio of all residents to sex offenders in Boca Raton is 910 to 1.

The ratio of registered sex offenders to all residents in this city is lower than the state average.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is smaller than the state average.- means the value is about the same as the state average.

- means the value is bigger than the state average.

Crime rate in Boca Raton detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 303 (207 officers - 166 male; 41 female).

| Officers per 1,000 residents here: | 2.04 |

| Florida average: | 2.33 |

| Moving to Boca Raton with parents (15 replies) |

| World-class $100+ million performing arts center coming to downtown Boca Raton (0 replies) |

| New Job in Boca Raton (5 replies) |

| Moving to Boca Raton from NYC (23 replies) |

| People always ask 4 questions about Boca Raton Florida (0 replies) |

| Fort Lauderdale vs Pompano Beach vs Boca Raton (9 replies) |

Latest news from Boca Raton, FL collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: Italian (10.0%), American (9.0%), Irish (5.5%), German (5.1%), English (4.6%), Russian (3.8%).

Current Local Time: EST time zone

Elevation: 16 feet

Land area: 27.2 square miles.

Population density: 3,642 people per square mile (average).

19,480 residents are foreign born (8.9% Latin America, 4.7% Europe, 3.8% Asia).

| This city: | 19.6% |

| Florida: | 21.1% |

Median real estate property taxes paid for housing units with mortgages in 2022: $5,378 (0.7%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $5,911 (0.7%)

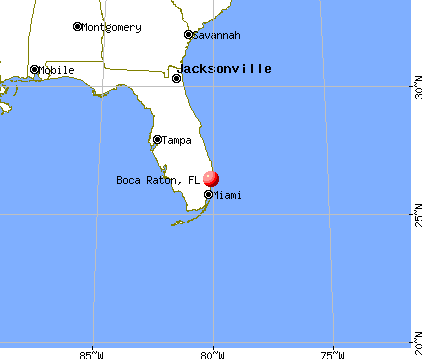

Nearest city with pop. 200,000+: Hialeah, FL (37.2 miles

, pop. 226,419).

Nearest city with pop. 1,000,000+: Houston, TX (961.0 miles

, pop. 1,953,631).

Nearest cities:

Latitude: 26.37 N, Longitude: 80.10 W

Daytime population change due to commuting: +59,791 (+60.4%)

Workers who live and work in this city: 24,039 (52.6%)

Area code: 561

Property values in Boca Raton, FL

Boca Raton tourist attractions:

- Boca Beach Club, The Waldorf Astoria Collection

- The Children's Museum of Boca Raton

- South Inlet Park Beach

- Sports Immortals Museum

- Coconut Cove Waterpark

- Daggerwing Nature Center

- Gatsby's Boca

- Little Palm Family Theatre

- Mizner Park

- Red Reef Park

- Sugar Sand Park

- Boca Raton Museum of Art

- Gumbo Limbo Nature Center

- Boca Raton Marriott at Boca Center

- Town Center - Boca Raton, FL - A Shopping Mall in the Southeastern Coast of Florida

Boca Raton, Florida accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 116 buildings, average cost: $1,503,400

- 2021: 147 buildings, average cost: $1,144,500

- 2020: 122 buildings, average cost: $691,000

- 2019: 113 buildings, average cost: $833,500

- 2018: 112 buildings, average cost: $687,500

- 2017: 90 buildings, average cost: $708,800

- 2016: 146 buildings, average cost: $542,100

- 2015: 131 buildings, average cost: $651,600

- 2014: 66 buildings, average cost: $841,900

- 2013: 54 buildings, average cost: $723,400

- 2012: 229 buildings, average cost: $274,300

- 2011: 218 buildings, average cost: $330,900

- 2010: 60 buildings, average cost: $433,100

- 2009: 17 buildings, average cost: $614,200

- 2008: 30 buildings, average cost: $707,800

- 2007: 37 buildings, average cost: $908,900

- 2006: 55 buildings, average cost: $707,400

- 2005: 75 buildings, average cost: $681,900

- 2004: 71 buildings, average cost: $711,400

- 2003: 89 buildings, average cost: $645,400

- 2002: 86 buildings, average cost: $568,900

- 2001: 88 buildings, average cost: $426,400

- 2000: 119 buildings, average cost: $372,900

- 1999: 151 buildings, average cost: $352,700

- 1998: 178 buildings, average cost: $269,000

- 1997: 213 buildings, average cost: $99,700

| Here: | 2.8% |

| Florida: | 2.9% |

- Professional, scientific, technical services (11.0%)

- Health care (9.1%)

- Finance & insurance (7.7%)

- Accommodation & food services (7.3%)

- Educational services (7.0%)

- Real estate & rental & leasing (5.4%)

- Construction (5.3%)

- Professional, scientific, technical services (11.9%)

- Finance & insurance (8.1%)

- Accommodation & food services (8.0%)

- Construction (7.8%)

- Health care (5.9%)

- Real estate & rental & leasing (5.1%)

- Educational services (3.9%)

- Health care (13.3%)

- Educational services (10.8%)

- Professional, scientific, technical services (9.8%)

- Finance & insurance (7.1%)

- Accommodation & food services (6.4%)

- Real estate & rental & leasing (5.7%)

- Administrative & support & waste management services (4.5%)

- Other management occupations, except farmers and farm managers (9.7%)

- Cooks and food preparation workers (6.1%)

- Retail sales workers, except cashiers (4.6%)

- Top executives (3.0%)

- Sales representatives, services, wholesale and manufacturing (2.7%)

- Computer specialists (2.7%)

- Lawyers (2.5%)

- Other management occupations, except farmers and farm managers (12.4%)

- Cooks and food preparation workers (6.8%)

- Retail sales workers, except cashiers (5.0%)

- Computer specialists (4.0%)

- Lawyers (3.8%)

- Sales representatives, services, wholesale and manufacturing (3.6%)

- Top executives (3.5%)

- Other management occupations, except farmers and farm managers (6.5%)

- Cooks and food preparation workers (5.4%)

- Secretaries and administrative assistants (4.4%)

- Retail sales workers, except cashiers (4.3%)

- Cashiers (3.6%)

- Advertising, marketing, promotions, public relations, and sales managers (3.4%)

- Other office and administrative support workers, including supervisors (2.9%)

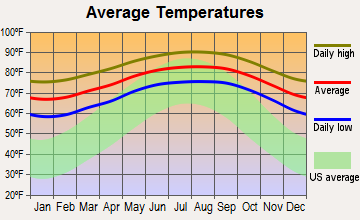

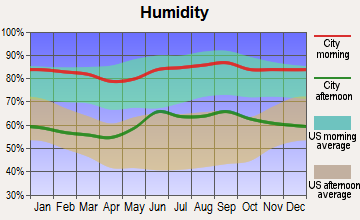

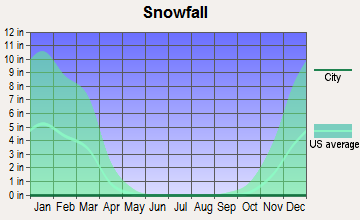

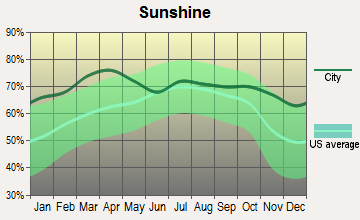

Average climate in Boca Raton, Florida

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2022 was 74.3. This is about average.

| City: | 74.3 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.328. This is worse than average. Closest monitor was 10.6 miles away from the city center.

| City: | 0.328 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 9.60. This is significantly worse than average. Closest monitor was 0.3 miles away from the city center.

| City: | 9.60 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.489. This is significantly better than average. Closest monitor was 15.0 miles away from the city center.

| City: | 0.489 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 28.2. This is about average. Closest monitor was 5.4 miles away from the city center.

| City: | 28.2 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 19.7. This is about average. Closest monitor was 1.9 miles away from the city center.

| City: | 19.7 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 7.53. This is about average. Closest monitor was 5.4 miles away from the city center.

| City: | 7.53 |

| U.S.: | 8.11 |

Tornado activity:

Boca Raton-area historical tornado activity is slightly below Florida state average. It is 25% smaller than the overall U.S. average.

On 3/1/1980, a category F3 (max. wind speeds 158-206 mph) tornado 8.3 miles away from the Boca Raton city center killed one person and injured 33 people and caused between $5,000,000 and $50,000,000 in damages.

On 2/23/1965, a category F3 tornado 13.8 miles away from the city center injured 6 people and caused between $50,000 and $500,000 in damages.

Earthquake activity:

Boca Raton-area historical earthquake activity is slightly above Florida state average. It is 95% smaller than the overall U.S. average.On 9/10/2006 at 14:56:08, a magnitude 5.9 (5.9 MB, 5.5 MS, 5.8 MW, Class: Moderate, Intensity: VI - VII) earthquake occurred 404.9 miles away from Boca Raton center

On 2/22/1992 at 04:21:34, a magnitude 3.2 (3.2 MB, Depth: 6.2 mi, Class: Light, Intensity: II - III) earthquake occurred 75.1 miles away from the city center

On 6/23/2016 at 17:20:29, a magnitude 3.8 (3.8 ML) earthquake occurred 253.9 miles away from the city center

On 7/16/2016 at 20:00:10, a magnitude 3.7 (3.7 MB) earthquake occurred 238.4 miles away from the city center

On 9/21/2016 at 16:30:52, a magnitude 3.8 (3.8 ML) earthquake occurred 258.9 miles away from Boca Raton center

On 9/4/2016 at 18:29:29, a magnitude 3.8 (3.8 ML) earthquake occurred 260.0 miles away from Boca Raton center

Magnitude types: body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Palm Beach County (27) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 15

Emergencies Declared: 8

Causes of natural disasters: Hurricanes: 17, Tropical Storms: 4, Fires: 3, Flood: 1, Freeze: 1, Storm: 1, Other: 2 (Note: some incidents may be assigned to more than one category).

Main business address for: DALEEN TECHNOLOGIES INC (SERVICES-PREPACKAGED SOFTWARE), POINTE FINANCIAL CORP (STATE COMMERCIAL BANKS), SPEAR & JACKSON INC (CUTLERY, HANDTOOLS & GENERAL HARDWARE), HYDRON TECHNOLOGIES INC (PERFUMES, COSMETICS & OTHER TOILET PREPARATIONS), CRT PROPERTIES INC (REAL ESTATE INVESTMENT TRUSTS), GEO GROUP INC (SERVICES-FACILITIES SUPPORT MANAGEMENT SERVICES), ECLIPSYS CORP (SERVICES-COMPUTER INTEGRATED SYSTEMS DESIGN), CROSS COUNTRY HEALTHCARE INC (SERVICES-HELP SUPPLY SERVICES) and 12 other public companies.

Hospitals in Boca Raton:

- BOCA RATON REGIONAL HOSPITAL (Voluntary non-profit - Private, provides emergency services, 800 MEADOWS RD)

- BRCH OUTPATIENT SURGERY CENTER (670 GLADES ROAD)

- HOSPICE BY THE SEA INC (1531 W PALMETTO PARK RD)

- NORTHWOOD SPORTS MEDICINE AND PH (1001 NW 13TH ST STE 102)

- WEST BOCA MEDICAL CENTER (Proprietary, 21644 STATE RD 7)

Nursing Homes in Boca Raton:

- AVANTE AT BOCA RATON, INC. (1130 NW 15TH STREET)

- BOCA RATON REHABILITATION CENTER (755 MEADOWS ROAD)

- FOUNTAINS NURSING HOME (3800 N FEDERAL HWY)

- HEARTLAND HEALTH CARE AND REHABILITATION CENTER OF (7225 BOCA DEL MAR DRIVE)

- MANORCARE HEALTH SERVICES (375 NW 51ST STREET)

- MENORAH HOUSE (9945 CENTRAL PARK BLVD NORTH)

- REGENTS PARK NURSING AND REHABILITATION CENTER (6363 VERDE TRAIL)

- STRATFORD COURT OF BOCA RATON (6343 VIA DE SONRISA DEL SUR)

- WHITEHALL BOCA RATON (7300 DEL PRADO SOUTH)

- WILLOWBROOKE COURT AT EDGEWATER POINTE ESTATES (23305 BLUE WATER CIRCLE)

- WILLOWBROOKE COURT AT ST ANDREWS (6152 NORTH VERDE TRAIL)

Dialysis Facilities in Boca Raton:

- ARA - BOCA RATON DIALYSIS LLC (1905 CLINT MOORE RD STE 211)

- BOCA RATON ARTIFICIAL KIDNEY CENTER (998 NW 9TH CT)

- BOCA/DELRAY RENAL ASSOCIATES INC (1905 CLINT MOORE RD STE 306)

- PINNACLE DIALYSIS OF BOCA RATON (2900 N MILITARY TRAIL SUITE 195)

- WEST BOCA DIALYSIS CENTER (19801 HAMPTON DR)

Home Health Centers in Boca Raton:

- ALL ABOUT YOU HOME HEALTH AGENCY INC (7300 W CAMINO REAL STE 215)

- ALLEGIANCE HOME HEALTH AND REHAB, INC (1700 SW 12TH AVENUE, STE B)

- ARDENT HOME CARE INC (123 NW 13TH STREET SUITE #304-14)

- BOCA HOME HEALTH (500 NE SPANISH RIVER BLVD STE 5)

- COMPLETE HOME CARE OF THE PALM BEACHES LLC (7280 W PALMETTO PARK ROAD SUITE 307-N)

- ELITE HOME HEALTH OF THE PALM BEACHES (1700 N DIXIE HIGHWAY)

- FIVE STAR HOME CARE (7025 BERACASA WAY STE 104)

- HEALTH FORCE INC (123 NORTH WEST 13TH STREET, STE 307)

- MACADAMS HOME HEALTH AGENCY, INC. (350 CAMINO GARDENS BLVD)

- THE NURSES GUILD OF THE PALM BEACHES INC (131 NE 1ST AVE STE 101)

- USA HOME HEALTH SERVICES (23123 STATE ROAD 7)

Airports and heliports located in Boca Raton:

- Boca Raton Airport (BCT) (Runways: 1, Air Taxi Ops: 6,742, Itinerant Ops: 33,085, Local Ops: 8,722, Military Ops: 103)

- A I M Heliport (58FL)

- West Boca Medical Center Heliport (3FD8)

Amtrak stations near Boca Raton:

- 4 miles: DEERFIELD BEACH (1300 W. HILLSBORO BLVD.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, free short-term parking, free long-term parking, call for taxi service, public transit connection.

- 6 miles: DELRAY BEACH (345 S. CONGRESS AVE.) . Services: enclosed waiting area, public restrooms, public payphones, vending machines, free short-term parking, free long-term parking, call for car rental service, call for taxi service, public transit connection.

- 18 miles: FORT LAUDERDALE (200 SW 21ST TERRACE) . Services: ticket office, partially wheelchair accessible, enclosed waiting area, public restrooms, public payphones, vending machines, free short-term parking, free long-term parking, call for car rental service, call for taxi service, public transit connection.

Colleges/Universities in Boca Raton:

- Florida Atlantic University (Full-time enrollment: 24,403; Location: 777 Glades Rd; Public; Website: www.fau.edu/; Offers Doctor's degree)

- Lynn University (Full-time enrollment: 2,151; Location: 3601 N. Military Trail; Private, not-for-profit; Website: www.lynn.edu; Offers Doctor's degree)

- Everglades University (Full-time enrollment: 1,136; Location: 5002 T-Rex Avenue, Suite 100; Private, not-for-profit; Website: www.EvergladesUniversity.edu; Offers Master's degree)

- Digital Media Arts College (Full-time enrollment: 356; Location: 5400 Broken Sound Blvd NW #100; Private, for-profit; Website: www.dmac.edu; Offers Master's degree)

- Boca Beauty Academy (Full-time enrollment: 78; Location: 7820 Glades Road; Private, for-profit; Website: www.bocabeautyacademy.edu)

Other colleges/universities with over 2000 students near Boca Raton:

- Everest University-Pompano Beach (about 10 miles; Pompano Beach, FL; Full-time enrollment: 2,316)

- Keiser University-Ft Lauderdale (about 14 miles; Fort Lauderdale, FL; FT enrollment: 18,270)

- Palm Beach State College (about 17 miles; Lake Worth, FL; FT enrollment: 19,938)

- Broward College (about 22 miles; Fort Lauderdale, FL; FT enrollment: 30,322)

- Nova Southeastern University (about 22 miles; Fort Lauderdale, FL; FT enrollment: 25,621)

- Palm Beach Atlantic University (about 24 miles; West Palm Beach, FL; FT enrollment: 2,868)

- DeVry University-Florida (about 31 miles; Miramar, FL; FT enrollment: 3,674)

Public high schools in Boca Raton:

- OLYMPIC HEIGHTS COMMUNITY HIGH (Students: 1,048, Location: 20101 LYONS RD, Grades: PK-12)

- A.D. HENDERSON UNIVERSITY SCHOOL & FAU HIGH SCHOOL (Students: 440, Location: 777 GLADES RD BLDG 26, Grades: KG-12)

- WEST BOCA RATON HIGH SCHOOL (Students: 231, Location: 12811 GLADES RD, Grades: 9-12)

- BOCA RATON COMMUNITY HIGH SCHOOL (Location: 1501 NW 15TH CT, Grades: 9-12)

- SPANISH RIVER COMMUNITY HIGH SCHOOL (Location: 5100 JOG RD, Grades: PK-12)

- INSPIRED 2 THINK VIRTUAL CHARTER SCHOOL (Location: 2385 NW EXEC CENTR DR ST100, Grades: 6-12, Charter school)

Biggest private high schools in Boca Raton:

- ST ANDREWS SCHOOL (Students: 1,312, Location: 3900 JOG RD, Grades: PK-12)

- DONNA KLEIN JEWISH ACADEMY (Students: 686, Location: 9701 DONNA KLEIN BLVD, Grades: KG-12)

- BOCA RATON CHRISTIAN SCHOOL (Students: 530, Location: 315 NW 4TH ST, Grades: PK-12)

- POPE JOHN PAUL II HIGH SCHOOL (Students: 474, Location: 4001 N MILITARY TRL, Grades: 9-12)

- WEINBAUM YESHIVA HIGH SCHOOL (Students: 255, Location: 7902 MONTOYA CIR N, Grades: 9-12)

- GRANDVIEW PREPARATORY SCHOOL (Students: 223, Location: 336 NW SPANISH RIVER BLVD, Grades: PK-12)

- THE HARID CONSERVATORY (Students: 38, Location: 2285 POTOMAC RD, Grades: 9-12)

- NEW HORIZON ACADEMY (Students: 37, Location: 2555 NW BOCA RATON BLVD, Grades: 6-12)

- ACADEMIC HIGH SCHOOL (Students: 36, Location: 23114 SANDALFOOT PLAZA DR, Grades: 7-12)

- SCORE AT THE TOP LEARNING CENTER & SCHOOL (Students: 6, Location: 750 PARK OF COMMERCE BLVD STE 120, Grades: 7-12)

Biggest public elementary/middle schools in Boca Raton:

- EAGLES LANDING MIDDLE SCHOOL (Students: 1,329, Location: 19500 CORAL RIDGE DR, Grades: 6-8)

- DON ESTRIDGE HIGH TECH MIDDLE SCHOOL (Students: 1,219, Location: 1798 NW SPANISH RIVER BLVD, Grades: 6-8)

- J. C. MITCHELL ELEMENTARY SCHOOL (Students: 1,218, Location: 2470 NW 5TH AVE, Grades: PK-5)

- SANDPIPER SHORES ELEMENTARY SCHOOL (Students: 960, Location: 11201 GLADES RD, Grades: PK-5)

- HAMMOCK POINTE ELEMENTARY SCHOOL (Students: 905, Location: 8400 SW 8TH ST, Grades: PK-5)

- BOCA RATON ELEMENTARY SCHOOL (Students: 842, Location: 103 SW 1ST AVE, Grades: PK-5)

- DEL PRADO ELEMENTARY SCHOOL (Students: 472, Location: 7900 DEL PRADO CIR N, Grades: PK-5)

- CORAL SUNSET ELEMENTARY SCHOOL (Students: 422, Location: 22400 HAMMOCK ST, Grades: PK-5)

- CALUSA ELEMENTARY SCHOOL (Students: 417, Location: 2051 CLINT MOORE RD, Grades: KG-5)

- VERDE ELEMENTARY SCHOOL (Students: 409, Location: 6590 VERDE TRL, Grades: PK-5)

Biggest private elementary/middle schools in Boca Raton:

- PINE CREST SCHOOL - BOCA RATON (Students: 890, Location: 2700 SAINT ANDREWS BLVD, Grades: PK-8)

- ST JOAN OF ARC SCHOOL (Students: 573, Location: 501 SW 3RD AVE, Grades: PK-8)

- SPANISH RIVER CHRISTIAN SCHOOL (Students: 554, Location: 2400 NW 51ST ST, Grades: PK-8)

- HILLEL DAY SCHOOL OF BOCA RATON (Students: 455, Location: 21011 95TH AVE S, Grades: PK-8)

- ST PAUL LUTHERAN SCHOOL (Students: 375, Location: 701 W PALMETTO PARK RD, Grades: PK-8)

- ST JUDE CATHOLIC SCHOOL (Students: 339, Location: 21689 TOLEDO RD, Grades: PK-8)

- BOCA RATON PREPARATORY SCHOOL (Students: 210, Location: 10333 DIEGO DR S, Grades: PK-T1)

- TORAH ACADEMY OF BOCA RATON (Students: 172, Location: 447 NW SPANISH RIVER BLVD, Grades: PK-6)

- GARDEN OF THE SAHABA ACADEMY (Students: 169, Location: 3100 NW 5TH AVE, Grades: PK-8)

- ADVENT LUTHERAN SCHOOL (Students: 168, Location: 300 E YAMATO RD, Grades: KG-8)

User-submitted facts and corrections:

- Since the most recent annexation, the population of Boca Raton has grown to 79,300. I speak as the Public Information Officer for the City.

added by Neil

- WTVX Channel 34 West Palm Beach, Florida

- College/University: PC Professor Technical Institute: 500 FT/PT students. 7056 Beracasa Way--on the NW corner of Powerline & Palmetto Park. Nationally accredited, private, Microsoft IT Academy offering both beginning and advanced computer certification classes starting weekly. 561-750-7879 www.PCProfessor.Edu

- DONNA KLEIN JEWISH ACADEMY (Students: 689; Location: 9701 DONNA KLEIN BLVD; Grades: KG - 10) is now k-12 -- thanks for the listing. Are you doing houses of worship? If so Please add: Temple Sinai of Palm Beach County: 2475 W Atlantic AV Delray Beach 33445, 561.276.6161 www.TempleSinaiPBC.org

- New high school in Boca Raton--West Boca Raton Community High School--opened August 2004

Points of interest:

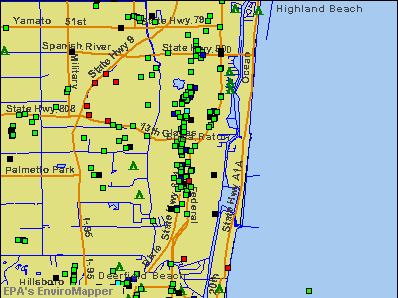

Notable locations in Boca Raton: Hidden Valley Country Club (A), Villa Rica Railroad Station (B), Boca Raton Water Pollution Control Facility (C), Golden Ocala Golf Course (D), Wiley Commerce Plaza (E), Crocker Plaza (F), Woodfield Country Club (G), Baytree National Golf Links (H), Royal Palm Country Club (I), Royal Palm Polo Grounds (J), Royal Palm Yacht Club (K), Christopher Center (L), Colony Shoppes (M), Town Square Center (N), Village Square (O), Glades Plaza (P), Tower and Shoppes at the Sanctuary (Q), Oaks Plaza (R), Fifth Avenue Shoppes (S), Boca Raton Fire and Rescue Station 6 (T). Display/hide their locations on the map

Shopping Centers: Health Mall Shopping Center (1), Glades Plaza Shopping Center (2), Camino Real Plaza Shopping Center (3), Winfield Shopping Center (4), 20th Street Shopping Center (5), Boca Raton Shopping Center (6), Del Mar Shopping Center (7), North Dixie Plaza Shopping Center (8), The Boardwalk Shopping Center (9). Display/hide their locations on the map

Main business address in Boca Raton include: DALEEN TECHNOLOGIES INC (A), SPEAR & JACKSON INC (B), HYDRON TECHNOLOGIES INC (C), CRT PROPERTIES INC (D), GEO GROUP INC (E), ECLIPSYS CORP (F), CROSS COUNTRY HEALTHCARE INC (G). Display/hide their locations on the map

Churches in Boca Raton include: Saint Gregory's Episcopal Church (A), Saint Pauls Church (B), Neighborhood Church (C). Display/hide their locations on the map

Cemetery: Boca Raton Cemetery (1). Display/hide its location on the map

Lakes: Lake Boca Raton (A), Paradise Lake (B), Lake Rogers (C), Lake Wyman (D). Display/hide their locations on the map

Parks in Boca Raton include: Silver Palm Park (1), South Beach Park (2), Wyman Park (3), Pine Breeze Park (4), Sand Pine Park (5), Hidden Lake Park (6), Boca Tierra Park (7), Spanish River Park (8), University Woodlands Park (9). Display/hide their locations on the map

Tourist attractions: Boca Raton Museum of Art (501 Plaza Real) (1), Boca Raton City - Sugar Sand Park- Community Center- Children's Science Explo (Museums; 300 South Military Trail) (2), Children's Museum (498 Crawford Boulevard) (3), Childrens Science Explorium (Museums; 300 South Military Trail) (4), ARTVision International (Cultural Attractions- Events- & Facilities; 9609 Carousel Circle North) (5), Rotelli Pizza & Pasta - Boca Raton (Planetariums; 2901 Clint Moore Road) (6), Boomer's Family Recreation Center (Amusement & Theme Parks; 3100 Airport Road) (7), Executive Get-A-Way Yacht Charters (6418 La Costa Drive) (8). Display/hide their approximate locations on the map

Hotels: Boca Raton Plaza Hotel (2901 North Federal Highway) (1), Carmen's At The Top Of The Bridge (999 East Camino Real) (2), Boca Raton's Boca Inn (1801 North Federal Highway) (3), Boca Raton Resort & Club (501 East Camino Real) (4), Brighton Gardens-A Marriott Assng Cmmnty of BCA RA (6341 Viaduct De Sonrisa Del South) (5), Chalet Restaurant & Lounge (1801 North Federal Highway) (6), Best Western University Inn (2700 North Federal Highway) (7). Display/hide their approximate locations on the map

Courts: Strattford Court Of Boca Raton (6341 Viaduct De Sonrisa Del South) (1), U S District Court Probation (2255 Glades Road) (2), Regency Court (3003 Yamato Road Suite C4) (3), Court C D (396 Sequoia) (4), Wm Court (5030 Champion Boulevard) (5). Display/hide their approximate locations on the map

Birthplace of: Ariana Grande - Actress, Taurean Green - College basketball player, Scott Gordon (soccer) - Soccer player, Steve Bellisari - Football player, Adam Picow - College basketball player (Central Florida Knights), Casey Wohlleb - College basketball player (Marshall Thundering Herd), Jonathan Chase (actor) - Film actor, Marissa Secundy - Figure skater, Sean Berdy - Deaf Actor in "Switched at Birth", Troy Gentile - Actor.

Drinking water stations with addresses in Boca Raton and their reported violations in the past:

BOCA RATON WTP (Population served: 128,000, Groundwater):Past health violations:COUNTRY COVE MOBILE HOME PARK (Population served: 197, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - In JUN-2005, Contaminant: Coliform. Follow-up actions: St Case dropped (NOV-25-2009)

- MCL, Acute (TCR) - In JUN-2005, Contaminant: Coliform. Follow-up actions: St Case dropped (NOV-25-2009)

- Follow-up Or Routine LCR Tap M/R - In JUL-01-2008, Contaminant: Lead and Copper Rule. Follow-up actions: St Violation/Reminder Notice (AUG-07-2009), St Civil Case referred to AG (JUN-25-2010), St Compliance achieved (FEB-23-2012), St Formal NOV issued (SEP-15-2012), St Case dropped (APR-30-2013)

- Monitoring, Repeat Major (TCR) - In JAN-2006, Contaminant: Coliform (TCR)

- Monitoring, Repeat Major (TCR) - In JUN-2005, Contaminant: Coliform (TCR). Follow-up actions: St Case dropped (NOV-25-2009)

Past health violations:MAPLE DRIVE HOLDING CORP.POOL (Address: Apt C801 , Serves NY, Population served: 75, Groundwater):Past monitoring violations:

- MCL, Average - Between APR-2007 and JUN-2007, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Compliance achieved (FEB-05-2008)

- MCL, Average - Between APR-2007 and JUN-2007, Contaminant: TTHM. Follow-up actions: St Compliance achieved (FEB-05-2008)

- MCL, Average - Between JAN-2007 and MAR-2007, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Violation/Reminder Notice (JUN-22-2007), St Compliance achieved (FEB-05-2008)

- MCL, Average - Between JAN-2007 and MAR-2007, Contaminant: TTHM. Follow-up actions: St Violation/Reminder Notice (JUN-22-2007), St Compliance achieved (FEB-05-2008)

- MCL, Average - Between OCT-2006 and DEC-2006, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Violation/Reminder Notice (JUN-22-2007), St Compliance achieved (FEB-05-2008)

- MCL, Average - Between JUL-2006 and SEP-2006, Contaminant: TTHM. Follow-up actions: St Violation/Reminder Notice (JUN-22-2007), St Compliance achieved (FEB-05-2008)

- 6 other older health violations

- Monitoring and Reporting (DBP) - Between OCT-2010 and DEC-2010, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Violation/Reminder Notice (FEB-09-2011), St Compliance achieved (SEP-13-2011)

- Follow-up Or Routine LCR Tap M/R - In JAN-01-2008, Contaminant: Lead and Copper Rule

- Monitoring and Reporting (DBP) - Between JUL-2007 and SEP-2007, Contaminant: TTHM. Follow-up actions: St Compliance achieved (2 times from FEB-05-2008 to SEP-13-2011)

- Monitoring and Reporting (DBP) - Between JUL-2007 and SEP-2007, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Compliance achieved (2 times from FEB-05-2008 to SEP-13-2011)

- Monitoring and Reporting (DBP) - Between OCT-2006 and DEC-2006, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Violation/Reminder Notice (JUN-22-2007), St Compliance achieved (FEB-05-2008)

- 5 other older monitoring violations

Past monitoring violations:SUBCO BEELINE AKA SUPERSTOP #407 (Population served: 25, Groundwater):

- 3 routine major monitoring violations

Past monitoring violations:WILLINGTON MOBIL (Serves CT, Population served: 25, Groundwater):

- Failure to Conduct Assessment Monitoring - Between APR-2014 and JUN-2014, Contaminant: E. COLI

- One routine major monitoring violation

Past monitoring violations:

- 5 routine major monitoring violations

| This city: | 2.2 people |

| Florida: | 2.5 people |

| This city: | 58.7% |

| Whole state: | 65.2% |

| This city: | 5.7% |

| Whole state: | 7.3% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.3% of all households

- Gay men: 0.5% of all households

People in group quarters in Boca Raton in 2010:

- 2,829 people in college/university student housing

- 415 people in nursing facilities/skilled-nursing facilities

- 86 people in other noninstitutional facilities

- 54 people in residential treatment centers for adults

- 26 people in workers' group living quarters and job corps centers

- 19 people in group homes intended for adults

- 15 people in residential treatment centers for juveniles (non-correctional)

People in group quarters in Boca Raton in 2000:

- 1,959 people in college dormitories (includes college quarters off campus)

- 536 people in nursing homes

- 164 people in other group homes

- 83 people in homes or halfway houses for drug/alcohol abuse

- 33 people in homes for the mentally retarded

- 12 people in hospitals/wards and hospices for chronically ill

- 12 people in other hospitals or wards for chronically ill

- 10 people in other noninstitutional group quarters

- 9 people in religious group quarters

Banks with most branches in Boca Raton (2011 data):

- Bank of America, National Association: 13 branches. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Wells Fargo Bank, National Association: 13 branches. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- SunTrust Bank: 10 branches. Info updated 2010/05/27: Bank assets: $171,291.7 mil, Deposits: $129,833.2 mil, headquarters in Atlanta, GA, positive income, Commercial Lending Specialization, 1716 total offices, Holding Company: Suntrust Banks, Inc.

- PNC Bank, National Association: 9 branches. Info updated 2012/03/20: Bank assets: $263,309.6 mil, Deposits: $197,343.0 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 3085 total offices, Holding Company: Pnc Financial Services Group, Inc., The

- JPMorgan Chase Bank, National Association: 7 branches. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- BankAtlantic: Boca Greens Branch, Fau Branch, 701 North Federal Highway Branch, Glades Road Branch. Info updated 2011/07/21: Bank assets: $3,648.1 mil, Deposits: $3,293.2 mil, headquarters in Fort Lauderdale, FL, negative income in the last year, Commercial Lending Specialization, 78 total offices

- TD Bank, National Association: Boca Raton Camino Real Branch, Boca Raton Branch, Boca Raton Main Branch, Boca Palmetto Branch. Info updated 2010/10/04: Bank assets: $188,912.6 mil, Deposits: $153,149.8 mil, headquarters in Wilmington, DE, positive income, 1314 total offices, Holding Company: Toronto-Dominion Bank, The

- Citibank, National Association: 7100 W. Camino Real Branch, Boca Raton Branch, Federal Highway Branch, Yamato Branch. Info updated 2012/01/10: Bank assets: $1,288,658.0 mil, Deposits: $882,541.0 mil, headquarters in Sioux Falls, SD, positive income, International Specialization, 1048 total offices, Holding Company: Citigroup Inc.

- BankUnited, National Association: Westwinds Of Boca Branch, St. Andrews Boulevard Branch, Boca Atrium Branch, Kimberly Boulevard Branch. Info updated 2012/03/05: Bank assets: $11,197.9 mil, Deposits: $7,515.1 mil, headquarters in Miami Lakes, FL, positive income, 82 total offices

- 26 other banks with 36 local branches

For population 15 years and over in Boca Raton:

- Never married: 33.3%

- Now married: 46.1%

- Separated: 1.1%

- Widowed: 7.0%

- Divorced: 12.5%

For population 25 years and over in Boca Raton:

- High school or higher: 94.8%

- Bachelor's degree or higher: 60.5%

- Graduate or professional degree: 25.3%

- Unemployed: 5.8%

- Mean travel time to work (commute): 17.9 minutes

| Here: | 10.6 |

| Florida average: | 12.2 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Boca Raton:

(Boca Raton, Florida Neighborhood Map)Religion statistics for Boca Raton, FL (based on Palm Beach County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 210,006 | 36 |

| Evangelical Protestant | 143,738 | 477 |

| Other | 62,520 | 124 |

| Mainline Protestant | 44,223 | 83 |

| Black Protestant | 17,533 | 47 |

| Orthodox | 5,695 | 8 |

| None | 836,419 | - |

Food Environment Statistics:

| Palm Beach County: | 2.05 / 10,000 pop. |

| State: | 2.04 / 10,000 pop. |

| Here: | 0.10 / 10,000 pop. |

| Florida: | 0.11 / 10,000 pop. |

| Here: | 1.28 / 10,000 pop. |

| Florida: | 1.28 / 10,000 pop. |

| This county: | 2.25 / 10,000 pop. |

| State: | 3.04 / 10,000 pop. |

| Palm Beach County: | 8.96 / 10,000 pop. |

| State: | 7.45 / 10,000 pop. |

| Palm Beach County: | 8.7% |

| Florida: | 9.2% |

| Here: | 19.3% |

| Florida: | 23.7% |

| Palm Beach County: | 17.3% |

| Florida: | 14.0% |

Health and Nutrition:

| Boca Raton: | 56.3% |

| State: | 51.4% |

| Here: | 56.1% |

| Florida: | 49.4% |

| Boca Raton: | 28.0 |

| Florida: | 28.6 |

| Here: | 18.2% |

| State: | 19.5% |

| Here: | 7.8% |

| Florida: | 10.7% |

| This city: | 7.0 |

| Florida: | 6.9 |

| Boca Raton: | 34.6% |

| Florida: | 34.7% |

| Here: | 61.7% |

| Florida: | 57.0% |

| Boca Raton: | 79.8% |

| State: | 79.2% |

More about Health and Nutrition of Boca Raton, FL Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Parks and Recreation | 417 | $1,543,936 | $44,430 | 202 | $252,720 |

| Firefighters | 234 | $2,507,820 | $128,606 | 0 | $0 |

| Police Protection - Officers | 194 | $2,089,392 | $129,241 | 0 | $0 |

| Financial Administration | 133 | $826,900 | $74,608 | 16 | $33,187 |

| Water Supply | 108 | $631,371 | $70,152 | 3 | $4,265 |

| Other and Unallocable | 102 | $567,190 | $66,728 | 12 | $24,317 |

| Police - Other | 94 | $553,233 | $70,625 | 5 | $8,684 |

| Streets and Highways | 62 | $354,946 | $68,699 | 2 | $2,992 |

| Other Government Administration | 61 | $435,953 | $85,761 | 7 | $11,275 |

| Sewerage | 47 | $236,542 | $60,394 | 0 | $0 |

| Solid Waste Management | 44 | $213,256 | $58,161 | 0 | $0 |

| Local Libraries | 35 | $157,435 | $53,978 | 44 | $80,414 |

| Fire - Other | 13 | $68,284 | $63,031 | 4 | $6,983 |

| Judicial and Legal | 7 | $84,140 | $144,240 | 0 | $0 |

| Housing and Community Development (Local) | 3 | $9,347 | $37,388 | 1 | $669 |

| Totals for Government | 1,554 | $10,279,745 | $79,380 | 296 | $425,506 |

Boca Raton government finances - Expenditure in 2021 (per resident):

- Construction - Regular Highways: $12,022,000 ($121.42)

Parks and Recreation: $459,000 ($4.64)

Police Protection: $286,000 ($2.89)

- Current Operations - General - Other: $63,522,000 ($641.58)

Police Protection: $56,067,000 ($566.28)

Local Fire Protection: $56,042,000 ($566.03)

Parks and Recreation: $40,413,000 ($408.18)

Sewerage: $21,637,000 ($218.54)

Natural Resources - Other: $20,600,000 ($208.06)

Water Utilities: $17,803,000 ($179.81)

Regular Highways: $14,921,000 ($150.70)

Financial Administration: $8,417,000 ($85.01)

Solid Waste Management: $7,996,000 ($80.76)

Central Staff Services: $6,949,000 ($70.19)

Libraries: $5,118,000 ($51.69)

Judicial and Legal Services: $1,481,000 ($14.96)

Protective Inspection and Regulation - Other: $1,334,000 ($13.47)

Housing and Community Development: $742,000 ($7.49)

Transit Utilities: $156,000 ($1.58)

- General - Interest on Debt: $1,768,000 ($17.86)

- Other Capital Outlay - Local Fire Protection: $165,000 ($1.67)

Water Utilities: $159,000 ($1.61)

Sewerage: $11,000 ($0.11)

- Water Utilities - Interest on Debt: $371,000 ($3.75)

Boca Raton government finances - Revenue in 2021 (per resident):

- Charges - Other: $25,503,000 ($257.58)

Sewerage: $23,910,000 ($241.49)

Solid Waste Management: $10,135,000 ($102.36)

Parks and Recreation: $6,005,000 ($60.65)

Natural Resources - Other: $3,221,000 ($32.53)

Parking Facilities: $2,676,000 ($27.03)

Miscellaneous Commercial Activities: $305,000 ($3.08)

- Federal Intergovernmental - Other: $5,315,000 ($53.68)

Housing and Community Development: $182,000 ($1.84)

- Local Intergovernmental - General Local Government Support: $31,056,000 ($313.67)

Other: $643,000 ($6.49)

- Miscellaneous - Interest Earnings: $8,777,000 ($88.65)

Donations From Private Sources: $1,764,000 ($17.82)

General Revenue - Other: $1,674,000 ($16.91)

Special Assessments: $1,546,000 ($15.61)

Fines and Forfeits: $1,218,000 ($12.30)

Sale of Property: $404,000 ($4.08)

Rents: $2,000 ($0.02)

- Revenue - Water Utilities: $34,946,000 ($352.96)

Transit Utilities: $24,000 ($0.24)

- State Intergovernmental - General Local Government Support: $9,923,000 ($100.22)

Other: $932,000 ($9.41)

Housing and Community Development: $161,000 ($1.63)

Public Welfare: $161,000 ($1.63)

- Tax - Property: $102,700,000 ($1037.28)

Public Utilities Sales: $21,824,000 ($220.42)

Other License: $15,844,000 ($160.03)

Occupation and Business License - Other: $14,587,000 ($147.33)

General Sales and Gross Receipts: $6,471,000 ($65.36)

Insurance Premiums Sales: $3,464,000 ($34.99)

Motor Fuels Sales: $2,018,000 ($20.38)

Boca Raton government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $62,902,000 ($635.32)

Outstanding Unspecified Public Purpose: $51,652,000 ($521.69)

Retired Unspecified Public Purpose: $11,370,000 ($114.84)

Boca Raton government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $22,383,000 ($226.07)

- Other Funds - Cash and Securities: $443,541,000 ($4479.80)

- Sinking Funds - Cash and Securities: $2,150,000 ($21.72)

7.12% of this county's 2021 resident taxpayers lived in other counties in 2020 ($242,201 average adjusted gross income)

| Here: | 7.12% |

| Florida average: | 8.80% |

0.02% of residents moved from foreign countries ($131 average AGI)

Palm Beach County: 0.02% Florida average: 0.05%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Broward County, FL | |

| from Miami-Dade County, FL | |

| from New York County, NY |

6.27% of this county's 2020 resident taxpayers moved to other counties in 2021 ($96,101 average adjusted gross income)

| Here: | 6.27% |

| Florida average: | 7.45% |

0.02% of residents moved to foreign countries ($206 average AGI)

Palm Beach County: 0.02% Florida average: 0.04%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Broward County, FL | |

| to St. Lucie County, FL | |

| to Miami-Dade County, FL |

| Businesses in Boca Raton, FL | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 7-Eleven | 2 | Justice | 1 | |

| ALDO | 1 | KFC | 1 | |

| AT&T | 9 | Kmart | 1 | |

| Abercrombie & Fitch | 1 | LA Fitness | 2 | |

| Abercrombie Kids | 1 | La-Z-Boy | 1 | |

| Ace Hardware | 1 | Lane Furniture | 2 | |

| Advance Auto Parts | 3 | LensCrafters | 2 | |

| Aeropostale | 1 | Lowe's | 1 | |

| Aerosoles | 1 | Macy's | 2 | |

| American Eagle Outfitters | 1 | Marriott | 6 | |

| Ann Taylor | 2 | Marshalls | 1 | |

| Apple Store | 1 | MasterBrand Cabinets | 9 | |

| Banana Republic | 2 | McDonald's | 7 | |

| Barnes & Noble | 1 | Men's Wearhouse | 2 | |

| Baskin-Robbins | 1 | Motherhood Maternity | 4 | |

| Bath & Body Works | 1 | New Balance | 9 | |

| Bebe | 1 | Nike | 23 | |

| Bed Bath & Beyond | 2 | Nordstrom | 2 | |

| Best Western | 1 | Office Depot | 3 | |

| Blockbuster | 5 | OfficeMax | 1 | |

| Brookstone | 1 | Old Navy | 1 | |

| Budget Car Rental | 1 | Olive Garden | 1 | |

| Burger King | 3 | Outback | 2 | |

| CVS | 10 | Outback Steakhouse | 2 | |

| Cache | 1 | Pac Sun | 1 | |

| Chick-Fil-A | 1 | Panera Bread | 3 | |

| Chico's | 2 | Papa John's Pizza | 3 | |

| Chipotle | 1 | Payless | 1 | |

| Chuck E. Cheese's | 1 | Penske | 1 | |

| Clarks | 1 | PetSmart | 1 | |

| Cold Stone Creamery | 1 | Pier 1 Imports | 1 | |

| Coldwater Creek | 1 | Pizza Hut | 2 | |

| Costco | 1 | Plato's Closet | 1 | |

| Crate & Barrel | 1 | Pottery Barn | 1 | |

| Curves | 1 | Publix Super Markets | 13 | |

| DHL | 9 | Quality | 1 | |

| Decora Cabinetry | 4 | Quiznos | 2 | |

| Dennys | 2 | RadioShack | 3 | |

| Domino's Pizza | 3 | Rooms To Go | 1 | |

| Dressbarn | 1 | Ruby Tuesday | 1 | |

| Dunkin Donuts | 10 | SAS Shoes | 2 | |

| Ethan Allen | 1 | Saks Fifth Avenue | 1 | |

| Express | 2 | Sears | 2 | |

| FedEx | 52 | Sephora | 1 | |

| Firestone Complete Auto Care | 1 | Skechers USA | 1 | |

| Foot Locker | 1 | Soma Intimates | 1 | |

| Forever 21 | 1 | Sprint Nextel | 1 | |

| GNC | 3 | Starbucks | 13 | |

| GameStop | 2 | T-Mobile | 6 | |

| Gap | 1 | T.G.I. Driday's | 1 | |

| Goodwill | 2 | T.J.Maxx | 1 | |

| Gymboree | 1 | Taco Bell | 2 | |

| H&R Block | 5 | Talbots | 1 | |

| Harmon Face Values | 1 | Target | 1 | |

| Hilton | 5 | The Cheesecake Factory | 1 | |

| Holiday Inn | 1 | The Limited | 1 | |

| Hollister Co. | 1 | Tire Kingdom | 3 | |

| Home Depot | 1 | Toys"R"Us | 2 | |

| Homestead Studio Suites | 1 | U-Haul | 7 | |

| IHOP | 1 | UPS | 67 | |

| J. Jill | 1 | Vans | 3 | |

| J.Crew | 1 | Verizon Wireless | 1 | |

| Jamba Juice | 2 | Victoria's Secret | 1 | |

| Jimmy John's | 1 | Walgreens | 7 | |

| JoS. A. Bank | 1 | Whole Foods Market | 1 | |

| Jones New York | 7 | YMCA | 2 | |

| Journeys | 1 | Z Gallerie | 1 | |

| Juicy Couture | 1 | |||

Strongest AM radio stations in Boca Raton:

- WLVJ (1040 AM; 25 kW; BOYNTON BEACH, FL; Owner: JAMES CRYSTAL BOYNTON BEACH, INC.)

- WFTL (850 AM; 50 kW; WEST PALM BEACH, FL; Owner: JAMES CRYSTAL ENTERPRISES II, L.L.C.)

- WWNN (1470 AM; 50 kW; POMPANO BEACH, FL; Owner: WWNN LICENSE, LLC)

- WDJA (1420 AM; 5 kW; DELRAY BEACH, FL; Owner: JAMES CRYSTAL DELRAY BEACH, INC.)

- WAQI (710 AM; 50 kW; MIAMI, FL; Owner: LICENSE CORPORATION #1)

- WRFX (940 AM; 50 kW; MIAMI, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WHSR (980 AM; 5 kW; POMPANO BEACH, FL; Owner: WWNN LICENSE, LLC)

- WWFE (670 AM; 50 kW; MIAMI, FL; Owner: FENIX BROADCASTING CORP.)

- WJNA (640 AM; 38 kW; ROYAL PALM BEACH, FL; Owner: SOUTH FLORIDA RADIO, INC.)

- WNMA (1210 AM; 49 kW; MIAMI SPRINGS, FL; Owner: RADIO UNICA OF MIAMI LICENSE CORP.)

- WSBR (740 AM; 2 kW; BOCA RATON, FL; Owner: WWNN LICENSE, LLC)

- WSUA (1260 AM; 50 kW; MIAMI, FL; Owner: WSUA BROADCASTING CORPORATION)

- WQBA (1140 AM; 50 kW; MIAMI, FL; Owner: WQBA-AM LICENSE CORP.)

Strongest FM radio stations in Boca Raton:

- WEAT-FM (104.3 FM; WEST PALM BEACH, FL; Owner: INFINITY RADIO OPERATIONS INC.)

- WXEL (90.7 FM; WEST PALM BEACH, FL; Owner: BARRY TELECOMMUNICATIONS, INC.)

- WEDR (99.1 FM; MIAMI, FL; Owner: COX RADIO, INC.)

- WRMF (97.9 FM; PALM BEACH, FL; Owner: PBB LICENSES, LLC)

- WRMB (89.3 FM; BOYNTON BEACH, FL; Owner: THE MOODY BIBLE INSTITUTE OF CHICAGO)

- WIRK-FM (107.9 FM; WEST PALM BEACH, FL; Owner: INFINITY RADIO OPERATIONS INC.)

- WBGG-FM (105.9 FM; FORT LAUDERDALE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WHYI-FM (100.7 FM; FORT LAUDERDALE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WKIS (99.9 FM; BOCA RATON, FL; Owner: WKIS LICENSE LIMITED PARTNERSHIP)

- WRMA (106.7 FM; FORT LAUDERDALE, FL; Owner: WRMA LICENSING, INC.)

- WOLL (105.5 FM; HOBE SOUND, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WXDJ (95.7 FM; NORTH MIAMI BEACH, FL; Owner: WXDJ LICENSING, INC.)

- WFLC (97.3 FM; MIAMI, FL; Owner: COX RADIO, INC.)

- WPYM (93.1 FM; MIAMI, FL; Owner: COX RADIO-MIAMI, LLC)

- WHQT (105.1 FM; CORAL GABLES, FL; Owner: COX RADIO, INC.)

- WLVE (93.9 FM; MIAMI BEACH, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WMIB (103.5 FM; FORT LAUDERDALE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WMXJ (102.7 FM; POMPANO BEACH, FL; Owner: JEFFERSON-PILOT COMMUNICATIONS CO. OF FLORIDA)

- WPOW (96.5 FM; MIAMI, FL; Owner: WPOW LICENSE LIMITED PARTNERSHIP)

- WZTA (94.9 FM; MIAMI BEACH, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

TV broadcast stations around Boca Raton:

- WPTV (Channel 5; WEST PALM BEACH, FL; Owner: SCRIPPS HOWARD BROADCASTING COMPANY)

- WFLX (Channel 29; WEST PALM BEACH, FL; Owner: RAYCOM NATIONAL, INC.)

- WHDT-LP (Channel 44; MIAMI, FL; Owner: GUENTER MARKSTEINER)

- WXEL-TV (Channel 42; WEST PALM BEACH, FL; Owner: BARRY TELECOMMUNICATIONS, INC.)

- WPEC (Channel 12; WEST PALM BEACH, FL; Owner: FREEDOM BROADCASTING OF FLORIDA, INC)

- WFGC (Channel 61; PALM BEACH, FL; Owner: CHRISTIAN TELEVISION OF PALM BEACH COUNTY, INC.)

- WPBT (Channel 2; MIAMI, FL; Owner: COMMUNITY TV FOUNDATION OF S. FLORIDA, INC.)

- WSVN (Channel 7; MIAMI, FL; Owner: SUNBEAM TELEVISION CORP.)

- WPXP (Channel 67; LAKE WORTH, FL; Owner: PAXSON WEST PALM BEACH LICENSE, INC.)

- WDLP-CA (Channel 21; POMPANO BEACH, FL; Owner: WDLP BROADCASTING COMPANY, LLC)

- W58BU (Channel 58; HALLANDALE, FL; Owner: NBC STATIONS MANAGEMENT,INC.)

- WPPB-TV (Channel 63; BOCA RATON, FL; Owner: THE SCHOOL BOARD OF BROWARD COUNTY, FLORIDA)

- WHFT-TV (Channel 45; MIAMI, FL; Owner: TRINITY BROADCASTING OF FLORIDA, INC.)

- WAMI-TV (Channel 69; HOLLYWOOD, FL; Owner: TELEFUTURA MIAMI LLC)

- W24CA (Channel 24; MARATHON, FL; Owner: KEY COMMUNICATIONS OF TEXAS)

- WSCV (Channel 51; FORT LAUDERDALE, FL; Owner: TELEMUNDO OF FLORIDA LICENSE CORP.)

- WLRN-TV (Channel 17; MIAMI, FL; Owner: THE SCHOOL BOARD OF MIAMI - DADE COUNTY, FL)

- WPLG (Channel 10; MIAMI, FL; Owner: POST-NEWSWEEK STATIONS, FLORIDA, INC.)

- WLTV (Channel 23; MIAMI, FL; Owner: WLTV LICENSE PARTNERSHIP, G.P.)

- WBFS-TV (Channel 33; MIAMI, FL; Owner: VIACOM STATIONS GROUP OF MIAMI INC.)

- WPXM (Channel 35; MIAMI, FL; Owner: PAXSON COMMUNICATIONS LICENSE COMPANY, LLC)

- WBZL (Channel 39; MIAMI, FL; Owner: CHANNEL 39, INC.)

- WLMF-LP (Channel 53; MIAMI, FL; Owner: PAGING SYSTEMS, INC.)

- WWHB-CA (Channel 15; STUART, FL; Owner: AMERICAN NETCOM, INC.)

- WFUN-CA (Channel 48; MIAMI, ETC., FL; Owner: LOCALONE TEXAS, LTD.)

- National Bridge Inventory (NBI) Statistics

- 114Number of bridges

- 1,545ft / 471mTotal length

- $20,286,000Total costs

- 4,942,324Total average daily traffic

- 384,419Total average daily truck traffic

- New bridges - historical statistics

- 11930-1939

- 41950-1959

- 131960-1969

- 361970-1979

- 201980-1989

- 121990-1999

- 122000-2009

- 162010-2019

FCC Registered Antenna Towers: 487 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 3 (See the full list of FCC Registered Commercial Land Mobile Towers in Boca Raton, FL)

FCC Registered Private Land Mobile Towers: 9 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 130 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 49 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 33 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 17 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 1,090 (See the full list of FCC Registered Amateur Radio Licenses in Boca Raton)

FAA Registered Aircraft Manufacturers and Dealers: 58 (See the full list of FAA Registered Manufacturers and Dealers in Boca Raton)

FAA Registered Aircraft: 445 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 18 full and 7 partial tracts) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 107 | $244,888 | 525 | $359,132 | 1,012 | $295,538 | 57 | $219,880 | 288 | $355,933 | 3 | $292,297 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 9 | $226,950 | 69 | $354,675 | 123 | $313,446 | 5 | $178,152 | 26 | $284,194 | 0 | $0 |

| APPLICATIONS DENIED | 32 | $220,473 | 126 | $351,292 | 595 | $355,775 | 21 | $189,129 | 125 | $387,143 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 18 | $246,724 | 78 | $479,094 | 265 | $313,376 | 10 | $221,333 | 70 | $349,424 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 9 | $191,842 | 33 | $506,212 | 101 | $334,315 | 3 | $99,000 | 19 | $406,544 | 0 | $0 |

Detailed mortgage data for all 25 tracts in Boca Raton, FL

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 11 full and 5 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 31 | $267,920 | 2 | $342,740 | 0 | $0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 14 | $255,443 | 7 | $296,183 | 0 | $0 |

| APPLICATIONS DENIED | 6 | $288,405 | 2 | $225,000 | 1 | $270,000 |

| APPLICATIONS WITHDRAWN | 0 | $0 | 4 | $272,750 | 1 | $270,000 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $349,390 | 0 | $0 | 0 | $0 |

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Boca Raton, FL

- 1,48943.1%Outside Fires

- 99328.8%Structure Fires

- 85724.8%Mobile Property/Vehicle Fires

- 1123.2%Other

Based on the data from the years 2002 - 2018 the average number of fires per year is 203. The highest number of fires - 315 took place in 2012, and the least - 67 in 2010. The data has a dropping trend.

Based on the data from the years 2002 - 2018 the average number of fires per year is 203. The highest number of fires - 315 took place in 2012, and the least - 67 in 2010. The data has a dropping trend. When looking into fire subcategories, the most reports belonged to: Outside Fires (43.1%), and Structure Fires (28.8%).

When looking into fire subcategories, the most reports belonged to: Outside Fires (43.1%), and Structure Fires (28.8%).Fire-safe hotels and motels in Boca Raton, Florida:

- Boca Raton Marriott, 5150 Town CTR Cir, Boca Raton, Florida 33486 , Phone: (561) 392-4600, Fax: (561) 395-8258

- Best Western Plus University Inn, 2700 N Federal Hwy, Boca Raton, Florida 33431 , Phone: (561) 395-5225, Fax: (561) 338-9180

- Howard Johnson Lodge, 80 W Camino Real, Boca Raton, Florida 33432

- Holiday Inn - Lakeside, 8144 Glades Rd, Boca Raton, Florida 33434 , Phone: (561) 482-7070, Fax: (561) 482-6076

- Waterstone Resort And Marina Doubletree By Hilton, 999 E Camino Real, Boca Raton, Florida 33432 , Phone: (561) 368-9500, Fax: (561) 362-0492

- Sheraton Of Boca Raton, 2000 NW 19TH St, Boca Raton, Florida 33431 , Fax: (561) 750-5437

- Wyndham Boca Raton, 1950 Glades Rd, Boca Raton, Florida 33431 , Phone: (561) 368-5200, Fax: (561) 395-4783

- Embassy Suites Hotel Boca Raton, 661 NW 53rd St, Boca Raton, Florida 33487 , Phone: (561) 994-8200, Fax: (561) 995-9821

- 9 other hotels and motels

| Most common first names in Boca Raton, FL among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| John | 1,125 | 77.2 years |

| William | 980 | 77.9 years |

| Mary | 929 | 82.0 years |

| Joseph | 916 | 78.8 years |

| Robert | 788 | 74.5 years |

| George | 648 | 79.2 years |

| Helen | 641 | 82.9 years |

| Ruth | 623 | 83.4 years |

| Charles | 581 | 79.0 years |

| Dorothy | 559 | 81.9 years |

| Most common last names in Boca Raton, FL among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Cohen | 337 | 81.6 years |

| Miller | 275 | 81.0 years |

| Smith | 217 | 79.9 years |

| Brown | 178 | 79.5 years |

| Schwartz | 168 | 81.2 years |

| Johnson | 148 | 80.6 years |

| Levine | 147 | 81.0 years |

| Davis | 123 | 79.6 years |

| Friedman | 120 | 81.4 years |

| Goldstein | 115 | 81.7 years |

- 91.1%Electricity

- 4.6%Utility gas

- 2.8%No fuel used

- 1.3%Bottled, tank, or LP gas

- 0.1%Solar energy

- 90.5%Electricity

- 4.8%No fuel used

- 4.5%Utility gas

- 0.2%Other fuel

Boca Raton compared to Florida state average:

- Median house value above state average.

- Unemployed percentage below state average.

- Black race population percentage significantly below state average.

- Median age above state average.

- Number of college students above state average.

- Percentage of population with a bachelor's degree or higher significantly above state average.

Boca Raton on our top lists:

- #5 on the list of "Top 101 cities with the most full-time park and recreation workers per 1000 residents (population 5,000+)"

- #5 on the list of "Top 101 cities with the largest percentage of elementary and middle school students in private schools (5,000+ students)"

- #7 on the list of "Top 101 cities with largest percentage of males in occupations: arts, design, entertainment, sports, and media occupations (population 50,000+)"

- #11 on the list of "Top 101 cities with the largest percentage of high school students in private schools (3,000+ students)"

- #18 on the list of "Top 101 cities that people commute into (largest positive percentage daily daytime population change due to commuting) (population 50,000+)"

- #19 on the list of "Top 101 cities with the lowest number of murders per 100,000 residents (population 50,000+)"

- #19 on the list of "Top 100 cities with oldest residents (pop. 50,000+)"

- #19 on the list of "Top 101 cities with the lowest number of arson incidents per 100,000 residents (population 50,000+)"

- #20 on the list of "Top 101 cities with largest percentage of males in industries: real estate and rental and leasing (population 50,000+)"

- #21 on the list of "Top 101 cities with largest percentage of females in industries: other services, except public administration (population 50,000+)"

- #22 on the list of "Top 101 cities with largest percentage of females in occupations: management occupations (population 50,000+)"

- #22 on the list of "Top 101 cities with largest percentage of males in occupations: sales and related occupations (population 50,000+)"

- #23 on the list of "Top 101 cities with largest percentage of males in occupations: management occupations (population 50,000+)"

- #26 on the list of "Top 101 cities with largest percentage of females in occupations: arts, design, entertainment, sports, and media occupations (population 50,000+)"

- #28 on the list of "Top 101 cities with the highest average yearly precipitation (population 50,000+)"

- #29 on the list of "Top 101 cities with the most local government spending on current operations of parks and recreation per resident (population 10,000+)"

- #30 on the list of "Top 101 cities with the largest percentage of elementary and middle school students in private schools (1,000+ students)"

- #30 on the list of "Top 101 cities with the highest average temperatures (population 50,000+)"

- #32 on the list of "Top 101 cities with largest percentage of males in industries: information (population 50,000+)"

- #32 on the list of "Top 101 cities with the largest house values disparities (population 50,000+)"

- #9 (33432) on the list of "Top 101 zip codes with the highest 2012 average taxable interest for individuals (pop 5,000+)"

- #27 (33432) on the list of "Top 101 zip codes with the most beauty salons in 2005"

- #44 (33434) on the list of "Top 101 zip codes with the smallest percentage of returns reporting salary or wage in 2012 (pop 5,000+)"

- #45 (33432) on the list of "Top 101 zip codes with the highest 2012 average net capital gain/loss (pop 5,000+)"

- #46 (33496) on the list of "Top 101 zip codes with the largest percentage of Russian first ancestries"

- #53 (33431) on the list of "Top 101 zip codes with the most finance and insurance companies in 2005"

- #54 (33431) on the list of "Top 101 zip codes with the most Internet business establishments in 2005"

- #90 (33432) on the list of "Top 101 zip codes with the highest 2012 average Adjusted Gross Income (AGI) for individuals (pop 5,000+)"

- #93 (33431) on the list of "Top 101 zip codes with the most offices of lawyers in 2005"

- #6 on the list of "Top 101 counties with the largest number of people without health insurance coverage in 2000 (pop. 50,000+)"

- #8 on the list of "Top 101 counties with the lowest average weight of females"

- #10 on the list of "Top 101 counties with the highest ground withdrawal of fresh water for public supply"

- #28 on the list of "Top 101 counties with the highest total withdrawal of fresh water for public supply"

- #35 on the list of "Top 101 counties with the most Evangelical Protestant congregations"

State forum archive:

- Florida Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81

- Brevard County Pages: 2 3 4 5 6 7 8 9 10

- Fort Lauderdale area Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

- Fort Myers - Cape Coral area Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

- Jacksonville Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56

- Miami Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52

- Naples Pages: 2 3 4 5 6 7 8 9 10 11

- Ocala Pages: 2 3 4 5 6 7

- Orlando Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72

- Pensacola Pages: 2 3 4 5 6

- Port St. Lucie - Sebastian - Vero Beach Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18

- Punta Gorda - Port Charlotte Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18

- Sarasota - Bradenton - Venice area Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56

- Tallahassee Pages: 2 3 4

- Tampa Bay Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97

- West Palm Beach - Boca Raton - Boynton Beach Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29

|

|

Total of 2850 patent applications in 2008-2024.