Broward Estates, Florida

Submit your own pictures of this place and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

| Males: 1,707 | |

| Females: 1,950 |

| Median resident age: | 34.3 years |

| Florida median age: | 38.7 years |

Zip codes: 33311.

| Broward Estates: | $63,499 |

| FL: | $69,303 |

Estimated per capita income in 2022: $21,384 (it was $12,471 in 2000)

Broward Estates CDP income, earnings, and wages data

Estimated median house or condo value in 2022: $298,490 (it was $77,900 in 2000)

| Broward Estates: | $298,490 |

| FL: | $354,100 |

Mean prices in 2022: all housing units: $501,555; detached houses: $618,997; townhouses or other attached units: $394,360; in 2-unit structures: $434,772; in 3-to-4-unit structures: $337,258; in 5-or-more-unit structures: $307,009; mobile homes: $121,359; occupied boats, rvs, vans, etc.: $108,860

Broward Estates, FL residents, houses, and apartments details

Detailed information about poverty and poor residents in Broward Estates, FL

- 3,28896.3%Black alone

- 521.5%Two or more races

- 421.2%Hispanic

- 190.6%White alone

- 100.3%Asian alone

- 40.1%Other race alone

- 10.03%American Indian alone

Races in Broward Estates detailed stats: ancestries, foreign born residents, place of birth

Latest news from Broward Estates, FL collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: West Indian (6.7%), United States (1.6%), Subsaharan African (1.5%).

Current Local Time: EST time zone

Land area: 0.52 square miles.

Population density: 7,078 people per square mile (high).

194 residents are foreign born (5.2% Latin America).

| This place: | 5.7% |

| Florida: | 16.7% |

| Broward Estates CDP: | 1.5% ($1,199) |

| Florida: | 1.4% ($1,262) |

Nearest city with pop. 50,000+: Plantation, FL (3.3 miles

, pop. 82,934).

Nearest city with pop. 200,000+: Hialeah, FL (19.3 miles

, pop. 226,419).

Nearest city with pop. 1,000,000+: Houston, TX (960.6 miles

, pop. 1,953,631).

Nearest cities:

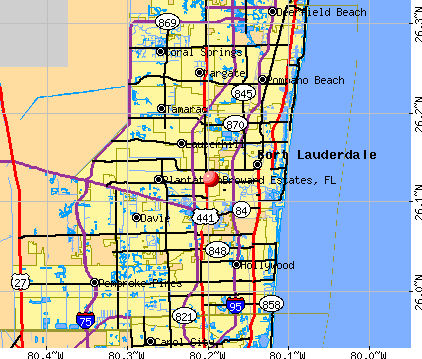

Latitude: 26.13 N, Longitude: 80.20 W

Property values in Broward Estates, FL

| Here: | 2.8% |

| Florida: | 2.9% |

- Educational services (17.8%)

- Public administration (7.8%)

- Accommodation & food services (7.8%)

- Construction (6.8%)

- Health care (6.2%)

- Department & other general merchandise stores (4.7%)

- Administrative & support & waste management services (4.7%)

- Construction (14.9%)

- Educational services (11.8%)

- Accommodation & food services (10.1%)

- Arts, entertainment, recreation (5.8%)

- Food & beverage stores (5.6%)

- Administrative & support & waste management services (5.1%)

- Public administration (4.6%)

- Educational services (22.9%)

- Public administration (10.5%)

- Health care (10.4%)

- Department & other general merchandise stores (7.2%)

- Finance & insurance (6.1%)

- Accommodation & food services (5.9%)

- Administrative & support & waste management services (4.4%)

- Building and grounds cleaning and maintenance occupations (9.1%)

- Driver/sales workers and truck drivers (4.7%)

- Other production occupations, including supervisors (4.5%)

- Information and record clerks, except customer service representatives (4.5%)

- Laborers and material movers, hand (4.4%)

- Material recording, scheduling, dispatching, and distributing workers (4.1%)

- Cooks and food preparation workers (4.0%)

- Building and grounds cleaning and maintenance occupations (13.0%)

- Driver/sales workers and truck drivers (9.1%)

- Laborers and material movers, hand (7.4%)

- Construction traders workers except carpenters, electricians, painters, plumbers, and construction laborers (7.0%)

- Material recording, scheduling, dispatching, and distributing workers (5.0%)

- Cooks and food preparation workers (4.5%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (4.3%)

- Information and record clerks, except customer service representatives (7.2%)

- Other production occupations, including supervisors (7.2%)

- Preschool, kindergarten, elementary, and middle school teachers (5.9%)

- Building and grounds cleaning and maintenance occupations (5.9%)

- Other teachers, instructors, education, training, and library occupations (5.3%)

- Retail sales workers, except cashiers (5.2%)

- Customer service representatives (5.0%)

Average climate in Broward Estates, Florida

Based on data reported by over 4,000 weather stations

(lower is better)

Air Quality Index (AQI) level in 2022 was 73.9. This is about average.

| City: | 73.9 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.394. This is significantly worse than average. Closest monitor was 1.7 miles away from the city center.

| City: | 0.394 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 12.6. This is significantly worse than average. Closest monitor was 1.7 miles away from the city center.

| City: | 12.6 |

| U.S.: | 5.1 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.472. This is significantly better than average. Closest monitor was 1.8 miles away from the city center.

| City: | 0.472 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 26.0. This is better than average. Closest monitor was 3.3 miles away from the city center.

| City: | 26.0 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 17.6. This is about average. Closest monitor was 3.1 miles away from the city center.

| City: | 17.6 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 9.15. This is about average. Closest monitor was 1.7 miles away from the city center.

| City: | 9.15 |

| U.S.: | 8.11 |

Tornado activity:

Broward Estates-area historical tornado activity is slightly below Florida state average. It is 25% smaller than the overall U.S. average.

On 2/23/1965, a category F3 (max. wind speeds 158-206 mph) tornado 2.4 miles away from the Broward Estates place center injured 6 people and caused between $50,000 and $500,000 in damages.

On 3/1/1980, a category F3 tornado 3.5 miles away from the place center killed one person and injured 33 people and caused between $5,000,000 and $50,000,000 in damages.

Earthquake activity:

Broward Estates-area historical earthquake activity is significantly below Florida state average. It is 99% smaller than the overall U.S. average.On 9/10/2006 at 14:56:08, a magnitude 5.9 (5.9 MB, 5.5 MS, 5.8 MW, Class: Moderate, Intensity: VI - VII) earthquake occurred 399.4 miles away from Broward Estates center

On 2/22/1992 at 04:21:34, a magnitude 3.2 (3.2 MB, Depth: 6.2 mi, Class: Light, Intensity: II - III) earthquake occurred 82.7 miles away from the city center

On 6/23/2016 at 17:20:29, a magnitude 3.8 (3.8 ML) earthquake occurred 271.5 miles away from Broward Estates center

On 7/16/2016 at 20:00:10, a magnitude 3.7 (3.7 MB) earthquake occurred 256.0 miles away from the city center

On 9/21/2016 at 16:30:52, a magnitude 3.8 (3.8 ML) earthquake occurred 276.4 miles away from the city center

On 9/4/2016 at 18:29:29, a magnitude 3.8 (3.8 ML) earthquake occurred 277.5 miles away from Broward Estates center

Magnitude types: body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Broward County (27) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 15

Emergencies Declared: 8

Causes of natural disasters: Hurricanes: 16, Fires: 3, Floods: 3, Tornadoes: 3, Freezes: 2, Tropical Storms: 2, Heavy Rain: 1, Storm: 1, Wind: 1, Other: 2 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers near Broward Estates:

- FMC DIALYSIS SERVICES - FT LAUDERDALE (Dialysis Facility, about 1 miles away; PLANTATION, FL)

- PLANTATION GENERAL HOSPITAL Acute Care Hospitals (about 1 miles away; PLANTATION, FL)

- COMPASSIONATE CARING HOME CARE, INC (Home Health Center, about 1 miles away; PLANTATION, FL)

- DEDICATED CAREGIVERS, LLC (Home Health Center, about 1 miles away; PLANTATION, FL)

- PLANTATION NURSING AND REHABILITATION CENTER (Nursing Home, about 1 miles away; PLANTATION, FL)

- K AND D HOME HEALTH CARE CORP (Home Health Center, about 1 miles away; PLANTATION, FL)

- ANN STORCK CENTER INC (Hospital, about 2 miles away; FORT LAUDERDALE, FL)

Amtrak stations near Broward Estates:

- 2 miles: FORT LAUDERDALE (200 SW 21ST TERRACE) . Services: ticket office, partially wheelchair accessible, enclosed waiting area, public restrooms, public payphones, vending machines, free short-term parking, free long-term parking, call for car rental service, call for taxi service, public transit connection.

- 9 miles: HOLLYWOOD (3001 HOLLYWOOD BLVD.) . Services: ticket office, partially wheelchair accessible, enclosed waiting area, public restrooms, public payphones, vending machines, free short-term parking, free long-term parking, taxi stand, public transit connection.

- 15 miles: DEERFIELD BEACH (1300 W. HILLSBORO BLVD.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, free short-term parking, free long-term parking, call for taxi service, public transit connection.

Colleges/universities with over 2000 students nearest to Broward Estates:

- Broward College (about 4 miles; Fort Lauderdale, FL; Full-time enrollment: 30,322)

- Nova Southeastern University (about 5 miles; Fort Lauderdale, FL; FT enrollment: 25,621)

- Keiser University-Ft Lauderdale (about 5 miles; Fort Lauderdale, FL; FT enrollment: 18,270)

- Everest University-Pompano Beach (about 10 miles; Pompano Beach, FL; FT enrollment: 2,316)

- DeVry University-Florida (about 14 miles; Miramar, FL; FT enrollment: 3,674)

- St Thomas University (about 15 miles; Miami Gardens, FL; FT enrollment: 2,096)

- Johnson & Wales University-North Miami (about 17 miles; North Miami, FL; FT enrollment: 2,051)

Points of interest:

| This place: | 3.4 people |

| Florida: | 2.5 people |

| This place: | 83.7% |

| Whole state: | 66.9% |

| This place: | 4.2% |

| Whole state: | 5.8% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.2% of all households

- Gay men: 0.5% of all households

| This place: | 23.2% |

| Whole state: | 12.5% |

| This place: | 10.4% |

| Whole state: | 5.7% |

For population 15 years and over in Broward Estates:

- Never married: 34.7%

- Now married: 42.3%

- Separated: 5.3%

- Widowed: 7.7%

- Divorced: 10.0%

For population 25 years and over in Broward Estates:

- High school or higher: 62.0%

- Bachelor's degree or higher: 10.5%

- Graduate or professional degree: 3.9%

- Unemployed: 8.1%

- Mean travel time to work (commute): 27.9 minutes

| Here: | 15.4 |

| Florida average: | 12.6 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Broward Estates, FL (based on Broward County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 280,324 | 47 |

| Evangelical Protestant | 221,258 | 701 |

| Other | 63,064 | 143 |

| Mainline Protestant | 53,412 | 88 |

| Black Protestant | 17,866 | 45 |

| Orthodox | 5,648 | 16 |

| None | 1,106,494 | - |

Food Environment Statistics:

| Broward County: | 2.05 / 10,000 pop. |

| Florida: | 2.04 / 10,000 pop. |

| This county: | 0.09 / 10,000 pop. |

| State: | 0.11 / 10,000 pop. |

| Here: | 1.53 / 10,000 pop. |

| Florida: | 1.28 / 10,000 pop. |

| Broward County: | 2.24 / 10,000 pop. |

| Florida: | 3.04 / 10,000 pop. |

| Broward County: | 8.00 / 10,000 pop. |

| Florida: | 7.45 / 10,000 pop. |

| Broward County: | 8.4% |

| Florida: | 9.2% |

| This county: | 20.6% |

| Florida: | 23.7% |

| Broward County: | 14.0% |

| Florida: | 14.0% |

6.62% of this county's 2021 resident taxpayers lived in other counties in 2020 ($102,632 average adjusted gross income)

| Here: | 6.62% |

| Florida average: | 8.80% |

0.03% of residents moved from foreign countries ($231 average AGI)

Broward County: 0.03% Florida average: 0.05%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Miami-Dade County, FL | |

| from Palm Beach County, FL | |

| from Orange County, FL |

6.99% of this county's 2020 resident taxpayers moved to other counties in 2021 ($73,182 average adjusted gross income)

| Here: | 6.99% |

| Florida average: | 7.45% |

0.03% of residents moved to foreign countries ($336 average AGI)

Broward County: 0.03% Florida average: 0.04%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Miami-Dade County, FL | |

| to Palm Beach County, FL | |

| to St. Lucie County, FL |

Strongest AM radio stations in Broward Estates:

- WWNN (1470 AM; 50 kW; POMPANO BEACH, FL; Owner: WWNN LICENSE, LLC)

- WSRF (1580 AM; 10 kW; FORT LAUDERDALE, FL; Owner: URBAN RADIO OF FLORIDA, LLC)

- WRFX (940 AM; 50 kW; MIAMI, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WAVS (1170 AM; 5 kW; DAVIE, FL; Owner: RADIO WAVS, INC.)

- WAQI (710 AM; 50 kW; MIAMI, FL; Owner: LICENSE CORPORATION #1)

- WEXY (1520 AM; 4 kW; WILTON MANORS, FL; Owner: MULTICULTURAL RADIO BROADCASTING, INC.)

- WNMA (1210 AM; 49 kW; MIAMI SPRINGS, FL; Owner: RADIO UNICA OF MIAMI LICENSE CORP.)

- WFLL (1400 AM; 1 kW; FORT LAUDERDALE, FL; Owner: JAMES CRYSTAL ENTERPRISES LICENSES, L.L.C.)

- WWFE (670 AM; 50 kW; MIAMI, FL; Owner: FENIX BROADCASTING CORP.)

- WLQY (1320 AM; 5 kW; HOLLYWOOD, FL; Owner: ENTRAVISION HOLDINGS, LLC)

- WSUA (1260 AM; 50 kW; MIAMI, FL; Owner: WSUA BROADCASTING CORPORATION)

- WQBA (1140 AM; 50 kW; MIAMI, FL; Owner: WQBA-AM LICENSE CORP.)

- WRHC (1550 AM; 45 kW; CORAL GABLES, FL; Owner: WRHC BROADCASTING CORP.)

Strongest FM radio stations in Broward Estates:

- WEDR (99.1 FM; MIAMI, FL; Owner: COX RADIO, INC.)

- WBGG-FM (105.9 FM; FORT LAUDERDALE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WHYI-FM (100.7 FM; FORT LAUDERDALE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WKIS (99.9 FM; BOCA RATON, FL; Owner: WKIS LICENSE LIMITED PARTNERSHIP)

- WRMA (106.7 FM; FORT LAUDERDALE, FL; Owner: WRMA LICENSING, INC.)

- WLRN-FM (91.3 FM; MIAMI, FL; Owner: THE SCHOOL BOARD OF MIAMI - DADE COUNTY, FL)

- WFLC (97.3 FM; MIAMI, FL; Owner: COX RADIO, INC.)

- WPYM (93.1 FM; MIAMI, FL; Owner: COX RADIO-MIAMI, LLC)

- WHQT (105.1 FM; CORAL GABLES, FL; Owner: COX RADIO, INC.)

- WLVE (93.9 FM; MIAMI BEACH, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WMIB (103.5 FM; FORT LAUDERDALE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WMXJ (102.7 FM; POMPANO BEACH, FL; Owner: JEFFERSON-PILOT COMMUNICATIONS CO. OF FLORIDA)

- WPOW (96.5 FM; MIAMI, FL; Owner: WPOW LICENSE LIMITED PARTNERSHIP)

- WZTA (94.9 FM; MIAMI BEACH, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WLYF (101.5 FM; MIAMI, FL; Owner: JEFFERSON-PILOT COMMUNICATIONS CO. OF FLORIDA)

- WXDJ (95.7 FM; NORTH MIAMI BEACH, FL; Owner: WXDJ LICENSING, INC.)

- WAFG (90.3 FM; FORT LAUDERDALE, FL; Owner: WESTMINSTER ACADEMY)

- WAMR-FM (107.5 FM; MIAMI, FL; Owner: WQBA-FM LICENSE CORP.)

- WEAT-FM (104.3 FM; WEST PALM BEACH, FL; Owner: INFINITY RADIO OPERATIONS INC.)

- WDNA (88.9 FM; MIAMI, FL; Owner: BASCOMB MEMORIAL BROADCASTING FOUNDATION)

TV broadcast stations around Broward Estates:

- W58BU (Channel 58; HALLANDALE, FL; Owner: NBC STATIONS MANAGEMENT,INC.)

- WPPB-TV (Channel 63; BOCA RATON, FL; Owner: THE SCHOOL BOARD OF BROWARD COUNTY, FLORIDA)

- WHFT-TV (Channel 45; MIAMI, FL; Owner: TRINITY BROADCASTING OF FLORIDA, INC.)

- WPBT (Channel 2; MIAMI, FL; Owner: COMMUNITY TV FOUNDATION OF S. FLORIDA, INC.)

- W24CA (Channel 24; MARATHON, FL; Owner: KEY COMMUNICATIONS OF TEXAS)

- WSVN (Channel 7; MIAMI, FL; Owner: SUNBEAM TELEVISION CORP.)

- WAMI-TV (Channel 69; HOLLYWOOD, FL; Owner: TELEFUTURA MIAMI LLC)

- WSCV (Channel 51; FORT LAUDERDALE, FL; Owner: TELEMUNDO OF FLORIDA LICENSE CORP.)

- WLRN-TV (Channel 17; MIAMI, FL; Owner: THE SCHOOL BOARD OF MIAMI - DADE COUNTY, FL)

- WPLG (Channel 10; MIAMI, FL; Owner: POST-NEWSWEEK STATIONS, FLORIDA, INC.)

- WLTV (Channel 23; MIAMI, FL; Owner: WLTV LICENSE PARTNERSHIP, G.P.)

- WBFS-TV (Channel 33; MIAMI, FL; Owner: VIACOM STATIONS GROUP OF MIAMI INC.)

- WPXM (Channel 35; MIAMI, FL; Owner: PAXSON COMMUNICATIONS LICENSE COMPANY, LLC)

- WLMF-LP (Channel 53; MIAMI, FL; Owner: PAGING SYSTEMS, INC.)

- WBZL (Channel 39; MIAMI, FL; Owner: CHANNEL 39, INC.)

- WHDT-LP (Channel 44; MIAMI, FL; Owner: GUENTER MARKSTEINER)

- WFUN-CA (Channel 48; MIAMI, ETC., FL; Owner: LOCALONE TEXAS, LTD.)

- WPTV (Channel 5; WEST PALM BEACH, FL; Owner: SCRIPPS HOWARD BROADCASTING COMPANY)

- WFLX (Channel 29; WEST PALM BEACH, FL; Owner: RAYCOM NATIONAL, INC.)

- WXEL-TV (Channel 42; WEST PALM BEACH, FL; Owner: BARRY TELECOMMUNICATIONS, INC.)

- WDLP-CA (Channel 21; POMPANO BEACH, FL; Owner: WDLP BROADCASTING COMPANY, LLC)

- WTVJ (Channel 6; MIAMI, FL; Owner: NBC STATIONS MANAGEMENT, INC.)

- WPEC (Channel 12; WEST PALM BEACH, FL; Owner: FREEDOM BROADCASTING OF FLORIDA, INC)

- WGEN-LP (Channel 55; MIAMI, FL; Owner: WDLP BROADCASTING COMPANY, LLC)

- WFGC (Channel 61; PALM BEACH, FL; Owner: CHRISTIAN TELEVISION OF PALM BEACH COUNTY, INC.)

Broward Estates fatal accident list:

May 7, 2005 04:37 AM, Nw 31st Ave, Nw 4th Place, Lat: 26.126350, Lon: -80.186370, Vehicles: 2, Persons: 3, Fatalities: 1

Jun 7, 2005 01:05 PM, Sr-842, Nw 33rd Ave, Lat: 26.121330, Lon: -80.189660, Vehicles: 1, Persons: 2, Pedestrians: 1, Fatalities: 1, Drunk persons involved: 1

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 1 partial tract) | ||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 17 | $153,849 | 1 | $29,400 | 7 | $139,453 | 0 | $0 | 0 | $0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | $0 | 1 | $30,190 | 1 | $85,820 | 0 | $0 | 1 | $59,990 |

| APPLICATIONS DENIED | 6 | $138,723 | 4 | $79,560 | 20 | $129,142 | 3 | $17,083 | 4 | $69,725 |

| APPLICATIONS WITHDRAWN | 5 | $141,360 | 0 | $0 | 4 | $172,925 | 0 | $0 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $197,460 | 0 | $0 | 2 | $139,650 | 0 | $0 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 0413.00

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 1 partial tract) | ||

| A) Conventional Home Purchase Loans | ||

|---|---|---|

| Number | Average Value | |

| LOANS ORIGINATED | 0 | $0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | $0 |

| APPLICATIONS DENIED | 0 | $0 |

| APPLICATIONS WITHDRAWN | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $162,100 |

Detailed PMIC statistics for the following Tracts: 0413.00

- 93.3%Electricity

- 4.6%Utility gas

- 1.4%No fuel used

- 0.7%Solar energy

- 95.9%Electricity

- 4.1%No fuel used

Broward Estates compared to Florida state average:

- Unemployed percentage below state average.

- Black race population percentage significantly above state average.

- Hispanic race population percentage significantly below state average.

- Median age below state average.

- Foreign-born population percentage significantly below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

- Percentage of population with a bachelor's degree or higher significantly below state average.