Canton, Ohio

Canton: Stadium Park

Canton: Palace theatre

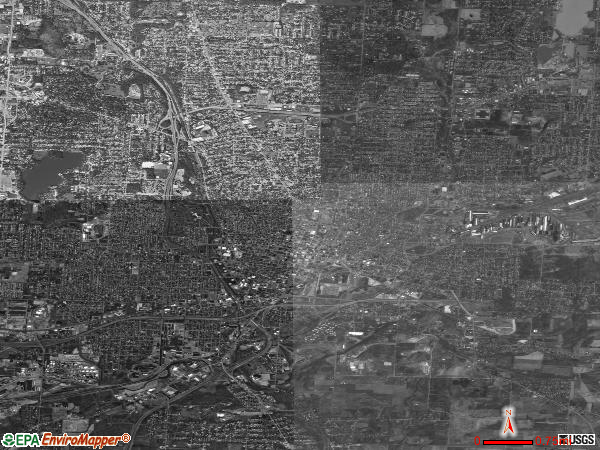

Canton: Beautiful Arial Shot of Downtown

Canton: Pro Football Hall Of Fame

Canton: Palace Theatre Downtown

Canton: Downtown Skyline

Canton: Central Plaza In Downtown

Canton: McKinley Monument

Canton: Downtown Canton Skyline

Canton: Banner on Light poles in Canton

Canton: Fall morning in Stadium park 10-31-10

- see

20

more - add

your

Submit your own pictures of this city and show them to the world

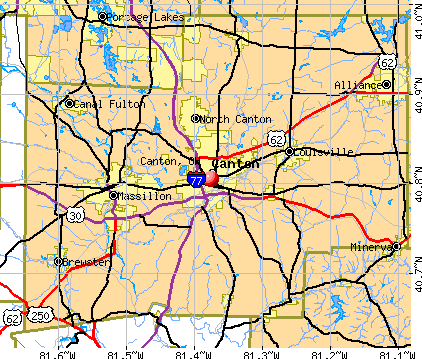

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: -13.8%

| Males: 33,392 | |

| Females: 36,279 |

| Median resident age: | 36.5 years |

| Ohio median age: | 39.9 years |

Zip codes: 44641, 44702, 44703, 44704, 44705, 44706, 44707, 44708, 44709, 44710, 44714, 44718, 44720, 44721, 44730.

Canton Zip Code Map| Canton: | $40,711 |

| OH: | $65,720 |

Estimated per capita income in 2022: $22,732 (it was $15,544 in 2000)

Canton city income, earnings, and wages data

Estimated median house or condo value in 2022: $89,500 (it was $66,400 in 2000)

| Canton: | $89,500 |

| OH: | $204,100 |

Mean prices in 2022: all housing units: $132,535; detached houses: $121,493; townhouses or other attached units: $210,882; in 2-unit structures: $711,130; in 3-to-4-unit structures: $132,282; in 5-or-more-unit structures: $85,860; mobile homes: $86,320

Median gross rent in 2022: $820.

(22.5% for White Non-Hispanic residents, 38.6% for Black residents, 45.4% for Hispanic or Latino residents, 36.4% for American Indian residents, 61.1% for other race residents, 47.1% for two or more races residents)

Detailed information about poverty and poor residents in Canton, OH

- 42,25560.1%White alone

- 17,53524.9%Black alone

- 6,8369.7%Two or more races

- 3,9655.6%Hispanic

- 3590.5%Asian alone

- 2930.4%Other race alone

- 150.02%American Indian alone

Races in Canton detailed stats: ancestries, foreign born residents, place of birth

According to our research of Ohio and other state lists, there were 374 registered sex offenders living in Canton, Ohio as of April 23, 2024.

The ratio of all residents to sex offenders in Canton is 192 to 1.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is bigger than the state average.- means the value is much bigger than the state average.

Crime rate in Canton detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 199 (159 officers - 139 male; 20 female).

| Officers per 1,000 residents here: | 2.28 |

| Ohio average: | 2.31 |

Latest news from Canton, OH collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: African (14.6%), German (11.4%), American (6.9%), European (5.6%), Irish (5.0%), English (4.9%).

Current Local Time: EST time zone

Elevation: 1100 feet

Land area: 20.5 square miles.

Population density: 3,391 people per square mile (average).

1,846 residents are foreign born (1.4% Latin America, 0.5% Europe, 0.4% Asia).

| This city: | 2.6% |

| Ohio: | 4.9% |

Median real estate property taxes paid for housing units with mortgages in 2022: $1,366 (1.3%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $939 (1.3%)

Nearest city with pop. 200,000+: Akron, OH (20.0 miles

, pop. 217,074).

Nearest city with pop. 1,000,000+: Philadelphia, PA (332.8 miles

, pop. 1,517,550).

Nearest cities:

Latitude: 40.80 N, Longitude: 81.38 W

Daytime population change due to commuting: +9,197 (+13.2%)

Workers who live and work in this city: 12,997 (42.4%)

Area code: 330

Canton tourist attractions:

Canton, Ohio accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 19 buildings, average cost: $188,400

- 2021: 31 buildings, average cost: $116,700

- 2020: 28 buildings, average cost: $116,700

- 2019: 14 buildings, average cost: $171,500

- 2018: 8 buildings, average cost: $63,300

- 2017: 12 buildings, average cost: $100,800

- 2016: 15 buildings, average cost: $142,200

- 2015: 11 buildings, average cost: $100,500

- 2014: 12 buildings, average cost: $139,100

- 2013: 11 buildings, average cost: $75,800

- 2012: 22 buildings, average cost: $103,500

- 2011: 13 buildings, average cost: $119,600

- 2010: 23 buildings, average cost: $138,700

- 2009: 10 buildings, average cost: $116,300

- 2008: 32 buildings, average cost: $111,100

- 2007: 54 buildings, average cost: $107,400

- 2006: 63 buildings, average cost: $131,700

- 2005: 80 buildings, average cost: $103,300

- 2004: 119 buildings, average cost: $82,200

- 2003: 144 buildings, average cost: $99,900

- 2002: 82 buildings, average cost: $106,400

- 2001: 59 buildings, average cost: $99,900

- 2000: 156 buildings, average cost: $68,400

- 1999: 79 buildings, average cost: $84,500

- 1998: 54 buildings, average cost: $84,500

- 1997: 83 buildings, average cost: $81,900

| Here: | 4.3% |

| Ohio: | 3.1% |

- Health care (11.2%)

- Accommodation & food services (8.5%)

- Metal & metal products (7.2%)

- Educational services (5.7%)

- Construction (4.8%)

- Administrative & support & waste management services (4.7%)

- Public administration (3.9%)

- Metal & metal products (11.9%)

- Construction (8.6%)

- Accommodation & food services (6.8%)

- Administrative & support & waste management services (5.5%)

- Public administration (3.6%)

- Educational services (3.5%)

- Health care (3.4%)

- Health care (18.9%)

- Accommodation & food services (10.1%)

- Educational services (7.8%)

- Finance & insurance (5.1%)

- Public administration (4.2%)

- Administrative & support & waste management services (3.9%)

- Department & other general merchandise stores (3.8%)

- Other production occupations, including supervisors (6.5%)

- Metal workers and plastic workers (4.7%)

- Building and grounds cleaning and maintenance occupations (4.4%)

- Other office and administrative support workers, including supervisors (4.3%)

- Laborers and material movers, hand (3.7%)

- Retail sales workers, except cashiers (3.2%)

- Driver/sales workers and truck drivers (3.2%)

- Other production occupations, including supervisors (8.8%)

- Metal workers and plastic workers (7.2%)

- Driver/sales workers and truck drivers (5.9%)

- Laborers and material movers, hand (5.5%)

- Building and grounds cleaning and maintenance occupations (4.6%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (4.0%)

- Construction traders workers except carpenters, electricians, painters, plumbers, and construction laborers (3.4%)

- Other office and administrative support workers, including supervisors (6.7%)

- Cashiers (5.2%)

- Nursing, psychiatric, and home health aides (5.1%)

- Secretaries and administrative assistants (4.5%)

- Building and grounds cleaning and maintenance occupations (4.3%)

- Other production occupations, including supervisors (4.2%)

- Retail sales workers, except cashiers (4.0%)

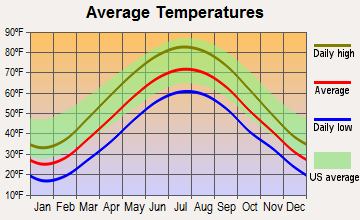

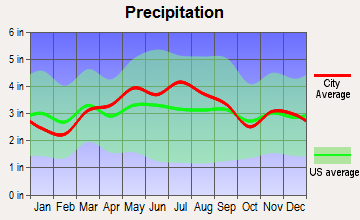

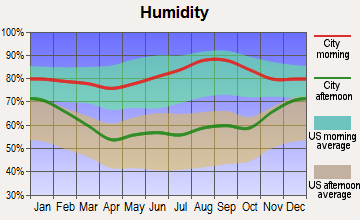

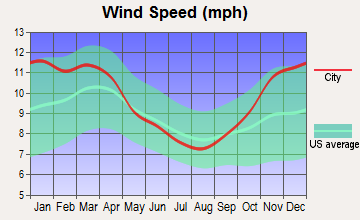

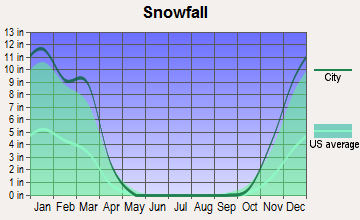

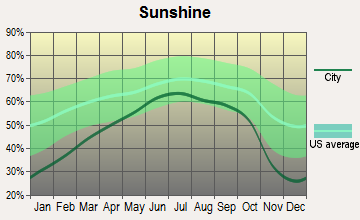

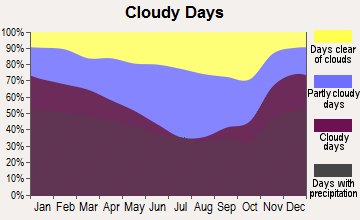

Average climate in Canton, Ohio

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2023 was 112. This is significantly worse than average.

| City: | 112 |

| U.S.: | 73 |

Carbon Monoxide (CO) [ppm] level in 2019 was 0.276. This is about average. Closest monitor was 0.3 miles away from the city center.

| City: | 0.276 |

| U.S.: | 0.251 |

Sulfur Dioxide (SO2) [ppb] level in 2021 was 0.136. This is significantly better than average. Closest monitor was 0.5 miles away from the city center.

| City: | 0.136 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 35.6. This is about average. Closest monitor was 0.5 miles away from the city center.

| City: | 35.6 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2004 was 20.4. This is about average. Closest monitor was 0.3 miles away from the city center.

| City: | 20.4 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 13.5. This is significantly worse than average. Closest monitor was 0.3 miles away from the city center.

| City: | 13.5 |

| U.S.: | 8.1 |

Tornado activity:

Canton-area historical tornado activity is near Ohio state average. It is 10% greater than the overall U.S. average.

On 5/31/1985, a category F5 (max. wind speeds 261-318 mph) tornado 29.8 miles away from the Canton city center killed 18 people and injured 310 people and caused between $50,000,000 and $500,000,000 in damages.

On 7/12/1992, a category F3 (max. wind speeds 158-206 mph) tornado 23.1 miles away from the city center caused between $500,000 and $5,000,000 in damages.

Earthquake activity:

Canton-area historical earthquake activity is significantly above Ohio state average. It is 47% smaller than the overall U.S. average.On 9/25/1998 at 19:52:52, a magnitude 5.2 (4.8 MB, 4.3 MS, 5.2 LG, 4.5 MW, Depth: 3.1 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 69.7 miles away from the city center

On 1/31/1986 at 16:46:43, a magnitude 5.0 (5.0 MB) earthquake occurred 56.3 miles away from Canton center

On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi) earthquake occurred 271.9 miles away from Canton center

On 7/27/1980 at 18:52:21, a magnitude 5.2 (5.1 MB, 4.7 MS, 5.0 UK, 5.2 UK) earthquake occurred 226.1 miles away from the city center

On 12/31/2011 at 20:05:01, a magnitude 4.0 (4.0 ML, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 42.2 miles away from Canton center

On 7/12/1986 at 08:19:37, a magnitude 4.5 (4.5 MB) earthquake occurred 158.2 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Stark County (10) is smaller than the US average (15).Major Disasters (Presidential) Declared: 6

Emergencies Declared: 3

Causes of natural disasters: Floods: 6, Storms: 5, Tornadoes: 3, Snowstorms: 2, Winds: 2, Blizzard: 1, Hurricane: 1, Mudslide: 1, Winter Storm: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: UNIZAN FINANCIAL CORP (NATIONAL COMMERCIAL BANKS), TIMKEN CO (BALL & ROLLER BEARINGS), DIEBOLD INC (CALCULATING & ACCOUNTING MACHINES (NO ELECTRONIC COMPUTERS)).

Hospitals in Canton:

- ACUTE CARE SPECIALTY HOSPITAL - AULTMAN (2000 SIXTH STREET)

- ART INC-CANTON GROUP HOME (2832 34TH STREET NE)

- AULTMAN HOSPICE PROGRAM (2821 WOODLAWN AVENUE NW)

- AULTMAN HOSPITAL (Voluntary non-profit - Other, provides emergency services, 2600 SIXTH STREET SW)

- MERCY MEDICAL CENTER (Voluntary non-profit - Church, 1320 MERCY DRIVE NW)

- PDS-DEBORAH (1121 DEBORAH STREET NW)

- VOCA OF OHIO/42ND STREET GH (1606 42ND STREET NW)

- VOCA OF OHIO/DAVID STREET HOME (4200 DAVID STREET NW)

- VOCA OF OHIO/MARKET STREET GH (2424 MARKET AVENUE N)

Nursing Homes in Canton:

- ALTERCARE OF NOBLES POND, INC (7006 FULTON DRIVE, NW)

- AULTMAN TRANSITIONAL CARE CENTER (2821 WOODLAWN AVENUE NW)

- BETHANY NURSING HOME, INC (626 34TH STREET, NW)

- CANTON HEALTH CARE CENTER (1223 MARKET AVENUE N)

- COLONIAL NURSING CENTER (1528 MARKET AVENUE N)

- JEAN CAROL NURSING HOME (1432 E TUSCARAWAS ST)

- MANOR CARE BELDEN VILLAGE (5005 HIGBEE AVE NW)

- MCKINLEY HEALTH CARE CTR LLC (800 MARKET AVENUE NORTH)

- SMITH NURSING HOME INC (2330 PENN PLACE NE)

- SUMSER RETIREMENT VILLAGE (836 34TH STREET NW)

- WHITE OAK CONVALESCENT HOME (3516 WHITE OAK DRIVE SW)

Dialysis Facilities in Canton:

- AULTMAN DIALYSIS CENTER OF CANTON (2912 WEST TUSCARAWAS STREET)

- AULTMAN HOSPITAL DIALYSIS UNIT (2600 6TH STREET SW)

- BELDEN COMMUNITY DIALYSIS (4685 FULTON ROAD NW)

- MERCY CANTON DIALYSIS (1320 MERCY DRIVE N W)

Home Health Centers in Canton:

- ADVANTAGE HOME HEALTH SERVICES, INC (100 30TH STREET, NW, SUITE 108)

- CAMBRIDGE HOME HEALTH CARE, INC (2605 BROAD AVENUE NW, SUITE 100)

- COLUMBIA MERCY MEDICAL CENTER HOMECARE (1320 MERCY DRIVE NW)

- HEALTH CARE IN YOUR HOME (2821 WOODLAWN AVENUE NW)

- IDEAL HOME HEALTH CARE, INC (1201 30TH STREET, NW, SUITE 200B)

- MAXIM HEALTHCARE SERVICES, INC (4150 BELDEN VILLAGE AVENUE, SUITE 301)

- MAXIM HOME HEALTH RESOURCES, LLC (4150 BELDEN VILLAGE STREET, SUITE 302)

- OHIO CARE RESPONSE HOME HEALTH AGENCY, CORP (3437 WHIPPLE AVENUE NW)

- PRESTIGE HOME HEALTH CARE, INC (4974 HIGBEE AVENUE NW, SUITE 100)

Airports and heliports located in Canton:

- Cross Airport (91OI) (Runways: 1)

- Lockeridge Airport (OI58) (Runways: 1)

- Aultman Hospital Heliport (OI65)

- Mercy Medical Center Heliport (52OI)

- Stark County Sheriff Heliport (5D1)

Colleges/Universities in Canton:

- Kent State University at Stark (Full-time enrollment: 3,259; Location: 6000 Frank Ave NW; Public; Website: www.stark.kent.edu; Offers Master's degree)

- Malone University (Full-time enrollment: 2,201; Location: 2600 Cleveland Avenue NW; Private, not-for-profit; Website: www.malone.edu; Offers Master's degree)

- Brown Mackie College-North Canton (Full-time enrollment: 599; Location: 4300 Munson Street, NW; Private, for-profit; Website: www.brownmackie.edu)

- Aultman College of Nursing and Health Sciences (Full-time enrollment: 288; Location: 2600 6th St SW; Private, not-for-profit; Website: www.aultmancollege.org)

- Canton City Schools Adult Career and Technical Education (Full-time enrollment: 113; Location: 116 McKinley Avenue NW; Public; Website: www.ccsdistrict.org)

- Regency Beauty Institute-Canton (Full-time enrollment: 107; Location: 5535 Dressler Road, Unit 9; Private, for-profit; Website: www.regency.edu)

- National Beauty College (Full-time enrollment: 81; Location: 4642 Cleveland Ave NW; Private, for-profit; Website: www.nationalbc.com)

- National College-Canton (Full-time enrollment: 42; Location: 4736 Dressler Rd NW; Private, for-profit; Website: www.national-college.edu/locations/stark-county-oh/)

Other colleges/universities with over 2000 students near Canton:

- Walsh University (about 5 miles; North Canton, OH; Full-time enrollment: 2,553)

- Stark State College (about 6 miles; North Canton, OH; FT enrollment: 7,707)

- University of Mount Union (about 16 miles; Alliance, OH; FT enrollment: 2,302)

- University of Akron Main Campus (about 21 miles; Akron, OH; FT enrollment: 22,216)

- Kent State University at Kent (about 24 miles; Kent, OH; FT enrollment: 25,431)

- The College of Wooster (about 30 miles; Wooster, OH; FT enrollment: 2,112)

- Youngstown State University (about 44 miles; Youngstown, OH; FT enrollment: 11,575)

Public high schools in Canton:

- GLENOAK HIGH SCHOOL (Students: 1,996, Location: 1801 SCHNEIDER ST NE, Grades: 9-12)

- MCKINLEY HIGH SCHOOL (Students: 1,608, Location: 2323 17TH ST NW, Grades: 9-12)

- TIMKEN HIGH SCHOOL (Students: 1,098, Location: 521 TUSCARAWAS ST W, Grades: 9-12)

- CANTON SOUTH HIGH SCHOOL (Students: 783, Location: 600 FAIRCREST ST SE, Grades: 9-12)

- LIFE SKILLS CENTER OF CANTON (Students: 238, Location: 1100 CLEVELAND AVE NW, Grades: 9-12, Charter school)

- CHOICES ALTERNATIVE SCHOOL (Students: 235, Location: 401 14TH ST SE, Grades: 11-12)

- CANTON CITY DIGITAL ACADEMY (Students: 157, Location: 401 14TH ST SE, Grades: 7-12)

- SUMMIT ACADEMY SECONDARY - CANTON (Students: 55, Location: 2400 CLEVELAND AVE NW, Grades: 9-12, Charter school)

- CANTON HARBOR HIGH SCHOOL (Location: 1731 GRACE AVE NE, Grades: 10-12, Charter school)

Private high school in Canton:

Biggest public elementary/middle schools in Canton:

- OAKWOOD MIDDLE SCHOOL (Students: 821, Location: 2300 SCHNEIDER ST NE, Grades: 7-8)

- WALKER ELEMENTARY SCHOOL (Students: 608, Location: 3525 SANDY AVE SE, Grades: PK-4)

- LEHMAN MIDDLE SCHOOL (Students: 552, Location: 1400 BROAD AVE NW, Grades: 6-8)

- FAIRCREST MEMORIAL MIDDLE SCHOOL (Students: 517, Location: 616 FAIRCREST ST SW, Grades: 5-8)

- HARTER ELEMENTARY SCHOOL (Students: 511, Location: 317 RAFF RD NW, Grades: PK-2)

- BARBARA F SCHREIBER ELEMENTARY SCHOOL (Students: 486, Location: 1503 WOODLAND AVE NW, Grades: PK-5)

- LAKE CABLE ELEMENTARY SCHOOL (Students: 453, Location: 5335 VILLA PADOVA DR NW, Grades: KG-5)

- CLARENDON ELEMENTARY SCHOOL (Students: 441, Location: 412 CLARENDON AVE NW, Grades: 3-5)

- MIDDLEBRANCH ELEMENTARY SCHOOL (Students: 423, Location: 7500 MIDDLEBRANCH AVE NE, Grades: KG-4)

- CEDAR ELEMENTARY SCHOOL (Students: 420, Location: 2823 9TH ST SW, Grades: 3-5)

Private elementary/middle schools in Canton:

- ST MICHAEL ELEMENTARY SCHOOL (Students: 397, Location: 3431 SAINT MICHAEL BLVD NW, Grades: PK-8)

- ST JOAN OF ARC SCHOOL (Students: 316, Location: 120 BORDNER AVE SW, Grades: PK-8)

- CANTON COUNTRY DAY SCHOOL (Students: 172, Location: 3000 DEMINGTON AVE NW, Grades: PK-8)

- ST JOSEPH SCHOOL (Students: 108, Location: 126 COLUMBUS AVE NW, Grades: PK-8)

- CANTON MONTESSORI SCHOOL (Students: 97, Location: 125 15TH ST NW, Grades: PK-4)

- WEAVER CDC AT MALONE UNIVERSITY (Students: 92, Location: 2600 CLEVELAND AVE NW, Grades: PK-3)

User-submitted facts and corrections:

- Walsh Univesity (Full time enrollment, 2100) 3 miles outside Canton

Points of interest:

Notable locations in Canton: Mahoning Road Plaza (A), Skyland Pines Golf Club (B), Fawcett Stadium (C), Stark County Fairgrounds (D), Ambulance Associates (E), American Medical Response (F), Stark County Courthouse (G), Canton Fire Department Station 1 (H), Canton Fire Department Station 6 (I), Canton Fire Department Station 7 (J), Canton Fire Department Station 9 (K), Canton Fire Department Station 10 (L), Plain Township Fire Department Station 2 (M), Canton Fire Department Station 2 (N), Canton Fire Department Station 8 (O), Canton Fire Department Station 4 (P), Canton Fire Department Station 5 (Q), Madge Youtz Branch Stark County Library (R), C T Branin Natatorium (S), McKinley Monument Historical Center (T). Display/hide their locations on the map

Shopping Centers: Canton Centre Shopping Center (1), Thirtieth Street Plaza Shopping Center (2), County Fair Shopping Center (3). Display/hide their locations on the map

Main business address in Canton include: UNIZAN FINANCIAL CORP (A), TIMKEN CO (B). Display/hide their locations on the map

Churches in Canton include: Simpson Church (A), First Methodist Church (B), First United Church of Christ (C), Saint Peter Church (D), Christian Tabernacle (E), Good Shepherd Lutheran Church (F), Our Lady of Peace Catholic Church (G), First Friends Church (H), Canton Gospel Center (I). Display/hide their locations on the map

Cemeteries: Saint Peters Cemetery (1), Forest Hill Cemetery (2), Westlawn Cemetery (3), North Lawn Cemetery (4), Rowland Cemetery (5), Saint Johns Cemetery (6). Display/hide their locations on the map

Streams, rivers, and creeks: Middle Branch Nimishillen Creek (A), Hurford Run (B), East Branch Nimishillen Creek (C), West Branch Nimishillen Creek (D), Sherrick Run (E). Display/hide their locations on the map

Parks in Canton include: Cook Park (1), Bauhoff Park (2), Avondale Arboretum (3), Robert W Starcher Baseball Field (4), Upper Downtown Canton Historic District (5), Covered Bridge Park (6), Arboretum Park (7), McKinley Monument (8), Maryland Park (9). Display/hide their locations on the map

Tourist attractions: Canton Classic Car Museum (Market Avenue) (1), Canton Art Institute (Museums; 1001 Market Avenue North) (2), Heart For The World (Cultural Attractions- Events- & Facilities; 1219 Barton Pl NE) (3), Convention & Visitors Bureau (222 Market Avenue North) (4), Canton Stark County Convention & Visitors Bureau - Tourist Information Ce (2141 George Halas Drive Northwest) (5), Convention & Visitors Bureau Tourists Informtn Center (2141 George Halas Drive Northwest) (6), Falconfyre Family Psychics (Arcades & Amusements; 800 Tenth Street Northwest) (7), Bingo Bugle (Arcades & Amusements; 1383 Gray Fox Drive) (8), Sailandsaave Cruise/ S.S. Travel (Recreational Trips & Guides; 173 Applegrove Northeast B-7) (9). Display/hide their approximate locations on the map

Hotels: Comfort Inn Canton (5345 Broadmoor Circle Northwest) (1), Canton Inn (1031 Tuscarawas Street West) (2), Canton-Days Inn (3970 Convenience Cir NW) (3), Glenmoor Country Club (4191 Glenmoor Rd NW) (4), Comfort Inn - Hall Of Fame (5345 Broadmoor Circle Northwest) (5), Bearback Ranch (320 Market Avenue South) (6), Fairfield Inn - Canton (5285 Broadmoor Cir NW) (7), Hampton Inn Canton (5335 Broadmoor Circle Northwest) (8), Four Seasons Nursery (707 Grove Street Northeast) (9). Display/hide their approximate locations on the map

Birthplace of: Mother Angelica - Roman Catholic nun, Marilyn Manson - Musician and artist, Alan Page - Judge, Jean Peters - Actress, Dick Kempthorn - Football player, William F. Raynolds - Army surveyor and topographer, Boz Scaggs - Blues guitarist, Dustin Fox - 2005 NFL player (Minnesota Vikings, born: Oct 8, 1982), James P. McCarthy - General, Todd Blackledge - Football player.

Drinking water stations with addresses in Canton and their reported violations in the past:

LITTLE FLOWER CATHOLIC PARISH PWS (Population served: 807, Groundwater):Past monitoring violations:MINI FOOD MART (Population served: 725, Groundwater):

- One routine major monitoring violation

Past monitoring violations:FOHL VILLAGE MHP (Population served: 450, Groundwater):

- One routine major monitoring violation

Past monitoring violations:SKYLAND PINE RUSTIC LODGE PWS (Population served: 127, Groundwater):

- Monitoring and Reporting (DBP) - Between JAN-2013 and SEP-2013, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Violation/Reminder Notice (NOV-20-2013), St Public Notif requested (NOV-20-2013)

- Monitoring and Reporting (DBP) - Between JAN-2013 and SEP-2013, Contaminant: TTHM. Follow-up actions: St Violation/Reminder Notice (NOV-20-2013), St Public Notif requested (NOV-20-2013)

- 2 regular monitoring violations

Past monitoring violations:MEADOWLAKE GOLF AND SWIM (Population served: 112, Groundwater):

- 4 routine major monitoring violations

Past health violations:WORD OF GOD COMMUNITY CHURCH INC PWS (Population served: 60, Groundwater):Past monitoring violations:

- Treatment Technique (SWTR and GWR) - In JUL-2008. Follow-up actions: St Violation/Reminder Notice (AUG-12-2008), St Public Notif requested (AUG-12-2008), St Compliance achieved (MAR-08-2011)

- Treatment Technique (SWTR and GWR) - In JUN-2008. Follow-up actions: St Violation/Reminder Notice (AUG-12-2008), St Public Notif requested (AUG-12-2008), St Compliance achieved (MAR-08-2011)

- Treatment Technique (SWTR and GWR) - In MAY-2008. Follow-up actions: St Violation/Reminder Notice (AUG-12-2008), St Public Notif requested (AUG-12-2008), St Compliance achieved (MAR-08-2011)

- Treatment Technique (SWTR and GWR) - In APR-2008. Follow-up actions: St Violation/Reminder Notice (MAY-29-2008), St Public Notif requested (MAY-29-2008), St Compliance achieved (MAR-08-2011)

- Treatment Technique (SWTR and GWR) - In MAR-2008. Follow-up actions: St Violation/Reminder Notice (APR-23-2008), St Public Notif requested (APR-23-2008), St Compliance achieved (MAR-08-2011)

- Treatment Technique (SWTR and GWR) - In FEB-2008. Follow-up actions: St Violation/Reminder Notice (MAR-25-2008), St Public Notif requested (MAR-25-2008), St Compliance achieved (MAR-08-2011)

- 36 other older health violations

- 16 routine major monitoring violations

- 4 minor monitoring violations

- 9 regular monitoring violations

Past health violations:WALBORN RESERVOIR MARINA (Population served: 50, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - Between APR-2014 and JUN-2014, Contaminant: Coliform

- MCL, Monthly (TCR) - In OCT-2012, Contaminant: Coliform. Follow-up actions: St Public Notif requested (NOV-05-2012), St Violation/Reminder Notice (NOV-05-2012), St Public Notif received (NOV-16-2012)

- One routine major monitoring violation

Past health violations:DEVILLE APARTMENTS (Address: SUITE 101 , Population served: 40, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - Between OCT-2012 and DEC-2012, Contaminant: Coliform. Follow-up actions: St Public Notif requested (OCT-19-2012), St Violation/Reminder Notice (OCT-19-2012), St Public Notif received (OCT-29-2012)

- One routine major monitoring violation

Past health violations:Past monitoring violations:

- MCL, Monthly (TCR) - In JUL-2011, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (JUL-22-2011), St Public Notif requested (JUL-22-2011), St Compliance achieved (FEB-09-2012), St Public Notif received (FEB-27-2012)

- Initial Tap Sampling for Pb and Cu - In JAN-01-2007, Contaminant: Lead and Copper Rule. Follow-up actions: St Public Notif requested (FEB-22-2007), St Violation/Reminder Notice (FEB-22-2007), St Public Notif received (APR-04-2007), St Compliance achieved (MAY-04-2007)

- Initial Tap Sampling for Pb and Cu - In JAN-01-2006, Contaminant: Lead and Copper Rule. Follow-up actions: St Violation/Reminder Notice (FEB-23-2006), St Public Notif requested (FEB-23-2006), St Compliance achieved (FEB-15-2008)

- Monitoring and Reporting (DBP) - Between JUL-2005 and SEP-2005, Contaminant: TTHM

- Monitoring and Reporting (DBP) - Between JUL-2005 and SEP-2005, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Violation/Reminder Notice (JAN-27-2006), St Public Notif requested (JAN-27-2006), St Compliance achieved (FEB-22-2006), St Public Notif received (MAR-28-2006)

- Initial Tap Sampling for Pb and Cu - In JUL-01-2005, Contaminant: Lead and Copper Rule. Follow-up actions: St Violation/Reminder Notice (AUG-15-2005), St Public Notif requested (AUG-15-2005), St Public Notif received (AUG-31-2005), St Compliance achieved (FEB-15-2008)

- 70 regular monitoring violations

Drinking water stations with addresses in Canton that have no violations reported:

- CANTON PUBLIC WATER SYSTEM (Population served: 98,260, Primary Water Source Type: Groundwater)

- BETH MOBILE HOME PARK (Population served: 188, Primary Water Source Type: Groundwater)

- TASTI CREME (Population served: 100, Primary Water Source Type: Groundwater)

| This city: | 2.4 people |

| Ohio: | 2.4 people |

| This city: | 57.7% |

| Whole state: | 65.0% |

| This city: | 9.3% |

| Whole state: | 6.8% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.5% of all households

- Gay men: 0.3% of all households

People in group quarters in Canton in 2010:

- 1,031 people in college/university student housing

- 701 people in nursing facilities/skilled-nursing facilities

- 528 people in other noninstitutional facilities

- 421 people in local jails and other municipal confinement facilities

- 148 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 125 people in correctional residential facilities

- 108 people in group homes intended for adults

- 31 people in residential treatment centers for adults

- 8 people in correctional facilities intended for juveniles

People in group quarters in Canton in 2000:

- 1,124 people in nursing homes

- 807 people in college dormitories (includes college quarters off campus)

- 419 people in local jails and other confinement facilities (including police lockups)

- 202 people in other noninstitutional group quarters

- 174 people in other nonhousehold living situations

- 162 people in other group homes

- 101 people in homes for the mentally retarded

- 23 people in homes or halfway houses for drug/alcohol abuse

- 16 people in religious group quarters

- 8 people in wards in general hospitals for patients who have no usual home elsewhere

- 3 people in training schools for juvenile delinquents

- 2 people in homes for the mentally ill

Banks with most branches in Canton (2011 data):

- The Huntington National Bank: 7 branches. Info updated 2012/04/02: Bank assets: $54,183.4 mil, Deposits: $44,300.3 mil, headquarters in Columbus, OH, positive income, Commercial Lending Specialization, 878 total offices, Holding Company: Huntington Bancshares Incorporated

- RBS Citizens, National Association: 7 branches. Info updated 2007/09/19: Bank assets: $106,940.6 mil, Deposits: $75,690.2 mil, headquarters in Providence, RI, positive income, 1135 total offices, Holding Company: Uk Financial Investments Limited

- Firstmerit Bank, National Association: 100 Central Plaza South Branch, East 62 Branch, Country Fair Branch, North Plaza Branch, Belden Village Branch, Hillsdale Branch. Info updated 2010/05/17: Bank assets: $14,420.6 mil, Deposits: $11,497.6 mil, headquarters in Akron, OH, positive income, Commercial Lending Specialization, 213 total offices, Holding Company: Firstmerit Corporation

- KeyBank National Association: Canton South Branch, Everhard Branch, 30th Street Branch, Hillsdale Branch, Canton Downtown Branch, Nobles Pond Branch. Info updated 2008/03/03: Bank assets: $86,198.8 mil, Deposits: $64,214.8 mil, headquarters in Cleveland, OH, positive income, Commercial Lending Specialization, 1067 total offices, Holding Company: Keycorp

- JPMorgan Chase Bank, National Association: Belden Dressler, 30th-Street Branch, Easton Branch, Canton Central Plaza Branch. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- PNC Bank, National Association: Canton Centre Branch, Cleveland And 34th Street Branch, Jackson-Belden Branch, Avondale Branch. Info updated 2012/03/20: Bank assets: $263,309.6 mil, Deposits: $197,343.0 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 3085 total offices, Holding Company: Pnc Financial Services Group, Inc., The

- Fifth Third Bank: Cleveland Ave Branch, Avondale Branch, Perry Township Branch. Info updated 2009/10/05: Bank assets: $114,540.4 mil, Deposits: $89,689.1 mil, headquarters in Cincinnati, OH, positive income, Commercial Lending Specialization, 1378 total offices, Holding Company: Fifth Third Bancorp

- The Bank of Magnolia Company: Canton South Branch at 3221 Cleveland Ave Sw, branch established on 1999/06/04. Info updated 2006/11/03: Bank assets: $69.1 mil, Deposits: $60.1 mil, headquarters in Magnolia, OH, positive income, 3 total offices, Holding Company: Magnolia Bancorp, Inc.

- Woodforest National Bank: Canton Ohio Branch at 3200 Atlantic Blvd Nw, branch established on 2010/02/27. Info updated 2011/05/10: Bank assets: $3,488.9 mil, Deposits: $3,097.6 mil, headquarters in Houston, TX, positive income, Commercial Lending Specialization, 766 total offices, Holding Company: Woodforest Financial Group Employee Stock Ownership Plan (With 401(K) Provisions)

For population 15 years and over in Canton:

- Never married: 43.3%

- Now married: 32.2%

- Separated: 2.4%

- Widowed: 6.9%

- Divorced: 15.2%

For population 25 years and over in Canton:

- High school or higher: 87.0%

- Bachelor's degree or higher: 16.8%

- Graduate or professional degree: 5.6%

- Unemployed: 7.8%

- Mean travel time to work (commute): 17.0 minutes

| Here: | 9.7 |

| Ohio average: | 11.0 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Canton:

(Canton, Ohio Neighborhood Map)- Avondale neighborhood

- Banker Heights (Banker's Hts.) neighborhood

- Belden Village neighborhood

- Colonial Heights (Colonial Hts.) neighborhood

- Crystal Park neighborhood

- Downtown Canton (Downtown) neighborhood

- Edgefield (Washington Park) neighborhood

- Edmeyer Park (Ed Meyer) neighborhood

- Fairgrounds neighborhood

- Fairmount (Fairmont) neighborhood

- Gambrinus neighborhood

- Gibbs (Gibb's) neighborhood

- Hampton Park Estates (Hampton Park Estate) neighborhood

- Harter Heights (Harter Hts.) neighborhood

- Market Heights (Market Hts.) neighborhood

- Meyers Lake (Meyer's Lake) neighborhood

- Mount Vernon (Mt. Vernon Estates) neighborhood

- Newton Zone (Newton) neighborhood

- Northeast Canton (North East Canton) neighborhood

- Northwest Canton (North West Canton) neighborhood

- Plain Center Estates (Plain Center Estate) neighborhood

- Reedurban (Reed Urban) neighborhood

- Ridgewood (Historic Ridgewood) neighborhood

- Southwest Canton (S. West Canton) neighborhood

- Summit neighborhood

- The Knolls neighborhood

- Village of Hills and Dales (Hills and Dales) neighborhood

- West Park (Westpark) neighborhood

- Westbrook (Westbrooke Park) neighborhood

- Whipple Heights (Whipole Hts.) neighborhood

- Whittier Park neighborhood

Religion statistics for Canton, OH (based on Stark County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 60,957 | 224 |

| Catholic | 55,831 | 28 |

| Mainline Protestant | 45,340 | 127 |

| Black Protestant | 5,327 | 25 |

| Orthodox | 5,014 | 8 |

| Other | 3,929 | 24 |

| None | 199,188 | - |

Food Environment Statistics:

| Stark County: | 1.87 / 10,000 pop. |

| Ohio: | 1.89 / 10,000 pop. |

| Stark County: | 0.13 / 10,000 pop. |

| Ohio: | 0.13 / 10,000 pop. |

| Here: | 0.90 / 10,000 pop. |

| Ohio: | 1.25 / 10,000 pop. |

| Here: | 2.69 / 10,000 pop. |

| Ohio: | 2.93 / 10,000 pop. |

| Stark County: | 6.67 / 10,000 pop. |

| Ohio: | 6.25 / 10,000 pop. |

| Stark County: | 10.9% |

| State: | 10.3% |

| This county: | 30.3% |

| State: | 29.1% |

| This county: | 12.5% |

| Ohio: | 11.9% |

Health and Nutrition:

| Canton: | 48.3% |

| State: | 50.4% |

| Canton: | 44.5% |

| Ohio: | 47.8% |

| Canton: | 28.9 |

| Ohio: | 28.7 |

| This city: | 21.1% |

| Ohio: | 20.6% |

| Canton: | 11.6% |

| State: | 10.4% |

| Canton: | 6.8 |

| Ohio: | 6.8 |

| Canton: | 33.6% |

| Ohio: | 34.3% |

| Canton: | 54.6% |

| Ohio: | 57.0% |

| Canton: | 78.7% |

| State: | 79.1% |

More about Health and Nutrition of Canton, OH Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 164 | $1,055,457 | $77,229 | 0 | $0 |

| Firefighters | 153 | $1,116,835 | $87,595 | 0 | $0 |

| Water Supply | 95 | $546,951 | $69,089 | 0 | $0 |

| Judicial and Legal | 81 | $383,052 | $56,748 | 10 | $30,810 |

| Financial Administration | 62 | $377,779 | $73,119 | 0 | $0 |

| Sewerage | 61 | $382,622 | $75,270 | 0 | $0 |

| Health | 60 | $315,739 | $63,148 | 15 | $46,848 |

| Solid Waste Management | 54 | $235,926 | $52,428 | 0 | $0 |

| Streets and Highways | 49 | $269,476 | $65,994 | 0 | $0 |

| Other and Unallocable | 47 | $262,524 | $67,027 | 2 | $3,490 |

| Police - Other | 37 | $202,264 | $65,599 | 14 | $2,028 |

| Parks and Recreation | 30 | $141,389 | $56,556 | 9 | $7,876 |

| Other Government Administration | 24 | $167,610 | $83,805 | 14 | $24,153 |

| Housing and Community Development (Local) | 14 | $79,624 | $68,249 | 0 | $0 |

| Correction | 6 | $26,578 | $53,156 | 0 | $0 |

| Fire - Other | 4 | $19,645 | $58,935 | 0 | $0 |

| Totals for Government | 941 | $5,583,470 | $71,203 | 64 | $115,205 |

Canton government finances - Expenditure in 2021 (per resident):

- Construction - Regular Highways: $41,136,000 ($590.43)

- Current Operations - Central Staff Services: $24,886,000 ($357.19)

General - Other: $21,897,000 ($314.29)

Police Protection: $18,672,000 ($268.00)

Local Fire Protection: $16,294,000 ($233.87)

Water Utilities: $15,316,000 ($219.83)

Housing and Community Development: $7,301,000 ($104.79)

Sewerage: $7,106,000 ($101.99)

Judicial and Legal Services: $6,911,000 ($99.19)

Solid Waste Management: $6,664,000 ($95.65)

Financial Administration: $6,248,000 ($89.68)

Parks and Recreation: $5,442,000 ($78.11)

Regular Highways: $3,656,000 ($52.48)

Protective Inspection and Regulation - Other: $2,243,000 ($32.19)

Health - Other: $1,254,000 ($18.00)

Miscellaneous Commercial Activities - Other: $697,000 ($10.00)

- General - Interest on Debt: $2,348,000 ($33.70)

- Other Capital Outlay - Water Utilities: $12,756,000 ($183.09)

Sewerage: $11,001,000 ($157.90)

Local Fire Protection: $1,735,000 ($24.90)

Police Protection: $1,267,000 ($18.19)

Solid Waste Management: $786,000 ($11.28)

Parks and Recreation: $380,000 ($5.45)

Protective Inspection and Regulation - Other: $179,000 ($2.57)

Judicial and Legal Services: $119,000 ($1.71)

- Total Salaries and Wages: $124,242,000 ($1783.27)

Canton government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $16,887,000 ($242.38)

Other: $11,145,000 ($159.97)

Solid Waste Management: $6,670,000 ($95.74)

Parking Facilities: $443,000 ($6.36)

Parks and Recreation: $100,000 ($1.44)

- Federal Intergovernmental - Highways: $6,350,000 ($91.14)

Health and Hospitals: $5,957,000 ($85.50)

Housing and Community Development: $5,249,000 ($75.34)

- Local Intergovernmental - Sewerage: $1,706,000 ($24.49)

Other: $499,000 ($7.16)

- Miscellaneous - General Revenue - Other: $32,577,000 ($467.58)

Interest Earnings: $812,000 ($11.65)

Donations From Private Sources: $574,000 ($8.24)

Sale of Property: $425,000 ($6.10)

Fines and Forfeits: $391,000 ($5.61)

Special Assessments: $172,000 ($2.47)

Rents: $109,000 ($1.56)

Royalties: $6,000 ($0.09)

- Revenue - Water Utilities: $19,346,000 ($277.68)

- State Intergovernmental - Highways: $11,365,000 ($163.12)

Other: $4,256,000 ($61.09)

General Local Government Support: $3,153,000 ($45.26)

Sewerage: $2,629,000 ($37.73)

Water Utilities: $2,331,000 ($33.46)

Health and Hospitals: $296,000 ($4.25)

- Tax - Individual Income: $54,057,000 ($775.89)

Property: $6,198,000 ($88.96)

Corporation Net Income: $6,098,000 ($87.53)

Other License: $911,000 ($13.08)

Occupation and Business License - Other: $726,000 ($10.42)

Amusements Sales: $363,000 ($5.21)

Other Selective Sales: $161,000 ($2.31)

Alcoholic Beverage License: $94,000 ($1.35)

Amusements License: $6,000 ($0.09)

Canton government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $104,602,000 ($1501.37)

Outstanding Unspecified Public Purpose: $97,866,000 ($1404.69)

Retired Unspecified Public Purpose: $6,736,000 ($96.68)

Canton government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $708,000 ($10.16)

- Other Funds - Cash and Securities: $3,000 ($0.04)

- Sinking Funds - Cash and Securities: $207,670,000 ($2980.72)

| Businesses in Canton, OH | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| ALDI | 3 | Knights Inn | 1 | |

| AMF Bowling | 1 | La Quinta | 1 | |

| AT&T | 6 | La-Z-Boy | 1 | |

| Abercrombie & Fitch | 1 | Lane Bryant | 1 | |

| Abercrombie Kids | 1 | Lane Furniture | 4 | |

| Ace Hardware | 1 | LensCrafters | 1 | |

| Advance Auto Parts | 4 | Little Caesars Pizza | 3 | |

| Aeropostale | 1 | Long John Silver's | 1 | |

| American Eagle Outfitters | 2 | Macy's | 1 | |

| Ann Taylor | 1 | Marriott | 3 | |

| Applebee's | 1 | MasterBrand Cabinets | 8 | |

| Arby's | 5 | Mazda | 1 | |

| AutoZone | 4 | McDonald's | 9 | |

| Bath & Body Works | 1 | Motherhood Maternity | 2 | |

| Blockbuster | 1 | New Balance | 5 | |

| Buffalo Wild Wings | 1 | New York & Co | 1 | |

| Burger King | 5 | Nike | 6 | |

| Burlington Coat Factory | 1 | OfficeMax | 1 | |

| Cache | 1 | Olive Garden | 1 | |

| Caribou Coffee | 1 | Outback | 1 | |

| Casual Male XL | 1 | Outback Steakhouse | 1 | |

| Catherines | 1 | Pac Sun | 1 | |

| Charlotte Russe | 1 | Panera Bread | 1 | |

| Chick-Fil-A | 1 | Papa John's Pizza | 2 | |

| Chipotle | 2 | Payless | 3 | |

| Chuck E. Cheese's | 1 | Penske | 1 | |

| Church's Chicken | 1 | Pier 1 Imports | 1 | |

| Cinnabon | 1 | Pizza Hut | 4 | |

| Circle K | 8 | Plato's Closet | 1 | |

| ColorTyme | 1 | Qdoba Mexican Grill | 1 | |

| Comfort Inn | 1 | Quiznos | 1 | |

| Curves | 3 | RadioShack | 3 | |

| Dairy Queen | 3 | Ramada | 1 | |

| Days Inn | 1 | Red Lobster | 1 | |

| Deb | 1 | Red Robin | 1 | |

| Decora Cabinetry | 2 | Rite Aid | 9 | |

| Dennys | 1 | Rue21 | 1 | |

| Domino's Pizza | 1 | SAS Shoes | 2 | |

| Dunkin Donuts | 2 | Sears | 3 | |

| Express | 1 | Spencer Gifts | 1 | |

| Famous Footwear | 1 | Sprint Nextel | 1 | |

| Fashion Bug | 2 | Starbucks | 3 | |

| FedEx | 21 | Steak 'n Shake | 1 | |

| Finish Line | 1 | Subway | 14 | |

| Firestone Complete Auto Care | 2 | T-Mobile | 7 | |

| Foot Locker | 1 | T.G.I. Driday's | 1 | |

| Ford | 1 | T.J.Maxx | 1 | |

| Forever 21 | 1 | Taco Bell | 4 | |

| GNC | 7 | Talbots | 1 | |

| GameStop | 4 | The Limited | 1 | |

| Gap | 1 | Toys"R"Us | 1 | |

| Gymboree | 1 | True Value | 2 | |

| H&R Block | 5 | U-Haul | 7 | |

| Hilton | 1 | UPS | 27 | |

| Hollister Co. | 1 | Value City Furniture | 1 | |

| Home Depot | 1 | Vans | 2 | |

| HomeTown Buffet | 1 | Verizon Wireless | 2 | |

| Hot Topic | 1 | Victoria's Secret | 1 | |

| JCPenney | 1 | Volkswagen | 1 | |

| JoS. A. Bank | 1 | Waffle House | 1 | |

| Jones New York | 2 | Walgreens | 3 | |

| Journeys | 1 | Walmart | 2 | |

| Justice | 2 | Wendy's | 6 | |

| KFC | 4 | Wet Seal | 1 | |

| Kmart | 1 | YMCA | 3 | |

Strongest AM radio stations in Canton:

- WRCW (1060 AM; daytime; 5 kW; CANTON, OH)

- WHBC (1480 AM; 15 kW; CANTON, OH; Owner: NM LICENSING, LLC)

- WINW (1520 AM; daytime; 1 kW; CANTON, OH)

- WCER (900 AM; 0 kW; CANTON, OH; Owner: MELODYNAMIC BROACASTING CORPORATION)

- WTAM (1100 AM; 50 kW; CLEVELAND, OH; Owner: JACOR BROADCASTING CORPORATION)

- WKNR (850 AM; 50 kW; CLEVELAND, OH; Owner: CARON BROADCASTING, INC.)

- WHK (1220 AM; 50 kW; CLEVELAND, OH; Owner: CARON BROADCASTING, INC.)

- WWVA (1170 AM; 53 kW; WHEELING, WV; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WHLO (640 AM; 5 kW; AKRON, OH; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WAKR (1590 AM; 5 kW; AKRON, OH; Owner: RUBBER CITY RADIO GROUP, INC.)

- KDKA (1020 AM; 50 kW; PITTSBURGH, PA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WWMK (1260 AM; 10 kW; CLEVELAND, OH; Owner: ABC, INC.)

- WTVN (610 AM; 50 kW; COLUMBUS, OH; Owner: CITICASTERS LICENSES, L.P.)

Strongest FM radio stations in Canton:

- WRQK-FM (106.9 FM; CANTON, OH; Owner: CUMULUS LICENSING CORP.)

- WKDD (98.1 FM; CANTON, OH; Owner: CITICASTERS LICENSES, L.P.)

- WHBC-FM (94.1 FM; CANTON, OH; Owner: NM LICENSING, LLC)

- WONE-FM (97.5 FM; AKRON, OH; Owner: RUBBER CITY RADIO GROUP, INC.)

- WZKL (92.5 FM; ALLIANCE, OH; Owner: D. A. PETERSON, INC.)

- WKSU-FM (89.7 FM; KENT, OH; Owner: KENT STATE UNIVERSITY)

- WQMX (94.9 FM; MEDINA, OH; Owner: RUBBER CITY RADIO GROUP, INC)

- WZIP (88.1 FM; AKRON, OH; Owner: THE UNIVERSITY OF AKRON)

- WNPQ (95.9 FM; NEW PHILADELPHIA, OH; Owner: TUSCARAWAS BROADCASTING COMPANY)

- WQXK (105.1 FM; SALEM, OH; Owner: CUMULUS LICENSING CORP.)

- WMXY (98.9 FM; YOUNGSTOWN, OH; Owner: CITICASTERS LICENSES, L.P.)

- WMJI (105.7 FM; CLEVELAND, OH; Owner: CITICASTERS LICENSES, L.P.)

- WOFN (88.7 FM; BEACH CITY, OH; Owner: CREATIVE EDUCATIONAL MEDIA CORP.)

- WAKS (96.5 FM; AKRON, OH; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WQAL (104.1 FM; CLEVELAND, OH; Owner: INFINITY RADIO OPERATIONS INC.)

- WAPS (91.3 FM; AKRON, OH; Owner: BOARD OF EDUCATION, AKRON CITY SCHOOL DISTRICT)

- WJER-FM (101.7 FM; DOVER, OH; Owner: WJER RADIO, INC.)

- WNIR (100.1 FM; KENT, OH; Owner: MEDIA-COM, INC.)

- WMVX (106.5 FM; CLEVELAND, OH; Owner: JACOR BROADCASTING CORPORATION)

- WNCX (98.5 FM; CLEVELAND, OH; Owner: INFINITY RADIO OF CLEVELAND INC.)

TV broadcast stations around Canton:

- WDLI (Channel 17; CANTON, OH; Owner: TRINITY BROADCASTING NETWORK, INC.)

- WIVM-LP (Channel 52; CANTON, OH; Owner: LUCINDA DeVAUL-TONGES)

- WVPX (Channel 23; AKRON, OH; Owner: PAXSON AKRON LICENSE, INC.)

- WEAO (Channel 49; AKRON, OH; Owner: NORTHEASTERN EDUCATIONAL TELEVISION OF OHIO, INC.)

- WAKN-LP (Channel 11; AKRON, OH; Owner: AKRON TELEVISION, INC.)

- WNEO (Channel 45; ALLIANCE, OH; Owner: NORTHEASTERN EDUCATIONAL TELEVISION OF OHIO, INC.)

- WKBN-TV (Channel 27; YOUNGSTOWN, OH; Owner: PIEDMONT TELEVISION OF YOUNGSTOWN LICENSE LLC)

- WOAC (Channel 67; CANTON, OH; Owner: WRAY, INC.)

- WOIO (Channel 19; SHAKER HEIGHTS, OH; Owner: RAYCOM NATIONAL, INC.)

- WBNX-TV (Channel 55; AKRON, OH; Owner: WINSTON BROADCASTING NETWORK, INC.)

- WAOH-LP (Channel 29; AKRON, OH; Owner: MEDIA-COM TELEVISION, INC.)

- WFMJ-TV (Channel 21; YOUNGSTOWN, OH; Owner: WFMJ TELEVISION, INC.)

- WQHS-TV (Channel 61; CLEVELAND, OH; Owner: UNIVISION CLEVELAND LLC)

- W35AX (Channel 35; CLEVELAND, OH; Owner: MEDIA-COM TELEVISION, INC.)

- National Bridge Inventory (NBI) Statistics

- 224Number of bridges

- 2,812ft / 857mTotal length

- $1,121,002,000Total costs

- 4,648,811Total average daily traffic

- 395,864Total average daily truck traffic

- New bridges - historical statistics

- 21900-1909

- 21910-1919

- 41920-1929

- 41930-1939

- 121940-1949

- 151950-1959

- 601960-1969

- 411970-1979

- 231980-1989

- 161990-1999

- 332000-2009

- 92010-2019

- 32020-2022

FCC Registered Antenna Towers: 428 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 4 (See the full list of FCC Registered Commercial Land Mobile Towers in Canton, OH)

FCC Registered Private Land Mobile Towers: 16 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 133 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 99 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 19 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 1 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 607 (See the full list of FCC Registered Amateur Radio Licenses in Canton)

FAA Registered Aircraft Manufacturers and Dealers: 7 (See the full list of FAA Registered Manufacturers and Dealers in Canton)

FAA Registered Aircraft: 97 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 13 full and 10 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 237 | $81,085 | 109 | $80,497 | 472 | $92,121 | 102 | $13,180 | 2 | $598,645 | 62 | $51,427 | 2 | $51,975 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 7 | $63,103 | 6 | $59,682 | 72 | $78,240 | 15 | $20,335 | 2 | $4,192,500 | 5 | $55,380 | 0 | $0 |

| APPLICATIONS DENIED | 30 | $66,937 | 29 | $50,122 | 399 | $79,074 | 119 | $20,338 | 0 | $0 | 47 | $45,376 | 1 | $40,000 |

| APPLICATIONS WITHDRAWN | 17 | $86,182 | 15 | $59,993 | 148 | $82,049 | 8 | $25,574 | 0 | $0 | 15 | $51,119 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 4 | $76,102 | 3 | $56,207 | 38 | $93,796 | 1 | $10,690 | 0 | $0 | 1 | $41,400 | 0 | $0 |

Detailed mortgage data for all 23 tracts in Canton, OH

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 9 full and 7 partial tracts) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 19 | $87,664 | 15 | $96,553 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 8 | $91,874 | 8 | $124,970 |

| APPLICATIONS DENIED | 4 | $86,618 | 4 | $137,515 |

| APPLICATIONS WITHDRAWN | 2 | $90,000 | 4 | $97,820 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 |

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Canton, OH

- 3,53653.6%Structure Fires

- 2,00030.3%Outside Fires

- 1,02715.6%Mobile Property/Vehicle Fires

- 300.5%Other

According to the data from the years 2002 - 2018 the average number of fires per year is 388. The highest number of reported fires - 673 took place in 2010, and the least - 61 in 2003. The data has a growing trend.

According to the data from the years 2002 - 2018 the average number of fires per year is 388. The highest number of reported fires - 673 took place in 2010, and the least - 61 in 2003. The data has a growing trend. When looking into fire subcategories, the most incidents belonged to: Structure Fires (53.6%), and Outside Fires (30.3%).

When looking into fire subcategories, the most incidents belonged to: Structure Fires (53.6%), and Outside Fires (30.3%).Fire-safe hotels and motels in Canton, Ohio:

- Holiday Inn Canton, 4520 Everhard Rd NW, Canton, Ohio 44718 , Phone: (330) 494-2770, Fax: (330) 494-6473

- La Quinta Inn & Suites Canton, 5335 Broadmoor Cir NW, Canton, Ohio 44709 , Phone: (330) 492-0151, Fax: (330) 492-7523

- Ramada Hall Of Fame, 4914 Everhard Rd NW, Canton, Ohio 44718 , Phone: (330) 499-1011, Fax: (330) 499-3175

- Canton Marriott Mckinley Grand, 320 Market Ave South, Canton, Ohio 44702 , Phone: (330) 454-5000, Fax: (330) 454-5494

- Hampton Inn & Suites Canton, 5256 Broadmoor Circle NW, Canton, Ohio 44709 , Phone: (330) 491-4335, Fax: (330) 491-8355

- America's Best Value Inn & Suites, 4285 Everhard Road NW, Canton, Ohio 44718 , Phone: (330) 494-2233, Fax: (330) 494-5115

- Fairfield Inn & Suites-Canton South, 4025 Greentree Ave SW, Canton, Ohio 44706 , Phone: (330) 484-0300, Fax: (330) 484-0400

- Quality Inn Hall Of Fame, 3970 Convenience Circle NW, CANTON, Ohio 44718 , Phone: (330) 956-5056, Fax: (330) 956-5184

- 3 other hotels and motels

| Most common first names in Canton, OH among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| Mary | 2,113 | 79.9 years |

| John | 1,939 | 74.9 years |

| William | 1,623 | 74.2 years |

| Robert | 1,391 | 71.3 years |

| James | 1,286 | 72.5 years |

| Charles | 1,106 | 74.6 years |

| George | 1,008 | 76.0 years |

| Helen | 973 | 80.2 years |

| Joseph | 852 | 75.6 years |

| Margaret | 760 | 80.0 years |

| Most common last names in Canton, OH among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 660 | 75.6 years |

| Miller | 612 | 76.8 years |

| Williams | 345 | 74.4 years |

| Johnson | 307 | 73.1 years |

| Jones | 291 | 75.8 years |

| Davis | 290 | 74.4 years |

| Brown | 265 | 75.4 years |

| Wilson | 220 | 76.6 years |

| Moore | 217 | 75.3 years |

| Snyder | 215 | 78.5 years |

- 91.4%Utility gas

- 6.8%Electricity

- 1.0%Bottled, tank, or LP gas

- 0.3%Other fuel

- 0.3%Wood

- 0.2%Fuel oil, kerosene, etc.

- 69.3%Utility gas

- 28.5%Electricity

- 1.0%Bottled, tank, or LP gas

- 0.7%No fuel used

- 0.4%Other fuel

Canton compared to Ohio state average:

- Median household income below state average.

- Median house value significantly below state average.

- Unemployed percentage below state average.

- Black race population percentage above state average.

- Median age below state average.

- Foreign-born population percentage below state average.

- House age above state average.

Canton on our top lists:

- #2 on the list of "Top 101 cities with largest percentage of females in occupations: food preparation and serving related occupations (population 50,000+)"

- #4 on the list of "Top 101 cities with largest percentage of females in occupations: healthcare support occupations (population 50,000+)"

- #5 on the list of "Top 101 cities with largest percentage of males in occupations: healthcare support occupations (population 50,000+)"

- #6 on the list of "Top 101 larger cities with the largest decrease or smallest increase in household income from 2000 (population 50,000+)"

- #10 on the list of "Top 100 cities with declining populations from 2000 to 2014 (pop. 50,000+)"

- #11 on the list of "Top 101 cities with the largest percentage population decrease from 2000 (population 50,000+)"

- #15 on the list of "Top 101 cities with the highest number of burglaries per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #16 on the list of "Top 101 cities with the highest number of robberies per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #18 on the list of "Top 101 cities with largest percentage of females in industries: health care and social assistance (population 50,000+)"

- #19 on the list of "Top 101 cities with the highest number of rapes per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #20 on the list of "Top 101 cities with the highest percentage of English-only speaking households, population 50,000+"

- #22 on the list of "Top 101 cities with the most people born in the same U.S. state as the city (population 50,000+)"

- #24 on the list of "Top 101 cities with largest percentage of females in industries: accommodation and food services (population 50,000+)"

- #24 on the list of "Top 101 cities with the highest city-data.com crime index, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #28 on the list of "Top 101 cities with largest percentage of females in occupations: transportation occupations (population 50,000+)"

- #29 on the list of "Top 101 cities with the highest percentage of single-parent households, population 50,000+"

- #30 on the list of "Top 100 cities with oldest houses (pop. 50,000+)"

- #31 on the list of "Top 101 cities with largest percentage of males in industries: manufacturing (population 50,000+)"

- #32 on the list of "Top 100 least-safe cities (highest city-data.com crime index) (pop. 50,000+)"

- #34 on the list of "Top 101 cities with the smallest racial income disparities between White and Black householders (with at least 2,000 householders)"

- #61 (44704) on the list of "Top 101 zip codes with the lowest average reported salary/wage in 2012 (pop 1,000+)"

- #72 (44714) on the list of "Top 101 zip codes with the largest percentage of Greek first ancestries (pop 5,000+)"

- #87 (44704) on the list of "Top 101 zip codes with the lowest 2012 average Adjusted Gross Income (AGI) for individuals (pop 1,000+)"

- #2 on the list of "Top 101 counties with the largest increase in the number of infant deaths per 1000 residents 2000-2006 to 2007-2013 (pop. 50,000+)"

- #23 on the list of "Top 101 counties with the lowest percentage of residents relocating from other counties between 2010 and 2011 (pop. 50,000+)"

- #25 on the list of "Top 101 counties with the lowest percentage of residents relocating to other counties in 2011 (pop. 50,000+)"

- #27 on the list of "Top 101 counties with the lowest percentage of residents relocating to foreign countries in 2011"

- #27 on the list of "Top 101 counties with the highest number of infant deaths per 1000 residents 2007-2013 (pop. 50,000+)"

|

|

Total of 723 patent applications in 2008-2024.