Cottonwood, Arizona

Cottonwood: Dead Horse Ranch State Park

Cottonwood: Old Town Cottonwood AZ December 2009

Cottonwood: Horseback rider near the Verde River

Cottonwood: Old gas station turned into a diner.

Cottonwood: Cottonwood AZ

Cottonwood: VIEW FROM MINGUS MOUNTAIN

Cottonwood: Cottonwood AZ

- add

your

Submit your own pictures of this city and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +41.0%

| Males: 6,038 | |

| Females: 6,905 |

| Median resident age: | 55.4 years |

| Arizona median age: | 38.8 years |

Zip codes: 86326.

| Cottonwood: | $44,317 |

| AZ: | $74,568 |

Estimated per capita income in 2022: $30,456 (it was $17,518 in 2000)

Cottonwood city income, earnings, and wages data

Estimated median house or condo value in 2022: $325,994 (it was $92,800 in 2000)

| Cottonwood: | $325,994 |

| AZ: | $402,800 |

Mean prices in 2022: all housing units: $269,935; detached houses: $297,345; townhouses or other attached units: $445,832; in 2-unit structures: $280,763; mobile homes: $106,395

Median gross rent in 2022: $1,029.

(22.7% for White Non-Hispanic residents, 100.0% for Black residents, 8.5% for Hispanic or Latino residents, 16.1% for American Indian residents, 4.6% for other race residents, 14.1% for two or more races residents)

Detailed information about poverty and poor residents in Cottonwood, AZ

- 9,60775.4%White alone

- 2,43919.1%Hispanic

- 4923.9%Two or more races

- 1611.3%American Indian alone

- 400.3%Asian alone

- 50.04%Black alone

According to our research of Arizona and other state lists, there were 47 registered sex offenders living in Cottonwood, Arizona as of April 23, 2024.

The ratio of all residents to sex offenders in Cottonwood is 254 to 1.

Type |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Murders (per 100,000) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 1 (8.7) | 1 (8.6) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 1 (8.1) | 0 (0.0) |

| Rapes (per 100,000) | 1 (8.6) | 2 (17.8) | 1 (8.8) | 0 (0.0) | 1 (8.9) | 2 (17.4) | 0 (0.0) | 1 (8.4) | 1 (8.3) | 2 (16.5) | 0 (0.0) | 3 (24.2) | 5 (39.4) |

| Robberies (per 100,000) | 4 (34.3) | 3 (26.6) | 3 (26.3) | 7 (61.2) | 3 (26.6) | 1 (8.7) | 1 (8.6) | 1 (8.4) | 4 (33.0) | 2 (16.5) | 5 (40.5) | 8 (64.6) | 4 (31.5) |

| Assaults (per 100,000) | 37 (317.2) | 53 (470.5) | 50 (437.7) | 44 (384.8) | 40 (354.5) | 36 (313.3) | 32 (274.0) | 38 (318.5) | 44 (363.2) | 11 (90.6) | 40 (324.4) | 35 (282.7) | 34 (268.1) |

| Burglaries (per 100,000) | 45 (385.8) | 51 (452.7) | 58 (507.7) | 37 (323.6) | 40 (354.5) | 43 (374.2) | 46 (393.9) | 66 (553.1) | 42 (346.6) | 13 (107.0) | 37 (300.1) | 56 (452.3) | 21 (165.6) |

| Thefts (per 100,000) | 312 (2,675) | 318 (2,823) | 389 (3,405) | 357 (3,122) | 346 (3,066) | 433 (3,768) | 353 (3,023) | 415 (3,478) | 314 (2,592) | 130 (1,070) | 359 (2,911) | 392 (3,166) | 213 (1,680) |

| Auto thefts (per 100,000) | 18 (154.3) | 7 (62.1) | 15 (131.3) | 17 (148.7) | 15 (132.9) | 18 (156.7) | 24 (205.5) | 25 (209.5) | 24 (198.1) | 7 (57.6) | 26 (210.9) | 30 (242.3) | 25 (197.2) |

| Arson (per 100,000) | 4 (34.3) | 3 (26.6) | 14 (122.5) | 14 (122.4) | 7 (62.0) | 4 (34.8) | 7 (59.9) | 3 (25.1) | 1 (8.3) | 1 (8.2) | 2 (16.2) | 7 (56.5) | 0 (0.0) |

| City-Data.com crime index | 226.9 | 265.9 | 284.7 | 254.8 | 244.0 | 286.1 | 239.4 | 267.5 | 232.9 | 91.1 | 231.4 | 289.2 | 189.2 |

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Crime rate in Cottonwood detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 58 (33 officers - 30 male; 3 female).

| Officers per 1,000 residents here: | 2.55 |

| Arizona average: | 1.75 |

Latest news from Cottonwood, AZ collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: English (14.8%), American (7.8%), German (6.0%), Italian (6.0%), Irish (4.0%), French Canadian (1.9%).

Current Local Time: MST (no DST) time zone

Incorporated in 1960

Elevation: 3322 feet

Land area: 10.7 square miles.

Population density: 1,213 people per square mile (low).

1,459 residents are foreign born (6.2% Latin America, 3.0% Europe, 1.1% North America).

| This city: | 11.4% |

| Arizona: | 13.0% |

Median real estate property taxes paid for housing units with mortgages in 2022: $1,255 (0.3%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $855 (0.4%)

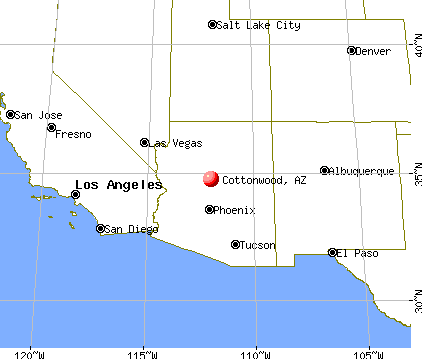

Nearest city with pop. 50,000+: Flagstaff, AZ (39.1 miles

, pop. 52,894).

Nearest city with pop. 200,000+: Scottsdale, AZ (79.3 miles

, pop. 202,705).

Nearest city with pop. 1,000,000+: Phoenix, AZ (83.3 miles

, pop. 1,321,045).

Nearest cities:

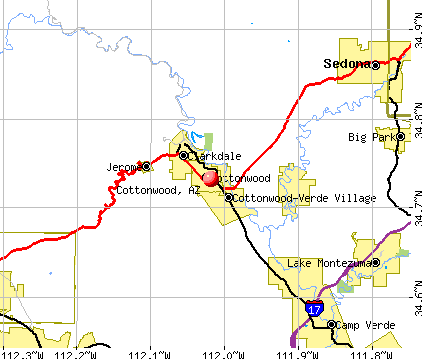

Latitude: 34.73 N, Longitude: 112.02 W

Daytime population change due to commuting: +3,963 (+31.1%)

Workers who live and work in this city: 2,308 (45.3%)

Cottonwood tourist attractions:

- Historic Old Town Cottonwood - Cottonwood, AZ - a historic city named for cottonwood trees

- Dead Horse Ranch State Park - Cottonwood, AZ - a park named for a horse found on the road side

- Old Town Center for the Arts - Cottonwood, AZ - an art theater and events facility in Cottonwood, Arizona

- Alcantara Vineyards - Cottonwood, Arizona - Located in the heart of the Arizona wine country

- Clemenceau Heritage Museum - Cottonwood, AZ - keeping the Verde Valley's history alive

- Take a Ride Through the Canyon

Cottonwood, Arizona accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 62 buildings, average cost: $140,400

- 2021: 78 buildings, average cost: $166,300

- 2020: 64 buildings, average cost: $173,900

- 2019: 44 buildings, average cost: $201,500

- 2018: 72 buildings, average cost: $157,800

- 2017: 36 buildings, average cost: $153,400

- 2016: 37 buildings, average cost: $142,800

- 2015: 35 buildings, average cost: $151,900

- 2014: 29 buildings, average cost: $144,300

- 2013: 30 buildings, average cost: $177,900

- 2008: 8 buildings, average cost: $155,300

- 2007: 52 buildings, average cost: $137,200

- 2006: 94 buildings, average cost: $93,100

- 2005: 122 buildings, average cost: $118,600

- 2004: 140 buildings, average cost: $127,500

- 2003: 34 buildings, average cost: $166,300

- 2002: 82 buildings, average cost: $124,600

- 2001: 140 buildings, average cost: $169,700

- 2000: 150 buildings, average cost: $143,900

- 1999: 133 buildings, average cost: $140,800

- 1998: 135 buildings, average cost: $132,200

- 1997: 115 buildings, average cost: $123,600

| Here: | 3.3% |

| Arizona: | 3.8% |

Population change in the 1990s: +3,167 (+52.7%).

- Accommodation & food services (16.4%)

- Health care (10.6%)

- Construction (9.4%)

- Educational services (5.2%)

- Administrative & support & waste management services (4.4%)

- Real estate & rental & leasing (3.9%)

- Food & beverage stores (3.4%)

- Construction (18.1%)

- Accommodation & food services (14.0%)

- Administrative & support & waste management services (5.3%)

- Repair & maintenance (4.0%)

- Educational services (3.8%)

- Health care (3.7%)

- Food & beverage stores (3.5%)

- Accommodation & food services (19.0%)

- Health care (17.9%)

- Educational services (6.7%)

- Real estate & rental & leasing (4.9%)

- Social assistance (3.8%)

- Department & other general merchandise stores (3.7%)

- Administrative & support & waste management services (3.5%)

- Building and grounds cleaning and maintenance occupations (8.9%)

- Material recording, scheduling, dispatching, and distributing workers (4.1%)

- Construction traders workers except carpenters, electricians, painters, plumbers, and construction laborers (3.8%)

- Other management occupations, except farmers and farm managers (3.7%)

- Cooks and food preparation workers (3.5%)

- Waiters and waitresses (3.4%)

- Retail sales workers, except cashiers (3.3%)

- Building and grounds cleaning and maintenance occupations (8.3%)

- Construction traders workers except carpenters, electricians, painters, plumbers, and construction laborers (7.3%)

- Material recording, scheduling, dispatching, and distributing workers (6.2%)

- Cooks and food preparation workers (4.5%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (4.3%)

- Other production occupations, including supervisors (4.1%)

- Driver/sales workers and truck drivers (3.8%)

- Building and grounds cleaning and maintenance occupations (9.5%)

- Secretaries and administrative assistants (5.7%)

- Waiters and waitresses (5.7%)

- Retail sales workers, except cashiers (5.3%)

- Other management occupations, except farmers and farm managers (5.2%)

- Cashiers (5.0%)

- Information and record clerks, except customer service representatives (4.7%)

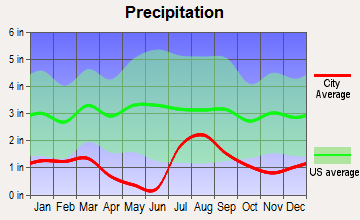

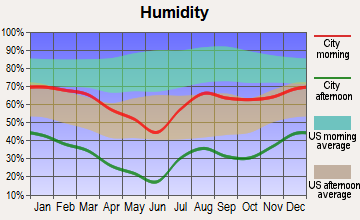

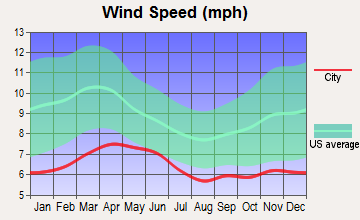

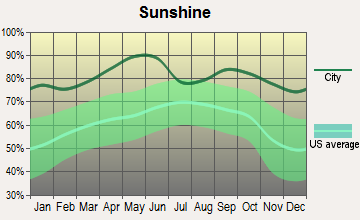

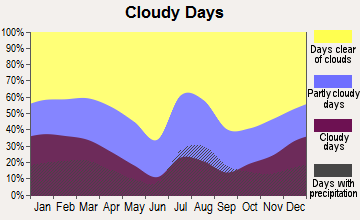

Average climate in Cottonwood, Arizona

Based on data reported by over 4,000 weather stations

|

|

Earthquake activity:

Cottonwood-area historical earthquake activity is significantly above Arizona state average. It is 2704% greater than the overall U.S. average.On 6/28/1992 at 11:57:34, a magnitude 7.6 (6.2 MB, 7.6 MS, 7.3 MW, Depth: 0.7 mi, Class: Major, Intensity: VIII - XII) earthquake occurred 260.2 miles away from the city center, causing 3 deaths (1 shaking deaths, 2 other deaths) and 400 injuries, causing $100,000,000 total damage and $40,000,000 insured losses

On 10/16/1999 at 09:46:44, a magnitude 7.4 (6.3 MB, 7.4 MS, 7.2 MW, 7.3 ML) earthquake occurred 251.8 miles away from the city center

On 5/19/1940 at 04:36:40, a magnitude 7.2 (7.2 UK) earthquake occurred 235.4 miles away from Cottonwood center, causing $33,000,000 total damage

On 12/31/1934 at 18:45:56, a magnitude 7.1 (7.1 UK) earthquake occurred 257.7 miles away from Cottonwood center

On 10/15/1979 at 23:16:54, a magnitude 7.0 (5.7 MB, 6.9 MS, 7.0 ML, 6.4 MW) earthquake occurred 246.8 miles away from the city center

On 7/21/1952 at 11:52:14, a magnitude 7.7 (7.7 UK) earthquake occurred 396.6 miles away from the city center, causing $50,000,000 total damage

Magnitude types: body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Yavapai County (18) is near the US average (15).Major Disasters (Presidential) Declared: 9

Emergencies Declared: 2

Causes of natural disasters: Floods: 9, Storms: 8, Fires: 6, Drought: 1, Hurricane: 1, Tornado: 1, Winter Storm: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers in Cottonwood:

- VERDE VALLEY MEDICAL CENTER (Voluntary non-profit - Private, 269 SOUTH CANDY LANE)

- RED ROCK CARE AND REHAB, INC (197 SOUTH WILLARD STREET)

- COTTONWOOD DIALYSIS (DSI) (203 S CANDY LN STE 11 A & B)

- ANGELS CARE HOME HEALTH OF ARIZONA (301 SOUTH WILLARD)

- NORTHERN ARIZONA HOMECARE COTTONWOOD (203 SOUTH CANDY LANE, SUITE 10 B)

Airports and heliports located in Cottonwood:

- Cottonwood Airport (P52) (Runways: 1, Air Taxi Ops: 300, Itinerant Ops: 10,500, Local Ops: 8,000, Military Ops: 100)

- Marcus J Lawrence Medical Center Heliport (AZ22)

Colleges/universities with over 2000 students nearest to Cottonwood:

- Northcentral University (about 18 miles; Prescott Valley, AZ; Full-time enrollment: 5,927)

- Yavapai College (about 28 miles; Prescott, AZ; FT enrollment: 4,258)

- Coconino Community College (about 38 miles; Flagstaff, AZ; FT enrollment: 2,090)

- Northern Arizona University (about 38 miles; Flagstaff, AZ; FT enrollment: 22,494)

- Universal Technical Institute of Arizona Inc-Motorcycle Mechanics Institute Division (about 73 miles; Phoenix, AZ; FT enrollment: 2,976)

- Paradise Valley Community College (about 75 miles; Phoenix, AZ; FT enrollment: 5,259)

- Arizona State University-West (about 79 miles; Glendale, AZ; FT enrollment: 3,454)

Private elementary/middle schools in Cottonwood:

User-submitted facts and corrections:

- Dr. Daniel Bright School is KG-2nd grade.

Points of interest:

Notable locations in Cottonwood: Cottonwood Substation (A), Black Canyon Recreation Site (B), Bignotti Recreation Site (C), Cottonwood Wastewater Treatment Facility (D), Coppergate Business Park (E), Cottonwood City Hall (F), Clemenceau Heritage Museum (G), Cottonwood Public Library (H), Verde Valley Fire District Station 31 (I), Cottonwood Fire Department (J), Verde Valley Ambulance Company (K), Cottonwood Police Department (L). Display/hide their locations on the map

Churches in Cottonwood include: First Southern Baptist Church (A), Evangel Worship Center (B), Emmanuel Fellowship (C), Cottonwood Seventh Day Adventist Church (D), Cottonwood Baptist Church (E), Cottonwood Assembly of God (F), Church of Christ (G), Calvary Chapel (H), Peace Lutheran Church (I). Display/hide their locations on the map

Reservoir: Black Mesa Tank (A). Display/hide its location on the map

Streams, rivers, and creeks: Oak Wash (A), Blowout Creek (B). Display/hide their locations on the map

Parks in Cottonwood include: Cottonwood Kids Park (1), Lions Club Park (2), Garrison Park (3). Display/hide their locations on the map

Tourist attractions: Verde Historical Society (Cultural Attractions- Events- & Facilities; 1 North Willard Street) (1), Old Town Association (Historical Places & Services; 1101 North Main Street) (2). Display/hide their approximate locations on the map

Hotels: Madame's Mercantile (930 North Main Street) (1), Cottonwood Hotel (930 North Main Street) (2), Little Daisy Motel (34 South Main Street) (3), Best Western Cottonwood Inn (993 South Main Street) (4), Quality Inn Cottonwood (301 West Highway 89A) (5), Pines Motel (920 South Camino Real) (6). Display/hide their approximate locations on the map

Courts: Yavapai County - Court Appointed Special Advocate (10 South 6th Street) (1), Cottonwood City - Municipal Court (824 North Main Street) (2), Yavapai County - Superior Court- Division Iv (3505 West Highway 260) (3). Display/hide their approximate locations on the map

Drinking water stations with addresses in Cottonwood and their reported violations in the past:

COTTONWOOD MUNICIPAL WATER CW1 (Address: 1480 W MINGUS AVE , Population served: 11,265, Groundwater):Past health violations:COTTONWOOD MUNICIPAL WATER VV6 (Address: 1480 W MINGUS AVE , Population served: 3,668, Groundwater):Past monitoring violations:

- MCL, Average - Between JAN-2011 and MAR-2011, Contaminant: Arsenic. Follow-up actions: St AO (w/penalty) issued (MAY-19-2009), Fed FAO issued (MAY-19-2009), St Compliance achieved (APR-11-2012)

- MCL, Average - Between OCT-2010 and DEC-2010, Contaminant: Arsenic. Follow-up actions: St AO (w/penalty) issued (MAY-19-2009), Fed FAO issued (MAY-19-2009), St Compliance achieved (APR-11-2012)

- MCL, Average - Between JUL-2010 and SEP-2010, Contaminant: Arsenic. Follow-up actions: Fed FAO issued (MAY-19-2009), St AO (w/penalty) issued (MAY-19-2009), State No Longer Subject to Rule (DEC-14-2010)

- MCL, Average - Between JUL-2010 and SEP-2010, Contaminant: Arsenic. Follow-up actions: St AO (w/penalty) issued (MAY-19-2009), Fed FAO issued (MAY-19-2009), St Compliance achieved (APR-11-2012)

- MCL, Average - Between JUL-2010 and SEP-2010, Contaminant: Arsenic. Follow-up actions: St AO (w/penalty) issued (MAY-19-2009), Fed FAO issued (MAY-19-2009), St Compliance achieved (APR-11-2012)

- MCL, Average - Between JUL-2010 and SEP-2010, Contaminant: Arsenic. Follow-up actions: St AO (w/penalty) issued (MAY-19-2009), Fed FAO issued (MAY-19-2009), St Compliance achieved (APR-11-2012)

- 27 other older health violations

- Monitoring and Reporting (DBP) - Between OCT-2013 and DEC-2013, Contaminant: Chlorine

- Monitoring and Reporting (DBP) - Between OCT-2012 and DEC-2012, Contaminant: Chlorine. Follow-up actions: St Violation/Reminder Notice (APR-02-2013), St Compliance achieved (APR-22-2013)

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2010, Contaminant: Lead and Copper Rule. Follow-up actions: St Compliance achieved (FEB-15-2013)

- Monitoring and Reporting (DBP) - Between APR-2009 and JUN-2009, Contaminant: Chlorine. Follow-up actions: St Violation/Reminder Notice (JUL-31-2009), St Compliance achieved (AUG-25-2009)

- Monitoring and Reporting (DBP) - Between OCT-2008 and DEC-2008, Contaminant: Chlorine. Follow-up actions: St Compliance achieved (FEB-09-2009), St Violation/Reminder Notice (FEB-13-2009)

- 2 routine major monitoring violations

- 6 minor monitoring violations

- 15 regular monitoring violations

- 16 other older monitoring violations

Past health violations:COTTONWOOD MUNICIPAL WATER VV2 (Address: 1480 W MINGUS AVE , Population served: 3,164, Groundwater):Past monitoring violations:

- MCL, Average - Between APR-2010 and JUN-2010, Contaminant: Arsenic. Follow-up actions: State No Longer Subject to Rule (OCT-15-2010)

- MCL, Average - Between JAN-2010 and MAR-2010, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (OCT-28-2010)

- MCL, Average - Between JAN-2010 and MAR-2010, Contaminant: Arsenic. Follow-up actions: State No Longer Subject to Rule (OCT-15-2010)

- MCL, Average - Between OCT-2009 and DEC-2009, Contaminant: Arsenic. Follow-up actions: State No Longer Subject to Rule (OCT-15-2010)

- MCL, Average - Between OCT-2009 and DEC-2009, Contaminant: Arsenic. Follow-up actions: State No Longer Subject to Rule (OCT-15-2010)

- MCL, Average - Between OCT-2009 and DEC-2009, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (OCT-28-2010)

- 23 other older health violations

- Monitoring and Reporting (DBP) - Between OCT-2013 and DEC-2013, Contaminant: Chlorine

- Monitoring and Reporting (DBP) - Between OCT-2012 and DEC-2012, Contaminant: Chlorine. Follow-up actions: St Violation/Reminder Notice (APR-02-2013), St Compliance achieved (APR-22-2013)

- Monitoring and Reporting (DBP) - Between APR-2009 and JUN-2009, Contaminant: Chlorine. Follow-up actions: St Violation/Reminder Notice (JUL-31-2009), St Compliance achieved (AUG-25-2009)

- Monitoring and Reporting (DBP) - Between JAN-2009 and DEC-2009, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Compliance achieved (APR-15-2013)

- Monitoring and Reporting (DBP) - Between JAN-2009 and DEC-2009, Contaminant: TTHM. Follow-up actions: St Compliance achieved (APR-15-2013)

- 2 routine major monitoring violations

- One minor monitoring violation

- 22 regular monitoring violations

- 19 other older monitoring violations

Past health violations:COTTONWOOD MUNICIPAL WATER VSF1 (Address: 111 N MAIN ST , Population served: 2,280, Groundwater):Past monitoring violations:

- MCL, Average - Between OCT-2010 and DEC-2010, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (APR-27-2011)

- MCL, Average - Between JUL-2010 and SEP-2010, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (APR-27-2011)

- MCL, Average - Between APR-2010 and JUN-2010, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (JAN-24-2011)

- MCL, Average - Between APR-2010 and JUN-2010, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (APR-27-2011)

- MCL, Average - Between JAN-2010 and MAR-2010, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (JAN-24-2011)

- MCL, Average - Between JAN-2010 and MAR-2010, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (APR-27-2011)

- 34 other older health violations

- Monitoring and Reporting (DBP) - Between OCT-2013 and DEC-2013, Contaminant: Chlorine

- Monitoring and Reporting (DBP) - Between OCT-2012 and DEC-2012, Contaminant: Chlorine. Follow-up actions: St Violation/Reminder Notice (APR-02-2013), St Compliance achieved (APR-22-2013)

- Monitoring and Reporting (DBP) - Between APR-2009 and JUN-2009, Contaminant: Chlorine. Follow-up actions: St Violation/Reminder Notice (JUL-31-2009), St Compliance achieved (AUG-25-2009)

- Monitoring and Reporting (DBP) - Between JAN-2009 and DEC-2009, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Compliance achieved (NOV-01-2012)

- Monitoring and Reporting (DBP) - Between JAN-2009 and DEC-2009, Contaminant: TTHM. Follow-up actions: St Compliance achieved (NOV-01-2012)

- 3 routine major monitoring violations

- One minor monitoring violation

- 20 regular monitoring violations

- 18 other older monitoring violations

Past health violations:COTTONWOOD MUNICIPAL WATER VV3 (Address: 1480 W MINGUS AVE , Population served: 1,689, Groundwater):Past monitoring violations:

- MCL, Average - Between JAN-2009 and MAR-2009, Contaminant: Arsenic. Follow-up actions: Fed FAO issued (AUG-25-2009), St Compliance achieved (JAN-24-2011)

- Monitoring and Reporting (DBP) - Between OCT-2013 and DEC-2013, Contaminant: Chlorine

- Monitoring and Reporting (DBP) - Between OCT-2012 and DEC-2012, Contaminant: Chlorine. Follow-up actions: St Violation/Reminder Notice (APR-02-2013), St Compliance achieved (APR-22-2013)

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2009, Contaminant: Lead and Copper Rule. Follow-up actions: St Violation/Reminder Notice (FEB-12-2010), St Compliance achieved (OCT-03-2011)

- Monitoring and Reporting (DBP) - Between APR-2009 and JUN-2009, Contaminant: Chlorine. Follow-up actions: St Violation/Reminder Notice (JUL-31-2009), St Compliance achieved (AUG-18-2009)

- Monitoring and Reporting (DBP) - Between OCT-2008 and DEC-2008, Contaminant: Chlorine. Follow-up actions: St Compliance achieved (FEB-09-2009), St Violation/Reminder Notice (FEB-13-2009)

- 5 routine major monitoring violations

- 6 regular monitoring violations

- 12 other older monitoring violations

Past health violations:COTTONWOOD MUNICIPAL WATER V V 1 (Address: 1480 W MINGUS AVE , Population served: 704, Groundwater):Past monitoring violations:

- MCL, Average - Between OCT-2010 and DEC-2010, Contaminant: Arsenic. Follow-up actions: Fed FAO issued (AUG-20-2009), St Compliance achieved (NOV-08-2011)

- MCL, Average - Between JUL-2010 and SEP-2010, Contaminant: Arsenic. Follow-up actions: Fed FAO issued (AUG-20-2009), St Compliance achieved (NOV-08-2011)

- MCL, Average - Between JUL-2010 and SEP-2010, Contaminant: Arsenic. Follow-up actions: Fed FAO issued (AUG-20-2009), St Compliance achieved (NOV-08-2011)

- MCL, Average - Between APR-2010 and JUN-2010, Contaminant: Arsenic. Follow-up actions: Fed FAO issued (AUG-20-2009), St Compliance achieved (NOV-08-2011)

- MCL, Average - Between APR-2010 and JUN-2010, Contaminant: Arsenic. Follow-up actions: Fed FAO issued (AUG-20-2009), St Compliance achieved (NOV-08-2011)

- MCL, Average - Between JAN-2010 and MAR-2010, Contaminant: Arsenic. Follow-up actions: Fed FAO issued (AUG-20-2009), St Compliance achieved (NOV-08-2011)

- 11 other older health violations

- Monitoring and Reporting (DBP) - Between OCT-2013 and DEC-2013, Contaminant: Chlorine

- Monitoring and Reporting (DBP) - Between OCT-2012 and DEC-2012, Contaminant: Chlorine. Follow-up actions: St Violation/Reminder Notice (APR-02-2013), St Compliance achieved (APR-22-2013)

- Monitoring and Reporting (DBP) - Between APR-2009 and JUN-2009, Contaminant: Chlorine. Follow-up actions: St Violation/Reminder Notice (JUL-31-2009), St Compliance achieved (AUG-25-2009)

- Monitoring and Reporting (DBP) - Between JAN-2009 and DEC-2009, Contaminant: TTHM. Follow-up actions: St Compliance achieved (NOV-01-2012)

- Monitoring and Reporting (DBP) - Between JAN-2009 and DEC-2009, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Compliance achieved (NOV-01-2012)

- 2 routine major monitoring violations

- 2 minor monitoring violations

- 6 regular monitoring violations

- 18 other older monitoring violations

Past health violations:THOUSAND TRAILS PRESERVE (Address: 6400 E THOUSAND TRAILS RD , Population served: 600, Groundwater):Past monitoring violations:

- MCL, Average - Between JUL-2009 and SEP-2009, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (FEB-18-2011)

- MCL, Average - Between JUL-2009 and SEP-2009, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (FEB-18-2011)

- MCL, Average - Between APR-2009 and JUN-2009, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (JAN-28-2010)

- MCL, Average - Between APR-2009 and JUN-2009, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (JUL-15-2010)

- MCL, Average - Between OCT-2008 and DEC-2008, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (JAN-28-2010)

- MCL, Average - Between OCT-2008 and DEC-2008, Contaminant: Arsenic. Follow-up actions: St Compliance achieved (JUL-15-2010)

- 6 other older health violations

- Monitoring and Reporting (DBP) - Between APR-2009 and JUN-2009, Contaminant: Chlorine. Follow-up actions: St Violation/Reminder Notice (JUL-31-2009), St Compliance achieved (AUG-25-2009)

- Monitoring and Reporting (DBP) - Between OCT-2008 and DEC-2008, Contaminant: Chlorine. Follow-up actions: St Compliance achieved (FEB-09-2009), St Violation/Reminder Notice (FEB-13-2009)

- Monitoring and Reporting (DBP) - Between JUL-2008 and SEP-2008, Contaminant: Chlorine. Follow-up actions: St Violation/Reminder Notice (OCT-20-2008), St Compliance achieved (FEB-10-2009)

- Monitoring and Reporting (DBP) - Between JUL-2007 and SEP-2007, Contaminant: Chlorine. Follow-up actions: St Compliance achieved (NOV-30-2007)

- Monitoring and Reporting (DBP) - Between APR-2007 and JUN-2007, Contaminant: Chlorine. Follow-up actions: St Compliance achieved (AUG-17-2007)

- 4 routine major monitoring violations

- 9 regular monitoring violations

- 14 other older monitoring violations

Past health violations:CITY OF COTTONWOOD QC1 (Address: 1480 W MINGUS AVE , Population served: 200, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - In SEP-2007, Contaminant: Coliform. Follow-up actions: St Compliance achieved (NOV-14-2008)

- MCL, Monthly (TCR) - In AUG-2007, Contaminant: Coliform. Follow-up actions: St Compliance achieved (NOV-14-2008)

- MCL, Monthly (TCR) - In JUL-2007, Contaminant: Coliform. Follow-up actions: St Compliance achieved (NOV-14-2008)

- MCL, Monthly (TCR) - In NOV-2006, Contaminant: Coliform. Follow-up actions: St Compliance achieved (JUL-05-2007)

- MCL, Monthly (TCR) - In OCT-2006, Contaminant: Coliform. Follow-up actions: St Compliance achieved (JUN-04-2007)

- MCL, Monthly (TCR) - In SEP-2006, Contaminant: Coliform. Follow-up actions: St Compliance achieved (MAY-25-2007)

- 6 other older health violations

- Monitoring, Repeat Major (TCR) - In AUG-2007, Contaminant: Coliform (TCR). Follow-up actions: St Compliance achieved (AUG-12-2008)

- Monitoring, Repeat Major (TCR) - In JUL-2007, Contaminant: Coliform (TCR). Follow-up actions: St Compliance achieved (AUG-12-2008)

- Monitoring, Repeat Major (TCR) - In NOV-2006, Contaminant: Coliform (TCR). Follow-up actions: St Compliance achieved (JUL-05-2007)

- Monitoring, Repeat Major (TCR) - In OCT-2006, Contaminant: Coliform (TCR). Follow-up actions: St Compliance achieved (JUN-04-2007)

- Monitoring, Repeat Major (TCR) - In SEP-2006, Contaminant: Coliform (TCR). Follow-up actions: St Compliance achieved (MAY-25-2007)

- 3 routine major monitoring violations

- 4 minor monitoring violations

- 2 regular monitoring violations

- One other older monitoring violation

Past monitoring violations:

- 2 routine major monitoring violations

| This city: | 2.1 people |

| Arizona: | 2.6 people |

| This city: | 52.2% |

| Whole state: | 66.2% |

| This city: | 8.0% |

| Whole state: | 7.8% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.2% of all households

People in group quarters in Cottonwood in 2010:

- 81 people in other noninstitutional facilities

- 59 people in nursing facilities/skilled-nursing facilities

- 18 people in group homes intended for adults

- 16 people in correctional residential facilities

- 3 people in residential treatment centers for adults

- 3 people in workers' group living quarters and job corps centers

People in group quarters in Cottonwood in 2000:

- 89 people in nursing homes

- 33 people in other noninstitutional group quarters

- 15 people in other group homes

- 3 people in orthopedic wards and institutions for the physically handicapped

Banks with branches in Cottonwood (2011 data):

- Sunwest Bank: Cottonwood Office Branch at 704 S Main Street, branch established on 2007/07/27. Info updated 2011/10/24: Bank assets: $609.2 mil, Deposits: $512.4 mil, headquarters in Irvine, CA, positive income, Commercial Lending Specialization, 11 total offices, Holding Company: Western Acquisitions, L.L.c.

- Country Bank: Cottonwood Branch at 597 E State Route 89a, branch established on 2005/10/03. Info updated 2006/11/03: Bank assets: $154.4 mil, Deposits: $137.2 mil, headquarters in Prescott, AZ, positive income, Commercial Lending Specialization, 4 total offices

- SunBank, National Association: Cottonwood In Store Branch at 2003 E Rodeo Dr, branch established on 2008/04/30. Info updated 2010/07/12: Bank assets: $31.4 mil, Deposits: $23.9 mil, headquarters in Phoenix, AZ, negative income in the last year, 16 total offices, Holding Company: Dickinson Financial Corporation Ii

- National Bank of Arizona: Cottonwood Branch at 1 East Highway 89a, branch established on 1997/01/15. Info updated 2008/09/11: Bank assets: $4,485.6 mil, Deposits: $3,731.3 mil, headquarters in Tucson, AZ, positive income, Commercial Lending Specialization, 73 total offices, Holding Company: Zions Bancorporation

- JPMorgan Chase Bank, National Association: Cottonwood Branch at 1540 Highway 89a, branch established on 1973/09/24. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- Bank of America, National Association: Cottonwood Branch at 611 South Main, branch established on 1979/12/04. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Wells Fargo Bank, National Association: Cottonwood Branch at 1201 Sthy 89a, branch established on 1947/11/01. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

For population 15 years and over in Cottonwood:

- Never married: 27.7%

- Now married: 40.9%

- Separated: 1.6%

- Widowed: 10.0%

- Divorced: 19.8%

For population 25 years and over in Cottonwood:

- High school or higher: 90.8%

- Bachelor's degree or higher: 25.1%

- Graduate or professional degree: 6.2%

- Unemployed: 6.0%

- Mean travel time to work (commute): 17.4 minutes

| Here: | 10.2 |

| Arizona average: | 12.2 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Cottonwood, AZ (based on Yavapai County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 22,957 | 156 |

| Catholic | 16,500 | 14 |

| Other | 10,740 | 47 |

| Mainline Protestant | 4,525 | 22 |

| Orthodox | 100 | 1 |

| None | 156,211 | - |

Food Environment Statistics:

| Yavapai County: | 1.93 / 10,000 pop. |

| Arizona: | 1.36 / 10,000 pop. |

| Here: | 0.14 / 10,000 pop. |

| Arizona: | 0.14 / 10,000 pop. |

| Yavapai County: | 0.57 / 10,000 pop. |

| Arizona: | 0.55 / 10,000 pop. |

| Yavapai County: | 3.25 / 10,000 pop. |

| State: | 2.47 / 10,000 pop. |

| Yavapai County: | 10.18 / 10,000 pop. |

| State: | 6.21 / 10,000 pop. |

| Here: | 7.5% |

| Arizona: | 8.0% |

| Yavapai County: | 17.7% |

| Arizona: | 22.8% |

| This county: | 10.4% |

| Arizona: | 14.2% |

Health and Nutrition:

| Here: | 49.9% |

| Arizona: | 49.0% |

| This city: | 46.8% |

| Arizona: | 47.3% |

| This city: | 28.7 |

| Arizona: | 28.5 |

| This city: | 19.9% |

| State: | 20.8% |

| Here: | 11.4% |

| State: | 10.2% |

| This city: | 6.9 |

| State: | 6.8 |

| This city: | 34.2% |

| Arizona: | 33.5% |

| This city: | 55.2% |

| State: | 56.1% |

| Cottonwood: | 76.4% |

| Arizona: | 79.4% |

More about Health and Nutrition of Cottonwood, AZ Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 35 | $229,848 | $78,805 | 0 | $0 |

| Firefighters | 26 | $169,339 | $78,156 | 0 | $0 |

| Police - Other | 25 | $127,014 | $60,967 | 1 | $806 |

| Other Government Administration | 24 | $112,412 | $56,206 | 0 | $0 |

| Financial Administration | 15 | $85,623 | $68,498 | 0 | $0 |

| Water Supply | 14 | $75,955 | $65,104 | 0 | $0 |

| Other and Unallocable | 14 | $69,668 | $59,715 | 3 | $5,208 |

| Transit | 12 | $45,278 | $45,278 | 2 | $3,068 |

| Streets and Highways | 9 | $43,535 | $58,047 | 0 | $0 |

| Local Libraries | 8 | $30,887 | $46,331 | 6 | $4,577 |

| Judicial and Legal | 7 | $37,847 | $64,881 | 0 | $0 |

| Parks and Recreation | 7 | $25,595 | $43,877 | 34 | $39,913 |

| Sewerage | 7 | $32,188 | $55,179 | 0 | $0 |

| Airports | 1 | $7,668 | $92,016 | 0 | $0 |

| Fire - Other | 1 | $3,539 | $42,468 | 0 | $0 |

| Welfare | 0 | $0 | 1 | $1,487 | |

| Totals for Government | 205 | $1,096,398 | $64,179 | 47 | $55,059 |

Cottonwood government finances - Expenditure in 2021 (per resident):

- Construction - Water Utilities: $1,743,000 ($134.67)

Regular Highways: $1,603,000 ($123.85)

Sewerage: $1,109,000 ($85.68)

Air Transportation: $209,000 ($16.15)

Parks and Recreation: $203,000 ($15.68)

- Current Operations - Police Protection: $7,439,000 ($574.75)

Central Staff Services: $7,421,000 ($573.36)

Local Fire Protection: $3,470,000 ($268.10)

Water Utilities: $3,421,000 ($264.31)

Sewerage: $2,163,000 ($167.12)

Transit Utilities: $2,067,000 ($159.70)

Parks and Recreation: $1,618,000 ($125.01)

Regular Highways: $1,218,000 ($94.10)

Libraries: $1,066,000 ($82.36)

Judicial and Legal Services: $892,000 ($68.92)

Financial Administration: $576,000 ($44.50)

Air Transportation: $230,000 ($17.77)

General - Other: $99,000 ($7.65)

- General - Interest on Debt: $1,098,000 ($84.83)

- Other Capital Outlay - Transit Utilities: $734,000 ($56.71)

Police Protection: $32,000 ($2.47)

Parks and Recreation: $19,000 ($1.47)

Libraries: $4,000 ($0.31)

- Total Salaries and Wages: $37,157,000 ($2870.82)

Cottonwood government finances - Revenue in 2021 (per resident):

- Charges - Other: $20,380,000 ($1574.60)

Sewerage: $4,035,000 ($311.75)

Parks and Recreation: $373,000 ($28.82)

Miscellaneous Commercial Activities: $275,000 ($21.25)

Air Transportation: $230,000 ($17.77)

- Federal Intergovernmental - Other: $4,159,000 ($321.33)

Air Transportation: $160,000 ($12.36)

Housing and Community Development: $56,000 ($4.33)

- Local Intergovernmental - Other: $1,084,000 ($83.75)

- Miscellaneous - Interest Earnings: $1,253,000 ($96.81)

Sale of Property: $984,000 ($76.03)

Fines and Forfeits: $259,000 ($20.01)

Rents: $25,000 ($1.93)

- Revenue - Water Utilities: $8,638,000 ($667.39)

- State Intergovernmental - General Local Government Support: $4,244,000 ($327.90)

Highways: $1,180,000 ($91.17)

Other: $308,000 ($23.80)

- Tax - General Sales and Gross Receipts: $21,435,000 ($1656.11)

Other Selective Sales: $466,000 ($36.00)

Public Utilities Sales: $405,000 ($31.29)

Other License: $131,000 ($10.12)

Occupation and Business License - Other: $89,000 ($6.88)

Cottonwood government finances - Debt in 2021 (per resident):

- Long Term Debt - Outstanding Unspecified Public Purpose: $54,107,000 ($4180.41)

Beginning Outstanding - Unspecified Public Purpose: $36,683,000 ($2834.20)

Issue, Unspecified Public Purpose: $20,380,000 ($1574.60)

Beginning Outstanding - Public Debt for Private Purpose: $18,268,000 ($1411.42)

Outstanding Nonguaranteed - Industrial Revenue: $16,883,000 ($1304.41)

Retired Unspecified Public Purpose: $2,955,000 ($228.31)

Retired Nonguaranteed - Public Debt for Private Purpose: $1,385,000 ($107.01)

Cottonwood government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $11,769,000 ($909.29)

- Sinking Funds - Cash and Securities: $16,883,000 ($1304.41)

| Businesses in Cottonwood, AZ | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| Ace Hardware | 1 | MasterBrand Cabinets | 4 | |

| Arby's | 1 | Maurices | 1 | |

| AutoZone | 1 | McDonald's | 2 | |

| Best Western | 1 | Motel 6 | 1 | |

| Big O Tires | 1 | Nike | 4 | |

| Budget Car Rental | 1 | OfficeMax | 1 | |

| CVS | 1 | Panda Express | 1 | |

| Carl\s Jr. | 1 | Payless | 1 | |

| Chevrolet | 1 | Pizza Hut | 1 | |

| Circle K | 1 | Quality | 1 | |

| Curves | 1 | RadioShack | 1 | |

| Dairy Queen | 1 | SONIC Drive-In | 1 | |

| Dennys | 1 | Safeway | 1 | |

| FedEx | 2 | Sears | 1 | |

| GNC | 1 | Starbucks | 1 | |

| Goodwill | 2 | Subway | 1 | |

| H&R Block | 1 | Super 8 | 1 | |

| Home Depot | 1 | T-Mobile | 2 | |

| JCPenney | 1 | Taco Bell | 1 | |

| Jack In The Box | 1 | U-Haul | 4 | |

| Jones New York | 2 | UPS | 4 | |

| KFC | 1 | Vans | 1 | |

| Kincaid | 1 | Vons | 1 | |

| Kroger | 1 | Walgreens | 1 | |

| La-Z-Boy | 1 | Walmart | 1 | |

| Little Caesars Pizza | 1 | |||

Strongest AM radio stations in Cottonwood:

- KYBC (1600 AM; 1 kW; COTTONWOOD, AZ; Owner: YAVAPAI BROADCASTING CORPORATION)

- KMIA (710 AM; 50 kW; BLACK CANYON CITY, AZ; Owner: ENTRAVISION HOLDINGS, LLC)

- KAZM (780 AM; 5 kW; SEDONA, AZ; Owner: TABBACK BROADCASTING CO.)

- KFNX (1100 AM; 50 kW; CAVE CREEK, AZ; Owner: NORTH AMERICAN BROADCASTING CO., INC.)

- KYET (1180 AM; 10 kW; WILLIAMS, AZ; Owner: GRAND CANYON GATEWAY BROADCASTING, LLC)

- KPXQ (1360 AM; 50 kW; GLENDALE, AZ; Owner: COMMON GROUND BROADCASTING, INC.)

- KMIK (1580 AM; 50 kW; TEMPE, AZ; Owner: ABC, INC.)

- KAFF (930 AM; 5 kW; FLAGSTAFF, AZ; Owner: GUYANN CORPORATION)

- KFNN (1510 AM; 22 kW; MESA, AZ; Owner: CRC BROADCASTING COMPANY, INC.)

- KQNA (1130 AM; daytime; 1 kW; PRESCOTT VALLEY, AZ; Owner: PRESCOTT VALLEY BROADCASTING CO. INC)

- KTNN (660 AM; 50 kW; WINDOW ROCK, AZ; Owner: THE NAVAJO NATION)

- KFLT (830 AM; 50 kW; TUCSON, AZ; Owner: FAMILY LIFE B/CING SYSTEM, INC.)

- KXEM (1010 AM; 15 kW; TOLLESON, AZ; Owner: JAMES CRYSTAL ENTERPRISES OF PHOENIX, INC.)

Strongest FM radio stations in Cottonwood:

- KVRD-FM (105.7 FM; COTTONWOOD, AZ; Owner: YAVAPAI BROADCASTING CORPORATION)

- KKLD (98.3 FM; PRESCOTT VALLEY, AZ; Owner: W. GRANT HAFLEY)

- KGCB (90.9 FM; PRESCOTT, AZ; Owner: GRAND CANYON BROADCASTERS, INC.)

- KZGL (95.9 FM; COTTONWOOD, AZ; Owner: YAVAPAI BROADCASTING CORPORATION)

- K201CQ (88.1 FM; PRESCOTT, AZ; Owner: FAMILY STATIONS, INC.)

- K220GI (91.9 FM; CAMP VERDE, AZ; Owner: CALVARY CHAPEL OF TWIN FALLS, INC.)

- KAHM (102.1 FM; PRESCOTT, AZ; Owner: SOUTHWEST FM BROADCASTING CO., INC.)

- KWMX (96.7 FM; WILLIAMS, AZ; Owner: RED ROCK COMMUNICATIONS II, LTD.)

- KJZA (89.5 FM; DRAKE, AZ; Owner: ST. PAUL BIBLE COLLEGE)

- K246AA (97.1 FM; PRESCOTT, AZ; Owner: LERNER FILM & TAPE PROD., INC.)

- KAFF-FM (92.9 FM; FLAGSTAFF, AZ; Owner: GUYANN CORPORATION)

- KPPV (106.7 FM; PRESCOTT VALLEY, AZ; Owner: PRESCOTT VALLEY BROADCASTING CO. INC)

- K223AG (92.5 FM; PRESCOTT, AZ; Owner: LERNER FILM & TAPE PROD., INC.)

- KNAQ (89.3 FM; PRESCOTT, AZ; Owner: NORTHERN ARIZONA UNIVERSITY)

- K207BR (89.3 FM; PRESCOTT, AZ; Owner: NORTHERN ARIZONA UNIVERSITY)

- KVNA-FM (97.5 FM; FLAGSTAFF, AZ; Owner: YAVAPAI BROADCASTING CORPORATION)

- KMGN (93.9 FM; FLAGSTAFF, AZ; Owner: GUYANN CORPORATION)

- KJTA (89.9 FM; FLAGSTAFF, AZ; Owner: JOY PUBLIC BROADCASTING CORPORATION)

- KQST (102.9 FM; SEDONA, AZ; Owner: ROCKET RADIO CORPORATION)

- KSED (107.5 FM; SEDONA, AZ; Owner: RED ROCK COMMUNICATIONS, LTD.)

TV broadcast stations around Cottonwood:

- K34EE (Channel 34; PRESCOTT/COTTONWOOD, AZ; Owner: KTVK, INC.)

- KAZT-TV (Channel 7; PRESCOTT, AZ; Owner: KAZT, L.L.C.)

- K16BP (Channel 16; COTTONWOOD, AZ; Owner: FOX TELEVISION STATIONS, INC.)

- K58AV (Channel 58; COTTONWOOD, AZ; Owner: TRINITY BROADCASTING OF ARIZONA, INC.)

- K18DD (Channel 18; CAMP VERDE, AZ; Owner: CENTRAL STATES COMMUNICATIONS)

- K24EP (Channel 24; PRESCOTT, AZ; Owner: TIGER EYE BROADCASTING CORPORATION)

- K38AI (Channel 38; COTTONWOOD, ETC., AZ; Owner: KTVK, INC.)

- K40AD (Channel 40; COTTONWOOD, ETC., AZ; Owner: MEREDITH CORPORATION)

- K42AC (Channel 42; COTTONWOOD, ETC., AZ; Owner: BOARD OF REGENTS,ARIZONA STATE UNIV.)

- K44CN (Channel 44; COTTONWOOD, AZ; Owner: SCRIPPS HOWARD BROADCASTING COMPANY)

- K36AE (Channel 36; CLARKDALE, ETC., AZ; Owner: KSAZ LICENSE, INC.)

- National Bridge Inventory (NBI) Statistics

- 19Number of bridges

- 217ft / 66.2mTotal length

- $7,000Total costs

- 172,026Total average daily traffic

- 12,188Total average daily truck traffic

- 173,568Total future (year 2032) average daily traffic

- New bridges - historical statistics

- 21930-1939

- 41960-1969

- 11980-1989

- 41990-1999

- 72000-2009

- 12010-2019

FCC Registered Antenna Towers: 39 (See the full list of FCC Registered Antenna Towers)

FCC Registered Private Land Mobile Towers: 1 (See the full list of FCC Registered Private Land Mobile Towers in Cottonwood, AZ)

FCC Registered Broadcast Land Mobile Towers: 13 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 63 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 2 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 3 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 259 (See the full list of FCC Registered Amateur Radio Licenses in Cottonwood)

FAA Registered Aircraft Manufacturers and Dealers: 2 (See the full list of FAA Registered Manufacturers and Dealers in Cottonwood)

FAA Registered Aircraft: 38 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 1 partial tract) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 19 | $141,733 | 18 | $132,128 | 71 | $161,146 | 2 | $146,185 | 11 | $147,517 | 6 | $86,553 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 2 | $170,435 | 2 | $108,025 | 10 | $190,638 | 0 | $0 | 2 | $115,035 | 1 | $104,130 |

| APPLICATIONS DENIED | 7 | $138,871 | 5 | $162,070 | 41 | $183,704 | 4 | $86,498 | 6 | $156,380 | 5 | $80,678 |

| APPLICATIONS WITHDRAWN | 3 | $128,977 | 2 | $222,945 | 15 | $176,457 | 1 | $176,000 | 2 | $180,445 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 1 | $137,060 | 6 | $163,575 | 1 | $136,170 | 1 | $132,610 | 1 | $72,090 |

Detailed HMDA statistics for the following Tracts: 0020.00

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 1 partial tract) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 1 | $209,370 | 1 | $224,720 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | $0 | 0 | $0 |

| APPLICATIONS DENIED | 0 | $0 | 1 | $111,030 |

| APPLICATIONS WITHDRAWN | 0 | $0 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 0020.00

2003 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Cottonwood, AZ

- 51842.0%Outside Fires

- 50340.8%Structure Fires

- 17314.0%Mobile Property/Vehicle Fires

- 403.2%Other

Based on the data from the years 2003 - 2018 the average number of fires per year is 77. The highest number of reported fires - 117 took place in 2004, and the least - 49 in 2003. The data has an increasing trend.

Based on the data from the years 2003 - 2018 the average number of fires per year is 77. The highest number of reported fires - 117 took place in 2004, and the least - 49 in 2003. The data has an increasing trend. When looking into fire subcategories, the most incidents belonged to: Outside Fires (42.0%), and Structure Fires (40.8%).

When looking into fire subcategories, the most incidents belonged to: Outside Fires (42.0%), and Structure Fires (40.8%).Fire-safe hotels and motels in Cottonwood, Arizona:

- Best Western Cottonwood Inn, 993 S Main St, Cottonwood, Arizona 86326 , Phone: (928) 634-5575, Fax: (928) 634-5576

- Pines Motel, 920 Camino Real, Cottonwood, Arizona 86326 , Phone: (928) 634-9975, Fax: (928) 634-5575

- 65.1%Utility gas

- 28.2%Electricity

- 4.8%Bottled, tank, or LP gas

- 1.6%Solar energy

- 0.2%Wood

- 61.7%Electricity

- 38.3%Utility gas

Cottonwood compared to Arizona state average:

- Median household income below state average.

- Unemployed percentage below state average.

- Black race population percentage significantly below state average.

- Median age significantly above state average.

- Length of stay since moving in significantly above state average.

Cottonwood on our top lists:

- #1 on the list of "Top 101 cities with largest percentage of females in occupations: construction and extraction occupations (population 5,000+)"

- #2 on the list of "Top 101 cities with the most residents born in Other South America (population 500+)"

- #7 on the list of "Top 101 cities with largest percentage of males in occupations: building and grounds cleaning and maintenance occupations (population 5,000+)"

- #22 on the list of "Top 101 cities with the highest number of arson incidents per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 5,000+)"

- #24 on the list of "Top 101 cities with largest percentage of males in industries: administrative and support and waste management services (population 5,000+)"

- #30 on the list of "Top 101 cities with the largest percentage of divorced people (15+ years)(population 5,000+)"

- #32 on the list of "Top 101 cities with largest percentage of males in industries: accommodation and food services (population 5,000+)"

- #47 on the list of "Top 101 cities with largest percentage of females in industries: mining, quarrying, and oil and gas extraction (population 5,000+)"

- #60 on the list of "Top 101 cities with largest percentage of females in industries: accommodation and food services (population 5,000+)"

- #80 on the list of "Top 101 cities with largest percentage of males in occupations: fire fighting and prevention workers including supervisors (population 5,000+)"

- #100 on the list of "Top 101 cities with largest percentage of females in occupations: building and grounds cleaning and maintenance occupations (population 5,000+)"

- #16 on the list of "Top 101 counties with the lowest Particulate Matter (PM2.5) Annual air pollution readings in 2012 (µg/m3)"

- #20 on the list of "Top 101 counties with the lowest number of births per 1000 residents 2007-2013"

- #45 on the list of "Top 101 counties with the lowest Particulate Matter (PM10) Annual air pollution readings in 2012 (µg/m3)"

- #68 on the list of "Top 101 counties with the highest Ozone (1-hour) air pollution readings in 2012 (ppm)"

- #76 on the list of "Top 101 counties with the highest number of deaths per 1000 residents 2007-2013 (pop. 50,000+)"

|

|

Total of 41 patent applications in 2008-2024.