Fort Lauderdale, Florida

Fort Lauderdale: Fort Lauderdale Beach right after sunrise

Fort Lauderdale: The Beach Along The A1A

Fort Lauderdale: Sunrise in Fort Lauderdale

Fort Lauderdale: Scenic Day at Fort Lauderdale Beach

Fort Lauderdale: Lunch on Las Olas

Fort Lauderdale: Early morning on Ft Lauderdale beach

Fort Lauderdale: Broward County Library

Fort Lauderdale: Marina at Fort Lauderdale, Florida

Fort Lauderdale: RiverWalk

Fort Lauderdale: Broward County Convention Center

Fort Lauderdale: Just another beachy day

- see

66

more - add

your

Submit your own pictures of this city and show them to the world

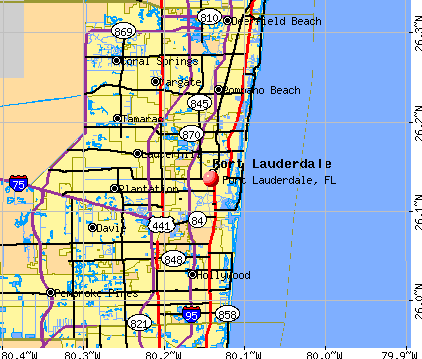

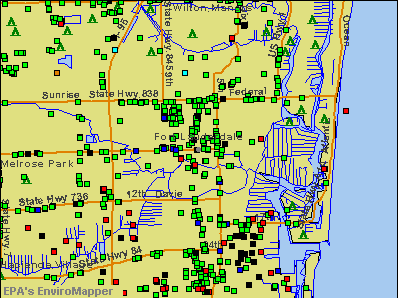

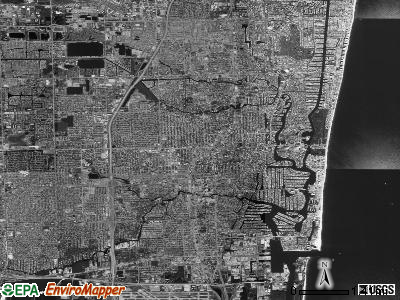

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +20.2%

| Males: 96,924 | |

| Females: 86,222 |

| Median resident age: | 43.1 years |

| Florida median age: | 42.7 years |

Zip codes: 33301, 33304, 33305, 33306, 33308, 33309, 33319, 33334.

Fort Lauderdale Zip Code Map| Fort Lauderdale: | $81,544 |

| FL: | $69,303 |

Estimated per capita income in 2022: $61,558 (it was $27,798 in 2000)

Fort Lauderdale city income, earnings, and wages data

Estimated median house or condo value in 2022: $485,800 (it was $132,600 in 2000)

| Fort Lauderdale: | $485,800 |

| FL: | $354,100 |

Mean prices in 2022: all housing units: $789,034; detached houses: $884,233; townhouses or other attached units: $841,956; in 2-unit structures: $569,559; in 3-to-4-unit structures: $688,953; in 5-or-more-unit structures: $605,185; mobile homes: $17,152

Median gross rent in 2022: $1,800.

Fort Lauderdale, FL residents, houses, and apartments details

(9.3% for White Non-Hispanic residents, 39.4% for Black residents, 12.4% for Hispanic or Latino residents, 5.3% for American Indian residents, 20.1% for other race residents, 8.9% for two or more races residents)

Detailed information about poverty and poor residents in Fort Lauderdale, FL

- 80,53144.0%White alone

- 50,71827.7%Black alone

- 38,34520.9%Hispanic

- 8,8294.8%Two or more races

- 3,1101.7%Asian alone

- 1,3190.7%Other race alone

- 3040.2%American Indian alone

Races in Fort Lauderdale detailed stats: ancestries, foreign born residents, place of birth

According to our research of Florida and other state lists, there were 653 registered sex offenders living in Fort Lauderdale, Florida as of April 24, 2024.

The ratio of all residents to sex offenders in Fort Lauderdale is 274 to 1.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is smaller than the state average.- means the value is about the same as the state average.

- means the value is bigger than the state average.

- means the value is much bigger than the state average.

Crime rate in Fort Lauderdale detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 664 (502 officers - 404 male; 98 female).

| Officers per 1,000 residents here: | 2.73 |

| Florida average: | 2.33 |

Latest news from Fort Lauderdale, FL collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: Haitian (8.5%), American (6.3%), Italian (5.2%), Irish (5.0%), Jamaican (3.8%), English (3.5%).

Current Local Time: EST time zone

Elevation: 8 feet

Land area: 31.7 square miles.

Population density: 5,772 people per square mile (average).

51,067 residents are foreign born (19.0% Latin America, 3.6% Europe).

| This city: | 27.9% |

| Florida: | 21.1% |

Median real estate property taxes paid for housing units with mortgages in 2022: $4,697 (1.0%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $4,169 (0.9%)

Nearest city with pop. 200,000+: Hialeah, FL (21.3 miles

, pop. 226,419).

Nearest city with pop. 1,000,000+: Houston, TX (963.6 miles

, pop. 1,953,631).

Nearest cities:

Latitude: 26.14 N, Longitude: 80.14 W

Daytime population change due to commuting: +73,655 (+40.2%)

Workers who live and work in this city: 51,276 (51.8%)

Area codes: 954, 754

Property values in Fort Lauderdale, FL

Fort Lauderdale tourist attractions:

- Bonnet House Museum and Gardens Provides a Touch of Old Florida

- Boomers! - Dania, FL - Family Amusement Center

- Fort Lauderdale-Hollywood International Airport - Fort Lauderdale FL Fort Lauderdale-Hollywood International Airport

- Las Olas Boulevard in Fort Lauderdale a Favorite Trendy Shopping Area

- 15th Street Fisheries

- Broward Center for the Performing Arts

- Broward County Main Library

- Everglades Holiday Park

- Fishing on the Monster

- Fort Lauderdale Beachfront

- Fort Lauderdale Sun Trolley

- Grand Bahamas Scuba

- Greater Fort Lauderdale & Broward County Convention Center

- Heliflite Too

- Intracoastal Waterway

- Island Adventure Sailing

- Fort Lauderdale Antique Car Museum

- Fort Lauderdale Stadium

- Hugh Taylor Birch State Park

- International Swimming Hall of Fame

- Laffing Matterz

- Stranahan House

- Las Olas Riverfront

- Museum of Art Fort Lauderdale

- Museum of Discovery and Science and IMAX 3D Theater

- New River

- Old Dillard Art and Cultural Museum

- Old Fort Lauderdale Village & Museum

- Riverfront Cruises and Anticipation Yachts

- Riverwalk Fort Lauderdale: Downtown Arts & Entertainment Center

- Secret Woods Nature Center

- The Gallery at Beach Place

- Tiki Beach Watersports

- Xtreme Indoor Karting

- Sawgrass Recreation Park Gives Visitors a Taste of the Everglades

- The Galleria Fort Lauderdale - Fort Lauderdale, FL - A Shopping Mall in the Southeastern Coast of Florida

Fort Lauderdale, Florida accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 141 buildings, average cost: $637,400

- 2021: 202 buildings, average cost: $698,500

- 2020: 155 buildings, average cost: $466,300

- 2019: 127 buildings, average cost: $572,400

- 2018: 109 buildings, average cost: $454,000

- 2017: 133 buildings, average cost: $441,200

- 2016: 124 buildings, average cost: $523,200

- 2015: 124 buildings, average cost: $530,400

- 2014: 79 buildings, average cost: $572,600

- 2013: 94 buildings, average cost: $466,800

- 2012: 81 buildings, average cost: $538,300

- 2011: 42 buildings, average cost: $557,600

- 2010: 42 buildings, average cost: $566,700

- 2009: 38 buildings, average cost: $694,300

- 2008: 92 buildings, average cost: $429,200

- 2007: 137 buildings, average cost: $165,400

- 2006: 289 buildings, average cost: $154,100

- 2005: 424 buildings, average cost: $143,400

- 2004: 378 buildings, average cost: $178,000

- 2003: 417 buildings, average cost: $231,700

- 2002: 232 buildings, average cost: $290,100

- 2001: 189 buildings, average cost: $346,900

- 2000: 188 buildings, average cost: $229,800

- 1999: 117 buildings, average cost: $283,700

- 1998: 135 buildings, average cost: $179,900

- 1997: 118 buildings, average cost: $175,600

| Here: | 2.9% |

| Florida: | 2.9% |

- Health care (10.6%)

- Accommodation & food services (9.7%)

- Professional, scientific, technical services (9.5%)

- Educational services (7.5%)

- Administrative & support & waste management services (6.8%)

- Construction (5.9%)

- Public administration (4.7%)

- Professional, scientific, technical services (10.7%)

- Construction (9.2%)

- Accommodation & food services (8.9%)

- Administrative & support & waste management services (8.5%)

- Health care (5.8%)

- Real estate & rental & leasing (5.3%)

- Educational services (4.8%)

- Health care (16.8%)

- Educational services (10.9%)

- Accommodation & food services (10.7%)

- Professional, scientific, technical services (7.8%)

- Public administration (5.4%)

- Finance & insurance (4.5%)

- Administrative & support & waste management services (4.5%)

- Cooks and food preparation workers (7.7%)

- Other management occupations, except farmers and farm managers (6.8%)

- Building and grounds cleaning and maintenance occupations (6.1%)

- Top executives (2.4%)

- Retail sales workers, except cashiers (2.3%)

- Other office and administrative support workers, including supervisors (2.1%)

- Waiters and waitresses (2.1%)

- Other management occupations, except farmers and farm managers (8.3%)

- Cooks and food preparation workers (7.9%)

- Building and grounds cleaning and maintenance occupations (7.3%)

- Top executives (3.3%)

- Computer specialists (2.9%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (2.7%)

- Lawyers (2.5%)

- Cooks and food preparation workers (7.3%)

- Other management occupations, except farmers and farm managers (4.8%)

- Building and grounds cleaning and maintenance occupations (4.5%)

- Secretaries and administrative assistants (3.9%)

- Other office and administrative support workers, including supervisors (3.8%)

- Nursing, psychiatric, and home health aides (3.8%)

- Health technologists and technicians (2.7%)

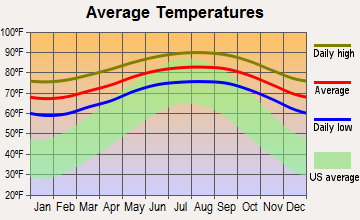

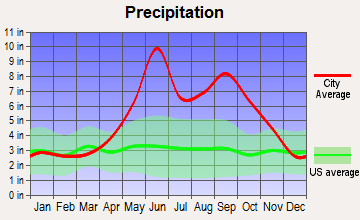

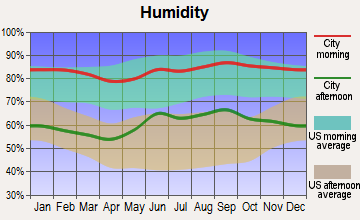

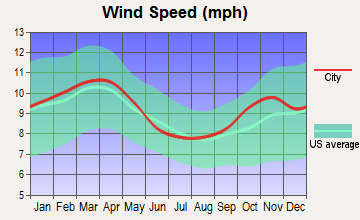

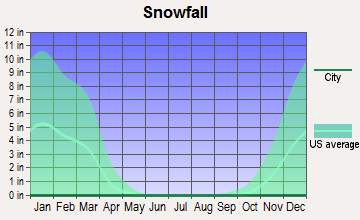

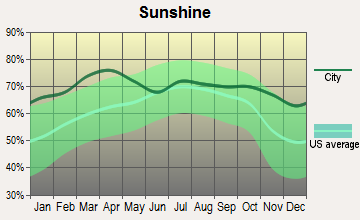

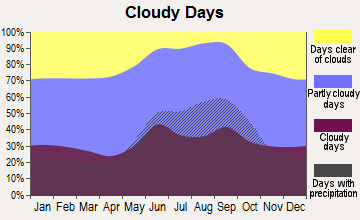

Average climate in Fort Lauderdale, Florida

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2022 was 73.9. This is about average.

| City: | 73.9 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.412. This is significantly worse than average. Closest monitor was 1.7 miles away from the city center.

| City: | 0.412 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 13.4. This is significantly worse than average. Closest monitor was 1.7 miles away from the city center.

| City: | 13.4 |

| U.S.: | 5.1 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.462. This is significantly better than average. Closest monitor was 1.7 miles away from the city center.

| City: | 0.462 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 26.5. This is better than average. Closest monitor was 3.6 miles away from the city center.

| City: | 26.5 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 18.4. This is about average. Closest monitor was 2.3 miles away from the city center.

| City: | 18.4 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 9.49. This is about average. Closest monitor was 1.8 miles away from the city center.

| City: | 9.49 |

| U.S.: | 8.11 |

Tornado activity:

Fort Lauderdale-area historical tornado activity is slightly below Florida state average. It is 26% smaller than the overall U.S. average.

On 2/23/1965, a category F3 (max. wind speeds 158-206 mph) tornado 2.7 miles away from the Fort Lauderdale city center injured 6 people and caused between $50,000 and $500,000 in damages.

On 3/1/1980, a category F3 tornado 2.9 miles away from the city center killed one person and injured 33 people and caused between $5,000,000 and $50,000,000 in damages.

Earthquake activity:

Fort Lauderdale-area historical earthquake activity is significantly below Florida state average. It is 99% smaller than the overall U.S. average.On 9/10/2006 at 14:56:08, a magnitude 5.9 (5.9 MB, 5.5 MS, 5.8 MW, Class: Moderate, Intensity: VI - VII) earthquake occurred 402.7 miles away from the city center

On 2/22/1992 at 04:21:34, a magnitude 3.2 (3.2 MB, Depth: 6.2 mi, Class: Light, Intensity: II - III) earthquake occurred 79.3 miles away from Fort Lauderdale center

On 6/23/2016 at 17:20:29, a magnitude 3.8 (3.8 ML) earthquake occurred 270.2 miles away from Fort Lauderdale center

On 7/16/2016 at 20:00:10, a magnitude 3.7 (3.7 MB) earthquake occurred 254.7 miles away from the city center

On 9/21/2016 at 16:30:52, a magnitude 3.8 (3.8 ML) earthquake occurred 275.2 miles away from the city center

On 9/4/2016 at 18:29:29, a magnitude 3.8 (3.8 ML) earthquake occurred 276.3 miles away from Fort Lauderdale center

Magnitude types: body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Broward County (27) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 15

Emergencies Declared: 8

Causes of natural disasters: Hurricanes: 16, Fires: 3, Floods: 3, Tornadoes: 3, Freezes: 2, Tropical Storms: 2, Heavy Rain: 1, Storm: 1, Wind: 1, Other: 2 (Note: some incidents may be assigned to more than one category).

Main business address for: STEPHAN CO (PERFUMES, COSMETICS & OTHER TOILET PREPARATIONS), OCEAN BIO CHEM INC (SPECIALTY CLEANING, POLISHING AND SANITATION PREPARATIONS), CITRIX SYSTEMS INC (SERVICES-PREPACKAGED SOFTWARE), SEABULK INTERNATIONAL INC (DEEP SEA FOREIGN TRANSPORTATION OF FREIGHT), CYBERGUARD CORP (ELECTRONIC COMPUTERS), FLANIGANS ENTERPRISES INC (RETAIL-EATING PLACES), NIMBUS GROUP INC (SERVICES-BUSINESS SERVICES, NEC), WEIDA COMMUNICATIONS, INC. (TELEPHONE COMMUNICATIONS (NO RADIO TELEPHONE)) and 9 other public companies.

Hospitals in Fort Lauderdale:

- ANN STORCK CENTER INC (1790 SW 43RD WAY)

- ATLANTIC SHORES HOSPITAL (provides emergency services, 4545 N FEDERAL HIGHWAY)

- BROWARD HEALTH IMPERIAL POINT (Government - Hospital District or Authority, provides emergency services, 6401 N FEDERAL HWY)

- BROWARD HEALTH MEDICAL CENTER (Government - Hospital District or Authority, provides emergency services, 1600 S ANDREWS AVE)

- CORAL RIDGE PSYCHIATRIC HOSPITAL (4545 N FEDERAL HIGHWAY)

- FORT LAUDERDALE HOSPITAL (1601 EAST LAS OLAS BLVD)

- HOLY CROSS HOSPITAL INC (Voluntary non-profit - Church, provides emergency services, 4725 N FEDERAL HWY)

- KINDRED HOSPITAL SOUTH FLORIDA (provides emergency services, 1516 E LAS OLAS BLVD)

- LAS OLAS HOSPITAL (1516 E LAS OLAS BLVD)

- VITAS HLTHCARE CORP OF FLORIDA (5420 NW 33RD AVE SUITE 100)

Airports and heliports located in Fort Lauderdale:

- Fort Lauderdale/Hollywood International Airport (FLL) (Runways: 2, Commercial Ops: 199,676, Air Taxi Ops: 31,076, Itinerant Ops: 37,015, Military Ops: 468)

- Fort Lauderdale Executive Airport (FXE) (Runways: 2, Air Taxi Ops: 12,880, Itinerant Ops: 20,153, Local Ops: 116,520, Military Ops: 157)

- Heliports: 7

Amtrak station:

FORT LAUDERDALE (200 SW 21ST TERRACE) . Services: ticket office, partially wheelchair accessible, enclosed waiting area, public restrooms, public payphones, vending machines, free short-term parking, free long-term parking, call for car rental service, call for taxi service, public transit connection.Colleges/Universities in Fort Lauderdale:

- Broward College (Full-time enrollment: 30,322; Location: 111 East Las Olas Blvd; Public; Website: www.broward.edu)

- Nova Southeastern University (Full-time enrollment: 25,621; Location: 3301 College Ave; Private, not-for-profit; Website: www.nova.edu; Offers Doctor's degree)

- Keiser University-Ft Lauderdale (Full-time enrollment: 18,270; Location: 1500 NW 49th St.; Private, not-for-profit; Website: www.keiseruniversity.edu; Offers Doctor's degree)

- The Art Institute of Fort Lauderdale (Full-time enrollment: 1,933; Location: 1799 SE 17th St; Private, for-profit; Website: www.aifl.edu)

- Sanford-Brown Institute-Ft Lauderdale (Full-time enrollment: 836; Location: 1201 W. Cypress Creek Road; Private, for-profit; Website: www.sbftlaud.com)

- City College-Fort Lauderdale (Full-time enrollment: 615; Location: 2000 W. Commerical Boulevard; Private, not-for-profit; Website: www.citycollege.edu)

- ITT Technical Institute-Fort Lauderdale (Full-time enrollment: 543; Location: 3401 S University Dr; Private, for-profit; Website: www.itt-tech.edu)

- Atlantic Institute of Oriental Medicine (Full-time enrollment: 423; Location: 100 E Broward Blvd, Suite 100; Private, not-for-profit; Website: www.atom.edu; Offers Master's degree)

- ITT Technical Institute-Deerfield Beach (Full-time enrollment: 114; Location: 3401 S University Drive, Suite 100; Private, for-profit; Website: www.itt-tech.edu)

- Coral Ridge Nurses Assistant Training School Inc (Location: 2121 W Oakland Pk Blvd; Private, for-profit)

Other colleges/universities with over 2000 students near Fort Lauderdale:

- Everest University-Pompano Beach (about 8 miles; Pompano Beach, FL; Full-time enrollment: 2,316)

- DeVry University-Florida (about 16 miles; Miramar, FL; FT enrollment: 3,674)

- St Thomas University (about 17 miles; Miami Gardens, FL; FT enrollment: 2,096)

- Florida Atlantic University (about 17 miles; Boca Raton, FL; FT enrollment: 24,403)

- Johnson & Wales University-North Miami (about 17 miles; North Miami, FL; FT enrollment: 2,051)

- Lynn University (about 18 miles; Boca Raton, FL; FT enrollment: 2,151)

- Barry University (about 19 miles; Miami, FL; FT enrollment: 7,181)

Public high schools in Fort Lauderdale:

- FORT LAUDERDALE HIGH SCHOOL (Students: 842, Location: 1600 NE 4TH AVE, Grades: 9-12)

- BROWARD DETENTION CENTER (Students: 647, Location: 222 NW 22ND AVE, Grades: 6-12)

- WINGATE OAKS CENTER (Students: 382, Location: 1211 NW 33RD TER, Grades: PK-12)

- STRANAHAN HIGH SCHOOL (Students: 317, Location: 1800 SW 5TH PL, Grades: 9-12)

- SEAGULL SCHOOL (Students: 292, Location: 425 SW 28TH ST, Grades: PK-12)

- WHIDDON RODGERS EDUCATION CENTER (Students: 41, Location: 700 SW 26TH ST, Grades: 6-12)

- DILLARD 6-12 (Location: 2501 NW 11TH ST, Grades: 6-12)

- PINE RIDGE ALTERNATIVE CENTER (Location: 1251 SW 42ND AVE, Grades: KG-12)

- FLORIDA VIRTUAL ACADEMY AT BROWARD COUNTY (Location: 110 SE 6TH ST 15 FL, Grades: KG-12, Charter school)

Private high schools in Fort Lauderdale:

- PINE CREST SCHOOL (Students: 2,654, Location: 1501 NE 62ND ST, Grades: PK-12)

- ST THOMAS AQUINAS HIGH SCHOOL (Students: 2,190, Location: 2801 SW 12TH ST, Grades: 9-12)

- CALVARY CHRISTIAN ACADEMY (Students: 1,726, Location: 2401 W CYPRESS CREEK RD, Grades: UG-12)

- CARDINAL GIBBONS HIGH SCHOOL (Students: 1,128, Location: 2900 NE 47TH ST, Grades: 9-12)

- FORT LAUDERDALE PREPARATORY SCHOOL (Students: 205, Location: 3275 W OAKLAND PARK BLVD, Grades: PK-12)

- MOUNT OLIVET SEVENTH-DAY ADVENTIST SCHOOL (Students: 83, Location: 3013 NW 11TH ST, Grades: PK-9)

Biggest public elementary/middle schools in Fort Lauderdale:

- HARBORDALE ELEMENTARY SCHOOL (Students: 1,509, Location: 900 SE 15TH ST, Grades: PK-5)

- CROISSANT PARK ELEMENTARY SCHOOL (Students: 979, Location: 1800 SW 4TH AVE, Grades: PK-5)

- WALKER ELEMENTARY SCHOOL (MAGNET) (Students: 975, Location: 1001 NW 4TH ST, Grades: PK-5)

- BENNETT ELEMENTARY SCHOOL (Students: 628, Location: 1755 NE 14TH ST, Grades: PK-5)

- DILLARD ELEMENTARY SCHOOL (Students: 404, Location: 2330 NW 12TH CT, Grades: PK-5)

- WILLIAM DANDY MIDDLE SCHOOL (Students: 347, Location: 2400 NW 26TH ST, Grades: 6-8)

- SUNLAND PARK ACADEMY (Students: 336, Location: 919 NW 13TH TER, Grades: PK-3)

- VIRGINIA SHUMAN YOUNG ELEMENTARY SCHOOL (Students: 324, Location: 101 NE 11TH AVE, Grades: PK-5)

- SUNRISE MIDDLE SCHOOL (Students: 319, Location: 1750 NE 14TH ST, Grades: 6-8)

- NORTH SIDE ELEMENTARY SCHOOL (Students: 316, Location: 120 NE 11TH ST, Grades: PK-5)

Biggest private elementary/middle schools in Fort Lauderdale:

- ST ANTHONY SCHOOL (Students: 413, Location: 820 NE 3RD ST, Grades: PK-8)

- BRAUSER MAIMONIDES ACADEMY (Students: 354, Location: 5300 SW 40TH AVE, Grades: PK-8)

- ST JEROME CATHOLIC SCHOOL (Students: 347, Location: 2601 SW 9TH AVE, Grades: PK-8)

- CHRIST CHURCH SCHOOL (Students: 312, Location: 4845 NE 25TH AVE, Grades: PK-5)

- BETHANY CHRISTIAN SCHOOL (Students: 236, Location: 880 S FEDERAL HWY, Grades: PK-8)

- OUR LADY QUEEN OF MARTYRS SCHOOL (Students: 204, Location: 2785 HAPPY HOYER ST, Grades: PK-8)

- SHEPHERD OF THE COAST LUTHERAN SCHOOL (Students: 165, Location: 1901 E COMMERCIAL BLVD, Grades: PK-8)

- GATEWAY CHRISTIAN ACADEMY (Students: 149, Location: 2130 NW 26TH ST, Grades: PK-5)

- FAITH LUTHERAN SCHOOL (Students: 106, Location: 1161 SW 30TH AVE, Grades: PK-8)

- HOLY TEMPLE CHRISTIAN ACADEMY (Students: 90, Location: 1800 NW 9TH AVE, Grades: PK-8)

Library in Fort Lauderdale:

- BROWARD COUNTY LIBRARIES DIVISION (Operating income: $69,966,642; Location: 100 S. ANDREWS AVE; 2,638,454 books; 29,829 e-books; 315,606 audio materials; 423,320 video materials; 14 local licensed databases; 62 state licensed databases; 6,766 print serial subscriptions; 200 electronic serial subscriptions)

Points of interest:

Notable locations in Fort Lauderdale: Bahia Mar Yacht Center (A), Coral Ridge Country Club (B), Trafalgar Plaza (C), Plaza Executive Center (D), One River Plaza (E), Imperial Shopping Plaza (F), Coral Ridge Shopping Plaza (G), Delray Dunes Golf and Country Club (H), Port Everglades Berths 5 and 6 (I), Port Everglades Berths 1and 2 And 3 (J), Port Everglades Berths 1A and 1B (K), Port Everglades Berth 4A (L), Port Everglades Berth 4 (M), Fiveash Waterworks (N), Fort Lauderdale Stadium (O), Lockhart Stadium (P), Port Everglades Approach Light (Q), Sunrise Bay Center (R), Fort Lauderdale Station (S), Best Plaza (T). Display/hide their locations on the map

Shopping Centers: North Ridge Shopping Center (1), Promenade at Bay Colony Shopping Center (2), Imperial Square Shopping Center (3), Galleria Mall (4), Benefit Mall (5), The Galleria at Fort Lauderdale Shopping Center (6), Gateway Shopping Center (7), Dailland Park Shopping Center (8), Manor Shopping Center (9). Display/hide their locations on the map

Main business address in Fort Lauderdale include: STEPHAN CO (A), CITRIX SYSTEMS INC (B), CYBERGUARD CORP (C), FLANIGANS ENTERPRISES INC (D), WEIDA COMMUNICATIONS, INC. (E). Display/hide their locations on the map

Churches in Fort Lauderdale include: Berean Church (A), Sunset Church (B), Our Lady of Assumption Catholic Church (C), First United Methodist Church (D), Methodist Church Parkway United (E), Saint Nicholas Episcopal Church (F), Saint Demetrios Greek Orthodox Church (G), Apostle Faith Church of Jesus (H), Church of God Pompano Beach (I). Display/hide their locations on the map

Cemeteries: Sunset Memorial Gardens (1), Lauderdale Memorial Park (2), Evergreen Cemetery (3). Display/hide their locations on the map

Lakes: Cliff Lake (A), Sunset Lake (B), Rock Pit Lake (C), Lake Sylvia (D), Lake Mabel (E), Seminole Lake (F), Mayan Lake (G), Lake Melva (H). Display/hide their locations on the map

Rivers and creeks: New River (A), Tarpon River (B), Osceola Creek (C), Middle River (D). Display/hide their locations on the map

Parks in Fort Lauderdale include: Hugh Taylor Birch State Park (1), Holiday Park (2), South Beach Park (3), Sunland Park (4), English Park (5), Warfield Park (6), S P Snyder Park (7), Flamingo Park (8), Bay View Drive Park (9). Display/hide their locations on the map

Beach: Fort Lauderdale Beach (A). Display/hide its location on the map

Tourist attractions: Gallery 721 Inc (Museums; 725 Progresso Drive) (1), Anhinga Indian Gift Shop & Museum (5985 South State Road 7) (2), Fort Lauderdale Historical Society (Museums; 219 Southwest 2nd Avenue) (3), Bonnet House Museum & Gardens (900 North Birch Road) (4), Antique Car Museum Inc (1527 Southwest 1st Avenue) (5), Broward County - Libraries Division- Book Renewals (Cultural Attractions- Events- & Facilities; 201 Southeast 6th Street) (6), Broward County - Libraries Division- Telephone Reference Information (Cultural Attractions- Events- & Facilities; 100 Southwest 12th Avenue) (7), Broward County - Libraries Division- Branch Libraries- Imperial Point Br (Cultural Attractions- Events- & Facilities; 5985 North Federal Highway) (8), Broward County - Libraries Division- Branch Libraries (Cultural Attractions- Events- & Facilities; 3301 College Avenue) (9). Display/hide their approximate locations on the map

Hotels: Baymont Inns & Suites (3800 West Commercial Boulevard) (1), Bamboo Resort (2733 Middle River Drive) (2), Birch Patio Motel (617 North Birch Road) (3), Bridge at Cordova (1441 Cordova Road) (4), By-Eddy Apartment Motel (1021 Ne 13th Av) (5), Best Western Oceanside Inn (1180 Seabreeze Boulevard) (6), Best Western Ft Lauderdale Inn (1221 State Road 84) (7), Buena Vista Hotel & Conference Center (4225 El Mar Drive) (8), Bimini Rental (4649 SW 37th Avenue) (9). Display/hide their approximate locations on the map

Courts: Florida State - Judicial- Public Defender (201 Southeast 6th Street) (1), U S Government - Courts- US District Court- Clerk of Court (299 East Broward Boulevard) (2), Courts-Federal - Bankruptcy Court- Clerk's Office Info (299 East Broward Boulevard) (3). Display/hide their approximate locations on the map

Birthplace of: Amy Dumas - Professional wrestler, Rielle Hunter - Sex scandal figure, Jessicka - Artist, Kevin Jennings - Educator, Patrick Peterson - College football player, Mark Sanford - Politician, David Heath (wrestler) - Professional wrestler, Robby Ginepri - Tennis player, Angel Orsini - Professional wrestler, Anthony Rizzo (baseball) - Professional baseball player.

Drinking water stations with addresses in Fort Lauderdale and their reported violations in the past:

RANCHO DAL PASO LLC DBA ADOBE VILLAGE (Address: 3200 PORT ROYALE DR APT 2109 E , Serves NM, Population served: 75, Groundwater):Past health violations:Past monitoring violations:

- MCL, Monthly (TCR) - In JUN-2005, Contaminant: Coliform. Follow-up actions: St Public Notif requested (JUN-13-2005), St Violation/Reminder Notice (JUN-13-2005), St Public Notif received (AUG-29-2005), St Compliance achieved (DEC-31-2006)

- One routine major monitoring violation

| This city: | 2.2 people |

| Florida: | 2.5 people |

| This city: | 47.6% |

| Whole state: | 65.2% |

| This city: | 10.1% |

| Whole state: | 7.3% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.5% of all households

- Gay men: 2.6% of all households

People in group quarters in Fort Lauderdale in 2010:

- 1,291 people in local jails and other municipal confinement facilities

- 559 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 467 people in residential treatment centers for adults

- 324 people in nursing facilities/skilled-nursing facilities

- 202 people in correctional residential facilities

- 191 people in other noninstitutional facilities

- 183 people in group homes intended for adults

- 144 people in workers' group living quarters and job corps centers

- 28 people in group homes for juveniles (non-correctional)

- 13 people in maritime/merchant vessels

- 8 people in residential treatment centers for juveniles (non-correctional)

- 8 people in in-patient hospice facilities

People in group quarters in Fort Lauderdale in 2000:

- 2,763 people in local jails and other confinement facilities (including police lockups)

- 777 people in other noninstitutional group quarters

- 617 people in nursing homes

- 279 people in college dormitories (includes college quarters off campus)

- 209 people in homes or halfway houses for drug/alcohol abuse

- 185 people in halfway houses

- 157 people in state prisons

- 156 people in other group homes

- 122 people in short-term care, detention or diagnostic centers for delinquent children

- 119 people in homes for the mentally ill

- 51 people in hospitals/wards and hospices for chronically ill

- 51 people in hospices or homes for chronically ill

- 33 people in mental (psychiatric) hospitals or wards

- 23 people in religious group quarters

- 18 people in federal prisons and detention centers

- 17 people in other nonhousehold living situations

- 15 people in schools, hospitals, or wards for the intellectually disabled

- 13 people in homes for abused, dependent, and neglected children

- 5 people in unknown juvenile institutions

Banks with most branches in Fort Lauderdale (2011 data):

- Wells Fargo Bank, National Association: 14 branches. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- Bank of America, National Association: 13 branches. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- BankAtlantic: 8 branches. Info updated 2011/07/21: Bank assets: $3,648.1 mil, Deposits: $3,293.2 mil, local headquarters, negative income in the last year, Commercial Lending Specialization, 78 total offices

- SunTrust Bank: West Ft Lauderdale Branch, Cypress Creek Branch, South Lauderdale Branch, Las Olas Branch, Galt Ocean Mile Branch, Coral Ridge Branch. Info updated 2010/05/27: Bank assets: $171,291.7 mil, Deposits: $129,833.2 mil, headquarters in Atlanta, GA, positive income, Commercial Lending Specialization, 1716 total offices, Holding Company: Suntrust Banks, Inc.

- Branch Banking and Trust Company: 17th Street Branch, Bayview Branch, Fort Lauderdale Main Branch, Coral Ridge Branch, Cypress Creek Branch. Info updated 2010/03/29: Bank assets: $168,867.6 mil, Deposits: $127,549.5 mil, headquarters in Winston Salem, NC, positive income, Commercial Lending Specialization, 1793 total offices, Holding Company: Bb&T Corporation

- TD Bank, National Association: Downtown Fort Lauderdale Branch, Lauderhill Fl Branch, Fort Lauderdale Nw 62nd Street Branc, Ft. Lauderdale 17th Street Branch, Sunrise East Branch. Info updated 2010/10/04: Bank assets: $188,912.6 mil, Deposits: $153,149.8 mil, headquarters in Wilmington, DE, positive income, 1314 total offices, Holding Company: Toronto-Dominion Bank, The

- PNC Bank, National Association: Cypress Creek Station Branch, Imperial Point Branch, Downtown Ft Lauderdale Branch, Waverly Branch. Info updated 2012/03/20: Bank assets: $263,309.6 mil, Deposits: $197,343.0 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 3085 total offices, Holding Company: Pnc Financial Services Group, Inc., The

- JPMorgan Chase Bank, National Association: East Broward Branch, Cleary & Nob Hill Banking Center, Federal Hwy & Ne 19th Banking Center, Fort Lauderdale - Harbor Shops. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- Regions Bank: Las Olas Branch, Fort Lauderdale Branch, East Commercial Blvd Branch, North Fort Lauderdale Branch. Info updated 2011/02/24: Bank assets: $123,368.2 mil, Deposits: $98,301.3 mil, headquarters in Birmingham, AL, positive income, Commercial Lending Specialization, 1778 total offices, Holding Company: Regions Financial Corporation

- 33 other banks with 44 local branches

For population 15 years and over in Fort Lauderdale:

- Never married: 38.8%

- Now married: 40.8%

- Separated: 2.1%

- Widowed: 4.7%

- Divorced: 13.7%

For population 25 years and over in Fort Lauderdale:

- High school or higher: 89.5%

- Bachelor's degree or higher: 43.0%

- Graduate or professional degree: 17.4%

- Unemployed: 6.3%

- Mean travel time to work (commute): 22.0 minutes

| Here: | 12.9 |

| Florida average: | 12.2 |

Graphs represent county-level data. Detailed 2008 Election Results

Political contributions by individuals in Fort Lauderdale, FL

Neighborhoods in Fort Lauderdale:

(Fort Lauderdale, Florida Neighborhood Map)- Arrowhead Country Club (Arrowhead Golf Club) neighborhood

- Bal Harbour neighborhood

- Bay Colony neighborhood

- Bermuda Riviera neighborhood

- Boulevard Forest neighborhood

- Boulevard West neighborhood

- Boulevard Woods neighborhood

- Breezeswept Park Estates neighborhood

- Broward Gardens neighborhood

- Cascades (Cascades of Lauderhill) neighborhood

- Central Beach neighborhood

- Central Park neighborhood

- Colee Hammock neighborhood

- Colonnades neighborhood

- Coral Heights neighborhood

- Coral Ridge neighborhood

- Coral Ridge Isles neighborhood

- Coral Shores neighborhood

- Coral Woods neighborhood

- Courts of Inverrary neighborhood

- Croissant Park neighborhood

- Cross Creek neighborhood

- Cypress Chase (Cypress Chase North) neighborhood

- Dillard Park neighborhood

- Dorsey-Riverbend neighborhood

- Downtown neighborhood

- Downtown Lauderdale Lakes (Town Center) neighborhood

- Downtown Oakland Park (Main St.) neighborhood

- Durrs neighborhood

- Eastgate (East Gate) neighborhood

- Edgewood neighborhood

- Fern Crest Village neighborhood

- Flagler Village neighborhood

- Flamingo Park neighborhood

- Galt Mile neighborhood

- Golden Heights neighborhood

- Hacienda Village neighborhood

- Harbor Beach (Harbour Inlet) neighborhood

- Harbordale neighborhood

- Hawaiian Gardens (Tahiti Village) neighborhood

- Hawks Landing (Hawk's Landing Club) neighborhood

- Hills of Inverrary neighborhood

- Imperial Point neighborhood

- Inverrary neighborhood

- Jacaranda (Jacaranda Golf Club) neighborhood

- Knoll Ridge neighborhood

- Lake Aire Palm View neighborhood

- Lake Ridge neighborhood

- Lakes of Newport neighborhood

- Lauderdale Beach neighborhood

- Lauderdale Harbors neighborhood

- Lauderdale Isles neighborhood

- Lauderdale Manors neighborhood

- Lauderdale Oaks neighborhood

- Marcano Estates neighborhood

- Melrose Park neighborhood

- Middle River Terrace neighborhood

- Nob Hill Estates neighborhood

- North Andrew Gardens neighborhood

- Northgate (North Gate) neighborhood

- Oak River neighborhood

- Oakland Estates (Oakland Estates North) neighborhood

- Oriole Estates neighborhood

- Palm Aire Village neighborhood

- Pine Island Ridge neighborhood

- Plantation Acres neighborhood

- Plantation Gardens neighborhood

- Plantation Isles neighborhood

- Plantation Park neighborhood

- Playland Village (Playland) neighborhood

- Poinciana neighborhood

- Pointsetta Heights neighborhood

- Progresso Village neighborhood

- Rio Vista neighborhood

- River Garden/Sweeting neighborhood

- River Oaks neighborhood

- River Run neighborhood

- Riverland neighborhood

- Riverside Park neighborhood

- Rock Island neighborhood

- Rock Island Village neighborhood

- Royal Palm Isles neighborhood

- Sailboat Bend neighborhood

- Shady Banks neighborhood

- Somerset (Somerset at Lauderdale Lakes) neighborhood

- South Middle River neighborhood

- Sunrise neighborhood

- Sunrise Heights neighborhood

- Sunset neighborhood

- Tarpon River neighborhood

- The Landings neighborhood

- Twin Lakes neighborhood

- Venice (Nurmi) neighborhood

- Victoria Park neighborhood

- Westgate (West Gate) neighborhood

- Wilton Drive (Arts and Entertainment District) neighborhood

Religion statistics for Fort Lauderdale, FL (based on Broward County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 280,324 | 47 |

| Evangelical Protestant | 221,258 | 701 |

| Other | 63,064 | 143 |

| Mainline Protestant | 53,412 | 88 |

| Black Protestant | 17,866 | 45 |

| Orthodox | 5,648 | 16 |

| None | 1,106,494 | - |

Food Environment Statistics:

| This county: | 2.05 / 10,000 pop. |

| State: | 2.04 / 10,000 pop. |

| Broward County: | 0.09 / 10,000 pop. |

| Florida: | 0.11 / 10,000 pop. |

| Broward County: | 1.53 / 10,000 pop. |

| Florida: | 1.28 / 10,000 pop. |

| This county: | 2.24 / 10,000 pop. |

| Florida: | 3.04 / 10,000 pop. |

| Broward County: | 8.00 / 10,000 pop. |

| Florida: | 7.45 / 10,000 pop. |

| Broward County: | 8.4% |

| Florida: | 9.2% |

| Broward County: | 20.6% |

| Florida: | 23.7% |

| This county: | 14.0% |

| State: | 14.0% |

Health and Nutrition:

| Fort Lauderdale: | 51.4% |

| Florida: | 51.4% |

| Fort Lauderdale: | 49.5% |

| Florida: | 49.4% |

| Fort Lauderdale: | 28.7 |

| Florida: | 28.6 |

| Fort Lauderdale: | 19.3% |

| Florida: | 19.5% |

| This city: | 9.7% |

| State: | 10.7% |

| Fort Lauderdale: | 6.8 |

| Florida: | 6.9 |

| Here: | 33.9% |

| Florida: | 34.7% |

| Here: | 57.6% |

| Florida: | 57.0% |

| This city: | 80.3% |

| State: | 79.2% |

More about Health and Nutrition of Fort Lauderdale, FL Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 515 | $4,411,292 | $102,787 | 0 | $0 |

| Firefighters | 368 | $2,825,563 | $92,138 | 25 | $14,936 |

| Parks and Recreation | 228 | $1,170,771 | $61,620 | 241 | $284,208 |

| Housing and Community Development (Local) | 199 | $1,014,802 | $61,194 | 10 | $1,340 |

| Other and Unallocable | 150 | $868,179 | $69,454 | 36 | $46,283 |

| Financial Administration | 149 | $1,075,738 | $86,637 | 8 | $13,870 |

| Other Government Administration | 129 | $955,145 | $88,851 | 15 | $28,689 |

| Police - Other | 107 | $540,034 | $60,565 | 11 | $22,658 |

| Fire - Other | 97 | $642,229 | $79,451 | 29 | $46,112 |

| Water Supply | 90 | $472,209 | $62,961 | 2 | $1,395 |

| Sewerage | 88 | $412,974 | $56,315 | 21 | $32,066 |

| Judicial and Legal | 27 | $271,389 | $120,617 | 1 | $11,139 |

| Streets and Highways | 23 | $128,316 | $66,947 | 2 | $2,642 |

| Airports | 16 | $96,677 | $72,508 | 3 | $2,988 |

| Solid Waste Management | 9 | $34,570 | $46,093 | 2 | $2,286 |

| Water Transport and Terminals | 6 | $34,646 | $69,292 | 2 | $2,642 |

| Correction | 2 | $11,525 | $69,150 | 5 | $17,302 |

| Totals for Government | 2,203 | $14,966,061 | $81,522 | 413 | $530,556 |

Fort Lauderdale government finances - Expenditure in 2021 (per resident):

- Construction - Water Utilities: $77,281,000 ($421.96)

General - Other: $23,448,000 ($128.03)

Parks and Recreation: $7,002,000 ($38.23)

Regular Highways: $2,971,000 ($16.22)

- Current Operations - Police Protection: $118,976,000 ($649.62)

Water Utilities: $102,047,000 ($557.19)

Local Fire Protection: $88,171,000 ($481.42)

Parks and Recreation: $35,261,000 ($192.53)

General - Other: $29,646,000 ($161.87)

Protective Inspection and Regulation - Other: $25,111,000 ($137.11)

Solid Waste Management: $24,469,000 ($133.60)

Financial Administration: $22,028,000 ($120.28)

Parking Facilities: $18,176,000 ($99.24)

Central Staff Services: $15,792,000 ($86.23)

Natural Resources - Other: $15,749,000 ($85.99)

Air Transportation: $12,308,000 ($67.20)

Regular Highways: $12,255,000 ($66.91)

Judicial and Legal Services: $5,019,000 ($27.40)

Transit Utilities: $1,189,000 ($6.49)

Housing and Community Development: $195,000 ($1.06)

- General - Interest on Debt: $13,176,000 ($71.94)

- Other Capital Outlay - Natural Resources - Other: $6,959,000 ($38.00)

Local Fire Protection: $3,785,000 ($20.67)

Police Protection: $993,000 ($5.42)

Protective Inspection and Regulation - Other: $818,000 ($4.47)

Central Staff Services: $158,000 ($0.86)

Judicial and Legal Services: $16,000 ($0.09)

Toll Highways: $16,000 ($0.09)

- Total Salaries and Wages: $419,000 ($2.29)

- Water Utilities - Interest on Debt: $18,788,000 ($102.58)

Fort Lauderdale government finances - Revenue in 2021 (per resident):

- Charges - Solid Waste Management: $20,729,000 ($113.18)

Natural Resources - Other: $18,926,000 ($103.34)

Other: $17,231,000 ($94.08)

Parking Facilities: $12,759,000 ($69.67)

Air Transportation: $4,858,000 ($26.53)

Parks and Recreation: $4,784,000 ($26.12)

- Federal Intergovernmental - Other: $42,056,000 ($229.63)

Highways: $840,000 ($4.59)

Transit Utilities: $651,000 ($3.55)

- Local Intergovernmental - General Local Government Support: $18,239,000 ($99.59)

Other: $125,000 ($0.68)

- Miscellaneous - Special Assessments: $52,255,000 ($285.32)

General Revenue - Other: $41,430,000 ($226.21)

Interest Earnings: $21,333,000 ($116.48)

Rents: $8,775,000 ($47.91)

Fines and Forfeits: $6,397,000 ($34.93)

Sale of Property: $1,106,000 ($6.04)

Donations From Private Sources: $547,000 ($2.99)

- Revenue - Water Utilities: $146,298,000 ($798.81)

- State Intergovernmental - General Local Government Support: $15,773,000 ($86.12)

Other: $2,018,000 ($11.02)

Highways: $1,452,000 ($7.93)

Housing and Community Development: $600,000 ($3.28)

Public Welfare: $207,000 ($1.13)

- Tax - Property: $164,538,000 ($898.40)

Public Utilities Sales: $39,010,000 ($213.00)

Occupation and Business License - Other: $26,961,000 ($147.21)

Other License: $17,712,000 ($96.71)

Insurance Premiums Sales: $6,610,000 ($36.09)

Fort Lauderdale government finances - Debt in 2021 (per resident):

- Long Term Debt - Outstanding Unspecified Public Purpose: $951,736,000 ($5196.60)

Beginning Outstanding - Unspecified Public Purpose: $812,484,000 ($4436.26)

Issue, Unspecified Public Purpose: $335,310,000 ($1830.83)

Retired Unspecified Public Purpose: $196,057,000 ($1070.50)

Fort Lauderdale government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $166,168,000 ($907.30)

- Other Funds - Cash and Securities: $745,468,000 ($4070.35)

- Sinking Funds - Cash and Securities: $20,577,000 ($112.35)

6.62% of this county's 2021 resident taxpayers lived in other counties in 2020 ($102,632 average adjusted gross income)

| Here: | 6.62% |

| Florida average: | 8.80% |

0.03% of residents moved from foreign countries ($231 average AGI)

Broward County: 0.03% Florida average: 0.05%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Miami-Dade County, FL | |

| from Palm Beach County, FL | |

| from Orange County, FL |

6.99% of this county's 2020 resident taxpayers moved to other counties in 2021 ($73,182 average adjusted gross income)

| Here: | 6.99% |

| Florida average: | 7.45% |

0.03% of residents moved to foreign countries ($336 average AGI)

Broward County: 0.03% Florida average: 0.04%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Miami-Dade County, FL | |

| to Palm Beach County, FL | |

| to St. Lucie County, FL |

| Businesses in Fort Lauderdale, FL | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 7-Eleven | 17 | Jones New York | 7 | |

| ALDO | 1 | KFC | 6 | |

| AT&T | 5 | La Quinta | 4 | |

| Abercrombie Kids | 1 | Lane Furniture | 1 | |

| Ace Hardware | 2 | Little Caesars Pizza | 1 | |

| Advance Auto Parts | 6 | Long John Silver's | 1 | |

| Ann Taylor | 1 | Macy's | 1 | |

| Apple Store | 1 | Marriott | 9 | |

| Applebee's | 4 | MasterBrand Cabinets | 3 | |

| Arby's | 2 | McDonald's | 3 | |

| Audi | 1 | Motherhood Maternity | 1 | |

| BMW | 2 | New Balance | 19 | |

| Barnes & Noble | 1 | Nike | 13 | |

| Baskin-Robbins | 2 | Nissan | 1 | |

| Bath & Body Works | 1 | Office Depot | 4 | |

| Bebe | 1 | Old Navy | 1 | |

| Bed Bath & Beyond | 1 | Olive Garden | 1 | |

| Bentleymotors.Com | 1 | Pac Sun | 1 | |

| Best Western | 3 | Panera Bread | 1 | |

| Blockbuster | 4 | Payless | 8 | |

| Brooks Brothers | 1 | Penske | 3 | |

| Burger King | 8 | Pier 1 Imports | 1 | |

| CVS | 10 | Pizza Hut | 3 | |

| Cache | 1 | Publix Super Markets | 8 | |

| Chevrolet | 1 | Quiznos | 2 | |

| Chico's | 2 | Ramada | 2 | |

| Cold Stone Creamery | 1 | Red Lobster | 1 | |

| Comfort Inn | 1 | Red Roof Inn | 1 | |

| Comfort Suites | 1 | Rodeway Inn | 1 | |

| Crossland Economy Studios | 1 | Ryder Rental & Truck Leasing | 1 | |

| Domino's Pizza | 6 | Sephora | 1 | |

| Dunkin Donuts | 19 | Sheraton | 2 | |

| Ethan Allen | 1 | Sprint Nextel | 3 | |

| Express | 1 | Starbucks | 9 | |

| Extended Stay America | 3 | Subway | 16 | |

| Extended Stay Deluxe | 1 | T-Mobile | 1 | |

| FedEx | 65 | Taco Bell | 2 | |

| Foot Locker | 3 | Target | 1 | |

| Ford | 1 | The Cheesecake Factory | 1 | |

| GNC | 2 | Tire Kingdom | 1 | |

| GameStop | 2 | Toys"R"Us | 2 | |

| H&R Block | 5 | Travelodge | 2 | |

| Haagen-Dazs | 1 | U-Haul | 17 | |

| Hilton | 11 | UPS | 69 | |

| Holiday Inn | 5 | Vans | 1 | |

| Home Depot | 1 | Verizon Wireless | 2 | |

| Honda | 1 | Waffle House | 1 | |

| Hyatt | 5 | Westin | 2 | |

| Jamba Juice | 2 | Whole Foods Market | 1 | |

| Jimmy John's | 1 | YMCA | 4 | |

Strongest AM radio stations in Fort Lauderdale:

- WWNN (1470 AM; 50 kW; POMPANO BEACH, FL; Owner: WWNN LICENSE, LLC)

- WEXY (1520 AM; 4 kW; WILTON MANORS, FL; Owner: MULTICULTURAL RADIO BROADCASTING, INC.)

- WRFX (940 AM; 50 kW; MIAMI, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WAQI (710 AM; 50 kW; MIAMI, FL; Owner: LICENSE CORPORATION #1)

- WFLL (1400 AM; 1 kW; FORT LAUDERDALE, FL; Owner: JAMES CRYSTAL ENTERPRISES LICENSES, L.L.C.)

- WSRF (1580 AM; 10 kW; FORT LAUDERDALE, FL; Owner: URBAN RADIO OF FLORIDA, LLC)

- WAVS (1170 AM; 5 kW; DAVIE, FL; Owner: RADIO WAVS, INC.)

- WNMA (1210 AM; 49 kW; MIAMI SPRINGS, FL; Owner: RADIO UNICA OF MIAMI LICENSE CORP.)

- WWFE (670 AM; 50 kW; MIAMI, FL; Owner: FENIX BROADCASTING CORP.)

- WFTL (850 AM; 50 kW; WEST PALM BEACH, FL; Owner: JAMES CRYSTAL ENTERPRISES II, L.L.C.)

- WSUA (1260 AM; 50 kW; MIAMI, FL; Owner: WSUA BROADCASTING CORPORATION)

- WLVJ (1040 AM; 25 kW; BOYNTON BEACH, FL; Owner: JAMES CRYSTAL BOYNTON BEACH, INC.)

- WQBA (1140 AM; 50 kW; MIAMI, FL; Owner: WQBA-AM LICENSE CORP.)

Strongest FM radio stations in Fort Lauderdale:

- WEDR (99.1 FM; MIAMI, FL; Owner: COX RADIO, INC.)

- WBGG-FM (105.9 FM; FORT LAUDERDALE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WHYI-FM (100.7 FM; FORT LAUDERDALE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WKIS (99.9 FM; BOCA RATON, FL; Owner: WKIS LICENSE LIMITED PARTNERSHIP)

- WRMA (106.7 FM; FORT LAUDERDALE, FL; Owner: WRMA LICENSING, INC.)

- WLRN-FM (91.3 FM; MIAMI, FL; Owner: THE SCHOOL BOARD OF MIAMI - DADE COUNTY, FL)

- WAFG (90.3 FM; FORT LAUDERDALE, FL; Owner: WESTMINSTER ACADEMY)

- WFLC (97.3 FM; MIAMI, FL; Owner: COX RADIO, INC.)

- WPYM (93.1 FM; MIAMI, FL; Owner: COX RADIO-MIAMI, LLC)

- WHQT (105.1 FM; CORAL GABLES, FL; Owner: COX RADIO, INC.)

- WLVE (93.9 FM; MIAMI BEACH, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WMIB (103.5 FM; FORT LAUDERDALE, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WMXJ (102.7 FM; POMPANO BEACH, FL; Owner: JEFFERSON-PILOT COMMUNICATIONS CO. OF FLORIDA)

- WPOW (96.5 FM; MIAMI, FL; Owner: WPOW LICENSE LIMITED PARTNERSHIP)

- WZTA (94.9 FM; MIAMI BEACH, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WLYF (101.5 FM; MIAMI, FL; Owner: JEFFERSON-PILOT COMMUNICATIONS CO. OF FLORIDA)

- WXDJ (95.7 FM; NORTH MIAMI BEACH, FL; Owner: WXDJ LICENSING, INC.)

- WAMR-FM (107.5 FM; MIAMI, FL; Owner: WQBA-FM LICENSE CORP.)

- WEAT-FM (104.3 FM; WEST PALM BEACH, FL; Owner: INFINITY RADIO OPERATIONS INC.)

- WRMF (97.9 FM; PALM BEACH, FL; Owner: PBB LICENSES, LLC)

TV broadcast stations around Fort Lauderdale:

- W58BU (Channel 58; HALLANDALE, FL; Owner: NBC STATIONS MANAGEMENT,INC.)

- WPPB-TV (Channel 63; BOCA RATON, FL; Owner: THE SCHOOL BOARD OF BROWARD COUNTY, FLORIDA)

- WHFT-TV (Channel 45; MIAMI, FL; Owner: TRINITY BROADCASTING OF FLORIDA, INC.)

- W24CA (Channel 24; MARATHON, FL; Owner: KEY COMMUNICATIONS OF TEXAS)

- WPBT (Channel 2; MIAMI, FL; Owner: COMMUNITY TV FOUNDATION OF S. FLORIDA, INC.)

- WAMI-TV (Channel 69; HOLLYWOOD, FL; Owner: TELEFUTURA MIAMI LLC)

- WSVN (Channel 7; MIAMI, FL; Owner: SUNBEAM TELEVISION CORP.)

- WSCV (Channel 51; FORT LAUDERDALE, FL; Owner: TELEMUNDO OF FLORIDA LICENSE CORP.)

- WLRN-TV (Channel 17; MIAMI, FL; Owner: THE SCHOOL BOARD OF MIAMI - DADE COUNTY, FL)

- WPLG (Channel 10; MIAMI, FL; Owner: POST-NEWSWEEK STATIONS, FLORIDA, INC.)

- WLTV (Channel 23; MIAMI, FL; Owner: WLTV LICENSE PARTNERSHIP, G.P.)

- WBFS-TV (Channel 33; MIAMI, FL; Owner: VIACOM STATIONS GROUP OF MIAMI INC.)

- WPXM (Channel 35; MIAMI, FL; Owner: PAXSON COMMUNICATIONS LICENSE COMPANY, LLC)

- WHDT-LP (Channel 44; MIAMI, FL; Owner: GUENTER MARKSTEINER)

- WLMF-LP (Channel 53; MIAMI, FL; Owner: PAGING SYSTEMS, INC.)

- WBZL (Channel 39; MIAMI, FL; Owner: CHANNEL 39, INC.)

- WDLP-CA (Channel 21; POMPANO BEACH, FL; Owner: WDLP BROADCASTING COMPANY, LLC)

- WFUN-CA (Channel 48; MIAMI, ETC., FL; Owner: LOCALONE TEXAS, LTD.)

- WPTV (Channel 5; WEST PALM BEACH, FL; Owner: SCRIPPS HOWARD BROADCASTING COMPANY)

- WFLX (Channel 29; WEST PALM BEACH, FL; Owner: RAYCOM NATIONAL, INC.)

- WXEL-TV (Channel 42; WEST PALM BEACH, FL; Owner: BARRY TELECOMMUNICATIONS, INC.)

- WTVJ (Channel 6; MIAMI, FL; Owner: NBC STATIONS MANAGEMENT, INC.)

- WPEC (Channel 12; WEST PALM BEACH, FL; Owner: FREEDOM BROADCASTING OF FLORIDA, INC)

- WFGC (Channel 61; PALM BEACH, FL; Owner: CHRISTIAN TELEVISION OF PALM BEACH COUNTY, INC.)

- WGEN-LP (Channel 55; MIAMI, FL; Owner: WDLP BROADCASTING COMPANY, LLC)

- National Bridge Inventory (NBI) Statistics

- 213Number of bridges

- 5,591ft / 1,704mTotal length

- $743,000Total costs

- 6,288,142Total average daily traffic

- 490,624Total average daily truck traffic

- New bridges - historical statistics

- 41920-1929

- 21930-1939

- 31940-1949

- 211950-1959

- 231960-1969

- 391970-1979

- 351980-1989

- 591990-1999

- 52000-2009

- 182010-2019

- 42020-2022

FCC Registered Commercial Land Mobile Towers: 5 (See the full list of FCC Registered Commercial Land Mobile Towers in Fort Lauderdale, FL)

FCC Registered Private Land Mobile Towers: 20 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 192 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 138 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 17 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 141 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 1,145 (See the full list of FCC Registered Amateur Radio Licenses in Fort Lauderdale)

FAA Registered Aircraft Manufacturers and Dealers: 178 (See the full list of FAA Registered Manufacturers and Dealers in Fort Lauderdale)

FAA Registered Aircraft: 777 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 27 full and 12 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 319 | $181,777 | 818 | $302,074 | 1,133 | $275,334 | 41 | $219,916 | 20 | $2,505,094 | 452 | $269,408 | 0 | $0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 21 | $195,415 | 134 | $352,723 | 198 | $240,489 | 22 | $96,950 | 3 | $1,880,000 | 70 | $232,860 | 1 | $29,940 |

| APPLICATIONS DENIED | 118 | $166,033 | 372 | $271,741 | 1,057 | $290,040 | 67 | $81,397 | 2 | $984,000 | 358 | $226,625 | 3 | $62,390 |

| APPLICATIONS WITHDRAWN | 60 | $174,146 | 171 | $293,373 | 422 | $275,684 | 14 | $293,426 | 1 | $744,190 | 109 | $260,017 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 21 | $165,541 | 54 | $235,260 | 148 | $295,283 | 5 | $135,930 | 0 | $0 | 30 | $277,768 | 0 | $0 |

Detailed mortgage data for all 37 tracts in Fort Lauderdale, FL

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 22 full and 9 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 35 | $220,878 | 4 | $185,578 | 0 | $0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 43 | $277,545 | 5 | $255,834 | 5 | $203,000 |

| APPLICATIONS DENIED | 17 | $276,131 | 3 | $215,847 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 5 | $130,346 | 1 | $68,760 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 10 | $246,125 | 2 | $208,875 | 2 | $421,000 |

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Fort Lauderdale, FL

- 1,89139.4%Structure Fires

- 1,55432.4%Outside Fires

- 1,16724.3%Mobile Property/Vehicle Fires

- 1853.9%Other

Based on the data from the years 2002 - 2018 the average number of fires per year is 282. The highest number of reported fire incidents - 606 took place in 2018, and the least - 0 in 2016. The data has an increasing trend.

Based on the data from the years 2002 - 2018 the average number of fires per year is 282. The highest number of reported fire incidents - 606 took place in 2018, and the least - 0 in 2016. The data has an increasing trend. When looking into fire subcategories, the most incidents belonged to: Structure Fires (39.4%), and Outside Fires (32.4%).

When looking into fire subcategories, the most incidents belonged to: Structure Fires (39.4%), and Outside Fires (32.4%).Fire-safe hotels and motels in Fort Lauderdale, Florida:

- Fort Lauderdale Marriott North, 6650 N Andrews Ave, Fort Lauderdale, Florida 33309 , Phone: (800) 228-9290, Fax: (954) 771-7519

- Golden West Motel, 710 N Birch Rd, Fort Lauderdale, Florida 33304

- Cascades Motel, 4117 N Ocean Blvd, Fort Lauderdale, Florida 33308

- America's Best Inn-Fort Lauderdale Airport, 3001 SE 6TH Ave, Fort Lauderdale, Florida 33316 , Phone: (954) 462-9175, Fax: (954) 523-1580

- Econolodge, 1 N Atlantic Blvd, Fort Lauderdale, Florida 33304

- Holiday Park Motel & Apartments, 614 Ne 6TH Ter, Fort Lauderdale, Florida 33304

- Relax Inn, 1851 S Federal Hwy, Fort Lauderdale, Florida 33316

- Ocean Park Motel, 2115 N Ocean Blvd, Fort Lauderdale, Florida 33305

- 98 other hotels and motels

| Most common first names in Fort Lauderdale, FL among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| John | 4,798 | 73.9 years |

| William | 4,099 | 74.9 years |

| Mary | 3,629 | 79.8 years |

| Joseph | 3,454 | 76.2 years |

| Robert | 3,068 | 70.2 years |

| James | 2,815 | 70.5 years |

| Charles | 2,535 | 75.2 years |

| George | 2,495 | 76.3 years |

| Helen | 2,429 | 80.5 years |

| Ruth | 1,888 | 80.2 years |

| Most common last names in Fort Lauderdale, FL among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 1,420 | 74.1 years |

| Brown | 960 | 72.7 years |

| Williams | 918 | 69.3 years |

| Johnson | 910 | 72.9 years |

| Miller | 896 | 76.6 years |

| Cohen | 825 | 79.4 years |

| Davis | 690 | 73.8 years |

| Jones | 678 | 71.1 years |

| Schwartz | 452 | 80.3 years |

| Anderson | 439 | 75.5 years |

- 90.0%Electricity

- 5.2%No fuel used

- 3.2%Utility gas

- 0.9%Bottled, tank, or LP gas

- 0.3%Solar energy

- 0.2%Fuel oil, kerosene, etc.

- 90.4%Electricity

- 6.9%No fuel used

- 2.0%Utility gas

- 0.4%Bottled, tank, or LP gas

- 0.1%Other fuel

Fort Lauderdale compared to Florida state average:

- Unemployed percentage below state average.

- Black race population percentage above state average.

- Foreign-born population percentage above state average.

- Number of rooms per house below state average.

- Percentage of population with a bachelor's degree or higher above state average.

Fort Lauderdale, FL compared to other similar cities:

Fort Lauderdale on our top lists:

- #2 on the list of "Top 101 cities with the largest percentage of likely homosexual households (counted as self-reported same-sex unmarried-partner households) (population 50,000+)"

- #2 on the list of "Top 101 cities with the largest percentage of likely gay men couples (counted as self-reported male-male unmarried-partner households) (population 50,000+)"

- #6 on the list of "Top 101 cities with the largest house values disparities (population 50,000+)"

- #7 on the list of "Top 100 cities with the largest percentage of males (pop. 50,000+)"

- #7 on the list of "Top 101 cities with largest percentage of males in industries: real estate and rental and leasing (population 50,000+)"

- #19 on the list of "Top 101 cities with the highest cost per building permit(population 50,000+)"

- #20 on the list of "Top 101 cities with largest percentage of females in occupations: transportation occupations (population 50,000+)"

- #20 on the list of "Top 101 cities with the largest household incomes disparities (population 50,000+)"

- #21 on the list of "Top 101 cities with the largest percentage of unmarried partner households (population 50,000+)"

- #21 on the list of "Top 101 cities with the highest average yearly precipitation (population 50,000+)"

- #26 on the list of "Top 101 cities with the lowest percentage of family households, population 100,000+"

- #27 on the list of "Top 101 cities with the highest number of robberies per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #29 on the list of "Top 101 cities with the highest average temperatures (population 50,000+)"

- #30 on the list of "Top 101 cities that people commute into (largest positive percentage daily daytime population change due to commuting) (population 50,000+)"

- #32 on the list of "Top 101 cities with the most residents born in Other South Eastern Asia (population 500+)"

- #33 on the list of "Top 101 cities with the smallest differences between daily high and daily low temperatures (population 50,000+)"

- #35 on the list of "Top 100 cities with strongest arts, entertainment, recreation, accommodation and food services industries (pop. 50,000+)"

- #36 on the list of "Top 101 cities with largest percentage of females in occupations: legal occupations (population 50,000+)"

- #37 on the list of "Top 101 cities with largest percentage of females in occupations: law enforcement workers including supervisors (population 50,000+)"

- #37 on the list of "Top 100 cities with smallest houses (pop. 50,000+)"

- #22 (33301) on the list of "Top 101 zip codes with the most offices of lawyers in 2005"

- #22 (33301) on the list of "Top 101 zip codes with the most museums in 2005"

- #29 (33304) on the list of "Top 101 zip codes with the most hotels or motels in 2005"

- #35 (33309) on the list of "Top 101 zip codes with the most Internet business establishments in 2005"

- #41 (33319) on the list of "Top 101 zip codes with the largest percentage of West Indian first ancestries"

- #57 (33309) on the list of "Top 101 zip codes with the most finance and insurance companies in 2005"

- #76 (33308) on the list of "Top 101 zip codes with the most offices of physicians in 2005"

- #84 (33309) on the list of "Top 101 zip codes with the most medium-big companies in 2005 (at least 100 employees)"

- #90 (33301) on the list of "Top 101 zip codes with the highest 2012 average taxable interest for individuals (pop 5,000+)"

- #7 on the list of "Top 101 counties with the highest ground withdrawal of fresh water for public supply"

- #15 on the list of "Top 101 counties with the most Evangelical Protestant congregations"

- #18 on the list of "Top 101 counties with the most Evangelical Protestant adherents"

- #20 on the list of "Top 101 counties with the lowest average weight of females"

- #24 on the list of "Top 101 counties with the highest total withdrawal of fresh water for public supply (pop. 50,000+)"

|

|

Total of 1262 patent applications in 2008-2024.