Gates-North Gates, New York

Submit your own pictures of this place and show them to the world

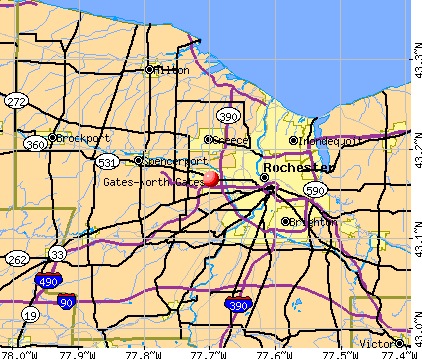

- OSM Map

- General Map

- Google Map

- MSN Map

| Males: 7,148 | |

| Females: 7,817 |

| Median resident age: | 39.0 years |

| New York median age: | 35.9 years |

Zip codes: 14606.

| Gates-North Gates: | $63,564 |

| NY: | $79,557 |

Estimated per capita income in 2022: $35,511 (it was $20,027 in 2000)

Gates-North Gates CDP income, earnings, and wages data

Estimated median house or condo value in 2022: $174,629 (it was $85,700 in 2000)

| Gates-North Gates: | $174,629 |

| NY: | $400,400 |

Mean prices in 2022: all housing units: $223,138; detached houses: $228,957; townhouses or other attached units: $212,541; in 2-unit structures: $243,541; in 3-to-4-unit structures: $249,438; in 5-or-more-unit structures: $387,764; mobile homes: $74,393; occupied boats, rvs, vans, etc.: $198,823

Gates-North Gates, NY residents, houses, and apartments details

Detailed information about poverty and poor residents in Gates-North Gates, NY

- 13,07186.3%White alone

- 9136.0%Black alone

- 4973.3%Hispanic

- 4212.8%Asian alone

- 1881.2%Two or more races

- 240.2%American Indian alone

- 190.1%Other race alone

- 50.03%Native Hawaiian and Other

Pacific Islander alone

Races in Gates-North Gates detailed stats: ancestries, foreign born residents, place of birth

Ancestries: Italian (36.0%), German (17.0%), Irish (12.6%), English (7.3%), Polish (4.5%), United States (3.3%).

Current Local Time: EST time zone

Land area: 4.65 square miles.

Population density: 3,215 people per square mile (average).

1,733 residents are foreign born (6.8% Europe, 2.6% Asia, 1.3% Latin America).

| This place: | 11.4% |

| New York: | 20.4% |

| Gates-North Gates CDP: | 2.6% ($2,196) |

| New York: | 1.9% ($2,847) |

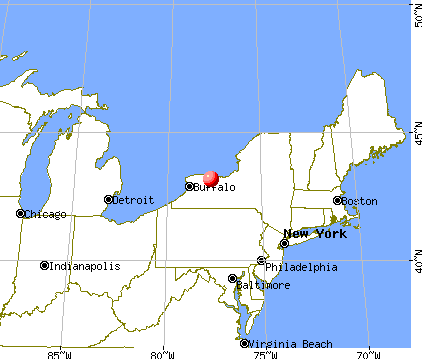

Nearest city with pop. 50,000+: Rochester, NY (4.4 miles

, pop. 219,773).

Nearest city with pop. 1,000,000+: Manhattan, NY (253.3 miles

, pop. 1,537,195).

Nearest cities:

Latitude: 43.17 N, Longitude: 77.70 W

Daytime population change due to commuting: -3,359 (-22.2%)

Workers who live and work in this place: 609 (8.5%)

Area code commonly used in this area: 585

| Here: | 4.1% |

| New York: | 4.4% |

- Machinery (8.9%)

- Educational services (8.3%)

- Health care (7.9%)

- Accommodation & food services (7.3%)

- Food & beverage stores (5.2%)

- Transportation equipment (4.1%)

- Finance & insurance (3.9%)

- Machinery (11.9%)

- Construction (6.2%)

- Accommodation & food services (6.1%)

- Transportation equipment (5.6%)

- Food & beverage stores (5.2%)

- Administrative & support & waste management services (4.8%)

- Educational services (4.4%)

- Health care (13.6%)

- Educational services (12.3%)

- Accommodation & food services (8.4%)

- Finance & insurance (6.6%)

- Machinery (5.9%)

- Professional, scientific, technical services (5.3%)

- Food & beverage stores (5.2%)

- Other production occupations, including supervisors (5.8%)

- Other office and administrative support workers, including supervisors (5.2%)

- Metal workers and plastic workers (4.9%)

- Assemblers and fabricators (4.5%)

- Secretaries and administrative assistants (3.8%)

- Material recording, scheduling, dispatching, and distributing workers (3.5%)

- Other sales and related occupations, including supervisors (3.4%)

- Other production occupations, including supervisors (8.2%)

- Metal workers and plastic workers (8.0%)

- Material recording, scheduling, dispatching, and distributing workers (5.7%)

- Driver/sales workers and truck drivers (5.1%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (5.1%)

- Assemblers and fabricators (4.0%)

- Other sales and related occupations, including supervisors (3.8%)

- Other office and administrative support workers, including supervisors (8.9%)

- Secretaries and administrative assistants (7.6%)

- Assemblers and fabricators (4.9%)

- Customer service representatives (4.4%)

- Cashiers (4.2%)

- Information and record clerks, except customer service representatives (4.1%)

- Other production occupations, including supervisors (3.5%)

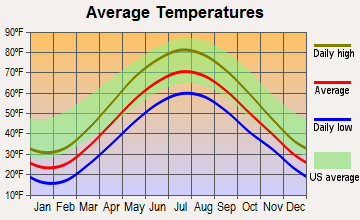

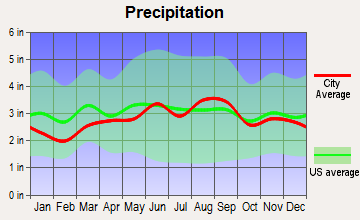

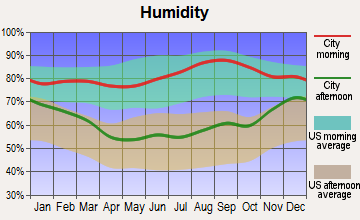

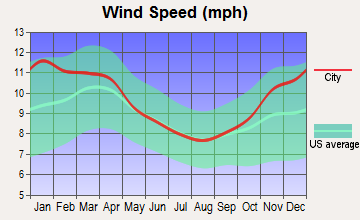

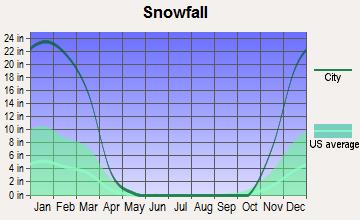

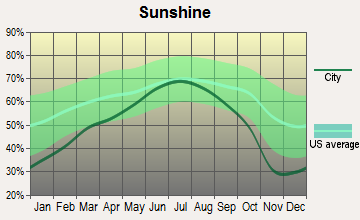

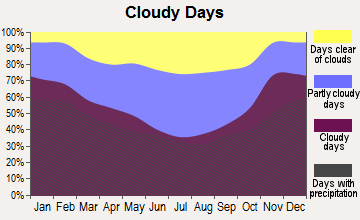

Average climate in Gates-North Gates, New York

Based on data reported by over 4,000 weather stations

(lower is better)

Air Quality Index (AQI) level in 2023 was 88.5. This is worse than average.

| City: | 88.5 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2023 was 0.225. This is about average. Closest monitor was 4.3 miles away from the city center.

| City: | 0.225 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2011 was 8.11. This is significantly worse than average. Closest monitor was 4.8 miles away from the city center.

| City: | 8.11 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2023 was 0.128. This is significantly better than average. Closest monitor was 2.6 miles away from the city center.

| City: | 0.128 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2023 was 31.3. This is about average. Closest monitor was 4.8 miles away from the city center.

| City: | 31.3 |

| U.S.: | 33.3 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 9.83. This is worse than average. Closest monitor was 4.8 miles away from the city center.

| City: | 9.83 |

| U.S.: | 8.11 |

Earthquake activity:

Gates-North Gates-area historical earthquake activity is significantly above New York state average. It is 68% smaller than the overall U.S. average.On 10/7/1983 at 10:18:46, a magnitude 5.3 (5.1 MB, 5.3 LG, 5.1 ML, Class: Moderate, Intensity: VI - VII) earthquake occurred 176.8 miles away from the city center

On 9/25/1998 at 19:52:52, a magnitude 5.2 (4.8 MB, 4.3 MS, 5.2 LG, 4.5 MW, Depth: 3.1 mi) earthquake occurred 180.1 miles away from Gates-North Gates center

On 4/20/2002 at 10:50:47, a magnitude 5.3 (5.3 ML, Depth: 3.0 mi) earthquake occurred 220.2 miles away from Gates-North Gates center

On 4/20/2002 at 10:50:47, a magnitude 5.2 (5.2 MB, 4.2 MS, 5.2 MW, 5.0 MW) earthquake occurred 218.6 miles away from Gates-North Gates center

On 1/31/1986 at 16:46:43, a magnitude 5.0 (5.0 MB) earthquake occurred 207.3 miles away from Gates-North Gates center

On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi) earthquake occurred 363.8 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Monroe County (17) is near the US average (15).Major Disasters (Presidential) Declared: 10

Emergencies Declared: 6

Causes of natural disasters: Floods: 5, Storms: 5, Winter Storms: 3, Hurricanes: 2, Ice Storms: 2, Blizzard: 1, Power Outage: 1, Tropical Storm: 1, Wind: 1, Other: 2 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers near Gates-North Gates:

- UNITY HOSPITAL OF ROCHESTER - PARK RIDGE CAMPUS (Dialysis Facility, about 2 miles away; ROCHESTER, NY)

- UNITY HOSPITAL OF ROCHESTER Acute Care Hospitals (about 2 miles away; ROCHESTER, NY)

- PARK RIDGE NURSING HOME (Nursing Home, about 2 miles away; ROCHESTER, NY)

- WESTGATE NURSING HOME (Nursing Home, about 3 miles away; ROCHESTER, NY)

- UNITY HOSPITAL OF ROCHESTER - ST. MARY'S (Dialysis Facility, about 4 miles away; ROCHESTER, NY)

- ST MARYS HOSPITAL (Hospital, about 4 miles away; ROCHESTER, NY)

- ST MARYS HOSPITAL BRAIN INJURY UNIT (Nursing Home, about 4 miles away; ROCHESTER, NY)

Amtrak station near Gates-North Gates:

Operable nuclear power plant near Gates-North Gates:

- 5 miles: R.E. Ginna in Rochester, NY.

Colleges/universities with over 2000 students nearest to Gates-North Gates:

- University of Rochester (about 5 miles; Rochester, NY; Full-time enrollment: 10,201)

- Rochester Institute of Technology (about 6 miles; Rochester, NY; FT enrollment: 14,177)

- Monroe Community College (about 7 miles; Rochester, NY; FT enrollment: 14,295)

- Saint John Fisher College (about 10 miles; Rochester, NY; FT enrollment: 3,373)

- Nazareth College (about 11 miles; Rochester, NY; FT enrollment: 2,632)

- SUNY College at Brockport (about 14 miles; Brockport, NY; FT enrollment: 7,398)

- Genesee Community College (about 25 miles; Batavia, NY; FT enrollment: 4,290)

Points of interest:

Notable location: Gates Ambulance Service (A). Display/hide its location on the map

Shopping Center: Gateway Plaza Shopping Center (1). Display/hide its location on the map

Churches in Gates-North Gates include: Elmgrove United Church (A), Gates Wesleyan Church (B), Trinity Alliance Church (C), Saint Nicholas Church (D), Saint Theodores Church (E), Alliance Church (F). Display/hide their locations on the map

| This place: | 2.4 people |

| New York: | 2.6 people |

| This place: | 66.8% |

| Whole state: | 66.2% |

| This place: | 5.1% |

| Whole state: | 5.4% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.2% of all households

- Gay men: 0.2% of all households

| This place: | 6.8% |

| Whole state: | 14.6% |

| This place: | 3.6% |

| Whole state: | 7.4% |

People in group quarters in Gates-North Gates in 2000:

- 11 people in other group homes

- 8 people in homes or halfway houses for drug/alcohol abuse

- 4 people in religious group quarters

For population 15 years and over in Gates-North Gates:

- Never married: 23.6%

- Now married: 54.2%

- Separated: 2.2%

- Widowed: 8.3%

- Divorced: 11.7%

For population 25 years and over in Gates-North Gates:

- High school or higher: 77.6%

- Bachelor's degree or higher: 13.6%

- Graduate or professional degree: 4.0%

- Unemployed: 3.4%

- Mean travel time to work (commute): 16.9 minutes

| Here: | 11.4 |

| New York average: | 14.2 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Gates-North Gates, NY (based on Monroe County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 191,112 | 65 |

| Evangelical Protestant | 60,385 | 240 |

| Mainline Protestant | 53,463 | 151 |

| Other | 28,550 | 74 |

| Black Protestant | 9,459 | 30 |

| Orthodox | 2,038 | 11 |

| None | 399,337 | - |

Food Environment Statistics:

| Monroe County: | 2.39 / 10,000 pop. |

| New York: | 4.13 / 10,000 pop. |

| This county: | 0.10 / 10,000 pop. |

| New York: | 0.06 / 10,000 pop. |

| This county: | 0.96 / 10,000 pop. |

| New York: | 0.92 / 10,000 pop. |

| Monroe County: | 2.32 / 10,000 pop. |

| State: | 1.68 / 10,000 pop. |

| This county: | 7.54 / 10,000 pop. |

| New York: | 8.82 / 10,000 pop. |

| Here: | 7.9% |

| New York: | 8.2% |

| Monroe County: | 26.4% |

| New York: | 23.8% |

| This county: | 13.4% |

| State: | 15.6% |

3.45% of this county's 2021 resident taxpayers lived in other counties in 2020 ($64,907 average adjusted gross income)

| Here: | 3.45% |

| New York average: | 5.29% |

0.01% of residents moved from foreign countries ($70 average AGI)

Monroe County: 0.01% New York average: 0.01%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Ontario County, NY | |

| from Wayne County, NY | |

| from Erie County, NY |

4.11% of this county's 2020 resident taxpayers moved to other counties in 2021 ($66,936 average adjusted gross income)

| Here: | 4.11% |

| New York average: | 6.93% |

0.01% of residents moved to foreign countries ($84 average AGI)

Monroe County: 0.01% New York average: 0.02%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Ontario County, NY | |

| to Wayne County, NY | |

| to Livingston County, NY |

Strongest AM radio stations in Gates-North Gates:

- WHAM (1180 AM; 50 kW; ROCHESTER, NY; Owner: CITICASTERS LICENSES, L.P.)

- WHTK (1280 AM; 5 kW; ROCHESTER, NY)

- WHIC (1460 AM; 5 kW; ROCHESTER, NY; Owner: HOLY FAMILY COMMUNICATIONS)

- WXXI (1370 AM; 5 kW; ROCHESTER, NY; Owner: WXXI PUBLIC BROADCASTING COUNCIL)

- WLGZ (990 AM; 5 kW; ROCHESTER, NY; Owner: KIMTRON, INC.)

- WROC (950 AM; 1 kW; ROCHESTER, NY)

- WWKB (1520 AM; 50 kW; BUFFALO, NY; Owner: ENTERCOM BUFFALO LICENSE, LLC)

- WYSL (1040 AM; 2 kW; AVON, NY; Owner: RADIO LIVINGSTON, LTD)

- WASB (1590 AM; 1 kW; BROCKPORT, NY; Owner: DAVID L. WOLFE)

- WACK (1420 AM; 5 kW; NEWARK, NY; Owner: PEMBROOK PINES, INC.)

- WTOR (770 AM; daytime; 9 kW; YOUNGSTOWN, NY; Owner: BIRACH BROADCASTING CORPORATION)

- WGR (550 AM; 5 kW; BUFFALO, NY; Owner: ENTERCOM BUFFALO LICENSE, LLC)

- WABH (1380 AM; 10 kW; BATH, NY)

Strongest FM radio stations in Gates-North Gates:

- WRMM-FM (101.3 FM; ROCHESTER, NY; Owner: INFINITY RADIO OPERATIONS INC.)

- WBZA (98.9 FM; ROCHESTER, NY; Owner: ENTERCOM ROCHESTER LICENSE, LLC.)

- WDCZ-FM (102.7 FM; WEBSTER, NY; Owner: KIMTRON, INC.)

- WDKX (103.9 FM; ROCHESTER, NY; Owner: MONROE COUNTY BROADCASTING CO., LTD.)

- WKGS (106.7 FM; IRONDEQUOIT, NY; Owner: CITICASTERS LICENSES, L.P.)

- WRUR-FM (88.5 FM; ROCHESTER, NY; Owner: UNIVERSITY OF ROCHESTER B/CAST CORP.)

- WCMF-FM (96.5 FM; ROCHESTER, NY; Owner: INFINITY RADIO OPERATIONS INC.)

- WXXI-FM (91.5 FM; ROCHESTER, NY; Owner: WXXI PUBLIC BROADCASTING COUNCIL)

- W238AB (95.5 FM; ROCHESTER, NY; Owner: CITICASTERS LICENSES, L.P.)

- WZNE (94.1 FM; BRIGHTON, NY; Owner: INFINITY RADIO OPERATIONS INC.)

- WPXY-FM (97.9 FM; ROCHESTER, NY; Owner: INFINITY RADIO OPERATIONS INC.)

- W220DE (91.9 FM; GREECE, NY; Owner: FAMILY LIFE MINISTRIES, INC.)

- WBEE-FM (92.5 FM; ROCHESTER, NY; Owner: ENTERCOM ROCHESTER LICENSE, LLC.)

- WMJQ (105.5 FM; BROCKPORT, NY; Owner: CANANDAIGUA BROADCASTING, INC.)

- WJZR (105.9 FM; ROCHESTER, NY; Owner: NORTH COAST RADIO, INC.)

- WBBF-FM (93.3 FM; FAIRPORT, NY; Owner: ENTERCOM ROCHESTER LICENSE, LLC.)

- WGMC (90.1 FM; GREECE, NY; Owner: GREECE CENTRAL SCHOOL DISTRICT)

- WITR (89.7 FM; HENRIETTA, NY; Owner: ROCHESTER INSTITUTE OF TECHNOLOGY)

- WZXV (99.7 FM; PALMYRA, NY; Owner: CALVARY CHAPEL OF FINGER LAKES, INC.)

- WVOR-FM (100.5 FM; ROCHESTER, NY; Owner: CITICASTERS LICENSES, L.P.)

TV broadcast stations around Gates-North Gates:

- WGCE-CA (Channel 6; GREECE/ROCHESTER, NY; Owner: SALVATORE J. CATERINO)

- WBXO-LP (Channel 15; ROCHESTER, NY; Owner: METRO TV, INC.)

- WUHF (Channel 31; ROCHESTER, NY; Owner: WUHF LICENSEE, LLC)

- WOKR (Channel 13; ROCHESTER, NY; Owner: CENTRAL NY NEWS, INC.)

- WHEC-TV (Channel 10; ROCHESTER, NY; Owner: WHEC-TV, LLC)

- W42CO (Channel 42; ROCHESTER, NY; Owner: TRI-STATE CHRISTIAN TV, INC.)

- WXXI-TV (Channel 21; ROCHESTER, NY; Owner: WXXI PUBLIC BROADCASTING COUNCIL)

- WROC-TV (Channel 8; ROCHESTER, NY; Owner: NEXSTAR BROADCASTING OF ROCHESTER, LLC)

- WBGT-LP (Channel 40; ROCHESTER, NY; Owner: WBGT, LLC)

- WPXJ-TV (Channel 51; BATAVIA, NY; Owner: PAXSON BUFFALO LICENSE, INC.)

- WAWW-LP (Channel 38; ROCHESTER, NY; Owner: VENTURE TECHNOLOGIES GROUP, LLC)

- WROH-LP (Channel 47; ROCHESTER, NY; Owner: TIGER EYE BROADCASTING CORPORATION)

- W26BZ (Channel 26; VICTOR, NY; Owner: WBGT, LLC)

Gates-North Gates fatal accident list:

Apr 17, 1988 01:02 PM, I490, Vehicles: 2, Persons: 4, Fatalities: 1

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 3 full tracts) | ||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 129 | $95,581 | 43 | $85,233 | 124 | $80,000 | 38 | $16,421 | 7 | $66,714 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 6 | $84,500 | 3 | $90,000 | 9 | $77,444 | 7 | $24,000 | 1 | $8,000 |

| APPLICATIONS DENIED | 15 | $89,867 | 9 | $85,333 | 64 | $96,516 | 24 | $14,833 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 6 | $85,667 | 2 | $107,500 | 36 | $85,750 | 2 | $101,000 | 2 | $70,500 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 1 | $95,000 | 12 | $89,750 | 2 | $83,500 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 0142.03 , 0143.01, 0143.02

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 3 full tracts) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 13 | $87,077 | 12 | $112,750 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 1 | $91,000 | 1 | $180,000 |

| APPLICATIONS DENIED | 0 | $0 | 1 | $164,000 |

| APPLICATIONS WITHDRAWN | 2 | $86,000 | 2 | $81,500 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 0142.03 , 0143.01, 0143.02

- 94.1%Utility gas

- 2.5%Fuel oil, kerosene, etc.

- 2.4%Electricity

- 0.6%Wood

- 0.4%Bottled, tank, or LP gas

- 59.8%Utility gas

- 34.6%Electricity

- 2.1%Bottled, tank, or LP gas

- 1.8%Other fuel

- 1.4%No fuel used

- 0.4%Fuel oil, kerosene, etc.

Gates-North Gates compared to New York state average:

- Median house value significantly below state average.

- Unemployed percentage significantly below state average.

- Black race population percentage below state average.

- Hispanic race population percentage significantly below state average.

- Foreign-born population percentage below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

- Percentage of population with a bachelor's degree or higher below state average.

Gates-North Gates on our top lists:

- #7 on the list of "Top 101 cities with largest percentage of females in industries: machinery (population 5,000+)"

- #9 on the list of "Top 101 cities with largest percentage of females in industries: metals and minerals, except petroleum, merchant wholesalers (population 5,000+)"

- #12 on the list of "Top 101 cities with largest percentage of males in industries: machinery (population 5,000+)"

- #24 on the list of "Top 101 cities with largest percentage of females in occupations: assemblers and fabricators (population 5,000+)"

- #26 on the list of "Top 101 cities with largest percentage of males in industries: food and beverage stores (population 5,000+)"

- #31 on the list of "Top 101 cities with largest percentage of males in occupations: assemblers and fabricators (population 5,000+)"

- #33 on the list of "Top 101 cities with largest percentage of males in occupations: cashiers (population 5,000+)"

- #36 on the list of "Top 101 cities with largest percentage of males in occupations: material recording, scheduling, dispatching, and distributing workers (population 5,000+)"

- #40 on the list of "Top 101 cities with largest percentage of females in industries: miscellaneous manufacturing (population 5,000+)"

- #41 on the list of "Top 101 cities with largest percentage of males in industries: paper and paper products merchant wholesalers (population 5,000+)"

- #45 on the list of "Top 101 cities with largest percentage of females in occupations: drafters, engineering, and mapping technicians (population 5,000+)"

- #48 on the list of "Top 101 cities with the smallest racial income disparities between White and Black householders (with at least 200 householders)"

- #51 on the list of "Top 101 cities with largest percentage of males in occupations: metal workers and plastic workers (population 5,000+)"

- #52 on the list of "Top 101 cities with largest percentage of males in industries: printing and related support activities (population 5,000+)"

- #80 on the list of "Top 101 cities with the smallest house values disparities (population 5,000+)"

- #98 on the list of "Top 101 cities with largest percentage of males in industries: broadcasting and telecommunications (population 5,000+)"

- #101 on the list of "Top 101 cities with largest percentage of males in industries: beverage and tobacco products (population 5,000+)"

- #20 on the list of "Top 101 counties with the highest percentage of residents that visited a dentist within the past year"

- #21 on the list of "Top 101 counties with the largest increase in the number of infant deaths per 1000 residents 2000-2006 to 2007-2013 (pop. 50,000+)"

- #22 on the list of "Top 101 counties with the lowest percentage of residents relocating from other counties between 2010 and 2011 (pop. 50,000+)"

- #33 on the list of "Top 101 counties with the lowest percentage of residents relocating to other counties in 2011"

- #35 on the list of "Top 101 counties with the most Catholic congregations (pop. 50,000+)"