Huntsville, Alabama

Huntsville: Jones Valley in Huntsville

Huntsville: Fall Cotton and Fall Leaves

Huntsville: Downtown Huntsville and Big Spring Park taken from Embassy Suites Hotel

Huntsville: Saturn V Rocket at U.S. Space and Rocket Center

Huntsville: Owl in monte sano state park

Huntsville: Downtown Basin Area Park

Huntsville: Fall Cotton and Fall Leaves

Huntsville: Embassy Suites at Von Braun Civic Center

Huntsville: Big Spring Park downtown

Huntsville: Blackbird at Space and Rocket Center

Huntsville: Old abandoned railroad in south Huntsville. User comment: This rail line in not abandoned. Huntsville Madison County Rail Road Association runs freight service on this line.

- see

33

more - add

your

Submit your own pictures of this city and show them to the world

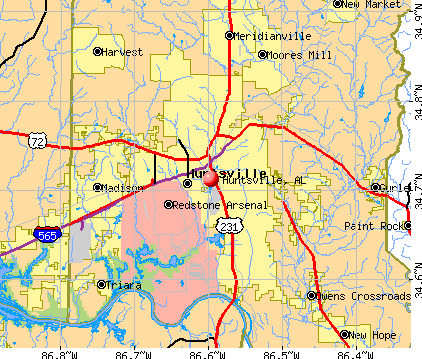

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +40.3%

| Males: 110,668 | |

| Females: 111,265 |

| Median resident age: | 36.8 years |

| Alabama median age: | 39.6 years |

Zip codes: 35649, 35741, 35757, 35758, 35759, 35763, 35801, 35802, 35803, 35805, 35806, 35808, 35810, 35811, 35816, 35824, 35896.

Huntsville Zip Code Map| Huntsville: | $68,930 |

| AL: | $59,674 |

Estimated per capita income in 2022: $45,819 (it was $24,015 in 2000)

Huntsville city income, earnings, and wages data

Estimated median house or condo value in 2022: $294,700 (it was $95,600 in 2000)

| Huntsville: | $294,700 |

| AL: | $200,900 |

Mean prices in 2022: all housing units: $358,833; detached houses: $373,670; townhouses or other attached units: $237,598; in 3-to-4-unit structures: $148,927; in 5-or-more-unit structures: $180,177; mobile homes: $32,038

Median gross rent in 2022: $1,074.

(8.5% for White Non-Hispanic residents, 23.2% for Black residents, 24.7% for Hispanic or Latino residents, 20.6% for American Indian residents, 38.9% for Native Hawaiian and other Pacific Islander residents, 28.8% for other race residents, 17.0% for two or more races residents)

Detailed information about poverty and poor residents in Huntsville, AL

- 129,53658.3%White alone

- 63,29628.5%Black alone

- 13,2075.9%Hispanic

- 9,9624.5%Two or more races

- 4,2721.9%Asian alone

- 1,1120.5%Other race alone

- 7630.3%American Indian alone

- 2150.10%Native Hawaiian and Other

Pacific Islander alone

According to our research of Alabama and other state lists, there were 157 registered sex offenders living in Huntsville, Alabama as of April 23, 2024.

The ratio of all residents to sex offenders in Huntsville is 1,250 to 1.

The ratio of registered sex offenders to all residents in this city is much lower than the state average.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is smaller than the state average.- means the value is about the same as the state average.

- means the value is bigger than the state average.

- means the value is much bigger than the state average.

Crime rate in Huntsville detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 529 (435 officers - 394 male; 41 female).

| Officers per 1,000 residents here: | 2.12 |

| Alabama average: | 2.40 |

Latest news from Huntsville, AL collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: American (13.8%), English (9.7%), Irish (4.9%), German (4.7%), European (3.0%), Scottish (1.3%).

Current Local Time: CST time zone

Incorporated in 1811

Elevation: 641 feet

Land area: 174.0 square miles.

Population density: 1,275 people per square mile (low).

13,647 residents are foreign born (2.7% Latin America, 1.8% Asia, 0.8% Europe, 0.6% Africa).

| This city: | 6.1% |

| Alabama: | 3.5% |

Median real estate property taxes paid for housing units with mortgages in 2022: $1,203 (0.4%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $1,216 (0.4%)

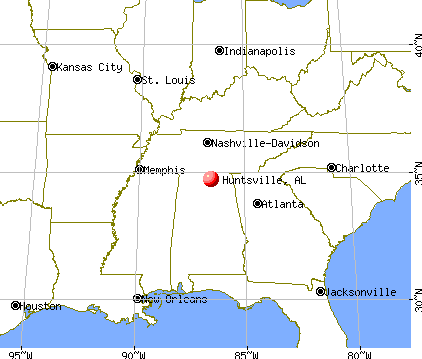

Nearest city with pop. 200,000+: Birmingham, AL (83.1 miles

, pop. 242,820).

Nearest city with pop. 1,000,000+: Chicago, IL (496.5 miles

, pop. 2,896,016).

Nearest cities:

Latitude: 34.71 N, Longitude: 86.60 W

Daytime population change due to commuting: +68,485 (+30.8%)

Workers who live and work in this city: 91,665 (81.3%)

Area code: 256

Huntsville tourist attractions:

- U. S. Space & Rocket Center - Huntsville, AL - experience space without leaving the ground

- Embassy Suites Huntsville - Huntsville, AL - luxury accommodations, business accommodations and all in the same building

- Huntsville Botanical Garden - Huntsville, AL - relax in intoxicating beauty

- Earlyworks Museum Complex - Huntsville, AL - three museums in one

- Huntsville Depot Museum - Huntsville, AL - the earliest of the railroad's influence on Huntsville

- Alabama Constitution Village - Huntsville, AL - Alabama obtained statehood because of this historical venue

- Huntsville Museum of Art - Huntsville, AL - rich history of art in a small town

- Von Braun Center - Huntsville, AL - multiple facilities to hold events or attend an event in comfort

- The Westin Huntsville - Huntsville, AL - luxury accommodations near some of the best attractions in the city

- Bridge Street Town Centre - Huntsville, Alabama - Town Center Featuring Shops, Hotel and

- Huntsville Museum Explores the Past

- Madison Square Mall - Huntsville, Alabama - Shopping Center

- Sci- Quest, Huntsville, AL

- Southern Adventures - Huntsville, Alabama - amusement park and family recreation center

Huntsville, Alabama accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 1083 buildings, average cost: $59,000

- 2021: 1483 buildings, average cost: $71,900

- 2020: 1705 buildings, average cost: $73,700

- 2019: 1436 buildings, average cost: $52,600

- 2018: 1241 buildings, average cost: $54,400

- 2017: 1144 buildings, average cost: $52,000

- 2016: 1091 buildings, average cost: $46,900

- 2015: 1021 buildings, average cost: $49,500

- 2014: 897 buildings, average cost: $47,500

- 2013: 1000 buildings, average cost: $46,800

- 2012: 960 buildings, average cost: $51,200

- 2011: 1018 buildings, average cost: $51,900

- 2010: 1073 buildings, average cost: $42,300

- 2009: 1096 buildings, average cost: $42,600

- 2008: 1004 buildings, average cost: $44,900

- 2007: 1558 buildings, average cost: $44,600

- 2006: 1375 buildings, average cost: $45,400

- 2005: 992 buildings, average cost: $54,400

- 2004: 714 buildings, average cost: $42,800

- 2003: 525 buildings, average cost: $42,700

- 2002: 514 buildings, average cost: $45,800

- 2001: 400 buildings, average cost: $45,100

- 2000: 531 buildings, average cost: $33,900

- 1999: 448 buildings, average cost: $41,500

- 1998: 446 buildings, average cost: $42,800

- 1997: 500 buildings, average cost: $40,900

| Here: | 2.4% |

| Alabama: | 2.6% |

- Professional, scientific, technical services (12.9%)

- Health care (10.2%)

- Accommodation & food services (8.7%)

- Educational services (8.2%)

- Public administration (7.6%)

- Construction (5.1%)

- Administrative & support & waste management services (4.7%)

- Professional, scientific, technical services (15.8%)

- Public administration (9.3%)

- Construction (8.1%)

- Accommodation & food services (7.7%)

- Administrative & support & waste management services (5.4%)

- Educational services (5.0%)

- Health care (4.1%)

- Health care (16.8%)

- Educational services (11.7%)

- Accommodation & food services (9.9%)

- Professional, scientific, technical services (9.8%)

- Public administration (5.7%)

- Administrative & support & waste management services (4.0%)

- Department & other general merchandise stores (3.6%)

- Cooks and food preparation workers (6.9%)

- Other management occupations, except farmers and farm managers (5.4%)

- Engineers (5.0%)

- Computer specialists (4.8%)

- Building and grounds cleaning and maintenance occupations (4.4%)

- Retail sales workers, except cashiers (3.1%)

- Cashiers (2.7%)

- Engineers (7.5%)

- Computer specialists (6.7%)

- Cooks and food preparation workers (6.1%)

- Other management occupations, except farmers and farm managers (5.8%)

- Building and grounds cleaning and maintenance occupations (5.3%)

- Material recording, scheduling, dispatching, and distributing workers (3.5%)

- Retail sales workers, except cashiers (3.0%)

- Cooks and food preparation workers (7.7%)

- Other management occupations, except farmers and farm managers (5.0%)

- Secretaries and administrative assistants (4.9%)

- Cashiers (4.1%)

- Registered nurses (3.7%)

- Waiters and waitresses (3.4%)

- Building and grounds cleaning and maintenance occupations (3.3%)

Average climate in Huntsville, Alabama

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

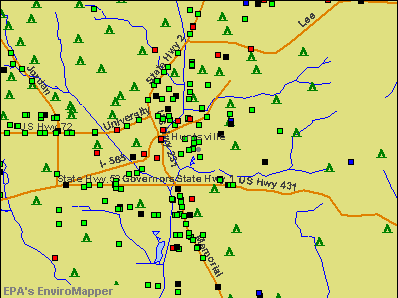

Air Quality Index (AQI) level in 2022 was 71.0. This is about average.

| City: | 71.0 |

| U.S.: | 72.6 |

Nitrogen Dioxide (NO2) [ppb] level in 2003 was 5.26. This is about average. Closest monitor was 0.7 miles away from the city center.

| City: | 5.26 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2003 was 1.61. This is about average. Closest monitor was 0.7 miles away from the city center.

| City: | 1.61 |

| U.S.: | 1.51 |

Ozone [ppb] level in 2022 was 31.3. This is about average. Closest monitor was 1.3 miles away from the city center.

| City: | 31.3 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 18.7. This is about average. Closest monitor was 1.3 miles away from the city center.

| City: | 18.7 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 8.68. This is about average. Closest monitor was 1.9 miles away from the city center.

| City: | 8.68 |

| U.S.: | 8.11 |

Tornado activity:

Huntsville-area historical tornado activity is slightly above Alabama state average. It is 146% greater than the overall U.S. average.

On 4/3/1974, a category F5 (max. wind speeds 261-318 mph) tornado 10.0 miles away from the Huntsville city center killed 28 people and injured 267 people.

On 3/22/1952, a category F4 (max. wind speeds 207-260 mph) tornado 2.9 miles away from the city center killed 4 people and injured 50 people and caused between $5000 and $50,000 in damages.

Earthquake activity:

Huntsville-area historical earthquake activity is significantly above Alabama state average. It is 162% greater than the overall U.S. average.On 4/29/2003 at 08:59:39, a magnitude 4.9 (4.4 MB, 4.6 MW, 4.9 LG, Class: Light, Intensity: IV - V) earthquake occurred 57.1 miles away from the city center

On 1/18/1999 at 07:00:53, a magnitude 4.8 (4.8 MB, 4.0 LG, Depth: 0.6 mi) earthquake occurred 98.0 miles away from Huntsville center

On 4/29/2003 at 08:59:39, a magnitude 4.6 (4.6 MW, Depth: 12.3 mi) earthquake occurred 57.1 miles away from the city center

On 4/18/2008 at 09:36:59, a magnitude 5.4 (5.1 MB, 4.8 MS, 5.4 MW, 5.2 MW, Class: Moderate, Intensity: VI - VII) earthquake occurred 268.4 miles away from Huntsville center

On 6/24/1975 at 11:11:36, a magnitude 4.5 (4.5 MB) earthquake occurred 98.9 miles away from the city center

On 3/25/1976 at 00:41:20, a magnitude 5.0 (4.9 MB, 5.0 LG) earthquake occurred 220.4 miles away from Huntsville center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Madison County (17) is near the US average (15).Major Disasters (Presidential) Declared: 10

Emergencies Declared: 5

Causes of natural disasters: Storms: 8, Tornadoes: 8, Floods: 6, Hurricanes: 3, Winds: 3, Drought: 1, Freeze: 1, Ice Storm: 1, Snowfall: 1, Winter Storm: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: WOLVERINE TUBE INC (ROLLING DRAWING & EXTRUDING OF NONFERROUS METALS), INTERGRAPH CORP (SERVICES-COMPUTER INTEGRATED SYSTEMS DESIGN), ADTRAN INC (TELEPHONE & TELEGRAPH APPARATUS).

Hospitals in Huntsville:

- CRESTWOOD MEDICAL CENTER (Proprietary, provides emergency services, ONE HOSPITAL DR SE)

- DAY SURGERY OF HUNTSVILLE (911 BIG COVE RD)

- HOSPICE FAMILY CARE (3304 WESTMILL DRIVE SOUTHWEST)

- HOSPICE OF NORTH ALABAMA, LLC (2720 GOVERNORS DRIVE SUITE A)

- HUNTSVILLE HOSPICE CARE INC (2225 DRAKE AVENUE SOUTHWEST SUITE 14)

- HUNTSVILLE HOSPITAL (Government - Hospital District or Authority, provides emergency services, 101 SIVLEY RD)

- HUNTSVILLE HOSPITAL EAST (provides emergency services, 911 BIG COVE RD)

- ODYSSEY HEALTHCARE OF HUNTSVILLE (2745 BOB WALLACE AVE, SUITE C)

- SOUTHERN CARE HUNTSVILLE (3322 SOUTH MEMORIAL PARKWAY SUITE 212)

- WIREGRASS HOSPICE HUNTSVILLE (303 WILLIAMS AVENUE, SUITE 116)

Airports and heliports located in Huntsville:

- Huntsville International-Carl T Jones Field Airport (HSV) (Runways: 2, Commercial Ops: 9,939, Air Taxi Ops: 11,371, Itinerant Ops: 11,569, Local Ops: 2,756, Military Ops: 22,751)

- Moontown Airport (3M5) (Runways: 1, Itinerant Ops: 10,000, Local Ops: 5,784)

- Big Sky Airport (AL93) (Runways: 1)

- Milton Airport (4AL8) (Runways: 1)

- Huntsville Field Heliport (0AL0)

- The Huntsville Hospital Heliport (AL36)

Colleges/Universities in Huntsville:

- University of Alabama in Huntsville (Full-time enrollment: 6,006; Location: 301 Sparkman Dr; Public; Website: www.uah.edu; Offers Doctor's degree)

- Oakwood University (Full-time enrollment: 1,824; Location: 7000 Adventist Blvd NW; Private, not-for-profit; Website: www.oakwood.edu; Offers Master's degree)

- J F Drake State Community and Technical College (Full-time enrollment: 921; Location: 3421 Meridian St N; Public; Website: www.drakestate.edu)

- Virginia College-Huntsville (Full-time enrollment: 434; Location: 2021 Drake Avenue, SW; Private, for-profit; Website: WWW.VC.EDU)

- Huntsville Bible College (Full-time enrollment: 36; Location: 904 Oakwood Ave; Private, not-for-profit; Website: www.hbc1.edu; Offers Master's degree)

- The Salon Professional Academy-Huntsville (Full-time enrollment: 30; Location: 4925 University Drive, Suite 134; Private, for-profit; Website: www.huntsvilletspa.com)

Other colleges/universities with over 2000 students near Huntsville:

- Alabama A & M University (about 6 miles; Normal, AL; Full-time enrollment: 4,524)

- John C Calhoun State Community College (about 21 miles; Tanner, AL; FT enrollment: 7,911)

- Athens State University (about 22 miles; Athens, AL; FT enrollment: 2,771)

- Northeast Alabama Community College (about 41 miles; Rainsville, AL; FT enrollment: 2,409)

- Snead State Community College (about 43 miles; Boaz, AL; FT enrollment: 2,023)

- George C Wallace State Community College-Hanceville (about 46 miles; Hanceville, AL; FT enrollment: 4,486)

- Motlow State Community College (about 49 miles; Tullahoma, TN; FT enrollment: 2,915)

Biggest public high schools in Huntsville:

- VIRGIL GRISSOM HIGH SCH (Students: 2,020, Location: 7901 BAILEY COVE RD, Grades: 9-12)

- HUNTSVILLE HIGH SCH (Students: 1,519, Location: 2304 BILLIE WATKINS SW, Grades: 9-12)

- JO JOHNSON HIGH SCH (Students: 811, Location: 6201 PUEBLO DR, Grades: 9-12)

- SR BUTLER HIGH SCH (Students: 801, Location: 3401 HOLMES AVE, Grades: 9-12)

- COLUMBIA HIGH SCHOOL (Students: 445, Location: 300 EXPLORER BOULEVARD, Grades: 9-12)

- NEW CENTURY TECH DEMO HIGH SCH (Students: 210, Location: 2500 MERIDIAN STREET NW, Grades: 9-12)

- HUNTSVILLE CTR FOR TECH (Students: 38, Location: 2800 DRAKE AVE SW, Grades: 9-12)

- MENTAL HEALTH CTR (Students: 29, Location: 4040 MEMORIAL PKWY S W, Grades: KG-12)

- ROBERT NEAVES CTR (Students: 8, Location: 817 COOK AVE, Grades: KG-12)

- LEE HIGH SCH (Location: 2500 MERIDIAN ST., Grades: 9-12)

Biggest private high schools in Huntsville:

- RANDOLPH SCHOOL (Students: 996, Location: 1005 DRAKE AVE SE, Grades: KG-12)

- WESTMINSTER CHRISTIAN ACADEMY (Students: 708, Location: 237 JOHNS RD NW, Grades: KG-12)

- POPE JOHN PAUL II CATHOLIC HIGH SCHOOL (Students: 393, Location: 7301 OLD MADISON PIKE, Grades: 9-12)

- WHITESBURG CHRISTIAN ACADEMY (Students: 360, Location: 6806 WHITESBURG DR SE, Grades: KG-12)

- OAKWOOD ADVENTIST ACADEMY (Students: 250, Location: 7000 ADVENTIST BLVD NW, Grades: KG-12)

- VALLEY FELLOWSHIP CHRISTIAN ACADEMY (Students: 187, Location: 3616 HOLMES AVE NW, Grades: PK-12)

- PROVIDENCE CLASSICAL SCHOOL (Students: 184, Location: 1705 SPARKMAN DR NW, Grades: PK-12)

- HUNTSVILLE CHRISTIAN ACADEMY (Students: 129, Location: 175 W PARK LOOP NW, Grades: PK-12)

- CALVARY BAPTIST ACADEMY (Students: 51, Location: 126 DOUGLASS RD NW, Grades: PK-12)

- IN THE BEGINNING CHRISTIAN ACADEMY (Students: 31, Location: 3211 LODGE RD NW, Grades: PK-11)

Biggest public elementary/middle schools in Huntsville:

- MT CARMEL ELEM SCH (Students: 918, Location: 335 HOMER NANCE ROAD, Grades: PK-3)

- RIVERTON ELEM SCH (Students: 834, Location: 2615 WINCHESTER ROAD, Grades: PK-3)

- CENTRAL SCH (Students: 735, Location: 990 RYLAND PIKE, Grades: KG-8)

- WILLIAMS MIDDLE SCH (Students: 639, Location: 155 A BARREN FORK, Grades: 6-8)

- HUNTSVILLE MIDDLE SCH (Students: 610, Location: 817 ADAMS ST SE, Grades: 6-8)

- CHALLENGER MIDDLE SCH (Students: 596, Location: 13555 CHANEY THOMPSON RD, Grades: 6-8)

- MONROVIA ELEM SCH (Students: 574, Location: 1030 JEFF RD, Grades: KG-5)

- WHITESBURG MIDDLE SCH (Students: 565, Location: 107 SANDERS RD, Grades: PK-8)

- WEATHERLY HEIGHTS ELEM SCH (Students: 552, Location: 1307 CANSTATT DR, Grades: PK-5)

- CHALLENGER ELEM SCH (Students: 549, Location: 13555 CHANEY THOMPSON RD, Grades: PK-5)

Biggest private elementary/middle schools in Huntsville:

- HOLY SPIRIT SCHOOL (Students: 414, Location: 619 AIRPORT RD SW, Grades: KG-8)

- FIRST BAPTIST CHILD DEVELOPMENT CENTER & ACADEMY (Students: 283, Location: 3509 BLUESPRING RD, Grades: UG-4)

- COVENANT CLASSICAL SCHOOL (Students: 220, Location: 220 EXCHANGE PL NW, Grades: PK-2)

- HOLY FAMILY PAROCHIAL SCHOOL (Students: 169, Location: 2300 BEASLEY AVE NW, Grades: PK-8)

- UNION CHAPEL CHRISTIAN ACADEMY (Students: 157, Location: 315-B WINCHESTER RD NW, Grades: KG-7)

- PREMIER SCHOOL OF RESEARCH PARK (Students: 146, Location: 5095 PREMIER DR NW, Grades: PK-1)

- GRACE LUTHERAN SCHOOL (Students: 137, Location: 3321 S MEMORIAL PKWY, Grades: PK-8)

- THE COUNTRY DAY SCHOOL (Students: 103, Location: 1699 OLD DRY CREEK RD, Grades: PK-8)

- THE MONTESSORI SCHOOL OF HUNTSVILLE (Students: 91, Location: 15975 CHANEY THOMPSON RD SE, Grades: PK-6)

- ISLAMIC ACADEMY OF HUNTSVILLE (Students: 53, Location: 1645 SPARKMAN DR, Grades: PK-5)

User-submitted facts and corrections:

- The tornado which killed over 20 people in Huntsville in November 1989 is not mentioned. It destroyed Airport Road at evening rush hour and had a live feed to the NBC Nightline TV show that day.

- New Century Technology High School has merged locations with the new Columbia H.S. located at the Columbia Campus in Huntsville.

- Don't forget the 1989 tornado on Airport Road.

- in the Birthplace of section: Aaron Hase - College Rugby Player (University of Alabama)

- I would like to add my church to the list for zip code 35806: Potter's Hand Church Ministries 983 Indian Creek Road Huntsville AL 35806 (256) 721-0807 We are Primitive Baptist denomination.

- The Janice Mitchell Isbell Academy (http://www.angelfire.com/al4/isbell_academy) serves students with learning disabilities or are perforoming below grade level expectations.

- Under private schools: Madison Academy, 800 students, preschool- 12th grade. located 325 Slaughter Road.

- The Janice Mitchell Isbell Academy (http://www.angelfire.com/al4/isbell_academy) serves students with learning disabilities or are perforoming below grade level expectations.

- Two other major tornadoes: (1) Nov (14) 1989 City of Huntsvile, down Airport Road and into Jones Valley. 19+ killed. (2) 1993 (April?) Monrovia near Anderson Hills and Hazel Green area. Would have to research to get exact statistics on both of these. The one in Nov 1989 was very bad. (Also one in 1984 in Monrovia area that hit the house we subsequently bought.)

- WAFF Channel 48 is also in Huntsville, AL http://www.waff.com

Points of interest:

Notable locations in Huntsville: Huntsville Filtration Plant (A), Huntsville Golf and Country Club (B), Huntsville Municipal Golf Course (C), Rocket Siding (D), Valley Hill Golf and Country Club (E), Nunn Store (F), Valley View Golf Course (G), Chickasaw Old Fields (H), Cummings Research Park (I), Cummings Research Park West (J), Executive Plaza Research Center (K), Hobbs Island Sewage Treatment Plant (L), Huntsville Industrial Center (M), Huntsville Sewage Treatment Plant (N), Jetport Municipal Golf Course (O), Lily Flagg Club (P), Ditto Landing Marina (Q), Lowe Industrial Park (R), Madison County Industrial Park (S), Manley Crossroads (T). Display/hide their locations on the map

Shopping Centers: Willowbrook Village Shopping Center (1), Willowbrook Square Shopping Center (2), Ardmore Shopping Center (3), Central Plaza Shopping Center (4), Clowers Shopping Center (5), Dunnavants Mall Shopping Center (6), Five Points Shopping Center (7), Hamilton Square Shopping Center (8), Haysland Square Shopping Center (9). Display/hide their locations on the map

Main business address in Huntsville include: WOLVERINE TUBE INC (A), INTERGRAPH CORP (B), ADTRAN INC (C). Display/hide their locations on the map

Churches in Huntsville include: Mount Olive Church (A), Parkway Church of God (B), Owens Chapel Missionary Baptist Church (C), Northside Baptist Church (D), Mountain View Baptist Church (E), Morris Chapel Baptist Church (F), Memorial Parkway Church of Christ (G), Meadow Hills Baptist Church (H), Meadow Drive Baptist Church (I). Display/hide their locations on the map

Cemeteries: Northside Cemetery (1), Holding Cemetery (2), Conley Cemetery (3), Merrimack Cemetery (4), Binford Cemetery (5), Sivley Cemetery (6), Jamar Cemetery (7). Display/hide their locations on the map

Lakes, reservoirs, and swamps: Williams Pond (A), Mouzon Lake (B), Pickett Pond (C), John Blue Co Tank (D), Lady Ann Lake (E), General Shoe Tank (F), Lake Clark (G), Beaverdam Swamp (H). Display/hide their locations on the map

Streams, rivers, and creeks: Sherwood Creek (A), Pinhook Creek (B), Merrimac Branch (C), McDonald Creek (D), Hambrick Slough (E), Fagan Creek (F), Dry Creek (G), Dallas Branch (H), Chase Creek (I). Display/hide their locations on the map

Parks in Huntsville include: Brahan Spring Park (1), Windsor Manor Park (2), Willow Park (3), Whitesburg Park (4), University Park (5), Robe Park (6), Pine Park (7), Piedmont Recreation Area (8), Pear Tree Park (9). Display/hide their locations on the map

Tourist attractions: Huntsville Museum of Art (300 Church Street Southwest) (1), The Alabama Center for Military History (Museums; 7811 Double Tree) (2), Professional Care Security (Museums; 2003 Poole Drive Northwest) (3), Constitution Village (Museums; 404 Madison Street Southeast) (4), Burritt Museum (3101 Burritt Drive Southeast) (5), North Alabama Railroad Museum Inc (694 Chase Road Northeast) (6), Banquet Facilities-Us Space & Rocket Center (Museums; 1 Tranquility Base) (7), Veterans Memorial Museum (2060 Airport Road Southwest # A) (8), Sci-Quest Hands-On Science Center (Museums; 102 Wynn Drive Northwest # D) (9). Display/hide their approximate locations on the map

Hotels: King's Inn (11245 Memorial Parkway Southwest) (1), Candlewood Suites (201 Exchange Place) (2), Economy Inn (3772 University Drive Northwest) (3), Huntsville AL Days Inn&Suites (1145 Mc Murtrie Drive) (4), Sheraton Airport Inn - Lounge- Restaurant (1000 Glenn Hearn Boulevard Southwest) (5), Park Valley Laundromat & Dry Cleaners (11821 Memorial Parkway Southwest) (6), Porter's Steakhouse (5 Tranquility Base) (7), Radisson Suite Htl Huntsville (6000 Memorial Parkway South) (8), LA Quinta Inn - Research Park (4870 University Drive Northwest) (9). Display/hide their approximate locations on the map

Courts: Marshals Service (101 Holmes Avenue Northeast) (1), Madison County - Court Administrator- Judges (100 Northside Square) (2), Madison County - Court Appointed Juvenile Advocate CAJA (205 Eastside Square) (3), Huntsville City - Housing Authority- Councill Court Site Office (710 Gallatin Street Southwest) (4), Huntsville City - Housing Authority- Councill Court Boys & Girls Club (400 Pelham Avenue Southwest Ofc) (5). Display/hide their approximate locations on the map

Birthplace of: Tallulah Bankhead - Actress, Bo Bice - Singer, Debby Ryan - Actress, Bobby Eaton - Semi-retired professional wrestler, Joseph Lowery - Religious leader, Felicia Day - Actor, Van Vandegrift - Businessman, John Hunt Morgan - (1826-1864) Confederate general in Civil War, Terri Sewell - Politician, Bryan Shelton - Professional tennis player.

Drinking water stations with addresses in Huntsville that have no violations reported:

- HUNTSVILLE UTILITIES (Population served: 219,168, Primary Water Source Type: Surface water)

- MADISON COUNTY WATER DEPARTMENT (Address: 266 - B SHIELDS ROAD , Population served: 85,947, Primary Water Source Type: Purch surface water)

- WATER WORKS, INC. (Population served: 564, Primary Water Source Type: Groundwater)

| This city: | 2.2 people |

| Alabama: | 2.5 people |

| This city: | 59.0% |

| Whole state: | 67.8% |

| This city: | 4.9% |

| Whole state: | 4.7% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.3% of all households

- Gay men: 0.3% of all households

People in group quarters in Huntsville in 2010:

- 4,247 people in college/university student housing

- 1,012 people in local jails and other municipal confinement facilities

- 874 people in nursing facilities/skilled-nursing facilities

- 262 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 226 people in other noninstitutional facilities

- 59 people in group homes intended for adults

- 58 people in residential treatment centers for adults

- 22 people in correctional facilities intended for juveniles

- 10 people in workers' group living quarters and job corps centers

- 8 people in residential treatment centers for juveniles (non-correctional)

- 5 people in group homes for juveniles (non-correctional)

- 3 people in hospitals with patients who have no usual home elsewhere

People in group quarters in Huntsville in 2000:

- 3,381 people in college dormitories (includes college quarters off campus)

- 885 people in local jails and other confinement facilities (including police lockups)

- 736 people in nursing homes

- 304 people in other noninstitutional group quarters

- 105 people in homes for the physically handicapped

- 45 people in short-term care, detention or diagnostic centers for delinquent children

- 35 people in other group homes

- 33 people in homes for the mentally ill

- 19 people in homes for the mentally retarded

- 15 people in other nonhousehold living situations

- 14 people in homes or halfway houses for drug/alcohol abuse

- 3 people in religious group quarters

Banks with most branches in Huntsville (2011 data):

- Regions Bank: 13 branches. Info updated 2011/02/24: Bank assets: $123,368.2 mil, Deposits: $98,301.3 mil, headquarters in Birmingham, AL, positive income, Commercial Lending Specialization, 1778 total offices, Holding Company: Regions Financial Corporation

- Compass Bank: Governors Drive Branch, Madison Square Mall Branch, Huntsville Northwest Branch, Haysland Square Branch, Jordan Lane Branch, Whitesburg Branch. Info updated 2011/02/24: Bank assets: $63,107.0 mil, Deposits: $46,232.4 mil, headquarters in Birmingham, AL, negative income in the last year, Commercial Lending Specialization, 720 total offices, Holding Company: Banco Bilbao Vizcaya Argentaria, S.A.

- Wells Fargo Bank, National Association: Downtown Branch, Jones Valley Office Branch, North Parkway Branch, Research Park Branch, South Parkway Branch, University Drive Branch. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- PNC Bank, National Association: Huntsville Branch, Huntsville-Church Street Branch, Piedmont Point Branch, University Drive Branch, Lily Flagg Branch. Info updated 2012/03/20: Bank assets: $263,309.6 mil, Deposits: $197,343.0 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 3085 total offices, Holding Company: Pnc Financial Services Group, Inc., The

- Branch Banking and Trust Company: Westbury Branch, Madison Square Branch, Huntsville Main Branch, South Memorial Parkway Branch, Huntsville Northwest Branch. Info updated 2010/03/29: Bank assets: $168,867.6 mil, Deposits: $127,549.5 mil, headquarters in Winston Salem, NC, positive income, Commercial Lending Specialization, 1793 total offices, Holding Company: Bb&T Corporation

- Synovus Bank: Huntsville Branch, Piedmont Branch, Westside Centre Branch. Info updated 2011/01/25: Bank assets: $26,863.3 mil, Deposits: $22,415.0 mil, headquarters in Columbus, GA, positive income, Commercial Lending Specialization, 296 total offices, Holding Company: Synovus Financial Corp.

- SouthBank, a Federal Savings Bank: Jones Valley Branch, Southbank, A Federal Savings Bank, 2801 Memorial Parkway Branch. Info updated 2011/07/21: Bank assets: $242.2 mil, Deposits: $183.8 mil, local headquarters, negative income in the last year, Commercial Lending Specialization, 13 total offices

- CB&S Bank, Inc.: Huntsville Branch, Huntsville Research Park Branch, Huntsville Downtown Branch. Info updated 2011/02/24: Bank assets: $1,276.1 mil, Deposits: $1,018.1 mil, headquarters in Russellville, AL, positive income, Commercial Lending Specialization, 42 total offices, Holding Company: Cbs Banc-Corp.

- Cadence Bank, N.A.: Jones Valley Branch at 1804 Four Mile Post Road Southeast, branch established on 2006/11/24; Huntsville Branch at 300 Clinton Avenue West, branch established on 1992/08/10. Info updated 2011/12/14: Bank assets: $3,909.7 mil, Deposits: $3,124.0 mil, headquarters in Birmingham, AL, positive income, Commercial Lending Specialization, 112 total offices, Holding Company: Cadence Bancorp Llc

- 11 other banks with 16 local branches

For population 15 years and over in Huntsville:

- Never married: 37.0%

- Now married: 44.6%

- Separated: 2.4%

- Widowed: 5.6%

- Divorced: 10.4%

For population 25 years and over in Huntsville:

- High school or higher: 92.2%

- Bachelor's degree or higher: 48.2%

- Graduate or professional degree: 21.3%

- Unemployed: 6.9%

- Mean travel time to work (commute): 17.4 minutes

| Here: | 11.0 |

| Alabama average: | 11.5 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Huntsville, AL (based on Madison County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 105,503 | 284 |

| Mainline Protestant | 35,533 | 72 |

| Catholic | 14,157 | 6 |

| Black Protestant | 6,710 | 41 |

| Other | 6,587 | 27 |

| Orthodox | 340 | 2 |

| None | 165,981 | - |

Food Environment Statistics:

| Madison County: | 1.12 / 10,000 pop. |

| State: | 1.89 / 10,000 pop. |

| This county: | 0.29 / 10,000 pop. |

| Alabama: | 0.20 / 10,000 pop. |

| Madison County: | 0.51 / 10,000 pop. |

| State: | 0.65 / 10,000 pop. |

| Here: | 5.66 / 10,000 pop. |

| Alabama: | 6.32 / 10,000 pop. |

| Madison County: | 6.47 / 10,000 pop. |

| Alabama: | 5.75 / 10,000 pop. |

| Here: | 12.1% |

| Alabama: | 11.8% |

| Madison County: | 30.9% |

| State: | 31.7% |

| Madison County: | 14.1% |

| Alabama: | 13.5% |

Health and Nutrition:

| Here: | 51.2% |

| Alabama: | 49.0% |

| Here: | 49.1% |

| Alabama: | 45.7% |

| This city: | 28.7 |

| Alabama: | 28.9 |

| Here: | 19.8% |

| Alabama: | 20.7% |

| This city: | 10.3% |

| Alabama: | 11.0% |

| Here: | 6.8 |

| Alabama: | 6.8 |

| Huntsville: | 34.5% |

| Alabama: | 34.4% |

| This city: | 57.2% |

| Alabama: | 55.2% |

| Huntsville: | 80.4% |

| Alabama: | 79.3% |

More about Health and Nutrition of Huntsville, AL Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Other and Unallocable | 609 | $3,409,196 | $67,176 | 20 | $35,248 |

| Police Protection - Officers | 428 | $2,536,351 | $71,113 | 36 | $78,094 |

| Firefighters | 376 | $2,131,741 | $68,034 | 1 | $3,160 |

| Streets and Highways | 193 | $867,964 | $53,967 | 4 | $8,239 |

| Electric Power | 187 | $689,066 | $44,218 | 1 | $1,211 |

| Sewerage | 120 | $694,243 | $69,424 | 0 | $0 |

| Parks and Recreation | 107 | $433,689 | $48,638 | 81 | $91,521 |

| Water Supply | 103 | $625,549 | $72,879 | 0 | $0 |

| Solid Waste Management | 103 | $405,928 | $47,293 | 0 | $0 |

| Police - Other | 101 | $434,426 | $51,615 | 81 | $109,863 |

| Financial Administration | 90 | $551,066 | $73,475 | 1 | $2,436 |

| Gas Supply | 77 | $501,201 | $78,109 | 0 | $0 |

| Transit | 77 | $302,706 | $47,175 | 50 | $70,208 |

| Other Government Administration | 76 | $488,508 | $77,133 | 5 | $10,876 |

| Judicial and Legal | 62 | $375,627 | $72,702 | 4 | $8,081 |

| Fire - Other | 51 | $203,131 | $47,796 | 2 | $2,769 |

| Housing and Community Development (Local) | 32 | $168,786 | $63,295 | 1 | $2,976 |

| Health | 29 | $116,039 | $48,016 | 3 | $4,580 |

| Natural Resources | 7 | $45,925 | $78,729 | 1 | $3,438 |

| Totals for Government | 2,828 | $14,981,141 | $63,569 | 291 | $432,700 |

Huntsville government finances - Expenditure in 2021 (per resident):

- Construction - General - Other: $97,776,000 ($440.57)

Regular Highways: $37,858,000 ($170.58)

Electric Utilities: $18,694,000 ($84.23)

Sewerage: $15,984,000 ($72.02)

Water Utilities: $15,818,000 ($71.27)

Parks and Recreation: $14,167,000 ($63.83)

Parking Facilities: $8,738,000 ($39.37)

Libraries: $7,713,000 ($34.75)

Police Protection: $6,059,000 ($27.30)

Gas Utilities: $5,649,000 ($25.45)

Housing and Community Development: $124,000 ($0.56)

- Current Operations - Electric Utilities: $471,376,000 ($2123.96)

General - Other: $58,490,000 ($263.55)

Police Protection: $52,078,000 ($234.66)

Local Fire Protection: $36,931,000 ($166.41)

Gas Utilities: $34,024,000 ($153.31)

Regular Highways: $26,783,000 ($120.68)

Parks and Recreation: $24,864,000 ($112.03)

Sewerage: $18,073,000 ($81.43)

Solid Waste Management: $11,217,000 ($50.54)

Central Staff Services: $9,548,000 ($43.02)

Judicial and Legal Services: $7,832,000 ($35.29)

Libraries: $5,873,000 ($26.46)

Transit Utilities: $5,712,000 ($25.74)

Housing and Community Development: $4,784,000 ($21.56)

Financial Administration: $4,752,000 ($21.41)

Protective Inspection and Regulation - Other: $3,025,000 ($13.63)

Health - Other: $2,336,000 ($10.53)

Parking Facilities: $1,777,000 ($8.01)

Miscellaneous Commercial Activities - Other: $1,165,000 ($5.25)

Natural Resources - Other: $704,000 ($3.17)

- Electric Utilities - Interest on Debt: $2,663,000 ($12.00)

- Gas Utilities - Interest on Debt: $248,000 ($1.12)

- General - Interest on Debt: $38,022,000 ($171.32)

- Intergovernmental to Local - Other - General - Other: $32,162,000 ($144.92)

Other - Correctional Institutions: $2,249,000 ($10.13)

Other - Health - Other: $1,335,000 ($6.02)

- Other Capital Outlay - Water Utilities: $28,087,000 ($126.56)

Electric Utilities: $10,450,000 ($47.09)

Gas Utilities: $4,136,000 ($18.64)

General - Other: $2,223,000 ($10.02)

Police Protection: $477,000 ($2.15)

Transit Utilities: $294,000 ($1.32)

Local Fire Protection: $190,000 ($0.86)

Parks and Recreation: $64,000 ($0.29)

Regular Highways: $62,000 ($0.28)

Parking Facilities: $52,000 ($0.23)

Financial Administration: $42,000 ($0.19)

Miscellaneous Commercial Activities - Other: $20,000 ($0.09)

Judicial and Legal Services: $12,000 ($0.05)

Central Staff Services: $5,000 ($0.02)

- Total Salaries and Wages: $49,371,000 ($222.46)

- Water Utilities - Interest on Debt: $3,388,000 ($15.27)

Huntsville government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $41,904,000 ($188.81)

Solid Waste Management: $13,010,000 ($58.62)

Parks and Recreation: $9,173,000 ($41.33)

Other: $5,062,000 ($22.81)

Parking Facilities: $3,292,000 ($14.83)

Miscellaneous Commercial Activities: $703,000 ($3.17)

Housing and Community Development: $195,000 ($0.88)

- Federal Intergovernmental - Housing and Community Development: $2,906,000 ($13.09)

- Miscellaneous - General Revenue - Other: $14,930,000 ($67.27)

Interest Earnings: $7,816,000 ($35.22)

Special Assessments: $5,702,000 ($25.69)

Fines and Forfeits: $3,382,000 ($15.24)

- Revenue - Electric Utilities: $512,131,000 ($2307.59)

Water Utilities: $46,359,000 ($208.89)

Gas Utilities: $44,945,000 ($202.52)

- State Intergovernmental - Other: $12,444,000 ($56.07)

General Local Government Support: $7,106,000 ($32.02)

Highways: $4,042,000 ($18.21)

- Tax - General Sales and Gross Receipts: $237,142,000 ($1068.53)

Property: $71,077,000 ($320.26)

Public Utilities Sales: $25,188,000 ($113.49)

Occupation and Business License - Other: $24,420,000 ($110.03)

Other Selective Sales: $15,237,000 ($68.66)

Other License: $6,956,000 ($31.34)

Alcoholic Beverage Sales: $3,419,000 ($15.41)

Tobacco Products Sales: $1,271,000 ($5.73)

Motor Fuels Sales: $1,222,000 ($5.51)

Huntsville government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $1,082,681,000 ($4878.41)

Outstanding Unspecified Public Purpose: $1,046,784,000 ($4716.67)

Retired Unspecified Public Purpose: $57,981,000 ($261.25)

Beginning Outstanding - Public Debt for Private Purpose: $48,567,000 ($218.84)

Outstanding Nonguaranteed - Industrial Revenue: $45,952,000 ($207.05)

Issue, Unspecified Public Purpose: $22,084,000 ($99.51)

Retired Nonguaranteed - Public Debt for Private Purpose: $2,615,000 ($11.78)

Huntsville government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $157,482,000 ($709.59)

- Other Funds - Cash and Securities: $283,010,000 ($1275.20)

- Sinking Funds - Cash and Securities: $45,952,000 ($207.05)

7.25% of this county's 2021 resident taxpayers lived in other counties in 2020 ($73,277 average adjusted gross income)

| Here: | 7.25% |

| Alabama average: | 6.87% |

0.07% of residents moved from foreign countries ($1,008 average AGI)

Madison County: 0.07% Alabama average: 0.02%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Limestone County, AL | |

| from Morgan County, AL | |

| from Jefferson County, AL |

6.24% of this county's 2020 resident taxpayers moved to other counties in 2021 ($77,445 average adjusted gross income)

| Here: | 6.24% |

| Alabama average: | 6.41% |

0.04% of residents moved to foreign countries ($728 average AGI)

Madison County: 0.04% Alabama average: 0.02%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Limestone County, AL | |

| to Morgan County, AL | |

| to Marshall County, AL |

| Businesses in Huntsville, AL | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| AMF Bowling | 2 | Justice | 3 | |

| AT&T | 4 | KFC | 5 | |

| Abercrombie & Fitch | 1 | Kincaid | 1 | |

| Abercrombie Kids | 1 | Kmart | 1 | |

| Advance Auto Parts | 5 | Knights Inn | 1 | |

| Aeropostale | 2 | Kroger | 6 | |

| American Eagle Outfitters | 2 | La Quinta | 3 | |

| Ann Taylor | 2 | La-Z-Boy | 1 | |

| Apple Store | 1 | Lane Bryant | 2 | |

| Applebee's | 2 | Lane Furniture | 1 | |

| Arby's | 5 | LensCrafters | 2 | |

| Ashley Furniture | 1 | Little Caesars Pizza | 3 | |

| Audi | 1 | Long John Silver's | 1 | |

| AutoZone | 3 | Lowe's | 2 | |

| Avenue | 1 | Marriott | 5 | |

| BMW | 1 | Marshalls | 2 | |

| Banana Republic | 1 | MasterBrand Cabinets | 2 | |

| Barnes & Noble | 2 | Mazda | 1 | |

| Baskin-Robbins | 1 | McDonald's | 10 | |

| Bath & Body Works | 3 | Men's Wearhouse | 3 | |

| Bebe | 1 | Microtel | 1 | |

| Bed Bath & Beyond | 2 | Motherhood Maternity | 1 | |

| Ben & Jerry's | 1 | New Balance | 5 | |

| Best Western | 1 | New York & Co | 2 | |

| Blockbuster | 2 | Nike | 21 | |

| Brookstone | 1 | Nissan | 1 | |

| Budget Car Rental | 1 | Office Depot | 2 | |

| Buffalo Wild Wings | 2 | Old Navy | 1 | |

| Burger King | 9 | Olive Garden | 1 | |

| Burlington Coat Factory | 1 | Outback | 1 | |

| CVS | 7 | Outback Steakhouse | 1 | |

| Cache | 1 | Pac Sun | 1 | |

| CarMax | 1 | Panera Bread | 1 | |

| Casual Male XL | 1 | Papa John's Pizza | 4 | |

| Catherines | 1 | Payless | 3 | |

| Charlotte Russe | 2 | Penske | 3 | |

| Chevrolet | 1 | PetSmart | 2 | |

| Chick-Fil-A | 6 | Pier 1 Imports | 2 | |

| Chico's | 2 | Pizza Hut | 4 | |

| Chuck E. Cheese's | 1 | Plato's Closet | 1 | |

| Church's Chicken | 2 | Popeyes | 3 | |

| Cinnabon | 1 | Pottery Barn | 1 | |

| Clarks | 1 | Publix Super Markets | 3 | |

| Cold Stone Creamery | 1 | Quality | 1 | |

| Coldwater Creek | 1 | Quiznos | 5 | |

| Comfort Inn | 1 | RadioShack | 3 | |

| Comfort Suites | 1 | Red Lobster | 1 | |

| Costco | 1 | Red Robin | 2 | |

| Cracker Barrel | 1 | Rite Aid | 4 | |

| Curves | 2 | Ruby Tuesday | 2 | |

| Dairy Queen | 1 | Rue21 | 1 | |

| Days Inn | 1 | Ryan's Grill | 1 | |

| Dennys | 1 | SAS Shoes | 1 | |

| Domino's Pizza | 8 | SONIC Drive-In | 7 | |

| DressBarn | 2 | Sam's Club | 2 | |

| Dressbarn | 2 | Sears | 3 | |

| Express | 1 | Shoe Carnival | 2 | |

| Extended Stay America | 1 | Sleep Inn | 1 | |

| FedEx | 47 | Soma Intimates | 1 | |

| Finish Line | 2 | Spencer Gifts | 2 | |

| Firestone Complete Auto Care | 5 | Sprint Nextel | 3 | |

| Foot Locker | 2 | Staples | 2 | |

| Ford | 1 | Starbucks | 7 | |

| Forever 21 | 1 | Steak 'n Shake | 1 | |

| GNC | 4 | Subaru | 1 | |

| GameStop | 5 | Subway | 24 | |

| Gap | 1 | Super 8 | 1 | |

| Goodwill | 3 | T-Mobile | 8 | |

| Gymboree | 3 | T.G.I. Driday's | 1 | |

| H&R Block | 9 | T.J.Maxx | 2 | |

| Hardee's | 2 | Taco Bell | 7 | |

| Havertys Furniture | 1 | Talbots | 1 | |

| Haworth | 1 | Target | 2 | |

| Hilton | 5 | The Athlete's Foot | 1 | |

| Hobby Lobby | 2 | The Room Place | 1 | |

| Holiday Inn | 4 | Toyota | 1 | |

| Hollister Co. | 1 | Toys"R"Us | 2 | |

| Home Depot | 2 | U-Haul | 11 | |

| Honda | 1 | UPS | 30 | |

| Hot Topic | 2 | Vans | 1 | |

| Hyundai | 1 | Verizon Wireless | 3 | |

| IHOP | 2 | Victoria's Secret | 3 | |

| InTown Suites | 1 | Volkswagen | 1 | |

| J. Jill | 1 | Waffle House | 5 | |

| J.Crew | 1 | Walgreens | 6 | |

| JCPenney | 1 | Walmart | 4 | |

| Jimmy Jazz | 1 | Wendy's | 6 | |

| JoS. A. Bank | 2 | Westin | 1 | |

| Jones New York | 6 | Wet Seal | 1 | |

| Journeys | 2 | YMCA | 5 | |

| Juicy Couture | 1 | |||

Strongest AM radio stations in Huntsville:

- WBHP (1230 AM; 1 kW; HUNTSVILLE, AL; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WLOR (1550 AM; 50 kW; HUNTSVILLE, AL; Owner: BCA RADIO, LLC)

- WTKI (1450 AM; 1 kW; HUNTSVILLE, AL; Owner: MOUNTAIN MIST MEDIA, LLC)

- WEUP (1600 AM; 10 kW; HUNTSVILLE, AL; Owner: HUNDLEY BATTS, SR. & VIRGINIA CAPLES)

- WEUV (1700 AM; 10 kW; HUNTSVILLE, AL; Owner: HUNDLEY BATTS, SR & VIRGINIA CAPLES)

- WDJL (1000 AM; daytime; 10 kW; HUNTSVILLE, AL; Owner: JAMES K. SHARP DBA 5TH AVE BROADCASTING)

- WBXR (1140 AM; daytime; 15 kW; HAZEL GREEN, AL; Owner: LOW COUNTRY CORPORATION, INC.)

- WVNN (770 AM; 10 kW; ATHENS, AL; Owner: ATHENS BROADCASTING COMPANY, INC.)

- WUMP (730 AM; 1 kW; MADISON, AL; Owner: TENNESSEE VALLEY RADIO, INC.)

- WWAM (820 AM; daytime; 50 kW; JASPER, TN; Owner: SHELTON BROADCASTING SYSTEM)

- WNSI (810 AM; 50 kW; JACKSONVILLE, AL; Owner: UNITED BROADCASTING NETWORK, INC.)

- WDJC (850 AM; 50 kW; BIRMINGHAM, AL; Owner: KIMTRON, INC.)

- WSM (650 AM; 50 kW; NASHVILLE, TN; Owner: GAYLORD ENTERTAINMENT COMPANY)

Strongest FM radio stations in Huntsville:

- WRTT-FM (95.1 FM; HUNTSVILLE, AL; Owner: BCA RADIO, LLC)

- W289AC (105.7 FM; HUNTSVILLE, AL; Owner: WILLIAM PAXTON ROGERS)

- WXQW (94.1 FM; MERIDIANVILLE, AL; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- W293AH (106.5 FM; NORMAL, AL; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- W249BB (97.7 FM; HUNTSVILLE, AL; Owner: WAY-FM MEDIA GROUP, INC.)

- W275AA (102.9 FM; HUNTSVILLE, AL; Owner: ARCHIE C. BOBO, PERSONAL REP. OF DORSEY E. NEWMAN ESTATE)

- W300AH (107.9 FM; HUNTSVILLE, AL; Owner: PORTER L. BATTS)

- W202BV (88.3 FM; HUNTSVILLE, AL; Owner: WAY-FM MEDIA GROUP, INC.)

- WAHR (99.1 FM; HUNTSVILLE, AL; Owner: BCA RADIO, LLC)

- W222AK (92.3 FM; HUNTSVILLE, AL; Owner: PRESS W. PARHAM)

- WYFD (91.7 FM; DECATUR, AL; Owner: BIBLE BROADCASTING NETWORK, INC.)

- W298AF (107.5 FM; HADEN, AL; Owner: HADEN RADIO COMPANY)

- WLRH (89.3 FM; HUNTSVILLE, AL; Owner: ALABAMA EDUCATIONAL TELEVISION COMMISSION)

- WZYP (104.3 FM; ATHENS, AL; Owner: ATHENS BROADCASTING COMPANY, INC.)

- W278AA (103.5 FM; MADISON, AL; Owner: TENNESSEE VALLEY RADIO, INC.)

- WDRM (102.1 FM; DECATUR, AL; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WJAB (90.9 FM; HUNTSVILLE, AL; Owner: ALABAMA A & M UNIVERSITY)

- WOCG (90.1 FM; HUNTSVILLE, AL; Owner: OAKWOOD COLLEGE)

- WAYH (88.1 FM; HARVEST, AL; Owner: WAY-FM MEDIA GROUP, INC.)

- WRSA-FM (96.9 FM; DECATUR, AL; Owner: NCA, INC.)

TV broadcast stations around Huntsville:

- WAAY-TV (Channel 31; HUNTSVILLE, AL; Owner: PIEDMONT TELEVISION OF HUNTSVILLE LICENSE LLC)

- WHNT-TV (Channel 19; HUNTSVILLE, AL; Owner: NEW YORK TIMES MANAGEMENT SERVICES)

- WZDX (Channel 54; HUNTSVILLE, AL; Owner: HUNTSVILLE TELEVISION ACQUISITION CORP.)

- W67CO (Channel 67; HUNTSVILLE, AL; Owner: TRINITY BROADCASTING NETWORK)

- WHIQ (Channel 25; HUNTSVILLE, AL; Owner: ALABAMA EDUCATIONAL TELEVISION COMMISSION)

- W38BQ (Channel 38; HUNTSVILLE, AL; Owner: THREE ANGELS BROADCASTING NETWORK)

- WTZT-LP (Channel 11; ATHENS, AL; Owner: WTZT-LP TELEVISION STATION, L.L.C.)

- W64BJ (Channel 64; SCOTTSBORO, AL; Owner: TRINITY BROADCASTING NETWORK)

- WYAM-LP (Channel 56; DECATUR, AL; Owner: DECATUR COMMUNICATION PROPERTIES, LLC)

- National Bridge Inventory (NBI) Statistics

- 639Number of bridges

- 11,867ft / 3,617mTotal length

- $1,521,431,000Total costs

- 10,240,811Total average daily traffic

- 528,271Total average daily truck traffic

- New bridges - historical statistics

- 21900-1909

- 31910-1919

- 131920-1929

- 381930-1939

- 241940-1949

- 421950-1959

- 711960-1969

- 551970-1979

- 1011980-1989

- 1771990-1999

- 662000-2009

- 352010-2019

- 122020-2022

FCC Registered Antenna Towers: 817 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 13 (See the full list of FCC Registered Commercial Land Mobile Towers in Huntsville, AL)

FCC Registered Private Land Mobile Towers: 24 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 184 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 207 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 26 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 24 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 2,380 (See the full list of FCC Registered Amateur Radio Licenses in Huntsville)

FAA Registered Aircraft Manufacturers and Dealers: 5 (See the full list of FAA Registered Manufacturers and Dealers in Huntsville)

FAA Registered Aircraft: 280 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 39 full and 21 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 883 | $143,445 | 966 | $168,199 | 3,305 | $174,673 | 348 | $36,503 | 9 | $1,571,131 | 465 | $104,736 | 8 | $42,160 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 18 | $142,878 | 46 | $193,436 | 213 | $164,406 | 28 | $42,852 | 0 | $0 | 12 | $65,574 | 5 | $44,066 |

| APPLICATIONS DENIED | 108 | $112,878 | 104 | $153,071 | 1,026 | $142,996 | 165 | $41,685 | 1 | $9,759,000 | 58 | $90,018 | 6 | $63,500 |

| APPLICATIONS WITHDRAWN | 107 | $154,269 | 124 | $187,970 | 804 | $157,324 | 19 | $73,736 | 0 | $0 | 43 | $87,927 | 2 | $43,025 |

| FILES CLOSED FOR INCOMPLETENESS | 21 | $121,854 | 27 | $207,836 | 195 | $145,414 | 18 | $96,725 | 0 | $0 | 13 | $112,265 | 1 | $36,890 |

Detailed mortgage data for all 55 tracts in Huntsville, AL

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 32 full and 20 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 168 | $183,828 | 141 | $174,042 | 4 | $76,332 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 30 | $168,468 | 46 | $179,273 | 4 | $113,690 |

| APPLICATIONS DENIED | 16 | $149,826 | 19 | $190,280 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 4 | $228,992 | 19 | $184,232 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 7 | $143,256 | 6 | $139,972 | 3 | $87,873 |

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Huntsville, AL

- 5,28240.8%Outside Fires

- 4,10131.7%Structure Fires

- 2,62320.3%Mobile Property/Vehicle Fires

- 9387.2%Other

According to the data from the years 2002 - 2018 the average number of fire incidents per year is 761. The highest number of reported fire incidents - 1,022 took place in 2007, and the least - 238 in 2002. The data has an increasing trend.

According to the data from the years 2002 - 2018 the average number of fire incidents per year is 761. The highest number of reported fire incidents - 1,022 took place in 2007, and the least - 238 in 2002. The data has an increasing trend. When looking into fire subcategories, the most reports belonged to: Outside Fires (40.8%), and Structure Fires (31.7%).

When looking into fire subcategories, the most reports belonged to: Outside Fires (40.8%), and Structure Fires (31.7%).Fire-safe hotels and motels in Huntsville, Alabama:

- Ramada, 4880 University Dr, Huntsville, Alabama 35816 , Phone: (256) 837-4070, Fax: (256) 837-4535

- Huntsville Marriott, 5 Tranquility Base, Huntsville, Alabama 35805 , Phone: (256) 830-2222, Fax: (256) 830-2929

- Days Inn, 3141 University Dr, Huntsville, Alabama 35816 , Phone: (256) 533-0756, Fax: (256) 539-5414

- America's Best Inn, 1304 N Memorial Pkwy, Huntsville, Alabama 35801 , Phone: (256) 539-9671

- Four Points Sheraton Huntsville Airport, 1000 Glenn Hearn Blvd, Huntsville, Alabama 35824 , Phone: (256) 772-9661, Fax: (256) 464-9116

- Super 8 Motel Of Huntsville, 3803 University Dr NW, Huntsville, Alabama 35816 , Phone: (800) 800-8000, Fax: (256) 533-5322

- Clarion Inn, 4815 University Dr, Huntsville, Alabama 35816 , Phone: (256) 830-9400, Fax: (256) 830-0978

- Guesthouse Suites Plus, 4020 Independence Dr, Huntsville, Alabama 35816 , Phone: (256) 837-8907, Fax: (256) 890-1195

- 44 other hotels and motels

| Most common first names in Huntsville, AL among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| James | 1,265 | 69.9 years |

| Mary | 1,023 | 78.2 years |

| William | 962 | 72.5 years |

| John | 882 | 73.3 years |

| Robert | 695 | 71.1 years |

| Charles | 480 | 70.8 years |

| George | 406 | 75.0 years |

| Willie | 347 | 74.2 years |

| Thomas | 336 | 71.2 years |

| Annie | 284 | 78.9 years |

| Most common last names in Huntsville, AL among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 528 | 74.1 years |

| Jones | 432 | 72.3 years |

| Johnson | 289 | 74.7 years |

| Moore | 262 | 71.5 years |

| Davis | 213 | 73.5 years |

| Williams | 212 | 72.6 years |

| Brown | 204 | 71.9 years |

| Miller | 188 | 74.0 years |

| Taylor | 176 | 75.6 years |

| Turner | 172 | 74.0 years |

- 66.6%Electricity

- 31.3%Utility gas

- 1.5%Bottled, tank, or LP gas

- 0.3%No fuel used

- 0.2%Fuel oil, kerosene, etc.

- 87.3%Electricity

- 10.8%Utility gas

- 1.0%No fuel used

- 0.7%Bottled, tank, or LP gas

- 0.3%Wood

Huntsville compared to Alabama state average:

- Unemployed percentage below state average.

- Hispanic race population percentage above state average.

- Median age below state average.

- Foreign-born population percentage significantly above state average.

- Length of stay since moving in below state average.

- Number of college students above state average.

- Percentage of population with a bachelor's degree or higher significantly above state average.

Huntsville, AL compared to other similar cities:

Huntsville on our top lists:

- #6 on the list of "Top 101 cities with largest percentage of males in occupations: architecture and engineering occupations (population 50,000+)"

- #6 on the list of "Top 101 cities with the lowest cost per building permit (population 50,000+)"

- #12 on the list of "Top 101 cities with largest percentage of females in occupations: architecture and engineering occupations (population 50,000+)"

- #35 on the list of "Top 101 cities with largest percentage of females in industries: construction (population 50,000+)"

- #46 on the list of "Top 101 cities with largest percentage of males in industries: professional, scientific, and technical services (population 50,000+)"

- #59 on the list of "Top 101 cities with the highest number of assaults per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #60 on the list of "Top 101 cities with largest percentage of females in occupations: law enforcement workers including supervisors (population 50,000+)"

- #60 on the list of "Top 101 cities with the highest average yearly precipitation (population 50,000+)"

- #61 on the list of "Top 101 cities with largest percentage of females in occupations: construction and extraction occupations (population 50,000+)"

- #62 on the list of "Top 101 cities with the largest city-data.com crime index increase from 2002 to 2012 (population 50,000+)"

- #70 on the list of "Top 100 cities with largest land areas (pop. 50,000+)"

- #75 on the list of "Top 101 cities with most building permits per 10,000 residents (population 50,000+)"

- #75 on the list of "Top 101 cities with largest percentage of males in industries: public administration (population 50,000+)"

- #82 on the list of "Top 101 cities with largest percentage of females in industries: information (population 50,000+)"

- #86 on the list of "Top 101 cities with the largest wind speed differences during a year (population 50,000+)"

- #92 on the list of "Top 101 cities with the most mentions on city-data.com forum"

- #94 on the list of "Top 101 cities with the highest average humidity (population 50,000+)"

- #95 on the list of "Top 101 cities with largest percentage population decreases in the 1990s) (population 50,000+)"

- #96 on the list of "Top 101 cities with the highest city-data.com crime index, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #99 on the list of "Top 101 cities with the highest percentage of English-only speaking households, population 50,000+"

- #22 (35801) on the list of "Top 101 zip codes with the most offices of physicians in 2005"

- #78 (35816) on the list of "Top 101 zip codes with the lowest 2012 average net capital gain/loss (pop 5,000+)"

- #95 (35808) on the list of "Top 101 zip codes with the smallest percentage of taxpayers using paid preparers for 2012 taxes (pop 1,000+)"

- #40 on the list of "Top 101 counties with the highest number of infant deaths per 1000 residents 2007-2013 (pop. 50,000+)"

- #66 on the list of "Top 101 counties with the most Evangelical Protestant adherents"

- #82 on the list of "Top 101 counties with the highest ground withdrawal of fresh water for public supply"

- #83 on the list of "Top 101 counties with the most Black Protestant congregations"

- #83 on the list of "Top 101 counties with the most Evangelical Protestant congregations"

|

|

Total of 1197 patent applications in 2008-2024.