Irving, Texas

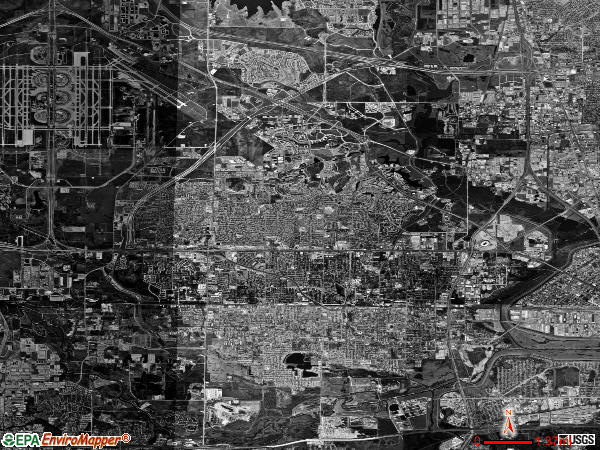

Irving: DFW Airport - The busiest airport in Texas and 7th busiest in the world

Irving: The Mustangs of Las Colinas... the world's largest equestrian statue is located in Williams Square

Irving: Mustangs at Las Colinas During Snowstorm of February 14, 2004

Irving: Landscaping on the grounds of the Dallas Cowboys Gnrl Office & Practice Facility

Irving: Irving High School

Irving: The Academy of Irving ISD

Irving: Texas Stadium

Irving: IMG_1425.JPG

Irving: International Pkwy - DFW Airport

Irving: Canals of Valley Ranch

Irving: in-n-out comes to Irving

- see

17

more - add

your

Submit your own pictures of this city and show them to the world

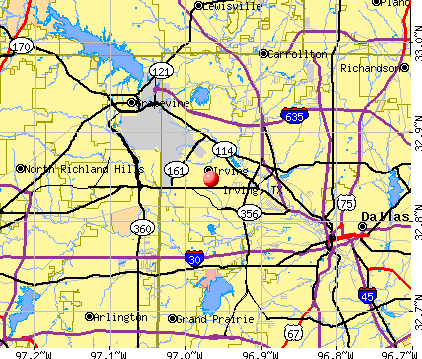

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +32.9%

| Males: 130,353 | |

| Females: 124,362 |

| Median resident age: | 33.2 years |

| Texas median age: | 35.6 years |

Zip codes: 75038.

| Irving: | $78,326 |

| TX: | $72,284 |

Estimated per capita income in 2022: $37,033 (it was $23,419 in 2000)

Irving city income, earnings, and wages data

Estimated median house or condo value in 2022: $292,600 (it was $92,600 in 2000)

| Irving: | $292,600 |

| TX: | $275,400 |

Mean prices in 2022: all housing units: $342,126; detached houses: $349,761; townhouses or other attached units: $390,307; in 2-unit structures: $378,985; in 3-to-4-unit structures: $278,103; in 5-or-more-unit structures: $236,843; mobile homes: $37,808; occupied boats, rvs, vans, etc.: $30,418

Median gross rent in 2022: $1,495.

(6.5% for White Non-Hispanic residents, 13.0% for Black residents, 14.3% for Hispanic or Latino residents, 5.1% for American Indian residents, 12.2% for other race residents, 11.7% for two or more races residents)

Detailed information about poverty and poor residents in Irving, TX

- 104,92841.2%Hispanic

- 57,96522.8%Asian alone

- 45,43717.8%White alone

- 34,57213.6%Black alone

- 8,7853.4%Two or more races

- 2,3670.9%Other race alone

- 3160.1%American Indian alone

- 3420.1%Native Hawaiian and Other

Pacific Islander alone

Races in Irving detailed stats: ancestries, foreign born residents, place of birth

According to our research of Texas and other state lists, there were 174 registered sex offenders living in Irving, Texas as of April 25, 2024.

The ratio of all residents to sex offenders in Irving is 1,369 to 1.

The ratio of registered sex offenders to all residents in this city is much lower than the state average.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is smaller than the state average.- means the value is about the same as the state average.

- means the value is bigger than the state average.

- means the value is much bigger than the state average.

Crime rate in Irving detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 553 (380 officers - 339 male; 41 female).

| Officers per 1,000 residents here: | 1.57 |

| Texas average: | 2.07 |

Latest news from Irving, TX collected exclusively by city-data.com from local newspapers, TV, and radio stations

Irving, TX City Guides:

Ancestries: American (2.6%), English (2.0%), African (1.6%), German (1.2%), Irish (1.2%).

Current Local Time: CST time zone

Land area: 67.2 square miles.

Population density: 3,789 people per square mile (average).

108,526 residents are foreign born (20.6% Latin America, 16.9% Asia).

| This city: | 42.6% |

| Texas: | 17.1% |

Median real estate property taxes paid for housing units with mortgages in 2022: $5,854 (1.7%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $3,671 (1.5%)

Nearest city with pop. 200,000+: Dallas, TX (10.9 miles

, pop. 1,188,580).

Nearest cities:

Latitude: 32.85 N, Longitude: 96.97 W

Daytime population change due to commuting: +48,450 (+19.0%)

Workers who live and work in this city: 56,196 (42.1%)

Area codes: 972, 469, 214

Property values in Irving, TX

Irving, Texas accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 157 buildings, average cost: $357,800

- 2021: 366 buildings, average cost: $255,200

- 2020: 627 buildings, average cost: $347,200

- 2019: 613 buildings, average cost: $376,800

- 2018: 517 buildings, average cost: $404,300

- 2017: 648 buildings, average cost: $407,900

- 2016: 625 buildings, average cost: $381,500

- 2015: 539 buildings, average cost: $398,400

- 2014: 490 buildings, average cost: $373,800

- 2013: 478 buildings, average cost: $344,600

- 2012: 455 buildings, average cost: $341,800

- 2011: 340 buildings, average cost: $350,900

- 2010: 338 buildings, average cost: $307,500

- 2009: 426 buildings, average cost: $296,800

- 2008: 457 buildings, average cost: $273,600

- 2007: 795 buildings, average cost: $260,900

- 2006: 723 buildings, average cost: $249,400

- 2005: 480 buildings, average cost: $261,000

- 2004: 346 buildings, average cost: $134,100

- 2003: 406 buildings, average cost: $129,700

- 2002: 349 buildings, average cost: $125,800

- 2001: 521 buildings, average cost: $187,100

- 2000: 497 buildings, average cost: $233,500

- 1999: 342 buildings, average cost: $218,100

- 1998: 329 buildings, average cost: $223,200

- 1997: 425 buildings, average cost: $188,100

| Here: | 3.1% |

| Texas: | 3.5% |

Population change in the 1990s: +35,836 (+23.0%).

- Professional, scientific, technical services (9.6%)

- Accommodation & food services (9.4%)

- Construction (8.2%)

- Health care (7.4%)

- Finance & insurance (6.8%)

- Administrative & support & waste management services (6.7%)

- Educational services (6.5%)

- Construction (13.5%)

- Professional, scientific, technical services (11.3%)

- Accommodation & food services (8.7%)

- Administrative & support & waste management services (7.1%)

- Finance & insurance (5.6%)

- Health care (3.6%)

- Other transportation, support activities, couriers (3.1%)

- Health care (12.3%)

- Educational services (11.0%)

- Accommodation & food services (10.2%)

- Finance & insurance (8.3%)

- Professional, scientific, technical services (7.3%)

- Administrative & support & waste management services (6.2%)

- Personal & laundry services (2.8%)

- Computer specialists (11.0%)

- Laborers and material movers, hand (5.3%)

- Cooks and food preparation workers (5.2%)

- Other management occupations, except farmers and farm managers (4.5%)

- Building and grounds cleaning and maintenance occupations (3.8%)

- Construction laborers (3.4%)

- Cashiers (2.2%)

- Computer specialists (15.7%)

- Construction laborers (6.0%)

- Other management occupations, except farmers and farm managers (4.9%)

- Laborers and material movers, hand (4.8%)

- Cooks and food preparation workers (3.8%)

- Driver/sales workers and truck drivers (3.3%)

- Engineers (2.8%)

- Cooks and food preparation workers (7.0%)

- Building and grounds cleaning and maintenance occupations (6.0%)

- Laborers and material movers, hand (6.0%)

- Computer specialists (5.2%)

- Other management occupations, except farmers and farm managers (3.9%)

- Registered nurses (3.4%)

- Cashiers (3.3%)

Average climate in Irving, Texas

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

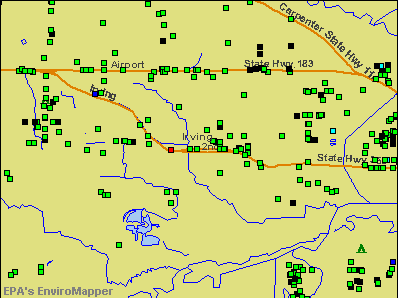

Air Quality Index (AQI) level in 2022 was 97.9. This is worse than average.

| City: | 97.9 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2014 was 0.219. This is about average. Closest monitor was 6.1 miles away from the city center.

| City: | 0.219 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 6.79. This is worse than average. Closest monitor was 0.6 miles away from the city center.

| City: | 6.79 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.679. This is significantly better than average. Closest monitor was 0.6 miles away from the city center.

| City: | 0.679 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 30.3. This is about average. Closest monitor was 4.9 miles away from the city center.

| City: | 30.3 |

| U.S.: | 33.3 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 8.79. This is about average. Closest monitor was 6.4 miles away from the city center.

| City: | 8.79 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2008 was 0.121. This is significantly worse than average. Closest monitor was 0.6 miles away from the city center.

| City: | 0.121 |

| U.S.: | 0.009 |

Tornado activity:

Irving-area historical tornado activity is above Texas state average. It is 156% greater than the overall U.S. average.

On 4/25/1994, a category F4 (max. wind speeds 207-260 mph) tornado 21.1 miles away from the Irving city center killed 3 people and injured 48 people and caused between $50,000,000 and $500,000,000 in damages.

On 3/28/2000, a category F3 (max. wind speeds 158-206 mph) tornado 6.8 miles away from the city center .

Earthquake activity:

Irving-area historical earthquake activity is significantly above Texas state average. It is 475% greater than the overall U.S. average.On 11/6/2011 at 03:53:10, a magnitude 5.7 (5.7 MW, Depth: 3.2 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 186.1 miles away from the city center

On 9/3/2016 at 12:02:44, a magnitude 5.8 (5.8 MW, Depth: 3.5 mi) earthquake occurred 247.5 miles away from Irving center

On 6/16/1978 at 11:46:54, a magnitude 5.3 (4.4 MB, 4.6 UK, 5.3 ML) earthquake occurred 220.9 miles away from the city center

On 5/17/2012 at 08:12:00, a magnitude 4.8 (4.8 MW, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 164.5 miles away from the city center

On 11/7/2016 at 01:44:24, a magnitude 5.0 (5.0 MW, Depth: 2.8 mi) earthquake occurred 217.6 miles away from Irving center

On 11/8/2011 at 02:46:57, a magnitude 4.8 (4.8 MW, Depth: 3.1 mi) earthquake occurred 185.9 miles away from the city center

Magnitude types: body-wave magnitude (MB), local magnitude (ML), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Dallas County (21) is greater than the US average (15).Major Disasters (Presidential) Declared: 9

Emergencies Declared: 10

Causes of natural disasters: Hurricanes: 7, Storms: 7, Floods: 5, Tornadoes: 5, Fires: 4, Winds: 2, Flash Flood: 1, Winter Storm: 1, Other: 2 (Note: some incidents may be assigned to more than one category).

Main business address for: MICHAELS STORES INC (RETAIL-HOBBY, TOY & GAME SHOPS), CEC ENTERTAINMENT INC (RETAIL-EATING PLACES), ACE CASH EXPRESS INC/TX (FUNCTIONS RELATED TO DEPOSITORY BANKING, NEC), DIGITAL GENERATION SYSTEMS INC (SERVICES-BUSINESS SERVICES, NEC), FLOWSERVE CORP (PUMPS & PUMPING EQUIPMENT), AEGIS COMMUNICATIONS GROUP INC (SERVICES-BUSINESS SERVICES, NEC), LA QUINTA PROPERTIES INC (HOTELS & MOTELS), ZALE CORP (RETAIL-JEWELRY STORES) and 18 other public companies.

Hospitals in Irving:

- ANNA HOUSE (1829 ANNA DR)

- APPLE TREE COURT HOUSE (917 APPLE TREE CT)

- BAYLOR MEDICAL CENTER AT IRVING (Proprietary, provides emergency services, 1901 N MACARTHUR BLVD)

- COMPASSIONATE HANDS HOSPICE (9150 ROYAL LANE SUITE 160)

- DALLAS COUNTY M H M R CENTER AT 6TH (408 W 6TH ST)

- FULTON COMMUNITY HOME (2501 CRESTVIEW)

- IRVING COPPELL SURGICAL HOSPITAL LLP (Proprietary, provides emergency services, 400 WEST INTERSTATE 635 SUITE 101)

- LAS COLINAS MEDICAL CENTER (Voluntary non-profit - Private, provides emergency services, 6800 N MACARTHUR BLVD)

- MAYKUS COMMUNITY HOME (600 MAYKUS CT)

- PIONEER PARK MEDICAL CENTER (1745 W IRVING BLVD)

- RINDIE COMMUNITY HOME (1701 RINDIE ST)

Heliports located in Irving:

- Baylor Health Center At Irving Coppell Heliport (4XA7)

- Baylor Scott & White Med Ctr - Irving Heliport (19XA)

- Las Colinas Medical Center Heliport (XA21)

Amtrak station near Irving:

Colleges/Universities in Irving:

- North Lake College (Full-time enrollment: 6,191; Location: 5001 North MacArthur Blvd.; Public; Website: www.northlakecollege.edu/Pages/default.aspx)

- DeVry University-Texas (Full-time enrollment: 4,098; Location: 4800 Regent Blvd., Ste. 200; Private, for-profit; Website: www.devry.edu; Offers Master's degree)

- University of Dallas (Full-time enrollment: 2,192; Location: 1845 E Northgate Drive; Private, not-for-profit; Website: www.udallas.edu; Offers Doctor's degree)

- Universal Technical Institute - Dallas Fort Worth (Full-time enrollment: 1,215; Location: 5151 Regent Blvd.; Private, for-profit; Website: www.uti.edu)

- Aviation Institute of Maintenance-Dallas (Full-time enrollment: 514; Location: 400 E Airport Freeway; Private, for-profit; Website: www.aviationmaintenance.edu)

- Anthem College-Irving (Full-time enrollment: 463; Location: 4250 N Beltline Road; Private, for-profit; Website: https://www.anthem.edu)

- Tint School of Makeup and Cosmetology-Irving (Full-time enrollment: 70; Location: 2716 W. Irving Blvd; Private, for-profit; Website: www.tintschoolofmakeupandcosmetology.com)

- Advanced Beauty College (Full-time enrollment: 52; Location: 3959 N. Beltline Rd.; Private, for-profit)

- DeVry University's Keller Graduate School of Management-Texas (Location: 4800 Regent Blvd., Suite 200; Private, for-profit; Website: www.keller.edu; Offers Master's degree)

- DeVry University-Texas (Location: 4800 Regent Blvd., Suite 200; Private, for-profit; Website: www.devry.edu)

Other colleges/universities with over 2000 students near Irving:

- Brookhaven College (about 9 miles; Farmers Branch, TX; Full-time enrollment: 6,868)

- Mountain View College (about 10 miles; Dallas, TX; FT enrollment: 4,988)

- Dallas Baptist University (about 10 miles; Dallas, TX; FT enrollment: 4,280)

- El Centro College (about 11 miles; Dallas, TX; FT enrollment: 6,086)

- Southern Methodist University (about 11 miles; Dallas, TX; FT enrollment: 9,150)

- The University of Texas at Arlington (about 12 miles; Arlington, TX; FT enrollment: 27,453)

- Richland College (about 15 miles; Dallas, TX; FT enrollment: 11,617)

Biggest public high schools in Irving:

- MACARTHUR H S (Students: 2,520, Location: 3700 N MAC ARTHUR BLVD, Grades: 9-12)

- NIMITZ H S (Students: 2,397, Location: 100 W OAKDALE, Grades: 9-12)

- IRVING H S (Students: 2,236, Location: 900 N OCONNOR RD, Grades: 9-12)

- JACK E SINGLEY ACADEMY (Students: 1,670, Location: 4601 N MACARTHUR BLVD, Grades: 9-12)

- RANCHVIEW H S (Students: 833, Location: 8401 VLY RANCH PKWY E, Grades: 9-12)

- UNIVERSAL ACADEMY (Students: 761, Location: 2616 N MACARTHUR BLVD, Grades: PK-12, Charter school)

- WINFREE ACADEMY CHARTER SCHOOL (IRVING) (Students: 338, Location: 3110 SKYWAY CIR S, Grades: 9-12, Charter school)

- BARBARA CARDWELL CAREER PREPARATORY CENTER (Students: 307, Location: 101 E UNION BOWER RD, Grades: 8-12)

- UPLIFT EDUCATION - INFINITY PREPARATORY MIDDLE SCH (Location: 1401 S MACARTHUR BLVD, Grades: 6-9, Charter school)

- PREMIER H S OF SOUTH IRVING (Location: 1081 W SHADY GROVE RD, Grades: 9-12, Charter school)

Private high schools in Irving:

Biggest public elementary/middle schools in Irving:

- HOUSTON MIDDLE (Students: 1,038, Location: 3033 W COUNTRY CLUB RD, Grades: 6-8)

- CROCKETT MIDDLE (Students: 1,013, Location: 2431 HANCOCK ST, Grades: 6-8)

- BOWIE MIDDLE (Students: 986, Location: 600 E 6TH ST, Grades: 6-8)

- AUSTIN MIDDLE (Students: 966, Location: 825 E UNION BOWER RD, Grades: 6-8)

- LORENZO DE ZAVALA MIDDLE (Students: 915, Location: 707 W PIONEER RD, Grades: 6-8)

- TOWNLEY EL (Students: 861, Location: 1030 W VILBIG ST, Grades: KG-5)

- LIVELY EL (Students: 860, Location: 1800 E PLYMOUTH DR, Grades: KG-5)

- BROWN EL (Students: 859, Location: 2501 W 10TH ST, Grades: KG-5)

- BRANDENBURG EL (Students: 831, Location: 2800 HILLCREST DR, Grades: KG-5)

- KEYES EL (Students: 818, Location: 1501 N BRITAIN RD, Grades: KG-5)

Private elementary/middle schools in Irving:

- HOLY FAMILY OF NAZARETH SCHOOL (Students: 179, Location: 2323 CHEYENNE ST, Grades: PK-8)

- THE SLOAN SCHOOL (Students: 177, Location: 3131 N O CONNOR RD, Grades: PK-5)

- REDEEMER MONTESSORI SCHOOL (Students: 137, Location: 2700 WARREN CIR, Grades: PK-6)

- ST LUKE CATHOLIC SCHOOL (Students: 126, Location: 1023 SCHULZE DR, Grades: PK-8)

- WESLEYAN ACADEME (Students: 108, Location: 1615 W AIRPORT FWY, Grades: PK-5)

- PIERCE PRIVATE DAY SCHOOL (Students: 46, Location: 9930 VALLEY RANCH PKWY W, Grades: PK-2)

- BEREAN CHRISTIAN ACADEMY (Students: 14, Location: 1000 E 6TH ST, Grades: KG-6)

User-submitted facts and corrections:

- A public high school that should be included in the appropriate section is the Academy of Irving ISD. Winfree Academy is a charter school.

- New high school in Irving, TX--- Ranchview High School

Points of interest:

Notable locations in Irving: Dallas Gun Club (A), Irving Country Club (B), Riverside Hills Golf Club (C), Trinity Valley Marketplace (D), Hackberry Ranch (E), Irving Fire Department Station 11 (F), Irving Fire Department Station 8 (G), Irving Fire Department Station 7 (H), Dallas Fort Worth International Airport Department of Public Safety Station 3 (I), Irving Fire Department Station 1 (J), Irving Fire Department Station 9 (K), Irving Fire Department Station 10 (L), Irving Fire Department Station 2 (M), Irving Fire Department Station 3 (N), Irving Fire Department Station 4 (O), Irving Fire Department Station 6 (P), Irving Fire Department Station 5 (Q), Dallas Fort Worth Airport Department of Public Safety Ambulance (R), MedCare Medical Service (S). Display/hide their locations on the map

Shopping Centers: Irving Mall (1), Plymouth Park Shopping Center (2), MacArthur Park Shopping Center (3), Irving Shopping Center (4). Display/hide their locations on the map

Main business address in Irving include: MICHAELS STORES INC (A), CEC ENTERTAINMENT INC (B), ACE CASH EXPRESS INC/TX (C), DIGITAL GENERATION SYSTEMS INC (D), FLOWSERVE CORP (E), AEGIS COMMUNICATIONS GROUP INC (F), LA QUINTA PROPERTIES INC (G), ZALE CORP (H). Display/hide their locations on the map

Churches in Irving include: Plymouth Park Church (A), Pentecostal Church (B), India Pentecostal Assembly Church (C), Iglesia Pentecostal Unida Hispana Church (D), First Pentecostal Church of God (E), Yeabon Presbyterian Church (F), Woodhaven Presbyterian Church (G), Saint Stephens Presbyterian Church (H), First Presbyterian Church (I). Display/hide their locations on the map

Cemeteries: Oak Grove Memorial Park (1), Smith Cemetery (2), Harrington Cemetery (3), Haley Cemetery (4), Sowers Cemetery (5). Display/hide their locations on the map

Lakes and reservoirs: Bear Slough (A), Vilbig Lakes (B), Spring Lake (C), Cabell Lake (D), Las Colinas Reservoir Number 7 (E), Las Colinas Reservoir Number 4 (F), Lake Carolyn (G). Display/hide their locations on the map

Streams, rivers, and creeks: South Fork Hackberry Creek (A), Mud Springs (B), Estelle Creek (C), Grapevine Creek (D), Delaware Creek (E), Cottonwood Branch (F), Bear Creek (G). Display/hide their locations on the map

Parks in Irving include: Lively Park (1), Jaycee Park (2), West Irving Acres Park (3), Southwest Park (4), Stardust Park (5), Northwest Park (6), Luzon Park (7), Woodridge Park (8), Wyche Park (9). Display/hide their locations on the map

Tourist attractions: Boy Scouts of America - National Scouting Museum (1329 West Walnut Hill Lane) (1), Cooksey Communications Inc (Cultural Attractions- Events- & Facilities; 5525 North Macarthur Boulevard Suite 530) (2), Amf Bowling Centers - Amf Irving Lanes (1717 North Belt Line Road) (3), Allstate Tours & Travels (Tours & Charters; 800 West Airport Freeway # 501) (4), Air Travel & Tours (Tours & Charters; 315 West Airport Freeway) (5). Display/hide their approximate locations on the map

Hotels: American Hospitality Services Corporation (1300 West Walnut Hill Lane Suite 148) (1), Best Western DFW Airport (5050 West John Carpenter Freeway) (2), Four Seasons Resort and Club Dallas at Las Colinas (4150 N Macarthur Blvd) (3), Four Seasons Resort & Club (4150 N Macarthur Blvd) (4), Best Western Irving Inn & Suites at DFW (4110 West Airport Freeway) (5), Atrium Suites Inn (215 East Airport Freeway) (6), Amerisuites Las Colinas (333 West 114) (7), Airport Inn (128 West Airport Freeway) (8), Candlewood Suites (5300 Green Park Drive) (9). Display/hide their approximate locations on the map

Court: John Hendry for Congress Committee (944 West Airport Freeway) (1). Display/hide its approximate location on the map

Birthplace of: Gus Malzahn - Football coach, Susan Ashton - Female singer, Davíd Garza - Singer-songwriter, DeMarcus Faggins - 2005 NFL player (Houston Texans, born: Jun 13, 1979), Eloy Salgado - Soccer player, Jay Boulware - Football player and coach, Josh Bell (outfielder) - Baseball player, Kerry Wood - 2005 Major League Baseball player (Chicago Cubs, born: Jun 16, 1977), Kevin Walker - 2005 Major League Baseball player (Chicago White Sox, born: Sep 20, 1976), Michael Huff - College football player.

Drinking water stations with addresses in Irving and their reported violations in the past:

FLORIDA CAMP INN (Serves FL, Population served: 1,150, Groundwater):Past monitoring violations:BURT VIEW CONDOMINIUMS (Address: 6012 W. Campus Circle Drive S-210 , Serves MI, Population served: 42, Groundwater):

- Follow-up Or Routine LCR Tap M/R - In JAN-01-2005, Contaminant: Lead and Copper Rule. Follow-up actions: St Violation/Reminder Notice (FEB-28-2008), St Public Notif requested (FEB-28-2008), St Compliance Meeting conducted (MAR-13-2008), St BCA signed (MAR-18-2008), St Public Notif received (APR-10-2008), St Compliance achieved (JUL-10-2008)

Past monitoring violations:

- One minor monitoring violation

| This city: | 2.6 people |

| Texas: | 2.8 people |

| This city: | 62.5% |

| Whole state: | 69.9% |

| This city: | 6.9% |

| Whole state: | 6.0% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.4% of all households

People in group quarters in Irving in 2010:

- 393 people in nursing facilities/skilled-nursing facilities

- 380 people in college/university student housing

- 56 people in other noninstitutional facilities

- 30 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 14 people in group homes intended for adults

People in group quarters in Irving in 2000:

- 461 people in college dormitories (includes college quarters off campus)

- 410 people in nursing homes

- 46 people in other noninstitutional group quarters

- 43 people in local jails and other confinement facilities (including police lockups)

- 37 people in homes for the mentally retarded

- 37 people in religious group quarters

- 24 people in other nonhousehold living situations

- 12 people in wards in general hospitals for patients who have no usual home elsewhere

- 3 people in schools, hospitals, or wards for the intellectually disabled

Banks with most branches in Irving (2011 data):

- JPMorgan Chase Bank, National Association: 10 branches. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- Bank of America, National Association: 9 branches. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Wells Fargo Bank, National Association: Irving Macarthur Branch, Hd Vesting Banking Pb Branch, Mac Arthur And Northcate, Irving Branch, Towne North Center Branch. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- First National Bank Texas: Macarthur Banking Center - Rc 577, Beltline Banking Center - Rc 402, West Airport Banking Center - Rc 677, Irving Banking Center - Rc 824. Info updated 2006/11/03: Bank assets: $944.3 mil, Deposits: $815.9 mil, headquarters in Killeen, TX, positive income, Mortgage Lending Specialization, 250 total offices, Holding Company: First Community Bancshares, Inc.

- Citibank, National Association: Las Colinas Plaza, Regent, Las Colinas Employee Financial Cente. Info updated 2012/01/10: Bank assets: $1,288,658.0 mil, Deposits: $882,541.0 mil, headquarters in Sioux Falls, SD, positive income, International Specialization, 1048 total offices, Holding Company: Citigroup Inc.

- Comerica Bank: Irving/Oconnor Branch, Sh161-Belt Line Rd Branch, Las Colinas-114 Branch. Info updated 2011/07/29: Bank assets: $60,970.5 mil, Deposits: $48,300.9 mil, headquarters in Dallas, TX, positive income, Commercial Lending Specialization, 497 total offices, Holding Company: Comerica Incorporated

- Compass Bank: Macarthur Crossing Branch, Las Colinas Branch, Irving Branch. Info updated 2011/02/24: Bank assets: $63,107.0 mil, Deposits: $46,232.4 mil, headquarters in Birmingham, AL, negative income in the last year, Commercial Lending Specialization, 720 total offices, Holding Company: Banco Bilbao Vizcaya Argentaria, S.A.

- Capital One, National Association: Valley Branch at 8000 N. Macarthur Blvd, branch established on 2006/05/15; O'connor Road Branch at 4975 O' Connor Boulevard, branch established on 2009/10/21. Info updated 2011/07/01: Bank assets: $133,477.8 mil, Deposits: $97,063.7 mil, headquarters in Mclean, VA, positive income, 984 total offices, Holding Company: Capital One Financial Corporation

- Bank of the West: Belt Line Branch at 950 North Belt Line Road, branch established on 1994/02/15; Irving Blvd at 2400 W Irving Blvd, branch established on 1998/02/03. Info updated 2009/05/18: Bank assets: $330.1 mil, Deposits: $296.1 mil, headquarters in Grapevine, TX, positive income, Commercial Lending Specialization, 10 total offices, Holding Company: Greater Southwest Bancshares, Inc.

- 11 other banks with 11 local branches

For population 15 years and over in Irving:

- Never married: 37.4%

- Now married: 50.4%

- Separated: 1.4%

- Widowed: 3.2%

- Divorced: 7.5%

For population 25 years and over in Irving:

- High school or higher: 82.4%

- Bachelor's degree or higher: 42.4%

- Graduate or professional degree: 18.1%

- Unemployed: 4.3%

- Mean travel time to work (commute): 19.3 minutes

| Here: | 15.4 |

| Texas average: | 14.0 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Irving:

(Irving, Texas Neighborhood Map)- Arts District (Irving Arts District) neighborhood

- Barton Estates neighborhood

- Beverly Oaks neighborhood

- Broadmoor Hills neighborhood

- Cardinal Family Village neighborhood

- Club Townhomes neighborhood

- Cottonwood Valley neighborhood

- Country Club Place neighborhood

- Del Paseo neighborhood

- Downtown Heritage District (Downtown) neighborhood

- Espanita neighborhood

- Fairway Vista neighborhood

- Fox Glen neighborhood

- Garden Oaks neighborhood

- Grauwyler Heights neighborhood

- Hackberry Creek neighborhood

- Hillcrest Oaks neighborhood

- Hospital District (Irving Hospital District) neighborhood

- Hospital District South (Irving Hospital District South) neighborhood

- Irving Heights neighborhood

- Irving Lake (Lake Vilbig) neighborhood

- Lakeside Landing neighborhood

- Lamar-Brown neighborhood

- Las Brisas Hills neighborhood

- Las Colinas neighborhood

- Macarthur Commons neighborhood

- Mandalay Place neighborhood

- Nichols Way neighborhood

- North Irving neighborhood

- Northgate Heights neighborhood

- Oaks on the Ridge neighborhood

- Pecan Estates neighborhood

- Plymouth Park neighborhood

- Quail Run neighborhood

- Revere Place neighborhood

- SONG neighborhood

- Sherwood Forest neighborhood

- South Irving neighborhood

- The Collections neighborhood

- Timberlake neighborhood

- Townlake II (Town Lake II) neighborhood

- Townlake III (Town Lake III) neighborhood

- Trinity Oaks neighborhood

- University Hills neighborhood

- University Park neighborhood

- Valley Ranch neighborhood

- Windsor Ridge neighborhood

- Woodhaven neighborhood

Religion statistics for Irving, TX (based on Dallas County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 615,849 | 1,672 |

| Catholic | 446,996 | 57 |

| Mainline Protestant | 166,224 | 240 |

| Other | 147,445 | 174 |

| Black Protestant | 69,831 | 174 |

| Orthodox | 8,813 | 19 |

| None | 912,981 | - |

Food Environment Statistics:

| Dallas County: | 1.64 / 10,000 pop. |

| State: | 1.47 / 10,000 pop. |

| This county: | 0.10 / 10,000 pop. |

| Texas: | 0.14 / 10,000 pop. |

| This county: | 1.15 / 10,000 pop. |

| Texas: | 1.11 / 10,000 pop. |

| Here: | 2.82 / 10,000 pop. |

| State: | 3.95 / 10,000 pop. |

| Dallas County: | 6.73 / 10,000 pop. |

| Texas: | 6.13 / 10,000 pop. |

| Dallas County: | 8.8% |

| Texas: | 8.9% |

| Dallas County: | 27.1% |

| State: | 26.6% |

| Here: | 17.0% |

| State: | 15.7% |

Health and Nutrition:

| Irving: | 47.9% |

| Texas: | 48.6% |

| Irving: | 46.8% |

| Texas: | 47.4% |

| This city: | 28.0 |

| Texas: | 28.5 |

| Irving: | 20.2% |

| State: | 20.6% |

| Irving: | 10.3% |

| State: | 10.3% |

| This city: | 6.8 |

| Texas: | 6.8 |

| Here: | 29.6% |

| State: | 33.1% |

| Irving: | 57.1% |

| Texas: | 56.2% |

| Irving: | 81.9% |

| State: | 80.7% |

More about Health and Nutrition of Irving, TX Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 438 | $3,190,529 | $87,412 | 0 | $0 |

| Firefighters | 325 | $2,679,113 | $98,921 | 0 | $0 |

| Police - Other | 242 | $1,627,374 | $80,696 | 8 | $11,975 |

| Streets and Highways | 186 | $884,155 | $57,042 | 0 | $0 |

| Parks and Recreation | 180 | $927,529 | $61,835 | 112 | $116,383 |

| Water Supply | 127 | $863,270 | $81,569 | 0 | $0 |

| Solid Waste Management | 98 | $411,503 | $50,388 | 0 | $0 |

| Financial Administration | 58 | $488,629 | $101,096 | 1 | $1,636 |

| Other and Unallocable | 55 | $277,415 | $60,527 | 5 | $2,956 |

| Local Libraries | 52 | $328,436 | $75,793 | 47 | $77,035 |

| Fire - Other | 52 | $364,102 | $84,024 | 1 | $1,909 |

| Judicial and Legal | 50 | $358,730 | $86,095 | 0 | $0 |

| Sewerage | 35 | $193,128 | $66,215 | 0 | $0 |

| Health | 33 | $205,098 | $74,581 | 0 | $0 |

| Natural Resources | 32 | $161,851 | $60,694 | 0 | $0 |

| Other Government Administration | 17 | $113,150 | $79,871 | 12 | $7,681 |

| Welfare | 11 | $63,030 | $68,760 | 0 | $0 |

| Housing and Community Development (Local) | 10 | $76,355 | $91,626 | 0 | $0 |

| Totals for Government | 2,001 | $13,213,396 | $79,241 | 186 | $219,575 |

Irving government finances - Expenditure in 2021 (per resident):

- Construction - Water Utilities: $18,551,000 ($72.83)

Parks and Recreation: $10,933,000 ($42.92)

Regular Highways: $8,254,000 ($32.40)

Sewerage: $7,950,000 ($31.21)

Local Fire Protection: $5,846,000 ($22.95)

Solid Waste Management: $2,712,000 ($10.65)

Natural Resources - Other: $1,915,000 ($7.52)

General Public Buildings: $1,846,000 ($7.25)

Police Protection: $1,311,000 ($5.15)

General - Other: $49,000 ($0.19)

- Current Operations - Police Protection: $68,908,000 ($270.53)

Local Fire Protection: $52,425,000 ($205.82)

Water Utilities: $38,101,000 ($149.58)

General - Other: $36,657,000 ($143.91)

Sewerage: $35,391,000 ($138.94)

Parks and Recreation: $33,692,000 ($132.27)

Regular Highways: $20,685,000 ($81.21)

Solid Waste Management: $12,857,000 ($50.48)

Libraries: $7,240,000 ($28.42)

Financial Administration: $5,978,000 ($23.47)

Judicial and Legal Services: $5,613,000 ($22.04)

Housing and Community Development: $4,452,000 ($17.48)

Central Staff Services: $4,343,000 ($17.05)

General Public Buildings: $4,144,000 ($16.27)

Natural Resources - Other: $3,747,000 ($14.71)

Protective Inspection and Regulation - Other: $3,231,000 ($12.68)

Public Welfare, Vendor Payments for Other Purposes: $169,000 ($0.66)

- General - Interest on Debt: $22,562,000 ($88.58)

- Other Capital Outlay - General - Other: $12,637,000 ($49.61)

Judicial and Legal Services: $117,000 ($0.46)

Central Staff Services: $13,000 ($0.05)

Natural Resources - Other: $6,000 ($0.02)

Financial Administration: $4,000 ($0.02)

- Total Salaries and Wages: $146,414,000 ($574.81)

- Water Utilities - Interest on Debt: $7,405,000 ($29.07)

Irving government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $39,569,000 ($155.35)

Solid Waste Management: $17,286,000 ($67.86)

Natural Resources - Other: $6,369,000 ($25.00)

Other: $4,228,000 ($16.60)

Parks and Recreation: $1,601,000 ($6.29)

- Federal Intergovernmental - Housing and Community Development: $4,181,000 ($16.41)

Other: $381,000 ($1.50)

- Local Intergovernmental - Housing and Community Development: $48,000 ($0.19)

- Miscellaneous - Interest Earnings: $8,663,000 ($34.01)

General Revenue - Other: $4,748,000 ($18.64)

Fines and Forfeits: $4,293,000 ($16.85)

Special Assessments: $1,056,000 ($4.15)

Donations From Private Sources: $389,000 ($1.53)

Rents: $343,000 ($1.35)

- Revenue - Water Utilities: $65,258,000 ($256.20)

- State Intergovernmental - Other: $10,573,000 ($41.51)

Highways: $7,333,000 ($28.79)

- Tax - Property: $166,611,000 ($654.11)

General Sales and Gross Receipts: $76,774,000 ($301.41)

Public Utilities Sales: $18,103,000 ($71.07)

Other Selective Sales: $16,279,000 ($63.91)

Other License: $6,384,000 ($25.06)

Irving government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $692,280,000 ($2717.86)

Outstanding Unspecified Public Purpose: $685,270,000 ($2690.34)

Retired Unspecified Public Purpose: $142,695,000 ($560.21)

Issue, Unspecified Public Purpose: $135,685,000 ($532.69)

Irving government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $81,728,000 ($320.86)

- Other Funds - Cash and Securities: $335,328,000 ($1316.48)

- Sinking Funds - Cash and Securities: $56,964,000 ($223.64)

7.50% of this county's 2021 resident taxpayers lived in other counties in 2020 ($78,710 average adjusted gross income)

| Here: | 7.50% |

| Texas average: | 8.12% |

0.01% of residents moved from foreign countries ($115 average AGI)

Dallas County: 0.01% Texas average: 0.04%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Tarrant County, TX | |

| from Collin County, TX | |

| from Denton County, TX |

8.56% of this county's 2020 resident taxpayers moved to other counties in 2021 ($74,660 average adjusted gross income)

| Here: | 8.56% |

| Texas average: | 7.40% |

0.02% of residents moved to foreign countries ($227 average AGI)

Dallas County: 0.02% Texas average: 0.03%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Tarrant County, TX | |

| to Collin County, TX | |

| to Denton County, TX |

| Businesses in Irving, TX | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 24 Hour Fitness | 2 | Lane Bryant | 1 | |

| 7-Eleven | 1 | Lane Furniture | 2 | |

| ALDI | 1 | LensCrafters | 1 | |

| AMF Bowling | 1 | Little Caesars Pizza | 3 | |

| AT&T | 6 | Long John Silver's | 2 | |

| Aeropostale | 1 | Lowe's | 1 | |

| American Eagle Outfitters | 1 | Macy's | 1 | |

| Applebee's | 2 | MainStay | 1 | |

| Arby's | 1 | Marriott | 10 | |

| AutoZone | 4 | MasterBrand Cabinets | 1 | |

| Avenue | 1 | Mazda | 1 | |

| Bakers | 1 | McDonald's | 11 | |

| Bally Total Fitness | 1 | Men's Wearhouse | 1 | |

| Baskin-Robbins | 1 | Motel 6 | 3 | |

| Bath & Body Works | 1 | Motherhood Maternity | 1 | |

| Best Western | 2 | New Balance | 1 | |

| Blockbuster | 3 | Nike | 10 | |

| Budget Car Rental | 1 | Nissan | 1 | |

| Burger King | 3 | Office Depot | 2 | |

| Burlington Coat Factory | 1 | OfficeMax | 1 | |

| CVS | 6 | Olive Garden | 1 | |

| CarMax | 1 | On The Border | 2 | |

| Chevrolet | 1 | Outback | 1 | |

| Chick-Fil-A | 3 | Outback Steakhouse | 1 | |

| Chipotle | 3 | Papa John's Pizza | 1 | |

| Chuck E. Cheese's | 1 | Payless | 5 | |

| Church's Chicken | 4 | Penske | 1 | |

| ColorTyme | 1 | PetSmart | 2 | |

| Comfort Inn | 2 | Pier 1 Imports | 1 | |

| Comfort Suites | 2 | Pizza Hut | 2 | |

| Crossland Economy Studios | 1 | Plato's Closet | 1 | |

| Curves | 1 | Popeyes | 2 | |

| Dennys | 2 | Quiznos | 2 | |

| Discount Tire | 2 | RadioShack | 3 | |

| Domino's Pizza | 4 | Red Lobster | 1 | |

| DressBarn | 1 | Red Roof Inn | 1 | |

| Dressbarn | 1 | SAS Shoes | 1 | |

| Express | 1 | SONIC Drive-In | 7 | |

| Extended Stay Deluxe | 1 | Safeway | 2 | |

| Famous Footwear | 1 | Sam's Club | 1 | |

| FedEx | 27 | Sears | 2 | |

| Finish Line | 1 | Sheraton | 1 | |

| Firestone Complete Auto Care | 3 | Sleep Inn | 1 | |

| Foot Locker | 1 | Spencer Gifts | 1 | |

| Ford | 1 | Sprint Nextel | 3 | |

| Fredericks Of Hollywood | 1 | Staples | 1 | |

| GNC | 3 | Starbucks | 8 | |

| GameStop | 6 | Steak 'n Shake | 1 | |

| Gap | 1 | Studio 6 | 2 | |

| H&R Block | 7 | Subway | 2 | |

| Hilton | 5 | Super 8 | 2 | |

| Holiday Inn | 6 | T-Mobile | 11 | |

| Home Depot | 2 | T.J.Maxx | 1 | |

| Homestead Studio Suites | 2 | Taco Bell | 3 | |

| Honda | 1 | Target | 2 | |

| Hot Topic | 1 | Toyota | 1 | |

| Hyatt | 1 | Toys"R"Us | 2 | |

| IHOP | 2 | U-Haul | 5 | |

| Jack In The Box | 8 | UPS | 38 | |

| Jamba Juice | 1 | Vans | 1 | |

| Jimmy John's | 3 | Verizon Wireless | 3 | |

| JoS. A. Bank | 1 | Victoria's Secret | 1 | |

| Jones New York | 2 | Volkswagen | 2 | |

| Journeys | 1 | Vons | 2 | |

| KFC | 3 | Waffle House | 3 | |

| Kohl's | 1 | Walmart | 2 | |

| Kroger | 4 | Wendy's | 4 | |

| LA Fitness | 1 | Westin | 1 | |

| La Quinta | 3 | YMCA | 1 | |

Strongest AM radio stations in Irving:

- KZMP (1540 AM; 50 kW; UNIVERSITY PARK, TX; Owner: ENTRAVISION HOLDINGS, LLC)

- KBIS (1150 AM; 25 kW; HIGHLAND PARK, TX; Owner: DALLAS AM RADIO PARTNERS, L.P.)

- KLIF (570 AM; 5 kW; DALLAS, TX; Owner: KLIF LICO, INC.)

- KESS (1270 AM; 50 kW; FORT WORTH, TX; Owner: KESS-AM LICENSE CORP.)

- WBAP (820 AM; 50 kW; FORT WORTH, TX; Owner: WBAP-KSCS OPERATING, LTD.)

- KTCK (1310 AM; 9 kW; DALLAS, TX; Owner: KRBE LICO, INC.)

- KRLD (1080 AM; 50 kW; DALLAS, TX; Owner: TEXAS INFINITY BROADCASTING L.P.)

- KSKY (660 AM; 20 kW; BALCH SPRINGS, TX; Owner: BISON MEDIA, INC.)

- KNAX (1630 AM; 10 kW; FT. WORTH, TX; Owner: MORTENSON BROADCASTING COMPANY)

- KAHZ (1360 AM; 50 kW; HURST, TX)

- KFXR (1190 AM; 50 kW; DALLAS, TX; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- KHVN (970 AM; 10 kW; FORT WORTH, TX; Owner: MORTENSON BROADCASTING COMPANY)

- KGGR (1040 AM; daytime; 5 kW; DALLAS, TX; Owner: MORTENSON BROADCASTING COMPANY)

Strongest FM radio stations in Irving:

- KPLX (99.5 FM; FORT WORTH, TX; Owner: KPLX LICO, INC.)

- KLUV-FM (98.7 FM; DALLAS, TX; Owner: INFINITY BROADCASTING CORPORATION OF DALLAS)

- K213BP (90.5 FM; IRVING, TX; Owner: CSN INTERNATIONAL)

- WRR (101.1 FM; DALLAS, TX; Owner: CITY OF DALLAS, TEXAS)

- KDBN (93.3 FM; HALTOM CITY, TX; Owner: TEXAS STAR RADIO, INC.)

- KLLI (105.3 FM; DALLAS, TX; Owner: INFINITY BROADCASTING CORPORATION OF DALLAS)

- KZPS (92.5 FM; DALLAS, TX; Owner: AMFM TEXAS LICENSES LIMITED PARTNERSHIP)

- KHKS (106.1 FM; DENTON, TX; Owner: AMFM TEXAS LICENSES LIMITED PARTNERSHIP)

- KVIL-FM (103.7 FM; HIGHLAND PARK-DALLAS, TX; Owner: INFINITY BROADCASTING CORPORATION OF TEXAS)

- KKDA-FM (104.5 FM; DALLAS, TX; Owner: SERVICE BROADCASTING I, LTD.)

- KOAI (107.5 FM; FORT WORTH, TX; Owner: INFINITY KOAI-FM, INC.)

- KBFB (97.9 FM; DALLAS, TX; Owner: RADIO ONE LICENSES, LLC)

- KSCS (96.3 FM; FORT WORTH, TX; Owner: WBAP-KSCS OPERATING, LTD.)

- KLNO (94.1 FM; FORT WORTH, TX; Owner: HBC LICENSE CORPORATION)

- KEGL (97.1 FM; FORT WORTH, TX; Owner: CITICASTERS LICENSES, L.P.)

- KCBI (90.9 FM; DALLAS, TX; Owner: CRISWELL CENTER FOR BIBLICAL STUDIES)

- KRBV (100.3 FM; DALLAS, TX; Owner: INFINITY BROADCASTING CORP. OF FORT WORTH)

- KDGE (102.1 FM; FORT WORTH-DALLAS, TX; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- KDMX (102.9 FM; DALLAS, TX; Owner: CITICASTERS LICENSES, L.P.)

- KERA (90.1 FM; DALLAS, TX; Owner: NORTH TEXAS PUBLIC BROADCASTING, INC.)

TV broadcast stations around Irving:

- KLDT (Channel 55; LAKE DALLAS, TX; Owner: JOHNSON BROADCASTING OF DALLAS, INC.)

- KXAS-TV (Channel 5; FORT WORTH, TX; Owner: STATION VENTURE OPERATIONS, LP)

- KDTN (Channel 2; DENTON, TX; Owner: NORTH TEXAS PUBLIC BROADCASTING, INC.)

- KTVT (Channel 11; FORT WORTH, TX; Owner: CBS STATIONS GROUP OF TEXAS L.P.)

- KLEG-LP (Channel 44; DALLAS, TX; Owner: DILIP VISWANATH)

- KSTR-TV (Channel 49; IRVING, TX; Owner: TELEFUTURA DALLAS LLC)

- KTXA (Channel 21; FORT WORTH, TX; Owner: VIACOM TELEVISION STATIONS GROUP OF DALLAS/FORT WORTH L.P.)

- KUVN (Channel 23; GARLAND, TX; Owner: KUVN LICENSE PARTNERSHIP, L.P.)

- KMPX (Channel 29; DECATUR, TX; Owner: WORD OF GOD FELLOWSHIP, INC.)

- KPXD (Channel 68; ARLINGTON, TX; Owner: PAXSON DALLAS LICENSE, INC.)

- WFAA-TV (Channel 8; DALLAS, TX; Owner: WFAA-TV, L.P.)

- KDTX-TV (Channel 58; DALLAS, TX; Owner: TRINITY BROADCASTING OF TEXAS, INC.)

- KXTX-TV (Channel 39; DALLAS, TX; Owner: TELEMUNDO OF TEXAS PARTNERSHIP, LP)

- KDFW (Channel 4; DALLAS, TX; Owner: KDFW LICENSE, INC.)

- KERA-TV (Channel 13; DALLAS, TX; Owner: NORTH TEXAS PUBLIC BROADCASTING, INC.)

- KDAF (Channel 33; DALLAS, TX; Owner: TRIBUNE TELEVISION COMPANY)

- KDFI (Channel 27; DALLAS, TX; Owner: NEW DMIC, INC.)

- K26HF (Channel 26; BRITTON, TX; Owner: MAKO COMMUNICATIONS, LLC)

- KHPK-LP (Channel 28; DE SOTO, TX; Owner: MAKO COMMUNICATIONS, LLC)

- K25FW (Channel 25; CORSICANA, TX; Owner: VENTANA TELEVISION, INC.)

- KJJM-LP (Channel 46; DALLAS/MESQUITE, TX; Owner: JANE McGINNIS)

- KATA-LP (Channel 60; MESQUITE, TX; Owner: JANE McGINNIS)

- KFWD (Channel 52; FORT WORTH, TX; Owner: HIC BROADCAST, INC.)

- KVFW-LP (Channel 65; FORT WORTH, TX; Owner: GERALD BENAVIDES)

- KTAQ (Channel 47; GREENVILLE, TX; Owner: MIKE SIMONS)

- National Bridge Inventory (NBI) Statistics

- 488Number of bridges

- 13,875ft / 4,229mTotal length

- $2,383,000Total costs

- 13,886,310Total average daily traffic

- 835,827Total average daily truck traffic

- New bridges - historical statistics

- 11920-1929

- 61940-1949

- 91950-1959

- 591960-1969

- 701970-1979

- 761980-1989

- 721990-1999

- 972000-2009

- 982010-2019

FCC Registered Private Land Mobile Towers: 14 (See the full list of FCC Registered Private Land Mobile Towers in Irving, TX)

FCC Registered Broadcast Land Mobile Towers: 168 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 233 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 26 (See the full list of FCC Registered Paging Towers)

FCC Registered Amateur Radio Licenses: 627 (See the full list of FCC Registered Amateur Radio Licenses in Irving)

FAA Registered Aircraft Manufacturers and Dealers: 5 (See the full list of FAA Registered Manufacturers and Dealers in Irving)

FAA Registered Aircraft: 112 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 43 full and 2 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 565 | $138,400 | 760 | $194,711 | 1,466 | $183,752 | 59 | $52,363 | 8 | $1,740,250 | 127 | $130,597 | 3 | $76,000 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 35 | $141,090 | 79 | $157,091 | 194 | $173,369 | 19 | $36,902 | 2 | $19,088,970 | 13 | $87,031 | 1 | $32,000 |

| APPLICATIONS DENIED | 94 | $132,306 | 179 | $143,174 | 703 | $152,926 | 134 | $29,389 | 4 | $4,135,675 | 49 | $103,502 | 13 | $33,955 |

| APPLICATIONS WITHDRAWN | 75 | $128,538 | 151 | $191,438 | 392 | $177,684 | 26 | $50,323 | 0 | $0 | 40 | $112,642 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 14 | $145,684 | 39 | $274,924 | 115 | $159,129 | 11 | $45,688 | 0 | $0 | 8 | $78,432 | 0 | $0 |

Detailed mortgage data for all 45 tracts in Irving, TX

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 39 full and 1 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 143 | $206,186 | 61 | $201,706 | 3 | $166,107 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 36 | $216,599 | 27 | $162,219 | 3 | $129,867 |

| APPLICATIONS DENIED | 17 | $215,900 | 19 | $208,309 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 10 | $221,966 | 7 | $194,824 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 2 | $428,140 | 2 | $262,550 | 0 | $0 |

2003 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Irving, TX

- 3,34540.8%Outside Fires

- 2,45830.0%Structure Fires

- 1,83022.3%Mobile Property/Vehicle Fires

- 5586.8%Other

According to the data from the years 2003 - 2018 the average number of fire incidents per year is 512. The highest number of fire incidents - 741 took place in 2006, and the least - 299 in 2005. The data has a rising trend.

According to the data from the years 2003 - 2018 the average number of fire incidents per year is 512. The highest number of fire incidents - 741 took place in 2006, and the least - 299 in 2005. The data has a rising trend. When looking into fire subcategories, the most incidents belonged to: Outside Fires (40.8%), and Structure Fires (30.0%).

When looking into fire subcategories, the most incidents belonged to: Outside Fires (40.8%), and Structure Fires (30.0%).Fire-safe hotels and motels in Irving, Texas:

- Omni Mandalay Hotel At Las Colinas, 221 E Las Colinas Blvd, Irving, Texas 75039 , Phone: (972) 556-0800, Fax: (972) 556-0729

- Best Western Irvin Inn & Suites At DFW Airport, 4110 W Airport Fwy, Irving, Texas 75062 , Phone: (972) 790-2262, Fax: (972) 986-7620

- Americas Best Value Inn & Suites, 2611 W Airport Fwy, Irving, Texas 75062 , Phone: (972) 570-9900

- Residence Inn By Marriott Las Colinas, 950 Walnut Hill Ln, Irving, Texas 75038 , Phone: (972) 580-7773, Fax: (972) 550-8824

- Marriott-Dallas-Fort Worth Airport, 8440 Freeport Pkwy, Irving, Texas 75063 , Phone: (972) 929-8800, Fax: (972) 929-6501

- Courtyard By Marriott Dallas Las Colinas, 1151 W Walnut Hill Ln, Irving, Texas 75038 , Phone: (972) 550-8100, Fax: (972) 550-0764

- Fairfield Inn & Suites DFW South, 4210 W Airport Fwy, Irving, Texas 75062 , Phone: (214) 441-9969, Fax: (214) 441-9954

- Red Roof Inn, 8150 Esters Blvd, Irving, Texas 75063 , Phone: (972) 929-0020, Fax: (972) 929-0007

- 55 other hotels and motels

| Most common first names in Irving, TX among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| Mary | 486 | 77.7 years |

| James | 455 | 69.1 years |

| William | 435 | 72.7 years |

| John | 392 | 73.5 years |

| Robert | 335 | 68.6 years |

| Charles | 262 | 70.3 years |

| Dorothy | 175 | 74.3 years |

| George | 159 | 73.1 years |

| Thomas | 149 | 70.5 years |

| Helen | 138 | 77.6 years |

| Most common last names in Irving, TX among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 237 | 74.5 years |

| Jones | 137 | 72.7 years |

| Johnson | 117 | 73.4 years |

| Williams | 115 | 74.1 years |

| Davis | 106 | 72.3 years |

| Brown | 105 | 74.1 years |

| Moore | 88 | 72.0 years |

| Taylor | 87 | 74.6 years |

| Miller | 80 | 76.3 years |

| Thompson | 78 | 73.2 years |

- 64.6%Utility gas

- 34.1%Electricity

- 1.1%Bottled, tank, or LP gas

- 0.1%No fuel used

- 85.2%Electricity

- 13.0%Utility gas

- 0.8%No fuel used

- 0.6%Bottled, tank, or LP gas

- 0.1%Solar energy

Irving compared to Texas state average:

- Unemployed percentage significantly below state average.

- Foreign-born population percentage significantly above state average.

- Renting percentage above state average.

- Number of rooms per house below state average.

- Percentage of population with a bachelor's degree or higher above state average.

Irving, TX compared to other similar cities:

Irving on our top lists:

- #29 on the list of "Top 101 cities with largest percentage of males in occupations: computer and mathematical occupations (population 50,000+)"

- #37 on the list of "Top 100 most racially diverse cities (pop. 50,000+)"

- #40 on the list of "Top 101 cities with the largest city-data.com crime index decrease from 2002 to 2012 (population 50,000+)"

- #42 on the list of "Top 101 cities with the hottest summers (population 50,000+)"

- #46 on the list of "Top 101 cities with largest percentage of females in industries: transportation and warehousing (population 50,000+)"

- #47 on the list of "Top 100 cities with highest percentage of renters (pop. 50,000+)"

- #51 on the list of "Top 101 cities with largest percentage of females in industries: administrative and support and waste management services (population 50,000+)"

- #51 on the list of "Top 100 cities with smallest houses (pop. 50,000+)"

- #58 on the list of "Top 101 cities with largest percentage of females in industries: management of companies and enterprises (population 50,000+)"

- #72 on the list of "Top 101 cities with the highest cost per building permit(population 50,000+)"

- #76 on the list of "Top 101 cities with largest percentage of males in industries: administrative and support and waste management services (population 50,000+)"

- #80 on the list of "Top 101 cities with largest percentage of females in industries: wholesale trade (population 50,000+)"

- #82 on the list of "Top 101 cities that people commute into (largest positive percentage daily daytime population change due to commuting) (population 50,000+)"

- #83 on the list of "Top 101 cities with largest percentage of females in occupations: computer and mathematical occupations (population 50,000+)"

- #83 on the list of "Top 101 cities with the highest daily high temperatures (population 50,000+)"

- #84 on the list of "Top 101 cities with the lowest percentage of English-only speaking households, population 50,000+"

- #86 on the list of "Top 101 cities with largest percentage of females in occupations: material moving occupations (population 50,000+)"

- #92 on the list of "Top 101 cities with largest percentage of females in occupations: construction and extraction occupations (population 50,000+)"

- #95 on the list of "Top 100 cities with highest percentage of foreign-born residents (pop. 50,000+)"

- #97 on the list of "Top 101 cities with largest percentage of males in occupations: construction and extraction occupations (population 50,000+)"

- #3 on the list of "Top 101 counties with the most Evangelical Protestant adherents"

- #3 on the list of "Top 101 counties with the most Evangelical Protestant congregations"

- #5 on the list of "Top 101 counties with the highest average weight of females"

- #6 on the list of "Top 101 counties with the most Mainline Protestant adherents"

- #7 on the list of "Top 101 counties with the most Black Protestant congregations"

|

|

Total of 2191 patent applications in 2008-2024.