Lansdowne-Baltimore Highlands, Maryland

Submit your own pictures of this place and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

Current weather forecast for Lansdowne-Baltimore Highlands, MD

| Males: 7,733 | |

| Females: 8,637 |

| Median resident age: | 31.7 years |

| Maryland median age: | 36.0 years |

Zip codes: 21227.

| Lansdowne-Baltimore Highlands: | $63,460 |

| MD: | $94,991 |

Estimated per capita income in 2022: $29,122 (it was $16,348 in 2000)

Lansdowne-Baltimore Highlands CDP income, earnings, and wages data

Estimated median house or condo value in 2022: $251,461 (it was $95,900 in 2000)

| Lansdowne-Baltimore Highlands: | $251,461 |

| MD: | $398,100 |

Mean prices in 2022: all housing units: $390,251; detached houses: $449,871; townhouses or other attached units: $271,818; in 2-unit structures: $329,780; in 3-to-4-unit structures: $232,361; in 5-or-more-unit structures: $277,436; mobile homes: $70,201; occupied boats, rvs, vans, etc.: $49,806

Lansdowne-Baltimore Highlands, MD residents, houses, and apartments details

Detailed information about poverty and poor residents in Lansdowne-Baltimore Highlands, MD

- 11,68974.3%White alone

- 2,86718.2%Black alone

- 5573.5%Hispanic

- 2901.8%Asian alone

- 2441.6%Two or more races

- 530.3%American Indian alone

- 210.1%Other race alone

- 30.02%Native Hawaiian and Other

Pacific Islander alone

Ancestries: German (24.1%), Irish (16.8%), English (8.5%), United States (6.1%), Italian (5.8%), Polish (3.0%).

Current Local Time: EST time zone

Land area: 4.10 square miles.

Population density: 3,994 people per square mile (average).

745 residents are foreign born (2.4% Asia, 1.8% Latin America).

| This place: | 4.7% |

| Maryland: | 9.8% |

| Lansdowne-Baltimore Highlands CDP: | 1.3% ($1,288) |

| Maryland: | 1.2% ($1,782) |

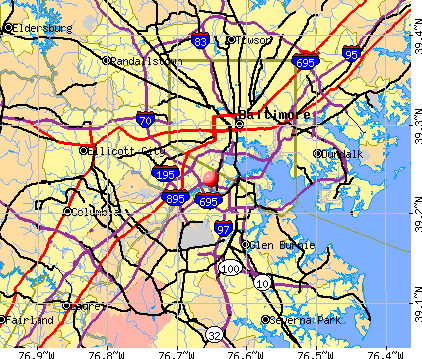

Nearest city with pop. 50,000+: Baltimore, MD (5.1 miles

, pop. 651,154).

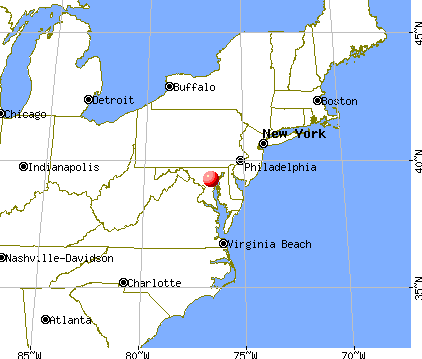

Nearest city with pop. 1,000,000+: Philadelphia, PA (95.9 miles

, pop. 1,517,550).

Nearest cities:

Latitude: 39.24 N, Longitude: 76.65 W

Daytime population change due to commuting: -3,236 (-20.6%)

Workers who live and work in this place: 478 (6.7%)

Property values in Lansdowne-Baltimore Highlands, MD

| Here: | 2.1% |

| Maryland: | 2.0% |

- Construction (8.7%)

- Health care (7.6%)

- Accommodation & food services (5.8%)

- Public administration (5.4%)

- Finance & insurance (5.2%)

- Educational services (4.7%)

- Professional, scientific, technical services (4.5%)

- Construction (15.9%)

- Truck transportation (6.9%)

- Accommodation & food services (5.0%)

- Administrative & support & waste management services (4.9%)

- Public administration (4.2%)

- Repair & maintenance (3.7%)

- Other transportation, support activities, couriers (3.7%)

- Health care (13.4%)

- Finance & insurance (8.9%)

- Educational services (7.7%)

- Accommodation & food services (6.6%)

- Public administration (6.6%)

- Professional, scientific, technical services (6.4%)

- Food & beverage stores (5.2%)

- Driver/sales workers and truck drivers (6.0%)

- Material recording, scheduling, dispatching, and distributing workers (5.5%)

- Other office and administrative support workers, including supervisors (4.7%)

- Cashiers (3.5%)

- Secretaries and administrative assistants (3.2%)

- Other production occupations, including supervisors (3.1%)

- Other management occupations, except farmers and farm managers (3.1%)

- Driver/sales workers and truck drivers (11.1%)

- Material recording, scheduling, dispatching, and distributing workers (6.9%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (5.3%)

- Vehicle and mobile equipment mechanics, installers, and repairers (4.7%)

- Laborers and material movers, hand (3.8%)

- Other production occupations, including supervisors (3.6%)

- Construction traders workers except carpenters, electricians, painters, plumbers, and construction laborers (3.4%)

- Other office and administrative support workers, including supervisors (7.5%)

- Secretaries and administrative assistants (6.3%)

- Cashiers (6.2%)

- Information and record clerks, except customer service representatives (5.8%)

- Bookkeeping, accounting, and auditing clerks (5.0%)

- Material recording, scheduling, dispatching, and distributing workers (4.1%)

- Other management occupations, except farmers and farm managers (3.5%)

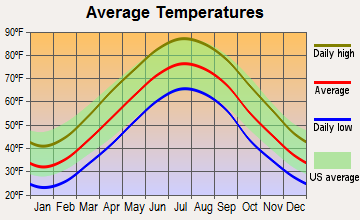

Average climate in Lansdowne-Baltimore Highlands, Maryland

Based on data reported by over 4,000 weather stations

(lower is better)

Air Quality Index (AQI) level in 2023 was 89.8. This is worse than average.

| City: | 89.8 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.210. This is about average. Closest monitor was 1.9 miles away from the city center.

| City: | 0.210 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2023 was 8.36. This is significantly worse than average. Closest monitor was 1.9 miles away from the city center.

| City: | 8.36 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.109. This is significantly better than average. Closest monitor was 1.9 miles away from the city center.

| City: | 0.109 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2023 was 30.3. This is about average. Closest monitor was 1.7 miles away from the city center.

| City: | 30.3 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2005 was 21.8. This is about average. Closest monitor was 1.7 miles away from the city center.

| City: | 21.8 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 8.50. This is about average. Closest monitor was 1.7 miles away from the city center.

| City: | 8.50 |

| U.S.: | 8.11 |

Tornado activity:

Lansdowne-Baltimore Highlands-area historical tornado activity is slightly above Maryland state average. It is 16% greater than the overall U.S. average.

On 6/9/1961, a category F3 (max. wind speeds 158-206 mph) tornado 3.0 miles away from the Lansdowne-Baltimore Highlands place center caused between $50,000 and $500,000 in damages.

On 9/24/2001, a category F3 tornado 9.6 miles away from the place center killed 2 people and injured 55 people and caused $101 million in damages.

Earthquake activity:

Lansdowne-Baltimore Highlands-area historical earthquake activity is significantly above Maryland state average. It is 59% smaller than the overall U.S. average.On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 115.2 miles away from Lansdowne-Baltimore Highlands center

On 1/16/1994 at 01:49:16, a magnitude 4.6 (4.6 MB, 4.6 LG, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 82.2 miles away from Lansdowne-Baltimore Highlands center

On 9/25/1998 at 19:52:52, a magnitude 5.2 (4.8 MB, 4.3 MS, 5.2 LG, 4.5 MW, Depth: 3.1 mi) earthquake occurred 251.4 miles away from the city center

On 8/25/2011 at 05:07:52, a magnitude 4.5 (4.5 ML, Depth: 4.2 mi) earthquake occurred 114.2 miles away from Lansdowne-Baltimore Highlands center

On 12/9/2003 at 20:59:18, a magnitude 4.5 (4.5 ML, Depth: 6.2 mi) earthquake occurred 128.1 miles away from the city center

On 12/9/2003 at 20:59:14, a magnitude 4.5 (4.5 MB, 4.5 LG) earthquake occurred 132.9 miles away from Lansdowne-Baltimore Highlands center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Baltimore County (21) is greater than the US average (15).Major Disasters (Presidential) Declared: 15

Emergencies Declared: 5

Causes of natural disasters: Hurricanes: 6, Winter Storms: 5, Floods: 4, Snowstorms: 4, Storms: 4, Tropical Storms: 2, Blizzard: 1, Heavy Rain: 1, Snow: 1, Snowfall: 1, Tornado: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers near Lansdowne-Baltimore Highlands:

- MARINER HEALTH OF CATONSVILLE (Nursing Home, about 1 miles away; CATONSVILLE, MD)

- GREATER NORTHEASTERN HOME HEALTH (Home Health Center, about 2 miles away; BALTIMORE, MD)

- PROFESSIONAL HEALTHCARE RESOURCES OF BALTIMORE (Home Health Center, about 2 miles away; BALTIMORE, MD)

- DAVITA - HARBOR PARK DIALYSIS (Dialysis Facility, about 3 miles away; BALTIMORE, MD)

- DAVITA - CATONSVILLE (Dialysis Facility, about 3 miles away; BALTIMORE, MD)

- AMEDISYS HOME HEALTH OF BALTIMORE (Home Health Center, about 3 miles away; BALTIMORE, MD)

- HARBOR HOSPITAL HOME HEALTH AGENCY (Home Health Center, about 3 miles away; BALTIMORE, MD)

Amtrak stations near Lansdowne-Baltimore Highlands:

- 5 miles: BWI AIRPORT RAIL STATION (BALTIMORE, AMTRAK WAY) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, snack bar, ATM, paid short-term parking, paid long-term parking, call for car rental service, call for taxi service, public transit connection.

- 6 miles: BALTIMORE (1500 N. CHARLES ST.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, full-service food facilities, snack bar, vending machines, ATM, paid short-term parking, paid long-term parking, call for car rental service, taxi stand, public transit connection.

Colleges/universities with over 2000 students nearest to Lansdowne-Baltimore Highlands:

- University of Maryland-Baltimore County (about 4 miles; Baltimore, MD; Full-time enrollment: 11,160)

- University of Maryland-Baltimore (about 4 miles; Baltimore, MD; FT enrollment: 3,162)

- University of Baltimore (about 5 miles; Baltimore, MD; FT enrollment: 3,592)

- Coppin State University (about 5 miles; Baltimore, MD; FT enrollment: 2,900)

- Maryland Institute College of Art (about 6 miles; Baltimore, MD; FT enrollment: 2,267)

- Baltimore City Community College (about 6 miles; Baltimore, MD; FT enrollment: 3,560)

- All-State Career-Baltimore (about 6 miles; Baltimore, MD; FT enrollment: 2,287)

Points of interest:

Notable locations in Lansdowne-Baltimore Highlands: Lansdowne Industrial Park (A), Lansdowne Volunteer Fire Department 1 Station 36 (B), English Consul Volunteer Firemens Association Station 37 (C), Lansdowne Branch Baltimore County Public Library (D). Display/hide their locations on the map

Churches in Lansdowne-Baltimore Highlands include: English Consul Church (A), First Baptist Church (B). Display/hide their locations on the map

Cemetery: Mount Zion Cemetery (1). Display/hide its location on the map

Parks in Lansdowne-Baltimore Highlands include: Hickory Hills Park (1), Hillcrest Park (2), Northeast Highlands Park (3), Riverview Park (4). Display/hide their locations on the map

| This place: | 2.7 people |

| Maryland: | 2.6 people |

| This place: | 72.3% |

| Whole state: | 69.1% |

| This place: | 9.7% |

| Whole state: | 5.6% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.3% of all households

- Gay men: 0.3% of all households

| This place: | 13.8% |

| Whole state: | 8.5% |

| This place: | 6.6% |

| Whole state: | 4.2% |

7 people in homes for the mentally ill in 2000

For population 15 years and over in Lansdowne-Baltimore Highlands:

- Never married: 33.7%

- Now married: 44.2%

- Separated: 4.2%

- Widowed: 7.9%

- Divorced: 10.0%

For population 25 years and over in Lansdowne-Baltimore Highlands:

- High school or higher: 66.8%

- Bachelor's degree or higher: 5.6%

- Graduate or professional degree: 1.5%

- Unemployed: 7.6%

- Mean travel time to work (commute): 25.6 minutes

| Here: | 11.1 |

| Maryland average: | 12.7 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Lansdowne-Baltimore Highlands, MD (based on Baltimore County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 153,243 | 34 |

| Evangelical Protestant | 62,367 | 232 |

| Mainline Protestant | 50,484 | 167 |

| Other | 32,628 | 54 |

| Black Protestant | 32,442 | 37 |

| Orthodox | 1,663 | 3 |

| None | 472,202 | - |

Food Environment Statistics:

| This county: | 1.74 / 10,000 pop. |

| Maryland: | 1.96 / 10,000 pop. |

| This county: | 0.09 / 10,000 pop. |

| Maryland: | 0.07 / 10,000 pop. |

| Here: | 1.12 / 10,000 pop. |

| Maryland: | 1.22 / 10,000 pop. |

| This county: | 1.91 / 10,000 pop. |

| State: | 2.05 / 10,000 pop. |

| This county: | 4.67 / 10,000 pop. |

| State: | 5.40 / 10,000 pop. |

| Baltimore County: | 9.1% |

| Maryland: | 9.1% |

| Here: | 26.4% |

| Maryland: | 26.7% |

| This county: | 12.7% |

| State: | 15.5% |

6.77% of this county's 2021 resident taxpayers lived in other counties in 2020 ($67,217 average adjusted gross income)

| Here: | 6.77% |

| Maryland average: | 7.42% |

0.01% of residents moved from foreign countries ($84 average AGI)

Baltimore County: 0.01% Maryland average: 0.05%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Baltimore city, MD | |

| from Anne Arundel County, MD | |

| from Harford County, MD |

7.32% of this county's 2020 resident taxpayers moved to other counties in 2021 ($75,485 average adjusted gross income)

| Here: | 7.32% |

| Maryland average: | 7.91% |

0.01% of residents moved to foreign countries ($168 average AGI)

Baltimore County: 0.01% Maryland average: 0.04%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Baltimore city, MD | |

| to Harford County, MD | |

| to Anne Arundel County, MD |

Strongest AM radio stations in Lansdowne-Baltimore Highlands:

- WWLG (1370 AM; 50 kW; BALTIMORE, MD; Owner: M-10 BROADCASTING, INC.)

- WBAL (1090 AM; 50 kW; BALTIMORE, MD; Owner: HEARST RADIO, INC.)

- WCBM (680 AM; 50 kW; BALTIMORE, MD; Owner: WCBM MARYLAND, INC.)

- WGOP (700 AM; daytime; 25 kW; WALKERSVILLE, MD; Owner: BIRACH BROADCASTING CORPORATION)

- WOLB (1010 AM; 1 kW; BALTIMORE, MD; Owner: RADIO ONE LICENSES, LLC)

- WBIS (1190 AM; 50 kW; ANNAPOLIS, MD; Owner: NATIONS RADIO, LLC)

- WTEM (980 AM; 50 kW; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WTOP (1500 AM; 50 kW; WASHINGTON, DC; Owner: BONNEVILLE HOLDING COMPANY)

- WMET (1150 AM; 50 kW; GAITHERSBURG, MD; Owner: BELTWAY ACQUISITION CORPORATION)

- WJFK (1300 AM; 5 kW; BALTIMORE, MD; Owner: INFINITY WLIF-AM, INC.)

- WPGC (1580 AM; 50 kW; MORNINGSIDE, MD; Owner: INFINITY WPGC(AM), INC.)

- WCAO (600 AM; 5 kW; BALTIMORE, MD; Owner: CITICASTERS LICENSES, L.P.)

- WJRO (1590 AM; 1 kW; GLEN BURNIE, MD; Owner: ERALD BROADCASTING INC.)

Strongest FM radio stations in Lansdowne-Baltimore Highlands:

- WRBS (95.1 FM; BALTIMORE, MD; Owner: PETER & JOHN RADIO FELLOWSHIP, INC.)

- WWMX (106.5 FM; BALTIMORE, MD; Owner: INFINITY RADIO OPERATIONS INC.)

- WIYY (97.9 FM; BALTIMORE, MD; Owner: HEARST RADIO, INC.)

- WPOC (93.1 FM; BALTIMORE, MD; Owner: CITICASTERS LICENSES, L.P.)

- WERQ-FM (92.3 FM; BALTIMORE, MD; Owner: RADIO ONE LICENSES, LLC)

- WYPR (88.1 FM; BALTIMORE, MD; Owner: WYPR LICENSE HOLDING LLC)

- WWIN-FM (95.9 FM; GLEN BURNIE, MD; Owner: RADIO ONE LICENSES, LLC)

- WXYV (105.7 FM; CATONSVILLE, MD; Owner: INFINITY RADIO OPERATIONS INC.)

- WLIF (101.9 FM; BALTIMORE, MD; Owner: INFINITY WLIF, INC.)

- WZBA (100.7 FM; WESTMINSTER, MD; Owner: SHAMROCK COMMUNICATIONS, INC.)

- WBJC (91.5 FM; BALTIMORE, MD; Owner: BALTIMORE CITY COMMUNITY COLLEGE)

- WQSR (102.7 FM; BALTIMORE, MD; Owner: INFINITY OF CHESAPEAKE LICENSEE CORP.)

- WEAA (88.9 FM; BALTIMORE, MD; Owner: MORGAN STATE COLLEGE)

- WFSI (107.9 FM; ANNAPOLIS, MD; Owner: FAMILY STATIONS, INC.)

- WSMJ (104.3 FM; BALTIMORE, MD; Owner: CITICASTERS LICENSES, L.P.)

- WTMD (89.7 FM; TOWSON, MD; Owner: TOWSON UNIVERSITY)

- WWDC-FM (101.1 FM; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WRQX (107.3 FM; WASHINGTON, DC; Owner: WMAL, INC.)

- WASH (97.1 FM; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WHUR-FM (96.3 FM; WASHINGTON, DC; Owner: THE HOWARD UNIVERSITY)

TV broadcast stations around Lansdowne-Baltimore Highlands:

- WBAL-TV (Channel 11; BALTIMORE, MD; Owner: WBAL HEARST-ARGYLE TV, INC. (CA CORP.))

- WMAR-TV (Channel 2; BALTIMORE, MD; Owner: SCRIPPS HOWARD BROADCASTING COMPANY)

- WBFF (Channel 45; BALTIMORE, MD; Owner: CHESAPEAKE TELEVISION LICENSEE, LLC)

- WNUV (Channel 54; BALTIMORE, MD; Owner: BALTIMORE (WNUV-TV) LICENSEE, INC.)

- WJZ-TV (Channel 13; BALTIMORE, MD; Owner: VIACOM INC.)

- WUTB (Channel 24; BALTIMORE, MD; Owner: FOX TELEVISION STATIONS, INC.)

- WMPB (Channel 67; BALTIMORE, MD; Owner: MARYLAND PUBLIC BROADCASTING COMMISSION)

- WMPT (Channel 22; ANNAPOLIS, MD; Owner: MARYLAND PUBLIC BROADCASTING COMMISSION)

- WTTG (Channel 5; WASHINGTON, DC; Owner: FOX TELEVISION STATIONS, INC.)

- WJLA-TV (Channel 7; WASHINGTON, DC; Owner: ACC LICENSEE, INC.)

- WUSA (Channel 9; WASHINGTON, DC; Owner: THE DETROIT NEWS, INC.)

- WBDC-TV (Channel 50; WASHINGTON, DC; Owner: WBDC BROADCASTING, INC.)

- WETA-TV (Channel 26; WASHINGTON, DC; Owner: THE GREATER WASHINGTON ED TELECOMM. ASSOC)

- W63BP (Channel 63; ANNAPOLIS, MD; Owner: ANNAPOLIS BROADCASTING COMPANY, INC.)

- WHUT-TV (Channel 32; WASHINGTON, DC; Owner: HOWARD UNIVERSITY)

- WDCA (Channel 20; WASHINGTON, DC; Owner: FOX TELEVISION STATIONS, INC.)

- W61BY (Channel 61; ANNAPOLIS, MD; Owner: ANNAPOLIS BROADCASTING COMPANY, INC.)

- WRC-TV (Channel 4; WASHINGTON, DC; Owner: NBC SUBSIDIARY (WRC-TV), INC.)

- WMJF-LP (Channel 16; TOWSON, MD; Owner: TOWSON UNIVERSITY)

- National Bridge Inventory (NBI) Statistics

- 16Number of bridges

- 446ft / 136mTotal length

- $551,000Total costs

- 408,691Total average daily traffic

- 9,276Total average daily truck traffic

- New bridges - historical statistics

- 11940-1949

- 141950-1959

- 11960-1969

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 4 full tracts) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 79 | $166,152 | 20 | $139,250 | 229 | $158,948 | 13 | $65,231 | 14 | $110,857 | 1 | $30,000 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 3 | $178,000 | 1 | $182,000 | 23 | $182,000 | 0 | $0 | 1 | $182,000 | 0 | $0 |

| APPLICATIONS DENIED | 6 | $147,833 | 2 | $135,500 | 104 | $167,413 | 19 | $73,737 | 4 | $93,250 | 1 | $23,000 |

| APPLICATIONS WITHDRAWN | 6 | $157,333 | 5 | $160,200 | 67 | $171,791 | 3 | $126,333 | 7 | $179,143 | 1 | $20,000 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $207,000 | 0 | $0 | 28 | $170,964 | 0 | $0 | 3 | $131,000 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 4301.01 , 4301.02, 4302.00, 4303.00

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 4 full tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | D) Loans On Manufactured Home Dwelling (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 2 | $165,500 | 7 | $178,286 | 0 | $0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 2 | $167,500 | 3 | $216,667 | 1 | $200,000 |

| APPLICATIONS DENIED | 2 | $194,000 | 2 | $189,000 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 0 | $0 | 2 | $188,000 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 4301.01 , 4301.02, 4302.00, 4303.00

- 71.9%Utility gas

- 15.4%Fuel oil, kerosene, etc.

- 11.0%Electricity

- 1.0%Bottled, tank, or LP gas

- 0.5%Wood

- 0.2%Other fuel

- 80.1%Utility gas

- 14.4%Electricity

- 4.5%Fuel oil, kerosene, etc.

- 1.0%Bottled, tank, or LP gas

Lansdowne-Baltimore Highlands compared to Maryland state average:

- Median house value below state average.

- Unemployed percentage below state average.

- Hispanic race population percentage significantly below state average.

- Foreign-born population percentage significantly below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

- Number of college students below state average.

- Percentage of population with a bachelor's degree or higher significantly below state average.

Lansdowne-Baltimore Highlands on our top lists:

- #4 on the list of "Top 101 cities with largest percentage of males in industries: paper and paper products merchant wholesalers (population 5,000+)"

- #13 on the list of "Top 101 cities with largest percentage of males in occupations: material recording, scheduling, dispatching, and distributing workers (population 5,000+)"

- #21 on the list of "Top 101 cities with largest percentage of males in occupations: driver/sales workers and truck drivers (population 5,000+)"

- #21 on the list of "Top 101 cities with largest percentage of males in industries: truck transportation (population 5,000+)"

- #30 on the list of "Top 101 cities with largest percentage of females in industries: warehousing and storage (population 5,000+)"

- #31 on the list of "Top 101 cities with largest percentage of females in industries: professional and commercial equipment and supplies merchant wholesalers (population 5,000+)"

- #36 on the list of "Top 101 cities with largest percentage of females in industries: beverage and tobacco products (population 5,000+)"

- #37 on the list of "Top 101 cities with largest percentage of males in occupations: pipelayers, plumbers, pipefitters, and steamfitters (population 5,000+)"

- #48 on the list of "Top 101 cities with largest percentage of females in industries: repair and maintenance (population 5,000+)"

- #49 on the list of "Top 101 cities with largest percentage of males in occupations: personal appearance workers (population 5,000+)"

- #49 on the list of "Top 101 cities with largest percentage of females in industries: printing and related support activities (population 5,000+)"

- #66 on the list of "Top 101 cities with largest percentage of females in industries: lumber and other construction materials merchant wholesalers (population 5,000+)"

- #71 on the list of "Top 101 cities with largest percentage of females in occupations: bookkeeping, accounting, and auditing clerks (population 5,000+)"

- #71 on the list of "Top 101 cities with largest percentage of females in industries: farm supplies merchant wholesalers (population 5,000+)"

- #72 on the list of "Top 101 cities with largest percentage of males in occupations: supervisors of transportation and material moving workers (population 5,000+)"

- #80 on the list of "Top 101 cities with largest percentage of males in industries: other transportation, and support activities, and couriers (population 5,000+)"

- #86 on the list of "Top 101 cities with largest percentage of males in industries: miscellaneous nondurable goods merchant wholesalers (population 5,000+)"

- #87 on the list of "Top 101 cities with largest percentage of males in industries: groceries and related products merchant wholesalers (population 5,000+)"

- #98 on the list of "Top 101 cities with largest percentage of females in industries: alcoholic beverages merchant wholesalers (population 5,000+)"

- #14 on the list of "Top 101 counties with the highest surface withdrawal of fresh water for public supply"

- #15 on the list of "Top 101 counties with the largest increase in the number of births per 1000 residents 2000-2006 to 2007-2013 (pop 50,000+)"

- #22 on the list of "Top 101 counties with the highest total withdrawal of fresh water for public supply"

- #29 on the list of "Top 101 counties with the most Black Protestant adherents"

- #35 on the list of "Top 101 counties with the lowest ground withdrawal of fresh water for public supply (pop. 50,000+)"