Little Rock, Arkansas

Little Rock: Arkansas State Capitol

Little Rock: Capitol

Little Rock: Downtown Little Rock

Little Rock: Old State House

Little Rock: County Court House

Little Rock: Downtown Little Rock

Little Rock: river, downtown, and razorback submarine

Little Rock: Littlerock Pedestrian Bridge over the River

Little Rock: Image of Dowtown Little Rock AR

Little Rock: down town little rock

Little Rock: Little Rock, AR The Old State House Museum

- see

41

more - add

your

Submit your own pictures of this city and show them to the world

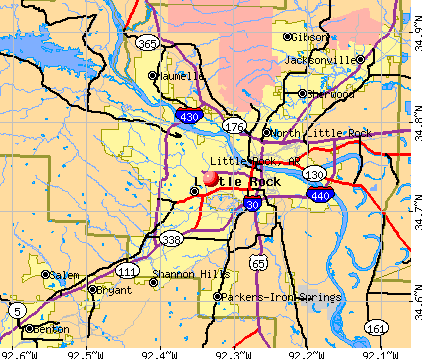

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +10.8%

| Males: 95,408 | |

| Females: 107,456 |

| Median resident age: | 36.9 years |

| Arkansas median age: | 38.9 years |

Zip codes: 72135, 72201, 72202, 72204, 72205, 72209, 72211, 72212, 72223, 72227.

Little Rock Zip Code Map| Little Rock: | $55,065 |

| AR: | $55,432 |

Estimated per capita income in 2022: $41,039 (it was $23,209 in 2000)

Little Rock city income, earnings, and wages data

Estimated median house or condo value in 2022: $215,000 (it was $87,300 in 2000)

| Little Rock: | $215,000 |

| AR: | $179,800 |

Mean prices in 2022: all housing units: $303,193; detached houses: $304,290; townhouses or other attached units: $476,420; in 2-unit structures: $366,918; in 3-to-4-unit structures: $140,456; in 5-or-more-unit structures: $330,561; mobile homes: $34,931

Median gross rent in 2022: $940.

(7.4% for White Non-Hispanic residents, 29.0% for Black residents, 19.4% for Hispanic or Latino residents, 48.7% for American Indian residents, 52.4% for Native Hawaiian and other Pacific Islander residents, 16.5% for other race residents, 19.1% for two or more races residents)

Detailed information about poverty and poor residents in Little Rock, AR

- 89,54544.1%White alone

- 85,15742.0%Black alone

- 14,4517.1%Hispanic

- 6,2153.1%Asian alone

- 6,2063.1%Two or more races

- 7670.4%Other race alone

- 4560.2%American Indian alone

- 540.03%Native Hawaiian and Other

Pacific Islander alone

According to our research of Arkansas and other state lists, there were 489 registered sex offenders living in Little Rock, Arkansas as of April 23, 2024.

The ratio of all residents to sex offenders in Little Rock is 406 to 1.

The ratio of registered sex offenders to all residents in this city is near the state average.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is much bigger than the state average.

Crime rate in Little Rock detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 659 (534 officers - 432 male; 102 female).

| Officers per 1,000 residents here: | 2.69 |

| Arkansas average: | 2.25 |

| Brief trip to Little Rock - suggestions? (12 replies) |

| Little Rock and North Little Rock (2 replies) |

| Little Rock Move Mistake (37 replies) |

| Yay or nay (move to little rock??) (56 replies) |

| Amazon Fulfillment Center coming to Little Rock (2 replies) |

| Bouse shopping; Conway vs Little Rock vs North Little Rock (0 replies) |

Latest news from Little Rock, AR collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: English (7.5%), American (7.4%), African (4.6%), German (3.9%), Irish (3.6%), European (2.6%).

Current Local Time: CST time zone

Incorporated on 11/07/1831

Elevation: 335 feet

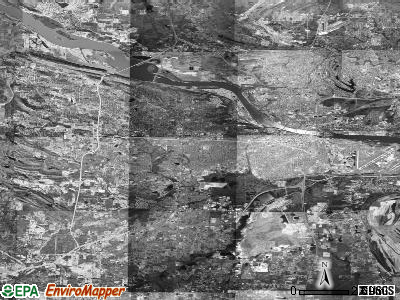

Land area: 116.2 square miles.

Population density: 1,746 people per square mile (low).

13,691 residents are foreign born (3.0% Latin America, 2.6% Asia).

| This city: | 6.8% |

| Arkansas: | 5.0% |

Median real estate property taxes paid for housing units with mortgages in 2022: $1,773 (0.8%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $1,475 (0.9%)

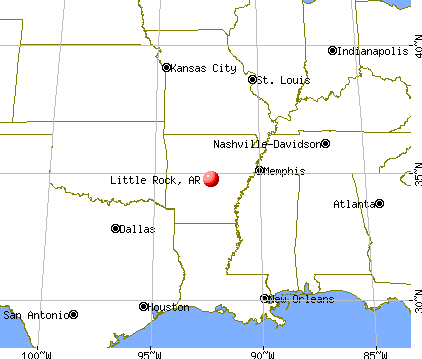

Nearest city with pop. 200,000+: Memphis, TN (136.4 miles

, pop. 650,100).

Nearest city with pop. 1,000,000+: Dallas, TX (289.1 miles

, pop. 1,188,580).

Nearest cities:

Latitude: 34.74 N, Longitude: 92.33 W

Daytime population change due to commuting: +67,913 (+33.5%)

Workers who live and work in this city: 74,640 (76.8%)

Area code: 501

Detailed articles:

- Little Rock: Introduction

- Little Rock Basic Facts

- Little Rock: Communications

- Little Rock: Convention Facilities

- Little Rock: Economy

- Little Rock: Education and Research

- Little Rock: Geography and Climate

- Little Rock: Health Care

- Little Rock: History

- Little Rock: Municipal Government

- Little Rock: Population Profile

- Little Rock: Recreation

- Little Rock: Transportation

Little Rock tourist attractions:

- The Peabody Little Rock, Little Rock, AR - Hotel

- Doubletree Hotel Little Rock, Little Rock, AR - Hotel

- Aerospace Education Center - Little Rock, Arkansas - Museum, Theater and Planetarium

- Place to Learn about Space Exploration

- Arkansas Arts Center - Little Rock AK - Children Theater Art Classes

- Visit the State Capitol Building in Little Rock

- Witness the Site of Civil Rights History

- Clinton Presidential Center and Library - Little Rock AK Bill Clinton River District Library

- Courtyard by Marriott - Little Rock AR Marriott business travel family River Market

- Exciting Way to Experience Arkansas History

- An Amateur Chef's Dream Come True

- Little Rock Zoo - Little Rock, Arkansas - large zoo in Arkansas with many exotic animals

- Site of Museum of Arkansas Military History

- Kitchen Co. Cooking School

- Museum Of Discovery

- Old State House

- Arkansas State Capitol

- Central High Museum and Visitor Center

- Old Mill - North Little Rock AR - Pugh's Old Mill Gone with the Wind

- Learn About Arkansas History at this Museum

- River Market District Little Rock AK-Farmers Market Development Entertainment Nightlife

- Convention Center in the Heart of Little Rock

- Arkansas School for the Deaf Historical Museum - Little Rock, Arkansas More than just a school for the deaf but a museum rich in history

- Kanis Park - Little Rock, AR - a skate park in Little Rock

- Arkansas Territorial Restoration - Little Rock, Arkansas - Not your typical Little Rock museum

- Little Rock Arsenal - Little Rock, AR - the first line of defense for the frontier

- MacArthur Museum of Arkansas Military History - Little Rock, AR - a museum dedicated to Arkansas's role in the military through history

- Maumelle Park - Little Rock, AR - a park on the Arkansas River

- Mount Holly Cemetery - Little Rock, AR - Arkansas' own Westminister Abby

- Murray Park - Little Rock, AR - one of several parks in Little Rock, Arkansas

- National Cemetery - Little Rock, AR - a cemetery originally dedicated for Confederate soldiers

- Rebsamen Golf Course - Little Rock, AR - an 18 holed golf course

- River Market Artspace- Little Rock, AR - an area of a flea market dedicated to art

- Robinson Center - Little Rock, Arkansas - conference center and performance hall

- Sesquicentennial Sundial - Little Rock, AR - a sundial celebrating 150 years of Arkansas existence

- Statehouse Convention Center - Little Rock, AR - a center to hold any function

- University of Arkansas at Little Rock Planetarium - Little Rock, AR Arkansas largest planetarium

- Alltel Arena - Little Rock, Arkansas - Concert and entertainment destination in North Little Rock

- Central High School - Little Rock, AR - the site of the Little Rock Nine

- Department of Parks and Tourism - Little Rock, AR - guide to attractions and parks in Arizona

- Arkansas Governor's Mansion - Little Rock, Arkansas - More than a home but a state symbol

- Hearne Fine Art Gallery - Little Rock, AR - an art gallery that has been in existence for two decades

- Hinderliter Tavern - Little Rock, AR - the oldest home in Little Rock, Arkansas

- Hindman Park Golf Course - Little Rock, AR - a golf course in existence since 1967

- Historic Arkansas Museum - Little Rock, AR - a museum preserving the history of Arkansas prior to the Civil War

- Large Venue for Little Rock Events

- The Capital Hotel - Little Rock AR Capital Hotel luxury accommodation business travel

- Willow Springs Water Park - Little Rock, Arkansas - privately-owned water park

Little Rock, Arkansas accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 377 buildings, average cost: $410,600

- 2021: 666 buildings, average cost: $260,200

- 2020: 415 buildings, average cost: $310,900

- 2019: 480 buildings, average cost: $265,200

- 2018: 325 buildings, average cost: $319,300

- 2017: 592 buildings, average cost: $218,800

- 2016: 330 buildings, average cost: $289,100

- 2015: 332 buildings, average cost: $261,700

- 2014: 338 buildings, average cost: $270,500

- 2013: 356 buildings, average cost: $267,700

- 2012: 347 buildings, average cost: $227,700

- 2011: 325 buildings, average cost: $199,800

- 2010: 344 buildings, average cost: $195,600

- 2009: 329 buildings, average cost: $224,600

- 2008: 361 buildings, average cost: $236,400

- 2007: 731 buildings, average cost: $230,900

- 2006: 827 buildings, average cost: $243,700

- 2005: 990 buildings, average cost: $255,300

- 2004: 805 buildings, average cost: $258,500

- 2003: 725 buildings, average cost: $241,700

- 2002: 591 buildings, average cost: $231,900

- 2001: 544 buildings, average cost: $202,400

- 2000: 515 buildings, average cost: $199,300

- 1999: 552 buildings, average cost: $184,500

- 1998: 491 buildings, average cost: $181,000

- 1997: 440 buildings, average cost: $155,600

| Here: | 3.5% |

| Arkansas: | 3.4% |

Population change in the 1990s: +5,944 (+3.4%).

- Health care (17.7%)

- Educational services (9.6%)

- Accommodation & food services (8.0%)

- Public administration (6.6%)

- Professional, scientific, technical services (6.3%)

- Finance & insurance (5.7%)

- Construction (3.7%)

- Health care (10.0%)

- Accommodation & food services (8.9%)

- Professional, scientific, technical services (7.3%)

- Educational services (6.7%)

- Construction (6.6%)

- Public administration (6.4%)

- Finance & insurance (5.4%)

- Health care (25.5%)

- Educational services (12.5%)

- Accommodation & food services (7.1%)

- Public administration (6.8%)

- Finance & insurance (6.0%)

- Social assistance (5.6%)

- Professional, scientific, technical services (5.2%)

- Other management occupations, except farmers and farm managers (5.7%)

- Cooks and food preparation workers (5.4%)

- Building and grounds cleaning and maintenance occupations (3.6%)

- Registered nurses (3.0%)

- Retail sales workers, except cashiers (2.9%)

- Material recording, scheduling, dispatching, and distributing workers (2.8%)

- Secretaries and administrative assistants (2.4%)

- Cooks and food preparation workers (6.5%)

- Other management occupations, except farmers and farm managers (6.0%)

- Building and grounds cleaning and maintenance occupations (4.7%)

- Material recording, scheduling, dispatching, and distributing workers (3.7%)

- Retail sales workers, except cashiers (3.5%)

- Computer specialists (3.4%)

- Laborers and material movers, hand (2.9%)

- Other management occupations, except farmers and farm managers (5.3%)

- Registered nurses (5.2%)

- Secretaries and administrative assistants (4.8%)

- Cooks and food preparation workers (4.3%)

- Other office and administrative support workers, including supervisors (3.8%)

- Health technologists and technicians (3.6%)

- Cashiers (3.5%)

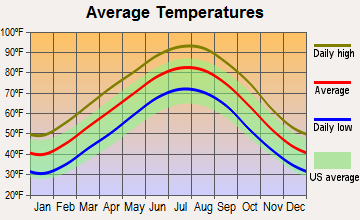

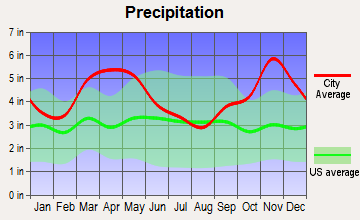

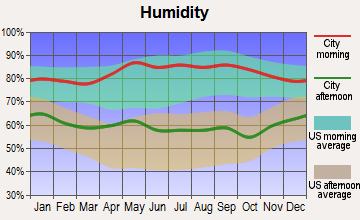

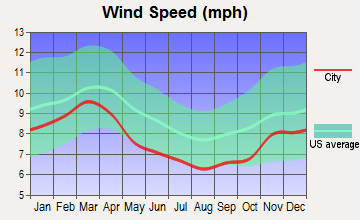

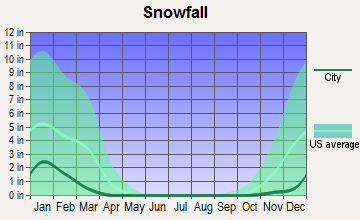

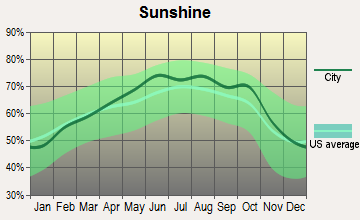

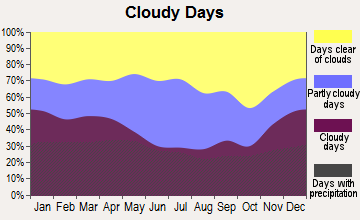

Average climate in Little Rock, Arkansas

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2023 was 72.9. This is about average.

| City: | 72.9 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2023 was 0.481. This is significantly worse than average. Closest monitor was 3.2 miles away from the city center.

| City: | 0.481 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 7.45. This is significantly worse than average. Closest monitor was 3.1 miles away from the city center.

| City: | 7.45 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.603. This is significantly better than average. Closest monitor was 3.1 miles away from the city center.

| City: | 0.603 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2023 was 25.2. This is better than average. Closest monitor was 3.2 miles away from the city center.

| City: | 25.2 |

| U.S.: | 33.3 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 9.25. This is about average. Closest monitor was 3.2 miles away from the city center.

| City: | 9.25 |

| U.S.: | 8.11 |

Tornado activity:

Little Rock-area historical tornado activity is slightly above Arkansas state average. It is 153% greater than the overall U.S. average.

On 3/1/1997, a category F4 (max. wind speeds 207-260 mph) tornado 6.0 miles away from the Little Rock city center killed 10 people and injured 40 people.

On 3/1/1997, a category F4 tornado 7.5 miles away from the city center killed 5 people and injured 180 people.

Earthquake activity:

Little Rock-area historical earthquake activity is significantly above Arkansas state average. It is 479% greater than the overall U.S. average.On 1/21/1982 at 00:33:54, a magnitude 4.7 (4.5 MB, 4.7 LG, 4.5 LG, Class: Light, Intensity: IV - V) earthquake occurred 30.8 miles away from the city center

On 5/4/2001 at 06:42:12, a magnitude 4.7 (4.2 MB, 4.7 LG, 4.5 LG) earthquake occurred 33.4 miles away from the city center

On 2/28/2011 at 05:00:50, a magnitude 4.7 (4.7 MW, Depth: 2.0 mi) earthquake occurred 36.9 miles away from Little Rock center

On 11/6/2011 at 03:53:10, a magnitude 5.7 (5.7 MW, Depth: 3.2 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 256.8 miles away from Little Rock center

On 9/3/2016 at 12:02:44, a magnitude 5.8 (5.8 MW, Depth: 3.5 mi) earthquake occurred 283.8 miles away from the city center

On 3/25/1976 at 00:41:20, a magnitude 5.0 (4.9 MB, 5.0 LG) earthquake occurred 129.3 miles away from Little Rock center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Pulaski County (26) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 20

Emergencies Declared: 3

Causes of natural disasters: Storms: 19, Floods: 16, Tornadoes: 13, Winter Storms: 4, Winds: 2, Hurricane: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: ACXIOM CORP (SERVICES-COMPUTER PROCESSING & DATA PREPARATION), DILLARDS INC (RETAIL-DEPARTMENT STORES), BANK OF THE OZARKS INC (STATE COMMERCIAL BANKS), ALLTEL CORP (TELEPHONE COMMUNICATIONS (NO RADIO TELEPHONE)).

Hospitals in Little Rock:

- ARKANSAS CHILDREN'S HOSPITAL (Voluntary non-profit - Private, provides emergency services, 800 MARSHALL STREET SLOT 301)

- ARKANSAS HEART HOSPITAL (Proprietary, provides emergency services, 1701 S SHACKLEFORD ROAD)

- ARKANSAS STATE HOSPITAL PSYCHIATRIC (provides emergency services, 4313 WEST MARKHAM STREET)

- BAPTIST HEALTH HOSPICE LITTLE (11900 COLONEL GLENN RD, SUITE 2300)

- HOSPICE HOME CARE INC (1501 N UNIVERSITY AVE PROSPECT BLG 340)

- LIVING HOPE MEDICAL SERVICES, LLC (6101 ST VINCENT CIRCLE)

- PINNACLE POINTE HOSPITAL (11501 FINANCIAL CENTRE PARKWAY)

- SELECT SPECIALTY HOSPITAL / LITTLE ROCK ("2 ST VINCENT CIRCLE, SIXTH FLOOR")

- ST VINCENT INFIRMARY MEDICAL CENTER (Voluntary non-profit - Private, TWO ST VINCENT CIRCLE)

- UAMS MEDICAL CENTER (Government - State, 4301 WEST MARKHAM STREET MAIL SLOT 612)

Airports and heliports located in Little Rock:

- Bill And Hillary Clinton National/Adams Fi Airport (LIT) (Runways: 4, Commercial Ops: 20,146, Air Taxi Ops: 16,905, Itinerant Ops: 38,812, Local Ops: 82,258, Military Ops: 5,101)

- Robinson Aaf/Ng Airport (RBM) (Runways: 1)

- Crystal Ridge Airport (3AR6) (Runways: 1)

- Punkin Patch Field Airport (0AR1) (Runways: 1)

- Heliports: 9

Colleges/Universities in Little Rock:

- University of Arkansas at Little Rock (Full-time enrollment: 9,227; Location: 2801 S University Ave; Public; Website: ualr.edu/www/; Offers Doctor's degree)

- University of Arkansas for Medical Sciences (Full-time enrollment: 1,329; Location: 4301 W Markham; Public; Website: www.uams.edu; Offers Doctor's degree)

- Baptist Health Schools-Little Rock (Full-time enrollment: 1,055; Location: 11900 Col Glenn Rd Ste 1000; Private, not-for-profit; Website: www.bhslr.edu)

- Arkansas Baptist College (Full-time enrollment: 877; Location: 1621 Dr. Martin Luther King Drive; Private, not-for-profit; Website: www.arkansasbaptist.edu)

- Philander Smith College (Full-time enrollment: 624; Location: 900 W. Daisy Bates Drive; Private, not-for-profit; Website: www.philander.edu)

- Heritage College-Little Rock (Full-time enrollment: 611; Location: 1309 Old Forge Drive; Private, for-profit; Website: heritage-education.com)

- University of Phoenix-Little Rock Campus (Full-time enrollment: 506; Location: 10800 Financial Centre Pkwy; Private, for-profit; Website: www.phoenix.edu; Offers Master's degree)

- Remington College-Little Rock Campus (Full-time enrollment: 401; Location: 19 Remington Dr.; Private, not-for-profit; Website: www.remingtoncollege.edu/little-rock-arkansas-technical-colleges)

- Eastern College of Health Vocations-Little Rock (Full-time enrollment: 323; Location: 200 South University Avenue; Private, for-profit; Website: www.easterncollege.edu)

- ITT Technical Institute-Little Rock (Full-time enrollment: 306; Location: 4520 S University Ave; Private, for-profit; Website: www.itt-tech.edu)

- Strayer University-Arkansas (Full-time enrollment: 150; Location: 10825 Financial Centre Pkwy Ste 400; Private, for-profit; Website: www.strayer.edu/arkansas/little-rock; Offers Master's degree)

- Washington Barber College Inc (Full-time enrollment: 89; Location: 5300 West 65th Street; Private, for-profit; Website: www.washingtonbarbercollege.com/)

- Regency Beauty Institute-Little Rock (Full-time enrollment: 85; Location: 2614 South Shackleford Road; Private, for-profit; Website: www.regency.edu)

- Arkansas Beauty School (Full-time enrollment: 52; Location: 5108 Baseline Rd; Private, for-profit; Website: arkbeautyschool.com)

- Velvatex College of Beauty Culture (Full-time enrollment: 24; Location: 1520 Martin Luther King Dr; Private, for-profit; Website: www.velvatexcollege.com)

- University of Arkansas System Office (Location: 2404 N University; Public; Website: WWW.UASYS.EDU; Offers Doctor's degree)

Other colleges/universities with over 2000 students near Little Rock:

- Pulaski Technical College (about 4 miles; North Little Rock, AR; Full-time enrollment: 8,396)

- University of Central Arkansas (about 25 miles; Conway, AR; FT enrollment: 9,972)

- Arkansas State University-Beebe (about 35 miles; Beebe, AR; FT enrollment: 3,387)

- University of Arkansas at Pine Bluff (about 39 miles; Pine Bluff, AR; FT enrollment: 2,558)

- National Park Community College (about 48 miles; Hot Springs, AR; FT enrollment: 2,237)

- Harding University (about 50 miles; Searcy, AR; FT enrollment: 5,360)

- Henderson State University (about 60 miles; Arkadelphia, AR; FT enrollment: 3,528)

Biggest public high schools in Little Rock:

- ARK. SCHOOL FOR THE BLIND H.S. (Location: 2600 W MARKHAM ST, Grades: 7-12)

- ARK. SCHOOL FOR THE DEAF H.S. (Location: 2400 W MARKHAM ST, Grades: 9-12)

- LISA ACADEMY (Location: 21 CORPORATE HILL DR, Grades: 6-9, Charter school)

- LISA ACADEMY HIGH (Location: 21 CORPORATE HILL DR, Grades: 8-12, Charter school)

- ARK CONSOLIDATED HIGH SCHOOL (Location: 700 S MAIN ST, Grades: 7-12)

- ARKANSAS VIRTUAL ACADEMY JR (Location: 10802 EXECUTIVE CTR DR STE 205, Grades: 5-10, Charter school)

- ESTEM PUBLIC CHARTER HIGH SCHOOL (Location: 112 W THIRD ST 3RD FLOOR, Grades: 9-12, Charter school)

- SIATECH HIGH CHARTER (Location: 6900 SCOTT HAMILTON RD, Grades: 9-12, Charter school)

- PREMIER HIGH SCHOOL OF LITTLE ROCK (Location: 1621 DR MARTIN LUTHER KING DR, Grades: 9-12, Charter school)

- METROPOLITAN VO-TECH SCHOOL (Location: 7701 SCOTT HAMILTON DR, Grades: 9-12)

Biggest private high schools in Little Rock:

- LITTLE ROCK CHRISTIAN ACADEMY (Students: 1,391, Location: 19010 HIGHWAY 10, Grades: PK-12)

- PULASKI ACADEMY (Students: 1,365, Location: 12701 HINSON RD, Grades: PK-12)

- ARKANSAS BAPTIST SCHOOL SYSTEM (Students: 776, Location: 62 PLEASANT VALLEY DR, Grades: PK-12)

- THE EPISCOPAL COLLEGIATE SCHOOL (Students: 727, Location: 1701 CANTRELL RD, Grades: PK-12)

- CATHOLIC HIGH SCHOOL FOR BOYS (Students: 713, Location: 6300 FATHER TRIBOU ST, Grades: 9-12, Boys only)

- SOUTHWEST CHRISTIAN ACADEMY (Students: 519, Location: 11301 GEYER SPRINGS RD, Grades: PK-12)

- MT ST MARY ACADEMY (Students: 486, Location: 3224 KAVANAUGH BLVD, Grades: 9-12, Girls only)

- WORDS OF OUTREACH CHRISTIAN ACADEMY (Students: 45, Location: 3300 ASHER AVE, Grades: PK-12)

- HERITAGE CHRISTIAN SCHOOL (Students: 30, Location: 4910 STAGECOACH RD, Grades: 1-12)

- LITTLE ROCK ADVENTIST ACADEMY (Students: 30, Location: 8708 RODNEY PARHAM RD, Grades: KG-11)

Biggest public elementary/middle schools in Little Rock:

- EAST END INTERMEDIATE SCHOOL (Location: 5205 W SAWMILL RD, Grades: 3-6)

- EAST END ELEMENTARY SCHOOL (Location: 21801 ARCH ST PIKE, Grades: PK-2)

- ARK. SCHOOL FOR THE BLIND ELEM (Location: 2600 W MARKHAM ST, Grades: PK-6)

- ARK. SCHOOL FOR THE DEAF ELEM. (Location: 2400 W MARKHAM ST, Grades: PK-8)

- ARKANSAS VIRTUAL ACADEMY (Location: 10802 EXECUTIVE CTR DR STE 205, Grades: KG-5, Charter school)

- COVENANT KEEPERS CHARTER (Location: 8300 GEYER SPRINGS RD, Grades: 6-8, Charter school)

- ESTEM MIDDLE SCHOOL (Location: 112 WEST 3RD STREET, Grades: 5-8, Charter school)

- ESTEM ELEMENTARY SCHOOL (Location: 112 WEST 3RD STREET, Grades: KG-4, Charter school)

- LITTLE ROCK PREP ACADEMY (Location: 1205 S SCHILLER ST, Grades: 5-8, Charter school)

- LITTLE PREP ACADEMY ELEMENTARY (Location: 1512 S SCHILLER ST, Grades: KG-4, Charter school)

Biggest private elementary/middle schools in Little Rock:

- CHRIST THE KING SCHOOL (Students: 691, Location: 4002 N RODNEY PARHAM RD, Grades: PK-8)

- OUR LADY-HOLY SOULS SCHOOL (Students: 533, Location: 1001 N TYLER ST, Grades: PK-8)

- THE ANTHONY SCHOOL (Students: 411, Location: 7700 OHIO ST, Grades: PK-8)

- MISS SELMA'S SCHOOLS (Students: 361, Location: 7814 T ST, Grades: PK-6)

- AGAPE ACADEMY (Students: 300, Location: 701 NAPA VALLEY DR, Grades: PK-5)

- ST EDWARDS SCHOOL (Students: 188, Location: 805 SHERMAN ST, Grades: PK-8)

- ST THERESA CATHOLIC SCHOOL (Students: 179, Location: 6311 BASELINE RD, Grades: PK-8)

- CHRIST LUTHERAN SCHOOL (Students: 138, Location: 315 S HUGHES ST, Grades: PK-8)

- THE CHILDRENS HOUSE MONTESSORI SCHOOL (Students: 112, Location: 4023 LEE AVE, Grades: PK-3)

- LITTLE ROCK MONTESSORI SCHOOL (Students: 107, Location: 3704 N RODNEY PARHAM RD, Grades: UG-3)

Points of interest:

Notable locations in Little Rock: Hastings Industrial Park (A), Little Rock Port Industrial Park (B), Mabelvale Industrial Park (C), Riverdale Business Park (D), Rock Creek Golf Course (E), Whispering Pine Golf Course (F), Barton Coliseum (G), Benton Speed Bowl (H), Little Rock Country Club (I), Pleasant Valley Country Club (J), Western Hills Country Club (K), Westridge Country Club (L), Cypress Junction (M), Aldersgate Camp (N), Twen Cen (O), First Security Center (P), Cumberland Tower (Q), Usable Corporate Center (R), Union Life Building (S), Quapaw Tower (T). Display/hide their locations on the map

Shopping Centers: Green Mountain Plaza Shopping Center (1), Hall Plaza Shopping Center (2), Broadmoor Shopping Center (3), Industrial Plaza Shopping Center (4), Mainstreet Market Shopping Center (5), Market Street Plaza Shopping Center (6), Markham Plaza Shopping Center (7), Oak Forest Plaza Shopping Center (8), Old Forge Shopping Center (9). Display/hide their locations on the map

Main business address in Little Rock include: ACXIOM CORP (A), DILLARDS INC (B), BANK OF THE OZARKS INC (C), ALLTEL CORP (D). Display/hide their locations on the map

Churches in Little Rock include: Trinity Church (A), Otter Creek First Baptist Church (B), Otter Creek Assembly of God Church (C), Hope Church (D), Galilee Church (E), Saint Luke United Methodist Church (F), Mount Zion Baptist Church (G), Annuciation Greek Orthodox Church (H), Williams Temple Church of God in Christ (I). Display/hide their locations on the map

Cemeteries: Alexander Cemetery (1), Lewis Cemetery (2), Roselawn Cemetery (3), Oakland Cemetery (4), State Hospital Cemetery (5), Pilgrims Rest Cemetery (6), Mount Holly Cemetery (7). Display/hide their locations on the map

Reservoirs: Swan Lake (A), Big Dickinson Lake (B), Cook Lake (C), Sandpiper Lake (D), Pleasant Valley Country Club Lake (E), Lake Bendine (F), Jackson Reservoir (G), Sprick Lake (H). Display/hide their locations on the map

Streams, rivers, and creeks: McHenry Creek (A), Little Maumelle River (B), Haw Branch (C), Grassy Flat Creek (D), Willow Springs Branch (E), Vinson Branch (F), Crooked Creek (G), Coleman Creek (H), Little Fourche Creek (I). Display/hide their locations on the map

Parks in Little Rock include: Murray Park (1), Lamar-Porter Field (2), Cheetam Park (3), West End Park (4), War Memorial Stadium (5), Wakefield Park (6), University Park (7), Winder Field (8), Gulley Park (9). Display/hide their locations on the map

Tourist attractions: Little Rock City-Of - Arkansas Arts Centers- the Decorative Arts Mu (Museums; 7th & Rock Street) (1), William J Clinton Presidential Center and Park (Museums; 1200 President Clinton Avenue) (2), Central High Museum & Visitor Center (2125 West Daisy L Gatson Bates) (3), Hendershott Museum Consultants Inc (2200 North Rodney Parham Road Suite 209) (4), Museum of Discovery (500 President Clinton Avenue Suite 150) (5), Quapaw Quarter Association (Museums; 1206 Main Street) (6), Macarthur Museum of Arkansas Military History (503 East 9th Street) (7), EMOBA- The Museum of Black Arkansans (1208 Louisiana) (8), Emoba (Museums; Po Box 46754) (9). Display/hide their approximate locations on the map

Hotels: LA Quinta - Inns- Medical Center Area (901 Fair Park Boulevard) (1), Hampton Inn & Suites (1301 South Shackleford Road) (2), Acme Motel (3301 West Roosevelt Road) (3), Comfort Inn West (300 Markham Center Drive) (4), GuestHouse Intl Little Rock (301 South University Avenue) (5), SpringHill Suites Little Rock (306 Markham Center Drive) (6), Markham House Suites (5120 West Markham Street) (7), La Quinta Little Rock South (2401 W 65th St) (8), Masters Inn - Little Rock Downtown (707 Interstate 30) (9). Display/hide their approximate locations on the map

Courts: Battered Women's Court Program (401 West Markham Street) (1), Ar Supreme Court (625 Marshall) (2), Arkansas-State - Judicial Discipline And Disability Commission (Tower Building) (3), U S Government - Courts- Bankruptcy Court- Clerk (300 West 2nd Street) (4), U S Government - Courts- District Court- General Information-Main Of (600 West Capitol Avenue) (5), Pulaski-County - Quorum Court (201 Broadway Street) (6), Pulaski-County - District Court (3001 West Roosevelt Road) (7), Pulaski-County - Circuit Court- First Division (401 West Markham Street) (8), Pulaski-County - Circuit Court Juvenile Division (3001 West Roosevelt Road) (9). Display/hide their approximate locations on the map

Birthplace of: Carlos Hathcock - Marine Corps Sniper, Brehon B. Somervell - Army general, Pratt C. Remmel - Soilder, Charles Willeford - Army soldier, Chelsea Clinton - Vegan, Len E. Blaylock - Soilder, Jermain Taylor - Boxer, Houston Nutt - College football player, John Kocinski - Motorcycle racer, Douglas MacArthur.

Drinking water stations with addresses in Little Rock and their reported violations in the past:

CENTRAL ARKANSAS WATER (Population served: 313,588, Surface water):Past monitoring violations:EAST END WATER (Population served: 5,456, Groundwater):

- Monitoring and Reporting (DBP) - In APR-2014, Contaminant: Chlorite. Follow-up actions: St Public Notif requested (JUN-03-2014)

Past health violations:

- MCL, Monthly (TCR) - In APR-2009, Contaminant: Coliform. Follow-up actions: St Public Notif requested (JUN-05-2009), St Public Notif received (JUL-10-2009), St Compliance achieved (FEB-17-2010)

| This city: | 2.3 people |

| Arkansas: | 2.5 people |

| This city: | 58.3% |

| Whole state: | 67.6% |

| This city: | 5.6% |

| Whole state: | 5.7% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.5% of all households

People in group quarters in Little Rock in 2010:

- 1,074 people in nursing facilities/skilled-nursing facilities

- 1,026 people in local jails and other municipal confinement facilities

- 692 people in college/university student housing

- 437 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 310 people in other noninstitutional facilities

- 276 people in mental (psychiatric) hospitals and psychiatric units in other hospitals

- 253 people in group homes intended for adults

- 188 people in correctional facilities intended for juveniles

- 118 people in correctional residential facilities

- 61 people in in-patient hospice facilities

- 53 people in workers' group living quarters and job corps centers

- 38 people in residential treatment centers for juveniles (non-correctional)

- 17 people in residential treatment centers for adults

People in group quarters in Little Rock in 2000:

- 1,026 people in nursing homes

- 1,017 people in local jails and other confinement facilities (including police lockups)

- 652 people in college dormitories (includes college quarters off campus)

- 480 people in other nonhousehold living situations

- 457 people in other noninstitutional group quarters

- 335 people in homes or halfway houses for drug/alcohol abuse

- 251 people in mental (psychiatric) hospitals or wards

- 150 people in state prisons

- 108 people in institutions for the deaf

- 93 people in other group homes

- 89 people in other types of correctional institutions

- 50 people in homes for the mentally retarded

- 46 people in institutions for the blind

- 45 people in short-term care, detention or diagnostic centers for delinquent children

- 41 people in homes for the physically handicapped

- 39 people in homes for abused, dependent, and neglected children

- 33 people in religious group quarters

- 3 people in hospitals/wards and hospices for chronically ill

- 3 people in hospices or homes for chronically ill

Banks with most branches in Little Rock (2011 data):

- Regions Bank: 17 branches. Info updated 2011/02/24: Bank assets: $123,368.2 mil, Deposits: $98,301.3 mil, headquarters in Birmingham, AL, positive income, Commercial Lending Specialization, 1778 total offices, Holding Company: Regions Financial Corporation

- Metropolitan National Bank: 17 branches. Info updated 2006/11/03: Bank assets: $1,048.4 mil, Deposits: $915.0 mil, local headquarters, negative income in the last year, Commercial Lending Specialization, 46 total offices, Holding Company: Rogers Bancshares, Inc.

- Arvest Bank: 10 branches. Info updated 2010/11/29: Bank assets: $12,520.8 mil, Deposits: $10,446.2 mil, headquarters in Fayetteville, AR, positive income, Commercial Lending Specialization, 241 total offices, Holding Company: Arvest Bank Group, Inc.

- Bank of the Ozarks: 9 branches. Info updated 2011/05/03: Bank assets: $3,828.0 mil, Deposits: $2,955.2 mil, local headquarters, positive income, Commercial Lending Specialization, 115 total offices, Holding Company: Bank Of The Ozarks Inc

- One Bank & Trust, National Association: 9 branches. Info updated 2006/11/03: Bank assets: $438.1 mil, Deposits: $364.2 mil, local headquarters, positive income, Commercial Lending Specialization, 10 total offices, Holding Company: Onefinancial Corporation

- Bank of America, National Association: 8 branches. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Iberiabank: 8 branches. Info updated 2011/06/08: Bank assets: $11,676.7 mil, Deposits: $9,387.9 mil, headquarters in Lafayette, LA, positive income, Commercial Lending Specialization, 187 total offices, Holding Company: Iberiabank Corporation

- Centennial Bank: 8 branches. Info updated 2012/02/29: Bank assets: $3,588.2 mil, Deposits: $2,891.9 mil, headquarters in Conway, AR, positive income, Commercial Lending Specialization, 109 total offices, Holding Company: Home Bancshares, Inc.

- U.S. Bank National Association: 7 branches. Info updated 2012/01/30: Bank assets: $330,470.8 mil, Deposits: $236,091.5 mil, headquarters in Cincinnati, OH, positive income, 3121 total offices, Holding Company: U.S. Bancorp

- 20 other banks with 46 local branches

For population 15 years and over in Little Rock:

- Never married: 40.0%

- Now married: 41.1%

- Separated: 1.4%

- Widowed: 6.1%

- Divorced: 11.5%

For population 25 years and over in Little Rock:

- High school or higher: 95.0%

- Bachelor's degree or higher: 41.0%

- Graduate or professional degree: 17.5%

- Unemployed: 3.8%

- Mean travel time to work (commute): 16.7 minutes

| Here: | 10.9 |

| Arkansas average: | 11.4 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Little Rock:

(Little Rock, Arkansas Neighborhood Map)Religion statistics for Little Rock, AR (based on Pulaski County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 128,692 | 351 |

| Mainline Protestant | 38,729 | 82 |

| Catholic | 23,960 | 15 |

| Black Protestant | 21,575 | 75 |

| Other | 9,112 | 31 |

| Orthodox | 398 | 3 |

| None | 160,282 | - |

Food Environment Statistics:

| Pulaski County: | 1.95 / 10,000 pop. |

| State: | 2.02 / 10,000 pop. |

| This county: | 0.11 / 10,000 pop. |

| State: | 0.25 / 10,000 pop. |

| Pulaski County: | 0.67 / 10,000 pop. |

| State: | 0.59 / 10,000 pop. |

| This county: | 4.57 / 10,000 pop. |

| State: | 4.94 / 10,000 pop. |

| Pulaski County: | 8.18 / 10,000 pop. |

| Arkansas: | 6.66 / 10,000 pop. |

| This county: | 9.1% |

| State: | 9.8% |

| This county: | 27.0% |

| Arkansas: | 29.1% |

| Pulaski County: | 11.5% |

| Arkansas: | 13.6% |

Health and Nutrition:

| Little Rock: | 48.2% |

| State: | 48.2% |

| Little Rock: | 45.2% |

| Arkansas: | 44.2% |

| Little Rock: | 29.2 |

| Arkansas: | 28.9 |

| This city: | 20.3% |

| Arkansas: | 21.6% |

| Here: | 12.0% |

| Arkansas: | 11.3% |

| This city: | 6.7 |

| Arkansas: | 6.8 |

| This city: | 34.1% |

| Arkansas: | 34.0% |

| Little Rock: | 55.1% |

| Arkansas: | 54.4% |

| Little Rock: | 80.5% |

| State: | 78.0% |

More about Health and Nutrition of Little Rock, AR Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 563 | $3,450,291 | $73,541 | 0 | $0 |

| Firefighters | 402 | $2,753,887 | $82,206 | 0 | $0 |

| Health | 343 | $1,545,475 | $54,069 | 14 | $16,437 |

| Sewerage | 226 | $1,262,461 | $67,033 | 0 | $0 |

| Parks and Recreation | 218 | $919,333 | $50,605 | 166 | $164,213 |

| Streets and Highways | 157 | $632,869 | $48,372 | 24 | $33,152 |

| Airports | 157 | $706,116 | $53,971 | 3 | $6,116 |

| Other and Unallocable | 154 | $730,772 | $56,943 | 41 | $33,954 |

| Police - Other | 126 | $521,323 | $49,650 | 28 | $29,842 |

| Solid Waste Management | 122 | $378,350 | $37,215 | 9 | $15,454 |

| Other Government Administration | 90 | $534,258 | $71,234 | 21 | $45,603 |

| Housing and Community Development (Local) | 85 | $337,738 | $47,681 | 41 | $59,781 |

| Financial Administration | 80 | $514,489 | $77,173 | 1 | $1,716 |

| Judicial and Legal | 46 | $223,452 | $58,292 | 1 | $153 |

| Correction | 18 | $64,586 | $43,057 | 0 | $0 |

| Water Transport and Terminals | 10 | $82,517 | $99,020 | 0 | $0 |

| Fire - Other | 7 | $31,895 | $54,677 | 0 | $0 |

| Totals for Government | 2,804 | $14,689,814 | $62,867 | 349 | $406,421 |

Little Rock government finances - Expenditure in 2021 (per resident):

- Construction - Sewerage: $49,914,000 ($246.05)

Parks and Recreation: $29,407,000 ($144.96)

Air Transportation: $28,621,000 ($141.08)

Regular Highways: $18,190,000 ($89.67)

General - Other: $15,734,000 ($77.56)

Solid Waste Management: $9,120,000 ($44.96)

Sea and Inland Port Facilities: $205,000 ($1.01)

Libraries: $27,000 ($0.13)

- Current Operations - Police Protection: $78,979,000 ($389.32)

Local Fire Protection: $53,955,000 ($265.97)

General - Other: $41,160,000 ($202.89)

Health - Other: $31,904,000 ($157.27)

Sewerage: $29,453,000 ($145.19)

Parks and Recreation: $28,920,000 ($142.56)

Air Transportation: $21,552,000 ($106.24)

Solid Waste Management: $18,558,000 ($91.48)

Regular Highways: $18,120,000 ($89.32)

Financial Administration: $9,183,000 ($45.27)

Housing and Community Development: $5,986,000 ($29.51)

Central Staff Services: $5,541,000 ($27.31)

Judicial and Legal Services: $4,499,000 ($22.18)

Sea and Inland Port Facilities: $3,686,000 ($18.17)

Protective Inspection and Regulation - Other: $1,372,000 ($6.76)

General Public Buildings: $1,030,000 ($5.08)

Parking Facilities: $959,000 ($4.73)

Miscellaneous Commercial Activities - Other: $678,000 ($3.34)

- General - Interest on Debt: $21,512,000 ($106.04)

- Intergovernmental to Local - Other - Transit Utilities: $15,882,000 ($78.29)

- Other Capital Outlay - General - Other: $6,519,000 ($32.13)

Financial Administration: $701,000 ($3.46)

Regular Highways: $74,000 ($0.36)

- Total Salaries and Wages: $1,643,000 ($8.10)

Little Rock government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $59,123,000 ($291.44)

Other: $42,099,000 ($207.52)

Air Transportation: $26,217,000 ($129.23)

Solid Waste Management: $23,204,000 ($114.38)

Sea and Inland Port Facilities: $5,044,000 ($24.86)

Parks and Recreation: $4,525,000 ($22.31)

Parking Facilities: $2,177,000 ($10.73)

Miscellaneous Commercial Activities: $462,000 ($2.28)

Regular Highways: $28,000 ($0.14)

- Federal Intergovernmental - Health and Hospitals: $10,657,000 ($52.53)

Air Transportation: $10,538,000 ($51.95)

Sewerage: $3,404,000 ($16.78)

Housing and Community Development: $2,517,000 ($12.41)

Other: $884,000 ($4.36)

- Local Intergovernmental - General Local Government Support: $46,177,000 ($227.63)

Other: $2,950,000 ($14.54)

- Miscellaneous - General Revenue - Other: $37,131,000 ($183.03)

Interest Earnings: $7,205,000 ($35.52)

Donations From Private Sources: $2,564,000 ($12.64)

Fines and Forfeits: $1,911,000 ($9.42)

Sale of Property: $607,000 ($2.99)

Rents: $343,000 ($1.69)

Special Assessments: $294,000 ($1.45)

- State Intergovernmental - Highways: $18,968,000 ($93.50)

Health and Hospitals: $12,213,000 ($60.20)

Other: $10,068,000 ($49.63)

General Local Government Support: $2,796,000 ($13.78)

- Tax - General Sales and Gross Receipts: $80,623,000 ($397.42)

Property: $58,240,000 ($287.09)

Public Utilities Sales: $32,964,000 ($162.49)

Other Selective Sales: $13,187,000 ($65.00)

Occupation and Business License - Other: $6,930,000 ($34.16)

Other License: $2,845,000 ($14.02)

Alcoholic Beverage Sales: $1,934,000 ($9.53)

Little Rock government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $484,621,000 ($2388.90)

Outstanding Unspecified Public Purpose: $481,343,000 ($2372.74)

Outstanding Nonguaranteed - Industrial Revenue: $157,040,000 ($774.11)

Retired Unspecified Public Purpose: $137,765,000 ($679.10)

Issue, Unspecified Public Purpose: $134,486,000 ($662.94)

Beginning Outstanding - Public Debt for Private Purpose: $111,698,000 ($550.61)

Issue, Nonguaranteed - Public Debt for Private Purpose: $45,342,000 ($223.51)

Little Rock government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $62,584,000 ($308.50)

- Other Funds - Cash and Securities: $289,884,000 ($1428.96)

- Sinking Funds - Cash and Securities: $195,115,000 ($961.80)

6.88% of this county's 2021 resident taxpayers lived in other counties in 2020 ($53,988 average adjusted gross income)

| Here: | 6.88% |

| Arkansas average: | 7.82% |

0.05% of residents moved from foreign countries ($374 average AGI)

Pulaski County: 0.05% Arkansas average: 0.01%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Saline County, AR | |

| from Faulkner County, AR | |

| from Lonoke County, AR |

7.11% of this county's 2020 resident taxpayers moved to other counties in 2021 ($57,239 average adjusted gross income)

| Here: | 7.11% |

| Arkansas average: | 7.23% |

0.06% of residents moved to foreign countries ($424 average AGI)

Pulaski County: 0.06% Arkansas average: 0.01%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Saline County, AR | |

| to Lonoke County, AR | |

| to Faulkner County, AR |

| Businesses in Little Rock, AR | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| ALDO | 1 | KFC | 7 | |

| AT&T | 6 | Kincaid | 2 | |

| Abercrombie & Fitch | 1 | Kmart | 1 | |

| Abercrombie Kids | 1 | Kohl's | 1 | |

| Academy Sports + Outdoors | 1 | Kroger | 11 | |

| Ace Hardware | 1 | La Quinta | 7 | |

| Advance Auto Parts | 3 | La-Z-Boy | 1 | |

| Aeropostale | 2 | Lane Bryant | 1 | |

| American Eagle Outfitters | 1 | Lane Furniture | 5 | |

| Ann Taylor | 3 | LensCrafters | 1 | |

| Applebee's | 2 | Little Caesars Pizza | 6 | |

| Arby's | 5 | Long John Silver's | 1 | |

| Audi | 1 | Marriott | 4 | |

| AutoZone | 5 | MasterBrand Cabinets | 17 | |

| BMW | 1 | Maurices | 1 | |

| Bakers | 1 | Mazda | 1 | |

| Banana Republic | 1 | McDonald's | 12 | |

| Barnes & Noble | 1 | Men's Wearhouse | 1 | |

| Baskin-Robbins | 3 | Motel 6 | 2 | |

| Bath & Body Works | 1 | Motherhood Maternity | 2 | |

| Baymont Inn | 1 | New Balance | 4 | |

| Bed Bath & Beyond | 1 | New York & Co | 1 | |

| Best Western | 2 | Nike | 18 | |

| Blockbuster | 3 | Nissan | 1 | |

| Budget Car Rental | 1 | Office Depot | 2 | |

| Buffalo Wild Wings | 1 | Old Navy | 1 | |

| Burger King | 10 | Olive Garden | 1 | |

| Burlington Coat Factory | 1 | On The Border | 1 | |

| Cache | 1 | Outback | 1 | |

| Casual Male XL | 1 | Outback Steakhouse | 1 | |

| Catherines | 1 | Panera Bread | 2 | |

| Chevrolet | 2 | Papa John's Pizza | 2 | |

| Chick-Fil-A | 3 | Payless | 3 | |

| Chico's | 2 | Penske | 4 | |

| Chuck E. Cheese's | 1 | PetSmart | 1 | |

| Church's Chicken | 4 | Pier 1 Imports | 1 | |

| Cold Stone Creamery | 1 | Pizza Hut | 7 | |

| Coldwater Creek | 2 | Popeyes | 4 | |

| Comfort Inn | 4 | Pottery Barn | 1 | |

| Comfort Suites | 1 | Quiznos | 5 | |

| Cracker Barrel | 1 | RadioShack | 4 | |

| Cricket Wireless | 9 | Ramada | 1 | |

| Curves | 3 | Red Lobster | 1 | |

| DHL | 3 | Rodeway Inn | 1 | |

| Days Inn | 2 | Rue21 | 1 | |

| Decora Cabinetry | 3 | Ryder Rental & Truck Leasing | 1 | |

| Dennys | 2 | SAS Shoes | 3 | |

| Domino's Pizza | 3 | SONIC Drive-In | 11 | |

| DressBarn | 1 | Sam's Club | 1 | |

| Dressbarn | 1 | Sears | 4 | |

| Eddie Bauer | 1 | Sephora | 2 | |

| Ethan Allen | 1 | Shoe Carnival | 1 | |

| Express | 1 | Spencer Gifts | 1 | |

| Extended Stay America | 1 | Sprint Nextel | 1 | |

| FedEx | 56 | Staples | 1 | |

| Finish Line | 1 | Starbucks | 12 | |

| Firestone Complete Auto Care | 4 | Studio Plus Deluxe Studios | 1 | |

| Foot Locker | 1 | Subaru | 1 | |

| Ford | 1 | Subway | 27 | |

| Forever 21 | 1 | T-Mobile | 9 | |

| GNC | 4 | T.J.Maxx | 1 | |

| GameStop | 2 | Taco Bell | 7 | |

| Gap | 1 | Talbots | 1 | |

| Gymboree | 1 | Target | 2 | |

| H&R Block | 10 | The Limited | 1 | |

| Haagen-Dazs | 1 | The Room Place | 2 | |

| Havertys Furniture | 1 | Toyota | 1 | |

| Hilton | 5 | Toys"R"Us | 2 | |

| Hobby Lobby | 1 | Travelodge | 1 | |

| Holiday Inn | 6 | U-Haul | 8 | |

| Hollister Co. | 1 | UPS | 77 | |

| Home Depot | 2 | Vans | 2 | |

| Honda | 1 | Verizon Wireless | 4 | |

| Hyundai | 1 | Victoria's Secret | 1 | |

| IHOP | 2 | Volkswagen | 1 | |

| J. Jill | 1 | Waffle House | 6 | |

| J.Crew | 1 | Walgreens | 9 | |

| JCPenney | 1 | Walmart | 3 | |

| Jimmy John's | 1 | Wendy's | 10 | |

| JoS. A. Bank | 2 | Whole Foods Market | 1 | |

| Jones New York | 8 | Wingate | 1 | |

| Journeys | 1 | YMCA | 2 | |

| Justice | 3 | |||

Strongest AM radio stations in Little Rock:

- KGHT (880 AM; 50 kW; SHERIDAN, AR; Owner: METROPOLITAN RADIO GROUP, INC.)

- KAAY (1090 AM; 50 kW; LITTLE ROCK, AR; Owner: CITADEL BROADCASTING COMPANY)

- KITA (1440 AM; 5 kW; LITTLE ROCK, AR; Owner: KITA, INCORPORATED)

- KARN (920 AM; 5 kW; LITTLE ROCK, AR; Owner: CITADEL BROADCASTING COMPANY)

- KMTL (760 AM; daytime; 10 kW; SHERWOOD, AR; Owner: GEORGE V. DOMERESE)

- KJBN (1050 AM; 1 kW; LITTLE ROCK, AR; Owner: JOSHUA MINISTRIES & COMM.DEVELOP COR)

- KLRG (1150 AM; 5 kW; NORTH LITTLE ROCK, AR; Owner: ARKANSAS RADIO CORPORATION)

- KLIH (1250 AM; 2 kW; LITTLE ROCK, AR; Owner: CITADEL BROADCASTING COMPANY)

- KDXE (1380 AM; 5 kW; NORTH LITTLE ROCK, AR; Owner: RADIO DISNEY AM 1380, LLC)

- KBHS (590 AM; 5 kW; HOT SPRINGS, AR; Owner: J & A, INC.)

- WCRV (640 AM; 50 kW; COLLIERVILLE, TN; Owner: BOTT BROADCASTING COMPANY/TENNESSEE)

- KBBL (1350 AM; 2 kW; CABOT, AR; Owner: CABOT RADIO, INC.)

- WDIA (1070 AM; 50 kW; MEMPHIS, TN; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

Strongest FM radio stations in Little Rock:

- KLAL (107.7 FM; WRIGHTSVILLE, AR; Owner: CITADEL BROADCASTING COMPANY)

- KOKY (102.1 FM; SHERWOOD, AR; Owner: CITADEL BROADCASTING COMPANY)

- KSSN (95.7 FM; LITTLE ROCK, AR; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- KKPT (94.1 FM; LITTLE ROCK, AR; Owner: SIGNAL MEDIA OF ARKANSAS, INC.)

- KABZ (103.7 FM; LITTLE ROCK, AR; Owner: SIGNAL MEDIA OF ARKANSAS, INC)

- KURB (98.5 FM; LITTLE ROCK, AR; Owner: CITADEL BROADCASTING COMPANY)

- KHKN (106.7 FM; BENTON, AR; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- KDJE (100.3 FM; JACKSONVILLE, AR; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- KMJX (105.1 FM; CONWAY, AR; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- KUAR (89.1 FM; LITTLE ROCK, AR; Owner: BD. OF TRUSTEES OF UNIV. OF ARKANSAS)

- KABF (88.3 FM; LITTLE ROCK, AR; Owner: ARKANSAS BROADCASTING FOUNDATION INC)

- KLRE-FM (90.5 FM; LITTLE ROCK, AR; Owner: LITTLE ROCK SCHOOL DISTRICT)

- KMSX (94.9 FM; MAUMELLE, AR; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- KDRE (101.1 FM; NORTH LITTLE ROCK, AR; Owner: FLINN BROADCASTING CORPORATION)

- KWLR (96.9 FM; MAUMELLE, AR; Owner: FLINN BROADCASTING CORPORATION)

- KKZR (93.3 FM; BRYANT, AR; Owner: ABG ARKANSAS, LLC)

- KIPR (92.3 FM; PINE BLUFF, AR; Owner: CITADEL BROADCASTING COMPANY)

- KHTE-FM (96.5 FM; ENGLAND, AR; Owner: ABG ARKANSAS, LLC)

- KVLO (102.9 FM; SHERIDAN, AR; Owner: CITADEL BROADCASTING COMPANY)

- KSBC (90.1 FM; HOT SPRINGS, AR; Owner: CENTRAL ARKANSAS CHRISTIAN BROADCASTING, INC.)

TV broadcast stations around Little Rock:

- KLRA-LP (Channel 58; LITTLE ROCK, AR; Owner: ARKANSAS MEDIA, L.L.C.)

- KHUG-LP (Channel 14; LITTLE ROCK, AR; Owner: LITTLE ROCK TV-14, L.L.C.)

- KJLR-LP (Channel 28; LITTLE ROCK, ETC., AR; Owner: COWSERT FAMILY, L.L.C.)

- K55GE (Channel 55; LITTLE ROCK, AR; Owner: THREE ANGELS BROADCASTING NETWORK INC.)

- KZJG-LP (Channel 13; LITTLE ROCK, ETC., AR; Owner: COWSERT FAMILY, L.L.C.)

- KTHV (Channel 11; LITTLE ROCK, AR; Owner: ARKANSAS TELEVISION COMPANY)

- KLRT-TV (Channel 16; LITTLE ROCK, AR; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- KATV (Channel 7; LITTLE ROCK, AR; Owner: KATV, LLC)

- KARK-TV (Channel 4; LITTLE ROCK, AR; Owner: KARK-TV, INC.)

- KWBF (Channel 42; LITTLE ROCK, AR; Owner: RIVER CITY BROADCASTING, INC.)

- KKYK-LP (Channel 22; LITTLE ROCK, AR; Owner: ARKANSAS 49, INC.)

- KETS (Channel 2; LITTLE ROCK, AR; Owner: ARKANSAS EDUCATIONAL TELEVISION COMMISSION)

- KHTE-LP (Channel 44; LITTLE ROCK, AR; Owner: EQUITY BROADCASTING CORPORATION)

- KASN (Channel 38; PINE BLUFF, AR; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- K27FF (Channel 27; EL DORADO, AR; Owner: MS COMMUNICATIONS, LLC)

- K34FH (Channel 34; LITTLE ROCK, AR; Owner: NATIONAL MINORITY T.V., INC.)

- KVTN (Channel 25; PINE BLUFF, AR; Owner: AGAPE CHURCH, INC.)

Medal of Honor Recipients

Medal of Honor Recipients born in Little Rock: Douglas MacArthur, Seymour W. Terry.

- National Bridge Inventory (NBI) Statistics

- 640Number of bridges

- 11,677ft / 3,559mTotal length

- $76,837,000Total costs

- 14,587,333Total average daily traffic

- 541,775Total average daily truck traffic

- New bridges - historical statistics

- 71920-1929

- 181930-1939

- 111940-1949

- 251950-1959

- 611960-1969

- 821970-1979

- 401980-1989

- 381990-1999

- 402000-2009

- 292010-2019

- 22020-2022

FCC Registered Antenna Towers: 1,087 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 36 (See the full list of FCC Registered Commercial Land Mobile Towers in Little Rock, AR)

FCC Registered Private Land Mobile Towers: 27 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 148 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 270 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 49 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 39 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 1,143 (See the full list of FCC Registered Amateur Radio Licenses in Little Rock)

FAA Registered Aircraft Manufacturers and Dealers: 35 (See the full list of FAA Registered Manufacturers and Dealers in Little Rock)

FAA Registered Aircraft: 259 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 33 full and 12 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 964 | $137,066 | 1,026 | $189,655 | 3,074 | $186,498 | 301 | $59,051 | 23 | $1,116,483 | 457 | $114,899 | 16 | $19,434 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 26 | $114,510 | 36 | $186,903 | 177 | $159,081 | 38 | $31,217 | 1 | $52,990 | 17 | $82,811 | 2 | $46,285 |

| APPLICATIONS DENIED | 171 | $115,221 | 114 | $148,949 | 961 | $147,605 | 237 | $29,223 | 5 | $2,335,228 | 114 | $94,529 | 9 | $43,112 |

| APPLICATIONS WITHDRAWN | 147 | $121,294 | 107 | $187,043 | 690 | $167,620 | 35 | $71,456 | 2 | $8,696,985 | 48 | $114,178 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 43 | $127,444 | 21 | $168,850 | 183 | $164,168 | 7 | $42,597 | 0 | $0 | 12 | $112,962 | 1 | $36,140 |

Detailed mortgage data for all 46 tracts in Little Rock, AR

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 25 full and 10 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 150 | $207,885 | 104 | $209,135 | 4 | $84,385 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 32 | $201,392 | 33 | $223,277 | 3 | $129,173 |

| APPLICATIONS DENIED | 11 | $199,407 | 13 | $196,968 | 1 | $163,510 |

| APPLICATIONS WITHDRAWN | 7 | $218,826 | 8 | $258,647 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 5 | $135,698 | 1 | $225,110 | 1 | $132,000 |

2003 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Little Rock, AR

- 9,06438.7%Structure Fires

- 8,84537.8%Outside Fires

- 3,74116.0%Mobile Property/Vehicle Fires

- 1,7507.5%Other

Based on the data from the years 2003 - 2018 the average number of fires per year is 1461. The highest number of fires - 2,005 took place in 2005, and the least - 78 in 2003. The data has an increasing trend.

Based on the data from the years 2003 - 2018 the average number of fires per year is 1461. The highest number of fires - 2,005 took place in 2005, and the least - 78 in 2003. The data has an increasing trend. When looking into fire subcategories, the most reports belonged to: Structure Fires (38.7%), and Outside Fires (37.8%).

When looking into fire subcategories, the most reports belonged to: Structure Fires (38.7%), and Outside Fires (37.8%).Fire-safe hotels and motels in Little Rock, Arkansas:

- Days Inn, 901 Fair Park Blvd, Little Rock, Arkansas 72204 , Phone: (501) 664-7000, Fax: (501) 664-1639

- Four Points by Sheraton Little Rock Midtown, 925 S University Ave, Little Rock, Arkansas 72204 , Phone: (501) 664-5020, Fax: (501) 748-4758

- Quality Inn & Suites, 6100 Mitchell Dr, Little Rock, Arkansas 72209 , Phone: (501) 562-6667, Fax: (501) 568-6832

- Crowne Plaza Little Rock, 201 S Shackleford, Little Rock, Arkansas 72211 , Phone: (501) 223-3000, Fax: (501) 537-2334

- Americas Best Value Inn, 7900 Scott Hamilton Dr, Little Rock, Arkansas 72209 , Phone: (800) 733-7663, Fax: (501) 562-1723

- La Quinta Inn-otter Creek, 11701 I-30, Little Rock, Arkansas 72209 , Phone: (501) 455-2300, Fax: (501) 455-5876

- The Burgundy Hotel, an Ascend Hotel Collection Member, 1501 Merrill Dr, Little Rock, Arkansas 72211 , Phone: (501) 224-8051, Fax: (501) 221-7552

- Motel 6, 7501 I-30, Little Rock, Arkansas 72209 , Phone: (501) 568-8888, Fax: (501) 568-8355

- 41 other hotels and motels

| Most common first names in Little Rock, AR among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| James | 1,475 | 71.2 years |

| Mary | 1,427 | 78.7 years |

| William | 1,323 | 74.3 years |

| John | 1,270 | 73.0 years |

| Robert | 838 | 70.1 years |

| Charles | 711 | 71.1 years |

| George | 615 | 74.5 years |

| Willie | 543 | 74.6 years |

| Dorothy | 411 | 74.4 years |

| Margaret | 390 | 78.7 years |

| Most common last names in Little Rock, AR among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 806 | 74.0 years |

| Williams | 725 | 72.5 years |

| Johnson | 652 | 72.3 years |

| Jones | 645 | 74.0 years |

| Brown | 530 | 73.4 years |

| Davis | 419 | 73.9 years |

| Moore | 297 | 74.8 years |

| Wilson | 285 | 74.1 years |

| Jackson | 284 | 70.4 years |

| Harris | 283 | 74.7 years |

- 68.3%Utility gas

- 30.3%Electricity

- 1.0%Bottled, tank, or LP gas

- 0.2%No fuel used

- 0.2%Wood

- 70.1%Electricity

- 27.2%Utility gas

- 1.4%Bottled, tank, or LP gas

- 1.2%No fuel used

- 0.1%Fuel oil, kerosene, etc.

Little Rock compared to Arkansas state average:

- Unemployed percentage significantly below state average.

- Black race population percentage significantly above state average.

- Foreign-born population percentage above state average.

- Percentage of population with a bachelor's degree or higher significantly above state average.

Little Rock, AR compared to other similar cities:

Little Rock on our top lists:

- #8 on the list of "Top 101 cities with the highest number of thefts per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #9 on the list of "Top 100 least-safe cities (highest city-data.com crime index) (pop. 50,000+)"

- #10 on the list of "Top 101 cities with the highest city-data.com crime index, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #16 on the list of "Top 101 cities with the highest number of burglaries per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #19 on the list of "Top 101 cities with the highest number of murders per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #21 on the list of "Top 101 cities with the largest house values disparities (population 50,000+)"

- #21 on the list of "Top 101 cities with the largest percentage of high school students in private schools (3,000+ students)"

- #22 on the list of "Top 101 cities with the largest percentage of people in institutions for the deaf (population 1,000+)"

- #22 on the list of "Top 101 cities with largest percentage of females in industries: health care and social assistance (population 50,000+)"

- #23 on the list of "Top 101 cities with the highest number of assaults per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #31 on the list of "Top 101 cities with the largest percentage of people in institutions for the blind (population 1,000+)"

- #33 on the list of "Top 101 cities with largest percentage of females in occupations: health diagnosing and treating practitioners and other technical occupations (population 50,000+)"

- #41 on the list of "Top 101 cities with the highest number of rapes per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #41 on the list of "Top 101 cities with the highest number of robberies per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #48 on the list of "Top 101 cities with the largest percentage of elementary and middle school students in private schools (5,000+ students)"

- #65 on the list of "Top 101 cities with the highest number of police officers per 1000 residents (population 50,000+)"

- #70 on the list of "Top 101 cities that people commute into (largest positive percentage daily daytime population change due to commuting) (population 50,000+)"

- #70 on the list of "Top 101 cities with the highest number of arson incidents per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #70 on the list of "Top 101 cities with the highest average snowfall in a year (population 50,000+)"

- #75 on the list of "Top 101 cities with largest percentage of males in occupations: business and financial operations occupations (population 50,000+)"

- #32 (72205) on the list of "Top 101 zip codes with the most offices of physicians in 2005"

- #62 (72201) on the list of "Top 101 zip codes with the most offices of lawyers in 2005"

- #26 on the list of "Top 101 counties with the highest percentage of residents that keep firearms around their homes"

- #30 on the list of "Top 101 counties with the most Black Protestant congregations"

- #35 on the list of "Top 101 counties with the highest number of infant deaths per 1000 residents 2007-2013 (pop. 50,000+)"

- #45 on the list of "Top 101 counties with the most Black Protestant adherents"

- #52 on the list of "Top 101 counties with the lowest percentage of residents that drank alcohol in the past 30 days"

State forum archive:

|

|

Total of 608 patent applications in 2008-2024.