Livingston, New Jersey

Livingston: CHCC GROUND HOG

Livingston: Path in winter woods

Livingston: a beautiful view down the street

- add

your

Submit your own pictures of this place and show them to the world

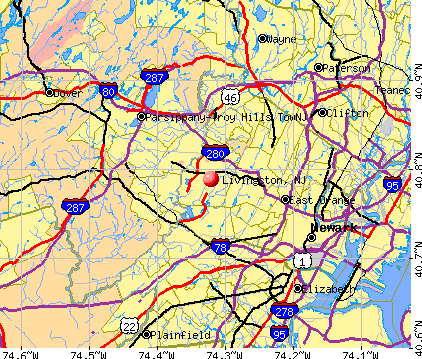

- OSM Map

- General Map

- Google Map

- MSN Map

| Males: 12,932 | |

| Females: 13,658 |

| Median resident age: | 40.6 years |

| New Jersey median age: | 36.7 years |

Zip codes: 07039.

| Livingston: | $164,974 |

| NJ: | $96,346 |

Estimated per capita income in 2022: $89,272 (it was $47,218 in 2000)

Livingston CDP income, earnings, and wages data

Estimated median house or condo value in 2022: $759,246 (it was $289,500 in 2000)

| Livingston: | $759,246 |

| NJ: | $428,900 |

Mean prices in 2022: all housing units: $574,104; detached houses: $657,086; townhouses or other attached units: $439,629; in 2-unit structures: $368,927; in 3-to-4-unit structures: $409,981; in 5-or-more-unit structures: $367,645; mobile homes: $225,735

Detailed information about poverty and poor residents in Livingston, NJ

- 22,15080.9%White alone

- 3,96414.5%Asian alone

- 6952.5%Hispanic

- 3251.2%Black alone

- 2090.8%Two or more races

- 380.1%Other race alone

- 80.03%American Indian alone

- 20.01%Native Hawaiian and Other

Pacific Islander alone

Races in Livingston detailed stats: ancestries, foreign born residents, place of birth

According to our research of New Jersey and other state lists, there were 2 registered sex offenders living in Livingston, New Jersey as of April 23, 2024.

The ratio of all residents to sex offenders in Livingston is 13,295 to 1.

The ratio of registered sex offenders to all residents in this city is much lower than the state average.

Type |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Murders (per 100,000) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 2 (6.7) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) |

| Rapes (per 100,000) | 1 (3.6) | 0 (0.0) | 1 (3.4) | 2 (6.8) | 0 (0.0) | 1 (3.4) | 1 (3.3) | 3 (10.1) | 1 (3.3) | 2 (6.7) | 3 (10.0) | 1 (3.3) | 2 (6.3) | 1 (3.2) |

| Robberies (per 100,000) | 7 (25.3) | 7 (23.8) | 6 (20.4) | 7 (23.7) | 8 (27.0) | 6 (20.2) | 6 (20.0) | 5 (16.8) | 5 (16.7) | 3 (10.1) | 1 (3.3) | 0 (0.0) | 3 (9.4) | 4 (13.0) |

| Assaults (per 100,000) | 8 (28.9) | 5 (17.0) | 7 (23.8) | 6 (20.3) | 7 (23.6) | 9 (30.3) | 4 (13.3) | 4 (13.4) | 3 (10.0) | 18 (60.4) | 2 (6.7) | 8 (26.3) | 1 (3.1) | 2 (6.5) |

| Burglaries (per 100,000) | 34 (122.6) | 46 (156.6) | 44 (149.3) | 41 (138.7) | 26 (87.8) | 45 (151.5) | 18 (60.0) | 29 (97.4) | 23 (76.7) | 22 (73.8) | 26 (86.7) | 27 (88.9) | 24 (75.5) | 21 (68.1) |

| Thefts (per 100,000) | 339 (1,223) | 329 (1,120) | 390 (1,324) | 342 (1,157) | 323 (1,090) | 256 (862.1) | 282 (939.3) | 299 (1,004) | 299 (997.1) | 238 (798.1) | 301 (1,003) | 193 (635.5) | 276 (868.3) | 251 (813.8) |

| Auto thefts (per 100,000) | 6 (21.6) | 11 (37.5) | 36 (122.2) | 40 (135.3) | 35 (118.2) | 8 (26.9) | 12 (40.0) | 12 (40.3) | 17 (56.7) | 17 (57.0) | 26 (86.7) | 25 (82.3) | 23 (72.4) | 41 (132.9) |

| Arson (per 100,000) | 3 (10.8) | 0 (0.0) | 0 (0.0) | 1 (3.4) | 0 (0.0) | 0 (0.0) | 1 (3.3) | 0 (0.0) | 0 (0.0) | 1 (3.4) | 0 (0.0) | 1 (3.3) | 1 (3.1) | 0 (0.0) |

| City-Data.com crime index | 75.5 | 69.3 | 86.7 | 83.4 | 72.0 | 62.1 | 56.3 | 79.4 | 59.5 | 62.1 | 63.5 | 46.1 | 54.3 | 55.7 |

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Crime rate in Livingston detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 85 (70 officers - 63 male; 7 female).

| Officers per 1,000 residents here: | 2.20 |

| New Jersey average: | 5.53 |

| Livingston or Scotch Plains? Where to Move - Please Help! (44 replies) |

| Help! warehouse hours of operation next to residential neighborhood (Livingston). (24 replies) |

| Livingston Flood zone (2 replies) |

| Livingston NJ- pls help (31 replies) |

| Livingston vs Morris county for special needs kids (0 replies) |

| Opinions needed..Holmdel Livingston Tenafly Westfield (52 replies) |

Latest news from Livingston, NJ collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: Italian (17.7%), Irish (10.3%), Russian (9.8%), German (7.4%), United States (7.0%), Polish (6.6%).

Current Local Time: EST time zone

Elevation: 307 feet

Land area: 13.9 square miles.

Population density: 1,915 people per square mile (low).

5,154 residents are foreign born (10.9% Asia, 5.5% Europe).

| This place: | 18.8% |

| New Jersey: | 17.5% |

| Livingston CDP: | 2.3% ($6,665) |

| New Jersey: | 2.4% ($4,047) |

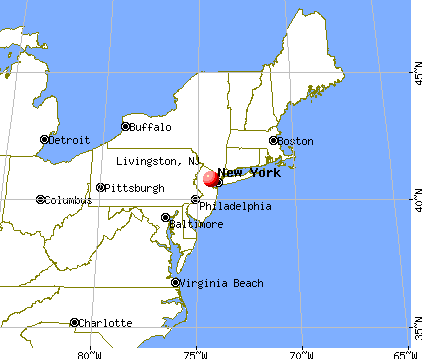

Nearest city with pop. 50,000+: East Orange, NJ (6.0 miles

, pop. 69,824).

Nearest city with pop. 200,000+: Newark, NJ (8.0 miles

, pop. 273,546).

Nearest city with pop. 1,000,000+: Manhattan, NY (18.3 miles

, pop. 1,537,195).

Nearest cities:

Latitude: 40.79 N, Longitude: 74.32 W

Daytime population change due to commuting: +9,455 (+34.5%)

Workers who live and work in this place: 2,898 (21.9%)

Area codes: 973, 862

Livingston tourist attractions:

Livingston, New Jersey accommodation & food services, waste management - Economy and Business Data

| Here: | 5.6% |

| New Jersey: | 4.5% |

- Professional, scientific, technical services (15.1%)

- Health care (11.2%)

- Finance & insurance (11.0%)

- Educational services (9.3%)

- Construction (4.0%)

- Real estate & rental & leasing (3.0%)

- Accommodation & food services (2.9%)

- Professional, scientific, technical services (17.5%)

- Finance & insurance (12.0%)

- Health care (7.6%)

- Construction (6.5%)

- Educational services (3.9%)

- Public administration (3.4%)

- Accommodation & food services (3.1%)

- Educational services (15.7%)

- Health care (15.3%)

- Professional, scientific, technical services (12.3%)

- Finance & insurance (9.8%)

- Real estate & rental & leasing (3.6%)

- Social assistance (3.4%)

- Accommodation & food services (2.6%)

- Other sales and related occupations, including supervisors (6.3%)

- Other management occupations, except farmers and farm managers (5.8%)

- Computer specialists (5.3%)

- Sales representatives, services, wholesale and manufacturing (5.0%)

- Lawyers (4.1%)

- Preschool, kindergarten, elementary, and middle school teachers (3.8%)

- Top executives (3.8%)

- Sales representatives, services, wholesale and manufacturing (7.1%)

- Other management occupations, except farmers and farm managers (6.8%)

- Computer specialists (6.4%)

- Lawyers (6.4%)

- Other sales and related occupations, including supervisors (6.1%)

- Top executives (5.9%)

- Accountants and auditors (4.1%)

- Secretaries and administrative assistants (7.8%)

- Preschool, kindergarten, elementary, and middle school teachers (7.1%)

- Other sales and related occupations, including supervisors (6.5%)

- Other office and administrative support workers, including supervisors (6.0%)

- Other management occupations, except farmers and farm managers (4.6%)

- Bookkeeping, accounting, and auditing clerks (4.3%)

- Retail sales workers, except cashiers (4.1%)

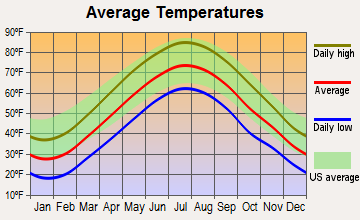

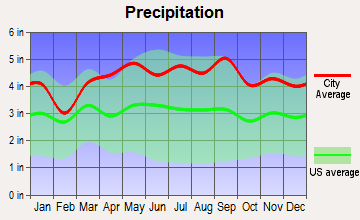

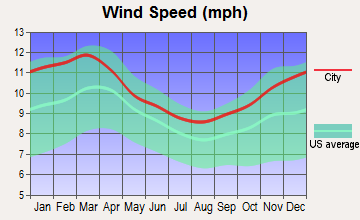

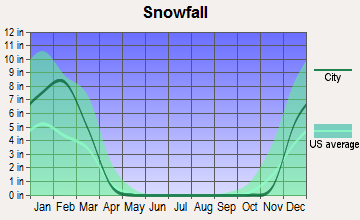

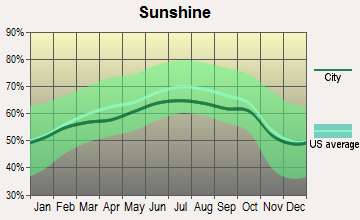

Average climate in Livingston, New Jersey

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

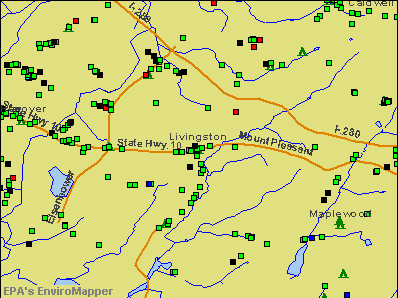

Air Quality Index (AQI) level in 2023 was 109. This is significantly worse than average.

| City: | 109 |

| U.S.: | 73 |

Carbon Monoxide (CO) [ppm] level in 2023 was 0.363. This is significantly worse than average. Closest monitor was 6.7 miles away from the city center.

| City: | 0.363 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2023 was 14.1. This is significantly worse than average. Closest monitor was 8.2 miles away from the city center.

| City: | 14.1 |

| U.S.: | 5.1 |

Sulfur Dioxide (SO2) [ppb] level in 2023 was 0.588. This is significantly better than average. Closest monitor was 6.7 miles away from the city center.

| City: | 0.588 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2023 was 30.3. This is about average. Closest monitor was 6.7 miles away from the city center.

| City: | 30.3 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2003 was 26.9. This is worse than average. Closest monitor was 8.2 miles away from the city center.

| City: | 26.9 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 9.18. This is about average. Closest monitor was 7.0 miles away from the city center.

| City: | 9.18 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2008 was 0.0125. This is worse than average. Closest monitor was 8.9 miles away from the city center.

| City: | 0.0125 |

| U.S.: | 0.0093 |

Tornado activity:

Livingston-area historical tornado activity is near New Jersey state average. It is 32% smaller than the overall U.S. average.

On 5/28/1973, a category F3 (max. wind speeds 158-206 mph) tornado 9.4 miles away from the Livingston place center caused between $50,000 and $500,000 in damages.

On 5/28/1973, a category F3 tornado 21.3 miles away from the place center injured 12 people and caused between $50,000 and $500,000 in damages.

Earthquake activity:

Livingston-area historical earthquake activity is significantly above New Jersey state average. It is 68% smaller than the overall U.S. average.On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 277.5 miles away from the city center

On 10/7/1983 at 10:18:46, a magnitude 5.3 (5.1 MB, 5.3 LG, 5.1 ML) earthquake occurred 218.9 miles away from the city center

On 1/16/1994 at 01:49:16, a magnitude 4.6 (4.6 MB, 4.6 LG, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 95.6 miles away from the city center

On 4/20/2002 at 10:50:47, a magnitude 5.3 (5.3 ML, Depth: 3.0 mi) earthquake occurred 259.5 miles away from Livingston center

On 4/20/2002 at 10:50:47, a magnitude 5.2 (5.2 MB, 4.2 MS, 5.2 MW, 5.0 MW) earthquake occurred 257.6 miles away from the city center

On 1/16/1994 at 00:42:43, a magnitude 4.2 (4.2 MB, 4.0 LG, Depth: 3.1 mi) earthquake occurred 94.2 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Essex County (30) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 19

Emergencies Declared: 10

Causes of natural disasters: Floods: 8, Hurricanes: 7, Storms: 7, Heavy Rains: 4, Snowstorms: 4, Winter Storms: 3, Blizzards: 2, Water Shortages: 2, Power Outage: 1, Tornado: 1, Tropical Storm: 1, Wind: 1, Other: 3 (Note: some incidents may be assigned to more than one category).

Main business address for: CIT GROUP INC (FINANCE LESSORS), COLUMBIA LABORATORIES INC (PHARMACEUTICAL PREPARATIONS).

Hospitals and medical centers in Livingston:

- LIVINGSTON COMMUNITY HOSPITAL,THE (provides emergency services, 204 HILLSIDE AVE)

- SAINT BARNABAS MEDICAL CENTER (Voluntary non-profit - Other, 94 OLD SHORT HILLS ROAD)

- VITAS HEALTHCARE CORPORATION ATLANTIC (70 SOUTH ORANGE AVENUE, SUITE 210)

- CARE ONE AT LIVINGSTON (68 PASSAIC AVENUE)

- INGLEMOOR REHABILITATION AND CARE CENTER OF LIVING (311 S LIVINGSTON AVE)

- INGLEMOOR WEST NURSING HOME (311 S LIVINGSTON AVE)

- RCG ST BARNABAS SO ORANGE AVE (OUTPATIENT HEMODIALYSIS)

Heliports located in Livingston:

Amtrak stations near Livingston:

- 10 miles: NEWARK (RAYMOND PLAZA WEST) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, snack bar, ATM, paid short-term parking, paid long-term parking, call for car rental service, taxi stand, intercity bus service, public transit connection.

- 10 miles: NEWARK INTERNATIONAL AIRPORT (NEWARK, ) . Services: ticket office, enclosed waiting area, public restrooms, public payphones.

- 16 miles: METROPARK (ISELIN, 100 MIDDLESEX-ESSEX TPK.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, paid short-term parking, call for car rental service, taxi stand, public transit connection.

Colleges/universities with over 2000 students nearest to Livingston:

- Seton Hall University (about 5 miles; South Orange, NJ; Full-time enrollment: 7,742)

- Drew University (about 6 miles; Madison, NJ; FT enrollment: 2,272)

- Fairleigh Dickinson University-College at Florham (about 7 miles; Madison, NJ; FT enrollment: 2,690)

- University of Medicine and Dentistry of New Jersey (about 8 miles; Newark, NJ; FT enrollment: 3,210)

- Montclair State University (about 9 miles; Montclair, NJ; FT enrollment: 16,277)

- New Jersey Institute of Technology (about 9 miles; Newark, NJ; FT enrollment: 8,212)

- Essex County College (about 9 miles; Newark, NJ; FT enrollment: 9,595)

Public high school in Livingston:

- LIVINGSTON HIGH SCHOOL (Students: 1,642, Location: 30 ROBERT HARP DRIVE, Grades: 9-12)

Private high school in Livingston:

Public elementary/middle schools in Livingston:

- HERITAGE MIDDLE SCHOOL (Students: 812, Location: 20 FOXCROFT DR, Grades: 7-8)

- HARRISON ELEMENTARY SCHOOL (Students: 531, Location: 148 N LIVINGSTON AVE, Grades: KG-5)

- RIKER HILL ELEMENTARY SCHOOL (Students: 450, Location: 31 BLACKSTONE DR, Grades: KG-5)

- BURNET HILL ELEMENTARY SCHOOL (Students: 428, Location: 25 BYRON PLACE, Grades: PK-5)

- COLLINS ELEMENTARY SCHOOL (Students: 427, Location: 67 MARTIN RD, Grades: KG-5)

- MOUNT PLEASANT MIDDLE SCHOOL (Students: 421, Location: 11 BROADLAWN DR, Grades: 6)

- MOUNT PLEASANT ELEMENTARY SCHOOL (Students: 388, Location: 11 BROADLAWN DR, Grades: KG-5)

- HILLSIDE ELEMENTARY SCHOOL (Location: 98 BELMONT DRIVE, Grades: KG-5)

Private elementary/middle school in Livingston:

Library in Livingston:

- RUTH L. ROCKWOOD MEMORIAL LIBRARY (Operating income: $3,179,848; Location: 10 ROBERT H. HARP DRIVE; 161,662 books; 8,910 audio materials; 9,312 video materials; 6 local licensed databases; 22 state licensed databases; 9 other licensed databases; 451 print serial subscriptions; 2 electronic serial subscriptions)

Points of interest:

Notable locations in Livingston: Cedar Ridge Country Club (A), Canoe Brook Golf Course (B), Short Hills Club (C), Ruth L Rockwood Memorial Library (D), Livingston First Aid Squad (E), Atlantic Ambulance Corporation (F), Livingston Fire Department Circle Station (G), Livingston Fire Department Northfield Station (H), Livingston Fire Department Headquarters (I). Display/hide their locations on the map

Shopping Center: Livingston Mall Shopping Center (1). Display/hide its location on the map

Main business address in Livingston include: CIT GROUP INC (A), COLUMBIA LABORATORIES INC (B). Display/hide their locations on the map

Churches in Livingston include: Olivet Church (A), Grace Church (B), Saint Peter Church (C), Trinity Covenant Church (D), White Oak Ridge Church (E). Display/hide their locations on the map

Cemetery: Ely Cemetery (1). Display/hide its location on the map

Lakes and reservoirs: North Pond (A), Butler Pond (B), South Pond (C), Commonwealth Water Company Reservoir Number Three (D), Canoe Brook Reservoir Number Two (E). Display/hide their locations on the map

Streams, rivers, and creeks: Cub Brook (A), Bear Brook (B). Display/hide their locations on the map

Park in Livingston: East Hills Park (1). Display/hide its location on the map

Tourist attractions: Essex County Offices & Institutions - Parks Recreation and Cultural Affairs Depart (Museums; Beaufort Avenue), Livingston Township - the Following Departments Can Be Dialed Directly (Cultural Attractions- Events- & Facilities; Memorial Park).

Hotel: Livingston Travelodge (550 W Mount Pleasant Ave).

Court: Livingston Township - Monmouth Court Pre-School (Monmouth Court).

Birthplace of: Chelsea Handler - Stand-up comedian, Eldridge Hawkins, Jr. - Mayor, Robert E. Grady - Investment banker and government official, Jack Ketchum - Horror writer, Alan B. Krueger - Economist, Lennie Friedman - 2005 NFL player (Washington Redskins, born: Oct 13, 1976), Bob Dukiet - Basketball coach, Brevin Knight - NBA player (Charlotte Bobcats, born: Nov 8, 1975), Marc Ecko - Fashion designer, Bruce Beck - Sportscaster.

| This place: | 2.9 people |

| New Jersey: | 2.7 people |

| This place: | 85.3% |

| Whole state: | 70.7% |

| This place: | 1.3% |

| Whole state: | 4.9% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.2% of all households

- Gay men: 0.2% of all households

| This place: | 1.8% |

| Whole state: | 8.5% |

| This place: | 1.0% |

| Whole state: | 4.2% |

People in group quarters in Livingston in 2000:

- 94 people in nursing homes

- 13 people in homes for the mentally retarded

- 9 people in religious group quarters

- 5 people in mental (psychiatric) hospitals or wards

- 5 people in homes for the mentally ill

Banks with most branches in Livingston (2011 data):

- Valley National Bank: Mayflower Branch, Norcrown Bank Branch, Northfield Branch, South Livingston (2) Branch. Info updated 2012/01/10: Bank assets: $14,186.7 mil, Deposits: $9,715.7 mil, headquarters in Wayne, NJ, positive income, Commercial Lending Specialization, 219 total offices, Holding Company: Valley National Bancorp

- Capital One, National Association: Livingston Avenue Branch at 507 S. Livingston Avenue, branch established on 2001/05/21; Livingston Circle Branch at 623 West Mount Pleasant Ave, branch established on 1989/12/19. Info updated 2011/07/01: Bank assets: $133,477.8 mil, Deposits: $97,063.7 mil, headquarters in Mclean, VA, positive income, 984 total offices, Holding Company: Capital One Financial Corporation

- Investors Bank: Susan B. Anthony Branch at 371 East Northfield Road, branch established on 1939/09/28; Livingston Plaza Branch at 493 South Livingston Avenue, branch established on 1939/09/28. Info updated 2012/02/27: Bank assets: $10,674.9 mil, Deposits: $7,419.7 mil, headquarters in Short Hills, NJ, positive income, Commercial Lending Specialization, 86 total offices, Holding Company: Investors Bancorp, Mhc

- Wells Fargo Bank, National Association: Livingston Center at 4160 Town Center Way, branch established on 1969/09/15; Livingston Circle at 313 West Mount Pleasant Avenue, branch established on 1974/11/06. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- Sovereign Bank, National Association: Livingston Branch at 301 South Livingston Avenue, branch established on 1941/11/01; Livingston Branch at 30 West Mount Pleasant Avenue, branch established on 1987/03/02. Info updated 2012/01/31: Bank assets: $78,146.9 mil, Deposits: $48,042.9 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 718 total offices, Holding Company: Banco Santander, S.A.

- Regal Bank: 504 South Livingston Branch at 504 South Livingston Avenue, branch established on 2007/12/07; at 570 West Mount Pleasant Avenue, branch established on 2007/12/06. Info updated 2007/12/10: Bank assets: $216.5 mil, Deposits: $190.7 mil, local headquarters, positive income, Commercial Lending Specialization, 4 total offices

- Hudson City Savings Bank: Livingston Branch at 232 South Livingston Avenue, branch established on 1854/01/01; Livingston Shopping Plaza Branch at 277 Eisenhower Parkway, branch established on 1995/09/09. Info updated 2012/01/09: Bank assets: $45,373.6 mil, Deposits: $25,645.6 mil, headquarters in Paramus, NJ, negative income in the last year, Mortgage Lending Specialization, 135 total offices

- Bank of America, National Association: Livingston/Vanderbilt Branch at 92 South Livingston Avenue, branch established on 1927/11/01; Northfield/Livingston Branch at 554 South Livingston Avenue, branch established on 1956/11/05. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Llewellyn-Edison Savings Bank, FSB: 25 W Northfield Rd Branch at 25 W Northfield Rd, branch established on 1912/01/01. Info updated 2011/07/21: Bank assets: $133.1 mil, Deposits: $104.6 mil, headquarters in West Orange, NJ, positive income, Mortgage Lending Specialization, 4 total offices

- 4 other banks with 4 local branches

For population 15 years and over in Livingston:

- Never married: 19.0%

- Now married: 69.6%

- Separated: 0.8%

- Widowed: 6.4%

- Divorced: 4.2%

For population 25 years and over in Livingston:

- High school or higher: 94.0%

- Bachelor's degree or higher: 57.7%

- Graduate or professional degree: 26.7%

- Unemployed: 2.1%

- Mean travel time to work (commute): 30.2 minutes

| Here: | 11.0 |

| New Jersey average: | 13.1 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Livingston, NJ (based on Essex County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 261,966 | 65 |

| Other | 61,850 | 81 |

| Mainline Protestant | 41,339 | 171 |

| Black Protestant | 38,687 | 88 |

| Evangelical Protestant | 34,666 | 191 |

| Orthodox | 6,188 | 12 |

| None | 339,273 | - |

Food Environment Statistics:

| Essex County: | 3.95 / 10,000 pop. |

| New Jersey: | 2.90 / 10,000 pop. |

| Here: | 1.54 / 10,000 pop. |

| State: | 1.76 / 10,000 pop. |

| Essex County: | 0.39 / 10,000 pop. |

| State: | 0.81 / 10,000 pop. |

| This county: | 6.00 / 10,000 pop. |

| State: | 7.15 / 10,000 pop. |

| This county: | 9.4% |

| New Jersey: | 8.3% |

| This county: | 25.3% |

| State: | 23.3% |

| This county: | 16.5% |

| State: | 18.0% |

6.52% of this county's 2021 resident taxpayers lived in other counties in 2020 ($103,528 average adjusted gross income)

| Here: | 6.52% |

| New Jersey average: | 6.70% |

0.01% of residents moved from foreign countries ($16 average AGI)

Essex County: 0.01% New Jersey average: 0.01%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Hudson County, NJ | |

| from Union County, NJ | |

| from Kings County, NY |

7.76% of this county's 2020 resident taxpayers moved to other counties in 2021 ($101,736 average adjusted gross income)

| Here: | 7.76% |

| New Jersey average: | 7.02% |

0.02% of residents moved to foreign countries ($107 average AGI)

Essex County: 0.02% New Jersey average: 0.02%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Union County, NJ | |

| to Morris County, NJ | |

| to Hudson County, NJ |

| Businesses in Livingston, NJ | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 7-Eleven | 1 | Journeys | 1 | |

| AT&T | 2 | Justice | 1 | |

| Ace Hardware | 1 | Lane Bryant | 1 | |

| Aeropostale | 1 | LensCrafters | 1 | |

| American Eagle Outfitters | 1 | Macy's | 1 | |

| Ann Taylor | 1 | MasterBrand Cabinets | 5 | |

| Bakers | 1 | Men's Wearhouse | 1 | |

| Barnes & Noble | 1 | Motherhood Maternity | 2 | |

| Baskin-Robbins | 1 | New York & Co | 1 | |

| Bath & Body Works | 1 | Nike | 9 | |

| Burger King | 1 | Old Navy | 1 | |

| CVS | 2 | Olive Garden | 1 | |

| Charlotte Russe | 1 | Pac Sun | 1 | |

| Chevrolet | 1 | Papa John's Pizza | 1 | |

| Cinnabon | 1 | Payless | 1 | |

| Curves | 1 | Popeyes | 1 | |

| Decora Cabinetry | 2 | RadioShack | 1 | |

| Dunkin Donuts | 3 | Sears | 2 | |

| Express | 1 | Spencer Gifts | 1 | |

| FedEx | 7 | Sprint Nextel | 1 | |

| Finish Line | 1 | Staples | 1 | |

| Firestone Complete Auto Care | 1 | Starbucks | 1 | |

| Foot Locker | 1 | Subway | 2 | |

| GNC | 1 | T-Mobile | 1 | |

| GameStop | 2 | The Room Place | 1 | |

| Gap | 1 | Toys"R"Us | 2 | |

| H&M | 1 | UPS | 9 | |

| H&R Block | 1 | Vans | 2 | |

| Hollister Co. | 1 | Verizon Wireless | 1 | |

| Hot Topic | 1 | Victoria's Secret | 1 | |

| JoS. A. Bank | 1 | Walgreens | 1 | |

| Jones New York | 3 | YMCA | 2 | |

Strongest AM radio stations in Livingston:

- WMCA (570 AM; 50 kW; NEW YORK, NY; Owner: SALEM MEDIA OF NEW YORK, LLC)

- WOR (710 AM; 50 kW; NEW YORK, NY; Owner: BUCKLEY BROADCASTING CORPORATION)

- WINS (1010 AM; 50 kW; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WABC (770 AM; 50 kW; NEW YORK, NY; Owner: WABC-AM RADIO, INC.)

- WEPN (1050 AM; 50 kW; NEW YORK, NY; Owner: NEW YORK AM RADIO, LLC)

- WSNR (620 AM; 20 kW; JERSEY CITY, NJ)

- WADO (1280 AM; 50 kW; NEW YORK, NY; Owner: WADO-AM LICENSE CORP.)

- WBBR (1130 AM; 50 kW; NEW YORK, NY; Owner: BLOOMBERG COMMUNICATIONS INC.)

- WLIB (1190 AM; 30 kW; NEW YORK, NY; Owner: ICBC BROADCAST HOLDINGS-NY, INC.)

- WMTR (1250 AM; 7 kW; MORRISTOWN, NJ; Owner: THE SENTINEL PUBLISHING CO.)

- WFAN (660 AM; 50 kW; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WNYC (820 AM; 10 kW; NEW YORK, NY; Owner: WNYC RADIO)

- WWRL (1600 AM; 25 kW; NEW YORK, NY; Owner: ACCESS.1 COMMUNICATIONS CORP.-NY)

Strongest FM radio stations in Livingston:

- WRKS (98.7 FM; NEW YORK, NY; Owner: EMMIS RADIO LICENSE CORP OF NEW YORK)

- WFME (94.7 FM; NEWARK, NJ; Owner: FAMILY STATIONS, INC.)

- WFMU (91.1 FM; EAST ORANGE, NJ; Owner: AURICLE COMMUNICATIONS)

- WNEW (102.7 FM; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WMSC (90.3 FM; UPPER MONTCLAIR, NJ; Owner: MONTCLAIR STATE UNIVERSITY)

- WSOU (89.5 FM; SOUTH ORANGE, NJ; Owner: SETON HALL UNIVERSITY)

- WNYC-FM (93.9 FM; NEW YORK, NY; Owner: WNYC RADIO)

- WPAT-FM (93.1 FM; PATERSON, NJ; Owner: WPAT LICENSING, INC.)

- WQCD (101.9 FM; NEW YORK, NY; Owner: EMMIS RADIO LICENSE CORPORATION)

- WKTU (103.5 FM; LAKE SUCCESS, NY; Owner: AMFM RADIO LICENSES, LLC)

- WAXQ (104.3 FM; NEW YORK, NY; Owner: AMFM NEW YORK LICENSES, LLC)

- WHTZ (100.3 FM; NEWARK, NJ; Owner: AMFM RADIO LICENSES, L.L.C.)

- WWPR-FM (105.1 FM; NEW YORK, NY; Owner: AMFM RADIO LICENSES, L.L.C.)

- WCAA (105.9 FM; NEWARK, NJ; Owner: WADO-AM LICENSE CORP. ("WADO"))

- WBAI (99.5 FM; NEW YORK, NY; Owner: PACIFICA FOUNDATION, INC.)

- WBLS (107.5 FM; NEW YORK, NY; Owner: ICBC BROADCAST HOLDINGS-NY, INC.)

- WLTW (106.7 FM; NEW YORK, NY; Owner: AMFM NEW YORK LICENSES, LLC)

- WQXR-FM (96.3 FM; NEW YORK, NY; Owner: THE NEW YORK TIMES ELECTRONIC MEDIA COMPANY)

- WSKQ-FM (97.9 FM; NEW YORK, NY; Owner: WSKQ LICENSING, INC.)

- WXRK (92.3 FM; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

TV broadcast stations around Livingston:

- WPXO-LP (Channel 34; EAST ORANGE, NJ; Owner: PAXSON COMMUNICATIONS LPTV, INC.)

- WNYW (Channel 5; NEW YORK, NY; Owner: FOX TELEVISION STATIONS, INC.)

- WCBS-TV (Channel 2; NEW YORK, NY; Owner: CBS BROADCASTING INC.)

- WABC-TV (Channel 7; NEW YORK, NY; Owner: AMERICAN BROADCASTING COMPANIES, INC)

- WPIX (Channel 11; NEW YORK, NY; Owner: WPIX, INC.)

- WWOR-TV (Channel 9; SECAUCUS, NJ; Owner: FOX TELEVISION STATIONS, INC.)

- WPXN-TV (Channel 31; NEW YORK, NY; Owner: PAXSON COMMUNICATIONS LICENSE COMPANY, LLC)

- WNBC (Channel 4; NEW YORK, NY; Owner: NATIONAL BROADCASTING COMPANY, INC.)

- WNET (Channel 13; NEWARK, NJ; Owner: EDUCATIONAL BROADCASTING CORPORATION)

- WXTV (Channel 41; PATERSON, NJ; Owner: WXTV LICENSE PARTNERSHIP, G.P.)

- WNJU (Channel 47; LINDEN, NJ; Owner: WNJU LICENSE CORPORATION)

- WFUT (Channel 68; NEWARK, NJ; Owner: UNIVISION NEW YORK LLC)

- WNYE-TV (Channel 25; NEW YORK, NY; Owner: NEW YORK CITY BOARD OF EDUCATION)

- WXNY-LP (Channel 32; NEW YORK, NY; Owner: ISLAND BROADCASTING COMPANY)

- WKOB-LP (Channel 53; NEW YORK, NY; Owner: WKOB COMMUNICATIONS, INC.)

- WEBR-CA (Channel 17; MANHATTAN, NY; Owner: K LICENSEE INC.)

- WRNN-LP (Channel 57; NYACK, NY; Owner: LP NYACK LIMITED PARTNERSHIP)

- W54CZ (Channel 54; MORRISTOWN, NJ; Owner: WLNY-TV, INC.)

- W60AI (Channel 60; NEW YORK, NY; Owner: VENTANA TELEVISION, INC.)

- WLBX-LP (Channel 22; CRANFORD, NJ; Owner: RENARD COMMUNICATIONS CORP.)

- WNXY-LP (Channel 26; NEW YORK, NY; Owner: ISLAND BROADCASTING COMPANY)

- WFME-TV (Channel 66; WEST MILFORD, NJ; Owner: FAMILY STATIONS, INC.)

- W33BS (Channel 33; DARIEN, CT; Owner: CT&T BROADCASTING, INC.)

- WNYN-LP (Channel 39; NEW YORK, NY; Owner: ISLAND BROADCASTING COMPANY)

- WNYX-LP (Channel 35; NEW YORK, NY; Owner: ISLAND BROADCASTING COMPANY)

- National Bridge Inventory (NBI) Statistics

- 16Number of bridges

- 59ft / 17.8mTotal length

- $893,000Total costs

- 202,370Total average daily traffic

- 7,496Total average daily truck traffic

- 246,943Total future (year 2039) average daily traffic

- New bridges - historical statistics

- 11920-1929

- 21940-1949

- 51950-1959

- 41960-1969

- 21990-1999

- 22000-2009

FCC Registered Antenna Towers: 24 (See the full list of FCC Registered Antenna Towers)

FCC Registered Private Land Mobile Towers: 2 (See the full list of FCC Registered Private Land Mobile Towers in Livingston, NJ)

FCC Registered Broadcast Land Mobile Towers: 20 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 8 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Amateur Radio Licenses: 111 (See the full list of FCC Registered Amateur Radio Licenses in Livingston)

FAA Registered Aircraft: 15 (See the full list of FAA Registered Aircraft in Livingston)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 5 full tracts) | ||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 54 | $388,259 | 242 | $451,806 | 1,123 | $362,299 | 40 | $240,625 | 10 | $318,900 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 4 | $390,750 | 20 | $393,650 | 106 | $353,396 | 6 | $129,667 | 1 | $288,000 |

| APPLICATIONS DENIED | 5 | $316,800 | 44 | $463,568 | 289 | $390,702 | 16 | $228,000 | 14 | $276,786 |

| APPLICATIONS WITHDRAWN | 6 | $387,000 | 26 | $445,962 | 164 | $369,524 | 3 | $308,333 | 5 | $283,800 |

| FILES CLOSED FOR INCOMPLETENESS | 3 | $367,333 | 8 | $389,625 | 55 | $354,109 | 1 | $400,000 | 2 | $307,500 |

Detailed HMDA statistics for the following Tracts: 0204.00 , 0205.00, 0206.00, 0207.00, 0208.00

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 5 full tracts) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 24 | $368,917 | 8 | $399,750 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 6 | $388,833 | 10 | $394,700 |

| APPLICATIONS DENIED | 1 | $540,000 | 7 | $444,429 |

| APPLICATIONS WITHDRAWN | 0 | $0 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $290,000 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 0204.00 , 0205.00, 0206.00, 0207.00, 0208.00

2003 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Livingston, NJ

- 35045.7%Structure Fires

- 26835.0%Outside Fires

- 13918.1%Mobile Property/Vehicle Fires

- 91.2%Other

Based on the data from the years 2003 - 2018 the average number of fires per year is 48. The highest number of fire incidents - 117 took place in 2005, and the least - 0 in 2006. The data has a dropping trend.

Based on the data from the years 2003 - 2018 the average number of fires per year is 48. The highest number of fire incidents - 117 took place in 2005, and the least - 0 in 2006. The data has a dropping trend. When looking into fire subcategories, the most incidents belonged to: Structure Fires (45.7%), and Outside Fires (35.0%).

When looking into fire subcategories, the most incidents belonged to: Structure Fires (45.7%), and Outside Fires (35.0%).

- 88.5%Utility gas

- 9.3%Fuel oil, kerosene, etc.

- 1.2%Electricity

- 0.6%Bottled, tank, or LP gas

- 0.2%Other fuel

- 0.1%Wood

- 57.3%Utility gas

- 31.2%Electricity

- 10.3%Fuel oil, kerosene, etc.

- 1.2%Other fuel

Livingston compared to New Jersey state average:

- Median household income above state average.

- Median house value above state average.

- Unemployed percentage significantly below state average.

- Black race population percentage significantly below state average.

- Hispanic race population percentage significantly below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

- Institutionalized population percentage significantly above state average.

- Percentage of population with a bachelor's degree or higher above state average.

Livingston on our top lists:

- #6 on the list of "Top 101 cities with largest percentage of males in occupations: accountants and auditors (population 5,000+)"

- #10 on the list of "Top 101 cities with largest percentage of males in occupations: lawyers (population 5,000+)"

- #19 on the list of "Top 101 cities with largest percentage of females in occupations: therapists (population 5,000+)"

- #24 on the list of "Top 101 cities with largest percentage of males in industries: apparel, fabrics, and notions merchant wholesalers (population 5,000+)"

- #38 on the list of "Top 101 cities with largest percentage of males in occupations: other health diagnosing and treating practitioners and technical occupations (population 5,000+)"

- #42 on the list of "Top 101 cities with largest percentage of females in occupations: accountants and auditors (population 5,000+)"

- #42 on the list of "Top 101 cities with largest percentage of males in industries: miscellaneous durable goods merchant wholesalers (population 5,000+)"

- #49 on the list of "Top 101 cities with largest percentage of females in occupations: computer specialists (population 5,000+)"

- #51 on the list of "Top 101 cities with largest percentage of males in industries: data processing, libraries, and other information services (population 5,000+)"

- #57 on the list of "Top 101 cities with largest percentage of females in industries: miscellaneous durable goods merchant wholesalers (population 5,000+)"

- #76 on the list of "Top 101 cities with largest percentage of males in industries: personal and laundry services (population 5,000+)"

- #78 on the list of "Top 101 cities with largest percentage of females in industries: alcoholic beverages merchant wholesalers (population 5,000+)"

- #82 on the list of "Top 101 cities with largest percentage of males in industries: furniture and home furnishing merchant wholesalers (population 5,000+)"

- #82 on the list of "Top 101 cities with largest percentage of females in industries: sporting goods, camera, and hobby and toy stores (population 5,000+)"

- #85 on the list of "Top 101 cities with largest percentage of males in industries: health care (population 5,000+)"

- #94 on the list of "Top 101 cities with largest percentage of females in industries: drugs, sundries, and chemical and allied products merchant wholesalers (population 5,000+)"

- #95 on the list of "Top 101 cities with largest percentage of males in industries: clothing and accessories, including shoe, stores (population 5,000+)"

- #97 on the list of "Top 101 cities with largest percentage of males in industries: electrical and electronic goods merchant wholesalers (population 5,000+)"

- #101 on the list of "Top 101 cities with largest percentage of females in industries: chemicals (population 5,000+)"

- #87 (07039) on the list of "Top 101 zip codes with the largest percentage of Russian first ancestries"

- #92 (07039) on the list of "Top 101 zip codes with the largest percentage of taxpayers using charity contributions deductions in 2012 (pop 5,000+)"

- #96 (07039) on the list of "Top 101 zip codes with the largest percentage of taxpayers reporting taxable interest in 2012 (pop 5,000+)"

- #7 on the list of "Top 101 counties with the highest Nitrogen Dioxide air pollution readings in 2012 (ppm)"

- #9 on the list of "Top 101 counties with the lowest percentage of residents that keep firearms around their homes"

- #19 on the list of "Top 101 counties with the most Black Protestant adherents"

- #20 on the list of "Top 101 counties with highest percentage of residents voting for Obama (Democrat) in the 2012 Presidential Election (pop. 50,000+)"

- #23 on the list of "Top 101 counties with the most Black Protestant congregations (pop. 50,000+)"

|

|

Total of 786 patent applications in 2008-2024.