Louisville, Kentucky

Louisville: Louisville colors

Louisville: louisville @ night

Louisville: Louisville ky

Louisville: Louisville from Indiana

Louisville: Louisville KY

Louisville: Louisville Kentucky at night from Jeffersonville.

Louisville: LG&E building

Louisville: U of L dorms: Louisville Hall & University Tower

Louisville: City Hall Annex

Louisville: City Hall

Louisville: Louisville, Kentucky from Indiana

- see

122

more - add

your

Submit your own pictures of this city and show them to the world

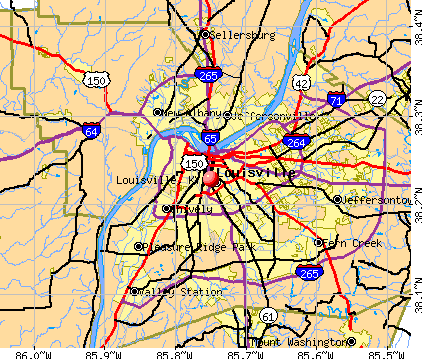

- OSM Map

- General Map

- Google Map

- MSN Map

| Males: 124,241 | |

| Females: 138,523 |

| Median resident age: | 35.8 years |

| Kentucky median age: | 35.9 years |

Zip codes: 40208.

| Louisville: | $47,236 |

| KY: | $59,341 |

Estimated per capita income in 2022: $33,267 (it was $18,193 in 2000)

Louisville city income, earnings, and wages data

Estimated median house or condo value in 2022: $197,356 (it was $81,900 in 2000)

| Louisville: | $197,356 |

| KY: | $196,300 |

Mean prices in 2022: all housing units: $289,784; detached houses: $296,246; townhouses or other attached units: $324,768; in 2-unit structures: $229,571; in 3-to-4-unit structures: $142,806; in 5-or-more-unit structures: $199,353; mobile homes: $137,257; occupied boats, rvs, vans, etc.: $80,553

Detailed information about poverty and poor residents in Louisville, KY

- 158,65161.9%White alone

- 84,01132.8%Black alone

- 4,7551.9%Hispanic

- 3,9231.5%Two or more races

- 3,6761.4%Asian alone

- 5490.2%American Indian alone

- 5650.2%Other race alone

- 1010.04%Native Hawaiian and Other

Pacific Islander alone

Races in Louisville detailed stats: ancestries, foreign born residents, place of birth

According to our research of Kentucky and other state lists, there were 1,643 registered sex offenders living in Louisville, Kentucky as of April 19, 2024.

The ratio of all residents to sex offenders in Louisville is 160 to 1.

| Louisville Construction/Development (12 replies) |

| Bound for Louisville! (40 replies) |

| Louisville News/Info (11 replies) |

| Ack. Louisville ranks #7 in highest increase in homicide (25 replies) |

| Louisville? Think again (87 replies) |

| Louisville Exceeded My Expectations!! Thinking of moving.. (21 replies) |

Latest news from Louisville, KY collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: German (15.2%), Irish (11.2%), United States (8.7%), English (7.8%), Italian (1.7%), French (1.7%).

Current Local Time: EST time zone

Incorporated on 02/13/1828

Elevation: 462 feet

Land area: 62.1 square miles.

Population density: 4,230 people per square mile (average).

9,650 residents are foreign born (1.3% Asia, 1.1% Latin America, 1.0% Europe).

| This city: | 3.8% |

| Kentucky: | 2.0% |

| Louisville city: | 0.9% ($719) |

| Kentucky: | 0.8% ($610) |

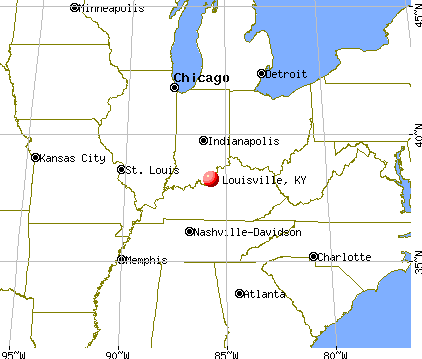

Nearest city with pop. 1,000,000+: Chicago, IL (269.9 miles

, pop. 2,896,016).

Nearest cities:

Latitude: 38.23 N, Longitude: 85.75 W

Daytime population change due to commuting: +80,342 (+31.4%)

Workers who live and work in this city: 67,206 (60.6%)

Area code: 502

Detailed articles:

- Louisville: Introduction

- Louisville Basic Facts

- Louisville: Communications

- Louisville: Convention Facilities

- Louisville: Economy

- Louisville: Education and Research

- Louisville: Geography and Climate

- Louisville: Health Care

- Louisville: History

- Louisville: Municipal Government

- Louisville: Population Profile

- Louisville: Recreation

- Louisville: Transportation

Louisville tourist attractions:

- Churchill Downs in Louisville, Kentucky

- Fourth Street Live! Is the premier spot in downtown Kentucky for entertainment and dining

- Jefferson Mall in Louisville, Kentucky

- Kentucky Action Park in Louisville, Kentucky

- Kentucky Derby Museum in Louisville, Kentucky

- Louisville International Airport (Standiford Field) - Louisville, KY Joint civil-military airport

- Louisville Zoological Garden - Louisville, Kentucky - large nationally acclaimed zoo with over 1,300 animals

- Louisville Slugger Museum - Louisville, Kentucky - Baseball Museum Teaches Principles of Bat Making

- Mall St. Matthews in Louisville, Kentucky

- Embassy Suites Hotel Louisville

- Oxmoor Center is a large 960,000 square foot enclosed shopping mall in Louisville

- Six Flags Kentucky Kingdom in Louisville, Kentucky

- The Brown Hotel in Louisville, Kentucky

Louisville, Kentucky accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2003: 47 buildings, average cost: $93,100

- 2002: 146 buildings, average cost: $74,300

- 2001: 277 buildings, average cost: $69,700

- 2000: 344 buildings, average cost: $74,700

- 1999: 260 buildings, average cost: $70,300

- 1998: 373 buildings, average cost: $79,900

- 1997: 207 buildings, average cost: $84,400

| Here: | 3.6% |

| Kentucky: | 3.8% |

- Health care (10.5%)

- Educational services (8.7%)

- Accommodation & food services (8.6%)

- Construction (5.6%)

- Finance & insurance (5.6%)

- Professional, scientific, technical services (5.1%)

- Public administration (4.3%)

- Construction (9.9%)

- Accommodation & food services (8.3%)

- Professional, scientific, technical services (5.6%)

- Educational services (5.3%)

- Health care (5.1%)

- Administrative & support & waste management services (4.8%)

- Other transportation, support activities, couriers (4.2%)

- Health care (15.9%)

- Educational services (12.1%)

- Accommodation & food services (8.9%)

- Finance & insurance (7.7%)

- Public administration (4.9%)

- Professional, scientific, technical services (4.7%)

- Social assistance (4.3%)

- Other office and administrative support workers, including supervisors (5.0%)

- Building and grounds cleaning and maintenance occupations (4.1%)

- Other production occupations, including supervisors (3.8%)

- Other management occupations, except farmers and farm managers (3.4%)

- Laborers and material movers, hand (3.2%)

- Material recording, scheduling, dispatching, and distributing workers (3.2%)

- Other sales and related occupations, including supervisors (3.1%)

- Other production occupations, including supervisors (4.9%)

- Laborers and material movers, hand (4.8%)

- Building and grounds cleaning and maintenance occupations (4.3%)

- Material recording, scheduling, dispatching, and distributing workers (3.9%)

- Other management occupations, except farmers and farm managers (3.8%)

- Driver/sales workers and truck drivers (3.8%)

- Other sales and related occupations, including supervisors (3.6%)

- Other office and administrative support workers, including supervisors (7.7%)

- Secretaries and administrative assistants (4.4%)

- Preschool, kindergarten, elementary, and middle school teachers (4.1%)

- Information and record clerks, except customer service representatives (4.0%)

- Building and grounds cleaning and maintenance occupations (3.8%)

- Cashiers (3.7%)

- Other management occupations, except farmers and farm managers (3.1%)

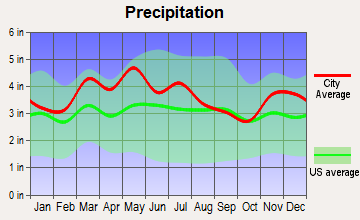

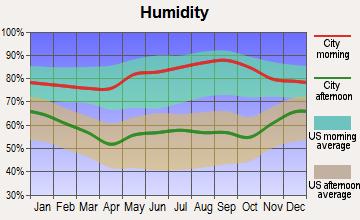

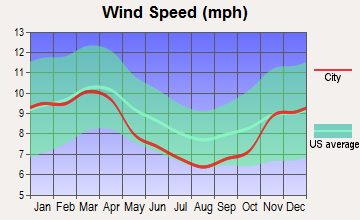

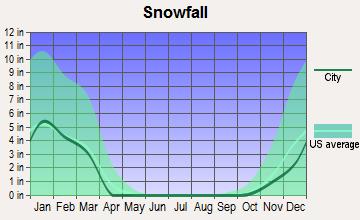

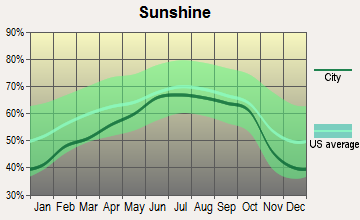

Average climate in Louisville, Kentucky

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

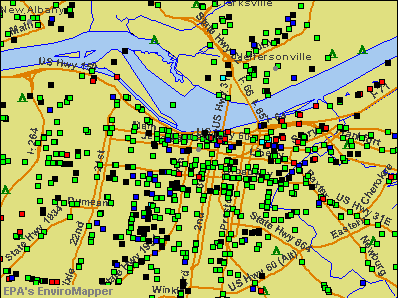

Air Quality Index (AQI) level in 2023 was 109. This is significantly worse than average.

| City: | 109 |

| U.S.: | 73 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.266. This is about average. Closest monitor was 0.6 miles away from the city center.

| City: | 0.266 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 11.0. This is significantly worse than average. Closest monitor was 1.3 miles away from the city center.

| City: | 11.0 |

| U.S.: | 5.1 |

Sulfur Dioxide (SO2) [ppb] level in 2023 was 0.602. This is significantly better than average. Closest monitor was 0.8 miles away from the city center.

| City: | 0.602 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2023 was 30.4. This is about average. Closest monitor was 1.3 miles away from the city center.

| City: | 30.4 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 18.9. This is about average. Closest monitor was 1.2 miles away from the city center.

| City: | 18.9 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 11.9. This is significantly worse than average. Closest monitor was 1.2 miles away from the city center.

| City: | 11.9 |

| U.S.: | 8.1 |

Tornado activity:

Louisville-area historical tornado activity is slightly above Kentucky state average. It is 66% greater than the overall U.S. average.

On 4/3/1974, a category F5 (max. wind speeds 261-318 mph) tornado 22.7 miles away from the Louisville city center killed 31 people and injured 270 people and caused between $500,000 and $5,000,000 in damages.

On 4/3/1974, a category F4 (max. wind speeds 207-260 mph) tornado 2.0 miles away from the city center killed 3 people and injured 225 people.

Earthquake activity:

Louisville-area historical earthquake activity is significantly above Kentucky state average. It is 113% greater than the overall U.S. average.On 4/18/2008 at 09:36:59, a magnitude 5.4 (5.1 MB, 4.8 MS, 5.4 MW, 5.2 MW, Class: Moderate, Intensity: VI - VII) earthquake occurred 116.9 miles away from Louisville center

On 7/27/1980 at 18:52:21, a magnitude 5.2 (5.1 MB, 4.7 MS, 5.0 UK, 5.2 UK) earthquake occurred 98.2 miles away from the city center

On 4/18/2008 at 09:36:59, a magnitude 5.2 (5.2 MW, Depth: 8.9 mi) earthquake occurred 116.9 miles away from Louisville center

On 6/10/1987 at 23:48:54, a magnitude 5.1 (4.9 MB, 4.4 MS, 4.6 MS, 5.1 LG) earthquake occurred 122.6 miles away from the city center

On 6/18/2002 at 17:37:15, a magnitude 5.0 (4.3 MB, 4.6 MW, 5.0 LG) earthquake occurred 111.8 miles away from the city center

On 4/18/2008 at 15:14:16, a magnitude 4.8 (4.5 MB, 4.8 MW, 4.6 MW, Class: Light, Intensity: IV - V) earthquake occurred 115.0 miles away from Louisville center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Jefferson County (17) is near the US average (15).Major Disasters (Presidential) Declared: 13

Emergencies Declared: 2

Causes of natural disasters: Floods: 10, Storms: 10, Tornadoes: 6, Mudslides: 3, Landslides: 2, Winds: 2, Winter Storms: 2, Blizzard: 1, Explosion: 1, Hurricane: 1, Tropical Depression: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: PAPA JOHNS INTERNATIONAL INC (RETAIL-EATING PLACES), HIGH SPEED ACCESS CORP (SERVICES-COMPUTER PROGRAMMING, DATA PROCESSING, ETC.), S Y BANCORP INC (STATE COMMERCIAL BANKS), Texas Roadhouse, Inc. (RETAIL-EATING PLACES), CHURCHILL DOWNS INC (SERVICES-RACING, INCLUDING TRACK OPERATION), VENTAS INC (REAL ESTATE INVESTMENT TRUSTS), YUM BRANDS INC (RETAIL-EATING PLACES), NTS PROPERTIES VI (REAL ESTATE) and 23 other public companies.

Hospitals in Louisville:

- ALLIANCE OF COMM HOSPICES AND PALLIATIVE CARE SERVI (3532 EPHRAIM MCDOWELL DRIVE)

- BAPTIST HOSPITAL HIGHLANDS (provides emergency services, 810 BARRET AVE)

- CENTRAL STATE HOSP (10510 LAGRANGE RD)

- CENTRAL STATE HOSPITAL ICF/MR (10510 LAGRANGE RD)

- GATEWAY REHAB HOSPITAL AT NORTON HEALTHCARE PAVILI (315 EAST BROADWAY)

- JEWISH HOSPITAL & ST MARY'S HEALTHCARE (Voluntary non-profit - Private, provides emergency services, 200 ABRAHAM FLEXNER WAY)

- METHODIST EVANGELICAL HOSP (315 E BROADWAY)

- NORTON SOUTHWEST HOSPITAL (9820 THIRD ST RD)

- STS MARY AND ELIZABETH MEDICAL CENTER (provides emergency services, 1850 BLUEGRASS AV)

- TEN BROECK HOSP (8521 LAGRANGE RD)

Airports and heliports located in Louisville:

- Louisville International-Standiford Field Airport (SDF) (Runways: 3, Commercial Ops: 99,720, Air Taxi Ops: 32,578, Itinerant Ops: 11,442, Local Ops: 364, Military Ops: 2,835)

- Bowman Field Airport (LOU) (Runways: 2, Air Taxi Ops: 3,500, Itinerant Ops: 34,858, Local Ops: 34,952, Military Ops: 936)

- Jeffries Farm Airport (6KY6) (Runways: 1)

- Heliports: 11

Biggest Colleges/Universities in Louisville:

- University of Louisville (Full-time enrollment: 16,640; Location: 2301 S 3rd St; Public; Website: www.louisville.edu; Offers Doctor's degree)

- Jefferson Community and Technical College (Full-time enrollment: 7,950; Location: 109 E Broadway; Public; Website: www.jefferson.kctcs.edu)

- Sullivan University (Full-time enrollment: 5,129; Location: 3101 Bardstown Rd; Private, for-profit; Website: www.sullivan.edu; Offers Doctor's degree)

- Bellarmine University (Full-time enrollment: 3,180; Location: 2001 Newburg Rd; Private, not-for-profit; Website: www.bellarmine.edu; Offers Doctor's degree)

- The Southern Baptist Theological Seminary (Full-time enrollment: 2,360; Location: 2825 Lexington Rd; Private, not-for-profit; Website: www.sbts.edu; Offers Doctor's degree)

- Spalding University (Full-time enrollment: 1,963; Location: 901 S Fourth Street; Private, not-for-profit; Website: www.spalding.edu; Offers Doctor's degree)

- Brown Mackie College-Louisville (Full-time enrollment: 1,637; Location: 3605 Fern Valley Road; Private, for-profit; Website: www.brownmackie.edu)

- Galen College of Nursing-Louisville (Full-time enrollment: 1,106; Location: 1031 Zorn Avenue , Suite 400; Private, for-profit; Website: www.galencollege.edu/louisville)

- Spencerian College-Louisville (Full-time enrollment: 718; Location: 4627 Dixie Hwy; Private, for-profit; Website: www.spencerian.edu)

- ITT Technical Institute-Louisville (Full-time enrollment: 592; Location: 9500 Ormsby Station Road, Suite 100; Private, for-profit; Website: www.itt-tech.edu)

- ATA College (Full-time enrollment: 471; Location: 10180 Linn Station Rd Ste A200; Private, for-profit; Website: www.ata.edu)

- Sullivan College of Technology and Design (Full-time enrollment: 378; Location: 3901 Atkinson Square Dr; Private, for-profit; Website: www.sctd.edu)

- Daymar College-Online (Full-time enrollment: 372; Location: 3309 Collins Lane; Private, for-profit; Website: www.daymarcollege.edu/)

- Daymar College-Louisville (Full-time enrollment: 293; Location: 4112 Fern Valley Road; Private, for-profit; Website: www.daymarcollege.edu)

- Paul Mitchell the School-Louisville (Full-time enrollment: 289; Location: 156 North Hurstbourne Parkway; Private, for-profit; Website: www.paulmitchelltheschool.com)

- University of Phoenix-Louisville Campus (Full-time enrollment: 166; Location: 10400 Linn Station Rd; Private, for-profit; Website: www.phoenix.edu/; Offers Master's degree)

- Empire Beauty School-Dixie (Full-time enrollment: 154; Location: 5120 Dixie Highway; Private, for-profit; Website: www.empire.edu)

- Louisville Presbyterian Theological Seminary (Full-time enrollment: 153; Location: 1044 Alta Vista Rd; Private, not-for-profit; Website: www.lpts.edu; Offers Doctor's degree)

- Empire Beauty School-Hurstborne (Full-time enrollment: 149; Location: 5314 Bardstown Rd; Private, for-profit; Website: www.empire.edu)

- Trend Setters' Academy of Beauty Culture-Louisville (Full-time enrollment: 132; Location: 7283 Dixie Hwy; Private, for-profit; Website: www.trendsettersabc.com)

Biggest public high schools in Louisville:

- DUPONT MANUAL HIGH (Students: 1,890, Location: 120 W LEE ST, Grades: 9-12)

- BALLARD HIGH (Students: 1,689, Location: 6000 BROWNSBORO ROAD, Grades: 9-12)

- LOUISVILLE MALE HIGH SCHOOL (Students: 1,680, Location: 4409 PRESTON HIGHWAY, Grades: 9-12)

- BUTLER TRADITIONAL HIGH SCHOOL (Students: 1,665, Location: 2222 CRUMS LN, Grades: 9-12)

- FERN CREEK TRADITIONAL HIGH (Students: 1,430, Location: 9115 FERN CREEK ROAD, Grades: 9-12)

- ATHERTON HIGH SCHOOL (Students: 1,066, Location: 3000 DUNDEE ROAD, Grades: 9-12)

- JEFFERSON COUNTY HIGH SCHOOL (Students: 927, Location: 900 S FLOYD ST, Grades: 9-12)

- MOORE TRADITIONAL SCHOOL (Students: 742, Location: 6415 OUTER LOOP, Grades: 6-12)

- IROQUOIS HIGH (Students: 616, Location: 4615 TAYLOR BLVD, Grades: 9-12)

- BROWN SCHOOL (Students: 168, Location: 546 S 1ST ST, Grades: KG-12)

Biggest private high schools in Louisville:

- CHRISTIAN ACADEMY OF LOUISVILLE SCHOOL SYSTEM (Students: 1,714, Location: 700 S ENGLISH STATION RD, Grades: PK-12)

- ST XAVIER HIGH SCHOOL (Students: 1,390, Location: 1609 POPLAR LEVEL RD, Grades: 9-12, Boys only)

- TRINITY HIGH SCHOOL (Students: 1,296, Location: 4011 SHELBYVILLE RD, Grades: 9-12, Boys only)

- KENTUCKY COUNTRY DAY SCHOOL (Students: 956, Location: 4100 SPRINGDALE RD, Grades: PK-12)

- ASSUMPTION HIGH SCHOOL (Students: 883, Location: 2170 TYLER LN, Grades: 9-12, Girls only)

- SACRED HEART ACADEMY (Students: 816, Location: 3175 LEXINGTON RD, Grades: 9-12, Girls only)

- WHITEFIELD ACADEMY (Students: 734, Location: 7711 FEGENBUSH LN, Grades: PK-12)

- LOUISVILLE COLLEGIATE SCHOOL (Students: 693, Location: 2427 GLENMARY AVE, Grades: PK-12)

- MERCY ACADEMY (Students: 600, Location: 5801 FEGENBUSH LN, Grades: 9-12, Girls only)

- ACADEMY FOR INDIVIDUAL EXCELLENCE (Students: 394, Location: 3101 BLUEBIRD LN, Grades: PK-12)

Biggest public elementary/middle schools in Louisville:

- NOE MIDDLE (Students: 1,264, Location: 121 W. LEE STREET, Grades: 6-8)

- MEYZEEK MIDDLE SCHOOL (Students: 1,105, Location: 828 SOUTH JACKSON STREET, Grades: 6-8)

- NEWBURG MIDDLE SCHOOL (Students: 1,084, Location: 4901 EXETER AV., Grades: 6-8)

- THOMAS JEFFERSON MIDDLE (Students: 1,042, Location: 1501 RANGELAND RD, Grades: 6-8)

- HIGHLAND MIDDLE SCHOOL (Students: 1,022, Location: 1700 NORRIS PLACE, Grades: 6-8)

- FARNSLEY MIDDLE (Students: 1,005, Location: 3400 LEES LANE, Grades: 6-8)

- JOHNSON TRADITIONAL MIDDLE (Students: 975, Location: 2509 WILSON AVE, Grades: 6-8)

- MYERS MIDDLE SCHOOL (Students: 937, Location: 330 S. HUBBARDS LN, Grades: 7-8)

- CONWAY MIDDLE SCHOOL (Students: 893, Location: 6300 TERRY RD, Grades: 6-8)

- KAMMERER MIDDLE (Students: 860, Location: 7315 WESBORO RD, Grades: 6-8)

Biggest private elementary/middle schools in Louisville:

- ST GABRIEL SCHOOL (Students: 796, Location: 5503 BARDSTOWN RD, Grades: PK-8)

- ST MARGARET MARY SCHOOL (Students: 752, Location: 7813 SHELBYVILLE RD, Grades: KG-8)

- HOLY TRINITY PARISH SCHOOL (Students: 721, Location: 423 CHERRYWOOD RD, Grades: PK-8)

- ST ALBERT THE GREAT SCHOOL (Students: 714, Location: 1395 GIRARD DR, Grades: PK-8)

- ST PATRICK SCHOOL (Students: 643, Location: 1000 N BECKLEY STATION RD, Grades: KG-8)

- ST MICHAEL SCHOOL (Students: 605, Location: 3705 STONE LAKES DR, Grades: PK-8)

- ST BERNARD CATHOLIC SCHOOL (Students: 479, Location: 7500 TANGELO DR, Grades: PK-8)

- ST ATHANASIUS (Students: 478, Location: 5915 OUTER LOOP, Grades: PK-8)

- ST MARTHA ELEMENTARY SCHOOL (Students: 461, Location: 2825 KLONDIKE LN, Grades: PK-8)

- OUR LADY OF LOURDES SCHOOL (Students: 454, Location: 510 BRECKENRIDGE LN, Grades: PK-8)

User-submitted facts and corrections:

- Louisville\'s pop. is over 600,000

added by Ken Rose Jr

- In 2000, The City of Louisville and Jefferson County merged to create Louisville Metro thus making it the sixteenth largest city in the country. Louisville Metro now includes Jefferson, Oldham, and Bullit Counties in Kentucky and Clark County in Indiana.

- Louisville is the only US city to have two consecutivly numbered 3-digit interstate highways. (I-264 and I-265)

- Home of Jeremi Johnson - Cincinnati Bengals

- Biggest Colleges/Universities in Louisville: World Academy of Realty -KY Real Estate School (FT enrollment: 70; Location: 1826 S. Hurstbourne Pkwy; Private, for-profit)

- Galen Health Institute should be changed to Galen College of Nursing

- Add UPS Inc to the list of major Louisville companies. The UPS Worldport hub is located at the airport.

- The population given in the 2000 census was for the former City of Louisville. On 1/1/2003, the City of Louisville government was merged with the County of Jefferson government; the new government being called Louisville-Jefferson County Metro Government. The estimated 2005 population for the new entity is 700,041.

Points of interest:

Notable locations in Louisville: Papa Johns Cardinal Stadium (A), Technology Park of Greater Louisville (B), Lutz Hall (C), Oak Saint Yards (D), Youngtown Yards (E), Gheens Science Hall (F), The Red Barn (G), Bettie Johnson Hall (H), Kentucky Fair and Exposition Center (I), River City Transit Authority (J), River Road Country Club (K), Renaissance Business Centers at the Normandy Building (L), South Louisville Yards (M), Churchill Downs (N), Audubon Country Club (O), Ekstrom Library (P), Environmental Protection Services Center (Q), Sacred Heart Home (R), Frazier Historical Arms Museum (S), Baptist Fellowship Center (T). Display/hide their locations on the map

Shopping Centers: Lyles Mall Shopping Center (1), Louisville Galleria Shopping Center (2), Iroquois Manor Shopping Center (3), Hikes Point Plaza Shopping Center (4), Germantown Square Shopping Center (5), Gardiner Lane Shopping Center (6), Fourth Street Live Shopping Center (7), Dahlem Center Shopping Center (8), Central Station Shopping Center (9). Display/hide their locations on the map

Main business address in Louisville include: HIGH SPEED ACCESS CORP (A), S Y BANCORP INC (B), Texas Roadhouse, Inc. (C), CHURCHILL DOWNS INC (D), YUM BRANDS INC (E). Display/hide their locations on the map

Churches in Louisville include: Grace Church (A), Metropolitan Community Church of Louisville (B), Mercy Seat Missionary Baptist Church (C), Manly Memorial Baptist Church (D), Magazine Street Seventh Day Adventist Church (E), M Street Church of Christ (F), Lynn Creek Baptist Church (G), Lynn Acres Baptist Church (H), Love of God Baptist Church (I). Display/hide their locations on the map

Cemeteries: Manslick Road Cemetery (1), Louisville Cemetery (2), Portland Cemetery (3), Calvary Cemetery (4), Cave Hill Cemetery (5), Clark Cemetery (6), Cave Hill National Cemetery (7). Display/hide their locations on the map

Lakes: Lighthouse Lake (A), Lakeside Pool (B). Display/hide their locations on the map

Streams, rivers, and creeks: Beargrass Creek (A), Muddy Fork (B). Display/hide their locations on the map

Parks in Louisville include: Iroquois Park (1), South Central Park (2), Central Park (3), Cherokee Park (4), Saint Michaels Park (5), Churchill Park (6), George Rogers Clark Park (7), Bandman Park (8), Fontaine Ferry Park (9). Display/hide their locations on the map

Tourist attractions: Historic Homes Foundation (Museums; 3110 Lexington Road) (1), Conrad-Caldwell House Museum (1402 Saint James Court) (2), Louisville-Jefferson County Metro - Museums- Riverside-The Farnsley-Moremen Lan (7410 Moorman Road) (3), Powerbilt (Museums; 800 West Main Street) (4), The Speed Art Museum (2035 South 3rd Street) (5), Kentucky Museum of Arts & Design (715 West Main Street) (6), Kentucky Derby Museum - Gate 1 of Churchhill Downs- Administration (704 Central Avenue) (7), Farmington Historic Home Museum (3033 Bardstown Road) (8), Brennan House the Inc (Museums; 631 South 5th Street) (9). Display/hide their approximate locations on the map

Hotels: The Galt House (On The River At Four) (1), Seelbach Hilton (500 South 4th Street) (2), Best Western Airport East (1921 Bishop Lane) (3), Holiday Inn Louisville Downtown (120 West Broadway) (4), Intown Suites Hurstbourne (4604 Wattbourne Lane) (5), Extended Stay America - St. Matthews (1401 Browns Ln) (6), Otto's Cafe (500 South 4th Street) (7), Louisville Concierge Inc (600 Terminal Drive) (8), Best Western Brownsboro Inn (4805 Brownsboro Rd) (9). Display/hide their approximate locations on the map

Courts: Kentucky State Of Louisville Area - Court Of Justice- Family Court Administr (700 West Jefferson Street) (1), Kentucky State Of Louisville Area - Court Of Justice- Circuit Court Clerk- Data Proces (700 West Jefferson Street) (2), Kentucky State Of Louisville Area - Court Of Justice- Circuit Court Clerk- Dispute Media (700 West Jefferson Street) (3), Kentucky State Of Louisville Area - Court Of Justice- Circuit Court Clerk- Drivers Lic (200 Juneau Drive) (4), Louisville-Jefferson County Metro - Circuit Court Clerk-Jefferson Co (600 West Main Street Suite 300) (5), Louisville-Jefferson County Metro - Jefferson County Attorneys Office- Drug Court Pro (600 West Jefferson Street) (6), Kentucky State Of Louisville Area - Ombudsman- Media- Court Of Justice- Circuit Court C (700 West Jefferson Street) (7), Half Court 4 Kids (2028 West Broadway) (8), Kentucky State Of Louisville Area - Court Of Justice- Circuit Court Clerk- Archives Rec (700 West Jefferson Street) (9). Display/hide their approximate locations on the map

Birthplace of: 2 Tuff Tony - Professional wrestler, Marc Tasman - Photographer, Greg Page (boxer) - Boxer, Leland T. Kennedy - Soilder, Michael W. McConnell - Judge, Don Rosa - (born 1951), Donald Duck cartoonist, Rob Conway - Professional wrestler, Audio Stepchild - Rap Group, Ned Beatty - Film actor, Jennifer Lawrence - Actress.

Drinking water stations with addresses in Louisville and their reported violations in the past:

LOUISVILLE WATER COMPANY (Population served: 730,611, Surface water):Past monitoring violations:THORTON OIL 351 (Serves IL, Population served: 600, Groundwater):

- Monitoring and Reporting (DBP) - Between OCT-2006 and DEC-2006, Contaminant: CARBON, TOTAL. Follow-up actions: St Compliance achieved (FEB-01-2007), St Public Notif requested (FEB-08-2007), St Formal NOV issued (FEB-08-2007), St Public Notif received (FEB-04-2008)

Past monitoring violations:TACO BELL #16184 (Serves MI, Population served: 200, Groundwater):

- One regular monitoring violation

Past monitoring violations:ERNIES MOBILE HOME PARK (Serves OH, Population served: 196, Groundwater):

- One regular monitoring violation

Past monitoring violations:

- Monitoring and Reporting (DBP) - Between JAN-2013 and SEP-2013, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Violation/Reminder Notice (NOV-20-2013), St Public Notif requested (NOV-20-2013)

- Monitoring and Reporting (DBP) - Between JAN-2013 and SEP-2013, Contaminant: TTHM. Follow-up actions: St Violation/Reminder Notice (NOV-20-2013), St Public Notif requested (NOV-20-2013)

- Lead Consumer Notice - In DEC-31-2011, Contaminant: Lead and Copper Rule. Follow-up actions: St Violation/Reminder Notice (FEB-09-2012)

- 2 routine major monitoring violations

| This city: | 2.2 people |

| Kentucky: | 2.5 people |

| This city: | 55.1% |

| Whole state: | 69.8% |

| This city: | 5.9% |

| Whole state: | 4.5% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.3% of all households

- Gay men: 0.4% of all households

| This city: | 21.6% |

| Whole state: | 15.8% |

| This city: | 10.5% |

| Whole state: | 6.6% |

People in group quarters in Louisville in 2000:

- 2,577 people in college dormitories (includes college quarters off campus)

- 2,065 people in nursing homes

- 1,546 people in other noninstitutional group quarters

- 930 people in local jails and other confinement facilities (including police lockups)

- 239 people in religious group quarters

- 188 people in homes for the mentally retarded

- 174 people in mental (psychiatric) hospitals or wards

- 170 people in homes or halfway houses for drug/alcohol abuse

- 124 people in halfway houses

- 93 people in short-term care, detention or diagnostic centers for delinquent children

- 88 people in other nonhousehold living situations

- 85 people in state prisons

- 64 people in residential treatment centers for emotionally disturbed children

- 36 people in hospitals/wards and hospices for chronically ill

- 36 people in other hospitals or wards for chronically ill

- 35 people in homes for abused, dependent, and neglected children

- 35 people in homes for the mentally ill

- 31 people in unknown juvenile institutions

- 22 people in other types of correctional institutions

- 17 people in other group homes

- 5 people in training schools for juvenile delinquents

- 3 people in homes for the physically handicapped

Banks with most branches in Louisville (2011 data):

- PNC Bank, National Association: 56 branches. Info updated 2012/03/20: Bank assets: $263,309.6 mil, Deposits: $197,343.0 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 3085 total offices, Holding Company: Pnc Financial Services Group, Inc., The

- Fifth Third Bank: 35 branches. Info updated 2009/10/05: Bank assets: $114,540.4 mil, Deposits: $89,689.1 mil, headquarters in Cincinnati, OH, positive income, Commercial Lending Specialization, 1378 total offices, Holding Company: Fifth Third Bancorp

- Branch Banking and Trust Company: 25 branches. Info updated 2010/03/29: Bank assets: $168,867.6 mil, Deposits: $127,549.5 mil, headquarters in Winston Salem, NC, positive income, Commercial Lending Specialization, 1793 total offices, Holding Company: Bb&T Corporation

- U.S. Bank National Association: 22 branches. Info updated 2012/01/30: Bank assets: $330,470.8 mil, Deposits: $236,091.5 mil, headquarters in Cincinnati, OH, positive income, 3121 total offices, Holding Company: U.S. Bancorp

- JPMorgan Chase Bank, National Association: 21 branches. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- Stock Yards Bank & Trust Company: 18 branches. Info updated 2011/11/29: Bank assets: $2,045.7 mil, Deposits: $1,643.0 mil, local headquarters, positive income, Commercial Lending Specialization, 31 total offices, Holding Company: S. Y. Bancorp, Inc.

- Republic Bank & Trust Company: 15 branches. Info updated 2012/01/30: Bank assets: $3,310.3 mil, Deposits: $1,691.4 mil, local headquarters, positive income, Mortgage Lending Specialization, 38 total offices, Holding Company: Republic Bancorp, Inc.

- Commonwealth Bank and Trust Company: 12 branches. Info updated 2007/05/31: Bank assets: $823.4 mil, Deposits: $646.9 mil, local headquarters, positive income, Commercial Lending Specialization, 17 total offices, Holding Company: Commonwealth Bancshares, Inc.

- The First Capital Bank of Kentucky: 8 branches. Info updated 2008/08/26: Bank assets: $462.7 mil, Deposits: $354.1 mil, local headquarters, positive income, Commercial Lending Specialization, 8 total offices, Holding Company: Fcb Bancorp, Inc.

- 16 other banks with 43 local branches

For population 15 years and over in Louisville:

- Never married: 35.2%

- Now married: 38.5%

- Separated: 3.1%

- Widowed: 8.9%

- Divorced: 14.3%

For population 25 years and over in Louisville:

- High school or higher: 76.1%

- Bachelor's degree or higher: 21.3%

- Graduate or professional degree: 8.7%

- Unemployed: 7.4%

- Mean travel time to work (commute): 20.2 minutes

| Here: | 13.0 |

| Kentucky average: | 13.8 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Louisville:

(Louisville, Kentucky Neighborhood Map)- Algonquin neighborhood

- Audubon neighborhood

- Belknap neighborhood

- Bonnycastle neighborhood

- Bowman neighborhood

- Bradley neighborhood

- Brownsboro Zorn neighborhood

- Butchertown neighborhood

- California neighborhood

- Camp Taylor neighborhood

- Cherokee Gardens neighborhood

- Cherokee Seneca neighborhood

- Cherokee Triangle neighborhood

- Chickasaw neighborhood

- Civic Center neighborhood

- Clifton neighborhood

- Clifton Heights neighborhood

- Crescent Hill neighborhood

- Deer Park neighborhood

- Downtown Louisville (Downtown) neighborhood

- East Main (eMain USA) neighborhood

- Fairgrounds neighborhood

- Fourth Street (Fourth St.) neighborhood

- Gardiner Lane neighborhood

- Germantown neighborhood

- Hallmark neighborhood

- Hawthorne neighborhood

- Hayfield Dundee neighborhood

- Highland Park neighborhood

- Highlands Douglass neighborhood

- Irish Hill neighborhood

- Jackson-Smoketown (Smoketown) neighborhood

- Jacobs neighborhood

- Limerick neighborhood

- Medical Center neighborhood

- Merriwether neighborhood

- Old Louisville neighborhood

- Paristown Pointe neighborhood

- Park Duvall (Park Duvalle) neighborhood

- Park Hill neighborhood

- Parkland neighborhood

- Phoenix Hill neighborhood

- Poplar Level neighborhood

- Portland neighborhood

- Prestonia neighborhood

- Rockcreek Lexington Road neighborhood

- Russell neighborhood

- Saint Joseph (St. Joseph) neighborhood

- Schnitzelburg neighborhood

- Shawnee neighborhood

- Shelby Park neighborhood

- South Louisville neighborhood

- Taylor Berry neighborhood

- The Highlands (Highlands) neighborhood

- Tyler Park neighborhood

- University neighborhood

- West Main neighborhood

- Wilder Park neighborhood

- Wyandotte neighborhood

Religion statistics for Louisville, KY (based on Jefferson County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 180,149 | 384 |

| Catholic | 120,620 | 60 |

| Mainline Protestant | 48,598 | 129 |

| Black Protestant | 35,305 | 70 |

| Other | 19,947 | 58 |

| Orthodox | 1,180 | 3 |

| None | 335,297 | - |

Food Environment Statistics:

| This county: | 1.79 / 10,000 pop. |

| Kentucky: | 2.19 / 10,000 pop. |

| Jefferson County: | 0.16 / 10,000 pop. |

| State: | 0.25 / 10,000 pop. |

| This county: | 0.71 / 10,000 pop. |

| Kentucky: | 0.74 / 10,000 pop. |

| This county: | 2.75 / 10,000 pop. |

| State: | 4.36 / 10,000 pop. |

| Jefferson County: | 6.86 / 10,000 pop. |

| Kentucky: | 5.74 / 10,000 pop. |

| Jefferson County: | 10.6% |

| Kentucky: | 11.0% |

| Here: | 27.6% |

| State: | 30.0% |

| Jefferson County: | 13.4% |

| Kentucky: | 15.9% |

| Local government employment and payroll (March 2002) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 721 | $2,966,012 | $49,365 | 0 | $0 |

| Firefighters | 508 | $1,872,927 | $44,242 | 0 | $0 |

| Parks and Recreation | 505 | $927,770 | $22,046 | 157 | $75,836 |

| Water Supply | 473 | $2,030,349 | $51,510 | 17 | $56,665 |

| Housing and Community Development (Local) | 283 | $853,871 | $36,207 | 15 | $14,716 |

| Streets and Highways | 264 | $559,595 | $25,436 | 4 | $1,849 |

| Solid Waste Management | 240 | $375,337 | $18,767 | 0 | $0 |

| Police - Other | 220 | $553,128 | $30,171 | 48 | $53,836 |

| Local Libraries | 212 | $534,577 | $30,259 | 148 | $103,232 |

| Other Government Administration | 195 | $669,029 | $41,171 | 15 | $11,453 |

| Fire - Other | 175 | $397,448 | $27,254 | 0 | $0 |

| Financial Administration | 172 | $574,661 | $40,093 | 12 | $20,347 |

| Other and Unallocable | 138 | $441,523 | $38,393 | 20 | $8,340 |

| Judicial and Legal | 47 | $170,398 | $43,506 | 6 | $10,702 |

| Welfare | 34 | $91,602 | $32,330 | 92 | $22,302 |

| Health | 22 | $61,932 | $33,781 | 0 | $0 |

| Totals for Government | 4,209 | $13,080,159 | $37,292 | 534 | $379,278 |

Louisville government finances - Expenditure in 2006 (per resident):

- Construction - General - Other: $93,268,000 ($354.95)

Air Transportation: $26,915,000 ($102.43)

Housing and Community Development: $6,687,000 ($25.45)

Parks and Recreation: $20,000 ($0.08)

Police Protection: $3,000 ($0.01)

- Current Operations - Police Protection: $129,085,000 ($491.26)

General - Other: $114,694,000 ($436.49)

Health - Other: $75,039,000 ($285.58)

Water Utilities: $56,877,000 ($216.46)

Local Fire Protection: $46,830,000 ($178.22)

Correctional Institutions: $40,784,000 ($155.21)

Parks and Recreation: $37,747,000 ($143.65)

Air Transportation: $24,171,000 ($91.99)

Solid Waste Management: $18,181,000 ($69.19)

Libraries: $16,865,000 ($64.18)

Public Welfare - Other: $16,660,000 ($63.40)

Regular Highways: $14,898,000 ($56.70)

Central Staff Services: $12,097,000 ($46.04)

Housing and Community Development: $11,205,000 ($42.64)

Protective Inspection and Regulation - Other: $8,059,000 ($30.67)

Financial Administration: $8,026,000 ($30.54)

Judicial and Legal Services: $7,319,000 ($27.85)

Parking Facilities: $6,863,000 ($26.12)

- General - Interest on Debt: $102,215,000 ($389.00)

- Intergovernmental to Local - Other - Air Transportation: $985,000 ($3.75)

- Intergovernmental to State - Air Transportation: $10,000 ($0.04)

- Other Capital Outlay - Air Transportation: $23,273,000 ($88.57)

Housing and Community Development: $20,977,000 ($79.83)

Central Staff Services: $3,587,000 ($13.65)

Police Protection: $781,000 ($2.97)

Financial Administration: $302,000 ($1.15)

Health - Other: $130,000 ($0.49)

Parks and Recreation: $109,000 ($0.41)

Regular Highways: $98,000 ($0.37)

General - Other: $96,000 ($0.37)

Local Fire Protection: $61,000 ($0.23)

Solid Waste Management: $57,000 ($0.22)

Public Welfare - Other: $1,000 ($0.00)

- Total Salaries and Wages: $383,835,000 ($1460.76)

Louisville government finances - Revenue in 2006 (per resident):

- Charges - Air Transportation: $61,838,000 ($235.34)

Other: $31,097,000 ($118.35)

Parking Facilities: $12,617,000 ($48.02)

Parks and Recreation: $11,197,000 ($42.61)

Solid Waste Management: $456,000 ($1.74)

- Federal Intergovernmental - Other: $41,986,000 ($159.79)

Air Transportation: $27,180,000 ($103.44)

Health and Hospitals: $3,507,000 ($13.35)

- Local Intergovernmental - Other: $5,626,000 ($21.41)

Health and Hospitals: $2,163,000 ($8.23)

General Local Government Support: $11,000 ($0.04)

- Miscellaneous - Interest Earnings: $93,440,000 ($355.60)

General Revenue - Other: $36,975,000 ($140.72)

Special Assessments: $15,798,000 ($60.12)

Donations From Private Sources: $11,820,000 ($44.98)

Sale of Property: $11,165,000 ($42.49)

Rents: $3,815,000 ($14.52)

Fines and Forfeits: $121,000 ($0.46)

- Revenue - Water Utilities: $115,230,000 ($438.53)

- State Intergovernmental - Other: $69,998,000 ($266.39)

Housing and Community Development: $18,527,000 ($70.51)

Highways: $411,000 ($1.56)

Health and Hospitals: $302,000 ($1.15)

- Tax - Individual Income: $285,559,000 ($1086.75)

Property: $123,941,000 ($471.68)

Insurance Premiums Sales: $51,645,000 ($196.55)

Corporation Net Income: $41,605,000 ($158.34)

Other License: $6,477,000 ($24.65)

Public Utilities Sales: $3,676,000 ($13.99)

Alcoholic Beverage License: $1,563,000 ($5.95)

Motor Vehicle License: $98,000 ($0.37)

Occupation and Business License - Other: $98,000 ($0.37)

Louisville government finances - Debt in 2006 (per resident):

- Long Term Debt - Beginning Outstanding - Public Debt for Private Purpose: $2,046,400,000 ($7787.98)

Outstanding Nonguaranteed - Industrial Revenue: $2,035,793,000 ($7747.61)

Beginning Outstanding - Unspecified Public Purpose: $508,972,000 ($1936.99)

Outstanding Unspecified Public Purpose: $483,769,000 ($1841.08)

Retired Unspecified Public Purpose: $73,073,000 ($278.09)

Issue, Unspecified Public Purpose: $47,870,000 ($182.18)

Retired Nonguaranteed - Public Debt for Private Purpose: $10,607,000 ($40.37)

Louisville government finances - Cash and Securities in 2006 (per resident):

- Bond Funds - Cash and Securities: $81,083,000 ($308.58)

- Other Funds - Cash and Securities: $176,733,000 ($672.59)

- Sinking Funds - Cash and Securities: $2,035,793,000 ($7747.61)

5.00% of this county's 2021 resident taxpayers lived in other counties in 2020 ($58,554 average adjusted gross income)

| Here: | 5.00% |

| Kentucky average: | 7.04% |

0.01% of residents moved from foreign countries ($178 average AGI)

Jefferson County: 0.01% Kentucky average: 0.02%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Bullitt County, KY | |

| from Clark County, IN | |

| from Oldham County, KY |

5.72% of this county's 2020 resident taxpayers moved to other counties in 2021 ($72,642 average adjusted gross income)

| Here: | 5.72% |

| Kentucky average: | 6.89% |

0.01% of residents moved to foreign countries ($55 average AGI)

Jefferson County: 0.01% Kentucky average: 0.01%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Bullitt County, KY | |

| to Clark County, IN | |

| to Oldham County, KY |

| Businesses in Louisville, KY | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| ALDI | 3 | Journeys | 2 | |

| ALDO | 1 | Justice | 4 | |

| AMF Bowling | 2 | KFC | 19 | |

| AT&T | 9 | Kincaid | 1 | |

| Abercrombie & Fitch | 2 | Kmart | 4 | |

| Abercrombie Kids | 2 | Kohl's | 4 | |

| Ace Hardware | 4 | Kroger | 27 | |

| Advance Auto Parts | 8 | La Quinta | 2 | |

| Aeropostale | 2 | La-Z-Boy | 4 | |

| American Eagle Outfitters | 3 | Lane Bryant | 3 | |

| Ann Taylor | 4 | Lane Furniture | 5 | |

| Apple Store | 1 | LensCrafters | 2 | |

| Applebee's | 7 | Little Caesars Pizza | 12 | |

| Arby's | 20 | Long John Silver's | 9 | |

| Ashley Furniture | 1 | Lowe's | 5 | |

| Audi | 1 | Macy's | 2 | |

| AutoZone | 16 | Marriott | 13 | |

| Avenue | 1 | Marshalls | 2 | |

| BMW | 1 | MasterBrand Cabinets | 10 | |

| Bakers | 1 | Mazda | 2 | |

| Banana Republic | 2 | McDonald's | 39 | |

| Barnes & Noble | 2 | Meijer | 4 | |

| Baskin-Robbins | 3 | Men's Wearhouse | 5 | |

| Bath & Body Works | 6 | Microtel | 1 | |

| Baymont Inn | 1 | Motel 6 | 1 | |

| Bebe | 1 | Motherhood Maternity | 4 | |

| Bed Bath & Beyond | 2 | New Balance | 11 | |

| Best Western | 3 | New York & Co | 2 | |

| Big O Tires | 10 | Nike | 27 | |

| Blockbuster | 8 | Nissan | 3 | |

| Brooks Brothers | 1 | Office Depot | 5 | |

| Brookstone | 1 | OfficeMax | 1 | |

| Budget Car Rental | 3 | Old Navy | 3 | |

| Buffalo Wild Wings | 4 | Olive Garden | 3 | |

| Burger King | 15 | Outback | 4 | |

| Burlington Coat Factory | 2 | Outback Steakhouse | 4 | |

| CVS | 14 | Pac Sun | 2 | |

| Cache | 2 | Panera Bread | 7 | |

| CarMax | 1 | Papa John's Pizza | 12 | |

| Casual Male XL | 2 | Payless | 9 | |

| Catherines | 2 | Penske | 6 | |

| Charlotte Russe | 2 | PetSmart | 3 | |

| Chevrolet | 4 | Pier 1 Imports | 3 | |

| Chick-Fil-A | 6 | Pizza Hut | 15 | |

| Chico's | 2 | Plato's Closet | 2 | |

| Chuck E. Cheese's | 1 | Popeyes | 3 | |

| Cinnabon | 1 | Pottery Barn | 1 | |

| Circle K | 35 | Pottery Barn Kids | 1 | |

| Cold Stone Creamery | 1 | Qdoba Mexican Grill | 10 | |

| Coldwater Creek | 1 | Quality | 2 | |

| ColorTyme | 1 | Quiznos | 6 | |

| Comfort Inn | 2 | RadioShack | 12 | |

| Comfort Suites | 2 | Ramada | 3 | |

| Costco | 1 | Red Lobster | 1 | |

| Cracker Barrel | 2 | Red Robin | 2 | |

| Cricket Wireless | 27 | Red Roof Inn | 3 | |

| Curves | 8 | Rite Aid | 15 | |

| DHL | 4 | Rodeway Inn | 1 | |

| Dairy Queen | 17 | Ruby Tuesday | 1 | |

| Days Inn | 4 | Rue21 | 1 | |

| Deb | 1 | Ryan's Grill | 1 | |

| Dennys | 1 | Ryder Rental & Truck Leasing | 3 | |

| Domino's Pizza | 16 | SAS Shoes | 2 | |

| DressBarn | 2 | SONIC Drive-In | 8 | |

| Dressbarn | 2 | Sam's Club | 1 | |

| Dunkin Donuts | 24 | Sears | 9 | |

| Econo Lodge | 2 | Sephora | 3 | |

| Eddie Bauer | 1 | Shoe Carnival | 4 | |

| Ethan Allen | 1 | Skechers USA | 1 | |

| Express | 2 | Sleep Inn | 2 | |

| Extended Stay America | 3 | Soma Intimates | 1 | |

| Fashion Bug | 3 | Spencer Gifts | 2 | |

| FedEx | 92 | Sprint Nextel | 9 | |

| Finish Line | 2 | Staples | 5 | |

| Firestone Complete Auto Care | 2 | Starbucks | 27 | |

| Foot Locker | 4 | Steak 'n Shake | 5 | |

| Ford | 6 | Subaru | 2 | |

| Forever 21 | 1 | Suburban | 1 | |

| GNC | 15 | Subway | 54 | |

| GameStop | 17 | Super 8 | 2 | |

| Gap | 2 | T-Mobile | 28 | |

| Goodwill | 9 | T.G.I. Driday's | 1 | |

| Gymboree | 2 | T.J.Maxx | 3 | |

| H&R Block | 22 | Taco Bell | 22 | |

| Hardee's | 2 | Talbots | 2 | |

| Havertys Furniture | 1 | Target | 7 | |

| Haworth | 1 | The Cheesecake Factory | 1 | |

| Hawthorn | 1 | The Limited | 2 | |

| Hilton | 8 | Toyota | 2 | |

| Hobby Lobby | 2 | Toys"R"Us | 7 | |

| Holiday Inn | 10 | Trader Joe's | 1 | |

| Hollister Co. | 2 | True Value | 1 | |

| Home Depot | 5 | U-Haul | 25 | |

| HomeTown Buffet | 2 | UPS | 147 | |

| Homestead Studio Suites | 1 | Value City Furniture | 2 | |

| Honda | 2 | Vans | 8 | |

| Hot Topic | 2 | Verizon Wireless | 3 | |

| Howard Johnson | 1 | Victoria's Secret | 4 | |

| Hyatt | 2 | Volkswagen | 2 | |

| Hyundai | 2 | Waffle House | 11 | |

| IHOP | 1 | Walgreens | 30 | |

| InTown Suites | 3 | Walmart | 12 | |

| J. Jill | 1 | Wendy's | 26 | |

| J.Crew | 1 | Wet Seal | 1 | |

| JCPenney | 3 | White Castle | 15 | |

| Jimmy Jazz | 1 | Whole Foods Market | 1 | |

| Jimmy John's | 9 | Wingate | 1 | |

| JoS. A. Bank | 2 | YMCA | 9 | |

| Jones New York | 4 | Z Gallerie | 1 | |

Strongest AM radio stations in Louisville:

- WKJK (1080 AM; 10 kW; LOUISVILLE, KY; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WHAS (840 AM; 50 kW; LOUISVILLE, KY; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WGTK (970 AM; 5 kW; LOUISVILLE, KY; Owner: SALEM MEDIA OF KENTUCKY, INC.)

- WLLV (1240 AM; 1 kW; LOUISVILLE, KY; Owner: MORTENSON BROADCASTING COMPANY)

- WLOU (1350 AM; 2 kW; LOUISVILLE, KY; Owner: MORTENSON BROADCASTING CO., INC.)

- WFIA (900 AM; 1 kW; LOUISVILLE, KY; Owner: SCA LICENSE CORPORATION)

- WXXA (790 AM; 5 kW; LOUISVILLE, KY)

- WAVG (1450 AM; 1 kW; JEFFERSONVILLE, IN; Owner: SUNNYSIDE COMMUNICATIONS, INC)

- WXLN (1570 AM; 2 kW; NEW ALBANY, IN; Owner: MORTENSON BROADCASTING COMPANY)

- WTMT (620 AM; 0 kW; LOUISVILLE, KY; Owner: JEFFERSON B/CASTING CMPANY, INC.)

- WDRD (680 AM; 1 kW; NEWBURG, KY; Owner: ABC, INC.)

- WLW (700 AM; 50 kW; CINCINNATI, OH; Owner: JACOR BROADCASTING CORPORATION)

- WSAI (1530 AM; 50 kW; CINCINNATI, OH; Owner: JACOR BROADCASTING CORPORATION)

Strongest FM radio stations in Louisville:

- WFPL (89.3 FM; LOUISVILLE, KY; Owner: KENTUCKY PUBLIC RADIO, INC.)

- WXMA (102.3 FM; LOUISVILLE, KY; Owner: BLUE CHIP BROADCASTING LICENSES II, LTD.)

- WPTI (103.9 FM; LOUISVILLE, KY; Owner: CXR HOLDINGS, INC.)

- WRKA (103.1 FM; ST. MATTHEWS, KY; Owner: CXR HOLDINGS, INC.)

- WMJM (101.3 FM; JEFFERSONTOWN, KY; Owner: BLUE CHIP BROADCASTING LICENSES II, LTD.)

- WFPK (91.9 FM; LOUISVILLE, KY; Owner: KENTUCKY PUBLIC RADIO, INC.)

- WUOL-FM (90.5 FM; LOUISVILLE, KY; Owner: KENTUCKY PUBLIC RADIO, INC.)

- WDJX (99.7 FM; LOUISVILLE, KY; Owner: BLUE CHIP BROADCASTING LICENSES II, LTD.)

- WRVI (105.9 FM; VALLEY STATION, KY; Owner: SALEM MEDIA OF KENTUCKY, INC.)

- WVEZ (106.9 FM; LOUISVILLE, KY; Owner: CXR HOLDINGS, INC.)

- WSFR (107.7 FM; CORYDON, IN; Owner: CXR HOLDINGS, INC.)

- WAMZ (97.5 FM; LOUISVILLE, KY; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- W230AK (93.9 FM; LOUISVILLE, KY; Owner: EVANGEL SCHOOLS, INC.)

- WQMF (95.7 FM; JEFFERSONVILLE, IN; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- W284AD (104.7 FM; NEW ALBANY, IN; Owner: LIFETALK RADIO, INC.)

- WTFX-FM (100.5 FM; LOUISVILLE, KY; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WJIE-FM (88.5 FM; OKOLONA, KY; Owner: EVANGEL SCHOOLS, INC.)

- WFIA-FM (94.7 FM; NEW ALBANY, IN; Owner: SALEM MEDIA OF KENTUCKY, INC.)

- WJZL (93.1 FM; CLARKSVILLE, IN; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WLRS (105.1 FM; SHEPHERDSVILLE, KY; Owner: BLUE CHIP BROADCASTING LICENSES II, LTD.)

TV broadcast stations around Louisville:

- W24BW (Channel 24; LOUISVILLE, KY; Owner: GREATER LOUISVILLE COMMUNICATIONS)

- WVHF-LP (Channel 5; JEFFERSONVILLE, ETC., IN; Owner: JOHN W. SMITH, JR.)

- WBXV-CA (Channel 13; LOUISVILLE, KY; Owner: THE BOX WORLDWIDE LLC)

- WHAS-TV (Channel 11; LOUISVILLE, KY; Owner: BELO KENTUCKY, INC.)

- WDRB (Channel 41; LOUISVILLE, KY; Owner: INDEPENDENCE TELEVISION COMPANY)

- WFTE (Channel 58; SALEM, IN; Owner: INDEPENDENCE TELEVISION COMPANY)

- WBKI-CA (Channel 28; LOUISVILLE, KY; Owner: LOUISVILLE COMMUNICATIONS, LLC)

- WLKY-TV (Channel 32; LOUISVILLE, KY; Owner: WLKY HEARST-ARGYLE TELEVISION, INC.)

- WAVE (Channel 3; LOUISVILLE, KY; Owner: LIBCO, INC.)

- WJYL-CA (Channel 45; CLARKSVILLE, IN; Owner: JOHN W. SMITH, JR.)

- WKPC-TV (Channel 15; LOUISVILLE, KY; Owner: KENTUCKY AUTHORITY FOR EDUC'L. TV)

- WKMJ-TV (Channel 68; LOUISVILLE, KY; Owner: KENTUCKY AUTHORITY FOR EDUCATIONAL TV)

- WBNA (Channel 21; LOUISVILLE, KY; Owner: WORD BROADCASTING NETWORK, INC.)

- W50CI (Channel 50; LOUISVILLE, KY; Owner: SOUTH CENTRAL COMMUNICATIONS CORP.)

Medal of Honor Recipients

Medal of Honor Recipients born in Louisville: James J. Nash, John C . Squires.

- National Bridge Inventory (NBI) Statistics

- 581Number of bridges

- 8,465ft / 2,580mTotal length

- $406,474,000Total costs

- 25,145,399Total average daily traffic

- 2,218,311Total average daily truck traffic

- New bridges - historical statistics

- 21900-1909

- 91910-1919

- 141920-1929

- 211930-1939

- 171940-1949

- 441950-1959

- 921960-1969

- 611970-1979

- 1061980-1989

- 481990-1999

- 382000-2009

- 1282010-2019

- 12020-2022

FCC Registered Antenna Towers: 1,738 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 16 (See the full list of FCC Registered Commercial Land Mobile Towers in Louisville, KY)

FCC Registered Private Land Mobile Towers: 40 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 580 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 355 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 35 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 56 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 2,353 (See the full list of FCC Registered Amateur Radio Licenses in Louisville)

FAA Registered Aircraft Manufacturers and Dealers: 4 (See the full list of FAA Registered Manufacturers and Dealers in Louisville)

FAA Registered Aircraft: 655 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 70 full and 16 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 774 | $118,278 | 1,283 | $125,682 | 3,796 | $146,975 | 289 | $66,806 | 50 | $782,892 | 889 | $81,014 | 1 | $53,930 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 45 | $107,350 | 67 | $108,774 | 285 | $151,864 | 50 | $48,054 | 2 | $128,500 | 44 | $125,757 | 2 | $29,635 |

| APPLICATIONS DENIED | 132 | $109,939 | 253 | $103,023 | 1,667 | $122,046 | 303 | $42,226 | 15 | $784,381 | 268 | $73,036 | 5 | $30,080 |

| APPLICATIONS WITHDRAWN | 105 | $120,281 | 118 | $143,829 | 926 | $142,148 | 39 | $65,896 | 6 | $633,012 | 70 | $92,559 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 20 | $114,426 | 26 | $209,701 | 296 | $142,092 | 19 | $78,001 | 1 | $200,000 | 26 | $60,066 | 0 | $0 |

Detailed mortgage data for all 86 tracts in Louisville, KY

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 51 full and 15 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 129 | $161,201 | 128 | $166,917 | 2 | $198,520 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 52 | $136,463 | 50 | $159,677 | 3 | $66,950 |

| APPLICATIONS DENIED | 16 | $163,248 | 18 | $187,771 | 1 | $136,740 |

| APPLICATIONS WITHDRAWN | 5 | $209,664 | 10 | $222,812 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 5 | $137,612 | 8 | $94,125 | 3 | $45,667 |

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Louisville, KY

- 15,35841.4%Structure Fires

- 13,88537.4%Outside Fires

- 6,73918.2%Mobile Property/Vehicle Fires

- 1,1313.0%Other

Based on the data from the years 2002 - 2018 the average number of fires per year is 2183. The highest number of reported fires - 3,083 took place in 2006, and the least - 539 in 2003. The data has an increasing trend.

Based on the data from the years 2002 - 2018 the average number of fires per year is 2183. The highest number of reported fires - 3,083 took place in 2006, and the least - 539 in 2003. The data has an increasing trend. When looking into fire subcategories, the most incidents belonged to: Structure Fires (41.4%), and Outside Fires (37.4%).

When looking into fire subcategories, the most incidents belonged to: Structure Fires (41.4%), and Outside Fires (37.4%).Fire-safe hotels and motels in Louisville, Kentucky:

- Red Roof Inn #0118, 4704 Preston Hwy, Louisville, Kentucky 40213 , Phone: (502) 968-0151, Fax: (502) 968-0194

- Archway Motel BLDG 4, 10615 Dixie Hwy, Louisville, Kentucky 40272 , Phone: (502) 937-0937

- Brown Motel, 335 W Broadway, Louisville, Kentucky 40202 , Phone: (502) 583-1234, Fax: (502) 587-7006

- Days Inn East, 4621 Shelbyville Rd, Louisville, Kentucky 40207 , Phone: (502) 896-8871, Fax: (502) 896-8871

- Galt House East, 140 N 4TH Ave, Louisville, Kentucky 40202 , Phone: (502) 589-5200

- Chariot Hotel, 1902 Embassy Square Blvd, Louisville, Kentucky 40299 , Phone: (502) 491-2577, Fax: (502) 491-1325

- Holiday Inn Hurstbourne, 1325 S Hurstbourne Pkwy, Louisville, Kentucky 40222 , Phone: (502) 426-2600, Fax: (502) 423-1605

- Hyatt Regency, 320 W Jefferson, Louisville, Kentucky 40202 , Phone: (800) 233-1234, Fax: (502) 581-0133

- 95 other hotels and motels

| Most common first names in Louisville, KY among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| Mary | 8,566 | 78.6 years |

| William | 6,826 | 72.6 years |

| James | 5,847 | 70.1 years |

| John | 5,766 | 73.2 years |

| Charles | 4,178 | 71.6 years |

| Robert | 3,901 | 70.4 years |

| George | 2,986 | 74.3 years |

| Joseph | 2,885 | 72.7 years |

| Margaret | 2,387 | 79.2 years |

| Anna | 2,302 | 79.9 years |

| Most common last names in Louisville, KY among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 2,546 | 74.1 years |

| Brown | 1,688 | 74.1 years |

| Johnson | 1,618 | 73.7 years |

| Miller | 1,593 | 75.4 years |

| Jones | 1,385 | 74.0 years |

| Williams | 1,331 | 73.1 years |

| Davis | 1,059 | 73.4 years |

| Wilson | 974 | 72.8 years |

| Thompson | 912 | 74.2 years |

| Taylor | 882 | 73.7 years |

- 89.7%Utility gas

- 9.2%Electricity

- 0.6%Bottled, tank, or LP gas

- 0.2%Fuel oil, kerosene, etc.

- 0.1%Other fuel

- 64.1%Utility gas

- 31.8%Electricity

- 1.5%Other fuel

- 1.3%Bottled, tank, or LP gas

- 1.1%No fuel used

- 0.2%Fuel oil, kerosene, etc.

Louisville compared to Kentucky state average:

- Unemployed percentage below state average.

- Black race population percentage significantly above state average.

- Hispanic race population percentage below state average.

- Median age below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

- Institutionalized population percentage significantly above state average.

Louisville, KY compared to other similar cities:

Louisville on our top lists:

- #1 on the list of "Top 101 cities with largest percentage of females in occupations: printing workers (population 50,000+)"

- #2 on the list of "Top 101 cities with largest percentage of males in occupations: laborers and material movers, hand (population 50,000+)"

- #2 on the list of "Top 101 cities with largest percentage of females in occupations: religious workers (population 50,000+)"

- #3 on the list of "Top 101 cities with largest percentage of males in industries: religious, grantmaking, civic, professional, and similar organizations (population 50,000+)"

- #3 on the list of "Top 101 cities with largest percentage of males in occupations: food processing workers (population 50,000+)"

- #3 on the list of "Top 101 cities with largest percentage of females in industries: electrical equipment, appliances, and components (population 50,000+)"

- #3 on the list of "Top 101 cities with largest percentage of females in industries: other transportation, and support activities, and couriers (population 50,000+)"

- #3 on the list of "Top 101 cities with largest percentage of females in industries: religious, grantmaking, civic, professional, and similar organizations (population 50,000+)"

- #4 on the list of "Top 101 cities with largest percentage of males in occupations: assemblers and fabricators (population 50,000+)"

- #5 on the list of "Top 101 cities with largest percentage of males in occupations: food and beverage serving workers except waiters/waitresses (population 50,000+)"

- #5 on the list of "Top 101 cities with largest percentage of females in industries: printing and related support activities (population 50,000+)"

- #6 on the list of "Top 101 cities with largest percentage of females in industries: food (population 50,000+)"

- #6 on the list of "Top 101 cities with largest percentage of males in industries: beverage and tobacco products (population 50,000+)"

- #6 on the list of "Top 101 cities with largest percentage of females in industries: beverage and tobacco products (population 50,000+)"

- #6 on the list of "Top 101 cities with largest percentage of males in industries: electrical equipment, appliances, and components (population 50,000+)"

- #6 on the list of "Top 101 cities with largest percentage of males in industries: food (population 50,000+)"

- #7 on the list of "Top 101 cities with largest percentage of females in industries: paper (population 50,000+)"

- #8 on the list of "Top 101 cities with largest percentage of males in industries: wood products (population 50,000+)"

- #9 on the list of "Top 101 cities with largest percentage of males in industries: personal and laundry services (population 50,000+)"

- #12 on the list of "Top 101 cities with largest percentage of males in industries: other transportation, and support activities, and couriers (population 50,000+)"

- #68 (40208) on the list of "Top 101 zip codes with the most museums in 2005"

- #18 on the list of "Top 101 counties with the worst general health status score of residents (1-5), 3 years of data"

- #22 on the list of "Top 101 counties with the highest average weight of females"

- #23 on the list of "Top 101 counties with the highest Particulate Matter (PM2.5) Annual air pollution readings in 2012 (µg/m3)"

- #23 on the list of "Top 101 counties with the most Black Protestant adherents"

- #31 on the list of "Top 101 counties with the lowest percentage of residents that exercised in the past month"

|

|

Total of 2720 patent applications in 2008-2024.