Mira Loma, California

Submit your own pictures of this place and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +24.5%

| Males: 11,133 | |

| Females: 10,797 |

| Median resident age: | 31.7 years |

| California median age: | 37.9 years |

Zip codes: 91752.

| Mira Loma: | $99,117 |

| CA: | $91,551 |

Estimated per capita income in 2022: $28,993 (it was $15,277 in 2000)

Mira Loma CDP income, earnings, and wages data

Estimated median house or condo value in 2022: $642,207 (it was $156,100 in 2000)

| Mira Loma: | $642,207 |

| CA: | $715,900 |

Mean prices in 2022: all housing units: $500,872; detached houses: $498,275; townhouses or other attached units: $513,191; mobile homes: $235,724

Median gross rent in 2022: $1,966.

(6.6% for White Non-Hispanic residents, 14.0% for Black residents, 11.8% for Hispanic or Latino residents, 3.3% for American Indian residents, 18.0% for other race residents, 5.6% for two or more races residents)

Detailed information about poverty and poor residents in Mira Loma, CA

- 17,07873.8%Hispanic

- 5,08822.0%White alone

- 6222.7%Black alone

- 5672.4%Two or more races

- 4662.0%Asian alone

- 190.08%American Indian alone

According to our research of California and other state lists, there were 8 registered sex offenders living in Mira Loma, California as of April 18, 2024.

The ratio of all residents to sex offenders in Mira Loma is 2,898 to 1.

The ratio of registered sex offenders to all residents in this city is much lower than the state average.

| Riverside #8 Coolest City According to Forbes (49 replies) |

| Paradise Fire/Camp Creek Fire 11/08/2018 (783 replies) |

| Suggestions for getting our first house (89 replies) |

| Rubidoux, Riverside, CA (18 replies) |

| Thinking about moving to Sacramento from SD * How do you like Sacramento? (279 replies) |

| What are your favorite cities/towns in the Inland Empire? (53 replies) |

Latest news from Mira Loma, CA collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: German (4.1%), American (1.9%), Irish (1.4%), English (1.2%), Italian (1.0%).

Current Local Time: PST time zone

Elevation: 700 feet

Land area: 6.44 square miles.

Population density: 3,403 people per square mile (average).

5,746 residents are foreign born (22.9% Latin America).

| This place: | 24.8% |

| California: | 100.0% |

Median real estate property taxes paid for housing units with mortgages in 2022: $3,267 (0.7%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $2,390 (0.6%)

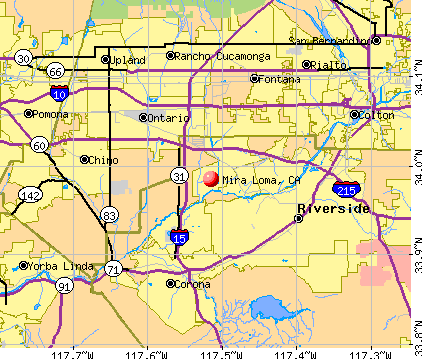

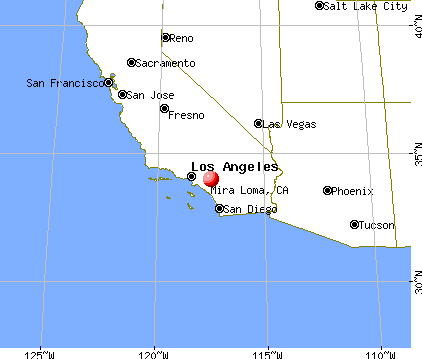

Nearest city with pop. 50,000+: Jurupa, CA (2.2 miles , pop. 85,106).

Nearest city with pop. 200,000+: Riverside, CA (7.3 miles

, pop. 255,166).

Nearest city with pop. 1,000,000+: Los Angeles, CA (49.8 miles

, pop. 3,694,820).

Nearest cities:

Latitude: 33.98 N, Longitude: 117.52 W

Daytime population change due to commuting: -4,626 (-19.5%)

Workers who live and work in this place: 1,044 (11.1%)

Area code: 909

| Here: | 5.2% |

| California: | 5.1% |

- Construction (10.7%)

- Health care (6.1%)

- Truck transportation (5.7%)

- Accommodation & food services (5.5%)

- Administrative & support & waste management services (4.7%)

- Educational services (4.0%)

- Agriculture, forestry, fishing & hunting (3.9%)

- Construction (16.2%)

- Truck transportation (8.4%)

- Agriculture, forestry, fishing & hunting (5.9%)

- Administrative & support & waste management services (5.8%)

- Accommodation & food services (4.9%)

- Repair & maintenance (4.3%)

- Metal & metal products (4.2%)

- Health care (13.2%)

- Educational services (7.1%)

- Accommodation & food services (6.4%)

- Finance & insurance (5.6%)

- Professional, scientific, technical services (4.9%)

- Social assistance (4.5%)

- Miscellaneous manufacturing (4.0%)

- Driver/sales workers and truck drivers (8.0%)

- Other production occupations, including supervisors (4.6%)

- Building and grounds cleaning and maintenance occupations (4.3%)

- Other office and administrative support workers, including supervisors (3.7%)

- Metal workers and plastic workers (3.6%)

- Vehicle and mobile equipment mechanics, installers, and repairers (3.4%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (3.3%)

- Driver/sales workers and truck drivers (12.7%)

- Building and grounds cleaning and maintenance occupations (5.7%)

- Vehicle and mobile equipment mechanics, installers, and repairers (5.6%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (5.1%)

- Metal workers and plastic workers (5.0%)

- Other production occupations, including supervisors (5.0%)

- Agricultural workers, including supervisors (4.3%)

- Other office and administrative support workers, including supervisors (7.4%)

- Bookkeeping, accounting, and auditing clerks (6.3%)

- Preschool, kindergarten, elementary, and middle school teachers (4.9%)

- Material recording, scheduling, dispatching, and distributing workers (4.2%)

- Other production occupations, including supervisors (4.0%)

- Financial clerks, except bookkeeping, accounting and auditing clerks (4.0%)

- Secretaries and administrative assistants (4.0%)

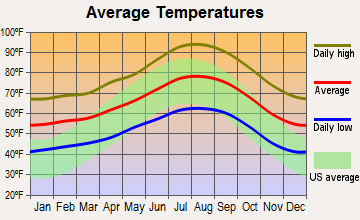

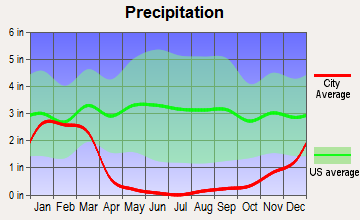

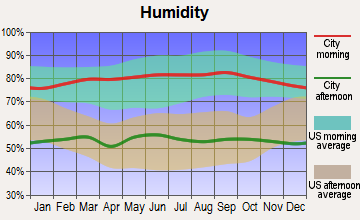

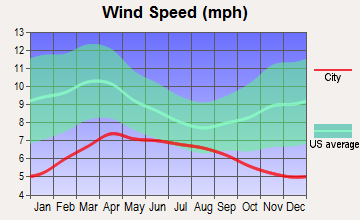

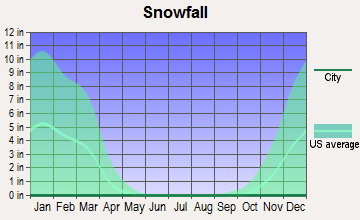

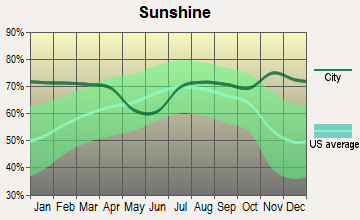

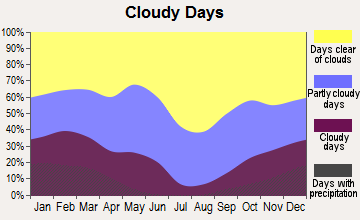

Average climate in Mira Loma, California

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

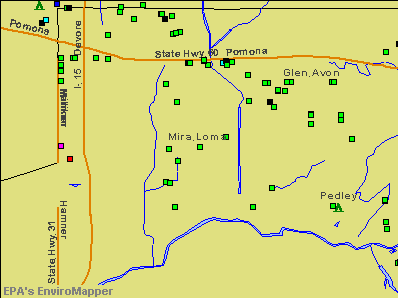

Air Quality Index (AQI) level in 2022 was 133. This is significantly worse than average.

| City: | 133 |

| U.S.: | 73 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.257. This is about average. Closest monitor was 1.5 miles away from the city center.

| City: | 0.257 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 10.8. This is significantly worse than average. Closest monitor was 1.5 miles away from the city center.

| City: | 10.8 |

| U.S.: | 5.1 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.511. This is significantly better than average. Closest monitor was 3.6 miles away from the city center.

| City: | 0.511 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 31.8. This is about average. Closest monitor was 1.5 miles away from the city center.

| City: | 31.8 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 45.9. This is significantly worse than average. Closest monitor was 1.5 miles away from the city center.

| City: | 45.9 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 12.5. This is significantly worse than average. Closest monitor was 1.5 miles away from the city center.

| City: | 12.5 |

| U.S.: | 8.1 |

Lead (Pb) [µg/m3] level in 2023 was 0.00426. This is significantly better than average. Closest monitor was 3.6 miles away from the city center.

| City: | 0.00426 |

| U.S.: | 0.00931 |

Earthquake activity:

Mira Loma-area historical earthquake activity is significantly above California state average. It is 7229% greater than the overall U.S. average.On 6/28/1992 at 11:57:34, a magnitude 7.6 (6.2 MB, 7.6 MS, 7.3 MW, Depth: 0.7 mi, Class: Major, Intensity: VIII - XII) earthquake occurred 58.0 miles away from Mira Loma center, causing 3 deaths (1 shaking deaths, 2 other deaths) and 400 injuries, causing $100,000,000 total damage and $40,000,000 insured losses

On 7/21/1952 at 11:52:14, a magnitude 7.7 (7.7 UK) earthquake occurred 110.0 miles away from the city center, causing $50,000,000 total damage

On 10/16/1999 at 09:46:44, a magnitude 7.4 (6.3 MB, 7.4 MS, 7.2 MW, 7.3 ML) earthquake occurred 71.8 miles away from the city center

On 4/21/1918 at 22:32:30, a magnitude 6.8 (6.8 UK, Class: Strong, Intensity: VII - IX) earthquake occurred 12.7 miles away from Mira Loma center

On 5/19/1940 at 04:36:40, a magnitude 7.2 (7.2 UK) earthquake occurred 117.3 miles away from Mira Loma center, causing $33,000,000 total damage

On 6/28/1992 at 15:05:30, a magnitude 6.9 (6.3 MB, 6.7 MS, 6.5 MW, 6.9 ME, Depth: 3.1 mi) earthquake occurred 45.2 miles away from the city center

Magnitude types: body-wave magnitude (MB), energy magnitude (ME), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Riverside County (46) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 27

Emergencies Declared: 1

Causes of natural disasters: Fires: 22, Floods: 20, Storms: 8, Winter Storms: 8, Landslides: 6, Mudslides: 5, Heavy Rains: 2, Earthquake: 1, Flash Flood: 1, Freeze: 1, Hurricane: 1, Tornado: 1, Tropical Storm: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers in Mira Loma:

Other hospitals and medical centers near Mira Loma:

- LIFEHOUSE OF RIVERSIDE HEALTHCARE CENTER (Nursing Home, about 3 miles away; RIVERSIDE, CA)

- BENTLEY HOUSE (Hospital, about 3 miles away; RIVERSIDE, CA)

- GREENTREE HOUSE (Hospital, about 4 miles away; NORCO, CA)

- CAMI HOUSE (Hospital, about 4 miles away; RIVERSIDE, CA)

- MAVERICK HOUSE (Hospital, about 4 miles away; RIVERSIDE, CA)

- LAUREL PARK HOUSE (Hospital, about 4 miles away; RIVERSIDE, CA)

- MILLER'S PROGRESSIVE CARE (Nursing Home, about 4 miles away; RIVERSIDE, CA)

Amtrak stations near Mira Loma:

- 9 miles: RIVERSIDE (4066 VINE ST.) - Bus Station . Services: fully wheelchair accessible, public payphones, full-service food facilities, free short-term parking, free long-term parking, call for car rental service, call for taxi service, public transit connection.

- 10 miles: ONTARIO (228 S. PLUM ST.) . Services: fully wheelchair accessible, public payphones, vending machines, free short-term parking, call for taxi service.

- 14 miles: CLAREMONT (200 W. 1ST ST.) - Bus Station . Services: fully wheelchair accessible, public payphones, full-service food facilities, free short-term parking, free long-term parking, call for car rental service, call for taxi service, public transit connection.

Colleges/universities with over 2000 students nearest to Mira Loma:

- La Sierra University (about 6 miles; Riverside, CA; Full-time enrollment: 2,205)

- Norco College (about 6 miles; Norco, CA; FT enrollment: 4,916)

- California Baptist University (about 7 miles; Riverside, CA; FT enrollment: 6,085)

- Universal Technical Institute of California Inc (about 8 miles; Rancho Cucamonga, CA; FT enrollment: 4,158)

- Riverside City College (about 8 miles; Riverside, CA; FT enrollment: 10,661)

- University of California-Riverside (about 11 miles; Riverside, CA; FT enrollment: 20,647)

- Chaffey College (about 12 miles; Rancho Cucamonga, CA; FT enrollment: 10,496)

User-submitted facts and corrections:

- Mira Loma, CA 91752 is divided between horse country east of Wineville Ave & Eastvale-area, new, tract homes to the west. Mira Loma is basically an extension of Norco as far as lifestyle and values. added by fiumicela

Points of interest:

Churches in Mira Loma include: The Church of Jesus Christ of Latter Day Saints (A), Joy Christian Fellowship Church (B), Riverside Chinese Alliance Church (C), Chinese Alliance Church (D). Display/hide their locations on the map

Birthplace of: Adam Reifer - Baseball player.

| This place: | 4.2 people |

| California: | 2.9 people |

| This place: | 85.7% |

| Whole state: | 68.7% |

| This place: | 6.9% |

| Whole state: | 7.2% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.2% of all households

People in group quarters in Mira Loma in 2010:

- 22 people in group homes intended for adults

- 20 people in nursing facilities/skilled-nursing facilities

- 3 people in workers' group living quarters and job corps centers

- 3 people in other noninstitutional facilities

People in group quarters in Mira Loma in 2000:

- 58 people in other noninstitutional group quarters

- 25 people in other group homes

- 11 people in homes for the mentally retarded

- 6 people in homes or halfway houses for drug/alcohol abuse

Banks with branches in Mira Loma (2011 data):

- U.S. Bank National Association: Limonite & Hamner Vons Branch at 6170 Hamner Avenue, branch established on 2004/09/08. Info updated 2012/01/30: Bank assets: $330,470.8 mil, Deposits: $236,091.5 mil, headquarters in Cincinnati, OH, positive income, 3121 total offices, Holding Company: U.S. Bancorp

- Bank of America, National Association: Eastvale Branch at 12511 Limonite Avenue, branch established on 2004/06/07. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- JPMorgan Chase Bank, National Association: Mira Loma - Eastvale at 6060 Hamner Ave, branch established on 2005/03/14. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- First Bank: Mira Loma Branch at 11010 Limonite Avenue, branch established on 1976/06/01. Info updated 2007/12/04: Bank assets: $6,579.8 mil, Deposits: $5,800.6 mil, headquarters in Creve Coeur, MO, negative income in the last year, Commercial Lending Specialization, 148 total offices, Holding Company: First Banks, Inc.

For population 15 years and over in Mira Loma:

- Never married: 35.1%

- Now married: 54.7%

- Separated: 1.5%

- Widowed: 4.0%

- Divorced: 4.6%

For population 25 years and over in Mira Loma:

- High school or higher: 66.0%

- Bachelor's degree or higher: 9.2%

- Graduate or professional degree: 1.9%

- Unemployed: 7.1%

- Mean travel time to work (commute): 29.3 minutes

| Here: | 20.0 |

| California average: | 15.5 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Mira Loma, CA (based on Riverside County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 602,765 | 51 |

| Evangelical Protestant | 240,306 | 741 |

| Other | 77,581 | 194 |

| Mainline Protestant | 29,535 | 103 |

| Black Protestant | 19,170 | 40 |

| Orthodox | 3,647 | 11 |

| None | 1,216,637 | - |

Food Environment Statistics:

| Riverside County: | 1.60 / 10,000 pop. |

| California: | 2.14 / 10,000 pop. |

| This county: | 0.05 / 10,000 pop. |

| California: | 0.04 / 10,000 pop. |

| Riverside County: | 0.44 / 10,000 pop. |

| State: | 0.62 / 10,000 pop. |

| Riverside County: | 1.51 / 10,000 pop. |

| State: | 1.49 / 10,000 pop. |

| Riverside County: | 5.45 / 10,000 pop. |

| California: | 7.42 / 10,000 pop. |

| Riverside County: | 7.7% |

| California: | 7.3% |

| Riverside County: | 24.5% |

| State: | 21.3% |

| This county: | 15.2% |

| California: | 17.9% |

7.19% of this county's 2021 resident taxpayers lived in other counties in 2020 ($71,521 average adjusted gross income)

| Here: | 7.19% |

| California average: | 5.19% |

0.03% of residents moved from foreign countries ($210 average AGI)

Riverside County: 0.03% California average: 0.03%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Los Angeles County, CA | |

| from San Bernardino County, CA | |

| from Orange County, CA |

6.28% of this county's 2020 resident taxpayers moved to other counties in 2021 ($64,593 average adjusted gross income)

| Here: | 6.28% |

| California average: | 6.14% |

0.02% of residents moved to foreign countries ($200 average AGI)

Riverside County: 0.02% California average: 0.02%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to San Bernardino County, CA | |

| to Los Angeles County, CA | |

| to Orange County, CA |

| Businesses in Mira Loma, CA | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| Applebee's | 1 | Lowe's | 1 | |

| AutoZone | 1 | New Balance | 1 | |

| Bed Bath & Beyond | 1 | Nike | 4 | |

| Blockbuster | 1 | On The Border | 1 | |

| Buffalo Wild Wings | 1 | Payless | 1 | |

| Carl\s Jr. | 1 | PetSmart | 1 | |

| Chipotle | 1 | Quiznos | 1 | |

| Church's Chicken | 1 | RadioShack | 1 | |

| Circle K | 2 | Safeway | 1 | |

| Cold Stone Creamery | 1 | Staples | 1 | |

| Dennys | 1 | Starbucks | 1 | |

| DressBarn | 1 | T-Mobile | 3 | |

| Dressbarn | 1 | T.J.Maxx | 1 | |

| Famous Footwear | 1 | Taco Bell | 1 | |

| FedEx | 1 | Target | 1 | |

| GNC | 1 | The Room Place | 2 | |

| GameStop | 1 | Toys"R"Us | 1 | |

| H&R Block | 1 | U-Haul | 1 | |

| Home Depot | 1 | UPS | 2 | |

| Jamba Juice | 1 | Verizon Wireless | 2 | |

| Johnny Rockets | 1 | Vons | 1 | |

| Kohl's | 1 | |||

Strongest AM radio stations in Mira Loma:

- KPLS (830 AM; 50 kW; ORANGE, CA; Owner: CRN LICENSES, LLC)

- KLAC (570 AM; 50 kW; LOS ANGELES, CA; Owner: AMFM RADIO LICENSES, L.L.C.)

- KFI (640 AM; 50 kW; LOS ANGELES, CA; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- KSPA (1510 AM; 10 kW; ONTARIO, CA; Owner: ONTARIO BROADCASTING, LLC)

- KWRM (1370 AM; 5 kW; CORONA, CA; Owner: MAJOR MARKET STATIONS, INC.)

- KTNQ (1020 AM; 50 kW; LOS ANGELES, CA; Owner: KTNQ-AM LICENSE CORP.)

- KXTA (1150 AM; 50 kW; LOS ANGELES, CA; Owner: CITICASTERS LICENSES, L.P.)

- KPRO (1570 AM; 5 kW; RIVERSIDE, CA; Owner: OLIVE L. SHERBAN)

- KDIS (1110 AM; 50 kW; PASADENA, CA; Owner: ABC,INC.)

- KFWB (980 AM; 50 kW; LOS ANGELES, CA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- KSPN (710 AM; 50 kW; LOS ANGELES, CA; Owner: KABC-AM RADIO, INC.)

- KMPC (1540 AM; 50 kW; LOS ANGELES, CA; Owner: ROSE CITY RADIO CORPORATION)

- KMNY (1600 AM; 5 kW; POMONA, CA; Owner: MULTICULTURAL RADIO BROADCASTING, INC.)

Strongest FM radio stations in Mira Loma:

- KOLA (99.9 FM; SAN BERNARDINO, CA; Owner: INLAND EMPIRE BROADCASTING CORP.)

- KUCR (88.3 FM; RIVERSIDE, CA; Owner: THE REGENTS OF THE UNIV. OF CA)

- KVCR (91.9 FM; SAN BERNARDINO, CA; Owner: SAN BERNARDINO COMMUNITY COLLEGE DISTRICT)

- KUOR-FM (89.1 FM; REDLANDS, CA; Owner: UNIVERSITY OF REDLANDS)

- K264AF (100.7 FM; GUASTI, CA; Owner: EDUCATIONAL MEDIA FOUNDATION)

- K295AI (106.9 FM; MUSCOY, CA; Owner: ASSOCIATION FOR COMMUNITY EDUCATION, INC.)

- KLRD (90.1 FM; YUCAIPA, CA; Owner: EDUCATIONAL MEDIA FOUNDATION)

- KCXX (103.9 FM; LAKE ARROWHEAD, CA; Owner: ALL-PRO BROADCASTING, INC.)

- KCBS-FM (93.1 FM; LOS ANGELES, CA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- KWVE (107.9 FM; SAN CLEMENTE, CA; Owner: CALVARY CHAPEL OF COSTA MESA)

- KSCA (101.9 FM; GLENDALE, CA; Owner: HBC LICENSE CORPORATION)

- KLOS (95.5 FM; LOS ANGELES, CA; Owner: KLOS-FM RADIO, INC.)

- K212FA (90.3 FM; TEMPLE CITY, CA; Owner: EDUCATIONAL MEDIA FOUNDATION)

- KOST (103.5 FM; LOS ANGELES, CA; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- KLVE (107.5 FM; LOS ANGELES, CA; Owner: KLVE-FM LICENSE CORP.)

- KIIS-FM (102.7 FM; LOS ANGELES, CA; Owner: CITICASTERS LICENSES, L.P.)

- KPCC (89.3 FM; PASADENA, CA; Owner: PASADENA AREA COMMUNITY COLLEGE DISTRICT)

- KHHT (92.3 FM; LOS ANGELES, CA; Owner: AMFM RADIO LICENSES, L.L.C.)

- KBIG-FM (104.3 FM; LOS ANGELES, CA; Owner: AMFM RADIO LICENSES, L.L.C.)

- KMZT-FM (105.1 FM; LOS ANGELES, CA; Owner: MOUNT WILSON FM BROADCASTERS, INC.)

TV broadcast stations around Mira Loma:

- KTRO-LP (Channel 50; LANCASTER, CA; Owner: ROBERT D. ADELMAN)

- KHIZ (Channel 64; BARSTOW, CA; Owner: SUNBELT TELEVISION, INC.)

- KCBS-TV (Channel 2; LOS ANGELES, CA; Owner: CBS BROADCASTING INC.)

- KVCR-TV (Channel 24; SAN BERNARDINO, CA; Owner: SAN BERNARDINO COMMUNITY COLLEGE DISTRICT)

- KRCA (Channel 62; RIVERSIDE, CA; Owner: KRCA LICENSE CORP.)

- KPXN (Channel 30; SAN BERNARDINO, CA; Owner: PAXSON LOS ANGELES LICENSE, INC.)

- KSGA-LP (Channel 59; SANTA BARBARA, CA; Owner: KJLA, LLC)

- National Bridge Inventory (NBI) Statistics

- 9Number of bridges

- 46ft / 14.1mTotal length

- 71,283Total average daily traffic

- 791Total average daily truck traffic

- 133,493Total future (year 2038) average daily traffic

FCC Registered Antenna Towers:

41 (See the full list of FCC Registered Antenna Towers in Mira Loma)FCC Registered Broadcast Land Mobile Towers:

32 (See the full list of FCC Registered Broadcast Land Mobile Towers in Mira Loma, CA)FCC Registered Microwave Towers:

12 (See the full list of FCC Registered Microwave Towers in this town)FCC Registered Amateur Radio Licenses:

112 (See the full list of FCC Registered Amateur Radio Licenses in Mira Loma)FAA Registered Aircraft:

4- Aircraft: SCHWEIZER SGS 1-26E (Category: Land, Weight: Up to 12,499 Pounds, Speed: 57 mph), Engine: None

N-Number: 17945, N17945, N-17945, Serial Number: 545, Year manufactured: 1972, Airworthiness Date: 12/15/1972, Certificate Issue Date: 06/02/2003

Registrant (Individual): Timothy J Ward, 6100 Lucretia Ave, Mira Loma, CA 91752 - Aircraft: BROWN WILLIAM S STREAK SHADOW (Category: Land, Seats: 2, Weight: Up to 12,499 Pounds), Engine: BOMBARDIER ROTAX (ALL) (Reciprocating)

N-Number: 7844E, N7844E, N-7844E, Serial Number: 0SS940810026, Year manufactured: 1996, Airworthiness Date: 10/31/1996, Certificate Issue Date: 04/19/1995

Registrant (Individual): William S Brown, 11562 Range View Rd, Mira Loma, CA 91752 - Aircraft: TRAUGHBER CHARLES W TRI-R TECHNLGIES INC (Category: Land, Seats: 2, Weight: Up to 12,499 Pounds), Engine: LYCOMING 0-290 SERIES (140 HP) (Reciprocating)

N-Number: 528BR, N528BR, N-528BR, Serial Number: 043, Year manufactured: 1996, Airworthiness Date: 11/25/1996, Certificate Issue Date: 10/25/2016

Registrant (Individual): Bravo Siddartha, 10527 56th St, Mira Loma, CA 91752

Deregistered: Cancel Date: 02/03/2020 - Aircraft: PIPER PA-23 (Category: Land, Engines: 2, Seats: 5, Weight: Up to 12,499 Pounds, Speed: 150 mph), Engine: LYCOMING 0-320 SERIES (180 HP) (Reciprocating)

N-Number: 2228P, N2228P, N-2228P, Serial Number: 23-837, Year manufactured: 1956, Certificate Issue Date: 01/25/1967

Registrant (Co-Owned): Ralph Co Ow Peltz, 6085 Bain, Mira Loma, CA 91752, Other Owners: Andy Anderson

Deregistered: Cancel Date: 09/16/2019

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 5 full tracts) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 117 | $213,480 | 76 | $162,778 | 143 | $208,889 | 10 | $136,916 | 27 | $128,180 | 2 | $179,810 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 14 | $194,704 | 14 | $196,782 | 27 | $225,789 | 0 | $0 | 3 | $166,410 | 1 | $179,620 |

| APPLICATIONS DENIED | 28 | $206,652 | 26 | $146,671 | 106 | $237,318 | 9 | $108,050 | 12 | $122,267 | 2 | $227,425 |

| APPLICATIONS WITHDRAWN | 29 | $197,688 | 19 | $185,010 | 55 | $228,512 | 3 | $215,513 | 8 | $161,068 | 1 | $67,000 |

| FILES CLOSED FOR INCOMPLETENESS | 3 | $289,667 | 6 | $224,592 | 16 | $232,738 | 1 | $139,000 | 4 | $125,565 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 0404.03 , 0406.03, 0406.04, 0406.05, 0406.06

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 4 full tracts) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 14 | $210,402 | 1 | $322,000 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 4 | $297,072 | 1 | $322,000 |

| APPLICATIONS DENIED | 3 | $164,903 | 1 | $310,000 |

| APPLICATIONS WITHDRAWN | 0 | $0 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 0404.03 , 0406.03, 0406.04, 0406.05, 0406.06

| Most common first names in Mira Loma, CA among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| John | 111 | 71.8 years |

| James | 92 | 70.8 years |

| Robert | 86 | 71.7 years |

| William | 85 | 73.7 years |

| Mary | 76 | 77.2 years |

| Charles | 59 | 72.7 years |

| George | 57 | 73.0 years |

| Helen | 51 | 79.9 years |

| Joseph | 51 | 74.5 years |

| Richard | 44 | 65.7 years |

| Most common last names in Mira Loma, CA among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 47 | 74.2 years |

| Johnson | 39 | 77.4 years |

| Jones | 24 | 74.4 years |

| Williams | 23 | 71.6 years |

| Miller | 20 | 75.5 years |

| Thompson | 19 | 75.2 years |

| Thomas | 18 | 76.6 years |

| Brown | 17 | 75.4 years |

| Martin | 17 | 74.7 years |

| Moore | 16 | 69.5 years |

- 81.5%Utility gas

- 12.3%Electricity

- 2.8%No fuel used

- 2.0%Wood

- 1.4%Bottled, tank, or LP gas

- 58.9%Utility gas

- 28.1%Electricity

- 8.9%No fuel used

- 1.8%Wood

- 1.2%Bottled, tank, or LP gas

- 1.1%Other fuel

Mira Loma compared to California state average:

- Median house value below state average.

- Unemployed percentage below state average.

- Hispanic race population percentage above state average.

- Renting percentage below state average.

- Length of stay since moving in significantly above state average.

- Percentage of population with a bachelor's degree or higher significantly below state average.

Mira Loma on our top lists:

- #1 on the list of "Top 101 cities with the most residents born in Europe, n.e.c. (population 500+)"

- #1 on the list of "Top 101 cities with the most residents born in Other Eastern Asia (population 500+)"

- #73 on the list of "Top 100 low-educated but high-earning cities (pop. 5,000+)"

- #3 on the list of "Top 101 counties with the highest lead air pollution readings in 2012 (µg/m3)"

- #4 on the list of "Top 101 counties with the highest ground withdrawal of fresh water for public supply"

- #11 on the list of "Top 101 counties with the most Catholic adherents"

- #11 on the list of "Top 101 counties with the highest total withdrawal of fresh water for public supply"

- #12 on the list of "Top 101 counties with the highest carbon monoxide air pollution readings in 2012 (ppm)"

State forum archive:

- California Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79

- Los Angeles Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123

- Monterey County Pages: 2 3

- Orange County Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36

- Sacramento Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32

- San Bernardino and Riverside Counties Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

- San Diego Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76

- San Francisco - Oakland Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72

- San Jose Pages: 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

- Ventura County Pages: 2 3 4 5 6 7

|

|

Total of 43 patent applications in 2008-2024.