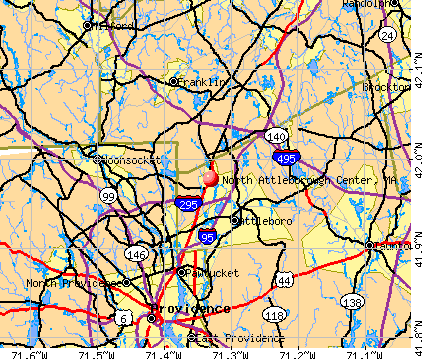

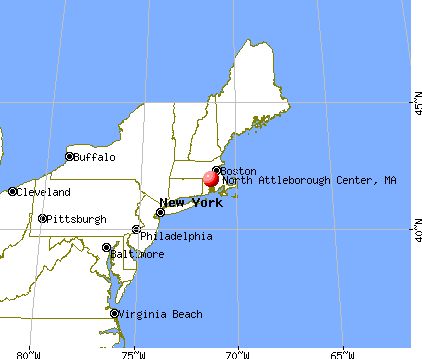

North Attleborough Center, Massachusetts

Submit your own pictures of this place and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

| Males: 8,231 | |

| Females: 8,830 |

| Median resident age: | 35.0 years |

| Massachusetts median age: | 36.5 years |

Zip codes: 02760.

| North Attleborough Center: | $95,386 |

| MA: | $94,488 |

Estimated per capita income in 2022: $50,386 (it was $24,710 in 2000)

North Attleborough Center CDP income, earnings, and wages data

Estimated median house or condo value in 2022: $464,892 (it was $158,300 in 2000)

| North Attleborough Center: | $464,892 |

| MA: | $534,700 |

Mean prices in 2022: all housing units: $449,660; detached houses: $484,124; townhouses or other attached units: $382,766; in 2-unit structures: $322,469; in 3-to-4-unit structures: $355,875; in 5-or-more-unit structures: $269,714; mobile homes: $156,871; occupied boats, rvs, vans, etc.: $49,834

North Attleborough Center, MA residents, houses, and apartments details

Detailed information about poverty and poor residents in North Attleborough Center, MA

- 15,86594.5%White alone

- 2911.7%Asian alone

- 2841.7%Hispanic

- 1781.1%Black alone

- 1350.8%Two or more races

- 270.2%American Indian alone

- 140.08%Other race alone

- 20.01%Native Hawaiian and Other

Pacific Islander alone

Ancestries: Irish (27.3%), Italian (15.7%), French (15.0%), English (13.7%), French Canadian (9.7%), German (7.6%).

Current Local Time: EST time zone

Land area: 5.52 square miles.

Population density: 3,090 people per square mile (average).

620 residents are foreign born (1.4% Asia, 0.9% Europe, 0.8% Latin America, 0.5% North America).

| This place: | 3.7% |

| Massachusetts: | 12.2% |

| North Attleborough Center CDP: | 1.3% ($2,089) |

| Massachusetts: | 1.3% ($2,336) |

Nearest city with pop. 50,000+: Pawtucket, RI (7.4 miles

, pop. 72,958).

Nearest city with pop. 200,000+: Boston, MA (26.9 miles

, pop. 589,141).

Nearest city with pop. 1,000,000+: Bronx, NY (153.3 miles

, pop. 1,332,650).

Nearest cities:

Latitude: 41.98 N, Longitude: 71.33 W

Daytime population change due to commuting: -4,071 (-24.2%)

Workers who live and work in this place: 1,352 (14.9%)

| Here: | 4.1% |

| Massachusetts: | 3.5% |

- Health care (8.1%)

- Educational services (8.0%)

- Finance & insurance (6.9%)

- Construction (6.1%)

- Accommodation & food services (6.0%)

- Computer & electronic products (5.8%)

- Professional, scientific, technical services (5.8%)

- Construction (11.5%)

- Computer & electronic products (6.8%)

- Finance & insurance (5.8%)

- Public administration (5.4%)

- Accommodation & food services (5.3%)

- Miscellaneous manufacturing (5.1%)

- Educational services (4.6%)

- Health care (14.0%)

- Educational services (11.8%)

- Finance & insurance (8.1%)

- Professional, scientific, technical services (7.2%)

- Accommodation & food services (6.7%)

- Miscellaneous manufacturing (5.6%)

- Computer & electronic products (4.8%)

- Other production occupations, including supervisors (5.5%)

- Other sales and related occupations, including supervisors (4.9%)

- Preschool, kindergarten, elementary, and middle school teachers (3.7%)

- Material recording, scheduling, dispatching, and distributing workers (3.5%)

- Other office and administrative support workers, including supervisors (3.4%)

- Retail sales workers, except cashiers (3.4%)

- Other management occupations, except farmers and farm managers (3.2%)

- Other production occupations, including supervisors (5.6%)

- Other sales and related occupations, including supervisors (5.2%)

- Driver/sales workers and truck drivers (4.8%)

- Material recording, scheduling, dispatching, and distributing workers (4.5%)

- Computer specialists (4.4%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (3.9%)

- Sales representatives, services, wholesale and manufacturing (3.9%)

- Preschool, kindergarten, elementary, and middle school teachers (6.1%)

- Secretaries and administrative assistants (6.1%)

- Other production occupations, including supervisors (5.4%)

- Other office and administrative support workers, including supervisors (5.3%)

- Registered nurses (4.8%)

- Other sales and related occupations, including supervisors (4.6%)

- Retail sales workers, except cashiers (3.1%)

Average climate in North Attleborough Center, Massachusetts

Based on data reported by over 4,000 weather stations

(lower is better)

Air Quality Index (AQI) level in 2022 was 67.2. This is about average.

| City: | 67.2 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.196. This is better than average. Closest monitor was 7.5 miles away from the city center.

| City: | 0.196 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 3.02. This is significantly better than average. Closest monitor was 4.3 miles away from the city center.

| City: | 3.02 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.179. This is significantly better than average. Closest monitor was 4.3 miles away from the city center.

| City: | 0.179 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 30.2. This is about average. Closest monitor was 3.8 miles away from the city center.

| City: | 30.2 |

| U.S.: | 33.3 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 6.41. This is better than average. Closest monitor was 7.3 miles away from the city center.

| City: | 6.41 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2001 was 0.0151. This is significantly worse than average. Closest monitor was 7.5 miles away from the city center.

| City: | 0.0151 |

| U.S.: | 0.0093 |

Tornado activity:

North Attleborough Center-area historical tornado activity is near Massachusetts state average. It is 45% smaller than the overall U.S. average.

On 6/9/1953, a category F4 (max. wind speeds 207-260 mph) tornado 24.4 miles away from the North Attleborough Center place center killed 90 people and injured 1228 people and caused between $50,000,000 and $500,000,000 in damages.

On 6/9/1953, a category F3 (max. wind speeds 158-206 mph) tornado 8.4 miles away from the place center injured 17 people and caused between $500,000 and $5,000,000 in damages.

Earthquake activity:

North Attleborough Center-area historical earthquake activity is significantly above Massachusetts state average. It is 73% smaller than the overall U.S. average.On 10/7/1983 at 10:18:46, a magnitude 5.3 (5.1 MB, 5.3 LG, 5.1 ML, Class: Moderate, Intensity: VI - VII) earthquake occurred 204.7 miles away from North Attleborough Center center

On 4/20/2002 at 10:50:47, a magnitude 5.3 (5.3 ML, Depth: 3.0 mi) earthquake occurred 212.0 miles away from North Attleborough Center center

On 1/19/1982 at 00:14:42, a magnitude 4.7 (4.5 MB, 4.7 MD, 4.5 LG, Class: Light, Intensity: IV - V) earthquake occurred 106.2 miles away from North Attleborough Center center

On 4/20/2002 at 10:50:47, a magnitude 5.2 (5.2 MB, 4.2 MS, 5.2 MW, 5.0 MW) earthquake occurred 211.2 miles away from North Attleborough Center center

On 10/16/2012 at 23:12:25, a magnitude 4.7 (4.7 ML, Depth: 10.0 mi) earthquake occurred 117.2 miles away from the city center

On 8/22/1992 at 12:20:32, a magnitude 4.8 (4.8 MB, 3.8 MS, 4.7 LG, Depth: 6.2 mi) earthquake occurred 205.6 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), duration magnitude (MD), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Bristol County (23) is greater than the US average (15).Major Disasters (Presidential) Declared: 12

Emergencies Declared: 11

Causes of natural disasters: Floods: 8, Hurricanes: 7, Storms: 5, Snows: 3, Snowstorms: 3, Winter Storms: 3, Blizzards: 2, Explosion: 1, Heavy Rain: 1, Snowfall: 1, Tropical Storm: 1, Wind: 1 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers near North Attleborough Center:

- MADONNA MANOR NURSING HOME (Nursing Home, about 1 miles away; NORTH ATTLEBORO, MA)

- PLAINVILLE NRSG HME (Nursing Home, about 2 miles away; PLAINVILLE, MA)

- COMMUNITY VISITING NURSE AGENCY, INC (Home Health Center, about 4 miles away; ATTLEBORO, MA)

- STURDY MEMORIAL HOSPITAL Acute Care Hospitals (about 4 miles away; ATTLEBORO, MA)

- ARBOUR-FULLER HOSPITAL (Hospital, about 4 miles away; SOUTH ATTLEBORO, MA)

- GOLDEN LIVING CENTER-ATTLEBORO (Nursing Home, about 4 miles away; ATTLEBORO, MA)

- RIDGEWOOD COURT NURS HOME (Nursing Home, about 4 miles away; ATTLEBORO, MA)

Amtrak stations near North Attleborough Center:

- 12 miles: PROVIDENCE (100 GASPEE ST.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, snack bar, ATM, paid short-term parking, paid long-term parking, call for car rental service, taxi stand, public transit connection.

- 19 miles: ROUTE 128 (WESTWOOD, UNIVERSITY AVE. & RTE. 128) . Services: ticket office, enclosed waiting area, public restrooms, public payphones, vending machines, paid short-term parking, taxi stand, public transit connection.

Colleges/universities with over 2000 students nearest to North Attleborough Center:

- Providence College (about 11 miles; Providence, RI; Full-time enrollment: 4,312)

- Brown University (about 12 miles; Providence, RI; FT enrollment: 8,458)

- Rhode Island School of Design (about 12 miles; Providence, RI; FT enrollment: 2,714)

- Bryant University (about 12 miles; Smithfield, RI; FT enrollment: 3,440)

- Johnson & Wales University-Providence (about 12 miles; Providence, RI; FT enrollment: 10,898)

- Rhode Island College (about 12 miles; Providence, RI; FT enrollment: 7,189)

- Stonehill College (about 15 miles; Easton, MA; FT enrollment: 2,563)

Points of interest:

Notable locations in North Attleborough Center: Emerald Square (A), Sandys Shopping Plaza (B), North Attleboro Fire Department Station 1 Headquarters (C). Display/hide their locations on the map

Shopping Centers: Emerald Square Shopping Center (1), Central Shopping Center (2), Kings Shopping Center (3). Display/hide their locations on the map

Cemetery: Mount Hope Cemetery (1). Display/hide its location on the map

Lakes and reservoirs: Peck Pond (A), Falls Pond (B), Hoppin Hill Reservoir (C), Whiting Pond (D). Display/hide their locations on the map

Streams, rivers, and creeks: Scotts Brook (A). Display/hide its location on the map

| This place: | 2.4 people |

| Massachusetts: | 2.5 people |

| This place: | 62.8% |

| Whole state: | 65.0% |

| This place: | 6.9% |

| Whole state: | 5.4% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.3% of all households

- Gay men: 0.2% of all households

| This place: | 4.7% |

| Whole state: | 9.3% |

| This place: | 1.9% |

| Whole state: | 4.4% |

People in group quarters in North Attleborough Center in 2000:

- 129 people in nursing homes

- 8 people in homes for the mentally retarded

- 7 people in religious group quarters

- 6 people in homes for the mentally ill

- 2 people in other noninstitutional group quarters

For population 15 years and over in North Attleborough Center:

- Never married: 29.4%

- Now married: 52.2%

- Separated: 1.7%

- Widowed: 5.4%

- Divorced: 11.3%

For population 25 years and over in North Attleborough Center:

- High school or higher: 87.5%

- Bachelor's degree or higher: 31.1%

- Graduate or professional degree: 8.5%

- Unemployed: 4.7%

- Mean travel time to work (commute): 27.4 minutes

| Here: | 10.4 |

| Massachusetts average: | 13.1 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for North Attleborough Center, MA (based on Bristol County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 286,113 | 72 |

| Evangelical Protestant | 18,765 | 128 |

| Mainline Protestant | 18,246 | 83 |

| Other | 7,807 | 33 |

| Orthodox | 1,565 | 4 |

| Black Protestant | 511 | 5 |

| None | 215,278 | - |

Food Environment Statistics:

| Here: | 2.00 / 10,000 pop. |

| Massachusetts: | 1.98 / 10,000 pop. |

| Bristol County: | 0.09 / 10,000 pop. |

| Massachusetts: | 0.05 / 10,000 pop. |

| Here: | 1.93 / 10,000 pop. |

| Massachusetts: | 2.22 / 10,000 pop. |

| Bristol County: | 2.35 / 10,000 pop. |

| Massachusetts: | 1.77 / 10,000 pop. |

| Bristol County: | 8.20 / 10,000 pop. |

| Massachusetts: | 8.76 / 10,000 pop. |

| Bristol County: | 9.5% |

| Massachusetts: | 8.1% |

| Bristol County: | 26.9% |

| Massachusetts: | 22.5% |

| This county: | 14.4% |

| Massachusetts: | 16.5% |

4.76% of this county's 2021 resident taxpayers lived in other counties in 2020 ($70,162 average adjusted gross income)

| Here: | 4.76% |

| Massachusetts average: | 6.35% |

0.01% of residents moved from foreign countries ($64 average AGI)

Bristol County: 0.01% Massachusetts average: 0.01%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Plymouth County, MA | |

| from Norfolk County, MA | |

| from Providence County, RI |

4.63% of this county's 2020 resident taxpayers moved to other counties in 2021 ($72,404 average adjusted gross income)

| Here: | 4.63% |

| Massachusetts average: | 7.18% |

0.01% of residents moved to foreign countries ($83 average AGI)

Bristol County: 0.01% Massachusetts average: 0.02%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Plymouth County, MA | |

| to Providence County, RI | |

| to Norfolk County, MA |

Strongest AM radio stations in North Attleborough Center:

- WARL (1320 AM; 5 kW; ATTLEBORO, MA; Owner: THE ADD RADIO GROUP, INC.)

- WALE (990 AM; 50 kW; GREENVILLE, RI; Owner: NORTH AMERICAN BROADCASTING CO., INC.)

- WDDZ (550 AM; 5 kW; PAWTUCKET, RI; Owner: ABC, INC.)

- WEEI (850 AM; 50 kW; BOSTON, MA; Owner: ENTERCOM BOSTON LICENSE, LLC)

- WKOX (1200 AM; 50 kW; FRAMINGHAM, MA; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WBIX (1060 AM; 40 kW; NATICK, MA; Owner: LANGER BROADCASTING CORPORATION)

- WRNI (1290 AM; 10 kW; PROVIDENCE, RI; Owner: WRNI FOUNDATION)

- WAMG (890 AM; 25 kW; DEDHAM, MA; Owner: MEGA COMMUNICATIONS OF DEDHAM LICENSEE, LLC)

- WSKO (790 AM; 5 kW; PROVIDENCE, RI; Owner: CITADEL BROADCASTING COMPANY)

- WRKO (680 AM; 50 kW; BOSTON, MA; Owner: ENTERCOM BOSTON LICENSE, LLC)

- WBZ (1030 AM; 50 kW; BOSTON, MA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WCRN (830 AM; 50 kW; WORCESTER, MA; Owner: CARTER BROADCASTING CORPORATION)

- WPMZ (1110 AM; daytime; 5 kW; EAST PROVIDENCE, RI; Owner: VIDEO MUNDO B/CASTING CO., LLC)

Strongest FM radio stations in North Attleborough Center:

- WWBB (101.5 FM; PROVIDENCE, RI; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WSNE-FM (93.3 FM; TAUNTON, MA; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WWKX (106.3 FM; WOONSOCKET, RI; Owner: AAA ENTERTAINMENT LICENSING LLC)

- WBRU (95.5 FM; PROVIDENCE, RI; Owner: BROWN BROADCASTING SERVICE, INC.)

- WHJY (94.1 FM; PROVIDENCE, RI; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WBMX (98.5 FM; BOSTON, MA; Owner: INFINITY RADIO OPERATIONS INC.)

- WBOS (92.9 FM; BROOKLINE, MA; Owner: GREATER BOSTON RADIO, INC.)

- WJMN (94.5 FM; BOSTON, MA; Owner: AMFM RADIO LICENSES, L.L.C.)

- WCRB (102.5 FM; WALTHAM, MA; Owner: CHARLES RIVER BROADCASTING WCRB LICE)

- WTKK (96.9 FM; BOSTON, MA; Owner: GREATER BOSTON RADIO, INC.)

- WROR-FM (105.7 FM; FRAMINGHAM, MA; Owner: GREATER BOSTON RADIO, INC.)

- WPRO-FM (92.3 FM; PROVIDENCE, RI; Owner: CITADEL BROADCASTING COMPANY)

- WGBH (89.7 FM; BOSTON, MA; Owner: WGBH EDUCATIONAL FOUNDATION)

- WWLI (105.1 FM; PROVIDENCE, RI; Owner: CITADEL BROADCASTING COMPANY)

- WBUR-FM (90.9 FM; BOSTON, MA; Owner: TRUSTEES OF BOSTON UNIVERSITY)

- WXKS-FM (107.9 FM; MEDFORD, MA; Owner: AMFM RADIO LICENSES, L.L.C.)

- WBOT (97.7 FM; BROCKTON, MA; Owner: RADIO ONE LICENSES, LLC)

- WMJX (106.7 FM; BOSTON, MA; Owner: GREATER BOSTON RADIO, INC.)

- WODS (103.3 FM; BOSTON, MA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WGAO (88.3 FM; FRANKLIN, MA; Owner: DEAN COLLEGE)

TV broadcast stations around North Attleborough Center:

- WPRI-TV (Channel 12; PROVIDENCE, RI; Owner: TVL BROADCASTING OF RHODE ISLAND, LLC)

- WNAC-TV (Channel 64; PROVIDENCE, RI; Owner: WNAC, LLC)

- WJAR (Channel 10; PROVIDENCE, RI; Owner: OUTLET BROADCASTING, INC.)

- WLNE-TV (Channel 6; NEW BEDFORD, MA; Owner: FREEDOM BROADCASTING OF SOUTHERN NEW ENGLAND, INC.)

- WSBE-TV (Channel 36; PROVIDENCE, RI; Owner: RHODE ISLAND PUBLIC TELECOM. AUTHORITY)

- WWDP (Channel 46; NORWELL, MA; Owner: NORWELL TELEVISION, LLC)

- WCVB-TV (Channel 5; BOSTON, MA; Owner: WCVB HEARST-ARGYLE TV, INC.)

- WGBH-TV (Channel 2; BOSTON, MA; Owner: WGBH EDUCATIONAL FOUNDATION)

- WMFP (Channel 62; LAWRENCE, MA; Owner: WSAH LICENSE, INC.)

- WHDH-TV (Channel 7; BOSTON, MA; Owner: WHDH-TV)

- WSBK-TV (Channel 38; BOSTON, MA; Owner: VIACOM INC.)

- WLVI-TV (Channel 56; CAMBRIDGE, MA; Owner: WLVI, INC.)

- WBZ-TV (Channel 4; BOSTON, MA; Owner: VIACOM INC.)

- WGBX-TV (Channel 44; BOSTON, MA; Owner: WGBH EDUCATIONAL FOUNDATION)

- WFXT (Channel 25; BOSTON, MA; Owner: FOX TELEVISION STATIONS INC.)

- WPXQ (Channel 69; BLOCK ISLAND, RI; Owner: OCEAN STATE TELEVISION, L.L.C.)

- WUTF (Channel 66; MARLBOROUGH, MA; Owner: TELEFUTURA BOSTON LLC)

- WUNI (Channel 27; WORCESTER, MA; Owner: ENTRAVISION HOLDINGS, LLC)

- W40BO (Channel 40; BOSTON, MA; Owner: PAXSON COMMUNICATIONS LPTV, INC.)

- WBPX (Channel 68; BOSTON, MA; Owner: PAXSON BOSTON-68 LICENSE, INC.)

- WRIW-LP (Channel 50; PROVIDENCE, RI; Owner: ZGS PROVIDENCE, INC.)

- WLWC (Channel 28; NEW BEDFORD, MA; Owner: C-28 FCC LICENSEE SUBSIDIARY, LLC)

- WTMU-LP (Channel 32; BOSTON, MA; Owner: ZGS BOSTON, INC.)

- WCEA-LP (Channel 58; BOSTON, MA; Owner: CHANNEL 19 TV CORPORATION)

- WYDN (Channel 48; WORCESTER, MA; Owner: EDUCATIONAL PUBLIC TV CORPORATION)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 1 full and 2 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 39 | $246,604 | 54 | $209,585 | 274 | $227,833 | 16 | $125,991 | 4 | $514,500 | 20 | $210,949 | 2 | $70,020 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 5 | $142,484 | 4 | $257,353 | 16 | $245,771 | 0 | $0 | 1 | $9,392,250 | 1 | $172,000 | 1 | $60,560 |

| APPLICATIONS DENIED | 4 | $207,852 | 9 | $181,784 | 75 | $235,369 | 4 | $95,332 | 0 | $0 | 5 | $201,200 | 1 | $18,170 |

| APPLICATIONS WITHDRAWN | 4 | $235,250 | 7 | $245,600 | 51 | $238,224 | 1 | $159,080 | 0 | $0 | 1 | $119,010 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $192,780 | 2 | $213,620 | 15 | $235,011 | 1 | $148,860 | 0 | $0 | 1 | $235,000 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 6301.00 , 6302.00, 6304.00

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 1 full and 2 partial tracts) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 11 | $253,828 | 4 | $316,202 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 4 | $242,125 | 2 | $417,150 |

| APPLICATIONS DENIED | 3 | $279,670 | 2 | $278,885 |

| APPLICATIONS WITHDRAWN | 1 | $169,000 | 1 | $346,000 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 6301.00 , 6302.00, 6304.00

- 64.5%Fuel oil, kerosene, etc.

- 22.2%Utility gas

- 12.3%Electricity

- 0.6%Bottled, tank, or LP gas

- 0.2%Coal or coke

- 0.2%Other fuel

- 42.6%Electricity

- 28.0%Utility gas

- 27.5%Fuel oil, kerosene, etc.

- 1.3%Bottled, tank, or LP gas

- 0.6%No fuel used

North Attleborough Center compared to Massachusetts state average:

- Unemployed percentage significantly below state average.

- Black race population percentage significantly below state average.

- Hispanic race population percentage significantly below state average.

- Median age below state average.

- Foreign-born population percentage significantly below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

- Institutionalized population percentage significantly above state average.

North Attleborough Center on our top lists:

- #12 on the list of "Top 101 cities with largest percentage of females in industries: miscellaneous manufacturing (population 5,000+)"

- #18 on the list of "Top 101 cities with largest percentage of males in industries: health and personal care, except drug, stores (population 5,000+)"

- #18 on the list of "Top 101 cities with largest percentage of males in industries: miscellaneous manufacturing (population 5,000+)"

- #33 on the list of "Top 101 cities with largest percentage of males in industries: drugs, sundries, and chemical and allied products merchant wholesalers (population 5,000+)"

- #37 on the list of "Top 101 cities with largest percentage of males in industries: other direct selling establishments (population 5,000+)"

- #39 on the list of "Top 101 cities with largest percentage of females in occupations: rail and water transportation workers (population 5,000+)"

- #45 on the list of "Top 101 cities with largest percentage of males in industries: vending machine operators (population 5,000+)"

- #58 on the list of "Top 101 cities with largest percentage of females in industries: computer and electronic products (population 5,000+)"

- #58 on the list of "Top 101 cities with largest percentage of females in industries: pharmacies and drug stores (population 5,000+)"

- #61 on the list of "Top 101 cities with largest percentage of males in industries: pharmacies and drug stores (population 5,000+)"

- #81 on the list of "Top 101 cities with largest percentage of females in occupations: judges, magistrates, and other judicial workers (population 5,000+)"

- #84 on the list of "Top 101 cities with largest percentage of males in industries: clothing and accessories, including shoe, stores (population 5,000+)"

- #85 on the list of "Top 101 cities with largest percentage of males in industries: computer and electronic products (population 5,000+)"

- #93 on the list of "Top 101 cities with largest percentage of females in occupations: other production occupations including supervisors (population 5,000+)"

- #100 on the list of "Top 101 cities with largest percentage of males in industries: leather and allied products (population 5,000+)"

- #14 on the list of "Top 101 counties with the lowest percentage of residents that keep firearms around their homes"

- #29 on the list of "Top 101 counties with the lowest percentage of residents relocating to foreign countries in 2011 (pop. 50,000+)"

- #32 on the list of "Top 101 counties with the most Catholic congregations"

- #34 on the list of "Top 101 counties with the highest percentage of residents that smoked 100+ cigarettes in their lives"

- #41 on the list of "Top 101 counties with the most Catholic adherents"