North Stanwood, Washington

Submit your own pictures of this place and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

| Males: 261 | |

| Females: 258 |

| Median resident age: | 40.4 years |

| Washington median age: | 35.3 years |

Zip codes: 98292.

| North Stanwood: | $111,356 |

| WA: | $91,306 |

Estimated per capita income in 2022: $52,896 (it was $24,128 in 2000)

North Stanwood CDP income, earnings, and wages data

Estimated median house or condo value in 2022: $596,350 (it was $157,700 in 2000)

| North Stanwood: | $596,350 |

| WA: | $569,500 |

Mean prices in 2022: all housing units: $766,619; detached houses: $825,949; townhouses or other attached units: $643,803; in 2-unit structures: $530,516; in 3-to-4-unit structures: $479,562; in 5-or-more-unit structures: $400,308; mobile homes: $303,974; occupied boats, rvs, vans, etc.: $101,172

North Stanwood, WA residents, houses, and apartments details

- 43693.2%White alone

- 122.6%Hispanic

- 102.1%Two or more races

- 61.3%Asian alone

- 30.6%American Indian alone

- 10.2%Native Hawaiian and Other

Pacific Islander alone

Races in North Stanwood detailed stats: ancestries, foreign born residents, place of birth

| moving to Stanwood (4 replies) |

Latest news from North Stanwood, WA collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: German (20.9%), English (17.5%), Norwegian (11.5%), French (11.3%), Swedish (7.7%), Irish (5.8%).

Current Local Time: PST time zone

Land area: 2.25 square miles.

Population density: 230 people per square mile (very low).

8 residents are foreign born

| This place: | 1.7% |

| Washington: | 10.4% |

| North Stanwood CDP: | 1.2% ($1,852) |

| Washington: | 1.2% ($1,915) |

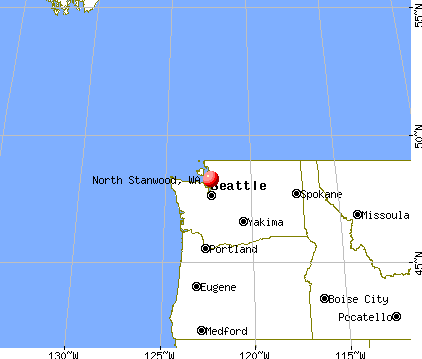

Nearest city with pop. 50,000+: Everett, WA (21.4 miles

, pop. 91,488).

Nearest city with pop. 200,000+: Seattle, WA (43.6 miles

, pop. 563,374).

Nearest city with pop. 1,000,000+: Los Angeles, CA (1001.3 miles

, pop. 3,694,820).

Nearest cities:

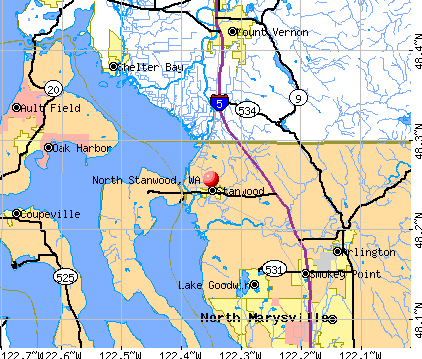

Latitude: 48.26 N, Longitude: 122.35 W

Property values in North Stanwood, WA

| Here: | 3.6% |

| Washington: | 4.6% |

- Construction (13.4%)

- Health care (11.9%)

- Educational services (7.5%)

- Food (6.3%)

- U. S. Postal service (6.3%)

- Religious, grantmaking, civic, professional, similar organizations (6.3%)

- Accommodation & food services (6.0%)

- Construction (24.7%)

- Wood products (9.6%)

- Building material & garden equipment & supplies dealers (6.8%)

- Transportation equipment (6.8%)

- Other transportation, support activities, couriers (6.8%)

- Food (6.2%)

- Paper (6.2%)

- Health care (26.2%)

- Educational services (16.4%)

- Real estate & rental & leasing (9.0%)

- Publishing, motion picture & sound recording industries (8.2%)

- Computer & electronic products (7.4%)

- Food (6.6%)

- U. S. Postal service (6.6%)

- Material recording, scheduling, dispatching, and distributing workers (13.4%)

- Other sales and related occupations, including supervisors (6.7%)

- Other management occupations, except farmers and farm managers (6.3%)

- Accountants and auditors (6.0%)

- Electricians (5.6%)

- Other production occupations, including supervisors (5.2%)

- Other teachers, instructors, education, training, and library occupations (4.1%)

- Material recording, scheduling, dispatching, and distributing workers (13.0%)

- Electricians (10.3%)

- Other production occupations, including supervisors (9.6%)

- Assemblers and fabricators (6.8%)

- Rail and water transportation workers (6.8%)

- Entertainers and performers, sports, and related workers (6.2%)

- Building and grounds cleaning and maintenance occupations (6.2%)

- Material recording, scheduling, dispatching, and distributing workers (13.9%)

- Accountants and auditors (13.1%)

- Other teachers, instructors, education, training, and library occupations (9.0%)

- Other sales and related occupations, including supervisors (9.0%)

- Art and design workers (8.2%)

- Other healthcare support occupations (8.2%)

- Other management occupations, except farmers and farm managers (7.4%)

Average climate in North Stanwood, Washington

Based on data reported by over 4,000 weather stations

(lower is better)

Air Quality Index (AQI) level in 2022 was 91.0. This is worse than average.

| City: | 91.0 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2002 was 0.749. This is significantly worse than average. Closest monitor was 20.3 miles away from the city center.

| City: | 0.749 |

| U.S.: | 0.251 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.347. This is significantly better than average. Closest monitor was 15.1 miles away from the city center.

| City: | 0.347 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 24.1. This is better than average. Closest monitor was 16.1 miles away from the city center.

| City: | 24.1 |

| U.S.: | 33.3 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 5.84. This is better than average. Closest monitor was 12.2 miles away from the city center.

| City: | 5.84 |

| U.S.: | 8.11 |

Earthquake activity:

North Stanwood-area historical earthquake activity is significantly above Washington state average. It is 1129% greater than the overall U.S. average.On 4/13/1949 at 19:55:42, a magnitude 7.0 (7.0 UK, Class: Major, Intensity: VIII - XII) earthquake occurred 69.9 miles away from the city center, causing $80,000,000 total damage

On 2/28/2001 at 18:54:32, a magnitude 6.8 (6.8 MD, Depth: 32.2 mi, Class: Strong, Intensity: VII - IX) earthquake occurred 78.6 miles away from North Stanwood center

On 2/28/2001 at 18:54:32, a magnitude 6.8 (6.5 MB, 6.6 MS, 6.8 MW) earthquake occurred 81.4 miles away from the city center, causing $2,000,000,000 total damage and $305,000,000 insured losses

On 4/29/1965 at 15:28:43, a magnitude 6.6 (6.6 UK) earthquake occurred 65.0 miles away from the city center, causing $28,000,000 total damage

On 7/3/1999 at 01:43:54, a magnitude 5.8 (5.4 MB, 5.5 MS, 5.8 MW, 5.3 ME, Depth: 25.2 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 92.4 miles away from the city center

On 5/3/1996 at 04:04:22, a magnitude 5.5 (5.2 MB, 5.3 MD, 5.5 ML, Depth: 2.5 mi) earthquake occurred 40.4 miles away from North Stanwood center

Magnitude types: body-wave magnitude (MB), duration magnitude (MD), energy magnitude (ME), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Snohomish County (31) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 27

Emergencies Declared: 2

Causes of natural disasters: Floods: 21, Storms: 17, Mudslides: 14, Landslides: 10, Winter Storms: 6, Winds: 5, Earthquakes: 2, Heavy Rain: 1, Hurricane: 1, Snow: 1, Tornado: 1, Volcanic Eruption: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers near North Stanwood:

- JOSEPHINE SUNSET HOME (Nursing Home, about 2 miles away; STANWOOD, WA)

- WARM BEACH HEALTH CARE CENTER (Nursing Home, about 6 miles away; STANWOOD, WA)

- PUGET SOUND KIDNEY CENTER SMOKEY POINT (Dialysis Facility, about 10 miles away; ARLINGTON, WA)

- SKAGIT HOSPICE SERVICES, LLC (Hospital, about 12 miles away; MOUNT VERNON, WA)

- SKAGIT VALLEY HOSPITAL Acute Care Hospitals (about 12 miles away; MOUNT VERNON, WA)

- REGENCY CARE CENTER AT ARLINGTON (Nursing Home, about 12 miles away; ARLINGTON, WA)

- LIFE CARE CENTER OF MOUNT VERNON (Nursing Home, about 12 miles away; MOUNT VERNON, WA)

Colleges/universities with over 2000 students nearest to North Stanwood:

- Skagit Valley College (about 13 miles; Mount Vernon, WA; Full-time enrollment: 3,803)

- Everett Community College (about 19 miles; Everett, WA; FT enrollment: 5,818)

- Edmonds Community College (about 31 miles; Lynnwood, WA; FT enrollment: 7,271)

- Western Washington University (about 34 miles; Bellingham, WA; FT enrollment: 13,875)

- University of Washington-Bothell Campus (about 36 miles; Bothell, WA; FT enrollment: 3,902)

- Cascadia Community College (about 36 miles; Bothell, WA; FT enrollment: 2,238)

- Shoreline Community College (about 36 miles; Shoreline, WA; FT enrollment: 5,026)

Points of interest:

Notable locations in North Stanwood: Aqua Farm (A), Harvey Arabian Farms (B), Tazer Valley Farm (C). Display/hide their locations on the map

Church in North Stanwood: Cedarhome Baptist Church (A). Display/hide its location on the map

| This place: | 2.7 people |

| Washington: | 2.5 people |

| This place: | 72.7% |

| Whole state: | 66.5% |

| This place: | 1.2% |

| Whole state: | 6.1% |

No gay or lesbian households reported

| This place: | 1.6% |

| Whole state: | 10.6% |

| This place: | 1.6% |

| Whole state: | 4.6% |

For population 15 years and over in North Stanwood:

- Never married: 19.8%

- Now married: 67.8%

- Separated: 0.0%

- Widowed: 0.0%

- Divorced: 12.4%

For population 25 years and over in North Stanwood:

- High school or higher: 88.1%

- Bachelor's degree or higher: 16.3%

- Graduate or professional degree: 6.1%

- Mean travel time to work (commute): 29.2 minutes

| Here: | 7.9 |

| Washington average: | 11.3 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for North Stanwood, WA (based on Snohomish County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 85,354 | 327 |

| Catholic | 75,393 | 16 |

| Other | 34,270 | 90 |

| Mainline Protestant | 21,642 | 71 |

| Orthodox | 1,943 | 6 |

| Black Protestant | 406 | 4 |

| None | 494,327 | - |

Food Environment Statistics:

| Snohomish County: | 1.79 / 10,000 pop. |

| Washington: | 2.06 / 10,000 pop. |

| This county: | 0.18 / 10,000 pop. |

| Washington: | 0.19 / 10,000 pop. |

| Snohomish County: | 1.42 / 10,000 pop. |

| Washington: | 1.18 / 10,000 pop. |

| Here: | 2.55 / 10,000 pop. |

| Washington: | 2.67 / 10,000 pop. |

| This county: | 6.95 / 10,000 pop. |

| Washington: | 8.26 / 10,000 pop. |

| Snohomish County: | 7.5% |

| State: | 7.7% |

| This county: | 27.4% |

| Washington: | 25.7% |

| Snohomish County: | 14.3% |

| Washington: | 13.9% |

7.60% of this county's 2021 resident taxpayers lived in other counties in 2020 ($97,930 average adjusted gross income)

| Here: | 7.60% |

| Washington average: | 7.53% |

0.04% of residents moved from foreign countries ($285 average AGI)

Snohomish County: 0.04% Washington average: 0.05%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from King County, WA | |

| from Pierce County, WA | |

| from Skagit County, WA |

7.20% of this county's 2020 resident taxpayers moved to other counties in 2021 ($85,049 average adjusted gross income)

| Here: | 7.20% |

| Washington average: | 7.40% |

0.02% of residents moved to foreign countries ($153 average AGI)

Snohomish County: 0.02% Washington average: 0.04%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to King County, WA | |

| to Pierce County, WA | |

| to Skagit County, WA |

Strongest AM radio stations in North Stanwood:

- KAPS (660 AM; 10 kW; MOUNT VERNON, WA; Owner: VALLEY BROADCASTERS, INC.)

- KRKO (1380 AM; 50 kW; EVERETT, WA; Owner: S-R BROADCASTING, CO.)

- KBRC (1430 AM; 5 kW; MOUNT VERNON, WA; Owner: JIM AND ANN KEANE)

- KIXI (880 AM; 50 kW; MERCER ISLAND/SEATTL, WA; Owner: BELLEVUE RADIO, INC.)

- KKOL (1300 AM; 50 kW; SEATTLE, WA; Owner: INSPIRATION MEDIA, INC.)

- KIRO (710 AM; 50 kW; SEATTLE, WA; Owner: ENTERCOM SEATTLE LICENSE, LLC)

- KRPI (1550 AM; 50 kW; FERNDALE, WA; Owner: BBC BROADCASTING, INC.)

- KGNW (820 AM; 50 kW; BURIEN-SEATTLE, WA; Owner: INSPIRATION MEDIA, INC.)

- KTTH (770 AM; 50 kW; SEATTLE, WA; Owner: ENTERCOM SEATTLE LICENSE, LLC)

- KOMO (1000 AM; 50 kW; SEATTLE, WA; Owner: FISHER BROADCASTING - SEATTLE RADIO, L.L.C.)

- KARI (550 AM; 25 kW; BLAINE, WA; Owner: WAY BROADCASTING, INC.)

- KYCW (1090 AM; 50 kW; SEATTLE, WA; Owner: INFINITY RADIO SUBSIDIARY OPERATIONS INC.)

- KJR (950 AM; 50 kW; SEATTLE, WA)

Strongest FM radio stations in North Stanwood:

- K206CU (89.1 FM; MOUNT VERNON, WA; Owner: CALVARY CHAPEL OF TWIN FALLS, INC.)

- KSVR (91.7 FM; MOUNT VERNON, WA; Owner: BOARD OF TRUSTEES OF SKAGIT VALLEY COLLEGE)

- KISM (92.9 FM; BELLINGHAM, WA; Owner: SAGA BROADCASTING, LLC)

- KWPZ (106.5 FM; LYNDEN, WA; Owner: CRISTA MINISTRIES, INC.)

- KAFE (104.3 FM; BELLINGHAM, WA; Owner: SAGA BROADCASTING, LLC)

- KISW (99.9 FM; SEATTLE, WA; Owner: ENTERCOM SEATTLE LICENSE, LLC)

- KQBZ (100.7 FM; SEATTLE, WA; Owner: ENTERCOM SEATTLE LICENSE, LLC)

- K205DL (88.9 FM; GRANITE FALLS/EVERET, WA; Owner: CALVARY CHAPEL OF TWIN FALLS, INC.)

- KMTT (103.7 FM; TACOMA, WA; Owner: ENTERCOM SEATTLE LICENSE, LLC)

- KNDD (107.7 FM; SEATTLE, WA; Owner: ENTERCOM SEATTLE LICENSE, LLC)

- KYPT (96.5 FM; SEATTLE, WA; Owner: INFINITY RADIO SUBSIDIARY OPERATIONS INC.)

- KCMS (105.3 FM; EDMONDS, WA; Owner: CRISTA MINISTRIES, INC.)

- KBSG-FM (97.3 FM; TACOMA, WA; Owner: ENTERCOM SEATTLE LICENSE, LLC)

- KZOK-FM (102.5 FM; SEATTLE, WA; Owner: INFINITY RADIO SUBSIDIARY OPERATIONS INC.)

- KBKS (106.1 FM; TACOMA, WA; Owner: INFINITY RADIO SUBSIDIARY OPERATIONS INC.)

- KING-FM (98.1 FM; SEATTLE, WA; Owner: CLASSIC RADIO, INC.)

- KLSY-FM (92.5 FM; BELLEVUE, WA; Owner: BELLEVUE RADIO INC.)

- KPLU-FM (88.5 FM; TACOMA, WA; Owner: PACIFIC LUTHERAN UNIVERSITY, INC.)

- KWJZ (98.9 FM; SEATTLE, WA; Owner: ORCA RADIO, INC.)

- KMPS-FM (94.1 FM; SEATTLE, WA; Owner: INFINITY RADIO SUBSIDIARY OPERATIONS INC.)

North Stanwood fatal accident list:

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 1 partial tract) | ||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 7 | $235,871 | 5 | $262,270 | 37 | $227,860 | 2 | $188,175 | 2 | $169,310 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | $0 | 1 | $253,460 | 7 | $218,059 | 1 | $12,420 | 1 | $180,490 |

| APPLICATIONS DENIED | 1 | $157,000 | 1 | $239,680 | 12 | $249,808 | 0 | $0 | 1 | $239,680 |

| APPLICATIONS WITHDRAWN | 1 | $376,120 | 1 | $85,390 | 10 | $247,790 | 0 | $0 | 1 | $65,060 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 | 3 | $242,617 | 0 | $0 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 0533.01

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 1 partial tract) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 1 | $189,300 | 1 | $332,300 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | $0 | 0 | $0 |

| APPLICATIONS DENIED | 0 | $0 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 0 | $0 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 0533.01

- 67.2%Electricity

- 18.2%Wood

- 7.3%Bottled, tank, or LP gas

- 7.3%Fuel oil, kerosene, etc.

- 75.0%Electricity

- 25.0%Wood

North Stanwood compared to Washington state average:

- Unemployed percentage significantly below state average.

- Black race population percentage significantly below state average.

- Hispanic race population percentage significantly below state average.

- Median age significantly above state average.

- Foreign-born population percentage significantly below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

- Percentage of population with a bachelor's degree or higher below state average.

North Stanwood on our top lists:

- #3 on the list of "Top 101 cities with the most cars per house, population 500+"

- #24 on the list of "Top 101 counties with the lowest Particulate Matter (PM2.5) Annual air pollution readings in 2012 (µg/m3)"

- #45 on the list of "Top 101 counties with the lowest number of infant deaths per 1000 residents 2007-2013 (pop. 50,000+)"

- #46 on the list of "Top 101 counties with the highest percentage of residents that exercised in the past month"

- #48 on the list of "Top 101 counties with the highest average weight of females"

- #60 on the list of "Top 101 counties with the most Other congregations (pop. 50,000+)"