Oklahoma City, Oklahoma

Oklahoma City: Skyline from I-235

Oklahoma City: Off of I-40 - Taken April 2006

Oklahoma City: Oklahoma City

Oklahoma City: Bricktown

Oklahoma City: Looking N. from 6700 blk. of Stoneycreek Dr.

Oklahoma City: Lighthouse at Hefner Lake in Oklahoma City at sunset.

Oklahoma City: Field of empty chairs - part of the 168 chairs one for each life lost, OKC National Memorial

Oklahoma City: OKC at Christmas

Oklahoma City: Oklahoma City memorial

Oklahoma City: I-40/I-35 in Oklahoma City

Oklahoma City: Downtown Oklahoma City

- see

118

more - add

your

Submit your own pictures of this city and show them to the world

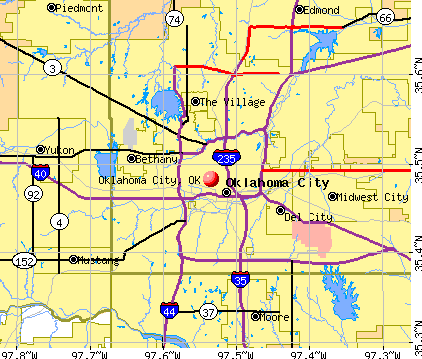

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +37.3%

| Males: 340,423 | |

| Females: 354,377 |

| Median resident age: | 34.7 years |

| Oklahoma median age: | 37.1 years |

Zip codes: 73078, 73097, 73099, 73102, 73103, 73104, 73105, 73106, 73107, 73108, 73109, 73111, 73112, 73114, 73118, 73119, 73128, 73129, 73131, 73134, 73139, 73142, 73149, 73151, 73159, 73162, 73169, 73173, 73179.

Oklahoma City Zip Code Map| Oklahoma City: | $63,713 |

| OK: | $59,673 |

Estimated per capita income in 2022: $35,902 (it was $19,098 in 2000)

Oklahoma City city income, earnings, and wages data

Estimated median house or condo value in 2022: $227,300 (it was $78,100 in 2000)

| Oklahoma City: | $227,300 |

| OK: | $191,700 |

Mean prices in 2022: all housing units: $268,616; detached houses: $277,368; townhouses or other attached units: $232,094; in 2-unit structures: $203,338; in 3-to-4-unit structures: $130,712; in 5-or-more-unit structures: $202,643; mobile homes: $84,317; occupied boats, rvs, vans, etc.: $48,932

Median gross rent in 2022: $1,020.

(10.1% for White Non-Hispanic residents, 26.0% for Black residents, 21.5% for Hispanic or Latino residents, 21.0% for American Indian residents, 8.9% for Native Hawaiian and other Pacific Islander residents, 25.9% for other race residents, 18.7% for two or more races residents)

Detailed information about poverty and poor residents in Oklahoma City, OK

- 356,31851.3%White alone

- 143,19120.6%Hispanic

- 84,87112.2%Black alone

- 57,1958.2%Two or more races

- 31,5614.5%Asian alone

- 18,6302.7%American Indian alone

- 1,9780.3%Other race alone

- 1,0240.1%Native Hawaiian and Other

Pacific Islander alone

Races in Oklahoma City detailed stats: ancestries, foreign born residents, place of birth

According to our research of Oklahoma and other state lists, there were 1,372 registered sex offenders living in Oklahoma City, Oklahoma as of April 25, 2024.

The ratio of all residents to sex offenders in Oklahoma City is 465 to 1.

The ratio of registered sex offenders to all residents in this city is near the state average.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is smaller than the state average.- means the value is about the same as the state average.

- means the value is bigger than the state average.

- means the value is much bigger than the state average.

Crime rate in Oklahoma City detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 1,378 (1,105 officers - 979 male; 126 female).

| Officers per 1,000 residents here: | 1.65 |

| Oklahoma average: | 2.27 |

| Oklahoma City Poverty (76 replies) |

| 70% of Oklahoma City Voters Reject City Sale Tax Cut (11 replies) |

| Kansas City vs Oklahoma City (218 replies) |

| Sorry To Break This To All Of You Oklahoma City Oklahoma Haters..... But OKC Is One Of AMERICA'S TOP TEN BOOM CITIES (139 replies) |

| Relocating to Oklahoma City and need some advice on Housing (6 replies) |

| NYC to OKC - Potential move (34 replies) |

Latest news from Oklahoma City, OK collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: American (8.8%), English (6.7%), German (5.6%), Irish (4.1%), European (2.6%), Italian (1.0%).

Current Local Time: CST time zone

Incorporated in 1890

Elevation: 1230 feet

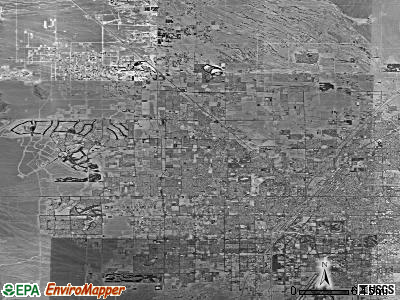

Land area: 607.0 square miles.

Population density: 1,145 people per square mile (low).

80,505 residents are foreign born (7.1% Latin America, 3.3% Asia).

| This city: | 11.7% |

| Oklahoma: | 6.1% |

Median real estate property taxes paid for housing units with mortgages in 2022: $2,478 (1.0%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $1,784 (1.0%)

Nearest city with pop. 1,000,000+: Dallas, TX (190.4 miles

, pop. 1,188,580).

Nearest cities:

Latitude: 35.48 N, Longitude: 97.53 W

Daytime population change due to commuting: +100,901 (+14.5%)

Workers who live and work in this city: 276,283 (80.1%)

Area codes: 405, 580

Property values in Oklahoma City, OK

Detailed articles:

- Oklahoma City: Introduction

- Oklahoma City Basic Facts

- Oklahoma City: Communications

- Oklahoma City: Convention Facilities

- Oklahoma City: Economy

- Oklahoma City: Education and Research

- Oklahoma City: Geography and Climate

- Oklahoma City: Health Care

- Oklahoma City: History

- Oklahoma City: Municipal Government

- Oklahoma City: Population Profile

- Oklahoma City: Recreation

- Oklahoma City: Transportation

Oklahoma City tourist attractions:

- Colcord Hotel - Oklahoma City OK - Colcord Hotel Downtown

- Crowne Plaza Oklahoma City - Oklahoma City OK - Crowne Plaza Hotel

- Ford Center Oklahoma City, Oklahoma

- Hilton Skirvin Hotel - Oklahoma City OK - Hilton Hotel

- Marriott Waterford - Oklahoma City OK - Marriot Hotel

- Oklahoma City Zoological Park - Oklahoma City, Oklahoma - large zoo and tourist attraction in Oklahoma

- Omniplex Science Museum, Oklahoma City, OK

- Renaissance Oklahoma City Convention Center Hotel - Oklahoma City OK Renaissance Hotel Convention Center

- Science Museum Oklahoma - Oklahoma City OK - Science Museum Planetarium

- Sheraton Oklahoma City - Oklahoma City OK - Sheration Downtown Hotel

- Will Rogers World Airport - Oklahoma City, OK - Commercial airport

Oklahoma City, Oklahoma accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 3298 buildings, average cost: $288,800

- 2021: 4127 buildings, average cost: $236,200

- 2020: 3800 buildings, average cost: $220,700

- 2019: 3243 buildings, average cost: $213,200

- 2018: 2955 buildings, average cost: $206,900

- 2017: 2707 buildings, average cost: $201,500

- 2016: 2899 buildings, average cost: $203,600

- 2015: 3141 buildings, average cost: $201,100

- 2014: 3306 buildings, average cost: $205,100

- 2013: 3609 buildings, average cost: $193,800

- 2012: 3260 buildings, average cost: $186,400

- 2011: 1293 buildings, average cost: $149,900

- 2010: 1312 buildings, average cost: $149,300

- 2009: 1371 buildings, average cost: $151,600

- 2008: 1474 buildings, average cost: $142,600

- 2007: 2559 buildings, average cost: $145,800

- 2006: 3540 buildings, average cost: $134,500

- 2005: 4066 buildings, average cost: $134,300

- 2004: 3815 buildings, average cost: $135,100

- 2003: 3402 buildings, average cost: $129,400

- 2002: 2997 buildings, average cost: $125,800

- 2001: 2373 buildings, average cost: $122,300

- 2000: 2044 buildings, average cost: $115,300

- 1999: 2867 buildings, average cost: $112,900

- 1998: 2402 buildings, average cost: $104,600

- 1997: 2040 buildings, average cost: $99,800

| Here: | 3.1% |

| Oklahoma: | 3.2% |

Population change in the 1990s: +61,176 (+13.7%).

- Health care (10.3%)

- Educational services (8.2%)

- Construction (7.7%)

- Public administration (7.6%)

- Professional, scientific, technical services (7.5%)

- Accommodation & food services (6.4%)

- Finance & insurance (5.2%)

- Construction (11.9%)

- Professional, scientific, technical services (8.8%)

- Public administration (8.8%)

- Accommodation & food services (5.6%)

- Administrative & support & waste management services (5.4%)

- Educational services (4.7%)

- Health care (4.4%)

- Health care (17.0%)

- Educational services (12.1%)

- Accommodation & food services (7.2%)

- Finance & insurance (6.5%)

- Public administration (6.3%)

- Professional, scientific, technical services (6.0%)

- Social assistance (4.4%)

- Other management occupations, except farmers and farm managers (5.7%)

- Cooks and food preparation workers (5.2%)

- Laborers and material movers, hand (4.0%)

- Building and grounds cleaning and maintenance occupations (3.8%)

- Computer specialists (3.4%)

- Information and record clerks, except customer service representatives (2.4%)

- Health technologists and technicians (2.0%)

- Other management occupations, except farmers and farm managers (6.0%)

- Computer specialists (5.3%)

- Laborers and material movers, hand (4.9%)

- Cooks and food preparation workers (4.2%)

- Building and grounds cleaning and maintenance occupations (4.0%)

- Vehicle and mobile equipment mechanics, installers, and repairers (3.2%)

- Construction laborers (3.0%)

- Cooks and food preparation workers (6.3%)

- Other management occupations, except farmers and farm managers (5.5%)

- Information and record clerks, except customer service representatives (4.2%)

- Registered nurses (3.5%)

- Building and grounds cleaning and maintenance occupations (3.4%)

- Health technologists and technicians (3.3%)

- Secretaries and administrative assistants (3.2%)

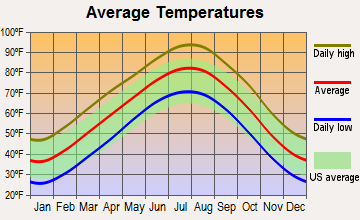

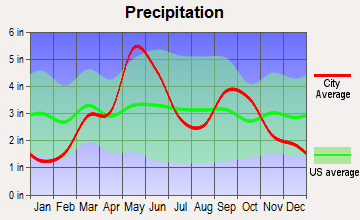

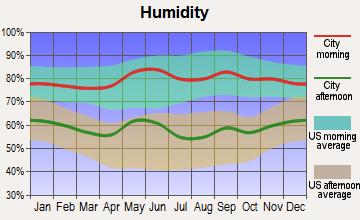

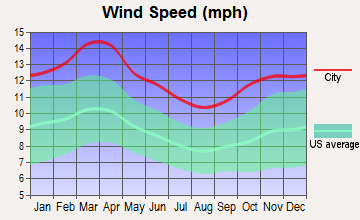

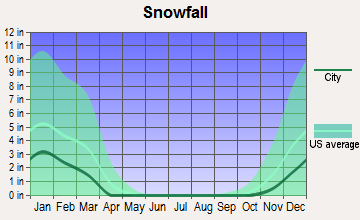

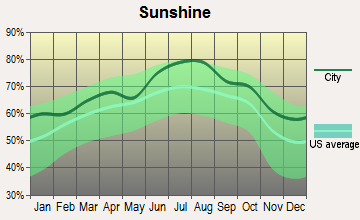

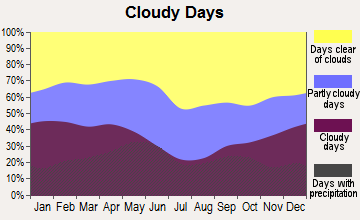

Average climate in Oklahoma City, Oklahoma

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

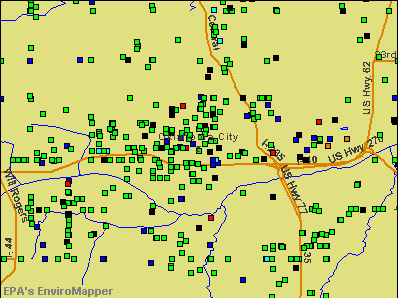

Air Quality Index (AQI) level in 2023 was 88.1. This is worse than average.

| City: | 88.1 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2023 was 0.439. This is significantly worse than average. Closest monitor was 0.7 miles away from the city center.

| City: | 0.439 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2018 was 6.55. This is worse than average. Closest monitor was 0.7 miles away from the city center.

| City: | 6.55 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2023 was 0.00505. This is significantly better than average. Closest monitor was 0.7 miles away from the city center.

| City: | 0.00505 |

| U.S.: | 1.51465 |

Ozone [ppb] level in 2023 was 38.0. This is about average. Closest monitor was 2.3 miles away from the city center.

| City: | 38.0 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2023 was 23.7. This is worse than average. Closest monitor was 0.8 miles away from the city center.

| City: | 23.7 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 10.2. This is worse than average. Closest monitor was 0.8 miles away from the city center.

| City: | 10.2 |

| U.S.: | 8.1 |

Lead (Pb) [µg/m3] level in 2022 was 0.00179. This is significantly better than average. Closest monitor was 0.7 miles away from the city center.

| City: | 0.00179 |

| U.S.: | 0.00931 |

Tornado activity:

Oklahoma City-area historical tornado activity is slightly above Oklahoma state average. It is 253% greater than the overall U.S. average.

On 5/3/1999, a category F5 (max. wind speeds 261-318 mph) tornado 6.3 miles away from the Oklahoma City city center killed 36 people and injured 583 people and caused $1000 million in damages.

On 5/8/2003, a category F4 (max. wind speeds 207-260 mph) tornado 10.5 miles away from the city center injured 134 people and caused $370 million in damages.

Earthquake activity:

Oklahoma City-area historical earthquake activity is significantly above Oklahoma state average. It is 839% greater than the overall U.S. average.On 11/6/2011 at 03:53:10, a magnitude 5.7 (5.7 MW, Depth: 3.2 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 43.5 miles away from Oklahoma City center

On 9/3/2016 at 12:02:44, a magnitude 5.8 (5.8 MW, Depth: 3.5 mi) earthquake occurred 73.5 miles away from the city center

On 11/7/2016 at 01:44:24, a magnitude 5.0 (5.0 MW, Depth: 2.8 mi) earthquake occurred 54.1 miles away from Oklahoma City center

On 2/13/2016 at 17:07:06, a magnitude 5.1 (5.1 MW, Depth: 5.2 mi) earthquake occurred 95.8 miles away from Oklahoma City center

On 11/8/2011 at 02:46:57, a magnitude 4.8 (4.8 MW, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 42.2 miles away from Oklahoma City center

On 11/5/2011 at 07:12:45, a magnitude 4.8 (4.8 MW, Depth: 1.9 mi) earthquake occurred 43.7 miles away from the city center

Magnitude types: moment magnitude (MW)

Natural disasters:

The number of natural disasters in Oklahoma County (43) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 26

Emergencies Declared: 6

Causes of natural disasters: Storms: 18, Floods: 15, Fires: 12, Tornadoes: 12, Winter Storms: 8, Winds: 3, Explosion: 1, Hurricane: 1, Ice Storm: 1, Snow: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: SIX FLAGS INC (SERVICES-MISCELLANEOUS AMUSEMENT & RECREATION), PANHANDLE ROYALTY CO (CRUDE PETROLEUM & NATURAL GAS), DEVON ENERGY CORP/DE (CRUDE PETROLEUM & NATURAL GAS), LOCAL FINANCIAL CORP /NV (NATIONAL COMMERCIAL BANKS), BEARD CO /OK (INDUSTRIAL INORGANIC CHEMICALS), DOBSON COMMUNICATIONS CORP (RADIO TELEPHONE COMMUNICATIONS), CHESAPEAKE ENERGY CORP (CRUDE PETROLEUM & NATURAL GAS), BANCFIRST CORP /OK/ (NATIONAL COMMERCIAL BANKS) and 7 other public companies.

Hospitals in Oklahoma City:

- ADVANCE CARE HOSPITAL OF OKLAHOMA (4300 WEST MEMORIAL ROAD, 3RD FLOOR)

- CEDAR RIDGE (provides emergency services, 6505 NORTHEAST 50TH STREET)

- CRESCENT HOSPICE SERVICES (3555 NW 58TH STREET, SUITE 900)

- HEARTLAND HOSPICE SERVICES (3000 UNITED FOUNDERS BLVD, SUITE 219)

- INTEGRIS SOUTHWEST MEDICAL CENTER (Proprietary, provides emergency services, 4401 SOUTH WESTERN AVENUE)

- MERCY HEALTH CENTER, INC (Voluntary non-profit - Church, 4300 WEST MEMORIAL ROAD)

- ODYSSEY HEALTHCARE OF OKLAHOMA CITY (2212 N W 50TH STREET, SUITE 246-C)

- OKLAHOMA SURGICARE (4317 WEST MEMORIAL ROAD)

- SOLAMOR HOSPICE (717 NW 17TH STREET)

- TCA OF CENTRAL OKLAHOMA INC (4401 S WESTERN 10TH FLOOR)

Airports and heliports located in Oklahoma City:

- Will Rogers World Airport (OKC) (Runways: 4, Commercial Ops: 42,242, Air Taxi Ops: 17,315, Itinerant Ops: 19,617, Local Ops: 1,705, Military Ops: 41,558)

- Tinker Afb Airport (TIK) (Runways: 2, Military Ops: 73,200)

- Wiley Post Airport (PWA) (Runways: 3, Air Taxi Ops: 3,128, Itinerant Ops: 43,967, Local Ops: 21,200, Military Ops: 1,732)

- Clarence E Page Municipal Airport (RCE) (Runways: 2, Itinerant Ops: 17,000, Local Ops: 13,000)

- Sundance Airport (HSD) (Runways: 1, Itinerant Ops: 1,000, Local Ops: 2,000)

- Heliports: 14

Biggest Colleges/Universities in Oklahoma City:

- Oklahoma City Community College (Full-time enrollment: 8,904; Location: 7777 S May Ave; Public; Website: www.occc.edu)

- Oklahoma State University-Oklahoma City (Full-time enrollment: 4,784; Location: 900 N Portland; Public; Website: www.osuokc.edu)

- Mid-America Christian University (Full-time enrollment: 2,869; Location: 3500 SW 119th St; Private, not-for-profit; Website: www.macu.edu; Offers Master's degree)

- Oklahoma City University (Full-time enrollment: 2,547; Location: 2501 N Blackwelder; Private, not-for-profit; Website: www.okcu.edu; Offers Doctor's degree)

- University of Oklahoma-Health Sciences Center (Full-time enrollment: 2,507; Location: 1100 N Lindsay; Public; Website: ouhsc.edu; Offers Doctor's degree)

- Francis Tuttle Technology Center (Full-time enrollment: 1,240; Location: 12777 N Rockwell Ave; Public; Website: www.francistuttle.edu)

- Metro Technology Centers (Full-time enrollment: 1,061; Location: 1900 Springlake Drive; Public; Website: www.metrotech.edu)

- Heritage College-Oklahoma City (Full-time enrollment: 875; Location: 7202 S. I-35 Service Road; Private, for-profit; Website: heritage-education.com)

- University of Phoenix-Oklahoma City Campus (Full-time enrollment: 421; Location: 3 Broadway Exec Pk, 6501 N. Broadway Ext.; Private, for-profit; Website: www.phoenix.edu; Offers Master's degree)

- ITT Technical Institute-Oklahoma City (Full-time enrollment: 390; Location: 50 Penn Place Office Tower, 1900 NW Expressway St.-Ste 305; Private, for-profit; Website: www.itt-tech.edu)

- Platt College-North OKC (Full-time enrollment: 390; Location: 2727 W. Memorial Rd; Private, for-profit; Website: www.plattcolleges.edu)

- Platt College-Central OKC (Full-time enrollment: 390; Location: 309 S Ann Arbor; Private, for-profit; Website: www.plattcollege.edu)

- Brown Mackie College-Oklahoma City (Full-time enrollment: 250; Location: 7101 NW Expressway, Suite 800; Private, for-profit; Website: www.brownmackie.edu)

- DeVry University-Oklahoma (Full-time enrollment: 213; Location: 4013 NW Expressway St., Ste. 100; Private, for-profit; Website: www.devry.edu; Offers Master's degree)

- Central State Beauty Academy (Full-time enrollment: 85; Location: 8494 Northwest Expressway; Private, for-profit; Website: www.csbaokc.com/)

- Academy of Hair Design-Oklahoma City (Full-time enrollment: 54; Location: 11920 N May Ave; Private, for-profit; Website: www.academyofhairdesignok.com)

- American Broadcasting School-Online Program (Full-time enrollment: 53; Location: 4511 SE 29th St; Private, for-profit; Website: radioschoolonline.com/homechat.htm)

- American Broadcasting School-Oklahoma City (Full-time enrollment: 20; Location: 4511 SE 29th St; Private, for-profit; Website: www.radioschool.com)

- Central State Massage Academy (Full-time enrollment: 18; Location: 8494 Northwest Expwy; Private, for-profit; Website: www.csmaokc.com)

- Brookline College-Oklahoma City (Full-time enrollment: 15; Location: 980 Broadway Extension; Private, for-profit; Website: www.brooklinecollege.edu)

Biggest public high schools in Oklahoma City:

- WESTMOORE HS (Students: 2,255, Location: 12613 SOUTH WESTERN AVENUE, Grades: 9-12)

- PUTNAM CITY NORTH HS (Students: 1,961, Location: 11800 NORTH ROCKWELL AVENUE, Grades: 9-12)

- PUTNAM CITY HS (Students: 1,931, Location: 5300 NORTHWEST 50TH STREET, Grades: 9-12)

- PUTNAM CITY WEST HS (Students: 1,686, Location: 8500 NORTHWEST 23RD STREET, Grades: 9-12)

- U. S. GRANT HS (Students: 1,566, Location: 5016 SOUTH PENNSYLVANIA AVENUE, Grades: 9-12)

- NORTHWEST CLASSEN HS (Students: 1,087, Location: 2801 NORTHWEST 27TH STREET, Grades: 9-12)

- CARL ALBERT HS (Students: 1,073, Location: 2009 S POST ROAD, Grades: 9-12)

- CAPITOL HILL HS (Students: 955, Location: 500 SW 36TH STREET, Grades: 9-12)

- WESTERN HEIGHTS HS (Students: 803, Location: 8201 SOUTHWEST 44TH STREET, Grades: 10-12)

- SOUTHEAST HS (Students: 691, Location: 5401 SOUTH SHIELDS BOULEVARD, Grades: 9-12)

Biggest private high schools in Oklahoma City:

- HERITAGE HALL (Students: 912, Location: 1800 NW 122ND ST, Grades: PK-12)

- CROSSINGS CHRISTIAN SCHOOL (Students: 733, Location: 14400 N PORTLAND AVE, Grades: PK-12)

- BISHOP MCGUINNESS CATHOLIC HIGH SCHOOL (Students: 722, Location: 801 NW 50TH ST, Grades: 9-12)

- MOUNT SAINT MARY HIGH SCHOOL (Students: 376, Location: 2801 S SHARTEL AVE, Grades: 9-12)

- VERITAS CLASSICAL ACADEMY (Students: 256, Location: 8901 S SHIELDS BLVD, Grades: PK-12)

- LIFE CHRISTIAN ACADEMY (Students: 167, Location: 6801 S ANDERSON RD, Grades: PK-12)

- WINDSOR HILLS BAPTIST SCHOOLS (Students: 134, Location: 5517 NW 23RD ST, Grades: KG-12)

- TRINITY SCHOOL (Students: 66, Location: 321 NW 36TH ST, Grades: KG-12)

- PARKVIEW ADVENTIST ACADEMY (Students: 57, Location: 4201 N MARTIN LUTHER KING AVE, Grades: PK-12)

- BETHANY CHRISTIAN ACADEMY (Students: 4, Location: 1133 SW 50TH ST, Grades: 12)

Biggest public elementary/middle schools in Oklahoma City:

- BRINK JHS (Students: 1,247, Location: 11420 SOUTH WESTERN AVENUE, Grades: 7-8)

- HEFNER MS (Students: 1,036, Location: 8400 NORTH MACARTHUR BOULEVARD, Grades: 6-8)

- CAPITOL HILL ES (Students: 973, Location: 2717 SOUTH ROBINSON AVENUE, Grades: PK-6)

- WEST JHS (Students: 896, Location: 9400 SOUTH PENNSYLVANIA AVENUE, Grades: 7-8)

- JEFFERSON MS (Students: 879, Location: 6800 SOUTH BLACKWELDER AVENUE, Grades: 7-8)

- ROOSEVELT MS (Students: 821, Location: 3233 SOUTHWEST 44TH STREET, Grades: 7-8)

- MILLWOOD ES (Students: 771, Location: 6710 N MARTIN LUTHER KING AVE, Grades: PK-8)

- COOPER MS (Students: 757, Location: 8001 RIVER BEND BOULEVARD, Grades: 6-8)

- TAFT MS (Students: 747, Location: 2901 NORTHWEST 23RD STREET, Grades: 7-8)

- WAYLAND BONDS ES (Students: 705, Location: 14025 SOUTH MAY AVENUE, Grades: PK-6)

Biggest private elementary/middle schools in Oklahoma City:

- WESTMINSTER SCHOOL (Students: 537, Location: 600 NW 44TH ST, Grades: PK-8)

- CHRIST THE KING CATHOLIC SCHOOL (Students: 513, Location: 1905 ELMHURST AVE, Grades: PK-8)

- ST EUGENE CATHOLIC SCHOOL (Students: 353, Location: 2400 W HEFNER RD, Grades: PK-8)

- CREATIVE KIDS LEARNING CENTER (Students: 259, Location: 335 SW 134TH ST, Grades: PK-6)

- ROSARY SCHOOL (Students: 248, Location: 1919 NW 18TH ST, Grades: PK-8)

- VILLA TERESA SCHOOL (Students: 238, Location: 1216 CLASSEN DR, Grades: PK-4)

- BISHOP JOHN CARROLL SCHOOL (Students: 194, Location: 1100 NW 32ND ST, Grades: PK-8)

- ST CHARLES BORROMEO CATHOLIC SCHOOL (Students: 193, Location: 5000 N GROVE AVE, Grades: PK-8)

- ST JAMES THE GREATER CATHOLIC SCHOOL (Students: 173, Location: 1224 SW 41ST ST, Grades: PK-8)

- SACRED HEART CATHOLIC SCHOOL (Students: 156, Location: 2700 S SHARTEL AVE, Grades: PK-8)

User-submitted facts and corrections:

- Churches: Grace Covenant Church Reaching the lost & restoring the found. Okcgrace.com added by Grace Media

- Oklahoma Christian University is located in north Oklahoma City. OC's most recent enrollment number is 2,052.

Points of interest:

Notable locations in Oklahoma City: Pentecostal Campground (A), Lecox (B), Santa Fe Station (C), East Yard (D), Union Station (E), Czech Hall (F), Camp Kickapoo (G), Hillcrest Country Club (H), Lake Hefner Golf Course (I), Walnut Creek Country Club (J), Higbee Community Hall (K), National Stockyards (L), Oklahoma City Country Club (M), Quail Creek Country Club (N), Surrey Hills Golf Club (O), Twin Hills Country Club (P), Deville Park Shop (Q), Putnam North Plaza (R), Mustang Trade Center (S), Amherst Square (T). Display/hide their locations on the map

Shopping Centers: Straka Terrace Shopping Center (1), Deville Shopping Center (2), Glen Oaks Shopping Center (3), Oakbrook Shopping Center (4), Silver Shopping Center (5), Almonte Shopping Center (6), Athena Mall (7), Brookwood North Shopping Center (8), Quail Springs Mall (9). Display/hide their locations on the map

Main business address in Oklahoma City include: SIX FLAGS INC (A), PANHANDLE ROYALTY CO (B), DEVON ENERGY CORP/DE (C), LOCAL FINANCIAL CORP /NV (D), BEARD CO /OK (E), DOBSON COMMUNICATIONS CORP (F), CHESAPEAKE ENERGY CORP (G), BANCFIRST CORP /OK/ (H). Display/hide their locations on the map

Churches in Oklahoma City include: Spring Creek Church (A), Saint Eugene Church (B), Quail Springs Church (C), Westernwood Church (D), Freewill Church (E), Westmore Baptist Church (F), Southpark Baptist Church (G), Crossroads Cathedral (H), Kingsview Freewill Baptist Church (I). Display/hide their locations on the map

Cemeteries: Temple B'Nai Israel Cemetery (1), Worley Cemetery (2), Emmanuel Cemetery (3), Wright's Cemetery (4), Fairlawn Cemetery (5), Forehand Cemetery (6), Frisco Cemetery (7). Display/hide their locations on the map

Lakes and reservoirs: Twin Lakes (A), Lake Leven (B), Shepherd Lake (C), Belle Isle Lake (D), Shadow Lake (E), Lake Stanley Draper (F), Saint Francis West Lake (G), Sportsmans Club Lake (H). Display/hide their locations on the map

Creeks: West Elm Creek (A), West Branch Hog Creek (B), Brock Creek (C), Crutcho Creek (D), Crooked Oak Creek (E), Cow Creek (F), Twin Creek (G), Bennett Creek (H), Coon Creek (I). Display/hide their locations on the map

Parks in Oklahoma City include: River Park (1), Highley Park (2), Myriad Gardens (3), North Britton Park (4), Military Park (5), Goodholm Park (6), 89'er Museum Park (7), Stiles Circle Park (8), Woodson Park (9). Display/hide their locations on the map

Tourist attractions: Guthrie Jazz Banjo Festival Inc (Museums; 8000 Southeast 15th Street) (1), Oklahoma City Museum of Art (415 Couch Drive) (2), Oklahoma City National Memorial & Museum (620 North Harvey Avenue) (3), Oklahoma Museums Association (2100 Northeast 52nd Street) (4), Lifehouse (Museums; 1 Northwest 12th Street) (5), Banker Art Museum (3915 North Pennsylvania Avenue) (6), Oklahoma Historical Society (Museums; 2100 North Lincoln Boulevard) (7), Amateur Softball Association of Amrca NTNL Hdqrtrs (Museums; 2801 Northeast 50th Street) (8), National Cowboy & Western Heritage Museum (1700 Northeast 63rd Street) (9). Display/hide their approximate locations on the map

Hotels: Rodeway Inn Oklahoma City (4601 1/2 Southwest 3rd Street) (1), Harvey Janitorial Sales (28 Northwest 10th Street) (2), Market Source (4525 North Cooper Avenue) (3), Innkeepers (301 Northwest 63rd Street) (4), The Westin Ok City (1 N Broadway Ave) (5), Travel Inn (1177 Northeast 23rd Street) (6), LA Quinta Inn Airport (800 South Meridian Avenue) (7), Motel 6 - Oklahoma City-West (4200 West Interstate 40) (8), Microtel Inn & Suites (624 South Macarthur Boulevard) (9). Display/hide their approximate locations on the map

Courts: Oklahoma State - Supreme Court- Richie Michael Court Clerk All Appellate Co (B2 State Capitol Building) (1), U S Government - Courts- Bankruptcy Court- Bankruptcy Court Clerk (215 Dean A McGee Avenue) (2), Oklahoma State - Court Of Criminal Appeals- Johnson Charles A Judge (230 State Capitol Building) (3), U S Government - Courts- District Court- Circuit Court- Henry Robert H Circuit J (10th Circuit Court Ouest) (4), U S Government - Courts- District Court- Circuit Court- Holloway Jr William J Senior Circuit J (10th Circuit Court Ouest) (5), Stanford Court (6457 Masons Drive) (6), Oklahoma State - Court Of Criminal Appeals- Chapel Charles S Presiding J (230 State Capitol Building) (7), Midwest City-City - Court-Municipal- Court Clerk (100 North Midwest Boulevard) (8), Aafes Base Exchange Group - Aafes Food Court Offices (3360 North) (9). Display/hide their approximate locations on the map

Birthplace of: Bobby Murcer - Baseball player, Don Demeter - Major League Baseball player, Olivia Munn - Actress, Aubrey McClendon - Businessman, Sam Bradford - College football player, Elizabeth Warren - Lawyer, Dee Andros - Football player and coach, Ken Wilber - (born 1949), philosopher, Mickey Tettleton - Baseball player, Lon Chaney, Jr. - Actor.

Drinking water stations with addresses in Oklahoma City and their reported violations in the past:

BURNTWOOD COURT (Address: 3308 SE 89th St., Lot 454 , Population served: 804, Purch surface water):Past monitoring violations:GOLDEN RULE MHP (Address: 2001 S. MacArthur , Population served: 540, Purch surface water):

- Monitoring and Reporting (DBP) - Between APR-2013 and JUN-2013, Contaminant: Total Haloacetic Acids (HAA5)

- Monitoring and Reporting (DBP) - Between APR-2013 and JUN-2013, Contaminant: TTHM

- Monitoring and Reporting (DBP) - Between JAN-2013 and MAR-2013, Contaminant: TTHM

- Monitoring and Reporting (DBP) - Between JAN-2013 and MAR-2013, Contaminant: Total Haloacetic Acids (HAA5)

- Monitoring, Routine (IDSE) - Between FEB-2010 and APR-2010, Contaminant: TTHM. Follow-up actions: Fed FAO issued (MAY-29-2009)

- 5 routine major monitoring violations

- 16 other older monitoring violations

Past monitoring violations:LOVES COUNTRY STORE 250 (Serves TX, Population served: 500, Groundwater):

- Follow-up Or Routine LCR Tap M/R - In JUL-01-2013, Contaminant: Lead and Copper Rule. Follow-up actions: St Violation/Reminder Notice (AUG-02-2013), St Public Notif requested (AUG-02-2013)

- 2 routine major monitoring violations

Past health violations:LAKE FOREST MHP (Address: 9009 N.W. 10TH , Population served: 500, Purch surface water):Past monitoring violations:

- MCL, Monthly (TCR) - In SEP-2005, Contaminant: Coliform. Follow-up actions: St Compliance achieved (SEP-30-2005), St Public Notif requested (OCT-02-2005), St Violation/Reminder Notice (OCT-02-2005), St Public Notif received (NOV-01-2005)

- 16 routine major monitoring violations

Past monitoring violations:LOVES COUNTRY STORE 229 (Serves TX, Population served: 500, Groundwater):

- 2 routine major monitoring violations

- One minor monitoring violation

Past monitoring violations:FOREST PARK ESTATES LLC (Address: 4800 S. Foster Rd. , Population served: 425, Purch surface water):

- Monitoring, Repeat Major (TCR) - In NOV-2007, Contaminant: Coliform (TCR). Follow-up actions: St Compliance achieved (NOV-30-2007), St Public Notif requested (APR-25-2008), St Violation/Reminder Notice (APR-25-2008)

- One routine major monitoring violation

- One minor monitoring violation

Past monitoring violations:HILLSIDE CORR. CENTER (Address: 3300 Martin Luther King , Population served: 424, Purch surface water):

- Monitoring, Routine (IDSE) - Between JUL-2009 and JUN-2010, Contaminant: TTHM

- Monitoring, Routine (IDSE) - Between JUL-2009 and JUN-2010, Contaminant: Total Haloacetic Acids (HAA5)

- Monitoring, Routine (IDSE) - Between JUL-2008 and JUN-2009, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: Fed Violation/Reminder Notice (DEC-08-2008), Fed FAO issued (MAY-29-2009), Fed Compliance achieved (NOV-09-2009)

- Monitoring, Routine (IDSE) - Between JUL-2008 and JUN-2009, Contaminant: TTHM. Follow-up actions: Fed Violation/Reminder Notice (DEC-08-2008), Fed FAO issued (MAY-29-2009), Fed Compliance achieved (NOV-09-2009)

- Monitoring, Routine (IDSE) - Between JUL-2007 and JUN-2008, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: Fed FAO issued (MAY-29-2009), Fed Compliance achieved (NOV-09-2009)

- 8 routine major monitoring violations

- One other older monitoring violation

Past monitoring violations:LAKEVIEW TERRACE MHP (Address: 1200 North Lakeview Drive , Population served: 403, Purch surface water):

- 4 routine major monitoring violations

Past monitoring violations:

- Monitoring and Reporting (DBP) - Between SEP-2012 and NOV-2012, Contaminant: Total Haloacetic Acids (HAA5)

- Monitoring and Reporting (DBP) - Between SEP-2012 and NOV-2012, Contaminant: TTHM

Drinking water stations with addresses in Oklahoma City that have no violations reported:

- LOVES TRAVEL STOP AND COUNTRY STORE (Serves NV, Population served: 500, Primary Water Source Type: Groundwater)

- GRANADA VILLAGE (Address: 2400 S. Macarthur Blvd. , Population served: 334, Primary Water Source Type: Purch surface water)

- LOVE`S TRAVEL PLAZA (Serves VA, Population served: 170, Primary Water Source Type: Groundwater)

- ALPINE MHP (Address: 4907 S. Santa Fe , Population served: 103, Primary Water Source Type: Purch surface water)

| This city: | 2.5 people |

| Oklahoma: | 2.5 people |

| This city: | 62.6% |

| Whole state: | 66.8% |

| This city: | 6.6% |

| Whole state: | 5.9% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.4% of all households

People in group quarters in Oklahoma City in 2010:

- 2,521 people in nursing facilities/skilled-nursing facilities

- 2,088 people in local jails and other municipal confinement facilities

- 2,000 people in college/university student housing

- 1,240 people in correctional residential facilities

- 972 people in military barracks and dormitories (nondisciplinary)

- 934 people in other noninstitutional facilities

- 880 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 534 people in state prisons

- 284 people in group homes intended for adults

- 249 people in residential treatment centers for adults

- 216 people in workers' group living quarters and job corps centers

- 103 people in group homes for juveniles (non-correctional)

- 103 people in mental (psychiatric) hospitals and psychiatric units in other hospitals

- 20 people in residential treatment centers for juveniles (non-correctional)

People in group quarters in Oklahoma City in 2000:

- 2,790 people in nursing homes

- 2,353 people in local jails and other confinement facilities (including police lockups)

- 1,844 people in college dormitories (includes college quarters off campus)

- 1,753 people in federal prisons and detention centers

- 1,456 people in other noninstitutional group quarters

- 797 people in state prisons

- 472 people in military barracks, etc.

- 291 people in other nonhousehold living situations

- 287 people in homes or halfway houses for drug/alcohol abuse

- 243 people in halfway houses

- 97 people in orthopedic wards and institutions for the physically handicapped

- 94 people in mental (psychiatric) hospitals or wards

- 88 people in schools, hospitals, or wards for the intellectually disabled

- 86 people in homes for the mentally retarded

- 78 people in religious group quarters

- 72 people in short-term care, detention or diagnostic centers for delinquent children

- 60 people in homes for the mentally ill

- 52 people in homes for abused, dependent, and neglected children

- 45 people in other group homes

- 44 people in hospitals/wards and hospices for chronically ill

- 40 people in other workers' dormitories

- 36 people in hospitals or wards for drug/alcohol abuse

- 32 people in other hospitals or wards for chronically ill

- 24 people in unknown juvenile institutions

- 19 people in military transient quarters for temporary residents

- 12 people in hospices or homes for chronically ill

- 12 people in wards in general hospitals for patients who have no usual home elsewhere

Banks with most branches in Oklahoma City (2011 data):

- BOKF, National Association: 22 branches. Info updated 2012/02/28: Bank assets: $25,360.0 mil, Deposits: $19,171.3 mil, headquarters in Tulsa, OK, positive income, Commercial Lending Specialization, 189 total offices, Holding Company: Bok Financial Corporation

- MidFirst Bank: 15 branches. Info updated 2011/07/21: Bank assets: $9,790.2 mil, Deposits: $6,308.2 mil, local headquarters, positive income, Commercial Lending Specialization, 77 total offices

- Bank of America, National Association: 13 branches. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- BancFirst: 13 branches. Info updated 2012/02/24: Bank assets: $5,407.8 mil, Deposits: $4,893.4 mil, local headquarters, positive income, Commercial Lending Specialization, 101 total offices, Holding Company: Bancfirst Corporation

- JPMorgan Chase Bank, National Association: 12 branches. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- First Fidelity Bank, National Association: 9 branches. Info updated 2010/09/21: Bank assets: $1,141.9 mil, Deposits: $903.8 mil, local headquarters, positive income, Commercial Lending Specialization, 28 total offices, Holding Company: First Fidelity Bancorp, Inc.

- Arvest Bank: 9 branches. Info updated 2010/11/29: Bank assets: $12,520.8 mil, Deposits: $10,446.2 mil, headquarters in Fayetteville, AR, positive income, Commercial Lending Specialization, 241 total offices, Holding Company: Arvest Bank Group, Inc.

- International Bank of Commerce: 8 branches. Info updated 2007/03/28: Bank assets: $9,621.9 mil, Deposits: $6,548.8 mil, headquarters in Laredo, TX, positive income, Commercial Lending Specialization, 197 total offices, Holding Company: International Bancshares Corporation

- Coppermark Bank: 7 branches. Info updated 2006/11/03: Bank assets: $1,262.6 mil, Deposits: $1,113.7 mil, local headquarters, positive income, Commercial Lending Specialization, 12 total offices, Holding Company: Coppermark Bancshares, Inc.

- 35 other banks with 75 local branches

For population 15 years and over in Oklahoma City:

- Never married: 33.8%

- Now married: 47.6%

- Separated: 1.8%

- Widowed: 4.7%

- Divorced: 12.2%

For population 25 years and over in Oklahoma City:

- High school or higher: 88.3%

- Bachelor's degree or higher: 35.8%

- Graduate or professional degree: 12.1%

- Unemployed: 3.6%

- Mean travel time to work (commute): 19.9 minutes

| Here: | 12.6 |

| Oklahoma average: | 11.3 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Oklahoma City:

(Oklahoma City, Oklahoma Neighborhood Map)- Adventure District neighborhood

- Arts District neighborhood

- Asia District neighborhood

- Automobile Alley neighborhood

- Bricktown neighborhood

- Business District neighborhood

- Capitol Hill neighborhood

- Deep Deuce neighborhood

- Downtown neighborhood

- Eastside neighborhood

- Flatiron District (Triangle District) neighborhood

- I-40 Expansion Area neighborhood

- Inner City Northside neighborhood

- Inner City Southside neighborhood

- Medical Community neighborhood

- Meridian Avenue Hospitality Corridor neighborhood

- Midtown District neighborhood

- Nichols Hills neighborhood

- Northwest 39 Street Enclave neighborhood

- Oklahoma School Of Science And Mathematics neighborhood

- Paseo Artists District neighborhood

- Presbyterian Health Foundation Research Park neighborhood

- Quail Springs neighborhood

- St. Anthony Hospital Campus neighborhood

- Stockyards City neighborhood

- Suburban Northside neighborhood

- Warr Acres neighborhood

Religion statistics for Oklahoma City, OK (based on Oklahoma County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 325,241 | 609 |

| Mainline Protestant | 83,693 | 122 |

| Catholic | 61,318 | 27 |

| Other | 26,587 | 73 |

| Black Protestant | 22,346 | 64 |

| Orthodox | 1,807 | 10 |

| None | 197,641 | - |

Food Environment Statistics:

| Here: | 2.79 / 10,000 pop. |

| State: | 1.97 / 10,000 pop. |

| Oklahoma County: | 0.17 / 10,000 pop. |

| Oklahoma: | 0.20 / 10,000 pop. |

| Here: | 0.41 / 10,000 pop. |

| Oklahoma: | 0.76 / 10,000 pop. |

| Oklahoma County: | 2.33 / 10,000 pop. |

| State: | 4.35 / 10,000 pop. |

| Oklahoma County: | 8.10 / 10,000 pop. |

| Oklahoma: | 6.89 / 10,000 pop. |

| Oklahoma County: | 9.8% |

| Oklahoma: | 10.3% |

| Oklahoma County: | 27.9% |

| State: | 29.2% |

Health and Nutrition:

| This city: | 48.0% |

| Oklahoma: | 48.6% |

| Oklahoma City: | 44.8% |

| Oklahoma: | 45.2% |

| Here: | 28.6 |

| Oklahoma: | 28.7 |

| Oklahoma City: | 21.0% |

| Oklahoma: | 21.4% |

| This city: | 11.2% |

| Oklahoma: | 10.8% |

| This city: | 6.8 |

| Oklahoma: | 6.8 |

| Oklahoma City: | 32.7% |

| Oklahoma: | 33.9% |

| Oklahoma City: | 55.0% |

| Oklahoma: | 55.2% |

| Here: | 79.5% |

| Oklahoma: | 78.4% |

More about Health and Nutrition of Oklahoma City, OK Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 1,152 | $12,234,759 | $127,445 | 0 | $0 |

| Firefighters | 972 | $7,277,835 | $89,850 | 0 | $0 |

| Water Supply | 479 | $2,557,292 | $64,066 | 11 | $9,490 |

| Streets and Highways | 360 | $2,001,173 | $66,706 | 8 | $14,745 |

| Other Government Administration | 304 | $2,421,657 | $95,592 | 19 | $29,702 |

| Police - Other | 251 | $2,087,450 | $99,798 | 101 | $131,474 |

| Health | 184 | $960,409 | $62,635 | 19 | $30,299 |

| Parks and Recreation | 133 | $626,398 | $56,517 | 147 | $165,366 |

| Airports | 120 | $689,503 | $68,950 | 3 | $4,856 |

| Solid Waste Management | 100 | $474,741 | $56,969 | 1 | $1,036 |

| Sewerage | 83 | $430,637 | $62,261 | 0 | $0 |

| Financial Administration | 78 | $562,632 | $86,559 | 2 | $5,910 |

| Housing and Community Development (Local) | 64 | $362,435 | $67,957 | 0 | $0 |

| Judicial and Legal | 48 | $249,273 | $62,318 | 1 | $1,991 |

| Fire - Other | 44 | $491,574 | $134,066 | 0 | $0 |

| Transit | 32 | $216,370 | $81,139 | 0 | $0 |

| Correction | 27 | $174,329 | $77,480 | 0 | $0 |

| Totals for Government | 4,431 | $33,818,466 | $91,587 | 312 | $394,870 |

Oklahoma City government finances - Expenditure in 2021 (per resident):

- Construction - Water Utilities: $123,183,000 ($177.29)

Parks and Recreation: $103,589,000 ($149.09)

Air Transportation: $52,797,000 ($75.99)

Regular Highways: $13,320,000 ($19.17)

General - Other: $8,249,000 ($11.87)

Health - Other: $4,245,000 ($6.11)

Local Fire Protection: $232,000 ($0.33)

Police Protection: $180,000 ($0.26)

Natural Resources - Other: $136,000 ($0.20)

- Current Operations - Police Protection: $195,084,000 ($280.78)

Water Utilities: $135,400,000 ($194.88)

Local Fire Protection: $134,850,000 ($194.08)

Parks and Recreation: $109,041,000 ($156.94)

Solid Waste Management: $72,461,000 ($104.29)

Regular Highways: $53,839,000 ($77.49)

Transit Utilities: $38,927,000 ($56.03)

Air Transportation: $37,381,000 ($53.80)

Sewerage: $35,992,000 ($51.80)

Protective Inspection and Regulation - Other: $21,838,000 ($31.43)

General - Other: $21,721,000 ($31.26)

Housing and Community Development: $21,441,000 ($30.86)

Judicial and Legal Services: $15,383,000 ($22.14)

Central Staff Services: $13,297,000 ($19.14)

Financial Administration: $9,611,000 ($13.83)

Health - Other: $4,199,000 ($6.04)

Parking Facilities: $2,539,000 ($3.65)

General Public Buildings: $2,508,000 ($3.61)

Sea and Inland Port Facilities: $39,000 ($0.06)

- General - Interest on Debt: $89,435,000 ($128.72)

Oklahoma City government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $128,153,000 ($184.45)

Solid Waste Management: $51,548,000 ($74.19)

Air Transportation: $47,114,000 ($67.81)

Parks and Recreation: $20,969,000 ($30.18)

Other: $19,875,000 ($28.61)

Parking Facilities: $5,507,000 ($7.93)

Sea and Inland Port Facilities: $36,000 ($0.05)

- Federal Intergovernmental - Other: $12,739,000 ($18.33)

Air Transportation: $12,455,000 ($17.93)

Housing and Community Development: $10,695,000 ($15.39)

Highways: $866,000 ($1.25)

- Local Intergovernmental - Other: $40,032,000 ($57.62)

- Miscellaneous - General Revenue - Other: $35,374,000 ($50.91)

Fines and Forfeits: $18,189,000 ($26.18)

Rents: $8,062,000 ($11.60)

Interest Earnings: $4,381,000 ($6.31)

Special Assessments: $2,143,000 ($3.08)

Royalties: $366,000 ($0.53)

- Revenue - Water Utilities: $190,687,000 ($274.45)

Transit Utilities: $2,727,000 ($3.92)

- State Intergovernmental - Other: $43,629,000 ($62.79)

General Local Government Support: $12,010,000 ($17.29)

Transit Utilities: $866,000 ($1.25)

Housing and Community Development: $378,000 ($0.54)

- Tax - General Sales and Gross Receipts: $586,517,000 ($844.15)

Property: $128,680,000 ($185.20)

Corporation License: $39,657,000 ($57.08)

Other License: $19,700,000 ($28.35)

Occupation and Business License - Other: $14,494,000 ($20.86)

Other Selective Sales: $11,908,000 ($17.14)

Public Utilities Sales: $6,183,000 ($8.90)

Oklahoma City government finances - Debt in 2021 (per resident):

- Long Term Debt - Outstanding Unspecified Public Purpose: $2,355,725,000 ($3390.51)

Beginning Outstanding - Unspecified Public Purpose: $2,235,875,000 ($3218.01)

Issue, Unspecified Public Purpose: $365,821,000 ($526.51)

Retired Unspecified Public Purpose: $245,971,000 ($354.02)

Oklahoma City government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $157,799,000 ($227.11)

- Other Funds - Cash and Securities: $1,886,476,000 ($2715.14)

- Sinking Funds - Cash and Securities: $133,169,000 ($191.67)

7.15% of this county's 2021 resident taxpayers lived in other counties in 2020 ($56,046 average adjusted gross income)

| Here: | 7.15% |

| Oklahoma average: | 8.28% |

0.04% of residents moved from foreign countries ($425 average AGI)

Oklahoma County: 0.04% Oklahoma average: 0.04%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Cleveland County, OK | |

| from Canadian County, OK | |

| from Tulsa County, OK |

7.53% of this county's 2020 resident taxpayers moved to other counties in 2021 ($55,930 average adjusted gross income)

| Here: | 7.53% |

| Oklahoma average: | 7.66% |

0.04% of residents moved to foreign countries ($348 average AGI)

Oklahoma County: 0.04% Oklahoma average: 0.03%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Cleveland County, OK | |

| to Canadian County, OK | |

| to Logan County, OK |

| Businesses in Oklahoma City, OK | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| ALDI | 4 | JoS. A. Bank | 2 | |

| ALDO | 1 | Jones New York | 16 | |

| AMF Bowling | 1 | Journeys | 4 | |

| AT&T | 15 | Justice | 3 | |

| Abercrombie & Fitch | 2 | KFC | 13 | |

| Abercrombie Kids | 2 | Knights Inn | 2 | |

| Academy Sports + Outdoors | 2 | Kohl's | 1 | |

| Ace Hardware | 5 | La Quinta | 3 | |

| Advance Auto Parts | 7 | La-Z-Boy | 2 | |

| Aeropostale | 2 | Lane Bryant | 4 | |

| American Eagle Outfitters | 2 | Lane Furniture | 9 | |

| Ann Taylor | 2 | LensCrafters | 3 | |

| Apple Store | 1 | Levi Strauss & Co. | 1 | |

| Applebee's | 5 | Little Caesars Pizza | 12 | |

| Arby's | 13 | Long John Silver's | 4 | |

| Ashley Furniture | 12 | Lowe's | 3 | |

| Audi | 1 | Macy's | 2 | |

| AutoZone | 11 | Marriott | 15 | |

| Avenue | 2 | Marshalls | 1 | |

| Bakers | 1 | MasterBrand Cabinets | 7 | |

| Banana Republic | 2 | Maurices | 1 | |

| Barnes & Noble | 2 | Mazda | 1 | |

| Baskin-Robbins | 1 | McDonald's | 37 | |

| Bath & Body Works | 4 | Men's Wearhouse | 2 | |

| Baymont Inn | 1 | Microtel | 1 | |

| Bed Bath & Beyond | 1 | Motel 6 | 3 | |

| Best Western | 4 | Motherhood Maternity | 7 | |

| Big O Tires | 1 | New Balance | 8 | |

| Blockbuster | 9 | New York & Co | 2 | |

| Brooks Brothers | 1 | Nike | 35 | |

| Brookstone | 1 | Nissan | 3 | |

| Budget Car Rental | 2 | Office Depot | 5 | |

| Burger King | 10 | Old Navy | 3 | |

| Burlington Coat Factory | 2 | Olive Garden | 3 | |

| CVS | 12 | On The Border | 3 | |

| Cache | 1 | Outback | 2 | |

| Cambria | 1 | Outback Steakhouse | 2 | |

| CarMax | 1 | Pac Sun | 2 | |

| Carl\s Jr. | 6 | Panda Express | 3 | |

| Casual Male XL | 2 | Panera Bread | 6 | |

| Catherines | 1 | Papa John's Pizza | 4 | |

| Charlotte Russe | 2 | Payless | 9 | |

| Chevrolet | 3 | Penske | 4 | |

| Chick-Fil-A | 6 | PetSmart | 5 | |

| Chico's | 2 | Pier 1 Imports | 2 | |

| Chipotle | 1 | Pizza Hut | 11 | |

| Chuck E. Cheese's | 2 | Plato's Closet | 1 | |

| Church's Chicken | 8 | Popeyes | 4 | |

| Circle K | 30 | Pottery Barn | 1 | |

| Clarion | 2 | Pottery Barn Kids | 1 | |

| Clarks | 1 | Qdoba Mexican Grill | 2 | |

| Cold Stone Creamery | 1 | Quality | 2 | |

| Coldwater Creek | 1 | Quiznos | 7 | |

| Comfort Inn | 5 | RadioShack | 8 | |

| Comfort Suites | 1 | Ramada | 3 | |

| Cracker Barrel | 1 | Red Lobster | 3 | |

| Cricket Wireless | 26 | Red Robin | 1 | |

| Curves | 1 | Red Roof Inn | 1 | |

| DHL | 4 | Rodeway Inn | 1 | |

| Dairy Queen | 1 | Rue21 | 2 | |

| Days Inn | 3 | Ryan's Grill | 1 | |

| Deb | 1 | Ryder Rental & Truck Leasing | 2 | |

| Decora Cabinetry | 1 | SAS Shoes | 4 | |

| Dennys | 6 | SONIC Drive-In | 41 | |

| Discount Tire | 5 | Sam's Club | 2 | |

| Domino's Pizza | 9 | Sears | 5 | |

| DressBarn | 3 | Sephora | 1 | |

| Dressbarn | 3 | Sheraton | 1 | |

| Dunkin Donuts | 2 | Shoe Carnival | 2 | |

| Econo Lodge | 3 | Skechers USA | 1 | |

| Eddie Bauer | 1 | Sleep Inn | 3 | |

| Ethan Allen | 1 | Soma Intimates | 1 | |

| Express | 2 | Spencer Gifts | 2 | |

| Extended Stay America | 2 | Sprint Nextel | 6 | |

| Extended Stay Deluxe | 1 | Staples | 2 | |

| Famous Footwear | 5 | Starbucks | 15 | |

| Fashion Bug | 1 | Steak 'n Shake | 1 | |

| FedEx | 101 | Studio 6 | 2 | |

| Finish Line | 3 | Subaru | 2 | |

| Firestone Complete Auto Care | 4 | Subway | 49 | |

| Foot Locker | 2 | Super 8 | 4 | |

| Ford | 5 | T-Mobile | 21 | |

| Forever 21 | 1 | T.G.I. Driday's | 2 | |

| Fredericks Of Hollywood | 1 | T.J.Maxx | 1 | |

| GNC | 7 | Taco Bell | 18 | |

| GameStop | 8 | Talbots | 2 | |

| Gap | 2 | Target | 4 | |

| Gymboree | 2 | The Cheesecake Factory | 1 | |

| H&R Block | 17 | The Limited | 1 | |

| Haworth | 1 | The Room Place | 1 | |

| Hawthorn | 1 | Torrid | 1 | |

| Hilton | 10 | Toyota | 2 | |

| Hobby Lobby | 4 | Toys"R"Us | 4 | |

| Holiday Inn | 10 | U-Haul | 26 | |

| Hollister Co. | 2 | U.S. Cellular | 7 | |

| Home Depot | 5 | UPS | 126 | |

| HomeTown Buffet | 1 | Vans | 10 | |

| Honda | 3 | Verizon Wireless | 6 | |

| Hot Topic | 3 | Victoria's Secret | 3 | |

| Howard Johnson | 2 | Volkswagen | 1 | |

| Hyatt | 2 | Waffle House | 5 | |

| IHOP | 8 | Walgreens | 17 | |

| IZOD | 1 | Walmart | 13 | |

| J. Jill | 1 | Wendy's | 8 | |

| J.Crew | 2 | Wet Seal | 2 | |

| JCPenney | 2 | Wingate | 1 | |

| Jamba Juice | 3 | YMCA | 4 | |

| Jimmy John's | 2 | |||

Strongest AM radio stations in Oklahoma City:

- KOMA (1520 AM; 50 kW; OKLAHOMA CITY, OK; Owner: RENDA BROADCASTING CORP. OF NEVADA)

- KEBC (1340 AM; 1 kW; OKLAHOMA CITY, OK; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WKY (930 AM; 5 kW; OKLAHOMA CITY, OK; Owner: CITADEL BROADCASTING COMPANY)

- KTOK (1000 AM; 5 kW; OKLAHOMA CITY, OK; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- KOCY (1560 AM; 1 kW; CHICKASHA, OK; Owner: TYLER ENTERPRISES, L.L.C.)

- WWLS (640 AM; 5 kW; MOORE, OK; Owner: CITADEL BROADCASTING COMPANY)

- KQCV (800 AM; 2 kW; OKLAHOMA CITY, OK; Owner: BOTT BROADCASTING COMPANY)

- KTLR (890 AM; daytime; 1 kW; OKLAHOMA CITY, OK; Owner: TYLER BROADCASTING CORPORATION)

- KVSP (1140 AM; daytime; 1 kW; OKLAHOMA CITY, OK; Owner: PERRY BROADCASTING COMPANY, INC.)

- KRMG (740 AM; 50 kW; TULSA, OK; Owner: CXR HOLDINGS, INC.)

- KFAQ (1170 AM; 50 kW; TULSA, OK; Owner: JOURNAL BROADCAST CORPORATION)

- KTLV (1220 AM; 0 kW; MIDWEST CITY, OK; Owner: FIRST CHOICE BROADCASTING, INC.)

- KJON (850 AM; daytime; 5 kW; ANADARKO, OK; Owner: CARROLLTON BROADCASTING OF TEXAS, LP)

Strongest FM radio stations in Oklahoma City:

- K259AM (99.7 FM; OKLAHOMA CITY, OK; Owner: THE LOVE STATION, INC.)

- KHBZ-FM (94.7 FM; OKLAHOMA CITY, OK; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- KTST (101.9 FM; OKLAHOMA CITY, OK; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- KMGL (104.1 FM; OKLAHOMA CITY, OK; Owner: RENDA BROADCASTING CORP. OF NEVADA)

- KOMA-FM (92.5 FM; OKLAHOMA CITY, OK; Owner: RENDA BROADCASTING CORPORATION OF NV)

- KRXO (107.7 FM; OKLAHOMA CITY, OK; Owner: RENDA BROADCASTING CORPORATION OF NV)

- KYIS (98.9 FM; OKLAHOMA CITY, OK; Owner: CITADEL BROADCASTING COMPANY)

- KATT-FM (100.5 FM; OKLAHOMA CITY, OK; Owner: CITADEL BROADCASTING COMPANY)

- KJYO (102.7 FM; OKLAHOMA CITY, OK; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- KXXY-FM (96.1 FM; OKLAHOMA CITY, OK; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- K246AF (97.1 FM; OKLAHOMA CITY, OK; Owner: MICHAEL A. BROOKS / DBA JIME'NEZ COM)

- WWLS-FM (104.9 FM; BETHANY, OK; Owner: CITADEL BROADCASTING COMPANY)

- KOKF (90.9 FM; EDMOND, OK; Owner: R.D.M BROADCASTING ENTERPRISES, INC.)

- KYLV (88.9 FM; OKLAHOMA CITY, OK; Owner: EDUCATIONAL MEDIA FOUNDATION)

- KCSC (90.1 FM; EDMOND, OK; Owner: THE UNIVERSITY OF CENTRAL OKLAHOMA)

- KKWD (97.9 FM; EDMOND, OK; Owner: CITADEL BROADCASTING COMPANY)

- KKNG-FM (93.3 FM; NEWCASTLE, OK; Owner: TYLER BROADCASTING CORPORATION)

- KROU (105.7 FM; SPENCER, OK; Owner: UNIVERSITY OF OKLAHOMA)

- K208CG (89.5 FM; OKLAHOMA CITY, OK; Owner: CALVARY CHAPEL OF TWIN FALLS, INC.)

- KTUZ-FM (106.7 FM; OKARCHE, OK; Owner: TYLER BROADCASTING CORPORATION)

TV broadcast stations around Oklahoma City:

- KWTV (Channel 9; OKLAHOMA CITY, OK; Owner: GRIFFIN ENTITIES, L.L.C.)

- KOCO-TV (Channel 5; OKLAHOMA CITY, OK; Owner: OHIO/OKLAHOMA HEARST- ARGYLE TELEVISION)

- KETA-TV (Channel 13; OKLAHOMA CITY, OK; Owner: OKLAHOMA EDUCATIONAL TELEVISION AUTHORITY)

- KOKH-TV (Channel 25; OKLAHOMA CITY, OK; Owner: KOKH LICENSEE, LLC)

- KOCB (Channel 34; OKLAHOMA CITY, OK; Owner: KOCB LICENSEE, LLC)

- K69EK (Channel 69; OKLAHOMA CITY, OK; Owner: ARKANSAS MEDIA, L.L.C.)

- KOPX (Channel 62; OKLAHOMA CITY, OK; Owner: PAXSON OKLAHOMA CITY LICENSE, INC.)

- KFOR-TV (Channel 4; OKLAHOMA CITY, OK; Owner: NEW YORK TIMES MANAGEMENT SERVICES)

- KSBI (Channel 52; OKLAHOMA CITY, OK; Owner: LOCKE SUPPLY CO.)

- KTBO-TV (Channel 14; OKLAHOMA CITY, OK; Owner: TRINITY BROADCASTING OF OKLAHOMA CITY, INC.)

- KXOC-LP (Channel 54; OKLAHOMA CITY, OK; Owner: LOCKE SUPPLY CO.)

- KOHC-LP (Channel 7; OKLAHOMA CITY, OK; Owner: TIGER EYE BROADCASTING CORPORATION)

- KCHM-LP (Channel 59; OKLAHOMA CITY, OK; Owner: TIGER EYE BROADCASTING CORPORATION)

- KDSA-LP (Channel 11; NORMAN, OK; Owner: DAY STAR BROADCASTING CORPORATION)

- KQOK (Channel 30; SHAWNEE, OK; Owner: SHAWNEE BROADCASTING, INC.)

- K30EC (Channel 30; BATESVILLE, AR; Owner: MS COMMUNICATIONS, LLC)

- KKCC-LP (Channel 19; OKLAHOMA CITY, OK; Owner: EICB-TV, LLC)

- KTOU-LP (Channel 21; OKLAHOMA CITY, OK; Owner: MAKO COMMUNICATIONS, LLC)

- KLHO-LP (Channel 17; OKLAHOMA CITY, OK; Owner: ARACELIS ORTIZ, EXECUTRIX OF THE ESTATE OF CARLOS ORTIZ)

- KAUT-TV (Channel 43; OKLAHOMA CITY, OK; Owner: VIACOM STATIONS GROUP OF OKC LLC)

- National Bridge Inventory (NBI) Statistics

- 1,901Number of bridges

- 21,391ft / 6,520mTotal length

- $2,061,419,000Total costs

- 30,433,195Total average daily traffic

- 3,708,300Total average daily truck traffic

- New bridges - historical statistics

- 11900-1909

- 71910-1919

- 541920-1929

- 491930-1939

- 1831940-1949

- 1481950-1959

- 2111960-1969

- 2811970-1979

- 2861980-1989

- 2571990-1999

- 2292000-2009

- 1382010-2019

- 572020-2022

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 182 full and 24 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 5,067 | $130,400 | 3,594 | $151,310 | 11,013 | $143,806 | 1,802 | $35,390 | 48 | $2,286,062 | 1,852 | $109,739 | 162 | $57,017 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 206 | $127,646 | 192 | $152,137 | 1,022 | $139,570 | 162 | $36,951 | 1 | $956,000 | 64 | $92,089 | 46 | $51,513 |

| APPLICATIONS DENIED | 546 | $121,379 | 593 | $113,605 | 3,905 | $132,345 | 1,389 | $27,505 | 8 | $2,193,549 | 371 | $76,587 | 139 | $52,949 |

| APPLICATIONS WITHDRAWN | 463 | $125,651 | 463 | $152,681 | 3,032 | $139,493 | 254 | $49,102 | 1 | $7,000,000 | 225 | $89,870 | 31 | $76,582 |

| FILES CLOSED FOR INCOMPLETENESS | 57 | $118,313 | 78 | $142,834 | 598 | $136,583 | 60 | $61,469 | 0 | $0 | 27 | $76,203 | 18 | $67,652 |

Detailed mortgage data for all 210 tracts in Oklahoma City, OK

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 153 full and 24 partial tracts) | ||||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | D) Loans On Manufactured Home Dwelling (A & B) | |||||

|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 642 | $173,736 | 639 | $170,633 | 7 | $87,913 | 0 | $0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 154 | $183,415 | 230 | $180,327 | 19 | $117,289 | 1 | $90,040 |

| APPLICATIONS DENIED | 62 | $158,952 | 114 | $156,403 | 6 | $125,333 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 30 | $181,335 | 55 | $171,795 | 1 | $72,000 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 19 | $149,643 | 5 | $128,200 | 6 | $90,847 | 0 | $0 |

2007 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Oklahoma City, OK

- 11,95941.3%Outside Fires

- 11,13038.4%Structure Fires

- 4,97917.2%Mobile Property/Vehicle Fires

- 9033.1%Other

According to the data from the years 2007 - 2018 the average number of fire incidents per year is 2396. The highest number of reported fire incidents - 2,996 took place in 2008, and the least - 1,944 in 2015. The data has a declining trend.

According to the data from the years 2007 - 2018 the average number of fire incidents per year is 2396. The highest number of reported fire incidents - 2,996 took place in 2008, and the least - 1,944 in 2015. The data has a declining trend. When looking into fire subcategories, the most incidents belonged to: Outside Fires (41.3%), and Structure Fires (38.4%).

When looking into fire subcategories, the most incidents belonged to: Outside Fires (41.3%), and Structure Fires (38.4%).Fire-safe hotels and motels in Oklahoma City, Oklahoma:

- Americinn Oklahoma City Airport, 1905 S Meridian Ave, Oklahoma City, Oklahoma 73108 , Phone: (405) 682-2080, Fax: (405) 682-3662

- Courtyard By Marriott, 4301 Highline Blvd, Oklahoma City, Oklahoma 73108 , Phone: (800) 321-2211, Fax: (405) 946-7638

- Baymont Inn & Suites Okc South, 8315 S I-35, Oklahoma City, Oklahoma 73149 , Phone: (405) 631-8661, Fax: (405) 631-1892

- Comfort Inn & Suites, 5405 N Lincoln Blvd, Oklahoma City, Oklahoma 73105 , Phone: (405) 528-7653, Fax: (405) 528-0425

- Lexington Hotel Suites, 1200 S Meridian Ave, Oklahoma City, Oklahoma 73108 , Phone: (405) 943-7800, Fax: (405) 943-8346

- Embassy Suites Hotel, 1815 S Meridian, Oklahoma City, Oklahoma 73108 , Phone: (405) 682-6000, Fax: (405) 682-9835

- Wyndham Oklahoma City, 2945 NW Exprwy, Oklahoma City, Oklahoma 73112 , Phone: (405) 848-4811, Fax: (405) 842-4328

- Waterford Marriott Hotel, 6300 Waterford Blvd, Oklahoma City, Oklahoma 73118 , Phone: (405) 848-4782, Fax: (405) 843-9161

- 139 other hotels and motels

| Most common first names in Oklahoma City, OK among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| Mary | 3,379 | 78.6 years |

| James | 3,369 | 71.6 years |

| John | 3,237 | 74.1 years |

| William | 3,098 | 74.2 years |

| Robert | 2,376 | 71.2 years |

| Charles | 1,973 | 72.1 years |

| George | 1,551 | 75.5 years |

| Dorothy | 1,254 | 76.1 years |

| Ruth | 1,215 | 80.1 years |

| Helen | 1,214 | 78.6 years |

| Most common last names in Oklahoma City, OK among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 2,121 | 74.7 years |

| Johnson | 1,374 | 74.0 years |

| Jones | 1,339 | 74.4 years |

| Williams | 1,233 | 73.5 years |

| Brown | 1,105 | 74.6 years |

| Davis | 1,010 | 73.9 years |

| Miller | 813 | 74.6 years |

| Wilson | 770 | 74.1 years |

| Moore | 675 | 73.8 years |

| Taylor | 657 | 74.9 years |

- 71.3%Utility gas

- 25.1%Electricity

- 2.7%Bottled, tank, or LP gas

- 0.3%Other fuel

- 0.3%No fuel used

- 0.1%Fuel oil, kerosene, etc.

- 62.5%Electricity

- 35.0%Utility gas

- 1.4%Bottled, tank, or LP gas

- 0.8%No fuel used

- 0.2%Wood

Oklahoma City compared to Oklahoma state average:

- Unemployed percentage significantly below state average.

- Black race population percentage above state average.

- Hispanic race population percentage above state average.

- Foreign-born population percentage significantly above state average.

- Percentage of population with a bachelor's degree or higher above state average.

Oklahoma City, OK compared to other similar cities:

Oklahoma City on our top lists:

- #11 on the list of "Top 100 cities with largest land areas (pop. 50,000+)"

- #16 on the list of "Top 101 cities with largest percentage of females in industries: mining, quarrying, and oil and gas extraction (population 50,000+)"

- #29 on the list of "Top 101 cities with the highest average wind speeds (population 50,000+)"

- #33 on the list of "Top 101 biggest cities in 2013"

- #33 on the list of "Top 100 biggest cities"

- #36 on the list of "Top 101 cities with largest percentage of males in industries: mining, quarrying, and oil and gas extraction (population 50,000+)"

- #40 on the list of "Top 101 cities with the largest city-data.com crime index per police officer (population 50,000+)"

- #46 on the list of "Top 101 cities with the highest city-data.com crime index, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #46 on the list of "Top 101 cities with the highest number of burglaries per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #50 on the list of "Top 101 cities with the highest number of murders per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #51 on the list of "Top 101 cities with the highest number of rapes per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #52 on the list of "Top 101 cities with the highest number of auto thefts per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #55 on the list of "Top 101 cities with the highest number of assaults per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #60 on the list of "Top 101 cities with largest percentage of females in industries: management of companies and enterprises (population 50,000+)"

- #67 on the list of "Top 101 cities with most building permits per 10,000 residents (population 50,000+)"

- #72 on the list of "Top 101 cities with largest percentage of males in industries: management of companies and enterprises (population 50,000+)"

- #75 on the list of "Top 100 least-safe cities (highest city-data.com crime index) (pop. 50,000+)"

- #83 on the list of "Top 101 cities with the largest house values disparities (population 50,000+)"

- #84 on the list of "Top 101 cities with largest percentage of females in occupations: construction and extraction occupations (population 50,000+)"

- #85 on the list of "Top 101 cities with largest percentage of males in occupations: construction and extraction occupations (population 50,000+)"

- #10 (73108) on the list of "Top 101 zip codes with the smallest percentage of taxpayers using charity contributions deductions in 2012 (pop 5,000+)"

- #29 (73108) on the list of "Top 101 zip codes with the smallest percentage of taxpayers reporting net capital gain/loss in 2012 (pop 1,000+)"

- #39 (73112) on the list of "Top 101 zip codes with the most offices of physicians in 2005"

- #44 (73102) on the list of "Top 101 zip codes with the most offices of lawyers in 2005"

- #83 (73108) on the list of "Top 101 zip codes with the smallest percentage of taxpayers reporting taxable interest in 2012 (pop 5,000+)"

- #100 (73108) on the list of "Top 101 zip codes with the most hotels or motels in 2005"

- #1 on the list of "Top 101 counties with the lowest Sulfur Oxides Annual air pollution readings in 2012 (µg/m3)"

- #7 on the list of "Top 101 counties with the highest lead air pollution readings in 2012 (µg/m3)"

- #8 on the list of "Top 101 counties with the most Evangelical Protestant adherents"

- #17 on the list of "Top 101 counties with the most Evangelical Protestant congregations"

- #21 on the list of "Top 101 counties with the lowest lead air pollution readings in 2012 (µg/m3)"

State forum archive:

|

|

Total of 903 patent applications in 2008-2024.