Roseville, California

Roseville: Vernon Street in Downtown Roseville

Roseville: Leaf on Royer Park Bridge, Roseville, CA

Roseville: Vernon Street in Downtown Roseville

Roseville: Vernon Street in Downtown Roseville

Roseville: Vernon Street in Downtown Roseville

Roseville: Vernon Street in Downtown Roseville

Roseville: Vernon Street in Downtown Roseville

Roseville: Vernon Street in Downtown Roseville

Roseville: Historic Train

Roseville: Vernon Street in Downtown Roseville

Roseville: Sun City Roseville California

- see

30

more - add

your

Submit your own pictures of this city and show them to the world

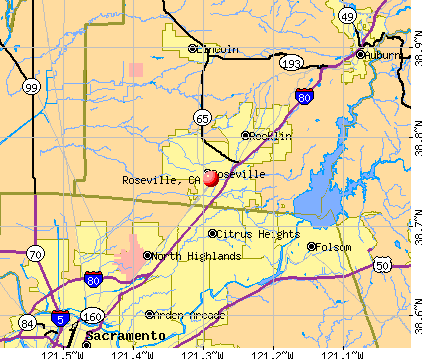

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +93.7%

| Males: 78,080 | |

| Females: 76,737 |

| Median resident age: | 42.7 years |

| California median age: | 37.9 years |

Zip codes: 95747.

| Roseville: | $100,739 |

| CA: | $91,551 |

Estimated per capita income in 2022: $50,648 (it was $27,021 in 2000)

Roseville city income, earnings, and wages data

Estimated median house or condo value in 2022: $650,600 (it was $192,300 in 2000)

| Roseville: | $650,600 |

| CA: | $715,900 |

Mean prices in 2022: all housing units: $658,034; detached houses: $673,465; townhouses or other attached units: $435,836; in 2-unit structures: $335,742; in 3-to-4-unit structures: $424,943; in 5-or-more-unit structures: $649,050; mobile homes: $233,940

Median gross rent in 2022: $2,088.

(5.2% for White Non-Hispanic residents, 7.3% for Black residents, 10.6% for Hispanic or Latino residents, 12.9% for American Indian residents, 20.0% for other race residents, 4.7% for two or more races residents)

Detailed information about poverty and poor residents in Roseville, CA

- 98,53063.6%White alone

- 23,62615.3%Hispanic

- 18,36511.9%Asian alone

- 10,1986.6%Two or more races

- 3,3052.1%Black alone

- 7050.5%Other race alone

- 970.06%American Indian alone

According to our research of California and other state lists, there were 139 registered sex offenders living in Roseville, California as of April 25, 2024.

The ratio of all residents to sex offenders in Roseville is 955 to 1.

The ratio of registered sex offenders to all residents in this city is lower than the state average.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is smaller than the state average.- means the value is about the same as the state average.

- means the value is bigger than the state average.

- means the value is much bigger than the state average.

Crime rate in Roseville detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 197 (135 officers - 125 male; 10 female).

| Officers per 1,000 residents here: | 0.92 |

| California average: | 2.30 |

| buying a house in Roseville vs Folsom in current market (9 replies) |

| Granite Bay, Rocklin, Roseville (8 replies) |

| Feedback on Roseville (Vineyard) area & schools? (4 replies) |

| Home prices right after bubble burst vs now - Folsom & Roseville (24 replies) |

| Granite Bay vs Roseville vs Rocklin (9 replies) |

| Roseville vs. Folsom? (20 replies) |

Latest news from Roseville, CA collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: English (7.5%), German (6.6%), American (4.9%), Italian (4.4%), Irish (4.4%), European (4.2%).

Current Local Time: PST time zone

Elevation: 160 feet

Land area: 30.5 square miles.

Population density: 5,080 people per square mile (average).

21,970 residents are foreign born (8.5% Asia, 2.6% Latin America, 2.4% Europe).

| This city: | 14.4% |

| California: | 26.5% |

Median real estate property taxes paid for housing units with mortgages in 2022: $5,111 (0.8%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $4,034 (0.6%)

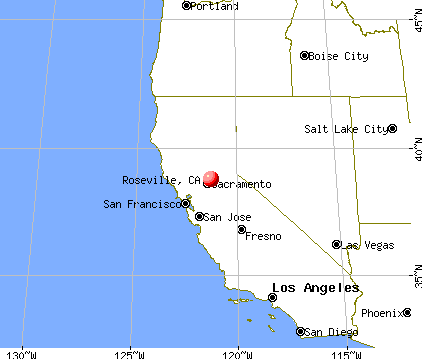

Nearest city with pop. 200,000+: Sacramento, CA (16.7 miles

, pop. 407,018).

Nearest city with pop. 1,000,000+: Los Angeles, CA (361.1 miles

, pop. 3,694,820).

Nearest cities:

Latitude: 38.75 N, Longitude: 121.29 W

Daytime population change due to commuting: +22,568 (+14.6%)

Workers who live and work in this city: 38,562 (52.0%)

Roseville tourist attractions:

Roseville, California accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 1578 buildings, average cost: $249,100

- 2021: 1883 buildings, average cost: $252,000

- 2020: 1264 buildings, average cost: $260,800

- 2019: 998 buildings, average cost: $265,300

- 2018: 808 buildings, average cost: $273,300

- 2017: 1191 buildings, average cost: $278,600

- 2016: 862 buildings, average cost: $282,900

- 2015: 967 buildings, average cost: $281,800

- 2014: 645 buildings, average cost: $239,900

- 2013: 535 buildings, average cost: $237,800

- 2012: 663 buildings, average cost: $235,100

- 2011: 411 buildings, average cost: $222,200

- 2010: 635 buildings, average cost: $235,600

- 2009: 602 buildings, average cost: $208,100

- 2008: 676 buildings, average cost: $229,400

- 2007: 1050 buildings, average cost: $222,500

- 2006: 776 buildings, average cost: $209,900

- 2005: 826 buildings, average cost: $203,900

- 2004: 1025 buildings, average cost: $247,100

- 2003: 1467 buildings, average cost: $261,800

- 2002: 2300 buildings, average cost: $228,900

- 2001: 1456 buildings, average cost: $244,700

- 2000: 1393 buildings, average cost: $225,200

- 1999: 1204 buildings, average cost: $192,300

- 1998: 2032 buildings, average cost: $168,400

- 1997: 1688 buildings, average cost: $157,500

| Here: | 3.9% |

| California: | 5.1% |

Population change in the 1990s: +34,499 (+76.0%).

- Public administration (8.3%)

- Health care (7.6%)

- Construction (7.2%)

- Educational services (7.1%)

- Finance & insurance (7.0%)

- Computer & electronic products (6.7%)

- Professional, scientific, technical services (6.3%)

- Construction (11.7%)

- Public administration (8.4%)

- Computer & electronic products (7.9%)

- Professional, scientific, technical services (7.0%)

- Finance & insurance (5.9%)

- Accommodation & food services (4.6%)

- Administrative & support & waste management services (4.2%)

- Health care (12.3%)

- Educational services (11.6%)

- Public administration (8.3%)

- Finance & insurance (8.3%)

- Professional, scientific, technical services (5.6%)

- Accommodation & food services (5.6%)

- Computer & electronic products (5.4%)

- Cooks and food preparation workers (6.6%)

- Other management occupations, except farmers and farm managers (5.3%)

- Computer specialists (4.4%)

- Retail sales workers, except cashiers (3.1%)

- Information and record clerks, except customer service representatives (3.1%)

- Customer service representatives (2.9%)

- Other office and administrative support workers, including supervisors (2.8%)

- Computer specialists (7.2%)

- Cooks and food preparation workers (6.3%)

- Other management occupations, except farmers and farm managers (5.6%)

- Building and grounds cleaning and maintenance occupations (3.3%)

- Driver/sales workers and truck drivers (3.2%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (2.8%)

- Engineers (2.7%)

- Cooks and food preparation workers (6.8%)

- Other management occupations, except farmers and farm managers (5.1%)

- Other office and administrative support workers, including supervisors (5.0%)

- Registered nurses (5.0%)

- Secretaries and administrative assistants (4.7%)

- Information and record clerks, except customer service representatives (3.7%)

- Cashiers (3.6%)

Average climate in Roseville, California

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2023 was 70.7. This is about average.

| City: | 70.7 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2021 was 0.194. This is better than average. Closest monitor was 1.4 miles away from the city center.

| City: | 0.194 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 5.99. This is about average. Closest monitor was 1.4 miles away from the city center.

| City: | 5.99 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.207. This is significantly better than average. Closest monitor was 5.7 miles away from the city center.

| City: | 0.207 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2023 was 30.1. This is about average. Closest monitor was 4.6 miles away from the city center.

| City: | 30.1 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 17.3. This is about average. Closest monitor was 1.4 miles away from the city center.

| City: | 17.3 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 6.75. This is better than average. Closest monitor was 1.4 miles away from the city center.

| City: | 6.75 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2023 was 0.00140. This is significantly better than average. Closest monitor was 1.4 miles away from the city center.

| City: | 0.00140 |

| U.S.: | 0.00931 |

Earthquake activity:

Roseville-area historical earthquake activity is significantly above California state average. It is 7586% greater than the overall U.S. average.On 4/18/1906 at 13:12:21, a magnitude 7.9 (7.9 UK, Class: Major, Intensity: VIII - XII) earthquake occurred 106.4 miles away from Roseville center, causing $524,000,000 total damage

On 10/3/1915 at 06:52:48, a magnitude 7.6 (7.6 UK) earthquake occurred 235.3 miles away from the city center

On 10/18/1989 at 00:04:15, a magnitude 7.1 (6.5 MB, 7.1 MS, 6.9 MW, 7.0 ML) earthquake occurred 116.6 miles away from the city center, causing 62 deaths (62 shaking deaths) and 3757 injuries, causing $1,305,032,704 total damage

On 1/31/1922 at 13:17:28, a magnitude 7.6 (7.6 UK) earthquake occurred 263.8 miles away from Roseville center

On 12/21/1932 at 06:10:09, a magnitude 7.2 (7.2 UK) earthquake occurred 174.0 miles away from the city center

On 7/21/1952 at 11:52:14, a magnitude 7.7 (7.7 UK) earthquake occurred 288.8 miles away from the city center, causing $50,000,000 total damage

Magnitude types: body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Placer County (17) is near the US average (15).Major Disasters (Presidential) Declared: 9

Emergencies Declared: 2

Causes of natural disasters: Floods: 10, Storms: 6, Fires: 4, Landslides: 4, Mudslides: 3, Winter Storms: 3, Drought: 1, Heavy Rain: 1, Hurricane: 1, Tornado: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: HUMBOLDT BANCORP (STATE COMMERCIAL BANKS), SUREWEST COMMUNICATIONS (TELEPHONE COMMUNICATIONS (NO RADIO TELEPHONE)).

Hospitals in Roseville:

- KAISER FOUNDATION HOSPITAL - ROSEVILLE (Voluntary non-profit - Private, provides emergency services, 1600 EUREKA ROAD)

- SUTTER ROSEVILLE MEDICAL CENTER (Voluntary non-profit - Other, ONE MEDICAL PLAZA)

- SUTTER VNA AND HOSPICE-ROSEVILLE (1836 SIERREA GARDENS DRIVE, SUITE 130)

Nursing Homes in Roseville:

- OAK RIDGE HEALTHCARE CENTER (310 OAK RIDGE DRIVE)

- PINE CREEK CARE CENTER (1139 CIRBY WAY)

- ROSEVILLE CARE CENTER (1161 CIRBY WAY)

- ROSEVILLE POINT HEALTH AND WELLNESS CENTER (600 SUNRISE AVENUE)

- TRANSITIONAL LIVING CENTER-D/P SNF (333 SUNRISE AVE)

Dialysis Facilities in Roseville:

- RAI HARDING BLVD (218 HARDING BLVD.)

- RAI SECRET RAVINE PARKWAY (1451 SECRET RAVINE PARKWAY SUITE 130)

Home Health Centers in Roseville:

Colleges/Universities in Roseville:

Colleges/universities with over 2000 students nearest to Roseville:

- Sierra College (about 5 miles; Rocklin, CA; Full-time enrollment: 11,488)

- American River College (about 8 miles; Sacramento, CA; FT enrollment: 20,452)

- Folsom Lake College (about 11 miles; Folsom, CA; FT enrollment: 5,308)

- Universal Technical Institute of Northern California Inc (about 15 miles; Sacramento, CA; FT enrollment: 3,193)

- California State University-Sacramento (about 16 miles; Sacramento, CA; FT enrollment: 22,234)

- University of Phoenix-Sacramento Valley Campus (about 16 miles; Sacramento, CA; FT enrollment: 2,855)

- Sacramento City College (about 19 miles; Sacramento, CA; FT enrollment: 15,963)

Public high schools in Roseville:

- WOODCREEK HIGH (Students: 1,501, Location: 2551 WOODCREEK OAKS BLVD., Grades: 9-12)

- ROSEVILLE HIGH (Students: 1,454, Location: 1 TIGER WAY, Grades: 9-12)

- OAKMONT HIGH (Students: 1,248, Location: 1710 CIRBY WAY, Grades: 9-12)

- INDEPENDENCE HIGH (ALTERNATIVE) (Students: 67, Location: 125 BERRY ST., Grades: 9-12)

- ADELANTE HIGH (CONTINUATION) (Students: 39, Location: 350 ATLANTIC ST., Grades: 9-12)

- JOHN ADAMS ACADEMY (Location: ONE SIERRAGATE PLAZA, Grades: KG-12, Charter school)

Private high schools in Roseville:

- VALLEY CHRISTIAN ACADEMY (Students: 255, Location: 301 W WHYTE AVE, Grades: PK-12)

- CORNERSTONE CHRISTIAN SCHOOL (Students: 166, Location: 143 CLINTON AVE, Grades: KG-12)

- GATES OF LEARNING CENTER (Students: 24, Location: 1780 VERNON ST STE 5, Grades: 7-12, Boys only)

- TRINITY CHRISTIAN ACADEMY (Students: 12, Location: 233 BERKSWELL CT, Grades: 1-9)

Biggest public elementary/middle schools in Roseville:

- WILSON C. RILES MIDDLE (Students: 1,145, Location: 4747 PFE RD., Grades: 7-8)

- GEORGE A. BULJAN MIDDLE (Students: 1,077, Location: 100 HALLISSY DR., Grades: 6-8)

- SILVERADO MIDDLE (Students: 951, Location: 2525 COUNTRY CLUB DR., Grades: 6-8)

- ROBERT C. COOLEY MIDDLE (Students: 889, Location: 9300 PRAIRIE WOODS WAY, Grades: 6-8)

- COYOTE RIDGE ELEMENTARY (Students: 579, Location: 1751 MORNING STAR DR., Grades: KG-5)

- OLYMPUS JUNIOR HIGH (Students: 540, Location: 2625 LA CROIX DR., Grades: 7-8)

- QUAIL GLEN ELEMENTARY (Students: 468, Location: 1250 CANEVARI DR., Grades: KG-5)

- HERITAGE OAK ELEMENTARY (Students: 445, Location: 2271 AMERICANA DR., Grades: KG-5)

- EXCELSIOR ELEMENTARY (Students: 436, Location: 2701 EUREKA RD., Grades: 4-6)

- CATHERYN GATES ELEMENTARY (Students: 408, Location: 1051 TREHOWELL DR., Grades: KG-5)

Private elementary/middle schools in Roseville:

- ADVENTURE CHRISTIAN SCHOOL (Students: 565, Location: 6401 STANFORD RANCH RD B, Grades: PK-8)

- ST ROSE SCHOOL (Students: 307, Location: 633 VINE AVE, Grades: KG-8)

- ST ALBANS COUNTRY DAY SCHOOL (Students: 240, Location: 2312 VERNON ST, Grades: PK-8)

- ST JOHN'S SCHOOL (Students: 199, Location: 4501 BOB DOYLE DR, Grades: PK-8)

- GRANITE BAY MONTESSORI (Students: 169, Location: 9330 SIERRA COLLEGE BLVD, Grades: PK-8)

- MERRYHILL SCHOOL (Students: 117, Location: 1622 SIERRA GARDENS DR, Grades: PK-5)

- ROSEVILLE COMMUNITY SCHOOL (Students: 41, Location: 50 CORPORATION YARD RD, Grades: KG-6)

- ARBOR VIEW MONTESSORI (Students: 24, Location: 7441 FOOTHILLS BLVD # 140, Grades: PK-T1)

Points of interest:

Notable locations in Roseville: Diamond Oaks Municipal Golf Course (A), Dry Creek Regional Wastewater Treatment Plant (B), W F Fiddyment Ranch (C), Diamond K Ranch (D), Sierra View Country Club (E), Veterans Memorial Building (F), Roseville Public Library (G), Roseville City Hall (H), Roseville Arts Center (I), Roseville Telephone Museum (J), Placer County Fire Department Station 1 / City of Roseville Fire Department Station 1 (K), American Medical Response (L), Telecare Placer County Psychiatric Health Facility (M), California Army National Guard 233rd Firefighting Team (N), Placer County Fire Department Station 5 / Roseville Fire Department Station 5 (O), Placer County Fire Department Station 2 / Roseville Fire Department Station 2 (P), Placer County Fire Department Station 4 / Roseville Fire Department Station 4 (Q), Placer County Fire Department Station 3 / Roseville Fire Department Station 3 (R), Placer County Fire Department Station 8 / Roseville Fire Department Station 8 (S), Placer County Fire Department Station 6 / Roseville Fire Department Station 6 (T). Display/hide their locations on the map

Shopping Centers: Creekside Town Center Shopping Center (1), Galleria At Roseville Shopping Center (2), Roseville Square Shopping Center (3), Roseville Shopping Center (4), Placer Center Plaza Shopping Center (5), Bel Air Shopping Center (6). Display/hide their locations on the map

Main business address in Roseville include: HUMBOLDT BANCORP (A), SUREWEST COMMUNICATIONS (B). Display/hide their locations on the map

Churches in Roseville include: First United Methodist Church (A), First Baptist Church of Roseville (B), Bethel Lutheran Church (C), Christian Life Center (D), Church of God (E), Faith Chapel Assembly of God Church (F), First Church of Christ Scientist (G), First Presbyterian Church (H), First Southern Baptist Church (I). Display/hide their locations on the map

Cemetery: Roseville Cemetery (1). Display/hide its location on the map

Reservoir: Roseville Reservoir (A). Display/hide its location on the map

Creeks: Linda Creek (A), Cirby Creek (B), Antelope Creek (C). Display/hide their locations on the map

Parks in Roseville include: Cirby Creek Park (1), Kenwood Oaks Park (2), Mark White Park (3), Sierra Gardens Park (4), Woodbridge Park (5), Cresthaven Park (6), Crestmont Park (7), Eastwood Park (8), Maidu Park (9). Display/hide their locations on the map

Tourist attractions: California Coin (503 Giuseppe Court Suite 5) (1), Chambers of Commerce (650 Douglas Boulevard) (2). Display/hide their approximate locations on the map

Hotels: Best Western Roseville Inn (220 Harding Boulevard) (1), Bridges at Woodcreek Oaks (7950 Foothills Boulevard) (2). Display/hide their approximate locations on the map

Court: Cox Dave Senator 1st District (2140 Professional Drive Suite 140) (1). Display/hide its approximate location on the map

Birthplace of: John Ensign - US politician, Molly Ringwald - (born 1968), actress, Dave Revering - Baseball player, Summer Sanders - Swimmer, Don Verlin - Basketball player-coach, Donovan Osborne - Baseball player, Fred Besana - Football player, Isaiah Frey - Football player, Ted Gaines - Politician, Brandon Coupe - Tennis player.

Drinking water stations with addresses in Roseville that have no violations reported:

- PARADISE APOSTOLIC CAMP (Population served: 150, Primary Water Source Type: Groundwater)

| This city: | 2.6 people |

| California: | 2.9 people |

| This city: | 68.9% |

| Whole state: | 68.7% |

| This city: | 6.2% |

| Whole state: | 7.2% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.2% of all households

People in group quarters in Roseville in 2010:

- 361 people in nursing facilities/skilled-nursing facilities

- 177 people in workers' group living quarters and job corps centers

- 126 people in other noninstitutional facilities

- 95 people in group homes intended for adults

- 67 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 13 people in residential treatment centers for adults

- 5 people in in-patient hospice facilities

- 3 people in correctional residential facilities

People in group quarters in Roseville in 2000:

- 646 people in nursing homes

- 90 people in other noninstitutional group quarters

- 67 people in orthopedic wards and institutions for the physically handicapped

- 65 people in homes for the mentally ill

- 34 people in other nonhousehold living situations

- 24 people in homes for the mentally retarded

- 2 people in religious group quarters

Banks with most branches in Roseville (2011 data):

- Wells Fargo Bank, National Association: 8 branches. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- Bank of America, National Association: Roseville Square Branch, Creekside Branch, Roseville Main Branch, Crocker Ranch Branch, West Roseville Branch, Roseville Bai Branch. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- U.S. Bank National Association: Woodcreek Oaks Safeway Branch, Roseville Branch, Pleasant Grove Boulevard Safeway Bra, Sunrise Avenue Safeway Branch, Highland Reserve Marketplace Branch. Info updated 2012/01/30: Bank assets: $330,470.8 mil, Deposits: $236,091.5 mil, headquarters in Cincinnati, OH, positive income, 3121 total offices, Holding Company: U.S. Bancorp

- JPMorgan Chase Bank, National Association: Blue Oaks And Woodcreek Oaks Branch, Douglas And Harding Branch, Roseville Branch, Roseville - Foothills. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- Umpqua Bank: Highland Crossing Branch, Roseville Douglas Boulevard Branch, Roseville Main Branch, Messenger Service Branch. Info updated 2011/09/02: Bank assets: $11,556.7 mil, Deposits: $9,325.3 mil, headquarters in Roseburg, OR, positive income, Commercial Lending Specialization, 193 total offices, Holding Company: Umpqua Holdings Corporation

- First Northern Bank of Dixon: Roseville Real Estate Office, Sba Loan Office Branch, Roseville Branch. Info updated 2006/11/03: Bank assets: $781.6 mil, Deposits: $684.6 mil, headquarters in Dixon, CA, positive income, Commercial Lending Specialization, 19 total offices, Holding Company: First Northern Community Bancorp

- River City Bank: Granite Bay Branch, West Roseville Branch, Bel Air Supermarket Branch. Info updated 2006/11/03: Bank assets: $1,119.8 mil, Deposits: $900.1 mil, headquarters in Sacramento, CA, positive income, Commercial Lending Specialization, 15 total offices

- Tri Counties Bank: Roseville Pleasant Grove at 900 Pleasant Grove Boulevard, branch established on 2005/10/25; Roseville Douglas Blvd Branch at 1915 Douglas Boulevard, branch established on 2003/11/10. Info updated 2011/09/26: Bank assets: $2,554.4 mil, Deposits: $2,191.2 mil, headquarters in Chico, CA, positive income, Commercial Lending Specialization, 71 total offices, Holding Company: Trico Bancshares

- Union Bank, National Association: Roseville West Branch at 1020 Pleasant Grove Boulevard, branch established on 2004/01/20; Roseville Branch at 1850 Douglas Boulevard, Suite 102, branch established on 1981/08/03. Info updated 2011/09/01: Bank assets: $88,967.5 mil, Deposits: $65,286.4 mil, headquarters in San Francisco, CA, positive income, Commercial Lending Specialization, 403 total offices, Holding Company: Mitsubishi Ufj Financial Group, Inc.

- 18 other banks with 21 local branches

For population 15 years and over in Roseville:

- Never married: 27.6%

- Now married: 53.6%

- Separated: 1.1%

- Widowed: 6.0%

- Divorced: 11.7%

For population 25 years and over in Roseville:

- High school or higher: 95.1%

- Bachelor's degree or higher: 40.7%

- Graduate or professional degree: 12.5%

- Unemployed: 4.0%

- Mean travel time to work (commute): 22.1 minutes

| Here: | 9.5 |

| California average: | 15.5 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Roseville:

(Roseville, California Neighborhood Map)- Adamson Estates neighborhood

- Adamson Tract neighborhood

- Alder Point neighborhood

- Almond Tree Village neighborhood

- Alta Vista Oaks neighborhood

- Autumn Glen neighborhood

- Azure Estates neighborhood

- Bedell Acres neighborhood

- Bitner neighborhood

- Blake Meadows neighborhood

- Blue Oaks neighborhood

- Bonnie Brae Acres neighborhood

- Briarcliff neighborhood

- Broadstone neighborhood

- Brookcliff neighborhood

- Butlers neighborhood

- California Legend neighborhood

- Canterbury Downs Apts neighborhood

- Cardinal Way Tract neighborhood

- Carlsberg Center neighborhood

- Champion Oaks neighborhood

- Cherry Glen neighborhood

- Cherry Glen Tract neighborhood

- Church Street Station neighborhood

- Cirby Hills neighborhood

- Cirby Hills Professional Park neighborhood

- Cirby Oaks neighborhood

- Cirby Place neighborhood

- Cirby Ranch neighborhood

- Cirby Ranch South neighborhood

- Cirby Side neighborhood

- Cirby Woods neighborhood

- Cirby Woods Townhouses neighborhood

- Claiborne Tract neighborhood

- Collins Tract neighborhood

- Colnar Tract neighborhood

- Country Estates neighborhood

- Courtside neighborhood

- Creekside neighborhood

- Creekside Center neighborhood

- Creekside Estates neighborhood

- Creekside Manor neighborhood

- Crestgate neighborhood

- Cresthaven neighborhood

- Cresthaven Park Estates neighborhood

- Crestmont neighborhood

- Crocker Ranch North neighborhood

- Crocker Ranch South neighborhood

- Crown Point neighborhood

- Diamond Creek neighborhood

- Diamond Oaks neighborhood

- Diamond Oaks East neighborhood

- Diamond Oaks Unit neighborhood

- Diamond Plaza neighborhood

- Diamond Woods Village neighborhood

- Douglas Center neighborhood

- Dunmore Junction neighborhood

- East Roseville Parkway neighborhood

- Eastwood Park neighborhood

- Elkhills neighborhood

- Elm Court neighborhood

- Emerson Place neighborhood

- Enwood neighborhood

- Eskaton Village neighborhood

- Eureka Centre neighborhood

- Eureka Village neighborhood

- Fairview Park neighborhood

- Fiddyment Ranch neighborhood

- Fiddyment Ranch Village neighborhood

- Folsom Road neighborhood

- Foothill Business Park neighborhood

- Foothills neighborhood

- Foothills Junction neighborhood

- Foothills Tennis Village Apts neighborhood

- Foothills/Junction Center neighborhood

- Forest Oaks neighborhood

- Galleria neighborhood

- Garbolino neighborhood

- Golfview Estates neighborhood

- Granite Bay Pavillions neighborhood

- Greenbriar neighborhood

- Hampton Village neighborhood

- Harding neighborhood

- Herb Robinson Subdivision neighborhood

- Hidden Hills neighborhood

- Highland Park Condominiums neighborhood

- Highland Reserve neighborhood

- Highland Reserve Marketplace neighborhood

- Highland Reserve North neighborhood

- Highland Reserve West neighborhood

- Hill Atkins neighborhood

- Hill Atkins Warehouse neighborhood

- Hillcrest neighborhood

- Hilltop Circle neighborhood

- Hilltop Industrial Center neighborhood

- Hooper Estates Unit neighborhood

- Hunting Creek neighborhood

- Huntington Oaks neighborhood

- Industrial Area East neighborhood

- Industrial Area West neighborhood

- Johnson Ranch neighborhood

- Judie Heights neighborhood

- Junction West neighborhood

- Kaseberg (Kingswood) neighborhood

- Kaseberg Commons neighborhood

- Keehner neighborhood

- Kenroy Industrial Park neighborhood

- Kenroy Warehouse Parcel neighborhood

- Kent Place Tract neighborhood

- Kentfield neighborhood

- Kenwood Estates neighborhood

- Kerry Downs neighborhood

- Kindred Haven neighborhood

- King Jennings neighborhood

- King Oaks Subdivision neighborhood

- Kings Subdivision neighborhood

- Kingswood Village neighborhood

- Lava Ridge Professional Center neighborhood

- Lead Hill neighborhood

- Legacy neighborhood

- Lexington Greens neighborhood

- Lincoln Estates neighborhood

- Livotti Tract neighborhood

- Longmeadow Village neighborhood

- Los Cerritos neighborhood

- Maciel neighborhood

- Maidu neighborhood

- Main Street Condo neighborhood

- March Industrial Park neighborhood

- Mcrae neighborhood

- Meadow Oaks neighborhood

- Meadowind neighborhood

- Melody Hills neighborhood

- Mount Industrial Park neighborhood

- Mourier neighborhood

- Mourier 160 neighborhood

- Munster Herring neighborhood

- Oak Creek Vista neighborhood

- Oakmont Meadows neighborhood

- Oakridge Estates neighborhood

- Oakridge Park neighborhood

- Olympus Heights neighborhood

- Olympus Pointe neighborhood

- Original Roseville neighborhood

- Paolini Tract neighborhood

- Parkland Estates neighborhood

- Parkside Industrial Center neighborhood

- Peridina Medical Hall neighborhood

- Pheasant Run neighborhood

- Pilgrims Creek neighborhood

- Pleasant Grove neighborhood

- Porter Estates neighborhood

- Portside Estates neighborhood

- Promontory Pointe neighborhood

- Prospector Point neighborhood

- Quail Glen neighborhood

- Reuter Ranch neighborhood

- Ridgewood neighborhood

- Ridgewood Oaks neighborhood

- Rocky Ridge Center neighborhood

- Rosedale Tract neighborhood

- Rosegarden neighborhood

- Rosekrest neighborhood

- Rosepark neighborhood

- Roseville Automall neighborhood

- Roseville Center neighborhood

- Roseville Crossing neighborhood

- Roseville Greens neighborhood

- Roseville Heights neighborhood

- Roseville Manor neighborhood

- Sawtell neighborhood

- Schellhous neighborhood

- Shadowbrook neighborhood

- Shadowbrook Condos neighborhood

- Shasta Oaks Townhomes neighborhood

- Sierra Center neighborhood

- Sierra Crossings neighborhood

- Sierra Douglas Office Center neighborhood

- Sierra Gardens neighborhood

- Sierra Oaks neighborhood

- Sierra View neighborhood

- Sierra Vista neighborhood

- Sierra Vista Park neighborhood

- Sierraview Townhomes neighborhood

- Silverado Oaks neighborhood

- Silverado Village neighborhood

- Smith Tract neighborhood

- Somersett Hills neighborhood

- South Cirby neighborhood

- South Roseville neighborhood

- Southfork neighborhood

- Springfield neighborhood

- Stanford neighborhood

- Stanford Crossing neighborhood

- Stone Canyon neighborhood

- Stone Point neighborhood

- Stoneridge East Village neighborhood

- Stoneridge West Village neighborhood

- Sun City neighborhood

- Sun City Village neighborhood

- Sun Meadows neighborhood

- Sunrise Foxborough neighborhood

- Sunrise Tract neighborhood

- Sunset Tract neighborhood

- Tanner Property neighborhood

- The Brickyard neighborhood

- The Village neighborhood

- Theiles neighborhood

- Theiles Manor neighborhood

- Treasure Manor neighborhood

- Tumbling Hills Estates neighborhood

- Twin Creek Commons neighborhood

- Venu At Galleria Condominiums neighborhood

- Vernon Meadows neighborhood

- Villemont Condominiums neighborhood

- Vineyard neighborhood

- Vineyard Estates neighborhood

- Vineyard Pointe neighborhood

- Vineyard Pointe Business Park neighborhood

- Vintage Oaks neighborhood

- Vintage Oaks Lot neighborhood

- Vista Oaks neighborhood

- Vitale Tract neighborhood

- Walton Estates neighborhood

- Wellington neighborhood

- West Colonial Estates neighborhood

- Westpark Village neighborhood

- Westwood Terrace neighborhood

- Wild Rose Tract neighborhood

- Woodcreek East neighborhood

- Woodcreek North Village neighborhood

- Woodcreek Oaks neighborhood

- Woodcreek West Village neighborhood

- Woodlake Village neighborhood

- Woodridge Creek neighborhood

- Wrsp Fiddyment Map neighborhood

- Wrsp Westpark neighborhood

Religion statistics for Roseville, CA (based on Placer County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 58,135 | 153 |

| Catholic | 51,342 | 12 |

| Other | 17,462 | 57 |

| Mainline Protestant | 6,376 | 30 |

| Orthodox | 400 | 1 |

| None | 214,717 | - |

Food Environment Statistics:

| This county: | 1.66 / 10,000 pop. |

| California: | 2.14 / 10,000 pop. |

| Placer County: | 0.06 / 10,000 pop. |

| California: | 0.04 / 10,000 pop. |

| Here: | 0.60 / 10,000 pop. |

| California: | 0.62 / 10,000 pop. |

| This county: | 2.23 / 10,000 pop. |

| California: | 1.49 / 10,000 pop. |

| Placer County: | 9.00 / 10,000 pop. |

| California: | 7.42 / 10,000 pop. |

| Placer County: | 6.7% |

| California: | 7.3% |

| Here: | 17.6% |

| California: | 21.3% |

| This county: | 14.5% |

| State: | 17.9% |

Health and Nutrition:

| Here: | 52.7% |

| California: | 49.4% |

| Here: | 51.5% |

| California: | 48.0% |

| This city: | 28.3 |

| State: | 28.1 |

| This city: | 19.8% |

| California: | 20.2% |

| Roseville: | 9.7% |

| California: | 11.2% |

| Roseville: | 6.9 |

| State: | 6.8 |

| Roseville: | 34.2% |

| California: | 31.5% |

| Roseville: | 59.1% |

| California: | 56.4% |

| This city: | 80.0% |

| California: | 80.9% |

More about Health and Nutrition of Roseville, CA Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 133 | $1,559,701 | $140,725 | 0 | $0 |

| Financial Administration | 114 | $1,026,972 | $108,102 | 1 | $3,511 |

| Firefighters | 109 | $1,603,809 | $176,566 | 0 | $0 |

| Electric Power | 100 | $1,451,971 | $174,237 | 1 | $4,498 |

| Sewerage | 97 | $868,516 | $107,445 | 3 | $15,934 |

| Other and Unallocable | 85 | $678,603 | $95,803 | 8 | $27,396 |

| Parks and Recreation | 83 | $553,347 | $80,002 | 276 | $411,549 |

| Other Government Administration | 82 | $788,408 | $115,377 | 12 | $36,965 |

| Solid Waste Management | 61 | $394,470 | $77,601 | 2 | $9,608 |

| Water Supply | 60 | $455,188 | $91,038 | 6 | $25,904 |

| Police - Other | 60 | $457,361 | $91,472 | 28 | $39,592 |

| Streets and Highways | 34 | $362,979 | $128,110 | 6 | $22,028 |

| Natural Resources | 33 | $203,699 | $74,072 | 36 | $29,502 |

| Fire - Other | 24 | $195,780 | $97,890 | 5 | $11,713 |

| Housing and Community Development (Local) | 23 | $191,938 | $100,142 | 0 | $0 |

| Local Libraries | 11 | $52,579 | $57,359 | 21 | $35,367 |

| Judicial and Legal | 9 | $122,957 | $163,943 | 0 | $0 |

| Transit | 9 | $103,436 | $137,915 | 18 | $36,737 |

| Totals for Government | 1,127 | $11,071,712 | $117,889 | 423 | $710,303 |

Roseville government finances - Expenditure in 2021 (per resident):

- Construction - Regular Highways: $60,468,000 ($390.58)

Parks and Recreation: $6,421,000 ($41.47)

General - Other: $1,718,000 ($11.10)

Housing and Community Development: $372,000 ($2.40)

Police Protection: $99,000 ($0.64)

- Current Operations - Electric Utilities: $126,151,000 ($814.84)

Sewerage: $60,410,000 ($390.20)

Police Protection: $47,490,000 ($306.75)

Regular Highways: $45,183,000 ($291.85)

Gas Utilities: $36,285,000 ($234.37)

Local Fire Protection: $35,707,000 ($230.64)

Water Utilities: $27,567,000 ($178.06)

Central Staff Services: $27,071,000 ($174.86)

Solid Waste Management: $24,930,000 ($161.03)

Parks and Recreation: $22,517,000 ($145.44)

Protective Inspection and Regulation - Other: $14,371,000 ($92.83)

Transit Utilities: $13,099,000 ($84.61)

Public Welfare - Other: $5,607,000 ($36.22)

General - Other: $4,967,000 ($32.08)

Housing and Community Development: $4,855,000 ($31.36)

Libraries: $4,800,000 ($31.00)

Health - Other: $1,338,000 ($8.64)

- Electric Utilities - Interest on Debt: $5,976,000 ($38.60)

- Gas Utilities - Interest on Debt: $10,486,000 ($67.73)

- General - Interest on Debt: $10,996,000 ($71.03)

- Water Utilities - Interest on Debt: $1,431,000 ($9.24)

Roseville government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $61,333,000 ($396.16)

Other: $58,671,000 ($378.97)

Solid Waste Management: $28,803,000 ($186.05)

Parks and Recreation: $4,508,000 ($29.12)

- Federal Intergovernmental - Other: $21,861,000 ($141.21)

Transit Utilities: $6,286,000 ($40.60)

Housing and Community Development: $1,676,000 ($10.83)

- Local Intergovernmental - Other: $2,378,000 ($15.36)

- Miscellaneous - General Revenue - Other: $185,363,000 ($1197.30)

Special Assessments: $91,909,000 ($593.66)

Interest Earnings: $16,195,000 ($104.61)

Sale of Property: $7,313,000 ($47.24)

Rents: $1,128,000 ($7.29)

Donations From Private Sources: $872,000 ($5.63)

Fines and Forfeits: $201,000 ($1.30)

- Revenue - Electric Utilities: $167,777,000 ($1083.71)

Water Utilities: $53,743,000 ($347.14)

Gas Utilities: $29,873,000 ($192.96)

Transit Utilities: $539,000 ($3.48)

- State Intergovernmental - Sewerage: $94,027,000 ($607.34)

Electric Utilities: $28,839,000 ($186.28)

Highways: $5,878,000 ($37.97)

Other: $4,322,000 ($27.92)

Transit Utilities: $3,687,000 ($23.82)

General Local Government Support: $283,000 ($1.83)

- Tax - General Sales and Gross Receipts: $63,701,000 ($411.46)

Property: $55,996,000 ($361.69)

Other: $24,513,000 ($158.34)

Other License: $5,057,000 ($32.66)

Public Utilities Sales: $2,401,000 ($15.51)

Other Selective Sales: $2,384,000 ($15.40)

Documentary and Stock Transfer: $1,793,000 ($11.58)

Occupation and Business License - Other: $859,000 ($5.55)

Roseville government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $1,210,998,000 ($7822.13)

Outstanding Unspecified Public Purpose: $1,090,463,000 ($7043.56)

Retired Unspecified Public Purpose: $159,649,000 ($1031.21)

Issue, Unspecified Public Purpose: $39,114,000 ($252.65)

Roseville government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $158,800,000 ($1025.73)

- Other Funds - Cash and Securities: $239,191,000 ($1544.99)

- Sinking Funds - Cash and Securities: $5,902,000 ($38.12)

9.43% of this county's 2021 resident taxpayers lived in other counties in 2020 ($99,508 average adjusted gross income)

| Here: | 9.43% |

| California average: | 5.19% |

0.03% of residents moved from foreign countries ($239 average AGI)

Placer County: 0.03% California average: 0.03%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Sacramento County, CA | |

| from Santa Clara County, CA | |

| from Alameda County, CA |

8.04% of this county's 2020 resident taxpayers moved to other counties in 2021 ($95,121 average adjusted gross income)

| Here: | 8.04% |

| California average: | 6.14% |

0.03% of residents moved to foreign countries ($247 average AGI)

Placer County: 0.03% California average: 0.02%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Sacramento County, CA | |

| to Nevada County, CA | |

| to El Dorado County, CA |

| Businesses in Roseville, CA | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 24 Hour Fitness | 1 | Journeys | 1 | |

| 7-Eleven | 6 | Juicy Couture | 1 | |

| 99 Cents Only Stores | 1 | Justice | 2 | |

| ALDO | 1 | KFC | 2 | |

| AT&T | 5 | Kincaid | 1 | |

| Abercrombie & Fitch | 1 | Kohl's | 1 | |

| Abercrombie Kids | 1 | La-Z-Boy | 1 | |

| Ace Hardware | 1 | Lane Furniture | 1 | |

| Aeropostale | 1 | Little Caesars Pizza | 2 | |

| American Eagle Outfitters | 2 | Lowe's | 1 | |

| Ann Taylor | 1 | Macy's | 2 | |

| Apple Store | 1 | Marriott | 5 | |

| AutoZone | 1 | Marshalls | 1 | |

| Avenue | 1 | MasterBrand Cabinets | 1 | |

| BMW | 1 | Mazda | 1 | |

| Baja Fresh Mexican Grill | 1 | McDonald's | 8 | |

| Banana Republic | 1 | Men's Wearhouse | 1 | |

| Barnes & Noble | 1 | Motherhood Maternity | 1 | |

| Baskin-Robbins | 3 | New Balance | 6 | |

| Bath & Body Works | 2 | New York & Co | 1 | |

| Bed Bath & Beyond | 1 | Nike | 15 | |

| Best Western | 1 | Nissan | 1 | |

| Big O Tires | 1 | Nordstrom | 2 | |

| Blockbuster | 3 | Office Depot | 1 | |

| Brooks Brothers | 1 | OfficeMax | 1 | |

| Burger King | 3 | Old Navy | 1 | |

| CVS | 3 | Olive Garden | 1 | |

| Cache | 1 | On The Border | 1 | |

| CarMax | 1 | Outback | 1 | |

| Carl\s Jr. | 4 | Outback Steakhouse | 1 | |

| Casual Male XL | 1 | Pac Sun | 1 | |

| Catherines | 1 | Panda Express | 4 | |

| Charlotte Russe | 1 | Panera Bread | 2 | |

| Chevrolet | 1 | Papa John's Pizza | 1 | |

| Chick-Fil-A | 1 | Payless | 2 | |

| Chico's | 1 | Penske | 1 | |

| Chipotle | 3 | PetSmart | 2 | |

| Chuck E. Cheese's | 1 | Pier 1 Imports | 1 | |

| Cinnabon | 1 | Pizza Hut | 1 | |

| Circle K | 4 | Pottery Barn | 1 | |

| Clarks | 1 | Pottery Barn Kids | 1 | |

| Cold Stone Creamery | 2 | Quiznos | 3 | |

| Coldwater Creek | 1 | RadioShack | 2 | |

| Costco | 1 | Red Robin | 1 | |

| Crate & Barrel | 1 | Rite Aid | 4 | |

| Curves | 3 | SONIC Drive-In | 1 | |

| Dairy Queen | 2 | Safeway | 4 | |

| Dennys | 1 | Sam's Club | 1 | |

| Discount Tire | 1 | Sears | 2 | |

| DressBarn | 1 | Sephora | 2 | |

| Dressbarn | 1 | Skechers USA | 1 | |

| Eddie Bauer | 1 | Soma Intimates | 1 | |

| Express | 1 | Sprint Nextel | 3 | |

| Extended Stay America | 1 | Staples | 1 | |

| Famous Footwear | 2 | Starbucks | 19 | |

| Fashion Bug | 1 | Subaru | 1 | |

| FedEx | 14 | Subway | 10 | |

| Firestone Complete Auto Care | 1 | T-Mobile | 8 | |

| Ford | 1 | T.J.Maxx | 1 | |

| Forever 21 | 1 | Taco Bell | 3 | |

| Fredericks Of Hollywood | 1 | Talbots | 1 | |

| GNC | 3 | Target | 2 | |

| GameStop | 3 | The Cheesecake Factory | 1 | |

| Gap | 1 | Toyota | 1 | |

| Gymboree | 1 | Toys"R"Us | 3 | |

| H&M | 1 | Trader Joe's | 1 | |

| H&R Block | 4 | U-Haul | 7 | |

| Hilton | 2 | UPS | 25 | |

| Hobby Lobby | 1 | Urban Outfitters | 1 | |

| Holiday Inn | 1 | Vans | 7 | |

| Hollister Co. | 1 | Verizon Wireless | 4 | |

| Home Depot | 2 | Victoria's Secret | 1 | |

| Honda | 1 | Volkswagen | 1 | |

| Hot Topic | 1 | Vons | 4 | |

| J. Jill | 1 | Walgreens | 1 | |

| JCPenney | 1 | Walmart | 2 | |

| Jack In The Box | 3 | Wendy's | 2 | |

| Jamba Juice | 5 | Wet Seal | 1 | |

| JoS. A. Bank | 1 | Whole Foods Market | 1 | |

| Jones New York | 3 | Z Gallerie | 1 | |

Strongest AM radio stations in Roseville:

- KFIA (710 AM; 25 kW; CARMICHAEL, CA; Owner: VISTA BROADCASTING INC.)

- KLIB (1110 AM; 10 kW; ROSEVILLE, CA; Owner: WAY BROADCASTING, INC.)

- KFSG (1690 AM; 10 kW; ROSEVILLE, CA; Owner: WAY BROADCASTING, INC.)

- KFBK (1530 AM; 50 kW; SACRAMENTO, CA; Owner: AMFM RADIO LICENSES, L.L.C.)

- KSTE (650 AM; 25 kW; RANCHO CORDOVA, CA; Owner: AMFM RADIO LICENSES, L.L.C.)

- KHTK (1140 AM; 50 kW; SACRAMENTO, CA; Owner: INFINITY RADIO SUBSIDIARY OPERATIONS INC.)

- KAHI (950 AM; 10 kW; AUBURN, CA; Owner: IHR EDUCATIONAL BROADCASTING)

- KSMH (1620 AM; 10 kW; WEST SACRAMENTO, CA; Owner: IHR EDUCATIONAL BROADCASTING)

- KTKZ (1380 AM; 5 kW; SACRAMENTO, CA; Owner: VISTA BROADCASTING, INC.)

- KIID (1470 AM; 5 kW; SACRAMENTO, CA; Owner: ABC, INC.)

- KCTC (1320 AM; 5 kW; SACRAMENTO, CA; Owner: ENTERCOM SACRAMENTO LICENSE, LLC)

- KCBC (770 AM; 50 kW; RIVERBANK, CA; Owner: KIERTRON, INC.)

- KCBS (740 AM; 50 kW; SAN FRANCISCO, CA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

Strongest FM radio stations in Roseville:

- KXOA (93.7 FM; ROSEVILLE, CA; Owner: INFINITY RADIO SUBSIDIARY OPERATIONS INC.)

- KXCL (103.9 FM; YUBA CITY, CA; Owner: HARLAN COMMUNICATIONS, INC.)

- KXPR (90.9 FM; SACRAMENTO, CA; Owner: CALIFORNIA STATE UNIVERSITY)

- KGBY (92.5 FM; SACRAMENTO, CA; Owner: AMFM RADIO LICENSES, L.L.C.)

- KSEG (96.9 FM; SACRAMENTO, CA; Owner: ENTERCOM SACRAMENTO LICENSE, LLC)

- K211DF (90.1 FM; FOOTHILL FARMS, CA; Owner: YOUR CHRISTIAN COMPANION NETWORK, INC.)

- KDND (107.9 FM; SACRAMENTO, CA; Owner: ENTERCOM SACRAMENTO LICENSE, LLC)

- KRXQ (98.5 FM; SACRAMENTO, CA; Owner: ENTERCOM SACRAMENTO LICENSE, LLC)

- KEDR (88.1 FM; SACRAMENTO, CA; Owner: FAMILY STATIONS, INC.)

- KNCI (105.1 FM; SACRAMENTO, CA; Owner: INFINITY RADIO SUBSIDIARY OPERATIONS INC.)

- KQEI-FM (89.3 FM; NORTH HIGHLANDS, CA; Owner: KQED, INC.)

- KRCX-FM (99.9 FM; MARYSVILLE, CA; Owner: ENTRAVISION HOLDINGS, LLC)

- KHYL (101.1 FM; AUBURN, CA; Owner: AMFM RADIO LICENSES, L.L.C.)

- K256AG (99.1 FM; CLARKSVILLE, CA; Owner: EDUCATIONAL MEDIA FOUNDATION)

- KMJE (101.5 FM; GRIDLEY, CA; Owner: RESULTS RADIO LICENSEE, LLC)

- KWOD (106.5 FM; SACRAMENTO, CA; Owner: ENTERCOM SACRAMENTO LICENSE, LLC)

- K213BZ (90.5 FM; RICHVALE, CA; Owner: FAMILY STATIONS, INC.)

- K258AH (99.5 FM; ROSEVILLE, CA; Owner: EDUCATIONAL MEDIA FOUNDATION)

- KKSF-FM1 (103.7 FM; PLEASANTON, ETC., CA; Owner: AMFM RADIO LICENSES, L.L.C.)

- KYMX (96.1 FM; SACRAMENTO, CA; Owner: INFINITY RADIO OPERATIONS INC.)

TV broadcast stations around Roseville:

- K27EU (Channel 27; SACRAMENTO, CA; Owner: ABUNDANT LIFE BROADCASTING, INC.)

- KMMK-LP (Channel 14; SACRAMENTO, CA; Owner: CABALLERO TELEVISION TEXAS, L.L.C.)

- KEZT-CA (Channel 23; SACRAMENTO, CA; Owner: TELEFUTURA SACRAMENTO LLC)

- K22FR (Channel 22; SACRAMENTO, CA; Owner: NATIONAL MINORITY T.V., INC.)

- K27FX (Channel 27; EUREKA, CA; Owner: MS COMMUNICATIONS, LLC)

- K17EH (Channel 17; EUREKA, CA; Owner: MS COMMUNICATIONS, LLC)

- KSAO-LP (Channel 49; SACRAMENTO, CA; Owner: GARY M. COCOLA FAMILY TRUST, GARY M. COCOLA TRUSTEE)

- KBTV-LP (Channel 8; SACRAMENTO, CA; Owner: INCISOR COMMUNICATIONS, L.L.C.)

- KMUM-CA (Channel 15; SACRAMENTO, CA; Owner: CABALLERO TELEVISION TEXAS, L.L.C.)

- KSPX (Channel 29; SACRAMENTO, CA; Owner: PAXSON SACRAMENTO LICENSE, INC.)

- K69FB (Channel 69; SACRAMENTO, CA; Owner: TRINITY BROADCASTING NETWORK)

- KTXL (Channel 40; SACRAMENTO, CA; Owner: CHANNEL 40, INC.)

- KQCA (Channel 58; STOCKTON, CA; Owner: KCRA HEARST-ARGYLE TELEVISION, INC.)

- KCSO-LP (Channel 33; SACRAMENTO, CA; Owner: SAINTE 51, L.P.)

- KCRA-TV (Channel 3; SACRAMENTO, CA; Owner: KCRA HEARST-ARGYLE TELEVISION, INC.)

- KVIE (Channel 6; SACRAMENTO, CA; Owner: KVIE, INC.)

- KOVR (Channel 13; STOCKTON, CA; Owner: SCI - SACRAMENTO LICENSEE, LLC)

- KXTV (Channel 10; SACRAMENTO, CA; Owner: KXTV, INC.)

- KMAX-TV (Channel 31; SACRAMENTO, CA; Owner: UPN STATIONS GROUP INC.)

- KUVS (Channel 19; MODESTO, CA; Owner: KUVS LICENSE PARTNERSHIP, G.P.)

- KRJR-LP (Channel 47; SACRAMENTO, CA; Owner: WORD OF GOD FELLOWSHIP, INC.)

- KGTN-LP (Channel 62; PLACERVILLE, CA; Owner: PRAISE THE LORD STUDIO CHAPEL)

- K61DW (Channel 61; SACRAMENTO, CA; Owner: DR. W. R. PORTEE)

- KSTV-LP (Channel 60; SACRAMENTO, CA; Owner: GARY M. COCOLA FAMILY TRUST, GARY M. COCOLA TRUSTEE)

- National Bridge Inventory (NBI) Statistics

- 110Number of bridges

- 2,274ft / 693mTotal length

- $7,808,000Total costs

- 3,479,033Total average daily traffic

- 221,097Total average daily truck traffic

- New bridges - historical statistics

- 11910-1919

- 31920-1929

- 41930-1939

- 21940-1949

- 91950-1959

- 91960-1969

- 121970-1979

- 281980-1989

- 171990-1999

- 182000-2009

- 72010-2019

FCC Registered Private Land Mobile Towers: 8 (See the full list of FCC Registered Private Land Mobile Towers in Roseville, CA)

FCC Registered Broadcast Land Mobile Towers: 82 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 86 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 8 (See the full list of FCC Registered Paging Towers)

FCC Registered Amateur Radio Licenses: 827 (See the full list of FCC Registered Amateur Radio Licenses in Roseville)

FAA Registered Aircraft Manufacturers and Dealers: 2 (See the full list of FAA Registered Manufacturers and Dealers in Roseville)

FAA Registered Aircraft: 89 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 10 full and 6 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 592 | $272,255 | 627 | $238,421 | 2,624 | $246,408 | 89 | $145,901 | 6 | $10,015,135 | 276 | $206,707 | 6 | $61,872 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 53 | $239,493 | 75 | $225,998 | 290 | $262,667 | 17 | $88,388 | 0 | $0 | 29 | $175,809 | 7 | $60,444 |

| APPLICATIONS DENIED | 88 | $282,191 | 112 | $234,742 | 671 | $277,437 | 45 | $73,458 | 1 | $500,000 | 94 | $202,758 | 12 | $59,578 |

| APPLICATIONS WITHDRAWN | 89 | $278,923 | 106 | $242,592 | 674 | $274,783 | 27 | $180,749 | 0 | $0 | 66 | $199,756 | 2 | $106,665 |

| FILES CLOSED FOR INCOMPLETENESS | 13 | $286,999 | 23 | $230,005 | 103 | $280,463 | 6 | $60,912 | 0 | $0 | 9 | $209,603 | 1 | $35,000 |

Detailed mortgage data for all 16 tracts in Roseville, CA

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 10 full and 6 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 79 | $261,351 | 41 | $305,913 | 0 | $0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 25 | $299,550 | 12 | $299,741 | 0 | $0 |

| APPLICATIONS DENIED | 10 | $293,678 | 12 | $288,362 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 4 | $222,508 | 5 | $403,844 | 1 | $268,000 |

| FILES CLOSED FOR INCOMPLETENESS | 4 | $257,045 | 0 | $0 | 0 | $0 |

2005 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Roseville, CA

- 1,31448.7%Outside Fires

- 85931.8%Structure Fires

- 41015.2%Mobile Property/Vehicle Fires

- 1164.3%Other

Based on the data from the years 2005 - 2018 the average number of fires per year is 193. The highest number of fires - 371 took place in 2013, and the least - 3 in 2008. The data has a rising trend.

Based on the data from the years 2005 - 2018 the average number of fires per year is 193. The highest number of fires - 371 took place in 2013, and the least - 3 in 2008. The data has a rising trend. When looking into fire subcategories, the most incidents belonged to: Outside Fires (48.7%), and Structure Fires (31.8%).

When looking into fire subcategories, the most incidents belonged to: Outside Fires (48.7%), and Structure Fires (31.8%).Fire-safe hotels and motels in Roseville, California:

- Best Western Roseville Inn, 220 Harding Blvd, Roseville, California 95678 , Phone: (916) 782-4434, Fax: (916) 782-8335

- Orchid Suites, 130 N Sunrise Ave, Roseville, California 95661 , Phone: (916) 784-2222

- Extended Stay America, 1000 Lead Hill Blvd, Roseville, California 95661 , Phone: (916) 781-9001, Fax: (916) 781-9030

- Hilton Garden Inn Roseville, 1951 Taylor Rd, Roseville, California 95661 , Phone: (916) 773-7171, Fax: (916) 773-7138

- Residence Inn Roseville, 1930 Taylor Rd, Roseville, California 95661 , Phone: (916) 772-5500

- Fairfield Inn Roseville, 1910 Taylor Rd, Roseville, California 95661 , Phone: (916) 772-3500

- Courtyard Roseville 1, 1920 Taylor Rd, Roseville, California 95661 , Phone: (916) 772-5555

- Courtyard Roseville 2, 301 Creekside Ridge Ct, Roseville, California 95678 , Phone: (916) 772-3404, Fax: (916) 772-2313

- 6 other hotels and motels

| Most common first names in Roseville, CA among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| John | 297 | 75.7 years |

| Mary | 271 | 79.9 years |

| Robert | 246 | 73.8 years |

| William | 238 | 76.0 years |

| James | 223 | 73.6 years |

| George | 156 | 77.8 years |

| Charles | 150 | 77.0 years |

| Dorothy | 134 | 80.9 years |

| Helen | 129 | 81.6 years |

| Donald | 126 | 74.4 years |

| Most common last names in Roseville, CA among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 114 | 76.5 years |

| Brown | 65 | 76.3 years |

| Johnson | 64 | 77.5 years |

| Anderson | 60 | 77.4 years |

| Jones | 59 | 80.0 years |

| Williams | 53 | 73.4 years |

| Davis | 51 | 77.8 years |

| Wilson | 48 | 78.0 years |

| Miller | 44 | 79.4 years |

| Martin | 36 | 73.8 years |

- 78.0%Utility gas

- 19.6%Electricity

- 0.9%Bottled, tank, or LP gas

- 0.8%Solar energy

- 0.3%Wood

- 0.3%No fuel used

- 50.8%Utility gas

- 46.0%Electricity

- 1.7%Bottled, tank, or LP gas

- 1.1%No fuel used

- 0.2%Wood

- 0.2%Fuel oil, kerosene, etc.

Roseville compared to California state average:

- Unemployed percentage significantly below state average.

- Median age above state average.

- Length of stay since moving in below state average.

- House age significantly below state average.

- Percentage of population with a bachelor's degree or higher above state average.

Roseville, CA compared to other similar cities:

Roseville on our top lists:

- #4 on the list of "Top 101 cities with the most local government spending on highway construction per resident (population 10,000+)"

- #15 on the list of "Top 101 cities with largest percentage of males in occupations: sales and related occupations (population 50,000+)"

- #16 on the list of "Top 101 cities with the highest maximum monthly sunshine amount (population 50,000+)"

- #26 on the list of "Top 101 cities with the smallest percentage of high school students in private schools (3,000+ students)"

- #32 on the list of "Top 101 cities with the largest sunshine amount differences during a year (population 50,000+)"

- #42 on the list of "Top 101 cities with largest percentage population increases in the 1990s) (population 50,000+)"

- #46 on the list of "Top 101 cities with most building permits per 10,000 residents (population 50,000+)"

- #49 on the list of "Top 101 cities with the lowest number of police officers per 1000 residents (population 50,000+)"

- #52 on the list of "Top 101 cities with largest percentage of females in occupations: health diagnosing and treating practitioners and other technical occupations (population 50,000+)"

- #56 on the list of "Top 101 cities with the largest percentage population increase from 2000 (population 50,000+)"

- #56 on the list of "Top 100 high-educated but low-earning cities (pop. 50,000+)"

- #57 on the list of "Top 101 cities with the largest percentage of one, detached housing units in structures (20,000+ housing units)"

- #64 on the list of "Top 101 cities with the highest number of days clear of clouds (population 50,000+)"

- #64 on the list of "Top 101 cities with the lowest number of days clear of clouds (population 50,000+)"

- #65 on the list of "Top 101 cities with largest percentage of males in occupations: health technologists and technicians (population 50,000+)"

- #71 on the list of "Top 101 cities with the largest differences between morning and afternoon humidity (population 50,000+)"

- #71 on the list of "Top 101 cities with the most residents born in Other Western Europe (population 500+)"

- #72 on the list of "Top 101 cities with the largest humidity differences during a year (population 50,000+)"

- #83 on the list of "Top 101 cities with the largest racial income disparity between any two races with at least 2,000 householders"

- #88 on the list of "Top 100 fastest growing cities from 2000 to 2014 (pop. 50,000+)"

- #11 on the list of "Top 101 counties with the highest lead air pollution readings in 2012 (µg/m3)"

- #19 on the list of "Top 101 counties with the lowest lead air pollution readings in 2012 (µg/m3)"

- #31 on the list of "Top 101 counties with the highest Nitrogen Dioxide air pollution readings in 2012 (ppm)"

- #32 on the list of "Top 101 counties with the lowest Particulate Matter (PM2.5) Annual air pollution readings in 2012 (µg/m3)"

- #48 on the list of "Top 101 counties with the lowest Particulate Matter (PM10) Annual air pollution readings in 2012 (µg/m3)"

|

|

Total of 806 patent applications in 2008-2024.