San Antonio, Texas

San Antonio: The Alamo at night

San Antonio: Riverwalk

San Antonio: This is near the forest in Castle Hills.

San Antonio: Riverwalk

San Antonio: City's patron

San Antonio: The Alamo - San Antonio, TX

San Antonio: The Sky in San Antonio-late winter

San Antonio: Emily Morgan Hotel

San Antonio: Night Sky View

San Antonio: Riverwalk

San Antonio: Riverwalk

- see

196

more - add

your

Submit your own pictures of this city and show them to the world

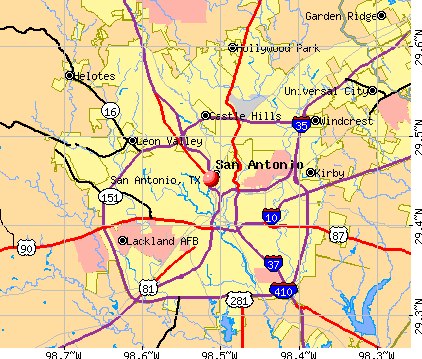

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +28.7%

| Males: 736,987 | |

| Females: 735,922 |

| Median resident age: | 34.1 years |

| Texas median age: | 35.6 years |

Zip codes: 78056, 78073, 78202, 78203, 78204, 78205, 78207, 78208, 78210, 78211, 78214, 78215, 78217, 78218, 78220, 78221, 78222, 78224, 78225, 78226, 78227, 78229, 78230, 78231, 78234, 78235, 78237, 78242, 78243, 78245, 78247, 78248, 78249, 78250, 78251, 78252, 78253, 78257, 78258, 78259, 78260, 78264.

San Antonio Zip Code Map| San Antonio: | $58,829 |

| TX: | $72,284 |

Estimated per capita income in 2022: $30,790 (it was $17,487 in 2000)

San Antonio city income, earnings, and wages data

Estimated median house or condo value in 2022: $230,700 (it was $67,500 in 2000)

| San Antonio: | $230,700 |

| TX: | $275,400 |

Mean prices in 2022: all housing units: $254,252; detached houses: $257,450; townhouses or other attached units: $278,164; in 2-unit structures: $323,201; in 3-to-4-unit structures: $186,623; in 5-or-more-unit structures: $209,743; mobile homes: $81,302; occupied boats, rvs, vans, etc.: $105,053

Median gross rent in 2022: $1,234.

(9.8% for White Non-Hispanic residents, 25.1% for Black residents, 21.7% for Hispanic or Latino residents, 21.3% for American Indian residents, 21.3% for Native Hawaiian and other Pacific Islander residents, 19.4% for other race residents, 21.4% for two or more races residents)

Detailed information about poverty and poor residents in San Antonio, TX

- 969,17965.8%Hispanic

- 320,94421.8%White alone

- 92,7926.3%Black alone

- 44,4733.0%Asian alone

- 35,4702.4%Two or more races

- 7,6200.5%Other race alone

- 1,5750.1%Native Hawaiian and Other

Pacific Islander alone - 8510.06%American Indian alone

Races in San Antonio detailed stats: ancestries, foreign born residents, place of birth

According to our research of Texas and other state lists, there were 3,773 registered sex offenders living in San Antonio, Texas as of April 19, 2024.

The ratio of all residents to sex offenders in San Antonio is 396 to 1.

The ratio of registered sex offenders to all residents in this city is near the state average.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is smaller than the state average.- means the value is about the same as the state average.

- means the value is bigger than the state average.

- means the value is much bigger than the state average.

Crime rate in San Antonio detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 2,982 (2,381 officers - 2,108 male; 273 female).

| Officers per 1,000 residents here: | 1.49 |

| Texas average: | 2.07 |

| MySa.com doing it best at poor journalism - San Antonio is shrinking (24 replies) |

| XFL looking to put team in San Antonio (49 replies) |

| San Antonio stores and businesses that MANDATE wearing masks (62 replies) |

| Why does San Antonio keep losing sports teams (63 replies) |

| Fun, fascinating facts about San Antonio some if you probably don't know (4 replies) |

| San Antonio / Austin CSA (14 replies) |

Latest news from San Antonio, TX collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: American (3.8%), German (2.9%), English (1.9%), Irish (1.6%).

Current Local Time: CST time zone

Land area: 407.6 square miles.

Population density: 3,614 people per square mile (average).

213,536 residents are foreign born (10.6% Latin America, 2.6% Asia).

| This city: | 14.4% |

| Texas: | 17.1% |

Median real estate property taxes paid for housing units with mortgages in 2022: $4,796 (1.9%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $2,846 (1.5%)

Nearest cities:

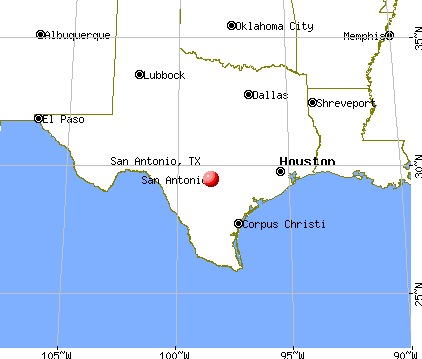

Latitude: 29.45 N, Longitude: 98.51 W

Daytime population change due to commuting: +139,968 (+9.5%)

Workers who live and work in this city: 621,412 (86.5%)

Area codes: 830, 210

Property values in San Antonio, TX

Detailed articles:

- San Antonio: Introduction

- San Antonio Basic Facts

- San Antonio: Communications

- San Antonio: Convention Facilities

- San Antonio: Economy

- San Antonio: Education and Research

- San Antonio: Geography and Climate

- San Antonio: Health Care

- San Antonio: History

- San Antonio: Municipal Government

- San Antonio: Population Profile

- San Antonio: Recreation

- San Antonio: Transportation

San Antonio tourist attractions:

- Alamo Heights Neighborhood in San Antonio

- Alamo Quarry Shopping Center in San Antonio

- Alta Vista Neighborhood in San Antonio

- Arneson River Theater in San Antonio

- Art Walk in San Antonio

- AT&T Center in San Antonio

- Aztec On The River in San Antonio

- Brackenridge Park in San Antonio

- Cathedral of San Fernando in San Antonio

- Fiesta Noche del Rio Celebration in San Antonio

- HemisFair Park in San Antonio

- Hotel Valencia Riverwalk in San Antonio

- Hyatt Regency Hill Country Resort and Spa in San Antonio

- Ingram Park Mall - San Antonio, TX - Popular shopping mall

- Japanese Tea Gardens in San Antonio

- King William Neighborhood in San Antonio

- Marion Koogler McNay Art Museum in San Antonio

- Menger Hotel in San Antonio

- Monte Vista Neighborhood in San Antonio

- Natural Bridge Caverns in San Antonio

- Crockett Hotel

- Embassy Suites Williamsburg

- Drury Inn & Suites Riverwalk

- Drury Plaza Hotel Riverwalk

- San Antonio Marriott Riverwalk

- San Antonio Marriott Rivercenter

- JW Marriott San Antonio Hill Country Resort & Spa

- Hilton Palacio del Rio

- Hyatt Regency San Antonio

- Grand Hyatt San Antonio

- Homewood Suites Riverwalk/ Downtown

- Hyatt Wild Oak Ranch

- San Antonio Convention and Visitors Bureau

- The Menger Hotel

- Sheraton Gunter Hotel San Antonio

- La Quinta San Antonio Convention Center

- Emily Morgan Hotel

- Hyatt Place San Antonio/Riverwalk

- The Fairmount

- Residence Inn San Antonio Downtown/Alamo Plaza

- North Star Mall in San Antonio

- Olmos Park Neighborhood in San Antonio

- Omni La Mansion del Rio in San Antonio

- Pecan Valley Golf Club, San Antonio, Texas ? A Texas Golf Treasure, Restored to Its Former Glory

- Rivercenter, San Antonio, Texas

- Rolling Oaks Mall, San Antonio, Texas

- San Antonio Zoological Gardens & Aquarium - San Antonio, Texas - large zoo and aquarium

- San Antonio Botanical Gardens and Conservatory

- San Antonio Children's Museum

- San Antonio International Airport

- San Antonio Zoo

- Six Flags Fiesta Texas

- South Park Mall, San Antonio, Texas

- Spanish Governor's Palace in San Antonio

- Splashtown in San Antonio

- Swig Martini Bar in San Antonio

- The Shops at La Cantera - San Antonio, TX - Upscale shopping mall

- The Alamodome in San Antonio

- The Dominion Neighborhood in San Antonio

- The Westin Riverwalk in San Antonio

- Westin La Cantera Resort in San Antonio

San Antonio, Texas accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 4686 buildings, average cost: $250,800

- 2021: 6567 buildings, average cost: $237,500

- 2020: 4275 buildings, average cost: $234,300

- 2019: 3890 buildings, average cost: $237,200

- 2018: 3266 buildings, average cost: $197,900

- 2017: 2489 buildings, average cost: $200,100

- 2016: 2152 buildings, average cost: $205,700

- 2015: 2217 buildings, average cost: $208,100

- 2014: 2270 buildings, average cost: $214,100

- 2013: 2102 buildings, average cost: $177,200

- 2012: 1896 buildings, average cost: $185,200

- 2011: 1594 buildings, average cost: $179,700

- 2010: 2337 buildings, average cost: $176,100

- 2009: 2836 buildings, average cost: $178,000

- 2008: 2665 buildings, average cost: $174,900

- 2007: 4253 buildings, average cost: $166,500

- 2006: 7266 buildings, average cost: $155,100

- 2005: 8266 buildings, average cost: $144,500

- 2004: 7431 buildings, average cost: $131,300

- 2003: 6105 buildings, average cost: $129,500

- 2002: 6454 buildings, average cost: $68,300

- 2001: 6281 buildings, average cost: $73,200

- 2000: 5570 buildings, average cost: $72,700

- 1999: 5892 buildings, average cost: $68,900

- 1998: 5752 buildings, average cost: $69,900

- 1997: 4323 buildings, average cost: $60,500

| Here: | 3.1% |

| Texas: | 3.5% |

Population change in the 1990s: +145,356 (+14.5%).

- Health care (11.6%)

- Accommodation & food services (9.8%)

- Educational services (9.1%)

- Construction (8.9%)

- Professional, scientific, technical services (6.6%)

- Finance & insurance (6.5%)

- Administrative & support & waste management services (5.8%)

- Construction (14.9%)

- Accommodation & food services (9.2%)

- Professional, scientific, technical services (7.4%)

- Administrative & support & waste management services (6.2%)

- Health care (5.9%)

- Finance & insurance (5.7%)

- Educational services (5.0%)

- Health care (18.2%)

- Educational services (13.8%)

- Accommodation & food services (10.4%)

- Finance & insurance (7.5%)

- Professional, scientific, technical services (5.7%)

- Administrative & support & waste management services (5.3%)

- Public administration (4.1%)

- Cooks and food preparation workers (7.2%)

- Other management occupations, except farmers and farm managers (5.3%)

- Building and grounds cleaning and maintenance occupations (4.1%)

- Laborers and material movers, hand (3.5%)

- Customer service representatives (3.2%)

- Computer specialists (3.0%)

- Retail sales workers, except cashiers (2.4%)

- Cooks and food preparation workers (7.1%)

- Other management occupations, except farmers and farm managers (5.8%)

- Building and grounds cleaning and maintenance occupations (4.7%)

- Computer specialists (4.2%)

- Laborers and material movers, hand (4.0%)

- Driver/sales workers and truck drivers (4.0%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (2.7%)

- Cooks and food preparation workers (7.3%)

- Customer service representatives (4.9%)

- Other management occupations, except farmers and farm managers (4.8%)

- Information and record clerks, except customer service representatives (3.9%)

- Nursing, psychiatric, and home health aides (3.6%)

- Cashiers (3.5%)

- Registered nurses (3.4%)

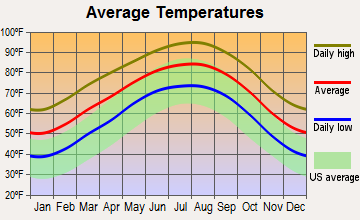

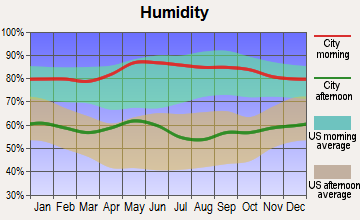

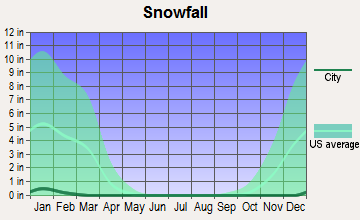

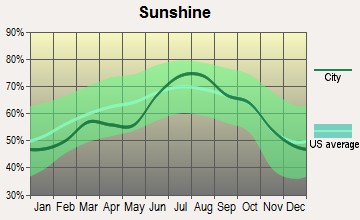

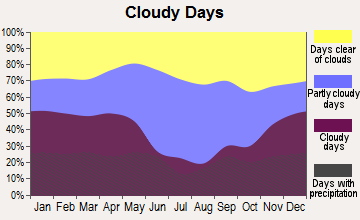

Average climate in San Antonio, Texas

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2022 was 96.2. This is worse than average.

| City: | 96.2 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2010 was 0.207. This is better than average. Closest monitor was 1.9 miles away from the city center.

| City: | 0.207 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 5.24. This is about average. Closest monitor was 1.9 miles away from the city center.

| City: | 5.24 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.0888. This is significantly better than average. Closest monitor was 2.1 miles away from the city center.

| City: | 0.0888 |

| U.S.: | 1.5147 |

Ozone [ppb] level in 2022 was 27.2. This is better than average. Closest monitor was 1.9 miles away from the city center.

| City: | 27.2 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2012 was 18.1. This is about average. Closest monitor was 2.1 miles away from the city center.

| City: | 18.1 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 9.27. This is about average. Closest monitor was 2.1 miles away from the city center.

| City: | 9.27 |

| U.S.: | 8.11 |

Tornado activity:

San Antonio-area historical tornado activity is below Texas state average. It is 9% smaller than the overall U.S. average.

On 4/28/1953, a category F4 (max. wind speeds 207-260 mph) tornado 13.9 miles away from the San Antonio city center killed 2 people and injured 15 people.

On 11/22/1961, a category F3 (max. wind speeds 158-206 mph) tornado 5.1 miles away from the city center caused between $500 and $5000 in damages.

Earthquake activity:

San Antonio-area historical earthquake activity is significantly above Texas state average. It is 26% smaller than the overall U.S. average.On 10/20/2011 at 12:24:41, a magnitude 4.8 (4.8 MW, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 48.3 miles away from the city center

On 4/14/1995 at 00:32:56, a magnitude 5.7 (5.6 MB, 5.7 MS, 5.7 MW, Depth: 11.1 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 296.7 miles away from San Antonio center

On 4/9/1993 at 12:29:19, a magnitude 4.3 (4.1 MB, 4.3 LG, Depth: 3.1 mi) earthquake occurred 50.1 miles away from the city center

On 6/16/1978 at 11:46:54, a magnitude 5.3 (4.4 MB, 4.6 UK, 5.3 ML) earthquake occurred 281.1 miles away from the city center

On 5/1/2018 at 16:28:56, a magnitude 4.0 (4.0 MW, Depth: 3.1 mi) earthquake occurred 46.6 miles away from San Antonio center

On 4/7/2008 at 09:51:12, a magnitude 3.9 (3.9 MW, Depth: 3.1 mi, Class: Light, Intensity: II - III) earthquake occurred 46.8 miles away from San Antonio center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Bexar County (21) is greater than the US average (15).Major Disasters (Presidential) Declared: 6

Emergencies Declared: 10

Causes of natural disasters: Hurricanes: 8, Fires: 7, Floods: 3, Storms: 3, Tropical Storms: 2, Tornado: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: CLEAR CHANNEL COMMUNICATIONS INC (RADIO BROADCASTING STATIONS), ARGONAUT GROUP INC (FIRE, MARINE & CASUALTY INSURANCE), LANCER CORP /TX/ (AIR COND & WARM AIR HEATING EQUIP & COMM & INDL REFRIG EQUIP), TESORO CORP /NEW/ (PETROLEUM REFINING), EXPLORATION CO OF DELAWARE INC (CRUDE PETROLEUM & NATURAL GAS), U S GLOBAL INVESTORS INC (INVESTMENT ADVICE), CATTLESALE CO (ELECTRONIC COMPUTERS), CULLEN FROST BANKERS INC (NATIONAL COMMERCIAL BANKS) and 15 other public companies.

Hospitals in San Antonio:

- 10115 CEDARMONT (10115 CEDARMONT)

- BETHANY HOSPICE SAN ANTONIO LLC (8918 TESORO DRIVE SUITE #575)

- COUNCIL OAKS AT CLOUDY RIDGE (6124 CLOUDY RIDGE)

- FLORAL WAY COMMUNITY HOME (2934 FLORAL WAY)

- HOSPICE SAN ANTONIO (8721 BOTTS STREET)

- LIFECARE HOSPITAL OF SAN ANTONIO (8026 FLOYD CURL DRIVE 2 WEST)

- MOCKINGBIRD HOME (7618 MOCKINGBIRD LN)

- SAGE TRAIL (14231 SAGE TRL)

- SOUTHWEST GENERAL HOSPITAL (Voluntary non-profit - Private, 7400 BARLITE BLVD)

- TREE GROVE (3238 TREE GROVE)

Airports and heliports located in San Antonio:

- San Antonio International Airport (SAT) (Runways: 3, Commercial Ops: 90,394, Air Taxi Ops: 24,025, Itinerant Ops: 50,583, Military Ops: 5,258)

- Stinson Municipal Airport (SSF) (Runways: 2, Air Taxi Ops: 402, Itinerant Ops: 31,798, Local Ops: 49,180, Military Ops: 9,996)

- Boerne Stage Field Airport (5C1) (Runways: 1, Itinerant Ops: 9,119, Local Ops: 20,090)

- Bulverde Airpark Airport (1T8) (Runways: 1, Itinerant Ops: 8,200, Local Ops: 16,400)

- Kestrel Airpark Airport (1T7) (Runways: 1, Itinerant Ops: 3,300, Local Ops: 6,600)

- Triple R Airport (75XS) (Runways: 1, Itinerant Ops: 1,200, Local Ops: 3,000)

- San Geronimo Airpark Airport (8T8) (Runways: 1, Itinerant Ops: 350, Local Ops: 2,000)

- Twin-Oaks Airport (T94) (Runways: 1, Itinerant Ops: 100, Local Ops: 500)

- Horizon Airport (74R) (Runways: 2, Itinerant Ops: 40, Local Ops: 400)

- Yates Airport (XS89) (Runways: 3)

- Camp Bullis Als (Cals) Airport (9TX5) (Runways: 1)

- Cross-B Airport (24XA) (Runways: 1)

- Kelly Fld Airport (SKF) (Runways: 1)

- Heliports: 20

Biggest Colleges/Universities in San Antonio:

- The University of Texas at San Antonio (Full-time enrollment: 25,503; Location: One UTSA Circle; Public; Website: www.utsa.edu/; Offers Doctor's degree)

- San Antonio College (Full-time enrollment: 15,182; Location: 1300 San Pedro Ave; Public; Website: www.alamo.edu/sac)

- Northwest Vista College (Full-time enrollment: 9,683; Location: 3535 N. Ellison Drive; Public; Website: www.alamo.edu/nvc/)

- University of the Incarnate Word (Full-time enrollment: 6,875; Location: 4301 Broadway; Private, not-for-profit; Website: www.uiw.edu; Offers Doctor's degree)

- St Philip's College (Full-time enrollment: 5,970; Location: 1801 Martin Luther King Dr; Public; Website: www.alamo.edu/spc/)

- Palo Alto College (Full-time enrollment: 5,055; Location: 1400 W Villaret Blvd; Public; Website: www.alamo.edu/pac/)

- Trinity University (Full-time enrollment: 2,467; Location: One Trinity Place; Private, not-for-profit; Website: www.trinity.edu; Offers Master's degree)

- Our Lady of the Lake University (Full-time enrollment: 2,133; Location: 411 SW 24th St; Private, not-for-profit; Website: www.ollusa.edu; Offers Doctor's degree)

- The University of Texas Health Science Center at San Antonio (Full-time enrollment: 1,933; Location: 7703 Floyd Curl Dr; Public; Website: www.uthscsa.edu; Offers Doctor's degree)

- St Mary's University (Full-time enrollment: 1,782; Location: One Camino Santa Maria; Private, not-for-profit; Website: www.stmarytx.edu/; Offers Doctor's degree)

- Galen College of Nursing-San Antonio (Full-time enrollment: 1,410; Location: 7411 John Smith Drive, Suite 300; Private, for-profit; Website: www.galencollege.edu/sanantonio/)

- Career Point College (Full-time enrollment: 1,208; Location: 4522 Fredericksburg RD Suite A-18; Private, for-profit; Website: www.careerpointcollege.edu)

- Kaplan College-San Antonio-San Pedro (Full-time enrollment: 1,083; Location: 7142 San Pedro Suite 100; Private, for-profit; Website: www.kaplancollege.com/north-san-antonio-tx/)

- Kaplan College-San Antonio-Ingram (Full-time enrollment: 1,067; Location: 6441 NW Loop 410; Private, for-profit; Website: www.kaplancollege.com/west-san-antonio-tx/)

- Southern Careers Institute-San Antonio (Full-time enrollment: 1,045; Location: 238 SW Military Drive, Suite 101; Private, for-profit; Website: www.scitexas.edu)

- The Art Institute of San Antonio (Full-time enrollment: 978; Location: 10000 IH-10 W Ste 200; Private, for-profit; Website: www.artinstitutes.edu/san-antonio)

- University of Phoenix-San Antonio Campus (Full-time enrollment: 861; Location: 8200 IH-10 West; Private, for-profit; Website: www.phoenix.edu; Offers Master's degree)

- Everest Institute-San Antonio (Full-time enrollment: 855; Location: 6550 First Park Ten; Private, for-profit; Website: www.everest.edu/campus/san_antonio)

- Hallmark College (Full-time enrollment: 825; Location: 10401 IH 10 W; Private, not-for-profit; Website: www.hallmarkcollege.edu; Offers Master's degree)

- ITT Technical Institute-San Antonio (Full-time enrollment: 689; Location: 5700 Northwest Pky; Private, for-profit; Website: www.itt-tech.edu)

Biggest public high schools in San Antonio:

- MADISON H S (Students: 3,350, Location: 5005 STAHL RD, Grades: 9-12)

- STEVENS H S (Students: 2,960, Location: 600 ELLISON N, Grades: 9-12)

- CHURCHILL H S (Students: 2,930, Location: 12049 BLANCO RD, Grades: 9-12)

- WARREN H S (Students: 2,867, Location: 9411 MILITARY DR W, Grades: 9-12)

- ROOSEVELT H S (Students: 2,767, Location: 5110 WALZEM RD, Grades: 9-12)

- EAST CENTRAL H S (Students: 2,603, Location: 7173 FM 1628, Grades: 9-12)

- MACARTHUR H S (Students: 2,559, Location: 2923 MACARTHUR VIEW, Grades: 9-12)

- MARSHALL H S (Students: 2,557, Location: 8000 LOBO LN, Grades: 9-12)

- CLARK H S (Students: 2,554, Location: 5150 DE ZAVALA RD, Grades: 9-12)

- REAGAN H S (Students: 2,513, Location: 19000 RONALD REAGAN, Grades: 9-12)

Biggest private high schools in San Antonio:

- SAN ANTONIO CHRISTIAN SCHOOLS (Students: 1,145, Location: 19202 REDLAND RD BLDG Z, Grades: PK-12)

- ANTONIAN COLLEGE PREPARATORY HIGH SCHOOL (Students: 770, Location: 6425 WEST AVE, Grades: 9-12)

- CORNERSTONE CHRISTIAN SCHOOLS (Students: 740, Location: 4802 VANCE JACKSON RD, Grades: PK-12)

- CHRISTIAN ACADEMY OF SAN ANTONIO (Students: 567, Location: 325 CASTROVILLE RD, Grades: PK-12)

- CENTRAL CATHOLIC HIGH SCHOOL (Students: 556, Location: 1403 N SAINT MARYS ST, Grades: 9-12, Boys only)

- ATONEMENT ACADEMY (Students: 551, Location: 15415 RED ROBIN RD, Grades: PK-12)

- UNIVERSITY OF INCARNATE WORD PREPARATORY HS (Students: 513, Location: 727 E HILDEBRAND AVE, Grades: 9-12, Girls only)

- INCARNATE WORD HIGH SCHOOL (Students: 513, Location: 727 E HILDEBRAND AVE, Grades: 9-12, Girls only)

- KEYSTONE SCHOOL (Students: 438, Location: 119 E CRAIG PL, Grades: KG-12)

- TMI-THE EPISCOPAL SCHOOL OF TEXAS (Students: 432, Location: 20955 W TEJAS TRL, Grades: 6-12)

Biggest public elementary/middle schools in San Antonio:

- SOUTHWEST EL (Students: 3,004, Location: 11914 DRAGON LN, Grades: PK-5)

- ALAMO HEIGHTS J H (Students: 1,522, Location: 7607 N NEW BRAUNFELS AVE, Grades: 6-8)

- STEVENSON MIDDLE (Students: 1,505, Location: 8403 TEZEL RD, Grades: 6-8)

- JEFFERSON MIDDLE (Students: 1,455, Location: 10900 SCHAENFIELD RD, Grades: 6-8)

- VALE MIDDLE (Students: 1,421, Location: 2120 N ELLISON DR, Grades: 6-8)

- LUNA MIDDLE (Students: 1,368, Location: 200 N GROSENBACHER, Grades: 6-8)

- BUSH MIDDLE (Students: 1,352, Location: 1500 EVANS RD, Grades: 6-8)

- GARCIA MIDDLE (Students: 1,293, Location: 14900 KYLE SEALE PKWY, Grades: 6-8)

- CANYON RIDGE EL (Students: 1,260, Location: 20522 STONE OAK PKWY, Grades: PK-5)

- BRADLEY MIDDLE (Students: 1,246, Location: 14819 HEIMER RD, Grades: 6-8)

Biggest private elementary/middle schools in San Antonio:

- ST MATTHEW CATHOLIC SCHOOL (Students: 737, Location: 10703 WURZBACH RD, Grades: PK-8)

- ST GREGORY THE GREAT CATHOLIC SCHOOL (Students: 602, Location: 700 DEWHURST RD, Grades: PK-8)

- ST LUKE CATHOLIC SCHOOL (Students: 519, Location: 4603 MANITOU, Grades: PK-8)

- ST GEORGE EPISCOPAL SCHOOL (Students: 511, Location: 6900 WEST AVE, Grades: PK-8)

- CONCORDIA LUTHERAN CHURCH-SCHOOL (Students: 490, Location: 16801 HUEBNER RD, Grades: PK-8)

- HOLY SPIRIT CATHOLIC SCHOOL (Students: 448, Location: 770 W RAMSEY RD, Grades: PK-8)

- MT SACRED HEART SCHOOL (Students: 384, Location: 619 MOUNT SACRED HEART RD, Grades: PK-8)

- NORTHWEST HILLS CHRISTIAN SCHOOL (Students: 383, Location: 8511 HEATH CIRCLE DR, Grades: PK-8)

- ST JOHN BERCHMANS SCHOOL (Students: 354, Location: 1147 CUPPLES RD, Grades: PK-8)

- ST LUKE'S EPISCOPAL SCHOOL (Students: 341, Location: 15 SAINT LUKES LN, Grades: PK-8)

User-submitted facts and corrections:

- ST LUKE CATHOLIC SCHOOL (Students: 575; Location: 4603 MANITOU; Grades: PK - 8)

- I read a fair amount about people, and I have noticed that Edward Higgins White, II, was reported to have been born (Nov 14, 1930) in San Antonio TX, yet he does not appear with another astronaut, David Scott, and other "famous" people (mostly sports figures) in your "Birthplace" section. Scott appears to be an after-thought in this section. White was the first American to take a spacewalk and died tragically in the Appolo I disaster while preparing for a launch along with Roger Chaffee and Virgil "Gus" Grissom.

- The new street address of Trinity University is: One Trinity Place, San Antonio, TX 78212-7200

- Birthplace of the group "Santana". added by Mac

- Wilford Hall Medical Center, Lackland AFB

- OTHER ZIP CODES IN SAN ANTONIO ARE:78250,78251'78230,78213,78216,78212,78210.

- BIGGEST private primary/middle schools - San Antonio CONCORDIA LUTHERAN SCHOOL - (Students: 434; Location: 16801 HUEBNER ROAD; Grades: PK-8)

Points of interest:

Notable locations in San Antonio: Alamo Downs Racetrack (A), Canyon Creek Country Club (B), Canyon Creek Golf Club (C), Dollar Downs Racetrack (D), Oak Hills Country Club (E), Oak Hills Golf Course (F), Pecan Valley Country Club (G), Riverside Golf Course (H), San Antonio Country Club (I), San Antonio Raceway (J), Seneca Country Club (K), Southwest Foundation for Research and Education (L), Willow Springs Golf Course (M), Bridgewood Wastewater Treatment Plant (N), Coates Esplanade (O), Incarnate Word Retirement Community (P), Leon Creek Water Resources Complex (Q), Pitman Courts (R), Salado Creek Water Resources Complex (S), San Antonio Water System Facility (T). Display/hide their locations on the map

Shopping Centers: Cross Creek Shopping Center (1), Culebra Crossing Shopping Center (2), Estrella Mall Shopping Center (3), Rivercenter Mall Shopping Center (4), South Park Mall Shopping Center (5), Sterling Oaks Shopping Center (6), Ingram Park Mall (7), Windsor Park Mall (8), Westlakes Shopping Center (9). Display/hide their locations on the map

Main business address in San Antonio include: CLEAR CHANNEL COMMUNICATIONS INC (A), ARGONAUT GROUP INC (B), TESORO CORP /NEW/ (C), EXPLORATION CO OF DELAWARE INC (D), U S GLOBAL INVESTORS INC (E), CATTLESALE CO (F), CULLEN FROST BANKERS INC (G). Display/hide their locations on the map

Churches in San Antonio include: San Jose Mission (A), Saint Andrew Church (B), Saint Francis Church (C), Zion Church (D), Greer Street Church of God (E), Good Shepherd Church of God (F), Gethsemene Aoh Church of God (G), Denver Heights Church of God and Christ (H), Denver Heights Church of God (I). Display/hide their locations on the map

Cemeteries: Locke Hill Cemetery (1), Mission North Burial Park (2), Mission Burial Park (3), Helotes Cemetery (4), Schulmeier Cemetery (5), Beitel Memorial Cemetery (6), Sunset Memorial Park (7). Display/hide their locations on the map

Reservoirs: Woodlawn Lake (A), Northern Hills Lake (B), Crea Brothers Lake (C), Elmendorf Lake (D), Victor Braunig Lake (E), Mitchell Lake (F), Soil Conservation Service Site 4 Reservoir (G), Soil Conservation Service Site 8 Reservoir (H). Display/hide their locations on the map

Creeks: Zarzamora Creek (A), Walzem Creek (B), San Pedro Creek (C), Rittiman Creek (D), Pershing Creek (E), Panther Springs Creek (F), Olmos Creek (G), Mud Creek (H), Martinez Creek (I). Display/hide their locations on the map

Parks in San Antonio include: Lee's Creek Park (1), Leon Creek Greenway Park (2), Levi Strauss Park (3), Lincoln Barkmeyer Park (4), Haskin Park (5), Harmony Hills Community Park (6), King William Park (7), Kirby City Park (8), La Villita Park (9). Display/hide their locations on the map

Tourist attractions: Alamo - Administration Office (Museums; 300 Alamo Plaza) (1), Alamo (Museums; 300 Alamo Plaza) (2), Children's Museum-San Antonio (305 East Houston Street) (3), Casa Navarro State Historic Park (Museums; 228 South Laredo Street) (4), Buckhorn Saloon & Museum (318 East Houston Street) (5), San Antonio Area Tourism Council (Tourism Consultants; 217 Alamo Plaza Suite 300) (6), Arte Por Vida-Art For Life Studios (Cultural Attractions- Events- & Facilities; 1727 Blanco Rd) (7), San Antonio City - Parks & Recreation Department- Botanical Gardens Conserva (Botanical Gardens; 555 Funston Place) (8), San Antonio Botanical Society - Office (Botanical Gardens; 555 Funston Place) (9). Display/hide their approximate locations on the map

Hotels: Alpha Hotel (315 North Main Avenue) (1), Alamo Executive Suites Inc (12079 Starcrest Drive) (2), Chevy Chase Apartments & Townhomes (1422 Northeast Loop 410 Ofc) (3), Clarion Collection O'Brien Historic Hotl (116 Navarro Street) (4), Best Western Lackland Lodge (6815 West US Highway 90) (5), Berg's Mill Motel (8888 South Presa Street) (6), Comfort Inn & Suites Airport (8640 Crownhill Boulevard) (7), Christmas House Bed & Breakfast (2307 McCullough Avenue) (8), Antonian Inn & Suites (2131 North Panam Expressway) (9). Display/hide their approximate locations on the map

Courts: San Antonio City - Metropolitan Health District- Dental Services & Support- Westend Dental Cl (1226 Northwest 18th) (1), San Antonio City - Metropolitan Health District- Immunization Clinics- Thousand Oaks Cl (4342 Thousand Oaks Drive) (2), San Antonio City - Metropolitan Health District- Personal Family Health Serv (1325 North Flores Street Suite 104) (3), San Antonio City - Metropolitan Health District- Women Infants And Children Nutrition Service (1013 Rittiman) (4), San Antonio City - Office Of The City Auditor- Internal City Auditor (111 Soledad Street Suite 600) (5), San Antonio City - Parks & Recreation Department- Swimming Pools- Outdoor- New Territo (9023 Bowen Drive) (6), San Antonio City - Planning Department- Development and Business Service Ce (1901 South Alamo Street) (7), San Antonio City - Public Works Department- Street Maintenance Division- Administrative Of (7402 South New Braunfels) (8), San Antonio City - Purchasing & General Services- Central Stores- City Hall A (131 West Nueva) (9). Display/hide their approximate locations on the map

Birthplace of: Robert Cade - Medical doctor, Hal Mumme - Football player and coach, Brad Hendricks - Prominent Arkansas attorney and businessman, Jerry Grote - Baseball player, Lupe Valdez - Sheriff, Carol Burnett - (born 1935), singer, actress, comedienne, Christopher Cross - Soft rock musician, Cito Gaston - Baseball player and coach, Dorian Leigh - Female model, Lamar S. Smith - Politician.

Drinking water stations with addresses in San Antonio and their reported violations in the past:

AIR FORCE VILLAGE II (Population served: 655, Groundwater):Past monitoring violations:SAN ANTONIO ROSE PALACE (Population served: 500, Groundwater):

- Monitoring and Reporting (DBP) - Between JUL-2010 and SEP-2010, Contaminant: Chlorine. Follow-up actions: St Compliance achieved (JUN-07-2011)

Past monitoring violations:CHILDRENS ASSOCIATIONS FOR MAXIMUM POTEN (Population served: 320, Groundwater):

- One routine major monitoring violation

Past health violations:NATURAL BRIDGE CAVERNS (Population served: 300, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - In MAR-2013, Contaminant: Coliform. Follow-up actions: St Public Notif requested (APR-09-2013), St Violation/Reminder Notice (APR-09-2013), St Public Notif received (APR-17-2013)

- Monitoring, Source Water (GWR) - In MAY-01-2013, Contaminant: E. COLI. Follow-up actions: St Public Notif requested (AUG-01-2013), St Violation/Reminder Notice (AUG-01-2013), St Public Notif received (AUG-12-2013)

- Monitoring, Source Water (GWR) - In OCT-01-2011, Contaminant: E. COLI. Follow-up actions: St Public Notif requested (DEC-09-2011), St Violation/Reminder Notice (DEC-09-2011), St Public Notif received (JAN-12-2012)

- 4 routine major monitoring violations

Past monitoring violations:CULLIGAN WEST TEXAS (Population served: 300, Purch groundwater):

- One routine major monitoring violation

Past monitoring violations:VALERO CORNER STORE 2351 (Population served: 299, Groundwater):

- 3 routine major monitoring violations

- One regular monitoring violation

Past monitoring violations:VALERO 592 (Population served: 275, Groundwater):

- Monitoring, Repeat Major (TCR) - In JAN-2008, Contaminant: Coliform (TCR). Follow-up actions: St Compliance achieved (JAN-31-2008), St Public Notif requested (JUN-25-2008), St Violation/Reminder Notice (JUN-25-2008)

- 2 routine major monitoring violations

- One minor monitoring violation

Past monitoring violations:CORNERSTONE CHURCH CONFERENCE AND RETREA (Population served: 255, Groundwater):

- 3 routine major monitoring violations

Past monitoring violations:

- One routine major monitoring violation

- One minor monitoring violation

Drinking water stations with addresses in San Antonio that have no violations reported:

- COSA EISENHOWER PARK (Population served: 600, Primary Water Source Type: Groundwater)

- TEJAS VALLEY RV PARK (Population served: 354, Primary Water Source Type: Groundwater)

- HERMANN SONS YOUTH CAMP HILLTOP (Population served: 285, Primary Water Source Type: Groundwater)

- VALERO CORNER STORE 937 (Population served: 150, Primary Water Source Type: Groundwater)

- TBS FOODS (Population served: 100, Primary Water Source Type: Purch surface water)

- MARTINEZ RANCH SUBDIVISION (Population served: 42, Primary Water Source Type: Groundwater)

- HEB EMERGENCY HAULING (Population served: 25, Primary Water Source Type: Purch surface water)

| This city: | 2.7 people |

| Texas: | 2.8 people |

| This city: | 66.3% |

| Whole state: | 69.9% |

| This city: | 7.2% |

| Whole state: | 6.0% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.5% of all households

- Gay men: 0.3% of all households

People in group quarters in San Antonio in 2010:

- 8,030 people in college/university student housing

- 5,617 people in nursing facilities/skilled-nursing facilities

- 4,140 people in local jails and other municipal confinement facilities

- 3,908 people in military barracks and dormitories (nondisciplinary)

- 1,504 people in other noninstitutional facilities

- 980 people in group homes intended for adults

- 868 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 631 people in federal detention centers

- 517 people in mental (psychiatric) hospitals and psychiatric units in other hospitals

- 401 people in correctional residential facilities

- 284 people in residential treatment centers for juveniles (non-correctional)

- 283 people in residential treatment centers for adults

- 248 people in workers' group living quarters and job corps centers

- 179 people in correctional facilities intended for juveniles

- 118 people in group homes for juveniles (non-correctional)

- 45 people in residential schools for people with disabilities

- 30 people in hospitals with patients who have no usual home elsewhere

- 17 people in in-patient hospice facilities

People in group quarters in San Antonio in 2000:

- 5,641 people in nursing homes

- 4,357 people in college dormitories (includes college quarters off campus)

- 4,207 people in local jails and other confinement facilities (including police lockups)

- 1,803 people in other noninstitutional group quarters

- 1,772 people in military transient quarters for temporary residents

- 1,231 people in other group homes

- 749 people in religious group quarters

- 549 people in mental (psychiatric) hospitals or wards

- 539 people in military barracks, etc.

- 379 people in homes for the mentally retarded

- 315 people in wards in general hospitals for patients who have no usual home elsewhere

- 272 people in homes or halfway houses for drug/alcohol abuse

- 213 people in other nonhousehold living situations

- 206 people in hospitals/wards and hospices for chronically ill

- 177 people in unknown juvenile institutions

- 157 people in hospices or homes for chronically ill

- 135 people in orthopedic wards and institutions for the physically handicapped

- 119 people in hospitals or wards for drug/alcohol abuse

- 111 people in training schools for juvenile delinquents

- 99 people in other workers' dormitories

- 94 people in residential treatment centers for emotionally disturbed children

- 70 people in schools, hospitals, or wards for the intellectually disabled

- 63 people in homes for the mentally ill

- 58 people in homes for abused, dependent, and neglected children

- 49 people in other hospitals or wards for chronically ill

- 17 people in homes for the physically handicapped

- 4 people in agriculture workers' dormitories on farms

Banks with most branches in San Antonio (2011 data):

- JPMorgan Chase Bank, National Association: 45 branches. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- Bank of America, National Association: 34 branches. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Wells Fargo Bank, National Association: 34 branches. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- International Bank of Commerce: 31 branches. Info updated 2007/03/28: Bank assets: $9,621.9 mil, Deposits: $6,548.8 mil, headquarters in Laredo, TX, positive income, Commercial Lending Specialization, 197 total offices, Holding Company: International Bancshares Corporation

- Compass Bank: 30 branches. Info updated 2011/02/24: Bank assets: $63,107.0 mil, Deposits: $46,232.4 mil, headquarters in Birmingham, AL, negative income in the last year, Commercial Lending Specialization, 720 total offices, Holding Company: Banco Bilbao Vizcaya Argentaria, S.A.

- The Frost National Bank: 24 branches. Info updated 2006/12/21: Bank assets: $20,372.1 mil, Deposits: $16,846.8 mil, local headquarters, positive income, Commercial Lending Specialization, 133 total offices, Holding Company: Cullen/Frost Bankers, Inc.

- Broadway National Bank: 21 branches. Info updated 2006/11/03: Bank assets: $2,465.8 mil, Deposits: $2,085.7 mil, local headquarters, positive income, Commercial Lending Specialization, 40 total offices, Holding Company: Broadway Bancshares, Inc.

- Woodforest National Bank: 13 branches. Info updated 2011/05/10: Bank assets: $3,488.9 mil, Deposits: $3,097.6 mil, headquarters in Houston, TX, positive income, Commercial Lending Specialization, 766 total offices, Holding Company: Woodforest Financial Group Employee Stock Ownership Plan (With 401(K) Provisions)

- USAA Federal Savings Bank: 11 branches. Info updated 2011/07/21: Bank assets: $52,181.7 mil, Deposits: $46,613.9 mil, local headquarters, positive income, Consumer Lending Specialization, 11 total offices

- 32 other banks with 90 local branches

For population 15 years and over in San Antonio:

- Never married: 39.7%

- Now married: 41.7%

- Separated: 2.7%

- Widowed: 5.0%

- Divorced: 11.0%

For population 25 years and over in San Antonio:

- High school or higher: 85.9%

- Bachelor's degree or higher: 29.1%

- Graduate or professional degree: 11.0%

- Unemployed: 4.0%

- Mean travel time to work (commute): 21.7 minutes

| Here: | 13.8 |

| Texas average: | 14.0 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in San Antonio:

(San Antonio, Texas Neighborhood Map)Religion statistics for San Antonio, TX (based on Bexar County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 528,827 | 104 |

| Evangelical Protestant | 288,534 | 765 |

| Mainline Protestant | 78,855 | 149 |

| Other | 61,554 | 122 |

| Black Protestant | 8,961 | 42 |

| Orthodox | 1,004 | 7 |

| None | 747,038 | - |

Food Environment Statistics:

| Here: | 1.02 / 10,000 pop. |

| Texas: | 1.47 / 10,000 pop. |

| This county: | 0.12 / 10,000 pop. |

| Texas: | 0.14 / 10,000 pop. |

| This county: | 1.14 / 10,000 pop. |

| State: | 1.11 / 10,000 pop. |

| Bexar County: | 3.06 / 10,000 pop. |

| Texas: | 3.95 / 10,000 pop. |

| Bexar County: | 6.75 / 10,000 pop. |

| Texas: | 6.13 / 10,000 pop. |

| Here: | 8.3% |

| State: | 8.9% |

| Here: | 26.3% |

| Texas: | 26.6% |

| Bexar County: | 16.8% |

| Texas: | 15.7% |

Health and Nutrition:

| Here: | 48.6% |

| Texas: | 48.6% |

| San Antonio: | 48.8% |

| Texas: | 47.4% |

| Here: | 28.4 |

| State: | 28.5 |

| San Antonio: | 19.9% |

| Texas: | 20.6% |

| San Antonio: | 10.1% |

| Texas: | 10.3% |

| This city: | 6.8 |

| Texas: | 6.8 |

| San Antonio: | 33.6% |

| Texas: | 33.1% |

| Here: | 56.3% |

| Texas: | 56.2% |

| Here: | 81.5% |

| State: | 80.7% |

More about Health and Nutrition of San Antonio, TX Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Electric Power | 2,657 | $22,529,204 | $101,750 | 0 | $0 |

| Police Protection - Officers | 2,467 | $21,180,504 | $103,026 | 0 | $0 |

| Firefighters | 1,775 | $16,162,512 | $109,268 | 0 | $0 |

| Water Supply | 1,368 | $7,908,492 | $69,373 | 13 | $18,210 |

| Parks and Recreation | 863 | $3,801,918 | $52,866 | 9 | $13,512 |

| Other and Unallocable | 727 | $3,813,048 | $62,939 | 26 | $25,560 |

| Solid Waste Management | 716 | $3,444,321 | $57,726 | 0 | $0 |

| Police - Other | 640 | $3,962,272 | $74,293 | 181 | $129,446 |

| Other Government Administration | 569 | $3,461,172 | $72,995 | 14 | $25,712 |

| Financial Administration | 530 | $3,575,496 | $80,955 | 0 | $0 |

| Streets and Highways | 508 | $2,472,438 | $58,404 | 0 | $0 |

| Health | 456 | $2,004,487 | $52,750 | 4 | $5,576 |

| Airports | 402 | $2,087,686 | $62,319 | 4 | $3,124 |

| Housing and Community Development (Local) | 391 | $2,092,573 | $64,222 | 16 | $25,951 |

| Sewerage | 371 | $1,997,780 | $64,618 | 0 | $0 |

| Local Libraries | 305 | $1,331,530 | $52,388 | 192 | $267,884 |

| Gas Supply | 295 | $2,503,246 | $101,827 | 0 | $0 |

| Welfare | 270 | $1,211,070 | $53,825 | 9 | $12,982 |

| Judicial and Legal | 181 | $1,171,078 | $77,641 | 5 | $7,847 |

| Natural Resources | 150 | $632,409 | $50,593 | 0 | $0 |

| Fire - Other | 51 | $176,483 | $41,525 | 0 | $0 |

| Totals for Government | 15,692 | $107,519,718 | $82,223 | 473 | $535,805 |

San Antonio government finances - Expenditure in 2021 (per resident):

- Construction - Electric Utilities: $469,107,000 ($318.49)

Water Utilities: $234,124,000 ($158.95)

Sewerage: $142,130,000 ($96.50)

General - Other: $110,995,000 ($75.36)

Gas Utilities: $82,784,000 ($56.20)

Parks and Recreation: $27,153,000 ($18.43)

Air Transportation: $25,321,000 ($17.19)

Regular Highways: $3,493,000 ($2.37)

General Public Buildings: $2,434,000 ($1.65)

Public Welfare - Other: $2,400,000 ($1.63)

Solid Waste Management: $709,000 ($0.48)

Local Fire Protection: $674,000 ($0.46)

Police Protection: $453,000 ($0.31)

Financial Administration: $418,000 ($0.28)

Housing and Community Development: $385,000 ($0.26)

Elementary and Secondary Education: $107,000 ($0.07)

Libraries: $87,000 ($0.06)

Parking Facilities: $2,000 ($0.00)

- Current Operations - Electric Utilities: $1,176,322,000 ($798.64)

Police Protection: $427,170,000 ($290.02)

Gas Utilities: $392,107,000 ($266.21)

Local Fire Protection: $314,251,000 ($213.35)

Water Utilities: $220,209,000 ($149.51)

Regular Highways: $172,621,000 ($117.20)

Solid Waste Management: $141,075,000 ($95.78)

Parks and Recreation: $131,113,000 ($89.02)

Public Welfare - Other: $127,438,000 ($86.52)

Sewerage: $126,838,000 ($86.11)

Housing and Community Development: $117,258,000 ($79.61)

General - Other: $117,059,000 ($79.47)

Financial Administration: $102,967,000 ($69.91)

Elementary and Secondary Education: $90,193,000 ($61.23)

Air Transportation: $76,097,000 ($51.66)

Libraries: $39,910,000 ($27.10)

Health - Other: $39,095,000 ($26.54)

Central Staff Services: $34,689,000 ($23.55)

Judicial and Legal Services: $28,728,000 ($19.50)

General Public Buildings: $18,763,000 ($12.74)

Protective Inspection and Regulation - Other: $14,274,000 ($9.69)

Parking Facilities: $11,840,000 ($8.04)

Natural Resources - Other: $1,479,000 ($1.00)

Sea and Inland Port Facilities: $288,000 ($0.20)

Miscellaneous Commercial Activities - Other: $264,000 ($0.18)

- Electric Utilities - Interest on Debt: $233,128,000 ($158.28)

- General - Interest on Debt: $176,297,000 ($119.69)

- Intergovernmental to Local - Other - General - Other: $60,000 ($0.04)

- Other Capital Outlay - Electric Utilities: $84,974,000 ($57.69)

Water Utilities: $36,285,000 ($24.63)

General - Other: $29,758,000 ($20.20)

Parks and Recreation: $17,484,000 ($11.87)

Gas Utilities: $14,995,000 ($10.18)

Sewerage: $7,432,000 ($5.05)

Police Protection: $6,397,000 ($4.34)

Local Fire Protection: $2,488,000 ($1.69)

Regular Highways: $1,149,000 ($0.78)

Financial Administration: $997,000 ($0.68)

Public Welfare - Other: $863,000 ($0.59)

Libraries: $837,000 ($0.57)

Air Transportation: $743,000 ($0.50)

Health - Other: $703,000 ($0.48)

Housing and Community Development: $512,000 ($0.35)

Solid Waste Management: $426,000 ($0.29)

Elementary and Secondary Education: $328,000 ($0.22)

Central Staff Services: $171,000 ($0.12)

Protective Inspection and Regulation - Other: $134,000 ($0.09)

Miscellaneous Commercial Activities - Other: $92,000 ($0.06)

Judicial and Legal Services: $88,000 ($0.06)

Parking Facilities: $37,000 ($0.03)

General Public Building: $36,000 ($0.02)

- Total Salaries and Wages: $10,904,000 ($7.40)

- Water Utilities - Interest on Debt: $54,845,000 ($37.24)

San Antonio government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $266,265,000 ($180.77)

Other: $139,119,000 ($94.45)

Solid Waste Management: $137,748,000 ($93.52)

Air Transportation: $95,362,000 ($64.74)

Parks and Recreation: $23,271,000 ($15.80)

Parking Facilities: $5,775,000 ($3.92)

Natural Resources - Other: $2,326,000 ($1.58)

Sea and Inland Port Facilities: $1,069,000 ($0.73)

Regular Highways: $968,000 ($0.66)

Housing and Community Development: $610,000 ($0.41)

Elementary and Secondary Education - Other: $470,000 ($0.32)

Miscellaneous Commercial Activities: $127,000 ($0.09)

- Federal Intergovernmental - Education: $23,924,000 ($16.24)

Housing and Community Development: $21,828,000 ($14.82)

Other: $12,772,000 ($8.67)

Air Transportation: $11,161,000 ($7.58)

- Local Intergovernmental - Education: $40,317,000 ($27.37)

Highways: $15,875,000 ($10.78)

Other: $15,394,000 ($10.45)

Public Welfare: $6,095,000 ($4.14)

Housing and Community Development: $1,890,000 ($1.28)

Health and Hospitals: $803,000 ($0.55)

- Miscellaneous - General Revenue - Other: $227,988,000 ($154.79)

Interest Earnings: $86,646,000 ($58.83)

Sale of Property: $25,284,000 ($17.17)

Rents: $16,077,000 ($10.92)

Special Assessments: $13,154,000 ($8.93)

Donations From Private Sources: $7,553,000 ($5.13)

Fines and Forfeits: $4,870,000 ($3.31)

- Revenue - Electric Utilities: $2,359,076,000 ($1601.64)

Water Utilities: $528,652,000 ($358.92)

Gas Utilities: $150,704,000 ($102.32)

- State Intergovernmental - Health and Hospitals: $307,269,000 ($208.61)

Public Welfare: $93,589,000 ($63.54)

Other: $30,861,000 ($20.95)

General Local Government Support: $6,881,000 ($4.67)

Highways: $5,431,000 ($3.69)

- Tax - Property: $617,480,000 ($419.22)

General Sales and Gross Receipts: $390,509,000 ($265.13)

Other Selective Sales: $52,245,000 ($35.47)

Other License: $34,838,000 ($23.65)

Other: $23,489,000 ($15.95)

Public Utilities Sales: $20,619,000 ($14.00)

Occupation and Business License - Other: $10,041,000 ($6.82)

Amusements Sales: $1,481,000 ($1.01)

Alcoholic Beverage License: $916,000 ($0.62)

Amusements License: $1,000 ($0.00)

San Antonio government finances - Debt in 2021 (per resident):

- Long Term Debt - Outstanding Unspecified Public Purpose: $11,794,089,000 ($8007.34)

Beginning Outstanding - Unspecified Public Purpose: $11,497,566,000 ($7806.03)

Issue, Unspecified Public Purpose: $1,996,584,000 ($1355.54)

Retired Unspecified Public Purpose: $1,700,061,000 ($1154.22)

Outstanding Nonguaranteed - Industrial Revenue: $612,133,000 ($415.59)

Beginning Outstanding - Public Debt for Private Purpose: $499,555,000 ($339.16)

Issue, Nonguaranteed - Public Debt for Private Purpose: $134,986,000 ($91.65)

Retired Nonguaranteed - Public Debt for Private Purpose: $22,408,000 ($15.21)

- Short Term Debt Outstanding - End of Fiscal Year: $420,000,000 ($285.15)

Beginning: $95,000,000 ($64.50)

San Antonio government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $1,825,210,000 ($1239.19)

- Other Funds - Cash and Securities: $3,013,335,000 ($2045.84)

- Sinking Funds - Cash and Securities: $934,873,000 ($634.71)

5.98% of this county's 2021 resident taxpayers lived in other counties in 2020 ($64,274 average adjusted gross income)

| Here: | 5.98% |

| Texas average: | 8.12% |

0.12% of residents moved from foreign countries ($1,410 average AGI)

Bexar County: 0.12% Texas average: 0.04%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Guadalupe County, TX | |

| from Travis County, TX | |

| from Harris County, TX |

5.48% of this county's 2020 resident taxpayers moved to other counties in 2021 ($65,369 average adjusted gross income)

| Here: | 5.48% |

| Texas average: | 7.40% |

0.09% of residents moved to foreign countries ($1,244 average AGI)

Bexar County: 0.09% Texas average: 0.03%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Guadalupe County, TX | |

| to Comal County, TX | |

| to Harris County, TX |

| Businesses in San Antonio, TX | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 99 Cents Only Stores | 5 | JCPenney | 7 | |

| ALDO | 3 | Jamba Juice | 5 | |

| AMF Bowling | 3 | JoS. A. Bank | 3 | |

| AT&T | 25 | Johnny Rockets | 1 | |

| Abercrombie & Fitch | 2 | Jones New York | 22 | |

| Abercrombie Kids | 2 | Journeys | 6 | |

| Academy Sports + Outdoors | 7 | Juicy Couture | 2 | |

| Advance Auto Parts | 20 | Justice | 5 | |

| Aeropostale | 7 | KFC | 19 | |

| Aerosoles | 1 | Kincaid | 1 | |

| American Eagle Outfitters | 9 | Knights Inn | 3 | |

| Ann Taylor | 6 | Kohl's | 3 | |

| Apple Store | 2 | La Quinta | 17 | |

| Applebee's | 5 | La-Z-Boy | 3 | |

| Arby's | 9 | Lane Bryant | 7 | |

| Ascend Collection | 1 | Lane Furniture | 32 | |

| Ashley Furniture | 2 | LensCrafters | 7 | |

| Audi | 1 | Little Caesars Pizza | 31 | |

| AutoZone | 36 | Long John Silver's | 9 | |

| Avenue | 5 | Lowe's | 10 | |

| BMW | 1 | Macy's | 7 | |

| Bakers | 3 | Marriott | 29 | |

| Bally Total Fitness | 4 | Marshalls | 4 | |

| Banana Republic | 4 | MasterBrand Cabinets | 4 | |

| Barnes & Noble | 6 | Maurices | 1 | |

| Baskin-Robbins | 10 | Mazda | 4 | |

| Bath & Body Works | 10 | McDonald's | 79 | |

| Bebe | 2 | Men's Wearhouse | 4 | |

| Bed Bath & Beyond | 4 | Microtel | 2 | |

| Ben & Jerry's | 3 | Motel 6 | 9 | |

| Best Western | 12 | Motherhood Maternity | 9 | |

| Blockbuster | 23 | New Balance | 16 | |

| Brooks Brothers | 1 | New York & Co | 5 | |

| Brookstone | 2 | Nike | 65 | |

| Brunswick Bowling & Billiards | 1 | Nissan | 4 | |

| Budget Car Rental | 3 | Nordstrom | 2 | |

| Burger King | 19 | Office Depot | 9 | |

| Burlington Coat Factory | 3 | OfficeMax | 7 | |

| CVS | 26 | Old Navy | 6 | |

| Cache | 2 | Olive Garden | 7 | |

| CarMax | 1 | Outback | 3 | |

| Carl\s Jr. | 3 | Outback Steakhouse | 3 | |

| Casual Male XL | 3 | Pac Sun | 5 | |

| Catherines | 4 | Panda Express | 16 | |

| Charlotte Russe | 3 | Panera Bread | 3 | |

| Chevrolet | 4 | Papa John's Pizza | 16 | |

| Chick-Fil-A | 21 | Payless | 31 | |

| Chico's | 5 | Penske | 12 | |

| Chipotle | 7 | PetSmart | 7 | |

| Chuck E. Cheese's | 4 | Pier 1 Imports | 4 | |

| Church's Chicken | 45 | Pizza Hut | 39 | |

| Cinnabon | 5 | Plato's Closet | 1 | |

| Clarion | 1 | Popeyes | 14 | |

| Clarks | 2 | Pottery Barn | 1 | |

| Cold Stone Creamery | 4 | Quality | 5 | |

| Coldwater Creek | 3 | Quiznos | 12 | |

| ColorTyme | 2 | RadioShack | 24 | |

| Comfort Inn | 2 | Ramada | 1 | |

| Comfort Suites | 5 | Red Lobster | 6 | |

| Costco | 2 | Red Robin | 3 | |

| Cracker Barrel | 3 | Red Roof Inn | 5 | |

| Cricket Wireless | 145 | Rodeway Inn | 5 | |

| Curves | 9 | Rooms To Go | 2 | |

| DHL | 15 | Ruby Tuesday | 3 | |

| Dairy Queen | 8 | Rue21 | 5 | |

| Days Inn | 10 | Ryder Rental & Truck Leasing | 1 | |

| Deb | 1 | SAS Shoes | 4 | |

| Decora Cabinetry | 1 | SONIC Drive-In | 53 | |

| Dennys | 13 | Saks Fifth Avenue | 1 | |

| Discount Tire | 13 | Sam's Club | 4 | |

| Domino's Pizza | 24 | Sears | 16 | |

| DressBarn | 5 | Sephora | 4 | |

| Dressbarn | 5 | Sheraton | 1 | |

| Dunkin Donuts | 2 | Shoe Carnival | 5 | |

| Econo Lodge | 4 | Skechers USA | 2 | |

| Eddie Bauer | 2 | Sleep Inn | 1 | |

| El Pollo Loco | 6 | Soma Intimates | 3 | |

| Ethan Allen | 1 | Spencer Gifts | 4 | |

| Express | 5 | Sprint Nextel | 24 | |

| Extended Stay Deluxe | 1 | Staples | 2 | |

| Famous Footwear | 1 | Starbucks | 61 | |

| Fashion Bug | 1 | Studio 6 | 1 | |

| FedEx | 171 | Subaru | 1 | |

| Finish Line | 5 | Subway | 59 | |

| Firestone Complete Auto Care | 15 | Super 8 | 10 | |

| Foot Locker | 7 | T-Mobile | 56 | |

| Ford | 6 | T.G.I. Driday's | 3 | |

| Forever 21 | 2 | T.J.Maxx | 2 | |

| Fredericks Of Hollywood | 2 | Taco Bell | 20 | |

| GNC | 20 | Talbots | 3 | |

| GameStop | 29 | Target | 11 | |

| Gap | 6 | The Cheesecake Factory | 1 | |

| Goodwill | 7 | The Limited | 2 | |

| Gymboree | 5 | The Room Place | 6 | |

| H&R Block | 41 | Torrid | 3 | |

| Haagen-Dazs | 3 | Toyota | 5 | |

| Havertys Furniture | 1 | Toys"R"Us | 6 | |

| Haworth | 1 | Travelodge | 3 | |

| Hawthorn | 1 | True Value | 2 | |

| Hilton | 12 | U-Haul | 38 | |

| Hobby Lobby | 5 | UPS | 167 | |

| Holiday Inn | 31 | Urban Outfitters | 1 | |

| Hollister Co. | 5 | Vans | 22 | |

| Home Depot | 12 | Verizon Wireless | 12 | |

| Homestead Studio Suites | 1 | Victoria's Secret | 9 | |

| Honda | 3 | Volkswagen | 3 | |

| Hot Topic | 6 | Walgreens | 46 | |

| Houlihan's | 1 | Walmart | 14 | |

| Howard Johnson | 1 | Wendy's | 27 | |

| Hyatt | 8 | Westin | 2 | |

| IHOP | 21 | Wet Seal | 2 | |

| InTown Suites | 5 | Whole Foods Market | 1 | |

| J. Jill | 2 | YMCA | 9 | |

| J.Crew | 2 | Z Gallerie | 1 | |

Strongest AM radio stations in San Antonio:

- KTKR (760 AM; 50 kW; SAN ANTONIO, TX; Owner: CCB TEXAS LICENSES, L.P.)

- KTSA (550 AM; 5 kW; SAN ANTONIO, TX; Owner: INFINITY BROADCASTING CORPORATION OF SAN ANTONIO)

- KKYX (680 AM; 50 kW; SAN ANTONIO, TX; Owner: CXR HOLDINGS, INC.)

- KONO (860 AM; 5 kW; SAN ANTONIO, TX; Owner: CXR HOLDINGS, INC.)

- KENS (1160 AM; 25 kW; SAN ANTONIO, TX; Owner: KENS-TV, INC.)

- KLUP (930 AM; 5 kW; TERRELL HILLS, TX; Owner: SOUTH TEXAS BROADCASTING, INC.)

- KDRY (1100 AM; 11 kW; ALAMO HEIGHTS, TX; Owner: KDRY RADIO, INC.)

- WOAI (1200 AM; 50 kW; SAN ANTONIO, TX; Owner: CCB TEXAS LICENSES, L.P.)

- KSLR (630 AM; 5 kW; SAN ANTONIO, TX; Owner: SALEM MEDIA OF TEXAS, INC.)

- KCOR (1350 AM; 5 kW; SAN ANTONIO, TX)

- KCHL (1480 AM; 2 kW; SAN ANTONIO, TX; Owner: MARTIN BROADCASTING, INC.)

- KXTN (1310 AM; 5 kW; SAN ANTONIO, TX)

- KZDC (1250 AM; 1 kW; SAN ANTONIO, TX; Owner: RADIO UNICA OF SAN ANTONIO LICENSE CORP.)

Strongest FM radio stations in San Antonio:

- KZEP-FM (104.5 FM; SAN ANTONIO, TX; Owner: TEXAS LOTUS LTD.)

- KQXT-FM (101.9 FM; SAN ANTONIO, TX; Owner: CCB TEXAS LICENSES, L.P.)

- KTFM (102.7 FM; SAN ANTONIO, TX; Owner: INFINITY BROADCASTING CORPORATION OF SAN ANTONIO)

- KSYM-FM (90.1 FM; SAN ANTONIO, TX; Owner: SAN ANTONIO COLLEGE)

- K237AS (95.3 FM; SAN ANTONIO, TX; Owner: CXR HOLDINGS, INC.)

- KSTX (89.1 FM; SAN ANTONIO, TX; Owner: TEXAS PUBLIC RADIO)

- KCYY (100.3 FM; SAN ANTONIO, TX; Owner: CXR HOLDINGS, INC.)

- KXXM (96.1 FM; SAN ANTONIO, TX; Owner: CCB TEXAS LICENSES, L.P.)

- KRTU-FM (91.7 FM; SAN ANTONIO, TX; Owner: TRINITY UNIVERSITY)

- K279AB (103.7 FM; SAN ANTONIO, TX; Owner: WILDCATTER WIRELESS, LLC)

- KONO-FM (101.1 FM; HELOTES, TX; Owner: CXR HOLDINGS, INC.)

- KXTN-FM (107.5 FM; SAN ANTONIO, TX; Owner: TICHENOR LICENSE CORPORATION ("TLC"))

- KAJA (97.3 FM; SAN ANTONIO, TX; Owner: CCB TEXAS LICENSES, L.P.)

- KROM (92.9 FM; SAN ANTONIO, TX; Owner: TICHENOR LICENSE CORPORATION ("TLC"))

- KSMG (105.3 FM; SEGUIN, TX; Owner: CXR HOLDINGS, INC.)

- KISS-FM (99.5 FM; SAN ANTONIO, TX; Owner: CXR HOLDINGS, INC.)

- KCJZ (106.7 FM; TERRELL HILLS, TX; Owner: CXR HOLDINGS, INC.)

- KPAC (88.3 FM; SAN ANTONIO, TX; Owner: TEXAS PUBLIC RADIO)

- KLEY-FM (94.1 FM; FLORESVILLE, TX; Owner: KLEY LICENSING, INC.)

- KBBT (98.5 FM; SCHERTZ, TX; Owner: HBC LICENSE CORPORATION)

TV broadcast stations around San Antonio:

- K31EX (Channel 31; SAN ANTONIO, TX; Owner: MAKO COMMUNICATIONS, LLC)

- KNIC-CA (Channel 17; SAN ANTONIO, TX; Owner: TELEFUTURA PARTNERSHIP OF SAN ANTONIO)

- K52EA (Channel 52; SAN ANTONIO, TX; Owner: ORTIZ BROADCASTING CORPORATION)

- K48DS (Channel 48; SAN ANTONIO, TX; Owner: SAN ANTONIO COLLEGE)

- KBNB-LP (Channel 10; SAN ANTONIO, TX; Owner: B COMMUNICATIONS JOINT VENTURE)

- KMHZ-LP (Channel 65; SAN ANTONIO, TX; Owner: LOUIS MARTINEZ FAMILY GROUP, LLC)

- KJLF-LP (Channel 7; SAN ANTONIO, TX; Owner: B COMMUNICATIONS JOINT VENTURE)

- KXTM-LP (Channel 21; SAN ANTONIO, TX; Owner: HUMBERTO LOPEZ)

- KLRN (Channel 9; SAN ANTONIO, TX; Owner: ALAMO PUBLIC TELECOMMUNICATIONS COUNCIL)

- KRRT (Channel 35; KERRVILLE, TX; Owner: SAN ANTONIO (KRRT-TV) LICENSEE, INC.)

- KENS-TV (Channel 5; SAN ANTONIO, TX; Owner: KENS-TV, INC.)

- KABB (Channel 29; SAN ANTONIO, TX; Owner: KABB LICENSEE, LLC)

- KVDA (Channel 60; SAN ANTONIO, TX; Owner: TELEMUNDO OF TEXAS PARTNERSHIP, LP)

- WOAI-TV (Channel 4; SAN ANTONIO, TX; Owner: CCB TEXAS LICENSES, L.P.)

- KWEX-TV (Channel 41; SAN ANTONIO, TX; Owner: KWEX LICENSE PARTNERSHIP, L.P.)

- KGMM-CA (Channel 58; SAN ANTONIO, TX; Owner: CABALLERO TELEVISION TEXAS, L.L.C.)

- KSAA-LP (Channel 28; SAN ANTONIO, TX; Owner: MAKO COMMUNICATIONS, LLC)

- KSAT-TV (Channel 12; SAN ANTONIO, TX; Owner: POST-NEWSWEEK STATIONS, SAN ANTONIO, LP)

- KOBS-LP (Channel 43; SAN ANTONIO, TX; Owner: CLARK ORTIZ)

- KHCE (Channel 23; SAN ANTONIO, TX; Owner: SAN ANTONIO COMMUNITY EDUCATIONAL TV, INC.)

- KFTO-CA (Channel 67; SAN ANTONIO, TX; Owner: TELEFUTURA PARTNERSHIP OF SAN ANTONIO)

- K57GO (Channel 57; SAN ANTONIO, TX; Owner: THREE ANGELS BROADCASTING NETWORK)

- KPXL (Channel 26; UVALDE, TX; Owner: PAXSON SAN ANTONIO LICENSE, INC.)

- KQVE-LP (Channel 46; La VERNIA, TX; Owner: WORD OF GOD FELLOWSHIP, INC.)

- K20BW (Channel 20; SAN ANTONIO, TX; Owner: TRINITY BROADCASTING NETWORK)

Medal of Honor Recipients

Medal of Honor Recipients born in San Antonio: Miguel Keith, William James Bordelon.

- National Bridge Inventory (NBI) Statistics

- 2,606Number of bridges

- 57,940ft / 17,660mTotal length

- $136,861,000Total costs

- 79,749,417Total average daily traffic

- 4,924,125Total average daily truck traffic

- New bridges - historical statistics

- 41900-1909

- 41910-1919

- 301920-1929

- 491930-1939

- 421940-1949

- 1161950-1959

- 6171960-1969

- 2631970-1979

- 4781980-1989

- 3851990-1999

- 2992000-2009

- 2512010-2019

- 682020-2022

FCC Registered Antenna Towers: 5,027 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 42 (See the full list of FCC Registered Commercial Land Mobile Towers in San Antonio, TX)

FCC Registered Private Land Mobile Towers: 79 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 794 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 1,045 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 129 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 97 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 4,692 (See the full list of FCC Registered Amateur Radio Licenses in San Antonio)

FAA Registered Aircraft Manufacturers and Dealers: 29 (See the full list of FAA Registered Manufacturers and Dealers in San Antonio)

FAA Registered Aircraft: 987 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 227 full and 21 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 6,205 | $140,639 | 3,594 | $172,353 | 10,942 | $148,364 | 1,549 | $42,792 | 36 | $2,419,592 | 1,229 | $117,763 | 34 | $100,674 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 289 | $136,549 | 365 | $154,783 | 1,505 | $134,500 | 369 | $33,596 | 2 | $14,504,700 | 122 | $110,917 | 41 | $46,598 |

| APPLICATIONS DENIED | 1,097 | $130,304 | 847 | $127,551 | 5,660 | $122,845 | 2,792 | $29,761 | 11 | $411,364 | 705 | $80,487 | 89 | $46,493 |

| APPLICATIONS WITHDRAWN | 857 | $143,025 | 651 | $163,324 | 3,124 | $142,886 | 494 | $46,180 | 4 | $7,495,500 | 356 | $110,502 | 8 | $85,560 |

| FILES CLOSED FOR INCOMPLETENESS | 117 | $129,086 | 108 | $140,010 | 658 | $139,634 | 61 | $53,416 | 0 | $0 | 78 | $108,197 | 3 | $50,067 |

Detailed mortgage data for all 248 tracts in San Antonio, TX

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 171 full and 21 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 662 | $170,669 | 298 | $176,593 | 21 | $161,691 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 141 | $168,162 | 97 | $179,598 | 16 | $114,759 |

| APPLICATIONS DENIED | 85 | $166,938 | 69 | $187,149 | 7 | $120,974 |

| APPLICATIONS WITHDRAWN | 42 | $157,470 | 29 | $155,391 | 1 | $110,890 |

| FILES CLOSED FOR INCOMPLETENESS | 30 | $166,206 | 2 | $157,105 | 11 | $106,160 |

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in San Antonio, TX

- 17,02344.8%Outside Fires

- 11,58930.5%Structure Fires

- 6,95118.3%Mobile Property/Vehicle Fires

- 2,4656.5%Other

According to the data from the years 2002 - 2018 the average number of fires per year is 2237. The highest number of fires - 4,534 took place in 2009, and the least - 129 in 2002. The data has an increasing trend.

According to the data from the years 2002 - 2018 the average number of fires per year is 2237. The highest number of fires - 4,534 took place in 2009, and the least - 129 in 2002. The data has an increasing trend. When looking into fire subcategories, the most incidents belonged to: Outside Fires (44.8%), and Structure Fires (30.5%).

When looking into fire subcategories, the most incidents belonged to: Outside Fires (44.8%), and Structure Fires (30.5%).Fire-safe hotels and motels in San Antonio, Texas:

- Embassy Suites San Antonio International Airport, 10110 Us Hwy 281 N, San Antonio, Texas 78216 , Phone: (210) 525-9999, Fax: (210) 525-0626

- Home Gate Studions & Suites Fiesta Park, 10950 Laureate Dr, San Antonio, Texas 78249 , Phone: (210) 691-1103, Fax: (210) 691-2180

- Marriott Rivercenter Hotel, 101 Bowie St, San Antonio, Texas 78205 , Phone: (210) 223-1000, Fax: (210) 223-6239

- Holiday Inn Riverwalk, 217 N St Mary's St, San Antonio, Texas 78205 , Phone: (210) 224-2500, Fax: (210) 226-0154

- Holiday Inn San Antonio International Airport, 77 NE Loop 410, San Antonio, Texas 78216 , Phone: (210) 349-9900, Fax: (210) 375-0183

- Doubletree Hotel, 37 Ne Loop 410, San Antonio, Texas 78216 , Phone: (210) 366-2424, Fax: (210) 341-0410

- Hilton Palacio Del Rio, 200 S Alamo St, San Antonio, Texas 78205 , Phone: (210) 222-1400, Fax: (210) 270-0761

- La Quinta Inn & Suites Convention Center, 303 Blum, San Antonio, Texas 78202 , Phone: (210) 222-9181, Fax: (210) 228-9816

- 254 other hotels and motels

| Most common first names in San Antonio, TX among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| Mary | 5,073 | 78.0 years |

| John | 4,130 | 72.9 years |

| Maria | 3,811 | 77.1 years |

| William | 3,607 | 74.5 years |

| Robert | 3,353 | 69.8 years |

| James | 3,173 | 71.5 years |

| Jose | 2,254 | 71.7 years |

| Charles | 2,210 | 72.8 years |

| George | 2,078 | 73.4 years |

| Joe | 1,894 | 70.1 years |

| Most common last names in San Antonio, TX among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Martinez | 3,071 | 72.4 years |

| Rodriguez | 3,031 | 72.8 years |

| Garcia | 2,934 | 72.4 years |

| Hernandez | 2,180 | 71.7 years |

| Smith | 1,784 | 76.0 years |

| Garza | 1,738 | 73.5 years |

| Gonzales | 1,627 | 71.8 years |

| Flores | 1,554 | 72.9 years |

| Lopez | 1,509 | 71.8 years |

| Sanchez | 1,341 | 71.6 years |

- 58.6%Electricity

- 39.6%Utility gas

- 0.8%Bottled, tank, or LP gas

- 0.4%No fuel used

- 0.4%Solar energy

- 82.9%Electricity

- 15.1%Utility gas

- 1.2%No fuel used

- 0.5%Bottled, tank, or LP gas

San Antonio compared to Texas state average:

- Unemployed percentage significantly below state average.

- Hispanic race population percentage above state average.

San Antonio, TX compared to other similar cities:

San Antonio on our top lists:

- #10 on the list of "Top 101 biggest cities in 2013"

- #10 on the list of "Top 100 biggest cities"

- #14 on the list of "Top 101 cities with the most mentions on city-data.com forum"

- #23 on the list of "Top 100 cities with largest land areas (pop. 50,000+)"

- #24 on the list of "Top 101 cities with the highest number of thefts per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #31 on the list of "Top 101 cities with the lowest average wind speeds (population 50,000+)"

- #47 on the list of "Top 101 cities with the largest percentage of people in military transient quarters for temporary residents (population 1,000+)"

- #74 on the list of "Top 101 cities with largest percentage of males in industries: mining, quarrying, and oil and gas extraction (population 50,000+)"

- #76 on the list of "Top 101 cities with the hottest summers (population 50,000+)"

- #95 on the list of "Top 101 cities with the most residents born in Other Western Europe (population 500+)"

- #96 on the list of "Top 101 cities with the largest house values disparities (population 50,000+)"

- #1 (78237) on the list of "Top 101 zip codes with the largest percentage of United States first ancestries (pop 5,000+)"

- #2 (78229) on the list of "Top 101 zip codes with the most offices of physicians in 2005"

- #9 (78237) on the list of "Top 101 zip codes with the smallest percentage of taxpayers reporting net capital gain/loss in 2012 (pop 1,000+)"

- #12 (78234) on the list of "Top 101 zip codes with the smallest percentage of taxpayers using paid preparers for 2012 taxes (pop 5,000+)"

- #17 (78234) on the list of "Top 101 zip codes with the smallest percentage of taxpayers reporting profit/loss from business in 2012 (pop 5,000+)"

- #18 (78207) on the list of "Top 101 zip codes with the smallest percentage of taxpayers using charity contributions deductions in 2012 (pop 5,000+)"

- #19 (78211) on the list of "Top 101 zip codes with the lowest charity contributions deductions as a percentage of AGI in 2012 (pop 5,000+)"

- #28 (78225) on the list of "Top 101 zip codes with the largest percentage of Lithuanian first ancestries (pop 5,000+)"

- #32 (78234) on the list of "Top 101 zip codes with the lowest 2012 average reported profit/loss from business (pop 5,000+)"

- #33 (78203) on the list of "Top 101 zip codes with the smallest percentage of taxpayers reporting taxable interest in 2012 (pop 5,000+)"

- #37 (78205) on the list of "Top 101 zip codes with the highest 2012 average net capital gain/loss (pop 1,000+)"

- #37 (78234) on the list of "Top 101 zip codes with the largest percentage of returns reporting salary or wage in 2012 (pop 5,000+)"

- #55 (78208) on the list of "Top 101 zip codes with the largest percentage of Swiss first ancestries (pop 5,000+)"

- #58 (78205) on the list of "Top 101 zip codes with the most alcohol drinking places in 2005"

- #58 (78205) on the list of "Top 101 zip codes with the most hotels or motels in 2005"

- #59 (78229) on the list of "Top 101 zip codes with the most big companies in 2005 (at least 1000 employees)"

- #60 (78231) on the list of "Top 101 zip codes with the largest charity contributions deductions as a percentage of AGI in 2012 (pop 5,000+)"

- #62 (78073) on the list of "Top 101 zip codes with the largest percentage of Hungarian first ancestries (pop 5,000+)"

- #75 (78205) on the list of "Top 101 zip codes with the most offices of lawyers in 2005"

- #78 (78207) on the list of "Top 101 zip codes with the lowest 2012 average Adjusted Gross Income (AGI) for individuals (pop 5,000+)"

- #8 on the list of "Top 101 counties with the highest ground withdrawal of fresh water for public supply"

- #11 on the list of "Top 101 counties with the most Evangelical Protestant adherents"

- #11 on the list of "Top 101 counties with the most Evangelical Protestant congregations"

- #12 on the list of "Top 101 counties with the lowest surface withdrawal of fresh water for public supply (pop. 50,000+)"

- #13 on the list of "Top 101 counties with the most Catholic adherents (pop. 50,000+)"

|

|

Total of 3783 patent applications in 2008-2024.