Toledo, Ohio

Toledo: One Seagate Tower

Toledo: Downtown Toledo, looking north.

Toledo: Taken From the 375 foot National City Tower

Toledo: Toledo, OH on the banks of the Maumee River

Toledo: Walbridge Park Christmas Lights Island on Broadway St in Toledo, Ohio on February 9, 2002

Toledo: Madison Avenue Downtown

Toledo: View from above downtown

Toledo: Toledo, Ohio March 2004

Toledo: Lake Erie Beach at Kelley's Island

Toledo: The Tall Ships visit Downtown Toledo

Toledo: Taken by Mark G Davis

- see

35

more - add

your

Submit your own pictures of this city and show them to the world

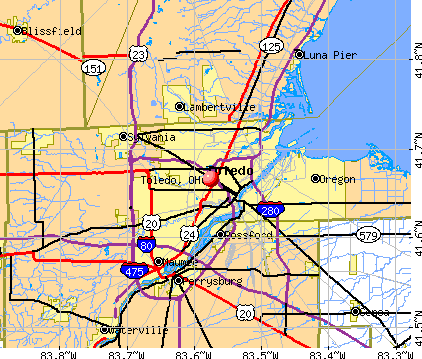

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: -15.1%

| Males: 128,017 | |

| Females: 138,284 |

| Median resident age: | 36.6 years |

| Ohio median age: | 39.9 years |

Zip codes: 43604, 43607, 43608, 43609, 43610, 43612, 43613, 43620.

Toledo Zip Code Map| Toledo: | $47,365 |

| OH: | $65,720 |

Estimated per capita income in 2022: $27,637 (it was $17,388 in 2000)

Toledo city income, earnings, and wages data

Estimated median house or condo value in 2022: $106,400 (it was $73,700 in 2000)

| Toledo: | $106,400 |

| OH: | $204,100 |

Mean prices in 2022: all housing units: $130,317; detached houses: $131,824; townhouses or other attached units: $138,651; in 2-unit structures: $69,256; in 3-to-4-unit structures: $676,342; in 5-or-more-unit structures: $123,968; mobile homes: $23,049

Median gross rent in 2022: $846.

(17.4% for White Non-Hispanic residents, 27.7% for Black residents, 30.8% for Hispanic or Latino residents, 25.4% for American Indian residents, 59.8% for Native Hawaiian and other Pacific Islander residents, 35.7% for other race residents, 40.9% for two or more races residents)

Detailed information about poverty and poor residents in Toledo, OH

- 149,19556.0%White alone

- 72,20227.1%Black alone

- 23,9739.0%Hispanic

- 15,9706.0%Two or more races

- 3,1371.2%Asian alone

- 1,6730.6%Other race alone

- 1030.04%American Indian alone

- 360.01%Native Hawaiian and Other

Pacific Islander alone

Races in Toledo detailed stats: ancestries, foreign born residents, place of birth

According to our research of Ohio and other state lists, there were 850 registered sex offenders living in Toledo, Ohio as of April 24, 2024.

The ratio of all residents to sex offenders in Toledo is 328 to 1.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is smaller than the state average.- means the value is about the same as the state average.

- means the value is bigger than the state average.

- means the value is much bigger than the state average.

Crime rate in Toledo detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 632 (580 officers - 483 male; 97 female).

| Officers per 1,000 residents here: | 2.15 |

| Ohio average: | 2.31 |

| Toledo or Cleveland (80 replies) |

| Moving to Toledo area (7 replies) |

| East Toledo - Crazy to Purchase (non-rental) Property?! (3 replies) |

| Just wondering...Are there "nightclubs" open in Toledo? (1 reply) |

| Tourism in Toledo? (11 replies) |

| Where to live near Toledo when you really want to leave? (9 replies) |

Latest news from Toledo, OH collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: German (11.9%), American (6.3%), Polish (5.8%), Irish (3.9%), English (3.2%), African (2.2%).

Current Local Time: EST time zone

Incorporated in 1914

Elevation: 615 feet

Land area: 80.6 square miles.

Population density: 3,303 people per square mile (average).

9,050 residents are foreign born (1.4% Asia, 0.9% Latin America, 0.5% Africa, 0.4% Europe).

| This city: | 3.4% |

| Ohio: | 4.9% |

Median real estate property taxes paid for housing units with mortgages in 2022: $2,013 (1.7%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $1,572 (1.9%)

Nearest city with pop. 1,000,000+: Chicago, IL (212.1 miles

, pop. 2,896,016).

Nearest cities:

Latitude: 41.67 N, Longitude: 83.58 W

Daytime population change due to commuting: +7,836 (+2.9%)

Workers who live and work in this city: 67,467 (57.9%)

Area codes: 419, 567

Property values in Toledo, OH

Detailed articles:

- Toledo: Introduction

- Toledo Basic Facts

- Toledo: Communications

- Toledo: Convention Facilities

- Toledo: Economy

- Toledo: Education and Research

- Toledo: Geography and Climate

- Toledo: Health Care

- Toledo: History

- Toledo: Municipal Government

- Toledo: Population Profile

- Toledo: Recreation

- Toledo: Transportation

Toledo, Ohio accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 22 buildings, average cost: $194,800

- 2021: 23 buildings, average cost: $163,700

- 2020: 9 buildings, average cost: $111,300

- 2019: 16 buildings, average cost: $112,700

- 2018: 20 buildings, average cost: $112,700

- 2017: 18 buildings, average cost: $112,700

- 2016: 15 buildings, average cost: $112,700

- 2015: 18 buildings, average cost: $112,700

- 2014: 26 buildings, average cost: $116,800

- 2013: 72 buildings, average cost: $114,900

- 2012: 32 buildings, average cost: $112,500

- 2011: 33 buildings, average cost: $139,000

- 2010: 39 buildings, average cost: $124,300

- 2009: 40 buildings, average cost: $100,900

- 2008: 68 buildings, average cost: $120,400

- 2007: 82 buildings, average cost: $131,300

- 2006: 100 buildings, average cost: $107,500

- 2005: 120 buildings, average cost: $90,100

- 2004: 152 buildings, average cost: $85,000

- 2003: 310 buildings, average cost: $81,100

- 2002: 133 buildings, average cost: $82,600

- 2001: 249 buildings, average cost: $94,400

- 2000: 93 buildings, average cost: $88,600

- 1999: 107 buildings, average cost: $67,200

- 1998: 109 buildings, average cost: $68,000

- 1997: 166 buildings, average cost: $67,600

| Here: | 4.2% |

| Ohio: | 3.1% |

- Health care (15.0%)

- Accommodation & food services (10.4%)

- Educational services (7.6%)

- Administrative & support & waste management services (5.0%)

- Construction (4.4%)

- Professional, scientific, technical services (3.8%)

- Transportation equipment (3.4%)

- Accommodation & food services (10.0%)

- Construction (8.3%)

- Administrative & support & waste management services (6.2%)

- Educational services (5.8%)

- Health care (5.8%)

- Transportation equipment (4.7%)

- Other transportation, support activities, couriers (4.2%)

- Health care (24.0%)

- Accommodation & food services (10.8%)

- Educational services (9.4%)

- Social assistance (4.8%)

- Professional, scientific, technical services (4.0%)

- Administrative & support & waste management services (3.9%)

- Department & other general merchandise stores (3.2%)

- Laborers and material movers, hand (6.7%)

- Cooks and food preparation workers (6.4%)

- Other management occupations, except farmers and farm managers (4.9%)

- Nursing, psychiatric, and home health aides (3.5%)

- Health technologists and technicians (3.5%)

- Building and grounds cleaning and maintenance occupations (3.1%)

- Material recording, scheduling, dispatching, and distributing workers (2.9%)

- Laborers and material movers, hand (7.2%)

- Cooks and food preparation workers (6.3%)

- Driver/sales workers and truck drivers (5.1%)

- Material recording, scheduling, dispatching, and distributing workers (4.1%)

- Building and grounds cleaning and maintenance occupations (3.8%)

- Assemblers and fabricators (3.7%)

- Other material moving workers, except laborers (3.5%)

- Other management occupations, except farmers and farm managers (7.1%)

- Cooks and food preparation workers (6.5%)

- Laborers and material movers, hand (6.3%)

- Nursing, psychiatric, and home health aides (6.0%)

- Health technologists and technicians (6.0%)

- Cashiers (4.1%)

- Other healthcare support occupations (3.6%)

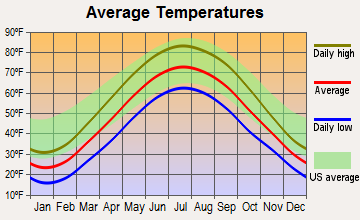

Average climate in Toledo, Ohio

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

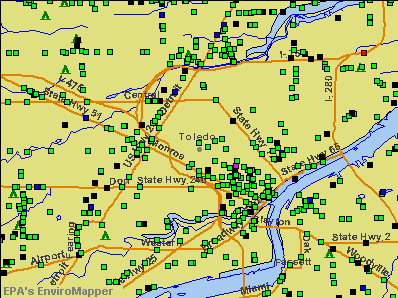

Air Quality Index (AQI) level in 2023 was 61.2. This is about average.

| City: | 61.2 |

| U.S.: | 72.6 |

Sulfur Dioxide (SO2) [ppb] level in 2023 was 0.247. This is significantly better than average. Closest monitor was 2.1 miles away from the city center.

| City: | 0.247 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 31.0. This is about average. Closest monitor was 2.1 miles away from the city center.

| City: | 31.0 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2012 was 23.5. This is worse than average. Closest monitor was 1.9 miles away from the city center.

| City: | 23.5 |

| U.S.: | 19.2 |

Tornado activity:

Toledo-area historical tornado activity is slightly above Ohio state average. It is 44% greater than the overall U.S. average.

On 4/11/1965, a category F4 (max. wind speeds 207-260 mph) tornado 1.3 miles away from the Toledo city center killed 18 people and injured 236 people and caused between $5,000,000 and $50,000,000 in damages.

On 6/8/1953, a category F4 tornado 7.9 miles away from the city center killed 4 people and injured 18 people and caused between $50,000 and $500,000 in damages.

Earthquake activity:

Toledo-area historical earthquake activity is significantly above Ohio state average. It is 32% smaller than the overall U.S. average.On 9/25/1998 at 19:52:52, a magnitude 5.2 (4.8 MB, 4.3 MS, 5.2 LG, 4.5 MW, Depth: 3.1 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 164.9 miles away from the city center

On 1/31/1986 at 16:46:43, a magnitude 5.0 (5.0 MB) earthquake occurred 124.9 miles away from Toledo center

On 7/12/1986 at 08:19:37, a magnitude 4.5 (4.5 MB, Class: Light, Intensity: IV - V) earthquake occurred 88.4 miles away from the city center

On 7/27/1980 at 18:52:21, a magnitude 5.2 (5.1 MB, 4.7 MS, 5.0 UK, 5.2 UK) earthquake occurred 240.2 miles away from the city center

On 4/18/2008 at 09:36:59, a magnitude 5.4 (5.1 MB, 4.8 MS, 5.4 MW, 5.2 MW) earthquake occurred 318.5 miles away from the city center

On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi) earthquake occurred 396.5 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Lucas County (13) is near the US average (15).Major Disasters (Presidential) Declared: 8

Emergencies Declared: 4

Causes of natural disasters: Storms: 8, Floods: 7, Tornadoes: 4, Snowstorms: 2, Blizzard: 1, Hurricane: 1, Power Outage: 1, Wind: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: MANOR CARE INC (SERVICES-SKILLED NURSING CARE FACILITIES), N-VIRO INTERNATIONAL CORP (PATENT OWNERS & LESSORS), LIBBEY INC (GLASS, GLASSWARE, PRESSED OR BLOWN), OWENS ILLINOIS GROUP INC (GLASS CONTAINERS), OWENS CORNING (ABRASIVE ASBESTOS & MISC NONMETALLIC MINERAL PRODUCTS), OWENS ILLINOIS INC /DE/ (GLASS CONTAINERS), HEALTH CARE REIT INC /DE/ (REAL ESTATE INVESTMENT TRUSTS), BLOCK COMMUNICATIONS INC (CABLE & OTHER PAY TELEVISION SERVICES) and 1 other public companies.

Hospitals in Toledo:

- BARBARA JEAN MCDONAGH HOME (2050 PARKSIDE BLVD)

- HEARTLAND HOSPICE SERVICES, INC (5700 SOUTHWYCK BLVD, SUITE 111)

- JOSINA LOTT RESIDENTIAL AND COMM (120 S HOLLAND SYLVANIA ROAD)

- MERCY ST ANNE HOSPITAL (Voluntary non-profit - Church, 3404 SYLVANIA AVENUE)

- NORTHCOAST BEHAVIORAL HEALTHCARE-TOLEDO CAMPUS (930 S DETROIT AVE)

- PARKVIEW HOSPITAL (1920 PARKWOOD AVE)

- SOUTHERNCARE TOLEDO (6545 WEST CENTRAL AVENUE, SUITE 103)

- SUNSHINE/KING ROAD FAMILY CARE (3211 KING ROAD)

- SUNSHINE/VANDERBILT FAMILY (828 VANDERBILT ROAD)

- UNIVERSITY OF TOLEDO MEDICAL CENTER (Government - State, provides emergency services, 3000 ARLINGTON AVENUE)

Airports, heliports and other landing facilities located in Toledo:

- Toledo Executive Airport (TDZ) (Runways: 2, Air Taxi Ops: 20,000, Itinerant Ops: 12,500, Local Ops: 58,000, Military Ops: 200)

- Toledo Express Airport (TOL) (Runways: 2, Commercial Ops: 2,312, Air Taxi Ops: 7,807, Itinerant Ops: 13,098, Local Ops: 14,402, Military Ops: 5,596)

- Heliports: 7

- Toledo Seaplane Base (2C9)

Colleges/Universities in Toledo:

- University of Toledo (Full-time enrollment: 18,409; Location: 2801 W Bancroft; Public; Website: www.utoledo.edu/; Offers Doctor's degree)

- Mercy College of Ohio (Full-time enrollment: 891; Location: 2221 Madison Avenue; Private, not-for-profit; Website: www.mercycollege.edu)

- Herzing University-Toledo (Full-time enrollment: 288; Location: 5212 Hill Ave; Private, for-profit; Website: www.herzing.edu/)

- Davis College (Full-time enrollment: 264; Location: 4747 Monroe St; Private, for-profit; Website: www.daviscollege.edu)

- Toledo Public Schools Adult and Continuing Education (Full-time enrollment: 167; Location: 2231 UPTON AVENUE; Public; Website: www.tps.org)

- Lincoln College of Technology-Toledo (Full-time enrollment: 163; Location: 5203 Airport Highway; Private, for-profit; Website: www.lincolnedu.com/campus/toledo-oh)

- Toni & Guy Hairdressing Academy-Toledo (Full-time enrollment: 137; Location: 3034 Wilford Drive; Private, for-profit; Website: www.toniguyacademy.com)

- Athena Career Academy (Full-time enrollment: 133; Location: 5203 Airport Hwy; Private, for-profit; Website: www.athenacareers.com)

- Toledo Restaurant Training Center (Full-time enrollment: 30; Location: 3450 W. Central Ave. Suite 102; Private, not-for-profit; Website: www.trtcoh.org)

Other colleges/universities with over 2000 students near Toledo:

- Owens Community College (about 6 miles; Perrysburg, OH; Full-time enrollment: 9,416)

- Monroe County Community College (about 19 miles; Monroe, MI; FT enrollment: 2,553)

- Bowling Green State University-Main Campus (about 21 miles; Bowling Green, OH; FT enrollment: 16,357)

- Siena Heights University (about 29 miles; Adrian, MI; FT enrollment: 2,009)

- Terra State Community College (about 31 miles; Fremont, OH; FT enrollment: 2,119)

- Eastern Michigan University (about 41 miles; Ypsilanti, MI; FT enrollment: 18,395)

- Northwest State Community College (about 41 miles; Archbold, OH; FT enrollment: 2,406)

Biggest public high schools in Toledo:

- WHITMER HIGH SCHOOL (Students: 2,077, Location: 5601 CLEGG DR, Grades: 9-12)

- ALTERNATIVE EDUCATION ACADEMY (Students: 1,799, Location: 1830 ADAMS ST, Grades: KG-12, Charter school)

- START HIGH SCHOOL (Students: 1,459, Location: 2010 TREMAINSVILLE RD, Grades: 9-12)

- BOWSHER HIGH SCHOOL (Students: 1,266, Location: 2200 ARLINGTON AVENUE, Grades: 9-12)

- WAITE HIGH SCHOOL (Students: 1,031, Location: 301 MORRISON DR, Grades: 9-12)

- ROGERS HIGH SCHOOL (Students: 994, Location: 222 MCTIGUE DR, Grades: 9-12)

- WOODWARD HIGH SCHOOL (Students: 751, Location: 701 E CENTRAL AVE, Grades: 9-12)

- PHOENIX ACADEMY COMMUNITY SCHOOL (Students: 717, Location: 1505 JEFFERSON AVE, Grades: 7-12, Charter school)

- TOLEDO SCHOOL FOR THE ARTS (Students: 563, Location: 333 14TH ST, Grades: 6-12, Charter school)

- MCTIGUE ELEMENTARY SCHOOL (Students: 560, Location: 5555 NEBRASKA AVE, Grades: KG-9)

Private high schools in Toledo:

- CENTRAL CATHOLIC HIGH SCHOOL (Students: 1,008, Location: 2550 CHERRY ST, Grades: 9-12)

- ST JOHN'S JESUIT HIGH SCHOOL (Students: 981, Location: 5901 AIRPORT HWY, Grades: 6-12, Boys only)

- NOTRE DAME ACADEMY (Students: 681, Location: 3535 W SYLVANIA AVE, Grades: 7-12, Girls only)

- ST FRANCIS DE SALES HIGH SCHOOL (Students: 631, Location: 2323 W BANCROFT ST, Grades: 9-12, Boys only)

- TOLEDO CHRISTIAN SCHOOLS (Students: 608, Location: 2303 BROOKFORD DR, Grades: PK-12)

- MAUMEE VALLEY COUNTRY DAY SCHOOL (Students: 476, Location: 1715 S REYNOLDS RD, Grades: PK-12)

- EMMANUEL CHRISTIAN SCHOOL (Students: 394, Location: 4607 W LASKEY RD, Grades: KG-12)

- APOSTOLIC CHRISTIAN ACADEMY (Students: 87, Location: 5701 W SYLVANIA AVE, Grades: KG-12)

Biggest public elementary/middle schools in Toledo:

- BENNETT VENTURE ACADEMY (Students: 674, Location: 5130 BENNETT ROAD, Grades: KG-8, Charter school)

- LONGFELLOW ELEMENTARY SCHOOL (Students: 595, Location: 1955 W LASKEY RD, Grades: KG-8)

- WINTERFIELD VENTURE ACADEMY (Students: 580, Location: 305 WENZ RD, Grades: KG-8, Charter school)

- BYRNEDALE ELEMENTARY SCHOOL (Students: 552, Location: 3635 GLENDALE AVE, Grades: KG-8)

- GLENDALE-FEILBACH ELEMENTARY SCHOOL (Students: 530, Location: 2317 CASS RD, Grades: KG-8)

- JEFFERSON JUNIOR HIGH SCHOOL (Students: 514, Location: 5530 WHITMER DR, Grades: 7)

- EAST BROADWAY ELEMENTARY SCHOOL (Students: 510, Location: 1755 E BROADWAY ST, Grades: KG-8)

- DORR STREET ELEMENTARY SCHOOL (Students: 485, Location: 1205 KING RD, Grades: PK-5)

- MEADOWVALE ELEMENTARY SCHOOL (Students: 484, Location: 2755 EDGEBROOK DR, Grades: KG-6)

- OTTAWA HILLS ELEMENTARY SCHOOL (Students: 479, Location: 3602 INDIAN RD, Grades: KG-6)

Biggest private elementary/middle schools in Toledo:

- ST PATRICK OF HEATERDOWNS SCHOOL (Students: 503, Location: 4201 HEATHERDOWNS BLVD, Grades: PK-8)

- CHRIST THE KING ELEMENTARY SCHOOL (Students: 502, Location: 4100 HARVEST LN, Grades: PK-8)

- ST JOAN OF ARC ELEMENTARY SCHOOL (Students: 402, Location: 5950 HEATHERDOWNS BLVD, Grades: KG-8)

- GESU ELEMENTARY SCHOOL (Students: 386, Location: 2045 PARKSIDE BLVD, Grades: PK-8)

- WEST SIDE MONTESSORI CENTER (Students: 368, Location: 2105 N MCCORD RD, Grades: PK-8)

- BLESSED SACRAMENT SCHOOL (Students: 305, Location: 42274255 BELLEVUE RD, Grades: PK-8)

- REGINA COELI SCHOOL (Students: 303, Location: 600 REGINA PKWY, Grades: PK-8)

- ST PIUS X ELEMENTARY SCHOOL (Students: 254, Location: 2950 ILGER AVE, Grades: PK-8)

- ST BENEDICT CATHOLIC SCHOOL (Students: 252, Location: 1620 OLIMPHIA RD, Grades: PK-8)

- OUR LADY OF PERPETUAL HELP SCHOOL (Students: 245, Location: 2255 CENTRAL GROVE, Grades: PK-8)

Library in Toledo:

- TOLEDO-LUCAS COUNTY PUBLIC LIBRARY (Operating income: $38,561,055; Location: 325 MICHIGAN ST.; 2,338,498 books; 901 e-books; 147,808 audio materials; 182,621 video materials; 43 local licensed databases; 266 state licensed databases; 81 other licensed databases; 6,172 print serial subscriptions; 5 electronic serial subscriptions)

User-submitted facts and corrections:

- WTOL, TV station 11 is now owned by Raycom , not Liberty

- WNWO is no longer owned by Raycom WTOL is now owned by Raycom The mayor of Toledo is Carleton S. Finkbeiner The Msdical College of Ohio merged with the University of Toledo, not sure of it's new name it has changed twice.

- Riverside Hospital is closed.

- Please add Toledo Metcalf airport, it is approx. 10 SE of Toledo. FAA identifier is KTDZ

- birthplace of Jamie Farr (July 1, 1934).

- Medical University of Ohio at Toledo. Mercy Riverside Hospital is no longer in operation

Points of interest:

Notable locations in Toledo: Glenbyrne Center (A), Gould Yard (B), Lang Yard (C), Oakdale Yard (D), West Toledo Yard (E), Harrison Marina (F), Bay View Yacht Club (G), The Toledo Yacht Club (H), Fifth Third Field (I), Glass Bowl Stadium (J), Fort Industry Square (K), Charles W Matthews Stadium (L), Heather Downs Country Club (M), Inverness Golf Club (N), Sunningdale Golf Course (O), Toledo Country Club (P), Jolly Roger Sailing Club (Q), Jocketts Marina (R), River View Yacht Club (S), Ottawa River Yacht Club (T). Display/hide their locations on the map

Shopping Centers: Westgate Shopping Center (1), Northstar Plaza Shopping Center (2), Heritage South Plaza Shopping Center (3), Douglas Plaza Shopping Center (4), Laskey Shopping Center (5), Cricket West Shopping Center (6), Kenwood Plaza Shopping Center (7), Franklin Park Plaza Shopping Center (8), Colonial Plaza Shopping Center (9). Display/hide their locations on the map

Main business address in Toledo include: MANOR CARE INC (A), N-VIRO INTERNATIONAL CORP (B), LIBBEY INC (C), OWENS ILLINOIS GROUP INC (D), OWENS CORNING (E), OWENS ILLINOIS INC /DE/ (F), HEALTH CARE REIT INC /DE/ (G), BLOCK COMMUNICATIONS INC (H). Display/hide their locations on the map

Churches in Toledo include: Calvary Bible Church (A), Eureka Baptist Church (B), El Bethel Church (C), Eastminster United Presbyterian Church (D), East Side Wesleyan Church (E), Covenant Presbyterian Church (F), Cornerstone Christian Center (G), Community Church of God in Christ (H), Zion Hill Baptist Church (I). Display/hide their locations on the map

Cemeteries: Resurrection Cemetery (1), Memorial Park (2), Calvary Cemetery (3), Houghton Cemetery (4), Collingwood Cemetery (5), Sunshine Cemetery (6), Forest Cemetery (7). Display/hide their locations on the map

Reservoir: Scott Park Pond (A). Display/hide its location on the map

Creeks: Mud Creek (A), Delaware Creek (B), Wolf Creek (C), Swan Creek (D), Sibley Creek (E). Display/hide their locations on the map

Parks in Toledo include: Ashley Field (1), Wernerts Field (2), Hyde Park (3), Collins Park (4), Close Park (5), Chippewa Playground (6), Bowman Park (7), Toledo Zoological Gardens (8), Friendship Park (9). Display/hide their locations on the map

Beach: Carland Beach (A). Display/hide its location on the map

Tourist attractions: COSI Toledo (Museums; 1 Discovery Way) (1), Toledo Success Center (Planetariums; 3540 Secor Road) (2), Enchanted Forest Playland & Rendv of R W Bshp & CO (Amusement & Theme Parks; 850 Matzinger Road) (3), Greater Toledo Convention & Visitors Bureau (401 Jefferson Avenue) (4), Fantazy Customized Travel Agency (Recreational Trips & Guides; 3337 Collingwood Floor One) (5), Ilona's Professional Tours Inc (Tours & Charters; 3152 Hill Avenue) (6). Display/hide their approximate locations on the map

Hotels: Hilton Toledo (3100 Gendale Avenue) (1), Genesis Dreamplex Hotel & Conference Center (2429 South Reynolds Road) (2), Bel-Air Motel (726 North Reynolds Road) (3), Comfort Inn North (445 East Alexis Road) (4), Crown Inn (1727 West Alexis Road) (5), Comfort Inn Westgate (3560 Secor Road) (6), Econo Lodge (2429 South Reynolds Road) (7), Classic Inn (1821 East Manhattan Boulevard) (8), Alexis Motel (217 West Alexis Road) (9). Display/hide their approximate locations on the map

Courts: Lucas County - Common Pleas Court-General Trial Division- Court Deputies Department- Courth (Courthouse) (1), Federal Bureau Of Investigation (420 Madison Avenue) (2), Toledo City - All Case Information-Questions- City Departments & Divis (555 North Erie Street) (3). Display/hide their approximate locations on the map

Birthplace of: Roger Bresnahan - Baseball player and coach, Rick Volk - Football player, Gene Kranz - NASA Flight Director and manager, Anita Baker - Singer-songwriter, Mark Kerr (fighter) - Mixed martial artist, Carty Finkbeiner - An Democratic politician who is the current mayor of Toledo, Urban Meyer - College football player, Bob Chappuis - Football player, Katie Holmes - Actress, David Saunders (American football) - Football player.

Drinking water stations with addresses in Toledo and their reported violations in the past:

BEDFORD MEADOWS (Serves MI, Population served: 156, Groundwater):Past monitoring violations:VINEYARD LAKE CONDOMINIUM ASSO (Serves MI, Population served: 150, Groundwater):

- One regular monitoring violation

Past monitoring violations:I.C.M.C. CAMPGROUND-EAST WELL (Serves MI, Population served: 100, Groundwater):

- One regular monitoring violation

Past monitoring violations:I.C.M.C. CAMPGROUND WEST WELL (Serves MI, Population served: 100, Groundwater):

- One routine major monitoring violation

Past monitoring violations:THE BUTTERFLY HOUSE (Population served: 25, Groundwater):

- One routine major monitoring violation

Past monitoring violations:

- 4 routine major monitoring violations

Drinking water stations with addresses in Toledo that have no violations reported:

- PIONEER SCOUT RESERVE [BSA]-CAMP (Population served: 235, Primary Water Source Type: Groundwater)

- SPRINGMILL DRIVE-IN THEATRE (Population served: 210, Primary Water Source Type: Groundwater)

- YMCA STORER CAMPS - CHAPMAN (Serves MI, Population served: 200, Primary Water Source Type: Groundwater)

- YMCA STORER CAMPS-S. DINING HL (Serves MI, Population served: 200, Primary Water Source Type: Groundwater)

- YMCA STORER CAMP-TURTLE PIT (Serves MI, Population served: 200, Primary Water Source Type: Groundwater)

- YMCA STORER CAMPS-FRONTIER (Serves MI, Population served: 100, Primary Water Source Type: Groundwater)

- YMCA FELLOWSHIP / KRESGE (Serves MI, Population served: 100, Primary Water Source Type: Groundwater)

- TRACTOR SUPPLY COMPANY (Address: 3231 CENTRAL PARK WEST DRIVE, SUITE 106 , Serves MI, Population served: 100, Primary Water Source Type: Groundwater)

- YMCA STORER-RANCH #2 (Serves MI, Population served: 40, Primary Water Source Type: Groundwater)

- PINE ISLAND CAMPGROUND (Serves MI, Population served: 31, Primary Water Source Type: Groundwater)

| This city: | 2.3 people |

| Ohio: | 2.4 people |

| This city: | 57.1% |

| Whole state: | 65.0% |

| This city: | 8.7% |

| Whole state: | 6.8% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.3% of all households

People in group quarters in Toledo in 2010:

- 3,690 people in college/university student housing

- 1,239 people in nursing facilities/skilled-nursing facilities

- 1,172 people in state prisons

- 981 people in other noninstitutional facilities

- 383 people in federal detention centers

- 368 people in group homes intended for adults

- 314 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 95 people in correctional facilities intended for juveniles

- 88 people in residential treatment centers for adults

- 69 people in correctional residential facilities

- 47 people in workers' group living quarters and job corps centers

- 26 people in in-patient hospice facilities

- 3 people in group homes for juveniles (non-correctional)

People in group quarters in Toledo in 2000:

- 2,505 people in college dormitories (includes college quarters off campus)

- 2,031 people in nursing homes

- 740 people in other noninstitutional group quarters

- 357 people in local jails and other confinement facilities (including police lockups)

- 320 people in homes for the mentally retarded

- 294 people in religious group quarters

- 158 people in other group homes

- 112 people in halfway houses

- 76 people in other nonhousehold living situations

- 69 people in short-term care, detention or diagnostic centers for delinquent children

- 63 people in homes or halfway houses for drug/alcohol abuse

- 37 people in other types of correctional institutions

- 36 people in homes for the mentally ill

- 32 people in other workers' dormitories

- 30 people in crews of maritime vessels

- 22 people in unknown juvenile institutions

- 8 people in mental (psychiatric) hospitals or wards

- 5 people in military barracks, etc.

Banks with most branches in Toledo (2011 data):

- KeyBank National Association: 17 branches. Info updated 2008/03/03: Bank assets: $86,198.8 mil, Deposits: $64,214.8 mil, headquarters in Cleveland, OH, positive income, Commercial Lending Specialization, 1067 total offices, Holding Company: Keycorp

- The Huntington National Bank: 16 branches. Info updated 2012/04/02: Bank assets: $54,183.4 mil, Deposits: $44,300.3 mil, headquarters in Columbus, OH, positive income, Commercial Lending Specialization, 878 total offices, Holding Company: Huntington Bancshares Incorporated

- RBS Citizens, National Association: 13 branches. Info updated 2007/09/19: Bank assets: $106,940.6 mil, Deposits: $75,690.2 mil, headquarters in Providence, RI, positive income, 1135 total offices, Holding Company: Uk Financial Investments Limited

- Fifth Third Bank: 13 branches. Info updated 2009/10/05: Bank assets: $114,540.4 mil, Deposits: $89,689.1 mil, headquarters in Cincinnati, OH, positive income, Commercial Lending Specialization, 1378 total offices, Holding Company: Fifth Third Bancorp

- PNC Bank, National Association: 9 branches. Info updated 2012/03/20: Bank assets: $263,309.6 mil, Deposits: $197,343.0 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 3085 total offices, Holding Company: Pnc Financial Services Group, Inc., The

- Signature Bank, National Association: Messenger Service Branch at 4607 West Sylvania Avenue, branch established on 2002/04/02; at 4607 West Sylvania Avenue, branch established on 2002/04/02. Info updated 2006/11/03: Bank assets: $554.5 mil, Deposits: $481.7 mil, local headquarters, positive income, Commercial Lending Specialization, 2 total offices, Holding Company: Signature Bancorp, Inc.

- Woodforest National Bank: Northwest Toledo Walmart at 5821 Central Avenue West, branch established on 2007/09/17; Central Toledo Walmart at 2925 Glendale Avenue, branch established on 2007/09/17. Info updated 2011/05/10: Bank assets: $3,488.9 mil, Deposits: $3,097.6 mil, headquarters in Houston, TX, positive income, Commercial Lending Specialization, 766 total offices, Holding Company: Woodforest Financial Group Employee Stock Ownership Plan (With 401(K) Provisions)

- Firstmerit Bank, National Association: Sylvania Branch at 7530 Kings Pointe Road, branch established on 2006/07/31; Toledo Downtown Branch at 411 Adams Street, branch established on 2004/06/01. Info updated 2010/05/17: Bank assets: $14,420.6 mil, Deposits: $11,497.6 mil, headquarters in Akron, OH, positive income, Commercial Lending Specialization, 213 total offices, Holding Company: Firstmerit Corporation

- Waterford Bank, N.A.: at 3900 N. Mccord Rd, branch established on 2007/08/29. Info updated 2007/10/01: Bank assets: $363.9 mil, Deposits: $325.5 mil, local headquarters, positive income, Commercial Lending Specialization, 1 total offices, Holding Company: Waterford Bancorp

- 2 other banks with 2 local branches

For population 15 years and over in Toledo:

- Never married: 42.5%

- Now married: 36.4%

- Separated: 1.9%

- Widowed: 5.5%

- Divorced: 13.7%

For population 25 years and over in Toledo:

- High school or higher: 90.6%

- Bachelor's degree or higher: 23.3%

- Graduate or professional degree: 8.9%

- Unemployed: 4.4%

- Mean travel time to work (commute): 19.4 minutes

| Here: | 10.3 |

| Ohio average: | 11.0 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Toledo:

(Toledo, Ohio Neighborhood Map)- Air Line Junction (Airline) neighborhood

- Alexis Addition neighborhood

- Alexis Road neighborhood

- Auburn-Delaware neighborhood

- BUMA (Bancroft-Upton-Monroe) neighborhood

- Bancroft Hills neighborhood

- Beverly neighborhood

- Birckhead Place neighborhood

- Birmingham neighborhood

- Cathedral Square neighborhood

- City Center (Downtown) neighborhood

- Collingwood Springs neighborhood

- DeVeaux neighborhood

- East Toledo neighborhood

- Elmhurst neighborhood

- Fitch neighborhood

- Five Points neighborhood

- Franklin Park neighborhood

- Glendale (Heatherdowns) neighborhood

- Gould neighborhood

- Harvard Terrace neighborhood

- Highland Heights neighborhood

- Homeville neighborhood

- Indian Hills neighborhood

- Inverness Village (Inverness) neighborhood

- Ironwood neighborhood

- Lagrange neighborhood

- Library Village neighborhood

- Lincolnshire neighborhood

- Nasby neighborhood

- North Toledo (North End) neighborhood

- North Towne neighborhood

- Northriver neighborhood

- ONYX neighborhood

- Old Orchard neighborhood

- Old Towne (Olde Towne) neighborhood

- Old West End neighborhood

- Ottawa neighborhood

- Point Place neighborhood

- Polish Village (Lagrange) neighborhood

- Reynolds Corner neighborhood

- River East neighborhood

- Roosevelt neighborhood

- Scott Park neighborhood

- Secor Gardens neighborhood

- Shoreland neighborhood

- South Side neighborhood

- Southwyck neighborhood

- Stickney neighborhood

- The Corridor neighborhood

- Trilby neighborhood

- United neighborhood

- University Hills neighborhood

- Uptown neighborhood

- Warehouse District neighborhood

- Warren Sherman neighborhood

- Wernert's Corner neighborhood

- West Toledo neighborhood

- Westgate neighborhood

- Westmoreland neighborhood

- Whitmer (Triby) neighborhood

- Woodsdale neighborhood

Religion statistics for Toledo, OH (based on Lucas County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 92,283 | 35 |

| Evangelical Protestant | 40,272 | 145 |

| Mainline Protestant | 39,991 | 115 |

| Black Protestant | 15,134 | 44 |

| Other | 7,578 | 29 |

| Orthodox | 2,680 | 4 |

| None | 243,877 | - |

Food Environment Statistics:

| Here: | 1.67 / 10,000 pop. |

| State: | 1.89 / 10,000 pop. |

| Lucas County: | 0.14 / 10,000 pop. |

| Ohio: | 0.13 / 10,000 pop. |

| This county: | 2.22 / 10,000 pop. |

| Ohio: | 1.25 / 10,000 pop. |

| Lucas County: | 2.98 / 10,000 pop. |

| Ohio: | 2.93 / 10,000 pop. |

| Lucas County: | 7.55 / 10,000 pop. |

| State: | 6.25 / 10,000 pop. |

| Lucas County: | 10.6% |

| State: | 10.3% |

| Lucas County: | 30.0% |

| State: | 29.1% |

| Lucas County: | 10.6% |

| Ohio: | 11.9% |

Health and Nutrition:

| Toledo: | 48.7% |

| Ohio: | 50.4% |

| Toledo: | 45.6% |

| Ohio: | 47.8% |

| Toledo: | 29.0 |

| Ohio: | 28.7 |

| This city: | 20.8% |

| State: | 20.6% |

| This city: | 11.5% |

| Ohio: | 10.4% |

| This city: | 6.8 |

| Ohio: | 6.8 |

| This city: | 34.0% |

| Ohio: | 34.3% |

| Toledo: | 55.4% |

| Ohio: | 57.0% |

| Toledo: | 79.6% |

| Ohio: | 79.1% |

More about Health and Nutrition of Toledo, OH Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 618 | $4,895,526 | $95,059 | 0 | $0 |

| Firefighters | 534 | $4,203,803 | $94,467 | 0 | $0 |

| Water Supply | 292 | $1,436,695 | $59,042 | 0 | $0 |

| Streets and Highways | 256 | $1,418,849 | $66,509 | 0 | $0 |

| Judicial and Legal | 209 | $1,057,403 | $60,712 | 0 | $0 |

| Financial Administration | 181 | $953,655 | $63,226 | 0 | $0 |

| Sewerage | 112 | $493,410 | $52,865 | 0 | $0 |

| Other and Unallocable | 111 | $559,101 | $60,443 | 0 | $0 |

| Parks and Recreation | 63 | $289,622 | $55,166 | 0 | $0 |

| Other Government Administration | 62 | $401,397 | $77,690 | 0 | $0 |

| Solid Waste Management | 56 | $312,182 | $66,896 | 0 | $0 |

| Police - Other | 53 | $222,889 | $50,465 | 0 | $0 |

| Housing and Community Development (Local) | 35 | $186,668 | $64,000 | 0 | $0 |

| Fire - Other | 18 | $85,923 | $57,282 | 0 | $0 |

| Totals for Government | 2,600 | $16,517,124 | $76,233 | 0 | $0 |

Toledo government finances - Expenditure in 2021 (per resident):

- Current Operations - Water Utilities: $45,139,000 ($169.50)

Sewerage: $39,956,000 ($150.04)

General - Other: $27,326,000 ($102.61)

Housing and Community Development: $23,281,000 ($87.42)

Health - Other: $10,240,000 ($38.45)

Protective Inspection and Regulation - Other: $4,604,000 ($17.29)

Parks and Recreation: $3,883,000 ($14.58)

Toledo government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $91,487,000 ($343.55)

Other: $26,256,000 ($98.60)

- Miscellaneous - Special Assessments: $26,233,000 ($98.51)

Fines and Forfeits: $5,713,000 ($21.45)

General Revenue - Other: $4,653,000 ($17.47)

Interest Earnings: $1,610,000 ($6.05)

- Revenue - Water Utilities: $81,801,000 ($307.17)

- Tax - Individual Income: $181,695,000 ($682.29)

Corporation Net Income: $21,300,000 ($79.98)

Property: $12,956,000 ($48.65)

Other License: $2,627,000 ($9.86)

Toledo government finances - Debt in 2021 (per resident):

- Long Term Debt - Outstanding Nonguaranteed - Industrial Revenue: $11,805,000 ($44.33)

Beginning Outstanding - Public Debt for Private Purpose: $11,805,000 ($44.33)

Beginning Outstanding - Unspecified Public Purpose: $1,620,000 ($6.08)

Retired Unspecified Public Purpose: $1,620,000 ($6.08)

Toledo government finances - Cash and Securities in 2021 (per resident):

- Other Funds - Cash and Securities: $157,134,000 ($590.06)

- Sinking Funds - Cash and Securities: $11,805,000 ($44.33)

4.37% of this county's 2021 resident taxpayers lived in other counties in 2020 ($52,879 average adjusted gross income)

| Here: | 4.37% |

| Ohio average: | 5.68% |

0.01% of residents moved from foreign countries ($120 average AGI)

Lucas County: 0.01% Ohio average: 0.01%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Wood County, OH | |

| from Monroe County, MI | |

| from Fulton County, OH |

| Businesses in Toledo, OH | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 7-Eleven | 7 | Kmart | 3 | |

| ALDI | 2 | Kohl's | 1 | |

| ALDO | 1 | Kroger | 8 | |

| AT&T | 4 | La-Z-Boy | 2 | |

| Abercrombie & Fitch | 1 | Lane Bryant | 1 | |

| Ace Hardware | 2 | Lane Furniture | 6 | |

| Advance Auto Parts | 3 | LensCrafters | 2 | |

| Aeropostale | 1 | Little Caesars Pizza | 7 | |

| American Eagle Outfitters | 1 | Long John Silver's | 1 | |

| Ann Taylor | 1 | Lowe's | 3 | |

| Applebee's | 4 | Macy's | 1 | |

| Arby's | 7 | Marriott | 1 | |

| AutoZone | 9 | MasterBrand Cabinets | 18 | |

| BMW | 1 | Mazda | 1 | |

| Bakers | 1 | McDonald's | 18 | |

| Bally Total Fitness | 1 | Meijer | 2 | |

| Banana Republic | 1 | Men's Wearhouse | 2 | |

| Barnes & Noble | 1 | Menards | 1 | |

| Baskin-Robbins | 2 | Motel 6 | 1 | |

| Bath & Body Works | 1 | Motherhood Maternity | 2 | |

| Bed Bath & Beyond | 1 | New Balance | 1 | |

| Ben & Jerry's | 1 | New York & Co | 1 | |

| Blockbuster | 2 | Nike | 14 | |

| Brookstone | 1 | Nissan | 1 | |

| Buffalo Wild Wings | 1 | Office Depot | 1 | |

| Burger King | 13 | OfficeMax | 2 | |

| Burlington Coat Factory | 1 | Old Navy | 1 | |

| Cache | 1 | Olive Garden | 2 | |

| Caribou Coffee | 2 | Outback | 1 | |

| Carson Pirie Scott | 1 | Outback Steakhouse | 1 | |

| Casual Male XL | 1 | Pac Sun | 1 | |

| Catherines | 2 | Panera Bread | 3 | |

| Charlotte Russe | 1 | Papa John's Pizza | 4 | |

| Chick-Fil-A | 1 | Payless | 4 | |

| Chico's | 1 | Penske | 4 | |

| Chipotle | 2 | Pier 1 Imports | 2 | |

| Chuck E. Cheese's | 2 | Pizza Hut | 4 | |

| Church's Chicken | 5 | Popeyes | 1 | |

| Circle K | 7 | Pottery Barn | 1 | |

| Clarks | 1 | Quality | 1 | |

| Cold Stone Creamery | 1 | Quiznos | 4 | |

| Coldwater Creek | 1 | RadioShack | 6 | |

| Comfort Inn | 1 | Ramada | 1 | |

| Costco | 1 | Red Lobster | 1 | |

| Curves | 3 | Red Robin | 1 | |

| Dairy Queen | 3 | Red Roof Inn | 1 | |

| Days Inn | 1 | Rite Aid | 19 | |

| Decora Cabinetry | 5 | Ruby Tuesday | 1 | |

| Discount Tire | 1 | SAS Shoes | 1 | |

| Dunkin Donuts | 1 | SONIC Drive-In | 1 | |

| Eddie Bauer | 1 | Sears | 2 | |

| Express | 1 | Sephora | 1 | |

| Fashion Bug | 1 | Shoe Carnival | 1 | |

| FedEx | 31 | Spencer Gifts | 1 | |

| Finish Line | 1 | Sprint Nextel | 6 | |

| Firestone Complete Auto Care | 1 | Starbucks | 5 | |

| Ford | 2 | Steak 'n Shake | 2 | |

| Forever 21 | 1 | Subaru | 1 | |

| GNC | 8 | Subway | 27 | |

| GameStop | 5 | T-Mobile | 13 | |

| Gap | 1 | T.G.I. Driday's | 1 | |

| Goodwill | 1 | T.J.Maxx | 1 | |

| Gymboree | 1 | Taco Bell | 11 | |

| H&M | 1 | Talbots | 1 | |

| H&R Block | 15 | Target | 2 | |

| Hilton | 1 | The Athlete's Foot | 1 | |

| Hobby Lobby | 1 | Tim Hortons | 3 | |

| Holiday Inn | 1 | Torrid | 1 | |

| Hollister Co. | 1 | Toyota | 1 | |

| Home Depot | 3 | Toys"R"Us | 3 | |

| HomeTown Buffet | 1 | True Value | 1 | |

| Honda | 1 | U-Haul | 11 | |

| Hot Topic | 1 | UPS | 51 | |

| IHOP | 2 | Value City Furniture | 1 | |

| J.Crew | 1 | Vans | 3 | |

| JCPenney | 1 | Verizon Wireless | 6 | |

| Jimmy Jazz | 1 | Victoria's Secret | 1 | |

| Jimmy John's | 4 | Waffle House | 2 | |

| JoS. A. Bank | 1 | Walgreens | 6 | |

| Jones New York | 6 | Walmart | 2 | |

| Journeys | 1 | Wendy's | 12 | |

| Justice | 1 | Wet Seal | 1 | |

| KFC | 5 | White Castle | 1 | |

| Kincaid | 1 | YMCA | 6 | |

Strongest AM radio stations in Toledo:

- WCWA (1230 AM; 1 kW; TOLEDO, OH; Owner: JACOR BROADCASTING CORPORATION)

- WTOD (1560 AM; daytime; 5 kW; TOLEDO, OH; Owner: CUMULUS LICENSING CORP.)

- WSPD (1370 AM; 5 kW; TOLEDO, OH; Owner: CITICASTERS LICENSES, L.P.)

- WFDF (910 AM; 50 kW; FLINT, MI; Owner: ABC, INC.)

- WJR (760 AM; 50 kW; DETROIT, MI; Owner: ABC, INC.)

- WDFN (1130 AM; 50 kW; DETROIT, MI; Owner: AMFM RADIO LICENSES, L.L.C.)

- WCHB (1200 AM; 50 kW; TAYLOR, MI; Owner: RADIO ONE OF DETROIT, LLC)

- WDMN (1520 AM; 1 kW; TOLEDO, OH)

- WLQR (1470 AM; 1 kW; TOLEDO, OH)

- WWJ (950 AM; 50 kW; DETROIT, MI; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WJYM (730 AM; 1 kW; BOWLING GREEN, OH; Owner: FAMILY WORSHIP CENTER CHURCH, INC.)

- WXYT (1270 AM; 50 kW; DETROIT, MI; Owner: INFINITY BROADCASTING CORP. OF DETROIT)

- WTKA (1050 AM; 10 kW; ANN ARBOR, MI; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

Strongest FM radio stations in Toledo:

- WOTL (90.3 FM; TOLEDO, OH; Owner: FAMILY STATIONS, INC.)

- WWWM-FM (105.5 FM; SYLVANIA, OH; Owner: CUMULUS LICENSING CORP.)

- WXTS-FM (88.3 FM; TOLEDO, OH; Owner: BD OF ED TOLEDO CITY SCHOOL DIST)

- WGTE-FM (91.3 FM; TOLEDO, OH; Owner: THE PUBLIC B/C FOUNDATION OF NW OHIO)

- WRVF (101.5 FM; TOLEDO, OH; Owner: CITICASTERS LICENSES, L.P.)

- WKKO (99.9 FM; TOLEDO, OH; Owner: CUMULUS LICENSING CORP.)

- WIOT (104.7 FM; TOLEDO, OH; Owner: JACOR BROADCASTING CORPORATION)

- WYSZ (89.3 FM; MAUMEE, OH; Owner: SIDE BY SIDE, INC.)

- WVKS (92.5 FM; TOLEDO, OH; Owner: CITICASTERS LICENSES, L.P.)

- WPOS-FM (102.3 FM; HOLLAND, OH; Owner: THE MAUMEE VALLEY BROADCASTING ASSN.)

- W264AK (100.7 FM; TOLEDO, OH; Owner: CALVARY CHAPEL OF TWIN FALLS, INC.)

- WTWR-FM (98.3 FM; LUNA PIER, MI; Owner: CUMULUS LICENSING CORP.)

- WXUT (88.3 FM; TOLEDO, OH; Owner: UNIVERSITY OF TOLEDO)

- WXQQ (96.9 FM; WAUSEON, OH; Owner: CORNERSTONE CHURCH, INC.)

- WRQN (93.5 FM; BOWLING GREEN, OH; Owner: CUMULUS LICENSING CORP.)

- WJZE (97.3 FM; OAK HARBOR, OH; Owner: RASP BROADCASTING ENTERPRISES, INC.)

- WIMX (95.7 FM; GIBSONBURG, OH; Owner: RIVERSIDE BROADCASTING, INC)

- WAAQ (88.3 FM; ONSTED, MI; Owner: GREAT LAKES COMMUNITY BROADCASTING, INC.)

- WRWK (106.5 FM; DELTA, OH; Owner: CUMULUS LICENSING CORP.)

- WJUC (107.3 FM; SWANTON, OH; Owner: WELCH COMMUNICATIONS, INC.)

TV broadcast stations around Toledo:

- W59DC (Channel 59; HOUGHTON LAKE, MI; Owner: MS COMMUNICATIONS, LLC)

- WBTL-LP (Channel 34; TOLEDO, OH; Owner: VENTURE TECHNOLOGIES GROUP, LLC)

- W64BM (Channel 64; TOLEDO, OH; Owner: VENTANA TELEVISION, INC.)

- WNGT-LP (Channel 48; TOLEDO, OH; Owner: L & M VIDEO PRODUCTIONS, INC.)

- WUPW (Channel 36; TOLEDO, OH; Owner: WUPW BROADCASTING, LLC)

- WGTE-TV (Channel 30; TOLEDO, OH; Owner: THE PUBLIC BROADCASTING FOUNDATION OF NW OHIO)

- WTOL (Channel 11; TOLEDO, OH; Owner: LIBCO, INC.)

- WTVG (Channel 13; TOLEDO, OH; Owner: WTVG, INC.)

- WNWO-TV (Channel 24; TOLEDO, OH; Owner: RAYCOM NATIONAL, INC.)

- W22CO (Channel 22; TOLEDO, OH; Owner: NATIONAL MINORITY T.V., INC.)

- WLMB (Channel 40; TOLEDO, OH; Owner: DOMINION BROADCASTING, INC.)

- WBGU-TV (Channel 27; BOWLING GREEN, OH; Owner: BOWLING GREEN STATE UNIVERSITY)

Medal of Honor Recipients

Medal of Honor Recipients born in Toledo: Burke Hanford, James E., Jr. Robinson, Oscar J. Upham.

- National Bridge Inventory (NBI) Statistics

- 309Number of bridges

- 7,083ft / 2,159mTotal length

- $659,445,000Total costs

- 7,287,020Total average daily traffic

- 979,698Total average daily truck traffic

- New bridges - historical statistics

- 51910-1919

- 21920-1929

- 71930-1939

- 31940-1949

- 201950-1959

- 571960-1969

- 371970-1979

- 141980-1989

- 281990-1999

- 562000-2009

- 612010-2019

- 192020-2022

FCC Registered Antenna Towers: 676 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 23 (See the full list of FCC Registered Commercial Land Mobile Towers in Toledo, OH)

FCC Registered Private Land Mobile Towers: 8 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 252 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 213 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 33 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 42 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 1,096 (See the full list of FCC Registered Amateur Radio Licenses in Toledo)

FAA Registered Aircraft Manufacturers and Dealers: 7 (See the full list of FAA Registered Manufacturers and Dealers in Toledo)

FAA Registered Aircraft: 102 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 90 full and 9 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 921 | $84,924 | 429 | $74,922 | 1,708 | $98,185 | 240 | $18,002 | 17 | $1,055,468 | 196 | $66,457 | 16 | $29,256 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 54 | $75,840 | 49 | $51,080 | 226 | $90,977 | 69 | $15,643 | 0 | $0 | 19 | $64,579 | 21 | $34,742 |

| APPLICATIONS DENIED | 157 | $74,778 | 149 | $57,904 | 1,433 | $87,233 | 631 | $16,382 | 2 | $3,175,000 | 159 | $51,682 | 38 | $24,047 |

| APPLICATIONS WITHDRAWN | 120 | $83,015 | 63 | $67,073 | 635 | $93,001 | 36 | $37,836 | 1 | $800,000 | 63 | $63,161 | 1 | $66,000 |

| FILES CLOSED FOR INCOMPLETENESS | 16 | $76,662 | 8 | $84,528 | 165 | $102,616 | 14 | $28,476 | 0 | $0 | 10 | $77,813 | 1 | $49,000 |

Detailed mortgage data for all 100 tracts in Toledo, OH

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 54 full and 9 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 78 | $91,376 | 78 | $112,430 | 2 | $89,000 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 30 | $109,805 | 44 | $106,700 | 4 | $108,250 |

| APPLICATIONS DENIED | 17 | $86,518 | 24 | $104,786 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 9 | $101,286 | 9 | $107,932 | 1 | $203,000 |

| FILES CLOSED FOR INCOMPLETENESS | 3 | $67,000 | 1 | $54,000 | 1 | $42,000 |

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Toledo, OH

- 9,82853.1%Structure Fires

- 5,02327.1%Outside Fires

- 3,61819.6%Mobile Property/Vehicle Fires

- 330.2%Other

According to the data from the years 2002 - 2018 the average number of fires per year is 1088. The highest number of fires - 2,108 took place in 2010, and the least - 67 in 2007. The data has a rising trend.

According to the data from the years 2002 - 2018 the average number of fires per year is 1088. The highest number of fires - 2,108 took place in 2010, and the least - 67 in 2007. The data has a rising trend. When looking into fire subcategories, the most incidents belonged to: Structure Fires (53.1%), and Outside Fires (27.1%).

When looking into fire subcategories, the most incidents belonged to: Structure Fires (53.1%), and Outside Fires (27.1%).Fire-safe hotels and motels in Toledo, Ohio:

- Park Inn Toledo, 101 N Summitt St, Toledo, Ohio 43604 , Phone: (419) 241-3000, Fax: (419) 321-2099

- Radisson Hotel At The University Of Toledo, 3100 Glendale Ave, Toledo, Ohio 43614 , Phone: (419) 381-6800, Fax: (419) 381-0478

- Comfort Inn Westgate, 3560 Secor Rd, Toledo, Ohio 43606 , Phone: (419) 531-2666, Fax: (419) 531-4757

- Red Roof Inn #196, 3530 Executive Pkwy, Toledo, Ohio 43606 , Phone: (419) 536-0118, Fax: (419) 536-1348

- Comfort Inn, 445 E Alexis Rd, Toledo, Ohio 43611 , Phone: (419) 476-0170, Fax: (419) 476-6111

- Ramada Hotel & Conference Center, 3536 Secor Rd, Toledo, Ohio 43606 , Phone: (419) 535-7070, Fax: (419) 536-4836

- Hampton Inn & Suites, 5865 Hagman Rd, Toledo, Ohio 43612 , Phone: (419) 727-8725, Fax: (419) 727-8955

- Toledo Grand Hotel & Suites, 2340 S Reynolds Rd, Toledo, Ohio 43614 , Phone: (419) 865-1361, Fax: (419) 865-6177

- 6 other hotels and motels

| Most common first names in Toledo, OH among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| Mary | 3,320 | 78.7 years |

| John | 3,306 | 74.5 years |

| William | 2,465 | 73.9 years |

| Robert | 2,342 | 70.1 years |

| James | 2,200 | 69.9 years |

| Helen | 2,015 | 79.7 years |

| Charles | 1,683 | 73.4 years |

| Joseph | 1,589 | 74.5 years |

| George | 1,550 | 75.4 years |

| Frank | 1,391 | 76.3 years |

| Most common last names in Toledo, OH among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 1,224 | 73.7 years |

| Miller | 873 | 75.3 years |

| Johnson | 726 | 73.1 years |

| Brown | 670 | 73.6 years |

| Williams | 663 | 72.2 years |

| Jones | 632 | 72.4 years |

| Davis | 475 | 73.6 years |

| Taylor | 367 | 73.3 years |

| Wilson | 326 | 74.5 years |

| Thomas | 314 | 73.0 years |

- 89.7%Utility gas

- 8.0%Electricity

- 1.4%Bottled, tank, or LP gas

- 0.3%Fuel oil, kerosene, etc.

- 0.3%No fuel used

- 0.2%Wood

- 0.1%Other fuel

- 58.1%Utility gas

- 39.5%Electricity

- 1.3%Bottled, tank, or LP gas

- 0.6%No fuel used

- 0.4%Other fuel

- 0.1%Wood

Toledo compared to Ohio state average:

- Median house value below state average.

- Unemployed percentage significantly below state average.

- Black race population percentage above state average.

- Hispanic race population percentage above state average.

- Median age below state average.

- Foreign-born population percentage below state average.

- House age above state average.

Toledo, OH compared to other similar cities:

Toledo on our top lists:

- #3 on the list of "Top 101 cities with the highest number of arson incidents per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #3 on the list of "Top 101 cities with the highest average snowfall in a year (population 50,000+)"

- #11 on the list of "Top 100 cities with declining populations from 2000 to 2014 (pop. 50,000+)"

- #11 on the list of "Top 101 cities with the highest number of burglaries per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #13 on the list of "Top 101 cities with the largest percentage population decrease from 2000 (population 50,000+)"

- #28 on the list of "Top 101 larger cities with the largest decrease or smallest increase in house/condo value from 2000 (population 50,000+)"

- #30 on the list of "Top 101 larger cities with the largest decrease or smallest increase in household income from 2000 (population 50,000+)"

- #32 on the list of "Top 101 cities with largest percentage population decreases in the 1990s) (population 50,000+)"

- #32 on the list of "Top 101 cities with the most people born in the same U.S. state as the city (population 50,000+)"

- #38 on the list of "Top 101 cities with largest percentage of females in occupations: health technologists and technicians (population 50,000+)"

- #38 on the list of "Top 101 cities with the highest number of assaults per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #39 on the list of "Top 101 cities with the highest city-data.com crime index, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #43 on the list of "Top 100 least-safe cities (highest city-data.com crime index) (pop. 50,000+)"

- #45 on the list of "Top 101 cities with the highest number of robberies per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #49 on the list of "Top 101 cities with largest percentage of females in industries: health care and social assistance (population 50,000+)"

- #50 on the list of "Top 101 cities with the largest percentage of people in crews of maritime vessels (population 1,000+)"

- #53 on the list of "Top 101 cities with the largest percentage of high school students in private schools (3,000+ students)"

- #57 on the list of "Top 101 cities with the highest number of murders per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #60 on the list of "Top 101 cities with the largest percentage of elementary and middle school students in private schools (5,000+ students)"

- #61 on the list of "Top 101 cities with largest percentage of males in occupations: farming, fishing, and forestry occupations (population 50,000+)"

- #41 (43608) on the list of "Top 101 zip codes with the lowest 2012 average net capital gain/loss (pop 5,000+)"

- #70 (43612) on the list of "Top 101 zip codes with the most alcohol drinking places in 2005"

- #10 on the list of "Top 101 counties with the largest number of people moving out compared to moving in (pop. 50,000+)"

- #43 on the list of "Top 101 counties with the highest number of infant deaths per 1000 residents 2007-2013 (pop. 50,000+)"

- #50 on the list of "Top 101 counties with the lowest percentage of residents relocating to foreign countries in 2011"

- #53 on the list of "Top 101 counties with the lowest percentage of residents relocating from foreign countries between 2010 and 2011"

- #54 on the list of "Top 101 counties with the lowest percentage of residents relocating from other counties between 2010 and 2011 (pop. 50,000+)"

|

|

Total of 820 patent applications in 2008-2024.