Warwick, Rhode Island

Warwick: pawtucket river, pretty shot from spring 2006

Warwick: Warwick Cove of Warwick Neck Ave

Warwick: Dlate Mill & The Blackstone river flow.

Warwick: Brush neck cove Warwick ri

Warwick: End of Nausauket Ave looking across the entrance into Apponaug Harbour

Warwick: Matunuck Beach Roy Carpentiers. 2009

Warwick: mouth of pawtuxet river

Warwick: from conimucut point

- add

your

Submit your own pictures of this city and show them to the world

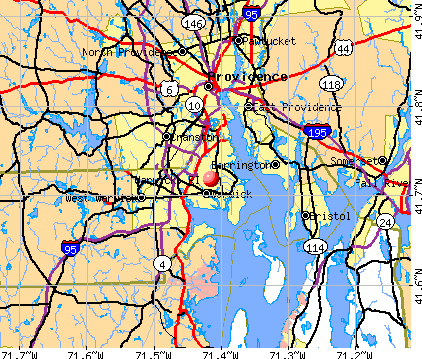

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: -3.3%

| Males: 41,172 | |

| Females: 41,844 |

| Median resident age: | 44.0 years |

| Rhode Island median age: | 40.7 years |

Zip codes: 02818, 02886, 02888, 02889, 02893.

Warwick Zip Code Map| Warwick: | $77,898 |

| RI: | $81,854 |

Estimated per capita income in 2022: $43,271 (it was $23,410 in 2000)

Warwick city income, earnings, and wages data

Estimated median house or condo value in 2022: $317,500 (it was $111,200 in 2000)

| Warwick: | $317,500 |

| RI: | $383,900 |

Mean prices in 2022: all housing units: $358,797; detached houses: $368,601; townhouses or other attached units: $386,389; in 2-unit structures: $328,857; in 3-to-4-unit structures: $209,890; in 5-or-more-unit structures: $264,994; mobile homes: $110,280

Median gross rent in 2022: $1,156.

(5.4% for White Non-Hispanic residents, 6.3% for Black residents, 15.4% for Hispanic or Latino residents, 22.3% for American Indian residents, 10.8% for Native Hawaiian and other Pacific Islander residents, 17.0% for other race residents, 11.7% for two or more races residents)

Detailed information about poverty and poor residents in Warwick, RI

- 71,49586.1%White alone

- 4,4345.3%Hispanic

- 3,8204.6%Two or more races

- 2,3402.8%Asian alone

- 9351.1%Black alone

Races in Warwick detailed stats: ancestries, foreign born residents, place of birth

According to our research of Rhode Island and other state lists, there were 81 registered sex offenders living in Warwick, Rhode Island as of April 18, 2024.

The ratio of all residents to sex offenders in Warwick is 1,013 to 1.

The ratio of registered sex offenders to all residents in this city is near the state average.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is smaller than the state average.- means the value is about the same as the state average.

- means the value is bigger than the state average.

Crime rate in Warwick detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 204 (162 officers - 148 male; 14 female).

| Officers per 1,000 residents here: | 1.93 |

| Rhode Island average: | 2.27 |

Latest news from Warwick, RI collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: Italian (17.1%), Irish (15.9%), American (7.2%), English (7.0%), Portuguese (6.2%), French (5.1%).

Current Local Time: EST time zone

Incorporated in 1642

Elevation: 64 feet

Land area: 35.5 square miles.

Population density: 2,339 people per square mile (low).

5,518 residents are foreign born (2.2% Asia, 2.0% Latin America, 1.8% Europe).

| This city: | 6.6% |

| Rhode Island: | 14.4% |

Median real estate property taxes paid for housing units with mortgages in 2022: $4,121 (1.3%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $3,920 (1.2%)

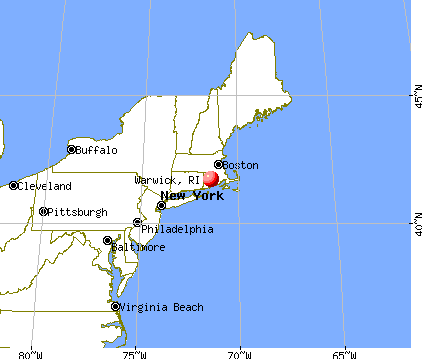

Nearest city with pop. 200,000+: Boston, MA (45.0 miles

, pop. 589,141).

Nearest city with pop. 1,000,000+: Bronx, NY (141.3 miles

, pop. 1,332,650).

Nearest cities:

Latitude: 41.72 N, Longitude: 71.42 W

Daytime population change due to commuting: +8,813 (+10.6%)

Workers who live and work in this city: 15,565 (37.2%)

Area code: 401

Detailed articles:

- Warwick: Introduction

- Warwick Basic Facts

- Warwick: Communications

- Warwick: Convention Facilities

- Warwick: Economy

- Warwick: Education and Research

- Warwick: Geography and Climate

- Warwick: Health Care

- Warwick: History

- Warwick: Municipal Government

- Warwick: Population Profile

- Warwick: Recreation

- Warwick: Transportation

Warwick tourist attractions:

Warwick, Rhode Island accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 62 buildings, average cost: $204,800

- 2021: 40 buildings, average cost: $166,500

- 2020: 32 buildings, average cost: $293,100

- 2019: 39 buildings, average cost: $147,600

- 2018: 47 buildings, average cost: $167,100

- 2017: 42 buildings, average cost: $161,800

- 2016: 41 buildings, average cost: $164,200

- 2015: 37 buildings, average cost: $128,400

- 2014: 36 buildings, average cost: $158,700

- 2013: 45 buildings, average cost: $122,300

- 2012: 32 buildings, average cost: $95,900

- 2011: 17 buildings, average cost: $106,400

- 2010: 21 buildings, average cost: $163,400

- 2009: 25 buildings, average cost: $118,400

- 2008: 30 buildings, average cost: $129,500

- 2007: 49 buildings, average cost: $104,900

- 2006: 54 buildings, average cost: $122,700

- 2005: 75 buildings, average cost: $110,000

- 2004: 73 buildings, average cost: $110,500

- 2003: 81 buildings, average cost: $106,900

- 2002: 112 buildings, average cost: $129,400

- 2001: 91 buildings, average cost: $107,200

- 2000: 94 buildings, average cost: $106,200

- 1999: 119 buildings, average cost: $105,200

- 1998: 144 buildings, average cost: $107,500

- 1997: 122 buildings, average cost: $127,100

| Here: | 2.7% |

| Rhode Island: | 3.3% |

Population change in the 1990s: +369 (+0.4%).

- Health care (11.8%)

- Educational services (8.0%)

- Finance & insurance (6.6%)

- Accommodation & food services (6.2%)

- Construction (5.1%)

- Professional, scientific, technical services (4.6%)

- Public administration (4.4%)

- Construction (9.1%)

- Accommodation & food services (5.5%)

- Public administration (5.4%)

- Educational services (4.9%)

- Professional, scientific, technical services (4.9%)

- Miscellaneous manufacturing (4.7%)

- Health care (4.7%)

- Health care (19.3%)

- Educational services (11.2%)

- Finance & insurance (9.5%)

- Accommodation & food services (6.9%)

- Professional, scientific, technical services (4.3%)

- Miscellaneous manufacturing (3.6%)

- Public administration (3.4%)

- Other management occupations, except farmers and farm managers (6.2%)

- Cooks and food preparation workers (5.7%)

- Material recording, scheduling, dispatching, and distributing workers (3.1%)

- Computer specialists (2.9%)

- Secretaries and administrative assistants (2.8%)

- Retail sales workers, except cashiers (2.7%)

- Building and grounds cleaning and maintenance occupations (2.6%)

- Other management occupations, except farmers and farm managers (7.4%)

- Cooks and food preparation workers (4.8%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (4.5%)

- Computer specialists (4.4%)

- Material recording, scheduling, dispatching, and distributing workers (4.4%)

- Building and grounds cleaning and maintenance occupations (3.3%)

- Driver/sales workers and truck drivers (3.0%)

- Cooks and food preparation workers (6.6%)

- Secretaries and administrative assistants (5.2%)

- Other management occupations, except farmers and farm managers (5.0%)

- Registered nurses (4.8%)

- Cashiers (4.2%)

- Information and record clerks, except customer service representatives (3.3%)

- Other office and administrative support workers, including supervisors (3.0%)

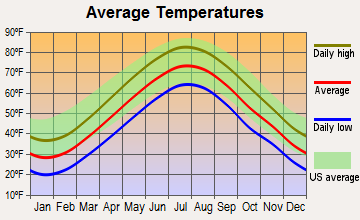

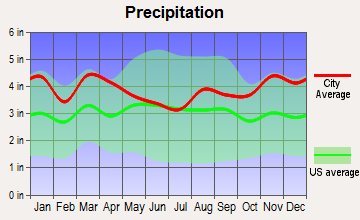

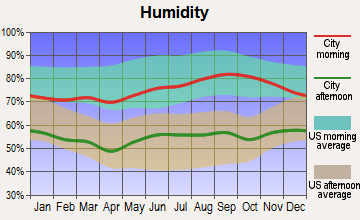

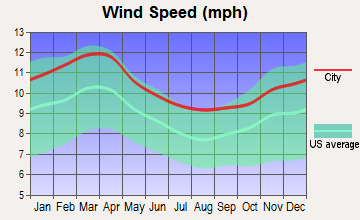

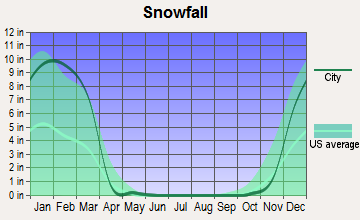

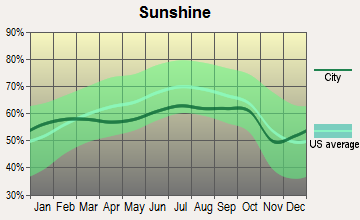

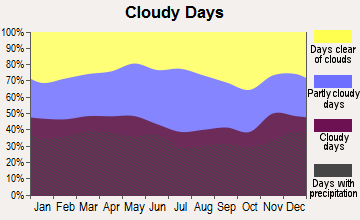

Average climate in Warwick, Rhode Island

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2022 was 65.2. This is about average.

| City: | 65.2 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.196. This is better than average. Closest monitor was 7.1 miles away from the city center.

| City: | 0.196 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2017 was 8.32. This is significantly worse than average. Closest monitor was 1.1 miles away from the city center.

| City: | 8.32 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.179. This is significantly better than average. Closest monitor was 1.1 miles away from the city center.

| City: | 0.179 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 31.8. This is about average. Closest monitor was 7.4 miles away from the city center.

| City: | 31.8 |

| U.S.: | 33.3 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 5.63. This is significantly better than average. Closest monitor was 1.6 miles away from the city center.

| City: | 5.63 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2001 was 0.0168. This is significantly worse than average. Closest monitor was 5.3 miles away from the city center.

| City: | 0.0168 |

| U.S.: | 0.0093 |

Tornado activity:

Warwick-area historical tornado activity is near Rhode Island state average. It is 53% smaller than the overall U.S. average.

On 6/9/1953, a category F4 (max. wind speeds 207-260 mph) tornado 40.6 miles away from the Warwick city center killed 90 people and injured 1228 people and caused between $50,000,000 and $500,000,000 in damages.

On 6/9/1953, a category F3 (max. wind speeds 158-206 mph) tornado 25.5 miles away from the city center injured 17 people and caused between $500,000 and $5,000,000 in damages.

Earthquake activity:

Warwick-area historical earthquake activity is significantly above Rhode Island state average. It is 74% smaller than the overall U.S. average.On 10/7/1983 at 10:18:46, a magnitude 5.3 (5.1 MB, 5.3 LG, 5.1 ML, Class: Moderate, Intensity: VI - VII) earthquake occurred 214.3 miles away from Warwick center

On 4/20/2002 at 10:50:47, a magnitude 5.3 (5.3 ML, Depth: 3.0 mi) earthquake occurred 225.0 miles away from the city center

On 1/19/1982 at 00:14:42, a magnitude 4.7 (4.5 MB, 4.7 MD, 4.5 LG, Class: Light, Intensity: IV - V) earthquake occurred 123.6 miles away from the city center

On 4/20/2002 at 10:50:47, a magnitude 5.2 (5.2 MB, 4.2 MS, 5.2 MW, 5.0 MW) earthquake occurred 224.0 miles away from Warwick center

On 10/16/2012 at 23:12:25, a magnitude 4.7 (4.7 ML, Depth: 10.0 mi) earthquake occurred 135.6 miles away from the city center

On 8/22/1992 at 12:20:32, a magnitude 4.8 (4.8 MB, 3.8 MS, 4.7 LG, Depth: 6.2 mi) earthquake occurred 189.7 miles away from Warwick center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), duration magnitude (MD), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Kent County (17) is near the US average (15).Major Disasters (Presidential) Declared: 8

Emergencies Declared: 8

Causes of natural disasters: Hurricanes: 6, Blizzards: 3, Snowstorms: 3, Floods: 2, Storms: 2, Winter Storms: 2, Snow: 1, Snowfall: 1, Tropical Storm: 1, Water Main Break: 1, Wind: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Hospitals in Warwick:

- KENT COUNTY MEMORIAL HOSPITAL (Voluntary non-profit - Private, provides emergency services, 455 TOLL GATE RD)

- ODYSSEY HEALTHCARE OF RHODE ISLAND (100 QUAKER LANE, SUITE 2)

Nursing Homes in Warwick:

- AVALON NURSING HOME (57 STOKES STREET)

- BRENTWOOD NURSING HOME (4000 POST ROAD)

- BURDICK CONV HOME (57 FAIR ST)

- BUTTONWOODS CREST HOME (139 HEMLOCK AVE)

- GREENWOOD CARE AND REHABILITATION CENTER (1139 MAIN AVENUE)

- GREENWOOD OAKS REST HOME (14 LAKE ST)

- HARBORSIDE/PAWTUXET VILLAGE NURSING AND REHABILITATI (270 POST ROAD)

- SUNNY VIEW NURSING HOME (83 CORONA STREET)

- WARWICK HLTH CTR (109 WEST SHORE DR)

- WARWICK REST HOME INC (348 WARWICK NECK AVENUE)

Dialysis Facilities in Warwick:

- DIALYSIS CENTER OF WEST WARWICK (1775 BALD HILL ROAD)

- FRESENIUS MEDICAL CARE OF WARWICK (2814 POST ROAD)

Home Health Centers in Warwick:

Airports and heliports located in Warwick:

- Theodore Francis Green State Airport (PVD) (Runways: 2, Commercial Ops: 32,149, Air Taxi Ops: 12,781, Itinerant Ops: 16,251, Local Ops: 13,251, Military Ops: 1,037)

- Kent County Memorial Hospital Heliport (RI01)

Amtrak stations near Warwick:

- 8 miles: PROVIDENCE (100 GASPEE ST.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, snack bar, ATM, paid short-term parking, paid long-term parking, call for car rental service, taxi stand, public transit connection.

- 18 miles: KINGSTON (WEST KINGSTON, FAIRGROUNDS RD.) . Services: ticket office, enclosed waiting area, public restrooms, public payphones, free short-term parking, free long-term parking, call for car rental service, call for taxi service, public transit connection.

Colleges/Universities in Warwick:

Other colleges/universities with over 2000 students near Warwick:

- New England Institute of Technology (about 6 miles; East Greenwich, RI; Full-time enrollment: 3,183)

- Johnson & Wales University-Providence (about 8 miles; Providence, RI; FT enrollment: 10,898)

- Rhode Island School of Design (about 8 miles; Providence, RI; FT enrollment: 2,714)

- Brown University (about 8 miles; Providence, RI; FT enrollment: 8,458)

- Providence College (about 9 miles; Providence, RI; FT enrollment: 4,312)

- Rhode Island College (about 10 miles; Providence, RI; FT enrollment: 7,189)

- Roger Williams University (about 10 miles; Bristol, RI; FT enrollment: 4,375)

Public high schools in Warwick:

- PILGRIM HIGH SCHOOL (Students: 1,288, Location: 111 PILGRIM PARKWAY, Grades: 9-12)

- WARWICK VETERANS HIGH (Students: 1,187, Location: 2401 WEST SHORE ROAD, Grades: 9-12)

- TOLL GATE HIGH SCHOOL (Students: 1,123, Location: 575 CENTERVILLE ROAD, Grades: 9-12)

Private high schools in Warwick:

- BISHOP HENDRICKEN HIGH SCHOOL (Students: 930, Location: 2615 WARWICK AVE, Grades: 9-12, Boys only)

- FIRST BAPTIST CHRISTIAN SCHOOL (Students: 78, Location: 550 COWESETT RD, Grades: PK-12)

- ELEANOR BRIGGS SCHOOL (Students: 33, Location: 116 LONG ST, Grades: 1-12)

- APPONAUG CHRISTIAN ACADEMY (Students: 16, Location: 75 PROSPECT ST, Grades: 3-11)

Biggest public elementary/middle schools in Warwick:

- ALDRICH JUNIOR HIGH (Students: 628, Location: 789 POST ROAD, Grades: 7-8)

- WINMAN JUNIOR HIGH SCHOOL (Students: 622, Location: 575 CENTERVILLE ROAD, Grades: 7-8)

- GORTON JUNIOR HIGH SCHOOL (Students: 552, Location: 69 DRAPER AVENUE, Grades: 7-8)

- CEDAR HILL SCHOOL (Students: 385, Location: 35 RED CHIMNEY DRIVE, Grades: KG-6)

- OAKLAND BEACH SCHOOL (Students: 349, Location: 383 OAKLAND BEACH AVENUE, Grades: PK-6)

- SHERMAN SCHOOL (Students: 343, Location: 120 KILLEY AVENUE, Grades: KG-6)

- HOLLIMAN SCHOOL (Students: 330, Location: 70 DEBORAH ROAD, Grades: KG-6)

- WICKES SCHOOL (Students: 300, Location: 50 CHILD LANE, Grades: KG-6)

- FRANCIS SCHOOL (Students: 278, Location: 325 MIANTONOMO DRIVE, Grades: KG-6)

- GREENWOOD SCHOOL (Students: 275, Location: 93 SHARON STREET, Grades: KG-6)

Private elementary/middle schools in Warwick:

Libraries in Warwick:

- WARWICK PUBLIC LIBRARY (Operating income: $3,729,227; Location: 600 SANDY LANE; 211,267 books; 691 e-books; 6,273 audio materials; 7,767 video materials; 18 local licensed databases; 2 state licensed databases; 17 other licensed databases; 441 print serial subscriptions)

- PONTIAC FREE LIBRARY (Operating income: $101,873; Location: 101 GREENWICH AVENUE; 19,245 books; 474 audio materials; 792 video materials; 2 other licensed databases; 25 print serial subscriptions)

Points of interest:

Notable locations in Warwick: Warwick Light (A), Ok-wa-nessett Camp (B), Warwick Country Club (C), Valley Country Club on Ledgemont (D), Bayside Country Club (E), Seaview Country Club (F), Budlong Farm (G), Cowesett Pound (H), Rhodes on the Pawtuxet (I), Goddard State Park Golf Course (J), Potowomut Golf Club (K), Pawtuxet River Reservation (L), Warwick Public Library (M), Warwick Museum (N), Pontiac Free Library Association (O), Norwood Branch Warwick Public Library (P), New England Institute of Technology Learning Resources Center (Q), National Foundation for Gifted and Creative Children Library (R), Kent County Memorial Hospital Library (S), Kent County Chamber of Commerce (T). Display/hide their locations on the map

Shopping Centers: Warwick Mall Shopping Center (1), Warwick Commons Shopping Center (2), Airport Shopping Center (3), Ann and Hope Shopping Center (4), Buttonwoods Plaza Shopping Center (5), Buttonwoods Shopping Center (6), Clocktower Square Shopping Center (7), Meadowbrook Shopping Center (8), East Greenwich Market Place Shopping Center (9). Display/hide their locations on the map

Churches in Warwick include: United Church of Christ (A), Amazing Grace Church (B), Reorganized Church of Jesus (C), Zion Korean United Methodist Church (D), Warwick Bible Chapel (E), Warwick Central Baptist Church (F), Greenwood Community Church (G), Warwick Christian Fellowship Church (H), Friendship Baptist Church (I). Display/hide their locations on the map

Cemeteries: Ambrose Taylor Lot (1), Arnold Lot (2), Benjamin Lockwood Lot (3), Bennett-Spencer Lot (4), Captain Joseph Spencer Lot (5), Captain Randall Holden Junior Lot (6), Captain Samuel Green Lot (7). Display/hide their locations on the map

Lakes, reservoirs, and swamps: Little Pond (A), Gorton Pond (B), Three Ponds (C), Warwick Pond (D), Posneganset Pond (E), Sand Pond (F), Crescent Lake (G), Cranberry Pond (H). Display/hide their locations on the map

Streams, rivers, and creeks: Carder Creek (A), Marys Creek (B), Meshanticut Brook (C), Knowles Brook (D), Warner Brook (E), Buckeye Brook (F), Pocasset River (G), Hunt River (H), Maskerchugg River (I). Display/hide their locations on the map

Parks in Warwick include: Pawtuxet Village Historic District (1), Pawtuxet Memorial Park (2), Buttonwoods Beach Historic District (3), Sprague Playground (4), Forge Road Historic District (5), John D Memorial Park (6), Goddard Memorial State Park (7), Apponaug Historic District (8). Display/hide their locations on the map

Beaches: Goddard Memorial State Park Beach (A), Sandy Point Beach (B), Sandy Beach (C), Buttonwoods Beach (D). Display/hide their locations on the map

Tourist attractions: Warwick Museum Of Art (3259 Post Rd) (1), Seabees Museum & Memorial Park (133 Central Street) (2), Cooperating Libraries Automated Network (Cultural Attractions- Events- & Facilities; 600 Sandy Lane) (3), Tours Inc (Ski & Helicopter Tours; 200 Bald Hill Road Suite 109) (4), Boat World (Tours & Charters; 2680 West Shore Road) (5), Honda Suzuki World (Tours & Charters; 250 Oakland Beach Avenue) (6), Bigboy II Fishing Charters (Tours & Charters; 220 natick ave) (7). Display/hide their approximate locations on the map

Hotels: Fairfield Inn Providence/Warwick (36 Jefferson Boulevard) (1), Extended Stay America (245 West Natick Road) (2), Courtyard by Marriott (55 Jefferson Park Road) (3), Henry L Johnson House Bed & Breakfast (131 Post Road) (4), COMFORT INN (1940 Post Road) (5), Residence Inn Providence (500 Kilvert Street) (6), Motel 6 (20 Jefferson Boulevard) (7), Holiday Inn at the Crossing (800 Greenwich Avenue) (8), Mainstay Suites Warwick (268 Metro Center Boulevard) (9). Display/hide their approximate locations on the map

Courts: Rhode Island State - Courts- Superior Court- Kent County Leighton Judicial Complex- General (222 Quaker Lane) (1), Rhode Island State - Public Defender- Leighton Judicial Complex- Kent County Courth (222 Quaker Lane) (2), Rhode Island State - Courts- Superior Court- Kent County Leighton Judicial Complex- Stenograp (222 Quaker) (3), Rhode Island State - Courts- Superior Court- Kent County Leighton Judicial Com (222 Quaker) (4), Rhode Island State - Courts- Family Court- Kent County Leighton Judicial Com (222 Quaker Lane) (5), Rhode Island State - Courts- District Court- 3rd Division Leighton Judicial Com (222 Quaker Lane) (6). Display/hide their approximate locations on the map

Birthplace of: V. Susan Sosnowski - Politician, William Greene (governor) - Governor of Rhode Island, Brian Krolicki - Banker, Christopher Greene - Continental Army officer, Dave Capuano - Ice hockey player, David Petrarca - Director and producer, Griffin Greene - Deputy to Quartermaster General of Continental Army, Ken Vandermark - Musician, Martha McSally - Aviator, Michaela McManus - Film actor.

Drinking water stations with addresses in Warwick and their reported violations in the past:

WARWICK-CITY OF (Population served: 75,000, Purch surface water):Past monitoring violations:WARWICK-POTOWOMUT (Population served: 2,357, Purch surface water):

- Monitoring and Reporting (DBP) - Between APR-2013 and JUN-2013, Contaminant: TTHM. Follow-up actions: St Violation/Reminder Notice (SEP-16-2013), St Formal NOV issued (SEP-16-2013), St Public Notif requested (SEP-16-2013), St Compliance achieved (JUN-05-2014)

- Monitoring and Reporting (DBP) - Between APR-01-2013 and JUN-05-2014, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Violation/Reminder Notice (SEP-16-2013), St Formal NOV issued (SEP-16-2013), St Public Notif requested (SEP-16-2013), St Compliance achieved (JUN-05-2014)

- Monitoring, Repeat Major (TCR) - In OCT-2005, Contaminant: Coliform (TCR). Follow-up actions: St Public Notif requested (NOV-23-2005), St Formal NOV issued (NOV-23-2005), St Violation/Reminder Notice (NOV-23-2005), St Compliance achieved (JUN-28-2006), St Public Notif received (JUN-28-2006)

- One routine major monitoring violation

Past monitoring violations:DEER BROOK WATER MANAGEMENT (Population served: 300, Groundwater):

- Monitoring and Reporting (DBP) - Between APR-01-2013 and JUN-05-2014, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Violation/Reminder Notice (SEP-16-2013), St Formal NOV issued (SEP-16-2013), St Public Notif requested (SEP-16-2013), St Compliance achieved (JUN-05-2014)

- Monitoring and Reporting (DBP) - Between APR-2013 and JUN-2013, Contaminant: TTHM. Follow-up actions: St Violation/Reminder Notice (SEP-16-2013), St Formal NOV issued (SEP-16-2013), St Public Notif requested (SEP-16-2013), St Compliance achieved (JUN-05-2014)

- One routine major monitoring violation

Past monitoring violations:CASTLE ROCK CONDOMINIUMS (Population served: 292, Groundwater):

- One routine major monitoring violation

Past health violations:CAMP COOKIE (Population served: 180, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - Between OCT-2005 and DEC-2005, Contaminant: Coliform. Follow-up actions: St Public Notif requested (NOV-01-2005), St Formal NOV issued (NOV-01-2005), St Violation/Reminder Notice (NOV-01-2005), St Compliance achieved (DEC-07-2005), St Public Notif received (DEC-07-2005)

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2006, Contaminant: Lead and Copper Rule. Follow-up actions: St Public Notif requested (DEC-08-2006), St Formal NOV issued (DEC-08-2006), St Violation/Reminder Notice (DEC-08-2006), St Compliance achieved (JAN-23-2007), St Public Notif received (JAN-23-2007)

Past monitoring violations:CAMP HOFFMAN (Population served: 160, Groundwater):

- One routine major monitoring violation

Past health violations:K & S PIZZA (Population served: 152, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - In JUL-2009, Contaminant: Coliform. Follow-up actions: St Public Notif received (JUL-01-2009), St Public Notif requested (JUL-28-2009), St Violation/Reminder Notice (JUL-28-2009), St Formal NOV issued (JUL-28-2009), St Boil Water Order (JUL-28-2009), St Compliance achieved (AUG-06-2009)

- MCL, Monthly (TCR) - Between APR-2009 and JUN-2009, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (JUN-26-2009), St Boil Water Order (JUN-26-2009), St Formal NOV issued (JUN-26-2009), St Public Notif requested (JUN-26-2009), St Public Notif received (JUL-01-2009), St Compliance achieved (AUG-06-2009)

- One routine major monitoring violation

Past health violations:LITTLE RHODY VASA PARK (Population served: 150, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - In NOV-2012, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (NOV-26-2012), St Boil Water Order (NOV-26-2012), St Formal NOV issued (NOV-26-2012), St Public Notif requested (NOV-26-2012), St Public Notif received (NOV-29-2012), St Compliance achieved (DEC-18-2012)

- MCL, Monthly (TCR) - Between APR-2012 and JUN-2012, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (MAY-31-2012), St Boil Water Order (MAY-31-2012), St Formal NOV issued (MAY-31-2012), St Public Notif requested (MAY-31-2012), St Compliance achieved (JUL-20-2012), St Public Notif received (JUL-20-2012)

- MCL, Monthly (TCR) - In SEP-2011, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (SEP-06-2011), St Boil Water Order (SEP-06-2011), St Formal NOV issued (SEP-06-2011), St Public Notif requested (SEP-06-2011), St Public Notif received (SEP-13-2011), St Compliance achieved (OCT-22-2011)

- MCL, Monthly (TCR) - Between JUL-2011 and SEP-2011, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (SEP-01-2011), St Boil Water Order (SEP-01-2011), St Public Notif requested (SEP-01-2011), St Formal NOV issued (SEP-01-2011), St Compliance achieved (OCT-10-2011)

- Monitoring, Source Water (GWR) - In NOV-21-2012, Contaminant: E. COLI. Follow-up actions: St Public Notif requested (NOV-28-2012), St Formal NOV issued (NOV-28-2012), St Violation/Reminder Notice (NOV-28-2012), St Public Notif received (NOV-29-2012), St Compliance achieved (DEC-18-2012)

- 3 routine major monitoring violations

- 2 minor monitoring violations

Past monitoring violations:

- 2 routine major monitoring violations

Drinking water stations with addresses in Warwick that have no violations reported:

- TWO PINES MOBILE HOME PARK (Serves NH, Population served: 25, Primary Water Source Type: Groundwater)

| This city: | 2.3 people |

| Rhode Island: | 2.4 people |

| This city: | 61.0% |

| Whole state: | 62.8% |

| This city: | 7.6% |

| Whole state: | 7.6% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.6% of all households

- Gay men: 0.3% of all households

People in group quarters in Warwick in 2010:

- 494 people in nursing facilities/skilled-nursing facilities

- 72 people in group homes intended for adults

- 52 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 30 people in other noninstitutional facilities

- 7 people in residential treatment centers for juveniles (non-correctional)

- 4 people in residential treatment centers for adults

People in group quarters in Warwick in 2000:

- 634 people in nursing homes

- 161 people in college dormitories (includes college quarters off campus)

- 99 people in other noninstitutional group quarters

- 44 people in homes for the mentally retarded

- 25 people in homes or halfway houses for drug/alcohol abuse

- 16 people in mental (psychiatric) hospitals or wards

- 7 people in homes for the mentally ill

- 4 people in religious group quarters

Banks with most branches in Warwick (2011 data):

- RBS Citizens, National Association: 7 branches. Info updated 2007/09/19: Bank assets: $106,940.6 mil, Deposits: $75,690.2 mil, headquarters in Providence, RI, positive income, 1135 total offices, Holding Company: Uk Financial Investments Limited

- Bank Rhode Island: Governor Francis Branch, Warwick Branch, Centreville Road Branch. Info updated 2006/09/28: Bank assets: $1,581.1 mil, Deposits: $1,131.1 mil, headquarters in Providence, RI, positive income, Commercial Lending Specialization, 17 total offices, Holding Company: Bancorp Rhode Island, Inc.

- Bank of America, National Association: Hoxsie Branch, Bald Hill Branch, Apponaug Branch. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Webster Bank, National Association: Warwick Avenue Branch at 2100 Warwick Avenue, branch established on 2004/05/14; Bald Hill Road Branch at 1376 Bald Hill Road, branch established on 2005/12/19. Info updated 2008/12/23: Bank assets: $18,674.3 mil, Deposits: $13,861.5 mil, headquarters in Waterbury, CT, positive income, Commercial Lending Specialization, 167 total offices, Holding Company: Webster Financial Corporation

- Sovereign Bank, National Association: Warwick-West Branch at 1071 Centreville Road, branch established on 1975/05/19; Warwick Branch at 1927 Post Road, branch established on 1962/06/15. Info updated 2012/01/31: Bank assets: $78,146.9 mil, Deposits: $48,042.9 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 718 total offices, Holding Company: Banco Santander, S.A.

- Home Loan Investment Bank, F.S.B.: Warwick Branch at 40 Airport Road, branch established on 1989/08/07; Home Loan Investment Bank, F.S.b. at 1 Home Loan Plaza, Suite 3, branch established on 1979/01/01. Info updated 2011/07/21: Bank assets: $195.4 mil, Deposits: $169.8 mil, local headquarters, negative income in the last year, Commercial Lending Specialization, 3 total offices

- The Washington Trust Company of Westerly: Governor Francis Branch at 1473 Warwick Avenue, branch established on 2009/10/26; Centerville Road Branch at 236 Centerville Road (Rt. 117), branch established on 2003/04/25. Info updated 2006/11/03: Bank assets: $3,059.8 mil, Deposits: $2,127.5 mil, headquarters in Westerly, RI, positive income, Commercial Lending Specialization, 19 total offices, Holding Company: Washington Trust Bancorp, Inc.

- Coastway Community Bank: Cowesett Branch at 3830 Post Rd, branch established on 2009/07/01; Warwick Avenue Branch at 2089 Warwick Ave, branch established on 2009/07/01. Info updated 2009/07/20: Bank assets: $324.2 mil, Deposits: $283.0 mil, headquarters in Cranston, RI, positive income, Commercial Lending Specialization, 9 total offices

- Admirals Bank: Bald Hill Road Branch at 650 Bald Hill Road, branch established on 2002/01/23. Info updated 2011/07/21: Bank assets: $518.7 mil, Deposits: $462.0 mil, headquarters in Cranston, RI, positive income, Commercial Lending Specialization, 12 total offices

- 2 other banks with 2 local branches

For population 15 years and over in Warwick:

- Never married: 32.9%

- Now married: 44.8%

- Separated: 0.4%

- Widowed: 7.1%

- Divorced: 14.7%

For population 25 years and over in Warwick:

- High school or higher: 93.6%

- Bachelor's degree or higher: 31.7%

- Graduate or professional degree: 10.4%

- Unemployed: 5.6%

- Mean travel time to work (commute): 22.1 minutes

| Here: | 9.8 |

| Rhode Island average: | 12.8 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Warwick, RI (based on Kent County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 79,337 | 23 |

| Mainline Protestant | 9,853 | 31 |

| Evangelical Protestant | 3,786 | 21 |

| Other | 2,175 | 11 |

| None | 71,007 | - |

Food Environment Statistics:

| This county: | 1.37 / 10,000 pop. |

| Rhode Island: | 1.92 / 10,000 pop. |

| Kent County: | 0.12 / 10,000 pop. |

| Rhode Island: | 0.05 / 10,000 pop. |

| Kent County: | 0.89 / 10,000 pop. |

| Rhode Island: | 1.42 / 10,000 pop. |

| Kent County: | 3.09 / 10,000 pop. |

| State: | 2.24 / 10,000 pop. |

| Kent County: | 10.04 / 10,000 pop. |

| Rhode Island: | 9.75 / 10,000 pop. |

| Kent County: | 8.4% |

| State: | 7.9% |

| Kent County: | 22.6% |

| State: | 22.6% |

| This county: | 15.4% |

| State: | 16.3% |

Health and Nutrition:

| Warwick: | 52.1% |

| Rhode Island: | 49.4% |

| Warwick: | 49.9% |

| Rhode Island: | 46.7% |

| Warwick: | 28.6 |

| Rhode Island: | 28.6 |

| Here: | 20.7% |

| Rhode Island: | 21.3% |

| Warwick: | 9.9% |

| State: | 10.8% |

| Warwick: | 6.9 |

| Rhode Island: | 6.8 |

| This city: | 35.2% |

| State: | 33.8% |

| Warwick: | 58.1% |

| Rhode Island: | 56.0% |

| Warwick: | 78.4% |

| Rhode Island: | 78.5% |

More about Health and Nutrition of Warwick, RI Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Elementary and Secondary - Instruction | 1,249 | $8,687,767 | $83,469 | 2 | $6,271 |

| Firefighters | 225 | $1,897,687 | $101,210 | 0 | $0 |

| Elementary and Secondary - Other Total | 187 | $836,740 | $53,695 | 167 | $262,167 |

| Police Protection - Officers | 181 | $1,453,324 | $96,353 | 0 | $0 |

| Other Government Administration | 41 | $238,842 | $69,905 | 5 | $7,582 |

| Streets and Highways | 40 | $229,768 | $68,930 | 0 | $0 |

| Financial Administration | 38 | $214,932 | $67,873 | 0 | $0 |

| Police - Other | 29 | $141,174 | $58,417 | 16 | $10,465 |

| Sewerage | 26 | $180,097 | $83,122 | 0 | $0 |

| Local Libraries | 23 | $121,086 | $63,175 | 14 | $21,718 |

| Solid Waste Management | 20 | $112,782 | $67,669 | 0 | $0 |

| Other and Unallocable | 20 | $113,907 | $68,344 | 0 | $0 |

| Water Supply | 16 | $91,357 | $68,518 | 0 | $0 |

| Parks and Recreation | 15 | $81,743 | $65,394 | 7 | $7,126 |

| Welfare | 10 | $42,567 | $51,080 | 5 | $5,638 |

| Fire - Other | 8 | $55,477 | $83,216 | 0 | $0 |

| Judicial and Legal | 2 | $10,877 | $65,262 | 0 | $0 |

| Totals for Government | 2,130 | $14,510,126 | $81,747 | 216 | $320,965 |

Warwick government finances - Expenditure in 2021 (per resident):

- Construction - Sewerage: $1,485,000 ($17.89)

- Current Operations - Elementary and Secondary Education: $192,294,000 ($2316.35)

General - Other: $63,461,000 ($764.44)

Local Fire Protection: $26,572,000 ($320.08)

Police Protection: $21,530,000 ($259.35)

Water Utilities: $9,378,000 ($112.97)

Sewerage: $7,822,000 ($94.22)

Regular Highways: $6,817,000 ($82.12)

Financial Administration: $3,562,000 ($42.91)

Solid Waste Management: $2,860,000 ($34.45)

Libraries: $2,830,000 ($34.09)

Central Staff Services: $2,457,000 ($29.60)

Parks and Recreation: $1,951,000 ($23.50)

General Public Buildings: $1,254,000 ($15.11)

Public Welfare - Other: $1,119,000 ($13.48)

Protective Inspection and Regulation - Other: $720,000 ($8.67)

Judicial and Legal Services: $589,000 ($7.10)

Health - Other: $190,000 ($2.29)

Housing and Community Development: $161,000 ($1.94)

- General - Interest on Debt: $2,072,000 ($24.96)

- Intergovernmental to Local - Other - Elementary and Secondary Education: $4,452,000 ($53.63)

- Other Capital Outlay - Regular Highways: $7,575,000 ($91.25)

Elementary and Secondary Education: $6,126,000 ($73.79)

General - Other: $207,000 ($2.49)

Water Utilities: $75,000 ($0.90)

- Total Salaries and Wages: $105,617,000 ($1272.25)

- Water Utilities - Interest on Debt: $1,409,000 ($16.97)

Warwick government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $16,990,000 ($204.66)

Other: $8,505,000 ($102.45)

Air Transportation: $1,978,000 ($23.83)

Elementary and Secondary Education School Lunch: $1,780,000 ($21.44)

Elementary and Secondary Education - Other: $849,000 ($10.23)

Parks and Recreation: $455,000 ($5.48)

Housing and Community Development: $143,000 ($1.72)

- Federal Intergovernmental - Housing and Community Development: $1,134,000 ($13.66)

Other: $225,000 ($2.71)

- Local Intergovernmental - Education: $822,000 ($9.90)

- Miscellaneous - Interest Earnings: $603,000 ($7.26)

Donations From Private Sources: $577,000 ($6.95)

General Revenue - Other: $553,000 ($6.66)

Fines and Forfeits: $97,000 ($1.17)

- Revenue - Water Utilities: $13,121,000 ($158.05)

- State Intergovernmental - Education: $54,998,000 ($662.50)

General Local Government Support: $4,455,000 ($53.66)

Other: $3,758,000 ($45.27)

Highways: $2,602,000 ($31.34)

- Tax - Property: $242,822,000 ($2925.00)

Other License: $5,014,000 ($60.40)

Other Selective Sales: $3,758,000 ($45.27)

Warwick government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $118,360,000 ($1425.75)

Outstanding Unspecified Public Purpose: $112,671,000 ($1357.22)

Retired Unspecified Public Purpose: $15,289,000 ($184.17)

Issue, Unspecified Public Purpose: $9,600,000 ($115.64)

Warwick government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $6,911,000 ($83.25)

- Other Funds - Cash and Securities: $99,599,000 ($1199.76)

| Businesses in Warwick, RI | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 7-Eleven | 1 | Lane Furniture | 2 | |

| ALDI | 1 | LensCrafters | 2 | |

| AT&T | 1 | Lowe's | 2 | |

| Ace Hardware | 1 | Marriott | 1 | |

| Advance Auto Parts | 1 | MasterBrand Cabinets | 13 | |

| Aeropostale | 1 | McDonald's | 3 | |

| American Eagle Outfitters | 1 | Men's Wearhouse | 2 | |

| Applebee's | 1 | Motel 6 | 1 | |

| Ashley Furniture | 1 | Motherhood Maternity | 1 | |

| Audi | 1 | New Balance | 2 | |

| AutoZone | 2 | New York & Co | 1 | |

| Avenue | 1 | Nike | 12 | |

| BMW | 1 | Nissan | 1 | |

| Bakers | 1 | Old Navy | 1 | |

| Barnes & Noble | 1 | Olive Garden | 1 | |

| Bath & Body Works | 1 | On The Border | 1 | |

| Bed Bath & Beyond | 1 | Panda Express | 1 | |

| Ben & Jerry's | 2 | Panera Bread | 1 | |

| Best Western | 1 | Papa John's Pizza | 1 | |

| Brooks Brothers | 1 | Payless | 3 | |

| Budget Car Rental | 1 | Penske | 1 | |

| Burger King | 5 | PetSmart | 1 | |

| CVS | 3 | Pier 1 Imports | 1 | |

| Cache | 1 | Pizza Hut | 2 | |

| Charlotte Russe | 1 | RadioShack | 4 | |

| Chevrolet | 1 | Raymour & Flanigan | 1 | |

| Chipotle | 1 | Red Robin | 1 | |

| Chuck E. Cheese's | 1 | Rite Aid | 4 | |

| Comfort Inn | 1 | Ryder Rental & Truck Leasing | 1 | |

| Dennys | 1 | SAS Shoes | 2 | |

| Domino's Pizza | 3 | Sears | 3 | |

| DressBarn | 1 | Shaw's | 1 | |

| Dressbarn | 1 | Sheraton | 1 | |

| Dunkin Donuts | 19 | Sprint Nextel | 1 | |

| Express | 1 | Staples | 2 | |

| Extended Stay America | 1 | Starbucks | 5 | |

| Famous Footwear | 1 | Stop & Shop | 3 | |

| Fashion Bug | 1 | Subaru | 1 | |

| FedEx | 17 | Subway | 10 | |

| Firestone Complete Auto Care | 2 | T-Mobile | 8 | |

| Foot Locker | 1 | T.G.I. Driday's | 2 | |

| GNC | 6 | T.J.Maxx | 1 | |

| GameStop | 2 | Taco Bell | 1 | |

| Gap | 1 | Target | 2 | |

| Gymboree | 1 | Toyota | 1 | |

| H&R Block | 4 | Toys"R"Us | 3 | |

| Hilton | 3 | Trader Joe's | 1 | |

| Holiday Inn | 2 | U-Haul | 3 | |

| Home Depot | 1 | UPS | 17 | |

| HomeTown Buffet | 1 | Vans | 1 | |

| Homestead Studio Suites | 1 | Verizon Wireless | 1 | |

| IHOP | 1 | Victoria's Secret | 1 | |

| JCPenney | 1 | Volkswagen | 1 | |

| Jones New York | 1 | Walgreens | 3 | |

| Justice | 1 | Walmart | 2 | |

| KFC | 1 | Wendy's | 3 | |

| Kohl's | 1 | Wet Seal | 1 | |

| La Quinta | 1 | YMCA | 1 | |

| La-Z-Boy | 1 | |||

Strongest AM radio stations in Warwick:

- WARV (1590 AM; 5 kW; WARWICK, RI; Owner: BLOUNT COMMUNICATIONS, INC.)

- WPRO (630 AM; 5 kW; PROVIDENCE, RI; Owner: CITADEL BROADCASTING COMPANY)

- WHJJ (920 AM; 5 kW; PROVIDENCE, RI)

- WALE (990 AM; 50 kW; GREENVILLE, RI; Owner: NORTH AMERICAN BROADCASTING CO., INC.)

- WSKO (790 AM; 5 kW; PROVIDENCE, RI; Owner: CITADEL BROADCASTING COMPANY)

- WRNI (1290 AM; 10 kW; PROVIDENCE, RI; Owner: WRNI FOUNDATION)

- WPMZ (1110 AM; daytime; 5 kW; EAST PROVIDENCE, RI; Owner: VIDEO MUNDO B/CASTING CO., LLC)

- WDDZ (550 AM; 5 kW; PAWTUCKET, RI; Owner: ABC, INC.)

- WEEI (850 AM; 50 kW; BOSTON, MA; Owner: ENTERCOM BOSTON LICENSE, LLC)

- WCRN (830 AM; 50 kW; WORCESTER, MA; Owner: CARTER BROADCASTING CORPORATION)

- WKOX (1200 AM; 50 kW; FRAMINGHAM, MA; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WSAR (1480 AM; 5 kW; FALL RIVER, MA; Owner: BRISTOL COUNTY BROADCASTING, INC.)

- WBIX (1060 AM; 40 kW; NATICK, MA; Owner: LANGER BROADCASTING CORPORATION)

Strongest FM radio stations in Warwick:

- WPRO-FM (92.3 FM; PROVIDENCE, RI; Owner: CITADEL BROADCASTING COMPANY)

- WWLI (105.1 FM; PROVIDENCE, RI; Owner: CITADEL BROADCASTING COMPANY)

- WWBB (101.5 FM; PROVIDENCE, RI; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WBRU (95.5 FM; PROVIDENCE, RI; Owner: BROWN BROADCASTING SERVICE, INC.)

- WHJY (94.1 FM; PROVIDENCE, RI; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WKKB (100.3 FM; MIDDLETOWN, RI; Owner: CITADEL BROADCASTING COMPANY)

- WSNE-FM (93.3 FM; TAUNTON, MA; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WSKO-FM (99.7 FM; WAKEFIELD-PEACEDALE, RI; Owner: CITADEL BROADCASTING COMPANY)

- WWKX (106.3 FM; WOONSOCKET, RI; Owner: AAA ENTERTAINMENT LICENSING LLC)

- WWRX-FM (103.7 FM; WESTERLY, RI; Owner: FNX BROADCASTING OF RHODE ISLAND, LLC)

- WRIU (90.3 FM; KINGSTON, RI; Owner: UNIVERSITY OF RHODE ISLAND)

- WBMX (98.5 FM; BOSTON, MA; Owner: INFINITY RADIO OPERATIONS INC.)

- WBOS (92.9 FM; BROOKLINE, MA; Owner: GREATER BOSTON RADIO, INC.)

- WJMN (94.5 FM; BOSTON, MA; Owner: AMFM RADIO LICENSES, L.L.C.)

- WCRB (102.5 FM; WALTHAM, MA; Owner: CHARLES RIVER BROADCASTING WCRB LICE)

- WTKK (96.9 FM; BOSTON, MA; Owner: GREATER BOSTON RADIO, INC.)

- WROR-FM (105.7 FM; FRAMINGHAM, MA; Owner: GREATER BOSTON RADIO, INC.)

- WGBH (89.7 FM; BOSTON, MA; Owner: WGBH EDUCATIONAL FOUNDATION)

- WDOM (91.3 FM; PROVIDENCE, RI; Owner: PROVIDENCE COLLEGE)

- WXKS-FM (107.9 FM; MEDFORD, MA; Owner: AMFM RADIO LICENSES, L.L.C.)

TV broadcast stations around Warwick:

- WNAC-TV (Channel 64; PROVIDENCE, RI; Owner: WNAC, LLC)

- WPXQ (Channel 69; BLOCK ISLAND, RI; Owner: OCEAN STATE TELEVISION, L.L.C.)

- WPRI-TV (Channel 12; PROVIDENCE, RI; Owner: TVL BROADCASTING OF RHODE ISLAND, LLC)

- WJAR (Channel 10; PROVIDENCE, RI; Owner: OUTLET BROADCASTING, INC.)

- WLNE-TV (Channel 6; NEW BEDFORD, MA; Owner: FREEDOM BROADCASTING OF SOUTHERN NEW ENGLAND, INC.)

- WSBE-TV (Channel 36; PROVIDENCE, RI; Owner: RHODE ISLAND PUBLIC TELECOM. AUTHORITY)

- WRIW-LP (Channel 50; PROVIDENCE, RI; Owner: ZGS PROVIDENCE, INC.)

- WWDP (Channel 46; NORWELL, MA; Owner: NORWELL TELEVISION, LLC)

- WCVB-TV (Channel 5; BOSTON, MA; Owner: WCVB HEARST-ARGYLE TV, INC.)

- WGBH-TV (Channel 2; BOSTON, MA; Owner: WGBH EDUCATIONAL FOUNDATION)

- WLWC (Channel 28; NEW BEDFORD, MA; Owner: C-28 FCC LICENSEE SUBSIDIARY, LLC)

- WHDH-TV (Channel 7; BOSTON, MA; Owner: WHDH-TV)

- WMFP (Channel 62; LAWRENCE, MA; Owner: WSAH LICENSE, INC.)

- WSBK-TV (Channel 38; BOSTON, MA; Owner: VIACOM INC.)

- WLVI-TV (Channel 56; CAMBRIDGE, MA; Owner: WLVI, INC.)

- WBZ-TV (Channel 4; BOSTON, MA; Owner: VIACOM INC.)

- WGBX-TV (Channel 44; BOSTON, MA; Owner: WGBH EDUCATIONAL FOUNDATION)

- WUNI (Channel 27; WORCESTER, MA; Owner: ENTRAVISION HOLDINGS, LLC)

- WFXT (Channel 25; BOSTON, MA; Owner: FOX TELEVISION STATIONS INC.)

- WUTF (Channel 66; MARLBOROUGH, MA; Owner: TELEFUTURA BOSTON LLC)

- WHPX (Channel 26; NEW LONDON, CT; Owner: PAXSON HARTFORD LICENSE, INC.)

Medal of Honor Recipients

Medal of Honor Recipient born in Warwick: George E. McDonald.

- National Bridge Inventory (NBI) Statistics

- 87Number of bridges

- 840ft / 256mTotal length

- $194,629,000Total costs

- 2,964,700Total average daily traffic

- 308,960Total average daily truck traffic

- New bridges - historical statistics

- 11900-1909

- 41920-1929

- 21930-1939

- 51950-1959

- 571960-1969

- 51970-1979

- 41990-1999

- 12000-2009

- 22010-2019

- 62020-2022

FCC Registered Private Land Mobile Towers: 1 (See the full list of FCC Registered Private Land Mobile Towers in Warwick, RI)

FCC Registered Broadcast Land Mobile Towers: 52 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 31 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 4 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 9 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 444 (See the full list of FCC Registered Amateur Radio Licenses in Warwick)

FAA Registered Aircraft Manufacturers and Dealers: 5 (See the full list of FAA Registered Manufacturers and Dealers in Warwick)

FAA Registered Aircraft: 40 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 20 full tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 501 | $175,483 | 354 | $159,342 | 2,011 | $177,835 | 143 | $83,657 | 3 | $5,638,333 | 103 | $137,214 | 2 | $76,500 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 33 | $183,455 | 23 | $208,304 | 185 | $179,178 | 14 | $38,429 | 0 | $0 | 3 | $110,000 | 0 | $0 |

| APPLICATIONS DENIED | 87 | $166,701 | 64 | $140,625 | 708 | $196,992 | 96 | $42,854 | 0 | $0 | 54 | $141,093 | 1 | $25,000 |

| APPLICATIONS WITHDRAWN | 42 | $165,595 | 44 | $164,318 | 404 | $184,262 | 18 | $99,056 | 0 | $0 | 23 | $149,217 | 1 | $3,000 |

| FILES CLOSED FOR INCOMPLETENESS | 16 | $144,312 | 16 | $169,562 | 151 | $203,974 | 2 | $107,500 | 0 | $0 | 7 | $108,571 | 0 | $0 |

Detailed mortgage data for all 20 tracts in Warwick, RI

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 20 full tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 55 | $193,909 | 42 | $237,476 | 1 | $138,000 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 13 | $186,538 | 22 | $223,045 | 0 | $0 |

| APPLICATIONS DENIED | 12 | $144,667 | 11 | $223,455 | 1 | $138,000 |

| APPLICATIONS WITHDRAWN | 3 | $188,667 | 2 | $194,000 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 2 | $161,500 | 2 | $291,000 | 0 | $0 |

2004 - 2015 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Warwick, RI

- 48345.5%Outside Fires

- 29127.4%Structure Fires

- 19818.7%Mobile Property/Vehicle Fires

- 898.4%Other

According to the data from the years 2004 - 2015 the average number of fires per year is 88. The highest number of reported fire incidents - 230 took place in 2010, and the least - 0 in 2005. The data has a growing trend.

According to the data from the years 2004 - 2015 the average number of fires per year is 88. The highest number of reported fire incidents - 230 took place in 2010, and the least - 0 in 2005. The data has a growing trend. When looking into fire subcategories, the most incidents belonged to: Outside Fires (45.5%), and Structure Fires (27.4%).

When looking into fire subcategories, the most incidents belonged to: Outside Fires (45.5%), and Structure Fires (27.4%).Fire-safe hotels and motels in Warwick, Rhode Island:

- Sonesta ES Suites Providence - Airport, 500 Kilvert St, Warwick, Rhode Island 02886 , Phone: (401) 737-7100

- Crowne Plaza Hotel At The Crossings, 801 Greenwich Ave, Warwick, Rhode Island 02886 , Phone: (401) 732-6000, Fax: (401) 738-1840

- Fairfield Inn, 36 Jefferson Blvd, Warwick, Rhode Island 02888 , Phone: (401) 941-6600, Fax: (401) 785-1260

- Radisson Airport Hotel Providence, 2081 Post Rd, Warwick, Rhode Island 02886 , Phone: (401) 739-3000, Fax: (401) 732-9309

- Homewood Suites Warwick, 33 International Way, Warwick, Rhode Island 02886 , Phone: (401) 738-0008

- Extended Stay America - Providence - Airport, 268 Metro Center Blvd, Warwick, Rhode Island 02886 , Phone: (401) 732-6667, Fax: (401) 732-6668

- Extended Stay America - Providence - Warwick, 245 W Natick Rd, Warwick, Rhode Island 02886 , Phone: (401) 732-2547, Fax: (401) 732-2548

- Hampton Inn & Suites Warwick, 2100 Post Rd, Warwick, Rhode Island 02886 , Phone: (401) 739-8888, Fax: (401) 739-1550

- 6 other hotels and motels

| Most common first names in Warwick, RI among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| Mary | 1,062 | 81.0 years |

| John | 968 | 73.6 years |

| William | 751 | 74.5 years |

| Joseph | 661 | 74.4 years |

| James | 497 | 74.0 years |

| George | 496 | 74.3 years |

| Robert | 442 | 69.5 years |

| Helen | 424 | 80.2 years |

| Charles | 422 | 75.7 years |

| Margaret | 421 | 79.7 years |

| Most common last names in Warwick, RI among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Johnson | 240 | 77.9 years |

| Smith | 187 | 75.9 years |

| Anderson | 165 | 77.6 years |

| Brown | 158 | 75.0 years |

| Martin | 108 | 74.8 years |

| Sullivan | 100 | 76.7 years |

| Miller | 93 | 76.8 years |

| Murphy | 88 | 78.3 years |

| Williams | 72 | 73.4 years |

| Kelly | 71 | 75.4 years |

- 67.9%Utility gas

- 24.0%Fuel oil, kerosene, etc.

- 5.1%Electricity

- 1.5%Bottled, tank, or LP gas

- 0.8%Wood

- 0.4%Other fuel

- 0.2%Solar energy

- 0.2%No fuel used

- 62.1%Utility gas

- 23.0%Electricity

- 11.4%Fuel oil, kerosene, etc.

- 1.9%Bottled, tank, or LP gas

- 0.6%No fuel used

- 0.5%Wood

- 0.3%Other fuel

- 0.2%Solar energy

Warwick compared to Rhode Island state average:

- Unemployed percentage below state average.

- Black race population percentage significantly below state average.

- Hispanic race population percentage significantly below state average.

- Foreign-born population percentage below state average.

- Number of college students below state average.

Warwick on our top lists:

- #3 on the list of "Top 101 cities with largest percentage of males in occupations: healthcare support occupations (population 50,000+)"

- #11 on the list of "Top 101 cities with the biggest property tax revenues per resident (population 10,000+)"

- #35 on the list of "Top 100 cities with oldest residents (pop. 50,000+)"

- #37 on the list of "Top 101 cities with largest percentage of females in industries: finance and insurance (population 50,000+)"

- #38 on the list of "Top 101 cities with largest percentage of males in occupations: law enforcement workers including supervisors (population 50,000+)"

- #38 on the list of "Top 101 cities with the smallest city-data.com crime index per police officer (population 50,000+)"

- #38 on the list of "Top 101 larger cities with the highest increase in household income from 2000 (population 50,000+)"

- #41 on the list of "Top 101 cities with the lowest cost per building permit (population 50,000+)"

- #42 on the list of "Top 101 cities with the largest percentage population decrease from 2000 (population 50,000+)"

- #45 on the list of "Top 100 cities with declining populations from 2000 to 2014 (pop. 50,000+)"

- #45 on the list of "Top 100 least racially diverse cities (pop. 50,000+)"

- #51 on the list of "Top 100 high-educated but low-earning cities (pop. 50,000+)"

- #53 on the list of "Top 101 cities with largest percentage of males in industries: health care and social assistance (population 50,000+)"

- #58 on the list of "Top 101 cities with the biggest local government total salary and wages expenses per resident (population 10,000+)"

- #63 on the list of "Top 101 cities with largest percentage of females in occupations: management occupations (population 50,000+)"

- #69 on the list of "Top 101 cities with the lowest maximum monthly sunshine amount (population 50,000+)"

- #69 on the list of "Top 101 cities with the largest percentage of one, detached housing units in structures (20,000+ housing units)"

- #70 on the list of "Top 101 cities with largest percentage of males in occupations: arts, design, entertainment, sports, and media occupations (population 50,000+)"

- #72 on the list of "Top 101 cities with the highest ratio of rapes to murders between 2002 and 2012 (population 50,000+)"

- #78 on the list of "Top 101 cities with the smallest precipitation differences during a year (population 50,000+)"

- #76 (02893) on the list of "Top 101 zip codes with the largest percentage of Portuguese first ancestries (pop 5,000+)"

- #3 on the list of "Top 101 counties with the lowest Nitrogen Dioxide air pollution readings in 2012 (ppm)"

- #8 on the list of "Top 101 counties with the lowest Particulate Matter (PM10) Annual air pollution readings in 2012 (µg/m3)"

- #14 on the list of "Top 101 counties with the lowest percentage of residents relocating from foreign countries between 2010 and 2011"

- #17 on the list of "Top 101 counties with the lowest total withdrawal of fresh water for public supply (pop. 50,000+)"

- #30 on the list of "Top 101 counties with the highest percentage of residents that smoked 100+ cigarettes in their lives"

State forum archive:

|

|

Total of 522 patent applications in 2008-2024.