Wesley Chapel South, Florida

Submit your own pictures of this place and show them to the world

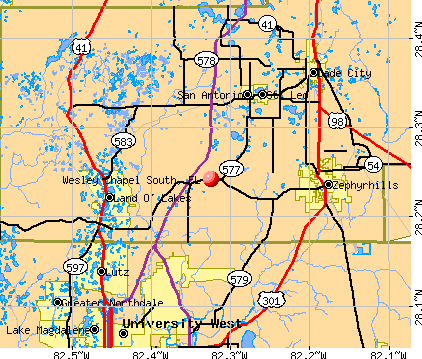

- OSM Map

- General Map

- Google Map

- MSN Map

| Males: 2,147 | |

| Females: 2,146 |

| Median resident age: | 40.0 years |

| Florida median age: | 38.7 years |

Zip codes: 33544.

| Wesley Chapel South: | $107,756 |

| FL: | $69,303 |

Estimated per capita income in 2022: $63,042 (it was $31,399 in 2000)

Wesley Chapel South CDP income, earnings, and wages data

Estimated median house or condo value in 2022: $519,875 (it was $115,000 in 2000)

| Wesley Chapel South: | $519,875 |

| FL: | $354,100 |

Mean prices in 2022: all housing units: $325,489; detached houses: $382,870; townhouses or other attached units: $293,775; in 2-unit structures: $216,640; in 3-to-4-unit structures: $193,355; in 5-or-more-unit structures: $213,163; mobile homes: $93,244; occupied boats, rvs, vans, etc.: $110,991

Wesley Chapel South, FL residents, houses, and apartments details

Detailed information about poverty and poor residents in Wesley Chapel South, FL

- 2,87588.6%White alone

- 2066.3%Hispanic

- 601.8%Asian alone

- 511.6%Two or more races

- 381.2%Black alone

- 130.4%American Indian alone

- 20.06%Other race alone

Races in Wesley Chapel South detailed stats: ancestries, foreign born residents, place of birth

| Who recently relocated to Brandon or Wesley Chapel (31 replies) |

Ancestries: German (19.2%), English (16.4%), United States (14.6%), Irish (13.5%), Italian (7.5%), Polish (3.7%).

Current Local Time: EST time zone

Land area: 11.1 square miles.

Population density: 386 people per square mile (very low).

240 residents are foreign born (3.0% Asia, 2.3% Europe, 1.2% Latin America, 0.9% Africa).

| This place: | 7.4% |

| Florida: | 16.7% |

| Wesley Chapel South CDP: | 1.3% ($1,481) |

| Florida: | 1.4% ($1,262) |

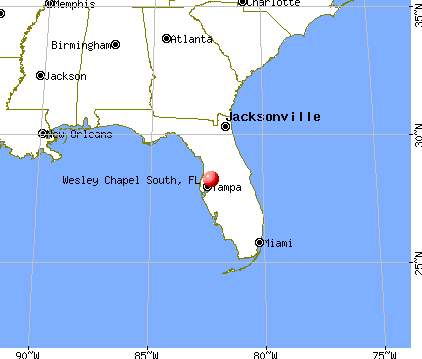

Nearest city with pop. 50,000+: Central Pasco, FL (2.6 miles , pop. 52,899).

Nearest city with pop. 200,000+: Tampa, FL (20.6 miles

, pop. 303,447).

Nearest city with pop. 1,000,000+: Houston, TX (796.5 miles

, pop. 1,953,631).

Nearest cities:

Latitude: 28.24 N, Longitude: 82.32 W

Area code commonly used in this area: 352

| Here: | 3.5% |

| Florida: | 2.9% |

- Health care (13.4%)

- Construction (10.4%)

- Professional, scientific, technical services (8.5%)

- Accommodation & food services (7.9%)

- Educational services (7.4%)

- Finance & insurance (5.2%)

- Public administration (4.7%)

- Construction (17.0%)

- Health care (6.9%)

- Educational services (5.8%)

- Accommodation & food services (5.8%)

- Public administration (5.4%)

- Professional, scientific, technical services (5.4%)

- Arts, entertainment, recreation (4.6%)

- Health care (21.7%)

- Professional, scientific, technical services (12.4%)

- Accommodation & food services (10.5%)

- Educational services (9.6%)

- Finance & insurance (7.0%)

- Food & beverage stores (4.5%)

- Public administration (3.8%)

- Other management occupations, except farmers and farm managers (6.1%)

- Other sales and related occupations, including supervisors (4.7%)

- Driver/sales workers and truck drivers (4.7%)

- Secretaries and administrative assistants (4.1%)

- Other office and administrative support workers, including supervisors (3.5%)

- Health technologists and technicians (3.2%)

- Entertainers and performers, sports, and related workers (2.9%)

- Driver/sales workers and truck drivers (8.4%)

- Other management occupations, except farmers and farm managers (6.4%)

- Other sales and related occupations, including supervisors (5.3%)

- Building and grounds cleaning and maintenance occupations (3.9%)

- Retail sales workers, except cashiers (3.8%)

- Construction laborers (3.6%)

- Entertainers and performers, sports, and related workers (3.6%)

- Secretaries and administrative assistants (9.3%)

- Health technologists and technicians (7.2%)

- Other office and administrative support workers, including supervisors (5.9%)

- Other management occupations, except farmers and farm managers (5.6%)

- Registered nurses (5.5%)

- Cashiers (4.5%)

- Other sales and related occupations, including supervisors (3.9%)

Average climate in Wesley Chapel South, Florida

Based on data reported by over 4,000 weather stations

(lower is better)

Air Quality Index (AQI) level in 2022 was 52.4. This is better than average.

| City: | 52.4 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.174. This is significantly better than average. Closest monitor was 14.5 miles away from the city center.

| City: | 0.174 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2008 was 3.96. This is better than average. Closest monitor was 16.4 miles away from the city center.

| City: | 3.96 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.832. This is significantly better than average. Closest monitor was 13.8 miles away from the city center.

| City: | 0.832 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 25.1. This is better than average. Closest monitor was 6.4 miles away from the city center.

| City: | 25.1 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 21.8. This is about average. Closest monitor was 14.5 miles away from the city center.

| City: | 21.8 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2015 was 9.96. This is worse than average. Closest monitor was 13.6 miles away from the city center.

| City: | 9.96 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2003 was 0.00395. This is significantly better than average. Closest monitor was 9.3 miles away from the city center.

| City: | 0.00395 |

| U.S.: | 0.00931 |

Tornado activity:

Wesley Chapel South-area historical tornado activity is above Florida state average. It is 56% greater than the overall U.S. average.

On 4/4/1966, a category F4 (max. wind speeds 207-260 mph) tornado 36.6 miles away from the Wesley Chapel South place center killed 11 people and injured 530 people and caused between $5,000,000 and $50,000,000 in damages.

On 5/4/1978, a category F3 (max. wind speeds 158-206 mph) tornado 31.9 miles away from the place center killed 3 people and injured 94 people and caused between $500,000 and $5,000,000 in damages.

Earthquake activity:

Wesley Chapel South-area historical earthquake activity is significantly above Florida state average. It is 88% smaller than the overall U.S. average.On 9/10/2006 at 14:56:08, a magnitude 5.9 (5.9 MB, 5.5 MS, 5.8 MW, Class: Moderate, Intensity: VI - VII) earthquake occurred 298.4 miles away from Wesley Chapel South center

On 10/24/1997 at 08:35:17, a magnitude 4.9 (4.8 MB, 4.2 MS, 4.9 LG, Depth: 6.2 mi, Class: Light, Intensity: IV - V) earthquake occurred 357.8 miles away from Wesley Chapel South center

On 11/22/1974 at 05:25:55, a magnitude 4.7 (4.7 MB) earthquake occurred 347.3 miles away from the city center

On 8/2/1974 at 08:52:09, a magnitude 4.9 (4.3 MB, 4.9 LG) earthquake occurred 389.5 miles away from Wesley Chapel South center

On 9/4/2016 at 18:29:29, a magnitude 3.8 (3.8 ML, Class: Light, Intensity: II - III) earthquake occurred 211.4 miles away from Wesley Chapel South center

On 6/23/2016 at 17:20:29, a magnitude 3.8 (3.8 ML) earthquake occurred 211.9 miles away from Wesley Chapel South center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Pasco County (21) is greater than the US average (15).Major Disasters (Presidential) Declared: 14

Emergencies Declared: 4

Causes of natural disasters: Hurricanes: 10, Floods: 4, Tropical Storms: 4, Storms: 3, Fires: 2, Tornadoes: 2, Freeze: 1, Wind: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers near Wesley Chapel South:

- BALDOMERO LOPEZ MEMORIAL VETERANS NURSING HOME (Nursing Home, about 8 miles away; LAND O LAKES, FL)

- CHAPEL HOME HEALTH (Home Health Center, about 9 miles away; ZEPHYRHILLS, FL)

- EAST PASCO OUTPATIENT SURGERY CENTER (Hospital, about 9 miles away; ZEPHYRHILLS, FL)

- FLORIDA HOSPITAL ZEPHYRHILLS Acute Care Hospitals (about 9 miles away; ZEPHYRHILLS, FL)

- ZEPHYRHILLS DIALYSIS (Dialysis Facility, about 9 miles away; ZEPHYRHILLS, FL)

- COMPASSIONATE HOME CARE INC (Home Health Center, about 9 miles away; ZEPHYRHILLS, FL)

- ZEPHYRHILLS HEALTH AND REHAB CENTER, INC (Nursing Home, about 9 miles away; ZEPHYRHILLS, FL)

Colleges/universities with over 2000 students nearest to Wesley Chapel South:

- Saint Leo University (about 8 miles; Saint Leo, FL; Full-time enrollment: 14,572)

- University of South Florida-Main Campus (about 14 miles; Tampa, FL; FT enrollment: 35,920)

- Ultimate Medical Academy-Tampa (about 17 miles; Tampa, FL; FT enrollment: 16,672)

- Everest University-Brandon (about 19 miles; Tampa, FL; FT enrollment: 7,702)

- Pasco-Hernando Community College (about 20 miles; New Port Richey, FL; FT enrollment: 7,030)

- Strayer University-Florida (about 23 miles; Tampa, FL; FT enrollment: 2,723)

- The University of Tampa (about 23 miles; Tampa, FL; FT enrollment: 7,216)

Points of interest:

| This place: | 2.6 people |

| Florida: | 2.5 people |

| This place: | 76.6% |

| Whole state: | 66.9% |

| This place: | 5.4% |

| Whole state: | 5.8% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.2% of all households

- Gay men: 0.2% of all households

| This place: | 6.6% |

| Whole state: | 12.5% |

| This place: | 1.8% |

| Whole state: | 5.7% |

For population 15 years and over in Wesley Chapel South:

- Never married: 18.5%

- Now married: 64.1%

- Separated: 1.9%

- Widowed: 4.1%

- Divorced: 11.5%

For population 25 years and over in Wesley Chapel South:

- High school or higher: 86.8%

- Bachelor's degree or higher: 25.1%

- Graduate or professional degree: 9.6%

- Unemployed: 4.4%

- Mean travel time to work (commute): 31.2 minutes

| Here: | 10.1 |

| Florida average: | 12.6 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Wesley Chapel South, FL (based on Pasco County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 42,599 | 194 |

| Catholic | 41,497 | 13 |

| Mainline Protestant | 12,376 | 36 |

| Other | 2,979 | 22 |

| Orthodox | 1,350 | 3 |

| Black Protestant | 623 | 5 |

| None | 363,273 | - |

Food Environment Statistics:

| Here: | 1.39 / 10,000 pop. |

| State: | 2.04 / 10,000 pop. |

| Here: | 0.13 / 10,000 pop. |

| Florida: | 0.11 / 10,000 pop. |

| Here: | 1.06 / 10,000 pop. |

| Florida: | 1.28 / 10,000 pop. |

| This county: | 2.54 / 10,000 pop. |

| Florida: | 3.04 / 10,000 pop. |

| Pasco County: | 4.75 / 10,000 pop. |

| State: | 7.45 / 10,000 pop. |

| Here: | 9.9% |

| Florida: | 9.2% |

| Here: | 23.9% |

| Florida: | 23.7% |

| Pasco County: | 13.6% |

| State: | 14.0% |

12.35% of this county's 2021 resident taxpayers lived in other counties in 2020 ($65,952 average adjusted gross income)

| Here: | 12.35% |

| Florida average: | 8.80% |

0.04% of residents moved from foreign countries ($174 average AGI)

Pasco County: 0.04% Florida average: 0.05%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Hillsborough County, FL | |

| from Pinellas County, FL | |

| from Hernando County, FL |

8.37% of this county's 2020 resident taxpayers moved to other counties in 2021 ($54,340 average adjusted gross income)

| Here: | 8.37% |

| Florida average: | 7.45% |

0.03% of residents moved to foreign countries ($207 average AGI)

Pasco County: 0.03% Florida average: 0.04%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Hillsborough County, FL | |

| to Pinellas County, FL | |

| to Hernando County, FL |

Strongest AM radio stations in Wesley Chapel South:

- WQYK (1010 AM; 50 kW; SEFFNER, FL; Owner: INFINITY BROADCASTING CORPORATION OF TAMPA)

- WFLF (540 AM; 50 kW; PINE HILLS, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WLCC (760 AM; 10 kW; BRANDON, FL; Owner: MEGA COMMUNICATIONS OF TAMPA LICENSEE)

- WTBN (570 AM; 5 kW; PINELLAS PARK, FL; Owner: COMMON GROUND BROADCASTING, INC.)

- WFLA (970 AM; 25 kW; TAMPA, FL; Owner: CITICASTERS LICENSES, L.P.)

- WMGG (820 AM; 50 kW; LARGO, FL; Owner: MEGA COMMUNICATIONS OF ST. PETERSBURG LICENSEE)

- WHNZ (1250 AM; 25 kW; TAMPA, FL; Owner: CITICASTERS LICENSES, L.P.)

- WQTM (740 AM; 50 kW; ORLANDO, FL; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WQBN (1300 AM; 5 kW; TEMPLE TERRACE, FL; Owner: RADIO TROPICAL, INC.)

- WTMP (1150 AM; 10 kW; EGYPT LAKE, FL; Owner: TAMPA BROADCASTING, LTD.)

- WTWD (910 AM; 5 kW; PLANT CITY, FL; Owner: SOUTH TEXAS BROADCASTING, INC.)

- WDYZ (990 AM; 50 kW; ORLANDO, FL; Owner: ABC, INC.)

- WAMA (1550 AM; 10 kW; TAMPA, FL; Owner: WAMA, INC)

Strongest FM radio stations in Wesley Chapel South:

- WRBQ-FM (104.7 FM; TAMPA, FL; Owner: INFINITY RADIO OPERATIONS INC.)

- WDUV (105.5 FM; NEW PORT RICHEY, FL; Owner: CXR HOLDINGS, INC.)

- WPOI (101.5 FM; ST. PETERSBURG, FL; Owner: CXR HOLDINGS, INC.)

- WWRM (94.9 FM; TAMPA, FL; Owner: COX RADIO, INC.)

- WXTB (97.9 FM; CLEARWATER, FL; Owner: CITICASTERS LICENSES, L.P.)

- WFLZ-FM (93.3 FM; TAMPA, FL; Owner: CITICASTERS LICENSES, L.P.)

- WMTX (100.7 FM; TAMPA, FL; Owner: CITICASTERS LICENSES, L.P.)

- WQYK-FM (99.5 FM; ST. PETERSBURG, FL; Owner: INFINITY BROADCASTING CORPORATION OF FLORIDA)

- WTBT (103.5 FM; BRADENTON, FL; Owner: CITICASTERS LICENSES, L.P.)

- WTMP-FM (96.1 FM; DADE CITY, FL; Owner: TAMA GROUP, L.C.)

- WBBY (107.3 FM; ST. PETERSBURG, FL; Owner: COX RADIO, INC.)

- WUSF (89.7 FM; TAMPA, FL; Owner: UNIVERSITY OF S. FLORIDA)

- WSJT (94.1 FM; LAKELAND, FL; Owner: INFINITY RADIO OPERATIONS INC.)

- WBVM (90.5 FM; TAMPA, FL; Owner: BISHOP OF THE DIOCESE/ST. PETERSBURG)

- WSUN-FM (97.1 FM; HOLIDAY, FL; Owner: COX RADIO, INC)

- WGUL-FM (106.3 FM; BEVERLY HILLS, FL; Owner: WGUL-FM, INC.)

- WXXL (106.7 FM; TAVARES, FL; Owner: AMFM RADIO LICENSES, L.L.C.)

- WPCV (97.5 FM; WINTER HAVEN, FL; Owner: HALL COMMUNICATIONS, INC.)

- WKES (91.1 FM; LAKELAND, FL; Owner: THE MOODY BIBLE INSTITUTE OF CHICAGO)

- WYFE (88.9 FM; TARPON SPRINGS, FL; Owner: BIBLE BROADCASTING NETWORK, INC.)

TV broadcast stations around Wesley Chapel South:

- WEDU (Channel 3; TAMPA, FL; Owner: FLORIDA WEST COAST PUBLIC BROADCASTING, INC.)

- WTSP (Channel 10; ST. PETERSBURG, FL; Owner: PACIFIC AND SOUTHERN COMPANY, INC.)

- WFLA-TV (Channel 8; TAMPA, FL; Owner: MEDIA GENERAL COMMUNICATIONS, INC.)

- WFTS-TV (Channel 28; TAMPA, FL; Owner: TAMPA BAY TELEVISION, INC.)

- WUSF-TV (Channel 16; TAMPA, FL; Owner: UNIVERSITY OF SOUTH FLORIDA)

- WTOG (Channel 44; ST. PETERSBURG, FL; Owner: VIACOM INTERNATIONAL INC.)

- WXPX (Channel 66; BRADENTON, FL; Owner: PAXSON COMMUNICATION LICENSE COMPANY, LLC)

- WTTA (Channel 38; ST. PETERSBURG, FL; Owner: BAY TELEVISION, INC.)

- WFTT (Channel 50; TAMPA, FL; Owner: TELEFUTURA TAMPA LLC)

- WTVT (Channel 13; TAMPA, FL; Owner: TVT LICENSE, INC.)

- WCLF (Channel 22; CLEARWATER, FL; Owner: CHRISTIAN TELEVISION CORPORATION, INC.)

- WTAM-LP (Channel 6; TAMPA, FL; Owner: U.S. INTERACTIVE, L.L.C.)

- WMOR-TV (Channel 32; LAKELAND, FL; Owner: WMOR-TV COMPANY)

- WRMD-LP (Channel 57; TAMPA, FL; Owner: ZGS TELEVISION OF TAMPA, INC.)

- W36CO (Channel 36; ST. PETERSBURG, FL; Owner: TRINITY BROADCASTING NETWORK)

- WVEA-LP (Channel 61; TAMPA, FL; Owner: ENTRAVISION HOLDINGS, LLC)

- W56EB (Channel 56; TAMPA, FL; Owner: TRINITY BROADCASTING NETWORK)

- W48AY (Channel 48; OLDSMAR, FL; Owner: AMKA BROADCAST NETWORK, INC.)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 2 partial tracts) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 72 | $163,752 | 36 | $156,904 | 74 | $175,688 | 1 | $41,680 | 11 | $128,725 | 5 | $79,266 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 4 | $184,752 | 4 | $158,420 | 13 | $169,185 | 0 | $0 | 2 | $106,625 | 1 | $17,950 |

| APPLICATIONS DENIED | 19 | $149,736 | 9 | $145,706 | 48 | $182,066 | 5 | $101,698 | 6 | $159,890 | 3 | $84,537 |

| APPLICATIONS WITHDRAWN | 9 | $136,046 | 8 | $127,772 | 24 | $181,948 | 1 | $91,080 | 4 | $141,992 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 3 | $151,137 | 2 | $157,145 | 6 | $164,928 | 0 | $0 | 0 | $0 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 0321.01 , 0321.02

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 2 partial tracts) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 7 | $185,249 | 1 | $176,180 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 2 | $181,935 | 1 | $154,160 |

| APPLICATIONS DENIED | 2 | $174,020 | 1 | $132,500 |

| APPLICATIONS WITHDRAWN | 1 | $135,830 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 0321.01 , 0321.02

- 95.8%Electricity

- 1.5%Fuel oil, kerosene, etc.

- 1.4%Utility gas

- 1.4%Bottled, tank, or LP gas

- 82.7%Electricity

- 13.3%Bottled, tank, or LP gas

- 4.0%No fuel used

Wesley Chapel South compared to Florida state average:

- Median household income above state average.

- Unemployed percentage significantly below state average.

- Black race population percentage significantly below state average.

- Hispanic race population percentage significantly below state average.

- Foreign-born population percentage significantly below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

Wesley Chapel South on our top lists:

- #42 on the list of "Top 101 cities with the most residents born in Other Central America (population 500+)"

- #12 on the list of "Top 101 counties with the largest decrease in the number of deaths per 1000 residents 2000-2006 to 2007-2013 (pop. 50,000+)"

- #24 on the list of "Top 101 counties with the highest ground withdrawal of fresh water for public supply"

- #72 on the list of "Top 101 counties with the highest number of deaths per 1000 residents 2007-2013 (pop. 50,000+)"

- #82 on the list of "Top 101 counties with the highest total withdrawal of fresh water for public supply"

- #91 on the list of "Top 101 counties with the lowest number of births per 1000 residents 2007-2013"