California

Taxation

In the mid-1970s, Californians were paying more in taxes than residents of any other state. On a per capita basis, California ranked 3rd among the 50 states in state and local taxation in 1977, but this heavy tax burden was reduced by the passage in 1978 of Proposition 13. By 1982, California ranked 5th in per capita state and local taxes. The state ranked 12th in federal tax burden per capita in 1990. In 2003, California ranked 8th, with combined state and local taxes amounting to 10.6% of income.

The state's progressive income tax rates range from 0% to 9.3% on net taxable income. The state corporate income tax on general corporations is 8.84% of net income from California sources; a minimum franchise tax of $800 is applied to all firms except banks and financial corporations, whose net income is taxed at rates 2% above the general corporation rate.

The state sales tax is 6% on retail sales (excepting food for home consumption, prescription medicines, gas, water, electricity, and certain other exempt products); 5.0% represented the basic state rate, and .50% was designated for localities. Localities derive most of their revenue from property taxes, which were limited in 1978 by Proposition 13 to 1% of market value, with annual increases in the tax not to exceed 2%. Other state taxes include inheritance and gift taxes, insurance tax, motor vehicle fees, cigarette tax, and an alcoholic beverage tax. In 2002, state taxes collected totaled $77.75 billion, of which 42.5% was from income taxes, 30.6% from the general sales tax, 30.6% from selective sales taxes, 7.3% from license fees, 6.85% from corporate taxes, 2.5% from state property taxes, and 1.2% from inheritance and gift taxes.

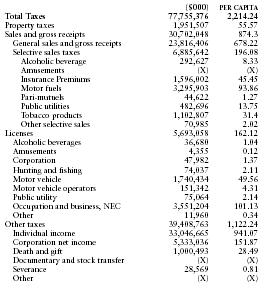

The following table from the US Census Bureau provides a summary of taxes collected by the state in 2002.

| ($000) | PER CAPITA | |

| Total Taxes | 77,755,376 | 2,214.24 |

| Property taxes | 1,951,507 | 55.57 |

| Sales and gross receipts | 30,702,048 | 874.3 |

| General sales and gross receipts | 23,816,406 | 678.22 |

| Selective sales taxes | 6,885,642 | 196.08 |

| Alcoholic beverage | 292,627 | 8.33 |

| Amusements | (X) | (X) |

| Insurance Premiums | 1,596,002 | 45.45 |

| Motor fuels | 3,295,903 | 93.86 |

| Pari-mutuels | 44,622 | 1.27 |

| Public utilities | 482,696 | 13.75 |

| Tobacco products | 1,102,807 | 31.4 |

| Other selective sales | 70,985 | 2.02 |

| Licenses | 5,693,058 | 162.12 |

| Alcoholic beverages | 36,680 | 1.04 |

| Amusements | 4,355 | 0.12 |

| Corporation | 47,982 | 1.37 |

| Hunting and fishing | 74,037 | 2.11 |

| Motor vehicle | 1,740,434 | 49.56 |

| Motor vehicle operators | 151,342 | 4.31 |

| Public utility | 75,064 | 2.14 |

| Occupation and business, NEC | 3,551,204 | 101.13 |

| Other | 11,960 | 0.34 |

| Other taxes | 39,408,763 | 1,122.24 |

| Individual income | 33,046,665 | 941.07 |

| Corporation net income | 5,333,036 | 151.87 |

| Death and gift | 1,000,493 | 28.49 |

| Documentary and stock transfer | (X) | (X) |

| Severance | 28,569 | 0.81 |

| Other | (X) | (X) |