Maryland

Taxation

In 2002, Maryland reduced its top individual income tax rate from 4.85% to 4.75%. The lowest rate on the four-bracket schedule is 2%, applicable up t to $1000 of taxable income, and the highest rate applies to taxable income above $3,000. The current federal definition of adjusted gross income can be used as the tax base. The corporate income tax rate is 7%. The state general sales and use tax is 5% with exemptions for food and other basic items, and no local sales taxes permitted. The state also imposes a full array of excise taxes covering motor fuels, tobacco products, insurance premiums, public utilities, alcoholic beverages, amusements, pari-mutuels, and other selected items. Maryland has enacted its own estate tax (maximum rate 10%) so it is unaffected by the scheduled phase-out of the federal estate tax credit by 2007. Maryland's 10% inheritance tax-exempts close (Class A) relatives. Death and gift taxes accounted for 0.7% of state tax collected in 2002. Other state taxes include property taxes including a motor vehicle use tax, various license and franchise fees, and stamp taxes. All county and some local governments levy property taxes. The counties also tax personal income at rates ranging from 30% to 60% of those imposed by the state; the city of Baltimore taxes personal income at rates equal to 50% of the state levy. Local income tax rates have a cap of 3.1%. In 2002, localities collected 43.6% of total state and local taxes.

The state collected $10.821 billion in taxes in 2002, of which 43.5% came from individual income taxes, 24.9% from the general sales tax, 18.5% from selective sales taxes, 4% from license fees, and 3.3% from corporate income taxes. In 2003, Maryland ranked 27th among the states in terms of state and local tax burden, which amounted to about 9.5% of income.

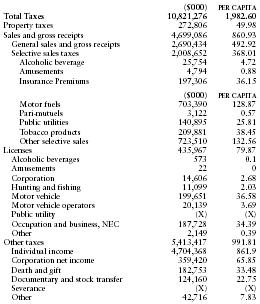

The following table from the US Census Bureau provides a summary of taxes collected by the state in 2002.

| ($000) | PER CAPITA | |

| Total Taxes | 10,821,276 | 1,982.60 |

| Property taxes | 272,806 | 49.98 |

| Sales and gross receipts | 4,699,086 | 860.93 |

| General sales and gross receipts | 2,690,434 | 492.92 |

| Selective sales taxes | 2,008,652 | 368.01 |

| Alcoholic beverage | 25,754 | 4.72 |

| Amusements | 4,794 | 0.88 |

| Insurance Premiums | 197,306 | 36.15 |

| ($000) | PER CAPITA | |

| Motor fuels | 703,390 | 128.87 |

| Pari-mutuels | 3,122 | 0.57 |

| Public utilities | 140,895 | 25.81 |

| Tobacco products | 209,881 | 38.45 |

| Other selective sales | 723,510 | 132.56 |

| Licenses | 435,967 | 79.87 |

| Alcoholic beverages | 573 | 0.1 |

| Amusements | 22 | 0 |

| Corporation | 14,606 | 2.68 |

| Hunting and fishing | 11,099 | 2.03 |

| Motor vehicle | 199,651 | 36.58 |

| Motor vehicle operators | 20,139 | 3.69 |

| Public utility | (X) | (X) |

| Occupation and business, NEC | 187,728 | 34.39 |

| Other | 2,149 | 0.39 |

| Other taxes | 5,413,417 | 991.81 |

| Individual income | 4,704,368 | 861.9 |

| Corporation net income | 359,420 | 65.85 |

| Death and gift | 182,753 | 33.48 |

| Documentary and stock transfer | 124,160 | 22.75 |

| Severance | (X) | (X) |

| Other | 42,716 | 7.83 |