Brentwood, Tennessee

Brentwood: Radnor Lake

Brentwood: House in Woodward Hills

Brentwood: House in Woodward Hills

Brentwood: sunrise in winter

Brentwood: House in Woodward Hills

Brentwood: Patio view of garden by Mary Higgins of Lavender Blue Garden Design

Brentwood: Pretty kitchen garden in Foxboro designed by Mary Higgins of Lavender Blue Garden Design

Brentwood: Winterberry holly in winter

Brentwood: Brentwood police

Brentwood: Herb Garden in Brentwood TN

Brentwood: House in Woodward Hills

- see

16

more - add

your

Submit your own pictures of this city and show them to the world

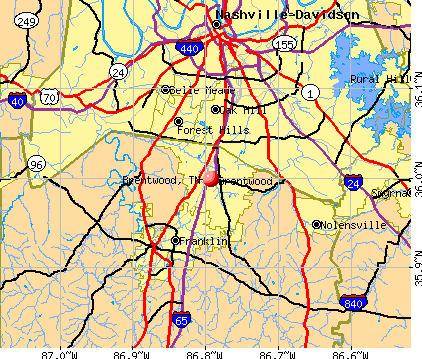

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +92.5%

| Males: 23,042 | |

| Females: 22,094 |

| Median resident age: | 44.1 years |

| Tennessee median age: | 39.2 years |

Zip codes: 37027, 37067, 37069.

Brentwood Zip Code Map| Brentwood: | $186,380 |

| TN: | $65,254 |

Estimated per capita income in 2022: $86,989 (it was $47,378 in 2000)

Brentwood city income, earnings, and wages data

Estimated median house or condo value in 2022: over $1,000,000 (it was $312,500 in 2000)

| Brentwood: | over $1,000,000 |

| TN: | $284,800 |

Mean prices in 2022: all housing units: $723,453; detached houses: $756,843; townhouses or other attached units: $417,572; in 2-unit structures: $385,506; in 3-to-4-unit structures: $292,414; in 5-or-more-unit structures: $348,487; mobile homes: $181,299

Median gross rent in 2022: $2,548.

(2.3% for White Non-Hispanic residents, 8.5% for Black residents, 1.2% for Hispanic or Latino residents, 14.1% for other race residents, 0.3% for two or more races residents)

Detailed information about poverty and poor residents in Brentwood, TN

- 38,12981.2%White alone

- 3,9298.4%Asian alone

- 1,7833.8%Hispanic

- 1,5383.3%Black alone

- 1,4063.0%Two or more races

- 1950.4%Other race alone

Races in Brentwood detailed stats: ancestries, foreign born residents, place of birth

According to our research of Tennessee and other state lists, there were 13 registered sex offenders living in Brentwood, Tennessee as of April 17, 2024.

The ratio of all residents to sex offenders in Brentwood is 3,194 to 1.

The ratio of registered sex offenders to all residents in this city is much lower than the state average.

Type |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Murders (per 100,000) | 0 (0.0) | 2 (5.4) | 0 (0.0) | 0 (0.0) | 1 (2.5) | 1 (2.5) | 0 (0.0) | 1 (2.3) | 0 (0.0) | 4 (9.2) | 0 (0.0) | 0 (0.0) | 1 (2.3) | 2 (4.4) |

| Rapes (per 100,000) | 0 (0.0) | 2 (5.4) | 1 (2.7) | 1 (2.6) | 3 (7.6) | 4 (9.8) | 1 (2.4) | 2 (4.7) | 10 (23.0) | 2 (4.6) | 13 (30.1) | 3 (6.9) | 4 (9.2) | 10 (21.9) |

| Robberies (per 100,000) | 5 (13.3) | 8 (21.6) | 2 (5.3) | 3 (7.8) | 4 (10.1) | 5 (12.3) | 4 (9.5) | 5 (11.7) | 5 (11.5) | 9 (20.7) | 13 (30.1) | 3 (6.9) | 5 (11.5) | 2 (4.4) |

| Assaults (per 100,000) | 16 (42.7) | 17 (45.9) | 15 (40.1) | 13 (33.8) | 9 (22.7) | 9 (22.1) | 12 (28.6) | 17 (39.8) | 16 (36.8) | 18 (41.4) | 13 (30.1) | 13 (29.9) | 22 (50.6) | 17 (37.3) |

| Burglaries (per 100,000) | 80 (213.5) | 85 (229.4) | 51 (136.4) | 49 (127.4) | 65 (164.0) | 71 (174.2) | 62 (147.7) | 53 (124.0) | 56 (128.8) | 37 (85.0) | 38 (87.9) | 66 (151.9) | 78 (179.4) | 43 (94.3) |

| Thefts (per 100,000) | 400 (1,067) | 341 (920.1) | 314 (839.7) | 262 (681.2) | 371 (936.0) | 280 (687.0) | 302 (719.3) | 328 (767.4) | 336 (773.0) | 354 (813.7) | 315 (728.9) | 252 (579.9) | 284 (653.0) | 320 (702.0) |

| Auto thefts (per 100,000) | 12 (32.0) | 14 (37.8) | 9 (24.1) | 3 (7.8) | 11 (27.8) | 6 (14.7) | 6 (14.3) | 19 (44.5) | 17 (39.1) | 24 (55.2) | 17 (39.3) | 17 (39.1) | 24 (55.2) | 21 (46.1) |

| Arson (per 100,000) | 4 (10.7) | 2 (5.4) | 1 (2.7) | 1 (2.6) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 2 (4.6) | 0 (0.0) | 1 (2.3) | 1 (2.3) | 1 (2.3) | 0 (0.0) |

| City-Data.com crime index | 72.7 | 86.6 | 56.8 | 48.0 | 69.8 | 61.7 | 50.7 | 62.8 | 72.3 | 79.5 | 77.6 | 50.5 | 68.6 | 73.5 |

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Crime rate in Brentwood detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 84 (67 officers - 59 male; 8 female).

| Officers per 1,000 residents here: | 1.54 |

| Tennessee average: | 2.57 |

Latest news from Brentwood, TN collected exclusively by city-data.com from local newspapers, TV, and radio stations

Brentwood, TN City Guides:

Ancestries: English (19.4%), American (13.3%), German (7.1%), European (6.4%), Irish (5.2%), Italian (3.2%).

Current Local Time: CST time zone

Incorporated in 1969

Elevation: 725 feet

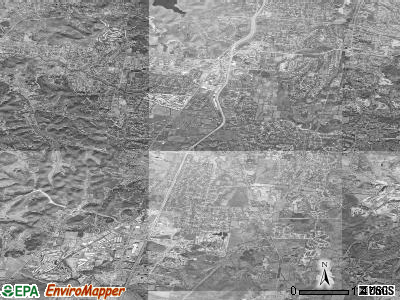

Land area: 34.6 square miles.

Population density: 1,303 people per square mile (low).

4,231 residents are foreign born (5.3% Asia, 1.2% Latin America, 0.9% Europe).

| This city: | 9.0% |

| Tennessee: | 5.4% |

Median real estate property taxes paid for housing units with mortgages in 2022: $4,236 (0.4%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $4,114 (0.4%)

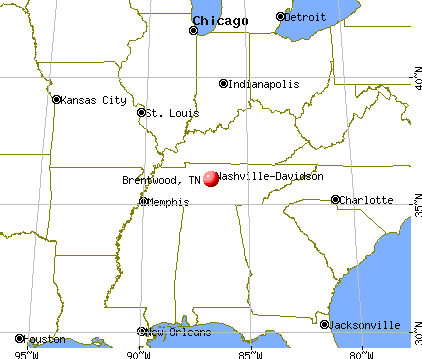

Nearest city with pop. 50,000+: Nashville-Davidson, TN (11.0 miles

, pop. 545,524).

Nearest city with pop. 1,000,000+: Chicago, IL (406.9 miles

, pop. 2,896,016).

Nearest cities:

Latitude: 36.00 N, Longitude: 86.79 W

Daytime population change due to commuting: +15,812 (+33.7%)

Workers who live and work in this city: 10,151 (46.0%)

Area code commonly used in this area: 615

Brentwood, Tennessee accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 83 buildings, average cost: $1,484,300

- 2021: 147 buildings, average cost: $1,135,400

- 2020: 141 buildings, average cost: $681,900

- 2019: 109 buildings, average cost: $539,000

- 2018: 139 buildings, average cost: $498,300

- 2017: 185 buildings, average cost: $436,100

- 2016: 175 buildings, average cost: $395,800

- 2015: 240 buildings, average cost: $397,200

- 2014: 251 buildings, average cost: $392,300

- 2013: 225 buildings, average cost: $380,300

- 2012: 253 buildings, average cost: $385,700

- 2011: 232 buildings, average cost: $374,200

- 2010: 137 buildings, average cost: $368,400

- 2009: 65 buildings, average cost: $403,900

- 2008: 104 buildings, average cost: $437,800

- 2007: 294 buildings, average cost: $328,500

- 2006: 502 buildings, average cost: $316,300

- 2005: 458 buildings, average cost: $275,300

- 2004: 633 buildings, average cost: $220,300

- 2003: 605 buildings, average cost: $207,500

- 2002: 458 buildings, average cost: $209,000

- 2001: 257 buildings, average cost: $215,100

- 2000: 171 buildings, average cost: $237,700

- 1999: 198 buildings, average cost: $228,800

- 1998: 212 buildings, average cost: $229,000

- 1997: 186 buildings, average cost: $222,800

| Here: | 2.4% |

| Tennessee: | 3.0% |

- Health care (11.9%)

- Finance & insurance (10.7%)

- Educational services (9.7%)

- Professional, scientific, technical services (9.4%)

- Arts, entertainment, recreation (4.2%)

- Construction (4.1%)

- Publishing, motion picture & sound recording industries (3.3%)

- Finance & insurance (11.2%)

- Professional, scientific, technical services (10.9%)

- Health care (9.6%)

- Construction (5.8%)

- Arts, entertainment, recreation (5.0%)

- Educational services (3.9%)

- Publishing, motion picture & sound recording industries (3.8%)

- Educational services (18.1%)

- Health care (15.3%)

- Finance & insurance (10.0%)

- Professional, scientific, technical services (7.2%)

- Accommodation & food services (4.7%)

- Real estate & rental & leasing (3.9%)

- Social assistance (3.4%)

- Top executives (8.8%)

- Other management occupations, except farmers and farm managers (6.7%)

- Sales representatives, services, wholesale and manufacturing (6.3%)

- Other sales and related occupations, including supervisors (5.3%)

- Accountants and auditors (4.3%)

- Preschool, kindergarten, elementary, and middle school teachers (4.1%)

- Retail sales workers, except cashiers (3.7%)

- Top executives (12.8%)

- Sales representatives, services, wholesale and manufacturing (8.4%)

- Other management occupations, except farmers and farm managers (8.3%)

- Other sales and related occupations, including supervisors (5.4%)

- Accountants and auditors (5.3%)

- Physicians and surgeons (4.2%)

- Advertising, marketing, promotions, public relations, and sales managers (4.2%)

- Preschool, kindergarten, elementary, and middle school teachers (9.7%)

- Registered nurses (6.6%)

- Secretaries and administrative assistants (5.5%)

- Other sales and related occupations, including supervisors (5.1%)

- Other office and administrative support workers, including supervisors (4.9%)

- Other management occupations, except farmers and farm managers (4.3%)

- Retail sales workers, except cashiers (4.3%)

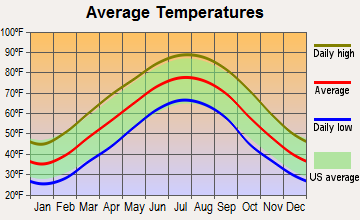

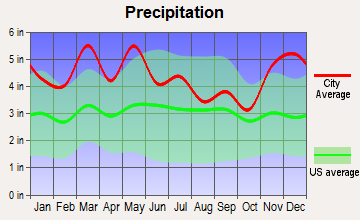

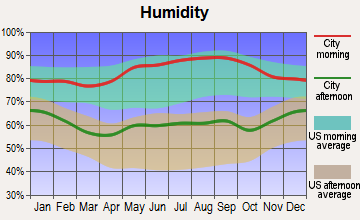

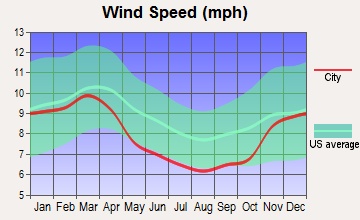

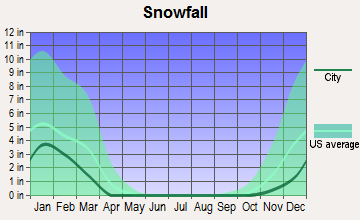

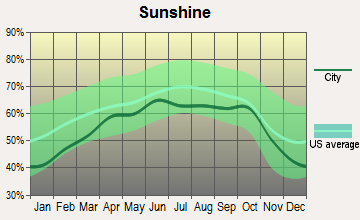

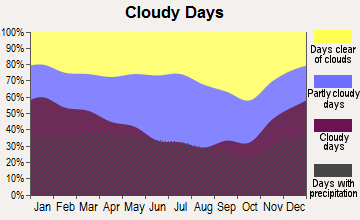

Average climate in Brentwood, Tennessee

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2022 was 78.0. This is about average.

| City: | 78.0 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.390. This is significantly worse than average. Closest monitor was 10.2 miles away from the city center.

| City: | 0.390 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 13.0. This is significantly worse than average. Closest monitor was 5.6 miles away from the city center.

| City: | 13.0 |

| U.S.: | 5.1 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.553. This is significantly better than average. Closest monitor was 5.6 miles away from the city center.

| City: | 0.553 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 28.9. This is about average. Closest monitor was 12.7 miles away from the city center.

| City: | 28.9 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 20.0. This is about average. Closest monitor was 10.3 miles away from the city center.

| City: | 20.0 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 9.23. This is about average. Closest monitor was 7.8 miles away from the city center.

| City: | 9.23 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2004 was 0.00573. This is significantly better than average. Closest monitor was 5.6 miles away from the city center.

| City: | 0.00573 |

| U.S.: | 0.00931 |

Tornado activity:

Brentwood-area historical tornado activity is slightly above Tennessee state average. It is 73% greater than the overall U.S. average.

On 12/24/1988, a category F4 (max. wind speeds 207-260 mph) tornado 2.3 miles away from the Brentwood city center killed one person and injured 7 people and caused between $5,000,000 and $50,000,000 in damages.

On 4/16/1998, a category F5 (max. wind speeds 261-318 mph) tornado 31.6 miles away from the city center killed 3 people and injured 36 people and caused $13 million in damages.

Earthquake activity:

Brentwood-area historical earthquake activity is significantly above Tennessee state average. It is 197% greater than the overall U.S. average.On 4/18/2008 at 09:36:59, a magnitude 5.4 (5.1 MB, 4.8 MS, 5.4 MW, 5.2 MW, Class: Moderate, Intensity: VI - VII) earthquake occurred 180.1 miles away from Brentwood center

On 4/18/2008 at 09:36:59, a magnitude 5.2 (5.2 MW, Depth: 8.9 mi) earthquake occurred 180.1 miles away from Brentwood center

On 4/29/2003 at 08:59:39, a magnitude 4.9 (4.4 MB, 4.6 MW, 4.9 LG, Class: Light, Intensity: IV - V) earthquake occurred 123.1 miles away from the city center

On 6/18/2002 at 17:37:15, a magnitude 5.0 (4.3 MB, 4.6 MW, 5.0 LG) earthquake occurred 148.0 miles away from the city center

On 9/26/1990 at 13:18:51, a magnitude 5.0 (4.7 MB, 4.8 LG, 5.0 LG, Depth: 7.7 mi) earthquake occurred 172.4 miles away from the city center

On 5/4/1991 at 01:18:54, a magnitude 5.0 (4.4 MB, 4.6 LG, 5.0 LG, Depth: 3.1 mi) earthquake occurred 173.4 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Williamson County (11) is smaller than the US average (15).Major Disasters (Presidential) Declared: 9

Emergencies Declared: 1

Causes of natural disasters: Floods: 7, Storms: 7, Tornadoes: 7, Winds: 2, Flash Flood: 1, Hurricane: 1, Ice Storm: 1, Winter Storm: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: LIFEPOINT HOSPITALS INC (SERVICES-GENERAL MEDICAL & SURGICAL HOSPITALS, NEC), PROVINCE HEALTHCARE CO (SERVICES-GENERAL MEDICAL & SURGICAL HOSPITALS, NEC), AMERICA SERVICE GROUP INC /DE (SERVICES-MISC HEALTH & ALLIED SERVICES, NEC), PRIVATE BUSINESS INC (SERVICES-BUSINESS SERVICES, NEC), AMERICAN HOMEPATIENT INC (SERVICES-HOME HEALTH CARE SERVICES), AMERICAN COLOR GRAPHICS INC (COMMERCIAL PRINTING), AMERICAN RETIREMENT CORP (SERVICES-SKILLED NURSING CARE FACILITIES), DOANE PET CARE CO (GRAIN MILL PRODUCTS) and 2 other public companies.

Hospitals and medical centers in Brentwood:

Other hospitals and medical centers near Brentwood:

- HOSPICE OF TENNESSEE INC FRANKLIN (Hospital, about 4 miles away; FRANKLIN, TN)

- NHC PLACE AT COOL SPRINGS (Nursing Home, about 5 miles away; FRANKLIN, TN)

- BETHANY HEALTH CARE CENTER (Nursing Home, about 6 miles away; NASHVILLE, TN)

- RCG FRANKLIN (Dialysis Facility, about 6 miles away; FRANKLIN, TN)

- WILLIAMSON COUNTY DIALYSIS (Dialysis Facility, about 7 miles away; FRANKLIN, TN)

- GENTIVA HEALTH SVS NASHVILLE (Home Health Center, about 7 miles away; NASHVILLE, TN)

- INTREPID USA HEALTHCARE SERVICES (Home Health Center, about 7 miles away; NASHVILLE, TN)

College/University in Brentwood:

Colleges/universities with over 2000 students nearest to Brentwood:

- Lipscomb University (about 8 miles; Nashville, TN; Full-time enrollment: 3,827)

- Belmont University (about 10 miles; Nashville, TN; FT enrollment: 5,795)

- Vanderbilt University (about 11 miles; Nashville, TN; FT enrollment: 10,518)

- Nashville State Community College (about 11 miles; Nashville, TN; FT enrollment: 6,436)

- Trevecca Nazarene University (about 11 miles; Nashville, TN; FT enrollment: 2,223)

- Tennessee State University (about 12 miles; Nashville, TN; FT enrollment: 7,341)

- Middle Tennessee State University (about 27 miles; Murfreesboro, TN; FT enrollment: 21,628)

Public high schools in Brentwood:

- RAVENWOOD HIGH SCHOOL (Students: 1,504, Location: 1724 WILSON PK, Grades: 9-12)

- BRENTWOOD HIGH SCHOOL (Students: 1,417, Location: 5304 MURRAY LA, Grades: 9-12)

Private high schools in Brentwood:

Biggest public elementary/middle schools in Brentwood:

- BRENTWOOD MIDDLE SCHOOL (Students: 1,081, Location: 5324 MURRAY LA, Grades: 6-8)

- WOODLAND MIDDLE SCHOOL (Students: 1,033, Location: 1500 VOLUNTEER PKWY, Grades: 6-8)

- GRASSLAND ELEMENTARY (Students: 712, Location: 6803 MANLEY LA, Grades: KG-5)

- KENROSE ELEMENTARY (Students: 676, Location: 1702 RAINTREE PW, Grades: PK-5)

- SUNSET ELEMENTARY SCHOOL (Students: 647, Location: 100 SUNSET TR, Grades: PK-5)

- CROCKETT ELEMENTARY (Students: 634, Location: 9019 CROCKETT RD, Grades: KG-5)

- EDMONDSON ELEMENTARY (Students: 631, Location: 851 EDMONDSON PK, Grades: KG-5)

- SCALES ELEMENTARY (Students: 604, Location: 6430 MURRAY LA, Grades: KG-5)

- LIPSCOMB ELEMENTARY (Students: 601, Location: 8011 CONCORD RD, Grades: PK-5)

- GRANBERY ELEMENTARY (Students: 553, Location: 5501 HILL RD, Grades: KG-4)

Private elementary/middle school in Brentwood:

User-submitted facts and corrections:

- Public High Schools in Brentwood (in addition to Brentwood High): Ravenwood High School 1724 Wilson Pike, grades 09-12, 1,300 students

- Private Schools: MONTESSORI ACADEMY (Students: 301; Location: 6021 CLOVERLAND DR; Grades: PK - 8, http://www.montessoriacad.org)

- Under hospitals near Brentwood: Williamson Medical Center is about 10 miles from Brentwood town center.

Points of interest:

Notable locations in Brentwood: Oak Hall (A), Crockett Springs National Golf and Country Club (B), Overlook Business Park (C), Brentwood Country Club (D), Brentwood Business Center (E), Brentwood Fire Department (F), Brentwood Fire Department Station 2 (G), Brentwood Fire Department Station 3 (H), Brentwood Fire Department Station 4 (I), Tennessee Baptist Orphans Home (J). Display/hide their locations on the map

Shopping Centers: Liberty Place Mall (1), Maryland Farms Shopping Center (2), Peachtree Village Shopping Center (3), Liberty Place Shopping Center (4), Brentwood Place Shopping Center (5), Brentwood House Shopping Center (6), Brentwood Mall Shopping Center (7), Cool Springs Pointe Shopping Center (8). Display/hide their locations on the map

Main business address in Brentwood include: LIFEPOINT HOSPITALS INC (A), PROVINCE HEALTHCARE CO (B), AMERICA SERVICE GROUP INC /DE (C), PRIVATE BUSINESS INC (D), AMERICAN COLOR GRAPHICS INC (E), AMERICAN RETIREMENT CORP (F), DOANE PET CARE CO (G). Display/hide their locations on the map

Churches in Brentwood include: Liberty Church (A), Johnson Church (B), Mount Lebanon Missionary Baptist Church (C), Holt Chapel (D), Owens Chapel (E), Concord Road Church (F). Display/hide their locations on the map

Cemeteries: Brooks Cemetery (1), Hamor Cemetery (2), Primm Cemetery (3), Green Hill Cemetery (4), Crockett Cemetery (5), Johnson Chapel Cemetery (6), Owen Cemetery (7). Display/hide their locations on the map

Reservoirs: Willow Lake (A), Dyer Lake (B), Crockett Springs Lake (C). Display/hide their locations on the map

Streams, rivers, and creeks: East Seward Hills Branch (A), North Sliders Branch (B), West Seward Hills Branch (C), Splitlog Creek (D), Little Harpeth West Branch (E). Display/hide their locations on the map

Tourist attraction: Befera- Inc. (Arcades & Amusements; 8110 Moores Lane) (1). Display/hide its approximate location on the map

Hotels: Homewood Suites Nashville/Brentwood (5107 Peter Taylor Park) (1), Hampton Inn Nashville-Brentwood-I-65s (5630 Franklin Pike Cir) (2), Hilton Suites Brentwood (9000 Overlook Boulevard) (3), Amerisuites Nashville Brentwood (202 Summit View Dr) (4), Hilton (9000 Overlook Boulevard) (5), English Willa Dean (6304 Murray Lane) (6), Baymont Nashville Brentwood (111 Penn Warren Drive) (7), Baymont Inn & Suites (111 Penn Warren Drive) (8), Hospitality America (9005 Overlook Boulevard) (9). Display/hide their approximate locations on the map

Birthplace of: John Markham - 2005 NFL player (Pittsburgh Steelers, born: Apr 27, 1979), Thelma Harper (politician) - Politician, David Wallace (catcher) - Baseball player, J.T. Wash - College football player (Tennessee Volunteers).

Drinking water stations with addresses in Brentwood and their reported violations in the past:

BRENTWOOD WATER DEPT. (Population served: 25,462, Purch surface water):Past health violations:TRACTOR SUPPLY COMPANY - FREMONT (Serves OH, Population served: 340, Groundwater):

- MCL, Monthly (TCR) - In FEB-2005, Contaminant: Coliform. Follow-up actions: St Compliance achieved (MAR-01-2005), St Public Notif requested (MAR-31-2005), St Violation/Reminder Notice (MAR-31-2005), St Public Notif received (MAY-11-2005)

Past health violations:TSC STORE 240 PWS (Serves OH, Population served: 203, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - Between JUL-2005 and SEP-2005, Contaminant: Coliform. Follow-up actions: St Public Notif requested (AUG-02-2005), St Violation/Reminder Notice (AUG-02-2005), St Compliance achieved (APR-19-2007)

- 4 routine major monitoring violations

- One regular monitoring violation

Past health violations:TRACTOR SUPPLY CO (Serves NJ, Population served: 157, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - Between APR-2007 and JUN-2007, Contaminant: Coliform. Follow-up actions: St Public Notif requested (JUL-12-2007), St Violation/Reminder Notice (JUL-12-2007), St Public Notif received (JUL-23-2007), St Compliance achieved (JAN-04-2008)

- 2 routine major monitoring violations

- One minor monitoring violation

- One regular monitoring violation

Past health violations:TRACTOR SUPPLY COLUMBUS (Serves TX, Population served: 137, Groundwater):Past monitoring violations:

- MCL, Acute (TCR) - In SEP-2013, Contaminant: Coliform. Follow-up actions: St Public Notif requested (OCT-07-2013), St Formal NOV issued (OCT-07-2013), St Compliance achieved (NOV-25-2013), St Public Notif received (NOV-26-2013)

- MCL, Monthly (TCR) - In AUG-2013, Contaminant: Coliform. Follow-up actions: St Public Notif requested (SEP-19-2013), St Formal NOV issued (SEP-19-2013), St Compliance achieved (NOV-25-2013)

- MCL, Monthly (TCR) - In MAY-2012, Contaminant: Coliform. Follow-up actions: St Compliance achieved (JUN-19-2012)

- MCL, Acute (TCR) - In MAY-2012, Contaminant: Coliform. Follow-up actions: St Public Notif requested (MAY-29-2012), St Formal NOV issued (MAY-29-2012), St Public Notif received (MAY-30-2012), St Compliance achieved (JUN-19-2012)

- Monitoring, Source Water (GWR) - Between OCT-04-2013 and OCT-31-2013, Contaminant: E. COLI. Follow-up actions: St Public Notif requested (OCT-18-2013), St Formal NOV issued (OCT-18-2013), St Compliance achieved (NOV-25-2013), St Public Notif received (NOV-26-2013)

- Monitoring, Repeat Major (TCR) - In SEP-2013, Contaminant: Coliform (TCR). Follow-up actions: St Public Notif requested (OCT-07-2013), St Formal NOV issued (OCT-07-2013), St Compliance achieved (NOV-25-2013), St Public Notif received (NOV-26-2013)

- One routine major monitoring violation

- One regular monitoring violation

Past monitoring violations:LHOIST NORTH AMERICA (Address: SUITE 2-200 , Population served: 51, Groundwater):

- One routine major monitoring violation

Past health violations:TRACTOR SUPPLY COMPANY ST ALBANS (Address: 200 POWELL PL , Serves VT, Population served: 35, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - In OCT-2012, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (DEC-07-2012), St Public Notif requested (DEC-07-2012)

- MCL, Acute (TCR) - In MAY-2012, Contaminant: Coliform. Follow-up actions: St Public Notif received (JUN-01-2012), St Public Notif requested (JUN-29-2012), St Violation/Reminder Notice (JUN-29-2012), St Compliance achieved (JUN-30-2012)

- MCL, Monthly (TCR) - In DEC-2008, Contaminant: Coliform. Follow-up actions: St Public Notif requested (FEB-09-2009), St Violation/Reminder Notice (FEB-09-2009), St Public Notif received (FEB-09-2009), St Compliance achieved (MAR-31-2009)

- 2 minor monitoring violations

Past monitoring violations:

- 4 routine major monitoring violations

Drinking water stations with addresses in Brentwood that have no violations reported:

- TRACTOR SUPPLY COMPANY (Serves FL, Population served: 25, Primary Water Source Type: Groundwater)

| This city: | 3.0 people |

| Tennessee: | 2.5 people |

| This city: | 87.3% |

| Whole state: | 67.3% |

| This city: | 1.5% |

| Whole state: | 5.8% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.2% of all households

- Gay men: 0.3% of all households

People in group quarters in Brentwood in 2010:

- 275 people in nursing facilities/skilled-nursing facilities

- 37 people in group homes for juveniles (non-correctional)

- 22 people in workers' group living quarters and job corps centers

- 15 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

People in group quarters in Brentwood in 2000:

- 120 people in other group homes

- 72 people in homes for abused, dependent, and neglected children

- 45 people in other noninstitutional group quarters

- 9 people in other nonhousehold living situations

Banks with most branches in Brentwood (2011 data):

- Fifth Third Bank: Mill Creek Branch, Nippers Corner Branch, Brentwood Branch, Cool Spring Branch. Info updated 2009/10/05: Bank assets: $114,540.4 mil, Deposits: $89,689.1 mil, headquarters in Cincinnati, OH, positive income, Commercial Lending Specialization, 1378 total offices, Holding Company: Fifth Third Bancorp

- U.S. Bank National Association: Maryland Farm Publix Branch, Brentwood Branch, Concord Road Publix Branch, Cool Springs Festival Publix Branch. Info updated 2012/01/30: Bank assets: $330,470.8 mil, Deposits: $236,091.5 mil, headquarters in Cincinnati, OH, positive income, 3121 total offices, Holding Company: U.S. Bancorp

- SunTrust Bank: Cool Springs Branch, Brentwood Branch - 861, Brentwood Branch. Info updated 2010/05/27: Bank assets: $171,291.7 mil, Deposits: $129,833.2 mil, headquarters in Atlanta, GA, positive income, Commercial Lending Specialization, 1716 total offices, Holding Company: Suntrust Banks, Inc.

- Regions Bank: Brentwood Branch, Cool Spring Branch, Brentwood Way. Info updated 2011/02/24: Bank assets: $123,368.2 mil, Deposits: $98,301.3 mil, headquarters in Birmingham, AL, positive income, Commercial Lending Specialization, 1778 total offices, Holding Company: Regions Financial Corporation

- Pinnacle National Bank: Cool Springs Branch at 1717 Mallory Lane, branch established on 2003/10/20; Brentwood Branch at 128 Franklin Road, branch established on 2000/11/30. Info updated 2010/01/06: Bank assets: $4,846.7 mil, Deposits: $3,690.4 mil, headquarters in Nashville, TN, positive income, Commercial Lending Specialization, 33 total offices, Holding Company: Pinnacle Financial Partners, Inc.

- Bank of America, National Association: Moore's Lane Branch at 7120 Moores Lane, branch established on 1984/11/16; Brentwood Branch at 133 Franklin Road, branch established on 1970/11/30. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Wells Fargo Bank, National Association: Brentwood Branch at 5415 Maryland Way, branch established on 1996/08/05; Moores Lane Branch at 1660 West Gate Circle, branch established on 2005/01/03. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- First Tennessee Bank, National Association: Brentwood Branch at 202 Franklin Road, branch established on 1956/07/02; Concord Hills Financial Center Branc at 7901 Concord Hills Drive, branch established on 2007/01/08. Info updated 2009/09/08: Bank assets: $24,563.4 mil, Deposits: $16,402.1 mil, headquarters in Memphis, TN, positive income, Commercial Lending Specialization, 180 total offices, Holding Company: First Horizon National Corporation

- Reliant Bank: at 1736 Carothers Pkwy, branch established on 2006/01/09; Maryland Farm Branch at 5109 Peter Taylor Park Drive, branch established on 2009/08/03. Info updated 2009/01/06: Bank assets: $363.4 mil, Deposits: $314.2 mil, local headquarters, negative income in the last year, Commercial Lending Specialization, 4 total offices

- 9 other banks with 9 local branches

For population 15 years and over in Brentwood:

- Never married: 22.1%

- Now married: 69.1%

- Separated: 0.3%

- Widowed: 3.3%

- Divorced: 5.2%

For population 25 years and over in Brentwood:

- High school or higher: 98.0%

- Bachelor's degree or higher: 75.4%

- Graduate or professional degree: 32.9%

- Unemployed: 1.9%

- Mean travel time to work (commute): 18.2 minutes

| Here: | 8.4 |

| Tennessee average: | 11.4 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Brentwood, TN (based on Williamson County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 66,790 | 151 |

| Mainline Protestant | 26,539 | 35 |

| Catholic | 16,836 | 3 |

| Other | 2,671 | 8 |

| Orthodox | 474 | 1 |

| Black Protestant | 323 | 2 |

| None | 69,549 | - |

Food Environment Statistics:

| Here: | 1.81 / 10,000 pop. |

| Tennessee: | 1.99 / 10,000 pop. |

| This county: | 0.18 / 10,000 pop. |

| Tennessee: | 0.17 / 10,000 pop. |

| This county: | 0.30 / 10,000 pop. |

| Tennessee: | 0.65 / 10,000 pop. |

| Here: | 3.26 / 10,000 pop. |

| Tennessee: | 5.16 / 10,000 pop. |

| Williamson County: | 8.69 / 10,000 pop. |

| Tennessee: | 6.56 / 10,000 pop. |

| Here: | 8.8% |

| Tennessee: | 11.4% |

| This county: | 25.1% |

| Tennessee: | 30.2% |

| Williamson County: | 13.6% |

| State: | 13.5% |

Health and Nutrition:

| Here: | 56.6% |

| Tennessee: | 49.3% |

| Here: | 57.0% |

| State: | 46.1% |

| This city: | 28.2 |

| Tennessee: | 28.8 |

| Brentwood: | 19.9% |

| State: | 21.0% |

| Brentwood: | 7.3% |

| Tennessee: | 10.5% |

| Here: | 6.9 |

| Tennessee: | 6.8 |

| This city: | 36.2% |

| State: | 33.9% |

| Brentwood: | 62.3% |

| Tennessee: | 55.9% |

| Brentwood: | 80.9% |

| Tennessee: | 79.1% |

More about Health and Nutrition of Brentwood, TN Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Firefighters | 67 | $494,388 | $88,547 | 0 | $0 |

| Police Protection - Officers | 64 | $426,421 | $79,954 | 0 | $0 |

| Streets and Highways | 29 | $158,335 | $65,518 | 0 | $0 |

| Other Government Administration | 21 | $210,873 | $120,499 | 7 | $7,330 |

| Police - Other | 17 | $121,795 | $85,973 | 0 | $0 |

| Financial Administration | 16 | $127,441 | $95,581 | 1 | $1,789 |

| Parks and Recreation | 15 | $70,078 | $56,062 | 6 | $9,280 |

| Sewerage | 15 | $67,516 | $54,013 | 0 | $0 |

| Water Supply | 15 | $67,516 | $54,013 | 0 | $0 |

| Local Libraries | 12 | $56,801 | $56,801 | 33 | $39,795 |

| Other and Unallocable | 3 | $18,201 | $72,804 | 0 | $0 |

| Fire - Other | 1 | $7,673 | $92,076 | 0 | $0 |

| Judicial and Legal | 1 | $5,795 | $69,540 | 0 | $0 |

| Totals for Government | 276 | $1,832,830 | $79,688 | 47 | $58,194 |

Brentwood government finances - Expenditure in 2021 (per resident):

- Construction - General - Other: $17,965,000 ($398.02)

Water Utilities: $3,332,000 ($73.82)

Sewerage: $1,428,000 ($31.64)

- Current Operations - Water Utilities: $10,602,000 ($234.89)

Police Protection: $8,375,000 ($185.55)

Local Fire Protection: $7,931,000 ($175.71)

Regular Highways: $7,929,000 ($175.67)

General - Other: $4,675,000 ($103.58)

Sewerage: $4,641,000 ($102.82)

Parks and Recreation: $3,001,000 ($66.49)

Libraries: $2,672,000 ($59.20)

Central Staff Services: $1,736,000 ($38.46)

Financial Administration: $954,000 ($21.14)

Protective Inspection and Regulation - Other: $822,000 ($18.21)

Judicial and Legal Services: $279,000 ($6.18)

Health - Other: $90,000 ($1.99)

- General - Interest on Debt: $718,000 ($15.91)

- Other Capital Outlay - Local Fire Protection: $622,000 ($13.78)

General - Other: $603,000 ($13.36)

Police Protection: $563,000 ($12.47)

Parks and Recreation: $260,000 ($5.76)

Sewerage: $71,000 ($1.57)

Libraries: $32,000 ($0.71)

- Total Salaries and Wages: $30,891,000 ($684.40)

- Water Utilities - Interest on Debt: $534,000 ($11.83)

Brentwood government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $7,790,000 ($172.59)

Other: $1,391,000 ($30.82)

Parks and Recreation: $758,000 ($16.79)

- Miscellaneous - Interest Earnings: $1,264,000 ($28.00)

Special Assessments: $1,134,000 ($25.12)

General Revenue - Other: $961,000 ($21.29)

Fines and Forfeits: $184,000 ($4.08)

- Revenue - Water Utilities: $10,968,000 ($243.00)

- State Intergovernmental - General Local Government Support: $11,939,000 ($264.51)

Other: $2,160,000 ($47.86)

Highways: $1,876,000 ($41.56)

- Tax - General Sales and Gross Receipts: $20,943,000 ($464.00)

Property: $13,537,000 ($299.92)

Alcoholic Beverage Sales: $2,128,000 ($47.15)

Other License: $2,056,000 ($45.55)

Other Selective Sales: $1,668,000 ($36.95)

Public Utilities Sales: $566,000 ($12.54)

Brentwood government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $51,376,000 ($1138.25)

Outstanding Unspecified Public Purpose: $47,561,000 ($1053.73)

Retired Unspecified Public Purpose: $3,815,000 ($84.52)

Brentwood government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $42,743,000 ($946.98)

- Other Funds - Cash and Securities: $98,100,000 ($2173.43)

- Sinking Funds - Cash and Securities: $3,911,000 ($86.65)

| Businesses in Brentwood, TN | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| AT&T | 1 | McDonald's | 1 | |

| Ace Hardware | 1 | New Balance | 2 | |

| Advance Auto Parts | 1 | Nike | 5 | |

| Ashley Furniture | 1 | Office Depot | 1 | |

| Audi | 1 | OfficeMax | 1 | |

| Barnes & Noble | 1 | Old Navy | 1 | |

| Baskin-Robbins | 1 | Outback | 1 | |

| Baymont Inn | 1 | Outback Steakhouse | 1 | |

| Best Western | 1 | Panera Bread | 1 | |

| CVS | 1 | Papa John's Pizza | 1 | |

| Chick-Fil-A | 1 | PetSmart | 1 | |

| Chipotle | 1 | Pizza Hut | 1 | |

| Church's Chicken | 1 | Publix Super Markets | 3 | |

| Cold Stone Creamery | 1 | Qdoba Mexican Grill | 1 | |

| Costco | 1 | Red Roof Inn | 1 | |

| Cracker Barrel | 1 | Rooms To Go | 2 | |

| Cricket Wireless | 1 | Ruby Tuesday | 1 | |

| Curves | 1 | SONIC Drive-In | 3 | |

| DHL | 1 | Sleep Inn | 1 | |

| Decora Cabinetry | 2 | Sprint Nextel | 2 | |

| Discount Tire | 1 | Starbucks | 4 | |

| Extended Stay America | 1 | Studio Plus Deluxe Studios | 1 | |

| FedEx | 14 | Subway | 3 | |

| Firestone Complete Auto Care | 2 | T-Mobile | 1 | |

| GNC | 1 | T.J.Maxx | 1 | |

| GameStop | 2 | Taco Bell | 1 | |

| H&R Block | 1 | Target | 1 | |

| Havertys Furniture | 1 | U-Haul | 1 | |

| Hilton | 2 | UPS | 15 | |

| Holiday Inn | 2 | Waffle House | 1 | |

| Home Depot | 1 | Walgreens | 2 | |

| Kroger | 2 | Wendy's | 1 | |

| MainStay | 1 | Wingate | 1 | |

| Marriott | 2 | YMCA | 2 | |

| MasterBrand Cabinets | 12 | |||

Strongest AM radio stations in Brentwood:

- WSM (650 AM; 50 kW; NASHVILLE, TN; Owner: GAYLORD ENTERTAINMENT COMPANY)

- WAKM (950 AM; 5 kW; FRANKLIN, TN; Owner: FRANKLIN RADIO ASSOCIATES, INC.)

- WAMB (1160 AM; 50 kW; DONELSON, TN; Owner: GREAT SOUTHERN BROADCASTING COMPANY, INC.)

- WKDA (1200 AM; 50 kW; NASHVILLE, TN; Owner: RADIO NASHVILLE, INC.)

- WNQM (1300 AM; 50 kW; NASHVILLE, TN; Owner: WNQM. INC.)

- WLAC (1510 AM; 50 kW; NASHVILLE, TN; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WHEW (1380 AM; 5 kW; FRANKLIN, TN; Owner: SG COMMUNICATIONS, INC.)

- WNSR (560 AM; 1 kW; BRENTWOOD, TN; Owner: SOUTHERN WABASH COMMNCTNS OF MIDDLE TN, INC.)

- WCOR (900 AM; 5 kW; LEBANON, TN)

- WPLN (1430 AM; 15 kW; MADISON, TN)

- WYFN (980 AM; 5 kW; NASHVILLE, TN; Owner: BIBLE BRADCASTING NETWORK, INC.)

- WVOL (1470 AM; 5 kW; BERRY HILL, TN)

- WMDB (880 AM; daytime; 2 kW; NASHVILLE, TN; Owner: BABB BROADCASTING COMPANY)

Strongest FM radio stations in Brentwood:

- WKDF (103.3 FM; NASHVILLE, TN; Owner: CITADEL BROADCASTING COMPANY)

- WNRQ (105.9 FM; NASHVILLE, TN; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WSIX-FM (97.9 FM; NASHVILLE, TN; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WPLN-FM (90.3 FM; NASHVILLE, TN; Owner: NASHVILLE PUBLIC RADIO)

- WAYM (88.7 FM; COLUMBIA, TN; Owner: WAY-FM MEDIA GROUP, INC.)

- WRLT (100.1 FM; FRANKLIN, TN; Owner: TUNED-IN BROADCASTING, INC)

- WSM-FM (95.5 FM; NASHVILLE, TN; Owner: CUMULUS LICENSING CORP.)

- WJXA (92.9 FM; NASHVILLE, TN; Owner: SOUTH CENTRAL COMMUNICATIONS CORP.)

- WGFX (104.5 FM; GALLATIN, TN; Owner: CITADEL BROADCASTING COMPANY)

- WRVU (91.1 FM; NASHVILLE, TN; Owner: VANDERBILT STUDENT COMMUNICATIONS, INC.)

- WMAK (96.3 FM; MURFREESBORO, TN; Owner: SOUTH CENTRAL COMMUNICATIONS CORP.)

- WRVW (107.5 FM; LEBANON, TN; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WNPL (106.7 FM; BELLE MEADE, TN; Owner: CUMULUS LICENSING CORP.)

- WBUZ (102.9 FM; LA VERGNE, TN; Owner: WYCQ, INC)

- WFFI (93.7 FM; KINGSTON SPRINGS, TN; Owner: CARON BROADCASTING, INC.)

- WMOT (89.5 FM; MURFREESBORO, TN; Owner: MIDDLE TENNESSEE STATE UNIVERSITY)

- W271AB (102.1 FM; NASHVILLE, TN; Owner: MONTGOMERY BROADCASTING COMPANY)

- WFCM-FM (91.7 FM; MURFREESBORO, TN; Owner: THE MOODY BIBLE INSTITUTE OF CHICAGO)

- WWTN (99.7 FM; MANCHESTER, TN; Owner: CUMULUS LICENSING CORP.)

- WNAZ-FM (89.1 FM; NASHVILLE, TN; Owner: TREVECCA NAZARENE UNIVERSITY, INC.)

TV broadcast stations around Brentwood:

- WKRN-TV (Channel 2; NASHVILLE, TN; Owner: WKRN, G.P.)

- WNPT (Channel 8; NASHVILLE, TN; Owner: NASHVILLE PUBLIC TELEVISION, INC.)

- WNAB (Channel 58; NASHVILLE, TN; Owner: NASHVILLE LICENSE HOLDINGS, L.L.C.)

- WSMV-TV (Channel 4; NASHVILLE, TN; Owner: MEREDITH CORPORATION)

- WZTV (Channel 17; NASHVILLE, TN; Owner: WZTV LICENSEE, LLC)

- WTVF (Channel 5; NASHVILLE, TN; Owner: NEWSCHANNEL 5 NETWORK, LP)

- WUXP-TV (Channel 30; NASHVILLE, TN; Owner: WUXP LICENSEE, LLC)

- WNPX (Channel 28; COOKEVILLE, TN; Owner: PAXSON COMMUNICATIONS LICENSE COMPANY, LLC)

- W36AK (Channel 36; NASHVILLE, TN; Owner: TRINITY BROADCASTING NETWORK)

- WGAP-LP (Channel 26; NASHVILLE, TN; Owner: SOUTH CENTRAL COMMUNICATIONS CORP.)

- WJDE-LP (Channel 24; NASHVILLE, TN; Owner: SOUTH CENTRAL COMMUNICATIONS CORP.)

- WRMX-LP (Channel 12; NASHVILLE, TN; Owner: SOUTH CENTRAL COMMUNICATIONS CORP.)

- WJNK-LP (Channel 61; NASHVILLE, TN; Owner: THREE ANGELS BROADCASTING NETWORK, INC.)

- WHTN (Channel 39; MURFREESBORO, TN; Owner: CHRISTIAN TELEVISION NETWORK, INC.)

- WNPX-LP (Channel 20; NASHVILLE, TN; Owner: PAXSON COMMUNICATIONS LPTV, INC.)

- W52CT (Channel 52; NASHVILLE, TN; Owner: JKB ASSOCIATES, INC.)

- WPGD (Channel 50; HENDERSONVILLE, TN; Owner: TRINITY BROADCASTING NETWORK)

- WIIW-LP (Channel 14; NASHVILLE, TN; Owner: EQUITY BROADCASTING CORPORATION)

- WETV-LP (Channel 11; MURFREESBORO, TN; Owner: CHANNEL ELEVEN, INC.)

- WHRT-LP (Channel 27; MURFREESBORO, TN; Owner: LANDMARK ARTS, INC.)

- National Bridge Inventory (NBI) Statistics

- 71Number of bridges

- 495ft / 151mTotal length

- $6,767,000Total costs

- 1,402,661Total average daily traffic

- 169,142Total average daily truck traffic

- New bridges - historical statistics

- 11920-1929

- 11930-1939

- 51950-1959

- 131960-1969

- 111970-1979

- 141980-1989

- 141990-1999

- 72000-2009

- 52010-2019

FCC Registered Commercial Land Mobile Towers: 3 (See the full list of FCC Registered Commercial Land Mobile Towers in Brentwood, TN)

FCC Registered Private Land Mobile Towers: 1 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 26 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 22 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 4 (See the full list of FCC Registered Paging Towers)

FCC Registered Amateur Radio Licenses: 326 (See the full list of FCC Registered Amateur Radio Licenses in Brentwood)

FAA Registered Aircraft Manufacturers and Dealers: 11 (See the full list of FAA Registered Manufacturers and Dealers in Brentwood)

FAA Registered Aircraft: 89 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 4 partial tracts) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 45 | $330,436 | 315 | $408,590 | 1,423 | $323,973 | 21 | $221,835 | 34 | $395,331 | 1 | $209,370 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | $0 | 28 | $395,705 | 98 | $326,483 | 4 | $180,785 | 4 | $120,810 | 0 | $0 |

| APPLICATIONS DENIED | 7 | $298,103 | 22 | $666,045 | 226 | $395,842 | 12 | $81,425 | 5 | $251,836 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 6 | $383,895 | 69 | $393,166 | 220 | $355,105 | 8 | $269,138 | 6 | $310,168 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 2 | $117,845 | 9 | $451,959 | 41 | $352,243 | 4 | $145,308 | 1 | $121,970 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 0502.01 , 0502.02, 0503.01, 0503.02

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 4 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 16 | $325,761 | 18 | $320,402 | 1 | $111,850 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 8 | $361,535 | 6 | $314,238 | 0 | $0 |

| APPLICATIONS DENIED | 1 | $249,180 | 6 | $342,940 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 1 | $412,750 | 2 | $317,910 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $94,220 | 2 | $251,170 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 0502.01 , 0502.02, 0503.01, 0503.02

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Brentwood, TN

- 62943.2%Outside Fires

- 45231.1%Structure Fires

- 31721.8%Mobile Property/Vehicle Fires

- 573.9%Other

Based on the data from the years 2002 - 2018 the average number of fires per year is 86. The highest number of fire incidents - 101 took place in 2007, and the least - 64 in 2013. The data has a growing trend.

Based on the data from the years 2002 - 2018 the average number of fires per year is 86. The highest number of fire incidents - 101 took place in 2007, and the least - 64 in 2013. The data has a growing trend. When looking into fire subcategories, the most incidents belonged to: Outside Fires (43.2%), and Structure Fires (31.1%).

When looking into fire subcategories, the most incidents belonged to: Outside Fires (43.2%), and Structure Fires (31.1%).Fire-safe hotels and motels in Brentwood, Tennessee:

- Four Points By Sheraton Nashville-Brentwood, 760 Old Hickory Blvd, Brentwood, Tennessee 37027 , Phone: (615) 964-5500, Fax: (615) 964-5501

- Hilton Suites Brentwood, 9000 Overlook Blvd, Brentwood, Tennessee 37027 , Phone: (615) 370-0111, Fax: (615) 370-0272

- Extended Stay America - Nashville - Brentwood, 9025 Church St E, Brentwood, Tennessee 37027 , Phone: (615) 373-4272, Fax: (615) 370-6906

- Extended Stay America - Nashville - Brentwood - South, 9020 Church St E, Brentwood, Tennessee 37027 , Phone: (615) 377-7847, Fax: (615) 377-6631

- Hyatt Place Nashville / Brentwood, 202 Smt View Dr, Brentwood, Tennessee 37027 , Phone: (615) 661-9477, Fax: (615) 661-9936

- Mainstay Suites, 107 Brentwood Blvd, Brentwood, Tennessee 37027 , Phone: (615) 371-8477, Fax: (615) 376-2968

- Hampton Inn Brentwood, 5630 Franklin Pike Cir, Brentwood, Tennessee 37027 , Phone: (615) 373-2212, Fax: (615) 370-9832

- Sleep Inn, 1611 Galleria Blvd, Brentwood, Tennessee 37027 , Phone: (615) 376-2122, Fax: (615) 309-8157

- 6 other hotels and motels

| Most common first names in Brentwood, TN among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| Mary | 121 | 80.0 years |

| William | 120 | 72.7 years |

| James | 108 | 74.2 years |

| John | 84 | 75.7 years |

| Robert | 65 | 72.4 years |

| Charles | 59 | 74.8 years |

| Margaret | 48 | 82.5 years |

| George | 42 | 79.5 years |

| Helen | 41 | 84.1 years |

| Elizabeth | 41 | 82.8 years |

| Most common last names in Brentwood, TN among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 54 | 77.9 years |

| Williams | 36 | 80.3 years |

| Johnson | 28 | 78.5 years |

| Davis | 28 | 81.1 years |

| Jones | 26 | 81.3 years |

| Brown | 26 | 79.9 years |

| Taylor | 19 | 83.3 years |

| Miller | 19 | 82.9 years |

| Moore | 19 | 73.9 years |

| Wilson | 17 | 78.1 years |

- 80.4%Utility gas

- 18.1%Electricity

- 1.2%Bottled, tank, or LP gas

- 0.3%Fuel oil, kerosene, etc.

- 50.2%Electricity

- 48.5%Utility gas

- 1.0%No fuel used

- 0.3%Bottled, tank, or LP gas

Brentwood compared to Tennessee state average:

- Median household income significantly above state average.

- Median house value significantly above state average.

- Unemployed percentage significantly below state average.

- Black race population percentage below state average.

- Foreign-born population percentage significantly above state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly above state average.

- House age below state average.

- Number of college students above state average.

- Percentage of population with a bachelor's degree or higher significantly above state average.

Brentwood on our top lists:

- #30 on the list of "Top 100 cities with biggest houses (pop. 5,000+)"

- #41 on the list of "Top 101 cities with largest percentage of males in occupations: management occupations (population 5,000+)"

- #76 on the list of "Top 101 cities with the largest percentage of people in homes for abused, dependent, and neglected children (population 1,000+)"

- #80 on the list of "Top 101 cities with largest percentage of males in industries: health care and social assistance (population 5,000+)"

- #84 on the list of "Top 101 cities with the highest percentage of family households, population 10,000+"

- #32 (37027) on the list of "Top 101 zip codes with the most finance and insurance companies in 2005"

- #95 (37027) on the list of "Top 101 zip codes with the most offices of physicians in 2005"

- #30 on the list of "Top 101 counties with the lowest total withdrawal of fresh water for public supply (pop. 50,000+)"

- #32 on the list of "Top 101 counties with the largest number of children under 18 without health insurance coverage in 2000 (pop. 50,000+)"

- #40 on the list of "Top 101 counties with the lowest number of deaths per 1000 residents 2007-2013 (pop. 50,000+)"

- #46 on the list of "Top 101 counties with the largest decrease in the number of births per 1000 residents 2000-2006 to 2007-2013 (pop 50,000+)"

- #58 on the list of "Top 101 counties with the largest number of people without health insurance coverage in 2000 (pop. 50,000+)"

|

|

Total of 690 patent applications in 2008-2024.