Brighton, Colorado

Brighton: Brighton Coldstone Creamery

Brighton: From the Fields of Brighton Over Looking The City

Brighton: Greater Brighton Fire Station 5

Brighton: Church

Brighton: Academy

Brighton: Brighton Grain Co.

Brighton: Brighton Astronomy Group Setup at Observatory Park 22nd and Bromley Lane

Brighton: hotel

Brighton: Main Street

Brighton: Adams County Admin

Brighton: Locksmith

- see

26

more - add

your

Submit your own pictures of this city and show them to the world

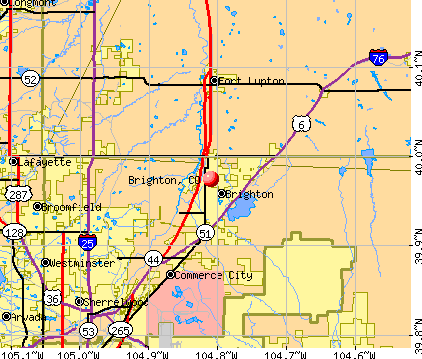

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +100.3%

| Males: 21,574 | |

| Females: 20,307 |

| Median resident age: | 35.0 years |

| Colorado median age: | 37.7 years |

Zip codes: 80601, 80602, 80603, 80640.

Brighton Zip Code Map| Brighton: | $92,085 |

| CO: | $89,302 |

Estimated per capita income in 2022: $39,458 (it was $17,927 in 2000)

Brighton city income, earnings, and wages data

Estimated median house or condo value in 2022: $488,430 (it was $143,000 in 2000)

| Brighton: | $488,430 |

| CO: | $531,100 |

Mean prices in 2022: all housing units: $511,179; detached houses: $576,428; townhouses or other attached units: $387,990; in 2-unit structures: $511,676; in 3-to-4-unit structures: $417,982; in 5-or-more-unit structures: $303,466; mobile homes: $84,031; occupied boats, rvs, vans, etc.: $6,549

Median gross rent in 2022: $1,655.

(5.3% for White Non-Hispanic residents, 19.0% for Black residents, 14.2% for Hispanic or Latino residents, 21.7% for other race residents, 12.2% for two or more races residents)

Detailed information about poverty and poor residents in Brighton, CO

- 20,98051.0%White alone

- 16,29739.6%Hispanic

- 1,5283.7%Two or more races

- 1,2883.1%Black alone

- 7441.8%Asian alone

- 950.2%American Indian alone

- 430.1%Native Hawaiian and Other

Pacific Islander alone - 600.1%Other race alone

According to our research of Colorado and other state lists, there were 139 registered sex offenders living in Brighton, Colorado as of April 19, 2024.

The ratio of all residents to sex offenders in Brighton is 271 to 1.

Type |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Murders (per 100,000) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 2 (5.8) | 0 (0.0) | 1 (2.8) | 0 (0.0) | 1 (2.6) | 0 (0.0) | 1 (2.4) | 0 (0.0) | 1 (2.4) | 0 (0.0) | 3 (7.3) |

| Rapes (per 100,000) | 14 (42.7) | 13 (39.0) | 19 (56.0) | 23 (66.6) | 22 (62.8) | 39 (107.8) | 35 (93.3) | 46 (119.9) | 39 (99.7) | 59 (141.8) | 51 (120.7) | 35 (82.3) | 35 (84.3) | 38 (92.2) |

| Robberies (per 100,000) | 15 (45.8) | 6 (18.0) | 4 (11.8) | 15 (43.4) | 15 (42.8) | 19 (52.5) | 17 (45.3) | 15 (39.1) | 24 (61.4) | 20 (48.1) | 6 (14.2) | 19 (44.7) | 12 (28.9) | 5 (12.1) |

| Assaults (per 100,000) | 60 (183.1) | 50 (149.9) | 67 (197.4) | 80 (231.6) | 47 (134.2) | 75 (207.3) | 84 (223.9) | 82 (213.7) | 127 (324.8) | 89 (213.9) | 108 (255.5) | 140 (329.1) | 111 (267.2) | 124 (300.9) |

| Burglaries (per 100,000) | 171 (521.8) | 163 (488.7) | 150 (442.0) | 126 (364.8) | 98 (279.8) | 141 (389.7) | 144 (383.9) | 159 (414.5) | 145 (370.9) | 139 (334.0) | 94 (222.4) | 110 (258.6) | 123 (296.1) | 95 (230.6) |

| Thefts (per 100,000) | 906 (2,765) | 944 (2,830) | 882 (2,599) | 804 (2,328) | 917 (2,618) | 920 (2,542) | 921 (2,455) | 1,002 (2,612) | 963 (2,463) | 960 (2,307) | 874 (2,068) | 928 (2,182) | 926 (2,229) | 833 (2,022) |

| Auto thefts (per 100,000) | 85 (259.4) | 86 (257.9) | 66 (194.5) | 65 (188.2) | 70 (199.9) | 85 (234.9) | 134 (357.2) | 176 (458.8) | 208 (532.0) | 177 (425.3) | 195 (461.4) | 274 (644.2) | 241 (580.2) | 281 (682.0) |

| Arson (per 100,000) | 19 (58.0) | 16 (48.0) | 13 (38.3) | 17 (49.2) | 8 (22.8) | 6 (16.6) | 9 (24.0) | 12 (31.3) | 8 (20.5) | 4 (9.6) | 3 (7.1) | 13 (30.6) | 8 (19.3) | 12 (29.1) |

| City-Data.com crime index | 252.4 | 234.6 | 238.3 | 257.9 | 230.2 | 296.7 | 286.7 | 325.8 | 330.2 | 325.1 | 287.1 | 306.7 | 285.9 | 303.7 |

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Crime rate in Brighton detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 106 (77 officers - 62 male; 15 female).

| Officers per 1,000 residents here: | 1.85 |

| Colorado average: | 2.14 |

| Commuting Brighton to Boulder (2 replies) |

| Houses in Thornton, Brighton, and maybe Erie? (7 replies) |

| Moving to Brighton Colorado (8 replies) |

| Non-Smoking Apartments in Denver area? (9 replies) |

| Commute to Airport Often - want schools and big lot (63 replies) |

| Moving soon - where to live with commutes btwn Boulder and Tech Center? (13 replies) |

Latest news from Brighton, CO collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: German (12.0%), American (6.4%), Irish (4.3%), English (3.0%), Italian (1.9%), European (1.9%).

Current Local Time: MST time zone

Incorporated on 9/1/1887

Elevation: 4983 feet

Land area: 17.1 square miles.

Population density: 2,452 people per square mile (low).

3,411 residents are foreign born (6.5% Latin America, 0.9% Asia).

| This city: | 8.3% |

| Colorado: | 9.5% |

Median real estate property taxes paid for housing units with mortgages in 2022: $3,201 (0.6%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $2,222 (0.5%)

Nearest city with pop. 50,000+: Thornton, CO (9.1 miles

, pop. 82,384).

Nearest city with pop. 200,000+: West Adams, CO (11.8 miles , pop. 259,628).

Nearest city with pop. 1,000,000+: Phoenix, AZ (600.3 miles

, pop. 1,321,045).

Nearest cities:

Latitude: 39.97 N, Longitude: 104.81 W

Daytime population change due to commuting: -3,094 (-7.5%)

Workers who live and work in this city: 7,382 (34.6%)

Area codes: 303, 720

Brighton, Colorado accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 375 buildings, average cost: $357,800

- 2021: 371 buildings, average cost: $307,400

- 2020: 647 buildings, average cost: $216,500

- 2019: 437 buildings, average cost: $290,500

- 2018: 297 buildings, average cost: $360,900

- 2017: 174 buildings, average cost: $323,000

- 2016: 172 buildings, average cost: $307,100

- 2015: 209 buildings, average cost: $283,300

- 2014: 98 buildings, average cost: $193,800

- 2013: 76 buildings, average cost: $195,200

- 2012: 64 buildings, average cost: $195,000

- 2011: 45 buildings, average cost: $195,900

- 2010: 50 buildings, average cost: $191,500

- 2009: 37 buildings, average cost: $212,200

- 2008: 37 buildings, average cost: $172,600

- 2007: 200 buildings, average cost: $162,900

- 2006: 391 buildings, average cost: $165,000

- 2005: 596 buildings, average cost: $165,600

- 2004: 493 buildings, average cost: $162,400

- 2003: 369 buildings, average cost: $144,900

- 2002: 303 buildings, average cost: $133,500

- 2001: 571 buildings, average cost: $108,900

- 2000: 514 buildings, average cost: $92,200

- 1999: 722 buildings, average cost: $87,800

- 1998: 167 buildings, average cost: $95,100

- 1997: 187 buildings, average cost: $94,500

| Here: | 3.7% |

| Colorado: | 3.2% |

Population change in the 1990s: +6,556 (+45.7%).

- Construction (12.0%)

- Health care (7.0%)

- Educational services (6.3%)

- Public administration (5.5%)

- Administrative & support & waste management services (4.6%)

- Accommodation & food services (4.5%)

- Professional, scientific, technical services (4.0%)

- Construction (18.4%)

- Administrative & support & waste management services (4.4%)

- Educational services (4.3%)

- Truck transportation (4.0%)

- Repair & maintenance (4.0%)

- Accommodation & food services (3.7%)

- Professional, scientific, technical services (3.7%)

- Health care (12.2%)

- Educational services (8.7%)

- Public administration (8.6%)

- Finance & insurance (5.5%)

- Accommodation & food services (5.5%)

- Administrative & support & waste management services (4.8%)

- Professional, scientific, technical services (4.3%)

- Building and grounds cleaning and maintenance occupations (4.4%)

- Other office and administrative support workers, including supervisors (4.3%)

- Driver/sales workers and truck drivers (4.0%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (3.8%)

- Other production occupations, including supervisors (3.7%)

- Information and record clerks, except customer service representatives (3.5%)

- Material recording, scheduling, dispatching, and distributing workers (3.4%)

- Driver/sales workers and truck drivers (6.9%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (6.3%)

- Building and grounds cleaning and maintenance occupations (4.8%)

- Other production occupations, including supervisors (4.3%)

- Vehicle and mobile equipment mechanics, installers, and repairers (4.2%)

- Material recording, scheduling, dispatching, and distributing workers (4.1%)

- Laborers and material movers, hand (3.9%)

- Other office and administrative support workers, including supervisors (8.0%)

- Secretaries and administrative assistants (7.7%)

- Information and record clerks, except customer service representatives (6.3%)

- Cashiers (5.1%)

- Building and grounds cleaning and maintenance occupations (3.8%)

- Other sales and related occupations, including supervisors (3.5%)

- Other management occupations, except farmers and farm managers (3.1%)

Average climate in Brighton, Colorado

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2023 was 121. This is significantly worse than average.

| City: | 121 |

| U.S.: | 73 |

Carbon Monoxide (CO) [ppm] level in 2023 was 0.291. This is about average. Closest monitor was 1.1 miles away from the city center.

| City: | 0.291 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2023 was 14.8. This is significantly worse than average. Closest monitor was 9.3 miles away from the city center.

| City: | 14.8 |

| U.S.: | 5.1 |

Sulfur Dioxide (SO2) [ppb] level in 2023 was 0.874. This is significantly better than average. Closest monitor was 9.3 miles away from the city center.

| City: | 0.874 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2023 was 34.6. This is about average. Closest monitor was 5.3 miles away from the city center.

| City: | 34.6 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2023 was 26.4. This is worse than average. Closest monitor was 0.9 miles away from the city center.

| City: | 26.4 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 8.31. This is about average. Closest monitor was 12.1 miles away from the city center.

| City: | 8.31 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2009 was 0.00502. This is significantly better than average. Closest monitor was 1.0 miles away from the city center.

| City: | 0.00502 |

| U.S.: | 0.00931 |

Tornado activity:

Brighton-area historical tornado activity is significantly above Colorado state average. It is 43% greater than the overall U.S. average.

On 5/18/1975, a category F3 (max. wind speeds 158-206 mph) tornado 11.0 miles away from the Brighton city center .

On 6/12/1982, a category F3 tornado 16.2 miles away from the city center caused between $500 and $5000 in damages.

Earthquake activity:

Brighton-area historical earthquake activity is significantly above Colorado state average. It is 686% greater than the overall U.S. average.On 8/18/1959 at 06:37:13, a magnitude 7.7 (7.7 UK, Class: Major, Intensity: VIII - XII) earthquake occurred 436.1 miles away from Brighton center, causing $26,000,000 total damage

On 10/18/1984 at 15:30:23, a magnitude 5.5 (5.4 MB, 5.1 MS, 5.5 ML, Class: Moderate, Intensity: VI - VII) earthquake occurred 172.0 miles away from the city center

On 10/28/1983 at 14:06:06, a magnitude 7.3 (6.2 MB, 7.3 MS, 7.0 MW) earthquake occurred 541.7 miles away from the city center, causing 2 deaths (2 shaking deaths) and 3 injuries, causing $15,000,000 total damage

On 8/23/2011 at 05:46:18, a magnitude 5.3 (5.3 MW, Depth: 2.5 mi) earthquake occurred 201.4 miles away from the city center

On 3/28/1975 at 02:31:05, a magnitude 6.2 (6.1 MB, 6.0 MS, 6.2 ML, Class: Strong, Intensity: VII - IX) earthquake occurred 424.1 miles away from Brighton center

On 8/10/2005 at 22:08:22, a magnitude 5.0 (5.0 MW, Depth: 3.1 mi) earthquake occurred 209.4 miles away from the city center

Magnitude types: body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Adams County (11) is smaller than the US average (15).Major Disasters (Presidential) Declared: 6

Emergencies Declared: 4

Causes of natural disasters: Floods: 6, Storms: 5, Landslides: 3, Mudslides: 3, Snows: 2, Tornadoes: 2, Fire: 1, Heavy Rain: 1, Hurricane: 1, Snowstorm: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers in Brighton:

- PLATTE VALLEY MEDICAL CENTER (Voluntary non-profit - Private, 1600 PRAIRIE CENTER PARKWAY)

- COTTONWOOD CARE CENTER (2311 EAST BRIDGE STREET)

- KINDRED TRANSITIONAL CARE AND REHABILITATION-BRIGHTO (2025 EAST EGBERT STREET)

- BRIGHTON DIALYSIS (DVA) (4700 E BROMLEY LN STE 103)

- RELIABLE HOME HEALTH SERVICES INC (822 SOUTH 4TH AVENUE)

Airports and heliports located in Brighton:

- Flying E Airport (22CO) (Runways: 1)

- Van Aire Airport (CO12) (Runways: 1)

- Platte Valley Medical Center Heliport (22CD)

Amtrak stations near Brighton:

- 12 miles: DENVER INTERNATIONAL AP'T (DENVER, DENVER INTERNATIONAL AIRPORT) - Bus Station . Services: enclosed waiting area, public restrooms, public payphones, full-service food facilities, paid short-term parking, paid long-term parking, car rental agency, taxi stand, public transit connection.

- 19 miles: DENVER (1701 WYNKOOP ST.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, full-service food facilities and snack bar, paid short-term parking, paid long-term parking, call for car rental service, taxi stand, public transit connection.

Colleges/universities with over 2000 students nearest to Brighton:

- Front Range Community College (about 14 miles; Westminster, CO; Full-time enrollment: 14,756)

- Regis University (about 18 miles; Denver, CO; FT enrollment: 6,975)

- Community College of Aurora (about 18 miles; Aurora, CO; FT enrollment: 4,730)

- University of Colorado Denver (about 19 miles; Denver, CO; FT enrollment: 14,727)

- Emily Griffith Technical College (about 19 miles; Denver, CO; FT enrollment: 2,460)

- Metropolitan State University of Denver (about 20 miles; Denver, CO; FT enrollment: 17,242)

- Community College of Denver (about 20 miles; Denver, CO; FT enrollment: 7,329)

Public high schools in Brighton:

- HORIZON HIGH SCHOOL (Students: 2,079, Location: 5321 EAST 136TH AVENUE, Grades: 9-12)

- BRIGHTON HIGH SCHOOL (Students: 1,502, Location: 270 SOUTH 8TH AVENUE, Grades: 9-12)

- BRIGHTON HERITAGE ACADEMY (Students: 288, Location: 830 BRIDGE STREET, Grades: 6-12)

- ADAMS YOUTH SERVICE CENTER (Location: 1933 EAST BRIDGE STREET, Grades: 4-12)

- EAGLE RIDGE ACADEMY (Location: 3551 SOUTHERN STREET, Grades: 9-12, Charter school)

- BOLT ACADEMY (Location: 1850 EGBERT STREET, Grades: 9-12)

Private high school in Brighton:

Biggest public elementary/middle schools in Brighton:

- MARY E PENNOCK ELEMENTARY SCHOOL (Students: 861, Location: 3707 ESTRELLA STREET, Grades: KG-5)

- BROMLEY EAST CHARTER SCHOOL (Students: 810, Location: 356 LONGSPUR DRIVE, Grades: PK-8, Charter school)

- SOUTHEAST ELEMENTARY SCHOOL (Students: 700, Location: 1595 SOUTHERN STREET, Grades: KG-5)

- NORTHEAST ELEMENTARY SCHOOL (Students: 618, Location: 1605 LONGSPEAK, Grades: PK-6)

- OVERLAND TRAIL MIDDLE SCHOOL (Students: 589, Location: 455 NORTH 19TH AVENUE, Grades: 6-8)

- GLACIER PEAK ELEMENTARY SCHOOL (Students: 584, Location: 12060 JASMINE STREET, Grades: KG-5)

- SOUTH ELEMENTARY SCHOOL (Students: 521, Location: 305 SOUTH 5TH AVENUE, Grades: KG-5)

- VIKAN MIDDLE SCHOOL (Students: 501, Location: 879 JESSUP STREET, Grades: 6-8)

- NORTH ELEMENTARY SCHOOL (Students: 441, Location: 89 NORTH 6TH AVENUE, Grades: PK-5)

- FOUNDATIONS ACADEMY (Location: 340 SOUTH 45TH AVENUE, Grades: KG-8, Charter school)

Private elementary/middle schools in Brighton:

Points of interest:

Notable locations in Brighton: Platte Valley Medical Center - Emergency Medical Service (A), Platte Valley Medical Center - Emergency Medical Services (B), Adams County Justice Center (C), Adams County Detention Facility (D), Adams County Sheriff's Office Headquarters (E), Brighton Police Department (F), Greater Brighton Fire Protection District Station 51 Headquarters (G), Brighton Fire Rescue District (H), Greater Brighton Fire Protection District Station 52 (I). Display/hide their locations on the map

Church in Brighton: Elmwood Church (A). Display/hide its location on the map

Cemeteries: Fairview Cemetery (1), Elmwood Cemetery (2), Black Cemetery (3). Display/hide their locations on the map

Reservoirs: Magers Reservoir (A), Higgins Lake (B), Skeel Reservoir Number 1 (C). Display/hide their locations on the map

Creek: Third Creek (A). Display/hide its location on the map

Park in Brighton: Benedict Park (1). Display/hide its location on the map

Tourist attraction: Adams County Historical Society (Museums; 9601 Henderson Road) (1). Display/hide its approximate location on the map

Hotels: Brighton Inn (15151 Brighton Road) (1), Comfort Inn Brighton (15150 Brighton Road) (2). Display/hide their approximate locations on the map

Court: Adams County Government - District Attorney- Trial Support Center-County C (1100 Judicial Center Drive) (1). Display/hide its approximate location on the map

Drinking water stations with addresses in Brighton and their reported violations in the past:

BRIGHTON CITY OF (Population served: 32,700, Purch surface water):Past health violations:BARR LAKE RVP (Population served: 253, Groundwater):Past monitoring violations:

- MCL, Acute (TCR) - In JUL-2013, Contaminant: Coliform. Follow-up actions: St Public Notif received (JUL-03-2013), St Public Notif requested (JUL-09-2013), St Violation/Reminder Notice (JUL-09-2013), St Boil Water Order (JUL-09-2013)

- 31 regular monitoring violations

Past monitoring violations:WAGON WHEEL SKATING RINK (Population served: 104, Groundwater):

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2004, Contaminant: Lead and Copper Rule. Follow-up actions: St Public Notif requested (APR-19-2005), St Violation/Reminder Notice (APR-19-2005), St Compliance achieved (FEB-01-2007)

- One routine major monitoring violation

Past monitoring violations:HOPE DITCH CO (Population served: 63, Groundwater):

- One routine major monitoring violation

- 2 regular monitoring violations

Past monitoring violations:PETROCCO FARMS (Population served: 42, Groundwater):

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2006, Contaminant: Lead and Copper Rule. Follow-up actions: St Public Notif requested (FEB-09-2007), St Violation/Reminder Notice (FEB-09-2007), St Compliance achieved (AUG-25-2008)

- Monitoring and Reporting (DBP) - Between APR-2006 and JUN-2006, Contaminant: Chlorine. Follow-up actions: St Public Notif requested (AUG-18-2006), St Violation/Reminder Notice (AUG-18-2006), St Compliance achieved (OCT-18-2006), St Public Notif received (OCT-23-2006)

- Monitoring and Reporting (DBP) - Between JAN-2006 and MAR-2006, Contaminant: Chlorine. Follow-up actions: St Public Notif requested (JUN-07-2006), St Violation/Reminder Notice (JUN-07-2006), St Compliance achieved (OCT-23-2006), St Public Notif received (DEC-23-2006)

- Follow-up Or Routine LCR Tap M/R - In OCT-01-2004, Contaminant: Lead and Copper Rule. Follow-up actions: St Public Notif requested (APR-19-2005), St Violation/Reminder Notice (APR-19-2005), St Compliance achieved (2 times from JAN-31-2007 to AUG-25-2008)

- One routine major monitoring violation

- 13 regular monitoring violations

Past monitoring violations:SIPRES LOUNGE (Population served: 32, Groundwater):

- One minor monitoring violation

Past health violations:Past monitoring violations:

- MCL, Single Sample - Between OCT-2007 and DEC-2007, Contaminant: Nitrate. Follow-up actions: St AO (w/o penalty) issued (AUG-30-2004), St Violation/Reminder Notice (JAN-14-2008), St Boil Water Order (JAN-14-2008), St Public Notif requested (JAN-14-2008), St Public Notif received (JAN-23-2008), St Compliance achieved (NOV-10-2008)

- MCL, Single Sample - Between JUL-2007 and SEP-2007, Contaminant: Nitrate. Follow-up actions: St AO (w/o penalty) issued (AUG-30-2004), St Violation/Reminder Notice (JAN-14-2008), St Boil Water Order (JAN-14-2008), St Public Notif requested (JAN-14-2008), St Public Notif received (JAN-23-2008), St Compliance achieved (NOV-10-2008)

- MCL, Single Sample - Between APR-2007 and JUN-2007, Contaminant: Nitrate. Follow-up actions: St AO (w/o penalty) issued (AUG-30-2004), St Compliance achieved (NOV-10-2008)

- One routine major monitoring violation

Drinking water stations with addresses in Brighton that have no violations reported:

- HI LAND ACRES WSD (Population served: 350, Primary Water Source Type: Groundwater)

| This city: | 3.0 people |

| Colorado: | 2.5 people |

| This city: | 74.5% |

| Whole state: | 63.9% |

| This city: | 6.7% |

| Whole state: | 6.5% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.3% of all households

People in group quarters in Brighton in 2010:

- 1,294 people in local jails and other municipal confinement facilities

- 197 people in nursing facilities/skilled-nursing facilities

- 27 people in correctional facilities intended for juveniles

- 19 people in group homes intended for adults

- 9 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

People in group quarters in Brighton in 2000:

- 831 people in local jails and other confinement facilities (including police lockups)

- 222 people in nursing homes

- 196 people in agriculture workers' dormitories on farms

- 47 people in other group homes

- 19 people in short-term care, detention or diagnostic centers for delinquent children

Banks with most branches in Brighton (2011 data):

- Valley Bank & Trust: at 4900 E. Bromley Lane, 30 North 4th Branch, East Branch. Info updated 2007/11/29: Bank assets: $245.2 mil, Deposits: $220.9 mil, local headquarters, positive income, Commercial Lending Specialization, 10 total offices, Holding Company: Valley Bancorp, Inc.

- Wells Fargo Bank, National Association: Brighton Branch at 15 South Main Street, branch established on 1932/01/01. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- Academy Bank, National Association: Bromley Lane Wal-Mart at 60 West Bromley Lane, branch established on 2001/07/25. Info updated 2008/06/10: Bank assets: $282.1 mil, Deposits: $218.0 mil, headquarters in Colorado Springs, CO, positive income, Commercial Lending Specialization, 54 total offices, Holding Company: Dickinson Financial Corporation Ii

- Bank of England: Eng Lending at 730 Bridge Street, Suite 2, branch established on 2010/11/15. Info updated 2011/01/06: Bank assets: $240.7 mil, Deposits: $209.4 mil, headquarters in England, AR, positive income, 16 total offices, Holding Company: Mhbc Investments Limited Partnership I Lllp

- U.S. Bank National Association: Sable & Bromley King Soopers Branch at 500 East Bromley Lane, branch established on 2000/04/19. Info updated 2012/01/30: Bank assets: $330,470.8 mil, Deposits: $236,091.5 mil, headquarters in Cincinnati, OH, positive income, 3121 total offices, Holding Company: U.S. Bancorp

- FirstBank: Brighton Branch at 410 East Bromley Lane, branch established on 2001/04/18. Info updated 2011/12/05: Bank assets: $11,597.1 mil, Deposits: $10,530.4 mil, headquarters in Lakewood, CO, positive income, Mortgage Lending Specialization, 130 total offices, Holding Company: Firstbank Holding Company

- Bank of the West: Brighton Branch at 1795 East Bridge Street, branch established on 1891/01/01. Info updated 2009/11/16: Bank assets: $62,408.3 mil, Deposits: $43,995.2 mil, headquarters in San Francisco, CA, positive income, 647 total offices, Holding Company: Bnp Paribas

- First National Bank of Omaha: Brighton Branch at 1600 E. Bridge Street, branch established on 1912/01/01. Info updated 2010/10/13: Bank assets: $13,433.1 mil, Deposits: $10,746.6 mil, headquarters in Omaha, NE, positive income, Commercial Lending Specialization, 102 total offices, Holding Company: Lauritzen Corporation

- Guaranty Bank and Trust Company: Brighton Branch at 2707 E Bromley Lane, branch established on 1997/09/15. Info updated 2010/12/21: Bank assets: $1,687.8 mil, Deposits: $1,331.8 mil, headquarters in Denver, CO, positive income, Commercial Lending Specialization, 34 total offices, Holding Company: Guaranty Bancorp

For population 15 years and over in Brighton:

- Never married: 28.6%

- Now married: 56.0%

- Separated: 1.4%

- Widowed: 3.9%

- Divorced: 10.1%

For population 25 years and over in Brighton:

- High school or higher: 85.2%

- Bachelor's degree or higher: 22.0%

- Graduate or professional degree: 7.2%

- Unemployed: 6.8%

- Mean travel time to work (commute): 26.0 minutes

| Here: | 12.1 |

| Colorado average: | 11.1 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Brighton:

(Brighton, Colorado Neighborhood Map)- Aberdeen South neighborhood

- Adams County Regional Park neighborhood

- Adams Ranch Estates neighborhood

- Adco Plaza neighborhood

- Amber Creek neighborhood

- Ash Grove at Sage Creek neighborhood

- Ash Meadows at Sage Creek neighborhood

- Aspen Ridge neighborhood

- Avondale neighborhood

- Bachman Tract neighborhood

- Barbara Jean neighborhood

- Barr City neighborhood

- Barr Lake Campground neighborhood

- Barr Lake Meadows neighborhood

- Base Line Park neighborhood

- Baseline Heights neighborhood

- Baseline Lakes neighborhood

- Berry Patch Farms neighborhood

- Berry View Estates neighborhood

- Boston Farms neighborhood

- Box Elder Creek neighborhood

- Box Elder Estates neighborhood

- Brantner Village neighborhood

- Brays Tract neighborhood

- Brentwood Village Apartments neighborhood

- Bridge Square neighborhood

- Brighton neighborhood

- Brighton Business Center neighborhood

- Brighton Center neighborhood

- Brighton Crossing neighborhood

- Brighton East Farms neighborhood

- Brighton East Horizions neighborhood

- Brighton Gardens neighborhood

- Brighton Mall neighborhood

- Brighton Manor neighborhood

- Brighton North Industrial Park neighborhood

- Brighton North Village neighborhood

- Brighton Park neighborhood

- Brighton Pavilions neighborhood

- Brighton Senior Apartments neighborhood

- Brighton Terrace neighborhood

- Broadview neighborhood

- Bromley Creek neighborhood

- Bromley Farms neighborhood

- Bromley Heights neighborhood

- Bromley Lane neighborhood

- Bromley Park neighborhood

- Buckley Acres neighborhood

- Buffs Landing neighborhood

- Cam Mar Estates neighborhood

- Campbell Park neighborhood

- Carrol Green neighborhood

- Carson Acres neighborhood

- Carter Acres neighborhood

- Chapel Hill neighborhood

- Cherry Meadows neighborhood

- Clover Meadows neighborhood

- Columbine Industrial Park neighborhood

- Corcilius Acres neighborhood

- Cottage Crossing neighborhood

- Cottonwood neighborhood

- Cottonwood Lanes neighborhood

- Country Haven neighborhood

- Country Hills Estates neighborhood

- Cramer Acres neighborhood

- Creekside Estates neighborhood

- Crescent Village neighborhood

- Crestmoor Acres neighborhood

- Deerfield Equestrian neighborhood

- Di Giorgio Industrial Park neighborhood

- Dogwood neighborhood

- Eagle Shadow neighborhood

- East Ridge neighborhood

- Ebonaire Community Center neighborhood

- Edgemark neighborhood

- Elliott Estates neighborhood

- Elmwood Acres neighborhood

- Fallbrook Farms neighborhood

- Farner Estates neighborhood

- Fountain Condominiums neighborhood

- Foxhill Estates neighborhood

- Foxridge Estates neighborhood

- Friendship Square neighborhood

- Friendship Village neighborhood

- Fulton Village neighborhood

- Gleneagle Estates neighborhood

- Grayson Estates neighborhood

- Greatrock North neighborhood

- Green Estates neighborhood

- Havana Estates neighborhood

- Hawk Ridge neighborhood

- Hayesmount Acres neighborhood

- Hayesmount Estates neighborhood

- Heritage Heights neighborhood

- Heritage Todd Creek neighborhood

- Hi Land Acres neighborhood

- Highland Park neighborhood

- Holly Crossing neighborhood

- Holly Hills neighborhood

- Holyoak neighborhood

- Home To Brighton neighborhood

- Homestead Hills neighborhood

- Homewood Estates neighborhood

- Hughes Station neighborhood

- Hutchcrofts Gardens neighborhood

- I.B.S. Industrial Park neighborhood

- Indigo Trails neighborhood

- Inglenook neighborhood

- J B Estates neighborhood

- Jasmine Estates neighborhood

- Jasper Street Condominiums neighborhood

- Johnsons Acres neighborhood

- Justice Center Office Plaza neighborhood

- King Ranch Estates neighborhood

- Kingdom Hall neighborhood

- Lakeview Estates neighborhood

- Leo Scepurek Memorial neighborhood

- Lewis Pointe neighborhood

- Leyva Landing neighborhood

- Little Texas neighborhood

- Longs Peak neighborhood

- Longspeak Condominiums neighborhood

- Lyons neighborhood

- M & H Industrial Park neighborhood

- Maguire Apartments neighborhood

- Manor Vista neighborhood

- Marshall Lake neighborhood

- Mayfield Appartment neighborhood

- Meadow Lark Acres neighborhood

- Midland Street South neighborhood

- Millers Suburb neighborhood

- Montview neighborhood

- Moonlight Serenade Condominiums neighborhood

- Mount View Park neighborhood

- Mustang Meadows neighborhood

- North Brighton neighborhood

- North Creek Farms neighborhood

- North Pond neighborhood

- Northbrook neighborhood

- Northview Place neighborhood

- Old Farms Townhomes neighborhood

- Overland Hills neighborhood

- Overland Park neighborhood

- Overland Vista neighborhood

- Palizzi Marketplace neighborhood

- Park Place neighborhood

- Park View Patio Homes neighborhood

- Peach Hollow Estates neighborhood

- Peak View Estates neighborhood

- Pheasant Ridge neighborhood

- Platte River Plaza Condominiums neighborhood

- Platte River Ranch neighborhood

- Platte Valley Terrace neighborhood

- Platte View Farm neighborhood

- Pleasant View neighborhood

- Prairie Center neighborhood

- Quail Valley neighborhood

- Quebec Highlands neighborhood

- Quebec Plaza neighborhood

- Quebec Riverdale neighborhood

- Queen Square neighborhood

- Ranchette Estate neighborhood

- Riverdale Park neighborhood

- Riverdale Peaks neighborhood

- Road Runners Rest neighborhood

- Roadgate Farms neighborhood

- Robin Industrial Park neighborhood

- Rocking Horse Farms neighborhood

- Rosedale Park neighborhood

- Sable Estates neighborhood

- Sage Creek neighborhood

- Shenandoah neighborhood

- Sheraton Park neighborhood

- Silver Springs neighborhood

- Silverleaf neighborhood

- Sorrento neighborhood

- Spring Hollow neighborhood

- Springvale neighborhood

- Sugar Creek neighborhood

- Sunflower Meadows neighborhood

- Sunflower Ranch neighborhood

- Sunrise Shadow neighborhood

- Sunset View neighborhood

- Sunset Vista Estates neighborhood

- Talon Pointe neighborhood

- The Fairways at Buffalo Run neighborhood

- The Haven at York Street neighborhood

- The Market Place neighborhood

- The Preserve neighborhood

- The Ridge at Bromley Lane Condominiums neighborhood

- The Ridge at Riverdale neighborhood

- The Village neighborhood

- The Villages at Riverdale neighborhood

- The Vistas At Cherrywood Park neighborhood

- Third Creek Estates neighborhood

- Tierra Fuerte Estates neighborhood

- Todd Creek Farms neighborhood

- Todd Creek Meadows neighborhood

- Tomahawk neighborhood

- Town of Darlow neighborhood

- Trade Center South neighborhood

- Trenton Estates neighborhood

- Triangle Point neighborhood

- Turnberry Market Place neighborhood

- Twin Lakes Estates neighborhood

- Valley View Estates neighborhood

- Vaughn Industrial Park neighborhood

- Vernon Park Apartments neighborhood

- View Point East neighborhood

- Village Lake Townhomes neighborhood

- Voiles Court neighborhood

- Wadley Farms neighborhood

- Walnut neighborhood

- Walnut Grove neighborhood

- Welchs Hilltop Acres neighborhood

- Wheatland Estates neighborhood

- Wheatland Heights neighborhood

- Whitfield Plaza neighborhood

- Wildflower Acres neighborhood

- Wright Farms neighborhood

Religion statistics for Brighton, CO (based on Adams County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 70,598 | 11 |

| Evangelical Protestant | 34,568 | 159 |

| Other | 17,157 | 38 |

| Mainline Protestant | 7,133 | 33 |

| Black Protestant | 195 | 2 |

| Orthodox | - | 1 |

| None | 311,952 | - |

Food Environment Statistics:

| Adams County: | 1.16 / 10,000 pop. |

| State: | 1.50 / 10,000 pop. |

| Adams County: | 0.17 / 10,000 pop. |

| Colorado: | 0.15 / 10,000 pop. |

| Adams County: | 0.21 / 10,000 pop. |

| Colorado: | 0.45 / 10,000 pop. |

| This county: | 2.47 / 10,000 pop. |

| State: | 3.13 / 10,000 pop. |

| Here: | 4.66 / 10,000 pop. |

| Colorado: | 8.99 / 10,000 pop. |

| Adams County: | 6.8% |

| State: | 5.3% |

| Adams County: | 24.3% |

| Colorado: | 18.4% |

| This county: | 10.0% |

| Colorado: | 9.6% |

Health and Nutrition:

| Here: | 47.4% |

| Colorado: | 49.4% |

| Brighton: | 45.8% |

| Colorado: | 47.8% |

| Here: | 28.7 |

| State: | 28.5 |

| This city: | 21.2% |

| State: | 20.7% |

| This city: | 10.4% |

| Colorado: | 9.7% |

| Brighton: | 6.8 |

| Colorado: | 6.8 |

| Brighton: | 33.1% |

| Colorado: | 33.3% |

| This city: | 55.5% |

| State: | 57.3% |

| This city: | 80.3% |

| State: | 80.2% |

More about Health and Nutrition of Brighton, CO Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 77 | $636,069 | $99,128 | 0 | $0 |

| Parks and Recreation | 55 | $260,779 | $56,897 | 86 | $70,441 |

| Water Supply | 48 | $265,415 | $66,354 | 0 | $0 |

| Other Government Administration | 44 | $283,659 | $77,362 | 8 | $10,854 |

| Housing and Community Development (Local) | 39 | $244,974 | $75,377 | 0 | $0 |

| Police - Other | 34 | $200,194 | $70,657 | 2 | $1,565 |

| Streets and Highways | 29 | $182,231 | $75,406 | 0 | $0 |

| Financial Administration | 27 | $206,013 | $91,561 | 2 | $7,343 |

| Judicial and Legal | 8 | $61,105 | $91,658 | 2 | $224 |

| Sewerage | 8 | $45,178 | $67,767 | 1 | $727 |

| Totals for Government | 369 | $2,385,617 | $77,581 | 101 | $91,154 |

Brighton government finances - Expenditure in 2021 (per resident):

- Construction - Water Utilities: $16,705,000 ($398.87)

Sewerage: $2,235,000 ($53.37)

Parks and Recreation: $1,881,000 ($44.91)

Regular Highways: $1,509,000 ($36.03)

General Public Buildings: $67,000 ($1.60)

Housing and Community Development: $8,000 ($0.19)

- Current Operations - Central Staff Services: $50,278,000 ($1200.50)

Water Utilities: $15,190,000 ($362.69)

Police Protection: $13,962,000 ($333.37)

Housing and Community Development: $5,995,000 ($143.14)

Parks and Recreation: $5,969,000 ($142.52)

Sewerage: $5,551,000 ($132.54)

Regular Highways: $3,450,000 ($82.38)

Financial Administration: $1,811,000 ($43.24)

General - Other: $1,600,000 ($38.20)

General Public Buildings: $1,424,000 ($34.00)

Miscellaneous Commercial Activities - Other: $506,000 ($12.08)

Judicial and Legal Services: $425,000 ($10.15)

- Other Capital Outlay - Regular Highways: $2,810,000 ($67.09)

General Public Building: $27,000 ($0.64)

- Total Salaries and Wages: $16,744,000 ($399.80)

- Water Utilities - Interest on Debt: $1,552,000 ($37.06)

Brighton government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $7,011,000 ($167.40)

Housing and Community Development: $294,000 ($7.02)

- Federal Intergovernmental - Public Welfare: $4,500,000 ($107.45)

Other: $135,000 ($3.22)

- Local Intergovernmental - General Local Government Support: $458,000 ($10.94)

Other: $426,000 ($10.17)

- Miscellaneous - General Revenue - Other: $47,076,000 ($1124.04)

Interest Earnings: $4,050,000 ($96.70)

Royalties: $1,026,000 ($24.50)

Fines and Forfeits: $433,000 ($10.34)

Rents: $17,000 ($0.41)

- Revenue - Water Utilities: $13,393,000 ($319.79)

- State Intergovernmental - Other: $313,000 ($7.47)

General Local Government Support: $128,000 ($3.06)

Highways: $7,000 ($0.17)

Health and Hospitals: $1,000 ($0.02)

- Tax - General Sales and Gross Receipts: $31,118,000 ($743.01)

Property: $8,707,000 ($207.90)

Other License: $4,495,000 ($107.33)

Occupation and Business License - Other: $1,303,000 ($31.11)

Alcoholic Beverage License: $3,000 ($0.07)

Alcoholic Beverage Sales: $2,000 ($0.05)

Brighton government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $38,794,000 ($926.29)

Outstanding Unspecified Public Purpose: $36,393,000 ($868.96)

Retired Unspecified Public Purpose: $25,402,000 ($606.53)

Issue, Unspecified Public Purpose: $23,000,000 ($549.18)

Brighton government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $31,076,000 ($742.01)

- Other Funds - Cash and Securities: $123,843,000 ($2957.02)

- Sinking Funds - Cash and Securities: $992,000 ($23.69)

11.65% of this county's 2021 resident taxpayers lived in other counties in 2020 ($55,974 average adjusted gross income)

| Here: | 11.65% |

| Colorado average: | 11.28% |

0.01% of residents moved from foreign countries ($73 average AGI)

Adams County: 0.01% Colorado average: 0.05%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Denver County, CO | |

| from Jefferson County, CO | |

| from Arapahoe County, CO |

11.37% of this county's 2020 resident taxpayers moved to other counties in 2021 ($59,124 average adjusted gross income)

| Here: | 11.37% |

| Colorado average: | 11.05% |

0.01% of residents moved to foreign countries ($78 average AGI)

Adams County: 0.01% Colorado average: 0.03%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Denver County, CO | |

| to Jefferson County, CO | |

| to Arapahoe County, CO |

| Businesses in Brighton, CO | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 7-Eleven | 1 | Kmart | 1 | |

| AT&T | 1 | Kohl's | 1 | |

| Ace Hardware | 1 | Kroger | 1 | |

| Advance Auto Parts | 1 | Little Caesars Pizza | 1 | |

| Applebee's | 1 | Long John Silver's | 1 | |

| Arby's | 1 | Lowe's | 1 | |

| AutoZone | 1 | McDonald's | 2 | |

| Best Western | 1 | Nike | 3 | |

| Blockbuster | 1 | Office Depot | 1 | |

| Buffalo Wild Wings | 1 | Payless | 1 | |

| Burger King | 1 | PetSmart | 1 | |

| Chevrolet | 1 | Pizza Hut | 1 | |

| Chick-Fil-A | 1 | Qdoba Mexican Grill | 1 | |

| Cold Stone Creamery | 1 | Quiznos | 1 | |

| Comfort Inn | 1 | RadioShack | 1 | |

| Cricket Wireless | 3 | SONIC Drive-In | 1 | |

| Curves | 1 | Safeway | 1 | |

| Dairy Queen | 1 | Starbucks | 4 | |

| Discount Tire | 1 | Subway | 4 | |

| Domino's Pizza | 1 | Super 8 | 1 | |

| Famous Footwear | 1 | T-Mobile | 2 | |

| FedEx | 3 | Taco Bell | 2 | |

| Ford | 1 | Target | 1 | |

| GNC | 1 | U-Haul | 1 | |

| H&R Block | 3 | UPS | 5 | |

| Hilton | 1 | Vans | 1 | |

| Holiday Inn | 1 | Verizon Wireless | 1 | |

| Home Depot | 1 | Village Inn | 1 | |

| IHOP | 1 | Vons | 1 | |

| JCPenney | 1 | Walmart | 2 | |

| KFC | 1 | Wendy's | 2 | |

Strongest AM radio stations in Brighton:

- KLTT (670 AM; 50 kW; COMMERCE CITY, CO; Owner: KLZ RADIO, INC.)

- KKZN (760 AM; 50 kW; THORNTON, CO; Owner: JACOR BROADCASTING OF COLORADO, INC.)

- KNUS (710 AM; 5 kW; DENVER, CO; Owner: SALEM MEDIA OF COLORADO, INC.)

- KHOW (630 AM; 5 kW; DENVER, CO; Owner: CITICASTERS LICENSES, L.P.)

- KMXA (1090 AM; 50 kW; AURORA, CO; Owner: ENTRAVISION HOLDINGS, LLC)

- KLDC (800 AM; 1 kW; BRIGHTON, CO; Owner: KLZ RADIO, INC.)

- KLZ (560 AM; 5 kW; DENVER, CO; Owner: KLZ RADIO, INC.)

- KKFN (950 AM; 5 kW; DENVER, CO; Owner: JEFFERSON-PILOT COMMUNICATIONS COMPANY OF COLORADO)

- KLMO (1060 AM; 30 kW; LONGMONT, CO; Owner: PILGRIM COMMUNICATIONS, INC.)

- KOA (850 AM; 50 kW; DENVER, CO; Owner: JACOR BROADCASTING OF COLORADO, INC.)

- KRKS (990 AM; 10 kW; DENVER, CO; Owner: SALEM MEDIA OF COLORADO, INC.)

- KBJD (1650 AM; 10 kW; DENVER, CO; Owner: SALEM MEDIA OF COLORADO, INC.)

- KJME (1390 AM; 5 kW; DENVER, CO; Owner: JO-MOR COMMUNICATIONS, INC.)

Strongest FM radio stations in Brighton:

- KJCD (104.3 FM; LONGMONT, CO; Owner: JEFFERSON-PILOT COMMUNICATIONS COMPANY OF COLORADO)

- KDJM (92.5 FM; BROOMFIELD, CO; Owner: INFINITY RADIO OPERATIONS INC.)

- KTCL (93.3 FM; FORT COLLINS, CO; Owner: JACOR BROADCASTING OF COLORADO, INC.)

- KQMT (99.5 FM; DENVER, CO; Owner: ENTERCOM DENVER LICENSE, LLC)

- KALC (105.9 FM; DENVER, CO; Owner: ENTERCOM DENVER LICENSE, LLC)

- KBPI (106.7 FM; DENVER, CO; Owner: JACOR BROADCASTING OF COLORADO, INC.)

- KBCO-FM (97.3 FM; BOULDER, CO; Owner: CITICASTERS LICENSES, L.P.)

- KRKS-FM (94.7 FM; LAFAYETTE, CO; Owner: SALEM MEDIA OF COLORADO, INC)

- KOSI (101.1 FM; DENVER, CO; Owner: ENTERCOM DENVER LICENSE, LLC)

- KFMD (95.7 FM; DENVER, CO; Owner: CITICASTERS LICENSES, L.P.)

- KRFX (103.5 FM; DENVER, CO; Owner: JACOR BROADCASTING OF COLORADO, INC.)

- KQKS (107.5 FM; LAKEWOOD, CO; Owner: JEFFERSON-PILOT COMMUNICATIONS COMPANY OF COLORADO)

- KSIR-FM1 (107.1 FM; HUDSON, CO; Owner: KKDD-FM BROADCASTERS)

- KBRU-FM (101.7 FM; FORT MORGAN, CO; Owner: ON-AIR FAMILY, LLC)

- KYGO-FM (98.5 FM; DENVER, CO; Owner: JEFFERSON-PILOT COMMUNICATIONS COMPANY OF COLORADO)

- KUVO (89.3 FM; DENVER, CO; Owner: DENVER EDUCATIONAL BROADCASTING)

- KJMN (92.1 FM; CASTLE ROCK, CO; Owner: ENTRAVISION HOLDINGS, LLC)

- KXKL-FM (105.1 FM; DENVER, CO; Owner: INFINITY RADIO OPERATIONS INC.)

- KIMN (100.3 FM; DENVER, CO; Owner: INFINITY RADIO OPERATIONS INC.)

- KXPK (96.5 FM; EVERGREEN, CO; Owner: ENTRAVISION HOLDINGS, LLC)

TV broadcast stations around Brighton:

- KDEN (Channel 25; LONGMONT, CO; Owner: LONGMONT CHANNEL 25, INC.)

- KMGH-TV (Channel 7; DENVER, CO; Owner: MCGRAW-HILL BROADCASTING COMPANY, INC.)

- KRMA-TV (Channel 6; DENVER, CO; Owner: ROCKY MOUNTAIN PUBLIC BROADCASTING NETWORK, INC.)

- K48FW (Channel 48; DENVER, CO; Owner: TRINITY BROADCASTING NETWORK)

- KUSA-TV (Channel 9; DENVER, CO; Owner: MULTIMEDIA HOLDINGS CORPORATION)

- KTVD (Channel 20; DENVER, CO; Owner: TWENVER BROADCAST, INC.)

- KCNC-TV (Channel 4; DENVER, CO; Owner: CBS TELEVISION STATIONS INC.)

- KDEO-LP (Channel 38; AURORA, CO; Owner: PETER B. VAN DE SANDE)

- KWGN-TV (Channel 2; DENVER, CO; Owner: KWGN INC.)

- KDEV-LP (Channel 62; AURORA, CO; Owner: TIGER EYE BROADCASTING CORPORATION)

- K66FB (Channel 66; DENVER, CO; Owner: TRINITY BROADCASTING NETWORK)

- National Bridge Inventory (NBI) Statistics

- 77Number of bridges

- 1,125ft / 343mTotal length

- $10,240,000Total costs

- 1,097,551Total average daily traffic

- 102,938Total average daily truck traffic

- New bridges - historical statistics

- 11930-1939

- 11940-1949

- 51950-1959

- 81960-1969

- 51970-1979

- 71980-1989

- 181990-1999

- 312000-2009

- 12010-2019

FCC Registered Antenna Towers: 67 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 1 (See the full list of FCC Registered Commercial Land Mobile Towers in Brighton, CO)

FCC Registered Private Land Mobile Towers: 1 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 40 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 78 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 2 (See the full list of FCC Registered Paging Towers)

FCC Registered Amateur Radio Licenses: 285 (See the full list of FCC Registered Amateur Radio Licenses in Brighton)

FAA Registered Aircraft Manufacturers and Dealers: 8 (See the full list of FAA Registered Manufacturers and Dealers in Brighton)

FAA Registered Aircraft: 157 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 2 full and 4 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 247 | $171,227 | 110 | $129,989 | 507 | $188,314 | 13 | $48,326 | 0 | $0 | 58 | $114,255 | 4 | $55,165 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 20 | $174,454 | 12 | $154,682 | 47 | $177,140 | 5 | $10,526 | 0 | $0 | 4 | $90,980 | 1 | $16,500 |

| APPLICATIONS DENIED | 35 | $183,819 | 24 | $134,627 | 175 | $179,173 | 23 | $24,410 | 0 | $0 | 12 | $94,954 | 3 | $37,947 |

| APPLICATIONS WITHDRAWN | 22 | $154,530 | 4 | $217,472 | 130 | $189,720 | 4 | $83,942 | 1 | $153,410 | 4 | $129,115 | 1 | $250,740 |

| FILES CLOSED FOR INCOMPLETENESS | 5 | $129,664 | 1 | $75,070 | 34 | $178,846 | 5 | $51,902 | 0 | $0 | 2 | $70,770 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 0085.12 , 0085.22, 0086.03, 0086.04, 0086.05, 0086.06

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 2 full and 4 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 23 | $182,347 | 22 | $200,776 | 1 | $126,810 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 12 | $179,112 | 6 | $137,227 | 2 | $51,355 |

| APPLICATIONS DENIED | 2 | $146,130 | 1 | $345,030 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 1 | $144,760 | 1 | $281,730 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $230,220 | 1 | $296,930 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 0085.12 , 0085.22, 0086.03, 0086.04, 0086.05, 0086.06

2004 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Brighton, CO

- 1,14953.9%Outside Fires

- 59627.9%Structure Fires

- 36617.2%Mobile Property/Vehicle Fires

- 221.0%Other

According to the data from the years 2004 - 2018 the average number of fire incidents per year is 142. The highest number of reported fires - 207 took place in 2008, and the least - 10 in 2004. The data has a growing trend.

According to the data from the years 2004 - 2018 the average number of fire incidents per year is 142. The highest number of reported fires - 207 took place in 2008, and the least - 10 in 2004. The data has a growing trend. When looking into fire subcategories, the most reports belonged to: Outside Fires (53.9%), and Structure Fires (27.9%).

When looking into fire subcategories, the most reports belonged to: Outside Fires (53.9%), and Structure Fires (27.9%).Fire-safe hotels and motels in Brighton, Colorado:

- Comfort Inn Brighton, 15150 Brighton Rd, Brighton, Colorado 80601 , Phone: (303) 654-1400, Fax: (303) 654-7973

- Holiday Inn Express & Suites, 2180 S Medical Center Dr, Brighton, Colorado 80601 , Phone: (720) 685-1500, Fax: (720) 685-1501

- Hampton Inn Brighton, 992 Platte River Blvd, Brighton, Colorado 80601 , Phone: (303) 654-8055, Fax: (303) 655-8294

- Candlewood Suites Denver Northeast Brighton, 2204 S Medical Center Dr, Brighton, Colorado 80601 , Phone: (303) 659-6929, Fax: (303) 659-0947

- Best Western Brighton Inn, 15151 Brighton Rd, Brighton, Colorado 80601 , Phone: (303) 637-7710, Fax: (303) 637-7625

- Holiday Inn Express & Suites Denver NE Brighton, 2212 S Medical Center Dr, Brighton, Colorado 80601 , Phone: (303) 659-8574, Fax: (303) 659-8806

- 80.8%Utility gas

- 16.7%Electricity

- 1.2%Solar energy

- 0.9%Bottled, tank, or LP gas

- 0.5%Wood

- 68.1%Utility gas

- 29.9%Electricity

- 1.2%Bottled, tank, or LP gas

- 0.4%Other fuel

- 0.3%No fuel used

Brighton compared to Colorado state average:

- Unemployed percentage below state average.

- Hispanic race population percentage significantly above state average.

- Median age below state average.

- Foreign-born population percentage above state average.

- Institutionalized population percentage above state average.

Brighton on our top lists:

- #92 on the list of "Top 101 cities with the largest percentage of people in agriculture workers' dormitories on farms (population 1,000+)"

- #3 on the list of "Top 101 counties with the highest Nitrogen Dioxide air pollution readings in 2012 (ppm)"

- #24 on the list of "Top 101 counties with the highest carbon monoxide air pollution readings in 2012 (ppm)"

- #32 on the list of "Top 101 counties with the lowest percentage of residents that visited a dentist within the past year"

- #59 on the list of "Top 101 counties with the lowest percentage of residents relocating from foreign countries between 2010 and 2011 (pop. 50,000+)"

- #59 on the list of "Top 101 counties with the largest decrease in the number of infant deaths per 1000 residents 2000-2006 to 2007-2013 (pop. 50,000+)"

|

|

Total of 240 patent applications in 2008-2024.