Chesterfield, Missouri

Chesterfield: Logan College of Chiropractic Campus

Chesterfield: A beautiful frozen fountain last January.

Chesterfield: Baxter Crossings

Chesterfield: Baxter Crossings

Chesterfield: Logan College of Chiropractic Campus

Chesterfield: Logan College of Chiropractic Campus

- add

your

Submit your own pictures of this city and show them to the world

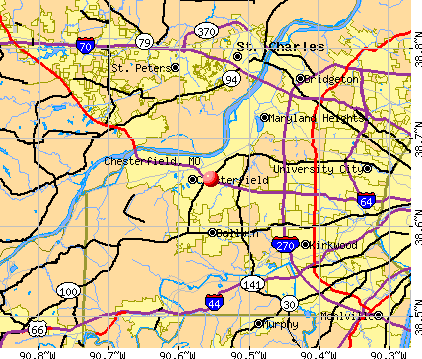

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +5.4%

| Males: 23,879 | |

| Females: 25,448 |

| Median resident age: | 47.3 years |

| Missouri median age: | 39.1 years |

| Chesterfield: | $139,462 |

| MO: | $64,811 |

Estimated per capita income in 2022: $75,012 (it was $43,288 in 2000)

Chesterfield city income, earnings, and wages data

Estimated median house or condo value in 2022: $463,108 (it was $232,100 in 2000)

| Chesterfield: | $463,108 |

| MO: | $221,200 |

Mean prices in 2022: all housing units: $529,738; detached houses: $566,392; townhouses or other attached units: $414,370; in 3-to-4-unit structures: $291,129; in 5-or-more-unit structures: $249,105; mobile homes: $33,763

Median gross rent in 2022: $1,450.

(3.9% for White Non-Hispanic residents, 4.0% for Black residents, 11.5% for Hispanic or Latino residents, 56.2% for American Indian residents, 3.8% for other race residents, 5.7% for two or more races residents)

Detailed information about poverty and poor residents in Chesterfield, MO

- 36,03073.3%White alone

- 6,81713.9%Asian alone

- 3,3946.9%Two or more races

- 1,6633.4%Hispanic

- 1,6323.3%Black alone

- 1420.3%Other race alone

- 230.05%American Indian alone

Races in Chesterfield detailed stats: ancestries, foreign born residents, place of birth

According to our research of Missouri and other state lists, there were 21 registered sex offenders living in Chesterfield, Missouri as of April 24, 2024.

The ratio of all residents to sex offenders in Chesterfield is 2,268 to 1.

The ratio of registered sex offenders to all residents in this city is much lower than the state average.

Type |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Murders (per 100,000) | 1 (2.2) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 2 (4.2) | 0 (0.0) | 0 (0.0) | 0 (0.0) |

| Rapes (per 100,000) | 1 (2.2) | 2 (4.2) | 3 (6.3) | 2 (4.2) | 2 (4.2) | 4 (8.4) | 4 (8.4) | 7 (14.6) | 8 (16.8) | 3 (6.3) | 5 (10.5) | 5 (10.5) | 3 (6.3) | 4 (8.1) |

| Robberies (per 100,000) | 6 (13.1) | 11 (23.2) | 9 (18.9) | 7 (14.7) | 6 (12.6) | 5 (10.5) | 13 (27.2) | 9 (18.8) | 11 (23.1) | 2 (4.2) | 5 (10.5) | 8 (16.8) | 5 (10.5) | 5 (10.1) |

| Assaults (per 100,000) | 19 (41.3) | 33 (69.5) | 21 (44.1) | 14 (29.4) | 17 (35.6) | 25 (52.3) | 18 (37.6) | 41 (85.5) | 34 (71.3) | 17 (35.7) | 19 (39.9) | 30 (63.1) | 27 (56.7) | 26 (52.6) |

| Burglaries (per 100,000) | 86 (187.1) | 99 (208.5) | 76 (159.5) | 68 (143.0) | 61 (127.8) | 42 (87.8) | 60 (125.4) | 55 (114.7) | 59 (123.7) | 56 (117.6) | 82 (172.0) | 118 (248.2) | 85 (178.7) | 49 (99.1) |

| Thefts (per 100,000) | 814 (1,770) | 876 (1,845) | 654 (1,372) | 667 (1,402) | 608 (1,273) | 677 (1,416) | 729 (1,524) | 780 (1,627) | 751 (1,575) | 654 (1,374) | 648 (1,360) | 630 (1,325) | 662 (1,391) | 630 (1,274) |

| Auto thefts (per 100,000) | 13 (28.3) | 21 (44.2) | 15 (31.5) | 20 (42.1) | 16 (33.5) | 11 (23.0) | 22 (46.0) | 33 (68.8) | 37 (77.6) | 22 (46.2) | 51 (107.0) | 89 (187.2) | 71 (149.2) | 70 (141.6) |

| Arson (per 100,000) | 4 (8.7) | 3 (6.3) | 1 (2.1) | 1 (2.1) | 0 (0.0) | 2 (4.2) | 1 (2.1) | 2 (4.2) | 0 (0.0) | 0 (0.0) | 2 (4.2) | 3 (6.3) | 2 (4.2) | 2 (4.0) |

| City-Data.com crime index | 104.4 | 116.1 | 88.1 | 83.1 | 76.8 | 84.9 | 95.8 | 113.0 | 112.5 | 80.3 | 102.9 | 111.4 | 99.6 | 89.2 |

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Crime rate in Chesterfield detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 112 (98 officers - 84 male; 14 female).

| Officers per 1,000 residents here: | 2.06 |

| Missouri average: | 2.54 |

| About Chesterfield (8 replies) |

| Living in chesterfield? (14 replies) |

| Chesterfield Mall and Sears? (13 replies) |

| Best suburb in St. Louis...... (43 replies) |

| Just got a job in Chesterfield. I don't want to live there. (10 replies) |

| Chesterfield area vs town and country (7 replies) |

Latest news from Chesterfield, MO collected exclusively by city-data.com from local newspapers, TV, and radio stations

Chesterfield, MO City Guides:

Ancestries: German (18.7%), American (6.3%), Irish (5.8%), English (5.6%), Russian (4.9%), European (3.1%).

Current Local Time: CST time zone

Incorporated in 1988

Elevation: 470 feet

Land area: 31.5 square miles.

Population density: 1,566 people per square mile (low).

7,765 residents are foreign born (10.4% Asia, 3.7% Europe).

| This city: | 15.8% |

| Missouri: | 4.2% |

Median real estate property taxes paid for housing units with mortgages in 2022: $5,267 (1.1%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $5,303 (1.2%)

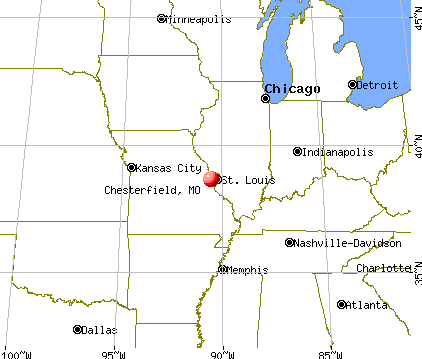

Nearest city with pop. 50,000+: St. Peters, MO (9.1 miles

, pop. 51,381).

Nearest city with pop. 200,000+: St. Louis, MO (16.9 miles

, pop. 348,189).

Nearest city with pop. 1,000,000+: Chicago, IL (267.6 miles

, pop. 2,896,016).

Nearest cities:

Latitude: 38.65 N, Longitude: 90.55 W

Daytime population change due to commuting: +24,656 (+50.1%)

Workers who live and work in this city: 10,854 (44.9%)

Area code: 636

Property values in Chesterfield, MO

Chesterfield, Missouri accommodation & food services, waste management - Economy and Business Data

| Here: | 2.5% |

| Missouri: | 2.8% |

- Professional, scientific, technical services (11.6%)

- Educational services (10.9%)

- Health care (10.1%)

- Finance & insurance (9.1%)

- Accommodation & food services (4.2%)

- Real estate & rental & leasing (3.3%)

- Chemicals (3.0%)

- Professional, scientific, technical services (14.7%)

- Finance & insurance (9.7%)

- Health care (7.0%)

- Educational services (4.4%)

- Accommodation & food services (4.4%)

- Transportation equipment (4.3%)

- Chemicals (3.8%)

- Educational services (18.7%)

- Health care (13.8%)

- Finance & insurance (8.3%)

- Professional, scientific, technical services (7.8%)

- Real estate & rental & leasing (4.0%)

- Accommodation & food services (3.9%)

- Social assistance (3.6%)

- Sales representatives, services, wholesale and manufacturing (7.6%)

- Other management occupations, except farmers and farm managers (6.5%)

- Other sales and related occupations, including supervisors (5.8%)

- Top executives (5.6%)

- Computer specialists (4.3%)

- Retail sales workers, except cashiers (4.1%)

- Preschool, kindergarten, elementary, and middle school teachers (3.8%)

- Sales representatives, services, wholesale and manufacturing (10.2%)

- Top executives (9.0%)

- Other management occupations, except farmers and farm managers (8.3%)

- Other sales and related occupations, including supervisors (6.0%)

- Computer specialists (5.5%)

- Engineers (5.5%)

- Retail sales workers, except cashiers (3.6%)

- Preschool, kindergarten, elementary, and middle school teachers (7.7%)

- Secretaries and administrative assistants (6.8%)

- Other sales and related occupations, including supervisors (5.6%)

- Other office and administrative support workers, including supervisors (4.9%)

- Retail sales workers, except cashiers (4.7%)

- Registered nurses (4.7%)

- Sales representatives, services, wholesale and manufacturing (4.4%)

Average climate in Chesterfield, Missouri

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

Air Quality Index (AQI) level in 2023 was 99.6. This is worse than average.

| City: | 99.6 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.248. This is about average. Closest monitor was 4.2 miles away from the city center.

| City: | 0.248 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2023 was 9.27. This is significantly worse than average. Closest monitor was 4.2 miles away from the city center.

| City: | 9.27 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2023 was 1.02. This is significantly better than average. Closest monitor was 4.2 miles away from the city center.

| City: | 1.02 |

| U.S.: | 1.51 |

Ozone [ppb] level in 2023 was 32.0. This is about average. Closest monitor was 4.2 miles away from the city center.

| City: | 32.0 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 23.2. This is worse than average. Closest monitor was 10.7 miles away from the city center.

| City: | 23.2 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 11.2. This is worse than average. Closest monitor was 11.0 miles away from the city center.

| City: | 11.2 |

| U.S.: | 8.1 |

Lead (Pb) [µg/m3] level in 2009 was 0.0519. This is significantly worse than average. Closest monitor was 4.2 miles away from the city center.

| City: | 0.0519 |

| U.S.: | 0.0093 |

Tornado activity:

Chesterfield-area historical tornado activity is near Missouri state average. It is 70% greater than the overall U.S. average.

On 1/24/1967, a category F4 (max. wind speeds 207-260 mph) tornado 1.9 miles away from the Chesterfield city center killed 3 people and injured 216 people and caused between $5,000,000 and $50,000,000 in damages.

On 2/10/1959, a category F4 tornado 8.9 miles away from the city center killed 21 people and injured 345 people and caused between $5,000,000 and $50,000,000 in damages.

Earthquake activity:

Chesterfield-area historical earthquake activity is significantly above Missouri state average. It is 326% greater than the overall U.S. average.On 4/18/2008 at 09:36:59, a magnitude 5.4 (5.1 MB, 4.8 MS, 5.4 MW, 5.2 MW, Class: Moderate, Intensity: VI - VII) earthquake occurred 145.0 miles away from the city center

On 4/18/2008 at 09:36:59, a magnitude 5.2 (5.2 MW, Depth: 8.9 mi) earthquake occurred 145.0 miles away from the city center

On 9/26/1990 at 13:18:51, a magnitude 5.0 (4.7 MB, 4.8 LG, 5.0 LG, Depth: 7.7 mi) earthquake occurred 116.9 miles away from Chesterfield center

On 6/10/1987 at 23:48:54, a magnitude 5.1 (4.9 MB, 4.4 MS, 4.6 MS, 5.1 LG) earthquake occurred 144.5 miles away from the city center

On 5/4/1991 at 01:18:54, a magnitude 5.0 (4.4 MB, 4.6 LG, 5.0 LG, Depth: 3.1 mi) earthquake occurred 150.0 miles away from the city center

On 6/18/2002 at 17:37:15, a magnitude 5.0 (4.3 MB, 4.6 MW, 5.0 LG) earthquake occurred 157.4 miles away from Chesterfield center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in St. Louis County (2) is a lot smaller than the US average (15).Causes of natural disasters: Flood: 1, Storm: 1, Tornado: 1, Wind: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: RELIV INTERNATIONAL INC (PHARMACEUTICAL PREPARATIONS), BRAND INTERMEDIATE HOLDINGS INC (CONSTRUCTION SPECIAL TRADE CONTRACTORS), REINSURANCE GROUP OF AMERICA INC (ACCIDENT & HEALTH INSURANCE), KELLWOOD CO (WOMEN'S, MISSES', AND JUNIORS OUTERWEAR), REINSURANCE GROUP OF AMERICA INC (ACCIDENT & HEALTH INSURANCE), MAVERICK TUBE CORPORATION (STEEL PIPE & TUBES), ANGELICA CORP /NEW/ (SERVICES-PERSONAL SERVICES), INSITUFORM TECHNOLOGIES INC (WATER, SEWER, PIPELINE, COMM AND POWER LINE CONSTRUCTION) and 1 other public companies.

Hospitals in Chesterfield:

- DUBUIS HOSPITAL OF ST LOUIS (13190 SOUTH OUTER 40 ROAD)

- PATHWAYS COMMUNITY HOSPICE (14805 NORTH OUTER 40 ROAD, SUITE 160)

- ST JOHN'S MERCY REHABILITATION HOSPITAL (14561 NORTH OUTER FORTY)

- ST LUKES HOSPITAL (Voluntary non-profit - Private, 232 S WOODS MILL RD)

Nursing Homes in Chesterfield:

- BROOKING PARK (307 SOUTH WOODS MILL ROAD)

- CEDARS OF TOWN AND COUNTRY, LLC, THE (13190 SOUTH OUTER 40 ROAD)

- CHESTERFIELD MANOR (14001 OLIVE ST RD)

- DELMAR GARDENS OF CHESTERFIELD (14855 NORTH OUTER 40 ROAD)

- DELMAR GARDENS ON THE GREEN (15197 CLAYTON ROAD)

- FRIENDSHIP VILLAGE CHESTERFIELD (15201 OLIVE BOULEVARD)

- GARDEN VIEW CARE CENTER OF CHESTERFIELD (1025 CHESTERFIELD POINTE PARKWAY)

- SURREY PLACE ST LUKES HOSP SKILLED NURSING AND RCF (14701 OLIVE BLVD)

- WESTCHESTER HOUSE, THE (550 WHITE ROAD)

Dialysis Facilities in Chesterfield:

Home Health Centers in Chesterfield:

Airports and heliports located in Chesterfield:

- Spirit Of St Louis Airport (SUS) (Runways: 2, Commercial Ops: 34, Air Taxi Ops: 21,855, Itinerant Ops: 51,510, Local Ops: 43,294, Military Ops: 1,759)

- St Lukes Hospital West Heliport (MO12)

Amtrak stations near Chesterfield:

- 10 miles: KIRKWOOD (110 W. ARGONNE RD.) . Services: ticket office, partially wheelchair accessible, enclosed waiting area, public restrooms, public payphones, free short-term parking, free long-term parking, taxi stand, intercity bus service, public transit connection.

- 19 miles: ST. LOUIS (550 S. 16TH ST.) . Services: ticket office, partially wheelchair accessible, enclosed waiting area, public restrooms, public payphones, vending machines, free short-term parking, free long-term parking, call for car rental service, taxi stand.

College/University in Chesterfield:

Colleges/universities with over 2000 students nearest to Chesterfield:

- Maryville University of Saint Louis (about 3 miles; Saint Louis, MO; Full-time enrollment: 3,651)

- Missouri Baptist University (about 6 miles; Saint Louis, MO; FT enrollment: 2,898)

- St Charles Community College (about 9 miles; Cottleville, MO; FT enrollment: 5,302)

- Lindenwood University (about 10 miles; Saint Charles, MO; FT enrollment: 11,117)

- Webster University (about 13 miles; Saint Louis, MO; FT enrollment: 12,406)

- Washington University in St Louis (about 14 miles; Saint Louis, MO; FT enrollment: 10,823)

- University of Missouri-St Louis (about 14 miles; Saint Louis, MO; FT enrollment: 10,322)

Public high schools in Chesterfield:

- MARQUETTE SR. HIGH (Students: 2,104, Location: 2351 CLARKSON RD, Grades: 9-12)

- CENTRAL HIGH (Students: 1,353, Location: 369 N WOODS MILL RD, Grades: 9-12)

- BABLER LODGE (Students: 633, Location: 1010 LODGE RD, Grades: 6-12)

Private high schools in Chesterfield:

Public elementary/middle schools in Chesterfield:

- WEST MIDDLE (Students: 938, Location: 2312 BAXTER RD, Grades: 6-8)

- CENTRAL MIDDLE (Students: 917, Location: 471 N WOODS MILL RD, Grades: 6-8)

- KEHRS MILL ELEM. (Students: 607, Location: 2650 KEHRS MILL RD, Grades: KG-5)

- CHESTERFIELD ELEM. (Students: 527, Location: 17700 WILD HORSE CREEK RD, Grades: KG-5)

- WILD HORSE ELEM. (Students: 523, Location: 16695 WILD HORSE CREEK RD, Grades: KG-5)

- GREEN TRAILS ELEM. (Students: 455, Location: 170 PORTICO DR, Grades: KG-5)

- SHENANDOAH VALLEY ELEM. (Students: 440, Location: 15399 APPALACHIAN TRAIL, Grades: KG-5)

- HIGHCROFT RIDGE ELEM. (Students: 398, Location: 15380 HIGHCROFT DR, Grades: KG-5)

- RIVER BEND ELEM. (Students: 269, Location: 224 RIVER VALLEY DR, Grades: KG-5)

Private elementary/middle schools in Chesterfield:

- ASCENSION SCHOOL (Students: 390, Location: 238 SANTA MARIA DR, Grades: KG-8)

- INCARNATE WORD PARISH SCHOOL (Students: 390, Location: 13416 OLIVE BLVD, Grades: KG-8)

- CHESTERFIELD MONTESSORI SCHOOL (Students: 118, Location: 14000 LADUE RD, Grades: PK-7)

- WEST COUNTY CHRISTIAN ACADEMY (Students: 67, Location: 13431 N OUTER 40 RD, Grades: KG-8)

- ST JOSEPH INSTITUTE FOR THE DEAF (Students: 32, Location: 1809 CLARKSON RD, Grades: PK-7)

- WESTWOOD JUNIOR ACADEMY (Students: 23, Location: 16601 WILD HORSE CREEK RD, Grades: PK-7)

User-submitted facts and corrections:

- marquette sr. high school is in the city of Clarkson Valley

Points of interest:

Notable locations in Chesterfield: Forum Center (A), Saint Louis City Waterworks (B), Monarch Station (C), Meadowbrook Country Club (D), Monarch Fire Protection District Station 4 (E), Monarch Fire Protection District Station 1 (F), Monarch Fire Protection District Station 5 (G). Display/hide their locations on the map

Shopping Centers: Claymont Shopping Center (1), Chesterfield Mall (2), Four Seasons Shopping Center (3), Chesterfield Plaza Shopping Center (4), Dierbergs Marketplace Shopping Center (5). Display/hide their locations on the map

Main business address in Chesterfield include: RELIV INTERNATIONAL INC (A), BRAND INTERMEDIATE HOLDINGS INC (B), REINSURANCE GROUP OF AMERICA INC (C), MAVERICK TUBE CORPORATION (D), INSITUFORM TECHNOLOGIES INC (E). Display/hide their locations on the map

Churches in Chesterfield include: Bonhomme Church (A), Gumbo Church (B), Saint Johns Church (C), Saint Thomas Church (D), Antioch Baptist Church (E). Display/hide their locations on the map

Cemeteries: Conway Cemetery (1), Everwine Cemetery (2), Saint Johns United Church of Christ Cemetery (3). Display/hide their locations on the map

Reservoirs: Fienup Lake (A), Number 126 Reservoir (B), Arrowhead Estates Lower Lake (C). Display/hide their locations on the map

Creeks: Bonhomme Creek (A), Caulks Creek (B). Display/hide their locations on the map

Tourist attractions: Kemp Auto Museum (16955 Chesterfield Airport) (1), Faust-Park Thornhill Home & Historical Village (Museums; 15185 Olive Boulevard) (2), Butterfly House (Museums; 15193 Olive Boulevard) (3), E B Games (Amusement & Theme Parks; 17225 Chesterfield Airport) (4), Balloon Society St Louis Inc (641 Cepi Drive) (5), Gateway Travel (Tours & Charters; 14848 Clayton Road) (6). Display/hide their approximate locations on the map

Hotels: Hampton Inn Suites (5 McBride And Son Cent) (1), Country Club Hotel & Spa (2225 Village Green Parkway) (2), Homewood Suites Chesterfield (840 Chesterfield Parkway West) (3), Doubletree Hotel & Conferance Center St Louis (16625 SWingley Ridge Road) (4), Hampton Inn St. Louis-Chesterfield (16201 Swingley Ridge) (5), Comfort Inn & Suites (18375 Chesterfield Arpt Road) (6), Hampton Inn & Suites St. Louis-Chesterfi (5 McBride & Son Center Drive) (7), Hilton Garden Inn St. Louis/Chesterfield (16631 Chesterfield Grove Road) (8), Doubletree Hotel & Conference Center St. (16625 Swingley Ridge Road) (9). Display/hide their approximate locations on the map

Courts: St Louis-County - Family Court Center- Family Court Outlying Offices- West Co (80 Clarkson Wilson Centre) (1), Chesterfield-City - Municipal Court- Court Clerk (690 Chesterfield Parkway West) (2), St Louis-County - Municipal Court-Dept- West Division Court (82 Clarkson Wilson Centre) (3), Home Court Advantaged Llc (17361 Edison Avenue) (4). Display/hide their approximate locations on the map

Birthplace of: Jeremy Maclin - College football player, Al Lowe - Musician and game designer, Neil Grant Komadoski - Ice hockey player, Travis Turnbull - Ice hockey player, Jeff LoVecchio - Ice hockey player, James Twellman - Major League Soccer player (San Jose, born: Dec 24, 1982), Michael Davies (ice hockey) - Ice hockey player, Philip McRae - Ice hockey player.

| This city: | 2.4 people |

| Missouri: | 2.5 people |

| This city: | 70.0% |

| Whole state: | 65.3% |

| This city: | 2.8% |

| Whole state: | 6.7% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.2% of all households

- Gay men: 0.2% of all households

People in group quarters in Chesterfield in 2010:

- 925 people in nursing facilities/skilled-nursing facilities

- 5 people in group homes intended for adults

- 4 people in other noninstitutional facilities

People in group quarters in Chesterfield in 2000:

- 1,001 people in nursing homes

- 47 people in institutions for the deaf

- 22 people in local jails and other confinement facilities (including police lockups)

- 3 people in religious group quarters

Banks with most branches in Chesterfield (2011 data):

- U.S. Bank National Association: Woods Mill Office, Chesterfield Schnucks Branch, Woods Mill Schnucks Branch, Clarkson Square Branch, Chesterfield Hilltown Office. Info updated 2012/01/30: Bank assets: $330,470.8 mil, Deposits: $236,091.5 mil, headquarters in Cincinnati, OH, positive income, 3121 total offices, Holding Company: U.S. Bancorp

- Lindell Bank & Trust Company: Chesterfield Branch # 91, Clarkson Branch, Chesterfield Valley Branch # 93. Info updated 2010/01/07: Bank assets: $506.6 mil, Deposits: $373.2 mil, headquarters in St. Louis, MO, positive income, Commercial Lending Specialization, 10 total offices, Holding Company: First Illinois Bancorp, Inc.

- Bank of America, National Association: Baxter Branch at 505 Baxter Road Branch, branch established on 1975/09/15; Chesterfield Commons Branch at 16900 Chesterfield Airport Rd, branch established on 1985/02/21. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Commerce Bank: Chesterfield Branch at 1699 Clarkson Rd, branch established on 1983/04/04; Town And Country Branch at 1090 Schnucks Woodsmill Plz, branch established on 1992/02/12. Info updated 2011/07/07: Bank assets: $20,493.6 mil, Deposits: $16,805.3 mil, headquarters in Kansas City, MO, positive income, 206 total offices, Holding Company: Commerce Bancshares, Inc.

- PNC Bank, National Association: Chesterfield Valley Branch at 17389 Chesterfield Airport Road, branch established on 2006/01/09; Chesterfield Branch at 2501 Clarkson Road, branch established on 2000/05/01. Info updated 2012/03/20: Bank assets: $263,309.6 mil, Deposits: $197,343.0 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 3085 total offices, Holding Company: Pnc Financial Services Group, Inc., The

- Eagle Bank and Trust Company of Missouri: Garden Villas Chesterfield at 14901 North Outer Forty Road, branch established on 2001/09/18; Garden Villas West Branch at 13590 South Outer Forty, branch established on 2002/01/01. Info updated 2012/02/21: Bank assets: $836.9 mil, Deposits: $681.2 mil, headquarters in Hillsboro, MO, positive income, Commercial Lending Specialization, 17 total offices, Holding Company: Jefferson County Bancshares, Incorporated

- Midland States Bank: Chesterfield Mobile Branch at 17107 Chestfield Airport Road, Suite 160, branch established on 2007/10/22; Chesterfield Branch at 17107 Chesterfield Airport Road, branch established on 2003/12/31. Info updated 2010/10/19: Bank assets: $1,510.0 mil, Deposits: $1,222.1 mil, headquarters in Effingham, IL, positive income, Commercial Lending Specialization, 32 total offices, Holding Company: Midland States Bancorp, Inc.

- First Bank: Chesterfield at 1730 Clarkson Road, branch established on 1988/07/12; Town & Country Office at 383 Lamp And Lantern Village, branch established on 1984/09/04. Info updated 2007/12/04: Bank assets: $6,579.8 mil, Deposits: $5,800.6 mil, headquarters in Creve Coeur, MO, negative income in the last year, Commercial Lending Specialization, 148 total offices, Holding Company: First Banks, Inc.

- Commercial Bank: Chesterfield Branch at 703 Long Road Crossing Drive, branch established on 2005/05/17. Info updated 2006/11/03: Bank assets: $163.1 mil, Deposits: $143.8 mil, headquarters in Saint Louis, MO, negative income in the last year, Commercial Lending Specialization, 3 total offices, Holding Company: Commercial Bancshares, Inc.

- 15 other banks with 15 local branches

For population 15 years and over in Chesterfield:

- Never married: 21.7%

- Now married: 63.8%

- Separated: 0.3%

- Widowed: 6.9%

- Divorced: 7.3%

For population 25 years and over in Chesterfield:

- High school or higher: 98.2%

- Bachelor's degree or higher: 71.8%

- Graduate or professional degree: 36.1%

- Unemployed: 2.5%

- Mean travel time to work (commute): 16.5 minutes

| Here: | 8.7 |

| Missouri average: | 11.1 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Chesterfield, MO (based on St. Louis County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 230,488 | 74 |

| Evangelical Protestant | 162,614 | 384 |

| Mainline Protestant | 74,404 | 130 |

| Other | 37,156 | 87 |

| Black Protestant | 9,369 | 48 |

| Orthodox | 2,042 | 7 |

| None | 482,881 | - |

Food Environment Statistics:

| St. Louis County: | 1.77 / 10,000 pop. |

| Missouri: | 1.88 / 10,000 pop. |

| This county: | 0.09 / 10,000 pop. |

| State: | 0.18 / 10,000 pop. |

| St. Louis County: | 0.50 / 10,000 pop. |

| Missouri: | 0.60 / 10,000 pop. |

| St. Louis County: | 2.95 / 10,000 pop. |

| Missouri: | 4.34 / 10,000 pop. |

| St. Louis County: | 6.87 / 10,000 pop. |

| Missouri: | 7.37 / 10,000 pop. |

| St. Louis County: | 8.6% |

| Missouri: | 8.8% |

| This county: | 28.0% |

| State: | 29.6% |

| This county: | 11.9% |

| State: | 13.5% |

Health and Nutrition:

| Chesterfield: | 59.3% |

| Missouri: | 50.9% |

| Chesterfield: | 60.3% |

| State: | 48.6% |

| Chesterfield: | 27.6 |

| Missouri: | 28.7 |

| This city: | 17.5% |

| State: | 20.6% |

| Here: | 7.9% |

| Missouri: | 10.1% |

| This city: | 7.0 |

| Missouri: | 6.8 |

| Here: | 33.6% |

| State: | 34.3% |

| Chesterfield: | 64.8% |

| Missouri: | 57.5% |

| Chesterfield: | 81.5% |

| State: | 79.3% |

More about Health and Nutrition of Chesterfield, MO Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 91 | $581,133 | $76,633 | 0 | $0 |

| Parks and Recreation | 43 | $197,567 | $55,135 | 4 | $756 |

| Other and Unallocable | 24 | $123,440 | $61,720 | 1 | $458 |

| Streets and Highways | 23 | $108,950 | $56,843 | 0 | $0 |

| Financial Administration | 15 | $89,836 | $71,869 | 0 | $0 |

| Other Government Administration | 13 | $90,358 | $83,407 | 12 | $5,594 |

| Police - Other | 13 | $48,577 | $44,840 | 0 | $0 |

| Judicial and Legal | 3 | $14,938 | $59,752 | 0 | $0 |

| Totals for Government | 225 | $1,254,798 | $66,923 | 17 | $6,807 |

Chesterfield government finances - Expenditure in 2021 (per resident):

- Current Operations - General - Other: $11,906,000 ($241.37)

Police Protection: $10,714,000 ($217.20)

Parks and Recreation: $4,164,000 ($84.42)

Central Staff Services: $2,472,000 ($50.11)

General Public Buildings: $922,000 ($18.69)

Financial Administration: $584,000 ($11.84)

Judicial and Legal Services: $267,000 ($5.41)

- General - Interest on Debt: $947,000 ($19.20)

- Other Capital Outlay - Parks and Recreation: $6,972,000 ($141.34)

Police Protection: $395,000 ($8.01)

General - Other: $114,000 ($2.31)

- Total Salaries and Wages: $13,882,000 ($281.43)

Chesterfield government finances - Revenue in 2021 (per resident):

- Charges - Other: $529,000 ($10.72)

Parks and Recreation: $260,000 ($5.27)

- Local Intergovernmental - Other: $8,986,000 ($182.17)

General Local Government Support: $4,001,000 ($81.11)

Highways: $2,036,000 ($41.28)

- Miscellaneous - Fines and Forfeits: $629,000 ($12.75)

Special Assessments: $558,000 ($11.31)

General Revenue - Other: $174,000 ($3.53)

Interest Earnings: $93,000 ($1.89)

Sale of Property: $2,000 ($0.04)

- State Intergovernmental - Highways: $1,861,000 ($37.73)

- Tax - General Sales and Gross Receipts: $10,811,000 ($219.17)

Public Utilities Sales: $6,344,000 ($128.61)

Occupation and Business License - Other: $1,353,000 ($27.43)

Alcoholic Beverage License: $73,000 ($1.48)

Chesterfield government finances - Debt in 2021 (per resident):

- Long Term Debt - Outstanding Unspecified Public Purpose: $27,590,000 ($559.33)

Beginning Outstanding - Unspecified Public Purpose: $25,760,000 ($522.23)

Issue, Unspecified Public Purpose: $11,770,000 ($238.61)

Retired Unspecified Public Purpose: $9,940,000 ($201.51)

Beginning Outstanding - Public Debt for Private Purpose: $1,807,000 ($36.63)

Outstanding Nonguaranteed - Industrial Revenue: $1,549,000 ($31.40)

Retired Nonguaranteed - Public Debt for Private Purpose: $258,000 ($5.23)

Chesterfield government finances - Cash and Securities in 2021 (per resident):

- Other Funds - Cash and Securities: $18,104,000 ($367.02)

- Sinking Funds - Cash and Securities: $1,549,000 ($31.40)

5.97% of this county's 2021 resident taxpayers lived in other counties in 2020 ($70,859 average adjusted gross income)

| Here: | 5.97% |

| Missouri average: | 7.67% |

0.01% of residents moved from foreign countries ($97 average AGI)

St. Louis County: 0.01% Missouri average: 0.02%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from St. Louis city, MO | |

| from St. Charles County, MO | |

| from Jefferson County, MO |

6.59% of this county's 2020 resident taxpayers moved to other counties in 2021 ($77,630 average adjusted gross income)

| Here: | 6.59% |

| Missouri average: | 7.51% |

0.01% of residents moved to foreign countries ($63 average AGI)

St. Louis County: 0.01% Missouri average: 0.01%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to St. Louis city, MO | |

| to St. Charles County, MO | |

| to Jefferson County, MO |

| Businesses in Chesterfield, MO | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 24 Hour Fitness | 1 | Lane Furniture | 2 | |

| 7-Eleven | 1 | LensCrafters | 1 | |

| AT&T | 2 | Lowe's | 1 | |

| Abercrombie & Fitch | 1 | Macy's | 1 | |

| Ace Hardware | 1 | Marriott | 2 | |

| Aeropostale | 1 | MasterBrand Cabinets | 5 | |

| American Eagle Outfitters | 2 | McDonald's | 3 | |

| Ann Taylor | 2 | Men's Wearhouse | 1 | |

| Bakers | 1 | Motherhood Maternity | 2 | |

| Banana Republic | 1 | New Balance | 5 | |

| Barnes & Noble | 1 | New York & Co | 1 | |

| Bath & Body Works | 2 | Nike | 10 | |

| Blockbuster | 1 | OfficeMax | 1 | |

| Brunswick Bowling & Billiards | 1 | Old Navy | 1 | |

| Budget Car Rental | 1 | Olive Garden | 1 | |

| Casual Male XL | 1 | Pac Sun | 1 | |

| Catherines | 1 | Panda Express | 1 | |

| Charlotte Russe | 1 | Panera Bread | 5 | |

| Chick-Fil-A | 1 | Payless | 1 | |

| Chico's | 1 | Penske | 1 | |

| Chipotle | 1 | PetSmart | 1 | |

| Circle K | 4 | Pier 1 Imports | 1 | |

| Comfort Inn | 1 | Pizza Hut | 2 | |

| DHL | 1 | Plato's Closet | 1 | |

| Dairy Queen | 1 | Pottery Barn | 1 | |

| Domino's Pizza | 2 | Qdoba Mexican Grill | 1 | |

| DressBarn | 1 | Quiznos | 2 | |

| Dressbarn | 1 | RadioShack | 2 | |

| Eddie Bauer | 1 | Red Lobster | 1 | |

| Ethan Allen | 1 | Red Robin | 1 | |

| Express | 1 | Rue21 | 1 | |

| Famous Footwear | 1 | SONIC Drive-In | 1 | |

| FedEx | 14 | Sam's Club | 1 | |

| Finish Line | 1 | Sears | 2 | |

| Firestone Complete Auto Care | 1 | Sephora | 1 | |

| Foot Locker | 1 | Soma Intimates | 1 | |

| Ford | 1 | Sprint Nextel | 2 | |

| Forever 21 | 1 | Starbucks | 2 | |

| GNC | 1 | Steak 'n Shake | 2 | |

| GameStop | 2 | Subway | 6 | |

| Gap | 1 | T-Mobile | 7 | |

| Gymboree | 1 | Taco Bell | 2 | |

| H&M | 1 | Talbots | 1 | |

| H&R Block | 1 | Target | 2 | |

| Hardee's | 1 | The Cheesecake Factory | 1 | |

| Hilton | 4 | The Limited | 1 | |

| Hollister Co. | 1 | Toys"R"Us | 3 | |

| Home Depot | 1 | Trader Joe's | 1 | |

| Houlihan's | 1 | UPS | 22 | |

| IHOP | 1 | Vans | 1 | |

| J. Jill | 1 | Victoria's Secret | 1 | |

| JoS. A. Bank | 1 | Walgreens | 3 | |

| Jones New York | 2 | Walmart | 1 | |

| Journeys | 1 | Wet Seal | 1 | |

| Justice | 1 | YMCA | 1 | |

| Lane Bryant | 1 | |||

Strongest AM radio stations in Chesterfield:

- KXEN (1010 AM; 50 kW; FESTUS-ST. LOUIS, MO; Owner: BDJ RADIO ENTERPRISES, LLC)

- KMOX (1120 AM; 50 kW; ST. LOUIS, MO; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- KFUO (850 AM; 5 kW; CLAYTON, MO; Owner: LUTHERAN CHURCH-MISSOURI SYNOD)

- KSIV (1320 AM; 5 kW; CLAYTON, MO; Owner: BOTT COMMUNICATIONS, INC.)

- KIRL (1460 AM; 5 kW; ST. CHARLES, MO; Owner: BRONCO BROADCASTING CO., INC.)

- KTRS (550 AM; 5 kW; ST. LOUIS, MO; Owner: KTRS-AM LICENSE, L.L.C.)

- WSDZ (1260 AM; 20 kW; BELLEVILLE, IL)

- KJSL (630 AM; 5 kW; ST. LOUIS, MO; Owner: WMUZ RADIO, INC.)

- KRFT (1190 AM; 10 kW; DE SOTO, MO; Owner: ALL SPORTS RADIO, LLC)

- KSLG (1380 AM; 5 kW; ST. LOUIS, MO; Owner: NEW HORIZON 7TH-DAY CHRISTIAN CHURCH, INC.)

- WRTH (1430 AM; 5 kW; ST. LOUIS, MO)

- KATZ (1600 AM; 5 kW; ST. LOUIS, MO; Owner: CITICASTERS LICENSES, L.P.)

- KSTL (690 AM; 1 kW; ST. LOUIS, MO; Owner: WMUZ RADIO, INC.)

Strongest FM radio stations in Chesterfield:

- KYMC (89.7 FM; BALLWIN, MO; Owner: THE YMCA OF GREATER ST. LOUIS)

- KEZK-FM (102.5 FM; ST. LOUIS, MO; Owner: INFINITY RADIO SUBSIDIARY OPERATIONS INC.)

- KIHT (96.3 FM; ST. LOUIS, MO; Owner: EMMIS RADIO LICENSE CORPORATION)

- KSD (93.7 FM; ST. LOUIS, MO; Owner: CITICASTERS LICENSES, L.P.)

- KWMU (90.7 FM; ST. LOUIS, MO; Owner: THE CURATORS OF THE UNIVERSITY OF MISSOURI)

- KSLZ (107.7 FM; ST. LOUIS, MO; Owner: CITICASTERS LICENSES, L.P.)

- KFUO-FM (99.1 FM; CLAYTON, MO; Owner: THE LUTHERAN CHURCH-MISSOURI SYNOD)

- KYKY (98.1 FM; ST. LOUIS, MO; Owner: INFINITY RADIO SUBSIDIARY OPERATIONS INC.)

- WSSM (106.5 FM; GRANITE CITY, IL; Owner: BONNEVILLE HOLDING COMPANY)

- KSHE (94.7 FM; CRESTWOOD, MO; Owner: EMMIS RADIO LICENSE CORPORATION)

- WIL-FM (92.3 FM; ST. LOUIS, MO; Owner: BONNEVILLE HOLDING COMPANY)

- KSIV-FM (91.5 FM; ST. LOUIS, MO; Owner: COMMUNITY BROADCASTING, INC.)

- KLOU (103.3 FM; ST. LOUIS, MO; Owner: CITICASTERS LICENSES, L.P.)

- KFTK (97.1 FM; FLORISSANT, MO; Owner: EMMIS RADIO LICENSE CORPORATION)

- KDHX (88.1 FM; ST. LOUIS, MO; Owner: DOUBLE HELIX CORPORATION)

- KPNT (105.7 FM; ST. GENEVIEVE, MO; Owner: EMMIS RADIO LICENSE CORPORATION)

- KNLH (89.5 FM; CEDAR HILL, MO; Owner: NEW LIFE EVANGELISTIC CENTER, INC.)

- KCLC (89.1 FM; ST. CHARLES, MO; Owner: LINDENWOOD COLLEGE)

- WMLL (104.1 FM; JERSEYVILLE, IL; Owner: EMMIS RADIO LICENSE CORPORATION)

- WSIE (88.7 FM; EDWARDSVILLE, IL; Owner: BOARD OF TRUSTEES, S. ILLINOIS UNIV.)

TV broadcast stations around Chesterfield:

- KSDK (Channel 5; ST. LOUIS, MO; Owner: MULTIMEDIA KSDK, INC.)

- KTVI (Channel 2; ST. LOUIS, MO; Owner: KTVI LICENSE, INC.)

- KPLR-TV (Channel 11; ST. LOUIS, MO; Owner: KPLR, INC.)

- KETC (Channel 9; ST. LOUIS, MO; Owner: ST. LOUIS REGIONAL & EDUCATIONAL PUBLIC TV COMMISSION)

- KDNL-TV (Channel 30; ST. LOUIS, MO; Owner: KDNL LICENSEE, LLC)

- K59GP (Channel 59; ST. CHARLES, MO; Owner: TRINITY BROADCASTING NETWORK)

- KMOV (Channel 4; ST. LOUIS, MO; Owner: KMOV-TV, INC.)

- KPTN-LP (Channel 58; ST. LOUIS, MO; Owner: KURT J. PETERSEN)

- WRBU (Channel 46; EAST ST. LOUIS, IL; Owner: ROBERTS BROADCASTING COMPANY)

- K63FW (Channel 63; JAMESTOWN, MO; Owner: ROGER E. HARDERS)

- KNLC (Channel 24; ST. LOUIS, MO; Owner: NEW LIFE EVANGELISTIC CENTER, INC.)

- K18BT (Channel 18; ST. LOUIS, MO; Owner: TRINITY BROADCASTING NETWORK)

- K40FF (Channel 40; ST. LOUIS, MO; Owner: EBC ST. LOUIS, INC.)

- K65FN (Channel 65; BATESVILLE, AR; Owner: MS COMMUNICATIONS, LLC)

- K49FC (Channel 49; ST. LOUIS, MO; Owner: THREE ANGELS BROADCASTING NETWORK)

- K62EG (Channel 62; ST. LOUIS, MO; Owner: ETERNAL FAMILY NETWORK)

- K64DT (Channel 64; ST. LOUIS, MO; Owner: WORD OF GOD FELLOWSHIP, INC.)

- K38HD (Channel 38; ST. LOUIS, MO; Owner: VENTANA TELEVISION, INC.)

- National Bridge Inventory (NBI) Statistics

- 66Number of bridges

- 863ft / 263mTotal length

- $4,644,000Total costs

- 1,379,544Total average daily traffic

- 120,133Total average daily truck traffic

- New bridges - historical statistics

- 11940-1949

- 141960-1969

- 21970-1979

- 71980-1989

- 111990-1999

- 52000-2009

- 262010-2019

FCC Registered Commercial Land Mobile Towers: 1 (See the full list of FCC Registered Commercial Land Mobile Towers in Chesterfield, MO)

FCC Registered Private Land Mobile Towers: 4 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 59 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 15 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 4 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 11 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 281 (See the full list of FCC Registered Amateur Radio Licenses in Chesterfield)

FAA Registered Aircraft Manufacturers and Dealers: 45 (See the full list of FAA Registered Manufacturers and Dealers in Chesterfield)

FAA Registered Aircraft: 192 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 4 full and 6 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 54 | $227,581 | 404 | $277,172 | 2,423 | $257,480 | 51 | $187,674 | 4 | $8,702,582 | 51 | $242,871 | 1 | $432,990 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 5 | $244,692 | 28 | $268,354 | 157 | $251,535 | 7 | $108,973 | 0 | $0 | 4 | $184,170 | 0 | $0 |

| APPLICATIONS DENIED | 6 | $164,902 | 25 | $320,350 | 275 | $297,492 | 19 | $92,862 | 0 | $0 | 8 | $241,412 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 9 | $236,861 | 34 | $267,469 | 250 | $264,656 | 7 | $141,166 | 0 | $0 | 10 | $277,631 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 6 | $319,642 | 59 | $280,505 | 3 | $213,680 | 0 | $0 | 2 | $225,825 | 0 | $0 |

Detailed mortgage data for all 10 tracts in Chesterfield, MO

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 4 full and 6 partial tracts) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 71 | $287,380 | 39 | $301,474 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 14 | $340,586 | 12 | $277,464 |

| APPLICATIONS DENIED | 10 | $222,642 | 6 | $309,515 |

| APPLICATIONS WITHDRAWN | 4 | $304,260 | 2 | $252,820 |

| FILES CLOSED FOR INCOMPLETENESS | 2 | $292,965 | 1 | $281,000 |

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Chesterfield, MO

- 69840.5%Structure Fires

- 61835.9%Outside Fires

- 29817.3%Mobile Property/Vehicle Fires

- 1086.3%Other

According to the data from the years 2002 - 2018 the average number of fires per year is 101. The highest number of fire incidents - 151 took place in 2006, and the least - 6 in 2002. The data has a rising trend.

According to the data from the years 2002 - 2018 the average number of fires per year is 101. The highest number of fire incidents - 151 took place in 2006, and the least - 6 in 2002. The data has a rising trend. When looking into fire subcategories, the most reports belonged to: Structure Fires (40.5%), and Outside Fires (35.9%).

When looking into fire subcategories, the most reports belonged to: Structure Fires (40.5%), and Outside Fires (35.9%).Fire-safe hotels and motels in Chesterfield, Missouri:

- Sonesta ES Suites St. Louis - Chesterfield, 15431 Conway Rd, Chesterfield, Missouri 63017 , Phone: (636) 537-1444

- Doubletree Chesterfield, 16625 Swingley Ridge Rd, Chesterfield, Missouri 63017 , Phone: (636) 532-5000

- Hilton Garden Inn Chesterfield, 16631 Chesterfield Grove Rd, Chesterfield, Missouri 63005 , Phone: (636) 532-9400

- Hampton Inn-chesterfield, 16201 Swingley RDG Rd, Chesterfield, Missouri 63017 , Phone: (636) 537-2500

- Springhill Suites-Chesterfield, 1065 Chesterfield Pkwy, Chesterfield, Missouri 63017 , Phone: (636) 519-7500, Fax: (636) 519-7575

- Drury Plaza Hotel St Louis Chesterfield, 355 Chestefield Center E, Chesterfield, Missouri 63017 , Phone: (636) 532-3300

- Hyatt Place St. Louis/Chesterfield, 333 Chesterfield Ctr, Chesterfield, Missouri 63017 , Phone: (636) 536-6262, Fax: (636) 536-3510

- Holiday Inn Express & Suites ST. LOUIS - CHESTERFIELD, 11 Arnage Blvd, Chesterfield, Missouri 63005 , Phone: (636) 540-6240, Fax: (636) 540-6240

- 2 other hotels and motels

| Most common first names in Chesterfield, MO among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| Mary | 265 | 82.8 years |

| John | 227 | 78.3 years |

| William | 213 | 79.1 years |

| Robert | 191 | 74.7 years |

| Helen | 180 | 85.1 years |

| Dorothy | 153 | 83.1 years |

| James | 133 | 75.5 years |

| Ruth | 130 | 85.5 years |

| Margaret | 125 | 83.2 years |

| Charles | 125 | 78.0 years |

| Most common last names in Chesterfield, MO among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 69 | 81.1 years |

| Miller | 51 | 82.4 years |

| Johnson | 45 | 80.0 years |

| Cohen | 34 | 83.7 years |

| Williams | 33 | 78.8 years |

| Brown | 32 | 82.0 years |

| Davis | 32 | 81.2 years |

| Schneider | 31 | 81.8 years |

| Jones | 28 | 83.3 years |

| Meyer | 27 | 83.1 years |

- 85.7%Utility gas

- 12.9%Electricity

- 1.0%Bottled, tank, or LP gas

- 0.3%Wood

- 61.9%Electricity

- 34.2%Utility gas

- 2.2%Bottled, tank, or LP gas

- 1.2%No fuel used

- 0.5%Wood

Chesterfield compared to Missouri state average:

- Median household income above state average.

- Median house value above state average.

- Unemployed percentage significantly below state average.

- Black race population percentage significantly below state average.

- Median age significantly above state average.

- Foreign-born population percentage significantly above state average.

- Length of stay since moving in above state average.

- Number of rooms per house above state average.

- Percentage of population with a bachelor's degree or higher significantly above state average.

Chesterfield on our top lists:

- #17 on the list of "Top 101 cities with the largest percentage of people in institutions for the deaf (population 1,000+)"

- #23 on the list of "Top 101 cities with the largest percentage of elementary and middle school students in private schools (5,000+ students)"

- #33 on the list of "Top 101 cities with largest percentage of males in industries: management of companies and enterprises (population 5,000+)"

- #19 (63141) on the list of "Top 101 zip codes with the most offices of physicians in 2005"

- #39 (63141) on the list of "Top 101 zip codes with the most finance and insurance companies in 2005"

- #90 (63141) on the list of "Top 101 zip codes with the most medium-big companies in 2005 (at least 100 employees)"

- #27 on the list of "Top 101 counties with the highest surface withdrawal of fresh water for public supply"

- #27 on the list of "Top 101 counties with the most Catholic congregations"

- #34 on the list of "Top 101 counties with the most Mainline Protestant adherents"

- #36 on the list of "Top 101 counties with the most Evangelical Protestant adherents"

- #39 on the list of "Top 101 counties with the highest total withdrawal of fresh water for public supply (pop. 50,000+)"

|

|

Total of 1692 patent applications in 2008-2024.