Cranford, New Jersey

Cranford: Canoeing, property of Denise Broesler, RE/MAX

Cranford: View from the Bridge

Cranford: Cranford September 11th Memorial Park

Cranford: Sunset at Big Bend Lake in Cranford NJ. This body of water is located near exit 136 of the Garden State Parkway and sits side by side with the flowing Rahway River, which winds its leisurely way through the town's center.

Cranford: Crane-Phillips House - Summer afternoon

Cranford

Cranford: 911 Memorial

Cranford: Cranford Memorial Field

Cranford: Cranford downtown Eastman Plaza

Cranford: Big Bend Lake near Wall Street

Cranford: High St foot bridge during flood

- see

17

more - add

your

Submit your own pictures of this place and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

| Males: 10,653 | |

| Females: 11,777 |

| Median resident age: | 40.4 years |

| New Jersey median age: | 36.7 years |

Zip codes: 07016.

| Cranford: | $135,226 |

| NJ: | $96,346 |

Estimated per capita income in 2022: $64,376 (it was $33,283 in 2000)

Cranford CDP income, earnings, and wages data

Estimated median house or condo value in 2022: $621,387 (it was $230,300 in 2000)

| Cranford: | $621,387 |

| NJ: | $428,900 |

Mean prices in 2022: all housing units: $571,611; detached houses: $596,477; townhouses or other attached units: $609,757; in 2-unit structures: $452,159; in 3-to-4-unit structures: $316,757; in 5-or-more-unit structures: $383,498; mobile homes: $54,657

Detailed information about poverty and poor residents in Cranford, NJ

- 20,46490.6%White alone

- 8793.9%Hispanic

- 5792.6%Black alone

- 4842.1%Asian alone

- 1380.6%Two or more races

- 240.1%Other race alone

- 50.02%American Indian alone

- 50.02%Native Hawaiian and Other

Pacific Islander alone

Races in Cranford detailed stats: ancestries, foreign born residents, place of birth

According to our research of New Jersey and other state lists, there were 2 registered sex offenders living in Cranford, New Jersey as of April 24, 2024.

The ratio of all residents to sex offenders in Cranford is 11,215 to 1.

The ratio of registered sex offenders to all residents in this city is much lower than the state average.

Type |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Murders (per 100,000) | 0 (0.0) | 0 (0.0) | 1 (4.4) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) |

| Rapes (per 100,000) | 3 (13.7) | 0 (0.0) | 0 (0.0) | 2 (8.7) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 1 (4.1) | 0 (0.0) | 3 (12.4) |

| Robberies (per 100,000) | 6 (27.5) | 5 (22.1) | 2 (8.8) | 7 (30.6) | 4 (17.3) | 3 (12.8) | 1 (4.1) | 3 (12.3) | 1 (4.1) | 2 (8.2) | 1 (4.1) | 0 (0.0) | 2 (7.9) | 0 (0.0) |

| Assaults (per 100,000) | 3 (13.7) | 5 (22.1) | 5 (22.0) | 4 (17.5) | 0 (0.0) | 2 (8.5) | 3 (12.4) | 4 (16.4) | 2 (8.2) | 5 (20.5) | 3 (12.4) | 2 (8.3) | 4 (15.9) | 6 (24.9) |

| Burglaries (per 100,000) | 48 (220.0) | 50 (221.0) | 42 (185.0) | 50 (218.7) | 26 (112.2) | 36 (153.3) | 13 (53.8) | 20 (82.2) | 15 (61.4) | 7 (28.7) | 11 (45.4) | 3 (12.4) | 27 (107.2) | 71 (294.2) |

| Thefts (per 100,000) | 157 (719.5) | 191 (844.2) | 192 (845.8) | 151 (660.4) | 150 (647.5) | 134 (570.5) | 152 (628.5) | 149 (612.6) | 153 (626.0) | 131 (537.9) | 175 (721.6) | 105 (434.1) | 95 (377.1) | 144 (596.7) |

| Auto thefts (per 100,000) | 7 (32.1) | 6 (26.5) | 12 (52.9) | 5 (21.9) | 11 (47.5) | 2 (8.5) | 2 (8.3) | 5 (20.6) | 7 (28.6) | 7 (28.7) | 16 (66.0) | 6 (24.8) | 27 (107.2) | 29 (120.2) |

| Arson (per 100,000) | 0 (0.0) | 1 (4.4) | 0 (0.0) | 1 (4.4) | 1 (4.3) | 0 (0.0) | 0 (0.0) | 2 (8.2) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 1 (4.1) | 0 (0.0) | 3 (12.4) |

| City-Data.com crime index | 68.7 | 62.4 | 66.9 | 63.2 | 42.7 | 39.8 | 33.3 | 38.9 | 34.5 | 32.4 | 41.0 | 25.2 | 36.7 | 69.0 |

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Crime rate in Cranford detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 66 (52 officers - 48 male; 4 female).

| Officers per 1,000 residents here: | 2.06 |

| New Jersey average: | 5.53 |

| Safety of a house in Cranford? (14 replies) |

| Cranford, Metuchen, Suggestions? (8 replies) |

| Cranford vs Westfield schools system (17 replies) |

| Hillside Ave School in Cranford (7 replies) |

| Cranford vs Maplewood (63 replies) |

| property taxes in Cranford (4 replies) |

Latest news from Cranford, NJ collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: Italian (25.4%), Irish (24.6%), German (18.1%), Polish (12.0%), English (7.2%), Russian (3.3%).

Current Local Time: EST time zone

Elevation: 81 feet

Land area: 4.82 square miles.

Population density: 4,653 people per square mile (average).

1,965 residents are foreign born (4.8% Europe, 1.8% Latin America, 1.7% Asia).

| This place: | 8.7% |

| New Jersey: | 17.5% |

| Cranford CDP: | 2.2% ($5,037) |

| New Jersey: | 2.4% ($4,047) |

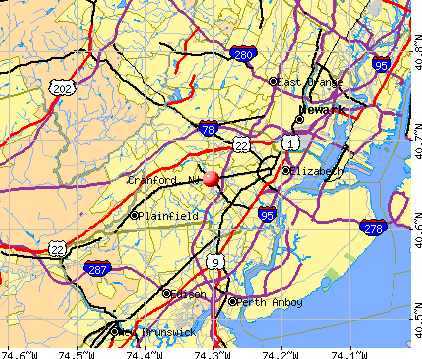

Nearest city with pop. 50,000+: Union, NJ (3.3 miles

, pop. 54,405).

Nearest city with pop. 200,000+: Newark, NJ (8.3 miles

, pop. 273,546).

Nearest city with pop. 1,000,000+: Brooklyn, NY (18.4 miles

, pop. 2,465,326).

Nearest cities:

Latitude: 40.66 N, Longitude: 74.30 W

Daytime population change due to commuting: +905 (+4.0%)

Workers who live and work in this place: 1,833 (16.0%)

Area code: 908

Cranford, New Jersey accommodation & food services, waste management - Economy and Business Data

| Here: | 4.7% |

| New Jersey: | 4.5% |

- Educational services (12.2%)

- Finance & insurance (11.3%)

- Professional, scientific, technical services (10.3%)

- Health care (6.7%)

- Public administration (5.4%)

- Construction (4.7%)

- Chemicals (3.8%)

- Finance & insurance (12.2%)

- Professional, scientific, technical services (10.2%)

- Construction (7.9%)

- Public administration (7.2%)

- Educational services (5.8%)

- Chemicals (3.9%)

- Broadcasting & telecommunications (3.5%)

- Educational services (19.5%)

- Health care (12.0%)

- Professional, scientific, technical services (10.4%)

- Finance & insurance (10.2%)

- Chemicals (3.7%)

- Accommodation & food services (3.4%)

- Public administration (3.3%)

- Other management occupations, except farmers and farm managers (6.5%)

- Preschool, kindergarten, elementary, and middle school teachers (5.2%)

- Other office and administrative support workers, including supervisors (5.0%)

- Other sales and related occupations, including supervisors (4.5%)

- Computer specialists (4.1%)

- Secretaries and administrative assistants (3.8%)

- Sales representatives, services, wholesale and manufacturing (3.8%)

- Other management occupations, except farmers and farm managers (8.3%)

- Computer specialists (5.6%)

- Other sales and related occupations, including supervisors (5.2%)

- Top executives (5.0%)

- Sales representatives, services, wholesale and manufacturing (4.8%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (3.8%)

- Material recording, scheduling, dispatching, and distributing workers (3.3%)

- Preschool, kindergarten, elementary, and middle school teachers (9.3%)

- Secretaries and administrative assistants (7.9%)

- Other office and administrative support workers, including supervisors (7.7%)

- Other management occupations, except farmers and farm managers (4.5%)

- Other sales and related occupations, including supervisors (3.7%)

- Registered nurses (3.1%)

- Bookkeeping, accounting, and auditing clerks (2.8%)

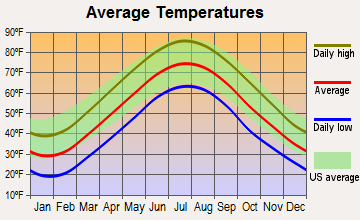

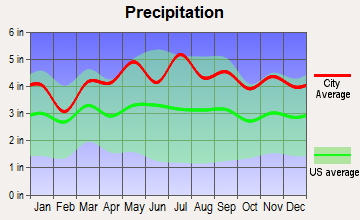

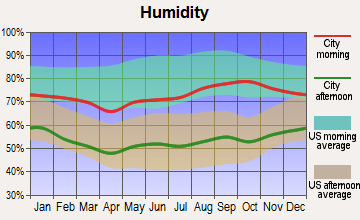

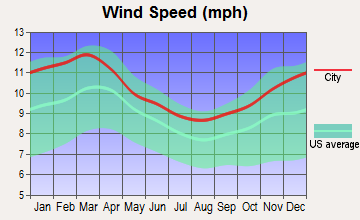

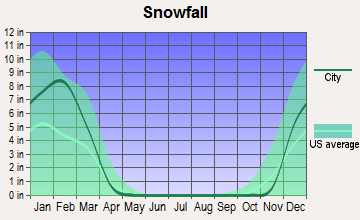

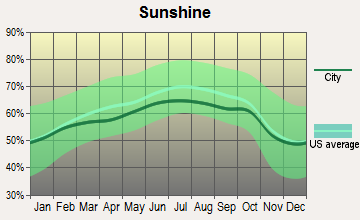

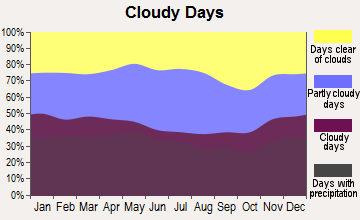

Average climate in Cranford, New Jersey

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

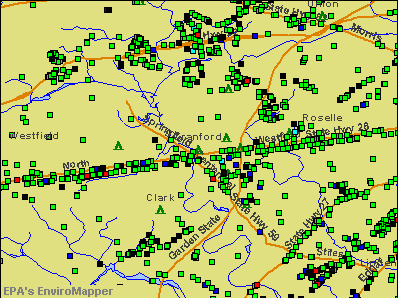

Air Quality Index (AQI) level in 2023 was 108. This is significantly worse than average.

| City: | 108 |

| U.S.: | 73 |

Carbon Monoxide (CO) [ppm] level in 2023 was 0.372. This is significantly worse than average. Closest monitor was 4.7 miles away from the city center.

| City: | 0.372 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2023 was 15.6. This is significantly worse than average. Closest monitor was 5.0 miles away from the city center.

| City: | 15.6 |

| U.S.: | 5.1 |

Sulfur Dioxide (SO2) [ppb] level in 2023 was 0.620. This is significantly better than average. Closest monitor was 4.7 miles away from the city center.

| City: | 0.620 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2023 was 29.4. This is about average. Closest monitor was 4.5 miles away from the city center.

| City: | 29.4 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2003 was 26.9. This is worse than average. Closest monitor was 7.3 miles away from the city center.

| City: | 26.9 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 9.32. This is about average. Closest monitor was 3.9 miles away from the city center.

| City: | 9.32 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2008 was 0.0125. This is worse than average. Closest monitor was 4.9 miles away from the city center.

| City: | 0.0125 |

| U.S.: | 0.0093 |

Tornado activity:

Cranford-area historical tornado activity is near New Jersey state average. It is 33% smaller than the overall U.S. average.

On 5/28/1973, a category F3 (max. wind speeds 158-206 mph) tornado 14.3 miles away from the Cranford place center caused between $50,000 and $500,000 in damages.

On 5/28/1973, a category F3 tornado 25.6 miles away from the place center injured 12 people and caused between $50,000 and $500,000 in damages.

Earthquake activity:

Cranford-area historical earthquake activity is significantly above New Jersey state average. It is 68% smaller than the overall U.S. average.On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 271.8 miles away from Cranford center

On 10/7/1983 at 10:18:46, a magnitude 5.3 (5.1 MB, 5.3 LG, 5.1 ML) earthquake occurred 228.0 miles away from the city center

On 1/16/1994 at 01:49:16, a magnitude 4.6 (4.6 MB, 4.6 LG, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 93.9 miles away from Cranford center

On 4/20/2002 at 10:50:47, a magnitude 5.3 (5.3 ML, Depth: 3.0 mi) earthquake occurred 268.5 miles away from the city center

On 4/20/2002 at 10:50:47, a magnitude 5.2 (5.2 MB, 4.2 MS, 5.2 MW, 5.0 MW) earthquake occurred 266.6 miles away from the city center

On 1/16/1994 at 00:42:43, a magnitude 4.2 (4.2 MB, 4.0 LG, Depth: 3.1 mi) earthquake occurred 92.4 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Union County (27) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 17

Emergencies Declared: 10

Causes of natural disasters: Floods: 7, Hurricanes: 7, Storms: 6, Heavy Rains: 4, Snowstorms: 3, Blizzards: 2, Water Shortages: 2, Winter Storms: 2, Power Outage: 1, Tornado: 1, Wind: 1, Other: 3 (Note: some incidents may be assigned to more than one category).

Main business address for: NEWARK GROUP, INC (PAPERBOARD MILLS), METALICO INC (PRIMARY SMELTING & REFINING OF NONFERROUS METALS), SYNERGY FINANCIAL GROUP INC /NJ/ (SAVINGS INSTITUTION, FEDERALLY CHARTERED), MACK CALI REALTY CORP (REAL ESTATE INVESTMENT TRUSTS), MACK CALI REALTY L P (REAL ESTATE INVESTMENT TRUSTS).

Hospitals and medical centers in Cranford:

Amtrak stations near Cranford:

- 7 miles: METROPARK (ISELIN, 100 MIDDLESEX-ESSEX TPK.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, paid short-term parking, call for car rental service, taxi stand, public transit connection.

- 7 miles: NEWARK INTERNATIONAL AIRPORT (NEWARK, ) . Services: ticket office, enclosed waiting area, public restrooms, public payphones.

- 10 miles: NEWARK (RAYMOND PLAZA WEST) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, snack bar, ATM, paid short-term parking, paid long-term parking, call for car rental service, taxi stand, intercity bus service, public transit connection.

College/University in Cranford:

Other colleges/universities with over 2000 students near Cranford:

- Kean University (about 4 miles; Union, NJ; Full-time enrollment: 12,648)

- Seton Hall University (about 7 miles; South Orange, NJ; FT enrollment: 7,742)

- University of Medicine and Dentistry of New Jersey (about 9 miles; Newark, NJ; FT enrollment: 3,210)

- Essex County College (about 9 miles; Newark, NJ; FT enrollment: 9,595)

- New Jersey Institute of Technology (about 9 miles; Newark, NJ; FT enrollment: 8,212)

- College of Staten Island CUNY (about 9 miles; Staten Island, NY; FT enrollment: 11,684)

- Rutgers University-Newark (about 9 miles; Newark, NJ; FT enrollment: 9,869)

Private high schools in Cranford:

Public elementary/middle schools in Cranford:

- ORANGE AVENUE SCHOOL (Students: 739, Location: 901 ORANGE AVENUE, Grades: 3-8)

- HILLSIDE AVENUE SCHOOL (Students: 679, Location: 125 HILLSIDE AVENUE, Grades: KG-8)

- BROOKSIDE PLACE SCHOOL (Students: 395, Location: 700 BROOKSIDE PLACE, Grades: KG-5)

- WALNUT AVENUE SCHOOL (Students: 287, Location: 370 WALNUT AVENUE, Grades: PK-2)

- BLOOMINGDALE AVENUE SCHOOL (Students: 248, Location: 200 BLOOMINGDALE AVENUE, Grades: KG-2)

- LIVINGSTON AVENUE SCHOOL (Students: 215, Location: 75 LIVINGSTON AVENUE, Grades: 3-5)

Private elementary/middle school in Cranford:

Library in Cranford:

- CRANFORD PUBLIC LIBRARY (Operating income: $1,538,405; Location: 224 WALNUT AVENUE; 128,445 books; 45 e-books; 7,440 audio materials; 6,701 video materials; 7 local licensed databases; 22 state licensed databases; 7 other licensed databases; 268 print serial subscriptions; 3 electronic serial subscriptions)

Points of interest:

Notable locations in Cranford: Cranford Station (A), Cranford First Aid Squad (B), Nationwide Ambulance Service (C), Cranford Fire Department (D). Display/hide their locations on the map

Main business address in Cranford include: NEWARK GROUP, INC (A), METALICO INC (B), SYNERGY FINANCIAL GROUP INC /NJ/ (C), MACK CALI REALTY CORP (D), MACK CALI REALTY L P (E). Display/hide their locations on the map

Churches in Cranford include: Cranford Alliance Church (A), First Baptist Church (B), First Presbyterian Church (C), Saint Mark's African Methodist Episcopal Church (D), Saint Michael's Church (E), Trinity Church (F). Display/hide their locations on the map

Streams, rivers, and creeks: Nomahegan Brook (A). Display/hide its location on the map

Parks in Cranford include: Memorial Field (1), Nomahegan Park (2). Display/hide their locations on the map

Tourist attractions: Cranford Historical Society (Museums; 38 Springfield Avenue), Crane-Phillips House Living History Museum (Cultural Attractions- Events- & Facilities; 124 North Union Avenue).

Hotel: Homewood Suites Newark Airport (2 Jackson Dr).

Birthplace of: Ron Miriello - Graphic designer.

Drinking water stations with addresses in Cranford and their reported violations in the past:

TRIPLEBROOK FAMILY CAMPGROUND (Population served: 105, Groundwater):Past health violations:TRIPLEBROOK FAMILY CAMPGROUND (Population served: 105, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - In JUL-2013, Contaminant: Coliform. Follow-up actions: St Public Notif requested (AUG-07-2013), St Formal NOV issued (AUG-07-2013), St Compliance achieved (SEP-06-2013), St Public Notif received (SEP-06-2013)

- MCL, Monthly (TCR) - In JUN-2013, Contaminant: Coliform. Follow-up actions: St Public Notif requested (JUN-25-2013), St Formal NOV issued (JUN-25-2013), St Public Notif received (AUG-01-2013), St Compliance achieved (SEP-06-2013)

- MCL, Monthly (TCR) - In SEP-2012, Contaminant: Coliform. Follow-up actions: St Public Notif requested (OCT-09-2012), St Formal NOV issued (OCT-09-2012), St Compliance achieved (NOV-05-2012)

- MCL, Monthly (TCR) - In AUG-2012, Contaminant: Coliform. Follow-up actions: St Public Notif received (AUG-30-2012), St Public Notif requested (SEP-06-2012), St Formal NOV issued (SEP-06-2012), St Compliance achieved (NOV-05-2012)

- MCL, Monthly (TCR) - In JUL-2012, Contaminant: Coliform. Follow-up actions: St Public Notif requested (AUG-06-2012), St Formal NOV issued (AUG-06-2012), St Public Notif received (AUG-21-2012), St Compliance achieved (NOV-05-2012)

- MCL, Monthly (TCR) - In JUL-2011, Contaminant: Coliform. Follow-up actions: St Formal NOV issued (2 times from JUL-19-2011 to JUL-19-2011), St Public Notif requested (2 times from JUL-19-2011 to JUL-19-2011), St Public Notif received (JUL-27-2011), St Compliance achieved (SEP-26-2011)

- 5 other older health violations

- One routine major monitoring violation

Past health violations:

- MCL, Monthly (TCR) - In AUG-2010, Contaminant: Coliform. Follow-up actions: St Compliance achieved (OCT-19-2010), St Public Notif requested (NOV-08-2010), St Formal NOV issued (NOV-08-2010)

- MCL, Monthly (TCR) - In JUL-2010, Contaminant: Coliform. Follow-up actions: St Public Notif received (JUL-22-2010), St Public Notif requested (AUG-10-2010), St Formal NOV issued (AUG-10-2010), St Compliance achieved (OCT-19-2010)

- MCL, Monthly (TCR) - In SEP-2009, Contaminant: Coliform. Follow-up actions: St Public Notif received (AUG-26-2009), St Formal NOV issued (OCT-22-2009), St Public Notif requested (OCT-22-2009), St Compliance achieved (APR-13-2010)

- MCL, Monthly (TCR) - In AUG-2009, Contaminant: Coliform. Follow-up actions: St Public Notif received (AUG-26-2009), St Compliance achieved (SEP-24-2009), St Public Notif requested (OCT-24-2009), St Formal NOV issued (OCT-24-2009)

| This place: | 2.6 people |

| New Jersey: | 2.7 people |

| This place: | 74.1% |

| Whole state: | 70.7% |

| This place: | 3.0% |

| Whole state: | 4.9% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.2% of all households

- Gay men: 0.2% of all households

| This place: | 2.5% |

| Whole state: | 8.5% |

| This place: | 1.5% |

| Whole state: | 4.2% |

People in group quarters in Cranford in 2000:

- 329 people in nursing homes

- 213 people in other noninstitutional group quarters

- 3 people in religious group quarters

Banks with most branches in Cranford (2011 data):

- Wells Fargo Bank, National Association: Cranford Drive-In Branch, Cranford North Ave Branch, Cranford Branch. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- PNC Bank, National Association: Cranford Branch at 643 Raritan Road, branch established on 1997/09/22; Senior Quarters Branch at Cranford Industrial Park, branch established on 1999/10/12. Info updated 2012/03/20: Bank assets: $263,309.6 mil, Deposits: $197,343.0 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 3085 total offices, Holding Company: Pnc Financial Services Group, Inc., The

- Northfield Bank: First State Branch at 16 Commerce Drive, branch established on 2006/01/18; 14 Commerce Drive Operations Branch at 14 Commerce Drive, branch established on 2011/02/14. Info updated 2011/10/17: Bank assets: $2,367.5 mil, Deposits: $1,506.5 mil, headquarters in Staten Island, NY, positive income, Commercial Lending Specialization, 24 total offices

- Valley National Bank: Cranford Branch at 113 South West Avenue, branch established on 2005/11/21. Info updated 2012/01/10: Bank assets: $14,186.7 mil, Deposits: $9,715.7 mil, headquarters in Wayne, NJ, positive income, Commercial Lending Specialization, 219 total offices, Holding Company: Valley National Bancorp

- New York Community Bank: Cranford Branch at 310 North Avenue East, branch established on 1952/01/01. Info updated 2010/03/29: Bank assets: $39,468.7 mil, Deposits: $20,709.8 mil, headquarters in Westbury, NY, positive income, Commercial Lending Specialization, 247 total offices, Holding Company: New York Community Bancorp, Inc.

- Two River Community Bank: Walnut Avenue Branch at 104 Walnut Avenue, branch established on 2007/11/13. Info updated 2009/01/22: Bank assets: $674.5 mil, Deposits: $555.1 mil, headquarters in Middletown, NJ, positive income, Commercial Lending Specialization, 16 total offices, Holding Company: Community Partners Bancorp

- TD Bank, National Association: Cranford/South Branch at 465 South Avenue, branch established on 2001/12/01. Info updated 2010/10/04: Bank assets: $188,912.6 mil, Deposits: $153,149.8 mil, headquarters in Wilmington, DE, positive income, 1314 total offices, Holding Company: Toronto-Dominion Bank, The

- JPMorgan Chase Bank, National Association: Cranford Banking Center at 40 South Avenue West, branch established on 2007/12/31. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- Bank of America, National Association: Cranford-South Avenue Branch at 101 South Avenue W., branch established on 2010/05/17. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- 4 other banks with 4 local branches

For population 15 years and over in Cranford:

- Never married: 22.1%

- Now married: 63.5%

- Separated: 1.0%

- Widowed: 8.0%

- Divorced: 5.5%

For population 25 years and over in Cranford:

- High school or higher: 91.5%

- Bachelor's degree or higher: 43.0%

- Graduate or professional degree: 16.0%

- Unemployed: 4.1%

- Mean travel time to work (commute): 29.8 minutes

| Here: | 11.0 |

| New Jersey average: | 13.1 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Cranford, NJ (based on Union County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 247,240 | 44 |

| Mainline Protestant | 35,313 | 109 |

| Evangelical Protestant | 30,123 | 129 |

| Other | 28,707 | 52 |

| Black Protestant | 7,858 | 38 |

| Orthodox | 5,717 | 10 |

| None | 181,541 | - |

Food Environment Statistics:

| Union County: | 2.97 / 10,000 pop. |

| New Jersey: | 2.90 / 10,000 pop. |

| This county: | 0.04 / 10,000 pop. |

| State: | 0.06 / 10,000 pop. |

| This county: | 1.80 / 10,000 pop. |

| New Jersey: | 1.76 / 10,000 pop. |

| This county: | 0.75 / 10,000 pop. |

| New Jersey: | 0.81 / 10,000 pop. |

| Here: | 7.38 / 10,000 pop. |

| New Jersey: | 7.15 / 10,000 pop. |

| Union County: | 8.3% |

| New Jersey: | 8.3% |

| This county: | 21.1% |

| New Jersey: | 23.3% |

| Union County: | 21.4% |

| State: | 18.0% |

6.55% of this county's 2021 resident taxpayers lived in other counties in 2020 ($90,395 average adjusted gross income)

| Here: | 6.55% |

| New Jersey average: | 6.70% |

0.02% of residents moved from foreign countries ($49 average AGI)

Union County: 0.02% New Jersey average: 0.01%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Essex County, NJ | |

| from Hudson County, NJ | |

| from Middlesex County, NJ |

7.45% of this county's 2020 resident taxpayers moved to other counties in 2021 ($103,155 average adjusted gross income)

| Here: | 7.45% |

| New Jersey average: | 7.02% |

0.01% of residents moved to foreign countries ($81 average AGI)

Union County: 0.01% New Jersey average: 0.02%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Middlesex County, NJ | |

| to Essex County, NJ | |

| to Somerset County, NJ |

| Businesses in Cranford, NJ | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| Dairy Queen | 1 | New Balance | 1 | |

| Domino's Pizza | 1 | Subway | 1 | |

| Dunkin Donuts | 3 | True Value | 1 | |

| FedEx | 7 | U-Haul | 1 | |

| H&R Block | 1 | UPS | 5 | |

| Hilton | 1 | Walgreens | 1 | |

| MasterBrand Cabinets | 2 | |||

Strongest AM radio stations in Cranford:

- WJDM (1530 AM; 10 kW; ELIZABETH, NJ; Owner: RADIO UNICA OF NEW YORK LICENSE CORP)

- WMCA (570 AM; 50 kW; NEW YORK, NY; Owner: SALEM MEDIA OF NEW YORK, LLC)

- WOR (710 AM; 50 kW; NEW YORK, NY; Owner: BUCKLEY BROADCASTING CORPORATION)

- WINS (1010 AM; 50 kW; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WEPN (1050 AM; 50 kW; NEW YORK, NY; Owner: NEW YORK AM RADIO, LLC)

- WABC (770 AM; 50 kW; NEW YORK, NY; Owner: WABC-AM RADIO, INC.)

- WNSW (1430 AM; 5 kW; NEWARK, NJ; Owner: MULTICULTURAL RADIO BROADCASTING INC)

- WBBR (1130 AM; 50 kW; NEW YORK, NY; Owner: BLOOMBERG COMMUNICATIONS INC.)

- WADO (1280 AM; 50 kW; NEW YORK, NY; Owner: WADO-AM LICENSE CORP.)

- WLIB (1190 AM; 30 kW; NEW YORK, NY; Owner: ICBC BROADCAST HOLDINGS-NY, INC.)

- WNYC (820 AM; 10 kW; NEW YORK, NY; Owner: WNYC RADIO)

- WQEW (1560 AM; 50 kW; NEW YORK, NY; Owner: THE NEW YORK TIMES ELECTRONIC MEDIA COMPANY)

- WFAN (660 AM; 50 kW; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

Strongest FM radio stations in Cranford:

- WRKS (98.7 FM; NEW YORK, NY; Owner: EMMIS RADIO LICENSE CORP OF NEW YORK)

- WNEW (102.7 FM; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WNYC-FM (93.9 FM; NEW YORK, NY; Owner: WNYC RADIO)

- WPAT-FM (93.1 FM; PATERSON, NJ; Owner: WPAT LICENSING, INC.)

- WQCD (101.9 FM; NEW YORK, NY; Owner: EMMIS RADIO LICENSE CORPORATION)

- WCAA (105.9 FM; NEWARK, NJ; Owner: WADO-AM LICENSE CORP. ("WADO"))

- WBAI (99.5 FM; NEW YORK, NY; Owner: PACIFICA FOUNDATION, INC.)

- WBLS (107.5 FM; NEW YORK, NY; Owner: ICBC BROADCAST HOLDINGS-NY, INC.)

- WLTW (106.7 FM; NEW YORK, NY; Owner: AMFM NEW YORK LICENSES, LLC)

- WQXR-FM (96.3 FM; NEW YORK, NY; Owner: THE NEW YORK TIMES ELECTRONIC MEDIA COMPANY)

- WSKQ-FM (97.9 FM; NEW YORK, NY; Owner: WSKQ LICENSING, INC.)

- WXRK (92.3 FM; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WKTU (103.5 FM; LAKE SUCCESS, NY; Owner: AMFM RADIO LICENSES, LLC)

- WAXQ (104.3 FM; NEW YORK, NY; Owner: AMFM NEW YORK LICENSES, LLC)

- WHTZ (100.3 FM; NEWARK, NJ; Owner: AMFM RADIO LICENSES, L.L.C.)

- WWPR-FM (105.1 FM; NEW YORK, NY; Owner: AMFM RADIO LICENSES, L.L.C.)

- WQHT (97.1 FM; NEW YORK, NY; Owner: EMMIS LICENSE CORPORATION OF NEW YORK)

- WFME (94.7 FM; NEWARK, NJ; Owner: FAMILY STATIONS, INC.)

- WCBS-FM (101.1 FM; NEW YORK, NY; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WSIA (88.9 FM; STATEN ISLAND, NY; Owner: THE COLLEGE OF STATEN ISLAND)

TV broadcast stations around Cranford:

- WCBS-TV (Channel 2; NEW YORK, NY; Owner: CBS BROADCASTING INC.)

- WPXO-LP (Channel 34; EAST ORANGE, NJ; Owner: PAXSON COMMUNICATIONS LPTV, INC.)

- WLBX-LP (Channel 22; CRANFORD, NJ; Owner: RENARD COMMUNICATIONS CORP.)

- WABC-TV (Channel 7; NEW YORK, NY; Owner: AMERICAN BROADCASTING COMPANIES, INC)

- WPIX (Channel 11; NEW YORK, NY; Owner: WPIX, INC.)

- WWOR-TV (Channel 9; SECAUCUS, NJ; Owner: FOX TELEVISION STATIONS, INC.)

- WNYW (Channel 5; NEW YORK, NY; Owner: FOX TELEVISION STATIONS, INC.)

- WPXN-TV (Channel 31; NEW YORK, NY; Owner: PAXSON COMMUNICATIONS LICENSE COMPANY, LLC)

- WNBC (Channel 4; NEW YORK, NY; Owner: NATIONAL BROADCASTING COMPANY, INC.)

- WNET (Channel 13; NEWARK, NJ; Owner: EDUCATIONAL BROADCASTING CORPORATION)

- WXTV (Channel 41; PATERSON, NJ; Owner: WXTV LICENSE PARTNERSHIP, G.P.)

- WNJU (Channel 47; LINDEN, NJ; Owner: WNJU LICENSE CORPORATION)

- WFUT (Channel 68; NEWARK, NJ; Owner: UNIVISION NEW YORK LLC)

- WNYE-TV (Channel 25; NEW YORK, NY; Owner: NEW YORK CITY BOARD OF EDUCATION)

- WXNY-LP (Channel 32; NEW YORK, NY; Owner: ISLAND BROADCASTING COMPANY)

- WKOB-LP (Channel 53; NEW YORK, NY; Owner: WKOB COMMUNICATIONS, INC.)

- WEBR-CA (Channel 17; MANHATTAN, NY; Owner: K LICENSEE INC.)

- WRNN-LP (Channel 57; NYACK, NY; Owner: LP NYACK LIMITED PARTNERSHIP)

- W60AI (Channel 60; NEW YORK, NY; Owner: VENTANA TELEVISION, INC.)

- WNJB (Channel 58; NEW BRUNSWICK, NJ; Owner: NEW JERSEY PUBLIC BROADCASTING AUTHORITY)

- WNXY-LP (Channel 26; NEW YORK, NY; Owner: ISLAND BROADCASTING COMPANY)

- W33BS (Channel 33; DARIEN, CT; Owner: CT&T BROADCASTING, INC.)

- WNYN-LP (Channel 39; NEW YORK, NY; Owner: ISLAND BROADCASTING COMPANY)

- WNYX-LP (Channel 35; NEW YORK, NY; Owner: ISLAND BROADCASTING COMPANY)

- W54CZ (Channel 54; MORRISTOWN, NJ; Owner: WLNY-TV, INC.)

- National Bridge Inventory (NBI) Statistics

- 17Number of bridges

- 207ft / 62.8mTotal length

- $436,000Total costs

- 1,168,810Total average daily traffic

- 15,806Total average daily truck traffic

- New bridges - historical statistics

- 11910-1919

- 21920-1929

- 11940-1949

- 61950-1959

- 11960-1969

- 11970-1979

- 11980-1989

- 11990-1999

- 22000-2009

- 12010-2019

FCC Registered Antenna Towers:

11 (See the full list of FCC Registered Antenna Towers in Cranford)FCC Registered Broadcast Land Mobile Towers:

11 (See the full list of FCC Registered Broadcast Land Mobile Towers in Cranford, NJ)FCC Registered Microwave Towers:

7 (See the full list of FCC Registered Microwave Towers in this town)FCC Registered Maritime Coast & Aviation Ground Towers:

1 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)FCC Registered Amateur Radio Licenses:

70 (See the full list of FCC Registered Amateur Radio Licenses in Cranford)FAA Registered Aircraft:

6- Aircraft: BARTO J/BARTO K V RV-6A (Category: Land, Seats: 2, Weight: Up to 12,499 Pounds), Engine: LYCOMING O&VO-360 SER (180 HP) (Reciprocating)

N-Number: 456RJ, N456RJ, N-456RJ, Serial Number: 21701, Year manufactured: 1995, Airworthiness Date: 11/20/1997, Certificate Issue Date: 07/21/2017

Registrant (Individual): Daniel S Matlosz, 203 Locust Dr, Cranford, NJ 07016

Deregistered: Cancel Date: 02/10/2009 - Aircraft: SMITH AEROSTAR 600 (Category: Land, Engines: 2, Seats: 6, Weight: Up to 12,499 Pounds, Speed: 186 mph), Engine: LYCOMING IO-540 SER (300 HP) (Reciprocating)

N-Number: 78TS, N78TS, N-78TS, Serial Number: 60-0470-155, Year manufactured: 1977, Airworthiness Date: 11/01/1978, Certificate Issue Date: 02/10/2014

Registrant (Corporation): Celeritas Corp, 17 Lasalle Ave, Cranford, NJ 07016 - Aircraft: TAYLORCRAFT BC12-D (Category: Land, Seats: 2, Weight: Up to 12,499 Pounds, Speed: 78 mph), Engine: CONT MOTOR A&C65 SERIES (65 HP) (Reciprocating)

N-Number: 95716, N95716, N-95716, Serial Number: 8016, Year manufactured: 1946, Airworthiness Date: 08/01/1958, Certificate Issue Date: 06/19/2003

Registrant (Individual): Thomas Gilbertson, 25 W Holly St, Cranford, NJ 07016 - Aircraft: BARTO J/BARTO K V RV-6A (Category: Land, Seats: 2, Weight: Up to 12,499 Pounds), Engine: LYCOMING O&VO-360 SER (180 HP) (Reciprocating)

N-Number: 6389, N6389, N-6389, Serial Number: 21701, Year manufactured: 1995, Airworthiness Date: 11/20/1997, Certificate Issue Date: 07/21/2017

Registrant (Individual): Daniel S Matlosz, 203 Locust Dr, Cranford, NJ 07016 - Aircraft: CANADAIR LTD CL-600-2B16 (Category: Land, Engines: 2, Seats: 22, Weight: 20,000+ Pounds), Engine: GE CF34 SERIES (9140 Pounds of Thrust) (Turbo-fan)

N-Number: 719UW, N719UW, N-719UW, Serial Number: 5046, Year manufactured: 1989, Airworthiness Date: 06/16/1989, Certificate Issue Date: 11/18/2015

Registrant (Corporation): Ak Air LLC, 11 Commerce Dr Fl 1, Cranford, NJ 07016 - Aircraft: ADAMS BALLOON A55S (Category: Land, Weight: Up to 12,499 Pounds, Speed: 30 mph), Engine: None

N-Number: 98093, N98093, N-98093, Serial Number: 186, Airworthiness Date: 05/25/1987, Certificate Issue Date: 08/01/1987

Registrant (Individual): Thomas E Iii Rush, 20 Georgia St, Cranford, NJ 07016

Deregistered: Cancel Date: 06/22/2017

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 5 full tracts) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 39 | $367,128 | 174 | $322,477 | 766 | $291,785 | 38 | $185,474 | 2 | $14,360,500 | 12 | $232,833 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | $0 | 12 | $359,250 | 72 | $257,903 | 2 | $144,000 | 0 | $0 | 0 | $0 |

| APPLICATIONS DENIED | 2 | $314,000 | 18 | $346,944 | 169 | $308,266 | 16 | $124,312 | 0 | $0 | 11 | $247,455 |

| APPLICATIONS WITHDRAWN | 4 | $330,250 | 13 | $350,692 | 141 | $313,603 | 7 | $220,000 | 0 | $0 | 8 | $249,625 |

| FILES CLOSED FOR INCOMPLETENESS | 2 | $281,000 | 3 | $380,000 | 28 | $339,107 | 5 | $214,000 | 0 | $0 | 1 | $400,000 |

Detailed HMDA statistics for the following Tracts: 0370.00 , 0371.00, 0372.00, 0373.00, 0374.00

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 5 full tracts) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 38 | $366,211 | 9 | $377,333 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 11 | $378,727 | 5 | $386,000 |

| APPLICATIONS DENIED | 4 | $343,250 | 4 | $347,500 |

| APPLICATIONS WITHDRAWN | 3 | $374,000 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 0370.00 , 0371.00, 0372.00, 0373.00, 0374.00

2003 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Cranford, NJ

- 57850.0%Structure Fires

- 37932.8%Outside Fires

- 18816.3%Mobile Property/Vehicle Fires

- 111.0%Other

According to the data from the years 2003 - 2018 the average number of fires per year is 72. The highest number of reported fires - 94 took place in 2008, and the least - 49 in 2006. The data has a decreasing trend.

According to the data from the years 2003 - 2018 the average number of fires per year is 72. The highest number of reported fires - 94 took place in 2008, and the least - 49 in 2006. The data has a decreasing trend. When looking into fire subcategories, the most incidents belonged to: Structure Fires (50.0%), and Outside Fires (32.8%).

When looking into fire subcategories, the most incidents belonged to: Structure Fires (50.0%), and Outside Fires (32.8%).

- 68.3%Utility gas

- 29.1%Fuel oil, kerosene, etc.

- 1.9%Electricity

- 0.6%Bottled, tank, or LP gas

- 0.1%Coal or coke

- 60.5%Utility gas

- 22.2%Fuel oil, kerosene, etc.

- 13.7%Electricity

- 3.1%Bottled, tank, or LP gas

- 0.4%No fuel used

Cranford compared to New Jersey state average:

- Unemployed percentage significantly below state average.

- Black race population percentage significantly below state average.

- Hispanic race population percentage significantly below state average.

- Foreign-born population percentage significantly below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

- Institutionalized population percentage significantly above state average.

Cranford on our top lists:

- #28 on the list of "Top 101 cities with largest percentage of females in industries: chemicals (population 5,000+)"

- #30 on the list of "Top 101 cities with largest percentage of females in occupations: life and physical scientists (population 5,000+)"

- #38 on the list of "Top 101 cities with largest percentage of females in occupations: preschool, kindergarten, elementary and middle school teachers (population 5,000+)"

- #55 on the list of "Top 101 cities with largest percentage of males in industries: miscellaneous durable goods merchant wholesalers (population 5,000+)"

- #56 on the list of "Top 101 cities with largest percentage of females in occupations: secondary school teachers (population 5,000+)"

- #59 on the list of "Top 101 cities with the most people taking railroad to work (population 5,000+)"

- #64 on the list of "Top 101 cities with largest percentage of females in occupations: advertising, marketing, promotions, public relations, and sales managers (population 5,000+)"

- #64 on the list of "Top 101 cities with largest percentage of males in industries: broadcasting and telecommunications (population 5,000+)"

- #66 on the list of "Top 101 cities with largest percentage of females in industries: drugs, sundries, and chemical and allied products merchant wholesalers (population 5,000+)"

- #73 on the list of "Top 101 cities with largest percentage of males in industries: chemicals (population 5,000+)"

- #75 on the list of "Top 101 cities with the largest racial income disparity between any two races with at least 200 householders"

- #77 on the list of "Top 101 cities with largest percentage of males in industries: sewing, needlework, and piece goods stores (population 5,000+)"

- #79 on the list of "Top 101 cities with largest percentage of males in occupations: accountants and auditors (population 5,000+)"

- #86 on the list of "Top 101 cities with largest percentage of females in occupations: occupational and physical therapist assistants and aides (population 5,000+)"

- #91 on the list of "Top 101 cities with largest percentage of males in industries: jewelry, luggage, and leather goods stores (population 5,000+)"

- #98 on the list of "Top 101 cities with largest percentage of females in industries: petroleum and coal products (population 5,000+)"

- #99 on the list of "Top 101 cities with largest percentage of males in industries: apparel (population 5,000+)"

- #15 on the list of "Top 101 counties with the lowest percentage of residents that keep firearms around their homes"

- #17 on the list of "Top 101 counties with the largest decrease in the number of deaths per 1000 residents 2000-2006 to 2007-2013 (pop. 50,000+)"

- #47 on the list of "Top 101 counties with the most Orthodox adherents"

- #53 on the list of "Top 101 counties with the most Catholic adherents"

- #58 on the list of "Top 101 counties with the lowest percentage of residents that drank alcohol in the past 30 days"

|

|

Total of 404 patent applications in 2008-2024.