Dayton, Ohio

Dayton: River Scape

Dayton: River Scape

Dayton: Riverscape Park downtown 4

Dayton: arial view

Dayton: Dayton

Dayton: Riverscape Park downtown 5

Dayton: Dayton Aerial View

Dayton: RiverScape - Dayton Outdoor Laser Shows Riverside Bridge.

Dayton: Dayton skyline by night

Dayton: Riverscape Park downtown 3

Dayton: Downtown Dayton from the banks of the Great Miami River

- see

38

more - add

your

Submit your own pictures of this city and show them to the world

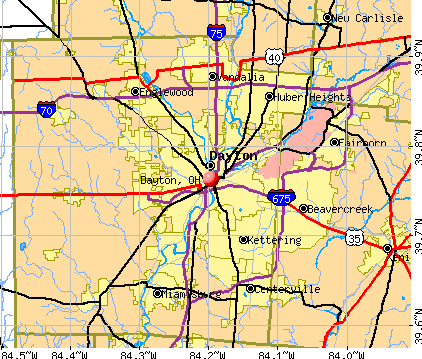

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: -18.2%

| Males: 68,482 | |

| Females: 67,462 |

| Median resident age: | 38.4 years |

| Ohio median age: | 39.9 years |

Zip codes: 45377, 45402, 45403, 45404, 45405, 45406, 45409, 45410, 45414, 45416, 45417, 45419, 45420, 45424, 45426, 45428.

Dayton Zip Code Map| Dayton: | $43,780 |

| OH: | $65,720 |

Estimated per capita income in 2022: $28,730 (it was $15,547 in 2000)

Dayton city income, earnings, and wages data

Estimated median house or condo value in 2022: $97,700 (it was $66,700 in 2000)

| Dayton: | $97,700 |

| OH: | $204,100 |

Mean prices in 2022: all housing units: $117,705; detached houses: $118,555; townhouses or other attached units: $161,663; in 2-unit structures: $98,242; in 3-to-4-unit structures: $163,520; in 5-or-more-unit structures: $187,975; mobile homes: $18,721

Median gross rent in 2022: $824.

(17.6% for White Non-Hispanic residents, 33.0% for Black residents, 31.1% for Hispanic or Latino residents, 44.3% for American Indian residents, 23.1% for Native Hawaiian and other Pacific Islander residents, 39.9% for other race residents, 32.9% for two or more races residents)

Detailed information about poverty and poor residents in Dayton, OH

- 70,93852.2%White alone

- 49,19936.2%Black alone

- 7,2205.3%Two or more races

- 5,9044.3%Hispanic

- 1,4451.1%Asian alone

- 1,1710.9%Other race alone

- 610.04%American Indian alone

Races in Dayton detailed stats: ancestries, foreign born residents, place of birth

According to our research of Ohio and other state lists, there were 987 registered sex offenders living in Dayton, Ohio as of April 25, 2024.

The ratio of all residents to sex offenders in Dayton is 143 to 1.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is bigger than the state average.- means the value is much bigger than the state average.

Crime rate in Dayton detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 395 (355 officers - 308 male; 47 female).

| Officers per 1,000 residents here: | 2.54 |

| Ohio average: | 2.31 |

| Moving to Ohio and considering Dayton (32 replies) |

| Is the University of Dayton a good school? (36 replies) |

| Dayton Pictures Thread (151 replies) |

| Moving to Dayton - where should I live? (7 replies) |

| The Dayton "Attitude" problem (114 replies) |

| PBS Frontline Episode About Dayton (12 replies) |

Latest news from Dayton, OH collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: German (7.4%), Irish (5.7%), American (5.1%), African (3.1%), English (3.0%), European (2.0%).

Current Local Time: EST time zone

Incorporated in 1913

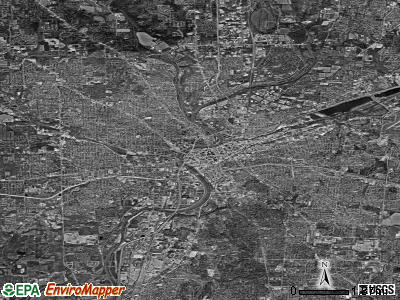

Elevation: 750 feet

Land area: 55.8 square miles.

Population density: 2,437 people per square mile (low).

6,824 residents are foreign born (1.7% Latin America, 1.5% Asia, 1.3% Africa).

| This city: | 5.0% |

| Ohio: | 4.9% |

Median real estate property taxes paid for housing units with mortgages in 2022: $1,689 (1.4%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $1,244 (1.7%)

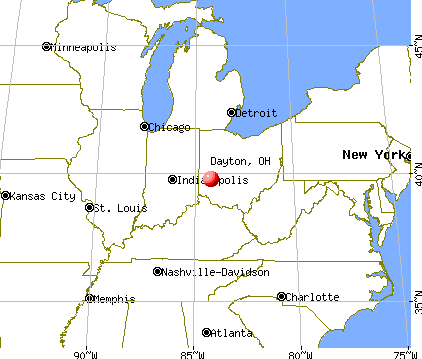

Nearest city with pop. 200,000+: Cincinnati, OH (46.3 miles

, pop. 331,285).

Nearest city with pop. 1,000,000+: Chicago, IL (232.1 miles

, pop. 2,896,016).

Nearest cities:

Latitude: 39.76 N, Longitude: 84.20 W

Daytime population change due to commuting: +23,791 (+17.5%)

Workers who live and work in this city: 26,865 (44.4%)

Area code: 937

Detailed articles:

- Dayton: Introduction

- Dayton Basic Facts

- Dayton: Communications

- Dayton: Convention Facilities

- Dayton: Economy

- Dayton: Education and Research

- Dayton: Geography and Climate

- Dayton: Health Care

- Dayton: History

- Dayton: Municipal Government

- Dayton: Population Profile

- Dayton: Recreation

- Dayton: Transportation

Dayton tourist attractions:

- Boonshoft Museum of Discovery in Dayton, Ohio

- National Museum of the United States Air Force and IMAX Theater in Dayton, Ohio a Hit with Military Buffs

- The Boonshoft Museum of Discovery in Dayton, Ohio a Kid-Oriented Favorite

- Dayton Art Institute in Dayton, Ohio a Small but Comprehensive Museum and Education Center

- National City Second Street Market in Dayton, Ohio Boasts Local Goodies

- The Oregon District of Dayton, Ohio is Full of History

Dayton, Ohio accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 32 buildings, average cost: $146,800

- 2021: 14 buildings, average cost: $300,200

- 2020: 3 buildings, average cost: $100,700

- 2019: 1 building, cost: $230,000

- 2018: 7 buildings, average cost: $222,900

- 2017: 21 buildings, average cost: $137,500

- 2016: 38 buildings, average cost: $115,500

- 2015: 60 buildings, average cost: $135,700

- 2014: 7 buildings, average cost: $90,000

- 2013: 44 buildings, average cost: $78,600

- 2012: 153 buildings, average cost: $88,400

- 2011: 90 buildings, average cost: $105,700

- 2010: 27 buildings, average cost: $141,600

- 2009: 120 buildings, average cost: $85,500

- 2008: 83 buildings, average cost: $97,900

- 2007: 134 buildings, average cost: $92,800

- 2006: 186 buildings, average cost: $103,700

- 2005: 215 buildings, average cost: $117,700

- 2004: 185 buildings, average cost: $118,500

- 2003: 277 buildings, average cost: $106,300

- 2002: 222 buildings, average cost: $102,700

- 2001: 192 buildings, average cost: $107,900

- 2000: 39 buildings, average cost: $151,100

- 1999: 43 buildings, average cost: $151,200

- 1998: 40 buildings, average cost: $151,000

- 1997: 36 buildings, average cost: $151,700

| Here: | 3.9% |

| Ohio: | 3.1% |

- Educational services (11.9%)

- Health care (11.9%)

- Accommodation & food services (10.5%)

- Administrative & support & waste management services (5.3%)

- Public administration (5.2%)

- Social assistance (4.3%)

- Construction (4.3%)

- Accommodation & food services (9.6%)

- Educational services (9.2%)

- Construction (7.9%)

- Public administration (6.5%)

- Administrative & support & waste management services (6.3%)

- Health care (5.4%)

- Transportation equipment (4.7%)

- Health care (17.9%)

- Educational services (14.4%)

- Accommodation & food services (11.2%)

- Social assistance (7.0%)

- Department & other general merchandise stores (4.4%)

- Administrative & support & waste management services (4.4%)

- Public administration (3.9%)

- Cooks and food preparation workers (8.5%)

- Building and grounds cleaning and maintenance occupations (5.2%)

- Other management occupations, except farmers and farm managers (4.3%)

- Cashiers (3.6%)

- Nursing, psychiatric, and home health aides (3.0%)

- Material recording, scheduling, dispatching, and distributing workers (2.9%)

- Supervisors and other personal care and service workers, except child care workers (2.6%)

- Cooks and food preparation workers (7.7%)

- Building and grounds cleaning and maintenance occupations (6.7%)

- Other management occupations, except farmers and farm managers (4.4%)

- Metal workers and plastic workers (4.1%)

- Material recording, scheduling, dispatching, and distributing workers (4.0%)

- Laborers and material movers, hand (4.0%)

- Driver/sales workers and truck drivers (3.5%)

- Cooks and food preparation workers (9.2%)

- Cashiers (5.1%)

- Nursing, psychiatric, and home health aides (4.8%)

- Other management occupations, except farmers and farm managers (4.1%)

- Building and grounds cleaning and maintenance occupations (3.9%)

- Other office and administrative support workers, including supervisors (3.8%)

- Secretaries and administrative assistants (3.7%)

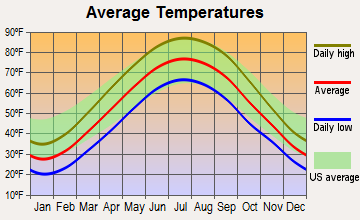

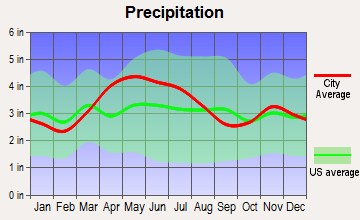

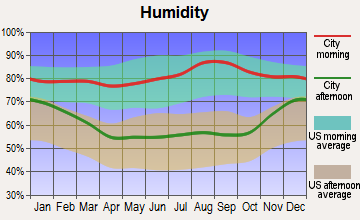

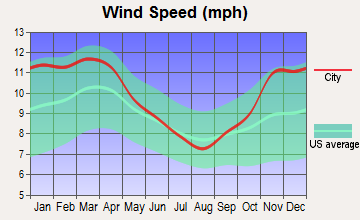

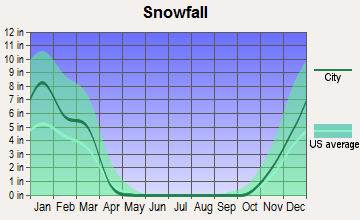

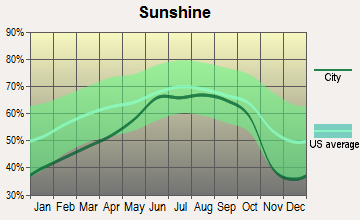

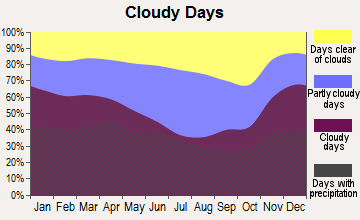

Average climate in Dayton, Ohio

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

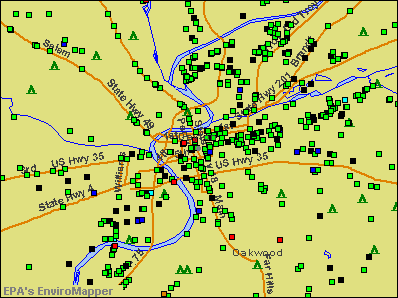

Air Quality Index (AQI) level in 2023 was 97.8. This is worse than average.

| City: | 97.8 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2010 was 0.300. This is about average. Closest monitor was 0.3 miles away from the city center.

| City: | 0.300 |

| U.S.: | 0.251 |

Sulfur Dioxide (SO2) [ppb] level in 2020 was 0.813. This is significantly better than average. Closest monitor was 0.3 miles away from the city center.

| City: | 0.813 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 31.7. This is about average. Closest monitor was 0.3 miles away from the city center.

| City: | 31.7 |

| U.S.: | 33.3 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 11.4. This is significantly worse than average. Closest monitor was 0.3 miles away from the city center.

| City: | 11.4 |

| U.S.: | 8.1 |

Tornado activity:

Dayton-area historical tornado activity is slightly above Ohio state average. It is 59% greater than the overall U.S. average.

On 4/3/1974, a category F5 (max. wind speeds 261-318 mph) tornado 12.0 miles away from the Dayton city center killed 36 people and injured 1150 people and caused between $50,000,000 and $500,000,000 in damages.

On 9/20/2000, a category F4 (max. wind speeds 207-260 mph) tornado 13.9 miles away from the city center killed one person and injured 100 people and caused $15 million in damages.

Earthquake activity:

Dayton-area historical earthquake activity is significantly above Ohio state average. It is 26% greater than the overall U.S. average.On 7/27/1980 at 18:52:21, a magnitude 5.2 (5.1 MB, 4.7 MS, 5.0 UK, 5.2 UK, Class: Moderate, Intensity: VI - VII) earthquake occurred 108.6 miles away from the city center

On 4/18/2008 at 09:36:59, a magnitude 5.4 (5.1 MB, 4.8 MS, 5.4 MW, 5.2 MW) earthquake occurred 217.8 miles away from the city center

On 7/12/1986 at 08:19:37, a magnitude 4.5 (4.5 MB, Class: Light, Intensity: IV - V) earthquake occurred 54.3 miles away from the city center

On 4/18/2008 at 09:36:59, a magnitude 5.2 (5.2 MW, Depth: 8.9 mi) earthquake occurred 217.8 miles away from Dayton center

On 6/10/1987 at 23:48:54, a magnitude 5.1 (4.9 MB, 4.4 MS, 4.6 MS, 5.1 LG) earthquake occurred 207.9 miles away from Dayton center

On 9/25/1998 at 19:52:52, a magnitude 5.2 (4.8 MB, 4.3 MS, 5.2 LG, 4.5 MW, Depth: 3.1 mi) earthquake occurred 232.6 miles away from Dayton center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Montgomery County (9) is smaller than the US average (15).Major Disasters (Presidential) Declared: 4

Emergencies Declared: 3

Causes of natural disasters: Floods: 4, Storms: 3, Mudslides: 2, Winds: 2, Blizzard: 1, Heavy Rain: 1, Hurricane: 1, Landslide: 1, Snow: 1, Snowstorm: 1, Tornado: 1, Tropical Depression: 1, Winter Storm: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: ROBBINS & MYERS INC (PUMPS & PUMPING EQUIPMENT), DAY INTERNATIONAL GROUP INC (FABRICATED RUBBER PRODUCTS, NEC), STANDARD REGISTER CO (MANIFOLD BUSINESS FORMS), NCR CORP (CALCULATING & ACCOUNTING MACHINES (NO ELECTRONIC COMPUTERS)), REX STORES CORP (RETAIL-RADIO TV & CONSUMER ELECTRONICS STORES), DAYTON SUPERIOR CORP (STEEL PIPE & TUBES), DPL INC (ELECTRIC & OTHER SERVICES COMBINED), DT INDUSTRIES INC (SPECIAL INDUSTRY MACHINERY, NEC) and 4 other public companies.

Hospitals in Dayton:

- DAYTON HEART HOSPITAL (provides emergency services, 707 EDWIN C MOSES BLVD)

- DAYTON REHABILITATION INSTITUTE (ONE ELIZABETH PLACE)

- DAYTON VA MEDICAL CENTER (Government Federal, provides emergency services, 4100 WEST THIRD STREET)

- ECHOING VALLEY RESIDENTIAL CEN (7040 UNION SCHOOL HOUSE ROAD)

- FRANCISCAN MEDICAL CTR-DAYTON CAMPUS (ONE FRANCISCAN WAY)

- GOOD SAMARITAN HOSPITAL (Voluntary non-profit - Church, provides emergency services, 2222 PHILADELPHIA DRIVE)

- GRANDVIEW HOSPITAL & MEDICAL CENTER (Voluntary non-profit - Other, provides emergency services, 405 GRAND AVENUE)

- KINDRED HOSPITAL-DAYTON (provides emergency services, "ONE ELIZABETH PLACE, 5TH AND 6TH FLOOR")

- MEDICAL CENTER AT ELIZABETH PLACE (Government - Federal, provides emergency services, ONE ELIZABETH PLACE)

- MIAMI VALLEY HOSPITAL (Voluntary non-profit - Private, ONE WYOMING STREET)

Airports and heliports located in Dayton:

- Dayton-Wright Brothers Airport (MGY) (Runways: 1, Air Taxi Ops: 6,350, Itinerant Ops: 39,900, Local Ops: 42,700, Military Ops: 95)

- James M Cox Dayton International Airport (DAY) (Runways: 3, Commercial Ops: 15,496, Air Taxi Ops: 25,883, Itinerant Ops: 9,905, Local Ops: 1,974, Military Ops: 435)

- Greene County-Lewis A Jackson Regional Airport (I19) (Runways: 1, Itinerant Ops: 3,900, Local Ops: 39,000)

- Moraine Air Park Airport (I73) (Runways: 1, Air Taxi Ops: 5,225, Itinerant Ops: 6,930, Local Ops: 7,000, Military Ops: 33)

- Dahio Trotwood Airport (I44) (Runways: 1, Itinerant Ops: 615, Local Ops: 1,238)

- Wright-Patterson Afb Airport (FFO) (Runways: 2)

- Childrens Medical Center Heliport (2OH5)

- Dayton Transportation Cntr Heliport (5D7)

- Good Samaritan Hospital Heliport (OH56)

- Miami Valley Hospital Heliport (00OI)

- Rogers Heliport (OI37)

Colleges/Universities in Dayton:

- Wright State University-Main Campus (Full-time enrollment: 14,482; Location: 3640 Colonel Glenn Highway; Public; Website: www.wright.edu; Offers Doctor's degree)

- Sinclair Community College (Full-time enrollment: 13,779; Location: 444 W. Third St.; Public; Website: www.sinclair.edu)

- University of Dayton (Full-time enrollment: 10,392; Location: 300 College Park; Private, not-for-profit; Website: www.udayton.edu; Offers Doctor's degree)

- Kaplan College-Dayton (Full-time enrollment: 724; Location: 2800 East River Road; Private, for-profit; Website: www.kaplancollege.com/dayton-oh/)

- Creative Images Institute of Cosmetology-North Dayton (Full-time enrollment: 384; Location: 7535 Poe Avenue; Private, for-profit; Website: www.creativeimages.edu)

- ITT Technical Institute-Dayton (Full-time enrollment: 357; Location: 3325 Stop Eight Rd; Private, for-profit; Website: www.itt-tech.edu)

- Dayton School of Medical Massage (Full-time enrollment: 331; Location: 4457 Far Hills Ave; Private, for-profit; Website: www.massageschools.com)

- Miami-Jacobs Career College-Dayton (Full-time enrollment: 247; Location: 110 N. Patterson Blvd.; Private, for-profit; Website: www.miamijacobs.edu)

- Creative Images Institute of Cosmetology-South Dayton (Full-time enrollment: 245; Location: 568 Miamisburg-Centrville Rd; Private, for-profit; Website: www.creativeimages.edu)

- United Theological Seminary (Full-time enrollment: 212; Location: 4501 Denlinger Rd.; Private, not-for-profit; Website: www.united.edu; Offers Doctor's degree)

- Ohio Medical Career Center (Full-time enrollment: 195; Location: 1133 S. Edwin C Moses Blvd, Suite 110; Private, for-profit; Website: www.omcc.edu)

- Lincoln College of Technology-Dayton (Full-time enrollment: 188; Location: 111 W First Street; Private, for-profit; Website: www.lincolnedu.com)

- Ross Medical Education Center-Dayton (Full-time enrollment: 171; Location: 4490 Brandt Pike; Private, for-profit; Website: www.rosseducation.edu)

- Regency Beauty Institute-Dayton (Full-time enrollment: 88; Location: 2040 Miamisburg-Centerville Road; Private, for-profit; Website: www.regency.edu)

- International College of Broadcasting (Full-time enrollment: 72; Location: 6 S Smithville Rd; Private, for-profit; Website: www.icb.edu)

- Ohio Business College-Dayton (Full-time enrollment: 53; Location: 1133 South Edwin C Moses Blvd; Private, for-profit; Website: www.ohiobusinesscollege.edu)

- Carousel Beauty College-Dayton (Full-time enrollment: 26; Location: 125 E Second St; Private, for-profit; Website: www.CarouselBeauty.com)

Other colleges/universities with over 2000 students near Dayton:

- Fortis College-Centerville (about 9 miles; Centerville, OH; Full-time enrollment: 4,527)

- Central State University (about 18 miles; Wilberforce, OH; FT enrollment: 2,094)

- Cedarville University (about 21 miles; Cedarville, OH; FT enrollment: 3,396)

- Clark State Community College (about 24 miles; Springfield, OH; FT enrollment: 3,689)

- Edison State Community College (about 28 miles; Piqua, OH; FT enrollment: 2,049)

- Miami University-Hamilton (about 34 miles; Hamilton, OH; FT enrollment: 2,906)

- Miami University-Oxford (about 34 miles; Oxford, OH; FT enrollment: 17,670)

Biggest public high schools in Dayton:

- STEBBINS HIGH SCHOOL (Students: 1,117, Location: 1900 HARSHMAN RD, Grades: 9-12)

- STIVERS SCHOOL FOR THE ARTS (Students: 937, Location: 1313 E 5TH ST, Grades: 7-12)

- BELMONT HIGH SCHOOL (Students: 807, Location: 2615 WAYNE AVE, Grades: 7-12)

- OAKWOOD HIGH SCHOOL (Students: 663, Location: 1200 FAR HILLS AVE, Grades: 9-12)

- MEADOWDALE HIGH SCHOOL (Students: 625, Location: 3873 WHITESTONE CT, Grades: 9-12)

- THURGOOD MARSHALL HIGH SCHOOL (Students: 594, Location: 4447 HOOVER AVE, Grades: 9-12)

- DUNBAR HIGH SCHOOL (Students: 590, Location: 1400 ALBRITTON DR, Grades: 9-12)

- NORTHRIDGE HIGH SCHOOL (Students: 532, Location: 2251 TIMBER LN, Grades: 7-12)

- DAVID H. PONITZ CAREER TECHNOLOGY CENTER (Students: 502, Location: 741 WASHINGTON ST, Grades: 9-12)

- MEADOWDALE PREK-8 SCHOOL (Students: 444, Location: 3871 YELLOWSTONE AVE, Grades: PK-9)

Private high schools in Dayton:

- CARROLL HIGH SCHOOL (Students: 781, Location: 4524 LINDEN AVE, Grades: 9-12)

- CHAMINADE JULIENNE HIGH SCHOOL (Students: 623, Location: 505 S LUDLOW ST, Grades: 9-12)

- EAST DAYTON CHRISTIAN SCHOOL (Students: 502, Location: 999 SPINNING RD, Grades: PK-12)

- THE MIAMI VALLEY SCHOOL (Students: 480, Location: 5151 DENISE DR, Grades: PK-12)

- SPRING VALLEY ACADEMY (Students: 304, Location: 1461 E SPRING VALLEY PIKE, Grades: PK-12)

- DOMINION ACADEMY (Students: 120, Location: 925 N MAIN ST, Grades: UG-12)

- TEMPLE CHRISTIAN SCHOOL (Students: 112, Location: 1617 OHMER AVE, Grades: PK-12)

- NICHOLAS-LIBERTY SCHOOL (Students: 14, Location: 5581 DAYTON LIBERTY RD, Grades: 7-11, Boys only)

Biggest public elementary/middle schools in Dayton:

- HADLEY E WATTS MIDDLE SCHOOL (Students: 747, Location: 7056 MCEWEN RD, Grades: 6-8)

- PATHWAY SCHOOL OF DISCOVERY (Students: 699, Location: 173 AVONDALE DR, Grades: KG-8, Charter school)

- DAYTON LEADERSHIP ACADEMIES-DAYTON LIBERTY CAMPUS (Students: 613, Location: 4401 DAYTON LIBERTY RD, Grades: KG-2, Charter school)

- BAUER ELEMENTARY SCHOOL (Students: 575, Location: 701 N. SPRINGBORO PIKE, Grades: KG-5)

- EMERSON ACADEMY (Students: 565, Location: 501 HICKORY ST, Grades: KG-8, Charter school)

- DAYTON LEADERSHIP ACADEMIES-DAYTON VIEW CAMPUS (Students: 559, Location: 1416 W RIVERVIEW AVE, Grades: 3-8, Charter school)

- NORTH DAYTON SCHOOL OF SCIENCE & DISCOVERY (Students: 548, Location: 3901 TURNER RD, Grades: KG-8, Charter school)

- SMITH MIDDLE SCHOOL (Students: 535, Location: 3625 LITTLE YORK RD, Grades: 4-5)

- SPINNING HILLS MIDDLE SCHOOL (5-6) (Students: 523, Location: 5001 EASTMAN AVE, Grades: 5-6)

- MAD RIVER MIDDLE SCHOOL (Students: 510, Location: 1801 HARSHMAN RD, Grades: 6-8)

Biggest private elementary/middle schools in Dayton:

- BISHOP LEIBOLD SCHOOL (Students: 476, Location: 6666 SPRINGBORO PIKE, Grades: PK-8)

- BRUNNER CATHOLIC SCHOOL (Students: 375, Location: 4870 DENLINGER RD, Grades: KG-8)

- MARY QUEEN OF PEACE CATHOLIC SCHOOL - HOMEWOOD (Students: 350, Location: 200 HOMEWOOD AVE, Grades: PK-8)

- HOLY ANGELS ELEMENTARY SCHOOL (Students: 343, Location: 223 L ST, Grades: PK-8)

- ST HELEN ELEMENTARY SCHOOL (Students: 319, Location: 5086 BURKHARDT RD, Grades: KG-8)

- IMMACULATE CONCEPTION SCHOOL (Students: 222, Location: 2268 S SMITHVILLE RD, Grades: KG-8)

- OUR LADY OF THE ROSARY SCHOOL (Students: 203, Location: 40 NOTRE DAME AVE, Grades: KG-8)

- ST ANTHONY ELEMENTARY SCHOOL (Students: 190, Location: 1824 SAINT CHARLES AVE, Grades: KG-8)

- CAROUSEL HOUSE SCHOOL (Students: 54, Location: 5520 FAR HILLS AVE, Grades: PK-3)

- GLORIA DEI MONTESSORI SCHOOL (Students: 54, Location: 615 SHILOH DR, Grades: PK-6)

Library in Dayton:

User-submitted facts and corrections:

- Central State University In Wilberforce,ohio added by Pro-Black Fist

- Roth Middle School was demolished a little over 6 months ago.

- The Dayton Synchronettes is a competetive masters Synchronized Swimming organization that has been around since the 1950's. October 2005 they won National Champion title in their Clermont, FL competition. The youngest swimmer is 21 and the eldest on the team is currently 89. - In 2006 During the International competition they ranked in the top 3.

Points of interest:

Notable locations in Dayton: Lebanon Junction (A), Stanley Avenue Distribution Center (B), Dayton Water Works (C), Fairmont Golf Course (D), University of Dayton Arena (E), Perc Welcome Stadium (F), Wrightgate Industrial Park (G), Valley Intercity Industrial Park (H), Inter Point Corporate Center (I), Concourse 7075 Industrial Park (J), Valerie Woods Professional Park (K), Dayton Speedway (L), Polish Country Club (M), Kitty Hawk Golf Course (N), Stony Hollow Hardfill (O), Dayton Wastewater Treatment Plant (P), North Sanitary Landfill (Q), Stony Hollow Landfill (R), Vance Landfill (S), Dayton Correction Farm (T). Display/hide their locations on the map

Shopping Centers: Westtown Shopping Center (1), McCook Shopping Center (2), Cornell Shopping Center (3), Eastown Shopping Center (4), Pinewood Plaza Shopping Center (5), Belmont Shopping Center (6), Breitenstrater Square Shopping Center (7), Village Square Shopping Center (8), Mid-Town Mall Shopping Center (9). Display/hide their locations on the map

Main business address in Dayton include: ROBBINS & MYERS INC (A), DAY INTERNATIONAL GROUP INC (B), STANDARD REGISTER CO (C), NCR CORP (D), REX STORES CORP (E), DPL INC (F), DT INDUSTRIES INC (G). Display/hide their locations on the map

Churches in Dayton include: True Holy Church of the Living God (A), Townview Baptist Church (B), Masonic Temple (C), Mount Enon Baptist Church (D), Christ Holy Temple (E), Grace Missionary Baptist Church (F), Belmont Community Church (G), Belmont United Methodist Church (H), Memorial Presbyterian Church (I). Display/hide their locations on the map

Cemeteries: Greencastle Cemetery (1), Westmont Cemetery (2), Woodland Cemetery (3), Florence Cemetery (4), Jewish Cemetery (5), Old Greencastle Cemetery (6), University of Dayton Cemetery (7). Display/hide their locations on the map

Reservoir: Island Park Reservoir (A). Display/hide its location on the map

Rivers and creeks: Mad River (A), Wolf Creek (B), Stillwater River (C). Display/hide their locations on the map

Parks in Dayton include: Central Avenue Historic District (1), Dayton Motor Car Company Historic District (2), Dayton Terra-Cotta Historic District (3), Dayton View Historic District (4), Cleveland Park (5), Carillon Historical Park (6), Burkham Center Park (7), Residence Park (8), Westwood Park (9). Display/hide their locations on the map

Tourist attractions: Dayton Cultural Center Reflections Gallery - Bureau of Cultural Affairs- Dayton Cultural Ce (Museums; 216 North Main Street) (1), Dayton Art Institute (Museums; 456 Belmonte Park North) (2), Boonshoft Museum of Discovery (2600 Deweese Parkway) (3), Dunbar House State Memorial (Museums; 219 North Paul Laurence Dunbar) (4), Centerville Wash Township Historical Society (Museums; 93 West Franklin Street) (5), Air Force Museum Foundation Inc (20489 Springfield Park) (6), Aviation Trail (Museums; 22 South Williams Street) (7), Aullwood Audubon Center & Farm (Museums; 1000 Aullwood Road) (8), America's Packard Museum (420 South Ludlow Street) (9). Display/hide their approximate locations on the map

Hotels: Extended Stayamerica (6688 Miller Lane) (1), Cross Country Inns- Dayton (9325 North Main Street) (2), Days Inn North (7470 Miller Lane) (3), Fairfield Inn Dayton North (6960 Miller Lane) (4), Drury Inn and Suites North (6616 Miller Lane) (5), Comfort Inn Dayton (7125 Miller Lane) (6), Hampton Inn Dayton - South (8099 Old Yankee Street) (7), Best Western Executive Hotel (2401 Needmore Road) (8), Hampton Inn (5588 Merily Way) (9). Display/hide their approximate locations on the map

Courts: U S Government - National Archives & Records Administration- Great Lakes Re (3150 Springboro Road West) (1), Montgomery County - Juvenile Court- Judges- Detention Services- Dora Lee Tate Youth Ce (581 Infirmary Road) (2), Warren County Of Dayton - Switchboard (360 East Lytle 5 Points Road) (3), Montgomery County - Juvenile Court- Reibold Building (117 South Main Street) (4), Montgomery County - Administrative Office- Judge Frank W Nicholas (5581 Dayton Liberty Road) (5). Display/hide their approximate locations on the map

Birthplace of: Derick Neikirk - Professional wrestler, Thomas Watson, Jr. - Aviator, Nancy Cartwright - Voice actor, CeCe Peniston - African recording artist, Mike Turner - Ohio politician, Mike Schmidt - Professional baseball player, Shark Boy - Professional wrestler, Jim Ferguson - Composer, Javon Ringer - College football player, Brady Hoke - College football player.

Drinking water stations with addresses in Dayton and their reported violations in the past:

DAYTON PUBLIC WATER SYSTEM (Population served: 141,359, Surface water):Past health violations:MAYBERRY MINI-MART PWS (Population served: 237, Groundwater):Past monitoring violations:

- Treatment Technique (SWTR and GWR) - In MAY-2009. Follow-up actions: St Public Notif requested (JUN-11-2009), St Violation/Reminder Notice (JUN-11-2009), St Compliance achieved (JUN-30-2009)

- Monitoring of Treatment (SWTR-Filter) - In JAN-2005. Follow-up actions: St Violation/Reminder Notice (FEB-01-2005), St Public Notif requested (FEB-01-2005), St Compliance achieved (FEB-12-2008)

Past health violations:ROLLING HILLS GIRL SCOUT (Population served: 200, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - Between JUL-2011 and SEP-2011, Contaminant: Coliform. Follow-up actions: St Public Notif requested (AUG-29-2011), St Violation/Reminder Notice (AUG-29-2011), St Compliance achieved (MAY-07-2012)

- Monitoring, Source Water (GWR) - In JUN-01-2011, Contaminant: E. COLI. Follow-up actions: St Violation/Reminder Notice (JUL-20-2011), St Public Notif requested (JUL-20-2011), St Compliance achieved (JUL-26-2011)

- Monitoring, Repeat Major (TCR) - Between APR-2011 and JUN-2011, Contaminant: Coliform (TCR). Follow-up actions: St Violation/Reminder Notice (JUL-20-2011), St Public Notif requested (JUL-20-2011), St Public Notif received (JUL-29-2011)

- Monitoring, Repeat Major (TCR) - Between JUL-2008 and SEP-2008, Contaminant: Coliform (TCR). Follow-up actions: St Violation/Reminder Notice (OCT-20-2008), St Public Notif requested (OCT-20-2008), St Compliance achieved (MAY-27-2009)

- 3 routine major monitoring violations

- 4 regular monitoring violations

Past health violations:POLK GROVE UNITED CHURCH OF CHRIST (Address: 9190 Frederick Pike , Population served: 200, Purch groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - Between JUL-2006 and SEP-2006, Contaminant: Coliform. Follow-up actions: St Public Notif requested (JUL-27-2006), St Violation/Reminder Notice (JUL-27-2006), St Compliance achieved (FEB-08-2008), St BCA signed (SEP-23-2009), St Public Notif received (OCT-05-2009)

- MCL, Monthly (TCR) - Between JUL-2005 and SEP-2005, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (AUG-19-2005), St Public Notif requested (AUG-19-2005), St Public Notif received (SEP-29-2005), St Compliance achieved (APR-19-2007), St BCA signed (SEP-23-2009), St Public Notif received (OCT-05-2009)

- 8 routine major monitoring violations

- One regular monitoring violation

Past monitoring violations:KINGDOM HALL JEHOVAH WITNESS-NEW CARLISL (Population served: 195, Groundwater):

- Monitoring, Repeat Major (TCR) - Between JUL-2008 and SEP-2008, Contaminant: Coliform (TCR). Follow-up actions: St Violation/Reminder Notice (AUG-05-2008), St Public Notif requested (AUG-05-2008), St Public Notif received (AUG-18-2008), St Compliance achieved (MAY-27-2009)

- 8 routine major monitoring violations

Past health violations:JACKASS FLATS PWS (Population served: 100, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - Between OCT-2005 and DEC-2005, Contaminant: Coliform. Follow-up actions: St Public Notif requested (NOV-07-2005), St Violation/Reminder Notice (NOV-07-2005), St Compliance achieved (APR-19-2007)

- Monitoring, Repeat Major (TCR) - Between OCT-2008 and DEC-2008, Contaminant: Coliform (TCR). Follow-up actions: St Violation/Reminder Notice (DEC-09-2008), St Public Notif requested (DEC-09-2008), St Compliance achieved (AUG-05-2009)

- 7 routine major monitoring violations

- One minor monitoring violation

- 3 regular monitoring violations

Past health violations:KNOLLWOOD FLOWERS (Population served: 100, Groundwater):Past monitoring violations:

- MCL, Monthly (TCR) - In OCT-2013, Contaminant: Coliform. Follow-up actions: St Public Notif requested (NOV-12-2013), St Violation/Reminder Notice (NOV-12-2013), St Compliance achieved (NOV-27-2013)

- MCL, Monthly (TCR) - Between JUL-2013 and SEP-2013, Contaminant: Coliform. Follow-up actions: St Public Notif requested (NOV-04-2013), St Violation/Reminder Notice (NOV-04-2013), St Compliance achieved (NOV-27-2013)

- MCL, Monthly (TCR) - Between JUL-2011 and SEP-2011, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (SEP-06-2011), St Public Notif requested (SEP-06-2011), St Compliance achieved (DEC-28-2011)

- MCL, Monthly (TCR) - In JUL-2007, Contaminant: Coliform. Follow-up actions: St Public Notif requested (OCT-16-2007), St Violation/Reminder Notice (OCT-16-2007), St Compliance achieved (FEB-08-2008)

- Monitoring, Source Water (GWR) - In OCT-14-2013, Contaminant: E. COLI. Follow-up actions: St Public Notif requested (OCT-21-2013), St Violation/Reminder Notice (OCT-21-2013), St Compliance achieved (OCT-30-2013)

- Monitoring, Repeat Major (TCR) - Between JUL-2013 and SEP-2013, Contaminant: Coliform (TCR). Follow-up actions: St Public Notif requested (OCT-21-2013), St Violation/Reminder Notice (OCT-21-2013), St Compliance achieved (OCT-30-2013)

- Monitoring, Repeat Major (TCR) - Between JUL-2011 and SEP-2011, Contaminant: Coliform (TCR). Follow-up actions: St Violation/Reminder Notice (JUL-27-2011), St Public Notif requested (JUL-27-2011), St Compliance achieved (MAR-28-2012)

- Monitoring, Source Water (GWR) - In JUL-01-2011, Contaminant: E. COLI. Follow-up actions: St Violation/Reminder Notice (JUL-27-2011), St Public Notif requested (JUL-27-2011), St Compliance achieved (AUG-31-2011)

- Monitoring, Source Water (GWR) - In JUL-01-2010, Contaminant: E. COLI. Follow-up actions: St Compliance achieved (JUL-14-2010), St Public Notif requested (JUL-21-2010), St Violation/Reminder Notice (JUL-21-2010)

- 4 routine major monitoring violations

- 3 regular monitoring violations

- One other older monitoring violation

Past monitoring violations:WOODYS BAR B Q PWS (Population served: 100, Groundwater):

- One routine major monitoring violation

Past health violations:Past monitoring violations:

- MCL, Monthly (TCR) - Between APR-2011 and JUN-2011, Contaminant: Coliform. Follow-up actions: St Public Notif requested (JUN-22-2011), St Violation/Reminder Notice (JUN-22-2011), St Public Notif received (JUL-08-2011)

- MCL, Monthly (TCR) - Between OCT-2006 and DEC-2006, Contaminant: Coliform. Follow-up actions: St Public Notif requested (DEC-01-2006), St Violation/Reminder Notice (DEC-01-2006), St Compliance achieved (JUN-05-2007)

- MCL, Monthly (TCR) - Between JUL-2006 and SEP-2006, Contaminant: Coliform. Follow-up actions: St Public Notif requested (SEP-20-2006), St Violation/Reminder Notice (SEP-20-2006), St Compliance achieved (JUN-05-2007)

- MCL, Monthly (TCR) - Between OCT-2005 and DEC-2005, Contaminant: Coliform. Follow-up actions: St Public Notif requested (OCT-12-2005), St Violation/Reminder Notice (OCT-12-2005), St Public Notif received (NOV-04-2005), St Compliance achieved (APR-19-2007)

- 5 routine major monitoring violations

- One minor monitoring violation

Drinking water stations with addresses in Dayton that have no violations reported:

- RANDALLS COVE COOPERATIVE (Serves MI, Population served: 25, Primary Water Source Type: Groundwater)

| This city: | 2.3 people |

| Ohio: | 2.4 people |

| This city: | 53.2% |

| Whole state: | 65.0% |

| This city: | 8.4% |

| Whole state: | 6.8% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.5% of all households

People in group quarters in Dayton in 2010:

- 5,576 people in college/university student housing

- 781 people in local jails and other municipal confinement facilities

- 773 people in nursing facilities/skilled-nursing facilities

- 707 people in other noninstitutional facilities

- 329 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 318 people in state prisons

- 313 people in workers' group living quarters and job corps centers

- 201 people in residential treatment centers for adults

- 140 people in group homes intended for adults

- 103 people in correctional facilities intended for juveniles

- 97 people in correctional residential facilities

- 17 people in residential treatment centers for juveniles (non-correctional)

- 10 people in group homes for juveniles (non-correctional)

People in group quarters in Dayton in 2000:

- 6,276 people in college dormitories (includes college quarters off campus)

- 1,237 people in local jails and other confinement facilities (including police lockups)

- 959 people in nursing homes

- 724 people in state prisons

- 353 people in other noninstitutional group quarters

- 306 people in mental (psychiatric) hospitals or wards

- 288 people in job corps and vocational training facilities

- 156 people in homes for the mentally ill

- 145 people in other nonhousehold living situations

- 131 people in homes or halfway houses for drug/alcohol abuse

- 80 people in other group homes

- 65 people in hospitals/wards and hospices for chronically ill

- 65 people in hospices or homes for chronically ill

- 33 people in homes for the physically handicapped

- 20 people in hospitals or wards for drug/alcohol abuse

- 17 people in orthopedic wards and institutions for the physically handicapped

- 17 people in homes for the mentally retarded

- 14 people in religious group quarters

- 8 people in halfway houses

Banks with most branches in Dayton (2011 data):

- Fifth Third Bank: 19 branches. Info updated 2009/10/05: Bank assets: $114,540.4 mil, Deposits: $89,689.1 mil, headquarters in Cincinnati, OH, positive income, Commercial Lending Specialization, 1378 total offices, Holding Company: Fifth Third Bancorp

- JPMorgan Chase Bank, National Association: 16 branches. Info updated 2011/11/10: Bank assets: $1,811,678.0 mil, Deposits: $1,190,738.0 mil, headquarters in Columbus, OH, positive income, International Specialization, 5577 total offices, Holding Company: Jpmorgan Chase & Co.

- PNC Bank, National Association: 13 branches. Info updated 2012/03/20: Bank assets: $263,309.6 mil, Deposits: $197,343.0 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 3085 total offices, Holding Company: Pnc Financial Services Group, Inc., The

- KeyBank National Association: 9 branches. Info updated 2008/03/03: Bank assets: $86,198.8 mil, Deposits: $64,214.8 mil, headquarters in Cleveland, OH, positive income, Commercial Lending Specialization, 1067 total offices, Holding Company: Keycorp

- U.S. Bank National Association: Wilmington Pike Walmart, Courthouse Plaza Branch, Gettysburg Branch, Englewood Meijer Branch, Springboro Pike Meijer Branch. Info updated 2012/01/30: Bank assets: $330,470.8 mil, Deposits: $236,091.5 mil, headquarters in Cincinnati, OH, positive income, 3121 total offices, Holding Company: U.S. Bancorp

- Liberty Savings Bank, F.S.B.: W. Second Street Branch, W. Alex Bell Road Branch, Dayton Office, Dayton Branch. Info updated 2011/07/21: Bank assets: $683.0 mil, Deposits: $553.2 mil, headquarters in Wilmington, OH, positive income, Mortgage Lending Specialization, 33 total offices

- The Huntington National Bank: Oakwood Office Branch at 2401 Far Hills Avenue, branch established on 1991/10/21; The Dayton City Branch at 10 North Ludlow Street, branch established on 1980/03/24. Info updated 2012/04/02: Bank assets: $54,183.4 mil, Deposits: $44,300.3 mil, headquarters in Columbus, OH, positive income, Commercial Lending Specialization, 878 total offices, Holding Company: Huntington Bancshares Incorporated

- Woodforest National Bank: Dayton Walmart Branch at 3465 York Commons Blvd, branch established on 2007/08/11; Miamisburg-Dayton Oh Walmart Branch at 8800 Kingridge Drive, branch established on 2009/06/17. Info updated 2011/05/10: Bank assets: $3,488.9 mil, Deposits: $3,097.6 mil, headquarters in Houston, TX, positive income, Commercial Lending Specialization, 766 total offices, Holding Company: Woodforest Financial Group Employee Stock Ownership Plan (With 401(K) Provisions)

- Union Savings Bank: Washington Township Branch at 5651 Far Hills Avenue, branch established on 1996/01/16. Info updated 2012/01/04: Bank assets: $2,218.6 mil, Deposits: $1,997.4 mil, headquarters in Cincinnati, OH, positive income, Mortgage Lending Specialization, 25 total offices

- 5 other banks with 5 local branches

For population 15 years and over in Dayton:

- Never married: 46.9%

- Now married: 31.2%

- Separated: 2.6%

- Widowed: 4.2%

- Divorced: 15.1%

For population 25 years and over in Dayton:

- High school or higher: 89.0%

- Bachelor's degree or higher: 24.4%

- Graduate or professional degree: 10.6%

- Unemployed: 9.3%

- Mean travel time to work (commute): 18.8 minutes

| Here: | 11.0 |

| Ohio average: | 11.0 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Dayton:

(Dayton, Ohio Neighborhood Map)- Arlington Heights neighborhood

- Belmont neighborhood

- Burkhardt neighborhood

- Carillon neighborhood

- College Hill neighborhood

- Cornell Heights neighborhood

- Dayton View Triangle neighborhood

- DeWeese neighborhood

- Downtown neighborhood

- Eastern Hills neighborhood

- Eastmont neighborhood

- Edgemont neighborhood

- Fairlane neighborhood

- Fairview neighborhood

- Five Oaks neighborhood

- Five Points neighborhood

- Forest Ridge (Quail Hollow) neighborhood

- Gateway neighborhood

- Germantown Meadows neighborhood

- Grafton Hill neighborhood

- Greenwich Village neighborhood

- Hearthstone neighborhood

- Highview Hills neighborhood

- Hillcrest neighborhood

- Historic Inner East neighborhood

- Kittyhawk neighborhood

- Lakeview neighborhood

- Linden Heights neighborhood

- Little Richmond neighborhood

- MacFarlane neighborhood

- Madden Hills neighborhood

- McCook Field neighborhood

- McPherson neighborhood

- Miami Chapel neighborhood

- Midtown neighborhood

- Mount Vernon neighborhood

- North Riverdale neighborhood

- Northern Hills neighborhood

- Northridge Estates neighborhood

- Old Dayton View neighborhood

- Old North Dayton neighborhood

- Oregon neighborhood

- Patterson Park neighborhood

- Pheasant Hill neighborhood

- Philadelphia Woods neighborhood

- Pineview neighborhood

- Princeton Heights neighborhood

- Residence Park neighborhood

- Riverdale neighborhood

- Roosevelt neighborhood

- Santa Clara neighborhood

- Shroyer Park neighborhood

- South Park neighborhood

- Southern Dayton View neighborhood

- Springfield neighborhood

- Stoney Ridge neighborhood

- Twin Towers neighborhood

- University Park neighborhood

- University Row neighborhood

- Walnut Hills neighborhood

- Webster Station neighborhood

- Wesleyan Hill neighborhood

- Westwood neighborhood

- Wolf Creek neighborhood

- Wright View neighborhood

Religion statistics for Dayton, OH (based on Montgomery County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 93,334 | 306 |

| Catholic | 78,909 | 34 |

| Mainline Protestant | 47,961 | 143 |

| Black Protestant | 21,263 | 56 |

| Other | 14,123 | 41 |

| Orthodox | 4,205 | 3 |

| None | 275,358 | - |

Food Environment Statistics:

| Montgomery County: | 1.52 / 10,000 pop. |

| Ohio: | 1.89 / 10,000 pop. |

| Montgomery County: | 0.15 / 10,000 pop. |

| Ohio: | 0.13 / 10,000 pop. |

| Montgomery County: | 1.39 / 10,000 pop. |

| State: | 1.25 / 10,000 pop. |

| Montgomery County: | 2.31 / 10,000 pop. |

| Ohio: | 2.93 / 10,000 pop. |

| This county: | 5.76 / 10,000 pop. |

| Ohio: | 6.25 / 10,000 pop. |

| Montgomery County: | 11.0% |

| Ohio: | 10.3% |

| Montgomery County: | 30.5% |

| Ohio: | 29.1% |

| This county: | 9.3% |

| Ohio: | 11.9% |

Health and Nutrition:

| Here: | 47.3% |

| State: | 50.4% |

| Dayton: | 43.6% |

| Ohio: | 47.8% |

| Here: | 29.1 |

| Ohio: | 28.7 |

| Here: | 19.4% |

| Ohio: | 20.6% |

| Here: | 11.8% |

| Ohio: | 10.4% |

| This city: | 6.7 |

| Ohio: | 6.8 |

| Dayton: | 33.4% |

| Ohio: | 34.3% |

| Dayton: | 54.1% |

| Ohio: | 57.0% |

| This city: | 80.7% |

| Ohio: | 79.1% |

More about Health and Nutrition of Dayton, OH Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 342 | $2,404,048 | $84,353 | 0 | $0 |

| Firefighters | 284 | $1,943,246 | $82,109 | 0 | $0 |

| Water Supply | 276 | $1,654,390 | $71,930 | 2 | $7,030 |

| Judicial and Legal | 114 | $595,495 | $62,684 | 2 | $5,815 |

| Other and Unallocable | 99 | $540,915 | $65,565 | 1 | $2,843 |

| Other Government Administration | 88 | $596,394 | $81,326 | 7 | $29,355 |

| Financial Administration | 80 | $456,794 | $68,519 | 1 | $4,435 |

| Solid Waste Management | 79 | $369,562 | $56,136 | 0 | $0 |

| Airports | 77 | $475,624 | $74,123 | 1 | $8,288 |

| Parks and Recreation | 77 | $378,189 | $58,939 | 4 | $10,024 |

| Sewerage | 73 | $438,951 | $72,156 | 0 | $0 |

| Police - Other | 66 | $275,849 | $50,154 | 0 | $0 |

| Streets and Highways | 59 | $345,883 | $70,349 | 0 | $0 |

| Housing and Community Development (Local) | 44 | $276,314 | $75,358 | 0 | $0 |

| Health | 12 | $109,957 | $109,957 | 0 | $0 |

| Fire - Other | 11 | $61,466 | $67,054 | 0 | $0 |

| Totals for Government | 1,781 | $10,923,076 | $73,597 | 18 | $67,790 |

Dayton government finances - Expenditure in 2021 (per resident):

- Construction - General - Other: $39,231,000 ($288.58)

Air Transportation: $23,714,000 ($174.44)

Sewerage: $19,079,000 ($140.34)

Water Utilities: $15,938,000 ($117.24)

Housing and Community Development: $2,434,000 ($17.90)

- Current Operations - Police Protection: $56,183,000 ($413.28)

Water Utilities: $50,361,000 ($370.45)

Local Fire Protection: $42,428,000 ($312.10)

Sewerage: $34,110,000 ($250.91)

Air Transportation: $32,534,000 ($239.32)

Regular Highways: $25,284,000 ($185.99)

Central Staff Services: $24,917,000 ($183.29)

General - Other: $19,718,000 ($145.05)

Housing and Community Development: $14,056,000 ($103.40)

Judicial and Legal Services: $12,027,000 ($88.47)

Parks and Recreation: $9,240,000 ($67.97)

Financial Administration: $4,649,000 ($34.20)

General Public Buildings: $2,754,000 ($20.26)

- General - Interest on Debt: $7,100,000 ($52.23)

- Intergovernmental to State - Sewerage: $864,000 ($6.36)

General - Other: $791,000 ($5.82)

- Other Capital Outlay - Central Staff Services: $620,000 ($4.56)

Parks and Recreation: $477,000 ($3.51)

General - Other: $52,000 ($0.38)

Housing and Community Development: $28,000 ($0.21)

- Water Utilities - Interest on Debt: $1,129,000 ($8.30)

Dayton government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $41,141,000 ($302.63)

Air Transportation: $34,324,000 ($252.49)

Other: $25,410,000 ($186.92)

Parks and Recreation: $2,708,000 ($19.92)

Regular Highways: $383,000 ($2.82)

Housing and Community Development: $77,000 ($0.57)

- Federal Intergovernmental - Housing and Community Development: $11,568,000 ($85.09)

Air Transportation: $8,137,000 ($59.86)

- Miscellaneous - General Revenue - Other: $10,071,000 ($74.08)

Interest Earnings: $4,798,000 ($35.29)

Special Assessments: $3,307,000 ($24.33)

Sale of Property: $1,350,000 ($9.93)

Fines and Forfeits: $925,000 ($6.80)

- Revenue - Water Utilities: $55,738,000 ($410.01)

- State Intergovernmental - Other: $30,331,000 ($223.11)

General Local Government Support: $10,059,000 ($73.99)

Highways: $7,838,000 ($57.66)

- Tax - Individual Income: $137,582,000 ($1012.05)

Property: $13,226,000 ($97.29)

Other License: $1,960,000 ($14.42)

Dayton government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $172,165,000 ($1266.44)

Outstanding Unspecified Public Purpose: $159,445,000 ($1172.87)

Retired Unspecified Public Purpose: $12,720,000 ($93.57)

Dayton government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $25,651,000 ($188.69)

- Other Funds - Cash and Securities: $396,284,000 ($2915.05)

- Sinking Funds - Cash and Securities: $34,559,000 ($254.21)

5.90% of this county's 2021 resident taxpayers lived in other counties in 2020 ($51,044 average adjusted gross income)

| Here: | 5.90% |

| Ohio average: | 5.68% |

0.06% of residents moved from foreign countries ($588 average AGI)

Montgomery County: 0.06% Ohio average: 0.01%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Greene County, OH | |

| from Warren County, OH | |

| from Miami County, OH |

6.00% of this county's 2020 resident taxpayers moved to other counties in 2021 ($58,304 average adjusted gross income)

| Here: | 6.00% |

| Ohio average: | 5.79% |

0.04% of residents moved to foreign countries ($390 average AGI)

Montgomery County: 0.04% Ohio average: 0.01%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Greene County, OH | |

| to Warren County, OH | |

| to Miami County, OH |

| Businesses in Dayton, OH | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| AT&T | 5 | Kincaid | 2 | |

| Abercrombie & Fitch | 1 | Kmart | 2 | |

| Ace Hardware | 2 | Knights Inn | 1 | |

| Advance Auto Parts | 6 | Kohl's | 1 | |

| Aeropostale | 2 | Kroger | 8 | |

| American Eagle Outfitters | 1 | La-Z-Boy | 1 | |

| Ann Taylor | 1 | Lane Bryant | 1 | |

| Applebee's | 5 | Lane Furniture | 5 | |

| Arby's | 10 | LensCrafters | 1 | |

| Ashley Furniture | 1 | Little Caesars Pizza | 3 | |

| Audi | 1 | Long John Silver's | 4 | |

| AutoZone | 5 | Macy's | 1 | |

| BMW | 2 | Marriott | 7 | |

| Bakers | 1 | Marshalls | 1 | |

| Barnes & Noble | 1 | MasterBrand Cabinets | 12 | |

| Baskin-Robbins | 1 | Maurices | 1 | |

| Bath & Body Works | 1 | Mazda | 1 | |

| Ben & Jerry's | 1 | McDonald's | 17 | |

| Blockbuster | 3 | Meijer | 2 | |

| Budget Car Rental | 3 | Men's Wearhouse | 2 | |

| Buffalo Wild Wings | 1 | Microtel | 1 | |

| Burger King | 9 | Motel 6 | 1 | |

| Burlington Coat Factory | 2 | Motherhood Maternity | 4 | |

| CVS | 8 | New Balance | 6 | |

| Caribou Coffee | 1 | New York & Co | 1 | |

| Carson Pirie Scott | 4 | Nike | 19 | |

| Catherines | 2 | Nissan | 1 | |

| Charlotte Russe | 1 | Office Depot | 3 | |

| Chevrolet | 1 | Old Navy | 1 | |

| Chick-Fil-A | 3 | Olive Garden | 2 | |

| Chico's | 2 | Outback | 1 | |

| Chipotle | 3 | Outback Steakhouse | 1 | |

| Church's Chicken | 5 | Pac Sun | 2 | |

| Cinnabon | 1 | Panera Bread | 4 | |

| Circle K | 4 | Papa John's Pizza | 7 | |

| Clarks | 1 | Payless | 3 | |

| Cold Stone Creamery | 4 | Penske | 1 | |

| Comfort Inn | 2 | PetSmart | 3 | |

| Comfort Suites | 1 | Pier 1 Imports | 1 | |

| Cracker Barrel | 1 | Pizza Hut | 8 | |

| Cricket Wireless | 28 | Plato's Closet | 1 | |

| Curves | 1 | Qdoba Mexican Grill | 1 | |

| DHL | 2 | RadioShack | 5 | |

| Dairy Queen | 5 | Red Lobster | 1 | |

| Days Inn | 4 | Red Roof Inn | 1 | |

| Deb | 1 | Rite Aid | 7 | |

| Decora Cabinetry | 8 | Ruby Tuesday | 1 | |

| Dennys | 1 | Ryder Rental & Truck Leasing | 1 | |

| Discount Tire | 1 | SAS Shoes | 1 | |

| Domino's Pizza | 11 | SONIC Drive-In | 1 | |

| Dressbarn | 1 | Sam's Club | 2 | |

| Dunkin Donuts | 1 | Sears | 4 | |

| Express | 2 | Sephora | 1 | |

| Extended Stay America | 2 | Shoe Carnival | 1 | |

| Famous Footwear | 1 | Soma Intimates | 1 | |

| Fashion Bug | 2 | Sprint Nextel | 2 | |

| FedEx | 50 | Starbucks | 6 | |

| Finish Line | 1 | Steak 'n Shake | 3 | |

| Firestone Complete Auto Care | 2 | Subaru | 1 | |

| Foot Locker | 1 | Subway | 1 | |

| Forever 21 | 1 | T-Mobile | 8 | |

| GNC | 8 | T.G.I. Driday's | 1 | |

| GameStop | 6 | Taco Bell | 12 | |

| Gap | 1 | Talbots | 1 | |

| Gymboree | 1 | Target | 2 | |

| H&R Block | 9 | The Limited | 1 | |

| Hardee's | 1 | The Room Place | 1 | |

| Haworth | 1 | Tim Hortons | 4 | |

| Hawthorn | 1 | Torrid | 1 | |

| Hilton | 2 | Toys"R"Us | 3 | |

| Holiday Inn | 1 | U-Haul | 8 | |

| Hollister Co. | 1 | UPS | 70 | |

| Home Depot | 2 | Vans | 2 | |

| Honda | 2 | Verizon Wireless | 2 | |

| Hot Topic | 1 | Victoria's Secret | 1 | |

| InTown Suites | 1 | Volkswagen | 2 | |

| JCPenney | 1 | Waffle House | 3 | |

| Jimmy John's | 2 | Walgreens | 7 | |

| Jones New York | 6 | Walmart | 3 | |

| Journeys | 1 | Wendy's | 12 | |

| Justice | 2 | Wet Seal | 1 | |

| KFC | 6 | YMCA | 2 | |

Strongest AM radio stations in Dayton:

- WDAO (1210 AM; daytime; 1 kW; DAYTON, OH; Owner: JOHNSON COMMUNICATIONS, INC.)

- WONE (980 AM; 5 kW; DAYTON, OH; Owner: CITICASTERS LICENSES, L.P.)

- WING (1410 AM; 5 kW; DAYTON, OH)

- WHIO (1290 AM; 5 kW; DAYTON, OH; Owner: CXR HOLDINGS, INC.)

- WLW (700 AM; 50 kW; CINCINNATI, OH; Owner: JACOR BROADCASTING CORPORATION)

- WTVN (610 AM; 50 kW; COLUMBUS, OH; Owner: CITICASTERS LICENSES, L.P.)

- WGNZ (1110 AM; daytime; 2 kW; FAIRBORN, OH; Owner: L&D BROADCASTORS INC.)

- WSAI (1530 AM; 50 kW; CINCINNATI, OH; Owner: JACOR BROADCASTING CORPORATION)

- WRFD (880 AM; daytime; 23 kW; COLUMBUS-WORTHINGTON, OH; Owner: SALEM MEDIA OF OHIO, INC.)

- WOWO (1190 AM; 50 kW; FORT WAYNE, IN; Owner: PATHFINDER COMMUNICATIONS CORPORATION)

- WHAS (840 AM; 50 kW; LOUISVILLE, KY; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WIBC (1070 AM; 50 kW; INDIANAPOLIS, IN; Owner: EMMIS RADIO LICENSE CORPORATION)

- WPFB (910 AM; 1 kW; MIDDLETOWN, OH)

Strongest FM radio stations in Dayton:

- WDPS (89.5 FM; DAYTON, OH; Owner: DAYTON CITY SCHOOLS)

- WHKO (99.1 FM; DAYTON, OH; Owner: CXR HOLDINGS, INC.)

- WLQT (99.9 FM; KETTERING, OH; Owner: CITICASTERS LICENSES, L.P.)

- WMMX (107.7 FM; DAYTON, OH; Owner: CITICASTERS LICENSES, L.P.)

- WTUE (104.7 FM; DAYTON, OH; Owner: CITICASTERS LICENSES, L.P.)

- WXEG (103.9 FM; BEAVERCREEK, OH; Owner: CITICASTERS LICENSES, L.P.)

- WRNB (92.1 FM; WEST CARROLLTON, OH; Owner: RADIO ONE OF DAYTON LICENSES, LLC)

- WDPR (88.1 FM; WEST CARROLLTON, OH; Owner: DAYTON PUBLIC RADIO, INC.)

- WQRP (89.5 FM; DAYTON, OH; Owner: WQRP FAMILY RADIO, INC.)

- W258AI (99.5 FM; DAYTON, OH; Owner: UNIVERSITY OF DAYTON)

- WFCJ (93.7 FM; MIAMISBURG, OH; Owner: MIAMI VALLEY CHRISTIAN BROADCASTING ASSOCIATION)

- WGTZ (92.9 FM; EATON, OH; Owner: BLUE CHIP BROADCASTING LICENSES, LTD)

- WWSU (106.9 FM; FAIRBORN, OH; Owner: WRIGHT STATE UNIVERSITY)

- WDKF (94.5 FM; ENGLEWOOD, OH; Owner: CITICASTERS LICENSES, L.P.)

- WPFB-FM (105.9 FM; MIDDLETOWN, OH; Owner: RADIO STATIONS WPAY/WPFB, INC.)

- WGXM (98.1 FM; DAYTON, OH; Owner: NORTHRIDGE LOCAL BOARD OF EDUCATION)

- WYSO (91.3 FM; YELLOW SPRINGS, OH; Owner: ANTIOCH UNIVERSITY)

- WCWT-FM (101.5 FM; CENTERVILLE, OH; Owner: CENTERVILLE CITY BOARD OF EDUCATION)

- WRVT (88.7 FM; RUTLAND, VT; Owner: VERMONT PUBLIC RADIO)

- WMOJ (94.9 FM; FAIRFIELD, OH; Owner: WVAE LICO, INC.)

TV broadcast stations around Dayton:

- WHIO-TV (Channel 7; DAYTON, OH; Owner: WHIO-TV HOLDINGS, INC.)

- WDTN (Channel 2; DAYTON, OH; Owner: WDTN BROADCASTING, LLC)

- WPTD (Channel 16; DAYTON, OH; Owner: GREATER DAYTON PUBLIC TV, INC.)

- WKEF (Channel 22; DAYTON, OH; Owner: WKEF LICENSEE L.P.)

- WRGT-TV (Channel 45; DAYTON, OH; Owner: WRGT LICENSEE, LLC)

- W61DE (Channel 61; CINCINNATI, OH; Owner: TRINITY BROADCASTING NETWORK)

- WRCX-LP (Channel 51; DAYTON, OH; Owner: ROSS COMMUNICATIONS, LTD.)

- WBDT (Channel 26; SPRINGFIELD, OH; Owner: ACME TV LICENSES OF OHIO, LLC)

- WWRD-LP (Channel 55; CENTERVILLE, OH; Owner: LIFE BROADCASTING NETWORK)

- WKOI (Channel 43; RICHMOND, IN; Owner: TRINITY BROADCASTING OF INDIANA, INC.)

- WPTO (Channel 14; OXFORD, OH; Owner: GREATER DAYTON PUBLIC TELEVISION, INC.)

- W47BC (Channel 47; SPRINGFIELD, OH; Owner: TRINITY BROADCASTING NETWORK)

- W66AQ (Channel 66; DAYTON, OH; Owner: WSTR LICENSEE, INC.)

Medal of Honor Recipients

Medal of Honor Recipients born in Dayton: Charles G. Bickham, Joseph G., Jr. Lapointe, Sammy L. Davis, Tony Stein.

- National Bridge Inventory (NBI) Statistics

- 245Number of bridges

- 4,478ft / 1,365mTotal length

- $16,503,000Total costs

- 7,097,912Total average daily traffic

- 621,897Total average daily truck traffic

- New bridges - historical statistics

- 21930-1939

- 11940-1949

- 131950-1959

- 621960-1969

- 471970-1979

- 41980-1989

- 281990-1999

- 322000-2009

- 532010-2019

- 32020-2022

FCC Registered Commercial Land Mobile Towers: 24 (See the full list of FCC Registered Commercial Land Mobile Towers in Dayton, OH)

FCC Registered Private Land Mobile Towers: 23 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 257 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 288 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 27 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 45 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 1,792 (See the full list of FCC Registered Amateur Radio Licenses in Dayton)

FAA Registered Aircraft Manufacturers and Dealers: 2 (See the full list of FAA Registered Manufacturers and Dealers in Dayton)

FAA Registered Aircraft: 219 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 39 full and 18 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 460 | $86,498 | 189 | $72,537 | 988 | $94,473 | 95 | $18,614 | 4 | $21,707,358 | 119 | $64,778 | 3 | $27,963 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 36 | $66,732 | 18 | $69,623 | 163 | $81,438 | 36 | $11,819 | 0 | $0 | 22 | $58,195 | 1 | $16,550 |

| APPLICATIONS DENIED | 88 | $67,147 | 53 | $59,708 | 691 | $78,353 | 204 | $20,589 | 0 | $0 | 106 | $52,092 | 5 | $9,360 |

| APPLICATIONS WITHDRAWN | 46 | $74,028 | 23 | $61,678 | 257 | $89,047 | 21 | $33,288 | 0 | $0 | 36 | $48,160 | 2 | $46,730 |

| FILES CLOSED FOR INCOMPLETENESS | 9 | $67,416 | 10 | $110,297 | 59 | $84,241 | 7 | $35,890 | 0 | $0 | 15 | $69,611 | 0 | $0 |

Detailed mortgage data for all 57 tracts in Dayton, OH

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 25 full and 13 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 38 | $88,156 | 47 | $105,779 | 0 | $0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 15 | $90,267 | 28 | $95,784 | 3 | $50,023 |

| APPLICATIONS DENIED | 8 | $54,990 | 7 | $99,559 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 3 | $67,063 | 6 | $123,315 | 1 | $71,000 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $32,950 | 2 | $56,500 | 1 | $32,950 |

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Dayton, OH

- 5,74547.0%Structure Fires

- 4,37335.8%Outside Fires

- 2,05216.8%Mobile Property/Vehicle Fires

- 500.4%Other

According to the data from the years 2002 - 2018 the average number of fires per year is 719. The highest number of fire incidents - 1,589 took place in 2010, and the least - 229 in 2005. The data has an increasing trend.

According to the data from the years 2002 - 2018 the average number of fires per year is 719. The highest number of fire incidents - 1,589 took place in 2010, and the least - 229 in 2005. The data has an increasing trend. When looking into fire subcategories, the most incidents belonged to: Structure Fires (47.0%), and Outside Fires (35.8%).

When looking into fire subcategories, the most incidents belonged to: Structure Fires (47.0%), and Outside Fires (35.8%).Fire-safe hotels and motels in Dayton, Ohio:

- Hawthorn Suites - Dayton North, 7070 Poe Ave, Dayton, Ohio 45414 , Phone: (937) 898-7764, Fax: (937) 890-5891

- Quality Inn, 1944 Miamisburg Rd, Dayton, Ohio 45459 , Phone: (937) 435-1550, Fax: (937) 438-1878

- Rodeway Inn, 4079 Little York Rd, Dayton, Ohio 45414 , Phone: (937) 890-9500, Fax: (937) 890-8525

- Doubletree Dayton Downtown, 11 S Ludlow St, Dayton, Ohio 45402 , Phone: (937) 461-4700, Fax: (397) 461-6981

- Red Roof Inn, 7370 Miller Ln, Dayton, Ohio 45414 , Phone: (513) 898-1054, Fax: (937) 898-1059

- Dayton Marriott Hotel, 1414 S Patterson Blvd, Dayton, Ohio 45409 , Phone: (937) 223-1000, Fax: (937) 223-7853

- Americas Best Value Inn, 7130 Miller Ln, Dayton, Ohio 45414 , Phone: (937) 898-3606, Fax: (937) 890-3898

- Extended Stay America - Dayton - South, 7851 Lois Cir, Dayton, Ohio 45459 , Phone: (937) 439-2022, Fax: (937) 436-8273

- 34 other hotels and motels

| Most common first names in Dayton, OH among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| Mary | 4,761 | 79.2 years |

| John | 4,017 | 73.8 years |

| William | 3,813 | 73.2 years |

| Robert | 3,670 | 71.2 years |

| James | 3,348 | 70.3 years |

| Charles | 2,914 | 73.5 years |

| Helen | 1,975 | 80.7 years |

| George | 1,875 | 75.1 years |

| Dorothy | 1,573 | 77.8 years |

| Ruth | 1,551 | 80.0 years |

| Most common last names in Dayton, OH among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 1,985 | 74.1 years |

| Miller | 1,141 | 77.3 years |

| Johnson | 1,141 | 73.4 years |

| Jones | 1,118 | 73.1 years |

| Brown | 1,086 | 73.1 years |

| Williams | 1,003 | 72.6 years |

| Davis | 791 | 74.6 years |

| Wilson | 610 | 74.7 years |

| Moore | 588 | 74.0 years |

| Jackson | 555 | 72.6 years |

- 82.2%Utility gas

- 15.9%Electricity

- 0.8%Bottled, tank, or LP gas

- 0.5%No fuel used

- 0.2%Other fuel

- 0.1%Wood

- 0.1%Fuel oil, kerosene, etc.

- 59.2%Utility gas

- 38.1%Electricity

- 1.4%No fuel used

- 0.9%Bottled, tank, or LP gas

- 0.4%Other fuel

Dayton compared to Ohio state average:

- Median household income below state average.

- Median house value below state average.

- Black race population percentage above state average.

- Median age below state average.

- Renting percentage above state average.

- House age above state average.

Dayton, OH compared to other similar cities:

Dayton on our top lists:

- #7 on the list of "Top 100 cities with declining populations from 2000 to 2014 (pop. 50,000+)"

- #8 on the list of "Top 101 cities with the largest percentage population decrease from 2000 (population 50,000+)"

- #13 on the list of "Top 101 cities with the highest number of arson incidents per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #13 on the list of "Top 101 cities with the highest average snowfall in a year (population 50,000+)"

- #17 on the list of "Top 101 cities with largest percentage population decreases in the 1990s) (population 50,000+)"

- #17 on the list of "Top 101 cities with the highest number of burglaries per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #25 on the list of "Top 101 cities with the largest wind speed differences during a year (population 50,000+)"

- #25 on the list of "Top 101 larger cities with the largest decrease or smallest increase in house/condo value from 2000 (population 50,000+)"

- #25 on the list of "Top 101 cities with largest percentage of males in industries: other services, except public administration (population 50,000+)"

- #27 on the list of "Top 101 cities with the lowest cost per building permit (population 50,000+)"

- #27 on the list of "Top 101 cities with the highest percentage of single-parent households, population 50,000+"

- #29 on the list of "Top 101 cities with the highest number of rapes per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #32 on the list of "Top 101 cities with the highest number of robberies per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #33 on the list of "Top 101 cities with largest percentage of females in industries: accommodation and food services (population 50,000+)"

- #36 on the list of "Top 101 cities with largest percentage of females in occupations: food preparation and serving related occupations (population 50,000+)"

- #38 on the list of "Top 101 cities with the highest number of murders per 100,000 residents, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #38 on the list of "Top 100 cities with oldest houses (pop. 50,000+)"

- #45 on the list of "Top 101 cities with the highest city-data.com crime index, excludes tourist destinations and others with a lot of outsiders visiting based on city industries data (population 50,000+)"

- #48 on the list of "Top 101 cities with the lowest percentage of family households, population 100,000+"

- #48 on the list of "Top 100 least-safe cities (highest city-data.com crime index) (pop. 50,000+)"

- #56 (45402) on the list of "Top 101 zip codes with the most Internet business establishments in 2005"

- #20 on the list of "Top 101 counties with the largest increase in the number of infant deaths per 1000 residents 2000-2006 to 2007-2013 (pop. 50,000+)"

- #25 on the list of "Top 101 counties with the highest ground withdrawal of fresh water for public supply"

- #37 on the list of "Top 101 counties with the highest number of infant deaths per 1000 residents 2007-2013 (pop. 50,000+)"

- #40 on the list of "Top 101 counties with the lowest percentage of residents that drank alcohol in the past 30 days"

- #47 on the list of "Top 101 counties with the most Black Protestant adherents"

|

|

Total of 1224 patent applications in 2008-2024.