Jamestown, New York

Jamestown: jamestown public library

Jamestown: downtown jamestown

Jamestown: 4 street

Jamestown: north fouth street jamestown ny

Jamestown: saint peter and paul roman catholic church jamestown

Jamestown: saint peter and paul roman catholic church jamestown

Jamestown: Saint Luke's Episcopal Church - Jamestown, NY

Jamestown: Jamestown, NY. Downtown

Jamestown: Downtown 3rd Street

Jamestown: Jamestown, NY

Jamestown: Down English St.

- see

28

more - add

your

Submit your own pictures of this city and show them to the world

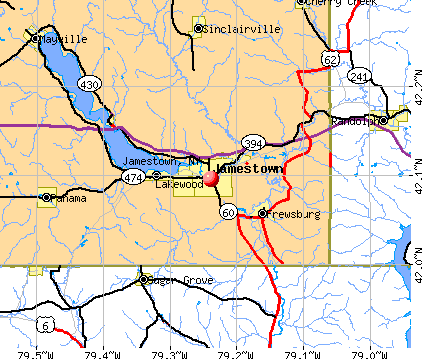

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: -11.0%

| Males: 13,533 | |

| Females: 14,710 |

| Median resident age: | 37.8 years |

| New York median age: | 40.0 years |

Zip codes: 14701.

| Jamestown: | $40,109 |

| NY: | $79,557 |

Estimated per capita income in 2022: $25,482 (it was $15,316 in 2000)

Jamestown city income, earnings, and wages data

Estimated median house or condo value in 2022: $84,060 (it was $50,500 in 2000)

| Jamestown: | $84,060 |

| NY: | $400,400 |

Mean prices in 2022: all housing units: $130,522; detached houses: $131,932; townhouses or other attached units: $81,415; in 2-unit structures: $98,361; in 3-to-4-unit structures: $59,960; in 5-or-more-unit structures: $745,624; mobile homes: $94,348

Median gross rent in 2022: $755.

(24.8% for White Non-Hispanic residents, 33.4% for Black residents, 44.8% for Hispanic or Latino residents, 50.9% for American Indian residents, 21.7% for other race residents, 50.3% for two or more races residents)

Detailed information about poverty and poor residents in Jamestown, NY

- 22,50079.3%White alone

- 3,39612.0%Hispanic

- 1,1714.1%Two or more races

- 9733.4%Black alone

- 3401.2%Asian alone

- 720.3%American Indian alone

- 180.06%Other race alone

Races in Jamestown detailed stats: ancestries, foreign born residents, place of birth

According to our research of New York and other state lists, there were 142 registered sex offenders living in Jamestown, New York as of April 25, 2024.

The ratio of all residents to sex offenders in Jamestown is 214 to 1.

Type |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Murders (per 100,000) | 1 (3.4) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 1 (3.3) | 2 (6.6) | 4 (13.4) | 1 (3.4) | 1 (3.4) | 0 (0.0) | 1 (3.5) | 2 (7.0) | 2 (7.1) |

| Rapes (per 100,000) | 20 (68.5) | 24 (77.1) | 22 (70.3) | 14 (44.9) | 19 (62.0) | 45 (146.8) | 42 (138.8) | 40 (133.9) | 26 (88.0) | 48 (163.4) | 31 (106.5) | 24 (83.2) | 24 (83.8) | 32 (113.4) |

| Robberies (per 100,000) | 26 (89.0) | 35 (112.4) | 36 (115.1) | 39 (125.1) | 39 (127.2) | 45 (146.8) | 55 (181.7) | 47 (157.3) | 31 (104.9) | 28 (95.3) | 19 (65.3) | 24 (83.2) | 38 (132.6) | 26 (92.2) |

| Assaults (per 100,000) | 105 (359.5) | 121 (388.5) | 145 (463.5) | 129 (413.6) | 110 (358.8) | 132 (430.7) | 139 (459.3) | 134 (448.5) | 138 (466.8) | 150 (510.5) | 149 (512.0) | 151 (523.5) | 167 (582.9) | 163 (577.9) |

| Burglaries (per 100,000) | 266 (910.8) | 342 (1,098) | 335 (1,071) | 359 (1,151) | 281 (916.6) | 355 (1,158) | 297 (981.4) | 323 (1,081) | 226 (764.5) | 191 (650.0) | 203 (697.5) | 207 (717.7) | 203 (708.6) | 179 (634.6) |

| Thefts (per 100,000) | 814 (2,787) | 895 (2,874) | 753 (2,407) | 784 (2,514) | 829 (2,704) | 884 (2,885) | 663 (2,191) | 687 (2,299) | 610 (2,063) | 602 (2,049) | 621 (2,134) | 461 (1,598) | 547 (1,909) | 580 (2,056) |

| Auto thefts (per 100,000) | 20 (68.5) | 44 (141.3) | 36 (115.1) | 37 (118.6) | 30 (97.9) | 48 (156.6) | 52 (171.8) | 53 (177.4) | 43 (145.5) | 24 (81.7) | 39 (134.0) | 35 (121.4) | 43 (150.1) | 63 (223.3) |

| Arson (per 100,000) | 10 (34.2) | 9 (28.9) | 11 (35.2) | 26 (83.4) | 10 (32.6) | 16 (52.2) | 21 (69.4) | 16 (53.5) | 29 (98.1) | 7 (23.8) | 13 (44.7) | 9 (31.2) | 24 (83.8) | 11 (39.0) |

| City-Data.com crime index | 341.0 | 376.2 | 363.9 | 346.8 | 339.7 | 463.2 | 440.7 | 452.6 | 349.6 | 402.2 | 352.1 | 327.1 | 375.3 | 392.7 |

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Crime rate in Jamestown detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 66 (59 officers - 52 male; 7 female).

| Officers per 1,000 residents here: | 2.06 |

| New York average: | 3.28 |

| Upper Middle class african-american communities in ny (2034 replies) |

| Girls flag football officially comes to New York State (249 replies) |

| Buffalo-Boom/Bust II (584 replies) |

| Culturally diverse areas in Upstate NY (160 replies) |

| For those interested in state political issues (423 replies) |

| Conflicting priorities: Rustic + Wegmans (88 replies) |

Latest news from Jamestown, NY collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: Italian (17.1%), Swedish (11.3%), German (11.2%), English (6.1%), Irish (5.5%), American (5.1%).

Current Local Time: EST time zone

Incorporated in 1827

Land area: 8.98 square miles.

Population density: 3,146 people per square mile (average).

761 residents are foreign born (1.4% Latin America, 0.5% Europe, 0.5% Asia).

| This city: | 2.7% |

| New York: | 22.6% |

Median real estate property taxes paid for housing units with mortgages in 2022: $2,672 (2.9%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $2,113 (2.7%)

Nearest city with pop. 50,000+: Erie, PA (43.0 miles

, pop. 103,717).

Nearest city with pop. 200,000+: Buffalo, NY (59.4 miles

, pop. 292,648).

Nearest city with pop. 1,000,000+: Philadelphia, PA (258.1 miles

, pop. 1,517,550).

Nearest cities:

Latitude: 42.10 N, Longitude: 79.24 W

Daytime population change due to commuting: +1,306 (+4.6%)

Workers who live and work in this city: 5,827 (49.7%)

Area code: 716

Jamestown, New York accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 1 building, cost: $211,500

- 2020: 1 building, cost: $80,000

- 2019: 1 building, cost: $132,200

- 2016: 1 building, cost: $195,400

- 2015: 1 building, cost: $467,700

- 2012: 1 building, cost: $400,000

- 2011: 1 building, cost: $400,000

- 2010: 1 building, cost: $200,000

- 2008: 14 buildings, average cost: $234,900

- 2007: 8 buildings, average cost: $158,100

- 2006: 29 buildings, average cost: $207,800

- 2005: 5 buildings, average cost: $127,000

- 2004: 8 buildings, average cost: $139,600

- 2003: 1 building, cost: $50,000

- 2002: 1 building, cost: $50,000

- 2001: 1 building, cost: $50,000

- 2000: 1 building, cost: $50,000

- 1999: 1 building, cost: $50,000

- 1998: 1 building, cost: $125,000

- 1997: 1 building, cost: $111,800

| Here: | 5.0% |

| New York: | 4.4% |

- Health care (12.7%)

- Metal & metal products (8.3%)

- Educational services (7.8%)

- Accommodation & food services (6.9%)

- Furniture & related product manufacturing (6.1%)

- Social assistance (4.5%)

- Food & beverage stores (4.4%)

- Metal & metal products (13.4%)

- Furniture & related product manufacturing (7.7%)

- Construction (5.7%)

- Accommodation & food services (5.1%)

- Health care (4.8%)

- Educational services (4.4%)

- Public administration (3.9%)

- Health care (20.8%)

- Educational services (11.5%)

- Accommodation & food services (8.8%)

- Social assistance (6.8%)

- Food & beverage stores (5.0%)

- Furniture & related product manufacturing (4.3%)

- Religious, grantmaking, civic, professional, similar organizations (4.2%)

- Other production occupations, including supervisors (6.0%)

- Metal workers and plastic workers (5.0%)

- Building and grounds cleaning and maintenance occupations (3.8%)

- Other office and administrative support workers, including supervisors (3.5%)

- Laborers and material movers, hand (3.5%)

- Other sales and related occupations, including supervisors (3.4%)

- Cashiers (3.0%)

- Metal workers and plastic workers (8.6%)

- Other production occupations, including supervisors (8.3%)

- Driver/sales workers and truck drivers (4.9%)

- Building and grounds cleaning and maintenance occupations (4.8%)

- Laborers and material movers, hand (4.6%)

- Material recording, scheduling, dispatching, and distributing workers (3.5%)

- Other sales and related occupations, including supervisors (3.3%)

- Other office and administrative support workers, including supervisors (5.4%)

- Nursing, psychiatric, and home health aides (5.2%)

- Cashiers (5.2%)

- Secretaries and administrative assistants (4.9%)

- Preschool, kindergarten, elementary, and middle school teachers (3.9%)

- Waiters and waitresses (3.7%)

- Registered nurses (3.6%)

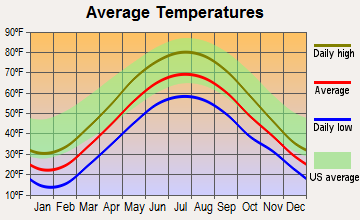

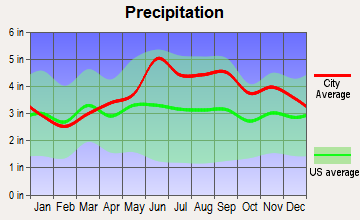

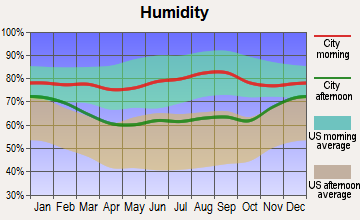

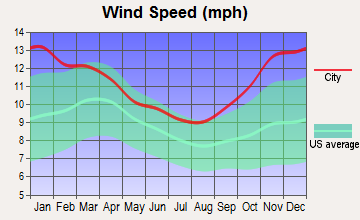

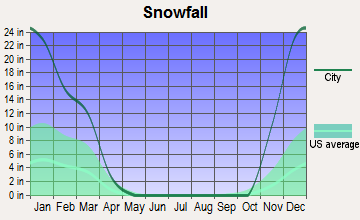

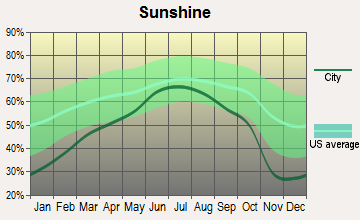

Average climate in Jamestown, New York

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

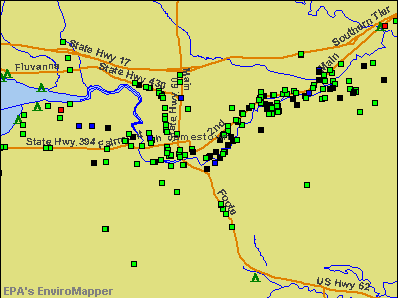

Air Quality Index (AQI) level in 2023 was 12.3. This is significantly better than average.

| City: | 12.3 |

| U.S.: | 72.6 |

Sulfur Dioxide (SO2) [ppb] level in 2023 was 1.53. This is about average. Closest monitor was 0.1 miles away from the city center.

| City: | 1.53 |

| U.S.: | 1.51 |

Ozone [ppb] level in 2012 was 36.2. This is about average. Closest monitor was 22.5 miles away from the city center.

| City: | 36.2 |

| U.S.: | 33.3 |

Tornado activity:

Jamestown-area historical tornado activity is above New York state average. It is 40% smaller than the overall U.S. average.

On 5/31/1985, a category F4 (max. wind speeds 207-260 mph) tornado 10.3 miles away from the Jamestown city center .

On 5/31/1985, a category F3 (max. wind speeds 158-206 mph) tornado 4.5 miles away from the city center injured 10 people and caused between $500,000 and $5,000,000 in damages.

Earthquake activity:

Jamestown-area historical earthquake activity is significantly above New York state average. It is 64% smaller than the overall U.S. average.On 9/25/1998 at 19:52:52, a magnitude 5.2 (4.8 MB, 4.3 MS, 5.2 LG, 4.5 MW, Depth: 3.1 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 72.9 miles away from Jamestown center

On 1/31/1986 at 16:46:43, a magnitude 5.0 (5.0 MB) earthquake occurred 104.7 miles away from the city center

On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi) earthquake occurred 297.6 miles away from the city center

On 10/7/1983 at 10:18:46, a magnitude 5.3 (5.1 MB, 5.3 LG, 5.1 ML) earthquake occurred 278.9 miles away from Jamestown center

On 4/20/2002 at 10:50:47, a magnitude 5.3 (5.3 ML, Depth: 3.0 mi) earthquake occurred 325.1 miles away from the city center

On 1/16/1994 at 01:49:16, a magnitude 4.6 (4.6 MB, 4.6 LG, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 206.5 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Chautauqua County (21) is greater than the US average (15).Major Disasters (Presidential) Declared: 11

Emergencies Declared: 9

Causes of natural disasters: Floods: 9, Storms: 9, Snowstorms: 4, Hurricanes: 2, Winter Storms: 2, Blizzard: 1, Ice Storm: 1, Power Outage: 1, Snow: 1, Tropical Storm: 1, Wind: 1, Other: 2 (Note: some incidents may be assigned to more than one category).

Main business address for: AMERICAN LOCKER GROUP INC (PARTITIONS, SHELVING, LOCKERS & OFFICE AND STORE FIXTURES).

Hospitals and medical centers in Jamestown:

- CHAUTAUQUA COUNTY CHAPTER NYS ARC, INC (165 CHANDLER STREET (TEMP 160 BENEDICT AVE))

- CHAUTAUQUA COUNTY CHAPTER NYS ARC, INC (862 FOOTE AVE)

- JAMESTOWN GENERAL HOSPITAL (provides emergency services, 51 GLASGOW AVE)

- WOMAN'S CHRISTIAN ASSOCIATION (Voluntary non-profit - Private, 207 FOOTE AVENUE)

- HERITAGE PARK HEALTH CARE CENTER (150 PRATHER AVENUE)

- LUTHERAN RETIREMENT HOME (715 FALCONER STREET)

- MANOR OAK SKILLED NURSING FACILITIES JAMESTOWN (423 BAKER STREET)

- PRESBYTERIAN HOMES (715 FALCONER ST)

- WOMENS CHRISTIAN ASSOC. HOSP. (207 FOOTE AVENUE)

Airports and heliports located in Jamestown:

- Chautauqua County/Jamestown Airport (JHW) (Runways: 2, Commercial Ops: 1,925, Itinerant Ops: 7,969, Local Ops: 24,116, Military Ops: 827)

- Fairbank Farms Airport (NY89) (Runways: 3)

- Laska Airport (3NK4) (Runways: 1)

- Ridgeview Airport (55NY) (Runways: 1)

- Wca Hospital Heliport (4NK0)

Colleges/Universities in Jamestown:

Other colleges/universities with over 2000 students near Jamestown:

- SUNY at Fredonia (about 26 miles; Fredonia, NY; Full-time enrollment: 5,523)

- Pennsylvania State University-Penn State Erie-Behrend College (about 39 miles; Erie, PA; FT enrollment: 4,025)

- St Bonaventure University (about 40 miles; Saint Bonaventure, NY; FT enrollment: 2,286)

- Mercyhurst University (about 42 miles; Erie, PA; FT enrollment: 2,888)

- Gannon University (about 44 miles; Erie, PA; FT enrollment: 3,760)

- Edinboro University of Pennsylvania (about 49 miles; Edinboro, PA; FT enrollment: 6,746)

- Bryant & Stratton College-Online (about 54 miles; Orchard Park, NY; FT enrollment: 2,212)

Public high schools in Jamestown:

- JAMESTOWN HIGH SCHOOL (Students: 1,469, Location: 350 E 2ND ST, Grades: 9-12)

- SOUTHWESTERN ELEMENTARY SCHOOL (Students: 674, Location: 600 HUNT RD W, Grades: PK-11)

- SOUTHWESTERN SENIOR HIGH SCHOOL (Students: 474, Location: 600 HUNT RD W, Grades: 9-12)

Private high schools in Jamestown:

- BETHEL BAPTIST CHRISTIAN ACADEMY (Students: 73, Location: 200 HUNT RD, Grades: KG-12)

- GUSTAVUS ADOLPHUS LEARNING CENTER (Students: 65, Location: 200 GUSTAVUS AVE, Grades: 4-12)

Public elementary/middle schools in Jamestown:

- PERSELL MIDDLE SCHOOL (Students: 510, Location: 375 BAKER ST, Grades: 5-8)

- GEORGE WASHINGTON MIDDLE SCHOOL (Students: 501, Location: 159 BUFFALO ST, Grades: 5-8)

- THOMAS JEFFERSON MIDDLE SCHOOL (Students: 485, Location: 195 MARTIN RD, Grades: 5-8)

- MILTON J FLETCHER ELEMENTARY SCHOOL (Students: 465, Location: 301 COLE AVE, Grades: PK-4)

- CARLYLE C RING ELEMENTARY SCHOOL (Students: 454, Location: 333 BUFFALO ST, Grades: PK-4)

- ABRAHAM LINCOLN ELEMENTARY SCHOOL (Students: 398, Location: 301 FRONT ST, Grades: PK-4)

- SOUTHWESTERN MIDDLE SCHOOL (Students: 353, Location: 600 HUNT RD W, Grades: 6-8)

- SAMUEL G LOVE ELEMENTARY SCHOOL (Students: 329, Location: 50 E 8TH ST, Grades: PK-4)

- CLINTON V BUSH ELEMENTARY SCHOOL (Students: 287, Location: 150 PARDEE AVE, Grades: PK-4)

Private elementary/middle schools in Jamestown:

- CATHOLIC ACADEMY OF THE HOLY FAMILY (Students: 91, Location: 1135 N MAIN ST, Grades: PK-8)

- LIGHTHOUSE BAPTIST ACADEMY (Students: 41, Location: 381 CAMP ST, Grades: KG-4)

- JAMESTOWN SDA SCHOOL (Students: 6, Location: 130 MCDANIEL AVE, Grades: 3-8)

Libraries in Jamestown:

- JAMES PRENDERGAST LIBRARY ASSOCIATION (Operating income: $1,151,886; Location: 509 CHERRY STREET; 196,674 books; 18 e-books; 8,299 audio materials; 1,486 video materials; 10 local licensed databases; 14 state licensed databases; 7 other licensed databases; 358 print serial subscriptions)

- HAZELTINE PUBLIC LIBRARY (Operating income: $61,335; Location: 891 BUSTI-SUGAR GROVE ROAD; 15,511 books; 476 audio materials; 514 video materials; 14 state licensed databases; 5 other licensed databases; 74 print serial subscriptions)

- FLUVANNA FREE LIBRARY (Operating income: $32,831; Location: 3532 FLUVANNA AVENUE EXTENSION; 11,215 books; 210 audio materials; 1,196 video materials; 14 state licensed databases; 5 other licensed databases; 14 print serial subscriptions)

User-submitted facts and corrections:

- wrfa-lp is a new low power station at 107.9 fm. it went on the air about a year ago. wkza 106.9 is another station not listed.

- add this FM station to your listing for Jamestown, NY please: WRFA (107.9 FM; JAMESTOWN, NY; Owner: Arts Council for Chautauqua County)

- Jamestown was the home of the Honorable Robert H. Jackson who performed such duties as General Counsel, Bureau of Internal Revenue, Assistant Attorney General (Tax), Assistant Attorney Gerneral (Antitrust), Soicitor General, Attorney General, Supreme Court Justice, and most importantly in 1945 RHJ was selected to serve as the chief counsel at the International Military Tribunal for the prosecution of Nazi war criminals.

- Brad Anderson, the creator of the cartoon panel Marmaduke, also grew up in Jamestown, NY.

Points of interest:

Notable locations in Jamestown: Municipal Lighting Plant Sub-Station Number 3 (A), Washington Street Sub-Station (B), Reg Lenna Civic Center (C), Jamestown Savings Bank Ice Arena (D), City of Jamestown Municipal Lighting Plant (E), James Prendergast Free Library (F), Marvin Community House (G), Western New York Technology Development Center (H), Physical Education Complex (I), Hultquist Library (J), Katharine Jackson Carnahan Center (K), Arts And Sciences Center (L), Hamilton Collegiate Center (M), Buffalo Street Booster Pumping Station (N), Saint John's Roman Catholic Youth Center (O), Governor Fenton Mansion (P), Fenton Park Nursing Home (Q), Agnes Home for Girls (R), Jamestown Engine Company Number 3 (S), Jamestown Boys Club (T). Display/hide their locations on the map

Shopping Centers: South Side Plaza Shopping Center (1), Commons Mall Building (2). Display/hide their locations on the map

Main business address in Jamestown: AMERICAN LOCKER GROUP INC (A). Display/hide its location on the map

Churches in Jamestown include: Blackwell Chapel African Methodist Episcopal Church (A), Camp Street United Methodist Church (B), Christ First United Methodist Church (C), Concordia Lutheran Church (D), Crosspointe Community Church (E), Emmanuel Temple Church (F), First Baptist Church of Jamestown (G), New Life Christian Fellowship (H), Southtown Christian Center (I). Display/hide their locations on the map

Cemetery: Lake View Cemetery (1). Display/hide its location on the map

Parks in Jamestown include: School Park (1), Roseland Park (2), Lincoln Park (3), Fenton Park (4), Emory Park (5), Dow Park (6), Baker Park (7), Allen Park (8), Willard Park (9). Display/hide their locations on the map

Tourist attraction: Centi Astro-Space Activities (Cultural Attractions- Events- & Facilities; 142 Broadhead Avenue).

Hotels: Best Western Downtown Jamestwn (200 West Third Street), Comfort Inn Jamestown (2800 North Main Street), Colony Motel (620 Fairmount Avenue), Cottage Inn (330 W 3 St).

Court: Jamestown City - City Court (City Hall).

Birthplace of: Lucille Ball - (1911-1989), comedy actress, Roger Goodell - Commissioner of the National Football League, Natalie Merchant - (born 1963), musician, Nick Carter (musician) - Male singer, Charles Goodell - Politician, Dale Willman - Journalist, Jud Strunk - Singer, Laura Kightlinger - Comedian, Michael G. Foster - Karateka, Pandora Boxx - Performance artist.

Drinking water stations with addresses in Jamestown and their reported violations in the past:

LASCALA II (Population served: 150, Groundwater):Past monitoring violations:PETERSON FARM (Address: 3030 Strunk Rd , Population served: 100, Groundwater):

- One routine major monitoring violation

Past monitoring violations:BAKER ESTATES (Population served: 50, Groundwater under infl of surface water):

- One regular monitoring violation

Past monitoring violations:

- One routine major monitoring violation

Drinking water stations with addresses in Jamestown that have no violations reported:

- HIDDEN VALLEY CAMPGROUND (Population served: 250, Primary Water Source Type: Groundwater)

- JAMESTOWN AUDUBON SOCIETY (Population served: 125, Primary Water Source Type: Groundwater)

- HOUSE THAT JACK BUILT, THE (Population served: 80, Primary Water Source Type: Groundwater)

| This city: | 2.3 people |

| New York: | 2.6 people |

| This city: | 56.5% |

| Whole state: | 63.5% |

| This city: | 11.3% |

| Whole state: | 6.8% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.5% of all households

- Gay men: 0.3% of all households

People in group quarters in Jamestown in 2010:

- 353 people in nursing facilities/skilled-nursing facilities

- 311 people in other noninstitutional facilities

- 214 people in college/university student housing

- 150 people in group homes intended for adults

- 50 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 37 people in residential treatment centers for juveniles (non-correctional)

- 10 people in residential treatment centers for adults

- 9 people in group homes for juveniles (non-correctional)

People in group quarters in Jamestown in 2000:

- 300 people in nursing homes

- 204 people in other noninstitutional group quarters

- 143 people in homes for the mentally retarded

- 23 people in homes for the mentally ill

- 18 people in mental (psychiatric) hospitals or wards

- 18 people in other group homes

- 13 people in orthopedic wards and institutions for the physically handicapped

- 10 people in hospitals or wards for drug/alcohol abuse

- 5 people in other nonhousehold living situations

Banks with branches in Jamestown (2011 data):

- Manufacturers and Traders Trust Company: Jamestown-Main Branch, Jamestown - South Side Branch, Jamestown Drive-In Branch. Info updated 2011/08/08: Bank assets: $76,887.1 mil, Deposits: $60,064.2 mil, headquarters in Buffalo, NY, positive income, Commercial Lending Specialization, 808 total offices, Holding Company: M&T Bank Corporation

- Community Bank, National Association: Jamestown - North Main Branch at 1281 North Main Street, branch established on 1998/09/21; Jamestown - Brooklyn Square Branch at 25 South Main Street, branch established on 1982/07/06. Info updated 2011/06/13: Bank assets: $6,460.6 mil, Deposits: $4,840.4 mil, headquarters in Canton, NY, positive income, 175 total offices, Holding Company: Community Bank System, Inc.

- Lake Shore Savings Bank: Jamestown Branch at 115 East 4th Street, branch established on 1997/09/22; West Ellicot Branch at 1 N Green Ave, branch established on 1996/06/30. Info updated 2011/07/21: Bank assets: $485.8 mil, Deposits: $383.2 mil, headquarters in Dunkirk, NY, positive income, Mortgage Lending Specialization, 10 total offices

- Northwest Savings Bank: Jamestown Branch at 23 West Third Street, branch established on 1996/11/09; Southside Branch at 768 Foote Avenue, branch established on 1997/11/05. Info updated 2009/11/23: Bank assets: $7,975.9 mil, Deposits: $5,985.6 mil, headquarters in Warren, PA, positive income, Mortgage Lending Specialization, 172 total offices

- KeyBank National Association: Jamestown Quality Market Branch at 730 Foote Avenue, branch established on 1958/11/12; 202-204 North Main Street Branch at 202 North Main Street, branch established on 1990/03/28. Info updated 2008/03/03: Bank assets: $86,198.8 mil, Deposits: $64,214.8 mil, headquarters in Cleveland, OH, positive income, Commercial Lending Specialization, 1067 total offices, Holding Company: Keycorp

- Cattaraugus County Bank: Fairmount Avenue Branch at 870 Fairmount Avenue, branch established on 2006/07/10. Info updated 2008/07/14: Bank assets: $186.4 mil, Deposits: $165.9 mil, headquarters in Little Valley, NY, positive income, Commercial Lending Specialization, 9 total offices, Holding Company: C.C.bancorp, Inc.

- RBS Citizens, National Association: Jamestown/Tops Branch at 2000 Washington Street, branch established on 2003/05/12. Info updated 2007/09/19: Bank assets: $106,940.6 mil, Deposits: $75,690.2 mil, headquarters in Providence, RI, positive income, 1135 total offices, Holding Company: Uk Financial Investments Limited

- HSBC Bank USA, National Association: Jamestown Branch at 417 Spring Street, branch established on 1953/04/07. Info updated 2010/11/30: Bank assets: $206,009.7 mil, Deposits: $149,026.8 mil, headquarters in Mc Lean, VA, positive income, 474 total offices, Holding Company: Hsbc Holdings Plc

For population 15 years and over in Jamestown:

- Never married: 37.0%

- Now married: 40.7%

- Separated: 2.5%

- Widowed: 5.8%

- Divorced: 13.9%

For population 25 years and over in Jamestown:

- High school or higher: 86.7%

- Bachelor's degree or higher: 21.0%

- Graduate or professional degree: 8.4%

- Unemployed: 8.3%

- Mean travel time to work (commute): 14.1 minutes

| Here: | 10.5 |

| New York average: | 13.9 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Jamestown, NY (based on Chautauqua County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 20,912 | 13 |

| Mainline Protestant | 18,659 | 86 |

| Evangelical Protestant | 11,175 | 105 |

| Other | 2,884 | 19 |

| Orthodox | 230 | 2 |

| Black Protestant | 120 | 1 |

| None | 80,925 | - |

Food Environment Statistics:

| Chautauqua County: | 2.76 / 10,000 pop. |

| New York: | 4.13 / 10,000 pop. |

| This county: | 0.07 / 10,000 pop. |

| New York: | 0.06 / 10,000 pop. |

| Chautauqua County: | 1.12 / 10,000 pop. |

| New York: | 0.92 / 10,000 pop. |

| Chautauqua County: | 3.06 / 10,000 pop. |

| State: | 1.68 / 10,000 pop. |

| Here: | 11.05 / 10,000 pop. |

| New York: | 8.82 / 10,000 pop. |

| This county: | 8.1% |

| New York: | 8.2% |

| This county: | 29.3% |

| New York: | 23.8% |

| Here: | 12.4% |

| New York: | 15.6% |

Health and Nutrition:

| Jamestown: | 48.6% |

| New York: | 50.1% |

| Here: | 44.2% |

| New York: | 48.1% |

| This city: | 28.7 |

| New York: | 28.5 |

| Jamestown: | 20.8% |

| New York: | 20.3% |

| Jamestown: | 11.4% |

| New York: | 11.1% |

| Jamestown: | 6.8 |

| State: | 6.8 |

| Jamestown: | 33.9% |

| New York: | 33.4% |

| Jamestown: | 54.5% |

| State: | 56.5% |

| This city: | 77.3% |

| New York: | 80.2% |

More about Health and Nutrition of Jamestown, NY Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Higher Education - Other | 147 | $783,474 | $63,957 | 73 | $95,017 |

| Higher Education - Instructional | 63 | $394,193 | $75,084 | 159 | $224,800 |

| Police Protection - Officers | 58 | $478,023 | $98,901 | 0 | $0 |

| Firefighters | 56 | $358,532 | $76,828 | 0 | $0 |

| Streets and Highways | 54 | $297,555 | $66,123 | 0 | $0 |

| Parks and Recreation | 16 | $91,397 | $68,548 | 0 | $0 |

| Financial Administration | 12 | $54,958 | $54,958 | 2 | $3,081 |

| Housing and Community Development (Local) | 11 | $50,054 | $54,604 | 0 | $0 |

| Police - Other | 8 | $28,445 | $42,668 | 3 | $832 |

| Judicial and Legal | 7 | $29,194 | $50,047 | 4 | $5,236 |

| Other Government Administration | 4 | $19,985 | $59,955 | 9 | $3,833 |

| Other and Unallocable | 1 | $6,283 | $75,396 | 2 | $889 |

| Fire - Other | 1 | $2,876 | $34,512 | 0 | $0 |

| Totals for Government | 438 | $2,594,969 | $71,095 | 252 | $333,690 |

Jamestown government finances - Expenditure in 2021 (per resident):

- Construction - General Public Buildings: $4,614,000 ($163.37)

Regular Highways: $944,000 ($33.42)

Other Higher Education: $523,000 ($18.52)

Parks and Recreation: $34,000 ($1.20)

General - Other: $25,000 ($0.89)

- Current Operations - Other Higher Education: $28,834,000 ($1020.93)

Electric Utilities: $27,254,000 ($964.98)

General - Other: $14,953,000 ($529.44)

Police Protection: $6,055,000 ($214.39)

Local Fire Protection: $5,297,000 ($187.55)

Sewerage: $4,281,000 ($151.58)

Regular Highways: $3,407,000 ($120.63)

Water Utilities: $3,108,000 ($110.04)

Solid Waste Management: $2,397,000 ($84.87)

Higher Education Auxiliary Enterprises: $1,780,000 ($63.02)

Parks and Recreation: $1,394,000 ($49.36)

Financial Administration: $702,000 ($24.86)

Central Staff Services: $525,000 ($18.59)

General Public Buildings: $516,000 ($18.27)

Natural Resources - Other: $327,000 ($11.58)

Judicial and Legal Services: $185,000 ($6.55)

Corrections - Other: $176,000 ($6.23)

Health - Other: $106,000 ($3.75)

Libraries: $100,000 ($3.54)

Parking Facilities: $68,000 ($2.41)

- General - Interest on Debt: $1,504,000 ($53.25)

- Intergovernmental to Local - Other - Financial Administration: $5,568,000 ($197.15)

- Other Capital Outlay - General - Other: $200,000 ($7.08)

Other Higher Education: $92,000 ($3.26)

Parks and Recreation: $67,000 ($2.37)

Police Protection: $41,000 ($1.45)

General Public Building: $20,000 ($0.71)

Local Fire Protection: $15,000 ($0.53)

Financial Administration: $3,000 ($0.11)

Central Staff Services: $2,000 ($0.07)

Judicial and Legal Services: $1,000 ($0.04)

- Total Salaries and Wages: $18,447,000 ($653.15)

Jamestown government finances - Revenue in 2021 (per resident):

- Charges - Higher Education - Other: $9,507,000 ($336.61)

Sewerage: $4,186,000 ($148.21)

Solid Waste Management: $2,667,000 ($94.43)

Other: $1,852,000 ($65.57)

Higher Education Auxiliary Enterprises: $1,028,000 ($36.40)

Parking Facilities: $92,000 ($3.26)

Parks and Recreation: $1,000 ($0.04)

- Federal Intergovernmental - Education: $13,517,000 ($478.60)

Other: $99,000 ($3.51)

- Local Intergovernmental - Education: $6,902,000 ($244.38)

General Local Government Support: $6,810,000 ($241.12)

Other: $251,000 ($8.89)

- Miscellaneous - General Revenue - Other: $5,259,000 ($186.21)

Donations From Private Sources: $557,000 ($19.72)

Interest Earnings: $115,000 ($4.07)

Fines and Forfeits: $31,000 ($1.10)

- Revenue - Electric Utilities: $37,683,000 ($1334.24)

Water Utilities: $5,610,000 ($198.63)

- State Intergovernmental - Education: $11,106,000 ($393.23)

General Local Government Support: $4,572,000 ($161.88)

Other: $1,877,000 ($66.46)

Highways: $1,147,000 ($40.61)

- Tax - Property: $16,013,000 ($566.97)

Public Utilities Sales: $474,000 ($16.78)

Other License: $359,000 ($12.71)

Jamestown government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $19,350,000 ($685.13)

Outstanding Unspecified Public Purpose: $17,355,000 ($614.49)

Retired Unspecified Public Purpose: $3,785,000 ($134.02)

Issue, Unspecified Public Purpose: $1,790,000 ($63.38)

- Short Term Debt Outstanding - End of Fiscal Year: $5,467,000 ($193.57)

Beginning: $1,200,000 ($42.49)

Jamestown government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $2,047,000 ($72.48)

- Other Funds - Cash and Securities: $31,815,000 ($1126.47)

- Sinking Funds - Cash and Securities: $174,000 ($6.16)

| Businesses in Jamestown, NY | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| ALDI | 1 | Little Caesars Pizza | 1 | |

| AT&T | 1 | MasterBrand Cabinets | 1 | |

| Advance Auto Parts | 1 | McDonald's | 4 | |

| Arby's | 2 | New Balance | 1 | |

| AutoZone | 1 | Nissan | 1 | |

| Best Western | 1 | Pizza Hut | 2 | |

| Blockbuster | 1 | RadioShack | 1 | |

| Burger King | 2 | Rite Aid | 3 | |

| CVS | 1 | Sam's Club | 1 | |

| Chevrolet | 1 | Sears | 1 | |

| Clarion | 1 | Sprint Nextel | 1 | |

| Comfort Inn | 1 | Starbucks | 1 | |

| Domino's Pizza | 1 | Subaru | 1 | |

| Dunkin Donuts | 1 | Subway | 3 | |

| FedEx | 7 | T-Mobile | 1 | |

| GNC | 1 | Tim Hortons | 4 | |

| H&R Block | 2 | True Value | 1 | |

| Hilton | 1 | U-Haul | 1 | |

| Home Depot | 1 | UPS | 7 | |

| Hyundai | 1 | Verizon Wireless | 1 | |

| KFC | 1 | Walgreens | 1 | |

| Kmart | 1 | Wendy's | 1 | |

| La-Z-Boy | 1 | YMCA | 2 | |

| Lane Furniture | 1 | |||

Strongest AM radio stations in Jamestown:

- WKSN (1340 AM; 1 kW; JAMESTOWN, NY; Owner: VOX ALLEGANY, L.L.C.)

- WJTN (1240 AM; 1 kW; JAMESTOWN, NY; Owner: MEDIA ONE GROUP, LLC)

- WWKB (1520 AM; 50 kW; BUFFALO, NY; Owner: ENTERCOM BUFFALO LICENSE, LLC)

- WNAE (1310 AM; 5 kW; WARREN, PA; Owner: KINZUA BROADCASTING COMPANY)

- WHAM (1180 AM; 50 kW; ROCHESTER, NY; Owner: CITICASTERS LICENSES, L.P.)

- WGGO (1590 AM; 5 kW; SALAMANCA, NY; Owner: CATT COMMUNICATIONS, INC.)

- KDKA (1020 AM; 50 kW; PITTSBURGH, PA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WGR (550 AM; 5 kW; BUFFALO, NY; Owner: ENTERCOM BUFFALO LICENSE, LLC)

- WKNR (850 AM; 50 kW; CLEVELAND, OH; Owner: CARON BROADCASTING, INC.)

- WTAM (1100 AM; 50 kW; CLEVELAND, OH; Owner: JACOR BROADCASTING CORPORATION)

- WRIE (1260 AM; 5 kW; ERIE, PA; Owner: REGENT LICENSEE OF ERIE, INC.)

- WFNN (1330 AM; 5 kW; ERIE, PA; Owner: NM LICENSING, LLC)

- WNED (970 AM; 5 kW; BUFFALO, NY)

Strongest FM radio stations in Jamestown:

- WWSE (93.3 FM; JAMESTOWN, NY; Owner: MEDIA ONE GROUP, LLC)

- WMHU (101.9 FM; JAMESTOWN, NY; Owner: VOX ALLEGANY, L.L.C.)

- WNJA (89.7 FM; JAMESTOWN, NY; Owner: WESTERN NEW YORK PUBLIC B/CING ASSOC)

- WKZA (106.9 FM; LAKEWOOD, NY; Owner: CROSS COUNTRY COMMUNICATIONS, LLC)

- WUBJ (88.1 FM; JAMESTOWN, NY; Owner: STATE UNIVERSITY OF NEW YORK)

- W205BA (88.9 FM; JAMESTOWN, NY; Owner: BIBLE BROADCASTING NETWORK, INC.)

- WCOT (90.9 FM; JAMESTOWN, NY; Owner: FAMILY LIFE MINISTRIES, INC.)

- WQFX-FM (103.1 FM; RUSSELL, PA; Owner: SOUTHBRIDGE RADIO CORPORATION)

- WOGM-LP (105.9 FM; JAMESTOWN, NY; Owner: LIGHTHOUSE BAPTIST CHURCH)

- WBKX (96.5 FM; FREDONIA, NY; Owner: CHADWICK BAY BROADCASTING CORPORATION)

- WRRN (92.3 FM; WARREN, PA; Owner: KINZUA BROADCASTING COMPANY, INC.)

- WRKT (100.9 FM; NORTH EAST, PA; Owner: NM LICENSING, LLC)

- WTSS (102.5 FM; BUFFALO, NY; Owner: ENTERCOM BUFFALO LICENSE, LLC)

- WKNB (104.3 FM; CLARENDON, PA; Owner: KINZUA BROADCASTING CO., INC)

- WBRR (100.1 FM; BRADFORD, PA; Owner: RADIO STATION WESB, INC.)

- WQRT (98.3 FM; SALAMANCA, NY; Owner: CATT COMMUNICATIONS, INC.)

TV broadcast stations around Jamestown:

- W46BA (Channel 46; JAMESTOWN, NY; Owner: WESTERN NEW YORK PUBLIC B/CING.ASSN.)

- W10BH (Channel 10; JAMESTOWN, NY; Owner: TRINITY BROADCASTING NETWORK)

- WNYB (Channel 26; JAMESTOWN, NY; Owner: FAITH BROADCASTING NETWORK, INC.)

- WNGS (Channel 67; SPRINGVILLE, NY; Owner: CAROLINE K. POWLEY D/B/A UNICORN/SPRINGVILLE)

- WICU-TV (Channel 12; ERIE, PA; Owner: SJL OF PENNSYLVANIA, INC.)

Medal of Honor Recipients

Medal of Honor Recipient born in Jamestown: Henri Le Fevre Brown.

- National Bridge Inventory (NBI) Statistics

- 23Number of bridges

- 331ft / 101mTotal length

- $87,688,000Total costs

- 106,953Total average daily traffic

- 2,972Total average daily truck traffic

- New bridges - historical statistics

- 2Before 1900

- 21910-1919

- 11920-1929

- 11930-1939

- 11950-1959

- 31970-1979

- 21980-1989

- 41990-1999

- 32000-2009

- 42010-2019

FCC Registered Antenna Towers: 84 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 7 (See the full list of FCC Registered Commercial Land Mobile Towers in Jamestown, NY)

FCC Registered Private Land Mobile Towers: 5 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 46 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 26 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 11 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 11 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 199 (See the full list of FCC Registered Amateur Radio Licenses in Jamestown)

FAA Registered Aircraft: 11 (See the full list of FAA Registered Aircraft in Jamestown)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2003 (Based on 8 full tracts) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 78 | $55,256 | 187 | $59,674 | 404 | $51,359 | 84 | $13,190 | 3 | $61,667 | 60 | $44,600 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 6 | $50,000 | 12 | $64,083 | 67 | $49,836 | 11 | $30,273 | 0 | $0 | 7 | $44,143 |

| APPLICATIONS DENIED | 16 | $42,688 | 29 | $55,552 | 363 | $52,771 | 88 | $16,443 | 1 | $20,000 | 26 | $34,577 |

| APPLICATIONS WITHDRAWN | 3 | $45,000 | 14 | $46,571 | 243 | $56,033 | 10 | $19,800 | 0 | $0 | 9 | $37,000 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $24,000 | 3 | $45,333 | 16 | $63,125 | 2 | $127,500 | 0 | $0 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 0301.00 , 0302.00, 0303.00, 0304.00, 0305.00, 0306.00, 0307.00, 0308.00

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2003 (Based on 8 full tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 93 | $55,645 | 54 | $67,870 | 13 | $43,462 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 9 | $46,667 | 7 | $81,571 | 0 | $0 |

| APPLICATIONS DENIED | 1 | $48,000 | 2 | $59,000 | 1 | $80,000 |

| APPLICATIONS WITHDRAWN | 2 | $55,500 | 2 | $37,500 | 2 | $40,000 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 1 | $77,000 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 0301.00 , 0302.00, 0303.00, 0304.00, 0305.00, 0306.00, 0307.00, 0308.00

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Jamestown, NY

- 1,19548.3%Structure Fires

- 59424.0%Outside Fires

- 46018.6%Other

- 2269.1%Mobile Property/Vehicle Fires

According to the data from the years 2002 - 2018 the average number of fires per year is 146. The highest number of reported fire incidents - 214 took place in 2011, and the least - 21 in 2002. The data has an increasing trend.

According to the data from the years 2002 - 2018 the average number of fires per year is 146. The highest number of reported fire incidents - 214 took place in 2011, and the least - 21 in 2002. The data has an increasing trend. When looking into fire subcategories, the most incidents belonged to: Structure Fires (48.3%), and Outside Fires (24.0%).

When looking into fire subcategories, the most incidents belonged to: Structure Fires (48.3%), and Outside Fires (24.0%).Fire-safe hotels and motels in Jamestown, New York:

- Comfort Inn, 2800 N Main St, Jamestown, New York 14701 , Phone: (716) 664-5920, Fax: (716) 664-3068

- Ramada Jamestown Hotel, 150 W 4TH St, Jamestown, New York 14701 , Phone: (716) 664-3400

- Hampton Inn & Suites - Jamestown, Ny, 4 W Oak Hill Rd, Jamestown, New York 14701 , Phone: (716) 484-7829, Fax: (716) 484-9953

- Boxwood Hotels LLC DBA Holiday Inn Express Jamestown, 2811 N Main St, Jamestown, New York 14701 , Phone: (716) 487-0001, Fax: (716) 487-0039

- DoubleTree by Hilton, 150 W 4th St, Jamestown, New York 14701 , Phone: (800) 445-8426, Fax: (716) 484-4108

- DoubleTree by Hilton, 150 W 4th St, Jamestown, New York 14701 , Phone: (800) 445-8426, Fax: (716) 484-4108

| Most common first names in Jamestown, NY among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| John | 416 | 76.4 years |

| Mary | 380 | 81.2 years |

| Joseph | 271 | 76.0 years |

| Carl | 265 | 78.9 years |

| William | 260 | 74.9 years |

| Robert | 242 | 70.2 years |

| Charles | 233 | 76.0 years |

| Helen | 227 | 79.0 years |

| Anna | 214 | 85.0 years |

| James | 212 | 72.0 years |

| Most common last names in Jamestown, NY among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Johnson | 713 | 79.8 years |

| Anderson | 529 | 79.8 years |

| Carlson | 466 | 79.6 years |

| Peterson | 236 | 81.5 years |

| Nelson | 234 | 78.7 years |

| Swanson | 202 | 79.3 years |

| Olson | 153 | 80.1 years |

| Smith | 152 | 76.2 years |

| Larson | 126 | 80.3 years |

| Gustafson | 105 | 78.0 years |

- 80.9%Utility gas

- 17.3%Electricity

- 0.6%Fuel oil, kerosene, etc.

- 0.6%Bottled, tank, or LP gas

- 0.4%Wood

- 0.2%Solar energy

- 53.7%Utility gas

- 39.3%Electricity

- 3.1%Bottled, tank, or LP gas

- 1.9%No fuel used

- 1.1%Fuel oil, kerosene, etc.

- 0.7%Other fuel

- 0.2%Wood

Jamestown compared to New York state average:

- Median household income below state average.

- Median house value significantly below state average.

- Unemployed percentage below state average.

- Black race population percentage significantly below state average.

- Hispanic race population percentage below state average.

- Foreign-born population percentage significantly below state average.

Jamestown on our top lists:

- #51 on the list of "Top 100 cities with oldest houses (pop. 5,000+)"

- #55 on the list of "Top 101 cities with the most people taking a taxi to work (population 5,000+)"

- #67 on the list of "Top 100 cities with old houses but young residents (pop. 5,000+)"

- #90 on the list of "Top 101 cities with the largest percentage of unmarried partner households (population 5,000+)"

- #83 (14701) on the list of "Top 101 zip codes with the largest percentage of Swedish first ancestries"

- #8 on the list of "Top 101 counties with the lowest percentage of residents relocating from other counties between 2010 and 2011"

- #11 on the list of "Top 101 counties with the largest number of people moving out compared to moving in (pop. 50,000+)"

- #15 on the list of "Top 101 counties with the lowest percentage of residents relocating to foreign countries in 2011"

- #32 on the list of "Top 101 counties with the lowest percentage of residents relocating to other counties in 2011"

- #84 on the list of "Top 101 counties with the lowest number of births per 1000 residents 2007-2013"

|

|

Total of 40 patent applications in 2008-2024.