Laurel, Maryland

Submit your own pictures of this city and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +47.1%

| Males: 13,318 | |

| Females: 16,034 |

| Median resident age: | 37.2 years |

| Maryland median age: | 39.7 years |

Zip codes: 20707.

| Laurel: | $88,751 |

| MD: | $94,991 |

Estimated per capita income in 2022: $44,599 (it was $26,717 in 2000)

Laurel city income, earnings, and wages data

Estimated median house or condo value in 2022: $382,622 (it was $122,400 in 2000)

| Laurel: | $382,622 |

| MD: | $398,100 |

Mean prices in 2022: all housing units: $391,422; detached houses: $513,264; townhouses or other attached units: $331,849; in 3-to-4-unit structures: $300,208; in 5-or-more-unit structures: $236,544

Median gross rent in 2022: $1,760.

(5.9% for White Non-Hispanic residents, 8.1% for Black residents, 20.3% for Hispanic or Latino residents, 19.8% for other race residents, 24.6% for two or more races residents)

Detailed information about poverty and poor residents in Laurel, MD

- 14,48749.5%Black alone

- 5,61319.2%Hispanic

- 4,61915.8%White alone

- 2,7379.4%Asian alone

- 1,6485.6%Two or more races

- 640.2%American Indian alone

- 720.2%Other race alone

Races in Laurel detailed stats: ancestries, foreign born residents, place of birth

According to our research of Maryland and other state lists, there were 55 registered sex offenders living in Laurel, Maryland as of April 23, 2024.

The ratio of all residents to sex offenders in Laurel is 473 to 1.

Type |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Murders (per 100,000) | 1 (4.5) | 0 (0.0) | 1 (3.9) | 0 (0.0) | 0 (0.0) | 1 (3.9) | 0 (0.0) | 0 (0.0) | 1 (3.8) | 3 (11.5) | 1 (3.9) | 0 (0.0) |

| Rapes (per 100,000) | 1 (4.5) | 5 (19.9) | 4 (15.8) | 1 (3.9) | 4 (15.6) | 4 (15.4) | 3 (11.4) | 3 (11.4) | 9 (34.6) | 10 (38.4) | 8 (31.0) | 11 (42.8) |

| Robberies (per 100,000) | 74 (329.4) | 69 (274.7) | 50 (197.2) | 48 (187.6) | 67 (261.0) | 56 (215.8) | 43 (162.8) | 44 (166.5) | 55 (211.6) | 48 (184.3) | 51 (197.6) | 35 (136.2) |

| Assaults (per 100,000) | 93 (414.0) | 74 (294.6) | 122 (481.2) | 85 (332.1) | 76 (296.0) | 93 (358.3) | 72 (272.7) | 62 (234.6) | 94 (361.6) | 54 (207.4) | 63 (244.1) | 60 (233.4) |

| Burglaries (per 100,000) | 171 (761.3) | 163 (649.0) | 145 (571.9) | 125 (488.5) | 145 (564.8) | 115 (443.1) | 105 (397.6) | 111 (420.1) | 84 (323.1) | 74 (284.2) | 69 (267.3) | 41 (159.5) |

| Thefts (per 100,000) | 771 (3,432) | 768 (3,058) | 622 (2,453) | 594 (2,321) | 596 (2,321) | 713 (2,747) | 689 (2,609) | 812 (3,073) | 788 (3,031) | 777 (2,984) | 739 (2,863) | 604 (2,350) |

| Auto thefts (per 100,000) | 219 (974.9) | 153 (609.2) | 122 (481.2) | 92 (359.5) | 82 (319.4) | 86 (331.4) | 74 (280.2) | 88 (333.0) | 58 (223.1) | 78 (299.6) | 79 (306.0) | 65 (252.9) |

| Arson (per 100,000) | 5 (22.3) | 1 (4.0) | 2 (7.9) | 0 (0.0) | 1 (3.9) | 0 (0.0) | 0 (0.0) | 0 (0.0) | 1 (3.8) | 0 (0.0) | 0 (0.0) | 2 (7.8) |

| City-Data.com crime index | 462.7 | 373.8 | 352.6 | 281.6 | 307.9 | 323.8 | 267.1 | 284.9 | 332.9 | 313.8 | 298.3 | 247.2 |

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Crime rate in Laurel detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 86 (66 officers - 62 male; 4 female).

| Officers per 1,000 residents here: | 2.58 |

| Maryland average: | 2.47 |

| Advice on commuting from Laurel into DC (5 replies) |

| Good Seafood Market In the RT. 1 Corridor From Mt. Rainier to Laurel (0 replies) |

| West Laurel, MD - Whose county is it in (3 replies) |

| North Laurel new developments (3 replies) |

| Desktop Computer Repair - Laurel 'ish (1 reply) |

| Working in Greenbelt or Laurel MD- Help! (8 replies) |

Latest news from Laurel, MD collected exclusively by city-data.com from local newspapers, TV, and radio stations

Laurel, MD City Guides:

Ancestries: African (9.4%), Jamaican (4.9%), American (3.8%), Nigerian (2.9%), Irish (2.0%), Italian (1.3%).

Current Local Time: EST time zone

Incorporated in 1870

Elevation: 187 feet

Land area: 3.78 square miles.

Population density: 7,765 people per square mile (high).

9,132 residents are foreign born (14.1% Latin America, 8.4% Africa, 6.0% Asia).

| This city: | 31.2% |

| Maryland: | 15.7% |

Median real estate property taxes paid for housing units with mortgages in 2022: $4,306 (1.1%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $4,392 (1.2%)

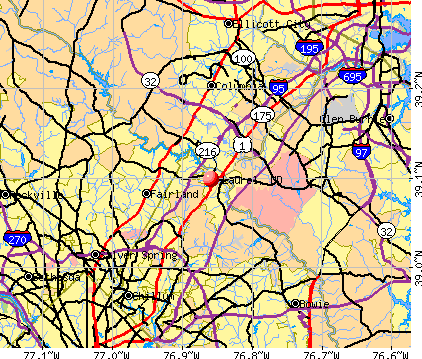

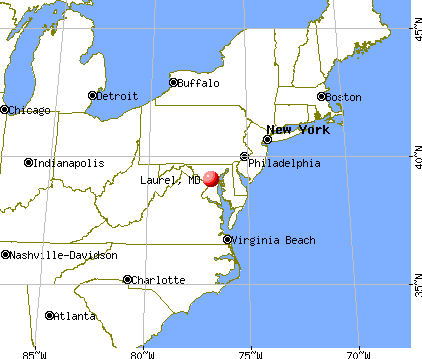

Nearest city with pop. 50,000+: Columbia, MD (7.3 miles

, pop. 88,254).

Nearest city with pop. 200,000+: Washington, DC (15.2 miles

, pop. 572,059).

Nearest city with pop. 1,000,000+: Philadelphia, PA (110.6 miles

, pop. 1,517,550).

Nearest cities:

Latitude: 39.10 N, Longitude: 76.86 W

Daytime population change due to commuting: +841 (+2.9%)

Workers who live and work in this city: 5,121 (31.3%)

Area codes: 301, 240

Property values in Laurel, MD

Laurel tourist attractions:

Laurel, Maryland accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 165 buildings, average cost: $309,400

- 2021: 11 buildings, average cost: $349,400

- 2020: 22 buildings, average cost: $281,600

- 2019: 30 buildings, average cost: $295,700

- 2018: 35 buildings, average cost: $261,000

- 2017: 39 buildings, average cost: $280,600

- 2016: 16 buildings, average cost: $274,300

- 2015: 1 building, cost: $269,100

- 2013: 21 buildings, average cost: $364,600

- 2012: 20 buildings, average cost: $275,400

- 2011: 1 building, cost: $316,200

- 2010: 22 buildings, average cost: $112,800

- 2009: 55 buildings, average cost: $223,600

- 2008: 44 buildings, average cost: $302,600

- 2007: 88 buildings, average cost: $249,400

- 2006: 93 buildings, average cost: $236,400

- 2005: 111 buildings, average cost: $199,800

- 2004: 35 buildings, average cost: $211,400

- 2003: 211 buildings, average cost: $216,500

- 2002: 41 buildings, average cost: $139,600

- 2001: 44 buildings, average cost: $115,500

- 2000: 30 buildings, average cost: $100,000

- 1999: 28 buildings, average cost: $104,200

- 1998: 21 buildings, average cost: $157,200

- 1997: 16 buildings, average cost: $148,500

| Here: | 2.3% |

| Maryland: | 2.0% |

Population change in the 1990s: +574 (+3.0%).

- Public administration (11.7%)

- Professional, scientific, technical services (10.2%)

- Health care (8.6%)

- Educational services (7.2%)

- Accommodation & food services (5.3%)

- Construction (5.3%)

- Finance & insurance (4.4%)

- Public administration (12.1%)

- Professional, scientific, technical services (9.6%)

- Construction (9.2%)

- Accommodation & food services (6.7%)

- Administrative & support & waste management services (4.7%)

- Educational services (4.0%)

- Health care (3.6%)

- Health care (13.7%)

- Public administration (11.3%)

- Professional, scientific, technical services (10.8%)

- Educational services (10.4%)

- Finance & insurance (7.0%)

- Religious, grantmaking, civic, professional, similar organizations (5.2%)

- Accommodation & food services (4.0%)

- Computer specialists (6.7%)

- Other office and administrative support workers, including supervisors (5.1%)

- Secretaries and administrative assistants (4.3%)

- Other management occupations, except farmers and farm managers (4.2%)

- Other sales and related occupations, including supervisors (3.8%)

- Retail sales workers, except cashiers (3.3%)

- Customer service representatives (3.1%)

- Computer specialists (7.9%)

- Other management occupations, except farmers and farm managers (5.3%)

- Retail sales workers, except cashiers (4.3%)

- Other sales and related occupations, including supervisors (3.7%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (3.1%)

- Building and grounds cleaning and maintenance occupations (3.0%)

- Laborers and material movers, hand (3.0%)

- Secretaries and administrative assistants (8.2%)

- Other office and administrative support workers, including supervisors (7.3%)

- Computer specialists (5.5%)

- Registered nurses (3.9%)

- Other sales and related occupations, including supervisors (3.8%)

- Customer service representatives (3.5%)

- Preschool, kindergarten, elementary, and middle school teachers (3.5%)

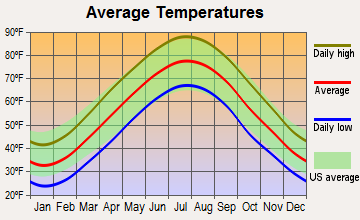

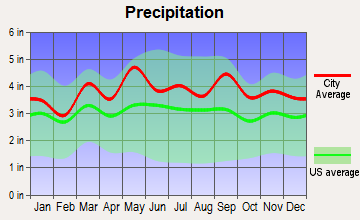

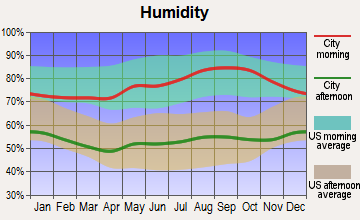

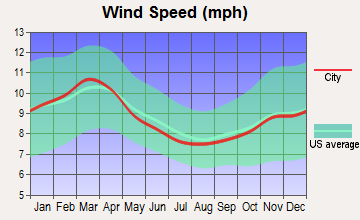

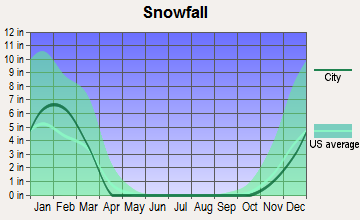

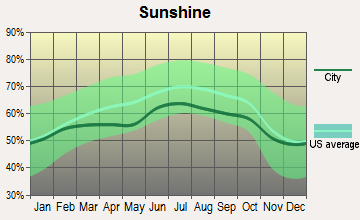

Average climate in Laurel, Maryland

Based on data reported by over 4,000 weather stations

(lower is better)

Air Quality Index (AQI) level in 2023 was 92.0. This is worse than average.

| City: | 92.0 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2023 was 0.231. This is about average. Closest monitor was 3.1 miles away from the city center.

| City: | 0.231 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2023 was 8.52. This is significantly worse than average. Closest monitor was 3.1 miles away from the city center.

| City: | 8.52 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2023 was 0.140. This is significantly better than average. Closest monitor was 3.1 miles away from the city center.

| City: | 0.140 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2023 was 30.3. This is about average. Closest monitor was 3.1 miles away from the city center.

| City: | 30.3 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 14.4. This is better than average. Closest monitor was 3.1 miles away from the city center.

| City: | 14.4 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 8.60. This is about average. Closest monitor was 3.1 miles away from the city center.

| City: | 8.60 |

| U.S.: | 8.11 |

Tornado activity:

Laurel-area historical tornado activity is slightly above Maryland state average. It is 14% greater than the overall U.S. average.

On 9/24/2001, a category F3 (max. wind speeds 158-206 mph) tornado 9.2 miles away from the Laurel city center killed 2 people and injured 55 people and caused $101 million in damages.

On 6/9/1961, a category F3 tornado 14.6 miles away from the city center caused between $50,000 and $500,000 in damages.

Earthquake activity:

Laurel-area historical earthquake activity is significantly above Maryland state average. It is 58% smaller than the overall U.S. average.On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 100.8 miles away from the city center

On 1/16/1994 at 01:49:16, a magnitude 4.6 (4.6 MB, 4.6 LG, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 95.8 miles away from Laurel center

On 8/25/2011 at 05:07:52, a magnitude 4.5 (4.5 ML, Depth: 4.2 mi) earthquake occurred 99.7 miles away from Laurel center

On 9/25/1998 at 19:52:52, a magnitude 5.2 (4.8 MB, 4.3 MS, 5.2 LG, 4.5 MW, Depth: 3.1 mi) earthquake occurred 249.4 miles away from the city center

On 12/9/2003 at 20:59:18, a magnitude 4.5 (4.5 ML, Depth: 6.2 mi) earthquake occurred 113.6 miles away from Laurel center

On 12/9/2003 at 20:59:14, a magnitude 4.5 (4.5 MB, 4.5 LG) earthquake occurred 118.9 miles away from Laurel center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Prince George's County (16) is near the US average (15).Major Disasters (Presidential) Declared: 11

Emergencies Declared: 5

Causes of natural disasters: Hurricanes: 5, Winter Storms: 5, Snowstorms: 3, Floods: 2, Storms: 2, Tropical Storms: 2, Blizzard: 1, Heavy Rain: 1, Ice Storm: 1, Snowfall: 1 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers in Laurel:

Airports and heliports located in Laurel:

- Suburban Airport (W18) (Runways: 1, Itinerant Ops: 10, Local Ops: 1,500)

- Citizens Bank Headquarters Heliport (MD37)

- Greater Laurel Beltsville Hospital Heliport (0MD5)

Amtrak stations near Laurel:

- 11 miles: NEW CARROLLTON (4300 GARDEN CITY DR.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, snack bar, ATM, paid short-term parking, paid long-term parking, call for car rental service, taxi stand, public transit connection.

- 11 miles: BWI AIRPORT RAIL STATION (BALTIMORE, AMTRAK WAY) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, snack bar, ATM, paid short-term parking, paid long-term parking, call for car rental service, call for taxi service, public transit connection.

- 16 miles: ROCKVILLE (HUNGERFORD DR. & PARK ST.) . Services: partially wheelchair accessible, public payphones, paid short-term parking, paid long-term parking, call for taxi service, public transit connection.

Colleges/Universities in Laurel:

- Capitol College (Full-time enrollment: 701; Location: 11301 Springfield Rd; Private, not-for-profit; Website: www.capitol-college.edu; Offers Doctor's degree)

- Maryland University of Integrative Health (Full-time enrollment: 583; Location: 7750 Montpelier Road; Private, not-for-profit; Website: WWW.muih.EDU; Offers Master's degree)

- Aspen Beauty Academy of Laurel (Full-time enrollment: 55; Location: 3535 Fort Meade Road; Private, for-profit; Website: www.aspenlaurel.com)

Colleges/universities with over 2000 students nearest to Laurel:

- Bowie State University (about 8 miles; Bowie, MD; Full-time enrollment: 4,517)

- Howard Community College (about 8 miles; Columbia, MD; FT enrollment: 6,528)

- University of Maryland-College Park (about 9 miles; College Park, MD; FT enrollment: 32,734)

- University of Maryland-University College (about 10 miles; Adelphi, MD; FT enrollment: 25,040)

- University of Maryland-Baltimore County (about 14 miles; Baltimore, MD; FT enrollment: 11,160)

- Catholic University of America (about 14 miles; Washington, DC; FT enrollment: 5,365)

- Prince George's Community College (about 15 miles; Largo, MD; FT enrollment: 8,537)

Public high schools in Laurel:

- MAYA ANGELOU ACADEMY AT NEW BEGINNINGS FORMERLY OA (Location: 3201 OAK HILL DR, Grades: 9-12)

- LAUREL HIGH (Location: 8000 CHERRY LN, Grades: 9-12)

- CHESAPEAKE MATH AND IT PUBLIC CHARTER (Location: 6100 FROST PL, Grades: 6-10, Charter school)

Private high schools in Laurel:

- ST VINCENT PALLOTTI HIGH SCHOOL (Students: 454, Location: 113 SAINT MARYS PL, Grades: 9-12)

- PHILLIPS SCHOOL - LAUREL (Students: 75, Location: 8920 WHISKEY BOTTOM RD, Grades: 3-12)

- HIGH ROAD ACADEMY (Students: 71, Location: 9705 WASHINGTON BLVD N, Grades: 4-11)

Biggest public elementary/middle schools in Laurel:

- BROCK BRIDGE ELEMENTARY (Location: 405 BROCK BRIDGE RD, Grades: PK-5)

- MARYLAND CITY ELEMENTARY (Location: 3359 CRUMPTON S, Grades: PK-5)

- MONARCH GLOBAL ACADEMY PCS LAUREL CAMPUS (Location: 430 BROCK BRIDGE ROAD, Grades: KG-5)

- FOREST RIDGE ELEMENTARY (Location: 9550 GORMAN RD, Grades: KG-5)

- HAMMOND ELEMENTARY (Location: 8110 ALADDIN DR, Grades: KG-5)

- HAMMOND MIDDLE SCHOOL (Location: 8100 ALADDIN DR, Grades: 6-8)

- LAUREL WOODS ELEMENTARY (Location: 9250 N LAUREL RD, Grades: PK-5)

- MURRAY HILL MIDDLE (Location: 9989 WINTER SUN RD, Grades: 6-8)

- GORMAN CROSSING ELEMENTARY (Location: 9999 WINTER SUN RD, Grades: PK-5)

- SCOTCHTOWN HILLS ELEMENTARY (Location: 15950 DORSET RD, Grades: PK-6)

Private elementary/middle schools in Laurel:

- ST MARY OF THE MILLS SCHOOL (Students: 427, Location: 106 SAINT MARYS PL, Grades: KG-8)

- FIRST BAPTIST SCHOOL OF LAUREL (Students: 178, Location: 15002 FIRST BAPTIST LN, Grades: PK-8)

- FAITH BAPTIST CHRISTIAN SCHOOL (Students: 157, Location: 12700 CLAXTON DR, Grades: PK-8)

- JULIA BROWN MONTESSORI SCHOOLS (Students: 87, Location: 9450 MADISON AVE, Grades: PK-3)

Points of interest:

Notable locations in Laurel: Patuxant Greens Country Club (A), Laurel Pines Country Club (B), Prince Georges County Fire / EMS Department Company 810 Laurel Volunteer Fire Department (C), Laurel Police Department (D), Laurel Branch Library (E), Laurel Municipal Center (F), Laurel Branch Prince George's County Memorial Library (G). Display/hide their locations on the map

Shopping Centers: Gorman Shopping Center (1), Laurel Shopping Center (2), Laurel Lakes Shopping Center (3), Laurel Centre Mall Shopping Center (4). Display/hide their locations on the map

Churches in Laurel include: Church of Christ (A), First Baptist Church of Laurel (B), First United Methodist Church (C), Glad Tidings Tabernacle (D), Holy Trinity Lutheran Church (E), Laurel Presbyterian Church (F), Oaklands United Presbyterian Church (G), Saint Marks United Methodist Church (H), Saint Mary of the Mills Roman Catholic Church (I). Display/hide their locations on the map

Cemeteries: Saint Philips Cemetery (1), Saint Mary of the Mill Cemetery (2), Ivy Hill Cemetery (3). Display/hide their locations on the map

Lake: Laurel Lake (A). Display/hide its location on the map

Streams, rivers, and creeks: Bear Branch (A). Display/hide its location on the map

Tourist attractions: Laurel Historical Society (Museums; 817 Main Street), Patuxent Wildlife Research Center - Migratory Bird Management Office US Fish and Wildli- Lib (Cultural Attractions- Events- & Facilities; 12100 Beech Forest Road), Howard County Libraries - Savage Branch- Childrens Services (Cultural Attractions- Events- & Facilities; 9525 Durness Lane), Howard County Libraries - Savage Branch- Information Desk (Cultural Attractions- Events- & Facilities; 9525 Durness Lane), Howard County - Libraries- Savage-Laurel Branch (Cultural Attractions- Events- & Facilities; 9525 Durness Lane), Delta Bingo (Amusement & Theme Parks; 3605 Fort Meade Road), XP Lasersport (Amusement & Theme Parks; 14705 Baltimore Avenue Suite A), Delta Daily Double Bingo (Amusement & Theme Parks; 3605 Laurel Fort Meade Road), Royal Flush Amusements (Amusement & Theme Parks; 9435 Washington Boulevard North).

Hotels: Ramada Inn Laurel (3400 Laurel Fort Meade Road), Comfort Inn (8828 Baltimore Washington), Quality Inn & Suites (1 Second Street), Best Western-Maryland Inn (15101 SWeitzer Lane), Ramada Inn Laurel MD (3400 Fort Meade Road), Fairfield Inn by Marriott (13700 Baltimore Avenue), Red Roof Inns - Laurel (12525 Laurel Bowie Road), Budget Host Valencia Motel & Efficiencies (10131 Washington Boulevard North), Dollar Inn (12663 Laurel Bowie Road).

Court: Prince Georges County School District - Montpelier Elementary School (9200 Muirkirk Road).

Birthplace of: Andrew Maynard (boxer) - Boxer, Brian Larsen - Singer-songwriter, Karl G. Taylor, Sr. - Marine Corps Medal of Honor recipient, Visanthe Shiancoe - 2005 NFL player (New York Giants, born: Jun 18, 1980), Bill Green (athlete) - Hammer thrower, Constance Cepko - Developmental biologist, Ed Hodgkiss - Football player and coach, Emen Ifon - College football player (Maryland Terrapins), Jim Brown (outfielder) - Baseball player, John Lillibridge - Football player and coach.

Drinking water stations with addresses in Laurel and their reported violations in the past:

FORT GEORGE G. MEADE (Address: 3220 LAUREL FT MEADE RD/RT 198 , Population served: 49,000, Groundwater):Past monitoring violations:WILLOW SPRINGS GOLF COURSE (Address: 14401 SWEITZER LANE, STE. 200 , Population served: 180, Groundwater):

- One routine major monitoring violation

- 12 regular monitoring violations

Past health violations:COLONIAL MOBILE HOME PARK (Serves FL, Population served: 115, Groundwater):

- MCL, Monthly (TCR) - In AUG-2011, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (AUG-11-2011), St Compliance achieved (MAR-12-2012)

- MCL, Monthly (TCR) - In JUL-2010, Contaminant: Coliform. Follow-up actions: St Public Notif received (JUL-19-2010), St Violation/Reminder Notice (JUL-19-2010), St Tech Assistance Visit (AUG-24-2010), St Compliance achieved (AUG-31-2010)

Past monitoring violations:OURISMAN AUTOMOTIVE (Population served: 90, Groundwater):

- 2 minor monitoring violations

Past health violations:WELSHS TRAILER PARK (Population served: 50, Groundwater):Past monitoring violations:

- Public Education - In MAR-03-2009, Contaminant: Lead and Copper Rule. Follow-up actions: St Violation/Reminder Notice (MAR-24-2011)

- Follow-up Or Routine LCR Tap M/R - In JUL-01-2013, Contaminant: Lead and Copper Rule. Follow-up actions: St Violation/Reminder Notice (4 times from APR-12-2013 to APR-22-2014)

- Water Quality Parameter M/R - Between JUL-2008 and DEC-2008, Contaminant: Lead and Copper Rule. Follow-up actions: St Violation/Reminder Notice (2 times from FEB-02-2009 to MAR-24-2011), St Compliance achieved (NOV-26-2012)

- Initial Tap Sampling for Pb and Cu - In JAN-01-2006, Contaminant: Lead and Copper Rule. Follow-up actions: St Violation/Reminder Notice (8 times from APR-06-2006 to JUL-17-2008), St Compliance achieved (OCT-01-2008)

- 11 routine major monitoring violations

- 13 regular monitoring violations

Past monitoring violations:

- Follow-up Or Routine LCR Tap M/R - In JAN-01-2009, Contaminant: Lead and Copper Rule. Follow-up actions: St Compliance achieved (FEB-05-2009), St Public Notif received (JUN-30-2009)

- Follow-up Or Routine LCR Tap M/R - In JAN-01-2005, Contaminant: Lead and Copper Rule. Follow-up actions: St Violation/Reminder Notice (JUN-03-2005), St Compliance achieved (MAR-20-2007)

- Initial, Follow-up, or Routine Source Water M/R - In JAN-01-2003, Contaminant: Lead and Copper Rule. Follow-up actions: St Violation/Reminder Notice (9 times from MAR-11-2003 to FEB-25-2009), St Compliance achieved (JAN-22-2010)

- 4 routine major monitoring violations

| This city: | 2.4 people |

| Maryland: | 2.6 people |

| This city: | 54.2% |

| Whole state: | 67.1% |

| This city: | 7.0% |

| Whole state: | 6.4% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.5% of all households

- Gay men: 0.3% of all households

People in group quarters in Laurel in 2010:

- 132 people in college/university student housing

- 29 people in other noninstitutional facilities

- 17 people in residential treatment centers for adults

- 5 people in group homes intended for adults

People in group quarters in Laurel in 2000:

- 106 people in other noninstitutional group quarters

- 24 people in homes or halfway houses for drug/alcohol abuse

- 16 people in homes for the mentally retarded

- 8 people in other nonhousehold living situations

Banks with most branches in Laurel (2011 data):

- PNC Bank, National Association: Laurel Center Branch, Van Dusen Branch, Russett Center Branch, Laurel Branch. Info updated 2012/03/20: Bank assets: $263,309.6 mil, Deposits: $197,343.0 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 3085 total offices, Holding Company: Pnc Financial Services Group, Inc., The

- Capital One, National Association: Corridor Marketplace Branch, Contee Road/Laurel Branch, Savage Shopping Center Branch, Laurel Shopping Center Branch. Info updated 2011/07/01: Bank assets: $133,477.8 mil, Deposits: $97,063.7 mil, headquarters in Mclean, VA, positive income, 984 total offices, Holding Company: Capital One Financial Corporation

- Branch Banking and Trust Company: Maple Lawn Branch at 10990 Johns Hopkins Road, branch established on 2009/01/26; Laurel Branch at 380 Main Street, branch established on 1986/06/30. Info updated 2010/03/29: Bank assets: $168,867.6 mil, Deposits: $127,549.5 mil, headquarters in Winston Salem, NC, positive income, Commercial Lending Specialization, 1793 total offices, Holding Company: Bb&T Corporation

- Manufacturers and Traders Trust Company: Laurel Branch at 207 Bowie Road, branch established on 1996/12/01; Laurel Lakes Branch at 14060 Baltimore Boulevard, branch established on 1986/01/09. Info updated 2011/08/08: Bank assets: $76,887.1 mil, Deposits: $60,064.2 mil, headquarters in Buffalo, NY, positive income, Commercial Lending Specialization, 808 total offices, Holding Company: M&T Bank Corporation

- Bank of America, National Association: Laurel Center Branch at 344 Montrose Avenue, branch established on 1956/11/14; Laurel Center Ii Branch at 8601 Oak Street, branch established on 1999/08/01. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- Sandy Spring Bank: Fulton Branch at 8315 Ice Crystal Drive, branch established on 2005/06/27; Laurel Lakes Community Branch at 14404 Baltimore Avenue, branch established on 1997/08/18. Info updated 2007/07/17: Bank assets: $3,709.4 mil, Deposits: $2,664.0 mil, headquarters in Olney, MD, positive income, Commercial Lending Specialization, 43 total offices, Holding Company: Sandy Spring Bancorp, Inc.

- Woodforest National Bank: Laurel Maryland Banch at 3549 Russett Green, branch established on 2010/06/14. Info updated 2011/05/10: Bank assets: $3,488.9 mil, Deposits: $3,097.6 mil, headquarters in Houston, TX, positive income, Commercial Lending Specialization, 766 total offices, Holding Company: Woodforest Financial Group Employee Stock Ownership Plan (With 401(K) Provisions)

- TD Bank, National Association: Laurel Branch at 14401 Baltimore Ave, branch established on 2008/11/08. Info updated 2010/10/04: Bank assets: $188,912.6 mil, Deposits: $153,149.8 mil, headquarters in Wilmington, DE, positive income, 1314 total offices, Holding Company: Toronto-Dominion Bank, The

- Wells Fargo Bank, National Association: Laurel Branch at 14817 Baltimore Boulevard, branch established on 1995/07/10. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- 4 other banks with 4 local branches

For population 15 years and over in Laurel:

- Never married: 39.7%

- Now married: 43.1%

- Separated: 3.0%

- Widowed: 3.5%

- Divorced: 10.7%

For population 25 years and over in Laurel:

- High school or higher: 88.4%

- Bachelor's degree or higher: 45.4%

- Graduate or professional degree: 23.3%

- Unemployed: 3.4%

- Mean travel time to work (commute): 27.1 minutes

| Here: | 14.2 |

| Maryland average: | 12.7 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Laurel, MD (based on Prince George's County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 179,374 | 430 |

| Catholic | 83,959 | 35 |

| Mainline Protestant | 51,153 | 156 |

| Black Protestant | 48,984 | 66 |

| Other | 28,743 | 57 |

| Orthodox | 1,218 | 6 |

| None | 469,989 | - |

Food Environment Statistics:

| Prince George's County: | 1.70 / 10,000 pop. |

| Maryland: | 1.96 / 10,000 pop. |

| Prince George's County: | 0.02 / 10,000 pop. |

| Maryland: | 0.07 / 10,000 pop. |

| This county: | 1.60 / 10,000 pop. |

| State: | 1.22 / 10,000 pop. |

| This county: | 1.66 / 10,000 pop. |

| State: | 2.05 / 10,000 pop. |

| Prince George's County: | 3.24 / 10,000 pop. |

| Maryland: | 5.40 / 10,000 pop. |

| This county: | 10.5% |

| Maryland: | 9.1% |

| Here: | 30.7% |

| Maryland: | 26.7% |

| Prince George's County: | 16.7% |

| State: | 15.5% |

Health and Nutrition:

| Laurel: | 49.6% |

| State: | 50.1% |

| Laurel: | 48.2% |

| Maryland: | 47.6% |

| Here: | 28.8 |

| State: | 28.8 |

| Laurel: | 19.3% |

| Maryland: | 20.0% |

| This city: | 11.6% |

| Maryland: | 11.3% |

| Laurel: | 6.7 |

| State: | 6.8 |

| Laurel: | 32.9% |

| State: | 34.1% |

| Laurel: | 57.6% |

| Maryland: | 56.5% |

| Here: | 82.7% |

| Maryland: | 80.5% |

More about Health and Nutrition of Laurel, MD Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Police Protection - Officers | 87 | $518,506 | $71,518 | 0 | $0 |

| Other Government Administration | 30 | $135,629 | $54,252 | 0 | $0 |

| Parks and Recreation | 21 | $87,414 | $49,951 | 0 | $0 |

| Streets and Highways | 18 | $32,587 | $21,725 | 0 | $0 |

| Solid Waste Management | 18 | $32,587 | $21,725 | 0 | $0 |

| Other and Unallocable | 9 | $41,436 | $55,248 | 2 | $1,621 |

| Financial Administration | 9 | $38,815 | $51,753 | 0 | $0 |

| Totals for Government | 192 | $886,973 | $55,436 | 2 | $1,621 |

Laurel government finances - Expenditure in 2021 (per resident):

- Current Operations - General - Other: $11,550,000 ($393.50)

Police Protection: $9,849,000 ($335.55)

Regular Highways: $6,094,000 ($207.62)

Solid Waste Management: $2,106,000 ($71.75)

Financial Administration: $2,062,000 ($70.25)

Parks and Recreation: $1,512,000 ($51.51)

Protective Inspection and Regulation - Other: $1,189,000 ($40.51)

Local Fire Protection: $655,000 ($22.32)

Central Staff Services: $653,000 ($22.25)

General Public Buildings: $161,000 ($5.49)

Transit Utilities: $75,000 ($2.56)

- General - Interest on Debt: $199,000 ($6.78)

- Total Salaries and Wages: $16,256,000 ($553.83)

Laurel government finances - Revenue in 2021 (per resident):

- Charges - Parks and Recreation: $283,000 ($9.64)

Solid Waste Management: $235,000 ($8.01)

Other: $168,000 ($5.72)

- Local Intergovernmental - Other: $2,001,000 ($68.17)

General Local Government Support: $6,000 ($0.20)

Highways: $3,000 ($0.10)

- Miscellaneous - Fines and Forfeits: $3,394,000 ($115.63)

General Revenue - Other: $551,000 ($18.77)

Interest Earnings: $43,000 ($1.46)

Rents: $12,000 ($0.41)

- State Intergovernmental - Other: $1,045,000 ($35.60)

Highways: $873,000 ($29.74)

- Tax - Property: $24,103,000 ($821.17)

Individual Income: $4,264,000 ($145.27)

Other License: $801,000 ($27.29)

Public Utility License: $437,000 ($14.89)

Other Selective Sales: $178,000 ($6.06)

Amusements Sales: $56,000 ($1.91)

Occupation and Business License - Other: $53,000 ($1.81)

Alcoholic Beverage License: $31,000 ($1.06)

Amusements License: $17,000 ($0.58)

Laurel government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $4,981,000 ($169.70)

Outstanding Unspecified Public Purpose: $3,743,000 ($127.52)

Retired Unspecified Public Purpose: $3,341,000 ($113.83)

Issue, Unspecified Public Purpose: $2,103,000 ($71.65)

Laurel government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $964,000 ($32.84)

- Other Funds - Cash and Securities: $43,891,000 ($1495.33)

6.37% of this county's 2021 resident taxpayers lived in other counties in 2020 ($55,200 average adjusted gross income)

| Here: | 6.37% |

| Maryland average: | 7.42% |

0.04% of residents moved from foreign countries ($466 average AGI)

Prince George's County: 0.04% Maryland average: 0.05%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from District of Columbia, DC | |

| from Montgomery County, MD | |

| from Anne Arundel County, MD |

8.15% of this county's 2020 resident taxpayers moved to other counties in 2021 ($59,145 average adjusted gross income)

| Here: | 8.15% |

| Maryland average: | 7.91% |

0.05% of residents moved to foreign countries ($401 average AGI)

Prince George's County: 0.05% Maryland average: 0.04%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Montgomery County, MD | |

| to Anne Arundel County, MD | |

| to District of Columbia, DC |

| Businesses in Laurel, MD | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 7-Eleven | 6 | Marriott | 1 | |

| AMF Bowling | 1 | Marshalls | 1 | |

| AT&T | 1 | MasterBrand Cabinets | 8 | |

| Advance Auto Parts | 2 | Mazda | 1 | |

| Applebee's | 1 | McDonald's | 6 | |

| Arby's | 1 | Motel 6 | 1 | |

| AutoZone | 1 | Motherhood Maternity | 1 | |

| Avenue | 1 | New Balance | 2 | |

| Baskin-Robbins | 1 | Nike | 10 | |

| Blockbuster | 1 | Nissan | 1 | |

| Budget Car Rental | 1 | Office Depot | 1 | |

| Burlington Coat Factory | 1 | Old Country Buffet | 1 | |

| CVS | 3 | Olive Garden | 1 | |

| CarMax | 1 | Outback | 1 | |

| Chevrolet | 1 | Outback Steakhouse | 1 | |

| Chick-Fil-A | 3 | Panda Express | 1 | |

| Chipotle | 1 | Panera Bread | 1 | |

| Chuck E. Cheese's | 1 | Papa John's Pizza | 2 | |

| Circle K | 2 | Payless | 2 | |

| Cold Stone Creamery | 1 | Penske | 1 | |

| Comfort Suites | 1 | PetSmart | 1 | |

| Cricket Wireless | 3 | Pier 1 Imports | 1 | |

| DHL | 3 | Pizza Hut | 3 | |

| Days Inn | 1 | Popeyes | 2 | |

| Dennys | 1 | Quality | 1 | |

| Domino's Pizza | 2 | Quiznos | 1 | |

| DressBarn | 1 | RadioShack | 1 | |

| Dressbarn | 1 | Red Lobster | 1 | |

| Dunkin Donuts | 3 | Red Roof Inn | 1 | |

| Econo Lodge | 1 | Rite Aid | 1 | |

| Famous Footwear | 1 | Safeway | 1 | |

| FedEx | 18 | Sam's Club | 1 | |

| Ford | 1 | Sears | 1 | |

| GNC | 1 | Sleep Inn | 1 | |

| GameStop | 2 | Sprint Nextel | 1 | |

| Giant | 1 | Staples | 1 | |

| H&R Block | 4 | Starbucks | 4 | |

| Hobby Lobby | 1 | Subway | 8 | |

| Holiday Inn | 1 | Super 8 | 1 | |

| Home Depot | 1 | T-Mobile | 2 | |

| Honda | 1 | T.G.I. Driday's | 1 | |

| Hyundai | 1 | Taco Bell | 1 | |

| IHOP | 1 | Target | 1 | |

| Jones New York | 1 | The Room Place | 1 | |

| KFC | 1 | U-Haul | 2 | |

| Knights Inn | 1 | UPS | 14 | |

| Kohl's | 1 | Verizon Wireless | 2 | |

| LA Fitness | 1 | Volkswagen | 1 | |

| Little Caesars Pizza | 1 | Vons | 1 | |

| Lowe's | 1 | Walmart | 1 | |

| Macy's | 1 | Wendy's | 3 | |

Strongest AM radio stations in Laurel:

- WILC (900 AM; 2 kW; LAUREL, MD; Owner: ILC CORPORATION)

- WTEM (980 AM; 50 kW; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WTOP (1500 AM; 50 kW; WASHINGTON, DC; Owner: BONNEVILLE HOLDING COMPANY)

- WCBM (680 AM; 50 kW; BALTIMORE, MD; Owner: WCBM MARYLAND, INC.)

- WPGC (1580 AM; 50 kW; MORNINGSIDE, MD; Owner: INFINITY WPGC(AM), INC.)

- WBAL (1090 AM; 50 kW; BALTIMORE, MD; Owner: HEARST RADIO, INC.)

- WMET (1150 AM; 50 kW; GAITHERSBURG, MD; Owner: BELTWAY ACQUISITION CORPORATION)

- WGOP (700 AM; daytime; 25 kW; WALKERSVILLE, MD; Owner: BIRACH BROADCASTING CORPORATION)

- WBIS (1190 AM; 50 kW; ANNAPOLIS, MD; Owner: NATIONS RADIO, LLC)

- WWLG (1370 AM; 50 kW; BALTIMORE, MD; Owner: M-10 BROADCASTING, INC.)

- WUST (1120 AM; daytime; 20 kW; WASHINGTON, DC)

- WWGB (1030 AM; daytime; 50 kW; INDIAN HEAD, MD; Owner: GOOD BODY MEDIA, LLC)

- WMAL (630 AM; 5 kW; WASHINGTON, DC; Owner: WMAL, INC.)

Strongest FM radio stations in Laurel:

- WWDC-FM (101.1 FM; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WPOC (93.1 FM; BALTIMORE, MD; Owner: CITICASTERS LICENSES, L.P.)

- WWMX (106.5 FM; BALTIMORE, MD; Owner: INFINITY RADIO OPERATIONS INC.)

- WRQX (107.3 FM; WASHINGTON, DC; Owner: WMAL, INC.)

- WASH (97.1 FM; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WHUR-FM (96.3 FM; WASHINGTON, DC; Owner: THE HOWARD UNIVERSITY)

- WBIG-FM (100.3 FM; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WARW (94.7 FM; BETHESDA, MD; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WCSP-FM (90.1 FM; WASHINGTON, DC; Owner: NATIONAL CABLE SATELLITE CORPORATION)

- WIHT (99.5 FM; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WIYY (97.9 FM; BALTIMORE, MD; Owner: HEARST RADIO, INC.)

- WKYS (93.9 FM; WASHINGTON, DC; Owner: RADIO ONE LICENSES, LLC)

- WFSI (107.9 FM; ANNAPOLIS, MD; Owner: FAMILY STATIONS, INC.)

- WRBS (95.1 FM; BALTIMORE, MD; Owner: PETER & JOHN RADIO FELLOWSHIP, INC.)

- WPGC-FM (95.5 FM; MORNINGSIDE, MD; Owner: INFINITY BROADCASTING CORPORATION OF MARYLAND)

- WGMS-FM (103.5 FM; WASHINGTON, DC; Owner: BONNEVILLE HOLDING COMPANY)

- WZBA (100.7 FM; WESTMINSTER, MD; Owner: SHAMROCK COMMUNICATIONS, INC.)

- WHFS (99.1 FM; ANNAPOLIS, MD; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WLIF (101.9 FM; BALTIMORE, MD; Owner: INFINITY WLIF, INC.)

- WAMU (88.5 FM; WASHINGTON, DC; Owner: THE EXEC. COMM. OF THE BD. OF TRUSTEES OF AMERICAN UNIV.)

TV broadcast stations around Laurel:

- WUTB (Channel 24; BALTIMORE, MD; Owner: FOX TELEVISION STATIONS, INC.)

- WMPT (Channel 22; ANNAPOLIS, MD; Owner: MARYLAND PUBLIC BROADCASTING COMMISSION)

- WBDC-TV (Channel 50; WASHINGTON, DC; Owner: WBDC BROADCASTING, INC.)

- WBAL-TV (Channel 11; BALTIMORE, MD; Owner: WBAL HEARST-ARGYLE TV, INC. (CA CORP.))

- WMAR-TV (Channel 2; BALTIMORE, MD; Owner: SCRIPPS HOWARD BROADCASTING COMPANY)

- WBFF (Channel 45; BALTIMORE, MD; Owner: CHESAPEAKE TELEVISION LICENSEE, LLC)

- WNUV (Channel 54; BALTIMORE, MD; Owner: BALTIMORE (WNUV-TV) LICENSEE, INC.)

- WTTG (Channel 5; WASHINGTON, DC; Owner: FOX TELEVISION STATIONS, INC.)

- WJLA-TV (Channel 7; WASHINGTON, DC; Owner: ACC LICENSEE, INC.)

- WUSA (Channel 9; WASHINGTON, DC; Owner: THE DETROIT NEWS, INC.)

- WETA-TV (Channel 26; WASHINGTON, DC; Owner: THE GREATER WASHINGTON ED TELECOMM. ASSOC)

- WHUT-TV (Channel 32; WASHINGTON, DC; Owner: HOWARD UNIVERSITY)

- WJZ-TV (Channel 13; BALTIMORE, MD; Owner: VIACOM INC.)

- WDCA (Channel 20; WASHINGTON, DC; Owner: FOX TELEVISION STATIONS, INC.)

- WRC-TV (Channel 4; WASHINGTON, DC; Owner: NBC SUBSIDIARY (WRC-TV), INC.)

- WMPB (Channel 67; BALTIMORE, MD; Owner: MARYLAND PUBLIC BROADCASTING COMMISSION)

- WZDC-LP (Channel 64; WASHINGTON, DC; Owner: ONDA CAPITAL, INC.)

- W28BY (Channel 63; BALTIMORE, MD; Owner: INFORMATION SUPER STATION, L.L.C.)

- WNVC (Channel 56; FAIRFAX, VA; Owner: COMMONWEALTH PUBLIC BROADCASTING CORPORATION)

- W63BP (Channel 63; ANNAPOLIS, MD; Owner: ANNAPOLIS BROADCASTING COMPANY, INC.)

- WMDO-CA (Channel 30; WASHINGTON, DC; Owner: ENTRAVISION HOLDINGS, LLC)

- W61BY (Channel 61; ANNAPOLIS, MD; Owner: ANNAPOLIS BROADCASTING COMPANY, INC.)

- WIAV-LP (Channel 58; WASHINGTON, DC; Owner: ASIAVISION, INC.)

- WFPT (Channel 62; FREDERICK, MD; Owner: MARYLAND PUBLIC BROADCASTING COMMISSION)

- WKRP-LP (Channel 42; WASHINGTON, DC; Owner: CAPITAL MEDIA, LLC)

Medal of Honor Recipients

Medal of Honor Recipients born in Laurel: Horace, Jr. Capron, Karl G., Sr. Taylor.

- National Bridge Inventory (NBI) Statistics

- 21Number of bridges

- 289ft / 88.3mTotal length

- $3,132,000Total costs

- 472,088Total average daily traffic

- 22,520Total average daily truck traffic

- New bridges - historical statistics

- 11920-1929

- 11940-1949

- 31950-1959

- 31960-1969

- 81970-1979

- 31980-1989

- 21990-1999

FCC Registered Antenna Towers: 161 (See the full list of FCC Registered Antenna Towers)

FCC Registered Commercial Land Mobile Towers: 1 (See the full list of FCC Registered Commercial Land Mobile Towers in Laurel, MD)

FCC Registered Private Land Mobile Towers: 7 (See the full list of FCC Registered Private Land Mobile Towers)

FCC Registered Broadcast Land Mobile Towers: 39 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 72 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 9 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 2 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 453 (See the full list of FCC Registered Amateur Radio Licenses in Laurel)

FAA Registered Aircraft: 30 (See the full list of FAA Registered Aircraft in Laurel)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 2 full and 5 partial tracts) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 134 | $241,953 | 51 | $234,695 | 285 | $224,475 | 13 | $74,004 | 1 | $6,000,000 | 14 | $205,439 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 10 | $211,557 | 5 | $252,054 | 34 | $222,359 | 5 | $18,316 | 0 | $0 | 5 | $177,660 |

| APPLICATIONS DENIED | 28 | $250,094 | 9 | $170,852 | 168 | $255,208 | 15 | $43,214 | 0 | $0 | 17 | $135,142 |

| APPLICATIONS WITHDRAWN | 34 | $227,583 | 12 | $257,742 | 106 | $239,244 | 1 | $21,230 | 0 | $0 | 4 | $111,852 |

| FILES CLOSED FOR INCOMPLETENESS | 5 | $175,256 | 1 | $274,480 | 31 | $231,381 | 1 | $143,650 | 0 | $0 | 4 | $208,540 |

Detailed HMDA statistics for the following Tracts: 8001.02 , 8001.03, 8001.05, 8001.06, 8001.07, 8002.02, 8002.11

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 2 full and 5 partial tracts) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 9 | $229,341 | 4 | $297,490 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 3 | $341,190 | 7 | $279,063 |

| APPLICATIONS DENIED | 1 | $368,910 | 2 | $219,290 |

| APPLICATIONS WITHDRAWN | 1 | $225,600 | 2 | $343,465 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 8001.02 , 8001.03, 8001.05, 8001.06, 8001.07, 8002.02, 8002.11

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Laurel, MD

- 1,50453.1%Structure Fires

- 70825.0%Outside Fires

- 44115.6%Mobile Property/Vehicle Fires

- 1826.4%Other

Based on the data from the years 2002 - 2018 the average number of fire incidents per year is 167. The highest number of fires - 275 took place in 2012, and the least - 85 in 2003. The data has a rising trend.

Based on the data from the years 2002 - 2018 the average number of fire incidents per year is 167. The highest number of fires - 275 took place in 2012, and the least - 85 in 2003. The data has a rising trend. When looking into fire subcategories, the most incidents belonged to: Structure Fires (53.1%), and Outside Fires (25.0%).

When looking into fire subcategories, the most incidents belonged to: Structure Fires (53.1%), and Outside Fires (25.0%).Fire-safe hotels and motels in Laurel, Maryland:

- DoubleTree by Hilton Laurel, 15101 Sweitzer Ln, Laurel, Maryland 20707 , Phone: (301) 776-5300, Fax: (301) 604-3667

- Ramada Inn Laurel, 3400 Ft Meade Rd, Laurel, Maryland 20724 , Phone: (301) 498-0900, Fax: (301) 498-3203

- Red Roof Inn Laurel, 12525 Laurel Bowie Rd, Laurel, Maryland 20708 , Phone: (301) 498-8811, Fax: (301) 498-1490

- Valencia Motel & Efficiencies, 10131 Washington Blvd, Laurel, Maryland 20723 , Phone: (301) 725-4200, Fax: (410) 776-4249

- Knights Inn-laurel, 3380 Ft Meade Rd, Laurel, Maryland 20724 , Phone: (301) 498-5553, Fax: (301) 604-4225

- Fairfield Inn By Marriott Laurel, 13700 Baltimore Ave, Laurel, Maryland 20707 , Phone: (301) 498-8900, Fax: (301) 498-5721

- Oakwood Corp Housing, 8500 Smt Vw Rd, Laurel, Maryland 20724 , Phone: (877) 969-8953, Fax: (410) 609-2019

- Hampton Inn Laurel, 7900 Braygreen Rd, Laurel, Maryland 20707 , Phone: (240) 456-0234, Fax: (240) 456-0504

- 5 other hotels and motels

| Most common first names in Laurel, MD among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| John | 214 | 72.7 years |

| Mary | 202 | 77.1 years |

| James | 195 | 71.1 years |

| William | 177 | 72.8 years |

| Robert | 153 | 68.5 years |

| Charles | 109 | 72.9 years |

| Margaret | 97 | 77.9 years |

| George | 84 | 72.1 years |

| Dorothy | 78 | 79.2 years |

| Helen | 76 | 81.6 years |

| Most common last names in Laurel, MD among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 71 | 72.6 years |

| Brown | 46 | 73.5 years |

| Johnson | 44 | 67.7 years |

| Jones | 42 | 73.2 years |

| Williams | 38 | 72.3 years |

| Davis | 34 | 70.7 years |

| Miller | 30 | 73.8 years |

| Thomas | 29 | 68.1 years |

| Merson | 24 | 78.2 years |

| Baker | 24 | 69.9 years |

- 59.3%Electricity

- 38.4%Utility gas

- 1.0%Bottled, tank, or LP gas

- 0.7%Fuel oil, kerosene, etc.

- 0.4%Solar energy

- 0.3%No fuel used

- 70.8%Electricity

- 25.7%Utility gas

- 1.5%No fuel used

- 1.1%Fuel oil, kerosene, etc.

- 0.6%Bottled, tank, or LP gas

- 0.2%Other fuel

Laurel compared to Maryland state average:

- Unemployed percentage significantly below state average.

- Black race population percentage above state average.

- Hispanic race population percentage above state average.

- Foreign-born population percentage significantly above state average.

- Renting percentage above state average.

- Number of rooms per house below state average.

- Number of college students above state average.

Laurel on our top lists:

- #26 on the list of "Top 101 cities with the most residents born in Nigeria (population 500+)"

- #48 on the list of "Top 101 cities with the smallest racial income disparities between White and Black householders (with at least 2,000 householders)"

- #57 on the list of "Top 101 cities with the most residents born in Middle Africa (population 500+)"

- #63 on the list of "Top 101 cities with the most residents born in Western Africa (population 500+)"

- #78 on the list of "Top 101 cities with the most residents born in Africa (population 500+)"

- #93 on the list of "Top 101 cities with the most residents born in Other Eastern Asia (population 500+)"

- #5 on the list of "Top 101 counties with highest percentage of residents voting for Obama (Democrat) in the 2012 Presidential Election"

- #12 on the list of "Top 101 counties with the highest number of infant deaths per 1000 residents 2007-2013 (pop. 50,000+)"

- #13 on the list of "Top 101 counties with the highest average weight of females"

- #14 on the list of "Top 101 counties with the highest Nitrogen Dioxide air pollution readings in 2012 (ppm)"

- #14 on the list of "Top 101 counties with the most Black Protestant adherents"

|

|

Total of 649 patent applications in 2008-2024.