Morristown, Tennessee

Morristown: A Morristown morning

Morristown: Yellow Fellow

Morristown: Morristown Barn

Morristown: Home in West Morristown

Morristown: Hamblen County Courthouse

Morristown: Morristown Skyline

Morristown: West morristown morning view!

Morristown: Meadowview Middle School in Morristown, TN

Morristown: A smokey morning

Morristown: This is my house. This is my hunting grounds.

Morristown: West Mooristown Tn. Goodwill store , next to kmart

- see

19

more - add

your

Submit your own pictures of this city and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +25.9%

| Males: 15,386 | |

| Females: 16,039 |

| Median resident age: | 36.9 years |

| Tennessee median age: | 39.2 years |

Zip codes: 37813, 37814, 37860.

Morristown Zip Code Map| Morristown: | $47,322 |

| TN: | $65,254 |

Estimated per capita income in 2022: $29,346 (it was $15,894 in 2000)

Morristown city income, earnings, and wages data

Estimated median house or condo value in 2022: $167,603 (it was $70,000 in 2000)

| Morristown: | $167,603 |

| TN: | $284,800 |

Mean prices in 2022: all housing units: $255,886; detached houses: $256,172; townhouses or other attached units: over $1,000,000; in 2-unit structures: $187,985; in 3-to-4-unit structures: $234,984; in 5-or-more-unit structures: $175,329; mobile homes: $75,410

Median gross rent in 2022: $733.

(18.2% for White Non-Hispanic residents, 43.1% for Black residents, 45.5% for Hispanic or Latino residents, 49.0% for American Indian residents, 40.4% for Native Hawaiian and other Pacific Islander residents, 63.5% for other race residents, 26.0% for two or more races residents)

Detailed information about poverty and poor residents in Morristown, TN

- 20,89167.1%White alone

- 6,56521.1%Hispanic

- 1,7765.7%Black alone

- 1,4864.8%Two or more races

- 3891.2%Asian alone

- 3271.1%Native Hawaiian and Other

Pacific Islander alone - 1290.4%Other race alone

- 770.2%American Indian alone

Races in Morristown detailed stats: ancestries, foreign born residents, place of birth

According to our research of Tennessee and other state lists, there were 114 registered sex offenders living in Morristown, Tennessee as of April 25, 2024.

The ratio of all residents to sex offenders in Morristown is 262 to 1.

Type |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Murders (per 100,000) | 1 (3.6) | 1 (3.4) | 1 (3.4) | 0 (0.0) | 2 (6.8) | 0 (0.0) | 0 (0.0) | 1 (3.4) | 2 (6.7) | 0 (0.0) | 2 (6.7) | 2 (6.6) | 1 (3.3) | 0 (0.0) |

| Rapes (per 100,000) | 18 (64.8) | 16 (54.9) | 13 (44.2) | 13 (43.9) | 11 (37.5) | 10 (34.0) | 14 (47.7) | 7 (23.7) | 14 (47.0) | 25 (83.7) | 17 (56.6) | 17 (56.1) | 16 (52.6) | 15 (48.4) |

| Robberies (per 100,000) | 35 (126.0) | 42 (144.1) | 35 (119.0) | 45 (151.9) | 25 (85.3) | 24 (81.6) | 15 (51.1) | 21 (71.0) | 23 (77.2) | 14 (46.8) | 19 (63.2) | 23 (75.8) | 19 (62.5) | 14 (45.2) |

| Assaults (per 100,000) | 160 (576.1) | 183 (628.1) | 146 (496.6) | 145 (489.6) | 120 (409.6) | 158 (537.4) | 189 (643.4) | 161 (544.4) | 186 (624.7) | 207 (692.7) | 219 (728.9) | 225 (741.8) | 192 (631.3) | 194 (626.0) |

| Burglaries (per 100,000) | 163 (586.9) | 179 (614.3) | 201 (683.7) | 191 (644.9) | 134 (457.3) | 169 (574.8) | 203 (691.0) | 208 (703.3) | 211 (708.7) | 166 (555.5) | 170 (565.8) | 180 (593.5) | 111 (365.0) | 132 (426.0) |

| Thefts (per 100,000) | 1,583 (5,699) | 1,841 (6,318) | 1,676 (5,701) | 1,531 (5,169) | 1,382 (4,717) | 1,242 (4,224) | 1,251 (4,258) | 1,048 (3,543) | 1,072 (3,600) | 1,133 (3,791) | 1,143 (3,804) | 1,001 (3,300) | 863 (2,838) | 851 (2,746) |

| Auto thefts (per 100,000) | 61 (219.6) | 81 (278.0) | 97 (329.9) | 85 (287.0) | 74 (252.6) | 63 (214.3) | 95 (323.4) | 111 (375.3) | 110 (369.4) | 95 (317.9) | 113 (376.1) | 115 (379.2) | 109 (358.4) | 158 (509.9) |

| Arson (per 100,000) | 5 (18.0) | 7 (24.0) | 4 (13.6) | 4 (13.5) | 5 (17.1) | 6 (20.4) | 5 (17.0) | 5 (16.9) | 6 (20.2) | 3 (10.0) | 1 (3.3) | 3 (9.9) | 2 (6.6) | 6 (19.4) |

| City-Data.com crime index | 498.7 | 537.6 | 479.5 | 453.5 | 392.1 | 385.5 | 426.7 | 376.9 | 422.3 | 435.5 | 445.2 | 433.0 | 361.4 | 357.9 |

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Crime rate in Morristown detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 81 (76 officers - 67 male; 9 female).

| Officers per 1,000 residents here: | 2.50 |

| Tennessee average: | 2.57 |

| Can you tell me about Morristown, Bean Station, etc? (3 replies) |

| Morristown? (1 reply) |

| Morristown water problems (3 replies) |

| Need help on locations to move (15 replies) |

| Tell me about Rutledge (8 replies) |

| Can someone tell me about the Rogersville area? (26 replies) |

Latest news from Morristown, TN collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: American (16.0%), English (5.7%), Irish (5.1%), Scottish (4.8%), German (4.7%), Scotch-Irish (1.8%).

Current Local Time: EST time zone

Incorporated in 1867

Elevation: 1350 feet

Land area: 20.9 square miles.

Population density: 1,504 people per square mile (low).

3,192 residents are foreign born (8.1% Latin America, 1.3% Asia).

| This city: | 10.3% |

| Tennessee: | 5.4% |

Median real estate property taxes paid for housing units with mortgages in 2022: $1,012 (0.5%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $796 (0.7%)

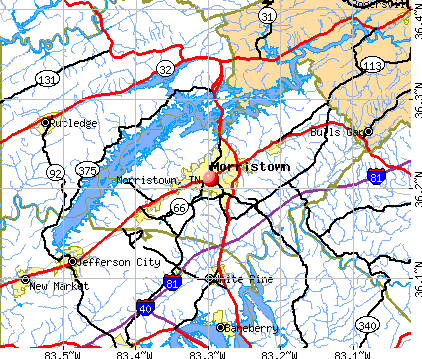

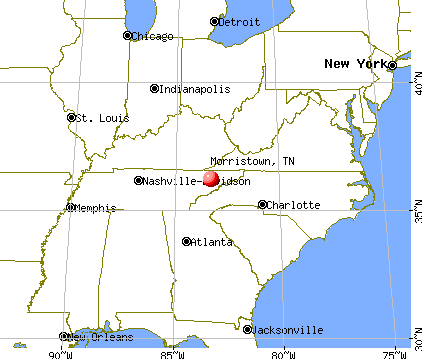

Nearest city with pop. 50,000+: Knoxville, TN (39.7 miles

, pop. 173,890).

Nearest city with pop. 200,000+: Fayette, KY (142.1 miles

, pop. 260,512).

Nearest city with pop. 1,000,000+: Chicago, IL (454.9 miles

, pop. 2,896,016).

Nearest cities:

Latitude: 36.21 N, Longitude: 83.30 W

Daytime population change due to commuting: +14,838 (+48.1%)

Workers who live and work in this city: 6,794 (52.3%)

Area code: 423

Morristown tourist attractions:

Morristown, Tennessee accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 219 buildings, average cost: $185,800

- 2021: 438 buildings, average cost: $114,800

- 2020: 151 buildings, average cost: $192,000

- 2019: 89 buildings, average cost: $149,900

- 2018: 102 buildings, average cost: $148,500

- 2017: 70 buildings, average cost: $150,400

- 2016: 41 buildings, average cost: $139,400

- 2015: 34 buildings, average cost: $191,700

- 2014: 28 buildings, average cost: $191,700

- 2013: 26 buildings, average cost: $185,900

- 2012: 36 buildings, average cost: $100,000

- 2011: 39 buildings, average cost: $97,200

- 2010: 41 buildings, average cost: $96,200

- 2009: 31 buildings, average cost: $101,900

- 2008: 78 buildings, average cost: $89,500

- 2007: 87 buildings, average cost: $131,900

- 2006: 90 buildings, average cost: $122,400

- 2005: 63 buildings, average cost: $137,400

- 2004: 54 buildings, average cost: $180,100

- 2003: 47 buildings, average cost: $137,800

- 2002: 34 buildings, average cost: $129,200

- 2001: 32 buildings, average cost: $102,600

- 2000: 50 buildings, average cost: $93,600

- 1999: 43 buildings, average cost: $97,600

- 1998: 59 buildings, average cost: $114,400

- 1997: 80 buildings, average cost: $89,500

| Here: | 3.5% |

| Tennessee: | 3.0% |

Population change in the 1990s: +2,177 (+9.6%).

- Furniture & related product manufacturing (10.8%)

- Accommodation & food services (7.3%)

- Health care (7.0%)

- Construction (5.6%)

- Transportation equipment (5.1%)

- Educational services (4.9%)

- Food (3.8%)

- Furniture & related product manufacturing (12.6%)

- Construction (9.2%)

- Transportation equipment (6.0%)

- Accommodation & food services (5.3%)

- Food (5.0%)

- Administrative & support & waste management services (3.8%)

- Health care (3.7%)

- Health care (11.3%)

- Accommodation & food services (10.0%)

- Educational services (8.7%)

- Furniture & related product manufacturing (8.5%)

- Food & beverage stores (4.9%)

- Miscellaneous manufacturing (4.6%)

- Department & other general merchandise stores (4.2%)

- Other production occupations, including supervisors (9.2%)

- Laborers and material movers, hand (6.1%)

- Assemblers and fabricators (5.1%)

- Metal workers and plastic workers (4.2%)

- Driver/sales workers and truck drivers (4.0%)

- Building and grounds cleaning and maintenance occupations (3.6%)

- Other sales and related occupations, including supervisors (3.0%)

- Laborers and material movers, hand (9.0%)

- Other production occupations, including supervisors (8.1%)

- Driver/sales workers and truck drivers (6.7%)

- Metal workers and plastic workers (5.6%)

- Assemblers and fabricators (5.2%)

- Building and grounds cleaning and maintenance occupations (4.0%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (3.9%)

- Other production occupations, including supervisors (10.7%)

- Cashiers (5.7%)

- Assemblers and fabricators (4.9%)

- Secretaries and administrative assistants (4.7%)

- Cooks and food preparation workers (4.5%)

- Preschool, kindergarten, elementary, and middle school teachers (3.6%)

- Nursing, psychiatric, and home health aides (3.5%)

Average climate in Morristown, Tennessee

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

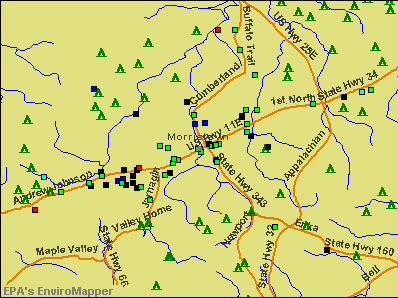

Air Quality Index (AQI) level in 2015 was 61.8. This is about average.

| City: | 61.8 |

| U.S.: | 72.6 |

Nitrogen Dioxide (NO2) [ppb] level in 2006 was 4.41. This is about average. Closest monitor was 2.7 miles away from the city center.

| City: | 4.41 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2007 was 4.34. This is significantly worse than average. Closest monitor was 2.7 miles away from the city center.

| City: | 4.34 |

| U.S.: | 1.51 |

Ozone [ppb] level in 2006 was 36.4. This is about average. Closest monitor was 11.3 miles away from the city center.

| City: | 36.4 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2015 was 26.0. This is worse than average. Closest monitor was 11.3 miles away from the city center.

| City: | 26.0 |

| U.S.: | 19.2 |

Tornado activity:

Morristown-area historical tornado activity is significantly below Tennessee state average. It is 60% smaller than the overall U.S. average.

On 5/9/1988, a category F3 (max. wind speeds 158-206 mph) tornado 33.4 miles away from the Morristown city center killed one person and injured 15 people and caused between $5,000,000 and $50,000,000 in damages.

On 2/21/1993, a category F3 tornado 38.4 miles away from the city center injured 3 people and caused between $500,000 and $5,000,000 in damages.

Earthquake activity:

Morristown-area historical earthquake activity is significantly above Tennessee state average. It is 54% greater than the overall U.S. average.On 7/27/1980 at 18:52:21, a magnitude 5.2 (5.1 MB, 4.7 MS, 5.0 UK, 5.2 UK, Class: Moderate, Intensity: VI - VII) earthquake occurred 142.5 miles away from Morristown center

On 8/9/2020 at 12:07:37, a magnitude 5.1 (5.1 MW, Depth: 4.7 mi) earthquake occurred 124.1 miles away from the city center

On 11/30/1973 at 07:48:41, a magnitude 4.7 (4.7 MB, 4.6 ML, Class: Light, Intensity: IV - V) earthquake occurred 46.9 miles away from Morristown center

On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi) earthquake occurred 318.3 miles away from the city center

On 8/2/1974 at 08:52:09, a magnitude 4.9 (4.3 MB, 4.9 LG) earthquake occurred 168.1 miles away from Morristown center

On 4/29/2003 at 08:59:39, a magnitude 4.9 (4.4 MB, 4.6 MW, 4.9 LG) earthquake occurred 177.2 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Hamblen County (9) is smaller than the US average (15).Major Disasters (Presidential) Declared: 5

Emergencies Declared: 2

Causes of natural disasters: Floods: 4, Heavy Rains: 2, Storms: 2, Tornadoes: 2, Winter Storms: 2, Flash Flood: 1, Hurricane: 1, Landslide: 1, Mudslide: 1, Snowfall: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Main business address for: JEFFERSON BANCSHARES INC (SAVINGS INSTITUTION, FEDERALLY CHARTERED).

Hospitals in Morristown:

- COVENANT HOMECARE HOSPICE (1530 WEST ANDREW JOHNSON HIGHWAY)

- LAKEWAY REGIONAL HOSPITAL (Proprietary, provides emergency services, 726 MCFARLAND ST)

- MORRISTOWN HAMBLEN HOSPITAL ASSOCIATION (Government - Local, 908 W 4TH NORTH ST)

Nursing Homes in Morristown:

Dialysis Facilities in Morristown:

Home Health Centers in Morristown:

Airports and heliports located in Morristown:

- Moore-Murrell Airport (MOR) (Runways: 1, Air Taxi Ops: 1,000, Itinerant Ops: 25,000, Local Ops: 23,000, Military Ops: 500)

- Lakeway Regional Hospital Heliport (72TN)

Colleges/Universities in Morristown:

Other colleges/universities with over 2000 students near Morristown:

- Tusculum College (about 30 miles; Greeneville, TN; Full-time enrollment: 2,070)

- Lincoln Memorial University (about 33 miles; Harrogate, TN; FT enrollment: 3,706)

- The University of Tennessee-Knoxville (about 40 miles; Knoxville, TN; FT enrollment: 25,483)

- Pellissippi State Community College (about 52 miles; Knoxville, TN; FT enrollment: 7,271)

- East Tennessee State University (about 53 miles; Johnson City, TN; FT enrollment: 12,774)

- Northeast State Community College (about 53 miles; Blountville, TN; FT enrollment: 4,480)

- Southeast Kentucky Community and Technical College (about 56 miles; Cumberland, KY; FT enrollment: 2,196)

Public high schools in Morristown:

- MORRISTOWN WEST HIGH (Students: 1,231, Location: ONE TROJAN TR, Grades: 9-12)

- MORRISTOWN EAST HIGH (Students: 1,208, Location: ONE HURRICANE LA, Grades: 9-12)

- HAMBLEN COUNTY ALTERNATIVE SCHOOL (Students: 7, Location: 376 SNYDER RD, Grades: KG-12)

Private high schools in Morristown:

- CORNERSTONE ACADEMY (Students: 157, Location: 260 JACOBS RD, Grades: KG-11)

- FAITH CHRISTIAN ACADEMY (Students: 56, Location: 1826 IVY LN, Grades: KG-12)

- MORRISTOWN COVENANT ACADEMY (Students: 51, Location: 503 S JACKSON ST, Grades: PK-12)

- LAKEWAY CHRISTIAN SCHOOL (Students: 33, Location: 415 CENTRAL CHURCH RD, Grades: 1-12)

Biggest public elementary/middle schools in Morristown:

- ALPHA ELEMENTARY (Students: 598, Location: 5620 OLD US 11E HW, Grades: KG-5)

- WEST VIEW MIDDLE SCHOOL (Students: 521, Location: 1 INDIAN PATH, Grades: 6-8)

- MEADOWVIEW MIDDLE SCHOOL (Students: 489, Location: 1623 MEADOWVIEW LN, Grades: 6-8)

- MANLEY ELEMENTARY (Students: 446, Location: 551 WEST ECONOMY RD, Grades: PK-5)

- HILLCREST ELEMENTARY (Students: 405, Location: 407 S LIBERTY HILL RD, Grades: KG-5)

- LINCOLN HEIGHTS MIDDLE SCHOOL (Students: 397, Location: 219 LINCOLN AV, Grades: 6-8)

- FAIRVIEW MARGUERITE (Students: 363, Location: 2125 FAIRVIEW RD, Grades: KG-5)

- WEST ELEMENTARY (Students: 323, Location: 235 W CONVERSE, Grades: KG-5)

- LINCOLN HEIGHTS ELEMENTARY (Students: 282, Location: 215 LINCOLN AV, Grades: PK-5)

- UNION HEIGHTS ELEMENTARY (Students: 233, Location: 3366 TORNADO TR, Grades: KG-5)

Private elementary/middle schools in Morristown:

Points of interest:

Notable locations in Morristown: The Country Club (A), New Line (B), West Hamblen County Volunteer Fire Department (C), Morristown Fire Department Station 2 (D), Morristown Fire Department Station 3 (E), Morristown Fire Department Station 4 (F), Morristown Fire Department Station 5 (G), Rose Center Historical Museum (H), Morristown City Hall (I), Hamblen County Courthouse (J), Morristown Fire Department (K), Morristown - Hamblen EMS (L). Display/hide their locations on the map

Shopping Centers: Western Willow Shopping Center (1), Sky City Shopping Center (2), Radio Center Shopping Center (3), Park Terrace Shopping Center (4), Northgate Shopping Center (5), Northfield Court Shopping Center (6), Morristown Plaza Shopping Center (7), Morristown Mall Shopping Center (8), Liberty Plaza Shopping Center (9). Display/hide their locations on the map

Main business address in Morristown: JEFFERSON BANCSHARES INC (A). Display/hide its location on the map

Churches in Morristown include: Fry Church (A), Liberty Hill Church (B), Rock of Ages Church (C), Alpha Church (D), Calvary Baptist Church (E), Cherokee Hills Baptist Church (F), First Baptist Church (G), Hillcrest Baptist Church (H), Montvue Baptist Church (I). Display/hide their locations on the map

Cemeteries: Martha Sunderland Cemetery (1), Morelock Cemetery (2). Display/hide their locations on the map

Creeks: West Fork Turkey Creek (A), West Fork Creek (B), Thompson Creek (C). Display/hide their locations on the map

Parks in Morristown include: Morristown College Historic District (1), Barron Park (2), Lon Price Park (3), Jaycee Park (4), Frank Lorino Park (5). Display/hide their locations on the map

Tourist attractions: Crockett Tavern Museum (2002 Morningside Drive) (1), Rose Center (Cultural Attractions- Events- & Facilities; 442 West 2nd North Street) (2), Hamblen County Boat Dock Inc (Tours & Charters; 3050 Cherokee Park Rd) (3). Display/hide their approximate locations on the map

Hotels: Days Inn Morristown (2512 East Andrew Johnson Highway) (1), Hampton Inn Morristown (3750 West Andrew Johnson Highway) (2), Economy Inn (1307 South Cumberland Street) (3), Holiday Inn Morristown Conference Center (I 81 & Highway 25 Exit East) (4), Days Inn (2512 East Andrew Johnson Highway) (5), Comfort Suites Morristown (3660 West Andrew Johnson Highway) (6). Display/hide their approximate locations on the map

Courts: Hamblen County Government - Circuit & Sessions Court Clerk (510 Allison Street) (1), Hamblen County Government - Juvenile Court Services (510 Allison Street) (2). Display/hide their approximate locations on the map

Birthplace of: Jane Wagner - Playwright, Tim Horner - Professional wrestler, Bob Neal (Atlanta sportscaster) - Radio personality, James Henry Mays - Politician, Frankie Pack - Baseball player.

Drinking water stations with addresses in Morristown and their reported violations in the past:

MORRISTOWN WATER SYSTEM (Population served: 34,417, Surface water):Past monitoring violations:WITT UTILITY DISTRICT (Population served: 4,995, Surface water):

- Record Keeping - In MAR-01-2012, Contaminant: IESWTR. Follow-up actions: St Public Notif requested (MAR-13-2013), St Violation/Reminder Notice (MAR-13-2013), St Public Notif received (JUN-15-2013)

- Monitoring and Reporting (DBP) - Between JUL-2011 and SEP-2011, Contaminant: Chlorine. Follow-up actions: St Public Notif requested (AUG-31-2011), St Violation/Reminder Notice (AUG-31-2011), St Compliance achieved (DEC-31-2011), St Public Notif received (MAY-09-2012)

- Single Turbidity Exceed (Enhanced SWTR) - In JUL-2005, Contaminant: IESWTR. Follow-up actions: St Compliance achieved (AUG-01-2005), St Boil Water Order (AUG-04-2005), St Public Notif requested (SEP-01-2005), St Violation/Reminder Notice (SEP-01-2005)

- One minor monitoring violation

Past monitoring violations:FASTRAX BP #2 (Population served: 100, Groundwater):

- Monitoring and Reporting (DBP) - Between JAN-2014 and MAR-2014, Contaminant: Total Haloacetic Acids (HAA5). Follow-up actions: St Compliance achieved (MAR-25-2014), St Public Notif requested (MAY-05-2014), St Violation/Reminder Notice (MAY-05-2014)

- Monitoring and Reporting (DBP) - Between JAN-2014 and MAR-2014, Contaminant: TTHM. Follow-up actions: St Compliance achieved (MAR-25-2014), St Public Notif requested (MAY-05-2014), St Violation/Reminder Notice (MAY-05-2014)

- Monitoring and Reporting (DBP) - Between OCT-2013 and DEC-2013, Contaminant: CARBON, TOTAL. Follow-up actions: St Public Notif requested (DEC-02-2013), St Violation/Reminder Notice (DEC-02-2013), St Compliance achieved (MAR-31-2014)

- Monitoring and Reporting (DBP) - Between OCT-2012 and DEC-2012, Contaminant: CARBON, TOTAL. Follow-up actions: St Public Notif requested (DEC-07-2012), St Violation/Reminder Notice (DEC-07-2012), St Public Notif requested (JAN-04-2013), St Violation/Reminder Notice (JAN-04-2013), St Compliance achieved (JUN-15-2013), St Public Notif received (JUN-15-2013)

- Monitoring and Reporting (DBP) - Between JAN-2012 and MAR-2012, Contaminant: CARBON, TOTAL. Follow-up actions: St Public Notif requested (MAR-02-2012), St Violation/Reminder Notice (MAR-02-2012), St Compliance achieved (MAR-31-2012)

- 2 minor monitoring violations

- 15 other older monitoring violations

Past monitoring violations:

- One routine major monitoring violation

Drinking water stations with addresses in Morristown that have no violations reported:

- HOLTS BAPTIST CHURCH (Population served: 150, Primary Water Source Type: Groundwater)

| This city: | 2.5 people |

| Tennessee: | 2.5 people |

| This city: | 63.8% |

| Whole state: | 67.3% |

| This city: | 6.0% |

| Whole state: | 5.8% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.2% of all households

- Gay men: 0.3% of all households

People in group quarters in Morristown in 2010:

- 487 people in nursing facilities/skilled-nursing facilities

- 276 people in local jails and other municipal confinement facilities

- 81 people in other noninstitutional facilities

- 42 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 17 people in group homes intended for adults

People in group quarters in Morristown in 2000:

- 475 people in nursing homes

- 178 people in local jails and other confinement facilities (including police lockups)

- 82 people in other noninstitutional group quarters

- 28 people in homes for the mentally retarded

- 16 people in college dormitories (includes college quarters off campus)

- 11 people in homes for the mentally ill

Banks with most branches in Morristown (2011 data):

- Jefferson Federal Bank: West Morris Branch, at 120 Evans Avenue, 123 Merchants Greene Branch, Stonewall Court Mortgage Branch, East Main Street Branch. Info updated 2008/12/04: Bank assets: $530.9 mil, Deposits: $432.6 mil, local headquarters, negative income in the last year, Commercial Lending Specialization, 13 total offices, Holding Company: Jefferson Bancshares, Inc.

- Regions Bank: East Side Branch, Colonial Loan Association Branch, Union Planters Bank Of The Lakeway A, Alpha-Talbott Branch. Info updated 2011/02/24: Bank assets: $123,368.2 mil, Deposits: $98,301.3 mil, headquarters in Birmingham, AL, positive income, Commercial Lending Specialization, 1778 total offices, Holding Company: Regions Financial Corporation

- SunTrust Bank: Colonial Square Branch, College Square Branch, Alpha Branch. Info updated 2010/05/27: Bank assets: $171,291.7 mil, Deposits: $129,833.2 mil, headquarters in Atlanta, GA, positive income, Commercial Lending Specialization, 1716 total offices, Holding Company: Suntrust Banks, Inc.

- Capital Bank, National Association: Morristown Plaza Branch, Morristown West Branch, Morristown College Square Branch. Info updated 2011/09/21: Bank assets: $6,448.0 mil, Deposits: $5,135.4 mil, headquarters in Miami, FL, positive income, Commercial Lending Specialization, 152 total offices, Holding Company: North American Financial Holdings, Inc.

- First Tennessee Bank, National Association: Morristown Branch, West Side Financial Center Branch, East Side Branch. Info updated 2009/09/08: Bank assets: $24,563.4 mil, Deposits: $16,402.1 mil, headquarters in Memphis, TN, positive income, Commercial Lending Specialization, 180 total offices, Holding Company: First Horizon National Corporation

- Community National Bank of the Lakeway Area: West Andrew Johnson Branch at 2640 West Andrew Johnson Highway, branch established on 2008/01/28; Community National Bank Of The Lakew at 225 West First North Street, branch established on 2003/04/09. Info updated 2006/05/02: Bank assets: $115.0 mil, Deposits: $90.3 mil, local headquarters, positive income, Commercial Lending Specialization, 3 total offices

- Citizens Bank: Morristown Branch at 2571 East Morris Boulevard, branch established on 2003/03/03. Info updated 2010/07/08: Bank assets: $152.6 mil, Deposits: $138.3 mil, headquarters in New Tazewell, TN, positive income, Commercial Lending Specialization, 6 total offices, Holding Company: Citizens Bancorp, Inc.

- Andrew Johnson Bank: Morristown Branch at 435 West First North Street, branch established on 1996/05/13. Info updated 2009/02/19: Bank assets: $267.9 mil, Deposits: $242.8 mil, headquarters in Greeneville, TN, positive income, Commercial Lending Specialization, 9 total offices, Holding Company: Andrew Johnson Bancshares, Inc.

- First Peoples Bank of Tennessee: Morristown East End Branch at 475 North Davy Crockett Parkway, branch established on 2001/07/18. Info updated 2006/11/03: Bank assets: $136.6 mil, Deposits: $116.4 mil, headquarters in Jefferson City, TN, positive income, Commercial Lending Specialization, 7 total offices, Holding Company: First Peoples Bancorp, Inc.

For population 15 years and over in Morristown:

- Never married: 27.7%

- Now married: 44.6%

- Separated: 1.4%

- Widowed: 8.9%

- Divorced: 17.5%

For population 25 years and over in Morristown:

- High school or higher: 82.5%

- Bachelor's degree or higher: 15.5%

- Graduate or professional degree: 5.8%

- Unemployed: 5.0%

- Mean travel time to work (commute): 22.8 minutes

| Here: | 12.4 |

| Tennessee average: | 11.4 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Morristown, TN (based on Hamblen County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Evangelical Protestant | 32,801 | 95 |

| Mainline Protestant | 5,544 | 18 |

| Catholic | 1,954 | 1 |

| Other | 1,010 | 3 |

| Black Protestant | 307 | 2 |

| None | 20,928 | - |

Food Environment Statistics:

| This county: | 2.11 / 10,000 pop. |

| State: | 1.99 / 10,000 pop. |

| This county: | 0.16 / 10,000 pop. |

| Tennessee: | 0.17 / 10,000 pop. |

| Here: | 0.65 / 10,000 pop. |

| State: | 0.65 / 10,000 pop. |

| Hamblen County: | 5.85 / 10,000 pop. |

| Tennessee: | 5.16 / 10,000 pop. |

| Here: | 4.87 / 10,000 pop. |

| Tennessee: | 6.56 / 10,000 pop. |

| Hamblen County: | 12.2% |

| Tennessee: | 11.4% |

| This county: | 29.4% |

| Tennessee: | 30.2% |

| This county: | 17.0% |

| State: | 13.5% |

Health and Nutrition:

| Here: | 46.3% |

| Tennessee: | 49.3% |

| This city: | 41.4% |

| Tennessee: | 46.1% |

| This city: | 28.7 |

| State: | 28.8 |

| Morristown: | 22.5% |

| Tennessee: | 21.0% |

| This city: | 11.7% |

| Tennessee: | 10.5% |

| Morristown: | 6.8 |

| Tennessee: | 6.8 |

| This city: | 32.0% |

| State: | 33.9% |

| Morristown: | 52.6% |

| Tennessee: | 55.9% |

| Morristown: | 77.0% |

| Tennessee: | 79.1% |

More about Health and Nutrition of Morristown, TN Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Firefighters | 83 | $389,118 | $56,258 | 0 | $0 |

| Electric Power | 78 | $587,798 | $90,430 | 0 | $0 |

| Police Protection - Officers | 75 | $370,267 | $59,243 | 0 | $0 |

| Other and Unallocable | 42 | $256,995 | $73,427 | 5 | $6,814 |

| Sewerage | 36 | $217,371 | $72,457 | 0 | $0 |

| Streets and Highways | 29 | $110,394 | $45,680 | 0 | $0 |

| Water Supply | 20 | $142,380 | $85,428 | 0 | $0 |

| Solid Waste Management | 18 | $61,326 | $40,884 | 0 | $0 |

| Parks and Recreation | 17 | $65,945 | $46,549 | 18 | $14,242 |

| Financial Administration | 12 | $54,955 | $54,955 | 0 | $0 |

| Other Government Administration | 6 | $44,575 | $89,150 | 10 | $3,772 |

| Police - Other | 5 | $17,683 | $42,439 | 0 | $0 |

| Natural Resources | 3 | $9,967 | $39,868 | 0 | $0 |

| Transit | 1 | $5,878 | $70,536 | 0 | $0 |

| Fire - Other | 1 | $7,618 | $91,416 | 0 | $0 |

| Judicial and Legal | 0 | $0 | 2 | $2,585 | |

| Totals for Government | 426 | $2,342,268 | $65,979 | 35 | $27,413 |

Morristown government finances - Expenditure in 2021 (per resident):

- Current Operations - Local Fire Protection: $8,585,000 ($273.19)

Police Protection: $8,367,000 ($266.25)

Regular Highways: $5,389,000 ($171.49)

Central Staff Services: $2,843,000 ($90.47)

Parks and Recreation: $2,021,000 ($64.31)

General - Other: $2,013,000 ($64.06)

Solid Waste Management: $1,761,000 ($56.04)

Financial Administration: $1,077,000 ($34.27)

Protective Inspection and Regulation - Other: $688,000 ($21.89)

General Public Buildings: $666,000 ($21.19)

Air Transportation: $270,000 ($8.59)

Natural Resources - Other: $256,000 ($8.15)

Public Welfare - Other: $227,000 ($7.22)

Housing and Community Development: $210,000 ($6.68)

Judicial and Legal Services: $143,000 ($4.55)

- General - Interest on Debt: $2,492,000 ($79.30)

- Intergovernmental to Local - Other - General - Other: $793,000 ($25.23)

Other - Libraries: $294,000 ($9.36)

Other - Public Welfare - Other: $294,000 ($9.36)

- Other Capital Outlay - Parks and Recreation: $12,185,000 ($387.75)

Regular Highways: $388,000 ($12.35)

Police Protection: $235,000 ($7.48)

Central Staff Services: $76,000 ($2.42)

General - Other: $24,000 ($0.76)

General Public Building: $10,000 ($0.32)

- Total Salaries and Wages: $44,968,000 ($1430.96)

Morristown government finances - Revenue in 2021 (per resident):

- Charges - Solid Waste Management: $2,146,000 ($68.29)

Sewerage: $1,947,000 ($61.96)

Air Transportation: $169,000 ($5.38)

- Federal Intergovernmental - General Local Government Support: $241,000 ($7.67)

- Local Intergovernmental - General Local Government Support: $2,885,000 ($91.81)

- Miscellaneous - Fines and Forfeits: $522,000 ($16.61)

Sale of Property: $71,000 ($2.26)

Interest Earnings: $38,000 ($1.21)

Donations From Private Sources: $2,000 ($0.06)

- State Intergovernmental - General Local Government Support: $5,319,000 ($169.26)

Highways: $1,420,000 ($45.19)

Other: $136,000 ($4.33)

- Tax - General Sales and Gross Receipts: $15,120,000 ($481.15)

Property: $14,893,000 ($473.92)

Other License: $3,054,000 ($97.18)

Alcoholic Beverage Sales: $1,387,000 ($44.14)

Morristown government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $70,185,000 ($2233.41)

Outstanding Unspecified Public Purpose: $67,276,000 ($2140.84)

Retired Unspecified Public Purpose: $2,908,000 ($92.54)

| Businesses in Morristown, TN | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| AT&T | 1 | KFC | 1 | |

| Advance Auto Parts | 2 | Kmart | 1 | |

| Aeropostale | 1 | Kohl's | 1 | |

| American Eagle Outfitters | 1 | Little Caesars Pizza | 2 | |

| Applebee's | 1 | Long John Silver's | 2 | |

| Arby's | 1 | Lowe's | 1 | |

| AutoZone | 2 | Maurices | 1 | |

| Baskin-Robbins | 1 | McDonald's | 4 | |

| Bath & Body Works | 1 | Nike | 7 | |

| Blockbuster | 1 | Nissan | 1 | |

| Burger King | 1 | OfficeMax | 1 | |

| CVS | 2 | Papa John's Pizza | 1 | |

| Chevrolet | 1 | Penske | 1 | |

| Chick-Fil-A | 1 | Pier 1 Imports | 1 | |

| Comfort Suites | 1 | Pizza Hut | 1 | |

| Cracker Barrel | 1 | RadioShack | 2 | |

| Curves | 1 | Rite Aid | 1 | |

| Dairy Queen | 1 | Ruby Tuesday | 1 | |

| Days Inn | 1 | Rue21 | 1 | |

| Domino's Pizza | 2 | Ryan's Grill | 1 | |

| Dunkin Donuts | 1 | SONIC Drive-In | 3 | |

| Econo Lodge | 1 | Sears | 2 | |

| FedEx | 6 | Subway | 7 | |

| Ford | 1 | Super 8 | 2 | |

| GNC | 1 | T-Mobile | 2 | |

| GameStop | 1 | T.J.Maxx | 1 | |

| H&R Block | 4 | Taco Bell | 1 | |

| Hardee's | 4 | Toyota | 1 | |

| Hilton | 1 | Travelodge | 1 | |

| Hobby Lobby | 1 | U-Haul | 6 | |

| Holiday Inn | 2 | UPS | 6 | |

| Home Depot | 1 | Vans | 2 | |

| Honda | 1 | Verizon Wireless | 1 | |

| Hyundai | 1 | Waffle House | 2 | |

| IHOP | 1 | Walgreens | 3 | |

| JCPenney | 1 | Walmart | 1 | |

| Journeys | 1 | Wendy's | 1 | |

Strongest AM radio stations in Morristown:

- WCRK (1150 AM; 5 kW; MORRISTOWN, TN; Owner: RADIO ACQUISITION CORP.)

- WMTN (1300 AM; 5 kW; MORRISTOWN, TN)

- WKVL (850 AM; daytime; 50 kW; KNOXVILLE, TN; Owner: HORNE RADIO, LLC)

- WLIK (1270 AM; 5 kW; NEWPORT, TN; Owner: WLIK, INC)

- WFGW (1010 AM; 50 kW; BLACK MOUNTAIN, NC; Owner: BLUE RIDGE BROADCASTING CORP.)

- WNOX (990 AM; 10 kW; KNOXVILLE, TN)

- WVLZ (1180 AM; daytime; 10 kW; KNOXVILLE, TN; Owner: KIRKLAND WIRELESS BROADCASTERS, INC.)

- WSEV (930 AM; 5 kW; SEVIERVILLE, TN; Owner: EAST TENNESSEE RADIO GROUP, L.P.)

- WLFJ (660 AM; daytime; 50 kW; GREENVILLE, SC; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WRJZ (620 AM; 5 kW; KNOXVILLE, TN; Owner: TENNESSEE MEDIA ASSOCIATES, INC)

- WKJV (1380 AM; 25 kW; ASHEVILLE, NC; Owner: INTERNATIONAL BAPTIST OUTREACH MISSIONS)

- WGOC (640 AM; 10 kW; BLOUNTVILLE, TN; Owner: CITADEL BROADCASTING COMPANY)

- WQBB (1040 AM; daytime; 10 kW; POWELL, TN; Owner: JOURNAL BROADCAST CORPORATION)

Strongest FM radio stations in Morristown:

- WMXK (94.1 FM; MORRISTOWN, TN; Owner: HORNE RADIO, LLC)

- WBGQ (100.7 FM; BULLS GAP, TN; Owner: CHEROKEE BROADCASTING)

- WJDT (106.5 FM; ROGERSVILLE, TN; Owner: C & S BROADCASTING)

- WIMZ-FM (103.5 FM; KNOXVILLE, TN; Owner: SOUTH CENTRAL COMM., CORP.)

- WNPC-FM (92.9 FM; NEWPORT, TN; Owner: HARRIS BROADCASTING INC DBA WNPC INC)

- WIVK-FM (107.7 FM; KNOXVILLE, TN; Owner: CITADEL BROADCASTING COMPANY)

- WWST (102.1 FM; SEVIERVILLE, TN; Owner: JOURNAL BROADCAST CORPORATION)

- WCTU (105.9 FM; TAZEWELL, TN; Owner: STAIR COMPANY, INC)

- WTFM (98.5 FM; KINGSPORT, TN; Owner: HOLSTON VALLEY BROADCASTING CORP.)

- WOKI-FM (100.3 FM; OAK RIDGE, TN; Owner: OAK RIDGE FM, INC.)

- WEZG (99.3 FM; JEFFERSON CITY, TN; Owner: EAST TENNESSEE RADIO GROUP, L.P.)

- WUOT (91.9 FM; KNOXVILLE, TN; Owner: UNIVERSITY OF TENNESSEE)

- W284AL (105.1 FM; MORRISTOWN, TN; Owner: BIBLE BROADCASTING NETWORK, INC.)

- W237AR (95.3 FM; HAZELWOOD, ETC., NC; Owner: WESTERN NORTH CAROLINA PUBLIC RADIO)

- WMIT (106.9 FM; BLACK MOUNTAIN, NC; Owner: BLUE RIDGE BROADCASTING CORPORATION)

- WNCW (88.7 FM; SPINDALE, NC; Owner: ISOTHERMAL COMMUNITY COLLEGE)

- WMIK-FM (92.7 FM; MIDDLESBORO, KY; Owner: GATEWAY BROADCASTING, INC.)

- WKSF (99.9 FM; ASHEVILLE, NC; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WJXB-FM (97.5 FM; KNOXVILLE, TN; Owner: SOUTH CENTRAL COMMUNICATIONS CORP.)

- WDVX (89.9 FM; CLINTON, TN; Owner: CUMBERLAND COMMUNITIES COMMUNI CORP.)

TV broadcast stations around Morristown:

- W61DG (Channel 61; MORRISTOWN, TN; Owner: TRINITY BROADCASTING NETWORK)

- WKOP-TV (Channel 15; KNOXVILLE, TN; Owner: EAST TENNESSEE PUBLIC COMMUNICATIONS CORP.)

- WBIR-TV (Channel 10; KNOXVILLE, TN; Owner: GANNETT PACIFIC CORPORATION)

- WVLT-TV (Channel 8; KNOXVILLE, TN; Owner: WVLT LICENSEE CORP.)

- WATE-TV (Channel 6; KNOXVILLE, TN; Owner: WATE, G.P.)

- WTNZ (Channel 43; KNOXVILLE, TN; Owner: RAYCOM AMERICA, INC.)

- WEEE-LP (Channel 32; KNOXVILLE, TN; Owner: TIGER EYE BROADCASTING CORPORATION)

- WETP-TV (Channel 2; SNEEDVILLE, TN; Owner: EAST TENNESSEE PUBLIC COMMUNICATIONS CORP.)

- WEZK-LP (Channel 28; KNOXVILLE, TN; Owner: SOUTH CENTRAL COMMUNICATIONS CORP.)

- WVLR (Channel 48; TAZEWELL, TN; Owner: VOLUNTEER CHRISTIAN TELEVISION, INC.)

- National Bridge Inventory (NBI) Statistics

- 155Number of bridges

- 1,581ft / 482mTotal length

- $103,177,000Total costs

- 2,001,117Total average daily traffic

- 461,219Total average daily truck traffic

- New bridges - historical statistics

- 11900-1909

- 31930-1939

- 61940-1949

- 51950-1959

- 441960-1969

- 471970-1979

- 171980-1989

- 151990-1999

- 32000-2009

- 142010-2019

FCC Registered Antenna Towers: 269 (See the full list of FCC Registered Antenna Towers)

FCC Registered Private Land Mobile Towers: 9 (See the full list of FCC Registered Private Land Mobile Towers in Morristown, TN)

FCC Registered Broadcast Land Mobile Towers: 52 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 20 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 10 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 7 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 312 (See the full list of FCC Registered Amateur Radio Licenses in Morristown)

FAA Registered Aircraft Manufacturers and Dealers: 2 (See the full list of FAA Registered Manufacturers and Dealers in Morristown)

FAA Registered Aircraft: 66 (See the full list of FAA Registered Aircraft)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 3 full and 4 partial tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 77 | $95,821 | 61 | $122,630 | 287 | $113,410 | 24 | $42,687 | 2 | $107,810 | 58 | $78,517 | 1 | $36,140 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 5 | $75,342 | 6 | $87,387 | 21 | $122,331 | 4 | $41,100 | 0 | $0 | 3 | $93,250 | 1 | $68,610 |

| APPLICATIONS DENIED | 4 | $114,785 | 11 | $79,904 | 114 | $101,377 | 21 | $26,993 | 0 | $0 | 19 | $58,271 | 3 | $55,627 |

| APPLICATIONS WITHDRAWN | 11 | $81,574 | 9 | $116,030 | 65 | $113,867 | 2 | $14,055 | 0 | $0 | 12 | $78,585 | 1 | $47,880 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | $98,590 | 1 | $19,620 | 9 | $147,983 | 0 | $0 | 0 | $0 | 1 | $19,620 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 1001.00 , 1002.00, 1003.00, 1004.00, 1008.00, 1009.00, 1011.00

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 1 full and 4 partial tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 10 | $177,819 | 5 | $186,382 | 2 | $119,840 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 1 | $289,840 | 2 | $82,795 | 0 | $0 |

| APPLICATIONS DENIED | 0 | $0 | 0 | $0 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 1 | $97,460 | 0 | $0 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 1001.00 , 1002.00, 1003.00, 1004.00, 1008.00, 1009.00, 1011.00

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Morristown, TN

- 1,26338.4%Outside Fires

- 1,21937.1%Structure Fires

- 55416.9%Mobile Property/Vehicle Fires

- 2497.6%Other

Based on the data from the years 2002 - 2018 the average number of fire incidents per year is 193. The highest number of fire incidents - 407 took place in 2007, and the least - 126 in 2015. The data has a decreasing trend.

Based on the data from the years 2002 - 2018 the average number of fire incidents per year is 193. The highest number of fire incidents - 407 took place in 2007, and the least - 126 in 2015. The data has a decreasing trend. When looking into fire subcategories, the most reports belonged to: Outside Fires (38.4%), and Structure Fires (37.1%).

When looking into fire subcategories, the most reports belonged to: Outside Fires (38.4%), and Structure Fires (37.1%).Fire-safe hotels and motels in Morristown, Tennessee:

- Super 8, 2430 E Andrew Johnson Hwy, Morristown, Tennessee 37814 , Phone: (423) 586-8880, Fax: (423) 585-0654

- Comfort Suites, 3660 W Andrew Johnson Hwy, Morristown, Tennessee 37814 , Phone: (423) 585-4000, Fax: (423) 585-4002

- Best Western Plus Morristown Conference Center Hotel, 130 Cracker Rd, Morristown, Tennessee 37813 , Phone: (423) 587-2400, Fax: (423) 581-7344

- Travelodge, 3304 W Andrew Johnson Hwy, Morristown, Tennessee 37814 , Phone: (423) 581-8700, Fax: (423) 581-7128

- Scottish Inns, 3515 W Andrew Johnson Hwy, Morristown, Tennessee 37814 , Phone: (423) 586-8121, Fax: (423) 586-3520

- Hampton Inn, 3750 W Andrew Johnson Hwy, Morristown, Tennessee 37814 , Phone: (423) 587-0952, Fax: (423) 587-0840

- Holiday Inn Express & Suites - Morristown, 2903 Millers Pointe Dr, Morristown, Tennessee 37813 , Phone: (423) 307-1111, Fax: (423) 307-1064

- Econo Lodge Morristown, 5984 W Andrew Johnson Hwy, Morristown, Tennessee 37814 , Phone: (423) 586-8504, Fax: (423) 839-2297

- 2 other hotels and motels

| Most common first names in Morristown, TN among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| James | 430 | 69.7 years |

| Mary | 372 | 77.1 years |

| William | 335 | 71.9 years |

| John | 269 | 72.0 years |

| Robert | 243 | 70.7 years |

| Charles | 193 | 70.0 years |

| George | 158 | 73.1 years |

| Margaret | 112 | 78.8 years |

| Roy | 96 | 71.7 years |

| Dorothy | 86 | 73.8 years |

| Most common last names in Morristown, TN among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 229 | 73.2 years |

| Collins | 138 | 72.6 years |

| Johnson | 124 | 75.6 years |

| Williams | 118 | 71.6 years |

| Long | 114 | 74.0 years |

| Davis | 107 | 71.0 years |

| Jones | 94 | 71.7 years |

| Moore | 93 | 73.9 years |

| Greene | 91 | 71.3 years |

| Noe | 77 | 76.2 years |

- 73.1%Electricity

- 23.7%Utility gas

- 2.2%Bottled, tank, or LP gas

- 0.9%Wood

- 0.1%Fuel oil, kerosene, etc.

- 88.1%Electricity

- 10.7%Utility gas

- 0.6%Bottled, tank, or LP gas

- 0.4%No fuel used

- 0.2%Fuel oil, kerosene, etc.

Morristown compared to Tennessee state average:

- Median house value below state average.

- Unemployed percentage below state average.

- Black race population percentage below state average.

- Hispanic race population percentage significantly above state average.

- Foreign-born population percentage significantly above state average.

Morristown on our top lists:

- #78 on the list of "Top 101 cities with largest percentage of females in industries: manufacturing (population 5,000+)"

- #28 (37860) on the list of "Top 101 zip codes with the lowest 2012 average net capital gain/loss (pop 1,000+)"

- #68 on the list of "Top 101 counties with highest percentage of residents voting for Romney (Republican) in the 2012 Presidential Election (pop. 50,000+)"

- #76 on the list of "Top 101 counties with the smallest number of people without health insurance coverage in 2000 (pop. 50,000+)"

- #100 on the list of "Top 101 counties with the smallest number of children under 18 without health insurance coverage in 2000 (pop. 50,000+)"

|

|

Total of 99 patent applications in 2008-2024.