Michigan

Taxation

Until the 1930s, Michigan relied mainly on the property tax for revenues to support both local and state governments. A state sales tax, first imposed in 1933, and a state income tax, first levied in 1967, are now the main sources of state revenues. Property taxes are reserved entirely to local governments.

The state income tax was 4% on taxable income for 2003, down from 4.2% in 2000 and 4.1% in 2001, and scheduled to be further reduced to 3.9% in 2004. There is no corporate income tax in Michigan, but there is a gross receipts tax which has also been gradually reduced since 1998, from 2.3% to 1.9% in 2002 on income over $45,000. In 1998, the gross receipts tax was set on a course of elimination in 23 years, decreasing 0.1% a year. However, if the Budget Stabilization Fund drops below $250 million, as was the case in 2002, the next rate reduction is cancelled. Companies must file if gross receipts are over $250,000 after a deduction of $45, 000. Financial institutions are assessed .10% of income. The state sales and use tax is 6% on most retail purchases, except food, medicines and some other basic goods. Local sales taxes are not permitted. The state also imposes a full array of excise taxes covering motor fuels, tobacco products, insurance premiums, public utilities, alcoholic beverages (the state controls all sales), amusements, pari-mutuels, and other selected items. In 2002, Michigan was one of 20 states to increase the tax on a pack of cigarettes, raising its excise from 75¢ a pack to $1.25 a pack. An estate tax ranging from 2% to 17% is levied on estates of more than $100, with the first $65,000 to the spouse and the first $10,000 to other close relatives being exempt. The Michigan estate tax is independent of the federal tax credit for state death taxes, and so is unaffected by the scheduled phase-out of the federal estate tax credit by 2007. Death and gift taxes accounted for 0.6% of state collections in 2002. Other state taxes include oil and gas severance taxes, various license fees, stamp taxes and state property taxes. Most property taxes are collected at the local level, although the tax system is relatively centralized, with the state collecting 65.5% of all state and local taxes in 2002.

The state collected $21.864 billion in taxes in 2002, of which 35.6% came from the general sales tax, 28% from individual income taxes, 10.4% from selective sales taxes, 9.4% from corporate income taxes, 8.6% from state property taxes, and 5.9% from license fees. In 2003, Michigan ranked 29th among the states in terms of state and local tax burden, which amounted to about 9.4% of income.

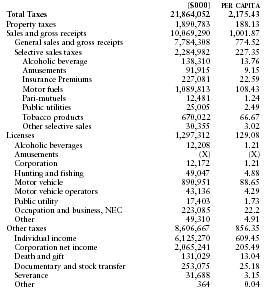

The following table from the US Census Bureau provides a summary of taxes collected by the state in 2002.

| ($000) | PER CAPITA | |

| Total Taxes | 21,864,052 | 2,175.43 |

| Property taxes | 1,890,783 | 188.13 |

| Sales and gross receipts | 10,069,290 | 1,001.87 |

| General sales and gross receipts | 7,784,308 | 774.52 |

| Selective sales taxes | 2,284,982 | 227.35 |

| Alcoholic beverage | 138,310 | 13.76 |

| Amusements | 91,915 | 9.15 |

| Insurance Premiums | 227,081 | 22.59 |

| Motor fuels | 1,089,813 | 108.43 |

| Pari-mutuels | 12,481 | 1.24 |

| Public utilities | 25,005 | 2.49 |

| Tobacco products | 670,022 | 66.67 |

| Other selective sales | 30,355 | 3.02 |

| Licenses | 1,297,312 | 129.08 |

| Alcoholic beverages | 12,208 | 1.21 |

| Amusements | (X) | (X) |

| Corporation | 12,172 | 1.21 |

| Hunting and fishing | 49,047 | 4.88 |

| Motor vehicle | 890,951 | 88.65 |

| Motor vehicle operators | 43,136 | 4.29 |

| Public utility | 17,403 | 1.73 |

| Occupation and business, NEC | 223,085 | 22.2 |

| Other | 49,310 | 4.91 |

| Other taxes | 8,606,667 | 856.35 |

| Individual income | 6,125,270 | 609.45 |

| Corporation net income | 2,065,241 | 205.49 |

| Death and gift | 131,029 | 13.04 |

| Documentary and stock transfer | 253,075 | 25.18 |

| Severance | 31,688 | 3.15 |

| Other | 364 | 0.04 |