Mississippi

Taxation

The state income tax for both individuals and corporations ranges from 3% on the first $5,000 of net income to 5% on amounts over $10,000; the corporate income tax rate is one of the lowest in the nation. Mississippi also imposes severance taxes on oil, natural gas, timber and salt. The state also imposes a full array of excise taxes covering motor fuels, tobacco products, insurance premiums, public utilities, alcoholic beverages amusements, pari-mutuels, and other selected items. A 7% retail sales tax is levied, with local-option sales taxes permitted only up to 0.25%. The state also imposes a full array of excise taxes covering motor fuels, tobacco products, insurance premiums, public utilities, alcoholic beverages amusements, pari-mutuels, and many other selected items. Mississippi's estate tax is tied to the federal exemption for state death taxes, and is therefore set to be phased out in tandem with the phasing out of the federal estate tax exemption by 2007, unless the state takes positive action to establish an independent estate tax. Mississippi's revenue losses from the phasing out of its estate tax are estimated at -$13 million for 2002/03, -$20 million for 2003/04 and -$30 million for 2006/07. Death and gift taxes accounted for 0.6% of state collections in 2002. Other state taxes include various license fee and state property taxes, though most property taxes are collected at the local level. In 2002, local collections accounted for 38.7% of total state and local tax revenue.

The state collected $4.729 billion in taxes in 2002, of which 49.4% came from the general sales tax, 20.8% from individual income taxes, 17.8% from selective sales taxes, 6.37% from state license fees, and 4.1% from corporate income taxes. In 2003, Mississippi ranked 24th among the states in terms of combined state and local tax burden, which amounted to about 9.6% of income.

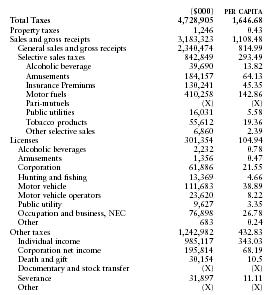

The following table from the US Census Bureau provides a summary of taxes collected by the state in 2002.

| ($000) | PER CAPITA | |

| Total Taxes | 4,728,905 | 1,646.68 |

| Property taxes | 1,246 | 0.43 |

| Sales and gross receipts | 3,183,323 | 1,108.48 |

| General sales and gross receipts | 2,340,474 | 814.99 |

| Selective sales taxes | 842,849 | 293.49 |

| Alcoholic beverage | 39,690 | 13.82 |

| Amusements | 184,157 | 64.13 |

| Insurance Premiums | 130,241 | 45.35 |

| Motor fuels | 410,258 | 142.86 |

| Pari-mutuels | (X) | (X) |

| Public utilities | 16,031 | 5.58 |

| Tobacco products | 55,612 | 19.36 |

| Other selective sales | 6,860 | 2.39 |

| Licenses | 301,354 | 104.94 |

| Alcoholic beverages | 2,232 | 0.78 |

| Amusements | 1,356 | 0.47 |

| Corporation | 61,886 | 21.55 |

| Hunting and fishing | 13,369 | 4.66 |

| Motor vehicle | 111,683 | 38.89 |

| Motor vehicle operators | 23,620 | 8.22 |

| Public utility | 9,627 | 3.35 |

| Occupation and business, NEC | 76,898 | 26.78 |

| Other | 683 | 0.24 |

| Other taxes | 1,242,982 | 432.83 |

| Individual income | 985,117 | 343.03 |

| Corporation net income | 195,814 | 68.19 |

| Death and gift | 30,154 | 10.5 |

| Documentary and stock transfer | (X) | (X) |

| Severance | 31,897 | 11.11 |

| Other | (X) | (X) |