Deficits, Debt, "Printing" Money & Higher Inflation

As with asset deflation, when it comes to monetary inflation, there are powerful and unfortunate differences between the 1970s and now.

The Federal government has had its credit rating downgraded because it is borrowing an amount equal to almost 10% of the total economy each year, with no end in sight, to fund ever-growing government promises. As documented in my article, "Six Layers Of Deficit Impossibilities" (

linked here), the current national debt amounts to $152,000 per able-to-pay US household, and the total amount owed increases to $640,000 per household when we include unfunded US government promises to future retirees.

The global financial system is being kept from collapse only by the direct creation of trillions of dollars and euros which are being passed to financial institutions and other favored corporate insiders on non-market terms.

Impossible promises to retirees and government bond buyers from effectively bankrupt governments are all too likely to

be repaid with inflation. If we assume not the historical 65% destruction of the value of money - but a 90% destruction (which is consistent with the Federal Reserve's creating dollars by the trillions out of thin air), then a dollar becomes worth ten cents.

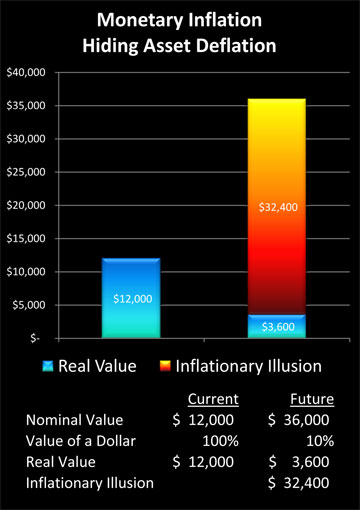

As shown below, if a dollar is worth ten cents, then the Dow must rise (in nominal terms) to 36,000, in order for it to be worth 3,600 in real terms.

The blue in the graph represents reality, with the purchasing power of our investments dropping 70% from our starting point on the left, to our ending point on the right. However, when we include the "Illusion Of Inflation" in the column on the right, and we combine 70% asset deflation with 90% dollar destruction - then we get Dow 36,000.

From:

Deadly Dow 36,000 & The Secret History Of A 70% Market Loss by Daniel R Amerman

Please register to participate in our discussions with 2 million other members - it's free and quick! Some forums can only be seen by registered members. After you create your account, you'll be able to customize options and access all our 15,000 new posts/day with fewer ads.

Please register to participate in our discussions with 2 million other members - it's free and quick! Some forums can only be seen by registered members. After you create your account, you'll be able to customize options and access all our 15,000 new posts/day with fewer ads.