over time a simple balanced portfolio or fund should provide 5% or so in real returns .

that is inflation adjusted.

something in the 60/40 area.

that can grow quite a bit of money over time .. not nearly what a 100% equities can do but it’s an alternative with lower volatility. but i personally would never be anything but 100% equities in my accumulation stage .

until i thought i was 5-8 years away from retiring i wouldn’t be anything but .

in my accumulation stage i never used individual stocks only diversified equity funds not subject to the rise and fall of a particular company .

market risk is enough for me without taking on a second layer of risk in individual company risk . stocks are severely punished today for even an earnings miss which can send them plunging 20% .

as well as you need to know not only what that company is doing but what the competitors have on their drawing board . quite frankly to much work to potentially ride things up and down with perhaps never returning like cisco . i found slow and steady in funds out performed most stocks over the decades .

cisco was high flyer in its day only to lag an s&p fund for decades . lucent technology, a high tech leader and darling of wall street ended up being a penny stock .the competition blew away anything they were known for doing or inventing .

most of us having at least 20 to 40 years in the accumulation stage and 2 to 3 decades in retirement there is always long term money that needs to grow.

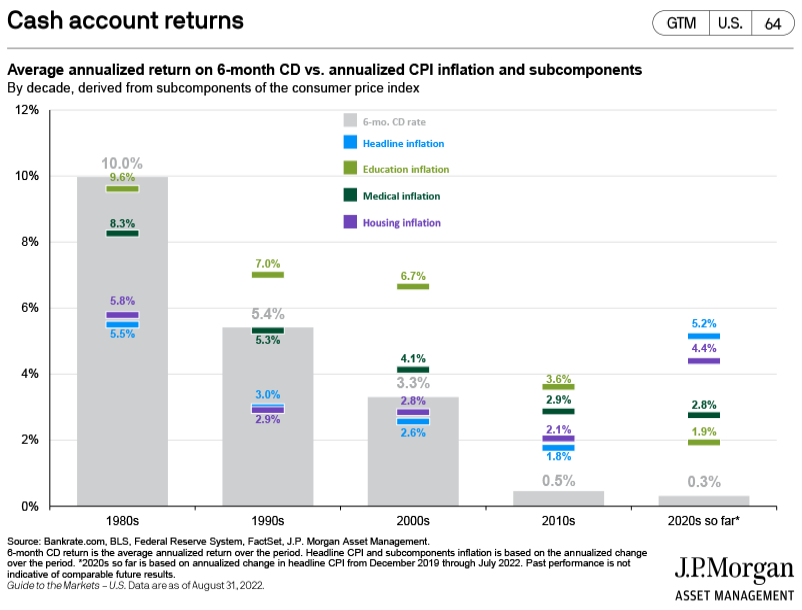

forget timing , most will do awful at it.. cash instruments are terrible at just keeping up with inflation and after taxes have negative real returns about 70% of the time .

even the income model i run in retirement has at least 25% low volatility equity funds and 17% floating rate high yield bond funds so as to keep pace over time and that is for relatively shorter term spending.

for our retirement i find 30% in the income portfolio , 25% equities

45% in a growth and income portfolio , 60-65% equities

15% in 100% equities , vti and berkshire

15% cash

all works nicely for us .

daily swings in dollars are still very very high with tens of thousands of dollars moving up or down on volatile days but it goes with the territory

you can see cash accounts are not a good plan .

Please register to participate in our discussions with 2 million other members - it's free and quick! Some forums can only be seen by registered members. After you create your account, you'll be able to customize options and access all our 15,000 new posts/day with fewer ads.

Please register to participate in our discussions with 2 million other members - it's free and quick! Some forums can only be seen by registered members. After you create your account, you'll be able to customize options and access all our 15,000 new posts/day with fewer ads.