New Jersey

Taxation

New Jersey's personal income tax is the largest single source of revenues, and the 6% retail sales tax is the 2nd largest. The personal income tax schedule has six brackets ranging from 1.4% (up to taxable income $20,000 for singles) to 6.37% (above $75,000; $150,000 for joint filers), with intermediate rates of 1.75%, 2.45%, 3.5%, and 5.25%. The net income of business corporations and banks is taxed at a rate of 7.5% for net income of less than $100,000, and 9% for higher net incomes. The state also imposes a full array of excise taxes covering motor fuels, tobacco products, insurance premiums, public utilities, alcoholic beverages (the state controls all sales), amusements, pari-mutuels, and other selected items. In 2002, the legislature raised both the gas tax (from 10.5 cents to 14.5 cents a gallon) and the cigarette tax (80 cents to $1.50 a pack). There are no local sales taxes. New Jersey has its own estate tax (maximum 18%), which is not affected by the scheduled phase-out of the federal exemption for state death taxes by 2007. The state graduated inheritance tax applies mainly to property passing out of the direct family line. Death and gift taxes accounted for 2.8% of state taxes collected in 2002. Other state taxes include various license and franchise fees, stamp taxes and state property taxes. Most property taxes are collected locally. A large percent (43.8% in 2000) of total non-federal tax revenues are collected at local levels.

The 566 New Jersey municipalities are dependent on the local property tax, state grants, and state aid for their finances. Non-senior citizens with gross incomes under $40,000 are eligible for a Homestead Rebate of 490 (homeowner) or $30 (tenant). Citizens age 65 and over with incomes under $100,000 are eligible for rebates ranging from $100–500 (homeowners) and $35–500 (tenants). Over $323 million in property tax relief is provided through this program each year. In addition, about $60 million per year is directed towards offsetting local property tax bills for senior citizens, veterans, and surviving spouses.

The state collected $18.777 billion in taxes in 2002, of which 37.3% came from individual income taxes, 32.7% came from the general sales tax, 15.2% from selective sales taxes, 6% from corporate income taxes and 5.2% from license fees. In 2003, New Jersey ranked 19th among the states in terms of combined state and local tax burden, which amounted to about 9.8% of income.

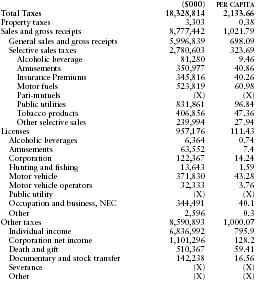

The following table from the US Census Bureau provides a summary of taxes collected by the state in 2002.

| ($000) | PER CAPITA | |

| Total Taxes | 18,328,814 | 2,133.66 |

| Property taxes | 3,303 | 0.38 |

| Sales and gross receipts | 8,777,442 | 1,021.79 |

| General sales and gross receipts | 5,996,839 | 698.09 |

| Selective sales taxes | 2,780,603 | 323.69 |

| Alcoholic beverage | 81,280 | 9.46 |

| Amusements | 350,977 | 40.86 |

| Insurance Premiums | 345,816 | 40.26 |

| Motor fuels | 523,819 | 60.98 |

| Pari-mutuels | (X) | (X) |

| Public utilities | 831,861 | 96.84 |

| Tobacco products | 406,856 | 47.36 |

| Other selective sales | 239,994 | 27.94 |

| Licenses | 957,176 | 111.43 |

| Alcoholic beverages | 6,364 | 0.74 |

| Amusements | 63,552 | 7.4 |

| Corporation | 122,367 | 14.24 |

| Hunting and fishing | 13,643 | 1.59 |

| Motor vehicle | 371,830 | 43.28 |

| Motor vehicle operators | 32,333 | 3.76 |

| Public utility | (X) | (X) |

| Occupation and business, NEC | 344,491 | 40.1 |

| Other | 2,596 | 0.3 |

| Other taxes | 8,590,893 | 1,000.07 |

| Individual income | 6,836,992 | 795.9 |

| Corporation net income | 1,101,296 | 128.2 |

| Death and gift | 510,367 | 59.41 |

| Documentary and stock transfer | 142,238 | 16.56 |

| Severance | (X) | (X) |

| Other | (X) | (X) |