Quote:

Originally Posted by MongooseHugger

Let's face it, it's getting harder to retire, pensions are becoming a relic of a bygone day (except for the CEO's and the public sector). Social Security and Medicare are in trouble. Do you think we should plan on working till we die?

And, if you do agree that this is more likely, what career paths would be the most viable for this?

|

To set the groundwork I am just short of my 68th birthday and I am not drawing social security yet as my plan is to put off collecting benefits until I reach 70. I will be working for at least two more years and during that time I will be paying social security and medicare taxes just like everyone else.

At my age I am on Medicare.

Since my mid 20's I have never been without health insurance, not even for one second, but I got to tell you Medicare is the best deal I've ever head but everyone needs to recognize it is not free.

Medicare part A is free and what this covers is a lot, but certainly not all, hospital bills.

Part B costs cover most,but not all, of doctor costs and it is not free; I pay $121.80/month for my Part B coverage.

Then there is the supplement plans and I chose the Plan G which covers everything Part A and Part B does not cover with the exception of drugs and the $147 annual deductible. I pay $138.00/month for my supplement.

Part D is drugs and I pay $44/month for my Part D supplement which covers much, but not all, of my drug costs. My out of pocket for drugs is right at $1,000/year so don't go thinking it's all free because it is not.

For my coverage I pay $303.80 which translates to $607.30 every month for the both of us so don't go thinking we get a free ride. A good ride as once I pay the $147 deductible for the year I am done paying for anything other than drugs.

I would like to see what I have become a national one payer system as long as everyone, and I do mean everyone, pays the same I do. A family of four would pay $1,215.20/monthly which might sound high but the deductible for a family would be limited to $588 for the year and there are not any co-pays.

Yeah, I am older, I cost more and I am riskier but, unlike a new family coming into the system, I have been paying Medicare taxes for the last 50 years.

I am making this point because so many millennials seem to think my Medicare and medical is all free when we really spend $8,000 or better every year in premiums and what little out of pocket we have.

Since I first became aware of social security in the 1960's the system was going to run out of money... blah blah... it's a Ponzi scheme blah, blah.... and it was going to go broke. I heard this tale of woe in the 60's, 70's, 80's, 90's, 2000's and on into today. It is all crap.

From CNN Money

Quote:

1. Can I count on Social Security when I retire?

The latest Social Security Trustees Report projects that the Social Security trust fund will run out of money in just 18 years, or 2033. But even if that forecast proves accurate, it doesn't mean payments will stop. The payroll taxes that Social Security collects from workers and employers will still be able to fund 77% of scheduled benefits.

So the real issue is whether benefits will be cut, not eliminated.

|

From Motley Fool

So if nothing is done beneficiaries might be faced with a 23% cut in benefits but to avoid tis all we need do is increase the social security tax or raise the cap on earnings.

Yeah, yeah... boo hoo how baby boomers never had their taxes increased..... yeah, right.

When I started working in

1966 my social security tax was 4.2% and over the years I have seen it rise to 7.65% which approaches nearly double.

I also saw the earnings cap go up. I remember in the 1980's the cap was low enough I'd feel like I got a raise come August or September but they raised the cap and I haven't felt that raise in many years now.

Raise rates a little bit (it happened to me too so don't you dare go bawling on my shoulder) and the cap.

Might have to raise the retirement age maybe to 68 since we are all living longer. All during the 80's and 90's my full retirement age was 65 but it turned into 66 and those younger than I am is getting even longer stretching to 70.

There is this thing that companies had pensions but I never had one. My wife does but it's $375/month which helps but won't fund any world cruises.

We do have IRA accounts but there aren't hundreds of thousands of dollars stashed away. We got some but nowhere near what we're told we should have which is one reason I am determined to work to at least 70 and perhaps as long as I am able after.

Waiting to collect is smart because the difference in collecting amount is

nearly double by simply waiting from 62 to 70. If your full retirement age benefit (66 years old) is $2,400 if you take it at 62 it will be reduced to $1,800 but waiting to 70 to collect it would increase to $3,168 which really isn't bad when you consider for most people that would be money that would be exempt from state and federal income taxes.

If you are just starting to plan you might find this helpful in making decisions and just playing around with figures

How much of my social security benefit may be taxed?

Quote:

|

Did you know that up to 85% of your Social Security Benefits may be subject to income tax? If this is the case you may want to consider repositioning some of your other income to minimize how much of your Social Security Benefit may be taxed and thereby, maximize your retirement income sources.

|

Take a husband who has FRA benefit of $2,400 his wife is entitled to her own benefit or 50% of her husbands whichever is higher. If the wife waits until she is 66 she will receive at least $1,200 and if her husband waits to 70 he will get the $3,168 giving a combined benefit of $4,368 which is equivalent to having a job with a take home paycheck of $1,008/week since zero taxes would be taken out. Who said you can't live on social security alone? If your house is paid for, which it should be by the time you hit 70, how much more cash would the average couple really need to live a comfortable life?

But this whole idea of social security running out of money, it is to the positive right now, is silly in my opinion and made to scare needlessly scare people.

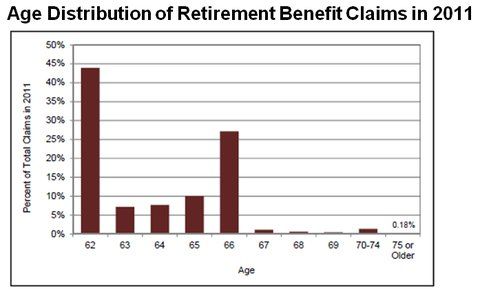

Why are benefits so low? A lot of it has to do with people collecting early so as to attempt to get their money out of the Ponzi scheme before it collapsed.

44% collect at age 62, no wonder so many live poor in retirement.

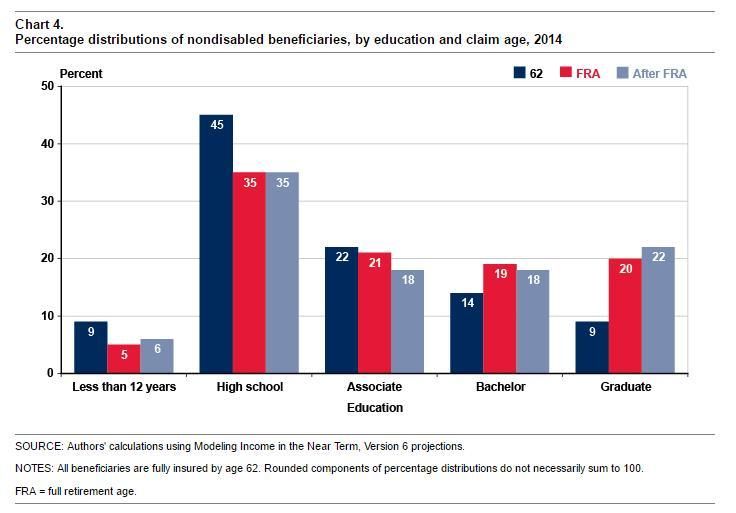

What does educated people do?

The more educated, and most likely higher paid who will get higher benefits, are the ones waiting the longest.

Please register to participate in our discussions with 2 million other members - it's free and quick! Some forums can only be seen by registered members. After you create your account, you'll be able to customize options and access all our 15,000 new posts/day with fewer ads.

Please register to participate in our discussions with 2 million other members - it's free and quick! Some forums can only be seen by registered members. After you create your account, you'll be able to customize options and access all our 15,000 new posts/day with fewer ads.