Rochester: Economy

Major Industries and Commercial Activity

Rochester is one of the leading manufacturing centers in the United States, dominated by Eastman Kodak, Bausch & Lomb, Inc., Delphi Automotive Systems and Xerox Corporation. The area is home to more than 1,500 small and mediumsized manufacturing companies, most of which are involved in high technology sectors such as computer and electronic products, machinery and chemicals. In 2004, companies in Greater Rochester exported more than $14 billion worth of products and services, exceeding 40 states. Rochester also benefits from the Monroe County Foreign Trade Zone, which offers tax advantages for international trade.

Items and goods produced: photographic and optical products, telecommunication system software, pharmaceuticals, automotive equipment, fibres and plastics

Incentive Programs—New and Existing Companies

A variety of incentives is available from city and county government organizations. The County of Monroe Industrial Development Agency (COMIDA) offers funding for industrial and non-industrial projects through tax-exempt bonds and sale/leaseback transactions; it also administers the JobsPlus tax abatement program for employers who increase full-time employee base by 10 percent or more. Over the last two decades COMIDA has financed more than 500 projects totaling $2 billion in investment and thousands of new jobs. The Monroe County Industrial Development Corporation (MCIDC) provides long-term financing for the purchase of land or equipment through the SBA 504 Program, interest rate subsidies on loans or capital leases, equipment purchase rebates, and gap financing. The Monroe Fund is a private venture capital fund investing in startup and turnaround businesses. Monroe County Economic Development provides customized advice, connecting businesses with the most advantageous programs or incentives.

Local programs

The City of Rochester offers a range of incentives for new and growing businesses. Loans from $25,000 to $500,000 are available to manufacturing or industrial businesses seeking to expand; approved projects must create or retain jobs and promote investment in the city. Similar loans are available to companies in the service, wholesale or retail sectors. The city offers 90/10 matching grants for exterior improvements in distressed commercial districts and will match up to $5,000 in advertising funds for businesses in low- or moderate-income areas. The City of Rochester administers the U.S. Department of Housing and Urban Development Section 108 Loan Program, which provides fixed asset and working capital financing to eligible businesses. The city also offers job growth credits which can be used to reduce payments on city loans.

State programs

The New York State Empire Zone Program offers incentives for developing new businesses, expanding existing operations or increasing human resources; incentives include wage tax credits, sales tax refunds, utility discounts, investment tax credits, and property tax abatements. New York also offers tax credits to businesses that create jobs and invest in production property or equipment. A nine percent corporate tax credit is available to businesses investing in research and development, and such companies may also be eligible for three-year job creation credits. Sales tax exemptions may be granted on equipment purchases, research and development property, and fuels or utilities. Empire State Development administers the Export Marketing Assistance Service, which helps businesses find distributors overseas, and the Global Export Market Service, which provides up to $25,000 of export marketing consultant services for small and medium sized businesses. New York State's Division of Minority- and Women-owned Business Development provides access to capital, procurement assistance, and loans from $20,000 to $500,000.

Job training programs

New York State offers funding for up to 50 percent of any employee training project and its Workforce Development Liaison helps coordinate employers and job seekers. RochesterWorks! provides on-the-job training incentives for companies who hire or retrain employees lacking in experience or credentials. The Rochester Corporate Training Initiative provides access to internal training programs of successful local companies as well as funding opportunities. Specialized job training programs are also available through Monroe Community College and various other agencies throughout the area.

Development Projects

The $230 million Renaissance Square project is underway on East Main Street; plans call for a performing arts center, underground bus terminal, and Monroe Community College satellite to revitalize the downtown area. The Strong Museum has begun a $33 million expansion that will double its current size, making it the second-largest children's museum in the nation. The museum's new "whimsical" design is a nod to its mission of learning through play. Eastman Theatre has completed a $5 million renovation to improve acoustics, lighting and rigging and enlarge the orchestra pit. A $52 million renovation of Xerox Tower is scheduled for completion in 2005. The Hyatt Regency Rochester Hotel will complete a $4 million renovation in 2006. Bausch & Lomb has announced a $35 million expansion of its research and development center, creating 200 new jobs.

Economic Development Information: Monroe County Department of Planning and Development, Economic Development Division, 50 West Main Street, Suite 8100, Rochester NY 14614; telephone (585)428-2970. County of Monroe Industrial Development Agency, 50 West Main Street, Suite 8100, Rochester NY 14614; telephone (585)428-5260

Commercial Shipping

Greater Rochester International Airport is served by a number of air cargo companies. Rail freight service is available from CSX, Norfolk Southern and Canadian Pacific railways. Rochester boasts an extensive network of highways. Shipping of oversize and bulk commodities can be arranged through the Lake Ontario New York State Barge Canal system.

Labor Force and Employment Outlook

According to the Manpower Employment Outlook, Greater Rochester has the third-highest job growth rate in the nation. More than half of the region's employers expect to increase staffing in the immediate future. Telecommunications is one of the fastest growing sectors, with over 85 companies in Rochester's "Telecom Valley." Manufacturing continues to play a major role in the local economy, while Rochester's high-tech output ranks 20th out of 319 metropolitan areas in the United States.

The following is a summary of data regarding the Rochester metropolitan area labor force, 2004 annual averages.

Size of nonagricultural labor force: 508,300

Number of workers employed in . . .

construction and mining: 17,900

manufacturing: 78,600

trade, transportation and utilities: 84,500

information: 12,300

financial activities: 21,800

professional and business services: 56,700

educational and health services: 98,600

leisure and hospitality: 38,700

other services: 18,800

government: 79,800

Average hourly earnings of production workers employed in manufacturing: $17.29 (statewide, 2004)

Unemployment rate: 4.5% (April 2005)

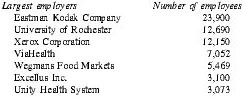

| Largest employers | Number of employees |

| Eastman Kodak Company | 23,900 |

| University of Rochester | 12,690 |

| Xerox Corporation | 12,150 |

| ViaHealth | 7,052 |

| Wegmans Food Markets | 5,469 |

| Excellus Inc. | 3,100 |

| Unity Health System | 3,073 |

| Delphi Automotive Systems Corp. | 3,000 |

| Valeo S.A. | 2,601 |

| Rochester Institute of Technology | 2,555 |

Cost of Living

Rochester prides itself on offering a high quality of life, from affordability of homes to recreational opportunities. In 2003, Rochester was one of three cities in the nation to receive top honors in the City Livability Awards Program, which recognizes mayors for their efforts to improve quality of life.

The following is a summary of data regarding several key cost of living factors in the Rochester area.

2004 ACCRA Average House Price: Not reported

2004 ACCRA Cost of Living Index: Not reported

State income tax rate: 4–6.85%

State sales tax rate: 4%

Local income tax rate: None

Local sales tax rate: 4%

Property tax rate: $37.11 per $1,000 of assessed value