Delaware

Public finance

The Budget Director has lead responsibility for preparing Delaware's annual executive budget for submission to the legislature in January, which is expected to adopt a budget by 30 June for the fiscal year, which begins 1 July. There are both constitutional and statutory requirements that the governor submit, the legislature adopt, and the governor sign, a balanced budget.

The general fund budget for 2002/03 totaled $2.39 billion, a 3.9% increase over the budget for 2001/02, and included a 2% increase for state employees. In June 2003, Delaware's revenue estimating council (the Delaware Economic and Financial Advisory Council or DEFAC) increased its estimates for 2001/02 and 2002/03 by $49 million, eliminating the need for a proposed hike in the cigarette tax. The budget crunch that afflicted most states in 2002 and 2003 was relatively mild in Delaware. Businesses incorporate in Delaware but most do not actually operate there, so while the recession and collapse of the stock market affected capital gains income elsewhere it mainly affected incorporation fees in Delaware. Even bankrupt companies are likely to maintain the incorporation status, although many did disappear without a trace and without paying their fees in 2001–03. Shortfalls in expected revenues led to cuts in Delaware's budgets after they were enacted—$23.8 million in 2002 and $44.1 million in 2003, mainly through across-the-board percentage cuts which exempted only debt service. The rainy day fund (the Budget Reserve Account), which requires a three-fifths vote of the legislature to activate, was not tapped, however, and there were no tax increases.

The general fund budget for 2003/04 was proposed at $2.432 billion, 1.6% above 2002/03. Appropriations included 41.5% for public and higher education, 30.7% for health, social services, and services for children and youth, 7.8% for corrections, 3.8% for safety and homeland security, and 16.2% for judicial and other operating expenses. Sources of revenues included business taxes (combination of corporate fees, business gross receipts taxes, franchise taxes, and the corporate income tax totaling 36.4%); personal income tax (29.4%); lottery earnings (9%); and abandoned corporate property turned over to the state (5%).

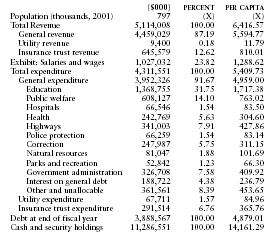

The following table from the US Census Bureau contains information on revenues, expenditures, indebtedness, and cash/securities for 2001.

| ($000) | PERCENT | PER CAPITA | |

| Population (thousands, 2001) | 797 | (X) | (X) |

| Total Revenue | 5,114,008 | 100.00 | 6,416.57 |

| General revenue | 4,459,029 | 87.19 | 5,594.77 |

| Utility revenue | 9,400 | 0.18 | 11.79 |

| Insurance trust revenue | 645,579 | 12.62 | 810.01 |

| Exhibit: Salaries and wages | 1,027,032 | 23.82 | 1,288.62 |

| Total expenditure | 4,311,551 | 100.00 | 5,409.73 |

| General expenditure | 3,952,326 | 91.67 | 4,959.00 |

| Education | 1,368,755 | 31.75 | 1,717.38 |

| Public welfare | 608,127 | 14.10 | 763.02 |

| Hospitals | 66,546 | 1.54 | 83.50 |

| Health | 242,769 | 5.63 | 304.60 |

| Highways | 341,003 | 7.91 | 427.86 |

| Police protection | 66,259 | 1.54 | 83.14 |

| Correction | 247,987 | 5.75 | 311.15 |

| Natural resources | 81,047 | 1.88 | 101.69 |

| Parks and recreation | 52,842 | 1.23 | 66.30 |

| Government administration | 326,708 | 7.58 | 409.92 |

| Interest on general debt | 188,722 | 4.38 | 236.79 |

| Other and unallocable | 361,561 | 8.39 | 453.65 |

| Utility expenditure | 67,711 | 1.57 | 84.96 |

| Insurance trust expenditure | 291,514 | 6.76 | 365.76 |

| Debt at end of fiscal year | 3,888,567 | 100.00 | 4,879.01 |

| Cash and security holdings | 11,286,551 | 100.00 | 14,161.29 |