Louisiana

Taxation

For most of the state's history, Louisianans paid little in taxes. Despite increases in taxation and expenditures since the late 1920s, when Huey Long introduced the graduated income tax, Louisiana's state tax burden per capita was typically well below the national average. In 2003, however, Louisiana ranked closer to the middle, at 28th in terms combined state and local taxes as a percent of income, which was at 9.5%.

Louisiana's individual income tax has three brackets ranging from 2% to 6%. The corporate income tax has five brackets ranging from 4% on the first $25,000 up to 8% on net income over $200,000. Federal taxes paid are deductible from state liabilities for both individual and corporate income taxes. The state's sales and use tax is levied at 4%. Effective 1 January 2003 (and due to a voter-approved constitutional amendment) the sales tax on food for home consumption, electricity, natural gas and water was reduced to 2%, and then eliminated altogether as of 1 July 2003. Prescription drugs are also exempted from the state sales tax. Parishes and municipalities may impose additional sales taxes up to combined rates of 6.7%, though some localities impose not additional sales taxes. The state imposes a full range of selective sales taxes including excises on motor fuels, tobacco products, soft drinks, alcoholic beverages, amusements, parimutuels, public utilities, insurance premiums, and other selected items. The cigarette tax was raised from 24 cents a pack to 36 cents a pack in 2002. Louisiana has natural resources severance taxes whose rates vary according to the resource. There is also an oil field site restoration fee. Louisiana's estate tax is tied to the federal tax credit for state death taxes, and is therefore slated to be phased out in tandem with the federal estate tax credit by 2007 absent any positive action by the Louisiana government to preserve it. Louisiana's revenue losses from the phasing out of its estate tax are estimated at $5.4 million in 2003, $11.5 million in 2004, and $24 million in 2007. Louisiana inheritance tax was scheduled to be abolished as of 1 July 2003. In 2002, 0.9% of state tax revenues came from gift and death taxes. Other state taxes include various license fees. The Louisiana Stadium and Exposition District, and the New Orleans Exhibition Hall Authority impose a tax on hotel and motel room occupancy in the greater New Orleans area. In addition, local taxing authorities may impose a tax on hotel and motel room occupancy. Taxes on beer and chain stores contribute to local revenues, as does the property tax. In 2002, 41.6% of non-federal tax revenue was collected locally.

Total state tax collections in Louisiana in 2002 came to $7.346 billion, of which 31.7% was generated by the state general sales and use tax, 25.4% by state excise taxes, 24.2% by the state income tax, 7% by state license fees, 6.7% by state severance taxes, and 3.6% by the state corporate income tax.

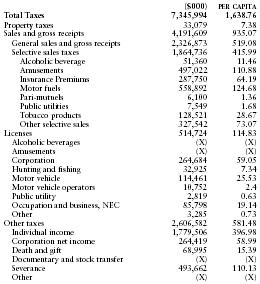

The following table from the US Census Bureau provides a summary of taxes collected by the state in 2002.

| ($000) | PER CAPITA | |

| Total Taxes | 7,345,994 | 1,638.76 |

| Property taxes | 33,079 | 7.38 |

| Sales and gross receipts | 4,191,609 | 935.07 |

| General sales and gross receipts | 2,326,873 | 519.08 |

| Selective sales taxes | 1,864,736 | 415.99 |

| Alcoholic beverage | 51,360 | 11.46 |

| Amusements | 497,022 | 110.88 |

| Insurance Premiums | 287,750 | 64.19 |

| Motor fuels | 558,892 | 124.68 |

| Pari-mutuels | 6,100 | 1.36 |

| Public utilities | 7,549 | 1.68 |

| Tobacco products | 128,521 | 28.67 |

| Other selective sales | 327,542 | 73.07 |

| Licenses | 514,724 | 114.83 |

| Alcoholic beverages | (X) | (X) |

| Amusements | (X) | (X) |

| Corporation | 264,684 | 59.05 |

| Hunting and fishing | 32,925 | 7.34 |

| Motor vehicle | 114,461 | 25.53 |

| Motor vehicle operators | 10,752 | 2.4 |

| Public utility | 2,819 | 0.63 |

| Occupation and business, NEC | 85,798 | 19.14 |

| Other | 3,285 | 0.73 |

| Other taxes | 2,606,582 | 581.48 |

| Individual income | 1,779,506 | 396.98 |

| Corporation net income | 264,419 | 58.99 |

| Death and gift | 68,995 | 15.39 |

| Documentary and stock transfer | (X) | (X) |

| Severance | 493,662 | 110.13 |

| Other | (X) | (X) |