Yardville-Groveville, New Jersey

Submit your own pictures of this place and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

| Males: 4,632 | |

| Females: 4,886 |

| Median resident age: | 38.7 years |

| New Jersey median age: | 36.7 years |

Zip codes: 08620.

| Yardville-Groveville: | $102,901 |

| NJ: | $96,346 |

Estimated per capita income in 2022: $46,074 (it was $25,391 in 2000)

Yardville-Groveville CDP income, earnings, and wages data

Estimated median house or condo value in 2022: $338,094 (it was $140,400 in 2000)

| Yardville-Groveville: | $338,094 |

| NJ: | $428,900 |

Mean prices in 2022: all housing units: $441,444; detached houses: $514,236; townhouses or other attached units: $262,860; in 2-unit structures: $482,741; in 3-to-4-unit structures: $396,024; in 5-or-more-unit structures: $217,488; mobile homes: $68,149

Yardville-Groveville, NJ residents, houses, and apartments details

Detailed information about poverty and poor residents in Yardville-Groveville, NJ

- 8,39791.2%White alone

- 2773.0%Hispanic

- 2652.9%Black alone

- 1842.0%Asian alone

- 720.8%Two or more races

- 80.09%Other race alone

- 30.03%American Indian alone

- 20.02%Native Hawaiian and Other

Pacific Islander alone

Races in Yardville-Groveville detailed stats: ancestries, foreign born residents, place of birth

| Ask the New Jersey Rail Guru (408 replies) |

| Yardville section of Hamilton (Mercer County) (10 replies) |

| Mercer towns "missing" from City Data (0 replies) |

Ancestries: Italian (28.8%), German (21.4%), Irish (19.4%), Polish (13.4%), English (11.2%), Hungarian (5.6%).

Current Local Time: EST time zone

Land area: 3.44 square miles.

Population density: 2,764 people per square mile (average).

595 residents are foreign born (3.1% Europe, 1.3% Latin America, 1.0% Asia, 0.9% Africa).

| This place: | 6.5% |

| New Jersey: | 17.5% |

| Yardville-Groveville CDP: | 2.8% ($3,864) |

| New Jersey: | 2.4% ($4,047) |

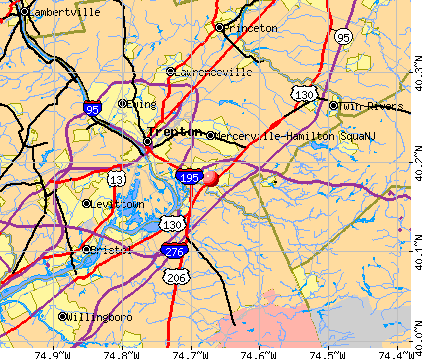

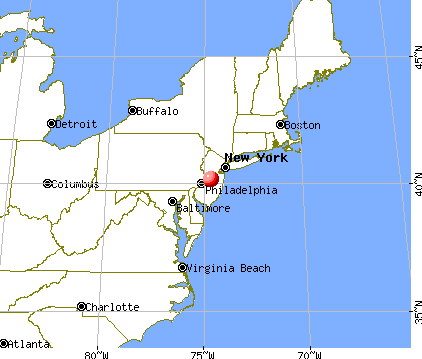

Nearest city with pop. 50,000+: Trenton, NJ (5.3 miles

, pop. 85,403).

Nearest city with pop. 200,000+: Philadelphia, PA (28.1 miles

, pop. 1,517,550).

Nearest cities:

Latitude: 40.18 N, Longitude: 74.67 W

Daytime population change due to commuting: -3,234 (-35.1%)

Workers who live and work in this place: 305 (6.5%)

Area code commonly used in this area: 609

Property values in Yardville-Groveville, NJ

| Here: | 3.7% |

| New Jersey: | 4.5% |

- Public administration (14.2%)

- Educational services (10.2%)

- Professional, scientific, technical services (9.5%)

- Health care (8.5%)

- Finance & insurance (5.7%)

- Construction (5.3%)

- Accommodation & food services (3.4%)

- Public administration (15.5%)

- Professional, scientific, technical services (10.4%)

- Construction (8.9%)

- Educational services (6.6%)

- Accommodation & food services (3.4%)

- Food & beverage stores (3.0%)

- Utilities (2.8%)

- Health care (15.7%)

- Educational services (14.5%)

- Public administration (12.8%)

- Finance & insurance (9.9%)

- Professional, scientific, technical services (8.5%)

- Administrative & support & waste management services (3.5%)

- Accommodation & food services (3.5%)

- Other office and administrative support workers, including supervisors (7.2%)

- Other management occupations, except farmers and farm managers (4.6%)

- Material recording, scheduling, dispatching, and distributing workers (4.6%)

- Secretaries and administrative assistants (4.5%)

- Computer specialists (3.1%)

- Preschool, kindergarten, elementary, and middle school teachers (3.0%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (2.9%)

- Material recording, scheduling, dispatching, and distributing workers (6.3%)

- Other management occupations, except farmers and farm managers (5.9%)

- Other office and administrative support workers, including supervisors (5.5%)

- Law enforcement workers, including supervisors (5.2%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (5.0%)

- Building and grounds cleaning and maintenance occupations (4.6%)

- Engineers (3.9%)

- Other office and administrative support workers, including supervisors (9.3%)

- Secretaries and administrative assistants (8.9%)

- Preschool, kindergarten, elementary, and middle school teachers (4.5%)

- Information and record clerks, except customer service representatives (4.5%)

- Registered nurses (4.3%)

- Sales representatives, services, wholesale and manufacturing (3.5%)

- Cashiers (3.4%)

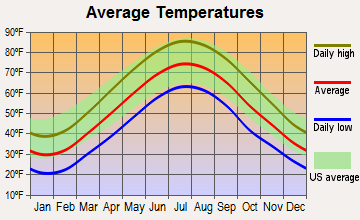

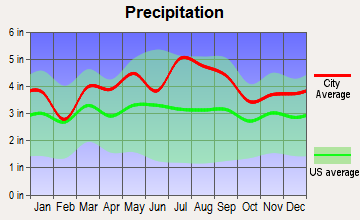

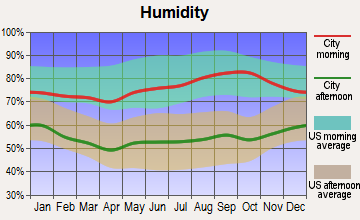

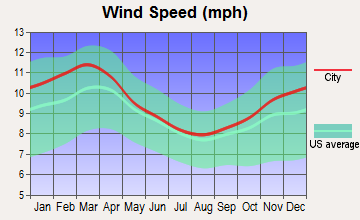

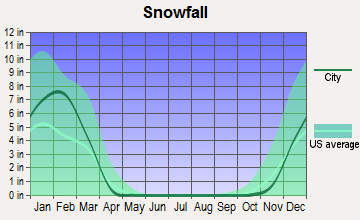

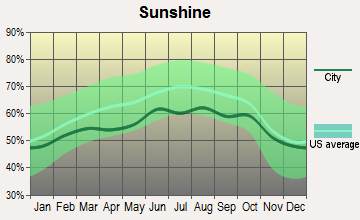

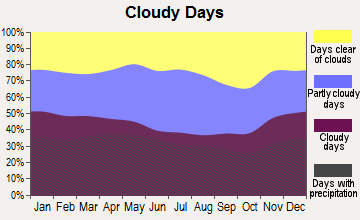

Average climate in Yardville-Groveville, New Jersey

Based on data reported by over 4,000 weather stations

(lower is better)

Air Quality Index (AQI) level in 2023 was 121. This is significantly worse than average.

| City: | 121 |

| U.S.: | 73 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.414. This is significantly worse than average. Closest monitor was 5.6 miles away from the city center.

| City: | 0.414 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 11.8. This is significantly worse than average. Closest monitor was 4.7 miles away from the city center.

| City: | 11.8 |

| U.S.: | 5.1 |

Sulfur Dioxide (SO2) [ppb] level in 2016 was 0.754. This is significantly better than average. Closest monitor was 5.6 miles away from the city center.

| City: | 0.754 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2023 was 31.5. This is about average. Closest monitor was 4.7 miles away from the city center.

| City: | 31.5 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2008 was 16.0. This is better than average. Closest monitor was 5.7 miles away from the city center.

| City: | 16.0 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 7.65. This is about average. Closest monitor was 5.7 miles away from the city center.

| City: | 7.65 |

| U.S.: | 8.11 |

Tornado activity:

Yardville-Groveville-area historical tornado activity is slightly above New Jersey state average. It is 21% smaller than the overall U.S. average.

On 10/18/1990, a category F3 (max. wind speeds 158-206 mph) tornado 21.4 miles away from the Yardville-Groveville place center injured 8 people and caused between $500,000 and $5,000,000 in damages.

On 6/13/1958, a category F2 (max. wind speeds 113-157 mph) tornado 1.1 miles away from the place center injured one person and caused between $50,000 and $500,000 in damages.

Earthquake activity:

Yardville-Groveville-area historical earthquake activity is significantly above New Jersey state average. It is 68% smaller than the overall U.S. average.On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 235.4 miles away from Yardville-Groveville center

On 1/16/1994 at 01:49:16, a magnitude 4.6 (4.6 MB, 4.6 LG, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 72.8 miles away from Yardville-Groveville center

On 10/7/1983 at 10:18:46, a magnitude 5.3 (5.1 MB, 5.3 LG, 5.1 ML) earthquake occurred 261.5 miles away from the city center

On 1/16/1994 at 00:42:43, a magnitude 4.2 (4.2 MB, 4.0 LG, Depth: 3.1 mi) earthquake occurred 71.2 miles away from Yardville-Groveville center

On 4/20/2002 at 10:50:47, a magnitude 5.3 (5.3 ML, Depth: 3.0 mi) earthquake occurred 303.7 miles away from the city center

On 11/30/2017 at 21:47:31, a magnitude 4.1 (4.1 MW, Depth: 6.1 mi) earthquake occurred 79.1 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Mercer County (25) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 16

Emergencies Declared: 9

Causes of natural disasters: Hurricanes: 7, Floods: 5, Storms: 4, Snowstorms: 3, Blizzards: 2, Heavy Rains: 2, Water Shortages: 2, Winter Storms: 2, Tornado: 1, Tropical Depression: 1, Tropical Storm: 1, Wind: 1, Other: 3 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers near Yardville-Groveville:

- HAMILTON SURGERY CENTER LLC (Hospital, about 3 miles away; HAMILTON, NJ)

- HAMILTON GROVE HEALTHCARE AND REHABILITATION, LLC (Nursing Home, about 4 miles away; HAMILTON, NJ)

- MERCER COUNTY GERIATRIC CENTER (Nursing Home, about 4 miles away; TRENTON, NJ)

- MILLHOUSE, THE (Nursing Home, about 5 miles away; TRENTON, NJ)

- VNA HOME CARE OF MERCER COUNTY (Home Health Center, about 5 miles away; TRENTON, NJ)

- ST FRANCIS MEDICAL CENTER Acute Care Hospitals (about 5 miles away; TRENTON, NJ)

- HAMILTON CONTINUING CARE (Nursing Home, about 5 miles away; HAMILTON, NJ)

Amtrak stations near Yardville-Groveville:

- 6 miles: TRENTON (72 S. CLINTON AVE.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, snack bar, ATM, paid short-term parking, paid long-term parking, car rental agency, taxi stand, public transit connection.

- 10 miles: PRINCETON JUNCTION (WALLACE RD.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, snack bar, paid short-term parking, paid long-term parking, call for car rental service, taxi stand, public transit connection.

Colleges/universities with over 2000 students nearest to Yardville-Groveville:

- Mercer County Community College (about 6 miles; West Windsor, NJ; Full-time enrollment: 5,728)

- Thomas Edison State College (about 6 miles; Trenton, NJ; FT enrollment: 4,972)

- Rider University (about 9 miles; Lawrenceville, NJ; FT enrollment: 4,960)

- The College of New Jersey (about 9 miles; Ewing, NJ; FT enrollment: 7,573)

- Princeton University (about 12 miles; Princeton, NJ; FT enrollment: 6,897)

- Burlington County College (about 16 miles; Pemberton, NJ; FT enrollment: 7,928)

- Strayer University-Pennsylvania (about 16 miles; Trevose, PA; FT enrollment: 2,027)

Points of interest:

Notable location: Hamilton Township Fire District 9 Groveville Fire Company 1 (A). Display/hide its location on the map

Church in Yardville-Groveville: Saint Vincent DePaul Church (A). Display/hide its location on the map

Creeks: Doctors Creek (A), Back Creek (B). Display/hide their locations on the map

| This place: | 2.7 people |

| New Jersey: | 2.7 people |

| This place: | 76.2% |

| Whole state: | 70.7% |

| This place: | 4.8% |

| Whole state: | 4.9% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.1% of all households

| This place: | 1.4% |

| Whole state: | 8.5% |

| This place: | 0.8% |

| Whole state: | 4.2% |

People in group quarters in Yardville-Groveville in 2000:

- 5 people in homes for the mentally retarded

- 4 people in religious group quarters

- 2 people in other nonhousehold living situations

For population 15 years and over in Yardville-Groveville:

- Never married: 21.5%

- Now married: 65.2%

- Separated: 1.1%

- Widowed: 5.7%

- Divorced: 6.5%

For population 25 years and over in Yardville-Groveville:

- High school or higher: 88.1%

- Bachelor's degree or higher: 23.4%

- Graduate or professional degree: 6.2%

- Unemployed: 3.3%

- Mean travel time to work (commute): 24.2 minutes

| Here: | 10.4 |

| New Jersey average: | 13.1 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Yardville-Groveville, NJ (based on Mercer County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 121,650 | 26 |

| Mainline Protestant | 29,638 | 86 |

| Evangelical Protestant | 17,274 | 91 |

| Other | 17,115 | 38 |

| Black Protestant | 5,146 | 30 |

| Orthodox | 1,960 | 5 |

| None | 173,730 | - |

Food Environment Statistics:

| This county: | 2.94 / 10,000 pop. |

| New Jersey: | 2.90 / 10,000 pop. |

| Mercer County: | 0.05 / 10,000 pop. |

| New Jersey: | 0.06 / 10,000 pop. |

| This county: | 1.51 / 10,000 pop. |

| New Jersey: | 1.76 / 10,000 pop. |

| Mercer County: | 0.63 / 10,000 pop. |

| New Jersey: | 0.81 / 10,000 pop. |

| Mercer County: | 7.42 / 10,000 pop. |

| State: | 7.15 / 10,000 pop. |

| Mercer County: | 8.3% |

| State: | 8.3% |

| Mercer County: | 22.2% |

| New Jersey: | 23.3% |

| This county: | 20.1% |

| State: | 18.0% |

6.32% of this county's 2021 resident taxpayers lived in other counties in 2020 ($101,265 average adjusted gross income)

| Here: | 6.32% |

| New Jersey average: | 6.70% |

0.02% of residents moved from foreign countries ($112 average AGI)

Mercer County: 0.02% New Jersey average: 0.01%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Middlesex County, NJ | |

| from Burlington County, NJ | |

| from Bucks County, PA |

7.01% of this county's 2020 resident taxpayers moved to other counties in 2021 ($114,313 average adjusted gross income)

| Here: | 7.01% |

| New Jersey average: | 7.02% |

0.02% of residents moved to foreign countries ($141 average AGI)

Mercer County: 0.02% New Jersey average: 0.02%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Burlington County, NJ | |

| to Middlesex County, NJ | |

| to Bucks County, PA |

Strongest AM radio stations in Yardville-Groveville:

- WPHT (1210 AM; 50 kW; PHILADELPHIA, PA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WBUD (1260 AM; 5 kW; TRENTON, NJ; Owner: MILLENNIUM CENTRAL NEW JERSEY LICENSE HOLDCO, LLC)

- WWJZ (640 AM; 50 kW; MOUNT HOLLY, NJ; Owner: ABC, INC.)

- KYW (1060 AM; 50 kW; PHILADELPHIA, PA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WZZD (990 AM; 50 kW; PHILADELPHIA, PA; Owner: PENNSYLVANIA MEDIA ASSOCIATES, INC.)

- WPEN (950 AM; 50 kW; PHILADELPHIA, PA; Owner: GREATER PHILADELPHIA RADIO, INC.)

- WHWH (1350 AM; 10 kW; PRINCETON, NJ; Owner: MULTICULTURAL RADIO BROADCASTING, INC.)

- WIFI (1460 AM; 5 kW; FLORENCE, NJ; Owner: REAL LIFE BROADCASTING)

- WTTM (1680 AM; 10 kW; PRINCETON, NJ; Owner: MULTICULTURAL RADIO BROADCASTING, INC.)

- WNWR (1540 AM; 50 kW; PHILADELPHIA, PA)

- WVCH (740 AM; 50 kW; CHESTER, PA; Owner: WVCH COMMUNICATIONS, INC.)

- WMCA (570 AM; 50 kW; NEW YORK, NY; Owner: SALEM MEDIA OF NEW YORK, LLC)

- WOR (710 AM; 50 kW; NEW YORK, NY; Owner: BUCKLEY BROADCASTING CORPORATION)

Strongest FM radio stations in Yardville-Groveville:

- WKXW-FM (101.5 FM; TRENTON, NJ; Owner: MILLENNIUM CENTRAL NEW JERSEY LICENSE HOLDCO, LLC)

- WNJT-FM (88.1 FM; TRENTON, NJ; Owner: NEW JERSEY PUBLIC BRD/CST AUTHORITY)

- WPRB (103.3 FM; PRINCETON, NJ; Owner: PRINCETON BROADCASTING SERVICE, INC.)

- WPST (97.5 FM; TRENTON, NJ; Owner: NASSAU BROADCASTING II, L.L.C.)

- WWFM (89.1 FM; TRENTON, NJ; Owner: MERCER COUNTY COMMUNITY COLLEGE)

- W220AG (91.9 FM; LAWRENCEVILLE, ETC., NJ; Owner: BUX-MONT EDUCATIONAL RADIO ASSOC.)

- WTHK (94.5 FM; TRENTON, NJ; Owner: NASSAU BROADCASTING II, L.L.C.)

- WMGK (102.9 FM; PHILADELPHIA, PA; Owner: GREATER PHILADELPHIA RADIO, INC.)

- WMWX (95.7 FM; PHILADELPHIA, PA; Owner: GREATER PHILADELPHIA RADIO, INC.)

- WOGL (98.1 FM; PHILADELPHIA, PA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WBEB (101.1 FM; PHILADELPHIA, PA; Owner: WEAZ-FM RADIO, INC.)

- WRTI (90.1 FM; PHILADELPHIA, PA; Owner: TEMPLE UNIV. OF THE COMMONWEALTH, ET)

- WSNI-FM (104.5 FM; PHILADELPHIA, PA; Owner: AMFM RADIO LICENSES, L.L.C.)

- WPHI-FM (103.9 FM; JENKINTOWN, PA; Owner: RADIO ONE LICENSES, LLC)

- WMMR (93.3 FM; PHILADELPHIA, PA; Owner: GREATER BOSTON RADIO, INC.)

- WHYY-FM (90.9 FM; PHILADELPHIA, PA; Owner: WHYY, INC.)

- WXPN (88.5 FM; PHILADELPHIA, PA; Owner: TRUSTEES OF THE UNIVERSITY OF PENNA.)

- WYSP (94.1 FM; PHILADELPHIA, PA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WXTU (92.5 FM; PHILADELPHIA, PA; Owner: WXTU LICENSE LIMITED PARTNERSHIP)

- WJJZ (106.1 FM; PHILADELPHIA, PA; Owner: AMFM RADIO LICENSES, L.L.C.)

TV broadcast stations around Yardville-Groveville:

- WNJT (Channel 52; TRENTON, NJ; Owner: NEW JERSEY PUBLIC BROADCASTING AUTHORITY)

- WNJN (Channel 50; MONTCLAIR, NJ; Owner: NEW JERSEY PUBLIC B/CNG AUTHORITY)

- W25AW (Channel 25; TRENTON, NJ; Owner: WZBN TV, INC.)

- KYW-TV (Channel 3; PHILADELPHIA, PA; Owner: CBS BROADCASTING INC.)

- WPHL-TV (Channel 17; PHILADELPHIA, PA; Owner: TRIBUNE TELEVISION COMPANY)

- WPVI-TV (Channel 6; PHILADELPHIA, PA; Owner: ABC, INC.)

- WPPX (Channel 61; WILMINGTON, DE; Owner: PAXSON PHILADELPHIA LICENSE, INC.)

- WPSG (Channel 57; PHILADELPHIA, PA; Owner: VIACOM STATIONS GROUP OF PHILADELPHIA INC.)

- WUVP (Channel 65; VINELAND, NJ; Owner: UNIVISION PHILADELPHIA LLC)

- WCAU (Channel 10; PHILADELPHIA, PA; Owner: NBC SUBSIDIARY (WCAU-TV), L.P.)

- WNYW (Channel 5; NEW YORK, NY; Owner: FOX TELEVISION STATIONS, INC.)

- WCBS-TV (Channel 2; NEW YORK, NY; Owner: CBS BROADCASTING INC.)

- WWJT-LP (Channel 7; PHILADELPHIA, PA; Owner: PHILADELPHIA TELEVISION NETWORK, INC)

- WGTW (Channel 48; BURLINGTON, NJ; Owner: BRUNSON COMMUNICATIONS, INC.)

- WYBE (Channel 35; PHILADELPHIA, PA; Owner: INDEPENDENCE PUBLIC MEDIA OF PHILADELPHIA, INC.)

- WABC-TV (Channel 7; NEW YORK, NY; Owner: AMERICAN BROADCASTING COMPANIES, INC)

- WPIX (Channel 11; NEW YORK, NY; Owner: WPIX, INC.)

- WWOR-TV (Channel 9; SECAUCUS, NJ; Owner: FOX TELEVISION STATIONS, INC.)

- WELL-LP (Channel 8; WILLOW GROVE, ETC., PA; Owner: WORD OF GOD FELLOWSHIP, INC.)

- WHYY-TV (Channel 12; WILMINGTON, DE; Owner: WHYY, INC.)

- WTXF-TV (Channel 29; PHILADELPHIA, PA; Owner: FOX TV STATIONS OF PHILADELPHIA)

- WPXN-TV (Channel 31; NEW YORK, NY; Owner: PAXSON COMMUNICATIONS LICENSE COMPANY, LLC)

- WNJS (Channel 23; CAMDEN, NJ; Owner: NEW JERSEY PUBLIC BROADCASTING AUTHORITY)

- WNBC (Channel 4; NEW YORK, NY; Owner: NATIONAL BROADCASTING COMPANY, INC.)

- WNET (Channel 13; NEWARK, NJ; Owner: EDUCATIONAL BROADCASTING CORPORATION)

- National Bridge Inventory (NBI) Statistics

- 17Number of bridges

- 128ft / 39.0mTotal length

- $14,410,000Total costs

- 293,788Total average daily traffic

- 17,549Total average daily truck traffic

- New bridges - historical statistics

- 11920-1929

- 71950-1959

- 21970-1979

- 21990-1999

- 12000-2009

- 32010-2019

- 12020-2022

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 2 partial tracts) | ||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 20 | $244,746 | 15 | $258,099 | 139 | $205,070 | 7 | $85,933 | 2 | $208,795 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 1 | $237,180 | 2 | $313,340 | 14 | $197,212 | 2 | $104,555 | 0 | $0 |

| APPLICATIONS DENIED | 1 | $95,670 | 2 | $281,980 | 44 | $225,937 | 5 | $52,782 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 1 | $264,680 | 1 | $225,190 | 32 | $215,118 | 2 | $29,990 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 1 | $132,760 | 4 | $306,688 | 1 | $21,050 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 0030.01 , 0030.03

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 2 partial tracts) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 3 | $211,663 | 3 | $260,687 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 1 | $269,260 | 2 | $242,050 |

| APPLICATIONS DENIED | 0 | $0 | 1 | $172,230 |

| APPLICATIONS WITHDRAWN | 1 | $73,330 | 1 | $313,950 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 1 | $174,160 |

Detailed PMIC statistics for the following Tracts: 0030.01 , 0030.03

- 91.6%Utility gas

- 8.1%Fuel oil, kerosene, etc.

- 0.3%Bottled, tank, or LP gas

- 71.0%Utility gas

- 18.4%Electricity

- 6.2%Fuel oil, kerosene, etc.

- 2.7%Other fuel

- 1.7%No fuel used

Yardville-Groveville compared to New Jersey state average:

- Unemployed percentage significantly below state average.

- Black race population percentage significantly below state average.

- Hispanic race population percentage significantly below state average.

- Foreign-born population percentage significantly below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

Yardville-Groveville on our top lists:

- #6 on the list of "Top 101 cities with largest percentage of males in occupations: drafters, engineering, and mapping technicians (population 5,000+)"

- #13 on the list of "Top 101 cities with largest percentage of males in occupations: other office and administrative support workers including supervisors (population 5,000+)"

- #14 on the list of "Top 101 cities with largest percentage of males in industries: health and personal care, except drug, stores (population 5,000+)"

- #20 on the list of "Top 101 cities with largest percentage of males in occupations: life and physical scientists (population 5,000+)"

- #21 on the list of "Top 101 cities with largest percentage of males in occupations: media and communication equipment workers (population 5,000+)"

- #22 on the list of "Top 101 cities with largest percentage of males in occupations: other transportation workers (population 5,000+)"

- #23 on the list of "Top 101 cities with largest percentage of females in occupations: rail and water transportation workers (population 5,000+)"

- #28 on the list of "Top 101 cities with largest percentage of females in industries: jewelry, luggage, and leather goods stores (population 5,000+)"

- #35 on the list of "Top 101 cities with largest percentage of males in industries: gasoline stations (population 5,000+)"

- #39 on the list of "Top 101 cities with largest percentage of females in industries: retail florists (population 5,000+)"

- #49 on the list of "Top 101 cities with largest percentage of males in industries: retail florists (population 5,000+)"

- #70 on the list of "Top 101 cities with largest percentage of males in industries: vending machine operators (population 5,000+)"

- #71 on the list of "Top 101 cities with largest percentage of males in industries: warehousing and storage (population 5,000+)"

- #73 on the list of "Top 101 cities with largest percentage of males in industries: farm supplies merchant wholesalers (population 5,000+)"

- #87 on the list of "Top 101 cities with largest percentage of males in industries: rail transportation (population 5,000+)"

- #96 on the list of "Top 101 cities with largest percentage of males in industries: machinery, equipment, and supplies merchant wholesalers (population 5,000+)"

- #14 on the list of "Top 101 counties with the largest increase in the number of infant deaths per 1000 residents 2000-2006 to 2007-2013 (pop. 50,000+)"

- #22 on the list of "Top 101 counties with the lowest percentage of residents that keep firearms around their homes"

- #34 on the list of "Top 101 counties with the highest average weight of females"

- #39 on the list of "Top 101 counties with the highest number of infant deaths per 1000 residents 2007-2013 (pop. 50,000+)"

- #40 on the list of "Top 101 counties with the largest number of people moving out compared to moving in (pop. 50,000+)"