Arkansas

Taxation

In 2000, the state income tax ranged from 0% to 6%; the corporate income tax ranged from 1% on the first $3,000 to 6.5% on amounts over $100,000. Corporate taxpayers with a net income of $100,000 or greater pay a flat rate of 6.5%. The state sales tax is 4.625%. The state also imposes severance taxes on oil, natural gas, and other natural resources, along with levies on liquor, gasoline, and cigarettes. City and county property taxes in Arkansas are among the lowest in the nation.

Total tax revenues for 2001 were forecast at approximately $3.3 billion, including $1.8 billion from individual income, and $1.4 billion from the sales tax. The severance and corporate franchise taxes were repealed in 1999, causing a drop in revenue from 1998.

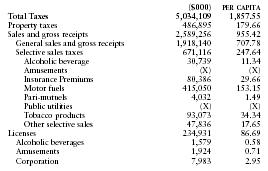

The following table from the US Census Bureau provides a summary of taxes collected by the state in 2002.

| ($000) | PER CAPITA | |

| Total Taxes | 5,034,109 | 1,857.55 |

| Property taxes | 486,895 | 179.66 |

| Sales and gross receipts | 2,589,256 | 955.42 |

| General sales and gross receipts | 1,918,140 | 707.78 |

| Selective sales taxes | 671,116 | 247.64 |

| Alcoholic beverage | 30,739 | 11.34 |

| Amusements | (X) | (X) |

| Insurance Premiums | 80,386 | 29.66 |

| Motor fuels | 415,050 | 153.15 |

| Pari-mutuels | 4,032 | 1.49 |

| Public utilities | (X) | (X) |

| Tobacco products | 93,073 | 34.34 |

| Other selective sales | 47,836 | 17.65 |

| Licenses | 234,931 | 86.69 |

| Alcoholic beverages | 1,579 | 0.58 |

| Amusements | 1,924 | 0.71 |

| Corporation | 7,983 | 2.95 |

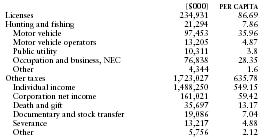

| ($000) | PER CAPITA | |

| Licenses | 234,931 | 86.69 |

| Hunting and fishing | 21,294 | 7.86 |

| Motor vehicle | 97,453 | 35.96 |

| Motor vehicle operators | 13,205 | 4.87 |

| Public utility | 10,311 | 3.8 |

| Occupation and business, NEC | 76,838 | 28.35 |

| Other | 4,344 | 1.6 |

| Other taxes | 1,723,027 | 635.78 |

| Individual income | 1,488,250 | 549.15 |

| Corporation net income | 161,021 | 59.42 |

| Death and gift | 35,697 | 13.17 |

| Documentary and stock transfer | 19,086 | 7.04 |

| Severance | 13,217 | 4.88 |

| Other | 5,756 | 2.12 |