Alexandria, Virginia

Alexandria: Old Town Alexandria

Alexandria: New urbanist mixed-use development near Alexandria Metro / Amtrak station

Alexandria: Oldtown Alexandria Boardwalk and Marina

Alexandria: Street Scene in Old Town Alexandria

Alexandria: Alexandria Seaport Foundation in a Snow Storm

Alexandria: Old Town Theater in Historic Alexandria

Alexandria: Torpedo Factory

Alexandria: Alexandria City Hall in Winter

Alexandria: Paddle Boat on Potomac

Alexandria: West end of Alexandria, VA at dusk

Alexandria: West End Alexandria after the big snowstorm

- see

24

more - add

your

Submit your own pictures of this city and show them to the world

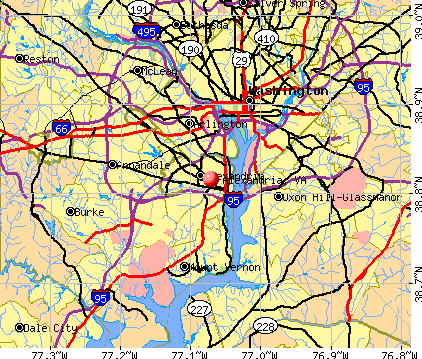

- OSM Map

- General Map

- Google Map

- MSN Map

Population change since 2000: +21.2%

| Males: 76,371 | |

| Females: 79,154 |

| Median resident age: | 38.0 years |

| Virginia median age: | 39.0 years |

Zip codes: 22206, 22301, 22302, 22304, 22305, 22311, 22312, 22314.

Alexandria Zip Code Map| Alexandria: | $111,955 |

| VA: | $85,873 |

Estimated per capita income in 2022: $76,762 (it was $37,645 in 2000)

Alexandria city income, earnings, and wages data

Estimated median house or condo value in 2022: $748,300 (it was $202,400 in 2000)

| Alexandria: | $748,300 |

| VA: | $365,700 |

Mean prices in 2022: all housing units: $810,227; detached houses: over $1,000,000; townhouses or other attached units: $902,237; in 2-unit structures: $720,104; in 3-to-4-unit structures: $430,465; in 5-or-more-unit structures: $390,441

Median gross rent in 2022: $1,960.

(3.7% for White Non-Hispanic residents, 15.3% for Black residents, 13.4% for Hispanic or Latino residents, 11.6% for American Indian residents, 21.0% for other race residents, 9.3% for two or more races residents)

Detailed information about poverty and poor residents in Alexandria, VA

- 77,62849.9%White alone

- 31,83620.5%Black alone

- 26,07216.8%Hispanic

- 9,5656.2%Asian alone

- 8,9335.7%Two or more races

- 1,4911.0%Other race alone

Races in Alexandria detailed stats: ancestries, foreign born residents, place of birth

According to our research of Virginia and other state lists, there were 272 registered sex offenders living in Alexandria, Virginia as of April 26, 2024.

The ratio of all residents to sex offenders in Alexandria is 573 to 1.

The ratio of registered sex offenders to all residents in this city is lower than the state average.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

- means the value is smaller than the state average.- means the value is about the same as the state average.

- means the value is bigger than the state average.

Crime rate in Alexandria detailed stats: murders, rapes, robberies, assaults, burglaries, thefts, arson

Full-time law enforcement employees in 2021, including police officers: 379 (295 officers - 234 male; 61 female).

| Officers per 1,000 residents here: | 1.84 |

| Virginia average: | 2.24 |

| Moving to Alexandria, need help with picking the right neighborhood (27 replies) |

| Non-resident vehicle in Alexandria (16 replies) |

| Relocating to Alexandria VA (3 replies) |

| Temporary relocation to Alexandria... Rent or Buy? (10 replies) |

| Living near Alexandria Amtrak station (11 replies) |

| Where to live: Alexandria or Arlington or D.C. Proper (19 replies) |

Latest news from Alexandria, VA collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: Ethiopian (8.1%), Irish (4.8%), English (4.5%), German (3.5%), European (3.3%), American (3.0%).

Current Local Time: EST time zone

Incorporated in 1852

Elevation: 30 feet

Land area: 15.2 square miles.

Population density: 10,247 people per square mile (high).

39,091 residents are foreign born (8.4% Latin America, 7.8% Africa, 5.6% Asia).

| This city: | 25.1% |

| Virginia: | 12.6% |

Median real estate property taxes paid for housing units with mortgages in 2022: $7,079 (1.0%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $8,026 (1.0%)

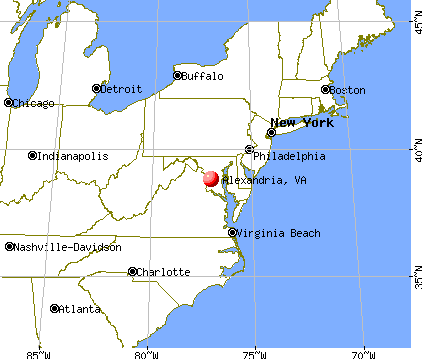

Nearest city with pop. 200,000+: Washington, DC (7.4 miles

, pop. 572,059).

Nearest city with pop. 1,000,000+: Philadelphia, PA (131.5 miles

, pop. 1,517,550).

Nearest cities:

Latitude: 38.82 N, Longitude: 77.07 W

Daytime population change due to commuting: +7,929 (+5.1%)

Workers who live and work in this city: 48,521 (50.0%)

Alexandria tourist attractions:

- Carlyle House, Alexandria, Virginia, A Mansion Full of History

- Crowne Plaza Hotel Old Town Alexandria - Alexandria, Virginia - Hotel

- Embassy Suites Alexandria-Old Town - Alexandria, Virginia - Hotel Featuring a Fitness Center and Swimming Pool

- Hilton Alexandria Mark Center - Alexandria, Virginia - Hotel

- Resort for Relaxation

- Morrison House - a Kimpton Hotel - Alexandria, Virginia - Hotel

- Mount Vernon Estate and Gardens, Alexandria, Virginia, Home of the Nation's First President

- Hotel Monaco Alexandria - a Kimpton Hotel

- Hampton Inn Alexandria - Old Town/King Street Metro

- Courtyard by Marriott Alexandria

- Homewood Suites Alexandria

- Holiday Inn Hotel & Suites

- Hampton Inn and Suites Alexandria Old Town Area South

- Washington Suites Alexandria

- Landmark Mall - Alexandria, VA - a mall offering service to the Alexandria area for over forty years

- Old Town in Alexandria, Alexandria, Virginia, A City Full of History

- Residence Inn Alexandria Old Town, Alexandria, Virginia - Hotel Featuring an Indoor Pool and Fitness Center

- Sheraton Suites Old Town Alexandria - Alexandria, Virginia - Hotel Featuring a Fitness Room and Swimming Pool

- Westin Alexandria - Alexandria, Virginia - Hotel Featuring an Indoor Pool and Gym

Alexandria, Virginia accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 25 buildings, average cost: $394,200

- 2021: 12 buildings, average cost: $305,000

- 2020: 107 buildings, average cost: $379,200

- 2019: 65 buildings, average cost: $256,200

- 2018: 112 buildings, average cost: $192,700

- 2017: 149 buildings, average cost: $221,700

- 2016: 145 buildings, average cost: $230,400

- 2015: 193 buildings, average cost: $221,600

- 2014: 174 buildings, average cost: $195,700

- 2013: 218 buildings, average cost: $203,400

- 2012: 151 buildings, average cost: $187,500

- 2011: 105 buildings, average cost: $230,900

- 2010: 65 buildings, average cost: $187,700

- 2009: 35 buildings, average cost: $243,200

- 2008: 65 buildings, average cost: $306,800

- 2007: 93 buildings, average cost: $164,200

- 2006: 137 buildings, average cost: $188,800

- 2005: 195 buildings, average cost: $189,600

- 2004: 171 buildings, average cost: $144,700

- 2003: 20 buildings, average cost: $143,300

- 2002: 380 buildings, average cost: $146,300

- 2001: 401 buildings, average cost: $154,400

- 2000: 386 buildings, average cost: $125,900

- 1999: 646 buildings, average cost: $116,400

- 1998: 680 buildings, average cost: $116,900

- 1997: 667 buildings, average cost: $118,200

| Here: | 2.2% |

| Virginia: | 2.7% |

Population change in the 1990s: +17,016 (+15.3%).

- Professional, scientific, technical services (18.3%)

- Public administration (14.2%)

- Religious, grantmaking, civic, professional, similar organizations (6.1%)

- Educational services (5.8%)

- Accommodation & food services (5.5%)

- Health care (5.4%)

- Construction (5.0%)

- Professional, scientific, technical services (19.9%)

- Public administration (14.0%)

- Construction (8.9%)

- Accommodation & food services (5.5%)

- Religious, grantmaking, civic, professional, similar organizations (4.4%)

- Finance & insurance (4.3%)

- Educational services (3.9%)

- Professional, scientific, technical services (16.6%)

- Public administration (14.5%)

- Health care (7.8%)

- Educational services (7.8%)

- Religious, grantmaking, civic, professional, similar organizations (7.7%)

- Accommodation & food services (5.6%)

- Finance & insurance (4.9%)

- Other management occupations, except farmers and farm managers (9.5%)

- Computer specialists (5.2%)

- Cooks and food preparation workers (5.1%)

- Building and grounds cleaning and maintenance occupations (3.9%)

- Lawyers (3.5%)

- Media and communications workers (2.8%)

- Other office and administrative support workers, including supervisors (2.4%)

- Other management occupations, except farmers and farm managers (9.3%)

- Computer specialists (6.9%)

- Cooks and food preparation workers (5.9%)

- Building and grounds cleaning and maintenance occupations (3.9%)

- Lawyers (3.0%)

- Engineers (2.9%)

- Media and communications workers (2.5%)

- Other management occupations, except farmers and farm managers (9.8%)

- Cooks and food preparation workers (4.1%)

- Lawyers (4.0%)

- Building and grounds cleaning and maintenance occupations (3.9%)

- Secretaries and administrative assistants (3.8%)

- Computer specialists (3.5%)

- Other office and administrative support workers, including supervisors (3.4%)

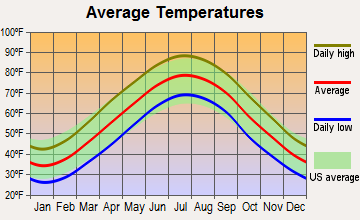

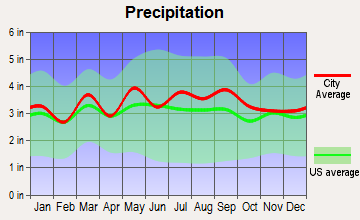

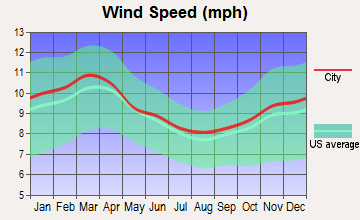

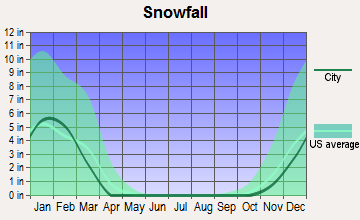

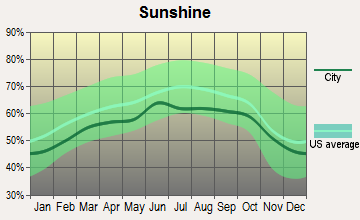

Average climate in Alexandria, Virginia

Based on data reported by over 4,000 weather stations

|

|

(lower is better)

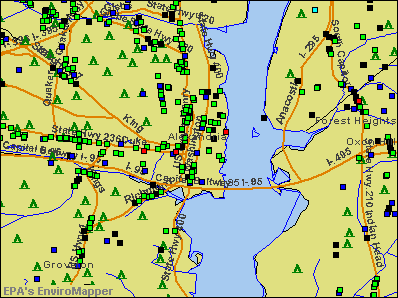

Air Quality Index (AQI) level in 2023 was 95.4. This is worse than average.

| City: | 95.4 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2023 was 0.251. This is about average. Closest monitor was 1.1 miles away from the city center.

| City: | 0.251 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2023 was 8.96. This is significantly worse than average. Closest monitor was 1.1 miles away from the city center.

| City: | 8.96 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2023 was 0.213. This is significantly better than average. Closest monitor was 0.8 miles away from the city center.

| City: | 0.213 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2023 was 31.3. This is about average. Closest monitor was 1.1 miles away from the city center.

| City: | 31.3 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 13.5. This is significantly better than average. Closest monitor was 1.5 miles away from the city center.

| City: | 13.5 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 9.90. This is worse than average. Closest monitor was 1.5 miles away from the city center.

| City: | 9.90 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2016 was 0.00212. This is significantly better than average. Closest monitor was 2.0 miles away from the city center.

| City: | 0.00212 |

| U.S.: | 0.00931 |

Tornado activity:

Alexandria-area historical tornado activity is above Virginia state average. It is 9% greater than the overall U.S. average.

On 4/28/2002, a category F4 (max. wind speeds 207-260 mph) tornado 19.3 miles away from the Alexandria city center killed 3 people and injured 122 people and caused $124 million in damages.

On 9/5/1979, a category F3 (max. wind speeds 158-206 mph) tornado 2.6 miles away from the city center killed one person and injured 6 people and caused between $500,000 and $5,000,000 in damages.

Earthquake activity:

Alexandria-area historical earthquake activity is significantly above Virginia state average. It is 57% smaller than the overall U.S. average.On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 78.3 miles away from the city center

On 8/25/2011 at 05:07:52, a magnitude 4.5 (4.5 ML, Depth: 4.2 mi, Class: Light, Intensity: IV - V) earthquake occurred 77.3 miles away from Alexandria center

On 12/9/2003 at 20:59:18, a magnitude 4.5 (4.5 ML, Depth: 6.2 mi) earthquake occurred 91.2 miles away from the city center

On 12/9/2003 at 20:59:14, a magnitude 4.5 (4.5 MB, 4.5 LG) earthquake occurred 96.3 miles away from the city center

On 1/16/1994 at 01:49:16, a magnitude 4.6 (4.6 MB, 4.6 LG, Depth: 3.1 mi) earthquake occurred 118.3 miles away from Alexandria center

On 9/25/1998 at 19:52:52, a magnitude 5.2 (4.8 MB, 4.3 MS, 5.2 LG, 4.5 MW, Depth: 3.1 mi) earthquake occurred 255.1 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Main business address for: HALIFAX CORP (SERVICES-COMPUTER PROGRAMMING, DATA PROCESSING, ETC.), AVALONBAY COMMUNITIES INC (REAL ESTATE INVESTMENT TRUSTS), ANALEX CORP (SERVICES-COMPUTER PROGRAMMING, DATA PROCESSING, ETC.), USA Mobility, Inc (RADIO TELEPHONE COMMUNICATIONS), COMTEX NEWS NETWORK INC (SERVICES-MISCELLANEOUS BUSINESS SERVICES), BOWL AMERICA INC (SERVICES-AMUSEMENT & RECREATION SERVICES), CUISINE SOLUTIONS INC (CANNED, FROZEN & PRESERVED FRUIT, VEG & FOOD SPECIALTIES), METROCALL HOLDINGS INC (RADIO TELEPHONE COMMUNICATIONS) and 2 other public companies.

Hospitals in Alexandria:

- COURTHOUSE ROAD ICF (4123 CONRAD ROAD)

- INOVA ALEXANDRIA HOSPITAL (Voluntary non-profit - Private, provides emergency services, 4320 SEMINARY RD)

- INOVA MOUNT VERNON HOSPITAL (Voluntary non-profit - Other, 2501 PARKERS LANE)

- JEFFERSON HOSPITAL (provides emergency services, 4600 KING STREET)

Nursing Homes in Alexandria:

- ENVOY OF ALEXANDRIA, LLC (900 VIRGINIA AVENUE)

- GOODWIN HOUSE (4800 FILLMORE AVE)

- GOODWIN HOUSE ALEXANDRIA (4800 FILLMORE AVE)

- MANORCARE HEALTH SERVICES-ALEXANDRIA (1510 COLLINGWOOD ROAD)

- MOUNT VERNON NRS CTR (TISWELL DR)

- MOUNT VERNON NURSING AND REHABILITATION CENTER (8111 TISWELL DRIVE)

- THE WASHINGTON HOUSE (5100 FILLMORE AVENUE)

- WOODBINE REHABILITATION AND HEALTHCARE CENTER (2729 KING ST)

Dialysis Facilities in Alexandria:

- ALEXANDRIA KIDNEY CENTER (4141 DUKE STREET)

- CDC - ALEXANDRIA (5999 STEVENSON AVE)

- DAVITA - ALEXANDRIA (5150 DUKE ST)

- FMC - FORT BELVOIR (8796 P SACRAMENTO DR)

- FRANCONIA DIALYSIS CENTER (5695 KING CENTER DR)

Home Health Centers in Alexandria:

- 1ST AMERICAN HOME HEALTH CARE SERVICES (6216 OLD FRANCONIA RD SUITE A)

- CONSIDERATE CARE (5021 SEMINARY RD SUITE 110)

- DEPENDABLE HOME HEALTH SERVICES (50 SOUTH PICKETT STREET, SUITE 200)

- DOMAIN MEDICAL HOME HEALTH AND STAFFING, INC (2121 EISENHOWER AVE)

- KIMBERLY QUALITY CARE (4900 LEESBURG PIKE STE 405)

- STGI HOME HEALTH LLC (99 CANAL CENTER PLAZA SUITE 430)

- THERAPEUTIC ALLIANCE HOME HEALTH SERVICES (5252 CHEROKEE AVE SUITE 220)

Heliports located in Alexandria:

See details about Heliports located in Alexandria, VAAmtrak station:

ALEXANDRIA (110 CALLAHAN DR.) . Services: ticket office, partially wheelchair accessible, enclosed waiting area, public restrooms, public payphones, vending machines, ATM, free short-term parking, free long-term parking, call for car rental service, call for taxi service, public transit connection.Colleges/Universities in Alexandria:

- Global Health College (Full-time enrollment: 351; Location: 25 S Quaker La 1st Fl; Private, for-profit; Website: www.global.edu)

- CET-Alexandria (Full-time enrollment: 131; Location: 6295 Edsall Rd, Plaza 500, Ste. 220; Private, not-for-profit; Website: www.cetweb.org/index.php)

- Centura College-Alexandria (Full-time enrollment: 23; Location: 6295 Edsall Rd Ste 250; Private, for-profit; Website: www.centuracollege.edu)

Colleges/universities with over 2000 students nearest to Alexandria:

- Strayer University-Virginia (about 6 miles; Arlington, VA; Full-time enrollment: 7,005)

- George Washington University (about 6 miles; Washington, DC; FT enrollment: 18,928)

- Georgetown University (about 7 miles; Washington, DC; FT enrollment: 12,535)

- Strayer University-Global Region (about 7 miles; Washington, DC; FT enrollment: 2,613)

- Medtech Institute (about 7 miles; Falls Church, VA; FT enrollment: 2,900)

- Marymount University (about 7 miles; Arlington, VA; FT enrollment: 3,361)

- Howard University (about 8 miles; Washington, DC; FT enrollment: 7,838)

Public high schools in Alexandria:

- TC WILLIAMS HIGH (Students: 2,868, Location: 3330 KING ST, Grades: 9-12)

- HAYFIELD SECONDARY (Students: 2,629, Location: 7630 TELEGRAPH RD, Grades: 7-12)

- WEST POTOMAC HIGH (Students: 2,074, Location: 6500 QUANDER RD, Grades: 9-12)

- MOUNT VERNON HIGH (Students: 1,823, Location: 8515 OLD MOUNT VERNON RD, Grades: 9-12)

- EDISON HIGH (Students: 1,811, Location: 5801 FRANCONIA RD, Grades: 9-12)

- THOMAS JEFFERSON HIGH (Students: 1,805, Location: 6560 BRADDOCK RD, Grades: 9-12)

- BRYANT ALTERNATIVE HIGH (Students: 234, Location: 2709 POPKINS LN, Grades: 7-12)

Private high schools in Alexandria:

- ST STEPHENS & ST AGNES SCHOOL (Students: 1,141, Location: 1000 SAINT STEPHENS RD, Grades: PK-12)

- BISHOP IRETON HIGH SCHOOL (Students: 828, Location: 201 CAMBRIDGE RD, Grades: 9-12)

- ISLAMIC SAUDI ACADEMY (Students: 614, Location: 8333 RICHMOND HWY, Grades: KG-12)

- EPISCOPAL HIGH SCHOOL (Students: 438, Location: 1200 N QUAKER LN, Grades: 9-12)

- COMMONWEALTH ACADEMY (Students: 131, Location: 1321 LESLIE AVE, Grades: 3-12)

- THE HOWARD GARDNER SCHOOL (Students: 48, Location: 4913 FRANCONIA RD, Grades: 7-12)

- ALEXANDRIA FRIENDS SCHOOL (Students: 4, Location: 3830 SEMINARY RD, Grades: 10-12)

Biggest public elementary/middle schools in Alexandria:

- SANDBURG MIDDLE (Students: 1,164, Location: 8428 FORT HUNT RD, Grades: 7-8)

- GLASGOW MIDDLE (Students: 1,102, Location: 4101 FAIRFAX PKWY, Grades: 6-8)

- WHITMAN MIDDLE (Students: 942, Location: 2500 PARKERS LN, Grades: 7-8)

- TWAIN MIDDLE (Students: 845, Location: 4700 FRANCONIA RD, Grades: 7-8)

- ROSE HILL ELEM (Students: 798, Location: 6301 ROSE HILL DR, Grades: PK-6)

- HOLMES MIDDLE (Students: 772, Location: 6525 MONTROSE ST, Grades: 6-8)

- ISLAND CREEK ELEM (Students: 761, Location: 7855 MORNING VIEW LN., Grades: PK-6)

- STRATFORD LANDING ELEM (Students: 752, Location: 8484 RIVERSIDE RD, Grades: PK-6)

- LANE ELEM (Students: 720, Location: 7137 BEULAH ST, Grades: PK-6)

- HYBLA VALLEY ELEM (Students: 691, Location: 3415 LOCKHEED BLVD, Grades: PK-6)

Biggest private elementary/middle schools in Alexandria:

- ST MARY'S ELEMENTARY SCHOOL (Students: 696, Location: 400 GREEN ST, Grades: PK-8)

- ST LOUIS CATHOLIC SCHOOL (Students: 411, Location: 2901 POPKINS LN, Grades: KG-8)

- BLESSED SACRAMENT SCHOOL & EARLY CHILDHOOD CENTER (Students: 343, Location: 1417 W BRADDOCK RD, Grades: PK-8)

- BURGUNDY FARM COUNTRY DAY SCHOOL (Students: 288, Location: 3700 BURGUNDY RD, Grades: PK-8)

- BROWNE ACADEMY (Students: 287, Location: 5917 TELEGRAPH RD, Grades: PK-8)

- CALVARY ROAD CHRISTIAN SCHOOL (Students: 267, Location: 6811 BEULAH ST, Grades: PK-8)

- ST RITA SCHOOL (Students: 233, Location: 3801 RUSSELL RD, Grades: UG-8)

- ALEXANDRIA COUNTRY DAY SCHOOL (Students: 224, Location: 2400 RUSSELL RD, Grades: KG-8)

- WASHINGTON ISLAMIC ACADEMY (Students: 214, Location: 6408 EDSALL RD STE 1, Grades: PK-8)

- QUEEN OF APOSTLES CATHOLIC SCHOOL (Students: 169, Location: 4409 SANO ST, Grades: KG-8)

Library in Alexandria:

User-submitted facts and corrections:

- The most common area code is 703.

Points of interest:

Notable locations in Alexandria: Braddock Road Metro Station (A), Potomac Yards (B), Jones Point Lighthouse (C), Washington Sailing Marina (D), Braddock Road Subway Station (E), Eisenhower Avenue Metro Station (F), King Street Metro Station (G), Mark Center Office Industrial Park (H), Alexandria Combined Sewer System (I), Alexandria Sanitation Authority Waste Treament Facility (J), Hoffman Town Center (K), Moss Number 2 Mine and Preparation Plant (L), Alexandria Union Station (M), George Washington Masonic National Memorial (N), Alexandria Fire Training (O), Alexandria Fire Department Maintenance (P), Alexandria Fire Marshal's Office (Q), Carlyle House (R), Arlington Visitors Center (S), Stevenson Square Recreation Center (T). Display/hide their locations on the map

Shopping Centers: Landmark Shopping Center (1), Arlandria Shopping Center (2), Bradley Shopping Center (3), Hamlet Shopping Center (4), Seminary Plaza Shopping Center (5), The Shops of Foxchase Shopping Center (6), Trade Center Shopping Center (7), Van Dorn Plaza Shopping Center (8), Potomac Yard Center Shopping Center (9). Display/hide their locations on the map

Main business address in Alexandria include: AVALONBAY COMMUNITIES INC (A), COMTEX NEWS NETWORK INC (B), CUISINE SOLUTIONS INC (C). Display/hide their locations on the map

Churches in Alexandria include: Abundant Life United Holy Church (A), Alexandria First Christian Disciples of Christ Church (B), Alexandria Presbyterian Church (C), Alfred Street Baptist Church (D), Bahai Faith of Northern Virginia (E), Christ House (F), Christian Community Center Church (G), Christian Science Reading Room (H), Christian Voice Church (I). Display/hide their locations on the map

Cemeteries: Alexandria National Cemetery (1), Ivy Hill Cemetery (2), Saint Marys Cemetery (3), Shuters Hill Cemetery (4). Display/hide their locations on the map

Streams, rivers, and creeks: Timber Branch (A), Hooff Run (B), Holmes Run (C), Backlick Run (D), Four Mile Run (E). Display/hide their locations on the map

Parks in Alexandria include: Mount Jefferson Park (1), Market Square (2), Fort Ward Park (3), George Washington Memorial Parkway (4), Colesanto Park (5), Waterfront Park (6), Marina Park (7), Jones Point Park (8), Founders Park (9). Display/hide their locations on the map

Tourist attractions: Friendship Fire House (Museums; 107 South Alfred Street) (1), Athenaeum (Museums; 201 Prince Street) (2), Alexandria Archaeology (Museums; 105 North Union Street) (3), Lyceum (Museums; 1201 South Washington Street) (4), Cammack David C (Museums; 107 North Payne Street) (5), Alexandria Black History Museum (638 North Alfred Street) (6), Gum Springs Historical Society (Museums; 8100 Fordson Road) (7), Alexandria Ballet (Museums; 201 Prince Street) (8), Apothecary Museum Shop (105 South Fairfax Street) (9). Display/hide their approximate locations on the map

Hotels: Comfort Inn-Landmark (I 395 & Duke Street West) (1), Best Western Old Colony Inn (1101 North Washington Street) (2), Hilton Inn (1767 King Street) (3), Alexandria-Towne Motel (808 North Washington Street) (4), Comfort Inn Landmark (6254 Duke St) (5), Harry Smith Motel (6140 Richmond Highway) (6), Brookside Motel (6001 Richmond Highway) (7), Fairview Motel (6411 Richmond Highway) (8), Friendship Inn (8849 Richmond Highway) (9). Display/hide their approximate locations on the map

Birthplace of: Neko Case - Singer-songwriter, Cueball Carmichael - Professional wrestler, Casey Wilson - Comedian, Samuel Wilbert Tucker - Lawyer, John Wells (TV producer) - Television producer, Tao Lin - Novelist, Rolf Saxon - Film actor, Mackenzie Phillips - Actress, Imani Lee - Professional wrestler, Rob Huebel - Comedian.

Drinking water stations with addresses in Alexandria and their reported violations in the past:

ALEXANDRIA, CITY OF (Population served: 143,885, Purch surface water):Past monitoring violations:TYLER DENTAL (Address: 624 N. WASHINGTON ST. , Serves MD, Population served: 52, Groundwater):

- Monitoring and Reporting (DBP) - Between JUL-2007 and SEP-2007, Contaminant: Chlorine. Follow-up actions: St Public Notif requested (OCT-12-2007), St Formal NOV issued (OCT-12-2007), St Compliance achieved (MAR-31-2008)

- 2 minor monitoring violations

Past health violations:

- MCL, Monthly (TCR) - In MAY-2013, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (MAY-16-2013)

- MCL, Acute (TCR) - In APR-2012, Contaminant: Coliform. Follow-up actions: St Compliance achieved (MAY-16-2012)

- MCL, Monthly (TCR) - In APR-2012, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (MAY-16-2012), St Public Notif received (MAY-29-2012), St Compliance achieved (AUG-07-2012)

- MCL, Monthly (TCR) - In FEB-2012, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (FEB-21-2012), St Public Notif received (FEB-27-2012), St Compliance achieved (MAR-19-2012)

- MCL, Monthly (TCR) - In DEC-2011, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (DEC-12-2011), St Public Notif received (DEC-15-2011), St Compliance achieved (JAN-06-2012)

- MCL, Monthly (TCR) - In JUL-2008, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (JUL-09-2008), St Compliance achieved (JAN-06-2009)

- MCL, Monthly (TCR) - In APR-2008, Contaminant: Coliform. Follow-up actions: St Violation/Reminder Notice (APR-08-2008), St Public Notif received (APR-28-2008), St Compliance achieved (MAY-20-2008)

Drinking water stations with addresses in Alexandria that have no violations reported:

- DALE CITY (Population served: 60,000, Primary Water Source Type: Purch surface water)

| This city: | 2.0 people |

| Virginia: | 2.5 people |

| This city: | 45.5% |

| Whole state: | 67.0% |

| This city: | 6.9% |

| Whole state: | 5.7% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.5% of all households

- Gay men: 0.7% of all households

People in group quarters in Alexandria in 2010:

- 506 people in nursing facilities/skilled-nursing facilities

- 471 people in college/university student housing

- 400 people in local jails and other municipal confinement facilities

- 223 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 59 people in other noninstitutional facilities

- 55 people in correctional facilities intended for juveniles

- 55 people in group homes intended for adults

- 23 people in residential treatment centers for adults

- 22 people in workers' group living quarters and job corps centers

- 13 people in group homes for juveniles (non-correctional)

People in group quarters in Alexandria in 2000:

- 948 people in nursing homes

- 412 people in local jails and other confinement facilities (including police lockups)

- 251 people in other noninstitutional group quarters

- 62 people in short-term care, detention or diagnostic centers for delinquent children

- 62 people in homes or halfway houses for drug/alcohol abuse

- 61 people in college dormitories (includes college quarters off campus)

- 42 people in homes for the mentally retarded

- 19 people in religious group quarters

- 14 people in other group homes

- 13 people in homes for the mentally ill

- 9 people in wards in general hospitals for patients who have no usual home elsewhere

- 8 people in halfway houses

Banks with most branches in Alexandria (2011 data):

- Wells Fargo Bank, National Association: 14 branches. Info updated 2011/04/05: Bank assets: $1,161,490.0 mil, Deposits: $905,653.0 mil, headquarters in Sioux Falls, SD, positive income, 6395 total offices, Holding Company: Wells Fargo & Company

- SunTrust Bank: 13 branches. Info updated 2010/05/27: Bank assets: $171,291.7 mil, Deposits: $129,833.2 mil, headquarters in Atlanta, GA, positive income, Commercial Lending Specialization, 1716 total offices, Holding Company: Suntrust Banks, Inc.

- Branch Banking and Trust Company: 12 branches. Info updated 2010/03/29: Bank assets: $168,867.6 mil, Deposits: $127,549.5 mil, headquarters in Winston Salem, NC, positive income, Commercial Lending Specialization, 1793 total offices, Holding Company: Bb&T Corporation

- Burke & Herbert Bank & Trust Company: 11 branches. Info updated 2010/05/12: Bank assets: $2,461.7 mil, Deposits: $2,022.3 mil, local headquarters, positive income, Commercial Lending Specialization, 25 total offices

- PNC Bank, National Association: 7 branches. Info updated 2012/03/20: Bank assets: $263,309.6 mil, Deposits: $197,343.0 mil, headquarters in Wilmington, DE, positive income, Commercial Lending Specialization, 3085 total offices, Holding Company: Pnc Financial Services Group, Inc., The

- Capital One, National Association: Carlyle Place Branch, Engleside Branch, Bradlee Shopping Center Branch, South Washington Branch, Beacon Mall Branch, Franconia Branch. Info updated 2011/07/01: Bank assets: $133,477.8 mil, Deposits: $97,063.7 mil, headquarters in Mclean, VA, positive income, 984 total offices, Holding Company: Capital One Financial Corporation

- Manufacturers and Traders Trust Company: Landmark Shoppers Branch, Old Towne Branch, Mount Vernon Square Branch, Franconia Shoppers Branch, Alexandria Jefferson Davis Highway S. Info updated 2011/08/08: Bank assets: $76,887.1 mil, Deposits: $60,064.2 mil, headquarters in Buffalo, NY, positive income, Commercial Lending Specialization, 808 total offices, Holding Company: M&T Bank Corporation

- Virginia Commerce Bank: King Street Branch, Mt Vernon Branch, Del Ray Branch 16 Branch, Duke Street Branch, Alexandria Branch. Info updated 2006/11/03: Bank assets: $2,936.3 mil, Deposits: $2,300.3 mil, headquarters in Arlington, VA, positive income, Commercial Lending Specialization, 29 total offices, Holding Company: Virginia Commerce Bancorp, Inc.

- Bank of America, National Association: Alexandria, Duke Street Branch, Beacon Mall Branch, Lake Barcroft Branch. Info updated 2009/11/18: Bank assets: $1,451,969.3 mil, Deposits: $1,077,176.8 mil, headquarters in Charlotte, NC, positive income, 5782 total offices, Holding Company: Bank Of America Corporation

- 6 other banks with 8 local branches

For population 15 years and over in Alexandria:

- Never married: 39.0%

- Now married: 44.6%

- Separated: 2.2%

- Widowed: 3.3%

- Divorced: 10.9%

For population 25 years and over in Alexandria:

- High school or higher: 94.6%

- Bachelor's degree or higher: 69.9%

- Graduate or professional degree: 36.0%

- Unemployed: 2.3%

- Mean travel time to work (commute): 19.8 minutes

| Here: | 10.6 |

| Virginia average: | 12.1 |

Graphs represent county-level data. Detailed 2008 Election Results

Neighborhoods in Alexandria:

(Alexandria, Virginia Neighborhood Map)- Alexandria West neighborhood

- Arcturus neighborhood

- Braddock Road Metro neighborhood

- Bradlee (Farlington) neighborhood

- Bren Mar Park neighborhood

- Brookland Estates neighborhood

- Bucknell Heights neighborhood

- Bucknell Manor neighborhood

- Burgundy Village neighborhood

- Bush Hill Woods neighborhood

- Cameron Villa Farms neighborhood

- Cannon neighborhood

- Clermont Woods neighborhood

- Collingwood neighborhood

- Del Ray (Potomac West) neighborhood

- Eisenhower Ave (King St Metro) neighborhood

- Eisenhower East neighborhood

- Fairland neighborhood

- Groveton Heights neighborhood

- Guilford neighborhood

- Gum Springs neighborhood

- Hayfield neighborhood

- Hollin Hall neighborhood

- Hollin Hills neighborhood

- Hollindale neighborhood

- Indian Run Park neighborhood

- Jefferson Manor neighborhood

- Kathmoor neighborhood

- Lincolnia Heights neighborhood

- Lincolnia park neighborhood

- Maple Grove Estates neighborhood

- Marlin Forest neighborhood

- Memorial Heights neighborhood

- Mount Hebron Park neighborhood

- Mount Vernon (Mt Vernon) neighborhood

- Mount Vernon Manor (Mt Vernon Manor) neighborhood

- Mount Vernon Woods (Mt Vernon Woods) neighborhood

- Newton Woods neighborhood

- North Mount Vernon neighborhood

- North Ridge (Rosemont) neighborhood

- Northeast neighborhood

- Oakwood neighborhood

- Old Town neighborhood

- Old Town North neighborhood

- Parker Gray (Parker-Gray) neighborhood

- Parklawn neighborhood

- Penn Draw neighborhood

- Penn Draw Village neighborhood

- Pinecrest neighborhood

- Potomac Yard (Potomac Greens) neighborhood

- Riverside Estates neighborhood

- Riverside Gardens neighborhood

- Rose Hill Farms neighborhood

- Seminary Hill neighborhood

- Snowden neighborhood

- Soutwest Quadrant neighborhood

- Stratford Landing neighborhood

- Stratford on the Potomac neighborhood

- Sulgrave Manor neighborhood

- Sunnyview neighborhood

- Van Dorn (Landmark) neighborhood

- Vernon Square neighborhood

- Villamay neighborhood

- Virginia Hills neighborhood

- Waldon Woods neighborhood

- Walhaven neighborhood

- Waynewood neighborhood

- Wellington neighborhood

- Wellington Heights neighborhood

- Weyanoke neighborhood

- White Oaks neighborhood

- Wilton Woods neighborhood

- Windsor Estates neighborhood

- Winslow Hills neighborhood

- Woodland Park neighborhood

- Woodlawn Manor neighborhood

- Woodley Hills neighborhood

- Yacht Haven neighborhood

Religion statistics for Alexandria, VA (based on Alexandria city County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 18,596 | 4 |

| Mainline Protestant | 16,973 | 26 |

| Evangelical Protestant | 11,290 | 33 |

| Other | 9,879 | 18 |

| Black Protestant | 6,813 | 12 |

| Orthodox | 400 | 2 |

| None | 76,015 | - |

Food Environment Statistics:

| Alexandria city: | 2.36 / 10,000 pop. |

| Virginia: | 2.03 / 10,000 pop. |

| This county: | 0.07 / 10,000 pop. |

| State: | 0.17 / 10,000 pop. |

| Alexandria city: | 1.36 / 10,000 pop. |

| Virginia: | 1.43 / 10,000 pop. |

| Alexandria city: | 1.50 / 10,000 pop. |

| State: | 4.03 / 10,000 pop. |

| Here: | 10.65 / 10,000 pop. |

| State: | 7.65 / 10,000 pop. |

| This county: | 7.1% |

| Virginia: | 9.3% |

| Alexandria city: | 21.4% |

| Virginia: | 26.7% |

| This county: | 26.7% |

| State: | 18.6% |

Health and Nutrition:

| This city: | 51.8% |

| State: | 50.6% |

| This city: | 52.2% |

| Virginia: | 48.6% |

| This city: | 28.0 |

| Virginia: | 28.6 |

| Alexandria: | 18.3% |

| Virginia: | 20.2% |

| This city: | 9.6% |

| State: | 10.5% |

| Alexandria: | 6.8 |

| Virginia: | 6.8 |

| Alexandria: | 31.4% |

| State: | 33.5% |

| Alexandria: | 60.3% |

| Virginia: | 57.4% |

| This city: | 83.4% |

| State: | 80.5% |

More about Health and Nutrition of Alexandria, VA Residents

| Local government employment and payroll (March 2022) | |||||

| Function | Full-time employees | Monthly full-time payroll | Average yearly full-time wage | Part-time employees | Monthly part-time payroll |

|---|---|---|---|---|---|

| Elementary and Secondary - Instruction | 2,134 | $13,981,360 | $78,621 | 36 | $147,488 |

| Elementary and Secondary - Other Total | 472 | $1,796,374 | $45,671 | 103 | $254,322 |

| Welfare | 370 | $2,470,784 | $80,134 | 79 | $211,557 |

| Police Protection - Officers | 296 | $2,357,805 | $95,587 | 0 | $0 |

| Firefighters | 272 | $2,436,886 | $107,510 | 0 | $0 |

| Correction | 193 | $1,421,700 | $88,396 | 6 | $19,009 |

| Financial Administration | 190 | $1,590,944 | $100,481 | 1 | $5,332 |

| Other and Unallocable | 166 | $1,246,718 | $90,124 | 10 | $23,130 |

| Judicial and Legal | 143 | $779,143 | $65,383 | 3 | $7,110 |

| Health | 141 | $1,028,487 | $87,531 | 12 | $37,005 |

| Parks and Recreation | 124 | $827,961 | $80,125 | 237 | $369,921 |

| Solid Waste Management | 112 | $719,771 | $77,118 | 4 | $8,259 |

| Sewerage | 111 | $800,343 | $86,524 | 1 | $202 |

| Other Government Administration | 106 | $878,742 | $99,480 | 5 | $3,217 |

| Housing and Community Development (Local) | 88 | $568,510 | $77,524 | 3 | $4,831 |

| Police - Other | 84 | $470,897 | $67,271 | 18 | $23,403 |

| Streets and Highways | 72 | $583,768 | $97,295 | 1 | $5,505 |

| Local Libraries | 51 | $290,160 | $68,273 | 61 | $64,872 |

| Fire - Other | 29 | $253,720 | $104,988 | 1 | $2,879 |

| Totals for Government | 5,154 | $34,504,071 | $80,335 | 581 | $1,188,042 |

Alexandria government finances - Expenditure in 2021 (per resident):

- Construction - Transit Utilities: $90,651,000 ($582.87)

General Public Buildings: $14,000,000 ($90.02)

Regular Highways: $11,243,000 ($72.29)

Elementary and Secondary Education: $9,605,000 ($61.76)

Housing and Community Development: $7,554,000 ($48.57)

Solid Waste Management: $6,464,000 ($41.56)

Central Staff Services: $5,614,000 ($36.10)

Parks and Recreation: $3,950,000 ($25.40)

Police Protection: $3,577,000 ($23.00)

- Current Operations - Elementary and Secondary Education: $307,216,000 ($1975.35)

Police Protection: $92,909,000 ($597.39)

Local Fire Protection: $56,634,000 ($364.15)

General - Other: $52,930,000 ($340.33)

Housing and Community Development: $44,346,000 ($285.14)

Regular Highways: $43,295,000 ($278.38)

Parks and Recreation: $31,987,000 ($205.67)

General Public Buildings: $22,479,000 ($144.54)

Judicial and Legal Services: $15,955,000 ($102.59)

Financial Administration: $13,112,000 ($84.31)

Central Staff Services: $12,652,000 ($81.35)

Transit Utilities: $12,547,000 ($80.68)

Protective Inspection and Regulation - Other: $7,491,000 ($48.17)

Correctional Institutions: $5,085,000 ($32.70)

- Intergovernmental to Local - Other - Elementary and Secondary Education: $57,000 ($0.37)

- Other Capital Outlay - Elementary and Secondary Education: $6,919,000 ($44.49)

Transit Utilities: $6,566,000 ($42.22)

- Total Salaries and Wages: $234,671,000 ($1508.90)

- Water Utilities - Interest on Debt: $27,223,000 ($175.04)

Alexandria government finances - Revenue in 2021 (per resident):

- Charges - Sewerage: $19,181,000 ($123.33)

Solid Waste Management: $8,811,000 ($56.65)

Parking Facilities: $2,815,000 ($18.10)

Parks and Recreation: $2,129,000 ($13.69)

Regular Highways: $335,000 ($2.15)

Elementary and Secondary Education School Lunch: $92,000 ($0.59)

Housing and Community Development: $54,000 ($0.35)

Elementary and Secondary Education - Other: $48,000 ($0.31)

Elementary and Secondary Education School Tuition and Transportation: $31,000 ($0.20)

- Federal Intergovernmental - General Local Government Support: $7,087,000 ($45.57)

Public Welfare: $3,741,000 ($24.05)

Housing and Community Development: $1,935,000 ($12.44)

Other: $1,464,000 ($9.41)

Education: $407,000 ($2.62)

Highways: $405,000 ($2.60)

- Local Intergovernmental - Education: $123,000 ($0.79)

- Miscellaneous - Interest Earnings: $190,744,000 ($1226.45)

Donations From Private Sources: $5,408,000 ($34.77)

Rents: $3,929,000 ($25.26)

General Revenue - Other: $3,812,000 ($24.51)

Fines and Forfeits: $3,077,000 ($19.78)

Sale of Property: $572,000 ($3.68)

- Revenue - Transit Utilities: $1,072,000 ($6.89)

- State Intergovernmental - Education: $83,465,000 ($536.67)

Other: $50,624,000 ($325.50)

Public Welfare: $47,881,000 ($307.87)

Housing and Community Development: $14,849,000 ($95.48)

General Local Government Support: $11,615,000 ($74.68)

Highways: $7,411,000 ($47.65)

Health and Hospitals: $256,000 ($1.65)

- Tax - Property: $536,260,000 ($3448.06)

General Sales and Gross Receipts: $37,440,000 ($240.73)

Occupation and Business License - Other: $37,042,000 ($238.17)

Other Selective Sales: $35,728,000 ($229.73)

Public Utilities Sales: $19,641,000 ($126.29)

Other License: $3,603,000 ($23.17)

Tobacco Products Sales: $2,138,000 ($13.75)

Public Utility License: $913,000 ($5.87)

Amusements Sales: $104,000 ($0.67)

Motor Vehicle License: $78,000 ($0.50)

Alexandria government finances - Debt in 2021 (per resident):

- Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $747,911,000 ($4808.94)

Outstanding Unspecified Public Purpose: $704,117,000 ($4527.36)

Beginning Outstanding - Public Debt for Private Purpose: $101,640,000 ($653.53)

Outstanding Nonguaranteed - Industrial Revenue: $99,140,000 ($637.45)

Retired Unspecified Public Purpose: $93,594,000 ($601.79)

Issue, Unspecified Public Purpose: $49,800,000 ($320.21)

Retired Nonguaranteed - Public Debt for Private Purpose: $2,500,000 ($16.07)

- Short Term Debt Outstanding - End of Fiscal Year: $30,000,000 ($192.90)

Beginning: $8,365,000 ($53.79)

Alexandria government finances - Cash and Securities in 2021 (per resident):

- Bond Funds - Cash and Securities: $204,350,000 ($1313.94)

- Other Funds - Cash and Securities: $556,811,000 ($3580.20)

- Sinking Funds - Cash and Securities: $99,140,000 ($637.45)

17.30% of this county's 2021 resident taxpayers lived in other counties in 2020 ($86,170 average adjusted gross income)

| Here: | 17.30% |

| Virginia average: | 10.16% |

0.30% of residents moved from foreign countries ($1,706 average AGI)

Alexandria city: 0.30% Virginia average: 0.12%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Fairfax County, VA | |

| from Arlington County, VA | |

| from District of Columbia, DC |

18.89% of this county's 2020 resident taxpayers moved to other counties in 2021 ($102,876 average adjusted gross income)

| Here: | 18.89% |

| Virginia average: | 10.20% |

0.22% of residents moved to foreign countries ($1,720 average AGI)

Alexandria city: 0.22% Virginia average: 0.09%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Fairfax County, VA | |

| to Arlington County, VA | |

| to Prince William County, VA |

| Businesses in Alexandria, VA | ||||

| Name | Count | Name | Count | |

|---|---|---|---|---|

| 7-Eleven | 40 | KFC | 3 | |

| AMF Bowling | 1 | Kroger | 1 | |

| AT&T | 7 | LA Fitness | 1 | |

| Ace Hardware | 1 | La-Z-Boy | 1 | |

| Advance Auto Parts | 5 | Lane Furniture | 1 | |

| Ann Taylor | 2 | LensCrafters | 1 | |

| Applebee's | 1 | Lowe's | 1 | |

| Arby's | 1 | Macy's | 1 | |

| AutoZone | 2 | Marriott | 5 | |

| Avenue | 1 | Marshalls | 1 | |

| BMW | 1 | MasterBrand Cabinets | 31 | |

| Baja Fresh Mexican Grill | 1 | Mazda | 1 | |

| Bally Total Fitness | 1 | McDonald's | 17 | |

| Banana Republic | 1 | Men's Wearhouse | 1 | |

| Barnes & Noble | 1 | Motherhood Maternity | 1 | |

| Baskin-Robbins | 6 | New Balance | 2 | |

| Bath & Body Works | 2 | New York & Co | 1 | |

| Bed Bath & Beyond | 1 | Nike | 11 | |

| Ben & Jerry's | 1 | Nissan | 1 | |

| Best Western | 2 | Office Depot | 1 | |

| Blockbuster | 4 | Old Country Buffet | 1 | |

| Budget Car Rental | 2 | Old Navy | 1 | |

| Burger King | 1 | Outback | 1 | |

| CVS | 16 | Outback Steakhouse | 1 | |

| Casual Male XL | 1 | Panera Bread | 4 | |

| Chevrolet | 2 | Papa John's Pizza | 4 | |

| Chick-Fil-A | 1 | Payless | 5 | |

| Chico's | 1 | Penske | 2 | |

| Chipotle | 4 | PetSmart | 2 | |

| Chuck E. Cheese's | 1 | Pier 1 Imports | 2 | |

| Cold Stone Creamery | 2 | Pizza Hut | 7 | |

| ColorTyme | 1 | Popeyes | 3 | |

| Comfort Inn | 2 | Quality | 2 | |

| Crate & Barrel | 1 | Quiznos | 5 | |

| Cricket Wireless | 10 | RadioShack | 5 | |

| Curves | 2 | Red Lobster | 1 | |

| DHL | 3 | Red Roof Inn | 1 | |

| Dairy Queen | 2 | Rite Aid | 7 | |

| Days Inn | 2 | Ruby Tuesday | 3 | |

| Decora Cabinetry | 12 | Safeway | 9 | |

| Dennys | 1 | Sears | 3 | |

| Domino's Pizza | 7 | Sheraton | 1 | |

| DressBarn | 2 | Sprint Nextel | 4 | |

| Dressbarn | 2 | Staples | 4 | |

| Dunkin Donuts | 7 | Starbucks | 20 | |

| Extended Stay America | 1 | Subaru | 1 | |

| FedEx | 63 | Subway | 2 | |

| Finish Line | 1 | T-Mobile | 9 | |

| Firestone Complete Auto Care | 1 | T.G.I. Driday's | 2 | |

| Foot Locker | 1 | T.J.Maxx | 2 | |

| Ford | 2 | Taco Bell | 2 | |

| GNC | 9 | Talbots | 1 | |

| GameStop | 3 | Target | 2 | |

| Gap | 1 | Toyota | 1 | |

| Giant | 7 | Toys"R"Us | 1 | |

| Goodwill | 2 | Trader Joe's | 1 | |

| H&R Block | 9 | Travelodge | 1 | |

| Haworth | 1 | True Value | 2 | |

| Hawthorn | 1 | U-Haul | 5 | |

| Hilton | 10 | UPS | 61 | |

| Holiday Inn | 4 | Verizon Wireless | 2 | |

| Home Depot | 3 | Victoria's Secret | 1 | |

| Homestead Studio Suites | 1 | Volkswagen | 1 | |

| Honda | 2 | Vons | 9 | |

| Hyundai | 1 | Walgreens | 3 | |

| IHOP | 3 | Walmart | 3 | |

| JoS. A. Bank | 1 | Wendy's | 3 | |

| Johnny Rockets | 1 | Westin | 1 | |

| Jones New York | 4 | Whole Foods Market | 1 | |

| Just Tires | 1 | YMCA | 2 | |

Strongest AM radio stations in Alexandria:

- WKDL (730 AM; 8 kW; ALEXANDRIA, VA; Owner: MEGA COMMUNICATIONS OF ALEXANDRIA LICENSEE, LLC)

- WTEM (980 AM; 50 kW; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WPGC (1580 AM; 50 kW; MORNINGSIDE, MD; Owner: INFINITY WPGC(AM), INC.)

- WUST (1120 AM; daytime; 20 kW; WASHINGTON, DC)

- WABS (780 AM; daytime; 5 kW; ARLINGTON, VA; Owner: SALEM MEDIA OF VIRGINIA, INC.)

- WTOP (1500 AM; 50 kW; WASHINGTON, DC; Owner: BONNEVILLE HOLDING COMPANY)

- WWGB (1030 AM; daytime; 50 kW; INDIAN HEAD, MD; Owner: GOOD BODY MEDIA, LLC)

- WFAX (1220 AM; 5 kW; FALLS CHURCH, VA; Owner: NEWCOMB BROADCASTING CORP.)

- WMET (1150 AM; 50 kW; GAITHERSBURG, MD; Owner: BELTWAY ACQUISITION CORPORATION)

- WZHF (1390 AM; 5 kW; ARLINGTON, VA; Owner: WAY BROADCASTING, INC.)

- WCBM (680 AM; 50 kW; BALTIMORE, MD; Owner: WCBM MARYLAND, INC.)

- WBIS (1190 AM; 50 kW; ANNAPOLIS, MD; Owner: NATIONS RADIO, LLC)

- WMAL (630 AM; 5 kW; WASHINGTON, DC; Owner: WMAL, INC.)

Strongest FM radio stations in Alexandria:

- WETA (90.9 FM; WASHINGTON, DC; Owner: GREATER WASHINGTON EDUCATIONAL TELECOMMUNICATIONS ASSN.)

- WGTS (91.9 FM; TAKOMA PARK, MD; Owner: COLUMBIA UNION COLLEGE BROADCASTING, INC.)

- WAVA (105.1 FM; ARLINGTON, VA; Owner: SALEM MEDIA OF VIRGINIA, INC.)

- WRQX (107.3 FM; WASHINGTON, DC; Owner: WMAL, INC.)

- WHUR-FM (96.3 FM; WASHINGTON, DC; Owner: THE HOWARD UNIVERSITY)

- WKYS (93.9 FM; WASHINGTON, DC; Owner: RADIO ONE LICENSES, LLC)

- WJFK-FM (106.7 FM; MANASSAS, VA; Owner: INFINITY BROADCASTING CORP. OF WASHINGTON, DC)

- WASH (97.1 FM; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WARW (94.7 FM; BETHESDA, MD; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WJZW (105.9 FM; WOODBRIDGE, VA; Owner: WMAL, INC.)

- WMZQ-FM (98.7 FM; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WIHT (99.5 FM; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WGMS-FM (103.5 FM; WASHINGTON, DC; Owner: BONNEVILLE HOLDING COMPANY)

- WAMU (88.5 FM; WASHINGTON, DC; Owner: THE EXEC. COMM. OF THE BD. OF TRUSTEES OF AMERICAN UNIV.)

- WPGC-FM (95.5 FM; MORNINGSIDE, MD; Owner: INFINITY BROADCASTING CORPORATION OF MARYLAND)

- WMMJ (102.3 FM; BETHESDA, MD; Owner: RADIO ONE LICENSES, LLC)

- WBIG-FM (100.3 FM; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WWDC-FM (101.1 FM; WASHINGTON, DC; Owner: AMFM RADIO LICENSES, L.L.C.)

- WHFS (99.1 FM; ANNAPOLIS, MD; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WCSP-FM (90.1 FM; WASHINGTON, DC; Owner: NATIONAL CABLE SATELLITE CORPORATION)

TV broadcast stations around Alexandria:

- WJLA-TV (Channel 7; WASHINGTON, DC; Owner: ACC LICENSEE, INC.)

- WUSA (Channel 9; WASHINGTON, DC; Owner: THE DETROIT NEWS, INC.)

- WTTG (Channel 5; WASHINGTON, DC; Owner: FOX TELEVISION STATIONS, INC.)

- WHUT-TV (Channel 32; WASHINGTON, DC; Owner: HOWARD UNIVERSITY)

- WRC-TV (Channel 4; WASHINGTON, DC; Owner: NBC SUBSIDIARY (WRC-TV), INC.)

- WETA-TV (Channel 26; WASHINGTON, DC; Owner: THE GREATER WASHINGTON ED TELECOMM. ASSOC)

- WNVC (Channel 56; FAIRFAX, VA; Owner: COMMONWEALTH PUBLIC BROADCASTING CORPORATION)

- WBDC-TV (Channel 50; WASHINGTON, DC; Owner: WBDC BROADCASTING, INC.)

- WDCA (Channel 20; WASHINGTON, DC; Owner: FOX TELEVISION STATIONS, INC.)

- W28BY (Channel 63; BALTIMORE, MD; Owner: INFORMATION SUPER STATION, L.L.C.)

- WMDO-CA (Channel 30; WASHINGTON, DC; Owner: ENTRAVISION HOLDINGS, LLC)

- WZDC-LP (Channel 64; WASHINGTON, DC; Owner: ONDA CAPITAL, INC.)

- WIAV-LP (Channel 58; WASHINGTON, DC; Owner: ASIAVISION, INC.)

- WPXW (Channel 66; MANASSAS, VA; Owner: PAXSON WASHINGTON LICENSE, INC.)

- WKRP-LP (Channel 42; WASHINGTON, DC; Owner: CAPITAL MEDIA, LLC)

- WMPT (Channel 22; ANNAPOLIS, MD; Owner: MARYLAND PUBLIC BROADCASTING COMMISSION)

- WNVT (Channel 53; GOLDVEIN, VA; Owner: COMMONWEALTH PUBLIC BROADCASTING CORPORATION)

- WBAL-TV (Channel 11; BALTIMORE, MD; Owner: WBAL HEARST-ARGYLE TV, INC. (CA CORP.))

- WMAR-TV (Channel 2; BALTIMORE, MD; Owner: SCRIPPS HOWARD BROADCASTING COMPANY)

- WBFF (Channel 45; BALTIMORE, MD; Owner: CHESAPEAKE TELEVISION LICENSEE, LLC)

- WNUV (Channel 54; BALTIMORE, MD; Owner: BALTIMORE (WNUV-TV) LICENSEE, INC.)

- W42BE (Channel 42; FAIRFAX, VA; Owner: FAIRFAX LOW POWER CO.)

- WUTB (Channel 24; BALTIMORE, MD; Owner: FOX TELEVISION STATIONS, INC.)

- WMPB (Channel 67; BALTIMORE, MD; Owner: MARYLAND PUBLIC BROADCASTING COMMISSION)

- WJZ-TV (Channel 13; BALTIMORE, MD; Owner: VIACOM INC.)

Medal of Honor Recipients

Medal of Honor Recipients born in Alexandria: Francis C. Hammond, James Patrick Lannon, Zachariah Woodall.

- National Bridge Inventory (NBI) Statistics

- 208Number of bridges

- 4,551ft / 1,387mTotal length

- $18,712,000Total costs

- 9,649,618Total average daily traffic

- 185,013Total average daily truck traffic

- New bridges - historical statistics

- 1Before 1900

- 21930-1939

- 31940-1949

- 21950-1959

- 251960-1969

- 601970-1979

- 131980-1989

- 61990-1999

- 802000-2009

- 162010-2019

FCC Registered Private Land Mobile Towers: 20 (See the full list of FCC Registered Private Land Mobile Towers in Alexandria, VA)

FCC Registered Broadcast Land Mobile Towers: 139 (See the full list of FCC Registered Broadcast Land Mobile Towers)

FCC Registered Microwave Towers: 121 (See the full list of FCC Registered Microwave Towers in this town)

FCC Registered Paging Towers: 31 (See the full list of FCC Registered Paging Towers)

FCC Registered Maritime Coast & Aviation Ground Towers: 7 (See the full list of FCC Registered Maritime Coast & Aviation Ground Towers)

FCC Registered Amateur Radio Licenses: 1,413 (See the full list of FCC Registered Amateur Radio Licenses in Alexandria)

FAA Registered Aircraft: 163 (See the full list of FAA Registered Aircraft in Alexandria)

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 32 full tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 835 | $355,710 | 1,097 | $359,179 | 4,150 | $341,400 | 140 | $216,500 | 5 | $16,533,800 | 343 | $267,289 | 0 | $0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 29 | $305,724 | 49 | $372,041 | 308 | $346,045 | 21 | $98,095 | 0 | $0 | 32 | $310,969 | 2 | $36,500 |

| APPLICATIONS DENIED | 48 | $286,854 | 80 | $318,900 | 968 | $335,897 | 56 | $143,589 | 0 | $0 | 121 | $251,959 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 93 | $299,613 | 143 | $305,462 | 862 | $346,551 | 19 | $152,105 | 1 | $20,000,000 | 81 | $278,358 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 11 | $392,364 | 18 | $394,889 | 186 | $308,441 | 8 | $142,500 | 0 | $0 | 25 | $244,800 | 1 | $370,000 |

Detailed mortgage data for all 32 tracts in Alexandria, VA

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 28 full tracts) | ||||||

| A) Conventional Home Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 148 | $335,297 | 74 | $379,000 | 3 | $250,667 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 32 | $347,281 | 27 | $381,481 | 1 | $153,000 |

| APPLICATIONS DENIED | 21 | $292,190 | 15 | $387,533 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 8 | $259,625 | 7 | $337,429 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 8 | $255,375 | 2 | $328,500 | 0 | $0 |

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Alexandria, VA

- 6,18355.2%Structure Fires

- 3,12727.9%Outside Fires

- 1,25111.2%Mobile Property/Vehicle Fires

- 6475.8%Other

According to the data from the years 2002 - 2018 the average number of fires per year is 659. The highest number of reported fire incidents - 978 took place in 2010, and the least - 392 in 2003. The data has an increasing trend.

According to the data from the years 2002 - 2018 the average number of fires per year is 659. The highest number of reported fire incidents - 978 took place in 2010, and the least - 392 in 2003. The data has an increasing trend. When looking into fire subcategories, the most reports belonged to: Structure Fires (55.2%), and Outside Fires (27.9%).

When looking into fire subcategories, the most reports belonged to: Structure Fires (55.2%), and Outside Fires (27.9%).Fire-safe hotels and motels in Alexandria, Virginia:

- Quality Inn Mt Vernon, 7212 Richmond Hwy, Alexandria, Virginia 22306 , Phone: (703) 765-9000, Fax: (703) 765-2325

- Fairfield Inn & Suites Alexandria West/Mark Center, 6254 Duke St, Alexandria, Virginia 22312 , Phone: (703) 642-3422, Fax: (703) 642-1354

- Sheraton Suites Alexandria, 801 North Saint Asaph St, Alexandria, Virginia 22314 , Phone: (703) 836-4700, Fax: (703) 548-4514

- Comfort Inn Alexandria, 5716 S Van Dorn St, Alexandria, Virginia 22310 , Phone: (703) 922-9200, Fax: (703) 922-0132

- The Alexandrian, 480 King St, Alexandria, Virginia 22314 , Phone: (703) 842-2733, Fax: (703) 519-0889

- Holiday Inn Alexandria, 2460 Eisenhower Ave, Alexandria, Virginia 22314 , Phone: (703) 960-2000, Fax: (703) 329-0953

- Crowne Plaza Old Town Hotel, 901 N Fairfax, Alexandria, Virginia 22314 , Phone: (703) 683-6000, Fax: (703) 683-5750

- Travelers Motel, 5916 Richmond Hwy, Alexandria, Virginia 22303 , Phone: (703) 329-1310, Fax: (703) 960-9211

- 37 other hotels and motels

| Most common first names in Alexandria, VA among deceased individuals | ||

| Name | Count | Lived (average) |

|---|---|---|

| John | 1,326 | 72.5 years |

| Mary | 1,323 | 78.8 years |

| William | 1,140 | 73.6 years |

| James | 1,033 | 70.3 years |

| Robert | 853 | 70.3 years |

| Charles | 709 | 73.1 years |

| Margaret | 639 | 79.7 years |

| George | 578 | 74.1 years |

| Helen | 563 | 80.4 years |

| Elizabeth | 503 | 79.7 years |

| Most common last names in Alexandria, VA among deceased individuals | ||

| Last name | Count | Lived (average) |

|---|---|---|

| Smith | 473 | 74.2 years |

| Johnson | 317 | 73.2 years |

| Jones | 277 | 71.5 years |

| Brown | 267 | 73.6 years |

| Williams | 255 | 73.0 years |

| Davis | 238 | 74.3 years |

| Miller | 234 | 75.0 years |

| Taylor | 173 | 75.8 years |

| Jackson | 165 | 72.3 years |

| Moore | 164 | 73.0 years |

- 57.2%Utility gas

- 40.2%Electricity

- 1.0%Fuel oil, kerosene, etc.

- 0.5%Bottled, tank, or LP gas

- 0.5%Other fuel

- 0.4%No fuel used

- 55.9%Electricity

- 40.6%Utility gas

- 1.5%Bottled, tank, or LP gas

- 0.8%No fuel used

- 0.7%Other fuel

- 0.4%Fuel oil, kerosene, etc.

Alexandria compared to Virginia state average:

- Median house value above state average.

- Unemployed percentage significantly below state average.

- Hispanic race population percentage above state average.

- Foreign-born population percentage significantly above state average.

- Renting percentage above state average.

- Number of rooms per house significantly below state average.

- Percentage of population with a bachelor's degree or higher significantly above state average.

Alexandria, VA compared to other similar cities:

Alexandria on our top lists:

- #3 on the list of "Top 101 cities with the lowest number of murders per 100,000 residents (population 50,000+)"

- #5 on the list of "Top 101 cities with largest percentage of females in industries: public administration (population 50,000+)"

- #6 on the list of "Top 101 cities with largest percentage of females in occupations: legal occupations (population 50,000+)"

- #8 on the list of "Top 101 cities with largest percentage of males in occupations: business and financial operations occupations (population 50,000+)"

- #10 on the list of "Top 101 cities with largest percentage of females in industries: professional, scientific, and technical services (population 50,000+)"

- #12 on the list of "Top 101 cities with the most residents born in Ethiopia (population 500+)"

- #13 on the list of "Top 101 cities with largest percentage of males in occupations: legal occupations (population 50,000+)"

- #16 on the list of "Top 101 larger cities with the highest increase in house/condo value from 2000 (population 50,000+)"

- #17 on the list of "Top 101 cities with the biggest property tax revenues per resident (population 10,000+)"

- #18 on the list of "Top 101 cities with the lowest percentage of family households, population 100,000+"

- #18 on the list of "Top 101 cities with the lowest number of burglaries per 100,000 residents (population 50,000+)"

- #19 on the list of "Top 101 larger cities with the highest increase in household income from 2000 (population 50,000+)"

- #21 on the list of "Top 101 cities with largest percentage of females in occupations: law enforcement workers including supervisors (population 50,000+)"

- #21 on the list of "Top 101 cities with largest percentage of males in industries: public administration (population 50,000+)"

- #22 on the list of "Top 101 cities with the smallest city-data.com crime index per police officer (population 50,000+)"

- #22 on the list of "Top 100 cities with smallest houses (pop. 50,000+)"

- #28 on the list of "Top 101 cities with the largest percentage of likely gay men couples (counted as self-reported male-male unmarried-partner households) (population 50,000+)"

- #28 on the list of "Top 101 cities with the smallest percentage of one, detached housing units in structures (20,000+ housing units)"

- #29 on the list of "Top 101 cities with largest percentage of males in industries: professional, scientific, and technical services (population 50,000+)"

- #29 on the list of "Top 101 cities with the most people having professional degrees (population 50,000+)"

- #50 (22314) on the list of "Top 101 zip codes with the most beauty salons in 2005"

- #73 (22314) on the list of "Top 101 zip codes with the most full service restaurants in 2005"

- #85 (22311) on the list of "Top 101 zip codes with the largest percentage of Subsaharan African first ancestries (pop 5,000+)"

- #85 (22314) on the list of "Top 101 zip codes with the most Internet business establishments in 2005"

- #94 (22314) on the list of "Top 101 zip codes with the most medium-big companies in 2005 (at least 100 employees)"

- #101 (22311) on the list of "Top 101 zip codes with the largest percentage of Arab first ancestries (pop 5,000+)"

- #6 on the list of "Top 101 counties with the highest number of births per 1000 residents 2007-2013"

- #10 on the list of "Top 101 counties with the highest percentage of residents relocating from other counties between 2010 and 2011"

- #15 on the list of "Top 101 counties with the highest percentage of residents relocating to other counties in 2011"

- #15 on the list of "Top 101 counties with the largest decrease in the number of deaths per 1000 residents 2000-2006 to 2007-2013 (pop. 50,000+)"

- #18 on the list of "Top 101 counties with the largest number of people without health insurance coverage in 2000 (pop. 50,000+)"

|

|

Total of 1818 patent applications in 2008-2024.