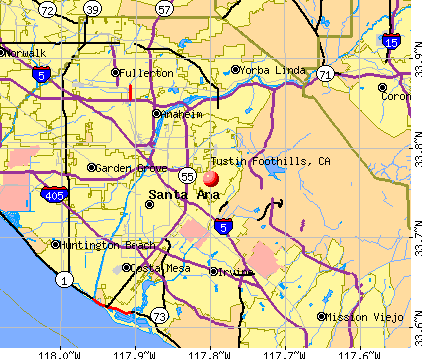

Tustin Foothills, California

Tustin Foothills: View South-West. Down town Santa Ana is to the right.

Tustin Foothills: View North. Orange is in the foreground. Mt Wilson in the Angeles Forest is directly ahead.

- add

your

Submit your own pictures of this place and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

| Males: 12,234 | |

| Females: 12,664 |

| Median resident age: | 42.1 years |

| California median age: | 33.3 years |

Zip codes: 92705.

| Tustin Foothills: | $173,759 |

| CA: | $91,551 |

Estimated per capita income in 2022: $84,802 (it was $42,656 in 2000)

Tustin Foothills CDP income, earnings, and wages data

Estimated median house or condo value in 2022: over $1,000,000 (it was $402,200 in 2000)

| Tustin Foothills: | over $1,000,000 |

| CA: | $715,900 |

Mean prices in 2022: all housing units: over $1,000,000; detached houses: over $1,000,000; townhouses or other attached units: $790,672; in 2-unit structures: over $1,000,000; in 3-to-4-unit structures: $673,483; in 5-or-more-unit structures: $580,884; mobile homes: $204,180; occupied boats, rvs, vans, etc.: $60,368

Tustin Foothills, CA residents, houses, and apartments details

Detailed information about poverty and poor residents in Tustin Foothills, CA

- 19,60881.6%White alone

- 2,0378.5%Hispanic

- 1,6777.0%Asian alone

- 4671.9%Two or more races

- 1210.5%Black alone

- 520.2%American Indian alone

- 510.2%Other race alone

- 310.1%Native Hawaiian and Other

Pacific Islander alone

| Verizon Wireless coverage? (10 replies) |

| Why do people say they love L.A., (38 replies) |

| Kudos to Anaheim Hills (125 replies) |

| Raising a family in Irvine, Ca (10 replies) |

| Oc - great to visit but no longer a place to live (92 replies) |

| Is Los Angeles a dump??? (175 replies) |

Latest news from Tustin Foothills, CA collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: German (18.3%), English (16.2%), Irish (13.9%), Italian (6.6%), French (4.4%), Scottish (4.4%).

Current Local Time: PST time zone

Elevation: 250 feet

Land area: 6.70 square miles.

Population density: 3,718 people per square mile (average).

2,929 residents are foreign born (6.3% Asia, 2.3% Europe, 2.1% Latin America).

| This place: | 12.2% |

| California: | 26.2% |

| Tustin Foothills CDP: | 0.6% ($2,332) |

| California: | 0.8% ($1,564) |

Nearest city with pop. 50,000+: Tustin, CA (1.9 miles

, pop. 67,504).

Nearest city with pop. 200,000+: Santa Ana, CA (5.0 miles

, pop. 337,977).

Nearest city with pop. 1,000,000+: Los Angeles, CA (39.9 miles

, pop. 3,694,820).

Nearest cities:

Latitude: 33.77 N, Longitude: 117.80 W

Daytime population change due to commuting: -8,618 (-35.8%)

Workers who live and work in this place: 1,253 (11.2%)

| Here: | 3.8% |

| California: | 5.1% |

- Professional, scientific, technical services (14.4%)

- Educational services (11.5%)

- Health care (9.8%)

- Construction (6.1%)

- Finance & insurance (5.8%)

- Real estate & rental & leasing (4.1%)

- Accommodation & food services (4.1%)

- Professional, scientific, technical services (16.0%)

- Construction (9.8%)

- Health care (7.0%)

- Educational services (6.2%)

- Finance & insurance (5.9%)

- Real estate & rental & leasing (4.4%)

- Accommodation & food services (4.1%)

- Educational services (18.3%)

- Health care (13.5%)

- Professional, scientific, technical services (12.3%)

- Finance & insurance (5.7%)

- Accommodation & food services (4.0%)

- Public administration (3.8%)

- Real estate & rental & leasing (3.7%)

- Other management occupations, except farmers and farm managers (8.9%)

- Top executives (6.1%)

- Other sales and related occupations, including supervisors (5.7%)

- Preschool, kindergarten, elementary, and middle school teachers (4.4%)

- Other office and administrative support workers, including supervisors (4.4%)

- Sales representatives, services, wholesale and manufacturing (4.2%)

- Accountants and auditors (3.0%)

- Other management occupations, except farmers and farm managers (12.1%)

- Top executives (8.7%)

- Other sales and related occupations, including supervisors (6.5%)

- Sales representatives, services, wholesale and manufacturing (5.9%)

- Computer specialists (3.6%)

- Physicians and surgeons (3.5%)

- Lawyers (3.4%)

- Preschool, kindergarten, elementary, and middle school teachers (8.1%)

- Other office and administrative support workers, including supervisors (7.6%)

- Secretaries and administrative assistants (6.4%)

- Other management occupations, except farmers and farm managers (4.8%)

- Other sales and related occupations, including supervisors (4.6%)

- Accountants and auditors (3.9%)

- Information and record clerks, except customer service representatives (3.8%)

Average climate in Tustin Foothills, California

Based on data reported by over 4,000 weather stations

(lower is better)

Air Quality Index (AQI) level in 2022 was 115. This is significantly worse than average.

| City: | 115 |

| U.S.: | 73 |

Carbon Monoxide (CO) [ppm] level in 2022 was 0.297. This is about average. Closest monitor was 7.6 miles away from the city center.

| City: | 0.297 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2022 was 12.8. This is significantly worse than average. Closest monitor was 4.2 miles away from the city center.

| City: | 12.8 |

| U.S.: | 5.1 |

Sulfur Dioxide (SO2) [ppb] level in 2022 was 0.466. This is significantly better than average. Closest monitor was 4.2 miles away from the city center.

| City: | 0.466 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 27.9. This is about average. Closest monitor was 4.2 miles away from the city center.

| City: | 27.9 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2022 was 26.6. This is worse than average. Closest monitor was 7.7 miles away from the city center.

| City: | 26.6 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2022 was 9.28. This is about average. Closest monitor was 7.7 miles away from the city center.

| City: | 9.28 |

| U.S.: | 8.11 |

Lead (Pb) [µg/m3] level in 2013 was 0.00274. This is significantly better than average. Closest monitor was 4.2 miles away from the city center.

| City: | 0.00274 |

| U.S.: | 0.00931 |

Earthquake activity:

Tustin Foothills-area historical earthquake activity is significantly above California state average. It is 6896% greater than the overall U.S. average.On 6/28/1992 at 11:57:34, a magnitude 7.6 (6.2 MB, 7.6 MS, 7.3 MW, Depth: 0.7 mi, Class: Major, Intensity: VIII - XII) earthquake occurred 78.3 miles away from the city center, causing 3 deaths (1 shaking deaths, 2 other deaths) and 400 injuries, causing $100,000,000 total damage and $40,000,000 insured losses

On 7/21/1952 at 11:52:14, a magnitude 7.7 (7.7 UK) earthquake occurred 109.5 miles away from the city center, causing $50,000,000 total damage

On 10/16/1999 at 09:46:44, a magnitude 7.4 (6.3 MB, 7.4 MS, 7.2 MW, 7.3 ML) earthquake occurred 93.8 miles away from the city center

On 4/21/1918 at 22:32:30, a magnitude 6.8 (6.8 UK, Class: Strong, Intensity: VII - IX) earthquake occurred 20.9 miles away from Tustin Foothills center

On 5/19/1940 at 04:36:40, a magnitude 7.2 (7.2 UK) earthquake occurred 126.9 miles away from Tustin Foothills center, causing $33,000,000 total damage

On 11/4/1927 at 13:51:53, a magnitude 7.5 (7.5 UK) earthquake occurred 201.0 miles away from the city center

Magnitude types: body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Orange County (32) is a lot greater than the US average (15).Major Disasters (Presidential) Declared: 22

Emergencies Declared: 2

Causes of natural disasters: Floods: 15, Fires: 13, Storms: 9, Landslides: 6, Winter Storms: 6, Mudslides: 5, Earthquakes: 2, Heavy Rain: 1, Hurricane: 1, Snow: 1, Tornado: 1, Wind: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers near Tustin Foothills:

- VNA HOME HEALTH SYSTEMS (Home Health Center, about 1 miles away; SANTA ANA, CA)

- DESERT SPRINGS HEALTHCARE AND WELLNESS CENTRE (Nursing Home, about 2 miles away; INDIO, CA)

- NEW ORANGE HILLS (Nursing Home, about 2 miles away; ORANGE, CA)

- KAISER FO HOSP ANAHEIM HHA (Home Health Center, about 2 miles away; TUSTIN, CA)

- TUSTIN CARE CENTER (Nursing Home, about 2 miles away; TUSTIN, CA)

- DAVITA-TUSTIN DIALYSIS CENTER (Dialysis Facility, about 3 miles away; SANTA ANA, CA)

- CAREHOUSE HEALTHCARE CENTER (Nursing Home, about 3 miles away; SANTA ANA, CA)

Amtrak stations near Tustin Foothills:

- 4 miles: SANTA ANA (1000 E. SANTA ANA BLVD.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, snack bar, free short-term parking, free long-term parking, call for car rental service, taxi stand, intercity bus service, public transit connection.

- 6 miles: ANAHEIM (2150 KATELLA AVE.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, vending machines, free short-term parking, free long-term parking, call for car rental service, call for taxi service.

- 7 miles: IRVINE (15215 BARRANCA PKWY.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, snack bar, free short-term parking, free long-term parking, call for taxi service, intercity bus service, public transit connection.

Colleges/universities with over 2000 students nearest to Tustin Foothills:

- Santiago Canyon College (about 3 miles; Orange, CA; Full-time enrollment: 6,050)

- Chapman University (about 4 miles; Orange, CA; FT enrollment: 7,089)

- Santa Ana College (about 6 miles; Santa Ana, CA; FT enrollment: 11,756)

- Irvine Valley College (about 7 miles; Irvine, CA; FT enrollment: 8,005)

- West Coast University-Orange County (about 8 miles; Anaheim, CA; FT enrollment: 2,464)

- University of Phoenix-Southern California Campus (about 8 miles; Costa Mesa, CA; FT enrollment: 8,110)

- Concordia University-Irvine (about 8 miles; Irvine, CA; FT enrollment: 3,284)

Points of interest:

Notable location: Orange County Fire Authority Station 8 (A). Display/hide its location on the map

Church in Tustin Foothills: Trinity United Presbyterian Church (A). Display/hide its location on the map

Parks in Tustin Foothills include: Esplanade Park (1), Gershon Place Mini Park (2). Display/hide their locations on the map

| This place: | 2.9 people |

| California: | 2.9 people |

| This place: | 84.0% |

| Whole state: | 69.4% |

| This place: | 2.8% |

| Whole state: | 5.9% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.2% of all households

- Gay men: 0.3% of all households

| This place: | 3.3% |

| Whole state: | 14.2% |

| This place: | 1.2% |

| Whole state: | 6.3% |

People in group quarters in Tustin Foothills in 2000:

- 50 people in other noninstitutional group quarters

- 27 people in other group homes

- 15 people in homes or halfway houses for drug/alcohol abuse

- 12 people in homes for the mentally retarded

- 7 people in nursing homes

For population 15 years and over in Tustin Foothills:

- Never married: 19.9%

- Now married: 66.2%

- Separated: 1.0%

- Widowed: 5.9%

- Divorced: 7.0%

For population 25 years and over in Tustin Foothills:

- High school or higher: 95.9%

- Bachelor's degree or higher: 53.8%

- Graduate or professional degree: 22.1%

- Unemployed: 3.0%

- Mean travel time to work (commute): 24.5 minutes

| Here: | 9.7 |

| California average: | 16.1 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Tustin Foothills, CA (based on Orange County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 797,473 | 67 |

| Evangelical Protestant | 345,893 | 894 |

| Other | 141,815 | 329 |

| Mainline Protestant | 76,574 | 202 |

| Orthodox | 13,406 | 19 |

| Black Protestant | 2,424 | 8 |

| None | 1,632,647 | - |

Food Environment Statistics:

| This county: | 1.78 / 10,000 pop. |

| California: | 2.14 / 10,000 pop. |

| This county: | 0.06 / 10,000 pop. |

| State: | 0.04 / 10,000 pop. |

| This county: | 0.49 / 10,000 pop. |

| California: | 0.62 / 10,000 pop. |

| This county: | 1.46 / 10,000 pop. |

| California: | 1.49 / 10,000 pop. |

| Orange County: | 8.19 / 10,000 pop. |

| State: | 7.42 / 10,000 pop. |

| Orange County: | 6.3% |

| State: | 7.3% |

| Orange County: | 18.5% |

| California: | 21.3% |

| This county: | 16.4% |

| California: | 17.9% |

4.86% of this county's 2021 resident taxpayers lived in other counties in 2020 ($95,983 average adjusted gross income)

| Here: | 4.86% |

| California average: | 5.19% |

0.01% of residents moved from foreign countries ($132 average AGI)

Orange County: 0.01% California average: 0.03%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Los Angeles County, CA | |

| from Riverside County, CA | |

| from San Diego County, CA |

5.71% of this county's 2020 resident taxpayers moved to other counties in 2021 ($106,828 average adjusted gross income)

| Here: | 5.71% |

| California average: | 6.14% |

0.01% of residents moved to foreign countries ($180 average AGI)

Orange County: 0.01% California average: 0.02%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Los Angeles County, CA | |

| to Riverside County, CA | |

| to San Diego County, CA |

Strongest AM radio stations in Tustin Foothills:

- KFI (640 AM; 50 kW; LOS ANGELES, CA; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- KPLS (830 AM; 50 kW; ORANGE, CA; Owner: CRN LICENSES, LLC)

- KLAC (570 AM; 50 kW; LOS ANGELES, CA; Owner: AMFM RADIO LICENSES, L.L.C.)

- KTNQ (1020 AM; 50 kW; LOS ANGELES, CA; Owner: KTNQ-AM LICENSE CORP.)

- KXTA (1150 AM; 50 kW; LOS ANGELES, CA; Owner: CITICASTERS LICENSES, L.P.)

- KVNR (1480 AM; 5 kW; SANTA ANA, CA; Owner: LBI RADIO LICENSE CORP.)

- KDIS (1110 AM; 50 kW; PASADENA, CA; Owner: ABC,INC.)

- KFWB (980 AM; 50 kW; LOS ANGELES, CA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- KNX (1070 AM; 50 kW; LOS ANGELES, CA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- KMPC (1540 AM; 50 kW; LOS ANGELES, CA; Owner: ROSE CITY RADIO CORPORATION)

- KSPN (710 AM; 50 kW; LOS ANGELES, CA; Owner: KABC-AM RADIO, INC.)

- KBLA (1580 AM; 50 kW; SANTA MONICA, CA)

- KXMX (1190 AM; 25 kW; ANAHEIM, CA; Owner: NEW INSPIRATION BROADCASTING COMPANY)

Strongest FM radio stations in Tustin Foothills:

- KALI-FM (106.3 FM; SANTA ANA, CA; Owner: KALI-FM, INC.)

- KWIZ (96.7 FM; SANTA ANA, CA; Owner: LBI RADIO LICENSE CORP.)

- KWVE (107.9 FM; SAN CLEMENTE, CA; Owner: CALVARY CHAPEL OF COSTA MESA)

- KFSH-FM (95.9 FM; ANAHEIM, CA; Owner: NEW INSPIRATION BROADCASTING COMPANY)

- KDLE (103.1 FM; NEWPORT BEACH, CA; Owner: ENTRAVISION HOLDINGS, LLC.)

- KCBS-FM (93.1 FM; LOS ANGELES, CA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- KSCA (101.9 FM; GLENDALE, CA; Owner: HBC LICENSE CORPORATION)

- KLOS (95.5 FM; LOS ANGELES, CA; Owner: KLOS-FM RADIO, INC.)

- K212FA (90.3 FM; TEMPLE CITY, CA; Owner: EDUCATIONAL MEDIA FOUNDATION)

- KOST (103.5 FM; LOS ANGELES, CA; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- KZLA-FM (93.9 FM; LOS ANGELES, CA; Owner: EMMIS RADIO LICENSE CORPORATION)

- KPWR (105.9 FM; LOS ANGELES, CA; Owner: EMMIS RADIO LICENSE CORPORATION)

- KLVE (107.5 FM; LOS ANGELES, CA; Owner: KLVE-FM LICENSE CORP.)

- KIIS-FM (102.7 FM; LOS ANGELES, CA; Owner: CITICASTERS LICENSES, L.P.)

- KEBN (94.3 FM; GARDEN GROVE, CA; Owner: LBI RADIO LICENSE CORP.)

- KLSX (97.1 FM; LOS ANGELES, CA; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- KPCC (89.3 FM; PASADENA, CA; Owner: PASADENA AREA COMMUNITY COLLEGE DISTRICT)

- KHHT (92.3 FM; LOS ANGELES, CA; Owner: AMFM RADIO LICENSES, L.L.C.)

- KBIG-FM (104.3 FM; LOS ANGELES, CA; Owner: AMFM RADIO LICENSES, L.L.C.)

- KUSC (91.5 FM; LOS ANGELES, CA; Owner: UNIVERSITY OF SOUTHERN CALIFORNIA)

TV broadcast stations around Tustin Foothills:

- KTRO-LP (Channel 50; LANCASTER, CA; Owner: ROBERT D. ADELMAN)

- KCBS-TV (Channel 2; LOS ANGELES, CA; Owner: CBS BROADCASTING INC.)

- KHIZ (Channel 64; BARSTOW, CA; Owner: SUNBELT TELEVISION, INC.)

- National Bridge Inventory (NBI) Statistics

- 1Number of bridges

- 9,000Total average daily traffic

- 90Total average daily truck traffic

FCC Registered Antenna Towers:

6- Towers Manager, 9764 Handy Creek Road (Lat: 33.777250 Lon: -117.755778), Type: 10.7, Structure height: 06059 m, Overall height: 10.7 m, Registrant: Wireless Applications Corporation, Fcc@wacorp.Net, , Belle-vue, Phone: (425) 643-5000

- Towers Manager, 9764 Handy Creek Road (Lat: 33.777250 Lon: -117.755778), Type: 10.7, Structure height: 06059 m, Overall height: 10.7 m, Registrant: Wireless Applications Corporation, Fcc@wacorp.Net, , Belle-vue, Phone: (425) 643-5000

- Towers Manager, 9764 Handy Creek Road (Lat: 33.777250 Lon: -117.755778), Type: 10.7, Structure height: 06059 m, Overall height: 10.7 m, Registrant: Wireless Applications Corporation, Fcc@wacorp.Net, , Belle-vue, Phone: (425) 643-5000

- Edward Schafer, 9764 Handy Creek Road (Lat: 33.777250 Lon: -117.755778), Type: 10.7, Structure height: 06059 m, Overall height: 10.7 m, Registrant: Iwg Towers Assets Ii, LLC, Eschafer@insitewireless.Com, , Alexa-ndria, Phone: (703) 535-3009

- Edward Schafer, 9764 Handy Creek Road (Lat: 33.777250 Lon: -117.755778), Type: 10.7, Structure height: 06059 m, Overall height: 10.7 m, Registrant: Insite Towers, LLC, Eschafer@insitewireless.Com, , Alexa-ndria, Phone: (703) 535-3009

- Leanne Wasilition, 9764 Handy Creek Road (Lat: 33.777250 Lon: -117.755778), Type: 10.7, Structure height: 06059 m, Overall height: 10.7 m, Registrant: American Towers LLC, Faa-Fcc@americantower.Com, , Wobur-n, Phone: (781) 926-4500

FCC Registered Microwave Towers:

1- CA-ORC5779A, 19211 Dodge Ave (Lat: 33.765833 Lon: -117.797222), Type: Pole, Structure height: 18 m, Call Sign: WQSI560,

Assigned Frequencies: 11095.0 MHz, Grant Date: 09/24/2013, Expiration Date: 09/24/2023, Cancellation Date: 11/17/2020, Certifier: Nadja S Sodos-Wallace, Registrant: Sprint Corporation, 12502 Sunrise Valley Drive, M/S: Varesa0209, Reston, VA 20196, Phone: (800) 572-8256, Fax: (703) 433-4483, Email:

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 2 full and 6 partial tracts) | ||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 47 | $469,275 | 174 | $489,793 | 1,008 | $387,864 | 38 | $328,600 | 27 | $337,543 | 1 | $448,180 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 2 | $558,140 | 23 | $519,457 | 103 | $435,628 | 6 | $120,465 | 2 | $492,495 | 1 | $296,650 |

| APPLICATIONS DENIED | 5 | $462,152 | 30 | $510,924 | 240 | $512,885 | 15 | $236,817 | 10 | $313,148 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 9 | $484,387 | 28 | $524,048 | 157 | $424,153 | 10 | $278,702 | 8 | $310,128 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 4 | $477,028 | 5 | $480,928 | 55 | $465,665 | 2 | $96,970 | 3 | $1,156,007 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 0755.04 , 0756.03, 0756.04, 0756.05, 0756.06, 0757.01, 0757.02, 0757.03

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 2 full and 6 partial tracts) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 7 | $409,847 | 1 | $303,240 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 2 | $543,450 | 2 | $467,555 |

| APPLICATIONS DENIED | 0 | $0 | 2 | $431,400 |

| APPLICATIONS WITHDRAWN | 1 | $261,410 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 0755.04 , 0756.03, 0756.04, 0756.05, 0756.06, 0757.01, 0757.02, 0757.03

- 90.0%Utility gas

- 9.0%Electricity

- 0.8%Bottled, tank, or LP gas

- 0.1%Wood

- 92.9%Utility gas

- 7.1%Electricity

Tustin Foothills compared to California state average:

- Median household income above state average.

- Unemployed percentage significantly below state average.

- Black race population percentage significantly below state average.

- Hispanic race population percentage significantly below state average.

- Median age significantly above state average.

- Foreign-born population percentage below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

- Institutionalized population percentage significantly above state average.

- Percentage of population with a bachelor's degree or higher above state average.

Tustin Foothills on our top lists:

- #12 on the list of "Top 101 cities with largest percentage of females in industries: hardware, plumbing and heating equipment, and supplies merchant wholesalers (population 5,000+)"

- #20 on the list of "Top 101 cities with largest percentage of females in occupations: accountants and auditors (population 5,000+)"

- #24 on the list of "Top 101 cities with largest percentage of females in occupations: top executives (population 5,000+)"

- #26 on the list of "Top 101 cities with largest percentage of males in occupations: top executives (population 5,000+)"

- #29 on the list of "Top 101 cities with largest percentage of females in occupations: lawyers (population 5,000+)"

- #42 on the list of "Top 101 cities with largest percentage of females in occupations: physicians and surgeons (population 5,000+)"

- #44 on the list of "Top 101 cities with largest percentage of males in industries: apparel, fabrics, and notions merchant wholesalers (population 5,000+)"

- #48 on the list of "Top 101 cities with largest percentage of males in occupations: physicians and surgeons (population 5,000+)"

- #64 on the list of "Top 101 cities with largest percentage of females in industries: petroleum and coal products (population 5,000+)"

- #89 on the list of "Top 101 cities with largest percentage of males in industries: professional and commercial equipment and supplies merchant wholesalers (population 5,000+)"

- #94 on the list of "Top 101 cities with largest percentage of males in industries: electrical and electronic goods merchant wholesalers (population 5,000+)"

- #40 (92705) on the list of "Top 101 zip codes with the most big companies in 2005 (at least 1000 employees)"

- #60 (92705) on the list of "Top 101 zip codes with the most finance and insurance companies in 2005"

- #87 (92705) on the list of "Top 101 zip codes with the most offices of physicians in 2005"

- #100 (92705) on the list of "Top 101 zip codes with the most medium-big companies in 2005 (at least 100 employees)"

- #4 on the list of "Top 101 counties with the highest total withdrawal of fresh water for public supply"

- #5 on the list of "Top 101 counties with the most Catholic adherents"

- #6 on the list of "Top 101 counties with the highest ground withdrawal of fresh water for public supply"

- #7 on the list of "Top 101 counties with the most Evangelical Protestant adherents"

- #8 on the list of "Top 101 counties with the highest Particulate Matter (PM2.5) Annual air pollution readings in 2012 (µg/m3)"