Back Mountain, Pennsylvania

Back Mountain: Back Mountain Trail

Back Mountain: Franci Slocum Park 1

Back Mountain: Francis Slocum 2

Back Mountain: Francis Slocum 3

Back Mountain: Lake Silkworth Pennsylvania

- add

your

Submit your own pictures of this place and show them to the world

- OSM Map

- General Map

- Google Map

- MSN Map

| Males: 13,520 | |

| Females: 12,614 |

| Median resident age: | 40.1 years |

| Pennsylvania median age: | 38.0 years |

Zip codes: 18612.

| Back Mountain: | $87,007 |

| PA: | $71,798 |

Estimated per capita income in 2022: $41,339 (it was $23,105 in 2000)

Back Mountain CDP income, earnings, and wages data

Estimated median house or condo value in 2022: $241,096 (it was $118,700 in 2000)

| Back Mountain: | $241,096 |

| PA: | $245,500 |

Mean prices in 2022: all housing units: $191,206; detached houses: $199,477; townhouses or other attached units: $136,517; in 2-unit structures: $172,827; in 3-to-4-unit structures: $114,904; in 5-or-more-unit structures: $423,960; mobile homes: $57,774

Detailed information about poverty and poor residents in Back Mountain, PA

- 25,01293.7%White alone

- 1,1334.2%Black alone

- 2811.1%Hispanic

- 1360.5%Asian alone

- 890.3%Two or more races

- 240.09%American Indian alone

- 110.04%Other race alone

- 40.01%Native Hawaiian and Other

Pacific Islander alone

Races in Back Mountain detailed stats: ancestries, foreign born residents, place of birth

| Future NE Penn. residents looking for personal opinions and experiences! (273 replies) |

| Kirby Park walking track... open, public? (7 replies) |

| What is a NEPA? (38 replies) |

| Information about Back Mountain Harvest Assembly of God (3 replies) |

| Relocating CT to Wilkes-Barre Area (29 replies) |

| Yalick Farms---Smart Growth in the Back Mountain? (50 replies) |

Latest news from Back Mountain, PA collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: Polish (18.6%), German (18.6%), Irish (15.5%), English (10.6%), Italian (10.4%), Welsh (8.4%).

Current Local Time: EST time zone

Elevation: 1260 feet

Land area: 107.0 square miles.

Population density: 244 people per square mile (very low).

459 residents are foreign born

| This place: | 1.7% |

| Pennsylvania: | 4.1% |

| Back Mountain CDP: | 1.4% ($1,696) |

| Pennsylvania: | 1.6% ($1,552) |

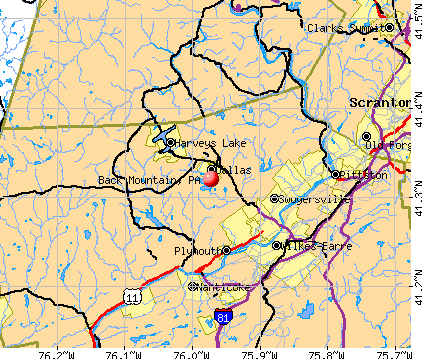

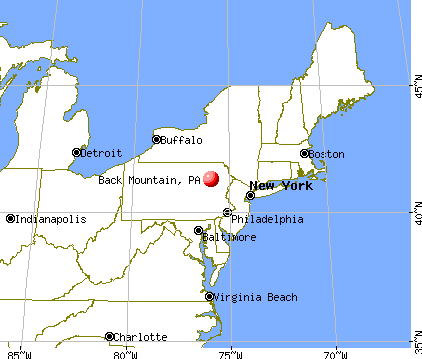

Nearest city with pop. 50,000+: Scranton, PA (17.0 miles

, pop. 76,415).

Nearest city with pop. 200,000+: Philadelphia, PA (101.2 miles

, pop. 1,517,550).

Nearest cities:

Latitude: 41.32 N, Longitude: 75.97 W

Daytime population change due to commuting: -6,881 (-25.8%)

Workers who live and work in this place: 1,695 (14.6%)

Area code commonly used in this area: 570

Property values in Back Mountain, PA

| Here: | 3.8% |

| Pennsylvania: | 2.9% |

- Health care (13.2%)

- Educational services (9.4%)

- Construction (7.1%)

- Finance & insurance (5.5%)

- Accommodation & food services (5.3%)

- Broadcasting & telecommunications (5.1%)

- Public administration (5.1%)

- Construction (11.5%)

- Health care (6.7%)

- Public administration (6.0%)

- Educational services (5.4%)

- Accommodation & food services (5.2%)

- Finance & insurance (4.8%)

- Professional, scientific, technical services (4.3%)

- Health care (21.3%)

- Educational services (14.4%)

- Broadcasting & telecommunications (6.9%)

- Finance & insurance (6.4%)

- Accommodation & food services (5.5%)

- Professional, scientific, technical services (5.0%)

- Public administration (3.9%)

- Other office and administrative support workers, including supervisors (4.4%)

- Other sales and related occupations, including supervisors (4.1%)

- Other management occupations, except farmers and farm managers (3.9%)

- Sales representatives, services, wholesale and manufacturing (3.7%)

- Secretaries and administrative assistants (3.6%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (3.3%)

- Registered nurses (2.9%)

- Sales representatives, services, wholesale and manufacturing (5.2%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (5.1%)

- Other sales and related occupations, including supervisors (4.5%)

- Other management occupations, except farmers and farm managers (4.5%)

- Other production occupations, including supervisors (4.3%)

- Driver/sales workers and truck drivers (4.2%)

- Top executives (4.2%)

- Secretaries and administrative assistants (8.0%)

- Other office and administrative support workers, including supervisors (7.9%)

- Registered nurses (6.2%)

- Preschool, kindergarten, elementary, and middle school teachers (5.3%)

- Health technologists and technicians (4.0%)

- Cashiers (3.7%)

- Other sales and related occupations, including supervisors (3.6%)

Average climate in Back Mountain, Pennsylvania

Based on data reported by over 4,000 weather stations

(lower is better)

Air Quality Index (AQI) level in 2023 was 96.5. This is worse than average.

| City: | 96.5 |

| U.S.: | 72.6 |

Carbon Monoxide (CO) [ppm] level in 2023 was 0.223. This is about average. Closest monitor was 6.8 miles away from the city center.

| City: | 0.223 |

| U.S.: | 0.251 |

Nitrogen Dioxide (NO2) [ppb] level in 2023 was 9.63. This is significantly worse than average. Closest monitor was 7.0 miles away from the city center.

| City: | 9.63 |

| U.S.: | 5.11 |

Sulfur Dioxide (SO2) [ppb] level in 2023 was 0.157. This is significantly better than average. Closest monitor was 7.6 miles away from the city center.

| City: | 0.157 |

| U.S.: | 1.515 |

Ozone [ppb] level in 2022 was 27.4. This is better than average. Closest monitor was 7.0 miles away from the city center.

| City: | 27.4 |

| U.S.: | 33.3 |

Particulate Matter (PM10) [µg/m3] level in 2023 was 17.3. This is about average. Closest monitor was 6.9 miles away from the city center.

| City: | 17.3 |

| U.S.: | 19.2 |

Particulate Matter (PM2.5) [µg/m3] level in 2023 was 15.0. This is significantly worse than average. Closest monitor was 7.6 miles away from the city center.

| City: | 15.0 |

| U.S.: | 8.1 |

Tornado activity:

Back Mountain-area historical tornado activity is slightly below Pennsylvania state average. It is 32% smaller than the overall U.S. average.

On 6/2/1998, a category F3 (max. wind speeds 158-206 mph) tornado 19.5 miles away from the Back Mountain place center killed 2 people and injured 15 people and caused $2 million in damages.

On 7/6/1984, a category F2 (max. wind speeds 113-157 mph) tornado 9.6 miles away from the place center injured 12 people and caused between $50,000 and $500,000 in damages.

Earthquake activity:

Back Mountain-area historical earthquake activity is significantly above Pennsylvania state average. It is 65% smaller than the overall U.S. average.On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 258.0 miles away from the city center

On 10/7/1983 at 10:18:46, a magnitude 5.3 (5.1 MB, 5.3 LG, 5.1 ML) earthquake occurred 200.1 miles away from the city center

On 1/16/1994 at 01:49:16, a magnitude 4.6 (4.6 MB, 4.6 LG, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 68.6 miles away from the city center

On 4/20/2002 at 10:50:47, a magnitude 5.3 (5.3 ML, Depth: 3.0 mi) earthquake occurred 249.0 miles away from Back Mountain center

On 9/25/1998 at 19:52:52, a magnitude 5.2 (4.8 MB, 4.3 MS, 5.2 LG, 4.5 MW, Depth: 3.1 mi) earthquake occurred 229.8 miles away from the city center

On 4/20/2002 at 10:50:47, a magnitude 5.2 (5.2 MB, 4.2 MS, 5.2 MW, 5.0 MW) earthquake occurred 247.0 miles away from the city center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Luzerne County (20) is greater than the US average (15).Major Disasters (Presidential) Declared: 15

Emergencies Declared: 5

Causes of natural disasters: Floods: 6, Storms: 6, Hurricanes: 5, Tropical Storms: 3, Winter Storms: 2, Blizzard: 1, Heavy Rain: 1, Mudslide: 1, Snowfall: 1, Snowstorm: 1, Tropical Depression: 1, Other: 1 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers near Back Mountain:

- HOMEBOUND HEALTH SERVICES INC (Home Health Center, about 2 miles away; SHAVERTOWN, PA)

- LAKESIDE HEALTH AND REHABILITATION CENTER (Nursing Home, about 4 miles away; DALLAS, PA)

- STEP BY STEP INC (Hospital, about 6 miles away; KINGSTON, PA)

- DIVERSIFIED NURSING INC (Home Health Center, about 6 miles away; KINGSTON, PA)

- ST JOSEPH'S CNTR COMM SWOYERSV (Hospital, about 6 miles away; SWOYERSVILLE, PA)

- PERSONAL CARE HH SRVCS (Home Health Center, about 6 miles away; KINGSTON, PA)

- ASSOCIATED FAMILY HOME CARE (Home Health Center, about 6 miles away; KINGSTON, PA)

Colleges/universities with over 2000 students nearest to Back Mountain:

- Misericordia University (about 2 miles; Dallas, PA; Full-time enrollment: 2,554)

- Wilkes University (about 7 miles; Wilkes-Barre, PA; FT enrollment: 3,912)

- King's College (about 7 miles; Wilkes-Barre, PA; FT enrollment: 2,392)

- Luzerne County Community College (about 9 miles; Nanticoke, PA; FT enrollment: 4,724)

- University of Scranton (about 18 miles; Scranton, PA; FT enrollment: 5,488)

- Marywood University (about 20 miles; Scranton, PA; FT enrollment: 2,959)

- Bloomsburg University of Pennsylvania (about 33 miles; Bloomsburg, PA; FT enrollment: 9,452)

Points of interest:

Notable locations in Back Mountain: Twin Oaks Golf Course (A), Suttons Creek (B), Irem Temple Country Club (C), Overbrook Gun Club (D), Wilkes Barre Filtration Plant (E), Trucksville Volunteer Fire Company (F), Jonathan R Davis Volunteer Fire Company (G), Franklin Township Volunteer Fire Company (H), Lehman Volunteer Fire Department (I), Kunkle Fire Company (J), Jackson Township Volunteer Fire Department (K), Lake Silkworth Volunteer Fire Company (L), Dallas Fire and Ambulance (M), Shavertown Volunteer Fire Department (N). Display/hide their locations on the map

Churches in Back Mountain include: Weavertown Church (A), Carverton Church (B), Bunker Hill Church (C), East Dallas Church (D). Display/hide their locations on the map

Cemeteries: Valley View Cemetery (1), Eaton Cemetery (2), Bronson Cemetery (3), Evergreen Cemetery (4), Saint Stephens Cemetery (5), Saint Anns Cemetery (6), Memorial Shrine Cemetery (7). Display/hide their locations on the map

Lakes and reservoirs: Simms Pond (A), Lake Silkworth (B), Smith Pond (C), Burkett Pond (D), Frances Slocum Lake (E), Bryant Pond (F), Lake Louise (G), Huntsville Reservoir (H). Display/hide their locations on the map

Streams, rivers, and creeks: Bear Hollow Creek (A), Huntsville Creek (B), Fades Creek (C), East Fork Harveys Creek (D), Drakes Creek (E), Cider Run (F), Trout Brook (G), Butternut Run (H), Browns Creek (I). Display/hide their locations on the map

Parks in Back Mountain include: Pine Brook Park (1), Frances Slocum State Park (2). Display/hide their locations on the map

| This place: | 2.6 people |

| Pennsylvania: | 2.5 people |

| This place: | 74.4% |

| Whole state: | 67.5% |

| This place: | 3.7% |

| Whole state: | 5.0% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.1% of all households

- Gay men: 0.3% of all households

| This place: | 6.5% |

| Whole state: | 11.0% |

| This place: | 3.0% |

| Whole state: | 5.1% |

People in group quarters in Back Mountain in 2000:

- 1,871 people in state prisons

- 486 people in college dormitories (includes college quarters off campus)

- 386 people in nursing homes

- 41 people in other nonhousehold living situations

- 37 people in other noninstitutional group quarters

- 18 people in religious group quarters

- 17 people in homes for the mentally retarded

- 4 people in unknown juvenile institutions

- 4 people in homes for the mentally ill

For population 15 years and over in Back Mountain:

- Never married: 25.6%

- Now married: 59.3%

- Separated: 1.3%

- Widowed: 7.3%

- Divorced: 6.5%

For population 25 years and over in Back Mountain:

- High school or higher: 86.0%

- Bachelor's degree or higher: 25.1%

- Graduate or professional degree: 9.5%

- Unemployed: 3.7%

- Mean travel time to work (commute): 23.5 minutes

| Here: | 11.2 |

| Pennsylvania average: | 11.8 |

Graphs represent county-level data. Detailed 2008 Election Results

Religion statistics for Back Mountain, PA (based on Luzerne County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 138,000 | 75 |

| Mainline Protestant | 31,734 | 142 |

| Evangelical Protestant | 12,502 | 108 |

| Other | 5,134 | 17 |

| Orthodox | 1,667 | 12 |

| Black Protestant | 118 | 1 |

| None | 131,763 | - |

Food Environment Statistics:

| Luzerne County: | 2.08 / 10,000 pop. |

| Pennsylvania: | 2.04 / 10,000 pop. |

| Luzerne County: | 0.06 / 10,000 pop. |

| State: | 0.09 / 10,000 pop. |

| Luzerne County: | 1.09 / 10,000 pop. |

| Pennsylvania: | 0.88 / 10,000 pop. |

| Luzerne County: | 3.08 / 10,000 pop. |

| Pennsylvania: | 2.52 / 10,000 pop. |

| This county: | 9.42 / 10,000 pop. |

| State: | 7.12 / 10,000 pop. |

| Luzerne County: | 9.6% |

| Pennsylvania: | 9.1% |

| Luzerne County: | 27.4% |

| Pennsylvania: | 27.2% |

| Luzerne County: | 9.6% |

| State: | 11.5% |

4.53% of this county's 2021 resident taxpayers lived in other counties in 2020 ($51,556 average adjusted gross income)

| Here: | 4.53% |

| Pennsylvania average: | 5.27% |

0.02% of residents moved from foreign countries ($67 average AGI)

Luzerne County: 0.02% Pennsylvania average: 0.01%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

| from Lackawanna County, PA | |

| from Bronx County, NY | |

| from Columbia County, PA |

3.97% of this county's 2020 resident taxpayers moved to other counties in 2021 ($53,147 average adjusted gross income)

| Here: | 3.97% |

| Pennsylvania average: | 5.44% |

0.02% of residents moved to foreign countries ($144 average AGI)

Luzerne County: 0.02% Pennsylvania average: 0.01%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

| to Lackawanna County, PA | |

| to Schuylkill County, PA | |

| to Columbia County, PA |

Strongest AM radio stations in Back Mountain:

- WILK (980 AM; 5 kW; WILKES-BARRE, PA; Owner: ENTERCOM WILKES-BARRE SCRANTON, LLC)

- WITK (1550 AM; 10 kW; PITTSTON, PA; Owner: ROBERT C. CORDARO, INC.)

- WARM (590 AM; 5 kW; SCRANTON, PA; Owner: CITADEL BROADCASTING COMPANY)

- WNAK (730 AM; 1 kW; NANTICOKE, PA; Owner: SEVEN-THIRTY BROADCASTERS, INC.)

- WBAX (1240 AM; 1 kW; WILKES-BARRE, PA; Owner: THE SCRANTON TIMES, L.P.)

- WWJZ (640 AM; 50 kW; MOUNT HOLLY, NJ; Owner: ABC, INC.)

- WEMR (1460 AM; 5 kW; TUNKHANNOCK, PA; Owner: CITADEL BROADCASTING COMPANY)

- WEJL (630 AM; 2 kW; SCRANTON, PA)

- WYCK (1340 AM; 1 kW; PLAINS, PA; Owner: LB RADIO CORPORATION)

- WMCA (570 AM; 50 kW; NEW YORK, NY; Owner: SALEM MEDIA OF NEW YORK, LLC)

- WOR (710 AM; 50 kW; NEW YORK, NY; Owner: BUCKLEY BROADCASTING CORPORATION)

- WVCH (740 AM; 50 kW; CHESTER, PA; Owner: WVCH COMMUNICATIONS, INC.)

- WZZD (990 AM; 50 kW; PHILADELPHIA, PA; Owner: PENNSYLVANIA MEDIA ASSOCIATES, INC.)

Strongest FM radio stations in Back Mountain:

- WCWQ (93.7 FM; DALLAS, PA; Owner: CITADEL BROADCASTING COMPANY)

- WMGS (92.9 FM; WILKES-BARRE, PA; Owner: CITADEL BROADCASTING COMPANY)

- WVIA-FM (89.9 FM; SCRANTON, PA; Owner: NORTHEASTERN PENNSYLVANIA EDUCATIONAL TV ASSN.)

- WBHT (97.1 FM; MOUNTAIN TOP, PA; Owner: CITADEL BROADCASTING COMPANY)

- WKRZ (98.5 FM; WILKES-BARRE, PA; Owner: ENTERCOM WILKES-BARRE SCRANTON, LLC)

- WQFM (92.1 FM; NANTICOKE, PA; Owner: THE SCRANTON TIMES, L.P.)

- WCLH (90.7 FM; WILKES-BARRE, PA; Owner: WILKES COLLEGE)

- W219CG (91.7 FM; WILKER-BARRE, PA; Owner: PENSACOLA CHRISTIAN COLLEGE, INC.)

- WEZX (106.9 FM; SCRANTON, PA; Owner: THE SCRANTON TIMES, L.P.)

- WGGY (101.3 FM; SCRANTON, PA; Owner: ENTERCOM WILKES-BARRE SCRANTON, LLC)

- WBSX (97.9 FM; HAZLETON, PA; Owner: CITADEL BROADCASTING COMPANY)

- WCWY (107.7 FM; TUNKHANNOCK, PA; Owner: CITADEL BROADCASTING COMPANY)

- WWDL-FM (104.9 FM; SCRANTON, PA; Owner: LANE BROADCASTING CORPORATION)

- WBHD (95.7 FM; OLYPHANT, PA; Owner: CITADEL BROADCASTING COMPANY)

- WUSR (99.5 FM; SCRANTON, PA; Owner: UNIVERSITY OF SCRANTON)

- W288BE (105.5 FM; WILKES-BARRE, PA; Owner: LUZERNE COUNTY COMMUNITY COLLEGE)

- WRGN (88.1 FM; SWEET VALLEY, PA; Owner: GOSPEL MEDIA INSTITUTE, INC.)

- W212AT (90.3 FM; CLARKS SUMMIT, PA; Owner: NORTHEASTERN PA. EDUCTNL TV ASSOC.)

- WAMT (103.1 FM; FREELAND, PA; Owner: ENTERCOM WILKES-BARRE SCRANTON, LLC)

- WPGP (88.3 FM; TAFTON, PA; Owner: SOUND OF LIFE, INC.)

TV broadcast stations around Back Mountain:

- WNEP-TV (Channel 16; SCRANTON, PA; Owner: NEW YORK TIMES MANAGEMENT SERVICES)

- WBRE-TV (Channel 28; WILKES-BARRE, PA; Owner: NEXSTAR BROADCASTING OF NORTHEASTERN PENNSYLVANIA, L.L.C.)

- WYOU (Channel 22; SCRANTON, PA; Owner: MISSION BROADCASTING, INC.)

- WOLF-TV (Channel 56; HAZLETON, PA; Owner: WOLF LICENSE CORP.)

- WVIA-TV (Channel 44; SCRANTON, PA; Owner: NE PA ED TV ASSOCIATION)

- W07BV (Channel 7; WILKES-BARRE, ETC., PA; Owner: CATHOLIC BROADCASTING OF SCRANTON, INC.)

- WQPX (Channel 64; SCRANTON, PA; Owner: PAXSON SCRANTON LICENSE, INC.)

- W54BO (Channel 54; KINGSTON, PA; Owner: KATHY POTERA)

- WSWB (Channel 38; SCRANTON, PA; Owner: KB PRIME MEDIA LLC)

- W67DE (Channel 67; NEWPORT, PA; Owner: TRIPLE J COMMUNITY BROADCASTING., L.L.C.)

- National Bridge Inventory (NBI) Statistics

- 40Number of bridges

- 148ft / 44.9mTotal length

- $9,181,000Total costs

- 317,811Total average daily traffic

- 20,936Total average daily truck traffic

- New bridges - historical statistics

- 51920-1929

- 51930-1939

- 101940-1949

- 21950-1959

- 21960-1969

- 41970-1979

- 21980-1989

- 61990-1999

- 12000-2009

- 32010-2019

FCC Registered Microwave Towers:

1- 2LU8973A, 4 Bronson Road (Lat: 41.312278 Lon: -76.126500), Type: Mtower, Structure height: 54.5 m, Overall height: 56.4 m, Call Sign: WRAU455,

Assigned Frequencies: 6197.24 MHz, 6197.24 MHz, 6197.24 MHz, 6197.24 MHz, 6197.24 MHz, 6197.24 MHz, 6197.24 MHz, 6197.24 MHz, Grant Date: 03/06/2018, Expiration Date: 03/06/2028, Cancellation Date: 03/24/2021, Certifier: David Werblow, Registrant: T-Mobile Usa, Inc., 12920 Se 38th Street, Bellevue, WA 98006, Phone: (425) 383-8401, Fax: (425) 383-4040, Email:

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009 (Based on 7 full tracts) | ||||||||||||||

| A) FHA, FSA/RHS & VA Home Purchase Loans | B) Conventional Home Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On Manufactured Home Dwelling (A B C & D) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 74 | $142,213 | 142 | $175,894 | 642 | $173,509 | 87 | $67,435 | 1 | $57,990 | 34 | $116,996 | 12 | $35,998 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 3 | $120,000 | 11 | $172,357 | 74 | $211,239 | 10 | $63,099 | 0 | $0 | 2 | $113,000 | 0 | $0 |

| APPLICATIONS DENIED | 26 | $140,188 | 39 | $171,738 | 264 | $173,923 | 32 | $46,029 | 0 | $0 | 15 | $104,464 | 9 | $88,214 |

| APPLICATIONS WITHDRAWN | 7 | $120,283 | 12 | $183,242 | 99 | $175,077 | 8 | $87,492 | 1 | $134,990 | 3 | $134,663 | 2 | $106,500 |

| FILES CLOSED FOR INCOMPLETENESS | 2 | $154,485 | 5 | $151,796 | 33 | $158,570 | 4 | $115,245 | 0 | $0 | 4 | $205,500 | 0 | $0 |

Detailed HMDA statistics for the following Tracts: 2112.01 , 2112.02, 2112.03, 2113.01, 2113.02, 2113.04, 2114.00

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009 (Based on 7 full tracts) | ||||

| A) Conventional Home Purchase Loans | B) Refinancings | |||

|---|---|---|---|---|

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 26 | $227,340 | 15 | $179,123 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 5 | $297,190 | 8 | $190,242 |

| APPLICATIONS DENIED | 10 | $253,800 | 5 | $213,584 |

| APPLICATIONS WITHDRAWN | 1 | $288,000 | 1 | $123,000 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | $0 | 0 | $0 |

Detailed PMIC statistics for the following Tracts: 2112.01 , 2112.02, 2112.03, 2113.01, 2113.02, 2113.04, 2114.00

- 35.5%Utility gas

- 33.9%Fuel oil, kerosene, etc.

- 19.9%Electricity

- 5.1%Bottled, tank, or LP gas

- 4.3%Coal or coke

- 1.2%Wood

- 0.1%Other fuel

- 32.7%Utility gas

- 30.5%Electricity

- 28.3%Fuel oil, kerosene, etc.

- 3.9%Bottled, tank, or LP gas

- 2.8%Coal or coke

- 0.7%No fuel used

- 0.6%Wood

- 0.6%Other fuel

Back Mountain compared to Pennsylvania state average:

- Unemployed percentage significantly below state average.

- Black race population percentage below state average.

- Hispanic race population percentage significantly below state average.

- Foreign-born population percentage significantly below state average.

- Renting percentage significantly below state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house significantly below state average.

- House age significantly below state average.

- Institutionalized population percentage significantly above state average.

Back Mountain on our top lists:

- #2 on the list of "Top 101 cities with largest percentage of females in industries: broadcasting and telecommunications (population 5,000+)"

- #33 on the list of "Top 101 cities with largest percentage of males in industries: nonmetallic mineral products (population 5,000+)"

- #42 on the list of "Top 101 cities with largest percentage of males in industries: printing and related support activities (population 5,000+)"

- #57 on the list of "Top 101 cities with largest percentage of males in industries: broadcasting and telecommunications (population 5,000+)"

- #68 on the list of "Top 101 cities with largest percentage of males in occupations: therapists (population 5,000+)"

- #76 on the list of "Top 101 cities with largest percentage of females in occupations: rail and water transportation workers (population 5,000+)"

- #76 on the list of "Top 101 cities with largest percentage of males in occupations: special education teachers (population 5,000+)"

- #91 on the list of "Top 101 cities with largest percentage of males in occupations: printing workers (population 5,000+)"

- #96 on the list of "Top 101 cities with largest percentage of males in industries: paper (population 5,000+)"

- #14 (18612) on the list of "Top 101 zip codes with the largest percentage of Welsh first ancestries (pop 5,000+)"

- #31 (18612) on the list of "Top 101 zip codes with the largest percentage of Lithuanian first ancestries (pop 5,000+)"

- #16 on the list of "Top 101 counties with the lowest percentage of residents relocating to other counties in 2011"

- #17 on the list of "Top 101 counties with the highest percentage of residents that smoked 100+ cigarettes in their lives"

- #17 on the list of "Top 101 counties with the largest decrease in the number of infant deaths per 1000 residents 2000-2006 to 2007-2013 (pop. 50,000+)"

- #26 on the list of "Top 101 counties with the most Catholic congregations"

- #30 on the list of "Top 101 counties with the highest number of deaths per 1000 residents 2007-2013 (pop. 50,000+)"