Dickson City, Pennsylvania Submit your own pictures of this borough and show them to the world

OSM Map

General Map

Google Map

MSN Map

OSM Map

General Map

Google Map

MSN Map

OSM Map

General Map

Google Map

MSN Map

OSM Map

General Map

Google Map

MSN Map

Please wait while loading the map...

Population in 2022: 5,997 (99% urban, 1% rural). Population change since 2000: -3.4%Males: 2,766 Females: 3,231

March 2022 cost of living index in Dickson City: 94.2 (less than average, U.S. average is 100) Percentage of residents living in poverty in 2022: 12.2%for White Non-Hispanic residents , 43.5% for Black residents , 63.8% for Hispanic or Latino residents , 71.4% for American Indian residents , 2.4% for other race residents , 87.7% for two or more races residents )Business Search - 14 Million verified businesses

Data:

Median household income ($)

Median household income (% change since 2000)

Household income diversity

Ratio of average income to average house value (%)

Ratio of average income to average rent

Median household income ($) - White

Median household income ($) - Black or African American

Median household income ($) - Asian

Median household income ($) - Hispanic or Latino

Median household income ($) - American Indian and Alaska Native

Median household income ($) - Multirace

Median household income ($) - Other Race

Median household income for houses/condos with a mortgage ($)

Median household income for apartments without a mortgage ($)

Races - White alone (%)

Races - White alone (% change since 2000)

Races - Black alone (%)

Races - Black alone (% change since 2000)

Races - American Indian alone (%)

Races - American Indian alone (% change since 2000)

Races - Asian alone (%)

Races - Asian alone (% change since 2000)

Races - Hispanic (%)

Races - Hispanic (% change since 2000)

Races - Native Hawaiian and Other Pacific Islander alone (%)

Races - Native Hawaiian and Other Pacific Islander alone (% change since 2000)

Races - Two or more races (%)

Races - Two or more races (% change since 2000)

Races - Other race alone (%)

Races - Other race alone (% change since 2000)

Racial diversity

Unemployment (%)

Unemployment (% change since 2000)

Unemployment (%) - White

Unemployment (%) - Black or African American

Unemployment (%) - Asian

Unemployment (%) - Hispanic or Latino

Unemployment (%) - American Indian and Alaska Native

Unemployment (%) - Multirace

Unemployment (%) - Other Race

Population density (people per square mile)

Population - Males (%)

Population - Females (%)

Population - Males (%) - White

Population - Males (%) - Black or African American

Population - Males (%) - Asian

Population - Males (%) - Hispanic or Latino

Population - Males (%) - American Indian and Alaska Native

Population - Males (%) - Multirace

Population - Males (%) - Other Race

Population - Females (%) - White

Population - Females (%) - Black or African American

Population - Females (%) - Asian

Population - Females (%) - Hispanic or Latino

Population - Females (%) - American Indian and Alaska Native

Population - Females (%) - Multirace

Population - Females (%) - Other Race

Coronavirus confirmed cases (May 10, 2024)

Deaths caused by coronavirus (May 10, 2024)

Coronavirus confirmed cases (per 100k population) (May 10, 2024)

Deaths caused by coronavirus (per 100k population) (May 10, 2024)

Daily increase in number of cases (May 10, 2024)

Weekly increase in number of cases (May 10, 2024)

Cases doubled (in days) (May 10, 2024)

Hospitalized patients (Apr 18, 2022)

Negative test results (Apr 18, 2022)

Total test results (Apr 18, 2022)

COVID Vaccine doses distributed (per 100k population) (Sep 19, 2023)

COVID Vaccine doses administered (per 100k population) (Sep 19, 2023)

COVID Vaccine doses distributed (Sep 19, 2023)

COVID Vaccine doses administered (Sep 19, 2023)

Likely homosexual households (%)

Likely homosexual households (% change since 2000)

Likely homosexual households - Lesbian couples (%)

Likely homosexual households - Lesbian couples (% change since 2000)

Likely homosexual households - Gay men (%)

Likely homosexual households - Gay men (% change since 2000)

Cost of living index

Median gross rent ($)

Median contract rent ($)

Median monthly housing costs ($)

Median house or condo value ($)

Median house or condo value ($ change since 2000)

Mean house or condo value by units in structure - 1, detached ($)

Mean house or condo value by units in structure - 1, attached ($)

Mean house or condo value by units in structure - 2 ($)

Mean house or condo value by units in structure by units in structure - 3 or 4 ($)

Mean house or condo value by units in structure - 5 or more ($)

Mean house or condo value by units in structure - Boat, RV, van, etc. ($)

Mean house or condo value by units in structure - Mobile home ($)

Median house or condo value ($) - White

Median house or condo value ($) - Black or African American

Median house or condo value ($) - Asian

Median house or condo value ($) - Hispanic or Latino

Median house or condo value ($) - American Indian and Alaska Native

Median house or condo value ($) - Multirace

Median house or condo value ($) - Other Race

Median resident age

Resident age diversity

Median resident age - Males

Median resident age - Females

Median resident age - White

Median resident age - Black or African American

Median resident age - Asian

Median resident age - Hispanic or Latino

Median resident age - American Indian and Alaska Native

Median resident age - Multirace

Median resident age - Other Race

Median resident age - Males - White

Median resident age - Males - Black or African American

Median resident age - Males - Asian

Median resident age - Males - Hispanic or Latino

Median resident age - Males - American Indian and Alaska Native

Median resident age - Males - Multirace

Median resident age - Males - Other Race

Median resident age - Females - White

Median resident age - Females - Black or African American

Median resident age - Females - Asian

Median resident age - Females - Hispanic or Latino

Median resident age - Females - American Indian and Alaska Native

Median resident age - Females - Multirace

Median resident age - Females - Other Race

Commute - mean travel time to work (minutes)

Travel time to work - Less than 5 minutes (%)

Travel time to work - Less than 5 minutes (% change since 2000)

Travel time to work - 5 to 9 minutes (%)

Travel time to work - 5 to 9 minutes (% change since 2000)

Travel time to work - 10 to 19 minutes (%)

Travel time to work - 10 to 19 minutes (% change since 2000)

Travel time to work - 20 to 29 minutes (%)

Travel time to work - 20 to 29 minutes (% change since 2000)

Travel time to work - 30 to 39 minutes (%)

Travel time to work - 30 to 39 minutes (% change since 2000)

Travel time to work - 40 to 59 minutes (%)

Travel time to work - 40 to 59 minutes (% change since 2000)

Travel time to work - 60 to 89 minutes (%)

Travel time to work - 60 to 89 minutes (% change since 2000)

Travel time to work - 90 or more minutes (%)

Travel time to work - 90 or more minutes (% change since 2000)

Marital status - Never married (%)

Marital status - Now married (%)

Marital status - Separated (%)

Marital status - Widowed (%)

Marital status - Divorced (%)

Median family income ($)

Median family income (% change since 2000)

Median non-family income ($)

Median non-family income (% change since 2000)

Median per capita income ($)

Median per capita income (% change since 2000)

Median family income ($) - White

Median family income ($) - Black or African American

Median family income ($) - Asian

Median family income ($) - Hispanic or Latino

Median family income ($) - American Indian and Alaska Native

Median family income ($) - Multirace

Median family income ($) - Other Race

Median year house/condo built

Median year apartment built

Year house built - Built 2005 or later (%)

Year house built - Built 2000 to 2004 (%)

Year house built - Built 1990 to 1999 (%)

Year house built - Built 1980 to 1989 (%)

Year house built - Built 1970 to 1979 (%)

Year house built - Built 1960 to 1969 (%)

Year house built - Built 1950 to 1959 (%)

Year house built - Built 1940 to 1949 (%)

Year house built - Built 1939 or earlier (%)

Average household size

Household density (households per square mile)

Average household size - White

Average household size - Black or African American

Average household size - Asian

Average household size - Hispanic or Latino

Average household size - American Indian and Alaska Native

Average household size - Multirace

Average household size - Other Race

Occupied housing units (%)

Vacant housing units (%)

Owner occupied housing units (%)

Renter occupied housing units (%)

Vacancy status - For rent (%)

Vacancy status - For sale only (%)

Vacancy status - Rented or sold, not occupied (%)

Vacancy status - For seasonal, recreational, or occasional use (%)

Vacancy status - For migrant workers (%)

Vacancy status - Other vacant (%)

Residents with income below the poverty level (%)

Residents with income below 50% of the poverty level (%)

Children below poverty level (%)

Poor families by family type - Married-couple family (%)

Poor families by family type - Male, no wife present (%)

Poor families by family type - Female, no husband present (%)

Poverty status for native-born residents (%)

Poverty status for foreign-born residents (%)

Poverty among high school graduates not in families (%)

Poverty among people who did not graduate high school not in families (%)

Residents with income below the poverty level (%) - White

Residents with income below the poverty level (%) - Black or African American

Residents with income below the poverty level (%) - Asian

Residents with income below the poverty level (%) - Hispanic or Latino

Residents with income below the poverty level (%) - American Indian and Alaska Native

Residents with income below the poverty level (%) - Multirace

Residents with income below the poverty level (%) - Other Race

Air pollution - Air Quality Index (AQI)

Air pollution - CO

Air pollution - NO2

Air pollution - SO2

Air pollution - Ozone

Air pollution - PM10

Air pollution - PM25

Air pollution - Pb

Crime - Murders per 100,000 population

Crime - Rapes per 100,000 population

Crime - Robberies per 100,000 population

Crime - Assaults per 100,000 population

Crime - Burglaries per 100,000 population

Crime - Thefts per 100,000 population

Crime - Auto thefts per 100,000 population

Crime - Arson per 100,000 population

Crime - City-data.com crime index

Crime - Violent crime index

Crime - Property crime index

Crime - Murders per 100,000 population (5 year average)

Crime - Rapes per 100,000 population (5 year average)

Crime - Robberies per 100,000 population (5 year average)

Crime - Assaults per 100,000 population (5 year average)

Crime - Burglaries per 100,000 population (5 year average)

Crime - Thefts per 100,000 population (5 year average)

Crime - Auto thefts per 100,000 population (5 year average)

Crime - Arson per 100,000 population (5 year average)

Crime - City-data.com crime index (5 year average)

Crime - Violent crime index (5 year average)

Crime - Property crime index (5 year average)

1996 Presidential Elections Results (%) - Democratic Party (Clinton)

1996 Presidential Elections Results (%) - Republican Party (Dole)

1996 Presidential Elections Results (%) - Other

2000 Presidential Elections Results (%) - Democratic Party (Gore)

2000 Presidential Elections Results (%) - Republican Party (Bush)

2000 Presidential Elections Results (%) - Other

2004 Presidential Elections Results (%) - Democratic Party (Kerry)

2004 Presidential Elections Results (%) - Republican Party (Bush)

2004 Presidential Elections Results (%) - Other

2008 Presidential Elections Results (%) - Democratic Party (Obama)

2008 Presidential Elections Results (%) - Republican Party (McCain)

2008 Presidential Elections Results (%) - Other

2012 Presidential Elections Results (%) - Democratic Party (Obama)

2012 Presidential Elections Results (%) - Republican Party (Romney)

2012 Presidential Elections Results (%) - Other

2016 Presidential Elections Results (%) - Democratic Party (Clinton)

2016 Presidential Elections Results (%) - Republican Party (Trump)

2016 Presidential Elections Results (%) - Other

2020 Presidential Elections Results (%) - Democratic Party (Biden)

2020 Presidential Elections Results (%) - Republican Party (Trump)

2020 Presidential Elections Results (%) - Other

Ancestries Reported - Arab (%)

Ancestries Reported - Czech (%)

Ancestries Reported - Danish (%)

Ancestries Reported - Dutch (%)

Ancestries Reported - English (%)

Ancestries Reported - French (%)

Ancestries Reported - French Canadian (%)

Ancestries Reported - German (%)

Ancestries Reported - Greek (%)

Ancestries Reported - Hungarian (%)

Ancestries Reported - Irish (%)

Ancestries Reported - Italian (%)

Ancestries Reported - Lithuanian (%)

Ancestries Reported - Norwegian (%)

Ancestries Reported - Polish (%)

Ancestries Reported - Portuguese (%)

Ancestries Reported - Russian (%)

Ancestries Reported - Scotch-Irish (%)

Ancestries Reported - Scottish (%)

Ancestries Reported - Slovak (%)

Ancestries Reported - Subsaharan African (%)

Ancestries Reported - Swedish (%)

Ancestries Reported - Swiss (%)

Ancestries Reported - Ukrainian (%)

Ancestries Reported - United States (%)

Ancestries Reported - Welsh (%)

Ancestries Reported - West Indian (%)

Ancestries Reported - Other (%)

Educational Attainment - No schooling completed (%)

Educational Attainment - Less than high school (%)

Educational Attainment - High school or equivalent (%)

Educational Attainment - Less than 1 year of college (%)

Educational Attainment - 1 or more years of college (%)

Educational Attainment - Associate degree (%)

Educational Attainment - Bachelor's degree (%)

Educational Attainment - Master's degree (%)

Educational Attainment - Professional school degree (%)

Educational Attainment - Doctorate degree (%)

School Enrollment - Nursery, preschool (%)

School Enrollment - Kindergarten (%)

School Enrollment - Grade 1 to 4 (%)

School Enrollment - Grade 5 to 8 (%)

School Enrollment - Grade 9 to 12 (%)

School Enrollment - College undergrad (%)

School Enrollment - Graduate or professional (%)

School Enrollment - Not enrolled in school (%)

School enrollment - Public schools (%)

School enrollment - Private schools (%)

School enrollment - Not enrolled (%)

Median number of rooms in houses and condos

Median number of rooms in apartments

Housing units lacking complete plumbing facilities (%)

Housing units lacking complete kitchen facilities (%)

Density of houses

Urban houses (%)

Rural houses (%)

Households with people 60 years and over (%)

Households with people 65 years and over (%)

Households with people 75 years and over (%)

Households with one or more nonrelatives (%)

Households with no nonrelatives (%)

Population in households (%)

Family households (%)

Nonfamily households (%)

Population in families (%)

Family households with own children (%)

Median number of bedrooms in owner occupied houses

Mean number of bedrooms in owner occupied houses

Median number of bedrooms in renter occupied houses

Mean number of bedrooms in renter occupied houses

Median number of vehichles in owner occupied houses

Mean number of vehichles in owner occupied houses

Median number of vehichles in renter occupied houses

Mean number of vehichles in renter occupied houses

Mortgage status - with mortgage (%)

Mortgage status - with second mortgage (%)

Mortgage status - with home equity loan (%)

Mortgage status - with both second mortgage and home equity loan (%)

Mortgage status - without a mortgage (%)

Average family size

Average family size - White

Average family size - Black or African American

Average family size - Asian

Average family size - Hispanic or Latino

Average family size - American Indian and Alaska Native

Average family size - Multirace

Average family size - Other Race

Geographical mobility - Same house 1 year ago (%)

Geographical mobility - Moved within same county (%)

Geographical mobility - Moved from different county within same state (%)

Geographical mobility - Moved from different state (%)

Geographical mobility - Moved from abroad (%)

Place of birth - Born in state of residence (%)

Place of birth - Born in other state (%)

Place of birth - Native, outside of US (%)

Place of birth - Foreign born (%)

Housing units in structures - 1, detached (%)

Housing units in structures - 1, attached (%)

Housing units in structures - 2 (%)

Housing units in structures - 3 or 4 (%)

Housing units in structures - 5 to 9 (%)

Housing units in structures - 10 to 19 (%)

Housing units in structures - 20 to 49 (%)

Housing units in structures - 50 or more (%)

Housing units in structures - Mobile home (%)

Housing units in structures - Boat, RV, van, etc. (%)

House/condo owner moved in on average (years ago)

Renter moved in on average (years ago)

Year householder moved into unit - Moved in 1999 to March 2000 (%)

Year householder moved into unit - Moved in 1995 to 1998 (%)

Year householder moved into unit - Moved in 1990 to 1994 (%)

Year householder moved into unit - Moved in 1980 to 1989 (%)

Year householder moved into unit - Moved in 1970 to 1979 (%)

Year householder moved into unit - Moved in 1969 or earlier (%)

Means of transportation to work - Drove car alone (%)

Means of transportation to work - Carpooled (%)

Means of transportation to work - Public transportation (%)

Means of transportation to work - Bus or trolley bus (%)

Means of transportation to work - Streetcar or trolley car (%)

Means of transportation to work - Subway or elevated (%)

Means of transportation to work - Railroad (%)

Means of transportation to work - Ferryboat (%)

Means of transportation to work - Taxicab (%)

Means of transportation to work - Motorcycle (%)

Means of transportation to work - Bicycle (%)

Means of transportation to work - Walked (%)

Means of transportation to work - Other means (%)

Working at home (%)

Industry diversity

Most Common Industries - Agriculture, forestry, fishing and hunting, and mining (%)

Most Common Industries - Agriculture, forestry, fishing and hunting (%)

Most Common Industries - Mining, quarrying, and oil and gas extraction (%)

Most Common Industries - Construction (%)

Most Common Industries - Manufacturing (%)

Most Common Industries - Wholesale trade (%)

Most Common Industries - Retail trade (%)

Most Common Industries - Transportation and warehousing, and utilities (%)

Most Common Industries - Transportation and warehousing (%)

Most Common Industries - Utilities (%)

Most Common Industries - Information (%)

Most Common Industries - Finance and insurance, and real estate and rental and leasing (%)

Most Common Industries - Finance and insurance (%)

Most Common Industries - Real estate and rental and leasing (%)

Most Common Industries - Professional, scientific, and management, and administrative and waste management services (%)

Most Common Industries - Professional, scientific, and technical services (%)

Most Common Industries - Management of companies and enterprises (%)

Most Common Industries - Administrative and support and waste management services (%)

Most Common Industries - Educational services, and health care and social assistance (%)

Most Common Industries - Educational services (%)

Most Common Industries - Health care and social assistance (%)

Most Common Industries - Arts, entertainment, and recreation, and accommodation and food services (%)

Most Common Industries - Arts, entertainment, and recreation (%)

Most Common Industries - Accommodation and food services (%)

Most Common Industries - Other services, except public administration (%)

Most Common Industries - Public administration (%)

Occupation diversity

Most Common Occupations - Management, business, science, and arts occupations (%)

Most Common Occupations - Management, business, and financial occupations (%)

Most Common Occupations - Management occupations (%)

Most Common Occupations - Business and financial operations occupations (%)

Most Common Occupations - Computer, engineering, and science occupations (%)

Most Common Occupations - Computer and mathematical occupations (%)

Most Common Occupations - Architecture and engineering occupations (%)

Most Common Occupations - Life, physical, and social science occupations (%)

Most Common Occupations - Education, legal, community service, arts, and media occupations (%)

Most Common Occupations - Community and social service occupations (%)

Most Common Occupations - Legal occupations (%)

Most Common Occupations - Education, training, and library occupations (%)

Most Common Occupations - Arts, design, entertainment, sports, and media occupations (%)

Most Common Occupations - Healthcare practitioners and technical occupations (%)

Most Common Occupations - Health diagnosing and treating practitioners and other technical occupations (%)

Most Common Occupations - Health technologists and technicians (%)

Most Common Occupations - Service occupations (%)

Most Common Occupations - Healthcare support occupations (%)

Most Common Occupations - Protective service occupations (%)

Most Common Occupations - Fire fighting and prevention, and other protective service workers including supervisors (%)

Most Common Occupations - Law enforcement workers including supervisors (%)

Most Common Occupations - Food preparation and serving related occupations (%)

Most Common Occupations - Building and grounds cleaning and maintenance occupations (%)

Most Common Occupations - Personal care and service occupations (%)

Most Common Occupations - Sales and office occupations (%)

Most Common Occupations - Sales and related occupations (%)

Most Common Occupations - Office and administrative support occupations (%)

Most Common Occupations - Natural resources, construction, and maintenance occupations (%)

Most Common Occupations - Farming, fishing, and forestry occupations (%)

Most Common Occupations - Construction and extraction occupations (%)

Most Common Occupations - Installation, maintenance, and repair occupations (%)

Most Common Occupations - Production, transportation, and material moving occupations (%)

Most Common Occupations - Production occupations (%)

Most Common Occupations - Transportation occupations (%)

Most Common Occupations - Material moving occupations (%)

People in Group quarters - Institutionalized population (%)

People in Group quarters - Correctional institutions (%)

People in Group quarters - Federal prisons and detention centers (%)

People in Group quarters - Halfway houses (%)

People in Group quarters - Local jails and other confinement facilities (including police lockups) (%)

People in Group quarters - Military disciplinary barracks (%)

People in Group quarters - State prisons (%)

People in Group quarters - Other types of correctional institutions (%)

People in Group quarters - Nursing homes (%)

People in Group quarters - Hospitals/wards, hospices, and schools for the handicapped (%)

People in Group quarters - Hospitals/wards and hospices for chronically ill (%)

People in Group quarters - Hospices or homes for chronically ill (%)

People in Group quarters - Military hospitals or wards for chronically ill (%)

People in Group quarters - Other hospitals or wards for chronically ill (%)

People in Group quarters - Hospitals or wards for drug/alcohol abuse (%)

People in Group quarters - Mental (Psychiatric) hospitals or wards (%)

People in Group quarters - Schools, hospitals, or wards for the mentally retarded (%)

People in Group quarters - Schools, hospitals, or wards for the physically handicapped (%)

People in Group quarters - Institutions for the deaf (%)

People in Group quarters - Institutions for the blind (%)

People in Group quarters - Orthopedic wards and institutions for the physically handicapped (%)

People in Group quarters - Wards in general hospitals for patients who have no usual home elsewhere (%)

People in Group quarters - Wards in military hospitals for patients who have no usual home elsewhere (%)

People in Group quarters - Juvenile institutions (%)

People in Group quarters - Long-term care (%)

People in Group quarters - Homes for abused, dependent, and neglected children (%)

People in Group quarters - Residential treatment centers for emotionally disturbed children (%)

People in Group quarters - Training schools for juvenile delinquents (%)

People in Group quarters - Short-term care, detention or diagnostic centers for delinquent children (%)

People in Group quarters - Type of juvenile institution unknown (%)

People in Group quarters - Noninstitutionalized population (%)

People in Group quarters - College dormitories (includes college quarters off campus) (%)

People in Group quarters - Military quarters (%)

People in Group quarters - On base (%)

People in Group quarters - Barracks, unaccompanied personnel housing (UPH), (Enlisted/Officer), ;and similar group living quarters for military personnel (%)

People in Group quarters - Transient quarters for temporary residents (%)

People in Group quarters - Military ships (%)

People in Group quarters - Group homes (%)

People in Group quarters - Homes or halfway houses for drug/alcohol abuse (%)

People in Group quarters - Homes for the mentally ill (%)

People in Group quarters - Homes for the mentally retarded (%)

People in Group quarters - Homes for the physically handicapped (%)

People in Group quarters - Other group homes (%)

People in Group quarters - Religious group quarters (%)

People in Group quarters - Dormitories (%)

People in Group quarters - Agriculture workers' dormitories on farms (%)

People in Group quarters - Job Corps and vocational training facilities (%)

People in Group quarters - Other workers' dormitories (%)

People in Group quarters - Crews of maritime vessels (%)

People in Group quarters - Other nonhousehold living situations (%)

People in Group quarters - Other noninstitutional group quarters (%)

Residents speaking English at home (%)

Residents speaking English at home - Born in the United States (%)

Residents speaking English at home - Native, born elsewhere (%)

Residents speaking English at home - Foreign born (%)

Residents speaking Spanish at home (%)

Residents speaking Spanish at home - Born in the United States (%)

Residents speaking Spanish at home - Native, born elsewhere (%)

Residents speaking Spanish at home - Foreign born (%)

Residents speaking other language at home (%)

Residents speaking other language at home - Born in the United States (%)

Residents speaking other language at home - Native, born elsewhere (%)

Residents speaking other language at home - Foreign born (%)

Class of Workers - Employee of private company (%)

Class of Workers - Self-employed in own incorporated business (%)

Class of Workers - Private not-for-profit wage and salary workers (%)

Class of Workers - Local government workers (%)

Class of Workers - State government workers (%)

Class of Workers - Federal government workers (%)

Class of Workers - Self-employed workers in own not incorporated business and Unpaid family workers (%)

House heating fuel used in houses and condos - Utility gas (%)

House heating fuel used in houses and condos - Bottled, tank, or LP gas (%)

House heating fuel used in houses and condos - Electricity (%)

House heating fuel used in houses and condos - Fuel oil, kerosene, etc. (%)

House heating fuel used in houses and condos - Coal or coke (%)

House heating fuel used in houses and condos - Wood (%)

House heating fuel used in houses and condos - Solar energy (%)

House heating fuel used in houses and condos - Other fuel (%)

House heating fuel used in houses and condos - No fuel used (%)

House heating fuel used in apartments - Utility gas (%)

House heating fuel used in apartments - Bottled, tank, or LP gas (%)

House heating fuel used in apartments - Electricity (%)

House heating fuel used in apartments - Fuel oil, kerosene, etc. (%)

House heating fuel used in apartments - Coal or coke (%)

House heating fuel used in apartments - Wood (%)

House heating fuel used in apartments - Solar energy (%)

House heating fuel used in apartments - Other fuel (%)

House heating fuel used in apartments - No fuel used (%)

Armed forces status - In Armed Forces (%)

Armed forces status - Civilian (%)

Armed forces status - Civilian - Veteran (%)

Armed forces status - Civilian - Nonveteran (%)

Fatal accidents locations in years 2005-2021

Fatal accidents locations in 2005

Fatal accidents locations in 2006

Fatal accidents locations in 2007

Fatal accidents locations in 2008

Fatal accidents locations in 2009

Fatal accidents locations in 2010

Fatal accidents locations in 2011

Fatal accidents locations in 2012

Fatal accidents locations in 2013

Fatal accidents locations in 2014

Fatal accidents locations in 2015

Fatal accidents locations in 2016

Fatal accidents locations in 2017

Fatal accidents locations in 2018

Fatal accidents locations in 2019

Fatal accidents locations in 2020

Fatal accidents locations in 2021

Alcohol use - People drinking some alcohol every month (%)

Alcohol use - People not drinking at all (%)

Alcohol use - Average days/month drinking alcohol

Alcohol use - Average drinks/week

Alcohol use - Average days/year people drink much

Audiometry - Average condition of hearing (%)

Audiometry - People that can hear a whisper from across a quiet room (%)

Audiometry - People that can hear normal voice from across a quiet room (%)

Audiometry - Ears ringing, roaring, buzzing (%)

Audiometry - Had a job exposure to loud noise (%)

Audiometry - Had off-work exposure to loud noise (%)

Blood Pressure & Cholesterol - Has high blood pressure (%)

Blood Pressure & Cholesterol - Checking blood pressure at home (%)

Blood Pressure & Cholesterol - Frequently checking blood cholesterol (%)

Blood Pressure & Cholesterol - Has high cholesterol level (%)

Consumer Behavior - Money monthly spent on food at supermarket/grocery store

Consumer Behavior - Money monthly spent on food at other stores

Consumer Behavior - Money monthly spent on eating out

Consumer Behavior - Money monthly spent on carryout/delivered foods

Consumer Behavior - Income spent on food at supermarket/grocery store (%)

Consumer Behavior - Income spent on food at other stores (%)

Consumer Behavior - Income spent on eating out (%)

Consumer Behavior - Income spent on carryout/delivered foods (%)

Current Health Status - General health condition (%)

Current Health Status - Blood donors (%)

Current Health Status - Has blood ever tested for HIV virus (%)

Current Health Status - Left-handed people (%)

Dermatology - People using sunscreen (%)

Diabetes - Diabetics (%)

Diabetes - Had a blood test for high blood sugar (%)

Diabetes - People taking insulin (%)

Diet Behavior & Nutrition - Diet health (%)

Diet Behavior & Nutrition - Milk product consumption (# of products/month)

Diet Behavior & Nutrition - Meals not home prepared (#/week)

Diet Behavior & Nutrition - Meals from fast food or pizza place (#/week)

Diet Behavior & Nutrition - Ready-to-eat foods (#/month)

Diet Behavior & Nutrition - Frozen meals/pizza (#/month)

Drug Use - People that ever used marijuana or hashish (%)

Drug Use - Ever used hard drugs (%)

Drug Use - Ever used any form of cocaine (%)

Drug Use - Ever used heroin (%)

Drug Use - Ever used methamphetamine (%)

Health Insurance - People covered by health insurance (%)

Kidney Conditions-Urology - Avg. # of times urinating at night

Medical Conditions - People with asthma (%)

Medical Conditions - People with anemia (%)

Medical Conditions - People with psoriasis (%)

Medical Conditions - People with overweight (%)

Medical Conditions - Elderly people having difficulties in thinking or remembering (%)

Medical Conditions - People who ever received blood transfusion (%)

Medical Conditions - People having trouble seeing even with glass/contacts (%)

Medical Conditions - People with arthritis (%)

Medical Conditions - People with gout (%)

Medical Conditions - People with congestive heart failure (%)

Medical Conditions - People with coronary heart disease (%)

Medical Conditions - People with angina pectoris (%)

Medical Conditions - People who ever had heart attack (%)

Medical Conditions - People who ever had stroke (%)

Medical Conditions - People with emphysema (%)

Medical Conditions - People with thyroid problem (%)

Medical Conditions - People with chronic bronchitis (%)

Medical Conditions - People with any liver condition (%)

Medical Conditions - People who ever had cancer or malignancy (%)

Mental Health - People who have little interest in doing things (%)

Mental Health - People feeling down, depressed, or hopeless (%)

Mental Health - People who have trouble sleeping or sleeping too much (%)

Mental Health - People feeling tired or having little energy (%)

Mental Health - People with poor appetite or overeating (%)

Mental Health - People feeling bad about themself (%)

Mental Health - People who have trouble concentrating on things (%)

Mental Health - People moving or speaking slowly or too fast (%)

Mental Health - People having thoughts they would be better off dead (%)

Oral Health - Average years since last visit a dentist

Oral Health - People embarrassed because of mouth (%)

Oral Health - People with gum disease (%)

Oral Health - General health of teeth and gums (%)

Oral Health - Average days a week using dental floss/device

Oral Health - Average days a week using mouthwash for dental problem

Oral Health - Average number of teeth

Pesticide Use - Households using pesticides to control insects (%)

Pesticide Use - Households using pesticides to kill weeds (%)

Physical Activity - People doing vigorous-intensity work activities (%)

Physical Activity - People doing moderate-intensity work activities (%)

Physical Activity - People walking or bicycling (%)

Physical Activity - People doing vigorous-intensity recreational activities (%)

Physical Activity - People doing moderate-intensity recreational activities (%)

Physical Activity - Average hours a day doing sedentary activities

Physical Activity - Average hours a day watching TV or videos

Physical Activity - Average hours a day using computer

Physical Functioning - People having limitations keeping them from working (%)

Physical Functioning - People limited in amount of work they can do (%)

Physical Functioning - People that need special equipment to walk (%)

Physical Functioning - People experiencing confusion/memory problems (%)

Physical Functioning - People requiring special healthcare equipment (%)

Prescription Medications - Average number of prescription medicines taking

Preventive Aspirin Use - Adults 40+ taking low-dose aspirin (%)

Reproductive Health - Vaginal deliveries (%)

Reproductive Health - Cesarean deliveries (%)

Reproductive Health - Deliveries resulted in a live birth (%)

Reproductive Health - Pregnancies resulted in a delivery (%)

Reproductive Health - Women breastfeeding newborns (%)

Reproductive Health - Women that had a hysterectomy (%)

Reproductive Health - Women that had both ovaries removed (%)

Reproductive Health - Women that have ever taken birth control pills (%)

Reproductive Health - Women taking birth control pills (%)

Reproductive Health - Women that have ever used Depo-Provera or injectables (%)

Reproductive Health - Women that have ever used female hormones (%)

Sexual Behavior - People 18+ that ever had sex (vaginal, anal, or oral) (%)

Sexual Behavior - Males 18+ that ever had vaginal sex with a woman (%)

Sexual Behavior - Males 18+ that ever performed oral sex on a woman (%)

Sexual Behavior - Males 18+ that ever had anal sex with a woman (%)

Sexual Behavior - Males 18+ that ever had any sex with a man (%)

Sexual Behavior - Females 18+ that ever had vaginal sex with a man (%)

Sexual Behavior - Females 18+ that ever performed oral sex on a man (%)

Sexual Behavior - Females 18+ that ever had anal sex with a man (%)

Sexual Behavior - Females 18+ that ever had any kind of sex with a woman (%)

Sexual Behavior - Average age people first had sex

Sexual Behavior - Average number of female sex partners in lifetime (males 18+)

Sexual Behavior - Average number of female vaginal sex partners in lifetime (males 18+)

Sexual Behavior - Average age people first performed oral sex on a woman (18+)

Sexual Behavior - Average number of woman performed oral sex on in lifetime (18+)

Sexual Behavior - Average number of male sex partners in lifetime (males 18+)

Sexual Behavior - Average number of male anal sex partners in lifetime (males 18+)

Sexual Behavior - Average age people first performed oral sex on a man (18+)

Sexual Behavior - Average number of male oral sex partners in lifetime (18+)

Sexual Behavior - People using protection when performing oral sex (%)

Sexual Behavior - Average number of times people have vaginal or anal sex a year

Sexual Behavior - People having sex without condom (%)

Sexual Behavior - Average number of male sex partners in lifetime (females 18+)

Sexual Behavior - Average number of male vaginal sex partners in lifetime (females 18+)

Sexual Behavior - Average number of female sex partners in lifetime (females 18+)

Sexual Behavior - Circumcised males 18+ (%)

Sleep Disorders - Average hours sleeping at night

Sleep Disorders - People that has trouble sleeping (%)

Smoking-Cigarette Use - People smoking cigarettes (%)

Taste & Smell - People 40+ having problems with smell (%)

Taste & Smell - People 40+ having problems with taste (%)

Taste & Smell - People 40+ that ever had wisdom teeth removed (%)

Taste & Smell - People 40+ that ever had tonsils teeth removed (%)

Taste & Smell - People 40+ that ever had a loss of consciousness because of a head injury (%)

Taste & Smell - People 40+ that ever had a broken nose or other serious injury to face or skull (%)

Taste & Smell - People 40+ that ever had two or more sinus infections (%)

Weight - Average height (inches)

Weight - Average weight (pounds)

Weight - Average BMI

Weight - People that are obese (%)

Weight - People that ever were obese (%)

Weight - People trying to lose weight (%)

Officers per 1,000 residents here:

1.21Pennsylvania average:

2.71

Latest news from Dickson City, PA collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: Polish (27.0%), Italian (13.2%), Irish (12.7%), German (12.4%), American (9.4%), English (3.3%).

Current Local Time:

Land area: 4.71 square miles.

Population density: 1,273 people per square mile (low).

106 residents are foreign born

This borough:

1.8%Pennsylvania:

7.3%

Median real estate property taxes paid for housing units with mortgages in 2022: $2,291 (1.2%)Median real estate property taxes paid for housing units with no mortgage in 2022: $1,923 (1.1%)

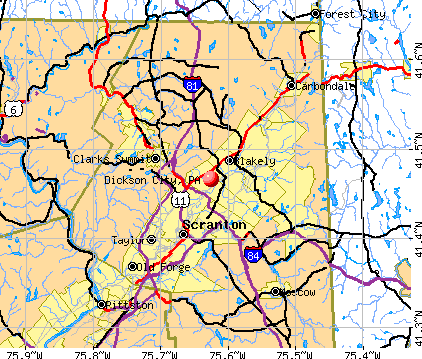

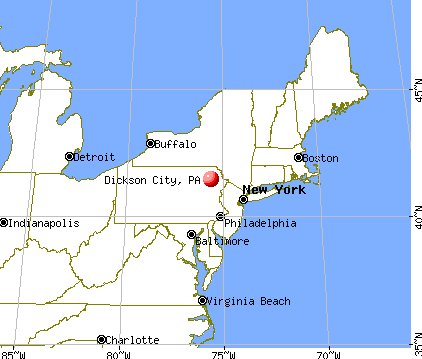

Nearest city with pop. 50,000+: Scranton, PA

Nearest city with pop. 200,000+: Newark, NJ

Nearest city with pop. 1,000,000+: Manhattan, NY

Nearest cities:

Latitude: 41.47 N, Longitude: 75.63 W

Daytime population change due to commuting: +4,155 (+69.0%)Workers who live and work in this borough: 597 (22.0%)

Area code commonly used in this area: 570

Property values in Dickson City, PA

Unemployment in December 2023: Here:

3.1%Pennsylvania:

2.9%

Most common occupations in Dickson City, PA (%)

Both Males Females

Other production occupations, including supervisors (7.0%)

Other sales and related occupations, including supervisors (5.3%)

Secretaries and administrative assistants (3.9%)

Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (3.8%)

Cashiers (3.6%)

Material recording, scheduling, dispatching, and distributing workers (3.5%)

Other office and administrative support workers, including supervisors (3.3%)

Other production occupations, including supervisors (8.7%)

Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (6.8%)

Other sales and related occupations, including supervisors (5.4%)

Material recording, scheduling, dispatching, and distributing workers (4.9%)

Laborers and material movers, hand (4.4%)

Building and grounds cleaning and maintenance occupations (4.1%)

Other protective service workers, including supervisors (3.3%)

Secretaries and administrative assistants (7.7%)

Other office and administrative support workers, including supervisors (6.9%)

Cashiers (6.7%)

Preschool, kindergarten, elementary, and middle school teachers (5.4%)

Other sales and related occupations, including supervisors (5.1%)

Other production occupations, including supervisors (5.1%)

Information and record clerks, except customer service representatives (4.6%)

Tornado activity:

Dickson City-area historical tornado activity is slightly below Pennsylvania state average. It is 39% smaller than the overall U.S. average.

On 6/2/1998, a category F3 (max. wind speeds 158-206 mph) tornado 11.6 miles away from the Dickson City borough center killed 2 people and injured 15 people and caused $2 million in damages.

On 5/31/1998, a category F3 tornado 29.6 miles away from the borough center injured 2 people and caused $1 million in damages.

Earthquake activity:

Dickson City-area historical earthquake activity is significantly above Pennsylvania state average. It is 66% smaller than the overall U.S. average. On 8/23/2011 at 17:51:04, a magnitude 5.8 (5.8 MW, Depth: 3.7 mi, Class: Moderate, Intensity: VI - VII) earthquake occurred 275.0 miles away from Dickson City center On 10/7/1983 at 10:18:46, a magnitude 5.3 (5.1 MB, 5.3 LG, 5.1 ML) earthquake occurred 184.0 miles away from the city center On 1/16/1994 at 01:49:16, a magnitude 4.6 (4.6 MB, 4.6 LG, Depth: 3.1 mi, Class: Light, Intensity: IV - V) earthquake occurred 81.5 miles away from the city center On 4/20/2002 at 10:50:47, a magnitude 5.3 (5.3 ML, Depth: 3.0 mi) earthquake occurred 232.2 miles away from the city center On 4/20/2002 at 10:50:47, a magnitude 5.2 (5.2 MB, 4.2 MS, 5.2 MW, 5.0 MW) earthquake occurred 230.2 miles away from the city center On 9/25/1998 at 19:52:52, a magnitude 5.2 (4.8 MB, 4.3 MS, 5.2 LG, 4.5 MW, Depth: 3.1 mi) earthquake occurred 247.2 miles away from Dickson City center Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), local magnitude (ML), surface-wave magnitude (MS), moment magnitude (MW) Natural disasters: The number of natural disasters in Lackawanna County (20) is greater than the US average (15).Major Disasters (Presidential) Declared: 16Emergencies Declared: 3Floods: 8, Storms: 8, Hurricanes: 3, Tropical Storms: 3, Winter Storms: 2, Blizzard: 1, Flash Flood: 1, Heavy Rain: 1, Mudslide: 1, Snowfall: 1, Tornado: 1, Tropical Depression: 1, Wind: 1, Other: 1 (Note: some incidents may be assigned to more than one category). Hospitals and medical centers in Dickson City: SOUTHERNCARE SCRANTON (851 COMMERCE BOULEVARD SUITE 101-102) Other hospitals and medical centers near Dickson City: REVOLUTIONARY HOME HEALTH INC (Home Health Center, about 1 miles away; OLYPHANT, PA)

VNA HOSPICE AND HOME HEALTH OF LACKAWANNA (Home Health Center, about 2 miles away; OLYPHANT, PA)

GREEN RIDGE CARE CENTER (Nursing Home, about 2 miles away; SCRANTON, PA)

MID VALLEY HOSPITAL (Hospital, about 2 miles away; PECKVILLE, PA)

MID-VALLEY HOSPITAL (about 2 miles away; PECKVILLE, PA)

HOLY FAMILY RESIDENCE (Nursing Home, about 3 miles away; SCRANTON, PA)

BAYADA NURSES, INC (Home Health Center, about 3 miles away; CLARKS SUMMIT, PA)

Colleges/universities with over 2000 students nearest to Dickson City:

Marywood University (about 3 miles; Scranton, PA ; Full-time enrollment: 2,959)

University of Scranton (about 5 miles; Scranton, PA ; FT enrollment: 5,488)

Misericordia University (about 20 miles; Dallas, PA ; FT enrollment: 2,554)

King's College (about 20 miles; Wilkes-Barre, PA ; FT enrollment: 2,392)

Wilkes University (about 21 miles; Wilkes-Barre, PA ; FT enrollment: 3,912)

Luzerne County Community College (about 27 miles; Nanticoke, PA ; FT enrollment: 4,724)

East Stroudsburg University of Pennsylvania (about 41 miles; East Stroudsburg, PA ; FT enrollment: 6,195)

Private elementary/middle school in Dickson City: LA SALLE ACADEMY - PRIMARY CENTER Students: 233, Location: 625 DUNDAFF ST, Grades: PK-3)

User-submitted facts and corrections:

wvmw-fm is no longer 91.5. marywood university's station is now 91.7fm

Birthplace of: Frank Parkinson (baseball) - Baseball player, John Koniszewski - Football player.

Lackawanna County has a predicted average indoor radon screening level greater than 4 pCi/L (pico curies per liter) - Highest Potential Average household size: This borough:

2.2 peoplePennsylvania:

2.5 people

Percentage of family households: This borough:

60.5%Whole state:

65.0%

Percentage of households with unmarried partners: This borough:

6.7%Whole state:

6.6%

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

Lesbian couples: 0.3% of all households Gay men: 0.2% of all households

6 people in group homes for juveniles (non-correctional) in 2010people in residential treatment centers for adults in 2010people in homes for the mentally retarded in 2000people in other nonhousehold living situations in 2000

Banks with branches in Dickson City (2011 data):

First National Bank of Pennsylvania: Dickson City Branch at 1601 Main Street, branch established on 1999/09/13. Info updated 2012/01/10: Bank assets: $9,581.0 mil, Deposits: $7,462.2 mil, headquarters in Greenville, PA, positive income , Commercial Lending Specialization, 291 total offices , Holding Company: F.N.b. Corporation

NBT Bank, National Association: Dickson City Branch at 736 Main Street, branch established on 1934/01/01. Info updated 2012/02/02: Bank assets: $5,558.5 mil, Deposits: $4,381.4 mil, headquarters in Norwich, NY, positive income , Commercial Lending Specialization, 133 total offices , Holding Company: Nbt Bancorp Inc.

Community Bank, National Association: Dickson City Branch at 901 Commerce Boulevard, branch established on 1999/09/07. Info updated 2011/06/13: Bank assets: $6,460.6 mil, Deposits: $4,840.4 mil, headquarters in Canton, NY, positive income , 175 total offices , Holding Company: Community Bank System, Inc.

First National Community Bank: Dickson City Branch at 934 Main Street, branch established on 1984/12/03. Info updated 2012/01/12: Bank assets: $1,105.2 mil, Deposits: $957.5 mil, headquarters in Dunmore, PA, positive income , Commercial Lending Specialization, 22 total offices , Holding Company: First National Community Bancorp Inc

For population 15 years and over in Dickson City:

Never married: 33.3%Now married: 44.2%Separated: 2.5%Widowed: 9.0%Divorced: 11.1% For population 25 years and over in Dickson City:

High school or higher: 90.1%Bachelor's degree or higher: 26.5%Graduate or professional degree: 12.3%Unemployed: 5.3%Mean travel time to work (commute): 24.4 minutes

Education Gini index (Inequality in education) Here:

11.1Pennsylvania average:

11.4

Religion statistics for Dickson City, PA (based on Lackawanna County data)

Religion Adherents Congregations Catholic 96,140 58 Mainline Protestant 18,728 72 Evangelical Protestant 11,047 58 Other 4,710 13 Orthodox 2,526 15 Black Protestant 569 2 None 80,717 -

Source: Clifford Grammich, Kirk Hadaway, Richard Houseal, Dale E.Jones, Alexei Krindatch, Richie Stanley and Richard H.Taylor. 2012. 2010 U.S.Religion Census: Religious Congregations & Membership Study. Association of Statisticians of American Religious Bodies. Jones, Dale E., et al. 2002. Congregations and Membership in the United States 2000. Nashville, TN: Glenmary Research Center. Graphs represent county-level data

Food Environment Statistics: Number of grocery stores : 42Lackawanna County :

2.01 / 10,000 pop.Pennsylvania :

2.04 / 10,000 pop.

Number of supercenters and club stores : 2Here :

0.10 / 10,000 pop.State :

0.09 / 10,000 pop.

Number of convenience stores (no gas) : 29Lackawanna County :

1.39 / 10,000 pop.Pennsylvania :

0.88 / 10,000 pop.

Number of convenience stores (with gas) : 57Lackawanna County :

2.72 / 10,000 pop.Pennsylvania :

2.52 / 10,000 pop.

Number of full-service restaurants : 195Lackawanna County :

9.32 / 10,000 pop.State :

7.12 / 10,000 pop.

Adult obesity rate : This county :

25.3%Pennsylvania :

27.2%

Low-income preschool obesity rate : Lackawanna County :

9.7%State :

11.5%

Health and Nutrition: Healthy diet rate : Here:

47.1%Pennsylvania:

50.2%

Average overall health of teeth and gums : This city:

41.5%Pennsylvania:

47.1%

Average BMI : Here:

28.5Pennsylvania:

28.7

People feeling badly about themselves : Here:

23.0%Pennsylvania:

20.8%

People not drinking alcohol at all : Here:

10.7%Pennsylvania:

10.9%

Average hours sleeping at night : This city:

6.9Pennsylvania:

6.8

Overweight people : This city:

34.1%State:

34.3%

General health condition : Dickson City:

51.6%Pennsylvania:

56.2%

Average condition of hearing : Dickson City:

75.0%State:

78.3%

More about Health and Nutrition of Dickson City, PA Residents

Local government employment and payroll (March 2022)

Function

Full-time employees

Monthly full-time payroll

Average yearly full-time wage

Part-time employees

Monthly part-time payroll

Streets and Highways

12 $62,182 $62,182 0 $0 Police Protection - Officers

8 $69,344 $104,016 5 $14,547 Other Government Administration

3 $15,491 $61,964 8 $3,040 Police - Other

1 $3,837 $46,044 0 $0 Local Libraries

1 $3,236 $38,832 0 $0 Other and Unallocable

0 $0 1 $1,363 Financial Administration

0 $0 3 $1,533

Totals for Government

25 $154,090 $73,963 17 $20,483

Dickson City government finances - Expenditure in 2017 (per resident):

Construction - General Public Buildings: $257,000 ($42.85)

Parks and Recreation: $151,000 ($25.18)Current Operations - Police Protection: $1,011,000 ($168.58)

Solid Waste Management: $804,000 ($134.07)General - Other: $793,000 ($132.23)Regular Highways: $604,000 ($100.72)Central Staff Services: $538,000 ($89.71)Parks and Recreation: $275,000 ($45.86)Local Fire Protection: $134,000 ($22.34)Judicial and Legal Services: $102,000 ($17.01)Financial Administration: $91,000 ($15.17)General Public Buildings: $57,000 ($9.50)Health - Other: $6,000 ($1.00)General - Interest on Debt: $233,000 ($38.85)

Other Capital Outlay - Police Protection: $96,000 ($16.01)

Regular Highways: $77,000 ($12.84)Total Salaries and Wages: $1,703,000 ($283.98)

Dickson City government finances - Revenue in 2017 (per resident):

Charges - Solid Waste Management: $275,000 ($45.86)

Other: $34,000 ($5.67)Regular Highways: $26,000 ($4.34)Sewerage: $1,000 ($0.17)Miscellaneous - Sale of Property: $289,000 ($48.19)

Fines and Forfeits: $82,000 ($13.67)General Revenue - Other: $29,000 ($4.84)Rents: $4,000 ($0.67)Interest Earnings: $3,000 ($0.50)State Intergovernmental - Other: $349,000 ($58.20)

Highways: $175,000 ($29.18)General Local Government Support: $11,000 ($1.83)Tax - Occupation and Business License - Other: $1,900,000 ($316.83)

Property: $1,431,000 ($238.62)Individual Income: $679,000 ($113.22)Documentary and Stock Transfer: $197,000 ($32.85)Public Utility License: $45,000 ($7.50)

Dickson City government finances - Debt in 2017 (per resident):

Long Term Debt - Beginning Outstanding - Unspecified Public Purpose: $6,601,000 ($1100.72)

Outstanding Unspecified Public Purpose: $6,406,000 ($1068.20)Retired Unspecified Public Purpose: $491,000 ($81.87)Issue, Unspecified Public Purpose: $296,000 ($49.36)

Dickson City government finances - Cash and Securities in 2017 (per resident):

Bond Funds - Cash and Securities: $209,000 ($34.85)

Other Funds - Cash and Securities: $254,000 ($42.35)

Businesses in Dickson City, PA

Name Count Name Count

CVS 1 Men's Wearhouse 1 Catherines 1 Microtel 1 Chuck E. Cheese's 1 Nike 3 DressBarn 1 Old Country Buffet 1 Dressbarn 1 Panera Bread 1 Dunkin Donuts 1 PetSmart 1 Famous Footwear 1 Pier 1 Imports 1 GameStop 1 Plato's Closet 1 Giant 1 Red Robin 1 Holiday Inn 1 Staples 1 Home Depot 1 Starbucks 1 Journeys 1 Subway 2 Kohl's 1 T-Mobile 3 Kroger 1 T.J.Maxx 1 Lane Furniture 1 Target 1 Lowe's 1 UPS 1 Marriott 1 Vans 1 Marshalls 1 Walmart 1 McDonald's 2 Wendy's 1

Strongest AM radio stations in Dickson City:

WEJL (630 AM; 2 kW; SCRANTON, PA)

WICK (1400 AM; 1 kW; SCRANTON, PA; Owner: LANCOM, INC.)

WITK (1550 AM; 10 kW; PITTSTON, PA; Owner: ROBERT C. CORDARO, INC.)

WARM (590 AM; 5 kW; SCRANTON, PA; Owner: CITADEL BROADCASTING COMPANY)

WQOR (750 AM; daytime; 2 kW; OLYPHANT, PA; Owner: HOLY FAMILY COMMUNICATIONS)

WKJN (1440 AM; 5 kW; CARBONDALE, PA; Owner: CITADEL BROADCASTING COMPANY)

WGBI (910 AM; 1 kW; SCRANTON, PA; Owner: ENTERCOM WILKES-BARRE SCRANTON, LLC)

WWJZ (640 AM; 50 kW; MOUNT HOLLY, NJ; Owner: ABC, INC.)

WEMR (1460 AM; 5 kW; TUNKHANNOCK, PA; Owner: CITADEL BROADCASTING COMPANY)

WMCA (570 AM; 50 kW; NEW YORK, NY; Owner: SALEM MEDIA OF NEW YORK, LLC)

WILK (980 AM; 5 kW; WILKES-BARRE, PA; Owner: ENTERCOM WILKES-BARRE SCRANTON, LLC)

WOR (710 AM; 50 kW; NEW YORK, NY; Owner: BUCKLEY BROADCASTING CORPORATION)

WABC (770 AM; 50 kW; NEW YORK, NY; Owner: WABC-AM RADIO, INC.)

Strongest FM radio stations in Dickson City:

W212AT (90.3 FM; CLARKS SUMMIT, PA; Owner: NORTHEASTERN PA. EDUCTNL TV ASSOC.)

WWDL-FM (104.9 FM; SCRANTON, PA; Owner: LANE BROADCASTING CORPORATION)

WUSR (99.5 FM; SCRANTON, PA; Owner: UNIVERSITY OF SCRANTON)

WBHD (95.7 FM; OLYPHANT, PA; Owner: CITADEL BROADCASTING COMPANY)

WEZX (106.9 FM; SCRANTON, PA; Owner: THE SCRANTON TIMES, L.P.)

WGGY (101.3 FM; SCRANTON, PA; Owner: ENTERCOM WILKES-BARRE SCRANTON, LLC)

WCWI (94.3 FM; CARBONDALE, PA; Owner: CITADEL BROADCASTING COMPANY)

WPGP (88.3 FM; TAFTON, PA; Owner: SOUND OF LIFE, INC.)

WQFN (100.1 FM; FOREST CITY, PA; Owner: THE SCRANTON TIMES, L.P.)

WMGS (92.9 FM; WILKES-BARRE, PA; Owner: CITADEL BROADCASTING COMPANY)

WKRZ (98.5 FM; WILKES-BARRE, PA; Owner: ENTERCOM WILKES-BARRE SCRANTON, LLC)

WVIA-FM (89.9 FM; SCRANTON, PA; Owner: NORTHEASTERN PENNSYLVANIA EDUCATIONAL TV ASSN.)

WCWY (107.7 FM; TUNKHANNOCK, PA; Owner: CITADEL BROADCASTING COMPANY)

WBHT (97.1 FM; MOUNTAIN TOP, PA; Owner: CITADEL BROADCASTING COMPANY)

WQFM (92.1 FM; NANTICOKE, PA; Owner: THE SCRANTON TIMES, L.P.)

WCLH (90.7 FM; WILKES-BARRE, PA; Owner: WILKES COLLEGE)

W219CG (91.7 FM; WILKER-BARRE, PA; Owner: PENSACOLA CHRISTIAN COLLEGE, INC.)

WBSX (97.9 FM; HAZLETON, PA; Owner: CITADEL BROADCASTING COMPANY)

WCWQ (93.7 FM; DALLAS, PA; Owner: CITADEL BROADCASTING COMPANY)

WVMW-FM (91.5 FM; SCRANTON, PA; Owner: MARYWOOD COLLEGE)

TV broadcast stations around Dickson City:

WQPX (Channel 64; SCRANTON, PA; Owner: PAXSON SCRANTON LICENSE, INC.)

WSWB (Channel 38; SCRANTON, PA; Owner: KB PRIME MEDIA LLC)

W26CD (Channel 26; SCRANTON, PA; Owner: NATIONAL MINORITY T.V., INC.)

W51BP (Channel 51; CLARKS SUMMIT, ETC., PA; Owner: NEXSTAR BROADCASTING OF NORTHEASTERN PENNSYLVANIA, L.L.C.)

W19AR (Channel 19; CLARKS SUMMIT, PA; Owner: MISSION BROADCASTING, INC.)

W48AQ (Channel 48; CLARKS SUMMIT, ETC., PA; Owner: NORTHEASTERN PA EDUC'L. TV ASSN.)

WNEP-TV (Channel 16; SCRANTON, PA; Owner: NEW YORK TIMES MANAGEMENT SERVICES)

WOLF-TV (Channel 56; HAZLETON, PA; Owner: WOLF LICENSE CORP.)

WVIA-TV (Channel 44; SCRANTON, PA; Owner: NE PA ED TV ASSOCIATION)

WBRE-TV (Channel 28; WILKES-BARRE, PA; Owner: NEXSTAR BROADCASTING OF NORTHEASTERN PENNSYLVANIA, L.L.C.)

WYOU (Channel 22; SCRANTON, PA; Owner: MISSION BROADCASTING, INC.)

W14CO (Channel 14; CLARKS SUMMIT, ETC., PA; Owner: NEW YORK TIMES MANAGEMENT SERVICES)

W07BV (Channel 7; WILKES-BARRE, ETC., PA; Owner: CATHOLIC BROADCASTING OF SCRANTON, INC.)

W18BN (Channel 18; SCRANTON, PA; Owner: COMMONWEALTH TELECASTERS)

National Bridge Inventory (NBI) Statistics 1 Number of bridges3ft / 0.7m Total length400 Total average daily traffic8 Total average daily truck traffic600 Total future (year 2040) average daily traffic

Home Mortgage Disclosure Act Aggregated Statistics For Year 2009(Based on 2 full tracts) A) FHA, FSA/RHS & VA B) Conventional C) Refinancings D) Home Improvement Loans E) Loans on Dwellings For 5+ Families F) Non-occupant Loans on Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 25 $118,120 27 $124,037 87 $139,759 27 $61,852 1 $280,000 7 $87,571 APPLICATIONS APPROVED, NOT ACCEPTED 0 $0 3 $310,333 6 $82,000 3 $26,667 0 $0 1 $548,000 APPLICATIONS DENIED 1 $83,000 1 $250,000 43 $124,791 11 $55,455 0 $0 3 $114,000 APPLICATIONS WITHDRAWN 0 $0 1 $306,000 15 $111,133 0 $0 1 $55,000 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 6 $123,667 1 $98,000 0 $0 1 $135,000

Aggregated Statistics For Year 2008(Based on 2 full tracts) A) FHA, FSA/RHS & VA B) Conventional C) Refinancings D) Home Improvement Loans E) Loans on Dwellings For 5+ Families F) Non-occupant Loans on G) Loans On Manufactured Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 17 $97,118 36 $109,861 60 $111,533 21 $45,143 1 $133,000 18 $106,944 1 $55,000 APPLICATIONS APPROVED, NOT ACCEPTED 1 $119,000 4 $89,500 9 $118,444 2 $79,500 0 $0 4 $103,000 0 $0 APPLICATIONS DENIED 0 $0 10 $93,300 48 $126,458 23 $43,739 0 $0 8 $71,500 0 $0 APPLICATIONS WITHDRAWN 3 $120,667 2 $75,000 23 $127,217 1 $84,000 0 $0 0 $0 0 $0 FILES CLOSED FOR INCOMPLETENESS 1 $68,000 1 $70,000 4 $89,750 1 $30,000 0 $0 0 $0 0 $0

Aggregated Statistics For Year 2007(Based on 2 full tracts) A) FHA, FSA/RHS & VA B) Conventional C) Refinancings D) Home Improvement Loans E) Loans on Dwellings For 5+ Families F) Non-occupant Loans on G) Loans On Manufactured Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 5 $111,800 56 $104,196 76 $89,184 37 $47,324 2 $64,000 21 $97,714 0 $0 APPLICATIONS APPROVED, NOT ACCEPTED 1 $139,000 10 $121,600 13 $117,615 7 $43,143 2 $138,500 7 $100,857 0 $0 APPLICATIONS DENIED 0 $0 6 $79,333 67 $105,955 18 $67,556 0 $0 11 $91,000 2 $20,000 APPLICATIONS WITHDRAWN 2 $131,000 7 $81,429 44 $108,341 4 $44,000 0 $0 9 $65,556 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 1 $66,000 4 $87,000 0 $0 0 $0 3 $86,000 0 $0

Aggregated Statistics For Year 2006(Based on 2 full tracts) A) FHA, FSA/RHS & VA B) Conventional C) Refinancings D) Home Improvement Loans E) Loans on Dwellings For 5+ Families F) Non-occupant Loans on G) Loans On Manufactured Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 5 $127,400 84 $88,702 113 $82,168 44 $38,136 1 $140,000 11 $72,000 0 $0 APPLICATIONS APPROVED, NOT ACCEPTED 0 $0 5 $63,000 19 $91,526 1 $52,000 0 $0 3 $76,667 0 $0 APPLICATIONS DENIED 0 $0 18 $124,167 93 $111,516 25 $56,000 0 $0 8 $78,875 3 $37,667 APPLICATIONS WITHDRAWN 1 $87,000 9 $71,556 71 $97,704 4 $101,000 0 $0 7 $103,571 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 4 $98,250 14 $94,714 0 $0 0 $0 1 $72,000 1 $42,000

Aggregated Statistics For Year 2005(Based on 2 full tracts) A) FHA, FSA/RHS & VA B) Conventional C) Refinancings D) Home Improvement Loans E) Loans on Dwellings For 5+ Families F) Non-occupant Loans on G) Loans On Manufactured Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 6 $101,667 64 $103,422 105 $72,219 26 $32,115 1 $148,000 18 $88,056 0 $0 APPLICATIONS APPROVED, NOT ACCEPTED 0 $0 4 $82,250 16 $71,188 3 $75,667 0 $0 2 $57,500 0 $0 APPLICATIONS DENIED 0 $0 13 $69,846 105 $91,667 17 $41,294 1 $125,000 5 $84,000 2 $55,000 APPLICATIONS WITHDRAWN 1 $65,000 13 $96,923 59 $106,458 7 $70,714 0 $0 2 $81,000 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 4 $78,250 7 $122,714 0 $0 0 $0 0 $0 0 $0

Aggregated Statistics For Year 2004(Based on 2 full tracts) A) FHA, FSA/RHS & VA B) Conventional C) Refinancings D) Home Improvement Loans F) Non-occupant Loans on G) Loans On Manufactured Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 7 $87,000 57 $94,526 95 $79,084 26 $55,654 14 $71,286 1 $60,000 APPLICATIONS APPROVED, NOT ACCEPTED 0 $0 6 $60,833 17 $95,647 3 $23,000 1 $54,000 0 $0 APPLICATIONS DENIED 0 $0 9 $71,000 74 $103,446 23 $29,000 8 $81,625 0 $0 APPLICATIONS WITHDRAWN 0 $0 5 $63,800 65 $110,954 6 $28,500 3 $63,333 1 $102,000 FILES CLOSED FOR INCOMPLETENESS 0 $0 1 $212,000 16 $88,250 4 $43,250 0 $0 0 $0

Aggregated Statistics For Year 2003(Based on 2 full tracts) A) FHA, FSA/RHS & VA B) Conventional C) Refinancings D) Home Improvement Loans E) Loans on Dwellings For 5+ Families F) Non-occupant Loans on Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 6 $82,500 53 $81,019 214 $77,846 25 $25,200 1 $50,000 17 $80,176 APPLICATIONS APPROVED, NOT ACCEPTED 0 $0 7 $48,429 27 $101,296 2 $20,000 0 $0 2 $90,000 APPLICATIONS DENIED 2 $78,000 7 $59,286 93 $83,989 15 $33,667 0 $0 7 $54,857 APPLICATIONS WITHDRAWN 1 $49,000 5 $83,000 44 $103,205 2 $16,000 0 $0 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 2 $39,000 12 $94,167 2 $39,000 0 $0 1 $50,000

Aggregated Statistics For Year 2002(Based on 2 full tracts) A) FHA, FSA/RHS & VA B) Conventional C) Refinancings D) Home Improvement Loans E) Loans on Dwellings For 5+ Families F) Non-occupant Loans on Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 10 $87,900 36 $85,917 127 $77,661 25 $39,520 1 $50,000 10 $70,000 APPLICATIONS APPROVED, NOT ACCEPTED 0 $0 2 $50,500 35 $80,200 3 $48,333 0 $0 2 $57,500 APPLICATIONS DENIED 2 $96,500 8 $88,000 61 $79,869 7 $27,857 0 $0 5 $93,400 APPLICATIONS WITHDRAWN 0 $0 5 $87,400 40 $82,775 3 $30,333 0 $0 3 $81,333 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 8 $65,000 0 $0 0 $0 0 $0

Aggregated Statistics For Year 2001(Based on 2 full tracts) A) FHA, FSA/RHS & VA B) Conventional C) Refinancings D) Home Improvement Loans F) Non-occupant Loans on Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 18 $73,389 40 $77,425 110 $69,336 41 $20,829 11 $46,273 APPLICATIONS APPROVED, NOT ACCEPTED 0 $0 3 $84,333 36 $69,778 10 $29,600 2 $91,000 APPLICATIONS DENIED 0 $0 8 $70,125 68 $70,221 8 $39,500 4 $41,250 APPLICATIONS WITHDRAWN 1 $132,000 5 $83,200 52 $79,500 6 $20,833 2 $81,500 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 13 $60,846 0 $0 0 $0

Aggregated Statistics For Year 2000(Based on 2 full tracts) A) FHA, FSA/RHS & VA B) Conventional C) Refinancings D) Home Improvement Loans F) Non-occupant Loans on Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 9 $80,333 49 $66,265 48 $68,688 39 $18,333 9 $58,333 APPLICATIONS APPROVED, NOT ACCEPTED 2 $71,500 4 $66,750 17 $60,000 6 $17,667 3 $46,000 APPLICATIONS DENIED 0 $0 15 $59,067 36 $48,389 19 $17,105 1 $71,000 APPLICATIONS WITHDRAWN 0 $0 5 $34,800 26 $64,269 6 $18,167 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 5 $47,800 0 $0 0 $0

Aggregated Statistics For Year 1999(Based on 2 full tracts) A) FHA, FSA/RHS & VA B) Conventional C) Refinancings D) Home Improvement Loans F) Non-occupant Loans on Number Average Value Number Average Value Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 8 $72,678 47 $66,949 81 $60,342 36 $20,109 6 $35,188 APPLICATIONS APPROVED, NOT ACCEPTED 0 $0 6 $92,685 28 $45,757 3 $12,227 3 $46,757 APPLICATIONS DENIED 0 $0 7 $72,293 51 $62,350 16 $25,266 1 $24,700 APPLICATIONS WITHDRAWN 0 $0 6 $72,790 29 $55,508 7 $37,220 2 $84,455 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 2 $66,675 0 $0 0 $0

Detailed HMDA statistics for the following Tracts:

1115.00

, 1116.00

Private Mortgage Insurance Companies Aggregated Statistics For Year 2009(Based on 2 full tracts) A) Conventional B) Refinancings C) Non-occupant Loans on Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 4 $91,000 3 $123,000 0 $0 APPLICATIONS APPROVED, NOT ACCEPTED 1 $108,000 2 $130,000 1 $108,000 APPLICATIONS DENIED 0 $0 3 $118,667 0 $0 APPLICATIONS WITHDRAWN 0 $0 0 $0 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 0 $0

Aggregated Statistics For Year 2008(Based on 2 full tracts) A) Conventional B) Refinancings C) Non-occupant Loans on Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 12 $143,167 7 $124,143 1 $101,000 APPLICATIONS APPROVED, NOT ACCEPTED 3 $109,000 3 $156,667 0 $0 APPLICATIONS DENIED 1 $167,000 1 $122,000 0 $0 APPLICATIONS WITHDRAWN 5 $131,400 0 $0 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 0 $0

Aggregated Statistics For Year 2007(Based on 2 full tracts) A) Conventional B) Refinancings C) Non-occupant Loans on Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 23 $103,348 4 $132,250 3 $84,333 APPLICATIONS APPROVED, NOT ACCEPTED 6 $88,000 2 $111,000 3 $80,000 APPLICATIONS DENIED 0 $0 0 $0 0 $0 APPLICATIONS WITHDRAWN 0 $0 0 $0 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 0 $0

Aggregated Statistics For Year 2006(Based on 2 full tracts) A) Conventional B) Refinancings C) Non-occupant Loans on Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 19 $104,263 9 $120,111 2 $93,500 APPLICATIONS APPROVED, NOT ACCEPTED 2 $130,000 4 $92,250 0 $0 APPLICATIONS DENIED 0 $0 0 $0 0 $0 APPLICATIONS WITHDRAWN 0 $0 0 $0 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 0 $0

Aggregated Statistics For Year 2005(Based on 2 full tracts) A) Conventional B) Refinancings C) Non-occupant Loans on Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 16 $78,750 3 $80,333 2 $79,000 APPLICATIONS APPROVED, NOT ACCEPTED 3 $120,333 3 $86,667 0 $0 APPLICATIONS DENIED 3 $54,667 0 $0 2 $49,000 APPLICATIONS WITHDRAWN 0 $0 0 $0 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 0 $0

Aggregated Statistics For Year 2004(Based on 2 full tracts) A) Conventional B) Refinancings C) Non-occupant Loans on Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 12 $87,583 6 $89,167 1 $43,000 APPLICATIONS APPROVED, NOT ACCEPTED 2 $119,000 1 $47,000 0 $0 APPLICATIONS DENIED 1 $81,000 1 $52,000 0 $0 APPLICATIONS WITHDRAWN 0 $0 0 $0 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 0 $0

Aggregated Statistics For Year 2003(Based on 2 full tracts) A) Conventional B) Refinancings C) Non-occupant Loans on Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 23 $73,087 19 $87,105 1 $55,000 APPLICATIONS APPROVED, NOT ACCEPTED 2 $64,500 2 $82,500 0 $0 APPLICATIONS DENIED 1 $43,000 1 $110,000 1 $43,000 APPLICATIONS WITHDRAWN 0 $0 0 $0 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 0 $0

Aggregated Statistics For Year 2002(Based on 2 full tracts) A) Conventional B) Refinancings Number Average Value Number Average Value

LOANS ORIGINATED 17 $76,059 7 $90,286 APPLICATIONS APPROVED, NOT ACCEPTED 2 $73,500 4 $137,500 APPLICATIONS DENIED 0 $0 0 $0 APPLICATIONS WITHDRAWN 0 $0 1 $105,000 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0

Aggregated Statistics For Year 2001(Based on 2 full tracts) A) Conventional B) Refinancings C) Non-occupant Loans on Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 15 $76,467 7 $93,429 1 $94,000 APPLICATIONS APPROVED, NOT ACCEPTED 1 $125,000 1 $85,000 0 $0 APPLICATIONS DENIED 0 $0 2 $75,000 0 $0 APPLICATIONS WITHDRAWN 0 $0 0 $0 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 0 $0

Aggregated Statistics For Year 2000(Based on 2 full tracts) A) Conventional B) Refinancings C) Non-occupant Loans on Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 12 $59,833 2 $81,000 1 $60,000 APPLICATIONS APPROVED, NOT ACCEPTED 1 $62,000 0 $0 0 $0 APPLICATIONS DENIED 1 $79,000 1 $90,000 1 $79,000 APPLICATIONS WITHDRAWN 0 $0 0 $0 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 0 $0

Aggregated Statistics For Year 1999(Based on 2 full tracts) A) Conventional B) Refinancings C) Non-occupant Loans on Number Average Value Number Average Value Number Average Value

LOANS ORIGINATED 13 $62,778 5 $77,698 1 $37,540 APPLICATIONS APPROVED, NOT ACCEPTED 2 $89,890 2 $89,560 0 $0 APPLICATIONS DENIED 0 $0 0 $0 0 $0 APPLICATIONS WITHDRAWN 0 $0 0 $0 0 $0 FILES CLOSED FOR INCOMPLETENESS 0 $0 0 $0 0 $0

Detailed PMIC statistics for the following Tracts:

1115.00

, 1116.00 Fire-safe hotels and motels in Dickson City, Pennsylvania:

Fairfield Inn Scranton, 949 Viewmont Dr, Dickson City, Pennsylvania 18519 Phone: (570) 346-3222

Microtel Inn & Suites, 232 Main St, Dickson City, Pennsylvania 18519 Phone: (570) 307-1200, Fax: (570) 307-1270

Holiday Inn Express & Suites, 1265 Commerce Blvd, Dickson City, Pennsylvania 18519 Phone: (570) 307-4437

All 3 fire-safe hotels and motels in Dickson City, Pennsylvania

Most common first names in Dickson City, PA among deceased individuals Name Count Lived (average)

John 196 73.4 years Mary 166 79.7 years Joseph 147 72.0 years Anna 92 81.2 years Helen 87 76.5 years Frank 83 73.1 years Stanley 73 73.2 years Edward 69 72.0 years George 54 73.8 years Michael 50 71.5 years

Most common last names in Dickson City, PA among deceased individuals Last name Count Lived (average)

Rutkowski 19 73.3 years Hall 17 75.9 years Thomas 15 71.6 years Parchinski 13 74.5 years Tylenda 12 77.5 years Turock 10 77.5 years Bartkowski 10 78.9 years Novak 10 75.7 years Bielinski 9 77.2 years Pabis 9 75.9 years

Dickson City compared to Pennsylvania state average:

Unemployed percentage below state average. Black race population percentage significantly below state average. Hispanic race population percentage below state average. Foreign-born population percentage significantly below state average. Length of stay since moving in significantly above state average. Number of college students below state average.

Top Patent Applicants

Christopher Art (2)

Christine Wargo (2)

Matthew Madden (1)

Richard J. Kern, Ii (1)

Total of 6 patent applications in 2008-2024.

(4.4 miles

, pop. 76,415).

(90.5 miles

, pop. 273,546).

(98.6 miles

, pop. 1,537,195).

Based on the data from the years 2003 - 2018 the average number of fires per year is 14. The highest number of reported fire incidents - 51 took place in 2013, and the least - 0 in 2004. The data has a rising trend.

Based on the data from the years 2003 - 2018 the average number of fires per year is 14. The highest number of reported fire incidents - 51 took place in 2013, and the least - 0 in 2004. The data has a rising trend. When looking into fire subcategories, the most incidents belonged to: Structure Fires (44.5%), and Outside Fires (30.8%).

When looking into fire subcategories, the most incidents belonged to: Structure Fires (44.5%), and Outside Fires (30.8%).